The role of interpersonal trust for

entrepreneurial exchange in a

transition economy

Tatiana S. Manolova

Bentley College, Waltham, Massachusetts, USA

Bojidar S. Gyoshev

International Business School, Botevgrad, Bulgaria, and

Ivan M. Manev

Maine Business School, University of Maine, Orono, Maine, USA

Abstract

Purpose – While trust is widely recognized as central to the establishment of an effective market

economy, research on transition economies has not examined sufficiently its role in promulgating

economic development. This study seeks to ascertain the links between supplier trust, asset specificity,

and uncertainty reduction in the context of a transition economy, and to validate a measure of trust

developed in a Western developed market economy in the conditions of a transition economy.

Design/methodology/approach – A confirmatory factor analysis of trust, asset specificity and

uncertainty reduction was performed with a sample of Bulgarian small business owners.

Findings – Commensurate with expectations, supplier trust is significantly and positively associated

with both asset specificity and uncertainty reduction. The six-item measure of supplier trust is a valid

measure for new and small ventures in the context of a transition economy.

Originality/value – This paper demonstrates that private entrepreneurs in transition economies

compensate for the lack of institutional support through embeddedness in their relational exchange

network.

Keywords Trust, Assets management, Uncertainty management

Paper type Research paper

Introduction

Organizational researchers have devoted considerable attention to understanding the

significance of trust for organizations and economic activities (McEvily et al., 2003a).

Trust, or “the mutual confidence that no party in an exchange will exploit another’s

vulnerabilities” (Barney and Hansen, 1994), is an important non-market governance

mechanism, which facilitates long-term relationships between firms and is an

important component in the success of strategic alliances (Gulati, 1995). In more

uncertain environments trust lowers transaction costs in inter-firm collaborations,

thereby providing firms with a source of competitive advantage (Barney and Hansen,

1994). Trust is increasingly considered to be not only an organizing principle providing

the logic by which work is coordinated and information is gathered, disseminated, and

processed within and between organizations (Zander and Kogut, 1995; McEvily et al.,

2003b), but also a valuable contributor to economic exchange (Doney et al., 1998).

The current issue and full text archive of this journal is available at

www.emeraldinsight.com/1746-8809.htm

A previous version of this paper was presented at the Academy of Management Annual Meeting

in Honolulu, August, 2005.

Role of

interpersonal

trust

107

International Journal of Emerging

Markets

Vol. 2 No. 2, 2007

pp. 107-122

q Emerald Group Publishing Limited

1746-8809

DOI 10.1108/17468800710739207

In the area of entrepreneurship and small business research, in particular, trust has

been documented to significantly facilitate small firms’ commercial transactions

(Saparito et al., 2004).

The role of trust for entrepreneurial exchange is even more vital in the context of

transition economies, which are characterized by the fluidity, inconsistency, and

ambivalence of their formal institutions (Peng, 2004). These institutions, which are

themselves in upheaval (Newman, 2000; Roth and Kostova, 2003), offer few safeguards

that would relieve the need for added transaction-specific support (Khanna and Palepu,

2002; Hohmann et al., 2002). Personal trust often complements and even substitutes for

some of the legal and regulatory deficiencies, reduces uncertainty and encourages

entrepreneurial commitment to economic exchange.

While trust is widely recognized as central to the establishment of an effective

market economy, extant research has not examined sufficiently its role in

promulgating development in transition economies (Humphrey and Schmitz, 1998).

The patterns of institutional and governance mechanisms that have emerged in the

absence of strong legal regimes or binding social norms have been less understood

(Choi et al., 1999). In particular, research on the role of trust as a relational governance

mechanism has focused predominantly on the impact of informal social and business

networks fostering entrepreneurship in China (Wu and Choi, 2004; Peng, 2004; Choi

et al., 1999), while the role of trust in the institutional milieus of Central and Eastern

Europe has remained at the periphery of scholarly attention (Hohmann et al., 2002).

This study seeks to contribute to the better understanding of the role of trust in

forming the context for entrepreneurial economic exchange in an Eastern European

transition economy. Our goal is twofold. First, we seek to ascertain the links between

supplier trust, asset specificity, and uncertainty reduction. Our research context is

Bulgaria: a relatively understudied Eastern European country mid-way in its

transition to a market-based economy. Second, we seek to validate a measure of

supplier trust in the context of new and small ventures in a transition economy, thus

responding to recent calls for empirical validation of the theoretical developments on

trust (McEvily et al., 2003b), especially in the context of transition economies (Choi et al.,

1999; Humphrey and Schmitz, 1998). To entrepreneurs in transition economies, our

study provides insights to the role of supplier trust in reducing uncertainty and

facilitating economic exchange.

The paper is structured as follows. We start by presenting the context of the study

and discuss the role of trust in the formation of a context for entrepreneurial exchange

in transition economies, and in the context of Bulgaria, in particular. We then define the

constructs of interest to the study and present the hypothesized relationships between

them. Next, we describe our method and report on the findings from the analysis.

We conclude by discussing the study’s research and practitioner implications.

Trust and entrepreneurial exchange in transition economies

Transition economies have generally been described as “low-trust” societies

(Fukuyama, 1995; Humphrey and Schmitz, 1998; Hohmann et al., 2002),

characterized by a low regard for formal institutions, the rule of law, or contracts.

To a large degree, “low-trust” attitudes in transition economies are the institutional

legacy of central planning and single party political system. Under the former socialist

social order, the individual had little reason to trust a system in which contracts were

IJOEM

2,2

108

supplanted by central planning directives, laws were superseded by party decrees, and

the party-state faced no institutional checks and balances. After the fall of communism,

the institutional upheaval of the transition to a market economy bred even more

caution and distrust, as the formal and informal bonds holding the economy together

were ruptured and uprooted. A recent study by the World Bank (Broadman et al., 2004)

established that economic growth in the emerging market economies in South Eastern

Europe has been impeded by the absence of effective market-based institutions to

protect property rights, fair competition, and financial discipline, making the risk and

costs of doing business excessively high. A large survey of over 6,000 firms across

26 transition economies sponsored by the European Bank for Reconstruction and

Development found that the average prepayment levels (a measure of the degree of

mistrust in economic exchange) are markedly higher in less reform-oriented and poorer

transition economies (Raiser et al., 2004).

