Business Intelligence in Retail Customer

Management

Bringing Information Together to Build the Accurate Customer Profile

November 2006

Sponsored, in part, by:

The Business Intelligence in Customer Management Benchmark Report

All print and electronic rights are the property of Aberdeen Group © 2006.

Aberdeen Group • i

Executive Summary

ndersatanding customer behavior has long been the elusive challenge of retailers

to unlocking the true potential of programs, promotion, product sales, and much

more. Stymied in the past by unruly data locked away in a data warehouses, the

art of mastering this challenge may be at hand with technology advancements of

late in the area of retail business intelligence. Historically, retailers have tended to look

at their customers in aggregate: that is they look at classes of customers, clusters of stores

and general target demographics. As a consequence, retailers would yield less than opti-

mal results when changing elements such as their messaging, marketing, merchandising

and pricing strategies.

Key Business Value Findings

• Best-in-Class retailers lead the way when it comes to managing customer product

interaction: 70% of these organizations track new product adoption; 100% track

promotion participation; and 91% of these retailers track product preferences/affinity.

The net result is that Best-in-class retailers have a sharper understanding of cus-

tomer/product behaviors.

• Eighty two percent of respondents are using BI on an enterprise-wide basis. How-

ever, only 16% of survey respondents, and 33% of Best-in-Class respondents, use

real- or near-real-time business intelligence-related data measuring techniques.

Implications and Analysis

The behaviors and activities of retailers utilizing business intelligence in retail customer

management directly affect bottom-line performance. For example:

• Eighty two percent of respondents are using BI on an enterprise-wide basis, however,

only 16% of survey respondents, and 33% of Best-in-Class respondents, use real- or

near-real-time business intelligence-related data measuring techniques.

• Fifty six percent of respondents use BI functionality to manage customer cross-sells

and up-sells, but only in a limited way (e.g. not typically done in real time).

Recommendations for Action

• Move to real-time BI-related data measurement.

• Prioritize the formal measurement of customer behavior analytics, such as the use of

customer conversion, acquisition, and retention measurement activities.

• Address the internal, non-technical challenges associated with BI, such as resistance

to trusting data generated by business intelligence systems, and the ability to BI to

replace existing functionality.

U

The Business Intelligence in Customer Management Benchmark Report

All print and electronic rights are the property of Aberdeen Group © 2006.

Aberdeen Group

Table of Contents

Good Customer Service Comes From Good Customer Data ........................ 2

Chapter Two: Key Business Value Findings .........................................................4

Best in Class Keep their C-Level Executives Invested in

Business Intelligence.................................................................................... 7

Challenges and Responses........................................................................... 8

Process and Organization ........................................................................... 10

Data and Knowledge – Opportunity Missed................................................. 11

Measurement............................................................................................... 11

Pressures, Actions, Capabilities, Enablers (PACE)...................................... 12

Chapter Four: Recommendations for Action ......................................................14

Laggard Steps to Success........................................................................... 14

Industry Norm Steps to Achieve Best in Class Results................................ 14

Best in Class Next Steps ............................................................................. 15

Appendix B: Related Aberdeen Research & Tools .............................................21

The Business Intelligence in Customer Management Benchmark Report

All print and electronic rights are the property of Aberdeen Group © 2006.

Aberdeen Group

Figures

Figure 1: Cross-sells and Up-sells, Loyalty Programs Dominate BI Use..............3

Figure 2: Active BI Users More Likely to Have Traditional

Customer Measurements Available for Use .........................................................5

Figure 3: Best-in-Class Companies Focus on Traditional

Customer Buying Habits.......................................................................................6

Figure 4: C-Level Executives Using BI to Understand their Customers ...............7

Figure 5: Best in Class Measure Performance at the Enterprise Level ..............10

Figure 6: Retailers Miss Opportunities to Use Their Data .................................. 11

Figure 7: Traditional Store Sales Remains as Top KPI to Measure BI................12

Tables

Table 1: Top Pressures Driving In-Store Improvements .......................................1

Table 2: Business Intelligence: Retailer Challenges and Responses ...................8

Table 3: Business Intelligence in Customer Management

Competitive Framework .......................................................................................9

Table 4: PACE (Pressures, Actions, Capabilities, Enablers)...............................13

Table 6: Relationship between PACE and Competitive Framework ...................19

The Business Intelligence in Customer Management Benchmark Report

All print and electronic rights are the property of Aberdeen Group © 2006.

Aberdeen Group • 1

Chapter One:

Issue at Hand

argeting and retaining in-store customers has never been an easy task for retailers,

especially in today’s rapidly expanding multi-channel selling environment. Tradi-

tionally, retailers have tended to look at their customers in aggregate: that is they

look at classes of customers, clusters of stores and general target demographics.

This analysis can often result in an incomplete picture of customer behavior and buying

patterns. As a consequence, retailers would yield less than optimal results when changing

elements such as their messaging, marketing, merchandising and pricing strategies. Lack

of internal systems that allow retailers to effectively evaluate and act on customer behav-

ior trends has stood in the way of progress.

Providing a higher level of customer performance has been center stage for retailers for

some time. On the one hand, retailers feel constant pressure from Wall Street and other

stakeholders to maximize earnings per share, predictability, and performance against

their peers. On the other hand, these same retailers recognize that these metrics alone,

achieved in isolation without understanding, are short lived.

Recent Aberdeen research confirms these challenges and the priority retailers place on

providing increased customer performance. For example, in

lighting Customers, Motivating Employees, and Pleasing Shareholders

, as well as

Empowered Point of Service: The Customer Reclaims Her Kingdom

, eroding customer

loyalty and improving customer service were two of the top three pressures for opera-

tional improvements.

Table 1: Top Pressures Driving In-Store Improvements

Pressures Within the Store Environment

91% — Inconsistent store execution

87% — Product or service differentiation on factors besides price

73% — Eroding consumer loyalty

92% — Improve customer service without increasing labor costs

80% — Improved employee productivity

Source:

Aberdeen

Group

, November 2006

R

Key Takeaways

• Retailers tend to look at their customers in aggregate: classes of customers, clusters of

stores and general target demographics.

• Fifty six percent of respondents use BI functionality to manage customer cross-sells and

up-sells. Other top areas of BI use include loyalty rewards programs, sales analysis, and

identification and targeting of specific households.

T

The Business Intelligence in Customer Management Benchmark Report

All print and electronic rights are the property of Aberdeen Group © 2006.

2 • AberdeenGroup

Good Customer Service Comes

From Good Customer Data

Good customer service is heavily dependent

on how well a retailer knows its customer.

However, most retailers still manage mes-

saging, marketing, merchandising and pric-

ing strategies, independent of understanding

the impact on individual customer behavior.

Left uncoordinated, retailers will find them-

selves challenged to make optimized deci-

sions to truly impact the bottom line.

As a response to the challenge business in-

telligence application are being deployed

and are changing the way retailers manage

customer data within their enterprises. Fal-

ling hardware prices and increased process-

ing power, coupled with advances in ana-

lytic engines, are coming together to raise

the value of a next generation business intelligence offerings. Business intelligence

functionality has evolved beyond simple dashboards that show red, yellow, and green

flags for exception reporting, to simple but sophisticated systems capable helping retail-

ers understand future trends based on past performance and missed opportunities.

