David Floyd How I Make A LivingÚy Trading Stocks Stock Market Trade www tradingmarkets com

mm

We will match Amazon.com's price on every trading book we offer (including shipping) plus send you a free report on our latest research.

For Help, Cali 1-888-484-8220 ext. 1

(Outside the U.S. dial 213-955-5858 ext. 1)

&Home Stocks

Eminis/Futures

Testimonials Shopping Cart

(® Add to Shopping Cart

Dear Fellow Trader,

David Floyd is a Professional daytrader and managing partner of Aspen Trading Group. He trades highly I i q u i d NYSÄ stocks and makes between 25 and 100 trades each day. His strategy, which incorporates market dynamics, patterns and momentum, has allowed him to achieve triple-digit annual returns from 1998 to 2001.

ReceiyÄ lntensive Training Directly From David Floyd

Free Shipping!

Would You Like To Learn How To Daytrade For A Living?

Let David Floyd Show How In His New Training Module: "How I Make A Living Daytrading Stocks"

My name is David Floyd. Since 1994,1 have madÄ my living as a trader.

Past results are not indicative of futurÄ returns. There are no assurances you will achieve success using David Floyd s techniques. Also. the attainability of these results will be affected by the margin requirements that are permitted to use by your broker.

In my new training module, "How I Make A Living Daytrading Stocks." I will train you to apply High Velocity Trading (HVT). the methodology upon which I have built my successful trading career.

What Is High-Velocity Trading?

HVT is fast-paced form of daytrading in which you trade brief bursts of price momentum that only occur when you see a distinct combination of movements in the S&P Futures, tick charts and the individual stock you are trading. By applying HVT. you can potentially capture sharp intraday trends trading the same 3 to 5 stocks many times each day.

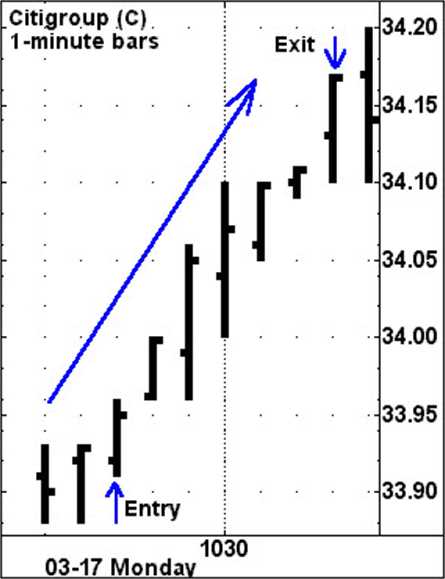

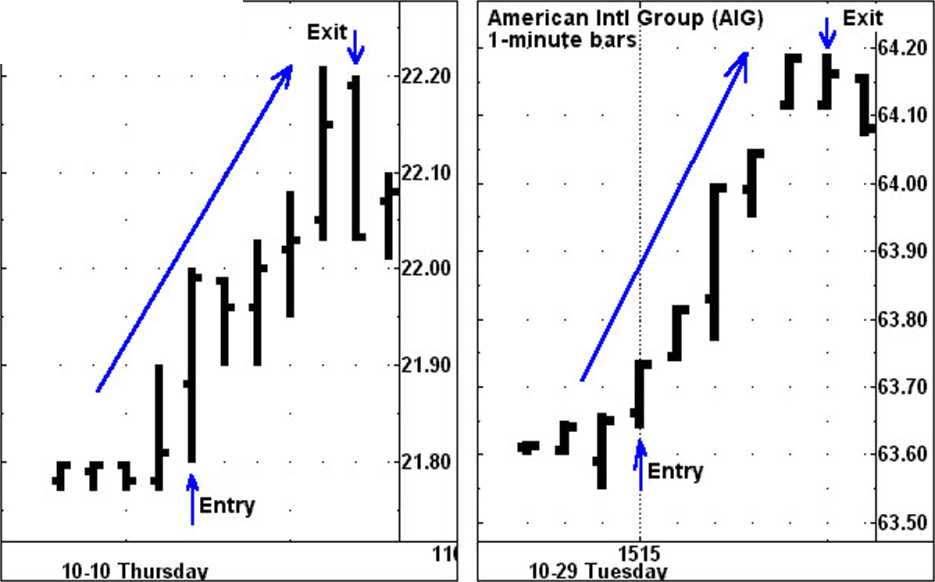

I will teach you the strategy that allows you to trade sudden momentum moves as in these actual trades I recently did -many times in one day.

