1

Share Capital

Transactions and

Financial Instrument

(IAS 32 & IAS 39)

Chapter

15

2

15.1

Issue of shares

Incorporated organisations can raise finance by issuing shares.

1

Ordinary share capital (UK)

A limited company issues shares, which investors buy and then these investors become owners of

the company. These shares may be issued privately (ltd) or to the public (plc). Ownership in the

company is through the issue of shares. The shareholders have an equity stake in the business and

have voting rights.

Usually for large organisations the shareholders do not run the business. The directors do this.

The shareholders are entitled to dividends declared by the directors. The dividends are declared at

the discretion of the directors and depend on how much profit the company has made.

Authorised share capital

This is the number of shares that the company is allowed to issue

and is stipulated in its memorandum or articles of association.

Issued share capital

This is the number of shares that the company actually issues. This

cannot exceed the authorised share capital

Called up share capital

This is the issued share capital for which the shareholders are

required to pay to the company.

Paid up share capital

This is the amount of share capital paid up by the shareholders

Nominal value

This is the value of the each share which the company will originally

issue the shares at, (also known as face or par value)

Market value

This is the trading value of the shares, and is the price an individual

pays for the shares

Share premium

This is the increase from nominal value to market value of the share

The double entry to record issue of ordinary share capital is:

Debit

Bank (statement of financial position)

Credit Ordinary share capital – nominal value(statement of financial position)

Credit Share premium (issue value less nominal value)

(statement of financial position)

3

Procedures for new issue of equity shares

Issue and forfeiture

Application

Potential shareholders apply for shares in the company and send

cash to cover the amount applied for.

Allotment

The company allocates shares to the successful applicants and

returns cash to unsuccessful applicants.

Call

Where purchase price is payable in instalments, the company will

‘call’ for instalments on their due dates of payment

Forfeiture

If shareholders fail to pay a call, their shares may be forfeited

without the need to return the money they have paid; the forfeited

shares may then be reissued to other shareholders

2

Rights issue of ordinary shares

If a company issues ordinary shares for cash it must first offer them to its existing ordinary

shareholders in proportion to their shareholdings. This is called a rights issue because members

may obtain new shares in right of their existing holdings.

Double entry to record issue of ordinary share capital under a rights issue:

Debit

Bank (statement of financial position)

Credit Ordinary share capital – nominal value(statement of financial position)

Credit Share premium (rights issue price less nominal value)

(statement of financial position)

3

Bonus issue of ordinary shares

A bonus issue is when new shares are issued to existing shareholders but no money is received.

Instead the company capitalises its reserves, this is only permitted to the extent that the articles

permit it and the correct procedure must be observed.

Double entry to record issue of ordinary share capital under a bonus issue:

Debit

Share premium (to its extent) - (statement of financial position)

Debit

Distributable profit (remainder) - (statement of financial position)

Credit Ordinary share capital (nominal value) - (statement of financial position)

4

4

Preference shares

Preference shares are issued by companies to raise finance. These shares are different from

ordinary shares. Preference shares do not give voting rights and therefore holders of preference

shares do not have a stake in the business.

Preference shares usually carry a fixed dividend. This means the company has to pay dividends on

the preference shares (obligation to pay dividends if the company makes profits). The company

has the option to pay dividends on ordinary shares (no obligation).

Direct issue costs of all share issues are never treated as an expense, but instead are debited to the

share premium (i.e. the direct costs of raising capital finance is capitalised).

15.2

Reserves

Revenue reserves arise when a company makes profits and does not pay out all the profits to the

shareholders. There is no statutory requirement for a company to have any amounts in its revenue

reserve. These non-statutory reserves take various names like “retained profits”, “profit and loss

reserves”, “un-appropriated profits” etc.

A company can make dividend payments out of revenue reserves i.e. they are distributable to the