Newly emerging private entrepreneurs in transition economies are especially

vulnerable to the pressures imposed by an uncertain, complex, and hostile institutional

environment. Frustrated by the ineffective legal enforcement of contracts and property

rights, private entrepreneurs depend to a large extent on informal norms for security

(Peng, 2004) and actively seek to design alternative governance structures and

contractual arrangements. Informal ties and relational governance fill in the

“institutional voids” left in the formal institutional infrastructure (Khanna and

Palepu, 1997; Peng and Heath, 1996; Xin and Pearce, 1996).

Empirical research has explored how firms operating in an environment where

formal institutions cannot be trusted invent compensatory strategies for overcoming

institutional deficiencies. Using a combination of surveys and in-depth interviews with

Russian business owners and top managers, Radaev (2004) found two main coping

strategies: private contract enforcement, which can undermine the standard rule-of-law

solution, and “bottom-up” conventions, based on informal shared understandings

within specific segments of the market, which in the long run may be backed by

government agencies and translate into formal government regulations. Similarly, a

study comparing business relationship governance mechanisms among small firms in

Slovenia and Bosnia found that business relations in Bosnia, characterized by a weaker

institutional environment, were likely to be based more on interpersonal, rather than on

institutional trust (Rus and Iglic, 2005). This finding is echoed by a comparative

exploratory study of small businesses in Germany, Estonia, and Russia (Welter et al.,

2004), which found that in more fragile institutional environments interpersonal trust

can substitute for institutional deficiencies.

Our research focuses specifically on entrepreneurial exchange in the context of

Bulgaria, whose institutional profile shares many commonalities with other economies

in transition, being characterized by voids in business legislation, compounded by a

regulatory flux. The high environmental turbulence and unpredictability have

presented numerous challenges to the growth of the private sector. Case-based research

documents that institutional actors are perceived as “opportunistic,” “self-serving,”

“obstructing,” “unfair,” and “hostile” (Manolova and Yan, 2002). Bartlett and

Rangelova (1997, p. 330) reported:

. . . many complaints that the administrative apparatus is not user friendly towards new

private projects, and that much red tape remains in place which hinders the entry and growth

of firms.

Role of

interpersonal

trust

109

In his interview-based study of 45 Bulgarian entrepreneurs Dadak (1995) noted that

most of the problems experienced by these entrepreneurs were created by government

inefficiency, bureaucratic obstruction, high taxes, and outdated and inconsistent

legislation. A study by Dragneva (1998) also echoed numerous problems arising from a

legal system that is weak in enforcing contracts. Overall, the high cost and uncertainty

of third party enforcement is characteristic of the task and institutional environment of

Bulgaria. Not surprisingly, experimental research based on economic game-theoretic

approaches has ascertained the high levels of horizontal (e.g. interpersonal) and low

levels of vertical (e.g. between an individual and an institution) trust characterizing the

Bulgarian institutional environment (Koford, 2003).

The main premise of our study is that in the context of a fragile institutional

environment, interpersonal trust will be positively associated with uncertainty

reduction and will encourage entrepreneurial commitment to economic exchange.

We focus on the dyad exchange relationships between new and small business owners

and their suppliers. Issues of trust and risk can be significantly more important in

supply chain relationships because these relationships often involve a longer-term

and a higher degree of interdependency between actors (La Londe, 2002). Thus,

buyer-supplier relationships provide a clearer representation of what may otherwise be

a common phenomenon: namely, that there is a significant and positive association

between interpersonal trust, uncertainty reduction, and resource commitment.

Theoretical perspectives and hypothesis development

This study draws on perspectives from transaction cost economics (Williamson, 1975,

1985, 1993) and social embeddedness (Granovetter, 1985) to assess the relationships

between interpersonal trust, uncertainty reduction, and resource commitment

(asset specificity). The transaction cost perspective suggests that under conditions of

asset specificity and environmental uncertainty, trust is an optimal non-market

governance structure because it reduces the information processing requirements and

alleviates the need for contractual hazard safeguards, thus lowering transaction costs

(Chiles and McMackin, 1996, pp. 91-2). The social embeddedness perspective

emphasizes the social nature of exchange (Macneil, 1980). It examines how economic

exchange relations “become overlaid with social content that carries strong expectations

of trust and abstention from opportunism” (Granovetter, 1985, p. 490).

Interpersonal trust

There is a considerable divergence in the conceptualization, as well as the levels of

analysis of trust (Zaheer et al., 1998). The transaction cost perspective (Williamson,

1993) makes a distinction between calculative, personal, and institutional trust.

Calculative trust refers to a “rational form of trust fostered by mutual hostages and

other economic commitments.” Personal trust applies, according to Williamson, only to

personal relationships. Finally, institutional trust derives from the social and

organizational embeddedness but in fact, according to Williamson, is calculative as

well (Young-Ybarra and Wiersema, 1999, p. 446). In other words, in the classic

transaction cost model, it is calculative trust (as residual risk) that dominates business

relations.

This self-interest-based conceptualization of trust contrasts with the views of

social embeddedness theorists (Granovetter, 1985; Gambetta, 1990) who argue that,

IJOEM

2,2

110

as a matter of human nature, opportunism is far rarer and trust far more common than

is posited in transaction cost economics (Bensaou and Anderson, 1999, p. 462).

Through the interpretive view of social norms, “global trust in generalized others” is

generated through social norms such as reciprocity, obligation, cooperation, and

fairness (Chiles and McMackin, 1996, p. 86; Ghoshal and Moran, 1996).

Bridging the two perspectives, in her work of the production of trust Zucker (1986)

identified three forms of trust production: institution-, characteristic-, and

process-based. Institution-based trust relies on enforceable rules and rights, as well

as availability of reliable information on potential partners. Characteristic-based trust

is established by group membership and reputation. Process-based trust draws on

first-hand experience of exchange or cooperation with potential partners. Extending

this argument to the “low-trust” context of transition economies, characterized by low

levels of institution-based trust and low levels of “global trust in generalized others,”

it appears that the main form of trust production will be “process-based” trust,

stemming from first-hand experience of exchange and cooperation. Since, by definition,

first-hand experiences are generated by interpersonal relations, it follows that the main

form of trust governing business relations will be interpersonal trust.

Following Zaheer et al. (1998, p. 143), we conceptualize trust as the expectation that:

.

the actor can be relied on to fulfill obligations;

.

will behave in a predictable manner; and

.

will act and negotiate fairly when the possibility for opportunism is present.

We also follow Zaheer et al. (1998, p. 143) in that we focus on the exchange dyad and

develop a definition of trust that is inherently relational, because we are specifically

interested in studying the role of trust in economic exchange.