Theoretically, the “Holy Grail” of retailing is the prospect of establishing a single view

of manageable data across the enterprise. When it comes down to coordinating en-

hanced customer performance strategies, this mantra could not be truer. Although the

retail industry has a long way to go to hit that goal, the vendor community is moving in

the right direction. Best in Class retailers, defined as having

annual store sales growth of more than 3%, improved cus-

tomer retention, and decreased shrink rates are seeking new

and improved solutions to managing this process.

Retailers Utilize BI for Increased Customer

Touches

Between March and November of 2006, the Aberdeen

Group surveyed more than 175 respondents on their BI

strategies. Fifty three percent of these respondents indicated

that they have active Business Intelligence implementations

in place for their customer management processes – the most

popular category of BI use (along with BI in Merchandising)

among survey respondents. (See

Business Intelligence in

Retail Merchandising: Harnessing Advanced Data Manage-

ment to Address Today’s Merchandising Challenges

) Ac-

cording to these executives, cross-selling/up-selling, loyalty

rewards programs and sales analysis were the top three uses

PACE Key — For more detailed descrip-

tion see Appendix A

Aberdeen applies a methodology to benchmark

research that evaluates the business pressures,

actions, capabilities, and enablers (PACE) that

indicate corporate behavior in specific business

processes. These terms are defined as follows:

Pressures —

external forces that impact an

organization’s market position, competitiveness,

or business operations

Actions —

the strategic approaches an organi-

zation takes in response to industry pressures

Capabilities —

the business process competen-

cies required to execute corporate strategy

Enablers — the key functionality of technology

solutions required to support the organization’s

enabling business practices

Competitive Framework

Key

The Aberdeen Competitive

Framework defines enter-

prises as falling into one of

the three following levels of

practices and performance:

Laggards — practices that

are significantly behind the

average of the industry

Industry norm — practices

that represent the average

or norm

Best in Class — practices

that are the best currently

being employed and signifi-

cantly superior to the indus-

try norm

The Business Intelligence in Customer Management Benchmark Report

All print and electronic rights are the property of Aberdeen Group © 2006.

Aberdeen Group • 3

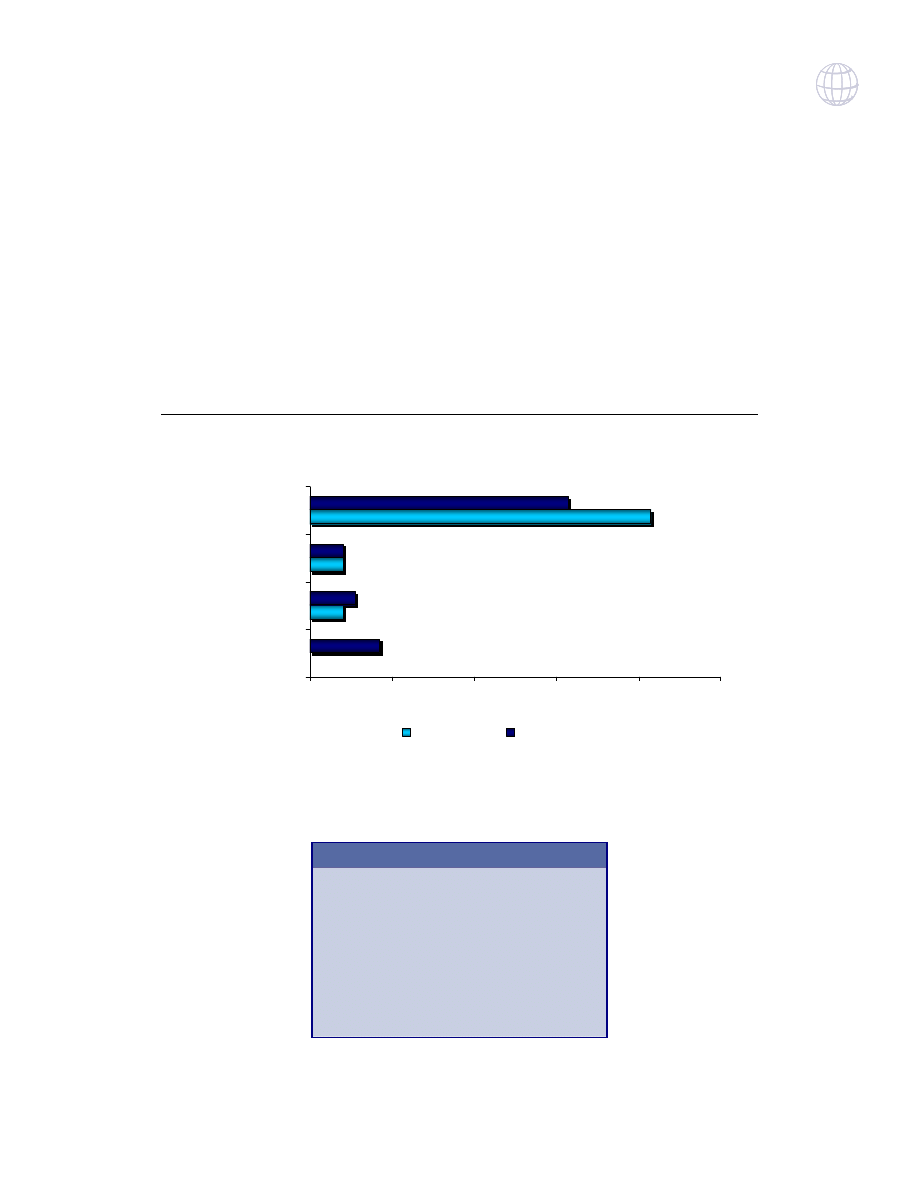

of BI for customer management within the enterprise. Other top uses of BI in customer

management included sales analysis, identification and targeting specific households as

potential customers, and prediction of spending patterns (Figure 1).

