IMAG0775

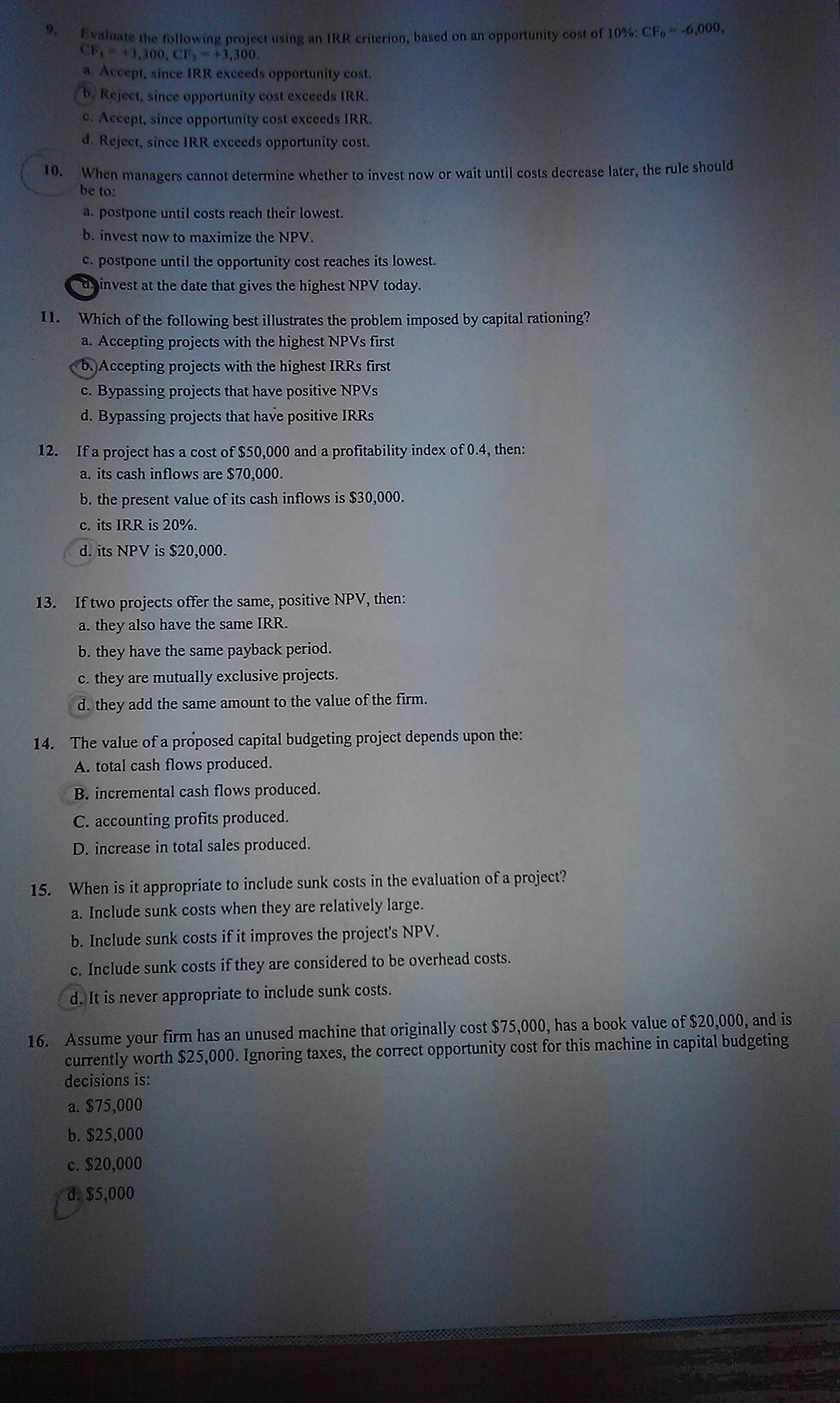

f' v«lu.tic ihe fbllowing project using «*n IRR crii«rioH, bn*ed o tran opportunity cost of 10%; CF<> >6,000,

C?! * ♦1,300, CFj • +3,300.