shareholders

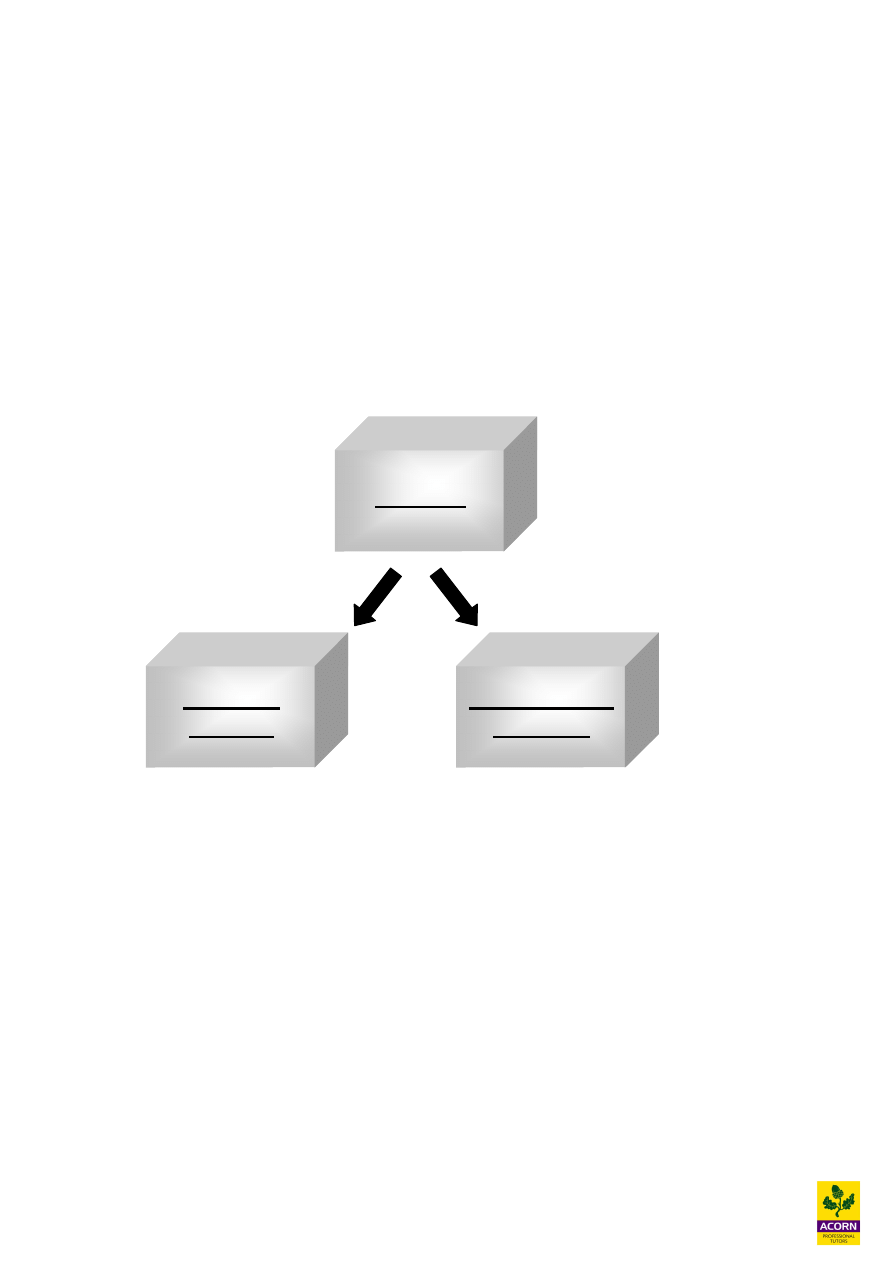

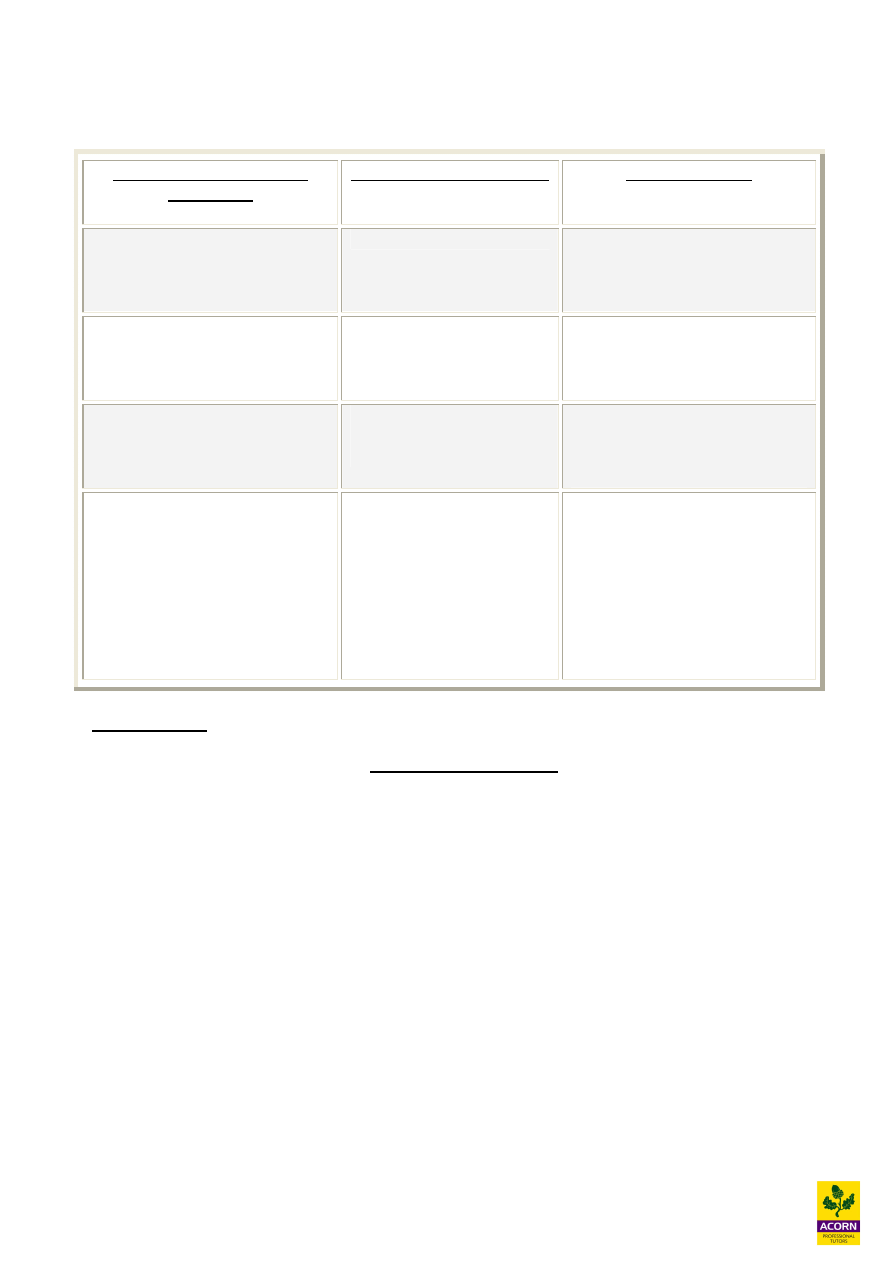

Capital reserves must be established in certain circumstances by law. These statutory reserves

include:

§ Share premium account (set up when ordinary shares issued)

§ Revaluation reserve (set up when fixed assets revalued)

A company cannot make dividend payments out of capital reserves, i.e. they are un-distributable

Reserves

Statutory

(capital)

Non-statutory

(revenue)

5

15.3

Distributable profits

Distribution to shareholders can only be made out of distributable profits. This is the law.

Distributable profits are realised profits, for example profits earned on sale of goods or returns

from investments. Unrealised profits or gains include revaluation of non current assets. This

revaluation gain is not realised because the organisation hasn’t sold the asset, it is still continuing

to use it.

All accumulated profits are distributable profits.

The reason for making distribution to shareholders only from distributable profits is to safeguard

the rights of creditors. Any amounts owing to creditors must be paid first before capital is returned

to the shareholders, this is also known as the “creditors’ buffer”.

15.4

Redemption of shares

A company may decide to buy back some of its issued ordinary shares and then cancel them. For

this to happen, their must be authorisation from articles of association, special resolutions and

sometimes from the court.

Redemption of shares from capital

The accounting treatment for the redemption of shares is strict. A company must set up a “capital

redemption reserve” to protect the creditors. This is done by utilising the accumulated realised

profits (distributable reserves). The amount taken to the capital redemption reserve is the nominal

value of the shares redeemed.