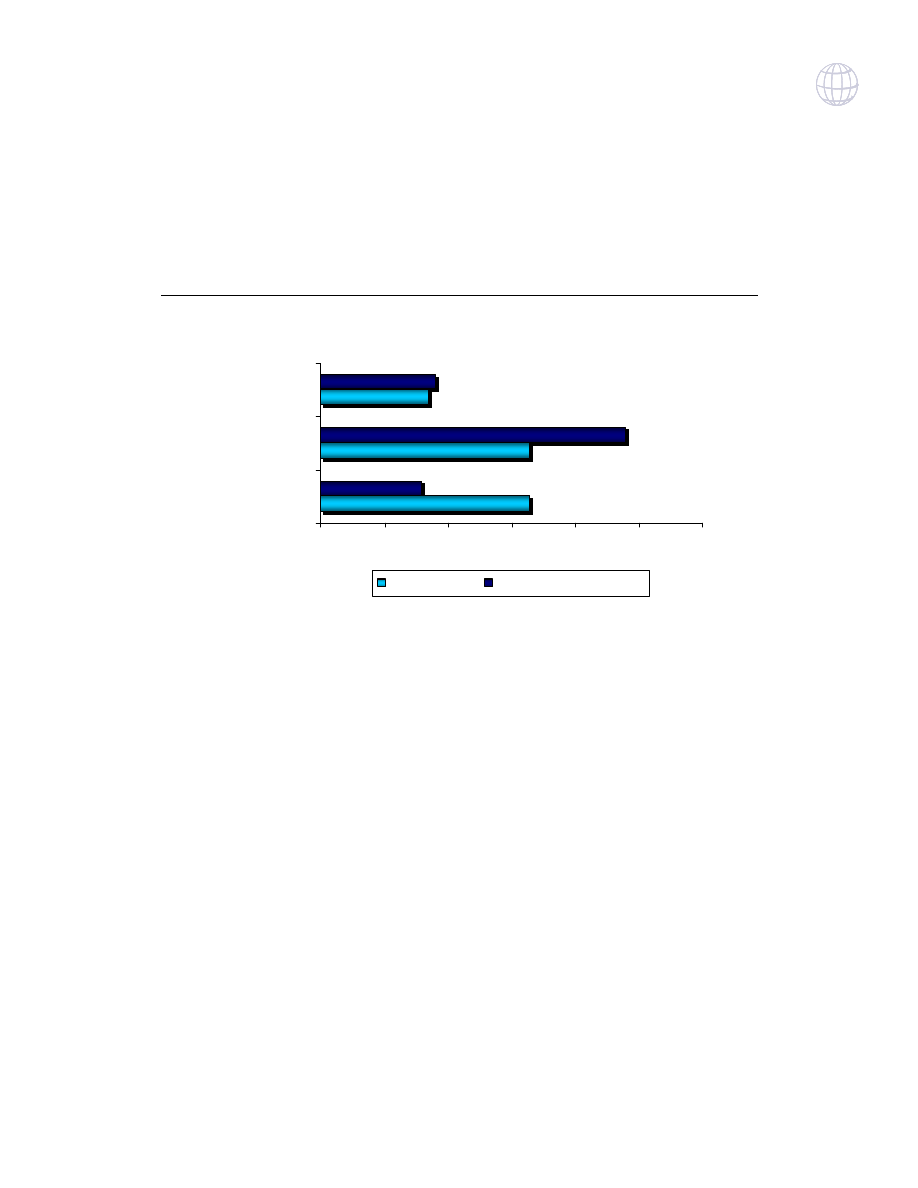

Figure 1: Cross-sells and Up-sells, Loyalty Programs Dominate BI Use

Use of BI for Customer Management

25%

27%

27%

37%

51%

54%

56%

0% 10% 20% 30% 40% 50% 60%

New customer acquisition

One-on-one marketing

Predict spending patterns

Identify and target specific households

as potential customers

Sales Analysis

Loyalty rewards programs

Cross-sells and up-sells

Source:

Aberdeen

Group

, November 2006

The Business Intelligence in Customer Management Benchmark Report

All print and electronic rights are the property of Aberdeen Group © 2006.

4 • AberdeenGroup

Chapter Two:

Key Business Value Findings

Key Takeaways

• Best-in-Class retailers are on the cutting edge of quantifying customer behaviors: 73% of

these organizations measure customer conversion, and 100% of Best-in-Class retailers

measure retention and acquisition.

• Best-in-Class retailers also lead the way when it comes to managing a customer’s prod-

uct interaction: 70% of these organizations track new product adoption, 100% track pro-

motion participation, and 91% of these retailers track product preferences/affinity.

• Lack of data management centralization was the top challenge associated with business

intelligence in customer management (according to 49% of respondents), and data

cleansing projects to improve data quality was the top response to existing challenges

(according to 61% of respondents).

n the Aberdeen Group BI benchmark report,

Business Intelligence in Retail: Bringing

Cohesion to a Fragmented Enterprise,

it was reported that 76% of respondents indi-

cated they use or have active, budgeted plans to use business intelligence in some

form within their organizations. Although such high metrics are promising news for the

retailers themselves, understanding the role of business intelligence in the organization is

essential to its success. For example, retailers need to consider:

•

What executive-level support is required to ensure successful BI implementations?

•

Should business intelligence be measured in real time, batched, or ad-hoc to achieve

balanced results?

•

How will BI data be viewed and applied?

•

What role does BI have beyond customer management and how will this impact cus-

tomer performance?

In addition to understanding and answering these key questions, retailers should also

look to understand the advantages of using BI to empower customer relationship man-

agement (CRM) or marketing automation applications, and measuring such traditional

customer metrics as acquisition, retention and conversion. In addition, there is the pos-

sibility of using BI to strengthen “sales floor” decision-making and track customer buy-

ing behavior such as product preference/affinity, promotion participation, and new

product adoption.

The Business Intelligence in Customer Management Benchmark Report

All print and electronic rights are the property of Aberdeen Group © 2006.

Aberdeen Group • 5

Acquisition, Retention and Conversion:

