Risk Disclosure: Trading Futures, Options on Futures, and Foreign Exchange involves substantial risk of loss and

may not be suitable for all investors. You should carefully consider whether trading is suitable for you in light of

your circumstances, knowledge, and financial resources. Opinions, market data, and recommendations are

subject to change at any time. The information contained on this website does not constitute a solicitation to buy

or sell by NCMFX, INC., and/or its affiliates, and is not to be available to individuals in a jurisdiction where such

availability would be contrary to local regulation or law.

© 2007 NCMFX, Inc. All Rights Reserved

1

How To Choose The Right Dealing Firm:

A Practical Guide For Getting The Best

Out Of Your Forex Trading

By

Alexander Nekritin

Risk Disclosure: Trading Futures, Options on Futures, and Foreign Exchange involves substantial risk of loss and

may not be suitable for all investors. You should carefully consider whether trading is suitable for you in light of

your circumstances, knowledge, and financial resources. Opinions, market data, and recommendations are

subject to change at any time. The information contained on this website does not constitute a solicitation to buy

or sell by NCMFX, INC., and/or its affiliates, and is not to be available to individuals in a jurisdiction where such

availability would be contrary to local regulation or law.

© 2007 NCMFX, Inc. All Rights Reserved

2

TABLE OF CONTENTS

Introduction .................................................................................. 3

Regulation and Capitalization ..................................................... 5

Dealing Practices........................................................................... 7

Platforms ..................................................................................... 12

Customer Service ........................................................................ 17

Leverage ...................................................................................... 18

Your Style and Your Dealer ...................................................... 18

Forex Managers .............................................................. 29

Introducing Brokers and Perks ..................................... 32

Conclusion ....................................................................... 34

Risk Disclosure: Trading Futures, Options on Futures, and Foreign Exchange involves substantial risk of loss and

may not be suitable for all investors. You should carefully consider whether trading is suitable for you in light of

your circumstances, knowledge, and financial resources. Opinions, market data, and recommendations are

subject to change at any time. The information contained on this website does not constitute a solicitation to buy

or sell by NCMFX, INC., and/or its affiliates, and is not to be available to individuals in a jurisdiction where such

availability would be contrary to local regulation or law.

© 2007 NCMFX, Inc. All Rights Reserved

3

Introduction

When it comes to forex trading, choosing the right dealing firm could

be the difference between success and failure. Because currency trading does

not have a centralized exchange many features differ from firm to firm.

These include price feed, market making system, platform, capitalization

order execution, and much more.

To make matters more complicated different trading firms will fit to

different trading styles. On top of that in many cases the deal and

relationship that you put together with a dealing firm will also have an

impact on your trading. As of right now, forex is a very unregulated industry

with a very high income potential to brokers. Because of this it becomes

almost impossible to distinguish solid clearing firms from low level bucket

shops that will do everything possible to make you lose.

Other than basic price movements in forex trading there are many

other forces working against you. Unless you have at least a basic

understanding of the players and forces involved you will have absolutely no

chance. Even seasoned veteran traders take counterparties and other players

into consideration when trading in order to be successful.

Here are the basic aspects to focus on when it comes to broker

selection: 1) Players involved 2) Regulation and Capitalization 3) Platform

4) Price feed 5) Trade Execution and Dealing 6) Customer Service

In this guide we will show you all the intricacies and tricks of the

trade to make sure that your trading will not be negatively impacted by your

dealing firm. I will also discuss which broker best fits to certain trading

styles like news trading, position trading, scalping and carry trading. I will

focus on how you can stay under the radar and the importance of using a

proper introducing broker.

Finally I will discuss the best dealing firms for money manager and

introducing brokers to use and cap it off with a brief broker review of some

of the major dealing firms.

Risk Disclosure: Trading Futures, Options on Futures, and Foreign Exchange involves substantial risk of loss and

may not be suitable for all investors. You should carefully consider whether trading is suitable for you in light of

your circumstances, knowledge, and financial resources. Opinions, market data, and recommendations are

subject to change at any time. The information contained on this website does not constitute a solicitation to buy

or sell by NCMFX, INC., and/or its affiliates, and is not to be available to individuals in a jurisdiction where such

availability would be contrary to local regulation or law.

© 2007 NCMFX, Inc. All Rights Reserved

4

One important thing to understand is that forex is a zero sum game. So

for every loser there is usually a winner and for every winner there is usually

a loser. A good analogy to use is think of poker as one big poker room with

some regulars (FCM’s and Bank) who live of the game, some tourist visitors

(retail traders) who are coming in to have fun, and everything in between.

As you can imagine the regulars who do this for a living really do not

like to lose and they have many advantages on their sides to make sure they

do not lose. For an individual trader or a small or mid level money manager

the key is not to fight with the big players but to work the system in order to

increase success. Many traders don’t realize that and start out trading with

the wrong firms, and doing the wrong things and get burnt and discouraged,

when in reality they may have had a good approach but just chose the wrong

counterparties at the wrong time.

Some traders may have a good strategy but choose a firm so small and

dangerous that they can never collect on their winnings. It amazes me how

many clients are willing to just throw their hard earned money into anything

without doing thorough and diligent research. Smart traders take every angle

into consideration before risking their hard earned money.

Risk Disclosure: Trading Futures, Options on Futures, and Foreign Exchange involves substantial risk of loss and

may not be suitable for all investors. You should carefully consider whether trading is suitable for you in light of

your circumstances, knowledge, and financial resources. Opinions, market data, and recommendations are

subject to change at any time. The information contained on this website does not constitute a solicitation to buy

or sell by NCMFX, INC., and/or its affiliates, and is not to be available to individuals in a jurisdiction where such

availability would be contrary to local regulation or law.

© 2007 NCMFX, Inc. All Rights Reserved

5

Regulation and Capitalization

Before you start worrying about being a successful trader you need to

be comfortable with how secure your money is at a dealing firm. When you

open a margined forex account you are not considered a secured creditor like

you are with stocks or futures. What this means is that is the dealing firm

goes out of business you do not get your money back. Dealing firms have

gone out of business before and they most likely will do it again. This

happened with large firms like Refco and small shops like CFG.

When it comes to regulation, it is pretty straight forward. In my

opinion you should stick to US based, NFA and CFTC registered firms

unless you absolutely have to go off shore because of your trading style.

The NFA is a Self Regulatory Organization (SRO) that monitors the

behavior of forex dealing firms. The NFA always makes sure that the firms

have sufficient capitalization, proper trade reconciliation, ethical business

solicitation, solid anti money laundering policy and much more.

There are a few key things that you can use the NFA for. First is to

visit the NFA website

. All US firms should be

registered as an FCM (Futures Commission Merchant).

There is a way to check the registration status of a firm and that is

with the NFA Basic Service

http://www.nfa.futures.org/basicnet/

page, you can put a firm’s NFA ID or name and receive their registration

information, the name of the principles and prior registration of the

principles. You can also see if there was any history of complaints against

the firm.

There are a few things to keep in mind, however, when it comes to

complaints. In our opinion you need to take into consideration the size of the

firm. The more customers a firm has the more likely they are to have a

complaint. So you can not weigh just complaints, you need to take into

consideration a firm's capitalization and client base.

Risk Disclosure: Trading Futures, Options on Futures, and Foreign Exchange involves substantial risk of loss and

may not be suitable for all investors. You should carefully consider whether trading is suitable for you in light of

your circumstances, knowledge, and financial resources. Opinions, market data, and recommendations are

subject to change at any time. The information contained on this website does not constitute a solicitation to buy

or sell by NCMFX, INC., and/or its affiliates, and is not to be available to individuals in a jurisdiction where such

availability would be contrary to local regulation or law.

© 2007 NCMFX, Inc. All Rights Reserved

6

A good place to find out how well a firm is capitalized is on the CFTC

website. The CFTC is the Commodity Futures Trading Commission. Their

website is www.cftc.gov. In order to look up a firm’s capitalization you need

to go to this website

http://www.cftc.gov/tm/tmfcm.htm

. Look at the

adjusted net capital, the capital requirement and the difference in the two.

Obviously the more overcapitalized a firm is the better.

As of right now the minimum capital requirement for a forex FCM is

$1,000,000. However based on some of the business practices of the firms

you will soon understand $1,000,000 may not be enough. In many cases the

dealing firm will be acting as a market maker and taking the opposite side of

all the trades that come into to the firm.

This is a good idea to them, for two reasons, a) most traders lose

money b) they are charging the spread so they have a distinct advantage over

most customers.

However a problem could arise for them; a trader may be right in his

speculation and the firm will start losing money to the trader. If they don’t

hedge the trade of properly the firm could lose all their capitalization to the

trader and go out of business. This has happened before. So I suggest that

you go for larger firms with larger access net capital that are registered with

the NFA and the CFTC especially if you are trading a bigger account.

If you are a large client, there is another loophole. Because forex is a

margined trading vehicle, in certain cases if your firm deals in both forex

and futures you can open up an account on the futures as well as the forex

side and use that account as margin for the foreign exchange trading. This

way you will be considered as a secured creditor.

These arrangements are doable on a case by case basis for larger

clients usually through introducing broker relationships such as NCMFX,

INC..

Risk Disclosure: Trading Futures, Options on Futures, and Foreign Exchange involves substantial risk of loss and

may not be suitable for all investors. You should carefully consider whether trading is suitable for you in light of

your circumstances, knowledge, and financial resources. Opinions, market data, and recommendations are

subject to change at any time. The information contained on this website does not constitute a solicitation to buy

or sell by NCMFX, INC., and/or its affiliates, and is not to be available to individuals in a jurisdiction where such

availability would be contrary to local regulation or law.

