M

any technical trading

strategies revolve around

the assumption that mar-

kets will hover within a

given range — and with good rea-

son. Seventy percent of the time

markets will bounce back and forth

between support and resistance lev-

els, or fluctuate randomly. The rest

of the time, market behavior is char-

acterized by persistent price moves

— trends — that shatter support and

resistance levels.

Although these basic probabilities

work against traders who try to

exploit trends, the potential rewards

can be worth the risk. It is possible to

increase your ability to capitalize on

t rends by locating trend signals,

identifying specific entry points

within the trend and using risk man-

agement techniques to limit losses.

The following sections will

explain how a trading system based

on these concepts works especially

well in the foreign exchange (Forex),

or curre n c y, market, particularly

with the “major” currencies — the

U.S. dollar, Euro, Japanese yen,

British

pound,

Swiss

franc,

Canadian dollar and Australian dol-

lar. More than 85 percent of transac-

tions in the $1 trillion per day Forex

market involve the majors.

The strategy uses two charts with differ-

ent time periods (10-minute and hourly),

along with two technical indicators: a

200-bar moving average and a 14-bar

slow stochastic study (see “Stochastic

2

www.activetradermag.com • October 2002 • ACTIVE TRADER

Cashing in on short-term

CURRENCY TRENDS

Trends may be rarer than trading ranges, but that

doesn’t mean they can’t be traded. This strategy

uses two time frames to identify the trend, an

overbought-oversold indicator to pinpoint entry and

a trailing stop to protect gains on profitable trades.