Asset specificity

Consistent with the transaction-cost approach, we use asset specificity to conceptualize

the resource commitment to a transaction. We follow Williamson (1985), who defined

asset specificity as “durable investments that are undertaken in support of particular

transactions, and the opportunity cost of (such) investments is much lower in best

alternative uses.” Thus, asset specificity refers to investments in physical or human

assets that are dedicated to a particular business partner and whose redeployment

entails considerable switching costs (Erramilli and Rao, 1993). Asset specificity is

particularly critical in the context of transition economies, because the market clearing

mechanisms are not sufficiently developed, which makes asset redeployment

problematic and very costly.

Uncertainty reduction

Uncertainty is a dimension of economic exchange, which arises when it is hard to

foresee the contingencies that might occur during the course of the transaction

(Williamson, 1985). Uncertainty causes problems in part because of bounded

rationality. Economic actors cannot foresee all possible eventualities. It might also

occur as a result of information asymmetries: buyers do not have the product or cost

information that suppliers do. Uncertainty causes problems because of the danger of

opportunistic ex-post renegotiation of contracts. Environmental uncertainty is one

of defining characteristics of transition economies. In addition, low financial and

Role of

interpersonal

trust

111

reporting transparency aggravates information asymmetry problems, thus increasing

uncertainty even more. Well established and stable relationships in economic

exchange, therefore, are instrumental in bringing order to a volatile and unpredictable

environment. We follow Zaheer et al. (1998), in conceptualizing uncertainty reduction

as the degree to which exchange relationships between a focal buyer and supplier help

reduce uncertainty in the task environment.

Asset specificity and interpersonal trust

The central proposition of the transaction cost perspective is that asset specificity

(i.e. anything tangible or intangible of value which is costly to shift from one

transaction context to another), creates contractual hazards: the greater the asset

specificity, the more elaborate the governance mechanism required to constrain the

opportunism

that

may

result.

As

specificity

mounts,

such

contracts

become (cognitively) impossible to write and (in practical terms) impossible to

enforce. This sparks a move to less complete contracts, which leave more to be worked

out later, and to relational governance mechanisms, such as close relationships and

joint actions between two parties that safeguard the firm’s transaction-specific assets

(Bensaou and Anderson, 1999, p. 462; Zaheer et al., 1998).

Trust reduces the information processing requirements and requires fewer

contractual hazard safeguards, thus lowering transaction costs (Chiles and

McMackin, 1996, p. 91-2). Dyer and Singh (1998, p. 670) suggest that self-enforcing

governance mechanisms such as trust are more effective than third-party enforcement

mechanisms at both minimizing transaction costs and maximizing value-creation

initiatives. We hypothesize a bidirectional causal relationship between trust and asset

specificity. For instance, when one trusts another party, one would be more willing to

make relation-specific investments, thus increasing asset specificity. Conversely, when

such relation-specific investments are made, this is likely to act as a sign of goodwill,

leading to the other party’s trust. In line with the central propositions of transaction-cost

economics, we expect the bi-directional relationship between trust and asset specificity

to be stronger under conditions of environmental uncertainty and small numbers

trading. Uncertainty exacerbates the problems arising from bounded rationality and

opportunism, while the presence of only a small number of players in a market limits the

possibility for disciplining the transaction partner (Williamson, 1975). Formally:

H1.

There is a positive relationship between asset specificity and interpersonal

trust.

Interpersonal trust and uncertainty reduction

Uncertainty prevents voluntary interactions, but institutions of trust can substitute for

knowledge by making promises relatively credible. In transition economies, in particular,

private sources of trust and recourse are superior to state-provided recourse (Benson,

2001). Trust reduces ex-ante information processing costs and increases information

sharing – a particularly valuable resource in contexts characterized by uncertainty (Dyer

and Chu, 2003). The need for trust is especially acute in risky situations (Mayer et al., 1995),

related to vulnerability and/or uncertainty about an outcome (Doney et al., 1998). Lewis

and Weigart (1985, p. 970) emphasize the need for uncertainty, because “if one were

omniscient, actions could be undertaken with complete certainty, leaving no need, or even

possibility, for trust to develop” (Doney et al., 1998, p. 603).

IJOEM

2,2

112

Generally speaking, risk would be present, and trust necessary, in settings where

parties make transaction-specific investments and where there is a high degree of

environmental uncertainty (Dyer and Chu, 2003). Trust allows idiosyncratic exchange

relationships to survive greater stress and display greater adaptability (Williamson,

1975, pp. 62-3). Without trust, the uncertainty that pervades the organization and

coordination of economic activity would be debilitating. Although trust is not the only

solution to the organization of work, it can generate efficiencies by reducing

uncertainty, thus conserving cognitive resources, lowering ex-ante transaction costs,

and simplifying decision making (McEvily et al., 2003a, b). Conversely, having a

trusted partner in a relationship reduces uncertainty. Formally:

H2.

There is a positive relationship between uncertainty reduction and

interpersonal trust.

Transaction contextual factors: asset specificity and uncertainty

Finally, we assess the relationship between uncertainty and asset specificity.

We surmise that when a party in a relationship makes relation-specific investments,

this serves as a powerful goodwill signal, which helps reduce the uncertainty

surrounding the relationship. Conversely, the reduction of uncertainty encourages

asset-specific investments. In formal terms:

H3.

There is a positive relationship between asset specificity and uncertainty

reduction.

Methods

Survey and sample characteristics

We conducted a survey in a medium-sized city in Bulgaria with 170 owners of small

businesses, who underwent small business management training at a local university.

The survey was forward and backward translated to ensure semantic consistency.

Non-responses and unusable responses rendered a usable sample of 119 small business

owners, representing a response rate of 70 percent. Most of the studied businesses were

in retail (about 61 percent) and services (18 percent) while the rest were in

manufacturing (12 percent), wholesale (6 percent), and construction (3 percent).

This distribution is not much different from the industry structure of small businesses

in the country[1]. These were fairly young firms that have been established after the

beginning of reforms around 1990 (mean firm age seven years, sd. 3.1, range 1-13).

These firms were also small, with an average of about 4.6 employees (not counting the

owner; sd. 8.4, range 0-50). Again, this is typical for the country, where more than

70 percent employed of small businesses employed only one or two people, and over

90 percent had less than ten employees (Doudeva, 2001). The respondents ranged in

age between 20 and 61 years, with average 39.5 and sd. 10.2 years. Of them, 41 percent

were women, and 30 percent had at least some college education.

