B

USINESS

C

ONTINUITY AND

D

ISASTER

R

ECOVERY

P

AGE

1

D

ECEMBER

2004

I

SSUE

O

VERVIEW

Business Continuity Management (BCM) is defined by the Business Continuity Institute as

“a holistic management process that identifies potential impacts that threaten an

organization and provides a framework for building resilience and the capability for an

effective response that safeguards the interests of its key stakeholders, reputation, brand

and value-creating activities.”

1

More tangibly, BCM, also referred to as BCP (Business

Continuity Planning), is designed

to reduce the risk of an unexpected disruption to the

critical functions and operations (both manual and automated) necessary for the survival

of the business.

2

Since the terrorist attacks of September 11, 2001, financ ial institutions have increased the

emphasis placed on business continuity management. As such, BCM today is

significantly different than BCM in the early 1990’s. Figure I, below, illustrates the gradual

evolution of BCM practices and processes , as originally developed by Gartner.

3,4

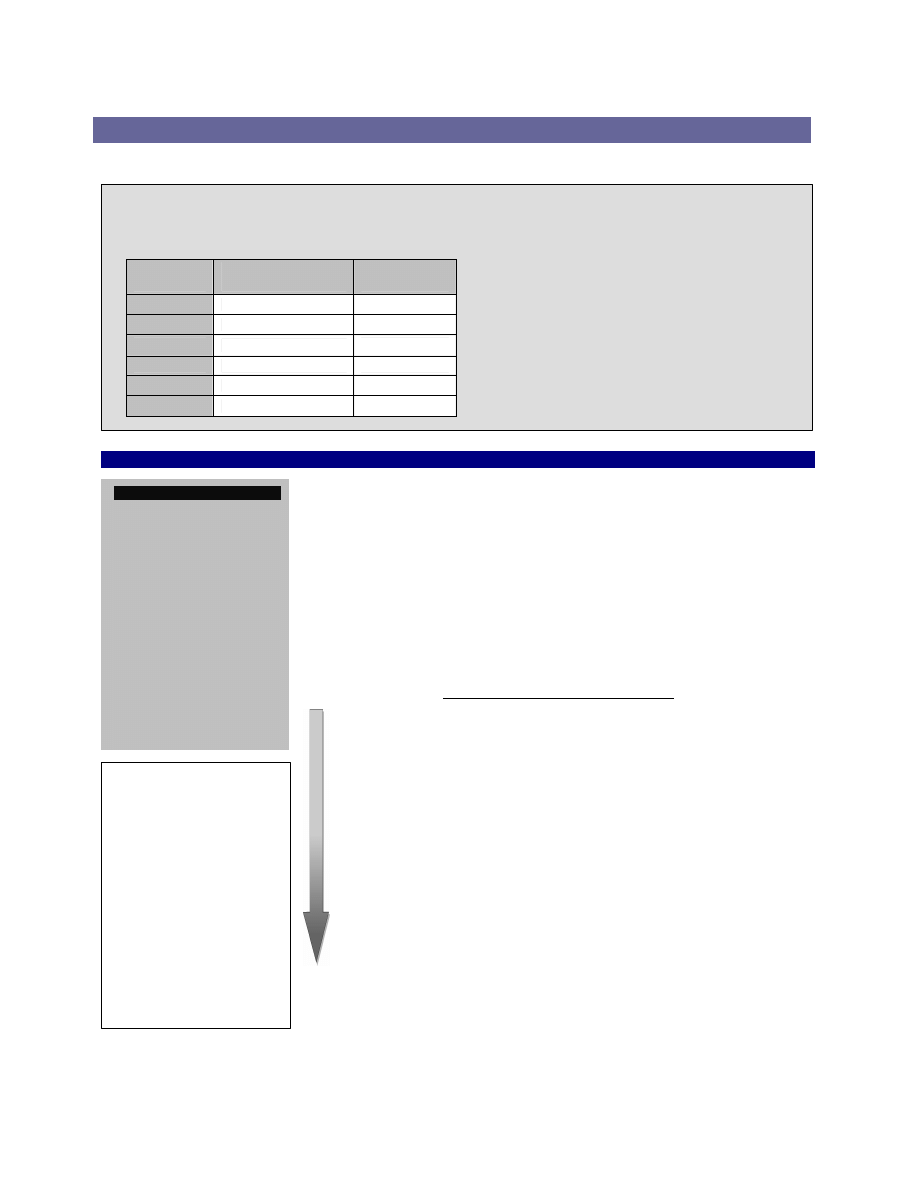

Figure I: Business Continuity Timeline

1990 - Principal component of BCM is IT disaster recovery; BCM provides

protection from natural disasters and component failure; recovery time objective is

72 hours.

