Home

About

NEW BOOK!!

Weis Wave Plugin

DVD

Mentoring

FREE! Nightly Report

Store

Contact

The Weis Wave Plugin

The Weis Wave Plugin stands head and shoulders above anything currently available to the

trading community. I have been trading for 25 years and have used the Weis Wave for the

past three. With its unique wave volume, the Weis Wave helps traders recognize turning

points. —Alfred T., Austria

I have to tell you that your Weis Wave has been EXTREMELY useful!

I’ve been trading for a living for over 15 years now… this tool you have provided has made

things much clearer to me. —T.K.

The Weis Wave Plugin is the end product of 30 years work to find the most accurate portrayal of volume.

The insights gained from this plugin are a great help in anticipating trend changes of varying degree.

Anyone who has watched intraday price movement knows it unfolds in a series of buying and selling

waves—a process of building up and tearing down. Prices do not unfold in bundles of equal time. When

the natural movement of prices is bound by time, the trend still remains visible. Volume, however, does

not fare so well. Subdividing volume into time periods obscures the true force of the buying and selling.

The Weis Wave Plugin creates wave charts along with their corresponding wave volume.

Wave charts were first created by

Richard D. Wyckoff

. In his famous course on stock market technique,

he instructed students to “think in waves.” Wave analysis was an integral part of his trading method. The

Weis Wave is an adaptation of Wyckoff’s method that handles today’s volatile markets. It works in all

time periods and can be applied to the futures, forex, stock, and commodity markets. You will be amazed

at how well the Weis Wave identifies turning points. Many of these same turning points are not obvious