Best-in-Class Customer Management BI Users Know Them Well

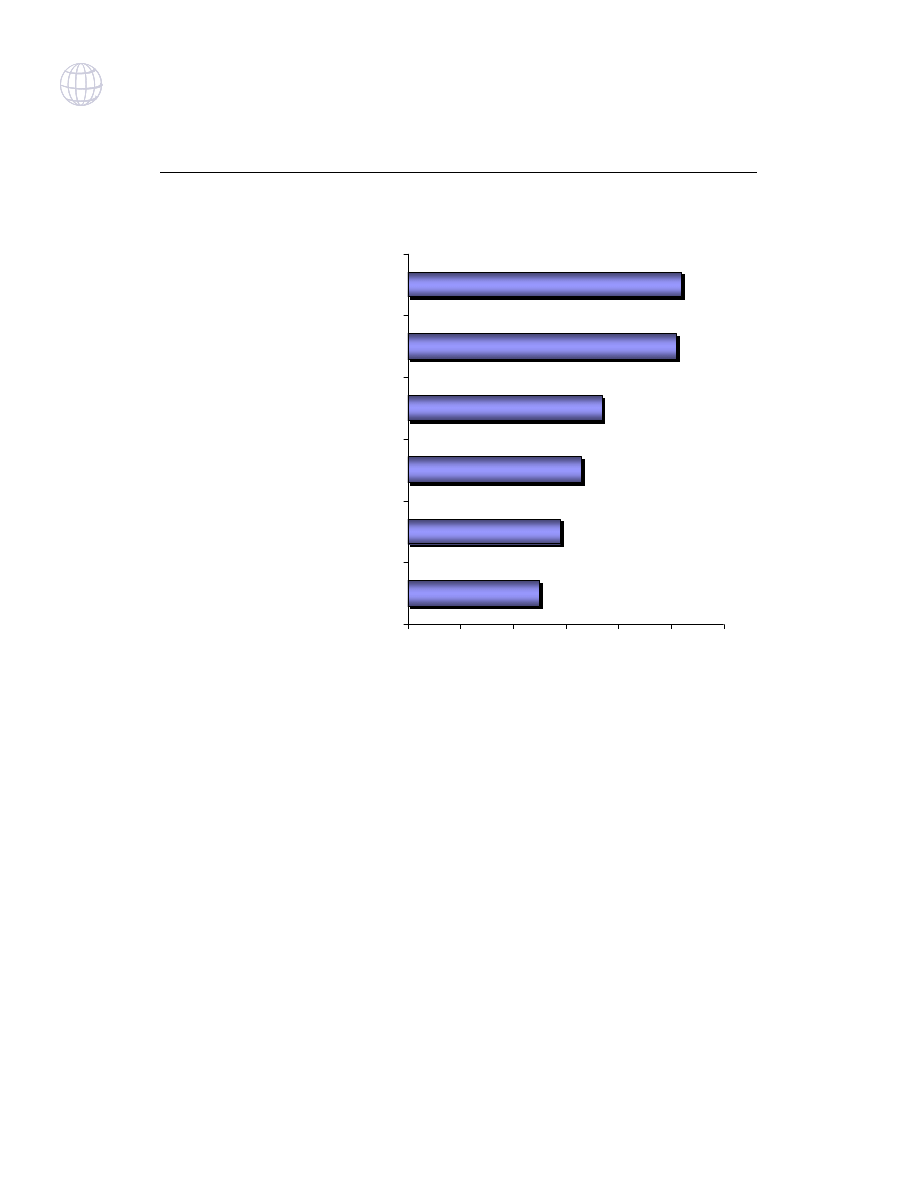

Respondents who currently use of BI for customer management have demonstrated a

specific willingness to use customer metrics such as retention, acquisition, and conver-

sion to monitor their customer base, in comparison to those who are still planning for this

specific use of BI. In two of those three metrics (and extremely close in the third), those

who are already using BI for customer management were more likely to actively conduct

these measurements. In addition, in all three metrics, Best-in-Class were much more

likely then either of the previous two groups to use such metrics in their business process.

Traditional CRM functionality can be a crucial first step into collecting and managing

customer conversion, retention, and acquisition data. In addition, Knowledge Manage-

ment functionality may bolster this data to provide consistency through out the organiza-

tion. Providing top-line decision-making based on advanced customer data management,

however, can be achieved by combining measurement of traditional customer manage-

ment parameters with business intelligence functionality. Customer management business

intelligence solutions that utilize these metrics allow for a more holistic picture of the

customer, and provide the specificity decision-makers need to increase potential cross-

and up-sells on a per-customer basis, versus a per demographic basis. While the analysis

cannot guarantee respondents’ actual utilization of these metrics with BI, their shear

availability puts retailers in a position to strengthen existing BI functionality with this

data, already available for use.

Figure 2: Active BI Users More Likely to Have Traditional Customer Measure-

ments Available for Use

Use of Traditional Customer Management

100%

100%

73%

73%

77%

47%

51%

54%

48%

0%

20%

40%

60%

80%

100%

120%

Acquisition

Retention

Conversion

Best-in-Class

Active BI User

Planned BI User

Source:

Aberdeen

Group

, November 2006

The Business Intelligence in Customer Management Benchmark Report

All print and electronic rights are the property of Aberdeen Group © 2006.

6 • AberdeenGroup

Customer Preferences, Promotions, New Product Adoptions:

The Pattern Continues

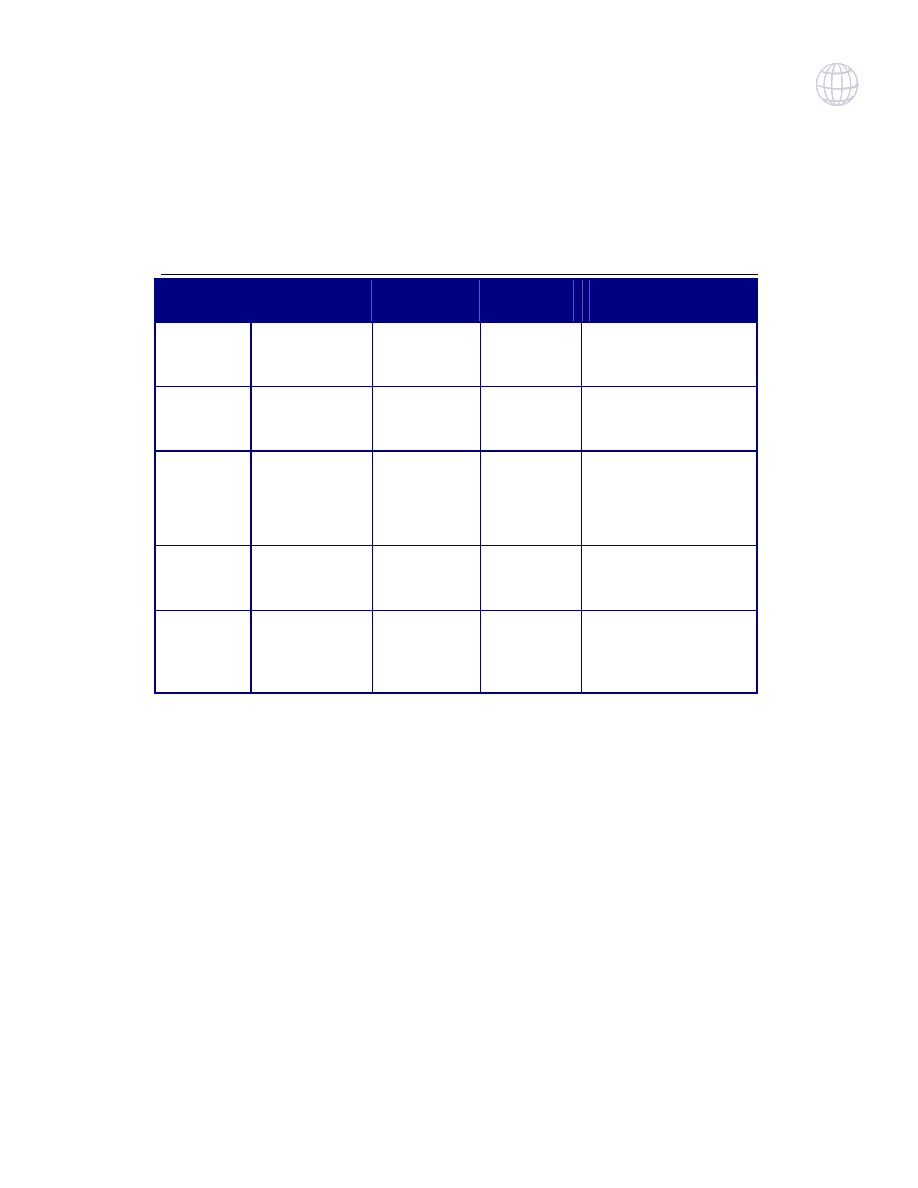

Traditional ways of tracking customer behavior, such as acquisition, retention and con-

version are helpful in gaining a good understanding of the customer and his or her overall

touch points with the retail enterprise. However, by themselves, they may not provide the

specificity to accurately qualify a customer’s exact behavior when it comes to the spe-

cific interaction with that particular retailer. Thus, more specific metrics, such as an un-

derstanding of customer adoptions, promotion participations, and what types of product

preferences they prefer may provide retailers with a more approximate level of customer

characteristics. If this data is collected, the ability to generate more intelligent BI deci-

sions becomes that much greater.

