5-Step Investing Formula

Online Course Manual

Introduction to Investing

www.investools.com

© 2005 INVESTools Inc. All rights reserved.

2

Section 2 of 11

THE 5-STEP INVESTING FORMULA

Introduction to Investing

page 2 of 13

© 2005 INVESTools Inc. All rights reserved.

SECTION 2 Introduction to Investing

Tolerance for Risk .................................................................................. 4

Setting Goals ........................................................................................ 6

Asset Allocation .................................................................................... 6

Tax Exposure ........................................................................................ 7

Brokerage Firms .................................................................................... 8

Introduction to the 5-Step Investing Formula ........................................ 9

Section Contents

THE 5-STEP INVESTING FORMULA

Introduction to Investing

page 3 of 13

© 2005 INVESTools Inc. All rights reserved.

INTRODUCTION

SECTION 1 Getting Started

Logging into the INVESTools Investor Toolbox

Support Links

Workshop Review

Account Information

Subscription Renewal

Technical Support

Contact an Instructor

SECTION 2 Introduction to Investing

Tolerance for Risk

Setting Goals

Asset Allocation

Tax Exposure

Brokerage Firms

Introduction to the 5-Step Investing Formula

THE 5-STEP INVESTING FORMULA

SECTION 3 Step 1: Searching for Stocks

Using a Prebuilt Search

Navigating the List of Stocks

SECTION 4 Step 2: Industry Group Analysis

Top-Down Analysis

Big Chart

AutoAnalyzing All Stocks in a Group

Best & Worst Industries List

SECTION 5 Step 3: Fundamental Analysis

Phase 1

Phase 2

Price Pattern

Volatility

Zacks Report

Market Guide

News

AutoAnalyzer™

SECTION 6 Step 4: Technical Analysis

Technical Indicators

Moving Averages

MACD

Stochastics

Volume

Support & Resistance

Buy Signals

Money Management

Sell Stop Orders

How Many Shares to Buy

Sell Signals

Insider Trading

SECTION 7 Step 5: Portfolio Management

Creating a Portfolio

Managing Your Portfolio

Paper Trading Account

BONUS SECTION

SECTION 8 Bonus Topics

TurboSearch

Index Tracking Stocks / Exchange-Traded Funds

Dow Jones Industrial Average—

The Diamonds (DIA)

S&P 500—The Spider (SPY)

NASDAQ—The Qs (QQQQ)

SECTION 9 Introduction to Options

Advantages/Risks of Options

Leverage

Call Options

Put Options

Covered Calls

SECTION 10 Appendix

Phase 2 Stock Scoring Form

Phase 2 Quick List for Zacks Report and

Market Guide

Investment Tracking Record

SECTION 11 Glossary

Course Overview

THE 5-STEP INVESTING FORMULA

Introduction to Investing

page 4 of 13

© 2005 INVESTools Inc. All rights reserved.

Introduction to Investing

Tolerance for Risk

Investing in the stock market involves both risk and reward. The rewards are

easy to deal with; in fact, you want rewards... the more rewards the better. But

it’s different with risk—where it’s possible to lose money in an investment.

There are different levels of risks associated with investing and you need to

find the level of risk you can manage and that you’re comfortable with.

One of the biggest mistakes new investors make is that they invest money

they can’t afford to lose. They invest their grocery money or rent money in the

stock market and hope that money will double or triple overnight... instantly

solving all their financial problems. But that’s not investing; that’s gambling.

If you’re not willing to take the risks of gambling in Las Vegas or other places,

why do it in the stock market?

The stock market has proven to be a wonderful place to invest money and

to make money over the long term. However, investing in hopes of quickly

doubling or tripling your money involves risks and should never be done

except with “risk capital”—money you can afford to lose without dramatically

changing your financial circumstances if it is lost.

When dealing with your money, focus on things you understand. Most

novice investors make the same mistakes again and again because they don’t

understand what they’re doing wrong or they don’t have the discipline to stop.

