1

Other areas of taxation

and the power of

tax authorities

Chapter

19

2

19.1 Indirect taxes

As mentioned in a previous chapter these are those taxes levied on the final consumer of a good or

service that is of course unknown from the outset.

The effective incidence of tax is the tax person who ultimately bears the tax. In the case of an

indirect tax this will be the final consumer of the product or service, being a person or entity, who

will bear the effective incidence of tax.

The formal incidence of tax is the entity that has direct contact with the tax authorities and who is

responsible for collecting the tax revenues and passing them on to the tax authorities, this is the

formal incidence of tax burden. For example in the UK the sales tax known as value added tax

(VAT) must be collected and calculated by the employer and the VAT revenues must then be

passed on to the tax authorities. In this case it is the employer who bears the formal incidence of

tax.

Unit tax – is based on physical measure being perhaps the number of units sold or produced.

Examples of a unit tax are excise duties; quantity of petrol sold and amount of oil extracted.

Unit taxes are useful in that they can specifically target certain commodities and thereby allowing

precision without impacting on other commodities. There are many reasons for their use:

· To discourage over consumption of goods this may harm the consumer or others.

· To alter wealth distribution by taxing the luxury items.

· To allow for externalities which are the economic side-effects that impact on the

environment due to the consumption of the commodity and which have not been fully

included in the price. For example the use of petrol or diesel increases CO2 emissions

which research now shows that there is a direct link to an increase allergies and asthma in

the population as a whole. The excise duty on petrol and diesel can help pay towards the

increased cost of healthcare.

· To place the burden of paying the tax on the consumer of the product or service, for

example excise duty on car fuel used to maintain and build roads.

Ad valorem tax – is based on the value of sales. The most common example of this is a sales tax

or value added tax (VAT).

Companies must be registered for sales tax before they can start charging this tax. Rules of

registration are based on a company reaching a minimum turnover before they are obliged to

become registered for sales tax.

A company can voluntarily register for sales tax irrespective of how small their turnover level is.

ü Can recover the sales tax suffered on business expenditure.

ü Improves the image of the company.

ü No problem if supplies are made to other sales tax registered persons.

ü Recovery of pre-registration expenses.

Additional administration burden for small businesses.

Problem if sales are made to the general public as they are not sales tax registered.

3

19.2 VAT (sales tax) under UK rules

VAT is charged on the taxable supply of goods and services, other than an exempt supply.

Output VAT (output sales tax) accounted for on sales at 17.5% on most goods and services.

Input VAT (input sales tax) accounted for expenses and purchases made by the business at the rate

of 17.5%

The company or unincorporated business works out the net payment, or repayment of VAT,

normally every quarter as a period of accounting.

Working out VAT on transactions if the rate was 17.5%

· 17.5% x Net of VAT amount (17.5% x £100.00 = £17.50)

· 17.5/117.5 x Gross of VAT amount (17.5/117.5 x £117.50 = £17.50)

Standard rated goods and services – sales are taxable at 17.5%

· The supply of most goods and services

Zero rated goods and services – sales are taxable at 0%

· Clothing and footwear for young children and certain protective clothing

· Books and newspapers

· Construction of new dwellings

· Prescription drugs and medicines

· Non luxury food (and water)

In both types of supply the above traders can recover any input VAT incurred for business

expenditure, zero rated traders therefore more likely to be receiving repayments of VAT and

normally as a result of this may choose to elect for monthly accounting for VAT.

‘Standard rated and zero rated sales together are called taxable supplies’

Exempt supplies – sales are exempt and outside the scope of sales tax.

· Insurance

· Financial services

· Postal services

· Health services

· Burial services

A trader who makes exempt supplies will not be permitted to register for VAT, as it does not

make taxable supplies – input VAT is therefore irrecoverable on business expenditure.

EXAM POINT – you will not need to know for the exam examples of standard rated, zero rated or

exempt supplies however have an awareness these different types of taxable and non-taxable

supplies exist.

4

Worked example – Casino Royale Ltd

Casino Royale Ltd has sales of £150,000, excluding sales tax. It also has purchases of £35,000,

including sales tax. The purchases figure also includes 20% zero-rated items. Sales tax is 15%.

What is the sales tax payable?

Output tax = £150,000 x 15%

= £22,500

Input tax = £35,000 x 80% x (15/115)

= (£3,652)

Sales tax payable

= £18,848

Lecture Example 19.1 – (CIMA P7 Nov 05)

Country OS has a value added tax (VAT) system where VAT is charged on all goods and

services. Registered VAT entities are allowed to recover input VAT paid on their purchases.

VAT operates at different levels in OS:

• Standard rate 10%

• Luxury rate 20%

• Zero rate 0%

During the last VAT period, an entity, BZ, purchased materials and services costing $100,000,

excluding VAT. All materials and services were at standard rate VAT.

BZ converted the materials into two products Z and L; product Z is zero rated and product L is

luxury rated for VAT purposes.

During the VAT period, BZ made the following sales, excluding VAT:

Z $60,000

L $120,000

At the end of the period, BZ paid the net VAT due to the tax authorities.

Assuming BZ had no other VAT-related transactions, how much VAT did BZ pay?