Journal entry for redemption of shares is done in 2 stages:

1

To record the share-buy back

Debit

Ordinary share capital (nominal value) - (statement of financial position)

Debit

Share premium (but restricted) - (statement of financial position)

Debit

Retained profits (with remainder) - (statement of financial position)

Credit Bank (statement of financial position)

2

To record the capital maintenance by setting up a capital redemption reserve

Debit

Retained profits (nominal value) - (statement of financial position)

Credit Capital redemption reserve - (statement of financial position)

6

The rule on share premium account

When the shares are redeemed at a premium, the excess redemption value is debited to the share

premium account but the amount debited is the lower of:

(i)

Share premium originally received from the issue

(ii)

Current balance of the share premium account

(iii)

Actual premium on redemption

Redemption of shares out of new issue of shares

If the redemption of share is financed entirely by a new issue of shares, then no capital redemption

reserve is set up as the capital is maintained.

New issue of shares

Debit

Bank - (statement of financial position)

Credit Ordinary share capital - (statement of financial position)

Credit Share premium - (statement of financial position)

Redemption of share

Debit

Ordinary share capital - (statement of financial position)

Debit

Share premium - (statement of financial position)

Credit Bank (statement of financial position)

Redemption of share out of partial new issue

If the redemption of shares is financed partly by a new issue of shares, then the amount of offset

against the new issue is also partial. A capital redemption reserve needs to be created but only to

the extent that the nominal value of shares redeemed exceed the total proceeds from the new issue

(nominal plus premium).

Note that the rules also apply to preference shares.

7

Worked example

The following are extracts from Sebastian plc’s statement of financial position.

Equity and reserves

$’000

Ordinary share capital ($1 equity shares fully paid up)

8,000

Share premium

2,000

Retained profits

5,000

The company buys back 2 million shares for $1.30. The shares were originally issued at a price of

$1.25.

Scenario 1

Redemption through capital

The total value of share buy back is 2 million shares x $1.30 = $2.6 million, of which $2 million is

nominal value and $600,000 is share premium.

But only $500,000 can be used from the share premium (original share premium was $0.25 x 2

million shares), the rest will be taken from retained profits

The accounting entry is:

Debit Ordinary share capital

$2,000,000

Debit Share premium

$ 500,000

Debit Retained profits

$ 100,000

Credit

Bank

$2,600,000

An amount equal to the nominal value of the shares redeemed will be credited to the capital

redemption reserve from retained profits.

Credit

Capital redemption reserve

$2,000,000

Debit

Retained profits

$2,000,000

The total amount of retained profits utilised = $2,100,000

Statement of financial position after redemption of shares

Equity and reserves

$’000

Ordinary share capital ($1 equity shares fully paid up)

6,000

Share premium

1,500

Capital redemption reserve

2,000

Retained profits

2,900

8

Scenario 2 – Redemption through issue of new shares

The company issues 1.5 million new shares at a price of $1.00 each.

New issue of shares

Debit Bank

$1,500,000

Credit Ordinary share capital

$1,500,000

Redemption of shares

Debit Ordinary share capital

$2,000,000

Debit Share premium

$ 500,000

Debit Retained profits

$ 100,000

Credit

Bank

$2,600,000

A capital redemption reserve needs to be created but only to the extent that the nominal value of

shares redeemed exceed the total proceeds from the new issue (nominal plus premium).

$2 million - $1.5 million = $0.5 million

Debit Retained profits

$500,000

Credit Capital redemption reserve

$500,000

The total amount of retained profits utilised = $600,000

Statement of financial position after redemption of shares

Equity and reserves

$’000

Ordinary share capital ($1 equity shares fully paid up)

7,500

Share premium

1,500

Capital redemption reserve

500

Retained profits

4,400

9

15.5

IAS 32 and IAS 39 – financial instruments

(Tutor note: IAS 32 and IAS 39 are not examinable in this paper, this is additional reading for

better understanding).

Financial instruments

Financial instruments are all instruments that are issued by companies as a means of raising finance

(capital) including shares, debentures, loans, debt instruments, options and warrants that give the

holder the right to subscribe for or obtain capital instruments. It also includes derivative

instruments such as options and futures.