© 2007 NCMFX, Inc. All Rights Reserved

7

Dealing Practices

Next to safety of funds a firms dealing practices and the execution you

get on your trades is the most important thing. Just like anything else all

brokers differ when it comes to execution and you need to make sure that the

execution and dealing practices of the broker match to your trading style.

When you are talking about dealing practices, you need to take

numerous variables into consideration. These include, price feed,

dealing desk, banking relationships, net capital, platform, order type

and execution.

The tricky thing is that you can not look at each variable stand alone

they all play of each other. The best thing for you to do is determine your

trading style and make a list of exactly what you need to accomplish and

than work to find a forex dealing firm that will most closely match your

requirements. Of course keep in mind that nothing will ever match your

requirements perfectly. No firm will ever match your desires perfectly; you

just need to take the best fit and work around it to create your trading set up.

Obviously some firms you need to fully steer away from based on

their dealing practices capital requirements and platforms. A good

introducing broker that works with multiple platforms is a good resource to

use. You don’t have to pay anything to the introducing broker the dealing

firms take care of them on the back end, however one thing to keep in mind

is that he may be biased to sending you to firms that pay the most to him.

The good thing is that now days most firms pay the same to the IB but

its still good to ask so there are no issues.

Many people are scared by the dealing desk and they assume that

there is someone on the other side sitting there and just looking to get them

on every trade. In many cases this is true. I have seen many horror stories,

like dealers getting into clients positions and manually exiting trades,

slippage, re-quoting, dealer intervention and much more. What you need to

keep in mind is that it’s not the fact that there is a dealing desk that this

happens; it’s the way a desk is run. Market makers exist in all markets, even

the NYSE. They have to take all trades.

The way they make money is that most traders statistically are wrong

and the market maker has the advantage of the spread. This is called the

auction/specialist market type. A solid market maker internally matches all

orders and hedges off the net position if it becomes too large. This is called

the delta hedge. With this strategy, as many buy and sell orders are internally

matched as possible with the market maker picking up the spread and the

remainder is hedged off.

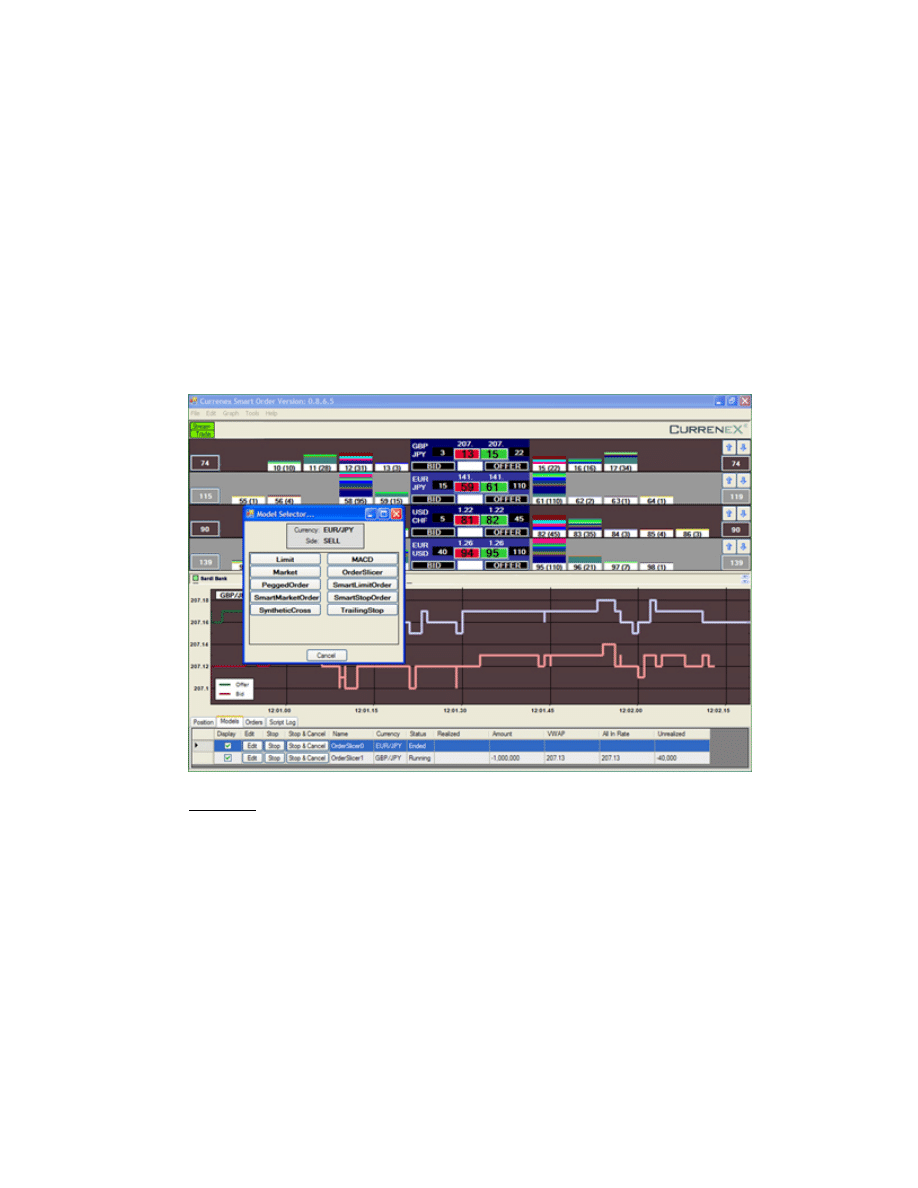

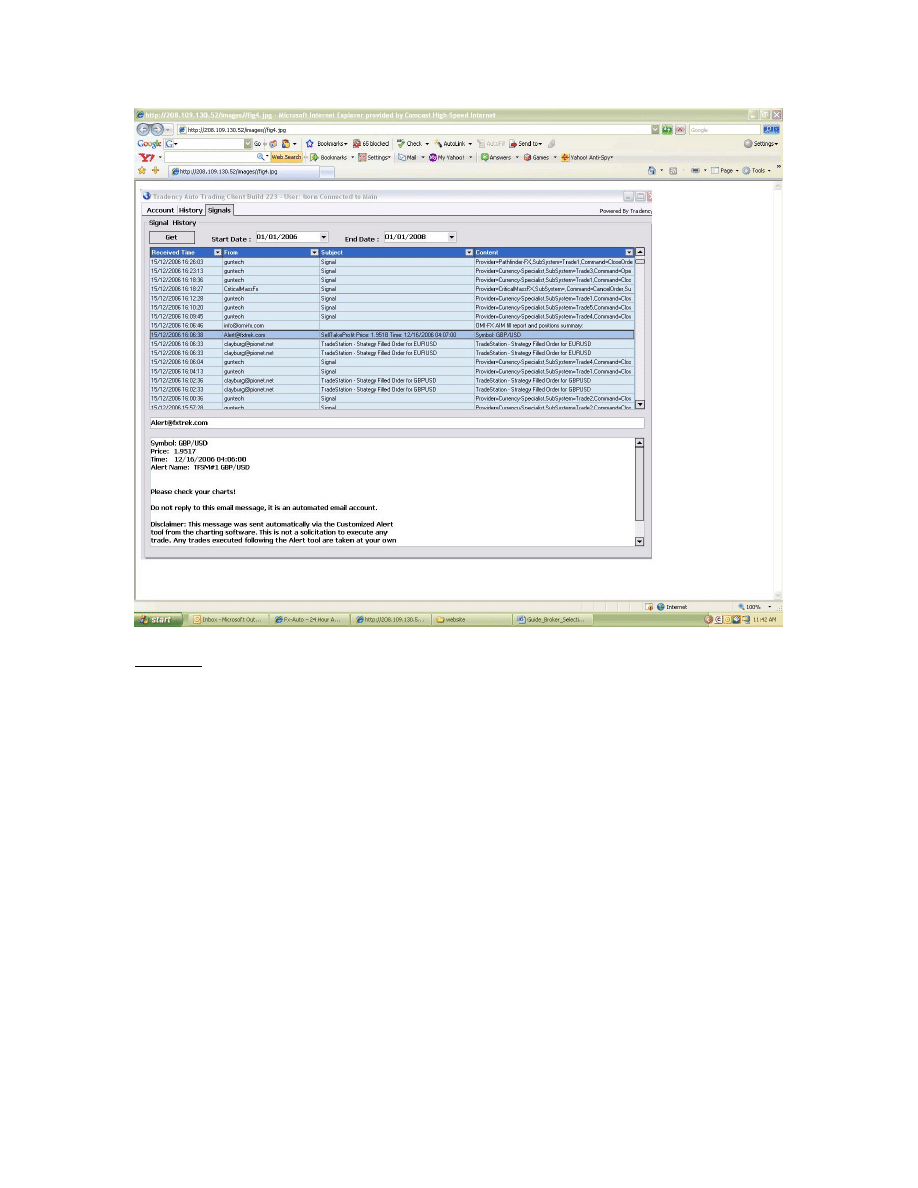

Exhibit 1: Here’s an example of a popular ECN platform called Currenex.

Now with ECN models like Currenex, Hotspot FXI, Lava and a few

others this can be done electronically. With the ECN platforms, banks and

institutions provide liquidity into a platform which shows the best bid/offer

prices available. These platforms charge a commission for the service. The

benefit of an institutional platform like this is that you can trade in between

Risk Disclosure: Trading Futures, Options on Futures, and Foreign Exchange involves substantial risk of loss and

may not be suitable for all investors. You should carefully consider whether trading is suitable for you in light of

your circumstances, knowledge, and financial resources. Opinions, market data, and recommendations are

subject to change at any time. The information contained on this website does not constitute a solicitation to buy

or sell by NCMFX, INC., and/or its affiliates, and is not to be available to individuals in a jurisdiction where such

availability would be contrary to local regulation or law.

