CARDINAL STEFAN WYSZYŃSKI UNIVERSITY IN WARSAW

CRASHES AND CRISES IN

THE FINANCIAL

MARKETS . THE

IMPORTANCE OF

SPECULATIVE BUBBLES.

Global Financial Markets

Magdalena Cupryjak, Patrycja Gniadzik, Mateusz Jarzębski

Warsaw 2016

The article presents the phenomenon of speculative bubbles, which is an integral part of modern

financial markets. Most often the term speculative bubble understands the movement of asset prices,

which can not be explained by fundamental premises or other rational factors having a significant

impact on the price of these assets.

CRASHES AND CRISES IN THE FINANCIAL MARKETS . THE

IMPORTANCE OF SPECULATIVE BUBBLES.

Patrycja Gniadzik, Magdalena Cupryjak, Mateusz Jarzębski

Strona 1

A SPECULATIVE BUBBLE

The stock market bubble (speculative) is a phenomenon known for centuries. The

history of the free market is a story about growing bubbles and more painful craches. The

sharp price increases in many markets - not only stocks - are known for many hundreds of

years. Often these sharp increases end in equally spectacular decline of trading. Sometimes

assets lose 90% of its value in a few months. In this case, it speaks of "inflating and then

bursting of the speculative bubble". Very important (if not the most important) in this process

is played by the psychological attitude of investors.

An economic bubble “is trade in an asset at a price or price range that strongly

deviates from the corresponding asset's intrinsic value”

1

. This phenomenon may also be

understood as “a social epidemic whose contagion is mediated by price movements. News of

price increase enriches the early investors, creating word-of-mouth stories about their

successes, which stir envy and interest. The excitement then lures more and more people into

the market, which causes prices to increase further, attracting yet more people and fueling

'new era' stories, and so on, in successive feedback loops as the bubble grows”

2

. It follows

that the price bubble is self-perpetuating mechanism, in which the price increase is not

justified by economic and financial factors, and psychological, for example, constantly rising

expectations. Bubble occurs when a sharp increase in prices above their value followed by

equally rapid decline - a price correction. The place of frequent formation of bubbles are

securities exchanges. Investors saw a sudden upward trend in prices to buy shares in order to

achieve a quick and large profit. This is the tense atmosphere and high noise created by the

media creating the image of the potential profits. Investors behave in a herd by buying

advantages of not paying attention to the lack of justification for the price in the current

financial results. Usually speculative bubbles do not last long. When starting to fall in share

prices, investors are selling previously purchased securities. Followed by the deep downturn

in the market and serious losses of many shareholders and a period of low prices

3

.

1

King R., Smith V., Williams A., van Boening M., "The Robustness of Bubbles and Crashes in Experimental

Stock Markets". In Day, R. H.; Chen, P.Nonlinear Dynamics and Evolutionary Economics. New York: Oxford

University Press, 1993.

2

Shiller R., "Bubbles without Markets". Project Syndicate. Retrieved 17 August 2012

3

Garber P., Famous First Bubbles: The Fundamentals of Early Manias. Cambridge, MA: MIT Press, 2001

CRASHES AND CRISES IN THE FINANCIAL MARKETS . THE

IMPORTANCE OF SPECULATIVE BUBBLES.

Patrycja Gniadzik, Magdalena Cupryjak, Mateusz Jarzębski

Strona 2

Can be identified 5 steps of creating a bubble in the market - displacement, boom,

euphoria, profit and panic. Although there are different interpretations of these cycle, the

overall activity pattern bubble remains relatively consistent.

1. Displacement. Displacement occurs when investors are delighted with the new

paradigm, such as the new advanced technology or interest rates that are

historically low.

2. Boom. Prices are rising slowly, after moving, but then gain momentum as more

participants enter the market, setting the stage for the boom phase. During this

second phase of the bubble, the asset attracted widespread media attention. Fear of

missing out on what could be an opportunity once-in-a-lifetime spurs more

speculation, drawing more and more members into the fold.

3. Euphoria. During this phase, caution is abandoned by investors and asset prices

soar very high. "Great fool" theory played out wherever possible on the market.

During the phase of euphoria, new means of measurement and metrics are

promoted to justify the unstoppable rise in asset prices.

4. Profit. At this time, the smart money - heeding the warning signs - overall sold

positions and implemented profits. But estimating the time when the bubble is the

result of the collapse is a difficult task and extremely dangerous to the health of the

financial, because, as John Maynard Keynes said, "Markets can remain irrational

longer than you can stay solvent."

5. Panic. During panic, asset prices are changing gear and fall as quickly as rose.

Investors and speculators, faced calls and plunging values of their farms, and now

they want to sell the share at any price to be rid of them. Because the supply

overwhelms demand, asset prices slide steeply

4

.

Market bubbles in some asset or another are inevitable in a free market economy. However,

refer to the steps of the formation of bubbles can help to see the next one and avoid becoming

involuntary participant in it.

There are a list of groups of criteria for early identification of a market bubble. Here

are some measurable criteria to help track down speculative bubbles before they burst.

1. The deviation from historical average valuation. Traditional indicators

(capitalization, price / profit, price / sales) start to uncontrollably change values. If

4

Five steps of a bubble, Forbes, published: 17.06.2010, web: http://www.forbes.com/2010/06/17/guide-

financial-bubbles-personal-finance-bubble.html, access 15.05.2016

CRASHES AND CRISES IN THE FINANCIAL MARKETS . THE

IMPORTANCE OF SPECULATIVE BUBBLES.

Patrycja Gniadzik, Magdalena Cupryjak, Mateusz Jarzębski

Strona 3

they grow above two standard deviations from the levels historically recognized as

the norm, we should verify that fundamentals have changed justifying such

behavior on the market.

2. Above-average returns. The ability to quickly get rich work for the investors like a

magnet in final phase of pumping the bubble. The first spectacular stock exchange

debuts and takeovers of innovative companies signal that if it has just created

another stock bubble, it is still at a very early stage. The expectation that similar

results will be repeated in the coming years, may negatively surprise the market

participants.

3. Excessive leverage. Cheap capital from various sources (subprime loans and

securitization, investors amateur and Internet bubble, central banks), but mostly

contributed to pumping the biggest bubbles.

4. New financial products. The Internet bubble boosted management and employee

options instead of cash. Their owners became millionaires when the company

entered the stock market. Currently, can also see an increased creativity of

financial engineers and bankers.

5. The increase in the number of transactions. Just before the spectacular bubble burst

trading volume is growing rapidly, investor greed and fear of missing the occasion

reaching the summit.

6. "Ripped off" rationalization, new indicators. Lovers of assets whose prices are

growing so fast, usually argue that "this time is different" and come up with

various arguments intended to suppress the voices of critics.

7. Conflicts of interest. There are conflicting interests of various stakeholder groups.

Similar mechanisms can watch in the business models of powerful Internet

startups.

8. Workplaces. New trends generate demand for workers in hot sectors, hence the

number of estate brokers and bankers grow unnaturally quickly in the United

States in the years 2004 -2007 before a mortgage crisis in 2008.

9. Lowering credit standards. "Easy" money goes on preferential terms to those not

prepared to repay loans, which almost always means big problems in the future.

10. Unnatural changes in the prices low. If the addition is accompanied by a price

movement almost exclusively in one direction, a sign that market participants there

is suspicious, unnatural unanimity. In such conditions often flowing information

CRASHES AND CRISES IN THE FINANCIAL MARKETS . THE

IMPORTANCE OF SPECULATIVE BUBBLES.

Patrycja Gniadzik, Magdalena Cupryjak, Mateusz Jarzębski

Strona 4

that "no one could to foresee" but viewed from the side, sooner or later something

has to restore balance to the market

5

6

.

Most bubbles are noticeable only in retrospect, when everyone involved in the pursuit of

profit, shaking his head in disbelief. Flexibility and willingness to change his mind as the

development of the market situation is one of the most important characteristics of successful

investors. We decided to take a look at the most - from tulip mania, who was one of the first

bubbles so large in size, and ending with one of the freshest, the US bubble in the property

market.