Measures

We asked respondents to list their four most important suppliers and then describe

each relationship separately. We then averaged these responses. For interpersonal

trust, we used Rempel and Holmes’ (1986) and Zaheer et al.’s (1998) instruments for

Role of

interpersonal

trust

113

supplier trust which we adapted to our research context. The selected questions reflect

the three components of trust – reliability, predictability, and fairness.

A fundamental challenge in conceptualizing the role of trust in economic exchange

is extending what is primarily an individual level phenomenon to the organizational

level of analysis. When research does not clearly specify how trust translates from the

individual to the organizational level, this may lead to theoretical confusion about who

is trusting whom because it is individuals as members of organizations themselves,

who trust (Zaheer et al., 1998, p. 141). Zaheer et al. (1998) find the degree of

interorganizational trust and interpersonal trust between boundary spanning agents to

be related, though empirically and theoretically distinct. The nature of our sample

alleviates the concern about the relationship between interpersonal and

interorganizational trust, being a sample of predominantly new and small, therefore,

less socially complex organizations. New and small businesses are built around the

entrepreneur, who determines to a large extent the strategic choices of the organization

(Cooper et al., 1994). Small business owners are the key, and oftentimes the sole

decision makers in their organizations. Therefore, small business behaviors are “little

more than the extension of the will of the dominant coalition of individuals” (Hannan

and Freeman, 1984, p. 158).

For uncertainty reduction, we asked respondents about the degree to which each of

their four suppliers reduced uncertainty. Again, we used items validated in extant

research in a Western context (Noordewier et al., 1990; Zaheer et al., 1998). Asset

specificity was measured by the degree of customization for the requirements of

the particular supplier. All items were measured on a seven-point Likert-type scale

(1 – strongly disagree, 7 – strongly agree). The questions are listed in the Appendix[2].

The reliability values for both trust and uncertainty reduction were above the

suggested threshold of 0.70 (Nunnally, 1978).

Results

Descriptive statistics and zero-order correlations are presented in Table I.

We first performed factor analysis for each construct to make sure it is unidimensional.

The items for both trust and uncertainty reduction loaded on single factors.

Mean

SD

T1

T2

T3

T4

T5

T6

UR1

UR2

UR3

UR4

UR5

T1

6.14

1.12

T2

5.32

1.44

0.64

T3

5.85

1.23

0.72

0.60

T4

4.92

1.85

0.39

0.30

0.44

T5

5.58

1.67

0.42

0.30

0.53

0.18

T6

6.10

1.14

0.78

0.59

0.76

0.38

0.41

UR1

6.17

1.07

0.34

0.25

0.27

0.24

0.31

0.34

UR2

6.18

1.08

0.54

0.42

0.43

0.25

0.30

0.43

0.55

UR3

5.81

1.30

0.52

0.44

0.45

0.25

0.22

0.46

0.42

0.57

UR4

5.83

1.22

0.56

0.44

0.50

0.37

0.20

0.52

0.45

0.48

0.45

UR5

5.02

1.79

0.09

0.14

0.09

0.16

0.09

0.12

0.17

0.23

0.25

0.23

AS1

6.02

1.49

0.30

0.33

0.26

0.12

0.26

0.19

0.40

0.49

0.30

0.31

0.19

Notes: Coefficients of 0.18 and above are statistically significant at p , 0.05

Table I.

Descriptive statistics and

zero-order correlations

IJOEM

2,2

114

Next we performed a confirmatory factor analysis using Amos 4.01 software (Arbuckle

and Wothke, 1999), specifying a maximum likelihood estimation procedure that is robust

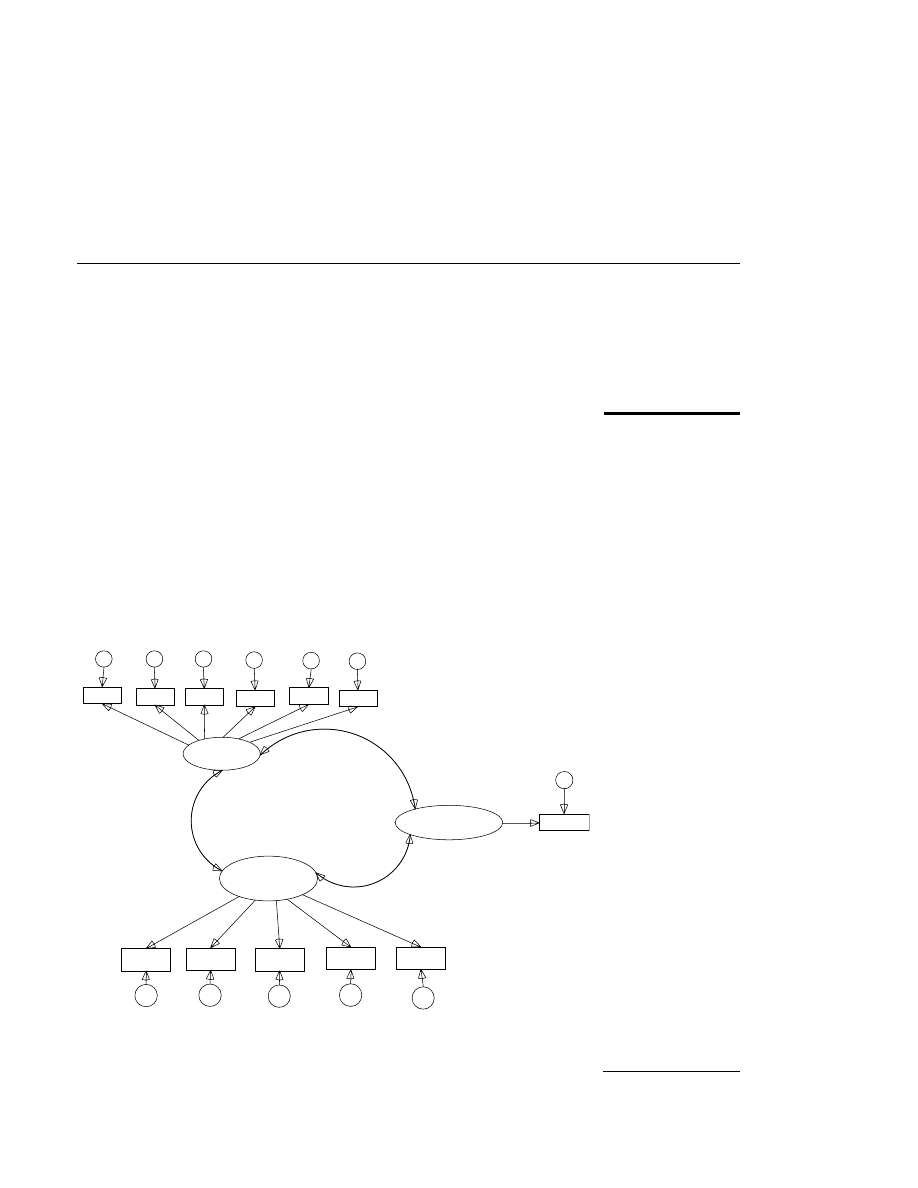

against non-normality of data. The fitted model is shown in Figure 1.