Figure 3: Best-in-Class Companies Focus on Traditional Customer Buying Habits

Use of Traditional Customer Buying Habits

91%

100%

70%

78%

73%

63%

60%

52%

48%

0%

20%

40%

60%

80%

100%

120%

Product

Preferences/affinity

Promotion

Participation

New product

adoption

Best-in-Class

Active BI User

Planned BI User

Source:

Aberdeen

Group

, November 2006

Case Study Quote

“Extremely large companies (Safeway, Albertsons, Wal-

Mart, etc.) obtain information so massive they cannot

interpret it on the micro level of the individual store that

[it was] generated [from].The larger the organization,

the harder and slower the information flow to the pro-

duce clerk and courtesy clerk, where it is needed for

direct impact on the customer base.”

The Business Intelligence in Customer Management Benchmark Report

All print and electronic rights are the property of Aberdeen Group © 2006.

Aberdeen Group • 7

Best in Class Keep their C-Level Executives Invested in Business

Intelligence

In the original Aberdeen Group business intelligence benchmark report, it was reported

that 58% of average performers, and 70% of Best-in-Class performers noted that their BI

endeavors were driven by top management, including C-level executives. In the case of

business intelligence specific to customer management, however, respondents were

slightly more inclined to have this C-level support. Indeed, Best-in-Class C-level execu-

tives may be using Corporate Performance Dashboards, in addition to and augmented by

operational BI, to monitor customer activity. The focus on customer management has

thus proven itself to be a concern driven from the top of an organization downwards.

Figure 4: C-Level Executives Using BI to Understand their Customers

Highest Enterprise Level Using BI

0%

8%

8%

83%

17%

11%

8%

63%

0%

20%

40%

60%

80%

100%

VP

Director

Manager

C-level

Best-in-Class

All Respondents

Source:

Aberdeen

Group

, November 2006

Case Study Quote

“…the business and IT departments can-

not seem to prioritize the utilization of

real-time or near real-time customer

data. Business intelligence is essentially

underused because the analytics and as-

sociated reports are not tied directly to

the user experience. Uptime is easier to

produce than true cross-selling.”

The Business Intelligence in Customer Management Benchmark Report

All print and electronic rights are the property of Aberdeen Group © 2006.

8 • AberdeenGroup

Challenges and Responses

Data cleanliness and lack of organizational control of customer management data metrics

were highlighted by retailers as top challenges associated with managing business intelli-

gence implementations within the enterprise. These challenges remain obstacles to retail-

ers of all sizes and success levels, and proves that while retailers are good at collecting

data, their analysis and decision-making skills need work.

Thirty percent of respondents also indicated that their organizations are somewhat un-

willing to use information generated by BI functionality. This type of challenge was con-

sistent among retailers of all types, such as laggard, industry average, and Best-in-Class

respondents. This is explained by that fact that advanced BI that uses predictive analytics

is a relatively new concept, as well as the cultural trust and reliance executives often

place on existing systems and functionality. Those who have completed advanced BI

processes may have to lead the way in addressing this challenge.

Table 2: Business Intelligence: Retailer Challenges and Responses

Challenges

% Selected

Responses to Challenges

% Selected

Data is scattered throughout the

organization; not centralized

49%

Data cleansing projects to improve

data quality

61%

Data is not clean enough

for analysis

46%

Executive mandates for change

44%

Business processes do not lend them-

selves to making use of this informa-

tion

40%

Small projects in pilot departments to

measure ROI

44%

Not enough customer-specific informa-

tion to generate valid results is avail-

able

35%

Select small cross-functional team to

implement

38%

Not have enough time to make use of

any more information - already drown-

ing in data.

33%

Bring in outside help to change busi-

ness processes

31%

Organization is unwilling to use the

information generated by the system.

29%

Select process areas that are easier

to install with simpler algorithms

31%

The use, integration, and complexity of

the algorithms of business intelligence

engines is daunting

29%

Align compensation incentives to BI

system results

22%

Source:

Aberdeen

Group

, November 2006

The Business Intelligence in Customer Management Benchmark Report

All print and electronic rights are the property of Aberdeen Group © 2006.

Aberdeen Group • 9

Chapter Three:

Implications & Analysis

s shown in Table 2, behaviors and activities directly affect performance for busi-

ness intelligence ROI recognition. Survey respondents in each of the three Com-

petitive Framework categories – Laggard, Industry Average, or Best in Class —

exhibited different characteristics in five key categories: process (consistency

across the enterprise); organization (corporate focus/philosophy, level of collaboration

among stakeholders); knowledge (visibility into and timing of results); technology (scope

of automation and productivity tools) and measurement (frequency of measuring per-

formance).

In each category, survey results show that firms exhibiting Best-in-Class behaviors and

characteristics also enjoy Best in Class sales improvements:

Table 3: Business Intelligence in Customer Management Competitive Framework

Laggards

Industry Average

Best in Class

Process

Process is different for

each store.

Process is consistent

across departments.

Process is standardized

company-wide, across

all banners or store

brands.

Organization

Business intelligence

programs, if existent,

measure enterprise or

departmental

performance.

Business intelligence

programs measure

departmental

performance.

Business intelligence

measures enterprise

performance, enabling

multi-departmental deci-

sions to be made.

Knowledge

Sales and receipt data

reviewed on an ad hoc

basis.

Business Intelligence

data on sales and re-

ceipt data reviewed

daily.

Business Intelligence

data on sales and re-

ceipt data reviewed in

near real-time.

Key Takeaways

• Eighty two percent of respondents are using BI on an enterprise-wide basis. However,

only 16% of survey respondents, and 33% of Best-in-Class respondents, use real- or

near-real-time business intelligence-related data measuring techniques.

• 100% of BIC organizations measure customer retention. However, retailers have noted a

specific difference between data collection and actual utilization. Only 33% of all respon-

dents use this measurement as a top BI-related KPI.

• Comparable same store sales and gross margin were the top two KPIs in which BI data

was used to measure performance.

A

The Business Intelligence in Customer Management Benchmark Report

All print and electronic rights are the property of Aberdeen Group © 2006.

10 • AberdeenGroup

Laggards

Industry Average

Best in Class

Technology

Business Intelligence

data is driven through a

spreadsheet.

Business Intelligence

data is driven through a

spreadsheet.

Business Intelligence

data is driven either

through portals or a

dashboard.

Measurement

Comparable store sales

by department, store

rank as top KPIs for data

measurement.

Gross margin, compara-

ble store sales by store

rank as top KPIs for data

measurement.

Gross margin, compara-

ble store sales by store

rank as top KPIs for data

measurement.

Source:

Aberdeen

Group

, November 2006

Process and Organization

Business processes and organizational structures for business intelligence are often

closely associated with overall sales success levels. For process and organization, how-

ever, some interesting correlations can be made between average and laggard retail per-

formers. While Best-in-Class retailers were focused on enterprise-related BI functionality

(100% of responses), a majority of both average (81%) and laggard responders (100%)

focused on departmental-based BI data. None of the three groups mentioned above were

focused solely on individual-based BI decision systems. This may indicate a step in the

right direction for retailers looking to increase the scope of their overall BI implementa-

tions.