© 2007 NCMFX, Inc. All Rights Reserved

8

Risk Disclosure: Trading Futures, Options on Futures, and Foreign Exchange involves substantial risk of loss and

may not be suitable for all investors. You should carefully consider whether trading is suitable for you in light of

your circumstances, knowledge, and financial resources. Opinions, market data, and recommendations are

subject to change at any time. The information contained on this website does not constitute a solicitation to buy

or sell by NCMFX, INC., and/or its affiliates, and is not to be available to individuals in a jurisdiction where such

availability would be contrary to local regulation or law.

© 2007 NCMFX, Inc. All Rights Reserved

9

the spreads, make your own market, scalp freely, and get tighter pricing. The

only thing you need to realize before you start banging away your trades is

that there is still someone providing pricing to you at the other end of the

trade.

Going back to my poker game analogy, if there is a guy consistently

beating everybody at the table or using an unfair strategy the other players

will leave and not want to play with him or complain to the casino. So if a

certain trader is using a trading method that is hard to hedge off or match up

internally for the liquidity providers even on an ECN platform. They will

still complain to the FCM and than the FCM will be faced with a decision;

who do I want to keep on my platform UBS or you? What do you think the

answer will be?

So if you are using a particular style that may be difficult to maintain

for the counterparties -- regardless of desk or no desk, you need to come in

under the radar and set your trading up properly so you do not get kicked

out. Once again a solid introducing broker should be able to help you with

that.

Another thing to be careful of is some firms claiming that they do not

have a deal desk when in actuality they just routing all trades to another

firms deal desk and getting some profit sharing. So you need to conduct

some very diligent research before you pick a firm.

The first step is to identify the players involved. There's you, the

client; there is the dealing firm you are using (FCM) and there are

banking/prime brokerage relationships of the FCM.

Here is the way it works: you make the trades with the FCM using

your online platform. The FCM matches your trade with another trader,

trades in the same direction with its liquidity provider (bigger FCM/Bank) or

takes the risk on itself.

Risk Disclosure: Trading Futures, Options on Futures, and Foreign Exchange involves substantial risk of loss and

may not be suitable for all investors. You should carefully consider whether trading is suitable for you in light of

your circumstances, knowledge, and financial resources. Opinions, market data, and recommendations are

subject to change at any time. The information contained on this website does not constitute a solicitation to buy

or sell by NCMFX, INC., and/or its affiliates, and is not to be available to individuals in a jurisdiction where such

availability would be contrary to local regulation or law.

© 2007 NCMFX, Inc. All Rights Reserved

10

With an ECN model your trades are straight through processed to the

banks/liquidity provider, or internally matched with other traders

electronically.

“So what’s it to me?” you may ask. Well it could literally be the

difference between success and failure depending on your trading style. First

of all you need to classify your trading style and determine how susceptible

you are to execution problems. Trading styles like trading around economic

releases, scalping, and trading styles that push your margin limits are

susceptible to execution problems.

I have seen firms close winning positions on traders also, but that is

punishable and happens much more rarely. When it comes to slippage, re-

quoting, and quoting off market there is nothing you can do but pick firms

that fit your style. I will discuss sensitive styles later on in this guide.

Next you need to determine how big the firm is and what liquidity

providers they use. Many firms can internally match most orders so they are

never taking on the risk on you in house. Some firms have little or no

liquidity providers and small credit lines and can not place trades that would

hedge your trades off and are forced to take the risk on all of your trades in

house.

This creates many problems, and will make them fight against you on

an individual basis. If this is the case you will start getting manual execution,

slippage and all the other issues imaginable. So when evaluating a firm you

need to ask, if they take risk on clients positions, who they hedge their risk

with, and do they have straight through processing available.

Price feed is something that you need to take into consideration as

well. Most firms use various price feeds to show their clients. Price feed can

work for you and against you depending on your trading style. Some firms

will quote a low spread but will be always off market by 1-2 pips. This is a

market making strategy that they use.

Risk Disclosure: Trading Futures, Options on Futures, and Foreign Exchange involves substantial risk of loss and

may not be suitable for all investors. You should carefully consider whether trading is suitable for you in light of

your circumstances, knowledge, and financial resources. Opinions, market data, and recommendations are

subject to change at any time. The information contained on this website does not constitute a solicitation to buy

or sell by NCMFX, INC., and/or its affiliates, and is not to be available to individuals in a jurisdiction where such

availability would be contrary to local regulation or law.

© 2007 NCMFX, Inc. All Rights Reserved

11

Something like this can be used to work against them. They may

quote you this way because they have a forecast of the general tendency of

the market and want you to overpay in that direction.

For example, if the market is going up they will always quote you 1-2

pips higher than the true price. This should be taken into consideration when

placing stops or limits in a particular direction. If you know you got in a few

pips above the true market you should set a slightly tighter target than you

would normally. This way when they hedge your trade, they hedge it at a

lower price with their liquidity provider and pick up a few more pips.

What you need to do is have an eSignal feed or a Rueters feed. These

companies are independent data providers. They compile pricing from

hundreds of institutions and show you the aggregate price. This price will

always change quickly and is a good indication of where the true market is

in my opinion. I know some traders that use eSignal as a fast data-feed and

scalp of the slower feeds by some brokers. This is good to make some short

term money but you will be caught and kicked out very quickly.

Another thing you should look into when you are a short term trader is

how dynamic a price is. That is how many times it changes during a

particular time interval. Certain firms will purposely show less movement to

eliminate short term scalping. The bottom line once you have narrowed

down your firms based on perceived safety and dealing practices it is a great

idea to watch the feeds.

When it comes to dealing practices the STP or ECN models are the

best in my opinion. Bigger firms that have been around longer are also better

to use than smaller shops. You should also look for firms that have solid

liquidity providers to hedge trades with and firms with a good price feed.

Risk Disclosure: Trading Futures, Options on Futures, and Foreign Exchange involves substantial risk of loss and

may not be suitable for all investors. You should carefully consider whether trading is suitable for you in light of

your circumstances, knowledge, and financial resources. Opinions, market data, and recommendations are

subject to change at any time. The information contained on this website does not constitute a solicitation to buy

or sell by NCMFX, INC., and/or its affiliates, and is not to be available to individuals in a jurisdiction where such

availability would be contrary to local regulation or law.

© 2007 NCMFX, Inc. All Rights Reserved

12

Platforms

Ease of use is equally important for beginner traders and professional

money managers. Having a platform that is user friendly and easy to operate

on all levels is critical. Execution has to be there of course, but platform

stability and reliability is also crucial.

There are a few aspects to factor in when it comes to platforms:

reporting and back office, look and feel, hosting, stability, security and

functionality. Various platforms have features that coincide with particular

trading styles also, so selecting a platform is important based on how you

trade.

I recommend that you first narrow your list of dealing firms to a few

that you are comfortable with based on execution, regulation, capitalization,

and adherence to your trading style and than demo each platform and read

any necessary reviews.