We evaluated the fit of the model though several indicators. The

x

2

value of 69.79,

with 52 df. ( p ¼ 0.05) is still statistically significant though barely so. Nevertheless,

this represents a substantial improvement (98.5 percent) over the independence model.

Comparative fit index (CFI) and normed fit index (NFI) exceed the 0.90 threshold, above

which models usually cannot be improved substantially (Bentler and Bonnet, 1980;

Jo¨reskog and So¨rbom, 1989) The upper bound of root mean square error of

approximation (RMSEA) (90 percent confidence level) is approximately at the

suggested threshold value of 0.08, therefore, the error of approximation is reasonable

(Browne and Cudeck, 1993). These measures demonstrate an acceptable fit between

the actual and predicted covariance structures.

The fitted model suggests that the six-item measure of supplier trust is a valid

measure for new and small ventures in the context of a transition economy. All the

l

estimates for the loadings of the observable indicators are statistically significant,

which demonstrates that they are in fact measuring the underlying latent variable. The

w

estimates for covariance are also statistically significant, which shows strong

relationships between trust, uncertainty reduction, and asset specificity. As predicted

by H1, trust is significantly and positively associated with asset specificity (R ¼ 0.31,

Figure 1.

Trust, asset specificity,

and uncertainty reduction:

confirmatory factor

analysis

Trust

ST1

e1

ST2

e2

ST3

e3

ST4

e4

ST5

e5

ST6

e6

Asset

Specificity

AS1

e7

Uncertainty

Reduction

UR3

e10

UR2

e9

UR1

e8

UR4

e11

UR5

e12

0.69

0.85

0.88

0.70

0.46

0.50 0.87

0.55

0.80

0.67

0.29

0.64

0.73

0.31

1.00

Notes:

χ

2

=69.7, 52 d.f., p =.05; NFI =0.98; CFI =0.99; RMSEA=0.05, lower bound 0.00,

upper bound 0.08.Standardized estimates.All coefficients are significantat p < 0.001,

except the correlation between trust and asset specificity as well as the regression

weight for UR5, both of which are significant at p < 0.01

Role of

interpersonal

trust

115

p , 0.01). H2 was also supported: trust is particularly strongly and positively

(R ¼ 0.73, p , 0.001) associated with uncertainty reduction. Finally, in support of H3,

asset specificity is strongly and positively associated with uncertainty reduction

(R ¼ 0.55, p , 0.001).

Discussion

With this research, we sought to make two contributions. First, we sought to ascertain

the relationships between interpersonal trust, asset specificity, and uncertainty

reduction, which form the context of economic exchange in a transition economy.

Second, we sought to validate a scale of supplier trust, developed in the context of

developed market institutions in a sample of new and small ventures in the context of a

transition economy with underdeveloped market institutions. The results from our

empirical analysis have implications in three principal areas, which we discuss below.

Interpersonal trust shapes the context of economic exchange for new and small players in

transition economies

Results from our empirical analysis show that in the context of transition economies asset

specificity is significantly and positively associated with interpersonal trust. In other

words, as the level of transaction-specific assets increases, so does the role of interpersonal

trust as a relational governance mechanism. To paraphrase Bensaou and Anderson (1999,

p. 462), if there is much at stake, the payment to collect on promises is high and collection

itself is uncertain, one would be very careful to act only on trustworthy promises. Further,

results reveal trust is significantly and positively associated with uncertainty reduction,

suggesting that suppliers who reduce uncertainty for the focal firm most have the highest

degree of trust. Interpersonal trust can generate efficiencies by reducing uncertainty, thus

conserving cognitive resources, lowering ex-ante transaction costs, and simplifying

decision making (McEvily et al., 2003a, b).

These findings support prior research which has suggested that when the social and

political infrastructure is lacking, private entrepreneurs in transition economies try to

compensate the lack of institutional support by seeking deeper embeddedness in their

relational exchange network (Peng, 2004; Peng and Heath, 1996; Xin and Pearce, 1996).

Thus, relational embeddedness is a compensatory mechanism for the lack of formal

institutional support (Xin and Pearce, 1996). It can clarify the meanings of activities and

define appropriate responses to uncertainties. It can foster information exchange,

facilitate recognition of mutual interests, and provide a forum for common identity

formation. It can also maintain credibility among customers and smoothen exchanges

by facilitating credible commitments or enabling collective action (Oliver, 1991; Miner

and Haunschild, 1995; McKendrick and Carroll, 2001, p. 664; Ingram and Simons, 2000).

For new and small players in transition economies who are extremely vulnerable

because of environmental turbulence and less than ubiquitous institutional endorsement,

this study suggests that effective relational, or social, capital should include a strong tie

network that provides support to the entrepreneur (Manev et al., 2005).

Interpersonal trust facilitates exchange in supplier networks in transition economies

Our second finding is related to the specific context of the study, namely supplier

networks in transition economies. Prior research has documented that high trust

increases affective commitment and reduces calculative commitment in distribution

IJOEM

2,2

116

channel relationships (Geyskens et al., 1996). Similarly, in a study of 561 firms in the

global construction industry, Sarkar et al. (1998) found trust and commitment were two

dimensions of relationship bonding. The strong positive association of supplier trust

with asset specificity and uncertainty reduction revealed by our empirical analysis

provides further evidence there are benefits that flow from interpersonal trust in

economic exchange.

Supplier trust scale demonstrates cross-cultural validity

In this study, we validated Holmes’ (1986) and Zaheer et al.’s (1998) instrument for

supplier trust in the context of a transition economy. The selected questions reflect

the three components of trust – reliability, predictability, and fairness. Results from

the confirmatory factor analysis revealed high reliability, internal consistency, and

construct validity. All three dimensions loaded on a single factor, suggesting the three

components of trust (reliability, predictability, and fairness) refer to a unitary

phenomenon. Thus, the study provides strong support for the cross-cultural validity of

a scale originally developed in the context of market economies with well established

institutional and market governance mechanisms. This finding has implications for

future research. In particular, the results from this study suggest that Zaheer et al.’s

(1998) supplier trust scale can be effectively employed when conducting research on

the topic of supplier trust in the context of transition economies.