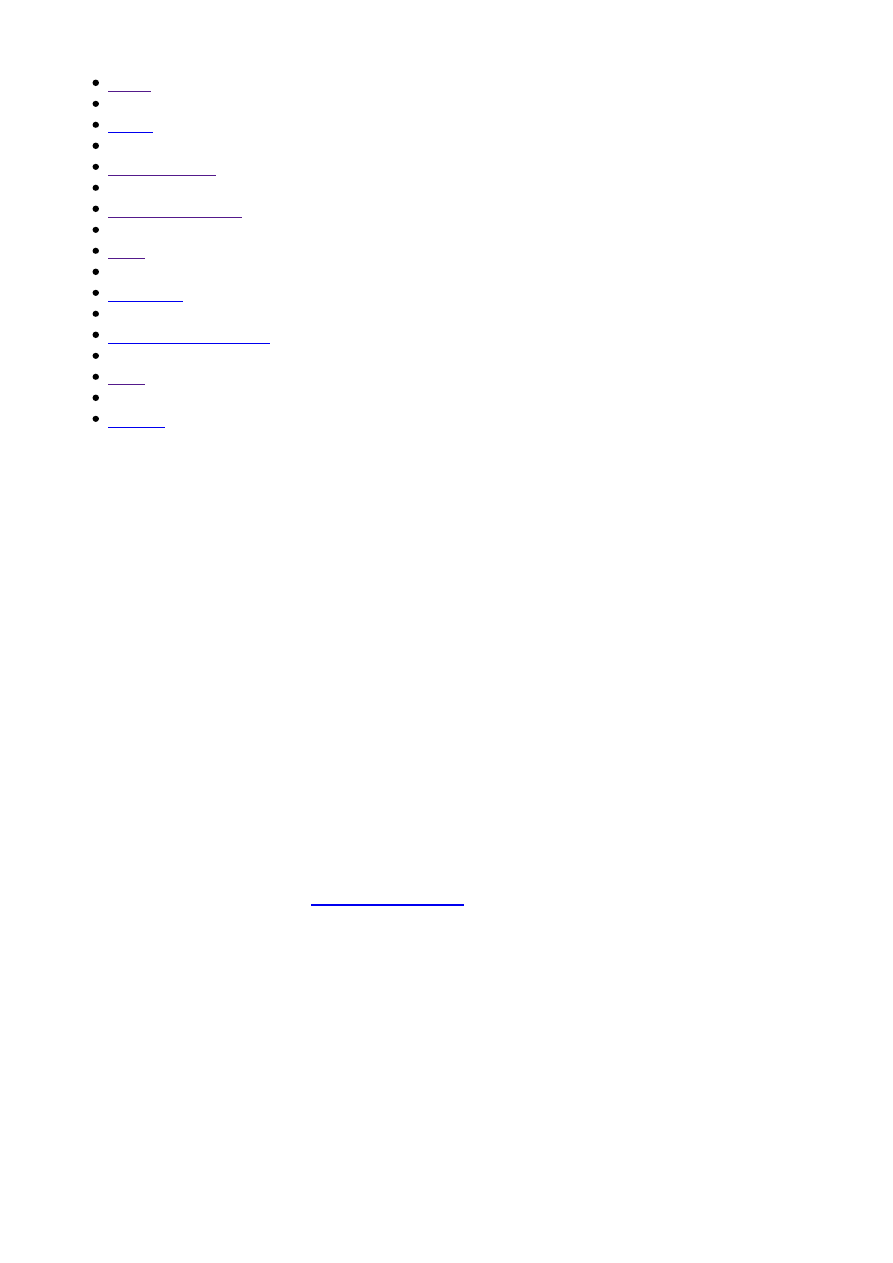

on conventional bar charts. Take a look at the daily stock chart of AEM:

Weis Wave Plugin: A Modern Adaptation of the Wyckoff Wave & Volume

http://weisonwyckoff.com/weis-wave/

1 z 7

2013-11-05 17:28

Moving from left to right, the first arrow refers to a two day up-wave that ends on July 18. The cumulative

volume equals 2.5 million shares. It stands out as a low volume test of the previous up-wave. On the

sell-off from this high, the wave volume exceeds all preceding volumes either up or down. Notice the daily

volumes do not show such a change in behavior. The third arrow points to a minute, one-day rally with

wave volume of 1.75 million shares, the lowest since June 27. It shouts out NO DEMAND. Prices fall

about $9 in the next three days and the fourth arrow points to the climactic action.

Notice the next up-wave. It is propelled by the heaviest up-wave volume to date. Here, for the first time,

demand appears. This message does not stand out with such clarity on the volume histogram. The last

arrow points to the August 4 low made on a one-day decline. Daily volume and wave volume are the

same. Yet in the context of the preceding down-waves, the wave volume is very low. Of the three

highlighted down-waves, it has the smallest volume and says supply is spent.