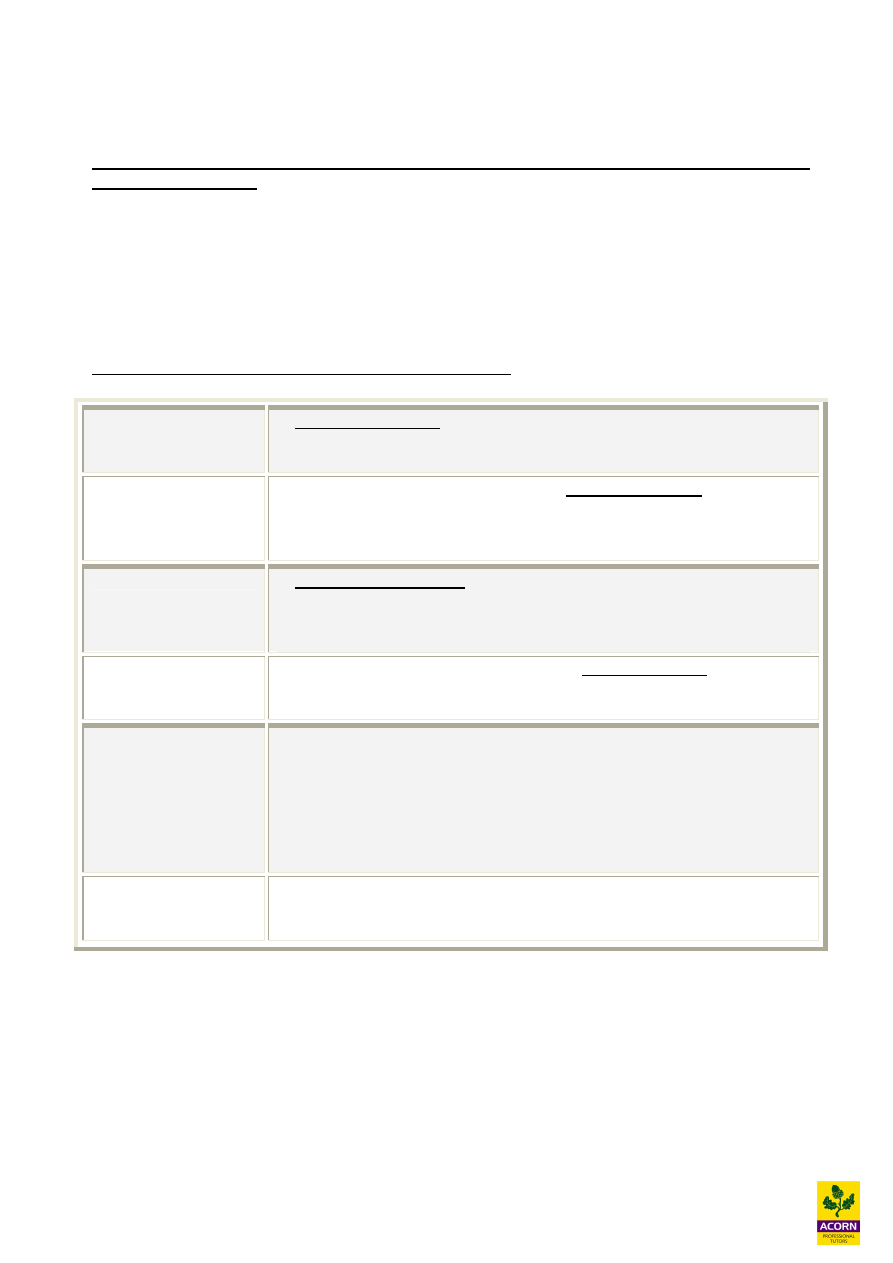

Definitions according to the relevant accounting standards

Financial instrument A financial instrument gives rise to both a financial asset of one company

and a financial liability or equity instrument of another entity.

Financial asset

A financial asset can be cash, equity or contractual right to receive cash

or exchange financial instrument in the company’s favour. This also

includes derivatives.

Financial liability

A contractual obligation to make payments in the future. This could be

cash or exchange financial instrument which are not in the company’s

favour

Equity instrument

Any contract that gives entitlement to the residual interest in a company

after all the liabilities have been settled

Derivatives

These are financial instruments that derive their value from the

underlying asset. They are used mainly for hedging against adverse

movements in prices, exchange rates and interest rates. Examples

include future contracts, forward contracts, options and swaps. There is

usually very little outlay on investment initially and are settled at a future

date.

Fair value

The amount for which an asset could be exchanged or a liability settled,

at an arm's length transaction between willing parties

.

The accounting standards that deal with financial instruments are:

(i)

IAS 32 financial instruments - presentation

(ii)

IAS 39 financial instruments - recognition and measurement

(iii)

IFRS 7 financial instruments - disclosures

10

15.5.1

IAS 32 financial instruments: presentation

This accounting standard states that companies must classify financial instruments as either a

financial liability or as equity. The classification is important because it has an impact on the

appearance of the balance sheet and therefore major ratios like gearing. Gearing measures the

company’s debt capital to its equity capital and shows how risky or stable the company is. The

correct classification will enhance the financial statements for user’s of these accounts in helping

them assess the organisation’s financial position, performance and cash flows according to IAS 32.

IAS 32 achieves its objectives by:

§ Clarifying the classification of a financial instrument as either a liability or equity

§ Gives the treatment for treasury shares (a company's own repurchased shares).

§ Gives strict conditions under which assets and liabilities may be offset in the statement of

financial position

§ Additional disclosure requirements about financial instruments, including information as to

their fair values. However there is a new disclosure accounting standard IFRS 7 which is

applicable in addition to IAS 32 from January 2007.

Equity instruments

Financial liabilities

Ordinary shares

Share warrants

Some type of preference shares

Trade payables

Bonds

Loan stock

Debentures

Bank loans

Some type of preference shares

The substance of the instrument is looked when assessing what the classification is. If there is an

obligation to transfer economic benefit, then this meets the definition of a liability and therefore

must be classified as such.

Normal equity shares and debt, like bank loans, long term debentures and loan stock are straight

forward with their classification. The problem arises on unusual financial instruments which are

discussed below.

Tradable debt securities

11

1

Compound (hybrid) financial instruments

Some financial instruments have both equity and liability elements. IAS 32 requires that liability

element and equity element be identified and classified separately. An example is convertible debt

which is debt that can be converted into equity shares at some point in the future. Another example

is debt issued with detachable share purchase warrants

IAS 32 requires the liability component be calculated. This amount is then deducted from the

whole value (or fair value) of the instrument, which leaves the equity element.

Worked example – convertible bonds / debt

A company issues 400 convertible bonds on 1

st

January 20X6. The bonds were issued at par value

of $100 per bond. Interest is paid annually in arrears at 8% pa, and the bonds are redeemable at par

on 31

st

December 20X9.

The bonds can be converted into ordinary shares at 5 shares per bond any time until maturity of the

bond.

The market interest rate for similar convertible bonds is 10%.

Establishing the liability and equity component

(i)

Find present value (PV) of redeemable value

(ii)

Find present value of interest payments

(iii)

Deduct (1 + 2) from the value of proceeds now

(iv)

The result of 3 is the equity component

The liability is calculated first. This is the present value (PV) of the redeemable value plus the

present value of the interest payments. The bonds will be redeemed in 4 years time.

PV of redeemable ($100 x 400)

$40,000 x 0.683 (DF @ 10% 4yrs)

$27.320

PV of interest payments ($40,000 x 8% x 3.17 (CDF @ 10% for 4 yrs)

$10,144

Total present value

$37,464

Proceeds of bond issue ($100 x 400)

$40,000

Equity component

$ 2,536

Debit Bank $40,000

Credit Bond liability $37,464

Credit Equity

$ 2,536

The split between the liability and equity component remains the same throughout the term of the

bond. The split is made when the financial instrument is issued and doesn’t change even if market

interest rates and share prices change. Even the changes in the likelihood of conversion won’t

change the initial split

Fair value of

bond

12

2

Warrants and options

These financial instruments give the holder the right to subscribe for equity shares at some point in

the future at a specified price. A common form of remuneration for senior staff is share options.

Traditionally when share options were granted, there was no accounting entry in the financial

statements. It was only once the options were exercised that the financial statements would be

affected.

This old method would result in companies with different remuneration policies showing different

results, thus making financial statements incomparable.

IFRS 2 share based payments was introduced by the IASB, which states that when the company

offers share options or warrants, it must treat this as a financial instrument and recognise them in

the financial statements at fair value, the charge going to the income statement and the credit going

either to equity or liabilities.