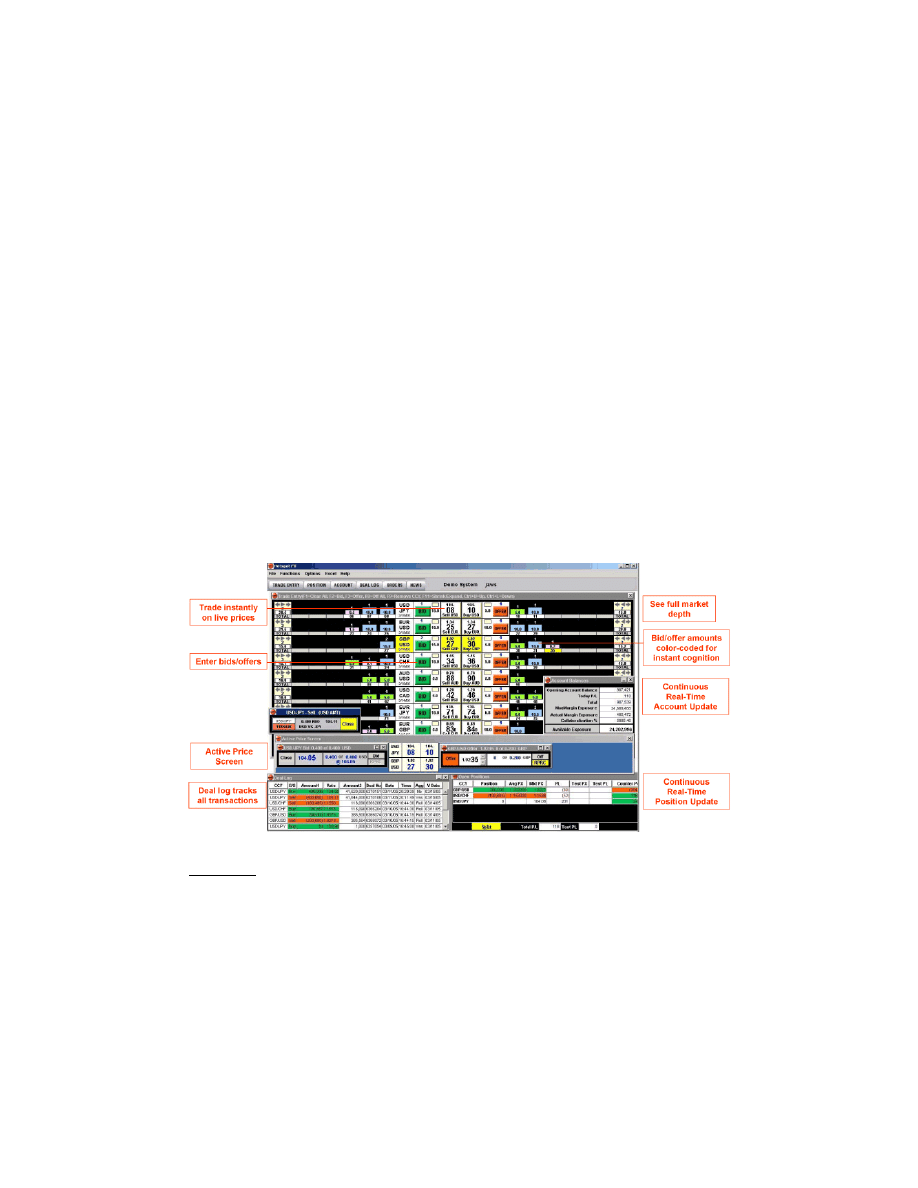

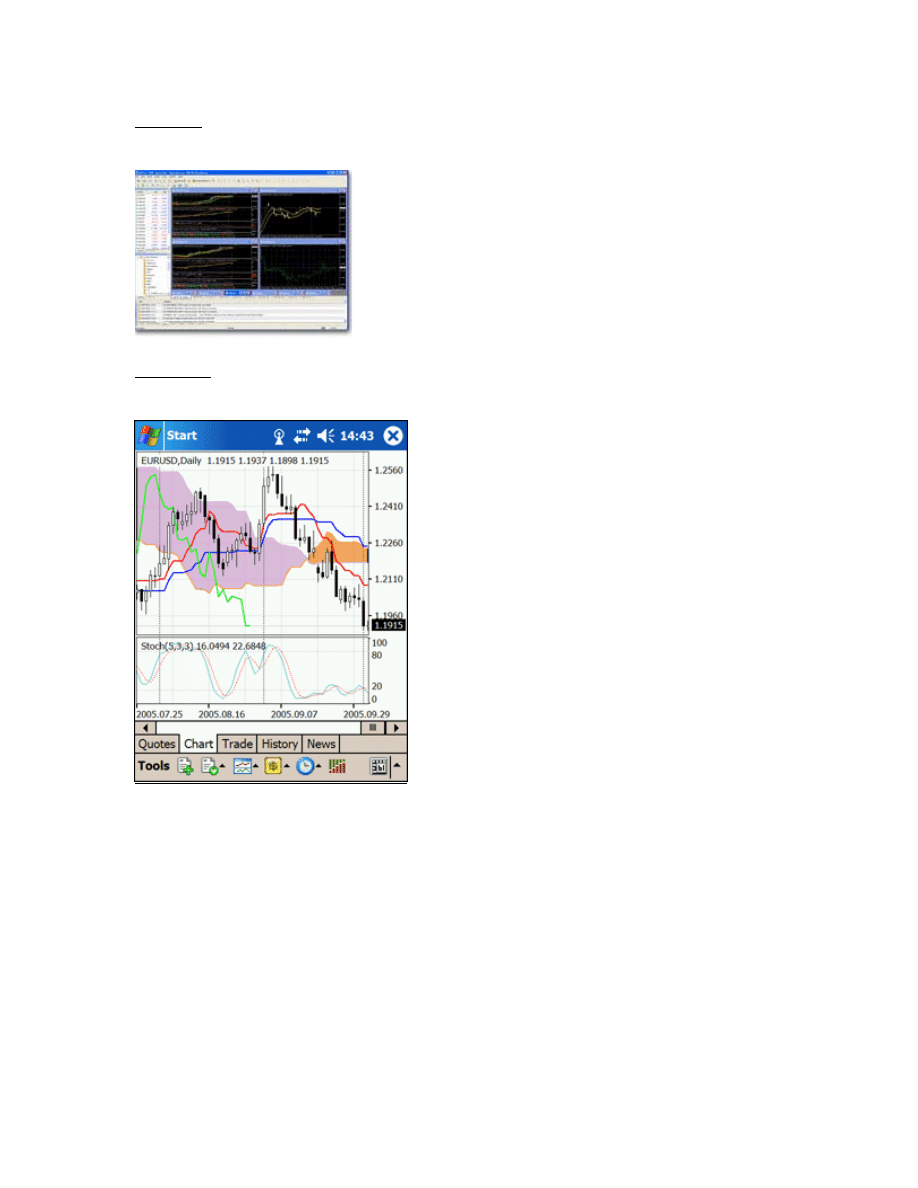

Exhibit 2: Certain platforms now have the capabilities to allow the trader to auto-execute

multiple automated systems from various system vendors and signal providers in the

same account. Above is an example of such a platform.

.

When it comes to functionality your own trading style and tools is

obviously a key factor to take into consideration. For example, if you are

scaling in to trades and want to be able to get out of the whole position at

once you need to make sure your platform can do it.

If you are scalping you need to have the ability to do one click entries

and exits, so a good way to plan when it comes to functionality is to write

down every feature you need and to consult somebody at the dealing firm or

a qualified introducing broker about those features. In many cases a

qualified independent introducing broker that works with many firms can

Risk Disclosure: Trading Futures, Options on Futures, and Foreign Exchange involves substantial risk of loss and

may not be suitable for all investors. You should carefully consider whether trading is suitable for you in light of

your circumstances, knowledge, and financial resources. Opinions, market data, and recommendations are

subject to change at any time. The information contained on this website does not constitute a solicitation to buy

or sell by NCMFX, INC., and/or its affiliates, and is not to be available to individuals in a jurisdiction where such

availability would be contrary to local regulation or law.

© 2007 NCMFX, Inc. All Rights Reserved

13

Risk Disclosure: Trading Futures, Options on Futures, and Foreign Exchange involves substantial risk of loss and

may not be suitable for all investors. You should carefully consider whether trading is suitable for you in light of

your circumstances, knowledge, and financial resources. Opinions, market data, and recommendations are

subject to change at any time. The information contained on this website does not constitute a solicitation to buy

or sell by NCMFX, INC., and/or its affiliates, and is not to be available to individuals in a jurisdiction where such

availability would be contrary to local regulation or law.

© 2007 NCMFX, Inc. All Rights Reserved

14

refer you to a specific platform based on what you need so that you don’t

have to waste time shopping around. Best of all they usually get

compensated out of the bid/ask spread by the dealing firm so their services

will cost you nothing and you can get added value.

Make sure you are comfortable with the platform in terms of exiting and

entering orders. In some cases because firms make the market they will

purposely make order entry or exit slightly difficult functionally so that your

slippage increases as you perform a necessary action. So in certain cases you

may be better of with a platform created by a third party rather than the

dealing firm itself.

If you are trading automated systems and want to integrate it with your

platform you need to make sure that the platform/ dealing firm, you need to

make sure that the dealing firm’s platform has an API that you can write into

and that it is FIX enabled so that you can write your system in via FIX

protocol.

Another good question to ask is does the firm have an SDK kit. Below is

a list of some questions to take into consideration. These are just a few

examples. There are many more questions you should ask:

• How far can I place stops/limits from my current price

• Does the platform allow one-click trading

• Can I trade off the chart?

• Can I get out of positions all at once if I scale in?

• Can I hedge?

• Can I set order types where I determine maximum allowable slippage?

• Is the platform server based, if so where?

• Does the platform allow wireless trading?

• Can I flatten out all positions with one click?

• Does the platform have its own language?

• Is the platform FIX enabled (for automated systems)?

In terms of security once again we recommend that the bigger the firm

and the longer it has been around the better it is for you. If the clearing firm

has been around for a while and it has a lot of money to spend and a lot to

lose. They will have much more resources to protect against any type of

hacking and identity theft. When you are dealing with a small new firm with

a low adjusted net cap, a red flag should go up.

When it comes to reporting and back office, once again determine how

you will reconcile your trades at the end of the month and keep track and

based on that ask any necessary questions. What kind of statements will the

company provide you with at year end for tax purposes? How often do they

send statements in the mail with your P/L and trades made?

Most firms show live P/L on their platforms. If you are a money

manager, you need to know what kind of statements you can get for all of

your sub accounts. All of this should be taken into consideration. Once again

I noticed that most bigger firms do this very easily.

Exhibit 3: This is another example of an ECN platform from HotSpot FX

Finally, you want the platform to look pleasant on your screen, be

configurable in shape and size so that you can adjust it to any other software

Risk Disclosure: Trading Futures, Options on Futures, and Foreign Exchange involves substantial risk of loss and

may not be suitable for all investors. You should carefully consider whether trading is suitable for you in light of

your circumstances, knowledge, and financial resources. Opinions, market data, and recommendations are

subject to change at any time. The information contained on this website does not constitute a solicitation to buy

or sell by NCMFX, INC., and/or its affiliates, and is not to be available to individuals in a jurisdiction where such

availability would be contrary to local regulation or law.

© 2007 NCMFX, Inc. All Rights Reserved

15

Risk Disclosure: Trading Futures, Options on Futures, and Foreign Exchange involves substantial risk of loss and

may not be suitable for all investors. You should carefully consider whether trading is suitable for you in light of

your circumstances, knowledge, and financial resources. Opinions, market data, and recommendations are

subject to change at any time. The information contained on this website does not constitute a solicitation to buy

or sell by NCMFX, INC., and/or its affiliates, and is not to be available to individuals in a jurisdiction where such

availability would be contrary to local regulation or law.

© 2007 NCMFX, Inc. All Rights Reserved

16

applications you are using. There are a few platforms that are widely used in

forex and each has its pluses and minuses.

One platform is called ACT and another is called MT4 and there is a

more institutional level platform called Currenex. Many firms use a variation

of ACT. ACT is very easy to use, has solid charting capabilities, allows

hedging, and has a PAMM and a LAMM for money managers. MT4 is

probably the most popular platform. Traders love it because it has its built in

programming language and because of its wide use communities have

sprung up where traders share various automated systems. The platform also

has a nice charting tool and user friendly functionality.