The best investors tend to be automatic, meaning they have a plan and they

stick to it. This course will give you that step-by-step plan. Throughout this

program, we will teach some strategies to help you become more disciplined

and automatic in your investing approach.

The biggest enemy of an investor is emotion. When stocks are dropping and

your investments are losing value, you may get that pit-in-the-bottom-of-

your-stomach feeling. When you get this feeling, it’s difficult to make a good

decision (this is when you find it hard to sleep). Instead of making a good,

appropriate decision, you tend to become paralyzed and do nothing... the worst

possible thing to do. We’ll teach you how to manage that risk going into a

trade, which helps take the emotion out of investing.

Keep in mind that investing in the stock market is not a get-rich-quick scheme.

If you’re trying to solve a huge financial burden by investing in the stock

market, you may be setting yourself up for disappointment.

It’s important to understand that getting into a good stock doesn’t happen

by accident. It’s something you have to research and patiently wait for. Just

because you take a course or invest in the stock market doesn’t assure you

instant success... nor does it assure you of any success, for that matter.

But if you follow the simple, time-proven approaches we teach, you’ll have

a greater opportunity to make money over time as you invest in the stock

market.

THE 5-STEP INVESTING FORMULA

Introduction to Investing

page 5 of 13

© 2005 INVESTools Inc. All rights reserved.

The Psychology of Trading

Most of what we do in the stock market is affected by emotions. It’s amazing

the impact what we think can have on the bottom line.

To find out what you think, there is a question you should ask yourself: Who

am I? This helps you determine your strengths and weaknesses. The market

has a way of pointing out your weaknesses if you don’t find them first. Not

only that, but it tends to cost you a lot of money. So shore up your weaknesses

before the market does it for you.

For example, ask yourself...

• Am I quick to make decisions or am I analytical?

• Am I a visual person? Do I like to look at charts?

• Can I respond to news and then make a buy or sell decision?

• Can I handle risk?

• How much am I willing to lose on any one trade without losing sleep

over it?

• What are my performance goals in the market over the next year... five

years... and ten years?

• Am I more comfortable with holding stocks for long periods of time or

shorter periods of time?

If you aren’t matching strategies in accordance with your personality and

trading style, you’ll ultimately undermine your own success. One of the

biggest mistakes people make is that they do not adopt strategies that fit their

personality.

If you find that trading doesn’t come naturally, you’re most likely pursuing

strategies that aren’t conducive to your comfort level. Pursue strategies that

mesh with you, your lifestyle, your family, and your tolerance for risk. If you

don’t, you’ll do poorly in the market.

Know Your Tolerance for Risk

Because there are so many risks and different levels of risks involved with

different investing strategies, realize your tolerance for risk. Everyone is a little

different, so you’ll need to start monitoring your levels as you start investing or

getting more involved in investing—whatever the case may be.

Sit down and take an inventory; figure out what your strengths and weaknesses

are. Doing this will also help you find your identity as an investor. Once you

identify your strengths and weaknesses, you’ll develop a trading style.

THE 5-STEP INVESTING FORMULA

Introduction to Investing

page 6 of 13

© 2005 INVESTools Inc. All rights reserved.

Setting Goals

You need to create your own mission statement for investing. This mission

statement represents your investment goals. Whether you’re investing for the

long term or short term, having goals gives you focus.

Anyone who invests needs to have goals and objectives. A goal defines what

percentage return you want to earn on a particular investment (which varies

from stock to stock depending on the duration of the investment).

For example, a common approach to investing is referred to as “buy and hold.”

With this strategy, investors take a longer term view of the market. They are

comfortable with the 10-12% annual returns the market has averaged over

the past 50-70 years. They simply want their money to grow in a market that

is compounding at a nice, consistent rate. Their goal is for a long-term gain

averaging 10-12% a year.

Be sure you set realistic goals (e.g., to do better than the market and to

improve on your return every year) and don’t get discouraged with mistakes.

Unfortunately, you’ll likely have some losing trades—even the experts do.