3

Irredeemable debt

This is debt that is issued without a redemption date. The holder of the debt receives interest

indefinitely and will not receive back the principle amount. This is classified as liability under IAS

32, although it does have the same characteristics of equity shares, which are not redeemable. But

with irredeemable debt, there is an obligation to pay the interest. There is no obligation to pay

dividends on equity shares.

With redeemable debt, there is an obligation to pay to repay the principal amount. So therefore this

is classified as liability.

4

Preference shares

Redeemable preference shares

The issuer has the obligation to pay preference dividends and redeem the shares. This gives the

characteristic of a liability and therefore should be classified as such. However in some country’s

(like UK), preference shares have to be shown as part of equity, so for the provisions of IAS 32 to

apply, the law had to change.

Irredeemable preference shares

The preference dividends are paid indefinitely and the shares are never redeemed (just like equity

shares). If the there is an obligation to pay the preference dividends then classify as debt (liability).

If there is no obligation to pay preference dividends they are then classified as equity.

5

Interest, dividends, losses and gains

IAS 32 states that:

1

Interest, dividends, gains and losses relating to financial instruments that are classified as

financial liabilities must be recognised as income or expense in the income statement.

2

Distributions made to equity instrument holders, must be debited to equity (i.e. reduce

retained profits).

3

Transaction costs on equity instruments are also debited to equity.

4

Transaction costs on all financial instruments are capitalised (debited to the relevant item in

the statement of financial position)

13

6

Treasury shares

Treasury share are shares held by the company that issued them. A company acquires treasury

shares by buying them in the market. The cost of buying back these shares is deducted from equity.

Gains or losses are not recognised on the purchase, sale, issue, or cancellation of treasury shares.

Consideration paid or received is recognised directly in equity.

Treasury shares are commonly used in employee share (or share option) schemes. Treasury shares

do not receive dividends or rights and they cannot be used to vote at or attend company meetings.

They are shown in the statement of financial position, but they are deducted from share capital.

Treasury shares are not used in the calculation of basic EPS.

7

Offsetting

IAS 32 states financial asset and financial liability can only be offset against each other when:

§ Has a legal right to set off the amounts.

§ Intends to settle on a net basis.

§ Intends to realise the asset and settle the liability simultaneously.

15.5.2

IAS 39 financial instruments: recognition and measurement

IAS 39 deals with recognition and de-recognition, the measurement of financial instruments and

hedge accounting. IAS 39 is a very controversial accounting standard and is still under review.

IAS 39 states that initially ALL financial instruments must be stated at their fair value. This

includes financial derivatives (the main area of disapproval). This rule is different from the

recognition rule of the framework, which states that items should only be recognised if there is a

probable inflow or outflow and can be measured reliably.

The standard states that a financial asset or a financial liability must be recognised in the statement

of financial position only when the organisation becomes a party to the contractual provisions of

the instrument.

The definitions of financial instrument, financial asset and financial liability are the same as IAS

32. Examples of financial instruments within the scope of IAS 39 are:

§ Cash and cash in time deposits.

§ Loans receivable and payable.

§ Debt and equity securities. These are financial instruments from the perspectives of both the

holder and the issuer. This category includes investments in subsidiaries, associates, and

joint ventures.

§ Asset backed securities (e.g. mortgage obligations)

§ Derivatives (options, rights, warrants, futures contracts, forward contracts, and swaps).

IAS 39 does not deal with equity instruments; it only deals with financial assets and financial

liabilities. Therefore it is very important that the classification between equity and liability is done

accurately under IAS 32.

14

IAS 39 states that all financial assets and all financial liabilities must be recognised in the statement

of financial position. This includes all derivatives. In the past derivatives were not recognised in

the statement of financial position. This is because at the time the derivative financial instrument

was entered into, the consideration paid or received was immaterial. This justified non-recognition

at that time. However the value of the derivative changes due to changes in the underlying asset,

which means the derivative, has a positive (asset) or negative (liability) value.

Financial assets

IAS 39 requires financial assets to be classified in one of the following categories:

§ Financial assets at fair value through profit or loss.

§ Loans and receivables.

§ Held-to-maturity investments

§ Available-for-sale financial assets

(i)

Financial assets at fair value through profit or loss

This category has two subcategories:

§ Designated. This is a financial asset that is designated on initial recognition as one to be

measured at fair value with fair value changes in profit or loss. Any financial instrument

can have this designation except for equity instruments with no market value.

§ Held for trading. These are all derivatives (except those designated and effective hedging

instruments) and financial assets acquired or held for the purpose of selling in the short

term or for which there is a recent pattern of short-term profit taking are held for trading

(i.e. part of a portfolio).

Once a financial instrument has been designated as a financial asset at fair value through profit or

loss, it can never be re-classified.

Example: shares purchased which are quoted on the stock market and which are held for

trading purposes.

(ii)

Loans and receivables

These are non-derivative financial assets, which are not quoted in an active market, not held for

trading, and not designated on initial recognition as assets at fair value through profit or loss or as

available-for-sale. The payments tend to be fixed or determinable. An example would be loan

issued to other companies, which can be sold or exchanged before maturity date.

(iii)

Held-to-maturity investments

These are non-derivative financial assets that are held to maturity date, with fixed or determinable

payments, that do not meet the definition of loans and receivables and are not designated on initial

recognition as assets at fair value through profit or loss or as available for sale. The organisation

intends and is able to hold to maturity this financial asset. An example would be loan issued to

other companies, which will be held until maturity.

Held-to-maturity investments are measured at amortised cost. If the organisation sells held-to-

maturity investments before maturity (unless it is of insignificant amount or it’s a one off isolated

event beyond their control), then all of its other held-to-maturity investments must be reclassified

as available-for-sale for the current and next two financial reporting years. This would then mean

that re-measurement is on fair value basis and amortised cost method can no longer be used.

15

(iv)

Available-for-sale financial assets

These are financial assets that do not fit into the above categories (e.g. shares purchased which

are quoted on the stock market, but which are not held for trading purposes)

1

Initial classification

Before the financial asset or liability is recognised, it needs to be classified. Financial assets are

classified as above and financial liabilities are more straightforward to classify.

2

Initial recognition

The financial asset or financial liability must initially be recognised at FAIR VALUE less direct

transaction costs.

Fair value can be derived from:

(i)

Quoted prices

(ii)

Where there is no active market, then use valuation techniques with references to market

conditions, e.g. discounted cash flows using market discount factor.

(iii)

If none of the above 2 is possible, then fair value is cost less any impairment.