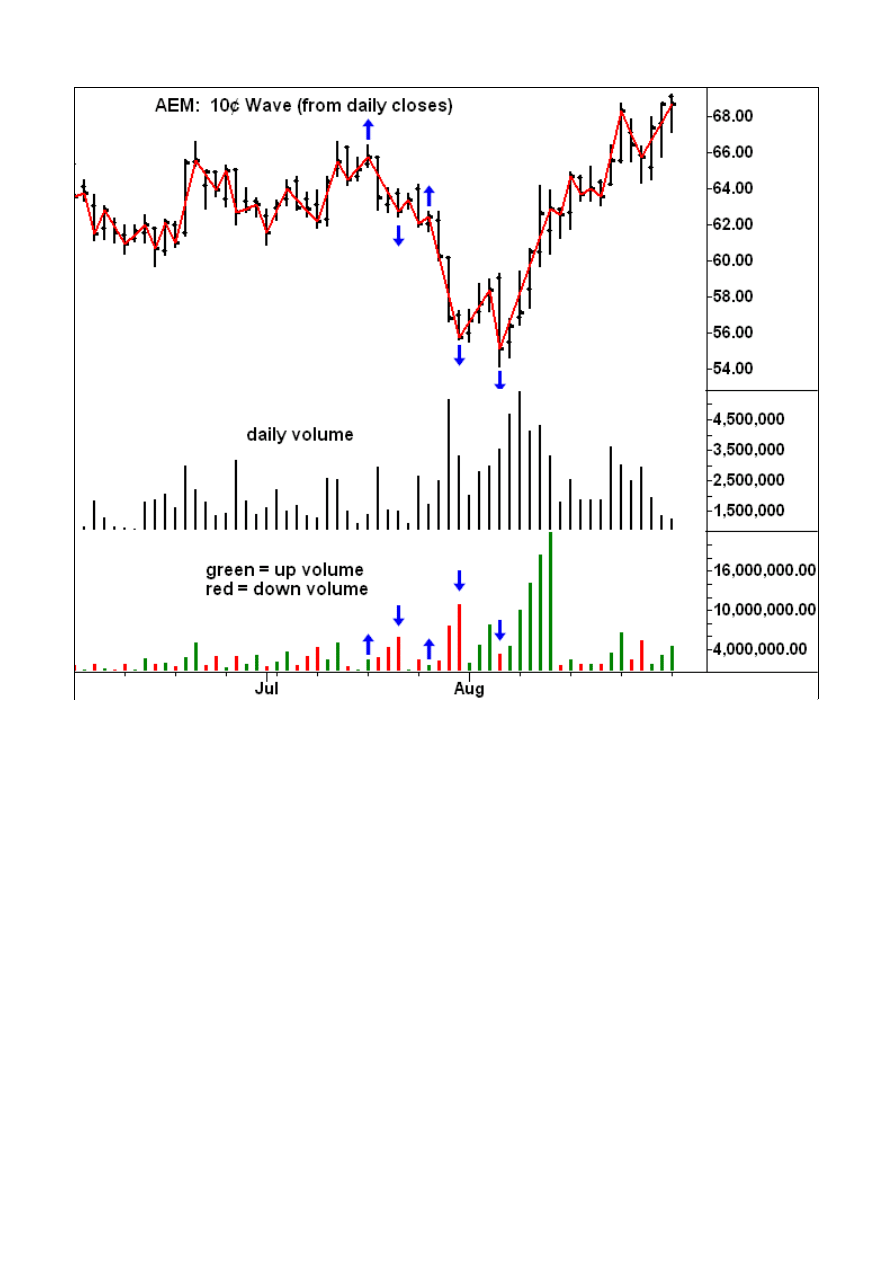

Many of the trades made with the Weis Wave involve pullbacks. For example, when price falls on heavy

volume, this is a bearish change in behavior. If the wave volume on the next pullback diminishes sharply,

a short trade is established with a close protective stop. This is the case on the September S&P chart

where price falls on 110k volume shortly after 13:00. This is the heaviest volume in several hours. The

relatively weak volume on the pullback reflects lack of demand. A great short trade unfolded from this

high. The five-minute volume reveals none of this information. After the decline below 1100 around

14:45, the next up-wave draws out 229k contracts, an overtly bullish change in behavior. On the next

pullback, volume shrinks to 63k, a sign the selling pressure has dried up. The rally from this low hit 1170

on the close!