THE TULIPOMANIA

One of the first and most spectacular examples of speculative bubbles, which reported

the story, is the so-called tulip mania. The tulip was introduced from Constantinople to

western Europe, and particularly to Holland, in the middle of the 16th century. Such was its

influence that it became one of the strangest features of moral epidemic. Lust of fast buck

broke out in the Netherlands at the beginning of the seventeenth century. In a short time,

prices of tulip bulbs grew there almost for astronomical values. Soon after the Dutch tulips

were attacked by a virus mottling tulip (TBV), which caused the tulip petals took on

unprecedented shapes of the edges jagged and undulating. Since this is a symptom of a

disease, infected specimens often withered, which was another element of risk. This anomaly

gardening has become a cause of the development of the Dutch "tulip fever"

7

.

5

Light J., How to spot a market bubble?, published; 18.04.2014, Web:

http://www.wsj.com/articles/SB10001424052702304626304579507413517999956, access;

13.05.2016

6

Davies G., How to detect a market buble?, published: 17.01.2014, Web:

http://blogs.ft.com/gavyndavies/2014/01/17/how-to-detect-a-market-bubble/, access; 16.05.2016

7

THE CONTEMPORARY WOMEN, Tulipomania: The Story about How the Tulip became a Distinctive Symbol

of the Netherlands, published: 26.05.2015, web:

http://thecontemporarywomen.com/2015/05/26/tulipomania-the-story-about-how-the-tulip-became-a-

distinctive-symbol-of-the-netherlands/, access: 28.05,2016

CRASHES AND CRISES IN THE FINANCIAL MARKETS . THE

IMPORTANCE OF SPECULATIVE BUBBLES.

Patrycja Gniadzik, Magdalena Cupryjak, Mateusz Jarzębski

Strona 5

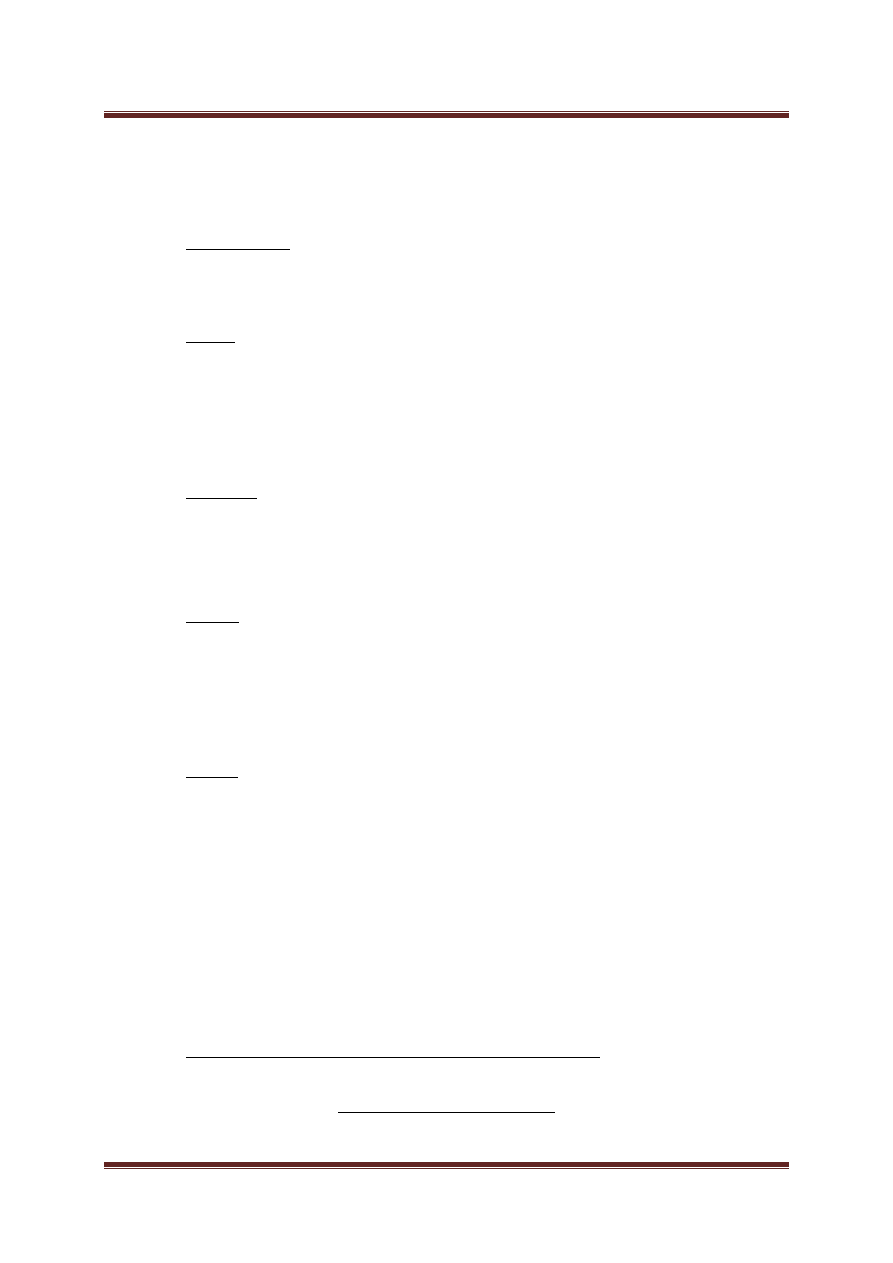

Chart 1. The value of tulips in the Netherlands during the bubble in the seventeenth century.

Source: THE CONTEMPORARY WOMEN, Tulipomania: The Story about How the Tulip became a Distinctive

Symbol

of

the

Netherlands,

published:

26.05.2015,

web:

http://thecontemporarywomen.com/2015/05/26/tulipomania-the-story-about-how-the-tulip-became-a-distinctive-

symbol-of-the-netherlands/, access: 20.05.2016

Flowers became soon a symbol of luxury and social status. In 1623 the single most

sought after varieties of onions reached a price of up to 1 thousand guilders (average annual

income in the Netherlands was then about 150 guilders)

8

. It happened that sometimes was

turned tulips for real estate, land or cattle. Top traders earned frequently about 6 thousand

guilders a month to trade tulips. In 1635 the reported sale of 40 bulbs for 100 thousand

guilders. For comparison, a ton of butter cost 100 guilders then, and 8 fat pigs 240 guilders

(chart number 1). In the 30s the seventeenth century, tulips were traded on the stock

exchanges of Dutch cities. The unprecedented demand for these flowers meant that many

people began to speculate on the market (in the manner in which this is done today with

securities), hoping to duplicate the inserted capital. Some sold everything they had to buy the

first seedlings

9

. Many people earned fortunes, others have lost wealth. In 1637 there was a

collapse of the market, which was caused by too excessive prices, for which there were no

takers. Another important factor that contributed to the crash, there was non-compliance with

counterparty obligations under contracts guaranteeing the purchase of bulbs at a fixed price in

the future. There was panic as a result of which thousands of people have become bankrupt

(in their possession were only tulips that were worth only a fraction of what they paid in

8

Goldgar A., Tulipmania: Money, Honor, and Knowledge in the Dutch Golden Age. London: University of

Chicago Press, 2008

9

Frankel A., When the Tulip Bubble Burst, ,Business Week, April 4, 2000

CRASHES AND CRISES IN THE FINANCIAL MARKETS . THE

IMPORTANCE OF SPECULATIVE BUBBLES.

Patrycja Gniadzik, Magdalena Cupryjak, Mateusz Jarzębski

Strona 6

advance). In the worst situation were those who took loans to purchase tulips, and as a result

of the crash become insolvent

1011

.

THE GREAT DEPRESSION

At the end of the 30s of the twentieth century John Maynard Keynes said: humanity

lives in the shadow of one of the greatest economic catastrophes of modern history

12

. This

statement referred to the then-greatest threat to the world economic system, which was the

Great Depression. Lionel Robbins of the London School of Economics wrote the book titled

“The Great Depression” (London 1934) in which he put the idea supposedly the world crisis

not erupted suddenly in 1929, but lasted since 1914

13

. World War was a terrible disaster for

humanity, especially for Europe, it brought huge economic and human destruction;

international division of labor has ceased to function, have broken world markets. State to

finance war expenses, took out large loans in other countries or in their own nationals. After

the war, winning the state had to pay off war debts and Germany – reparations. We come to

this debt on the need to rebuild the economy, mainly through loans taken out of the United

States

14

.