3

Subsequent measurement

Subsequent measurement depends on the initial classification. This is the area that was revised by

IAS 39 in December 2003, as before this, the standard proposed subsequent measurement to be at

fair value, which caused a great deal of backlash, as this introduced volatility to financial

statements. The standard now gives a choice.

16

IAS 39 now states that subsequent measurement can either be fair value and/or the following:

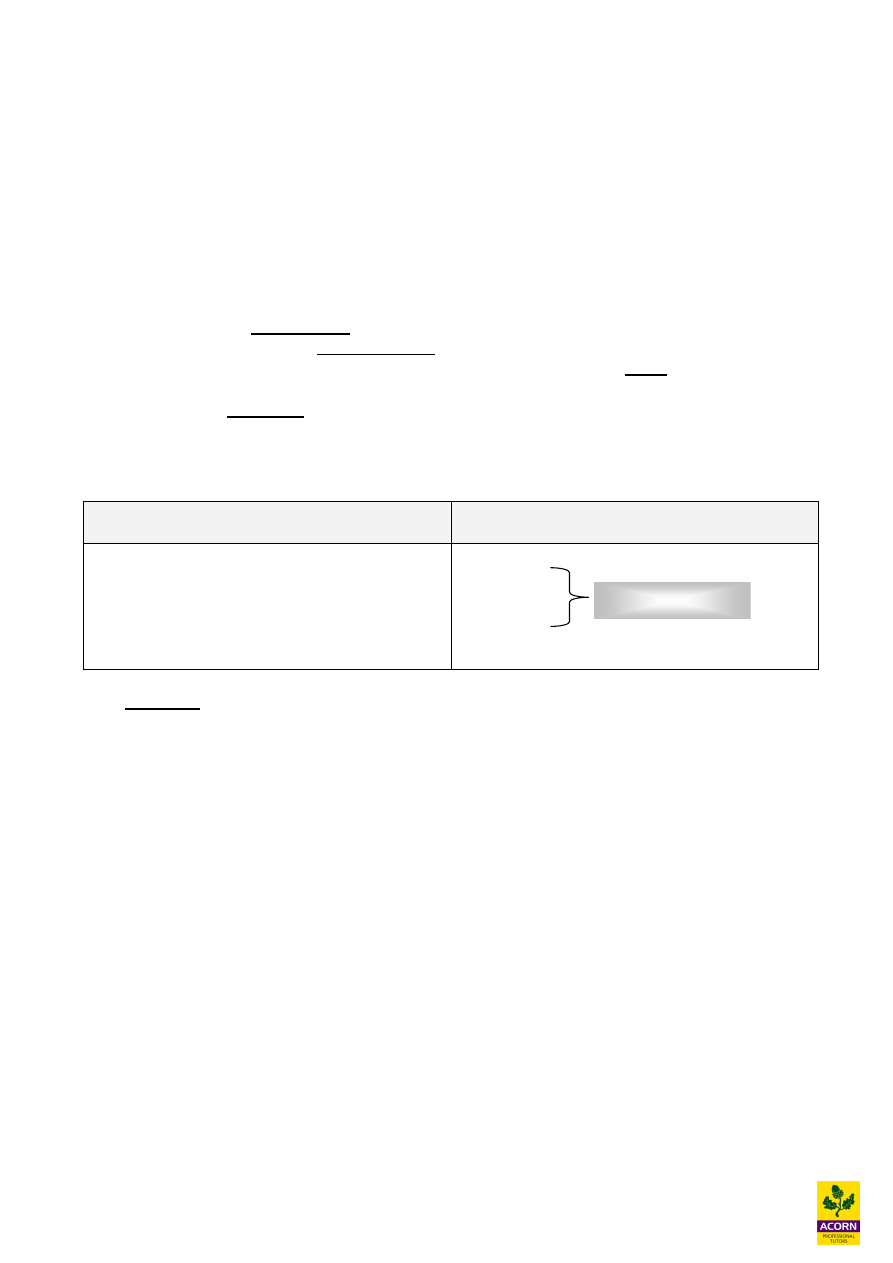

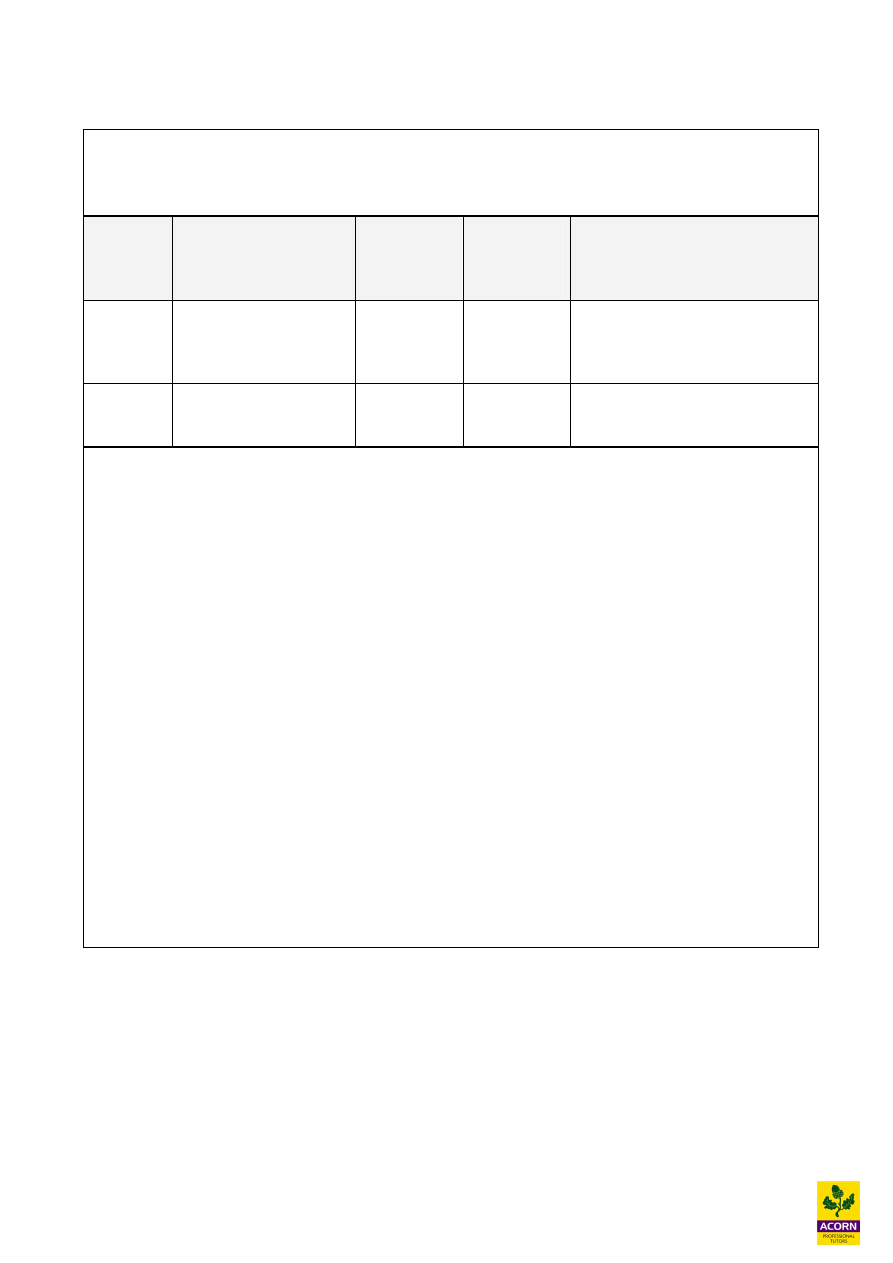

Classification of financial

instrument

Subsequent measurement

Change taken to

Financial assets at fair value

through profit or loss

Fair value

Gains and losses taken to the

income statement at each re-

measurement

Loans and receivables

Amortised cost, using the

effective

interest

rate

method, or fair value

Gains and losses taken to the

income statement at each re-

measurement

Held to maturity investments

Amortised cost, using the

effective

interest

rate

method, or fair value

Gains and losses taken to the

income statement at each re-

measurement

Available for sale financial

assets

Fair value

Gains and losses shown under

other comprehensive income

and

recognised

in

equity

(reserves). When the item is

sold or removed, the cumulative

gains or losses are reclassified

as part of the retained profit in

the statement of changes in

equity.

Amortised cost

Amortised cost is calculated using the effective interest method.

The effective interest rate is calculated by taking into consideration the life of the financial asset or

liability, all the payments and all the receipts. It is effectively a discount rate which when applied

will give the carrying value of the financial asset or liability (see the illustrative worked examples

later in this chapter).

17

Worked example - Financial assets – fair value

David plc has the following investments:

Date

Details

Market

value

31/12/X5

Market

value

on

disposal

during 20X6

Classification

July

20X5

5,000 shares in Andy

plc at £4.50 each

£5

£5.50

Financial assets at fair value

through profit or loss / held for

trading

August

20X5

3,000 shares in Lucas

plc at £16.50 each

£15

£12.50

Available for sale financial

asset

Initial recognition will be at fair value:

Andy plc investment (current asset)

Debit Financial assets at fair value through profit or loss (£4.50 x 5,000) £22,500

Credit Bank

£22,500

Lucas plc investment (non current asset)

Debit Financial assets available for sale (£16.50 x 3,000) £49,500

Credit Bank

£49,500

Year end

At the year end both the investments will be re-valued to fair

Andy plc – 5,000 x £5 = £25,000

This results in a gain of (25,000 – 22,500) = £2,500. This will go to the income statement as a

gain.

Debit Financial assets at fair value through profit or loss £2,500

Credit Income statement

£2,500

18