1995 - BCM begins to include business processes protection; development of

recovery plans for critical work processes common.

1999 - Y2K concerns cause institutions to reassess conting ency planning;

traditional 72 hour recovery periods are insufficient and improved to between four

and 24 hours.

2001 - Post-September 11

th

BCM concerns include increased emphasis on crisis

management, improved “people” management and testing scenarios for new

situations such as loss of life, lack of transportation and destruction of facilities.

2004 - Concerns with four to 24 hour site outages led institutions to incorporate

BCM into business processes, applications and technology architecture designs.

Emphasis on ability to provide round-the-clock availability.

With the increased dedication of resources to BCM, financial institutions have developed

new departments and have increased employee responsibilities. Not surprisingly, the

organization of these departments varies by institution. This primary research brief

highlights the various organizational structures and planning practices used at six

institutions from across the globe.

Profiled

Institution

Net Premiums

Written

Geographic

Region

A

Under $1 Billion

Europe

B

Under $1 Billion

Australia

C

$3 - $5 Billion

North America

D

$5 - $10 Billion

North America

E

$5 -$10 Billion

North America

F

$1 - $3 Billion

North America

Primary Research Brief

Business Continuity and Disaster Recovery

Key Questions:

§ How fast is a company’s critical information

restored?

§ Which software solutions and vendors

assist in recovering data?

§ Who supports the business continuity and

disaster recovery programs?

§ What form of training is provided on

business continuity and disaster recovery?

www.insuranceadvisoryboard.com

I

NSURANCE

A

DVISORY

B

OARD

D

ECEMBER

2004

T

ABLE OF

C

ONTENTS

Issue Overview ……………1

Summary of Findings ……2

Testing and Recovery

Process …………………….4

Strategies, Staff and

Training …………………….5

Vendors ………………….…6

Research Methodology ….7

Recommended

Readings …………………...8

This project was researched and written

to fulfill the specific research request of

a single member of the Insurance

Advisory Board and as a result may not

satisfy the information needs of other

members. In its short-answer research,

the Insurance Advisory Board refrains

from endorsing or recommending a

particular product, service or program

in any respect. Sources are contacted at

random within the parameters set by the

requesting member, and the resulting

sample is rarely of statistically

significant size. That said, it is the goal

of the Insurance Advisory Board to

provide a balanced review of the study

topic within the parameters of this

project. The Insurance Advisory Board

encourages members who have

additional questions about this topic to

assign short-answer research projects of

their own design.

Catalogue No.: IAB12OAA1I

B

USINESS

C

ONTINUITY AND

D

ISASTER

R

ECOVERY

P

AGE

2

D

ECEMBER

2004

S

UMMARY OF

F

INDINGS

§

Business continuity is defined by Gartner to include five principal components. Table I, below, highlights the objectives

of various BCM components. The crisis management component, as illustrated, addresses the management of an

event and the plans to protect employees and the institution, regardless of what type of interruption.

5

Table I: Principal Components of Business Continuity Management

Disaster

Recovery

Business

Recovery

Business

Resumption

Contingency

Planning

Objective

Mission-critical

applications

Mission-critical

business processing

(workspace)

Business process

workarounds

External event

Focus

Site or component

outage (external)

Site outage

(external)

Application

outage (internal)

External behavior

forcing change to

internal

Deliverable

Disaster recovery

plan

Business recovery

plan

Alternate

processing plan

Business

contingency plan

Sample

Event

Fire at data center

Electrical outage

Credit

authorization

system down

Main supplier cannot

ship due to external

problem

Sample

Solution

Recovery site in

different location

Recovery site in

different power grid

Manual procedure

25% backup of vital

products; backup

supplier

Crisis Management

Source: Gartner Research, 2004.

§

Financial companies’ spending on Business Continuity and Disaster Recovery (BCDR) has spiked in recent years.

After the September 11

t h

attacks, spending rose 19 percent to US$3.4 billion. According to TowerGroup, spending on

disaster recovery is expected to rise another 12 percent to US$4 billion by the end of 2004 .