In most cases with MT4 and ACT there is a standard dealing desk

system behind the platform. MT4 is not FIX enabled so getting ECN prices

into is difficult; however I know a few firms that are in the process.

Currenex is something that is used by larger traders and institutions to

trade and eliminate dealer intervention. The Currenex system which was just

recently bought by State Street Bank is an ECN type platform that pools

various liquidity providers such as banks, FCM’s and hedge funds together

and gives you the best bid/offer available. If you are looking for quick

execution and straight through trading this is the platform for you. The

platform is FIX enabled and has great tools for money managers. There are

however many distinct differences between Currenex and most retail

platforms.

First of all with Currenex you pay a commission to use it. Basically

you are paying this to get into the so called “traders club” and receive the

best bid and offer prices.

Another difference is that there are no lots; you pick the amount that

you want to trade and go from there. Since the platform is designed for

institutions and banks that typically only use market orders to enter and exit

trades there are no stop losses with Currenex.

Risk Disclosure: Trading Futures, Options on Futures, and Foreign Exchange involves substantial risk of loss and

may not be suitable for all investors. You should carefully consider whether trading is suitable for you in light of

your circumstances, knowledge, and financial resources. Opinions, market data, and recommendations are

subject to change at any time. The information contained on this website does not constitute a solicitation to buy

or sell by NCMFX, INC., and/or its affiliates, and is not to be available to individuals in a jurisdiction where such

availability would be contrary to local regulation or law.

© 2007 NCMFX, Inc. All Rights Reserved

17

Minimum order size is usually $500k. If you want to take your trading

to the next level and start using Currenex, I recommend that you take time to

thoroughly master the product before you risk your money. When choosing

a provider make sure that you have no debit balance risk because in many

cases with firms offering Currenex a margin call system similar to futures is

used and this may cause problems.

When we discuss particular trading styles and what to look for in a

broker for each of those styles, I will touch on more specifics for each

particular style of trading. The main thing I would like to stress in this

section is create a list of what you our looking for and out of the firms that

you or your introducing broker have narrowed down find the platform that

most closely fits your needs.

If you have 2 distinct trading styles for example, there is nothing

wrong with opening 2 separate trading accounts at 2 separate firms, one for

each style.

Customer Service

Just like selecting a trading platform that you can work with, you need

to select a firm that you can work with. First of all, and in most cases this is

available, you need to make sure that the firm has 24 hour dealing support.

You need to make sure that there is a customer support staff to assist you

with withdrawals and deposits and questions or issues.

Once again the bigger is better theme makes sense. If you are using a

big firm, in most cases the customer support procedures have been though

out and developed properly so that you should be taken care of most times.

I am aware of some small firms however that purely differentiate

themselves on customer service. There you are more than just a number.

They have boutique settings where your rep knows you by name and takes

care of all your needs. Those types of firms are very rare. I only know of one

or two and in many cases the smaller firms have little or no customer

Risk Disclosure: Trading Futures, Options on Futures, and Foreign Exchange involves substantial risk of loss and

may not be suitable for all investors. You should carefully consider whether trading is suitable for you in light of

your circumstances, knowledge, and financial resources. Opinions, market data, and recommendations are

subject to change at any time. The information contained on this website does not constitute a solicitation to buy

or sell by NCMFX, INC., and/or its affiliates, and is not to be available to individuals in a jurisdiction where such

availability would be contrary to local regulation or law.

© 2007 NCMFX, Inc. All Rights Reserved

18

service. There is nothing more frustrating than calling in and getting a voice

when you have an issue that has to do with your trading.

One way to alleviate the customer service issue is work with a large

IB. To an IB customers are everything since they do not need to worry about

the dealing end of the market. A large IB usually can take care of the

problem for you or direct you to someone in the dealing firm that can. Also

because a large introducing broker (IB) brings in large aggregate volume the

dealing firm (FCM) will go out of their way for the clients of the IB because

if the clients are treated poorly the IB will pick up all clients and leave.

So using an IB is definitely a huge plus when it comes to customer

service. It never costs you extra and you get added value that you would not

get by going to the FCM directly.

Leverage

There is nothing that drives me more crazy than traders looking for

leverage that is higher than 10:1. Many traders always ask for 200:1 or even

worse 400:1 leverage.

First of all if you are using this type of leverage your dealing firm is

always going to be bucketing your trades no matter what. Most big liquidity

providers do not allow customers leverage that is more than 50:1.

Other than the fact that trading with this type of leverage is a terrible

idea, you will be automatically placed in the group to take risk on by the

dealing firm if you choose to have higher leverage because they

automatically will expect you to lose and will not be able to cleanly hedge

your trades off. So take my advice, keep leverage low for many reasons. I

will save most of the reasons for another guide.

Your Style and Your Dealer

This is probably the most important section of the guide because there

are various features that you need to look for in your dealer based on your

trading style. In this section I will discuss some common trading styles

currently being used in forex and provide my personal recommendation for

the trading set up to use for each style.

Swing Trading

Swing trading is a trading style where positions are typically held 3-5 days.

This is probably one of the easiest styles to accommodate when it comes to

dealer selection. Because the trader is typically going for larger amounts of

pips, slippage and bad execution is not going to be as detrimental to him as it

would be to a scalper or day trader. However, over the long run it still will

have an effect.

For this type of style I would still recommend going with a big broker

with solid liquidity providers or an STP broker. If you go with an STP

broker one thing to pay attention to is what time of the day you are trading.

If you are trading during off market hours when banks and traders pull away

their spreads will be much wider than the fixed spread brokers so in that case

Risk Disclosure: Trading Futures, Options on Futures, and Foreign Exchange involves substantial risk of loss and

may not be suitable for all investors. You should carefully consider whether trading is suitable for you in light of

your circumstances, knowledge, and financial resources. Opinions, market data, and recommendations are

subject to change at any time. The information contained on this website does not constitute a solicitation to buy

or sell by NCMFX, INC., and/or its affiliates, and is not to be available to individuals in a jurisdiction where such

availability would be contrary to local regulation or law.

© 2007 NCMFX, Inc. All Rights Reserved

19

Risk Disclosure: Trading Futures, Options on Futures, and Foreign Exchange involves substantial risk of loss and

may not be suitable for all investors. You should carefully consider whether trading is suitable for you in light of

your circumstances, knowledge, and financial resources. Opinions, market data, and recommendations are

subject to change at any time. The information contained on this website does not constitute a solicitation to buy

or sell by NCMFX, INC., and/or its affiliates, and is not to be available to individuals in a jurisdiction where such

availability would be contrary to local regulation or law.

© 2007 NCMFX, Inc. All Rights Reserved

20

you would want to go with a fixed spread broker that does not trade against

you.

Other than that swing trading is fairly simple when it comes to broker

selection. In terms of your platform you don’t have to worry about one click

execution. You just really need a clean platform with all back office

capability. Because you are going to be holding positions over night make

sure you find a broker where you are not liable for debut balance in case a

drastic event happens and blows your account out.

Also you should pay attention to SWAP rates particularly if you are

going to be trading through Wednesdays because SWAP rates double on

those days. If you are holding positions through 5pm and you may are down

to a few choices compare the swap rates. They will add up also.

Position Trading

Position trading is trading that keeps you in positions for weeks or

even months. This is also one of the easier trading styles to fit your broker

to.

What you need to pay attention to here is the liquidity providers for

the broker, SWAP Rates and hedging ability. You obviously want to make

sure that the broker has the ability to hedge your trades off with their

liquidity providers. You want competitive SWAP rates.

Some brokers even pay rates at a higher margin on certain types of

trades. Finally, if you are in a position and an economic release is coming

out you may want to take the trade in the opposite direction through the

duration of the release. You need to have a broker that allows hedging for

that purpose.

All in all selecting brokers for this type of trading is not difficult. Just

make sure that they can hedge your trades with their liquidity providers. You

don’t want the firm taking risk on your winning position, because they will

do everything in their power to make you close it.

Risk Disclosure: Trading Futures, Options on Futures, and Foreign Exchange involves substantial risk of loss and

may not be suitable for all investors. You should carefully consider whether trading is suitable for you in light of

your circumstances, knowledge, and financial resources. Opinions, market data, and recommendations are

subject to change at any time. The information contained on this website does not constitute a solicitation to buy

or sell by NCMFX, INC., and/or its affiliates, and is not to be available to individuals in a jurisdiction where such

availability would be contrary to local regulation or law.

© 2007 NCMFX, Inc. All Rights Reserved

21

Day Trading and Scalping

When it comes to day trading you should be a little more careful in

your selection process. First determine how long you will stay in a trade. If

you are doing any sort of scalping or any type of trading where you are

going for less than 20 pips or less than 1 hour you should definitely consider

STP. With this type of trading execution issues will arise because a desk

type of broker will not have time to hedge your trades of and they will place

you on manual execution to protect themselves thus negatively impacting

your trading.

You do not need to worry about SWAP's because you will not be

holding positions over night. What you do need to have is one-click

execution because you do not want to be confirming trades when you are

scalping or doing any kind of short term trading. However, you need to be

very careful when entering your orders because there is no confirmation and

there is a good chance you can mess something up.

Many platforms will also have a feature that you can set that will

determine your preferences when placing your order this way you will not

have to fill in certain settings. For example say you want a market order of

20,000,000 EUR/USD every time you trade. You can set so that every time

you click on buy or sell these parameters will come up.

Another thing you want to find out if you are using any kind of stop or

limit orders is how far away from the market can you place them. In certain

cases you may have to place the stops/limits away from the market price by

more than a certain amount of pips and this could be a major problem if you

are using these order types and going for a small amount of volume.