What exactly was the Great Depression? The Great Depression – worldwide economic

downturn that began in 1929 and lasted until about 1939. It was the longest and most severe

depression ever experienced by the industrialized Western world – Christina D. Romer

15

wrote in her text. Great Depression originated in the United States, officially it lasted in the

years 1929-1932

16

. It resulted in drastic declines in output, severe unemployment, and acute

deflation in almost every country of the globe. In the United States the Great Depression right

after Civil War is considered to the gravest crisis in American history

17

.

10

Garber P.,. Tulipmania. „The Journal of Political Economy”. 3 (97), The University of Chicago Press, July

1989, p. 535-560.

11

Gross D., Bulb Bubble Trouble; That Dutch tulip bubble wasn't so crazy after all, Slate, July 16, 2004.

Retrieved on November 4, 2011.

12

Gabiś T., Wielki kryzys – wielka zagadka? , published: 29.02.2012, web:

http://nowadebata.pl/2012/02/29/wielki-kryzys-wielka-zagadka, access: 27.05.2016

13

Ibidem.

14

Ibidem.

15

Romer C.D., Great Depression, Forthcoming in the Encyclopedia Britannica, 2003, p. 223

16

Murray N. Rothbard, Wielki Kryzys w Ameryce / America’s Great Depression, The Ludwig von Mises

Institute, 2000, p. 151.

17

Romer C.D., Great Depression, Forthcoming in the Encyclopedia Britannica, 2003, p. 223

CRASHES AND CRISES IN THE FINANCIAL MARKETS . THE

IMPORTANCE OF SPECULATIVE BUBBLES.

Patrycja Gniadzik, Magdalena Cupryjak, Mateusz Jarzębski

Strona 7

The then US President Herbert Hoover in 1932, presented a summary of his campaign:

(…) we could do nothing. This would lead to the final catastrophe. Reacting to the situation,

we presented to entrepreneurs and the Congress of the largest in the history of the republic

program of defense and counterattack. We introduced it in life. (…) So far, no government in

Washington does not want to take so much responsibility for leadership in times of crisis

18

.

Well, his actions were completely different than all previously used in America in times of

crisis. So far, always guided by the principle of laissez-faire, just do not interfere to the

economy, so that the government does not exacerbated the crisis, and softened its course. The

president however has applied aggressive action and tossed aside laissez-faire

19

.

The situation was really serious, since Hebert Clark Hoover decided to introduce new

rules, discarding the previous one. The Great Depression brought about fundamental changes

in economic institutions, macroeconomic policy, and economic theory.

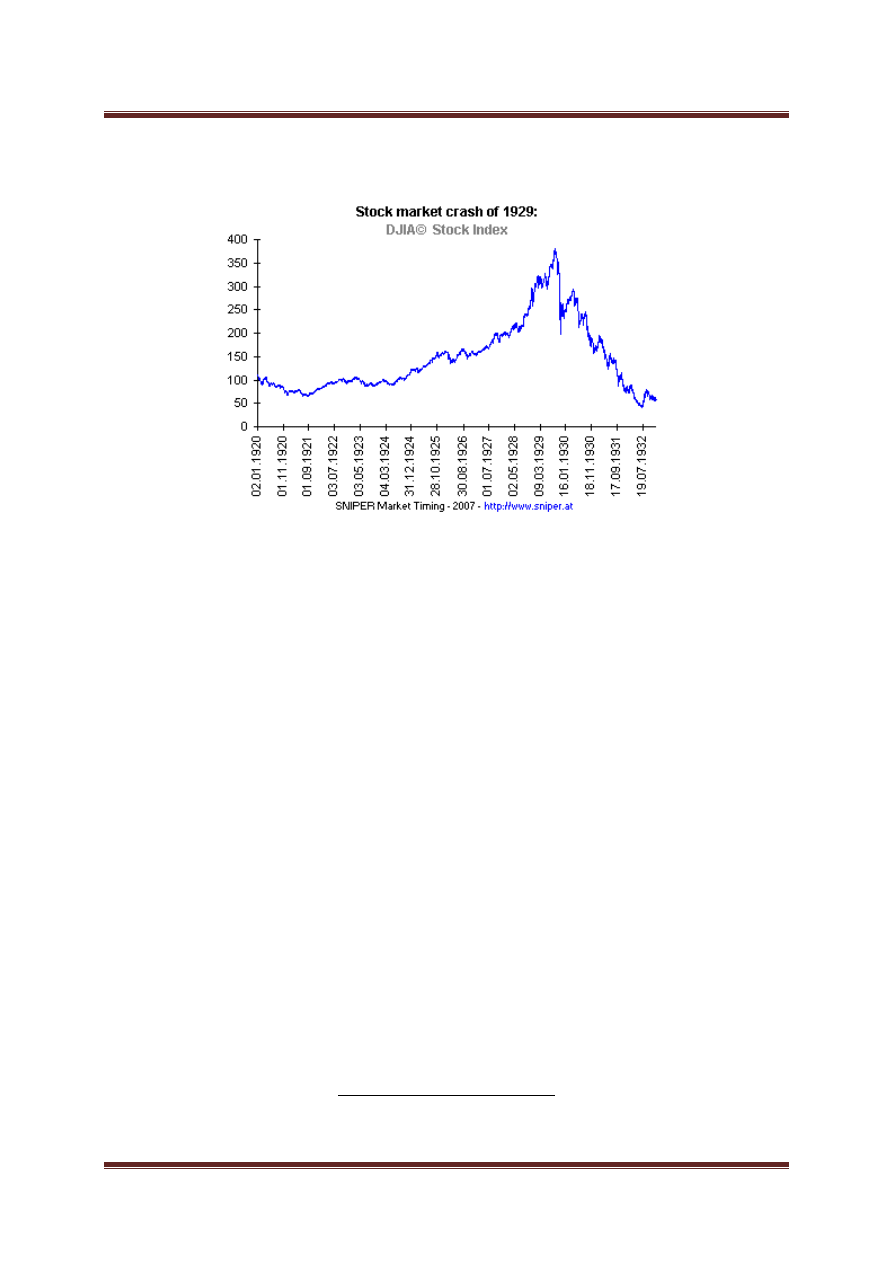

On October 24, 1929, the stock market bubble burst, as investors began dumping shares end

masse. A record 12.9 million shares were traded that day, known as “Black Thursday.” Five

days later, on “Black Tuesday” some 16 million shares were traded after another wave of

panic swept Wall Street. Millions of shares ended up worthless, and those investors who had

bought stocks “on margin” (with borrowed money) were wiped out completely

20

.