Worked example – Hostel Ltd

Hostel Ltd has sales of £420,000, including sales tax. It also has purchases of £350,000,

including sales tax. It has exempt sales of 10% and therefore input tax should be reduced by

10% also. Sales tax is 17.5%. What is the sales tax payable?

Output tax = £420,000 x 90% x (17.5/117.5)

= £56,298

Input tax = £350,000 x 90% x (17.5/117.5)

= (£46,915)

Sales tax payable

= £9,383

5

Lecture Example 19.3 – (Past CIMA question)

Country Y has a VAT system which allows entities to reclaim input tax paid.

In Country Y the VAT rates are:

Zero rated

0%

Standard rated

15%

DE runs a small retail store. DE’s sales include items that are zero rated, standard rated and

exempt. DE’s electronic cash register provides an analysis of sales. The figures for the three

months to 30 April 2007 were:

Sales value, excluding VAT

Zero rated

$11,000

Standard rated

$15,000

Exempt

$13,000

Total

$39,000

DE’s analysis of expenditure for the same period provided the following:

Expenditure, excluding VAT

Zero rated purchases

$5,000

Standard rated purchases relating to standard rate outputs

$9,000

Standard rated purchases relating to exempt outputs

$7,000

Standard rated purchases relating to zero rated outputs

$3,000

Total

$24,000

Calculate the VAT due to/from DE for the three months ended 30 April 2007.

Lecture Example 19.4

What is a zero rated taxable supply?

A

It is an exempt supply.

B

It is a taxable supply.

C

If supplied, input tax on purchases to do with these supplies cannot be recovered.

D

If supplied, input tax on purchases to do with these supplies can be partially recovered.

Lecture Example 19.2

Which of these is NOT an example of an indirect tax?

A

Tax on exports.

B

Tax on sales.

C

Tax on trading profits.

D

Tax on oil extracted.

6

19.3 Single stage and multi stage sales tax

A single stage sales tax system is where the sales tax is applied to a single point in the production

or sales, for example at the point of sale to the consumer. This is a much simpler system reducing

the administration burden.

A multi stage sales tax system is where the sales tax is applied at all stages of production and sales

where a transfer of the product has occurred, for example from manufacturer to wholesaler, and

any sales tax suffered by the receiving party can be deducted from any sales tax that they pay when

they transfer it on to a third party.

Worked example – (Past CIMA question)

Country D uses a value added tax (VAT) system whereby VAT is charged on all goods and

services at a rate of 15%. Registered VAT entities are allowed to recover input VAT paid on

their purchases.

Country E uses a multi-stage sales tax system, where a cumulative tax is levied every time a

sale is made. The tax rate is 7% and tax paid on purchases is not recoverable.

DA is a manufacturer and sells products to DB, a retailer, for $500 excluding tax. DB sells the

products to customers for a total of $1,000 excluding tax.

DA paid $200 plus VAT/sales tax for the manufacturing cost of its products.

Assume DA operates in Country D and sells products to DB in the same country.

Calculate the net VAT due to be paid by DA and DB for the products.

DA and DB operate in Country D where input and output VAT are charged at 15%.

Output VAT

Input VAT

Net VAT

DA

$500 x 0.15 = $75

$200 x 0.15 = $30

$75 - $30 = $45

DB

$1,000 x 0.15 = $150

$500 x 0.15 = $75

$150 - $75 = $75

Net VAT paid

$45 + $75 = $120

Assume DA operates in Country E and sells products to DB in the same country.

Calculate the total sales tax due to be paid on all of the sales of the products.

DA and DB operate in Country E where there is a cumulative tax on sales only of 7% and input

tax is not recoverable.

Output VAT

Input VAT

Net VAT

DA

$500 x 0.07 = $35

None

$35

DB

$1,000 x 0.07 = $70

None

$70

Net VAT paid

$35 + $70 = $105

7

19.4 Tax point and invoice details

Tax point

Determines when a transaction should be accounted for in a VAT return period. VAT return

periods are for 3 months at a time usually. The following are generally the main rules but of course

vary from country to country.

The basic tax point is the date goods or services are delivered or made available to the

customer.

However if payment is received earlier or invoice issued before the basic tax point, then the

earlier of these dates become the tax point.

Exception: If an invoice is issued within a certain number of days basic tax point, then the invoice

date replaces the basic tax point.

Lecture Example 19.5 – (Past CIMA question)

CU manufactures clothing and operates in a country that has a Value Added Tax system (VAT).

The VAT system allows entities to reclaim input tax that they have paid on taxable supplies.

VAT is at 15% of the selling price at all stages of the manufacturing and distribution chain.

CU manufactures a batch of clothing and pays expenses (taxable inputs) of $100 plus VAT. CU

sells the batch of clothing to a retailer CZ for $250 plus VAT. CZ unpacks the clothing and sells

the items separately to various customers for a total of $600 plus VAT.

How much VAT do CU and CZ each have to pay in respect of this one batch of clothing?

Lecture Example 19.6 – (Past CIMA question)

EF is an importer and imports perfumes and similar products in bulk. EF repackages the

products and sells them to retailers. EF is registered for Value Added Tax (VAT).