Limitations

This study had several limitations, which need to be considered when its results are

generalized. In the first place, the dataset comes from a single transition economy.

The context for entrepreneurial exchange may differ in other transforming economies,

warranting further research to extend these findings to other countries. Second, the

sample came from small business owners who were enrolled in business training.

Though their businesses are not substantially different from the national profile of

small businesses in the country, they may be somewhat better educated than the

national average. A future study with a random and larger sample would undoubtedly

correct for this. Thirdly, by studying trust in suppliers we focus on one side of

the entrepreneurial exchange – between the focal firm and its suppliers. As

entrepreneurial firms are often involved in buying from as well as selling to other

organizations, further research would benefit from examining relations between the

focal firm and its buyers as well[3]. Fourthly, our sample represented mostly retail and

services. The role of trust, asset specificity, and uncertainty reduction may differ

for other industries such as high technology or manufacturing, depending on the

configuration of the industry value chain.

Implications and conclusion

The results from this study encourage several directions for future research. One

logical extension would be to replicate the study in other transition economy contexts.

While transition economies have been broadly characterized as “low trust”

environments (Fukuyama, 1995), important cross-national differences may be

embedded in historical experiences, institutional heritage, norms, or cultural values

(Hohmann et al., 2002), providing idiosyncratic institutional milieus for entrepreneurial

behaviors and strategies. In addition, future research can incorporate multiple

Role of

interpersonal

trust

117

dimensions of trust, such as extended, or institution-based trust, process-based trust,

exemplified by trust in partners in economic exchange, as well as interpersonal

cognitive and affective trust. This would allow to ascertain which dimensions of trust

characterize the institutional milieus of individual transition economies, and how these

milieus change as the transition to better established market institutions progresses.

Finally, research is also suggested on the link between trust, transaction costs,

transactional value, and overall entrepreneurial performance. It is possible that

different configurations of the context for economic exchange would result in

differential performance outcomes.

In conclusion, the results from this study suggest that interpersonal trust, asset

specificity, and uncertainty reduction shape the context for economic exchange for new

and small ventures in transition economies. The study findings also indicate supplier

trust scales developed in the context of established market economies can be fruitfully

employed in research in other institutional contexts. It is hoped that this study will help

build a framework for future research on the topic.

Notes

1. The Bulgarian Government’s Agency for Small and Medium-Sized Enterprises reports the

following industry breakdown: agriculture and forestry 3.1 percent; extraction 0.1 percent;

manufacturing 11.2 percent; utilities 0.1 percent; construction 3.6 percent; retail and repair

shops 50.8 percent; lodging 9.7 percent; transport and communications 7.3 percent; finance

and insurance 0.7 percent; real estate 8.4 percent; education 0.6 percent; healthcare and

veterinary services 2.2 percent; others, including non-profits 2.3 percent (ASME, 2002, p. 32).

2. We asked a number of other questions, e.g. for asset specificity we inquired whether the

respondents had spent a lot of money to use the product/service of the supplier (per Zaheer

et al., 1998). This item exhibited poor correlation with the other measure of asset specificity

which appeared more relevant (whether there has been specific tailoring to meet the

requirements of a particular supplier’s product or service) and was dropped.

3. We are indebted to an anonymous reviewer for suggesting this point.

References

Arbuckle, J.L. and Wothke, W. (1999), Amos 4.0 User’s Guide, SmallWaters Corp., Chicago, IL.

ASME (2002), Report on the Small and Medium-sized Enterprises, 2000-2002, Agency for Small

and Medium-sized Enterprises, Sofia.

Barney, J.B. and Hansen, M.H. (1994), “Trustworthiness as a source of competitive advantage”,

Strategic Management Journal, Vol. 15 No. 8, pp. 175-90.

Bartlett, W. and Rangelova, R. (1997), “Small firms and economic transformation in Bulgaria”,

Small Business Economics, Vol. 9 No. 4, pp. 319-33.

Bensaou, M. and Anderson, E. (1999), “Buyer-supplier relations in industrial markets: when do

buyers risk making idiosyncratic investments?”, Organization Science, Vol. 10 No. 4,

pp. 460-81.

Benson, B.L. (2001), “Knowledge, trust and recourse: imperfect substitutes as sources of

assurance in emerging economies”, Economic Affairs, Vol. 21 No. 1, pp. 12-17.

Bentler, P.M. and Bonett, D.G. (1980), “Significance tests and goodness of fit in the analysis of

covariance structures”, Psychological Bulletin, Vol. 88, pp. 588-606.

Broadman, H.G., Anderson, J., Claessens, C.A., Ryterman, R., Slavova, S., Vagliasindi, M.

and Vincelette, G.A. (2004), Building Market Institutions in South Eastern Europe:

IJOEM

2,2

118

Comparative Prospects for Investment and Private Sector Development, The World Bank,

Washington, DC.

Browne, B.M. and Cudeck, R. (1993), “Alternative ways of assessing model fit”, in Bollen, K.A. and

Long, J.S. (Eds), Testing Structural Equation Models, Sage, Newbury Park, CA, pp. 136-62.

Chiles, T.H. and McMackin, J.F. (1996), “Integrating variable risk preferences, trust, and

transaction cost economics”, Academy of Management Review, Vol. 21 No. 1, pp. 73-99.

Choi, C.J., Lee, S.H. and Kim, J.B. (1999), “A note on countertrade: contractual uncertainty and

transaction governance in emerging economies”, Journal of International Business Studies,

Vol. 30 No. 1, pp. 189-202.

Cooper, A.C., Gimeno-Gascon, F.J. and Woo, C.Y. (1994), “Initial human and financial capital as

predictors of new venture performance”, Journal of Business Venturing, Vol. 9 No. 5,

pp. 371-95.

Dadak, K. (1995), “Entrepreneurship in Eastern Europe: the difficulties of small business

development in Bulgaria”, Review of Business, Vol. 16 No. 3, pp. 9-18.

Doney, P.M., Cannon, J.P. and Mullen, M.R. (1998), “Understanding the influence of national culture

on the development of trust”, Academy of Management Review, Vol. 23 No. 3, pp. 601-20.

Doudeva, L. (2001), Demography of the Small and Medium-sized Enterprises in Bulgaria within

the Period 1995-1999: Mapping the Changes in Business Enterprises in Bulgaria, Center

for Economic Development, Sofia.