6

§

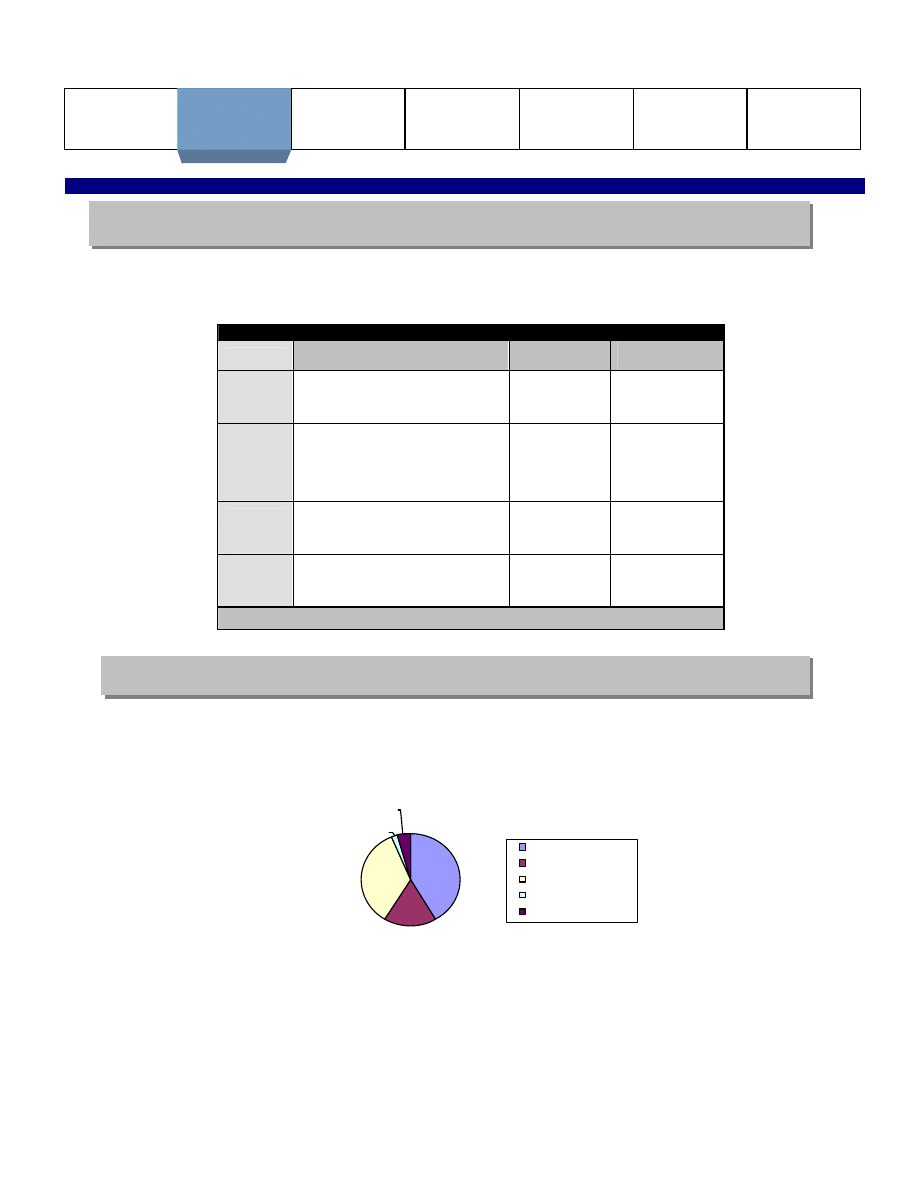

Figure II, below, depicts the growing concern for disaster recovery in relation to other IT security measures.

41.3%

17.4%

34.8%

2.2%

4.3%

Disaster Recovery

Privacy

Hackers/Viruses

Identity Theft/Fraud

Other

§

For the past 11 years, the federal government has mandated that financial institutions possess some form of disaster

recovery program. Since September 11

th

, 2001, more attention has been given to BCDR programs and companies

are now held accountable for their programs. All federally supervised financial institutions are now required to have

BCDR plans.

7

S

UMMARY OF

F

INDINGS

I

SSUE

O

VERVIEW

P

ROFILED

I

NSTITUTIONS

R

ESEARCH

M

ETHODOLOGY

Business Continuity Management is generally defined to include five components: disaster recovery, business

recovery, business resumption, contingency planning and crisis management.

Figure II: Top IT-Security Concerns at Insurance Companies

Source: Best’s Review, May 2004.

Disaster recovery is currently cited as the number one concern for Information Technology security at financial

institutions around the world.

I

SSUE

O

VERVIEW

S

UMMARY OF

F

INDINGS

T

ESTING AND

R

ECOVERY

P

ROCESS

S

TRATEGIE S

,

S

TAFF AND

T

RAINING

V

ENDORS

R

ESEARCH

M

ETHODOLOGY

R

ECOMMENDED

R

EADINGS

B

USINESS

C

ONTINUITY AND

D

ISASTER

R

ECOVERY

P

AGE

3

D

ECEMBER

2004

S

UMMARY OF

F

INDINGS

(

CONTINUED

)

Disaster Recovery is cited as the most important security concern for chief information officers and IT decision makers.