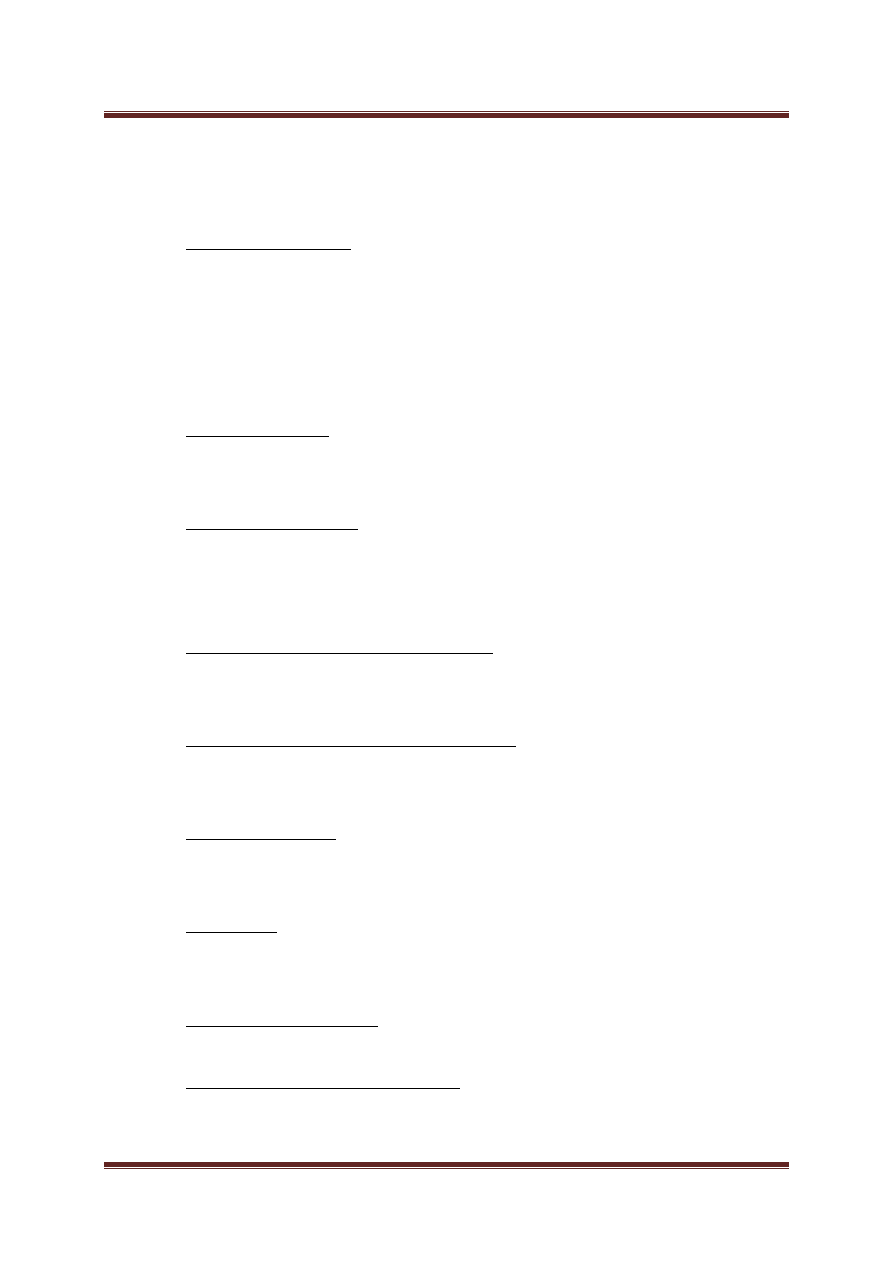

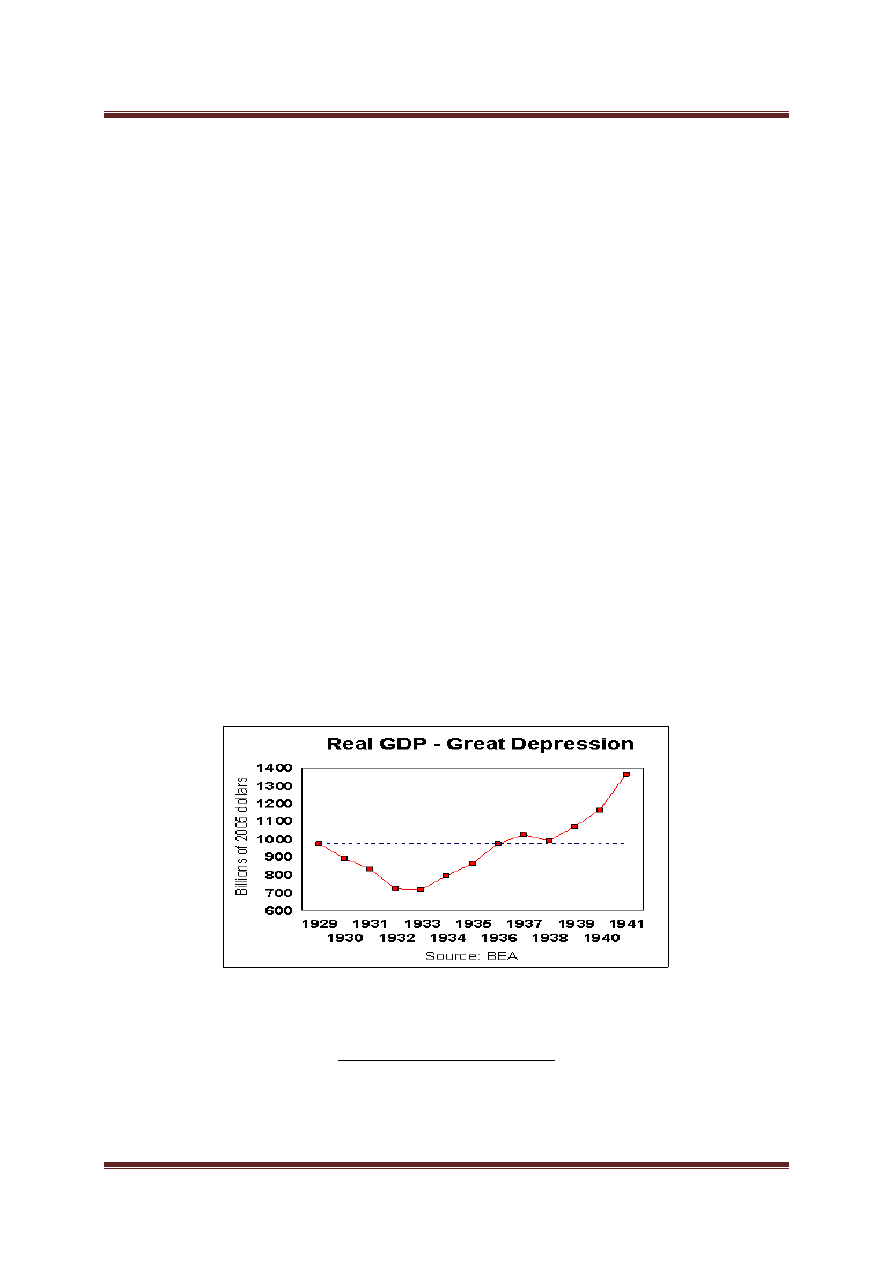

Chart 2. Real GNP in the U.S. during the Great Depression.

Source: Richman H., Growing Trade Deficit continues U.S. Depression, published: 31.10.2010, web:

http://www.idealtaxes.com/post3242.shtml, access: 04.06.2016

18

Starr Myers W., Newton W.H., The Hoover Administration, New York 1936, part 1; William Starr Myers

(red.), The State Papers of Herbert Hoover, New York 1934,

19

Murray N. Rothbard, Wielki Kryzys w Ameryce / America’s Great Depression, The Ludwig von Mises

Institute, 2000, p. 151-153.

20

The Great Depression, web: http://www.history.com/topics/great-depression, access: 27.05.2016,

CRASHES AND CRISES IN THE FINANCIAL MARKETS . THE

IMPORTANCE OF SPECULATIVE BUBBLES.

Patrycja Gniadzik, Magdalena Cupryjak, Mateusz Jarzębski

Strona 8

From the Wall Street crash , the world economy entered a period called the Great Depression

in the United States and in other countries of the Great Depression Economic. Production in

the major industrial countries has fallen from 30 to 50 %, the value of world trade in 1932 was

about one-third lower than three years earlier (chart number 2). In 1933, 30 million people