TRADING Strategies

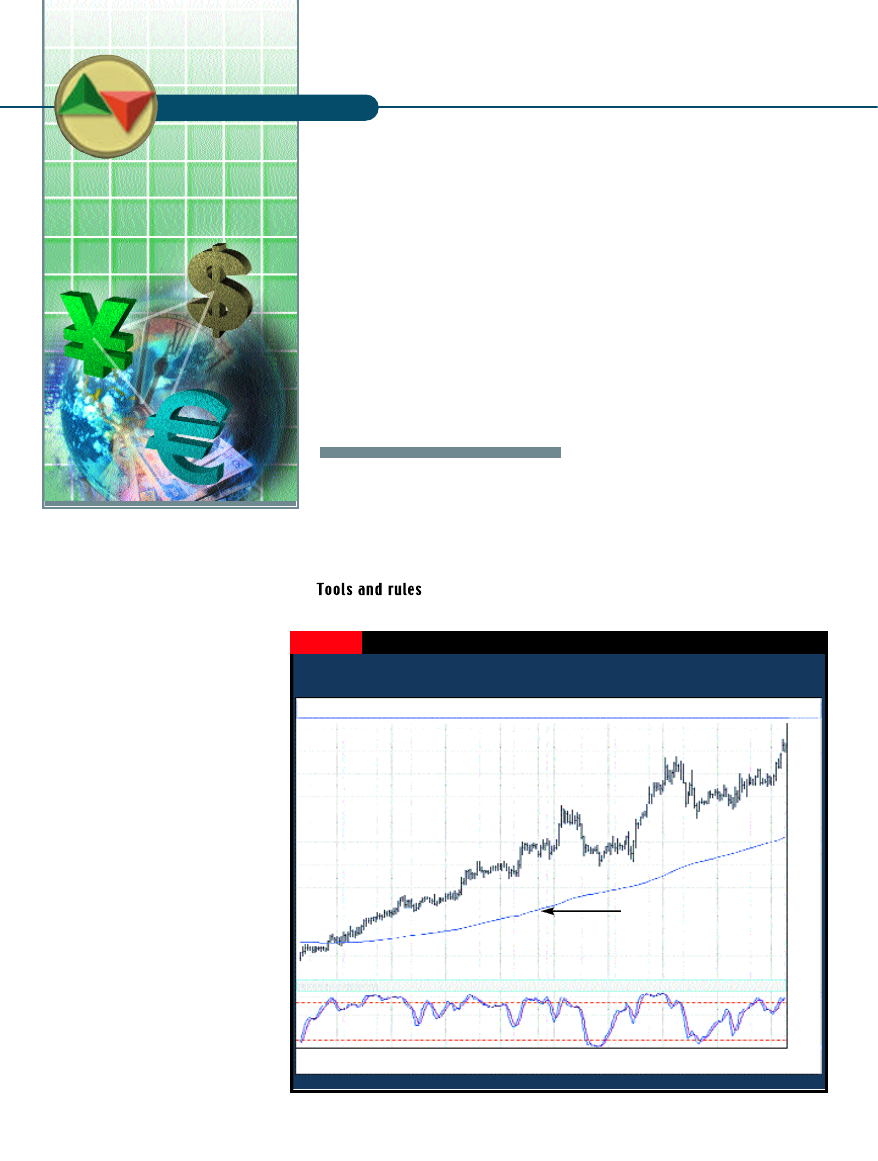

Euro/U.S. Dollar (EUR/USD), hourly

Stochastics (14, 3, 3)

12:00 3:00 18:00 9:00 0:00 15:00 6:00 21:00 12:00 3:00 18:00 9:00 0:00 15:00 6:00

18

19

20

21

23 24

25

26

27

28

1.002

0.996

0.990

0.984

0.978

0.972

0.966

0.960

0.954

0.949

0.942

90

60

30

With price consistently above the 200-bar moving average, the hourly chart reflects

the prevailing uptrend.

FIGURE 1 LONG TRADE, HOURLY TREND

Source: Gain Capital

BY TIMOTHY O’SULLIVAN

200-hour moving average

refresher,” right).

Step 1: Identify a trend. Compare the

moving averages on the 10-minute and

hourly charts. A trend is in effect when

price is consistently above/below the

moving averages on both charts.

Step 2: Pinpoint entry. Once you’ve

identified a trend, look for the following

two conditions at the same time on the

10-minute chart: 1) the market is no

more than 20 points above (to buy) or 20

points below (to sell) the moving aver-

age; and 2) the fast stochastic line cross-

es above the slow stochastic line below

20 (to buy) or crosses below the slow

stochastic line above 80 (to sell).

These conditions indicate: 1) the cur-

rency is currently in a short-term

uptrend or downtrend; and 2) the cur-

rency has paused or pulled back (reflect-

ed by the higher low stochastic reading

and the fact that price is within 20 points

of the moving average) and is poised to

turn (because the fast stochastic line is

crossing back above or below the slow

line).

Step 3: Ride the trend. Set a trailing

stop after the initial trade entry. On a

long position, enter a stop-loss order 10

points below the 200-period moving

average on the 10-minute chart. In the

case of a short position, place the initial

stop 10 points above this moving aver-

age. As the trade goes in your favor, raise

(for a long trade) or lower (for a short

trade) the stop to protect profits. For

simplicity’s sake, the following exam-

ples use a trailing stop 25 points from

each new top or bottom. The charts in

the next section illustrate the application

of this strategy in two currency pairs.

The first example took place in the

E u ro c u r rency-dollar (EUR/USD) cur-

rency pair during the fourth week of

June 2002. (For those unfamiliar with

currency quoting and charting conven-

tions, see “Quoting currencies,” p. xx.)

First, compare the hourly and 10-

minute EUR/USD charts. Look for a

time when price is above the 200-period

moving averages on both charts. On the

hourly chart (Figure 1, opposite page),

the fact that price is almost exclusively

above the 200-hour moving average

indicates a persistent uptrend. On the

10-minute chart (Figure 2, top left), price

moves (and remains above) the moving

continued on p. x

Stochastic refresher

The stochastic oscillator consists of two lines: %K and a moving average of

%K called %D.