News Trading

Through some advancements in technology news trading has become

a very popular way to trade forex recently. There are numerous services

providing clients with auto-click software and live trading rooms during

news announcements.

Risk Disclosure: Trading Futures, Options on Futures, and Foreign Exchange involves substantial risk of loss and

may not be suitable for all investors. You should carefully consider whether trading is suitable for you in light of

your circumstances, knowledge, and financial resources. Opinions, market data, and recommendations are

subject to change at any time. The information contained on this website does not constitute a solicitation to buy

or sell by NCMFX, INC., and/or its affiliates, and is not to be available to individuals in a jurisdiction where such

availability would be contrary to local regulation or law.

© 2007 NCMFX, Inc. All Rights Reserved

22

A popular way to trade the news has been, getting in based on the

deviation between the forecast and the actual number right at the moment

when the numbers come out. The biggest issue that these traders face is

execution because dealers are put at a significant disadvantage if the trader

has proper technology and capabilities.

What normally happens is the traders are getting in on a dead price

since the market has already spiked but the dealers platform has not caught

up. Although there is nothing illegal about this, there is also nothing illegal

about requiting, slipping or kicking a trader out from a dealing firm. So one

must be very careful and be able to slide under the radar.

This strategy is difficult to get away with both at deal desk and ECN

models. Trading this with an ECN platform will still cause problems because

the bigger counterparties get hurt as the price moves against them. They are

not able to hedge the trade quickly enough and have to pay for your gain

(their loss) out of their own pocket.

Now common sense will tell you that the bigger you trade at one place

the quicker you will get caught. Many of the auto-click programs out there

allow the trader to trade at multiple firms and that provides a huge advantage

for the traders. Many news traders try to go for the homerun and leverage

out as much as possible during every economic release.

This is a terrible idea for a couple of reasons: First, if something goes

wrong they will end up taking a huge hit on their account… and second,

your counterparties will catch on to you much quicker and stop trading with

you. Typically banks will not analyze orders of under 2million and smaller

FCM’s will not analyze orders under 2 lots. So the key to success in this

type of trading is to have multiple accounts and numerous firms. A solid

introducing broker should be able to set you up.

When it comes to selecting an introducing broker for this type of

trading there are a couple of thing to consider. First, you want to make sure

that it’s a large introducing broker. This way he will have leverage over the

dealing firm to protect his clients. Second, you need to be sure that the

Risk Disclosure: Trading Futures, Options on Futures, and Foreign Exchange involves substantial risk of loss and

may not be suitable for all investors. You should carefully consider whether trading is suitable for you in light of

your circumstances, knowledge, and financial resources. Opinions, market data, and recommendations are

subject to change at any time. The information contained on this website does not constitute a solicitation to buy

or sell by NCMFX, INC., and/or its affiliates, and is not to be available to individuals in a jurisdiction where such

availability would be contrary to local regulation or law.

© 2007 NCMFX, Inc. All Rights Reserved

23

broker does not only send in one particular trading style. If a broker only

sends in news traders it will be very easy for the dealer to flag all of the

traders and deny them execution during news times.

Finally, you want to see if the introducing broker can provide you

with any added value, such as cash rebates that can go towards the cost of

paying for the package that you can use to trade the news.

Now when it comes to dealer selection, there are a couple of nuances

that you have to take into consideration. First is the size of your

counterparty. If you are trading with a small firm that is taking risk on your

trades you need to understand that they can not afford to lose to you when

the numbers come out and will do everything in their power not to let you

into the trade.

Next you want to be sure that the dealer platform has one click

execution because obviously you need to get in quick. With some auto-click

software packages it allows to trade with multi click execution and that

makes things easier. Now an ECN or an STP model is always preferred

because it allows for you to stay under the radar longer. However there are a

few stipulations. Some ECN models internally match orders before they pass

it off to the liquidity providers.

The process of looking to internally match your order, especially

during the numbers when there is no one to match your order up with takes a

certain amount of milliseconds. This is just enough to prevent you from

getting in before the spike. So if the ECN internally matches orders

electronically before passing them of to the retail market you lose just

enough time not to get into your trade.

If you have sufficient funds setting up a prime brokerage account and

using an institutional trading platform such as Currenex, Hot Spot, Lava or

FX All is probably the best way to go. However you should still be careful.

The key is not to trade over 2 million (20 lots) at with any one FCM.

Risk Disclosure: Trading Futures, Options on Futures, and Foreign Exchange involves substantial risk of loss and

may not be suitable for all investors. You should carefully consider whether trading is suitable for you in light of

your circumstances, knowledge, and financial resources. Opinions, market data, and recommendations are

subject to change at any time. The information contained on this website does not constitute a solicitation to buy

or sell by NCMFX, INC., and/or its affiliates, and is not to be available to individuals in a jurisdiction where such

availability would be contrary to local regulation or law.

© 2007 NCMFX, Inc. All Rights Reserved

24

There are a couple of dealing firms out there now that have ECN

models for smaller accounts. Same principles hold true as discussed above,

however they are good option for clients to access STP capabilities with

smaller accounts.

Automation

Many traders have recently been turning to automated systems. As

with anything else the broker you choose can be the difference between

success and failure. The first thing to consider is the feed that you test and

implement your system on. Because forex does not have a centralized

exchange a particular systems results can vary from firm to firm depending

on the feed being used.

With some popular data-feed providers such as eSignal or Rueters you

can filter out what FCM/Banks you use on the feed to match up your trading

platform. Before getting into brokers we should review some of the more

common tools that are used to create, back test and integrate systems.