Lucas plc – 3,000 x £15 = £45,000

This results in a loss of (49,500 – 45,000) = £4,500. This will go other comprehensive income and

shown under equity (reserves).

Credit Financial assets available for sale

£4,500

Debit Other comprehensive income

£4,500

Disposal

Andy plc disposal proceeds are 5,000 x £5.50 = £27,500. This is a gain of (27,500 – 25,000) =

£2,500. This will go to the income statement as a gain. Note how the gain or loss is established

with reference to the last fair valuation

Debit Bank

£27,500

Credit Financial assets at fair value through profit or loss

£25,000

Credit Gain – income statement

£ 2,500

For Lucas plc, the gain or loss on disposal is calculated with reference the initial valuation.

Disposal proceeds 3,000 x £12.50 = £37,500. This is a loss of (49,500 – 37,500) = £12,000.

The loss will be recognised in the income statement, and the previous loss of £4,500 will be

transferred from reserves to the income statement.

Debit Bank

£37,500

Credit Financial assets available for sale

£45,000

Credit Reserves

£ 4,500

Debit Income statement

£12,000

Effectively the entire loss over the term of the financial asset is recognised when the asset is sold in

the income statement (which then forms part of the retained profits under equity).

Transaction costs

Financial assets at fair value through profit or loss / held for trading – expensed in the income

statement:

Dr Expense, Cr bank

Available for sale financial asset – capitalised in the statement of financial position

Dr Available for sale financial asset, Cr bank

19

Financial liabilities

Financial liabilities are initially recognised at fair value (just like financial assets). This would be

issue proceeds less direct costs. The subsequent measurement is at amortised cost using the

effective interest rate method.

Worked Example - Financial liability – amortised cost

A company issued bonds with a nominal value of £10 million at the beginning of its financial year.

Issue costs were £200,000 and interest payable on the bonds is 5% at the end of the year. The

bonds will be redeemable in 3 years time for a total value of £12.264 million.

Show how the company will account for the bond over the 3 years.

Answer

Firstly the interest rate implicit on the bond needs to be calculated as follows (this is normally

given in exams):

£’000

Net proceeds

(£10,000 - £200)

9,800

Total payable

Interest payments (£10m x 5% x 3 yrs)

1,500

Redemption value

12,264

13,764

Total finance cost (13,764 – 9,800)

3,964

Net proceeds

=

9,800 / 13,764 = 0.712

Total payable

Using the present value tables, for 3 years the discount rate is 12%. This means 12% will be used

to allocate the finance cost over 3 years. The effective cost of the bond is 12% compared to the

coupon interest rate of 5%. To ensure that the cost of the bond is spread over the term in a

systematic manner, 12% finance charge is used.