Best in Class respondents (100%) indicated widespread use of BI across the enterprise

(Figure 5). Merchandise planning, distribution, store operations, customer experience,

and multi-channel selling efforts are all coordinated for increased visibility. Considering

that the activities of a vast majority of business departments have some effect or another

on customer management, it is logical for retailers to use BI on an enterprise-wide basis.

Figure 5: Best in Class Measure Performance at the Enterprise Level

What is the Scope of BI Within Your Organization?

100%

58%

0%

82%

79%

31%

0%

20%

40%

60%

80%

100%

120%

Enterprise

performance

Department

Performance

Individual

Performance

Best-in-Class

Active Implementations

Source:

Aberdeen

Group

, November 2006

The Business Intelligence in Customer Management Benchmark Report

All print and electronic rights are the property of Aberdeen Group © 2006.

Aberdeen Group • 11

Data and Knowledge – Opportunity Missed

Only 33% of Best in Class and 16% of all survey respondents take the opportunity to

review BI-related information in real- or near-real-time (Figure 6). Given retailers’ objec-

tives to create a more dynamic and fast-moving supply network capable of interdepart-

mental data management processing, this remains an area that needs attention.

Figure 6: Retailers Miss Opportunities to Use Their Data

Time Frame for Measuring BI

33%

33%

17%

16%

48%

18%

0%

10%

20%

30%

40%

50%

60%

Real or near-real

time

Day

Week

Best-in-Class

All Survey Reciepients

Source:

Aberdeen

Group

, November 2006

Measurement

Comparable store by store sales volume was the number one way retailers are measuring

the successes of their business intelligence implementations. Gross margin was not far

behind, with 51% of respondents. Surprisingly, customer retention was indicated as a top

success measurement only by 33% of respondents.

The Business Intelligence in Customer Management Benchmark Report

All print and electronic rights are the property of Aberdeen Group © 2006.

12 • AberdeenGroup

Figure 7: Traditional Store Sales Remains as Top KPI to Measure BI

Top KPIs to Measure BI Success

25%

29%

33%

37%

51%

52%

0%

10%

20%

30%

40%

50%

60%

Logistics

performance

Merchandise Turn

Customer

Retention

Comparable Store

Sales by

Department

Gross Margin

Comparable Store

Sales by Store

Source:

Aberdeen

Group

, November 2006

Pressures, Actions, Capabilities, Enablers (PACE)

Aberdeen’s research has consistently shown a clear relationship between the pressures

companies identify and the actions they take, and their subsequent competitive perform-

ance. In other words, retailing excellence is not just an accident, a function of convenient

store locations, or the result of a merchant with a “hot hand”. We encourage all readers to

examine the prioritized PACE selections in Table 3. Comparing their own priorities to

those of Best in Class retailers can provide valuable insight into performance improve-

ment opportunities.

The Business Intelligence in Customer Management Benchmark Report

All print and electronic rights are the property of Aberdeen Group © 2006.

Aberdeen Group • 13

Table 4: PACE (Pressures, Actions, Capabilities, Enablers)

Priorities

Prioritized

Pressures

Prioritized

Actions

Prioritized

Capabilities

Prioritized

Enablers

1

Rapid response

ability to con-

sumer demand

Improve cus-

tomer service

Centralize

data in the

organization

Data cleansing projects to

improve data quality

2

Become more

operationally effi-

cient

Improve back-

office productiv-

ity

Clean existing

data

Small projects in pilot de-

partments to measure ROI

3

Manage demand

across multiple

channels

Sharpen pricing

life cycle capa-

bilities

Make use of

business in-

formation

Executive mandates for

change

4

Improve store

performance

Improve in-

store productiv-

ity

Generate spe-

cific customer

information

Select small cross-

functional team to imple-

ment

5

Stem the tide of

price deflation

and eroding gross

margins

Improve mer-

chandise as-

sortments

Make time to

use informa-

tion

Select process areas that

are easier to install with

simpler algorithms

Source:

Aberdeen

Group

, November 2006

The Business Intelligence in Customer Management Benchmark Report

All print and electronic rights are the property of Aberdeen Group © 2006.

14 • AberdeenGroup

Chapter Four:

Recommendations for Action

Key Takeaways

• Move to real-time BI-related data measurement.

• Prioritize the formal measurement of customer behavior analytics, such as the use of

customer conversion, acquisition, and retention measurement activities.

• Address the internal, non-technical challenges associated with BI, such as resistance to

trusting data generated by business intelligence systems, and the ability to BI to replace

existing functionality.

usiness Intelligence, especially when it comes to customer management, is neither

a monolithic business process, nor is it always supported by the same technology.

Solutions once considered “advanced” may be little more than glorified spread-

sheets. Whether a company is trying to gradually move from Laggard to Industry Aver-

age, or Industry Average to Best in Class, the following actions will help spur the neces-

sary performance improvements:

Laggard Steps to Success

1. Move to more frequent BI-related KPI measurements.

Seventeen percent of Laggard respondents indicated that they measure data only

on an ad-hoc basis, compared to zero Best in Class respondents. Measuring data

without a formal, repetitive plan prevents good data comparison. The more fre-

quent t the measurement, the better optimized the decision.

2. Use customer retention as a business intelligence success metric.

Seventy seven percent of respondents who used business intelligence in customer

management indicated they measure customer retention. However, only 33% of

these retailers indicated they use this KPI as a measurement of how successful

their business intelligence implementation is. Retailers should consider integrat-

ing this data with traditional comparable store sales information to get a more ac-

curate read on whether a technological implementation that directly affects cus-

tomer centricity is a success or failure.

Industry Norm Steps to Achieve Best in Class Results

1. Prioritize the formal measurement of customer behavior analytics, such as the

use of customer conversion, acquisition, and retention measurement activities.

Forty three percent of industry average respondents indicate that they currently

measure customer conversion metrics, versus 73% of Best-in-Class retailers. This

trend was similar in customer acquisition and retention, as well as product pref-

erences/affinity, promotion, and new product adoption. Industry average

retailers should consider focusing their success metrics around existing busi-

nesses intelligence functionality to gain a better understanding of the customer.

B

The Business Intelligence in Customer Management Benchmark Report

All print and electronic rights are the property of Aberdeen Group © 2006.

Aberdeen Group • 15

2. Take Business Intelligence Functionality to the Enterprise level with Corporate

Performance Management.

Obtaining a high level of customer transparency involves the utilization of many

metrics. Marketing information, supply chain movement, CRM data, and other

metrics all play a hand in true customer business intelligence. Industry norm re-

tailers must take this to heart, as only 57% of these executives use enterprise-

wide business intelligence (compared with a full 100% of Best-in-Class retail-

ers).

Best in Class Next Steps

1. Address the internal, non-technical challenges associated with BI, such as resis-

tance to trusting data generated by business intelligence systems, and the ability

to BI to replace existing functionality.

A consistent theme in Aberdeen’s research is the prohibitive internal challenges

associated with advanced BI functionality (See Table 1: Business Intelligence:

Retailer Challenges and Responses). Although these challenges are consistent

among all retailers, Best-in-Class show strength in other areas of BI use, such as

data measurement, and must now manage these other issues to increase their

overall process efficiency.

2. Extend business intelligence beyond traditional customer management opera-

tions.