8

Every hour of downtime costs companies immensely. Table II, below, displays the average hourly cost of downtime.

Source: AIIM E-Doc Magazine, July/August 2004.

BCDR experts state that it is better to have a plan that prevents a disaster from taking systems down than to rely on

quickly restoring data after a disaster or attack. However, some businesses would rather pay the cost of downtime than

pay for the upkeep of a mirrored site that replicates data applications and IT infrastructure.

9

To manage the IT needs of organizations, disaster recovery vendors offer identical sets of applications and data, which

are available at off-site locations in the event of a catastrophic system failure. Experts state that most financial services

firms run “hot” or “warm sites,” where data are mirrored at an offsite facility on either real-time or near real-time basis,

since several minutes of downtime can result in significant revenue losses.

10,11

Contingency Planning & Management Online categorizes the following four options available for alternate sites:

1 2

§

Hot Sites: Monthly subscriber fees pay for the availability, space, equipment, and services of fully

operational facilities maintained by independent providers.

§

Cold Sites: Computer-ready space held in reserve for the user’s own systems, for any subscriber whose

recovery exceeds the period pre-designated for hot site usage.

§

Warm Sites: Data center or office space partially equipped with hardware, communications interfaces,

power sources, and environmental conditioning.

§

Mobile Recovery Centers: Custom- designed, transportable structures outfitted with computer and

telecommunications equipment, transported to and set up at the chosen location.

In order to prevent downtime in a crisis, it is imperative that Human Resources (HR) be a key play er in programs that

manage internal and external operations and communication.

1 3

An effective key contingency plan includes setting aside reserve funds for dealing with the unexpected expenses

associated with replacing a key executive. Assigning a conti ngency planning team whose responsibilities include

proactively developing high potential employees in tandem with succession plans proves a useful tactic to prepare the

company for sudden leadership vacuums . Consequently, if a key officer at the top suddenly needs a replacement, ideally ,

executives have been groomed to assume key positions.

14,15

One tactic is to mentor and cross-train high- potential

employees for key positions throughout the organization. Such training also serves as an effective retention tool in an

industry with high turnover.

16

Table II: Average Hourly Cost of Downtime

Type of Business/Technology

Cost of Downtime

Brokerage House or Large E-commerce Site $6.4 million

Credit Card Sales and Authorization

$2.6 million

Catalog Sales

$90 thousand

Package Shipping and

Transportation Industry

$28 thousand

UNIX Networks

$75 thousand

PC LANs

$18 thousand

KEY

POINT

Human resources play a key role in minimizing the loss of data through contingency business resumption planning.