EF imports a consignment of perfume priced at $10,000 (excluding excise duty and VAT) and

pays excise duty of 20% and VAT on the total (including duty) at 15%.

EF pays $6,900 repackaging costs, including VAT at 15% and then sells all the perfume for

$40,250 including VAT at 15%. EF has not paid or received any VAT payments to/from the

VAT authorities for this consignment.

(i) Calculate EF’s net profit on the perfume consignment.

(ii) Calculate the net VAT due to be paid by EF on the perfume consignment.

8

Invoice details

A taxable supplier registered for VAT must supply a VAT invoice within a certain time of the

supply, and must keep the copy.

The usual items an invoice must show are:

· Suppliers name, address and registration number.

· Date of issue, the tax point and an invoice number.

· Name and address of the customer.

· The type of supply.

· Description of the goods and services supplied.

· Quantity.

· Rate of VAT, VAT amount, VAT exclusive amount.

· Rate of any cash discount.

In the UK every VAT registered trader must keep records for six years.

19.4 Partially exempt traders

A company that makes exempt as well as taxable (zero rated or standard rated) supplies. The

general rule used in different jurisdictions is as follows.

Normally input VAT in relation to exempt supplies is irrecoverable, so in the case of a partially

exempt supplier the amount calculated that will be due to taxable supplies made will be

recoverable, the balance will be input VAT in relation to exempt supplies made which will not be

recoverable.

Lecture Example 19.7

X Plc insists on invoicing customers before the job commences. It issued an invoice to a

customer on the 14 October 20X3, received half the payment on the 22 October 20X3 and the

balance on 18 November 20X3. The work for the customer started on the 20 November and

was completed by the 29 November 20X3.

The correct VAT tax point is:

A

22 October 20X3

B

29 November 20X3

C

18 November 20X3

D

14 October 20X3

9

19.5 Income from employment

‘Employment income’ income arising from an employment under a contract of service (both

employees and directors) where each employee is assessed how much tax he should pay as a

separate taxable person by the authorities.

Individuals pay income tax on net taxable earnings received for example in the tax year running

from 6.4.2010 to 5.4.2010 in the UK.

Pro-forma

Salaries, commission and bonuses received in tax year X

Benefits in kind (provided in the tax year)

X

General earnings

X

Deductions allowed for the employee

(X)

Net taxable earnings

X

Income tax payable by an employee/director is usually under a pay as you earn scheme, when the

employee gets paid his employer is responsible for deducting the correct amount of taxes and

handing this over to the tax authorities.

Worked example – Magoo Plc

Magoo Plc had the following sales in the quarter ended 31.3.X4 (all stated net of VAT)

Standard Rated

£120,000

Zero Rated

£30,000

Exempt

£50,000

The company also suffered input VAT in the quarter as follows

Taxable supplies

£3,400

Exempt supplies

£700

Unallocated VAT

£1,000

Total £5,100

How much input VAT can be reclaimed by the company, in this VAT return period?

Answer would be the entire £4,150

The £3,400 is definitely recoverable (in relation to taxable supplies made).

Unallocated £1,000 x (120 + 30) = £750 also recoverable

(120 + 30 + 50)

The £250 above remaining (to do with exempt supplies) + £700 = £950

10

19.6 Methods of rewarding staff

Certain benefits can be provided to a member of staff as well as their salary and these will have a

taxable value, the following however should be borne in mind when dealing with benefit.

Examples of which are:

· Accommodation paid for by employer.

· Furniture within accommodation provided by the employer.

· Other assets provided by the employer.

· Cars provided by the employer to the employee or employees members of family.

Allowable deductions

If the employee pays certain expenses themselves, then these amounts maybe allowed by the tax

authority as deductible in arriving at the earnings tax assessment of an individual.

They are broadly

· Professional subscriptions paid for by the employee.

· Payments (within certain) in to an occupational pension scheme.

· Any amount entitled by the employee for statutory mileage allowances not reimbursed by

the employer to the employee.

Examples of Statutory Mileage Allowances (SMA)

Employees own car

First 10,000 miles

40p per mile

> 10,000 miles

25p per mile

Employees own motorcycle or pedal cycle

Motor cycle

24p per mile

Pedal cycle

20p per mile

Any reimbursement of mileage expenses above these limits by the employer, the excess will be a

taxable benefit on the employee. However any amounts under-reimbursed by the employee can be

allowed as a deduction by the employee against taxable earnings.

11

Worked example – Mr Chai

Mr Chai was paid 10p per mile by his employer; he drove 18,000 business miles for the tax year

2003/X4. How much can he claim as a deduction against his taxable income for tax year?

10,000 x 40p

4,000

8,000 x 25p

2,000

Allowed under SMA

6,000

Reimbursed by employer (18,000 x 10p)

(1,800)

Deduction claimed against earnings for the tax year

4,200

19.7 Income tax calculations

Personal income tax rules are vary across jurisdictions but largely they take an approach of

allowing an amount to be tax free amount known as a tax allowance or personal allowance. Then

the rest of the employee’s taxable earnings are taxed in slices with increasing rates. Below is an

example of the tax regime used in the UK for employees.