Customer management and merchandising processes came across as the two

most popular uses of BI among all respondents. But for Best in Class retailers,

the focus of BI should not be limited to these specific niches of the enterprise. In-

stead, the entire business should benefit from good interdepartmental communi-

cations. Best-in-Class respondents indicated they measure customer management

data at the enterprise level. They should now extend these processes beyond cus-

tomer management, and into such processes as back-office, and loss prevention

BI strategies.

The Business Intelligence in Customer Management Benchmark Report

All print and electronic rights are the property of Aberdeen Group © 2006.

16 • AberdeenGroup

Featured Sponsors

Microsoft Smarter Retailing™ helps retailers win today by leveraging current invest-

ments, and win tomorrow by easing delivery of new retail experiences. Consisting of

Smarter Shopping, Smarter Selling and Smarter Operations, Microsoft Smarter Retailing

is designed to close the loop between the retailer’s strategy, the in-store execution and

familiar technologies already in the consumer’s hands. More information can be found at

http://www.microsoft.com/smartretail

Founded in 1975, Microsoft is the worldwide leader in software, services and solutions

that help people and businesses realize their full potential.

SeaTab Software is the developer of PivotLink Business Intelligence, a high-performance

BI solution created specifically to address the real-world needs of small and medium

business customers. PivotLink BI is an enterprise-grade, SaaS (Software as a Service)

solution that succeeds where conventional BI fails, in part through PivotLink’s support

for unlimited analytical granularity (even to the color or style level), seamless integration

of data from multiple sources, support for multiple calendars and ability to dynamically

accommodate changes in business operations (such as SKU reclassifications). PivotLink

can be deployed in days or weeks and is used by thousands of companies including REI,

Zones, CarToys and Novell. More information can be found at

The Business Intelligence in Customer Management Benchmark Report

All print and electronic rights are the property of Aberdeen Group © 2006.

Aberdeen Group • 17

Sponsor Directory

Microsoft

Microsoft Corporation

1 Microsoft Way

Mail Stop 22/3085

Redmond WA 98052

http://www.microsoft.com/smartretail

SeaTab Software

SeaTab Software

15325 SE 30th Place, Suite 300

Bellevue, WA 98007

(415) 460-1000

The Business Intelligence in Customer Management Benchmark Report

All print and electronic rights are the property of Aberdeen Group © 2006.

18 • AberdeenGroup

Appendix A:

Research Methodology

etween March and November 2006, Aberdeen Group examined the business in-

telligence practices, initiatives, procedures, experiences, and intentions of more

than 165 retailers, 78% of which indicated active or planned use of BI within the

enterprise. Of that 78%, 53% of respondents are actively using business intelli-

gence for retailer customer management, and an additional 43% are actively budgeting or

planning for BI in this area.

Responding executives completed an online survey that included questions designed to

determine the following:

• Methods of business intelligence-related deployment and management within the

organization (Business intelligence is defined as using data to harness the power

of massive customer and transaction data warehouses into a set of manageable

performance metrics);

• Current and planned use of various applications defined as “advanced” by their

use of sophisticated mathematical algorithms; and

• Business challenges and pressures these retailers face that drive adoption of new

initiatives.

Our intention was to determine whether and how each of the above created competitive

advantage for retailers that use them and a disadvantage for those that do not. From there,

we identified emerging best practices and provided a framework by which readers could

assess their own capabilities and ways to improve effectiveness.

Responding enterprises included the following:

• Job Titles/Functions:

The research sample included respondents with the following

job titles: Senior management, including CEOs, CFOs, CEOs and CIOs (32%), Vice

Presidents (7%); directors (17%), managers (27%) and internal consultants and staff

(9%). Functional areas represented included planning, allocation and/or replenish-

ment, merchandising, logistics, finance, information technology, marketing, product

development, and others.

• Retail Segments:

The research sample included respondents from across the retail

spectrum. Fast-moving consumer goods companies represented 33% of the respon-

dent base, including supermarket, convenience stores, chain drug, and warehouse

stores. More than 51% were from general merchandise and apparel, including large

and small footprint specialty stores, mass merchandisers, and department stores. The

other 19% came from hardware and “do it yourself,” furniture, and restaurant and

hospitality.

• Geography:

Fifty-three percent (53%) of respondents were from North America,

including the U.S., Canada, and Mexico. Twenty-three percent (23%) were from

Europe, the Middle East and Africa; and 20% were from the Asia/Pacific region.

B

The Business Intelligence in Customer Management Benchmark Report

All print and electronic rights are the property of Aberdeen Group © 2006.

Aberdeen Group • 19

Remaining respondents were from South and Central America and the Caribbean

(5%).

• Company Size:

About 29% of respondents were from large enterprises (annual reve-

nues more than $1 billion); 39% were from mid-size enterprises (between $50 mil-

lion and $1 billion); and 33% from small businesses ($50 million or less).

Solution providers recognized as sponsors of this report were solicited after the fact and

had no substantive influence on the direction of Business Intelligence in Retail Customer

Management: Bringing Information Together to Build the Accurate Customer Profile.

Their sponsorship has made it possible for

Aberdeen

Group

to make these findings avail-

able to readers at no charge.

Table 5: PACE Framework

PACE Key

Aberdeen applies a methodology to benchmark research that evaluates the business pressures, actions,

capabilities, and enablers (PACE) that indicate corporate behavior in specific business processes. These

terms are defined as follows:

Pressures —

external forces that impact an organization’s market position, competitiveness, or business

operations (e.g., economic, political and regulatory, technology, changing customer preferences, competi-

tive)

Actions —

the strategic approaches that an organization takes in response to industry pressures (e.g., align

the corporate business model to leverage industry opportunities, such as product/service strategy, target

markets, financial strategy, go-to-market, and sales strategy)

Capabilities —

the business process competencies required to execute corporate strategy (e.g., skilled

people, brand, market positioning, viable products/services, ecosystem partners, financing)

Enablers — the key functionality of technology solutions required to support the organization’s enabling

business practices (e.g., development platform, applications, network connectivity, user interface, training

and support, partner interfaces, data cleansing, and management)

Source:

Aberdeen

Group

, June 2006

Table 6: Relationship between PACE and Competitive Framework

PACE and Competitive Framework: How They Interact

Aberdeen research indicates that companies that identify the most impactful pressures and take the most

transformational and effective actions are most likely to achieve superior performance. The level of com-

petitive performance that a company achieves is strongly determined by the PACE choices that it makes

and how well it executes.

Source:

Aberdeen

Group

, June 2006

The Business Intelligence in Customer Management Benchmark Report

All print and electronic rights are the property of Aberdeen Group © 2006.

20 • AberdeenGroup

Table 7: Competitive Framework

Competitive Framework Key

The Aberdeen Competitive Framework defines enterprises as falling into one of the three following levels of

retail practices and performance:

Laggards (30%) — Retail practices that are significantly behind the average of the industry, and result in

below average performance. For this study, Laggards were defined as those retailers with similar or in-

creasing year-over-year levels of shrink, and similar or decreasing year-over-year levels of customer reten-

tion.

Industry norm (50%) — Retail practices that represent the average or norm, and result in average industry

performance. For this study, Industry Norm was defined as those retailers with improved customer reten-

tion.