The basic stochastic calculation compares the most recent close to the price

range (high of the range - low of the range) over a particular period. A basic

five-bar stochastic calculation is the difference between the most recent bar’s

close and the lowest low of the last five days divided by the difference

between the highest high and the lowest low of the last five days. The result

is multiplied by 100. The formula for this calculation, which is %K, is:

%K = 100*{(C

t

-L

n

)/(H

n

-L

n

)}

where

C

t

= the most recent bar’s closing price

L

n

= the lowest price of the most recent n bars

H

n

= the highest price of the most recent n bars

(for a stochastic calculated on daily bars, the default is five days)

The second line, %D, is simply a three-period moving average of %K:

average(%K,3)

Because this basic “fast” stochastic calculation is very volatile, an addition-

ally smoothed version of the indicator, where the original %D line becomes a

new “slow” %K line and a three-period average of this line becomes the “slow”

%D line, is more commonly used.

The stochastic can be made to reflect longer- or shorter-term price move-

ment and to be less or more sensitive to small price fluctuations by increasing

or decreasing the number of bars used to calculate %K and/or increasing or

decreasing the length of the moving average used to calculate %D. For exam-

ple, a stochastic using a 10-bar %K and a three-bar moving average for %D [sto-

chastic(10,3)] would be shorter-term and more sensitive than a stochastic

using a 20-bar %K and a five-bar moving average for %D [stochastic(20,5)].

ACTIVE TRADER • October 2002 • www.activetradermag.com

3

Seventy percent of the time markets

will bounce back and forth between

support and resistance levels,

or fluctuate randomly.