Weis Wave Plugin: A Modern Adaptation of the Wyckoff Wave & Volume

http://weisonwyckoff.com/weis-wave/

2 z 7

2013-11-05 17:28

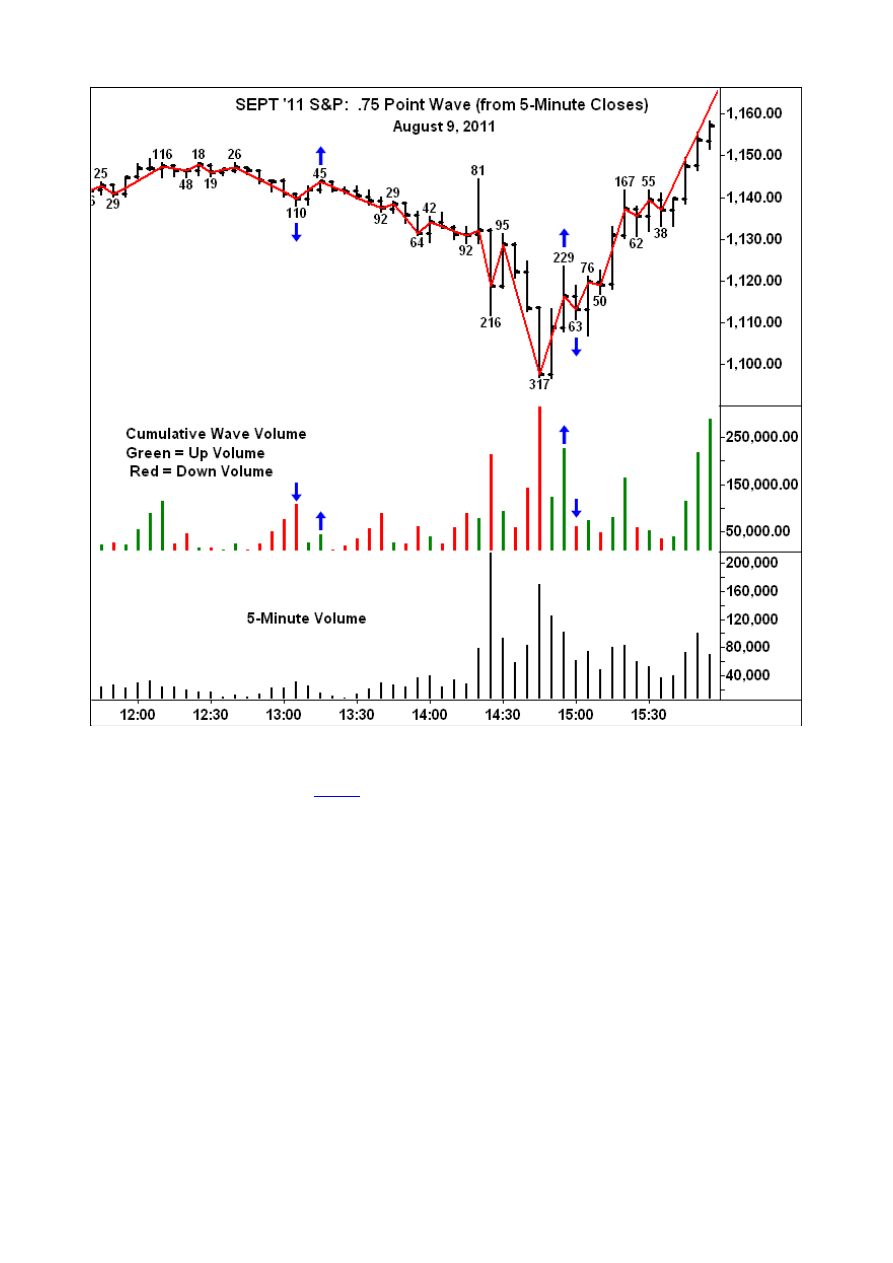

Weis Wave works equally well on

Forex

charts. The setup on the Euro 5-minute chart is classic. It begins

with heavy selling on the decline to the 9:50 a.m. low. After a failed attempt to renew the uptrend, the

Euro falls on even larger volume. This is the bearish change in behavior. It is followed by two small, low

volume up-waves that can be used to establish short positions. The combination of a bullish or bearish

change in behavior followed by a low-volume pullback produces a multitude of trades. Suddenly, you can

trade like a counter-puncher.