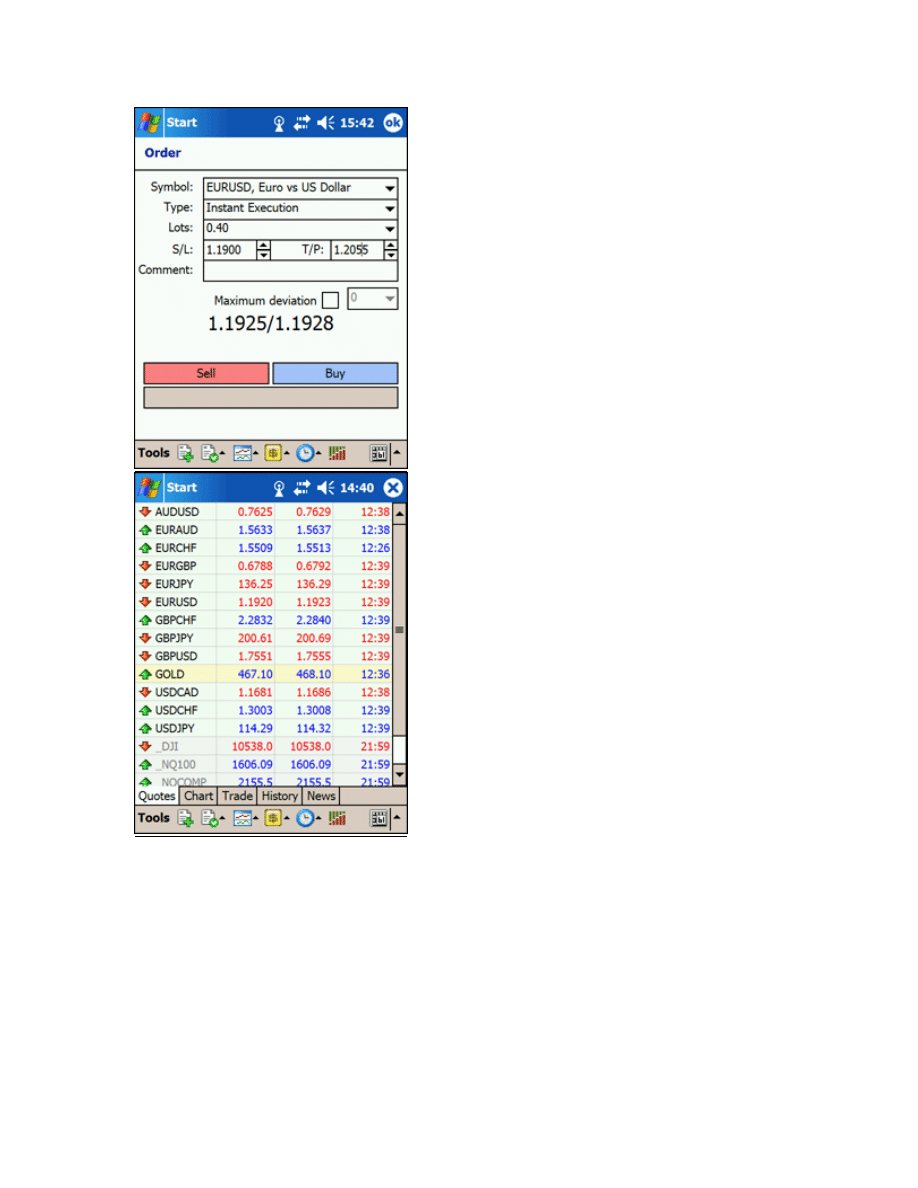

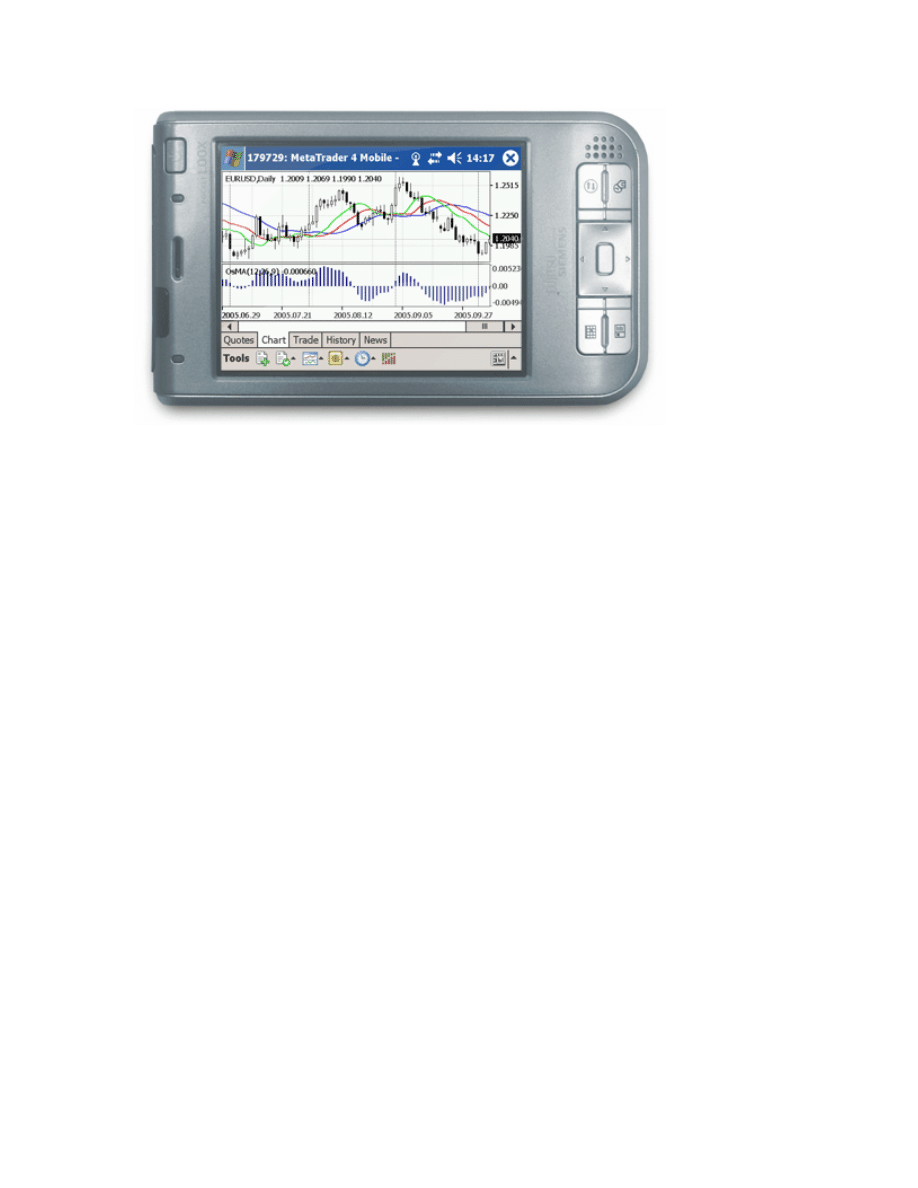

Exhibit 4: Below is an example of the Metatrader 4 platform. Many traders use a feature

known as the expert advisor (EA) in this platform for automation.

Exhibit 5: Another great feature of the MT4 platform is that it allows wireless trading so

you do not have to be in front of your home computer to trade.

Risk Disclosure: Trading Futures, Options on Futures, and Foreign Exchange involves substantial risk of loss and

may not be suitable for all investors. You should carefully consider whether trading is suitable for you in light of

your circumstances, knowledge, and financial resources. Opinions, market data, and recommendations are

subject to change at any time. The information contained on this website does not constitute a solicitation to buy

or sell by NCMFX, INC., and/or its affiliates, and is not to be available to individuals in a jurisdiction where such

availability would be contrary to local regulation or law.

© 2007 NCMFX, Inc. All Rights Reserved

25

Risk Disclosure: Trading Futures, Options on Futures, and Foreign Exchange involves substantial risk of loss and

may not be suitable for all investors. You should carefully consider whether trading is suitable for you in light of

your circumstances, knowledge, and financial resources. Opinions, market data, and recommendations are

subject to change at any time. The information contained on this website does not constitute a solicitation to buy

or sell by NCMFX, INC., and/or its affiliates, and is not to be available to individuals in a jurisdiction where such

availability would be contrary to local regulation or law.

© 2007 NCMFX, Inc. All Rights Reserved

26

When developing and back testing systems many forex traders turn to the

following: Metatrader is a platform that allows traders to write expert

advisers which automatically integrate with the trading platform. The benefit

to this is that you don’t need to worry about any integration issues.

There are a few other benefits like the products popularity, good back

office capabilities, and easy implementation. There are a few drawbacks

however. First of all you need to be careful about your counterparty. Many

dealing firms that use Metatrader are unfortunately smaller bucket shops.

This is not the fault of Metatrader. It’s the opposite. Metatrader is so

easy to use and affordable that many firms can purchase the product and use

it for very little money and don’t need to be well capitalized to implement it.

Another issue with MT4 is that it does not have a debugger when

programming which increases the amount of time it takes to write a

program.

Strategy Runner is another tool similar to MetaTrader. It can be used

as a trading platform and it allows for traders to program the systems into

the back end. The language used is C++. And if the platform is integrated

with a dealing firm you don’t need to worry about integration.

Risk Disclosure: Trading Futures, Options on Futures, and Foreign Exchange involves substantial risk of loss and

may not be suitable for all investors. You should carefully consider whether trading is suitable for you in light of

your circumstances, knowledge, and financial resources. Opinions, market data, and recommendations are

subject to change at any time. The information contained on this website does not constitute a solicitation to buy

or sell by NCMFX, INC., and/or its affiliates, and is not to be available to individuals in a jurisdiction where such

availability would be contrary to local regulation or law.

© 2007 NCMFX, Inc. All Rights Reserved

27

Risk Disclosure: Trading Futures, Options on Futures, and Foreign Exchange involves substantial risk of loss and

may not be suitable for all investors. You should carefully consider whether trading is suitable for you in light of

your circumstances, knowledge, and financial resources. Opinions, market data, and recommendations are

subject to change at any time. The information contained on this website does not constitute a solicitation to buy

or sell by NCMFX, INC., and/or its affiliates, and is not to be available to individuals in a jurisdiction where such

availability would be contrary to local regulation or law.

© 2007 NCMFX, Inc. All Rights Reserved

28

Based on my opinion some more solid firms use Strategy Runner. So

there is less of a fear of a bucket shop than with Metatrader platforms.

However the product is not as popular and with some brokers you need to

pay extra to use it unlike Metatrader.

Another approach to automating systems is using a system

development program such as Tradestation, Wealthlab, metastock,

Omnitrader… and integrating the program with your executing FCM. With

this approach there are a few things to keep in mind.

One, as discussed above you want to be sure that you test your system

out using the same feed as the FCM uses. When it comes to choosing an

FCM with this approach you want to take a few things into consideration.

First STP is always preferred, and if your system is good and you are using

STP try to send in orders under 2 million if possible to stay of the radar.

The FCM should be FIX enabled so that you can connect your system

directly into their price feed. If you are using an FCM with a desk, make

sure that they have strong lines of liquidity so that they can easily hedge

your trades of instead of trying to trade against you.

Now when it comes to integrating with this approach, you can write

directly in through FIX or you can use a middleware product such as

strategy runner. Strategy Runner and other middleware products will cost

extra on every lot that you will trade so you need to take that into

consideration.

Finally another approach that can be used for bigger traders is writing

in directly into Currenex. This is probably the most cost effective and

professional approach. The only issue is that it costs some money upfront to

write in to the Currenex. You can contact Currenex directly or an

introducing broker to be set up with this approach.

Carry Trading

Risk Disclosure: Trading Futures, Options on Futures, and Foreign Exchange involves substantial risk of loss and

may not be suitable for all investors. You should carefully consider whether trading is suitable for you in light of

your circumstances, knowledge, and financial resources. Opinions, market data, and recommendations are

subject to change at any time. The information contained on this website does not constitute a solicitation to buy

or sell by NCMFX, INC., and/or its affiliates, and is not to be available to individuals in a jurisdiction where such

availability would be contrary to local regulation or law.

© 2007 NCMFX, Inc. All Rights Reserved

29

Carry trading is a trading style where one tries to capture the swap rates on

the currency pairs that pay interest rates. There are many different

approaches to it. Certain traders just buy and hold pairs that pay good rates.

Other traders put on hedges in pairs that are highly correlated such as

EUR/USD and USD/CHF.

With this approach the best thing to do is narrow your list of firms

down to make sure that safety and security is taken care of. Once this part is

covered it is as simple as comparing the SWAP rates on the pairs that you

plan to trade. Keep in mind that Wednesdays the rates get paid twice.

Spreads obviously don’t play as key of a role in this type of trading

because you will not be trading as actively. Many traders like to use hedging

when it comes to this type of trading. You need to be in the position when

the rollovers are assigned usually at the end of the day. So during the day or

during the time when economic numbers are announced you can hedge your

trade.

So picking a broker that has hedging capabilities is a good idea. One

word of caution; many traders think that SWAP rates are just free money,

this is not the case. The underlying currency pair can go down substantially.

Because of this it is critical not to over leverage. This is a huge mistake that

carry traders make. They always ask for a 400:1 leverage broker. This is not

needed. Having access to 100:1 leverage is much more than enough.

Forex Managers

If you are a CTA managing multiple accounts or an investor into a

forex managed program this section will be important to you. If you are

trading money for friends and family or if you are running a CTA or a large

managed account program there are many things that you need to consider

when selecting a dealing firm. There are also many intricacies that managers

Risk Disclosure: Trading Futures, Options on Futures, and Foreign Exchange involves substantial risk of loss and

may not be suitable for all investors. You should carefully consider whether trading is suitable for you in light of

your circumstances, knowledge, and financial resources. Opinions, market data, and recommendations are

subject to change at any time. The information contained on this website does not constitute a solicitation to buy

or sell by NCMFX, INC., and/or its affiliates, and is not to be available to individuals in a jurisdiction where such

availability would be contrary to local regulation or law.

