Liquidity Black Holes

Avinash Persaud

The Gresham and Mercer Memorial Professor of Commerce

Managing Director & Head of Research

State Street Global Markets

April 2002

What is liquidity and why does it

matter?

•

Speed, ease and cost of transacting

•

Recorded spreads are a poor measure

•

Poor liquidity is associated with volatility

Price impact of trading

-0.2

0.0

0.2

0.4

0.6

0.8

1.0

1.2

1.4

1.6

1.8

Jul-97

Mar-98

Nov-98

Jul-99

Mar-00

Nov-00

Jul-01

Mar-02

Emerging Market Sells

Emerging Market Buys

% return per basis point of market

•

Big price-impact = low

liquidity

•

Liquidity is not one

number

•

Liquidity is variable and

this matters

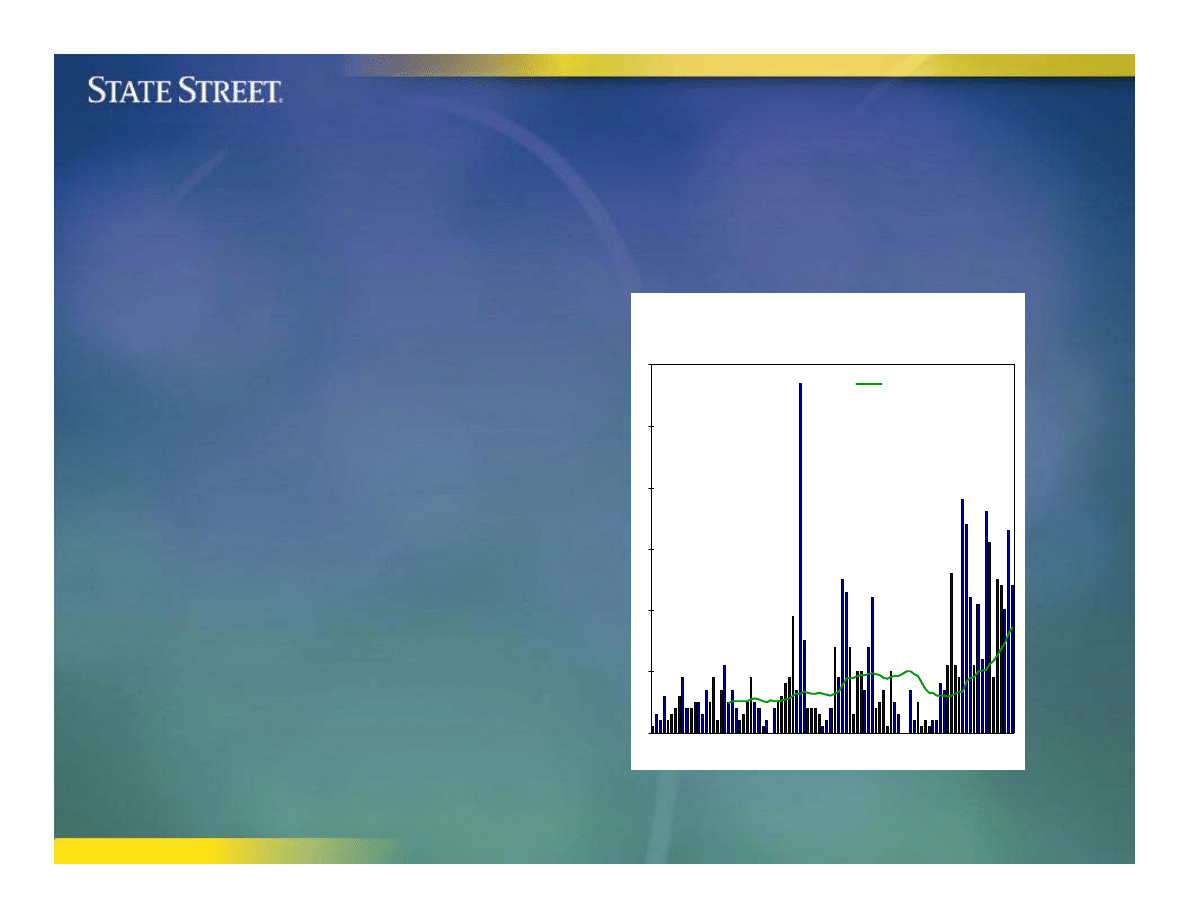

Liquidity Black Holes

0

10

20

30

40

50

60

78

Q

1

79

Q

1

80

Q

1

81

Q

1

82

Q

1

83

Q

1

84

Q

1

85

Q

1

86

Q

1

87

Q

1

88

Q

1

89

Q

1

90

Q

1

91

Q

1

92

Q

1

93

Q

1

94

Q

1

95

Q

1

96

Q

1

97

Q

1

98

Q

1

99

Q

1

00

Q

1

01

Q

1

5 year smoothed average

Number of days

Liquidity black holes: number of days per quarter that the

US, Japanese and UK broad stock indices have moved by 2

standard deviations more than the average daily price move

•

There are episodes in

which liquidity disappears

and then returns

•

Liquidity black holes are

becoming more frequent

•

Some markets are getting

bigger and yet thinner

Liquidity needs diversity

•

There is less diversity because

–

Information costs have fallen

–

Less diversity within and between firms

–

Switch to market-sensitive risk management systems

Liquidity needs losers

•

Regulators are encouraging these trends

•

Defending diversity means accepting losses

•

Financial system needs more freedom

Avoiding liquidity black holes

Average number of Liquidity Black Holes per quarter

Change from the last bubble

to the previous

FTSE 100

2.594

4.100

UK 10 year bond

2.784

-1.958

JP 10 year bond

2.986

-2.175

S&P500

3.078

3.133

Toronto SE

3.156

6.092

Topix

3.289

3.783

$/Yen

3.445

3.608

US 10 year bond

3.580

-1.667

$/CHF

3.742

-2.575

$/£

3.766

-5.500

Euro/$

3.898

-0.950

Conclusion

•

Liquidity black holes matter

•

Liquidity needs diversity and losers

•

Different asset classes have distinctive liquidity

trends

Document Outline

- Liquidity Black Holes

- What is liquidity and why does it matter?

- Price impact of trading

- Liquidity Black Holes

- Liquidity needs diversity

- Liquidity needs losers

- Avoiding liquidity black holes

- Conclusion

Wyszukiwarka

Podobne podstrony:

pair production of black holes on cosmic strings

Duality between Electric and Magnetic Black Holes

Pair Creation of Black Holes During Inflation

charged and rotating ADS black holes and their CFT duals

evolution of near extremal black holes

Black Holes

Evaporation of Two Dimensional Black Holes

General Relativity Theory, Quantum Theory of Black Holes and Quantum Cosmology

Black Holes In Supergravity And String Theory

1999 Black holes in the Milky Way Galaxy Filippenko

Black Holes & Gravitational Waves in String Cosmology(1998)

The Quantum Physics of Black Holes and String Theory

Egan, Greg Foundations 3 Black Holes

27 Black & Caspian Seas

instrukcja obs ugi do ekspresu do kawy JURA Impressa XS90 One Touch black PL (videotesty pl)

ebook microsoft sql server black book cff45xf7ii4jb4gq3rzk3uhmzhx5z3u62hytpuy CFF45XF7II4JB4GQ3RZK3

naprzemiennie migaj±ce diody (black)

Black Furies

więcej podobnych podstron