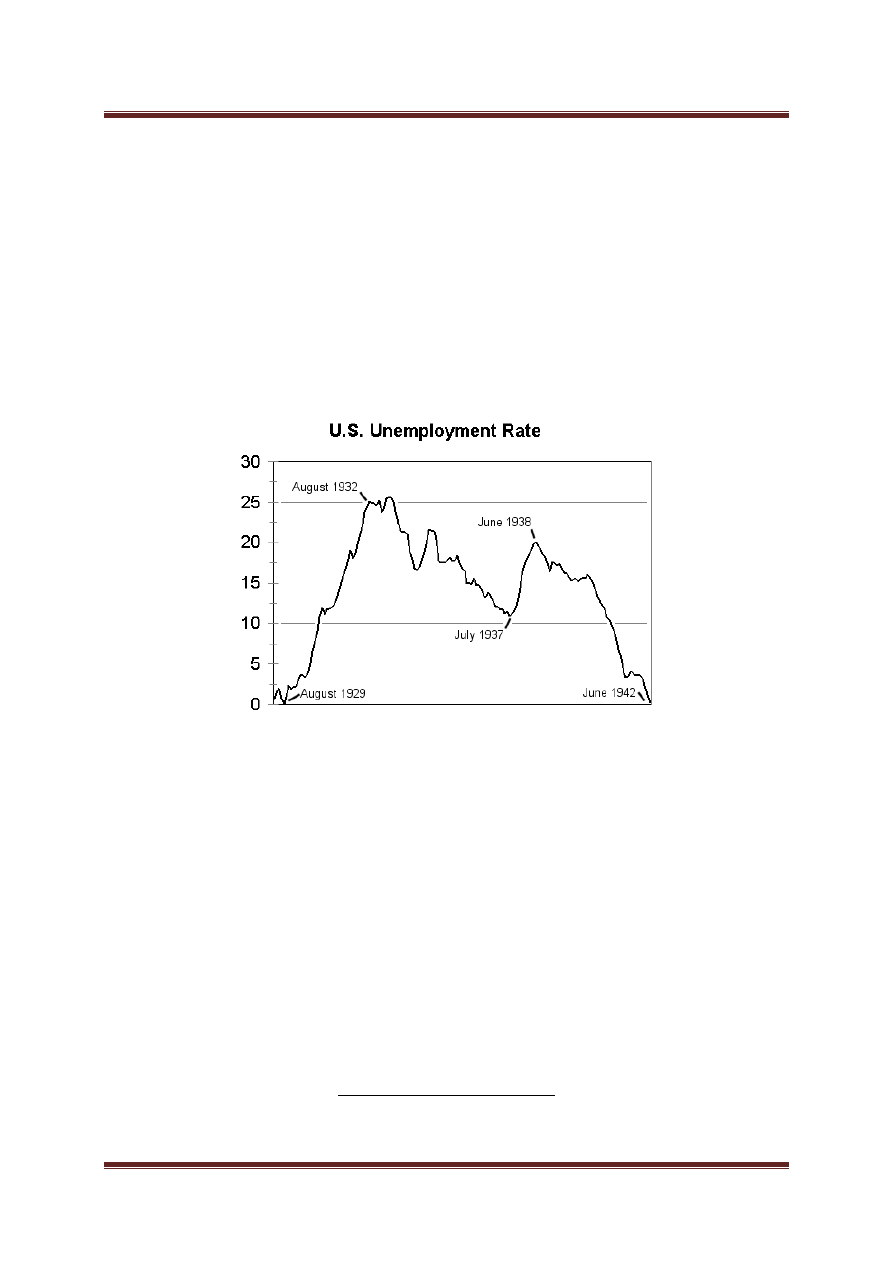

were out of work, everywhere decreased gross national income (chart number 3). Between

1929 and 1932 the average American family income fell by 40% - from 2,300 to 1,500 dollars

a year. Between 1929 and 1933 fell from 10 000 to 25 000 commercial banks USA

21

.

Chart 3. Unemployment in the United States in the years 1929-1942.

Source: PHOTOS OF-1930 -THE GREAT STOCK MARKET CRASH & DEPRESSION unemployment,poverty –

AMERICA, web: http://pazhayathu.blogspot.com/2010/10/photos-of-1930-great-stock-market-crash.html, access:

03.06.2016

British historian Paul Johnson wrote: The collapse of Wall Street in September and

October 1929 and the subsequent Great Depression them among the most important events of

the twentieth century. They made the Second World War, though not inevitable, it became

possible

22

.

21

T. Gabiś, Wielki kryzys – wielka zagadka?, published: 29.02.2012, web:

http://nowadebata.pl/2012/02/29/wielki-kryzys-wielka-zagadka, access: 27.05.2016

22

Ibidem.

CRASHES AND CRISES IN THE FINANCIAL MARKETS . THE

IMPORTANCE OF SPECULATIVE BUBBLES.

Patrycja Gniadzik, Magdalena Cupryjak, Mateusz Jarzębski

Strona 9

Chart 4. The US stock market (benchmark: Dow Jones Industrial Average (DJIA)© Index) in years

1920-1932.

Source: Stock market crash - Black Thursday / Black Tuesday - October 1929, web: http://www.sniper.at/stock-

market-crash-1929.htm, access: 04.06.2016

The unity of the world financial system collapsed ultimately prevailed monetary chaos. The

breakdown of global markets and the collapse of the international financial system and trade,

prepared the ground for World War II. It is not an exaggeration to say that the whole edifice

of world trade and global finance has implosion. Intensified social unrest, political crises and

conflicts between political elites of various countries

23

.

The Great Depression affected not only America. The USA was the place where it was born,

and later spread to the whole world. The Depression played a vital role in the development of

macroeconomic policies intended to temper economic downturns and upturns

24

. We can see

dates of the Great Depression in Various Countries: United States (1929-1933), Great Britain

(1930-1932), Germany (1928-1932), France (1930-1932), Canada (1929-1933), Switzerland

(1929-1933), Czechoslovakia (1929-1933), Italy (1929-1933), Belgium (1929-1933),

Netherlands (1929-1933), Sweden (1930-1932), Denmark (1930-1933), Poland (1929-1933),

Argentina (1929-1932), Brazil (1928-1931), Japan (1930-1932), India (1929-1931), South

Africa (1930-1933)

25

.

23

Ibidem.

24

Romer D. C., Great Depression, Forthcoming in the Encyclopedia Britannica, 2003, p. 223

25

Ibidem.

CRASHES AND CRISES IN THE FINANCIAL MARKETS . THE

IMPORTANCE OF SPECULATIVE BUBBLES.

Patrycja Gniadzik, Magdalena Cupryjak, Mateusz Jarzębski

Strona 10

The Great Depression surprised the United States – the only one industrialized country in the

world without some form of unemployment insurance or social security. In 1935, Congress

passed the Social Security Act, which for the first time provided Americans with

unemployment, disability and pensions for old age

26

.

A new deal taken an unequal fight against unemployment through the launch of public

works for the construction of roads and even bridges in the United States. Prosperity tried to

shoot the procurement and development of the defense industry. But in fact all the plans

reduce unemployment to only 10% ended in a fiasco

27

.

What was the real problem? Economic theory shows that the business cycle can be

invoked only by inflation stimulated by the government, and the inflationist and

interventionist methods can only prolong and deepen the crisis. the cause of the crisis was not

the principle of laissez – faire, because just government interventions have led to an unhealthy

boom of the twenties , and new methods of Hoover , involving advanced interventionism,

tightened the course of the Great Depression. A blame is not on the side of a free market

economy – it's time to clean the free market and laissez-faire. To be honest, someone else

should be blamed, it means: politicians, bureaucrats and a lot of “enlightened” economists.

DOT-COM BUBBLE

The dot-com bubble was a historic speculative bubble covering roughly 1997–2000

during which stock markets in industrialized nations saw their equity value rise rapidly from

growth in the Internet sector and related fields. While the latter part was a boom and bust

cycle, the Internet boom is sometimes meant to refer to the steady commercial growth of the

Internet with the advent of the World Wide Web, as exemplified by the first release of the

Mosaic web browser in 1993, and continuing through the 1990s.

During the late 20th century, the Internet created a euphoric attitude toward business

and inspired many hopes for the future of online commerce. For this reason, many Internet

26

The Great Depression, web: http://www.history.com/topics/great-depression

,

acces: 27.05.2016

27

Redakcja Investroom, Wielki Kryzys z 1933 r. – największy kryzys gospodarczy w historii, published:

16.03, web:

https://investroom.pl/blog/307-2/

, access: 30.05.2016

CRASHES AND CRISES IN THE FINANCIAL MARKETS . THE

IMPORTANCE OF SPECULATIVE BUBBLES.

Patrycja Gniadzik, Magdalena Cupryjak, Mateusz Jarzębski

Strona 11

companies (known as “dot-coms”) were launched, and investors assumed that a company that

operated online was going to be worth millions.

The dotcom bubble started growing in the late ’90s, as access to the internet expanded and

computing took on an increasingly important part in people’s daily lives. Online retailing was

one of the biggest drivers of this growth, with sites like Pets.com getting big investors and

gaining a place in American consumer culture

28

.