Tax band

Tax rate

First £8,105 (personal allowance)

0% Tax free

Next £34,370

20% Basic rate

Next £34,371 to £150,000

40% Higher rate

> £150,000

45% Additional rate

Tax collection, assistance and compliance

Employers are responsible for collecting the taxes which employees have to pay. They only pay the

net amount after all deductions to the employee. The deductions are sent to the tax authorities. This

is known as a “withholding tax system”.

Details about the rates and allowances for employees are given to the employers by the tax

authorities and so calculations can be made. Any final settlement of under or overpayment of taxes

are dealt with directly with the employee by the tax authorities.

19.8 Record keeping and record retention

Tax authorities have over time asked the company to do more and of the administration and

collection of taxes, while the authority acts as the inspector to ensure that there is adequate

compliance with rules.

In addition taxable person are expected to keep records which would be needed to support tax

returns (formal declaration of incomes, expenses and taxes paid) sent to the authorities.

12

Much of the information required for financial accounting purposes can be used for records

keeping for tax purposes however further documents will need to be kept should there be specific

tax matters to support these.

Examples of these are expenses which are allowable and disallowable would mean an adapted

version of the profit and loss account, the tax depreciation for non-current assets again would mean

separate records to financial account depreciation and employee records such as personal tax

allowances, medical benefits and other benefits in kind.

Records relating to tax issues should be retained for as long as reasonable amount of time to allow

the tax authorities to carry out there inspections and investigation as necessary. In the UK this time

period is 6 years after the accounting period to which it relates to. Records relating financial

accounting issues may have the same or different time period.

Filing returns and tax payments

Tax returns as mentioned before detail out the tax payers assessable amount and tax payable. They

can be in paper or electronic form completed by the tax payer or tax collector (e.g. employer) and

submitted tot the tax authorities.

Once submitted the tax authorities can inspect and if necessary challenge the return with regards to

any aspect, for example certain expenses claimed as allowable against trading profit, the authorities

may seek further evidence or discussions. There will be a final amount that payable or repayable as

agreed by both parties.

Deadlines for submission of returns vary but the basic principle is set a reasonable deadline for

submission allowing the authorities to investigate if necessary and then a final payment or

repayment by a certain date as well.

Penalties are designed to enforce these deadlines and in most countries they occur automatically

which increase over time if the return is still not submitted.

In the UK the filing deadline to return the CT form CT600 (company tax return on all earnings) is

always 12 months from (or the anniversary of) the end of the accounting period of the company.

If the Inland Revenue (UK tax authority) do not enquire into the return within 12 months from this

filing deadline then you can treat the return as finalised.

Long accounting periods will only have one return, which would be 12 months after (or the