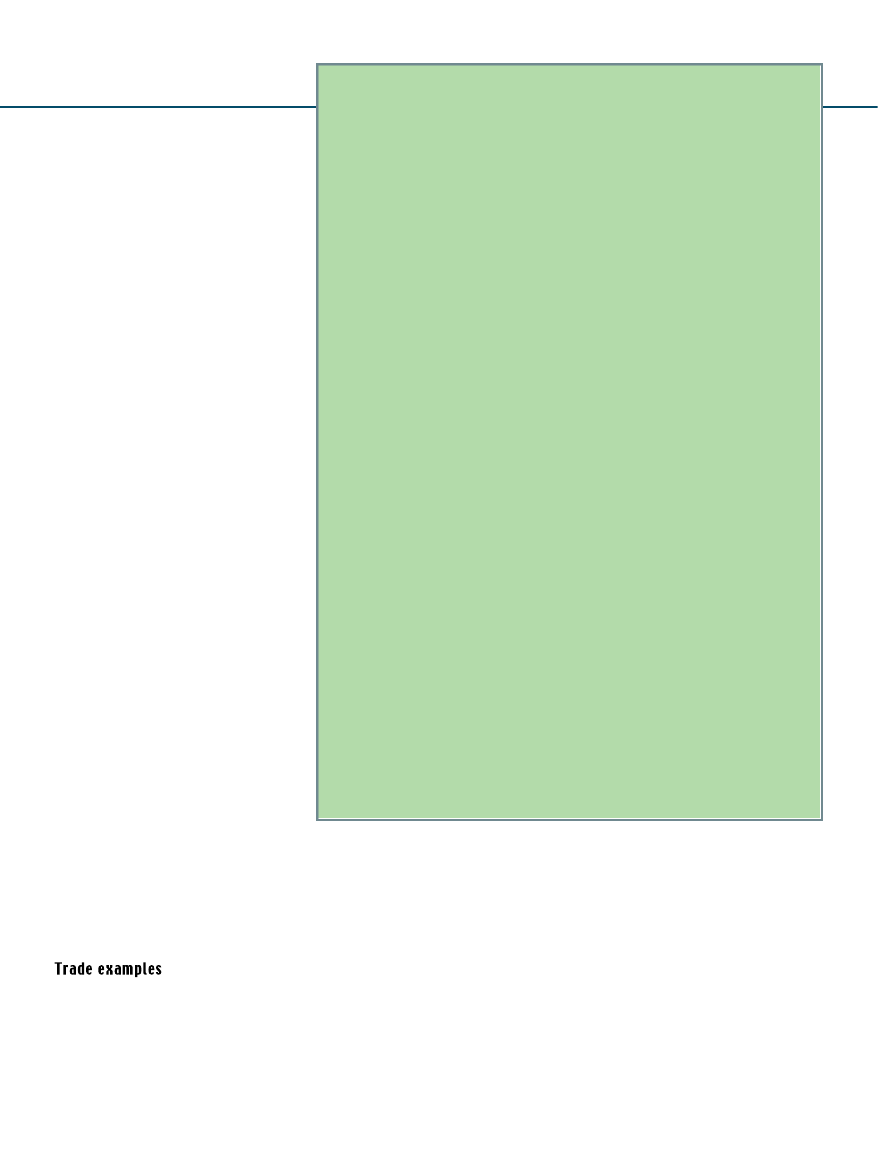

average in the last third of the

chart. The next step is to pin-

point the entry zone — when the

market is within 20 points of the

moving average on the 10-

minute chart and the stochastic

lines cross.

The range between 1 p.m. and

midnight on June 27 meets these

re q u i rements. The entry point

occurs when the fast stochastic

crosses above the slow stochastic

when the indicator is below 20. A

long position is entered at .9883

around 8 p.m., with an accompa-

nying stop-loss at .9858 (10

points below the 200-bar moving

average value of .9868). The stop

is then trailed upward as the

market makes new peaks. The

EUR/USD tops out at .9992, so

the stop scaled up to .9967,

where the position was closed

for an 84-point ($840) gain.

