Published on Zero Hedge (http://www.zerohedge.com)

Home > Bundesbank Warns China's Currency "On Its Way To Becoming Global Reserve Currency"

Bundesbank Warns China's Currency "On Its Way To Becoming Global

Reserve Currency"

By Tyler Durden

Created 07/06/2013 - 14:48

[1]

Submitted by Tyler Durden

[1]

on 07/06/2013 14:48 -0400

Following the most recent shift 'away' from a USD-centric world (with the China-Australia direct currency convertibility

[17]

), it seems the possibility of China's Yuan

as the next global reserve currency is getting closer. The Brits, Germans, and now the Swiss (who just signed a free-trade-agreement with China) are all

actively vying to become Europe's Yuan trading hub as it seems the long line of developments to internationalize the currency

[17]

over the past two years. As

Bundesbank board member Joachim Nagel noted in a speech entitled "Reniminbi as a potential reserve currency" this week, "the Chinese currency is well on

its way to becoming one of the future global reserve currencies." He noted that, although the USD is still the most commonly-used currency for settling trade

with China; from virtually zero in 2010, the Yuan is used to settle over 12% of trading transactions now - and is likley to increase further.

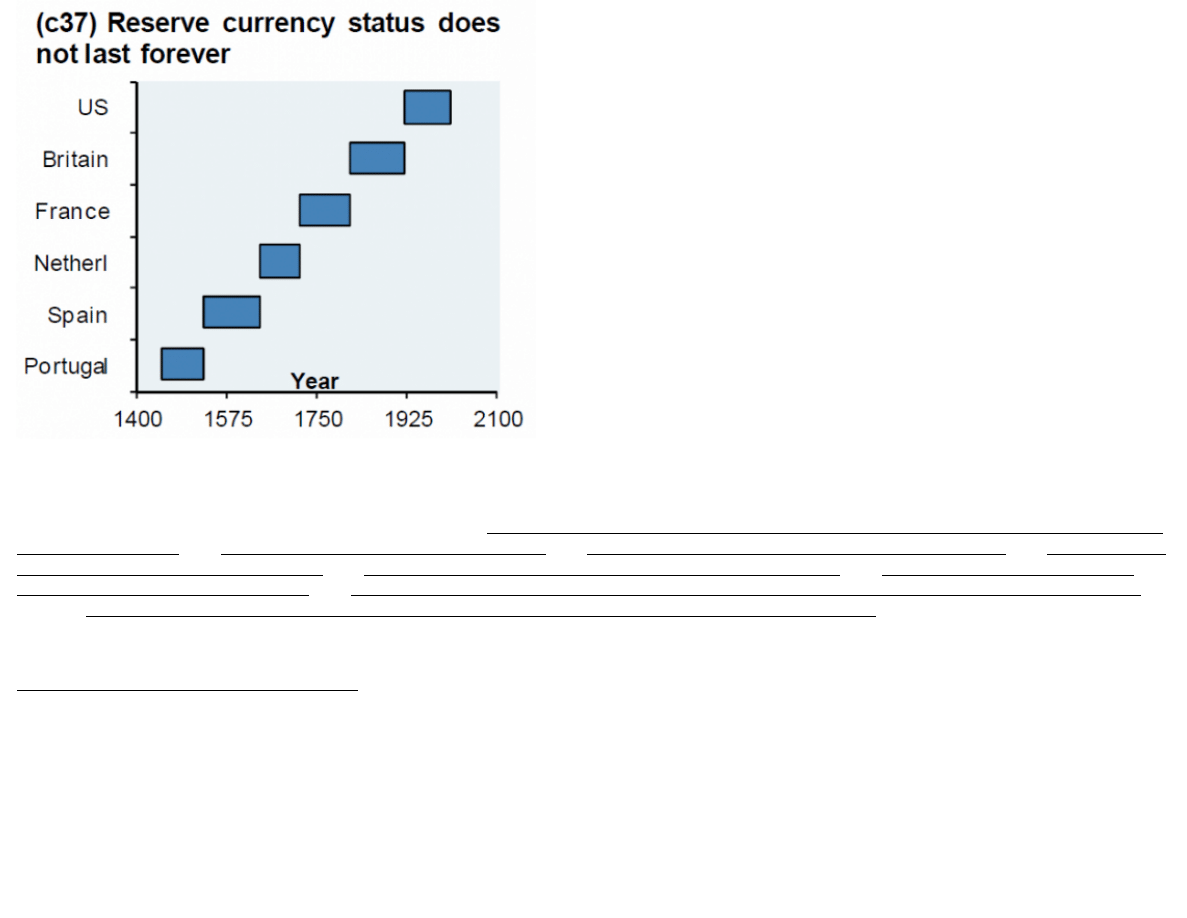

Remember, nothing lasts forever:

1

Like

[18]

This latest development in global currency relations should come as no surprise to those who have followed our series on China's slow but certain

internationalization of its currency over the past two years. To wit: "World's Second (China) And Third Largest (Japan) Economies To Bypass Dollar, Engage In

Direct Currency Trade

", "China, Russia Drop Dollar In Bilateral Trade

", "China And Iran To Bypass Dollar, Plan Oil Barter System

sign new $15bn currency swap agreement

", "Iran, Russia Replace Dollar With Rial, Ruble in Trade, Fars Says

", "India Joins Asian Dollar Exclusion

Zone, Will Transact With Iran In Rupees

[25]

[17]

."

Via Deutsche Bundebank (Dr. Joachim Nagel)

[26]

,

Renminbi as a potential reserve currency

According to Bundesbank Executive Board member Joachim Nagel, the Chinese currency is well on its way to becoming one of the future global reserve

currencies. This potential stems from the renminbi’s increasing convertibility, he said at a conference of the Chamber of Industry and Commerce in Frankfurt.

He emphasised that although the US dollar is currently the most commonly used currency for settling trade with China, the significance of the renminbi has

increased greatly over the last few years. He underlined this by referring to figures published by SWIFT, which indicate that the percentage of trading

transactions settled in renminbi jumped from virtually zero to around 12% between 2010 and 2012 – and is likely to increase further. In view of this, he pointed out

that the renminbi has already achieved the status of a trading currency.

Drawing parallels to the Deutsche Mark

Mr Nagel compared China’s growing importance with the German economic miracle of the 1950s and drew parallels between the renminbi's current growth and

the development of the Deutsche Mark. Thanks to the recovery of the German economy, the country accumulated a large volume of foreign exchange reserves and

the Deutsche Mark acquired the status of a global investment and reserve currency, he explained. He anticipates that "the renminbi is certain to have similar

long-term prospects if market access is liberalised further". Mr Nagel backed up his comments by citing a survey of reserve managers carried out by RBS.

The survey revealed that 14% of reserve managers have already invested in renminbi, with 37% of respondents considering investing in the currency in the

next five to ten years.

Mr Nagel sees the renminbi as currently transitioning from a being trading currency to an investment currency. While both inward and outward direct

investment is now possible, portfolio investments will continue to be regulated, he remarked, adding that improvements are expected in this area. "The

internationalisation process of the Chinese currency is taking place more gradually than was the case with the Deutsche Mark, which, at times, was subject to

radical upheaval", he added. Mr Nagel recalled, in this context, the collapse of the Bretton Woods system of fixed exchange rates and the crisis in the European

Monetary System at the beginning of the 1990s.

Renminbi financial centre in Frankfurt

Mr Nagel noted that "given China’s growing economic importance, the internationalisation of the renminbi seems long overdue". He explained the

Chinese government’s decision to employ offshore trading centres, which would allow China to establish its currency internationally, while protecting its domestic

financial system. Hong Kong, where around 80% of all renminbi trade is settled, is by far the most important trading centre for the currency, with London and

Singapore each accounting for 4% of renminbi trade since mid-2012. He added that the expansion of the market has led to the growing significance of other

financial centres for renminbi.

Mr Nagel welcomed Frankfurt’s endeavour to position itself as a trading hub for the Chinese currency, calling it a step in the right direction, towards

the free movement of capital. "The high level of interaction between China's and Germany's real economies highlights the necessity for a more active renminbi

trade", Mr Nagel remarked, "perhaps even using Germany as a hub"

[27]

.

- advertisements -

Wyszukiwarka

Podobne podstrony:

On the way to DSM V

Sunrise Avenue Album [On the Way to Wonderland]

On the Way to a Smile

RMB to be global reserve currency by 2030 Xinhua

2 4 Unit 1 Lesson 3 – On The Way To The Club

On the Way to Krishna

The paradox of China’s push to build a global currency Kynge

Khenchen Thrangu Rinpoche Middle Way Meditation Instructions, Based on Mipham s Gateway to Knowledge

santas on his way worksheet letter to santa

On a slow boat to China

Keys To Becoming Confident

Magnetic Treatment of Water and its application to agriculture

090219 3404 NUI FR 160 $3 9 million spent on the road to success in?ghanistan

Bushmen's way to work free life

ekonomia giełda, Globalizacja, Co to jest globalizacja

2 The way to ionize a compound (ESI, APCI, APPI)

10w to optym globalna bez ogran 2011

Kimon Nicolaides The Natural Way to Draw

PHOTOSHOP YOUR WAY TO AMAZING ASTROPHOTOS

więcej podobnych podstron