I

SSUE

O

VERVIEW

S

UMMARY OF

F

INDINGS

T

ESTING AND

R

ECOVERY

P

ROCESS

S

TRATEGIES

,

S

TAFF AND

T

RAINING

V

ENDORS

R

ESEARCH

M

ETHODOLOGY

R

ECOMMENDED

R

EADINGS

B

USINESS

C

ONTINUITY AND

D

ISASTER

R

ECOVERY

P

AGE

4

D

ECEMBER

2004

T

ESTING AND

R

ECOVERY

S

TRATEGIES

Business Continuity and Disaster Recovery Process

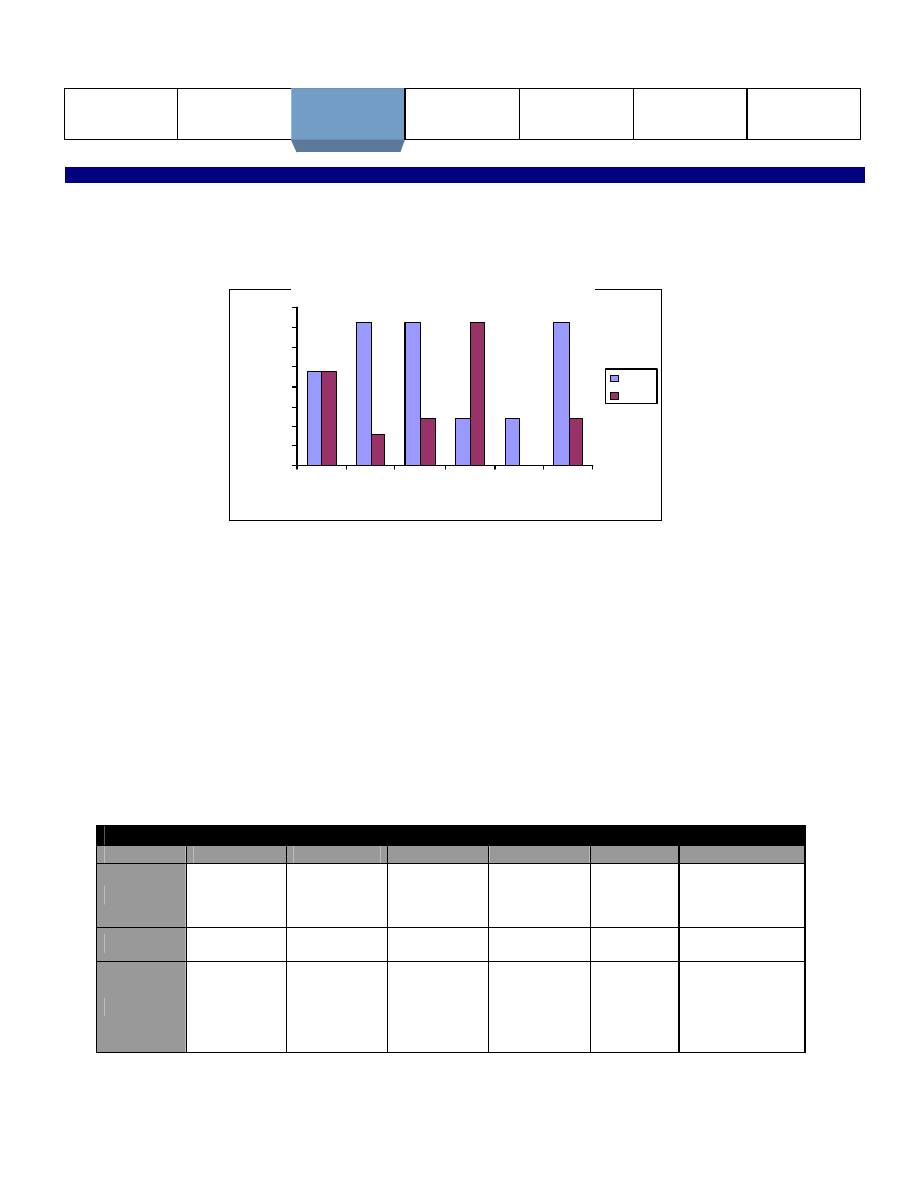

Figure III, below, charts the business- defined recovery time objective (RTO) and the business- defined recovery point objective

(RPO) for each of the six profiled institutions. Institution E currently lacks a definition for RPO, and therefore is not included in

the graph.

48

72

7 2

24

24

7 2

48

16

24

72

0

24

0

10

20

30

40

50

60

70

80

A

B

C

D

E

F

Institution

Hours

RTO

RPO

Each of the profiled institutions conducts a full continuity test once a year. The point of scope in these tests varies by

institution, although all include testing of critical systems:

§

Institution A tests their desktop and in-house databases. No third party is involved with the testing.

§

Institution B examines their mainframe and midrange systems. Employees participate in the testing of recovered

critical process chains and follow prepared test scripts.

§

Institution D conducts a continuity test by having a complete building outage of one of their seven offices. Third

party vendors are employed to carry out the testing.

§

Institution F conducts a full recovery test two times per year on the mainframe side and annually for distributed

processing and business functional plans.

None of the six companies who participated in this study had their BCDR plans certified. However, Institution B works closely

with the Australian Prudential Regulation Authority’s guidelines and has their plans benchmarked to best practice.

Business Continuity and Disaster Recovery t esting generally occurs ov er the course of several weeks . Table III, below,

displays the preparation, frequency, and involvement within the six profiled institutions.

Table III: Preparation, Frequency and Involvement of Testing

Institution A

Institution B

Institution C

Institution D

Institution E

Institution F

Preparation

3-4 days

spread over 4-

5 weeks

Rolling Basis

NA

Rolling Basis –

meet monthly

to discuss

testing

4-5 months

4-6 weeks part time

Frequency

NA

Once per year

Rolling Basis

NA

Once per

year

NA

Involvement

Business

coordinators

from each

department

IT Service

Continuity and

Corporate

Business

Continuity

Group

IT and

Business

Involved

IT and

Business

Involved

NA

Recovery

Coordinator and

Disaster Recovery

team leaders and

test participants

Figure III: RTO vs. RPO for Critical Resources

I

SSUE

O

VERVIEW

S

UMMARY OF

F

INDINGS

T

ESTING AND

R

ECOVERY

P

ROCESS

S

TRATEGIES

,

S

TAFF AND

T

RAINING

V

ENDORS

R

ESEARCH

M

ETHODOLOGY

R

ECOMMENDED

R

EADINGS

Source: Board Research, 2004.