American Intl Group (AIG) 1 -minutÄ bars

l

Exit

03-21 Friday

j-53.05 j 53.00 j 52.95 | 52.90

« 52.85 52.80 1100

Many days, I make dozens of trades like these, both on the long and short side.

How My HVT Module Is Mapped Out

In my module I will teach you how to enter into brief. fast price moves by applying my 8 specific HVT criteria. I will take you through each step using specific real-world examples. Then. once you understand my trading technique, I will then train you to apply it properly using real market action. We'll go through 25 of my own personal trades, bar by bar. This knowledge and training is broken up in to 5 sections. Let me walk you through them now.

In Section I, I will build your base of HVT knowledge by showing you how HVT works. what its advantages are. what the trade-offs are, and how it differs from otherforms of daytrading. Once you understand these basie principles. you will understand many of the unique advantages you will have, such as no "nightly researchâ and trading the same 3 to 5 stocks every day.

In Section II. I will teach you the basics you need in order to apply my 8 Trading HVT Trading Rules. You'11 learn about the relationship between S&P 500 Futures and equities that forms the basis for my HVT trading setups. Also. you will learn the types of stocks that are best suited for this style of trading. And I will teach you how to use the specific indicators that I apply in my rules.

In Section III. you will apply all everything IVe taught you in Sections I and II. as I walk you through the 8 rules of my HVT Methodology in Section III. Through numerous examples. you will see how HVT setups take shape during 2 to 7 minutes preceding each trade. You will be trained to recognize the same critical sequence of events that occurs over and over again prior to successful HVT trades. And once you are entered into a trade. I will show you the fastest and most direct ivay to detect the onset of momentum weakness and exit before it is reflected in the price action of the stock you are trading By working with me in this way both on the long and short side. you will learn how to make split-second trading decisions as trading setups take shape in the 1-minute time frame.

In Section IV. I will teach you some enhancements that you can apply to the core HVT Methodology which can significantly improve your trading results. You will learn how to anticipate key support and resistance levels for the best entries and exits using the Floyd Numbers. I will also teach you a variation on HVT that allows you to trade powerful reversals that occur after opening gaps. This is a strategy that I have not published prior to this module. And I will teach you how to use "bullets" in order to short stocks without having your hands tied by the "uptick rule."

Once you have mastered the core logie behind HVT, you will learn how to apply it to your own trading.

In Section V, I will train you through a series of simulations in which you will have numerous opportunities to execute each of the 8 HVT rules In these simulations, you will practice making trading decisions based upon my key indicators overlaid on the S&P Futures. S&P tick chart and individual stocks. I will also walk through through several opening gap trades.

Through this experience. you will learn how to successfully trade HVT in a variety of market conditions. You will learn the nuances of entries and exits. You learn how to quickly minimize losses when trades go against you. I will also test and train your ability to recognize bad setups and ignore them. And I will teach how to use HVT to trade multiple entries and exits, one right after another in the same stock.

My goal is that. once you have completed my module and reviewed the materiaÅ as needed. you will not only have the knowledge. but a sufficient amount of hands-on experience with which to successfully apply my HVT Methodology to your own trading.