Weis Wave Plugin: A Modern Adaptation of the Wyckoff Wave & Volume

http://weisonwyckoff.com/weis-wave/

3 z 7

2013-11-05 17:28

S&P Chart

Weis Wave Plugin: A Modern Adaptation of the Wyckoff Wave & Volume

http://weisonwyckoff.com/weis-wave/

4 z 7

2013-11-05 17:28

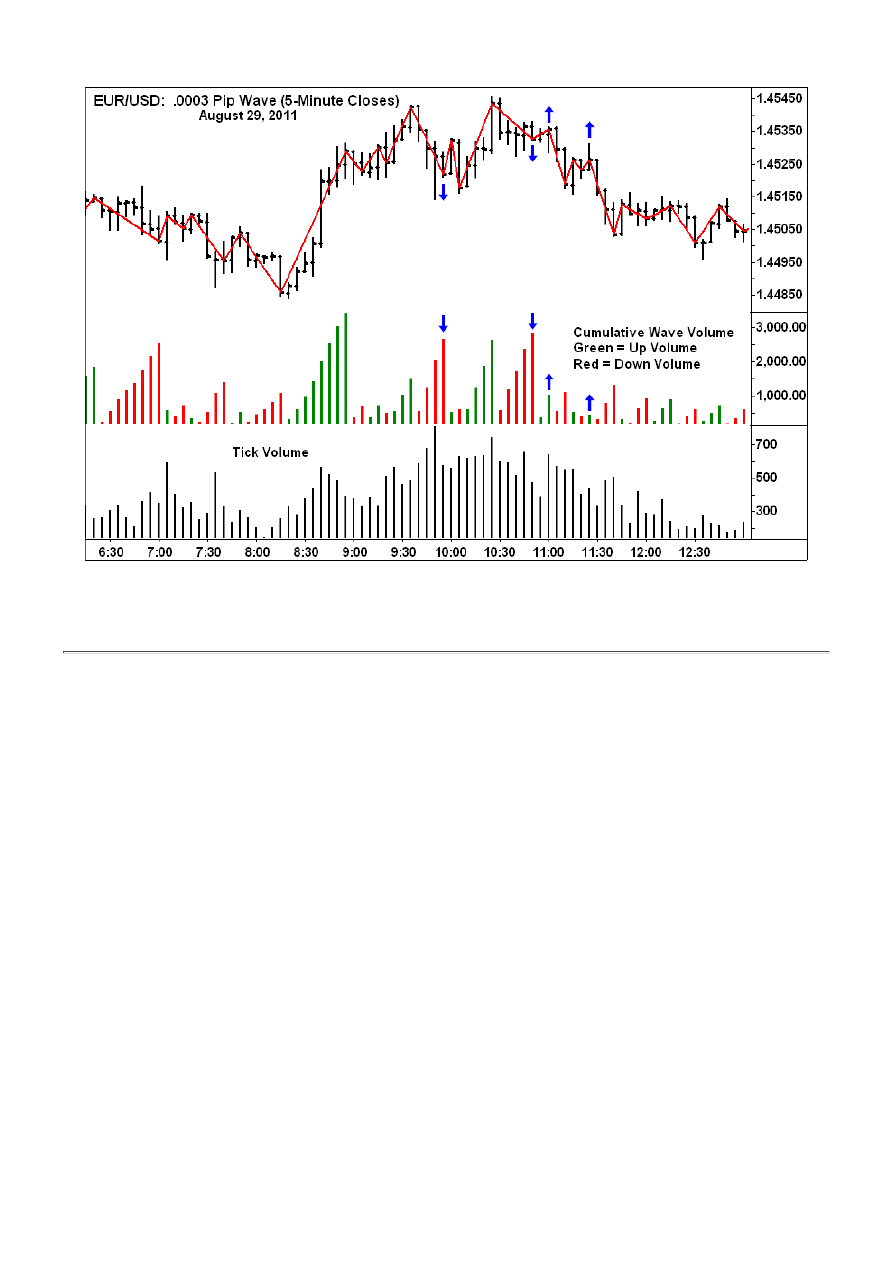

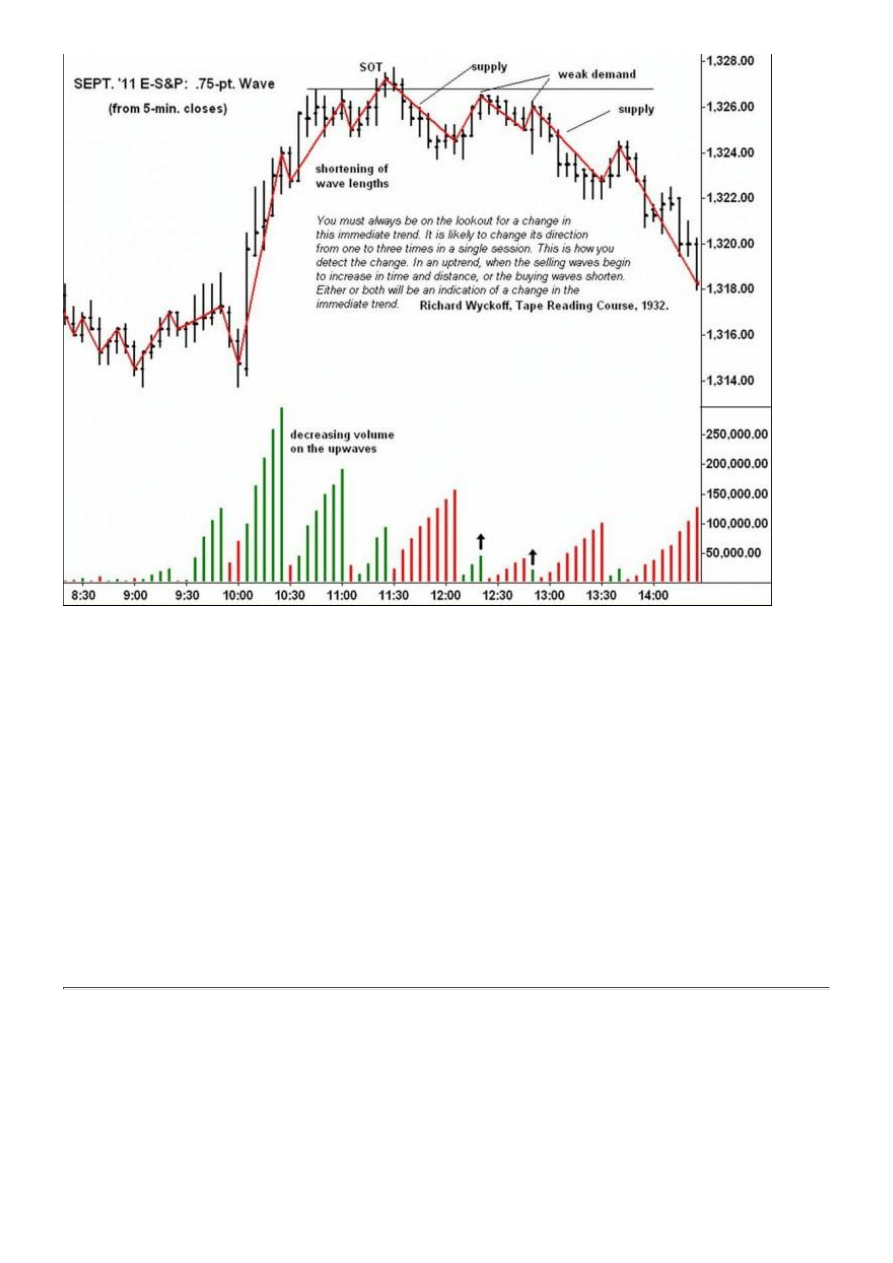

The intraday volatility in the E-S&P makes it a favorite among day traders. Some of the best wave volume

setups appear in this contract. Wednesday, July 13 created a number of such trading opportunities. On the

5-minute bar chart of the September ‘11 contract, a .75-point wave is included. In the middle of the chart,

I have copied Wyckoff’s statement on how to recognize intraday changes in trend. They are central to

reading the wave chart and volume. Within the uptrend on the left-hand side of the chart, you can readily

see how the wave lengths and wave volumes diminish as prices move higher. At the top of the third

upwave—where the thrust shortens, the wave length decreases in size and the wave volume drops—short

positions should have been established. The first downwave from this high draws out massive supply—the

heaviest of the day. On the subsequent two rallies, demand evaporated thus offering additional entry

points for new shorts. The second of these two upwaves consists of only one 5-minute bar. Without the

bearish picture of the wave volume, the strong close on that bar might have caused some traders to close

out short positions. Because the waves filter price data, they are not as ephemeral as the price bars.

Supply is dominant throughout the rest of the session.