B

USINESS

C

ONTINUITY AND

D

ISASTER

R

ECOVERY

P

AGE

5

D

ECEMBER

2004

S

TRATEGIES

,

S

TAFF AND

T

RAINING

Human Resources and Business Continuity and Disaster Recovery Staff and Training

Institution A has one full time BCM manager and one part time coordinator in each department.

Institution B has a full time BCM manager who reports to Fraud and Security Risk. Three additional

BCM coordinators work for each regional area of the company and report upwards to the BCM manager.

Two of these coordinators are part time staff, while the third operates full time. There is one contracted BCM

consultant who reports independently to the Risk Manager. This consultant has full responsibility for

Information Technology/Disaster Recovery Plans (ITDRP).

Institution C’s Business Continuity Program consists of one full time BCM coordinator, one full time

technical continuity coordinator and five directors of Information Security and Continuity Services.

Institution D has two full time staff on the IT/DR side who report through the CIO and up to the CFO. An

additional two full time staff are on the Business Recovery side, reporting up to the CFO. All four employees

meet monthly to coordinate their Information Security issues.

Institution F’s BCDR program consists of three full time Information Security/Information Technology

Recovery Coordinators. These coordinators report to the Security Officer, who then reports to the Director of

Enterprise Operations Applications. There are nine part time Business Recovery Coordinators who are all

director - level employees who report to Vice Presidents across the company.

Institution F also has a Corporate Business Continuity Team that is led by an IT/DR specialist and staffed

by Recovery Coordinators. About 200 Disaster Recovery Team Leaders, composed of department

managers, supervisors, or IT/IS technicians, are responsible for applications and support.

Institution E does not currently have a support staff for their BCDR program.

The number of people supporting the business continuity programs at each institution widely varies. However, all

institutions but Institution E have a mixture of full and part time employees who report to the overall BCM manager.

R

ECOVERY

S

TRATEGIES

Institution B has recovery strategies at the operational level to cover three scenarios: loss of a physical site, loss of

computers, and loss of telephones at a physical site. Each scenario has its own Action Plan which covers loss of systems

nationwide.

Institution F has implemented a mainframe hot site and work area for alliance distributed environments through SunGard.

Additionally, they have an in-house work area for home office and failover for critical distributed, quick ship for less critical

distributed, and acquire ATOD for least critical distributed.

B

USINESS

C

ONTINUITY AND

D

ISASTER

R

ECOVERY

T

RAINING

§

Institution A offers ongoing training for specific individuals in each area of the institution.

§

Institution B administers a Training and Awareness Pack to all employees at the business level. An additional intranet

site on business continuity exists to assist employees.

§

Institution C is revamping their strategy and developing a BCP Awareness program for all employees.

§

Institution D exercises teams annually on BCDR strategies; however, at this time there is no formal instruction available

to employees. A website defines expectations, policies and procedures for employees to follow in the case of a disaster.

§

To implement BCDR training across levels of the Institution F provides walk-through scenarios of business plans, mock

disaster sessions, hot site and question/answer testing

§

Institution E provides cursory training on BCDR, though not everyone is accountable for it.

I

SSUE

O

VERVIEW

S

UMMARY OF

F

INDINGS

T

ESTING AND

R

ECOVERY

P

ROCESS

S

TRATEGIES

,

S

TAFF AND

T

RAINING

V

ENDORS

R

ESEARCH

M

ETHODOLOGY

R

ECOMMENDED

R

EADINGS

B

USINESS

C

ONTINUITY AND

D

ISASTER

R

ECOVERY

P

AGE

6

D

ECEMBER

2004

V

ENDORS

Business Continuity and Disaster Recovery Vendors

Institutions A, B, C and F blend in-house processes and outsource processes to maintain a hybrid solution to disaster

recovery.

Table IV , below, depicts the vendors and software employed by the institutions in order to maintain BCDR plans.

Table IV: BCDR Vendors and Software

Outsource, Insource or

Hybrid Solutions

Software Used to Maintain BCDR

Plans

Institution A

Hybrid Solution: in-

house cold site,

outsource contracts to

Synstar

Utilizes C- Plan, an internally

developed software solution, to

maintain the BCDR plans. C- Plan

needs redevelopment as there is a

low level of satisfaction for the plan.