anniversary of) the end of the accounting period of the company

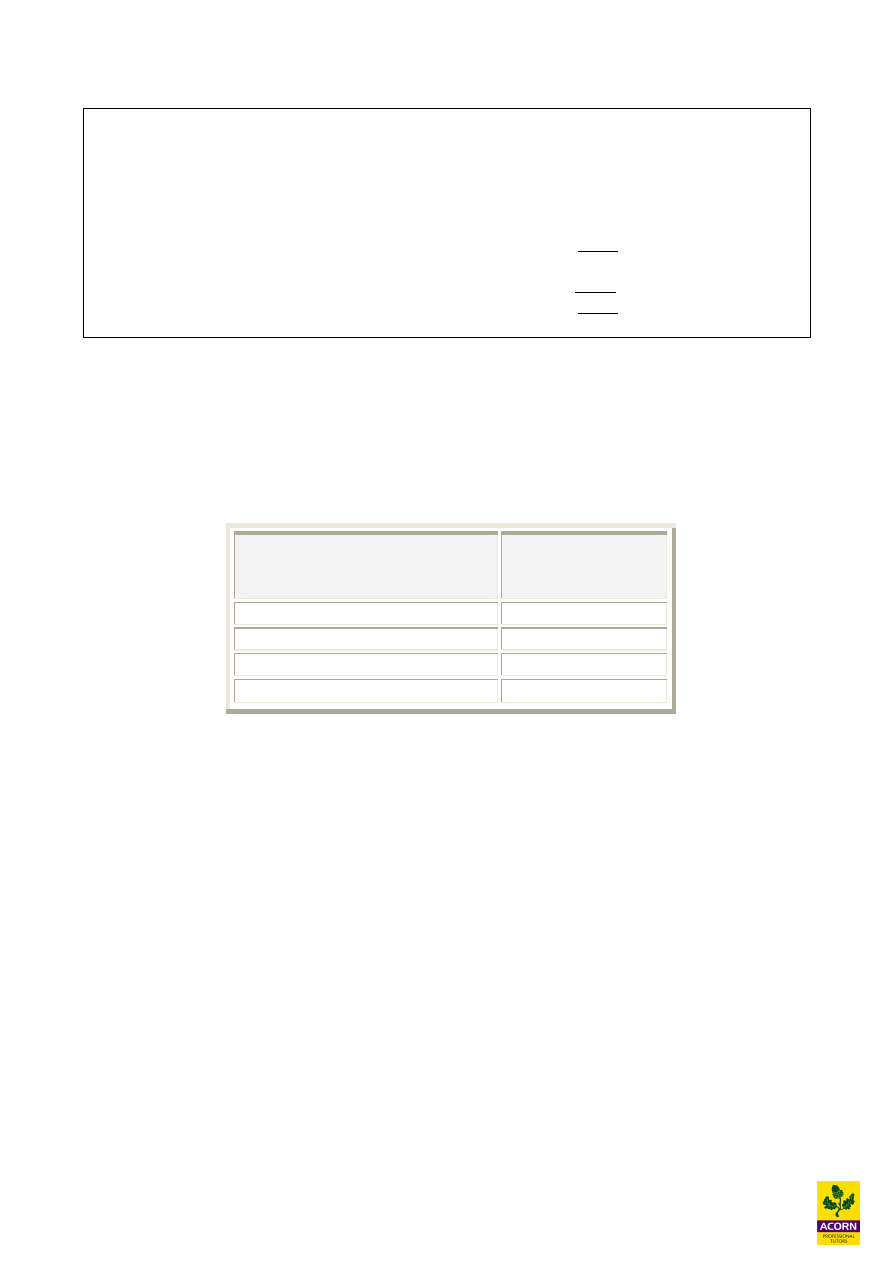

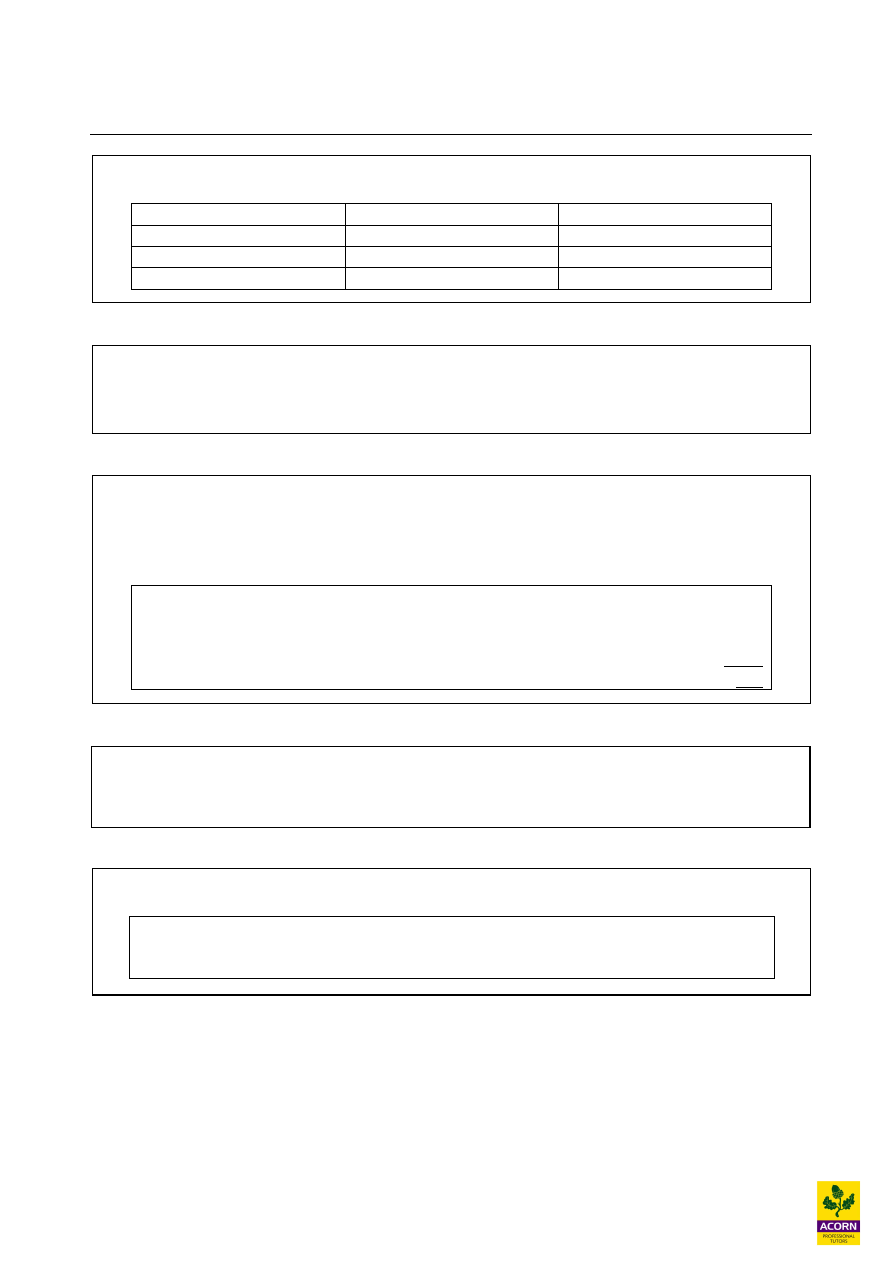

Penalties for late filing of returns in the UK

Have NOT Submitted a

return late in both the last two

accounting periods

Submitted a return late in

both the last two accounting

periods

Up to 3 months late

£100

£500

Exceeds 3 months late

£200

£1,000

13

Additional tax geared penalties may also apply

Penalty

Exceeds 6 months late

10% of the unpaid tax

Exceeds 12 months late

20% of the unpaid tax

19.9 Payment of tax on earnings

The payment of tax is not necessarily at the same time as when the tax return is submitted, it is

normally different due to the nature of the tax and tax rules. In the UK the following apply to tax

on company earnings.