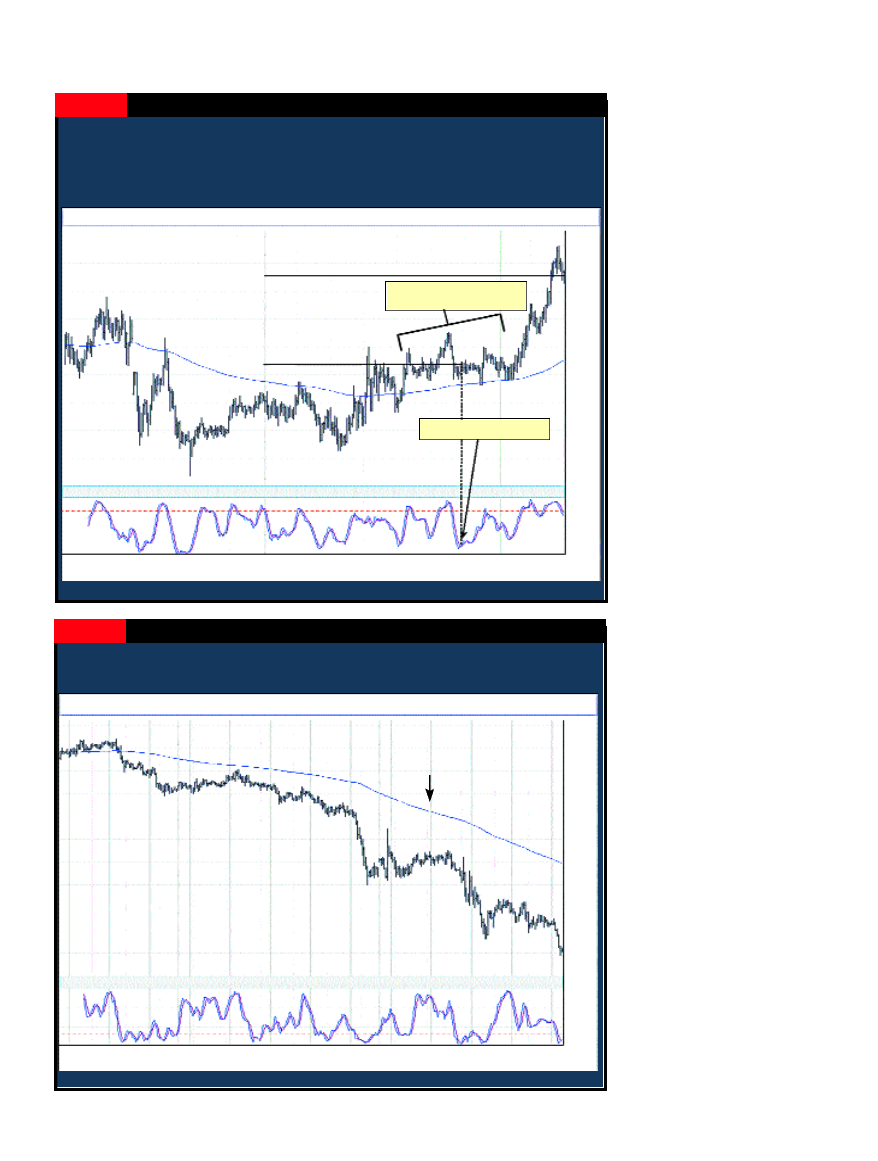

Figures 3 and 4 illustrate a

similar example in the dollar-yen

rate (USD/JPY). The hourly

chart (Figure 3, bottom left)

shows price was trading well

below the 200-bar moving aver-

age after June 21. On the 10-

4

www.activetradermag.com • October 2002 • ACTIVE TRADER

continued on p. x

Euro/U.S. Dollar (EUR/USD), 10-minute

Stochastics (14, 3, 3) 72.5152, 77.0424

5:40 9:10 13:10 17:10 20:30 23:50 3:10 6:30 9:50 13:10 17:00 20:20 23:40 3:00 6:20

6/26

6/27

6/28

1 . 0 0 0 0

0 . 9 9 7 5

0 . 9 9 5 0

0 . 9 9 2 5

0 . 9 9 0 0

0 . 9 8 7 5

0 . 9 8 5 0

0 . 9 8 2 5

0 . 9 8 0 0

0 . 9 7 7 5

8 0

4 0

Stop out @ 0.9967

Buy entry @ 0.9883

Market stays within 20 points

of moving average

Stochastic crosses below 20

Price is also above the 200-bar moving average in the final third of the 10-minute

chart. The market moves within 20 points of the moving average between 1 p.m.

and midnight on June 27. The entry is finally signaled when the fast stochastic

line crosses above the slow line (a sign of renewed upside momentum) when the

indicator is below 20 near 8 p.m.

FIGURE 2 LONG TRADE, 10-MINUTE TREND

Source: Gain Capital

U.S. Dollar/Japanese Yen (USD/JPY), hourly

Stochastics (14, 3, 3) 11.6808, 8.8996

14:00 10:00 6:00 2:00 22:00 18:00 14:00 10:00 6:00

2:00 22:00 18:00 14:00 10:00 6:00

12

13

14

16 17

18

19

20

21

23 24

25

26

27

28

1 2 6 . 4

1 2 5 . 6

1 2 4 . 8

1 2 4 . 0

1 2 3 . 2

1 2 2 . 4

1 2 1 . 6

1 2 0 . 8

1 2 0 . 0

1 1 9 . 2

1 1 8 . 4

1 1 7 . 6

6 0

3 0

On June 27, the down trending USD/JPY traded consistently below the 200-hour

moving average.

FIGURE 3 SHORT TRADE, HOURLY TREND

Source: Gain Capital

Although

the basic

probabilities

work against

traders who try

to exploit

trends, the

potential

rewards can be

worth the risk.