Caterpillar Chart

Weis Wave Plugin: A Modern Adaptation of the Wyckoff Wave & Volume

http://weisonwyckoff.com/weis-wave/

5 z 7

2013-11-05 17:28

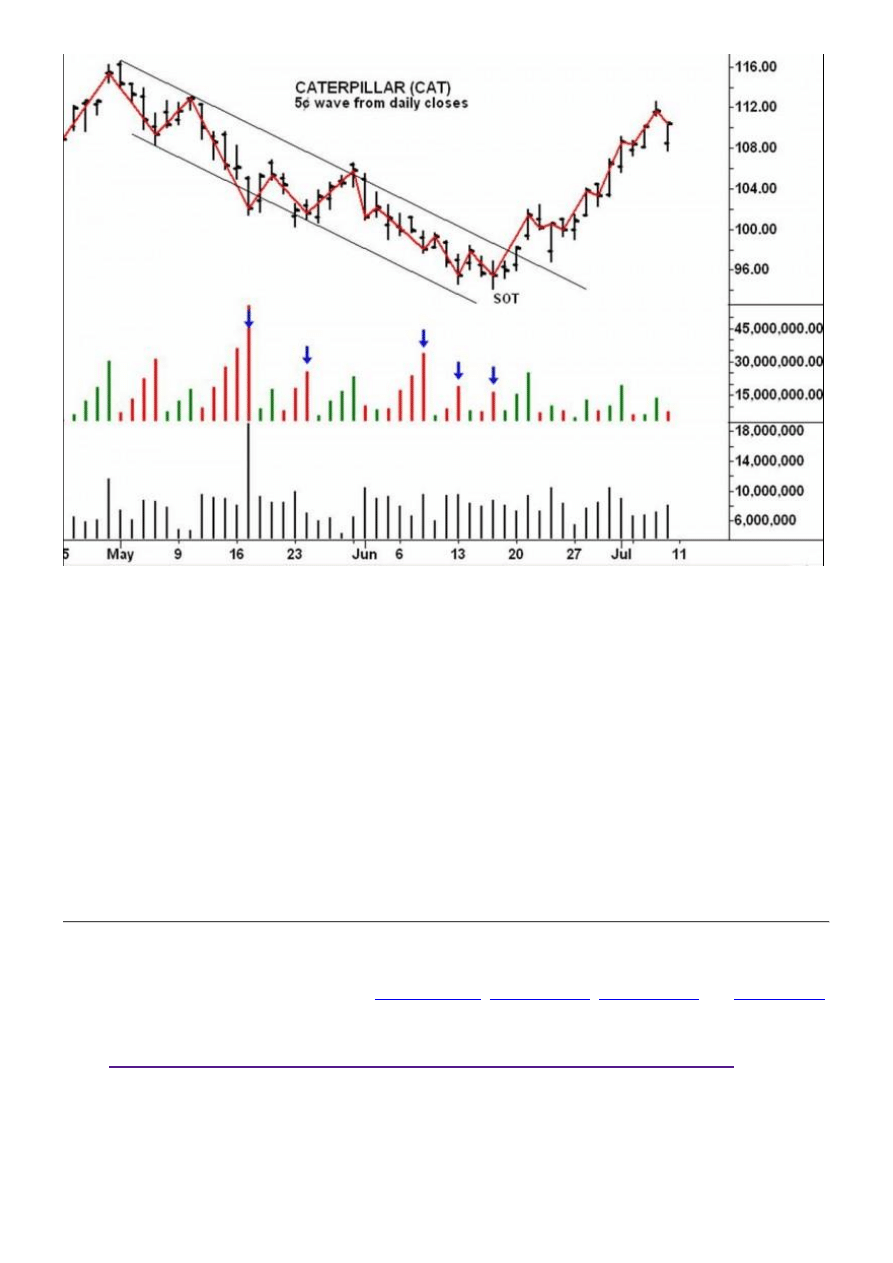

On the daily CAT chart, the wave volume shows how the selling gradually slackens as prices decline to

the June low. The bar chart shows the shortening of the downward thrust near the bottom of the price

channel. Below the price chart you first see the cumulative wave volume and then the actual, daily

volume.

In the week of June 20, the actual volumes all look the same. They look like the tree line on the horizon, a

phenomenon typical of many stock charts. The wave volume gives a truer picture of the reduced selling

pressure at the low. Notice the leap in wave volume on the first upwave off the low. It reflects aggressive

demand and leads to a nice 10% profit.