1. If profits are less than £1.5 million then companies will be required to pay corporation tax 9

months and one day after the accounting period.

2. If the profits are £1.5 million or more then companies will be required to make payments up

front, on account of its estimated corporation tax liability for the accounting period.

Payments on account in the UK

1. Estimate the corporation tax (tax on company earnings) liability at the beginning of the

accounting period.

2. Calculate the instalments

(% x estimated corporation tax) x 3 = instalment amount

Length of accounting period (months)

3. These instalment amounts calculated in 2 above will be payable on the 14

th

day of month 7

and 10 (which would be within the accounting period) and month 13 and 16, which would

be after the accounting period has ended.

4. Whatever balance is left, once the company has finalised it’s actual corporation tax liability,

will be payable 9 months and one day after the end of the accounting period.

The first month of whatever the accounting period is, is ‘month one’.

14

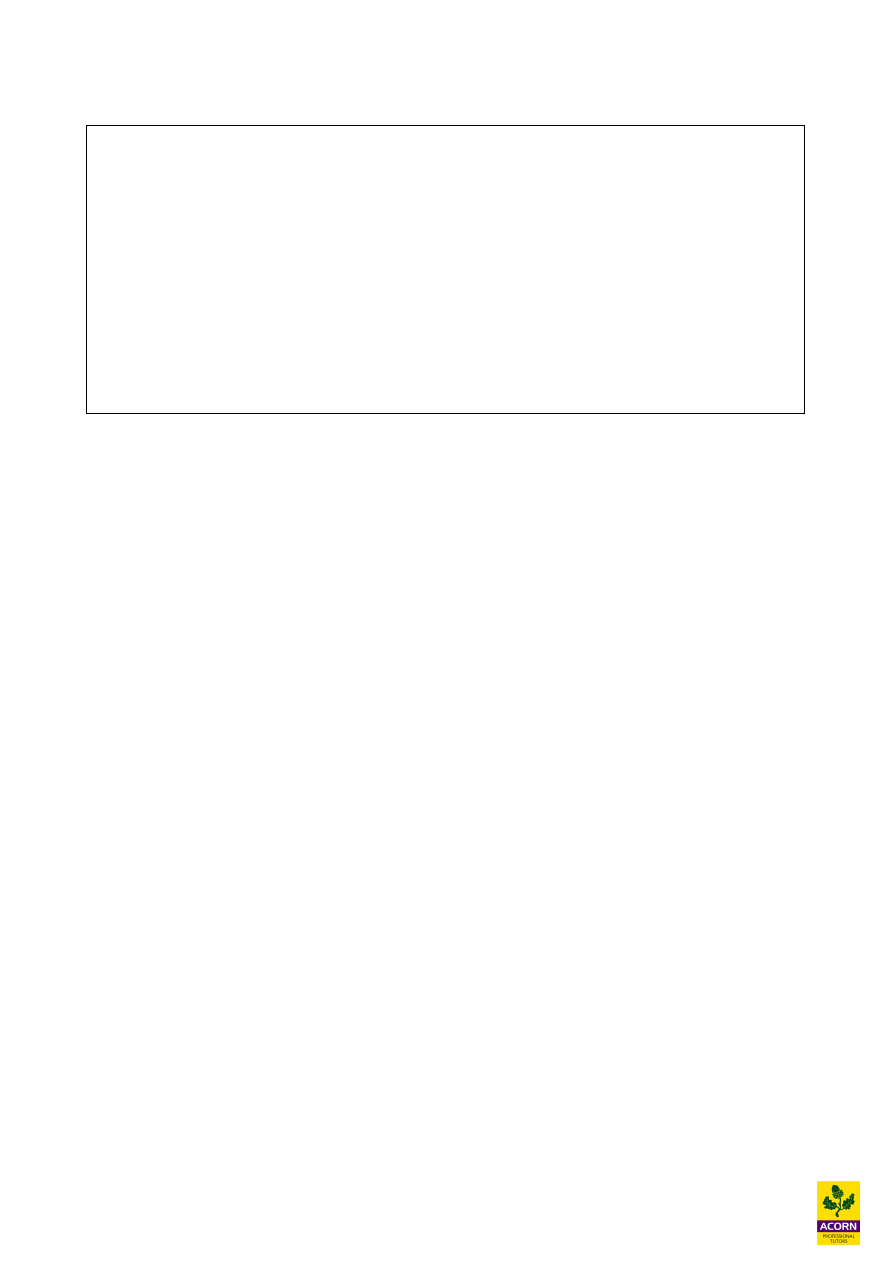

19.10 Powers of tax authorities

Review and query

If the tax inspector is uncertain or disagrees about items on a tax return he normally has powers to

question this in writing requesting further information or supporting documentation as evidence.