Dragneva, R. (1998), “Legal preconditions for contractual relationships in the transition to a

market economy”, IDS Bulletin, Vol. 29 No. 3, pp. 51-8.

Dyer, J.H. and Chu, W. (2003), “The role of trustworthiness in reducing transaction costs and

improving performance: empirical evidence from the United States, Japan, and Korea”,

Organization Science, Vol. 14 No. 1, pp. 57-68.

Dyer, J.H. and Singh, H. (1998), “The relational view: cooperative strategy and sources of

interorganizational competitive advantage”, Academy of Management Review, Vol. 23

No. 4, pp. 660-79.

Erramilli, M.K. and Rao, C.P. (1993), “Service firms’ international entry mode choice”, Journal of

Marketing, Vol. 57 No. 3, pp. 19-38.

Fukuyama, F. (1995), Trust: The Social Virtues and the Creation of Prosperity, The Free Press,

New York, NY.

Gambetta, D. (Ed.) (1990), Trust: Making and Breaking Cooperative Relations, Basil Blackwell

Ltd, Cambridge, MA.

Geyskens, I., Steenkamp, J-B.E.M., Scheer, L.K. and Kumar, N. (1996), “The effects of trust and

interdependence on relationship commitment: a trans-Atlantic study”, International

Journal of Research in Marketing, Vol. 13 No. 4, pp. 303-17.

Ghoshal, S. and Moran, P. (1996), “Bad for practice: a critique of the transaction cost economy”,

Academy of Management Review, Vol. 21 No. 1, pp. 13-47.

Granovetter, M. (1985), “Economic action and social structure: the problem of embeddedness”,

American Journal of Sociology, Vol. 91 No. 3, pp. 481-510.

Gulati, R. (1995), “Does familiarity breed trust? The implications of repeated ties for contractual

choice in alliances”, Academy of Management Journal, Vol. 38, pp. 85-112.

Hannan, M.T. and Freeman, J. (1984), “Structural inertia and organizational change”,

American Sociological Review, Vol. 49 No. 2, pp. 149-64.

Role of

interpersonal

trust

119

Hohmann, H., Kautonen, T., Lageman, B. and Welter, F. (2002), “Entrepreneurial strategies and

trust: a position paper”, Working Papers of the Research Centre for East European Studies,

No 37, Bremen, June.

Humphrey, J. and Schmitz, H. (1998), “Trust and inter-firm relations in developing and transition

economies”, Journal of Development Studies, Vol. 34 No. 4, pp. 32-62.

Ingram, P. and Simons, T. (2000), “State formation, ideological competition, and the ecology of

Israeli workers’ cooperatives 1920-1993”, Administrative Science Quarterly, Vol. 31 No. 1,

pp. 25-53.

Jo¨reskog, K.G. and So¨rbom, D. (1989), LISREL 7: A Guide to the Program and Applications, 2nd

ed., SPSS Inc., Chicago, IL.

Khanna, T. and Palepu, K. (1997), “Why focused strategies may be wrong for emerging markets”,

Harvard Business Review, Vol. 75 No. 4, pp. 41-54.

Khanna, T. and Palepu, K. (2002), “Emerging giants: building world-class companies in emerging

markets”, Case 9-703-431, Harvard Business School, Boston, MA.

Koford, K. (2003), “Experiments on trust and bargaining in Bulgaria: the effects of institutions

and culture”, paper presented at ISNIE 7th Annual Meeting, Budapest, 11-13 September.

La Londe, B. (2002), “Who can you trust these days?”, Supply Chain Management Review, Vol. 6

No. 3, pp. 9-10.

Lewis, D.J. and Weigert, A. (1985), “Trust as a social reality”, Social Forces, Vol. 63 No. 4,

pp. 967-85.

McEvily, B., Perrone, V. and Zaheer, A. (2003a), “Introduction to the special issue on trust in an

organizational context”, Organization Science, Vol. 14 No. 1, pp. 1-7.

McEvily, B., Perrone, V. and Zaheer, A. (2003b), “Trust as an organizing principle”, Organization

Science, Vol. 14 No. 1, pp. 91-106.

McKendrick, D.C. and Carroll, G.R. (2001), “On the genesis of organizational forms: evidence from

the market for disk arrays”, Organization Science, Vol. 12 No. 6, pp. 661-82.

Macneil, I.R. (1980), New Social Contract, Yale University Press, New Haven, CT.

Manev, I.M., Gyoshev, B.S. and Manolova, T.S. (2005), “The role of human and social capital and

entrepreneurial orientation for small business performance in a transition economy”,

International Journal of Innovation and Entrepreneurship Management, Vol. 5 Nos 3/4,

pp. 298-318.

Manolova, T.S. and Yan, A. (2002), “Institutional constraints and entrepreneurial responses in a

transforming economy: the case of Bulgaria”, International Small Business Journal, Vol. 20

No. 2, pp. 163-84.

Mayer, R.C., Davis, J.H. and Schoorman, D. (1995), “An integrative model of organizational trust”,

Academy of Management Review, Vol. 20 No. 3, pp. 709-34.

Miner, A.S. and Haunschild, P.R. (1995), “Population level learning”, in Cummings, L.L. and Staw,

B.M. (Eds), Research in Organizational Behavior,Vol. 17, JAI Press, Greenwich, CT, pp. 115-66.

Newman, K.L. (2000), “Organizational transformation during institutional upheaval”, Academy

of Management Review, Vol. 25 No. 3, pp. 602-19.

Noordewier, T.G., John, G. and Nevin, J.R. (1990), “Performance outcomes of purchasing

arrangements in industrial buyer-vendor relationships”, Journal of Marketing, Vol. 54

No. 4, pp. 80-93.

Nunnally, J. (1978), Psychometric Theory, McGraw Hill, New York, NY.

Oliver, C. (1991), “Strategic responses to institutional processes”, Academy of Management

Review, Vol. 16 No. 1, pp. 145-79.

IJOEM

2,2

120

Peng, Y. (2004), “Kinship networks and entrepreneurs in China’s transition economy”, American

Journal of Sociology, Vol. 109 No. 5, pp. 1045-74.

Peng, M.W. and Heath, P. (1996), “The growth of the firm in planned economies of transition:

institutions, organizations, and strategic choice”, Academy of Management Review, Vol. 21

No. 1, pp. 492-528.