Keep the losing plays small, as outlined later in the course.

Most of all, believe you can do it. Thousands of people with no experience in

the market have gone through this course and found consistent, market-beating

returns. There is no reason why you can’t do the same.

Wealth is rarely an accident and it certainly won’t happen by next week.

However, it can happen if you set goals and put in the time and effort to make

it all work. The tools and knowledge you gain from this course are the vehicles

to get you where you’ve dreamed of going.

The goal of most investors is to buy low and sell high. By consistently

applying the 5-Step Investing Formula, you can better attain this goal, which

helps you work toward reaching your overall goal of financial success in the

stock market.

Asset Allocation

Diversify your portfolio with different types of stocks from different industry

groups and sectors—this is called asset allocation. Asset allocation determines

how you would answer the questions below:

• How do I allocate money to the different types of investments in the

market?

• How much should I have “in cash”?

• How much do I put in interest-bearing investments, like a money

market fund or bonds?

• How much should I put into stocks?

THE 5-STEP INVESTING FORMULA

Introduction to Investing

page 7 of 13

© 2005 INVESTools Inc. All rights reserved.

• How much should I put into small stocks? ...Into mid-cap stocks?

...Into large stocks?

• How much should I invest in options?

• How much should I put into real estate?

Knowing what your goals and objectives are can help you determine where to

put the emphasis in your portfolio.

Small companies often can be riskier. However, oftentimes these companies

are the growth opportunities, as small companies tend to be the undiscovered

ones. If you do your homework with fundamental analysis (to be discussed),

you’ll find that a small company growing by 60-70% in earnings and revenues

could be a good company to buy at an early stage. It could be the next Cisco or

IBM... the next “big thing.”

Everyone seems to be interested in options these days. There are conservative

ways to use options to insure your portfolio against loss and to also create

income and cash flow. In addition, there are more aggressive (and thus more

risky) ways to use options as leverage to accelerate returns.

To manage the risk of these more aggressive options strategies, you should

initially devote no more than 5-10% of your total account to such strategies.

For example, if you have a $100,000 account, put no more than $5,000 to

$10,000 into aggressive option plays. As you continue with your education,

your knowledge will grow and accordingly you’ll learn of better ways to

accelerate your returns—while keeping your risk manageable.

Don’t judge the success of your investing by what you’ve accomplished with

your portfolio in a week or two. It generally takes a while to build a solid

portfolio. Continually work, progress, improve, and grow your account so

that when you finally reach retirement, you’ll have a big enough portfolio to

generate the kind of cash flow and income you need to sustain the lifestyle you

want.

Tax Exposure

There are tax advantages for investors... legal loopholes in the tax code

that can be taken advantage of if you know what they are and how to use

them. To discover the possible tax savings you can realize, meet with your

accountant. Depending on your trades and how often you trade, you could save

significantly.

Portfolio income is the type of income most investors have. It includes interest

earned, dividends, capital gains on the sale of investment assets, and mortgage

interest received. This income is taxed at ordinary rates and is not subject to

self-employment taxes. However, if done wisely, the income can be deducted

as an investment expense. Visit with a qualified accountant to find out what can

be done to save money in taxes on your investments.

THE 5-STEP INVESTING FORMULA

Introduction to Investing

page 8 of 13

© 2005 INVESTools Inc. All rights reserved.

Brokerage Firms

After you’ve researched a stock and decided it’s an investment you want to

make—a process we’ll discuss—it’s time to place the trade. You need to send

the order to an exchange where stocks, mutual funds, and options are bought

and sold. To do this, you need a broker.

Most orders are placed with a broker. A broker is the person you deal with

when it comes to trading stocks—however frequently you make decisions and

change your investment portfolio. The term “broker” refers to either a live

person who places the trade for you or the online broker, which is accessed

with a computer. Using a computer, you don’t actually deal with a person,

although you still deal with an online brokerage company.