200-hour moving average

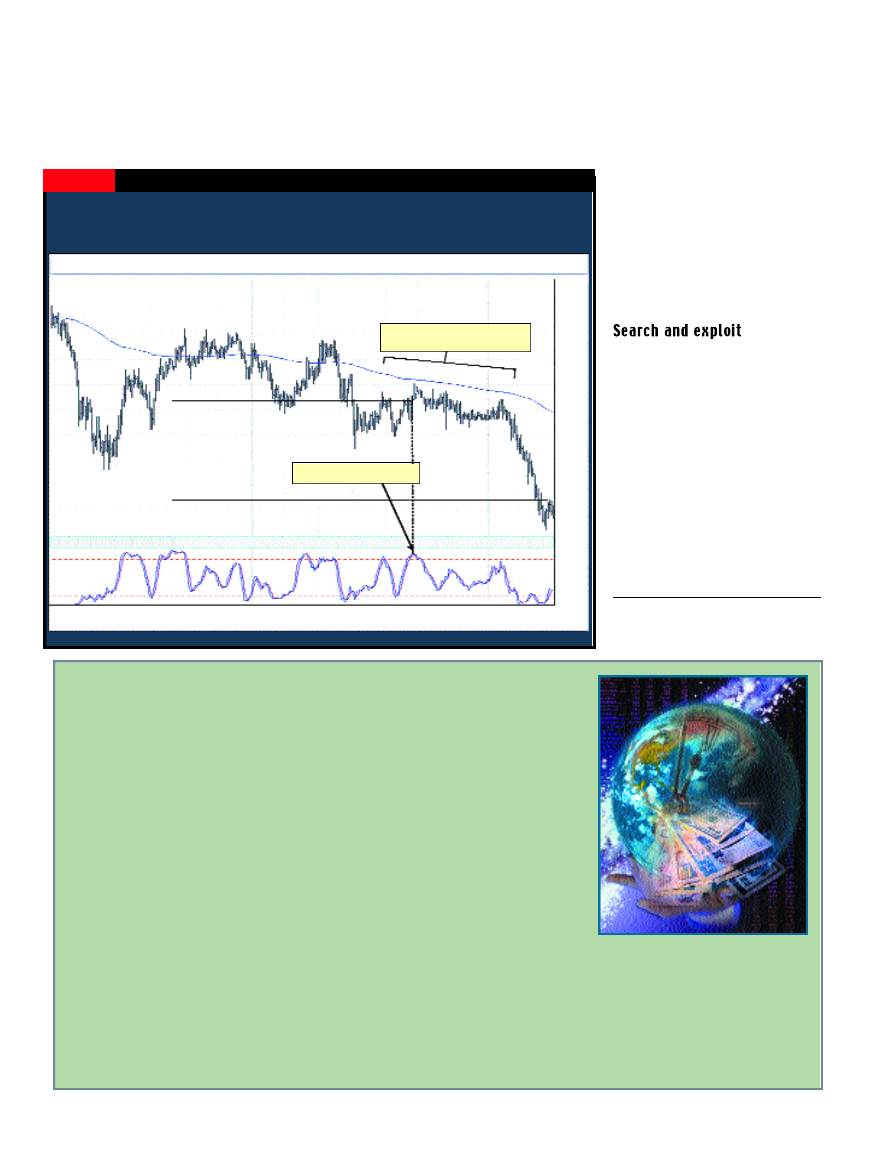

minute chart (Figure 4, below), price fell

below the moving average after 10 a.m.

on June 27, indicating a sell opportunity.

Also, price was within 20 points of the

moving average at this point. A short

trade was opened around 5 p.m. at

119.57 when the fast stochastic line

crossed below the slow stochastic line

when the indicator was above 80.

The trade was protected with a

stop-loss order at 119.86. In this

case, the stop remained intact until

the following day, when USD/JPY

began to decline. After trailing the

stop down as the market contin-

ued to decline, profits were taken

at 118.58 (25 points off the 118.33

low), for a gain of 99 points.

This short-term trading method

works well in the Forex market,

but it is also applicable to others.