I At c«pt, lince IRR exceeds opportunity cost,

/n. Rcjeci, sincc opportunity cost excoeds IRR.

c. Accept, sincc opportunity cost encccds IRR,

d. Rcjcct, sincc IRR cxcccds opportunity cost.

[ 0. When managers cannot determine whether to invest nbW or Walt until costs decrease iater, the rule should I ■v- beto:

a. postpone until costs reach their lowcst.

b. invcst now to maximize the NPV.

c. postpone until the opportunity cost reaches its lowest.

{^3ynvestat the datę that gives the highest NPV today.

11. Which of the following best illustrates the problem imposed by Capital rationing? a. Accepting projects with the highest NPVs firejt

ł^)Accepting projects with the highest IRRs flrst o. Bypassing projects that have positi ve

d. Bypassing projects that have positive IRRs

12. If a project has a cost of $50,000 and a profitability wflexlcffi0.4. then:

a. its cash inflows are $70,000.

b. the present value of its cash inflows is $30,000.

c. its IRR i^fe^

/dj)its ttFV WĘ$(0M

13. If two projects offer the same, positive NPV, then: pa. they also have the sanie IRR.

b. they have the same payback period.

c. they are mutually exclusive priójecte. . fcjathey add the same amount to the value of the fum.

14. The value of a proposed Capital budgeting project depends upon the:

A. total cash flows produced.

B. incremental cash flows produced.

C. accounting profits produced.

D. increase in total sales produced.

15. When is it appropriate to include sunk costs in the evaluation of a project?

a. Include sunk costs when they are relatively large.

b. Include sunk costs if it improves the projecfs NP V.

c. Include sunk costs if they are considered to be overhead costs.

(jijlt is never appropriate to include sunk costs.

16. Assume your firm has an unused machinę that originally cost $75,000, has a book value of $20,000, and is currently worth $25,000. Ignoring taxes, the correct opportunity cost for this machinę in capital budgeting. decisions is:

a. $75,000

b. $25,000

c. $20,000 ż&j $5,000

Wyszukiwarka

Podobne podstrony:

IMAG0752 Ii I ) I *-VNCL0iXi^_A^cVv<4.V V£u(.-> CK?W& t>xyV^C Ugr, C^rQCŁUC l~CCJ#

11str z4 r 1/0 wr» o-»v-e t ę ^ t-L ud/vV> r 1/0 wr» o-»v-e <LU ł X v, - g

24ddg37 Add File Biblio95.mdb Commenf for $/B iblioZBiblio95.mdb Local dafabase file for Ihe Biblio

Deulkalion i Pyrra n v AA . . 1 ~v V>Ł ./ 1 ^łu v v v3i A ~ r i~i>l ■ ~ I

010 7 g. , t= po ‘v--LU v/* c b lA^dd(p^LVŁ " t pQV

kolosy?rma zima 7Virp r.v•‘•m.. lU-, • i (TTtf u r.L PLAN ZADAŃ I KOLOKWIÓW DLA I r. FARMACJI

11str z4 r 1/0 wr» o-»v-e t ę ^ t-L ud/vV> r 1/0 wr» o-»v-e <LU ł X v, - g

Dual variable power supply project using LM317 and LM337(1) AC in Fuse Transformer &nbs

dzwonek karpacki campanula carpatica?1 Ł » • ■> 1 ^ ^ V§£u,v ,fl f ł / % -a* -

Zdj�cie1584 \ «r .04 INM Kiom spoAriSi WAm*tmonch wKłK»^v« lu^ ’;>> v,h posk&fe* ^ "

LLu LU± I LIBusiness Planning & Project Management Prof. Lambodar Saha Prof. Manisha

24ddg37 Add File Biblio95.mdb Comment for $/B iblioZBiblio95.mdb Local database file for Ihe Biblio

41589 Zdjęcie0088 (10) _______Poron na nie biblioteki ki IŁA GENOMOWA cDNA v■lun i

MR293R190)3 1 REMOTAL Using a fiat screwdriver, raise oover (1) at the ends of the strip. Puli the s

więcej podobnych podstron