When you buy a stock in the market, you pay a commission to do so. There

is no charge to hold the stock—you can hold it as long as you want. But as

soon as you sell it, you pay another commission for the sell. There are almost

always two commissions involved in each transaction: one to get into a stock

play and one to get out.

Internet technology has improved the entire communication process between

investor and broker. Using the Internet, you can view your investing account

online to see exactly how much money you have and to get up-to-the-minute

statistics on your account as it quickly updates after a change or trade is made.

If you withdraw money or buy stock, it is reflected online and available for

viewing so that you can constantly know your account status.

There are three different levels of brokerage firms (most are Web accessible):

1. Full-service brokers

2. Discount brokers

3. Online brokers

You pay more money in commissions for full-service brokers, but the return

for doing so is that they offer more services, information, and resources.

Discount brokers offer minimal services in return for lower commissions. They

are very popular with people who are looking to save money on commission

fees but who still want some of the services normally associated with a full-

service broker.

The last level of brokers is the online broker. These brokers have gained

recognition since about 1994 by developing tools and resources on the Internet

that allow investors to trade and transact business in the stock market much

quicker, easier, and cheaper than ever before. In return for a minimal level

of service, customers save money in commissions, reducing trading costs

dramatically.

Most INVESTools Investor Education graduates use the Investor Toolbox

for all of their research. They focus on the efficient execution and low

commissions when looking for a broker.

THE 5-STEP INVESTING FORMULA

Introduction to Investing

page 9 of 13

© 2005 INVESTools Inc. All rights reserved.

Opening an Account

To invest in the stock market, you need to open a brokerage account with the

firm that best meets your needs.

To open a brokerage account, you need to fill out an account agreement. This

agreement spells out the risks and safeguards of trading with the specific

broker. It also goes over the nature of your relationship with your broker

and clearly defines the nature of the services to be provided. Once you’ve

completed the account agreement, you’ll need to make a monetary deposit (the

minimum amount of the deposit varies from broker to broker) to open your

account and begin investing. You are then charged a commission per trade,

which varies from firm to firm.

Introduction to the 5-Step Investing Formula

The five steps of the 5-Step Online Investing Formula are as follows:

1. Searching for Stocks

2. Industry Group Analysis

3. Fundamental Analysis

4. Technical Analysis

5. Portfolio Management

THE 5-STEP INVESTING FORMULA

Introduction to Investing

page 10 of 13

© 2005 INVESTools Inc. All rights reserved.

Step 1 of the formula is to search for an investment. This step helps you find

stocks in a repeatable process. It allows you to search the entire database of

over 12,000 stocks using a set of easy-to-use, prebuilt search criteria. When

you run a search in its most basic form, it returns 25 stocks for evaluation.

More advanced searches will be outlined near the end of the course.

Step 2 covers industry group analysis, where you perform top-down analysis to

find stocks. You will learn how to focus on the strongest industry groups in the

market and how to find the best stocks in those strong groups. You will also

learn how to see where the institutional money is flowing in the market week

by week using our proprietary industry group tools.

THE 5-STEP INVESTING FORMULA

Introduction to Investing

page 11 of 13

© 2005 INVESTools Inc. All rights reserved.