Request special reports

This is a request for a special report or return in addition to the normal tax return to support certain

items in the tax returns.

Information exchange with other tax authorities in other jurisdictions

There maybe bilateral agreements in place between the tax authorities of different jurisdictions to

be able to have access to information pertaining to tax matters. Enabling authorities to obtain a

better understanding of the tax affairs of taxable persons around the world.

Examine records

Tax inspectors should have the power to investigate the original records that the tax return is based

on to satisfy any uncertainty or disagreement. They should also be allowed to be able to investigate

historical records up to a reasonable time limit. This is because investigations usually take a while

to fully conclude on and therefore reasonable time should be allowed. In the UK this time limit is 6

years but would vary between jurisdictions.

Entry and search

Tax authorities should also have the power to force entry into premises where records are kept and

seize what is necessary if the company is unwilling or if it is a case of suspected major fraud.

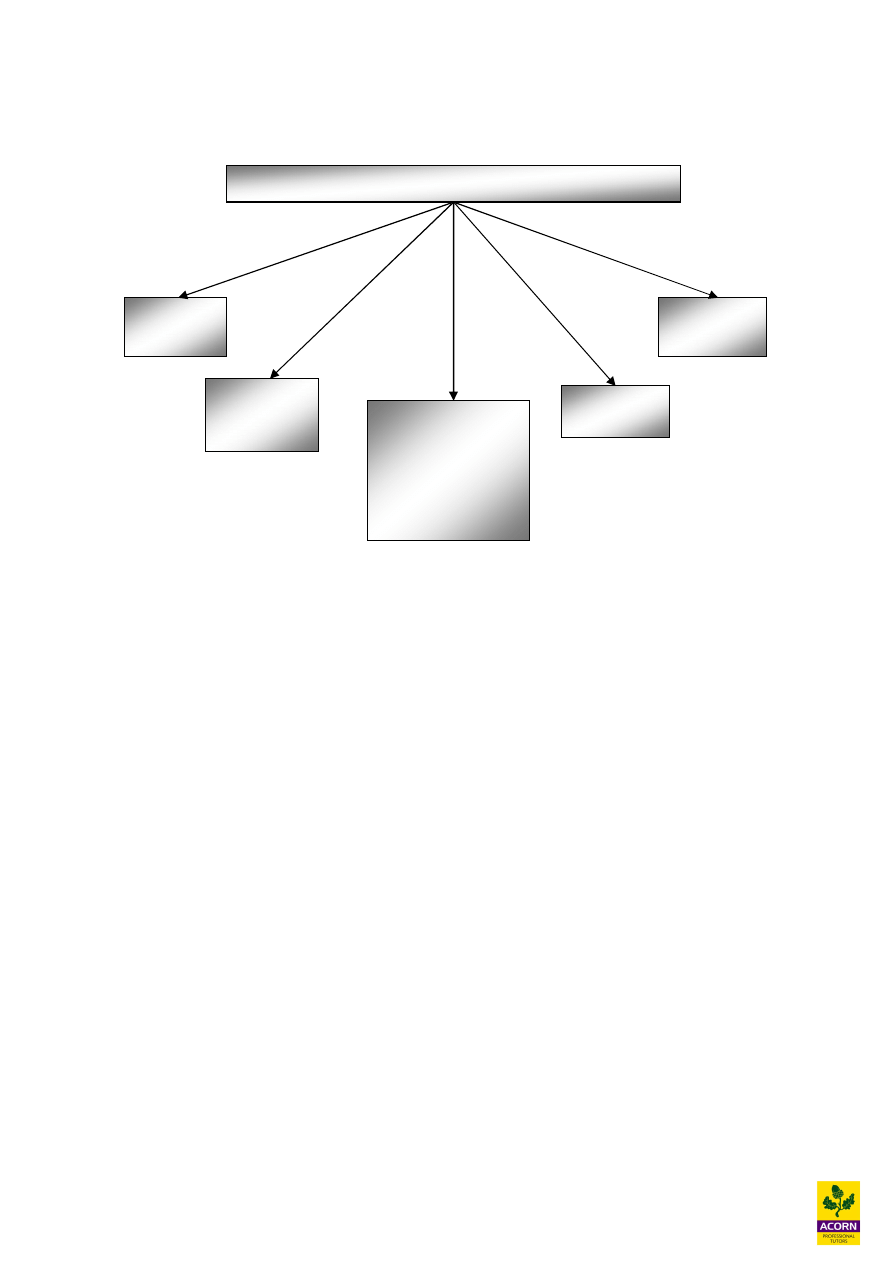

Powers of tax authorities

Review

and query

Request

special

reports

Examine

records

Entry and

search

Information

exchange with

other tax

authorities in

other

jurisdictions

15

Summary of chapter “Other areas of taxation and the power of tax authorities”

The effective incidence of tax – is the taxable person who ultimately bears the tax.

The formal incidence of tax - the entity that has direct contact with the tax authorities and who

is responsible for collecting the tax revenues and passing them on to the tax authorities has the

formal incidence of tax.

Unit tax – is based on physical measure being perhaps the number of units sold or produced.