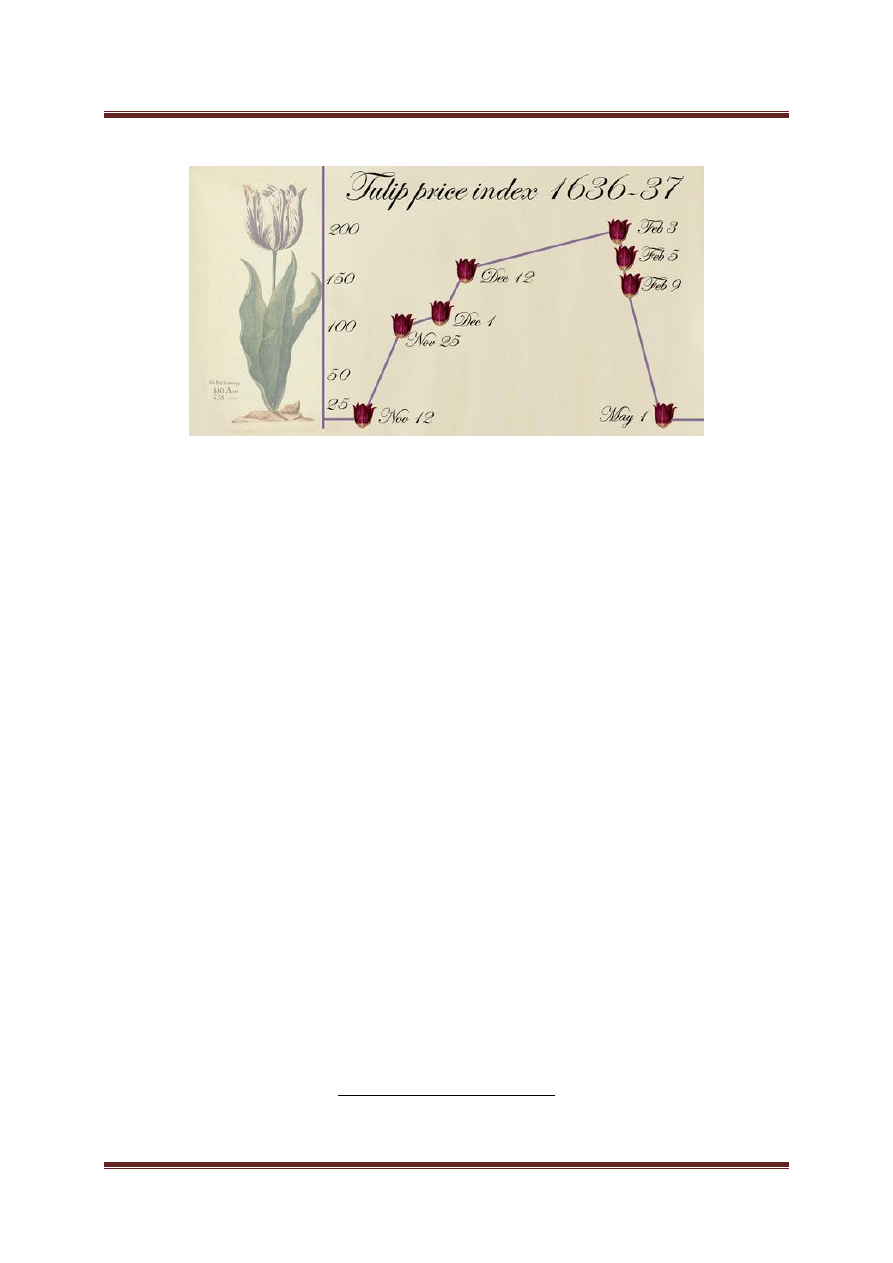

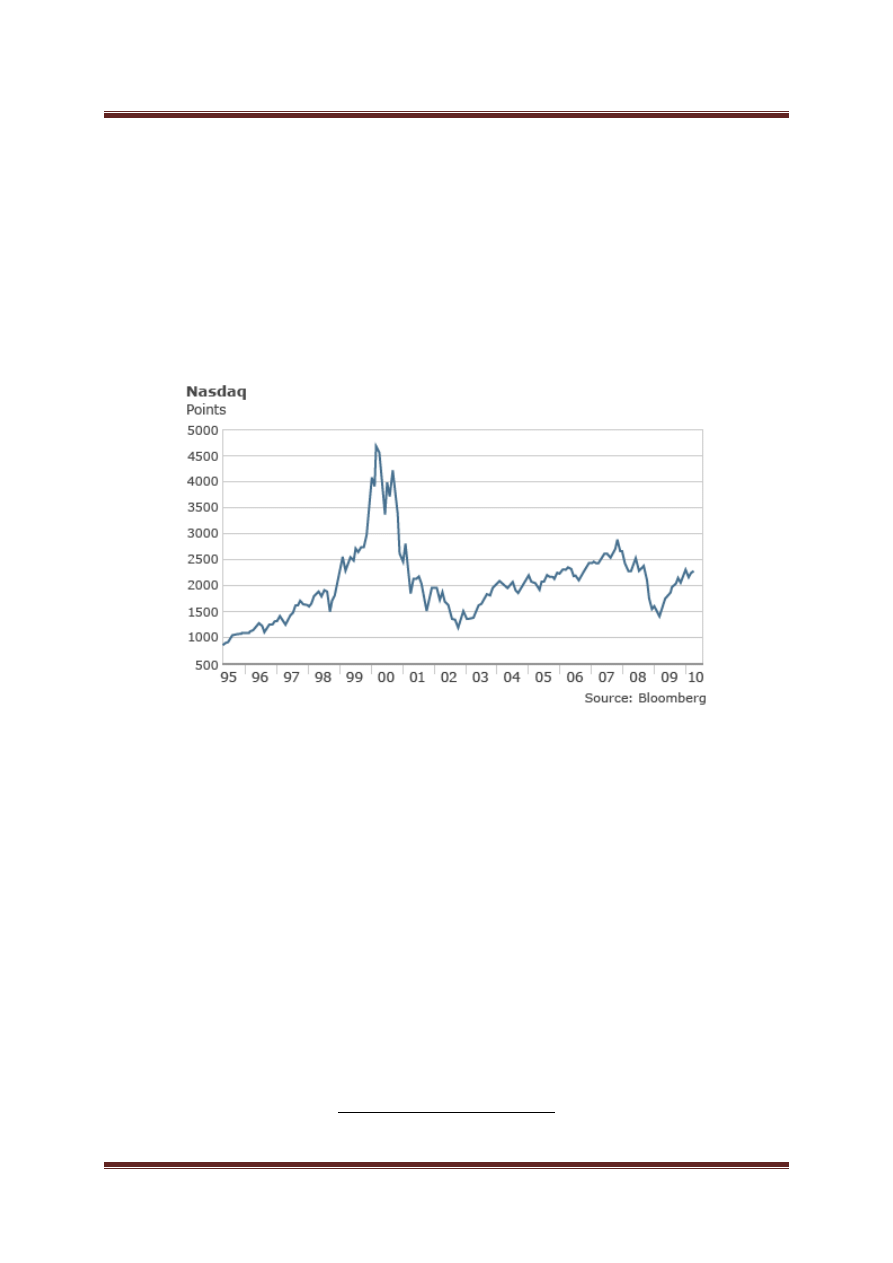

Chart 5. The Nasdaq (index of leading technology) in years 1995-2010).

Source: Madslien J., Dotcom bubble burst: 10 years on, published: 10.03.2010, web:

http://news.bbc.co.uk/2/hi/business/8558257.stm, access: 04.06.2016

With the investment and excitement, stock values grew. The value of the NASDAQ,

home to many of the biggest tech stocks, grew from around 1,000 points in 1995 to more than

5,000 in 2000. Companies were going to market with IPOs and fetching huge prices, with

stocks sometimes doubling on the first day. It was a seeming wonderland where anyone with

an idea could start making money.

Due to the rise in the commercial growth of the Internet, venture capitalists saw

record-setting growth as "dot-com" companies experienced meteoric rises in their stock prices

and therefore moved faster and with less caution than usual, choosing to mitigate the risk by

starting many contenders and letting the market decide which would succeed. The low interest

rates of 1998–99 helped increase the start-up capital amounts. A canonical “dot-com”

28

Smith K., History of the Dot-Com Bubble Burst and How to Avoid Another, web:

http://www.moneycrashers.com/dot-com-bubble-burst/, access: 02.06.2016

CRASHES AND CRISES IN THE FINANCIAL MARKETS . THE

IMPORTANCE OF SPECULATIVE BUBBLES.

Patrycja Gniadzik, Magdalena Cupryjak, Mateusz Jarzębski

Strona 12

company’s business model relied on harnessing network effects by operating at a sustained

net loss and building market share. These companies offered their services or end product for

free with the expectation that they could build enough brand awareness to charge profitable

rates for their services later. The motto “get big fast” reflected this strategy

29

.

This occurred in industrialized nations due to the reducing “digital divide” in the late

1990s, and early 2000s. Previously, individuals were less capable of accessing the Internet,

many stopped by lack of local access/connectivity to the infrastructure, and/or the failure to

understand use for Internet technologies. The absence of infrastructure and a lack of

understanding were two major obstacles that previously obstructed mass connectivity. For

these reasons, individuals had limited capabilities in what they could do and what they could

achieve in accessing technology. Increased means of connectivity to the Internet than

previously available allowed the use of ICT (Information and Communications Technology)

to progress from a luxury good to a necessity good. As connectivity grew, so did the potential

for venture capitalists to take advantage of the growing field. The functionalism, or impacts of

technologies driven from the cost effectiveness of new Internet websites ultimately influenced

the demand growth during this time.