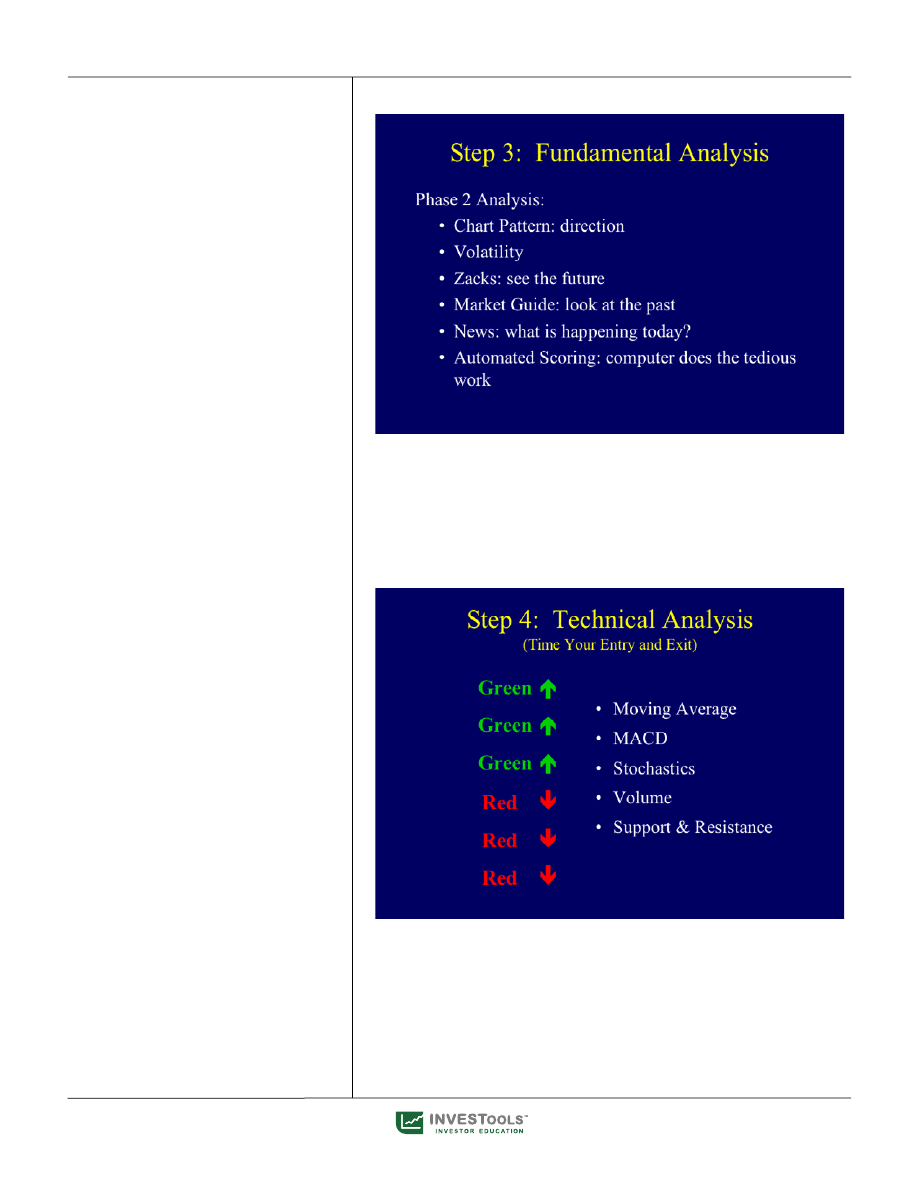

Step 3 narrows the list of 25 stocks using a process called fundamental analysis

or Phase 2. With this step, you decide whether or not a stock belongs in your

portfolio. It involves a specific set of repeatable steps that takes the emotion out

of choosing stocks and helps you approach the market like a professional.

This step has largely been automated by the Investor Toolbox. What would literally

take you hours of research using other financial Web sites takes a matter of seconds

with the Investor Toolbox. It does the tedious, time-consuming work for you.

Step 4 is technical analysis, which explains the buy and sell signals that appear

on a stock chart. This step includes the green and red signals on the following

indicators: moving average, MACD, and stochastics. It also looks at support and

resistance, as well as volume. Technical analysis helps you know when to buy and

sell a stock.

THE 5-STEP INVESTING FORMULA

Introduction to Investing

page 12 of 13

© 2005 INVESTools Inc. All rights reserved.

Step 5 consists of monitoring and managing stocks you own or stocks you

would like to own. Here you’ll look for sell signals on the stocks you own and

look for buy signals on the stocks you want to own. You can also check the

news on all the stocks you’re working with (which can influence signals) and

automatically score stocks through the Step 2 fundamental tests. The Investor

Toolbox Portfolio Management is also an easy way to set price alerts and buy

and sell signal alerts, and to look at various reports on stocks.