© 2007 NCMFX, Inc. All Rights Reserved

30

need to take into consideration to make sure that trading multiple accounts is

a seamless and effective process.

On top of all the basics discussed above when trading multiple

accounts a manager needs to pay attention to the following aspects of a

dealer; account management module, back office tool, statement distribution

and fee allocation.

Typically a manager does not want to trade multiple accounts

individually. He wants to trade them simultaneously. In order to accomplish

this he needs to use an account management module. This tool allows the

manager to control all accounts from one master account.

Typically there are 2 types of management modules: PAMM and

LAMM.

PAMM stands for Percentage Allocation Management Module. The

way a PAMM works is, it allocates from a master account into each sub

account based on the percentage of the master account that the sub account

is.

So, for example if you are trading two accounts one with $60,000 and

one with $40,000 and you make $10,000 $6,000 will go to the $60,000

account and $4,000 will go to the $40,000 account.

Typically there are 2 types of PAMM’s a FIFO and an aggregate.

Each has advantages and disadvantages. The FIFO module executes each

accounts trades individually with the position size varied based on

percentage of the master account. The drawback to this is if you are

reporting numbers to your investors the numbers from account to account

will not exactly match up. The reason for this is that this type of a PAMM

literally goes from account to account and enters the trade in each one

individually.

Now the one benefit of the FIFO PAMM, which is also the drawback

of the Aggregator PAMM, is that the FIFO enters all orders individually and

Risk Disclosure: Trading Futures, Options on Futures, and Foreign Exchange involves substantial risk of loss and

may not be suitable for all investors. You should carefully consider whether trading is suitable for you in light of

your circumstances, knowledge, and financial resources. Opinions, market data, and recommendations are

subject to change at any time. The information contained on this website does not constitute a solicitation to buy

or sell by NCMFX, INC., and/or its affiliates, and is not to be available to individuals in a jurisdiction where such

availability would be contrary to local regulation or law.

© 2007 NCMFX, Inc. All Rights Reserved

31

allows you to stay of the radar with your counterparties in case your trading

style is predatory in anyway.

Here is why; as we discussed before the banks will start to flag and

analyze orders of over $2,000,000 (20 Lots). Lets say use the above example

say you are entering an order of 20 lots in the $100,000 master account

described. If you are using a FIFO module you would enter 2 orders one for

12 lots (60% of 20 Lots) and one for 8 lots (40% of 20 lots) both orders are

under 20 Lots and allow you to stay of the radar. If your trading style is not

predatory however the aggregator model is easier for back office and

reconciliation purposes.

When selecting your forex FCM take these things into consideration,

weather you are a forex manager or just an investor in a forex managed

account.

The LAMM or the Lot Allocation Management Module allocates the

trades based on lots traded per account, rather than percentage of the

aggregate account.

For example, if you have 2 accounts 1 with $60,000 and 1 with

$40,000 you can set your position sizing per account. So you can say trade

10 lots per trade in the $40,000k account and 15 lots per trade in the $60,000

account.

The main advantage with this module is that you can adjust the

leverage from account to account. So if you have certain clients that are

more aggressive than others you can vary the amount of lots to be traded per

client.

Some of the disadvantages are that you have to calculate the amount

of lots traded for each account. The performance numbers are going to vary

from account to account because accounts are using different leverage and

trades are not entered simultaneously.

Risk Disclosure: Trading Futures, Options on Futures, and Foreign Exchange involves substantial risk of loss and

may not be suitable for all investors. You should carefully consider whether trading is suitable for you in light of

your circumstances, knowledge, and financial resources. Opinions, market data, and recommendations are

subject to change at any time. The information contained on this website does not constitute a solicitation to buy

or sell by NCMFX, INC., and/or its affiliates, and is not to be available to individuals in a jurisdiction where such

availability would be contrary to local regulation or law.

© 2007 NCMFX, Inc. All Rights Reserved

32

Most professional programs, particularly the ones interested in

expanding, use the PAMM model rather than the LAMM. So when selecting

a dealer or even a manager a LAMM is what you want to be looking for.

Introducing Brokers and Perks

Because many dealers implement a market making strategy there is

room for very large commissions to be made by dealers and introducing

brokers. For those that don’t know an introducing broker receives

compensation from the dealing firm (FCM) when their client makes the

trade.

It costs the client nothing extra to use an introducing broker and the

client will usually receive some sort of added value to entice him to use the

broker.

Just like with choosing a dealing firm you need to be careful when

choosing an introducing broker. Because forex is unregulated anyone can

come and say that they are an introducing broker. There are a few things to

pay attention to.

First of all registration. Most reputable FCM’s will only work with

registered entities. This could be a CTA registration or an IB registration.

Knowing that your IB is registered as something should give you a

piece of mind for a few reasons; you know he is somewhat qualified in

trading because he passed the series 3 test, he has to report to an

organization, and most likely the clearing firm he is introducing business to

is reputable.

The introducing broker does not have to be registered as an

Independent IB; it can be just as a CTA because that’s sufficient to be a

broker in forex at this time. So always ask for NFA ID when approached by

an introducing broker.

Risk Disclosure: Trading Futures, Options on Futures, and Foreign Exchange involves substantial risk of loss and

may not be suitable for all investors. You should carefully consider whether trading is suitable for you in light of

your circumstances, knowledge, and financial resources. Opinions, market data, and recommendations are

subject to change at any time. The information contained on this website does not constitute a solicitation to buy

or sell by NCMFX, INC., and/or its affiliates, and is not to be available to individuals in a jurisdiction where such

availability would be contrary to local regulation or law.

© 2007 NCMFX, Inc. All Rights Reserved

33

Another important aspect to pay attention to is conflict of interests.

Some of the biggest scams that I have seen is when a broker recommends

trades “for free” and is getting paid based on your volume without you

knowing about it. This creates a huge conflict of interest because the broker

only wants you to trade he does not care if you win or lose.

I suggest to make sure that your IB has no say in when you trade and

is an independent entity. Many independent introducing brokers that are not

service providers can offer numerous other perks such as trade rebates that

you can use towards whatever product you want to choose.

Size and diversification of client’s strategies is also very important

when it comes to introducing broker selection. If all clients of an introducing

broker are using the same strategy your chances of getting on the radar with

the dealer are much higher. If all of a sudden the strategy of a single strategy

broker becomes successful the dealing desk will be able to trade against the

whole IB’s group.

Also, if you are using a large IB that has some clients loosing to the

FCM than the FCM will give the client much more room to do well because

of the leverage of the large IB.

So using a large independent IB that is registered in some capacity is

your best approach. You can get many perks and benefits for doing this all

you have to do is ask because they want the business. Below are just a few

examples but there are many more:

Trade Rebates – Since the introducing broker is paid out of the spread he can

pass the savings back to you by rebating you out of his commissions. Win or

lose in your trading, it will be nice to receive a check at the end of the

month.

Interest On Unused – Large introducing brokerage have some leverage over

FCM’s and are able to provide you with interest on unused margin on certain

accounts. This way you can earn interest on all the money that is not put up

as margin on your trades.

Risk Disclosure: Trading Futures, Options on Futures, and Foreign Exchange involves substantial risk of loss and

may not be suitable for all investors. You should carefully consider whether trading is suitable for you in light of

your circumstances, knowledge, and financial resources. Opinions, market data, and recommendations are

subject to change at any time. The information contained on this website does not constitute a solicitation to buy

or sell by NCMFX, INC., and/or its affiliates, and is not to be available to individuals in a jurisdiction where such

availability would be contrary to local regulation or law.

© 2007 NCMFX, Inc. All Rights Reserved

34

Custom Consultation – A good broker usually either trades or has experience

trading at some point in his life. Combine that with his knowledge of all

dealing firms and you can have some one provide free consultation to you

about setting up your account properly to fit your trading style.

By going through a large introducing broker the quality of service that

you will receive will be far superior than you would receive by going

directly to the FCM.

First, the broker will go out of his way to keep you as a client and

provide top of the line service. Also, the dealing firm will provide you

specialized service because they will not want to jeopardize their

relationships with the IB. All in all, using an introducing broker is one place

where it benefits you to go through a middle man.

Conclusion

Hopefully this guide will help you find a dealing firm and an

introducing broker that will fit your needs and shift your focus entirely

towards trading. Don’t underestimate the broker selection issue; particularly

in forex it is very important. The common themes in this guide that you

should take with you are:

Bigger is better - Bigger FCM and bigger IB’s will be better equipped and

have systems in place to handle your account.

Use a solid introducing broker – using an introducing broker can provide

you with a lot of added value.

Control leverage – the bulk of problems arise in forex trading when you

over-leverage your account.

Risk Disclosure: Trading Futures, Options on Futures, and Foreign Exchange involves substantial risk of loss and

may not be suitable for all investors. You should carefully consider whether trading is suitable for you in light of

your circumstances, knowledge, and financial resources. Opinions, market data, and recommendations are

subject to change at any time. The information contained on this website does not constitute a solicitation to buy

or sell by NCMFX, INC., and/or its affiliates, and is not to be available to individuals in a jurisdiction where such

availability would be contrary to local regulation or law.

© 2007 NCMFX, Inc. All Rights Reserved

35

Steer towards ECN or STP models but do your research and make sure to

find out who the liquidity providers are. If STP goes to another deal desk

you are even worse of than you would be if the dealer had a desk in house.