1113450221

Partii

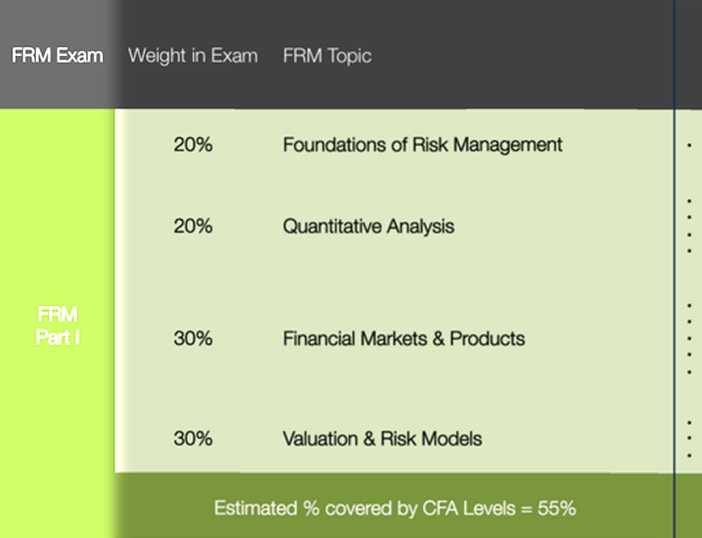

25% Market Risk Measurement & Management 25% Credit Risk Measurement & Management

25% Operational & Integrated Risk Management 15% Risk Management & lnvestment Management ! 10% Current Issues in Financial Markets

Estimated % covered by CFA Levels = 15%

Portfofco Risk & Return

Corporate Govemance Portfolio Concepts

Risk Management Evałuatmg Portfolio Performance

Correlatton & Regression Muttipte Regression Time Senes Anafysrs

Probabity & Statistics Common Probabiity Distributions Sampłing & Estimation Hypothestó Testing

Market Org & Structure Fixed Income Asset-backed Secunties Denvative Markets

Forwards. Futures. Options & Swaps

FX Ftates

Commodrties lnvesting Term Structure & Interest Ratę Dynamics

Forwards. Futures. Options & Swaps

Risk Management of Fonward. Futurę. Option & Swap Strategies

Fixed mcome Valuation Duration & Convexity Option Valuation

Arbitrage-free VaJuation Bonds w Embedded Options Option Markets & Contracts

Risk Management

Risk Management of Option

Strategies

|

• Term Structure & Interest Ratę Dynamics |

• Risk Management | |

|

Fundamenlais of Credit Anaiysis |

• Credit Anaiysis Modełs • Asset-backed Securities: CDOs • Credit Default Swaps |

• Risk Management |

|

• Risk Management | ||

|

Portfofco Risk & Return Alt lnvestments: Hedge Funds |

• Risk Management • Evaluating Portfolio Performance | |

|

5% |

5% |

5% |

Wyszukiwarka

Podobne podstrony:

Podstawowe rodzaje ryzyka finansowego Ryzyko rynkowe (market risk), Ryzyko kredytowe (credit risk),

AC1115 Introduction to Management Accounting 2, Credit weighting: 5 Teaching Period(s): Semester

Risk premium - function of both market conditions and the asset itself, composed of (a) market risk

AC1115 Introduction to Management Accounting 2, Credit weighting: 5 Teaching Period(s): Semester

Ryzyko rynku [market risk)Wynika ze zmiany na rynkach finansowych i innych (np towarowych, które są

Zarz Ryz Finans R19b1 Bibliografia 621 Healy James P. (1993), Working Paper of the Credit Risk Measu

img054 (21) edge every WS row 3 times—21 (21, 25, 25, 29, 29) sts rem for shoulder. Work even until&

PID 0,5 0,25 Rejestrator - Measurement ft Automation Explorer File Edit View Tools HelpConfiguration

PI 0,25 n2 Rejestrator - Measurement ft Automation Explorer File Edit View Tools HelpConfiguration ►

rozdział 1 (25) 28 Podstawy marketingu ^Współczesne rozumienie marketingu przyjmuje za punkt wyjścia

IPN Dodatek historyczny Komuniści?z partii, Polska?z FON Dodatek historyczny IPN Nasz Dziennik 6

rozdział 1 (25) 28 Podstawy marketingu ^Współczesne rozumienie marketingu przyjmuje za punkt wyjścia

DeloitteTracking the trends 2018 Top 10 trends shaping miningWater management -25% of mining product

więcej podobnych podstron