Examples of a unit tax are excise duties; quantity of petrol sold and amount of oil extracted.

Ad valorem tax – is based on the value of sales. The most common example of this is a sales tax

or value added tax (VAT).

VAT is charged on the taxable supply of goods and services, other than an exempt supply.

Output VAT (output sales tax) accounted for on sales on most goods and services.

Input VAT (input sales tax) accounted for expenses and purchases made by the business.

Standard rated goods and services – sales are taxable at standard rate.

Zero rated goods and services – sales are taxable at 0%

In both types of supply input VAT incurred for business expenditure can be recovered.

Standard rated and zero rated sales together are called taxable supplies.

Exempt supplies – sales are exempt and outside the scope of sales tax.

Single stage sales tax system - sales tax is applied to a single point in the production or sales, for

example at the point of sale to the consumer.

Multi stage sales tax system - sales tax is applied at all stages of production and sales where a

transfer of the product has occurred.

Tax point - basic tax point is the date goods or services are delivered or made available to the

customer.

16

Employment income - income arising from an employment under a contract of service (both

employees and directors) where each employee is assessed how much tax he should pay as a

separate taxable person by the authorities.

Tax collection, assistance and compliance

Employers are responsible for collecting the taxes which employees have to pay. They only pay the

net amount after all deductions to the employee. The deductions are sent to the tax authorities. This

is known as a “withholding tax system”.

Record keeping and record retention

Taxable person are expected to keep records which would be needed to support tax returns) sent to

the authorities. Records relating to tax issues should be retained for as long as reasonable amount

of time to allow the tax authorities to carry out there inspections and investigation as necessary.

Filing returns and tax payments

Once submitted the tax authorities can inspect and if necessary challenge the return with regards to

any aspect. Deadlines for submission of returns vary but the basic principle is set a reasonable

deadline for submission allowing the authorities to investigate if necessary and then a final

payment or repayment by a certain date as well.

Powers of tax authorities

Powers of tax authorities

Review

and query

Request

special

reports

Examine

records

Entry and

search

Information

exchange with

other tax

authorities in

other

jurisdictions

17

Solutions to Lecture Examples

Solution to Lecture Example 19.1

Input VAT

$100,000 x 10%

$10,000

Output VAT

Z - $60,000 x 0%

0

Output VAT

L - $120,000 x 20%

($24,000)

Net output VAT

10,000 – 24,000

($14,000)

Solution to Lecture Example 19.4

The answer is B.

Solution to Lecture Example 19.5

Output VAT

Input VAT

Net VAT

CU

$250 x 0.15 = $37.5

$100 x 0.15 = $15

$37.5 - $15 = $22.5

CZ

$600 x 0.15 = $90

$250 x 0.15 = $37.5

$90 - $37.5 = $52.5

Solution to Lecture Example 19.3

VAT can’t be claimed on purchases which are in relation to exempt goods. VAT can be

claimed on purchases relating to zero rated outputs.

$

Output VAT

15,000 x 15%

2,250

Input VAT – std rated

9,000 x 15%

(1,350)

Input VAT – Zero rated

3,000 x 15%

(450)

Net VAT due to be paid

450

Solution to Lecture Example 19.2

The answer is C.

18

Solution to Lecture Example 19.6

Net $

VAT

Total cost

Import consignment

10,000

Excise duty (10,000 x 20%)

2,000

12,000

Input VAT (12,000 x 0.15)

1,800

Repackaging costs (VAT = 6,900 x 15/115 = 900)

6,000

900

Total costs

18,000

Sales (VAT = 40,250 x 15/115 = 5,250)

35,000

5,250

Net profit (35,000 – 18,000)

17,000

Net VAT (5,250 – 900 – 1,800)

2,550

(i)

Net profit = $17,000

(ii)

Net VAT due to be paid = $2,550

Solution to Lecture Example 19.7

The answer is D.

The basic tax point is when the goods or services are provided to the customer unless invoice or

payment date is earlier. The tax point is therefore the earlier invoice date 14 October 20X3. X

Plc could have avoided this problem by issuing a pro-forma invoice (‘this is not a VAT invoice’

displayed clearly on it.).

Wyszukiwarka

Podobne podstrony:

ISO128 50 areas of sections

ISO128 50 areas of sections

Howard, Robert E The Gates of Empire and Other Tales of the Crusades

Frederik Pohl Eschaton 01 The Other End Of Time

ABC Other causes of parenchymal liver disease

Moore, Michael Other letter of Michael Moore [english]

Wicker, Bruno & other Both of us disgusted in My insula

Jack London The Son of the Wolf and Other Tales of the North

Ritual Abuse and Other Acts of Love Elspeth Liberty

Moja gorsza strona (the other side of me) Chapter 21 epilog

Coaching Specialities 100 Areas of Specialty

The 12 Areas of a Perfect Life

The other site of me

Pohl, Frederik Eschaton 1 The Other End of Time

Frederik Pohl Other End of Time

the other side of change resistance

The Other Side Of Me Hannah Montana

Moja gorsza strona the other side of me 1 20 by Aryaa Wersja poprawiona!

więcej podobnych podstron