Here Is An Example What You Will Learn In My Simulations

Here Is What You Will Learn Through My HVT Training Module

You will learn my complete daytrading methodology and trading rules. Not only that. but you will also learn numerous advanced techniques that I have not madÄ public until now For the first time, the interactive sequences of my trading simulations allow me to teach and demonstrate this information properly. Once you have completed my module, here is what you will know:

⢠How to daytrade successfully with no nightly research and the shortest work hours in the trading world Because you will be trading the same 3 to 5 stocks every day, there is no need for time-consuming seans in order to build a nightly hit list. If you trade HVT as mapped out in my module, your entire work day can be over within 1 to 4 hours after the ocen

⢠How to daytrade successfully both a buli and a bear market. After the current bear market began in early 2000,1 continued to trade the same way that I had in the late 90s with no significant changes to my basie HVT Methodology. You can successfully trade HVT, regardless of whetheryou are applying it during a buli or bear market.

⢠How to fade the opening gap I will teach you how, with only one modification to my standard HVT trading rules, you can trade powerful reyersals that occur after shortly after the market gaps ocen. I have not published this technique until now in this module.

I will teach you the strategy that allows you to trade sudden bursts of momentum like these - many times in one day.

General Electric (GE) 1-minute bars

Citigroup (C) 1-minute bars

-27.50

-27.40

-27.30

27.20

27.10

10-07 Monday

-27.60

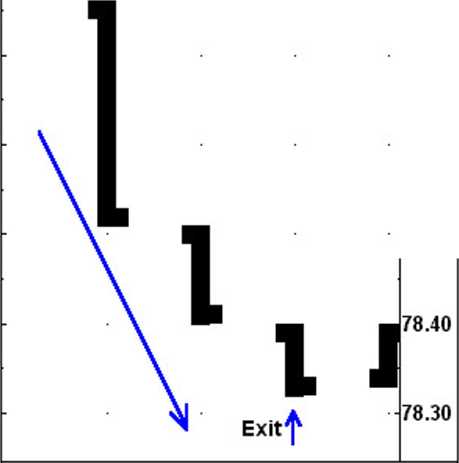

IBM (IBM)

Entry 1-minute bars 78.80

-78.70

78.60

-78.50

11-01 Fiiday

⢠How to short stocks without having your hands tied by the "uptick rule." You will learn how to use bullets and conversions in order to enter short positions just as downward momentum is beginning without having to wait for an uptick.

⢠The most error-free way to enter tradable pullbacks in powerful trends It s all too easy to enter bad trades if you focus on the noise price charts in the 1-minute time frame. I will show you an indicator I use which effectively filters out that noise so that you can accurately identify and enter tradable pullbacks

⢠How to enter and exit one stock multiple times in a single day. In some of my simulations. I will take you through a series of trades within one stock on a single day. You will learn how to enter trades each time that a stock pauses dunng an extended intraday trend in order to potentially extract the greatest possible gains from a momentum move.

⢠How to capture trades both on the long and short side in the same stock on the same day I will show you how to

seamlessly switch your trading direction back and forth between lonas and shorts on days which provide you with tradable trends on the up- and downside.

⢠How to use tick charts to time split-second entries and exits. The basis of HVT is to identify short pauses within trends and then pinpoint the moment when momentum is strongly rebounding. I will teach you the specific easily identifiable patterns in tick charts that enable you to detect the onset of momentum moves.

...and much. much morel

Click here now to order David Flovd's New Trading Module "How I Make A Uvina Daytrading Stocks"

ORDER TODAY!

Order my training module "How I Make A Living Daytrading Stocks." In it, I teach you the strategy, rules, discipline and thought processes that have enabled me to make my living as a daytrader siÅce 1994. You will learn every detail on how to master my bread-and-butter strategy, High-Velocity Trading, as I walk you through the main concepts through over 25 real-world trading simulations.

The cost of my new training module is $395.

Click here now, or cali toll-free 1-888-484-8220, x1 to start learning the daytrading strategy that I earn my living from. You will receive immediate online access to "How I Make A Living Daytrading Stocks".