Institution B

Hybrid Solution: shared

warm site facility that is

run by IBM/GSA and

staffed by Institution B’s

employees

Utilizes Microsoft Office products to

maintain BCDR plans. The products

“work well and are cost effective.”

Institution C

Hybrid Solution: many

systems, such as email

and network based

services, are replicated

between locations and

the rest is outsourced to

IBM

Utilizes LDRPS to ma intain their

BCDR plans. Likely to discontinue

because the product “adds little value

to the process.”

Institution D

In-house Solutions

NA

Institution E

Outsource to SunGard

NA - currently evaluating several

plans

Institution F

Hybrid Solution: in-

hous e solutions for

critical information that

cannot withstand a 72

hour RTO, SunGard is

used as a hot site

vendor

Utilizes ComPAS s oftware and is

currently evaluating other products.

Living Disaster Recovery

Planning System (LDRPS)

is a software product that

assists in organizing and

carrying out BCDR plans.

LDRPS offers plan

templates, language

modules, work station

recovery, call lists and

databases to support data

recovery.

ComPAS is a software

program developed by

SunGard. Its plans are

action oriented task lists

organized by function,

department and location.

ComPAS’ guides

companies through a step-

by-step process of

developing, testing and

implementing a

comprehensive continuity

plan.

K

EY

P

OINT

Institution D decided that it is less expensive to establish a hot site run by their employees. The company set up a data center

12 miles from their downtown office. While the center is in close proximity to the downtown offices, the worst case natural

disaster that could occur is a tornado. However, Institution D remarked that “a tornado is only likely to hit any given point

every 999 years and to hit two points 12 miles apart is highly unlikely.”

K

EY

O

BSERVATION

Each of the profiled institutions, except for Institution B, that apply software to maintain their BCDR plans are unsatisfied

with the results. While numerous software vendors exist, companies have trouble effectively integrating the software into

their institutions. Despite the immense loss of data for some companies after September 11, 2001, no standard practice has

been implemented across the insurance industry for BCDR plans, leaving many institutions questioning what steps to take to

protect their company from a disaster.

I

SSUE

O

VERVIEW

S

UMMARY OF

F

INDINGS

T

ESTING AND

R

ECOVERY

P

ROCESS

S

TRATEGIES

,

S

TAFF AND

T

RAINING

V

ENDORS

R

ESEARCH

M

ETHODOLOGY

R

ECOMMENDED

R

EADINGS

B

USINESS

C

ONTINUITY AND

D

ISASTER

R

ECOVERY

P

AGE

7

D

ECEMBER

2004

R

ESEARCH

M

ETHODOLOGY

Board staff interviewed business continuity and disaster recovery professionals at six

insurance companies. These individuals discussed the recovery process, IT vendors and

human resources within each institution. This report represents findings from primary and

secondary sources.

Ke y Questions:

1. What is the business-defined recovery time objective (RTO) for the Company’s critical resources?

2. What is the business-defined recovery point objective (RPO) for the Company’s critical information?

3. Does the Company outsource (e.g., SunGard) or in source disaster recovery or do you have a hybrid solution?

a.

If insourced solution, does the Company run a hot site, worksite or cold site.

b.

If outsourced, with what firm do you contract?

c.

If hybrid solution, explain the solution.

4. How often does the Company run a full continuity/recovery test?

a.

How often does the Company do point solution recovery tests?

b.

What is the scope of testing? (e.g., mainframe only, application testing, etc.)

c.

Does the testing include third party business partners, vendors, etc.?

5. Does the Company prepare for the test or is it spontaneous?

a.

If the Company prepares, how much preparation / planning is involved?

b.

Who is involved in this planning?

6. Are the Company’s business resumptions plans certified? If so, by which organization?

7. Is the Company’s DR plan(s) certified? If so, by which organization?

8. How many people support the business continuity program? Clarify full time or part time, roles and responsibilities

and where they report.

9. How often does the Company perform a business impact analysis?

a.

Is this done using existing staff or external resources?

10. Has the Company developed high availability solutions for critical business processes? Describe.

11. How many recovery strategies have been implemented? Describe.

12. Does the Company perform business continuity training? If so, to what extent?

a. Is it company-wide training or for specific individuals?

13. Does the Company utilize a software solution for maintaining business resumption plans, disaster recovery plans,

etc.? If so, please name the product and the satisfaction level.

a. If not, have you evaluated certain products?

b.

What is your opinion?