Radaev, V. (2004), “How trust is established in economic relationships when institutions and

individuals are not trustworthy: the case of Russia”, in Kornai, J., Rothstein, B. and

Rose-Ackerman, S. (Eds), Creating Social Trust in Post-Socialist Transition,

Palgrave/MacMillan, New York, NY, pp. 91-110.

Raiser, M., Rousso, A. and Steves, F. (2004), “Why and who do firms trust? Evidence from 26

transition economies”, in Kornai, J., Rothstein, B. and Rose-Ackerman, S. (Eds), Creating

Social Trust in Post-Socialist Transition, Palgrave/MacMillan, New York, NY, pp. 55-70.

Rempel, J.K. and Holmes, J.G. (1986), “How do I trust thee?”, Psychology Today, Vol. 20 No. 1,

pp. 28-34.

Roth, K. and Kostova, T. (2003), “Organizational coping with institutional upheaval in transition

economies”, Journal of World Business, Vol. 38 No. 4, pp. 314-30.

Rus, A. and Iglic, H. (2005), “Trust, governance and performance: the role of institutional and

interpersonal trust in SME development”, International Sociology, Vol. 20 No. 3, pp. 371-91.

Saparito, P.A., Chen, C.C. and Sapienza, H.J. (2004), “The role of relational trust in bank-small

firm relationships”, Academy of Management Journal, Vol. 47 No. 3, pp. 400-10.

Sarkar, M.B., Aulakh, P.S. and Cavusgil, S.T. (1998), “The strategic role of relational bonding in

interorganizational collaborations: an empirical study of the global construction industry”,

Journal of International Management, Vol. 4 No. 2, pp. 85-107.

Welter, F., Kautonen, T., Chepurenko, A., Malieva, E. and Venesaar, U. (2004), “Trust

environments and entrepreneurial behavior: exploratory evidence from Estonia, Germany,

and Russia”, Journal of Enterprising Culture, Vol. 12 No. 4, pp. 327-49.

Williamson, O.E. (1975), Markets and Hierarchies: Analysis and Antitrust Implications, The Free

Press, New York, NY.

Williamson, O.E. (1985), Economic Institutions of Capitalism, The Free Press, New York, NY.

Williamson, O.E. (1993), “Calculativeness, trust, and economic organization”, Journal of Law &

Economics, Vol. 36 Nos 1/2, pp. 453-86.

Wu, W.P. and Choi, W.L. (2004), “Transaction cost, social capital and firms’ synergy creation in

Chinese business networks: an integrative approach”, Asia Pacific Journal of Management,

Vol. 21 No. 3, pp. 325-43.

Xin, K.R. and Pearce, J.L. (1996), “Guangxi: connections as substitutes for formal institutional

support”, Academy of Management Journal, Vol. 39 No. 6, pp. 1641-58.

Young-Ibarra, C. and Wiersema, M. (1999), “Strategic flexibility in information technology

alliances: the influence of transaction cost economics and social exchange theory”,

Organization Science, Vol. 10 No. 4, pp. 439-59.

Zaheer, A., McEvily, B. and Perrone, V. (1998), “Does trust matter? Exploring the effects of

interorganizational and interpersonal trust on performance”, Organization Science, Vol. 9

No. 2, pp. 141-59.

Zander, U.B. and Kogut, B. (1995), “Knowledge and the speed of transfer and imitation of

organizational capabilities: an empirical test”, Organization Science, Vol. 5 No. 1, pp. 76-92.

Zucker, L.G. (1986), “The production of trust: institutional sources of economic structure,

1840-1920”, in Staw, B.M. and Cummings, L.L. (Eds), Research in Organizational

Behavior,Vol. 8, JAI Press, Greenwich, CT, pp. 53-111.

Role of

interpersonal

trust

121

Further reading

Zaheer, A. and Venkatraman, N. (1995), “Relational governance as an interorganizational

strategy: an empirical test of the role or trust in economic exchange”, Strategic

Management Journal, Vol. 19 No. 5, pp. 373-92.

Appendix

Interpersonal trust

T1. I know how this supplier is going to act. S/he can always be counted on to act as I

expect.

T2. I have faith in this supplier to look out for my own interests even when it is costly to

do so.

T3. This supplier is trustworthy.

T4. This supplier will use opportunities that arise to profit at our expense (reverse scaled).

T5. Based on past experience, I cannot with complete confidence rely on Supplier X to

keep his/her promises (reverse scaled).

T6. This supplier is an honest man or woman.

Internal reliability: Cronbach a ¼ 0.82

Uncertainty reduction

UR1. The product or service that this supplier offers is usually available.

UR2. The product or service that this supplier offers is usually of good quality.

UR3. The price for the product or service that this supplier offers is stable.

UR4. The price for the product or service that this supplier offers is usually competitive.

UR5. The market for the product or service that this supplier offers is usually unstable

[reverse scaled].

Internal reliability: Cronbach a ¼ 0.72

Asset specificity

AS1. My firm has been specifically tailored to meet the requirements of the product or

service that this supplier offers.

Corresponding author

Tatiana S. Manolova can be contacted at: tmanolova@bentley.edu

IJOEM

2,2

122

To purchase reprints of this article please e-mail: reprints@emeraldinsight.com

Or visit our web site for further details: www.emeraldinsight.com/reprints

Reproduced with permission of the copyright owner. Further reproduction prohibited without permission.

Wyszukiwarka

Podobne podstrony:

Li Yadav Lin Exploring the role of privacy programs on initial online trust formation

The Role of Trust and Contractual Safeguards on

Newell, Shanks On the Role of Recognition in Decision Making

Morimoto, Iida, Sakagami The role of refections from behind the listener in spatial reflection

Explaining welfare state survival the role of economic freedom and globalization

86 1225 1236 Machinability of Martensitic Steels in Milling and the Role of Hardness

the role of women XTRFO2QO36SL46EPVBQIL4VWAM2XRN2VFIDSWYY

Illiad, The Role of Greek Gods in the Novel

The Role of the Teacher in Methods (1)

THE ROLE OF CATHARSISI IN RENAISSANCE PLAYS - Wstęp do literaturoznastwa, FILOLOGIA ANGIELSKA

The Role of Women in the Church

The Role of the Teacher in Teaching Methods

The role of the Victorian woman

the role of the victorian woman 2YEN3FEPRXWLO7M54JRW7LEE3Z4EI2JP533IAAA

the role of women

[13]Role of oxidative stress and protein oxidation in the aging process

70 1003 1019 Influence of Surface Engineering on the Performance of Tool Steels for Die Casting

więcej podobnych podstron