In financial markets, a stock market bubble is a self-perpetuating rise or boom in the share

prices of stocks of a particular industry; the term may be used with certainty only in retrospect

after share prices have crashed. A bubble occurs when speculators note the fast increase in

value and decide to buy in anticipation of further rises, rather than because the shares are

undervalued. Typically, during a bubble, many companies thus become grossly overvalued.

When the bubble “bursts”, the share prices fall dramatically. The prices of many non-

technology stocks increased in tandem and were also pushed up to valuations discorrelated

relative to fundamentals

30

.

In March of 2000, everything started to change. On March 10, the combined values of

stocks on the NASDAQ was at $6.71 trillion; the crash began March 11. By March 30, the

NASDAQ was valued at $6.02 trillion. On April 6, 2000, it was $5.78 trillion. In less than a

month, nearly a trillion dollars worth of stock value had completely evaporated.

Companies started folding. (Pets.com was one.) Magazines, including TIME, started running

stories advising investors on how to limit their exposure to the tech sector, sensing that people

29

Galbraith J.K., Hale T., Income Distribution and the Information Technology Bubble, University of Texas,

2004, p. 14

30

Lowenstein R., Origins of the Crash: The Great Bubble and Its Undoing, Penguin Books, 2004, pp. 114–

115.

CRASHES AND CRISES IN THE FINANCIAL MARKETS . THE

IMPORTANCE OF SPECULATIVE BUBBLES.

Patrycja Gniadzik, Magdalena Cupryjak, Mateusz Jarzębski

Strona 13

were going to start taking a beating if their portfolios were too tied to e-tailers and other

companies that were dropping like flies.

Several communication companies could not weather the financial burden and were

forced to file for bankruptcy. One of the more significant players, WorldCom, was found

engaging in illegal accounting practices to exaggerate its profits on a yearly basis.

WorldCom’s stock price fell drastically when this information went public, and it eventually

filed the third-largest corporate bankruptcy in U.S. history. Other examples include

NorthPoint Communications, Global Crossing, JDS Uniphase, XO Communications, and

Covad Communications. Companies such as Nortel, Cisco, and Corning were at a

disadvantage because they relied on infrastructure that was never developed which caused the

stock of Corning to drop significantly. Many dot-coms ran out of capital and were acquired or

liquidated; the domain names were picked up by old-economy competitors, speculators or

cybersquatters. Several companies and their executives were accused or convicted of fraud for

misusing shareholders’ money, and the U.S. Securities and Exchange Commission fined top

investment firms like Citigroup and Merrill Lynch millions of dollars for misleading

investors. Various supporting industries, such as advertising and shipping, scaled back their

operations as demand for their services fell. A few large dot-com companies, such as

Amazon.com, eBay, and Google have become industry-dominating mega-firms. The stock

market crash of 2000–2002 caused the loss of $5 trillion in the market value of companies

from March 2000 to October 2002. The September 11, 2001, attacks accelerated the stock

market drop; the NYSE suspended trading for four sessions. When trading resumed, some of

it was transacted in temporary new locations

31

.

More in-depth analysis shows that 48% of the dot-com companies survived through

2004. With this, it is safe to assume that the assets lost from the stock market do not directly

link to the closing of firms. More importantly, however, it can be concluded that even

companies who were categorized as the “small players” were adequate enough to endure the

destruction of the financial market during 2000–2002. Additionally, retail investors who felt

burned by the burst transitioned their investment portfolios to more cautious positions.

Nevertheless, laid-off technology experts, such as computer programmers, found a glutted job

market. University degree programs for computer-related careers saw a noticeable drop in

31

Goldfarb, Brent; Kirsch, David; Miller, David A., Was there too little entry during the Dot Com Era?, Journal

of Financial Economics 86, 2007, (1): 100–44.

CRASHES AND CRISES IN THE FINANCIAL MARKETS . THE

IMPORTANCE OF SPECULATIVE BUBBLES.

Patrycja Gniadzik, Magdalena Cupryjak, Mateusz Jarzębski

Strona 14

new students. Anecdotes of unemployed programmers going back to school to become

accountants or lawyers were common

32

.

As the technology boom receded, consolidation and growth by market leaders caused

the tech industry to come to more closely resemble other traditional U.S. sectors. As of 2014,

ten information technology firms are among the 100 largest U.S. corporations by revenues.

HOUSING BUBBLE

A real estate bubble or property bubble (or housing bubble for residential markets) is a

type of economic bubble that occurs periodically in local or global real estate markets,

typically following a land boom. A land boom is the rapid increase in the market price of real

property such as housing until they reach unsustainable levels and then decline in a bubble.

Bubbles in housing markets are more critical than stock market bubbles. Housing price

busts are less frequent, but last nearly twice as long and lead to output losses that are twice as

large. A recent laboratory experimental study also shows that, compared to financial markets,

real estate markets involve longer boom and bust periods

33

.

As with all types of economic bubbles, disagreement exists over whether or not a real

estate bubble can be identified or predicted, then perhaps prevented. Speculative bubbles are

persistent, systematic and increasing deviations of actual prices from their fundamental

values. Bubbles can often be hard to identify, even after the fact, due to difficulty in

accurately estimating intrinsic values. In real estate, fundamentals can be estimated from

rental yields (where real estate is then considered in a similar vein to stocks and other

financial assets) or based on a regression of actual prices on a set of demand and/or supply

variables

34

.

Within mainstream economics it can be posed that real estate bubbles cannot be

identified as they occur and cannot or should not be prevented, with government and central

bank policy rather cleaning up after the bubble bursts. Economic bubbles, and in particular

real estate bubbles, are not considered major concerns. Within some schools of economics, by

32

Geier B., What Did We Learn From the Dotcom Stock Bubble of 2000?, published: 12.03.2015, web:

http://time.com/3741681/2000-dotcom-stock-bust/, access: 02.06.2016

33

Shiller R., Irrational Exuberance (2d ed.). Princeton University Press, 2005, p. 16

34

Laperriere A., Housing Bubble Trouble: Have we been living beyond our means?, published: 10.04.2006,

The Weekly Standard, 2006

CRASHES AND CRISES IN THE FINANCIAL MARKETS . THE

IMPORTANCE OF SPECULATIVE BUBBLES.

Patrycja Gniadzik, Magdalena Cupryjak, Mateusz Jarzębski

Strona 15

contrast, real estate bubbles are considered of critical importance and a fundamental cause of

financial crises and ensuing economic crises. The United States housing bubble was a real

estate bubble affecting over half of U.S. states. Housing prices peaked in early 2006, started to

decline in 2006 and 2007, and reached new lows in 2012. On December 30, 2008, the Case-

Shiller home price index reported its largest price drop in its history. The credit crisis

resulting from the bursting of the housing bubble is—according to general consensus—the

primary cause of the 2007–2009 recession in the United States

35

.

Any collapse of the U.S. housing bubble has a direct impact not only on home

valuations, but mortgage markets, home builders, real estate, home supply retail outlets, Wall

Street hedge funds held by large institutional investors, and foreign banks, increasing the risk

of a nationwide recession. Concerns about the impact of the collapsing housing and credit

markets on the larger U.S. economy caused President George W. Bush and the Chairman of

the Federal Reserve Ben Bernanke to announce a limited bailout of the U.S. housing market

for homeowners who were unable to pay their mortgage debts

36

.

The 2008 bubble burst within the red line districts of the United States residential

market. In their late stages, they are typically characterized by rapid increases in the

valuations of real property until unsustainable levels are reached relative to incomes, price-to-

rent ratios, and other economic indicators of affordability. This may be followed by decreases

in home prices that result in many owners finding themselves in a position of negative

equity—a mortgage debt higher than the value of the property. The underlying causes of the

housing bubble are complex. Factors include tax policy (exemption of housing from capital

gains), historically low interest rates, lax lending standards, failure of regulators to intervene,

and speculative fever. This bubble may be related to the stock market or dot-com bubble of

the 1990s.