Sincerely,

David Floyd

Click here now to order David Flovd's New Trading Module "How I Make A Liyina Daytrading Stocks"

Your Price: $395.00

Add to Shopping Cart

CD-Rom

If You Need Assistance or Wish to Order By Phone Cali Us At (888) 484-8220 ext. 1 OR (213) 955-5858 ext. 1

Home Stocks | Options Forex | Eminis/Futures | Events | Free Trials | Testimonials Contact Us Priyacy Policy Return Policy | Help

Disclaimer:

The Connors Group, Inc. ("Company") is not an investment advisory service, nor a registered investment advisor or broker-dealer and does not purport to tell or suggest which securities or currencies customers should buy or sell for themselves. The analysts and employees or affiliates of Company may hoÅd positions in the stocks, currencies or industries discussed here. You understand and acknowledge that there is a very high degree of risk involved in trading securities and/or currencies. The Company, the authors, the publisher, and all affiliates of Company assume no responsibility or liability for your trading and investment results. Factual statements on the Company's website, or in its publications, are madÄ as of the datÄ stated and are subject to change without notice.

It should not be assumed that the methods, techniques, or indicators presented in these products will be profitabie or that they will not result in losses. Past results of any individual trader or trading system published by Company are not indicative of futurÄ returns by that trader or system, and are not indicative of futurÄ returns which be realized by you. In addition, the indicators, strategies, columns, articles and all other features of Company's products (collectively, the "Information") are provided for informational and educational purposes only and should not be construed as investment advice. Examples presented on Company's website are for educational purposes only. Such set-ups are not solicitations of any order to buy or sell. Accordingly, you should not rely solely on the Information in making any investment. Rather, you should use the Information only as a starting point for doing additional independent research in order to allow you to form your own opinion regarding investments. You should always check with your licensed financial advisor and tax advisor to determine the suitability of any investment.

HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN INHERENT LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING AND MAY NOT BE IMPACTED BY BROKERAGE AND OTHER SLIPPAGE FEES. ALSO, SINCE THE TRADES HAVE NOT ACTUALLY BEEN EXECUTED, THE RESULTS MAY HAVE UNDER- OR OVER-COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADÄ THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN.

The Connors Group, Inc. 15260 Ventura Blvd., Ste. 2200 Sherman Oaks, CA 91403 © Copyright 2008 The Connors Group, Inc.

Wyszukiwarka

Podobne podstrony:

The Pity de Donie, from Åke Yillage of Orcincs.alamy stock photo A6DTW4 www.alamy.com

- ..... Å AV .. alamy stock photo DBAPBT www.alamy.com

cheiseafc,cóm a a a alamy stock photo G4Y63T www.alamy.com

EndreÅen MuWe Waffdihaifó pid* M iihlalamy stock photo HK4HP0 www.alamy.com

Willa UÅana. (WÅasnoÅÄ p. J. Klimczaka).alamy stock photo PKPGYX www.alamy.com

helmets in?r make it a law a public servte! m^Åsage 1 om www.pmlydon.com

Day Trading the emini US Stock market futures trading ` Minute Trader www 60minutetrader com Home

When and how to make aclaim In the case of hospital and physician services, most providers will invo

stocksplit Stock Split Ptay thn cjrd at any time to g«ve *10 Poww or Reuitance (your chotce) to any

S20C 409120813151 Szoatching Information You read this in every knitting book: Make a swatch! Swatrh

EMOTIONCARDS (11) The stock market is crashing. worried concernedYou have so many bills to pay. v%ww

F00574 019 f016 May protect against asthma Living on farm Large families Childhood infections,&

HOW MANY TO THE IEFT, HOW MANY TO THE RiGHT? ⢠i ⢠@depositpÅotos mage ID: 450932460 www.depositphot

FOREWORD BY RON PAULMeltdown A Free-Market Look at Why the Stock Market Collapsed, thc Economy

Home How it works? Pricing Order Affiliate Contact UsRemote support We provide remote desktop suppor

Effect Of Dividends On Stock Prices insignificant relation with Stock Market PrÅces. Return on EÄ uit

Effect Of Dividends On Stock Prices 17 relationship between the Earnings per Share and Stock Market

wiÄcej podobnych podstron