Best in Class (20%) — Retail practices that are the best currently being employed and significantly superior

to the industry norm, and result in the top industry performance. For this study, Best-in-Class was defined

as fulfilling three requirements: (1) Better than average year-over-year comparable store sales increases

(2) Improved shrink, and (3) Improved customer retention.

Source:

Aberdeen

Group

, June 2006

The Business Intelligence in Customer Management Benchmark Report

Aberdeen Group, Inc.

260 Franklin Street

Boston, Massachusetts

02110-3112

USA

Telephone: 617 723 7890

Fax: 617 723 7897

www.aberdeen.com

© 2006 Aberdeen Group, Inc.

All rights reserved

December 2006

Founded in 1988, Aberdeen Group is the technology-

driven research destination of choice for the global

business executive. Aberdeen Group has over 100,000

research members in over 36 countries around the world

that both participate in and direct the most comprehen-

sive technology-driven value chain research in the

market. Through its continued fact-based research,

benchmarking, and actionable analysis, Aberdeen Group

offers global business and technology executives a

unique mix of actionable research, KPIs, tools,

and services.

The information contained in this publication has been obtained from sources Aberdeen believes to be reliable, but

is not guaranteed by Aberdeen. Aberdeen publications reflect the analyst’s judgment at the time and are subject to

change without notice.

The trademarks and registered trademarks of the corporations mentioned in this publication are the property of their

respective holders.

Appendix B:

Related Aberdeen Research & Tools

Related Aberdeen research that forms a companion or reference to this report include:

•

The Proactive Merchant: Anticipating Consumer Demand

(December 2004)

•

(September 2004)

•

The Empowered Point of Service Benchmark Report: The Customer Regains Her

Kingdom

•

The Business Benefits of Advanced Planning and Replenishment

(December 2005)

•

Perspective: Retail Business Intelligence Drives Top and Bottom Line Growth

(March, 2006)

•

Customer Intelligence Management Benchmark Report: Converting Data to Profits

(December, 2005)

•

Chasing the Holy Grail: A Unified Planning Process for Retailers

(February 2005)

Information on these and any other Aberdeen publications can be found at

T

HIS

D

OCUMENT IS FOR

E

LECTRONIC

D

ELIVERY

O

NLY

The following acts are strictly prohibited:

• Reproduction for Sale

• Transmittal via the Internet

Copyright © 2006

AberdeenGroup

, Inc. Boston, Massachusetts

Terms and Conditions

Upon receipt of this electronic report, it is understood that the user will and must fully comply with the

terms of purchase as stipulated in the Purchase Agreement signed by the user or by an authorized

representative of the user’s organization. Aberdeen has granted this client permission to post this report

on its Web site.

This publication is protected by United States copyright laws and international treaties. Unless otherwise

noted in the Purchase Agreement, the entire contents of this publication are copyrighted by Aberdeen

Group, Inc., and may not be reproduced, stored in another retrieval system, or transmitted in any form or

by any means without prior written consent of the publisher. Unauthorized reproduction or distribution of

this publication, or any portion of it, may result in severe civil and criminal penalties, and will be

prosecuted to the maximum extent necessary to protect the rights of the publisher.

The trademarks and registered trademarks of the corporations mentioned in this publication are the

property of their respective holders.

All information contained in this report is current as of publication date. Information contained in this

publication has been obtained from sources Aberdeen believes to be reliable, but is not warranted by the

publisher. Opinions reflect judgment at the time of publication and are subject to change without notice.

Usage Tips

Report viewing in this PDF format offers several benefits:

• Table of Contents: A dynamic Table of Contents (TOC) helps you navigate through the

report. Simply select “Show Bookmarks” from the “Windows” menu, or click on the bookmark

icon (fourth icon from the left on the standard toolbar) to access this feature. The TOC is both

expandable and collapsible; simply click on the plus sign to the left of the chapter titles listed

in the TOC. This feature enables you to change your view of the TOC, depending on whether

you would rather see an overview of the report or focus on any given chapter in greater

depth.

• Scroll Bar: Another online navigation feature can be accessed from the scroll bar to the right

of your document window. By dragging the scroll bar, you can easily navigate through the

entire document page by page. If you continue to press the mouse button while dragging the

scroll bar, Acrobat Reader will list each page number as you scroll. This feature is helpful if

you are searching for a specific page reference.

• Text-Based Searching: The PDF format also offers online text-based searching capabilities.

This can be a great asset if you are searching for references to a specific type of technology

or any other elements within the report.

• Reader Guide: To further explore the benefits of the PDF file format, please consult the

Reader Guide available from the Help menu.

Document Outline

- Executive Summary

- Table of Contents

- Figures

- Figure 1: Cross-sells and Up-sells, Loyalty Programs Dominat

- Figure 2: Active BI Users More Likely to Have Traditional Cu

- Figure 3: Best-in-Class Companies Focus on Traditional Custo

- Figure 4: C-Level Executives Using BI to Understand their Cu

- Figure 5: Best in Class Measure Performance at the Enterpris

- Figure 6: Retailers Miss Opportunities to Use Their Data

- Figure 7: Traditional Store Sales Remains as Top KPI to Meas

- Tables

- Table 1: Top Pressures Driving In-Store Improvements

- Table 2: Business Intelligence: Retailer Challenges and Resp

- Table 3: Business Intelligence in Customer Management Compet

- Table 4: PACE (Pressures, Actions, Capabilities, Enablers)

- Table 5: PACE Framework

- Table 6: Relationship between PACE and Competitive Framework

- Table 7: Competitive Framework

- Chapter One:Issue at Hand

- Chapter Two:Key Business Value Findings

- Chapter Three: Implications & Analysis

- Chapter Four:Recommendations for Action

- Featured Sponsors

- Sponsor Directory

- Appendix A:Research Methodology

- Appendix B:Related Aberdeen Research & Tools

- Terms and Conditions 2006.pdf

Wyszukiwarka

Podobne podstrony:

The Wharton School Of Business Innovation In Retail Banking

Multiple Intelligences in the Elementary Classroom

gis and business intelligence i Nieznany

business etiquette in UK

Business Intelligence w zarządzaniu bartini W1

Gardner A Multiplicity of Intelligences In tribute to Professor Luigi Vignolo

cias strategic intelligence in iraq HSKSBK5T6FWN4OILAREHOEOKOVKKJGGUFJCVHIY

Business Intelligence id 95573 Nieznany (2)

Business Vocabulary In Use (Cambridge Professional English) JP4W3DF6O7XRB5ME36W5HIGUWIFECUMOYJJ2IZI

Getting Started with Data Warehouse and Business Intelligence

Multiple Intelligences in the Classroom

Business Intelligence Surma pytania i odpowiedzi

Ethics in Business ?ctors in?termining Moral?havior

Multiple Intelligences in the Elementary Classroom

gis and business intelligence i Nieznany

LECTURE 6 ATTACHMENT 1 Business entities in the British Isles

Wanner, Cunning Intelligence in Norse Myth Loki Odinn and the Limits of Sovereignty

Business Letters in English

w sapx363 Managing the Total Cost of Ownership of Business Intelligence

więcej podobnych podstron