A SUMMATION

Speculative Bubbles are a phenomenon that is not really fully understood. For a more

complete understanding of any speculative mania each case should be looked at separately, so

35

Holt J., A Summary of the Primary Causes of the Housing Bubble and the Resulting Credit Crisis: A Non-

Technical Paper, 2009, 8, 1, The Journal of Business Inquiry, p. 120-129.

36

Nielsen B., Why Housing Market Bubbles Pop, web:

http://www.investopedia.com/articles/07/housing_bubble.asp, access: 01.06.2016

CRASHES AND CRISES IN THE FINANCIAL MARKETS . THE

IMPORTANCE OF SPECULATIVE BUBBLES.

Patrycja Gniadzik, Magdalena Cupryjak, Mateusz Jarzębski

Strona 16

from a psychological, as well as the econometric point of view. Financial bubbles described

above are selected examples of crises of this kind in the history of mankind. They resulted in

huge financial losses and deprived of hope for a better tomorrow huge and powerful state and

its residents. Mechanisms of financial crashes are very similar, regardless of when and where

they occur. They point to the need for a rational assessment of the risks of investing. Global

capitalism is entering a new era. World trade continues to govern the logic of supply and

demand, just panic and euphoria, behind which follow the huge waves of financial resources.

CRASHES AND CRISES IN THE FINANCIAL MARKETS . THE

IMPORTANCE OF SPECULATIVE BUBBLES.

Patrycja Gniadzik, Magdalena Cupryjak, Mateusz Jarzębski

Strona 17

BIBLIOGRAPHY

Compact publications:

1. Gross D., Bulb Bubble Trouble; That Dutch tulip bubble wasn't so crazy after all,

Slate, July 16, 2004. Retrieved on November 4, 2011.

2. Romer C.D., Great Depression, Forthcoming in the Encyclopedia Britannica, 2003

3. Shiller R., "Bubbles without Markets". Project Syndicate. Retrieved 17 August 2012

4. Shiller R., Irrational Exuberance (2d ed.). Princeton University Press, 2005,

Science articles:

1. Frankel A., When the Tulip Bubble Burst, ,Business Week, April 4, 2000

2. Garber P., Famous First Bubbles: The Fundamentals of Early Manias. Cambridge,

MA: MIT Press, 2001

3. Galbraith J.K., Hale T., Income Distribution and the Information Technology Bubble,

University of Texas, 2004,

4. Goldfarb, Brent; Kirsch, David; Miller, David A., Was there too little entry during the

Dot Com Era?, Journal of Financial Economics 86, 2007,

5. Goldgar A., Tulipmania: Money, Honor, and Knowledge in the Dutch Golden Age.

London: University of Chicago Press, 2008

6. Gross D., Bulb Bubble Trouble; That Dutch tulip bubble wasn't so crazy after all,

Slate, July 16, 2004. Retrieved on November 4, 2011.

7. Holt J., A Summary of the Primary Causes of the Housing Bubble and the Resulting

Credit Crisis: A Non-Technical Paper, 2009, 8, 1, The Journal of Business Inquiry

8. King R., Smith V., Williams A., van Boening M., "The Robustness of Bubbles and

Crashes in Experimental Stock Markets". In Day, R. H.; Chen, P.Nonlinear Dynamics

and Evolutionary Economics. New York: Oxford University Press, 1993.

9. Laperriere A., Housing Bubble Trouble: Have we been living beyond our means?,

published: 10.04.2006, The Weekly Standard, 2006

10. Lowenstein R., Origins of the Crash: The Great Bubble and Its Undoing, Penguin

Books, 2004,

11. Murray N. Rothbard, Wielki Kryzys w Ameryce / America’s Great Depression, The

Ludwig von Mises Institute, 2000,

CRASHES AND CRISES IN THE FINANCIAL MARKETS . THE

IMPORTANCE OF SPECULATIVE BUBBLES.

Patrycja Gniadzik, Magdalena Cupryjak, Mateusz Jarzębski

Strona 18

12. Starr Myers W., Newton W.H., The Hoover Administration, New York 1936, part 1;

William Starr Myers (red.), The State Papers of Herbert Hoover, New York 1934,

Internet publications:

1.

Davies G., How to detect a market buble?, published: 17.01.2014, Web:

http://blogs.ft.com/gavyndavies/2014/01/17/how-to-detect-a-market-bubble/,

access;

16.05.2016

2. Five

steps

of

a

bubble,

Forbes,

published:

17.06.2010,

web:

http://www.forbes.com/2010/06/17/guide-financial-bubbles-personal-finance-

bubble.html, access 15.05.2016

3. Gabiś T., Wielki kryzys – wielka zagadka? , published: 29.02.2012, web:

http://nowadebata.pl/2012/02/29/wielki-kryzys-wielka-zagadka, access:

27.05.2016

4. Geier B., What Did We Learn From the Dotcom Stock Bubble of 2000?, published:

12.03.2015, web: http://time.com/3741681/2000-dotcom-stock-bust/, access:

02.06.2016

5. Light J., How to spot a market bubble?, published; 18.04.2014, Web:

http://www.wsj.com/articles/SB1000142405270230462630457950741351799

9956, access; 13.05.2016

6. Madslien J., Dotcom bubble burst: 10 years on, published: 10.03.2010, web:

http://news.bbc.co.uk/2/hi/business/8558257.stm, access: 04.06.2016

7. Nielsen B., Why Housing Market Bubbles Pop, web:

http://www.investopedia.com/articles/07/housing_bubble.asp, access: 01.06.2016

8. PHOTOS OF-1930 -THE GREAT STOCK MARKET CRASH & DEPRESSION

unemployment,poverty –AMERICA, web:

http://pazhayathu.blogspot.com/2010/10/photos-of-1930-great-stock-market-

crash.html, access: 03.06.2016

9. Redakcja Investroom, Wielki Kryzys z 1933 r. – największy kryzys gospodarczy w

historii, published: 16.03, web: https://investroom.pl/blog/307-2/, access: 30.05.2016

10. Richman H., Growing Trade Deficit continues U.S. Depression, published:

31.10.2010, web: http://www.idealtaxes.com/post3242.shtml, access: 04.06.2016

CRASHES AND CRISES IN THE FINANCIAL MARKETS . THE

IMPORTANCE OF SPECULATIVE BUBBLES.

Patrycja Gniadzik, Magdalena Cupryjak, Mateusz Jarzębski

Strona 19

11. Smith K., History of the Dot-Com Bubble Burst and How to Avoid Another, web:

http://www.moneycrashers.com/dot-com-bubble-burst/, access: 02.06.2016

12. Stock market crash - Black Thursday / Black Tuesday - October 1929, web:

http://www.sniper.at/stock-market-crash-1929.htm, access: 04.06.2016

13. THE CONTEMPORARY WOMEN, Tulipomania: The Story about How the Tulip

became a Distinctive Symbol of the Netherlands, published: 26.05.2015, web:

http://thecontemporarywomen.com/2015/05/26/tulipomania-the-story-about-how-the-

tulip-became-a-distinctive-symbol-of-the-netherlands/, access: 28.05,2016

14. The Great Depression, web: http://www.history.com/topics/great-depression, access:

27.05.2016,

Wyszukiwarka

Podobne podstrony:

CRASHES AND CRISES IN THE FINANCIAL MARKETS

Poultry Products and Processing in the International Market Place

Ideals and action in the reign of Otto III

Aftershock Protect Yourself and Profit in the Next Global Financial Meltdown

Aftershock Protect Yourself and Profit in the Next Global Financial Meltdown

Being Warren Buffett [A Classroom Simulation of Risk And Wealth When Investing In The Stock Market]

A Guide to the Law and Courts in the Empire

D Stuart Ritual and History in the Stucco Inscription from Temple XIX at Palenque

keohane nye Power and Interdependence in the Information Age

Philosophy and Theology in the Middle Ages by GR Evans (1993)

Copper and Molybdenum?posits in the United States

Nugent 5ed 2002 The Government and Politics in the EU part 1

Phoenicia and Cyprus in the firstmillenium B C Two distinct cultures in search of their distinc arch

F General government expenditure and revenue in the UE in 2004

20 Seasonal differentation of maximum and minimum air temperature in Cracow and Prague in the period

Art and Architecture in the Islamic Tradition

Derrida, Jacques Structure, Sign And Play In The Discourse Of The Human Sciences

A Guide to the Law and Courts in the Empire

więcej podobnych podstron