Each step of the system helps iden-

tify areas where effective trades

can be made. If at any point one of

the criteria is not met, you’ll

instantly know not to make a

trade. This model also gives you

the freedom to experiment with

d i ff e rent chart intervals. When

y o u ’ re equipped with a system

that can help you catch the trend

early, you can wait for the rest of

the market to follow.

Ý

For information on the author see p.

xx.

5

www.activetradermag.com • October 2002 • ACTIVE TRADER

Quoting currencies

B

ecause currencies are quoted in a different manner than equities, reading a

foreign exchange quote may seem a bit confusing at first. However, it’s real-

ly quite simple if you remember two things: 1) The first currency listed first

is the base currency and 2) the value of the base currency is always 1.

For example, if you see a quote of USD/CAD 1.54825, that means that one U.S.

dollar is equal to 1.54825 Canadian dollars. Likewise, USD/JPY 122.01 shows that one

U.S. dollar is equal to 122.01 Japanese yen.

In every trade involving the U.S. dollar, the dollar will be the base currency, with

three exceptions — the British pound (GBP), the Australian dollar (AUS) and the

European currency unit, or Euro (EUR). In these cases, you might see a quote such

as GBP/USD 1.4366, meaning that one British pound equals 1.4366 U.S. dollars.

Whenever the U.S. dollar is the base unit and a currency quote goes up, it means

the dollar has appreciated in value and the other currency has weakened. If the

USD/JPY quote we previously mentioned increases to 123.01, the dollar is stronger

because it will now buy more yen than before.

However, in the three instances where the U.S. dollar is not the base rate, a rising quote means a weakening dollar, as

it now takes more U.S. dollars to equal one pound, Euro or Australian dollar.

In other words, if a currency quote goes higher, that increases the value of the base currency. A lower quote means the

base currency is weakening.

Trades that do not involve the U.S. dollar are called cross rates, but the premise is the same. A quote of GBP/CHF 2.4577

signifies that one British pound is equal to 2.4577 Swiss francs.

U.S. Dollar/Japanese Yen (USD/JPY), 10-minute

Stochastics (14, 3, 3) 28.9156, 30.0101

6:30 10:00 13:20 17:20 20:40

0:003:20 6:40 10:00 13:20 17:10 20:30 23:50 3:10 6:30

6/26

6/27

6/28

1 2 0 . 7 5

1 2 0 . 5 0

1 2 0 . 2 5

1 2 0 . 0 0

1 1 9 . 7 5

1 1 9 . 5 0

1 1 9 . 2 5

1 1 9 . 0 0

1 1 8 . 7 5

90

60

30

On the 10-minute USD/JPY chart, a stochastic crossover (above 80) occurred around

5 p.m. — while price was below (but within 20 points of) the 200-bar moving average

— signaling a short trade.

FIGURE 4 SHORT TRADE, 10-MINUTE TREND

Source: Gain Capital

Stop out @ 118.58

Sell entry @ 119.57

Market stays within 20 points

of moving average

Stochastic crosses above 80

Wyszukiwarka

Podobne podstrony:

ICWR Forex Trading Strategy

Identifying Active Trading Strategies in the Bitcoin Market

Forex Trading Strategy Learn how to day tradeswing trade major currency pairs(1)

11 FOREX Trading Strategies

Tradingmarkets Com Trading Strategies How To Use S&P 500 Futures To Get A Heads Up On Stock Price

Beating The Bear Short Term Trading Tactics for Difficult Markets with Jea Yu

Encyclopedia of Trading Strategies

LEAPS Trading Strategies Powerful Techniques for Options Trading Success with Marty Kearney

80 Trading strategies id 47247 Nieznany (2)

Alan Farley Pattern Cycles Mastering Short Term Trading With Technical Analysis (Traders Library)

Trading Setups Review Trading Strategies, Guides, and Articles for Active Tech

Drakoln Noble Trade Like A Pro 15 High Profit Trading Strategies

The Power Option Strategy The Ultimate Options Trading Strategy High

więcej podobnych podstron