Because the daily prices are visible, the chart reader can combine the message of the wave volume with

the length of the bars and the position of the close—a powerful combination.

The Weis Wave Plugin is compatible with

TradeStation®

,

NinjaTrader®

,

MultiCharts®

and

MetaStock®

platforms; the Weis Wave plugin for MetaStock® now works on both 32-bit and 64-bit computers.

•

CLICK TO LEARN ABOUT PRICING AND HOW TO PURCHASE

Weis Wave Webinar

Buyers of the Weis Wave Plugin will be given access to a two-hour webinar given by David Weis on

Weis Wave Plugin: A Modern Adaptation of the Wyckoff Wave & Volume

http://weisonwyckoff.com/weis-wave/

6 z 7

2013-11-05 17:28

August 17, 2011 and hosted by Dr. Gary Dayton, Trading Psychology Edge.

This instructive webinar offers the most comprehensive explanation of the Weis Wave to date. It shows

how the Weis Wave evolved over several years. Starting from the tape reading charts developed by

Richard Wyckoff which dealt with every price change, I devised filters to accommodate today’s more

volatile markets. A few examples are provided of my handmade charts where I substituted time and true

range for volume. Numerous chart examples are explained, demonstrating the most important trade

setups. You can also get a copy of this webinar without a plugin purchase.

•

CLICK TO LEARN ABOUT PRICING AND HOW TO PURCHASE

NOTICE: The Weis Wave indicator does not provide automatic buy & sell signals. Trading with the

Weis Wave is interpretive. The arrows placed on the charts shown here pinpoint areas discussed in

the text. They are not part of the software. Any prospective buyer who wants further information on

this product should use our

contact form

and questions will be answered.

Sign up here

to receive the nightly

STOCK MARKET

UPDATE

Enter email

"Hands down, David’s Wave Chart is the most valuable trading tool I know."

— Dr.Gary Dayton, Trading Psychology Edge

"Your Weis Wave is truly amazing. If there is a secret weapon in the markets I think this is as good as it

can get!"

— Chris G., Australia

Copyright © David H. Weis, 2011. All Rights Reserved.

Any information contained on this website is provided for educational purposes only and should not in any

way be construed as investment advice.

Weis Wave Plugin: A Modern Adaptation of the Wyckoff Wave & Volume

http://weisonwyckoff.com/weis-wave/

7 z 7

2013-11-05 17:28

Wyszukiwarka

Podobne podstrony:

The Last Eyewitnesses, Children of the Holocaust Speak, Volume 2

38 Hann Piotrowski Wos Adaptation of the Oder River

Carney Scott M Harmonic Trading Profiting From The Natural Order Of The Financial Markets (Volume 1

Childhood Trauma, the Neurobiology of Adaptation, and Use dependent of the Brain

Dianetics The Modern Science of Mental Health[1]

Cities of the World, 6th Edn, Volume 1 Africa

or The Use of Extracorporeal Shock Wave Therapy to Improve Fracture Healing

Taylor, Charles Modernity and the Rise of the Public Sphere

Rootkits The new wave of invisible malware is here

Parsons Theorists of the Modernist Novel James Joyce, Dorothy Richardson, Virginia Woolf

Before the injection modern methods of sample preparation fo

Is the Body the Temple of the Soul Modern Yoga Practice as a Psychological Phenomenon

NWO Conspiracy THE GREATEST HOAX, A STUDY OF THE INCONSISTENT THEOLOGY OF MODERN DAY BIBLE PROPHECY

[0] Jung, Carl Gustav Volume 9 The Archetypes Of The Collective Unconscious

Wójcik, Marcin Rural space and the concept of modernisation Case of Poland (2014)

On the Adaptations of Organisms and the Fitness of Types

Chris Thornhill Niklas Luhmann, Carl Schmitt and the Modern Form of Political

Sosnowska, Joanna Adaptation to the institution of a kindergarten – does it concern only a child (2

więcej podobnych podstron