R

ESEARCH

M

ETHODOLOGY

I

SSUE

O

VERVIEW

S

UMMARY OF

F

INDINGS

T

ESTING AND

R

ECOVERY

P

ROCESS

S

TRATEGIES

,

S

TAFF AND

T

RAINING

V

ENDORS

R

ESEARCH

M

ETHODOLOGY

R

ECOMMENDED

R

EADINGS

B

USINESS

C

ONTINUITY AND

D

ISASTER

R

ECOVERY

P

AGE

8

D

ECEMBER

2004

R

ECOMMENDED

R

EADINGS

1.

“Trends in Information Security and Business Continuity Planning: From Infrastructure Protection to Business

Planning.” Working Council for Chief Information Officers, 2003.

2.

“Disaster Recovery Technologies.” Infrastructure Executive Council, April 2003.

3.

“Business Continuity Management Structures.” Operations Council, April 2004.

4.

“Crisis Management Strategies.” Corporate Leadership Council, May 2003.

5.

“Business Continuity Planning.” Working Council for Chief Executive Officers, September 2002.

6.

“Disaster Recovery Planning at Banks.” Operations Council, April 2002.

7.

“Disaster Recovery / Business Continuity Plans and Key Insights from September 11

th

.” Working Council for Chief

Information Officers, September 2002.

8.

“Disaster Recovery and Business Continuity Vendors.” Working Council for Chief Information Officers , July 2002.

9.

“HR and Business Process Recovery and Contingency Planning.” Corporate Leadership Council, February 2002.

3

1

“Business Continuity and Crisis Management.” Management Quarterly, January 2003.

2

“Leaving it to Chance.” CA Charter, 1 February 2004.

3

“Management Update: Best Practices in Business Continuity and Disaster Recovery.” Gartner, 17 March 2004.

4

“Business Continuity Management Structures.” Operations Council, April 2004.

5

ibid

6

Marlin, Steven and Martin J Garvey. “Disaster-Recovery Spending on the Rise.” Information Week, 9 August 2004.

7

Swann, James. “Be Prepared: Disaster Recovery Strategies.” Community Banker, February 2004.

8

“Moving IT Forward.” Best’s Review, May 2004.

9

Garvey, Martin J. “Mirrored Sites Keep Systems Up.” Information Week, August 2003.

10

“Disaster Recovery and Business Continuity Vendors.” Working Council for Chief Information Officers, July 2002.

11

“IT Challenge.” Wall Street & Technology Online, 9 October 2001.

12

“Contingency Planning & Management.” http://www.contingencyplanning.com

13

“Crisis Management Strategies.” Corporate Leadership Council, May 2003.

14

“Executive Succession Plans.” Change Management Group, November 2001.

15

“HR and Business Recovery and Contingency Planning.” Corporate Leadership Council, February 2002.

16

ibid

The Insurance Advisory Board has worked to ensure the accuracy of the information it provides to its

members. This project relies upon data obtained from many sources, however, and the Insurance Advisory

Board cannot guarantee the accuracy of the information or its analysis in all cases. Further, the Insurance

Advisory Board is not engaged in rendering legal, accounting or other professional services. Its projects

should not be construed as professional advi ce on any particular set of facts or circumstances. Members

requiring such services are advised to consult an appropriate professional. Neither Corporate Executive Board

nor its programs is responsible for any claims or losses that may arise from any errors or omissions in their

reports, whether caused by Corporate Executive Board or its sources.

Professional Services Note

I

SSUE

O

VERVIEW

S

UMMARY OF

F

INDINGS

T

ESTING AND

R

ECOVERY

P

ROCESS

S

TRATEGIES

,

S

TAFF AND

T

RAINING

V

ENDORS

R

ESEARCH

M

ETHODOLOGY

R

ECOMMENDED

R

EADINGS

Wyszukiwarka

Podobne podstrony:

Continuous real time data protection and disaster recovery

business groups and social welfae in emerging markets

226 General tips for Flash and SSD recovering)

49 The present continuous and the future simple

ABC Of Conflict and Disaster

Ecological effects of soil compaction and initial recovery dynamics a preliminary study

business relationships and networks

Financial Times Prentice Hall, Executive Briefings, Business Continuity Management How To Protect Y

Accidents and disaster experiences worksheet

Continuities and Discontinuities Patterns of Migration, Adolescent

Google Business Solutions and Tools

Web Services Business Objects And Component Model

Brin, David What Continues and What Fails

Offshore Oil and Gas Recovery Technology

business objecxtives and values 03

A Robbins Jay Abraham How To Get Any Business Going and Growing

SP 5 Disaster Recover Plan (DRP)

więcej podobnych podstron