Now, let’s get started. Open up section 3, which explains step 1 of the 5-Step

Investing Formula: Searching for Stocks.

THE 5-STEP INVESTING FORMULA

Introduction to Investing

page 13 of 13

© 2005 INVESTools Inc. All rights reserved.

© 2005 INVESTools Inc. All rights reserved. Neither INVESTools or its subsidiaries nor any of their respective officers, employees, representatives, agents or independent

contractors are, in such capacities, licensed financial advisers, registered investment advisers or registered broker-dealers. Neither do they provide investment or financial

advice or make investment recommendations, nor are they in the business of transacting trades. Nothing contained in this manual constitutes a solicitation, recommendation,

promotion, endorsement or offer (buy or sell) by INVESTools, or others described above, of any particular security, transaction or investment.

Warranty disclaimer: The content included in this manual and the Investor Toolbox Web site is provided as is, without any warranties. Neither INVESTools

no any of its subsidiaries or affiliates make any guarantees or warranties as to the accuracy or completeness of, or results to be obtained from using, any of its

products or services (including any content therein). INVESTools and its subsidiaries and affiliates hereby disclaim any and all warranties, express or implied,

including warranties of merchantability or fitness for a particular purpose or use. Neither INVESTools nor any of its subsidiaries or affiliates shall be liable to you

or anyone else for any inaccuracy, delay, interruption in service, error or omission, regardless of cause, or for any damages resulting therefrom. In no event will

INVESTools nor any of its subsidiaries or affiliates be liable for any indirect, special or consequential damages, including but not limited to lost time, lost money,

lost profits or lost good will, whether in contract, tort, strict liability or otherwise, and whether or not such damages are foreseen or unforeseen with respect to any

use of our products or services. In the event that liability is nevertheless imposed on INVESTools or any of its subsidiaries or affiliates, such parties’ cumulative

liability for damages under any legal theory shall not exceed the amount of fees you paid for the particular product or service. This warranty addresses specific

legal rights; you may also have other rights, which vary from state to state. Some states do not allow the exclusion or limitation of incidental or consequential

damages, so the above limitation or exclusion may not apply to you.

The principals and employees of, as well as those who provide contracted services for, INVESTools have not promised, represented or warranted that you will earn a profit

when or if you purchase securities. It is recommended that anyone trading securities should do so with caution and consult with a broker before doing so. Past performances

of any principals and employees of, as well as those who provide contracted services for, INVESTools or any of its subsidiaries or affiliates may not be indicative of

futur performance. Securities used as examples presented in this manual or the Investor Toolbox Web site are used for illustrative purposes only and do not constitute a

recommendation to buy or sell individual securities. They should be considered speculative with a high degree of volatility and risk.

Trading securities can involve high risks and the loss of any funds invested; trading options can result in the loss of more than the original amount invested.

No part of this manual may be reproduced in any form, by any means, photocopying, electronic or otherwise, without written permission from the publisher.

Wyszukiwarka

Podobne podstrony:

Introduction to VHDL

268257 Introduction to Computer Systems Worksheet 1 Answer sheet Unit 2

Introduction To Scholastic Ontology

Evans L C Introduction To Stochastic Differential Equations

Zizek, Slavoj Looking Awry An Introduction to Jacques Lacan through Popular Culture

Introduction to Lagrangian and Hamiltonian Mechanics BRIZARD, A J

Introduction to Lean for Poland

An Introduction to the Kabalah

Introduction to Apoptosis

Syzmanek, Introduction to Morphological Analysis

Brief Introduction to Hatha Yoga

0 Introduction to?onomy

Introduction to politics szklarski pytania

INTRODUCTION TO VERBS

An Introduction to USA 6 ?ucation

introdution to capabilities classes 5WEH7OVOF6IJEZ7SO6GMF63NSJPWSXDLGIJQTMA

An Introduction to Database Systems, 8th Edition, C J Date

Introduction to the MOSFET and MOSFET Inverter(1)

więcej podobnych podstron