At inception Debit Bank (statement of financial position)

£9,800,000

Credit Liability (statement of financial position)

£9,800,000

Year

Open liability

£’000

(1)

Finance cost x 12%

£’000

(2)

Interest payment

(10m x 5%)

£’000

(3)

Closing

liability

£’000

1 + 2 - 3

1

9,800

1,176

(500)

10,476

2

10,476

1,257

(500)

11,233

3

11,233

(bal)1,531

(500)

12,264

Total

3,964

20

The statement of financial position liability has increased to £12.264 million and when the bonds

are redeemed (Cr Cash £12.264m, Dr Liability £12.264m)

Each year the finance cost on the outstanding liability is charged to the income statement. The

outstanding liability is increased with the finance charge and reduced by the interest payments.

For year one the journal entry would be:

£’000

£’000

Dr Finance charge – income statement

1,176

Cr

Bond

676

Cr

Cash

500

The above workings would also be used for other items, such as loan stock, debentures and

preference shares.

IAS 39 is being replaced with IFRS 9 as part of the convergence program to bring US GAAP

and IASB in line. The IASB decided at its meeting to set 1 January 2018 as the effective date

for the mandatory application of IFRS 9. Please view IASB website for all the latest

developments www.iasb.org

21

Summary of chapter “share capital transaction”

A limited company issues shares, which investors buy and then these investors become owners of

the company. These shares may be issued privately (ltd) or to the public (plc). Ownership in the

company is through the issue of shares. The shareholders have an equity stake in the business and

have voting rights.

Usually for large organisations the shareholders do not run the business. The directors do this.

The shareholders are entitled to dividends declared by the directors. The dividends are declared

at the discretion of the directors and depend on how much profit the company has made.

Authorised share capital

This is the number of shares that the company is allowed to issue

and is stipulated in its memorandum or articles of association.

Issued share capital

This is the number of shares that the company actually issues. This

cannot exceed the authorised share capital

Called up share capital

This is the issued share capital for which the shareholders are

required to pay to the company.

Paid up share capital

This is the amount of share capital paid up by the shareholders

Nominal value

This is the value of the each share which the company will

originally issue the shares at, (also known as face or par value)

Market value

This is the trading value of the shares, and is the price an

individual pays for the shares

Share premium

This is the increase from nominal value to market value of the

share

Procedures for new issue of equity shares

Issue and forfeiture

Application

Potential shareholders apply for shares in the company and send

cash to cover the amount applied for.

Allotment

The company allocates shares to the successful applicants and

returns cash to unsuccessful applicants.

Call

Where purchase price is payable in instalments, the company will

‘call’ for instalments on their due dates of payment

Forfeiture

If shareholders fail to pay a call, their shares may be forfeited

without the need to return the money they have paid; the forfeited

shares may then be reissued to other shareholders

22

Rights issue of ordinary shares

If a company issues ordinary shares for cash it must first offer them to its existing ordinary

shareholders in proportion to their shareholdings. This is called a rights issue because members

may obtain new shares in right of their existing holdings.

Bonus issue of ordinary shares

A bonus issue is when new shares are issued to existing shareholders but no money is received.

Instead the company capitalises its reserves, this is only permitted to the extent that the articles

permit it and the correct procedure must be observed.

Preference shares

Preference shares are issued by companies to raise finance. These shares are different from

ordinary shares. Preference shares do not give voting rights and therefore holders of preference

shares do not have a stake in the business.

Revenue reserves arise when a company makes profits and does not pay out all the profits to the

shareholders. There is no statutory requirement for a company to have any amounts in its revenue

reserve. These non-statutory reserves take various names like “retained profits”, “profit and loss

reserves”, “un-appropriated profits” etc.. A company can make dividend payments out of revenue

reserves i.e. they are distributable to the shareholders

Capital reserves must be established in certain circumstances by law. These statutory reserves

include share premium account (set up when ordinary shares issued) and revaluation reserve (set

up when fixed assets revalued). A company cannot make dividend payments out of capital

reserves, i.e. they are un-distributable

Redemption of shares

A company may decide to buy back some of its issued ordinary shares and then cancel them. For

this to happen, their must be authorisation from articles of association, special resolutions and

sometimes from the court.

Redemption of shares from capital

The accounting treatment for the redemption of shares is strict. A company must set up a “capital

redemption reserve” to protect the creditors. This is done by utilising the accumulated realised

profits (distributable reserves). The amount taken to the capital redemption reserve is the nominal

value of the shares redeemed.

Redemption of shares out of new issue of shares

If the redemption of share is financed entirely by a new issue of shares, then no capital

redemption reserve is set up as the capital is maintained.

Redemption of share out of partial new issue

If the redemption of shares is financed partly by a new issue of shares, then the amount of offset

against the new issue is also partial. A capital redemption reserve needs to be created but only to

the extent that the nominal value of shares redeemed exceed the total proceeds from the new issue

(nominal plus premium).

23

IAS 32 and IAS 39 – financial instruments

Financial instruments

Financial instruments are all instruments that are issued by companies as a means of raising

finance (capital) including shares, debentures, loans, debt instruments, options and warrants that

give the holder the right to subscribe for or obtain capital instruments. It also includes derivative

instruments such as options and futures.

The accounting standards that deal with financial instruments are:

(i)

IAS 32 financial instruments - presentation

(ii)

IAS 39 financial instruments - recognition and measurement

(iii)

IFRS 7 financial instruments – disclosures

Wyszukiwarka

Podobne podstrony:

Creation of Financial Instruments for Financing Investments in Culture Heritage and Cultural and Cre

A Cebenoyan Risk Management, capital structure and lending at banks Journal of banking & finance v

7 3 1 2 Packet Tracer Simulation Exploration of TCP and UDP Instructions

Lab 6, 10.2.2.8 Packet Tracer - DNS and DHCP Instructions

5 4 1 1 MAC and Choose Instructions

Focus S Series Hand Held and GUI Instrukcja Obsługi

kosiarka Brigs and Straton instrukcja serwisowa PL

122 Dress cutting and sewing instructions original

9302 Franzi Vest cutting and sewing instructions original

Polityka zdrowotna Health Expenditure and Financing

Check your Vocabulary for Banking and Finance

Capital Punishment and the?ath Penalty

10 2 2 8 Packet Tracer DNS and DHCP Instructions

117 Dress cutting and sewing instructions original

Guide To Budgets And Financial Management

Lab 5, 7.3.1.2 Packet Tracer Simulation - Exploration of TCP and UDP Instructions

10 2 1 8 Packet Tracer Web and Email Instructions

więcej podobnych podstron