1

Absorption, marginal

and activity based costing

Chapter

4

2

4.1

Absorption costing

When costing for the manufacturing of different products, the direct or variable cost of

producing the product can be found easily enough to find a cost per unit. However the fixed

or indirect production overhead cost is harder to identify for the manufactured cost of making

a finished product. Fixed production overhead is an example of a period cost, a cost deducted

as an expense during an accounting period, it is a cost relating to time rather than the direct

manufacturing or brought in cost of a product.

Absorption costing attempts to calculate a budgeted fixed production overhead cost per

activity e.g. using units or hours, at the beginning of a period. This information can be used

for full cost pricing of different products (the variable as well as the fixed production

overhead cost per unit of a product identified). It will help to cost and price different

products more effectively; also it helps develop a costing system to charge fixed production

overhead during a period to different jobs, batches, contracts or work-in-progress accounts.

Indirect overhead or fixed cost is a cost which cannot be easily identified or related to a cost

per unit produced or an activity of any kind e.g. a cost which remains constant when the

production of a good or service within the organisation rises or falls.

Absorption costing forecasts the fixed production overhead to be budgeted at the

beginning of a period, for different cost centres e.g. departments or items of equipment.

It then divides the budgeted fixed overhead for the different cost centres, by a normal

(budgeted) activity level within each cost centre, to find an overhead absorption rate.

Overhead absorption rate (OAR) = Budgeted fixed production overhead

Normal (budgeted) level of activity

This is a simple method and allows fixed overhead to be allocated to products in order to

standard cost, value stock, obtain prices or measure profitability. It is over 100 years old.

Traditionally

1. A company had a single or small range of products.

2. Fixed overhead was a small percentage of total cost.

3. Mass production techniques were used.

This is why absorption costing 100 years ago and in simple modern environments today, is

still accepted and used in practice as a costing system.

3

4.2

Cost centres

Cost centres act as collection places or codes for costs to be analysed, before they are

analysed further and ascertained to a cost unit.

A cost centre is a production or service location, function, activity or item of equipment for

which overhead costs are accumulated. (CIMA)

A production cost centre is a cost centre directly involved in the production process e.g. a

production, machining or assembly department. A service cost centre supports the different

production cost centres. Service centres are not directly involved in the production process

e.g. the canteen, warehouse or quality control department.

4.3

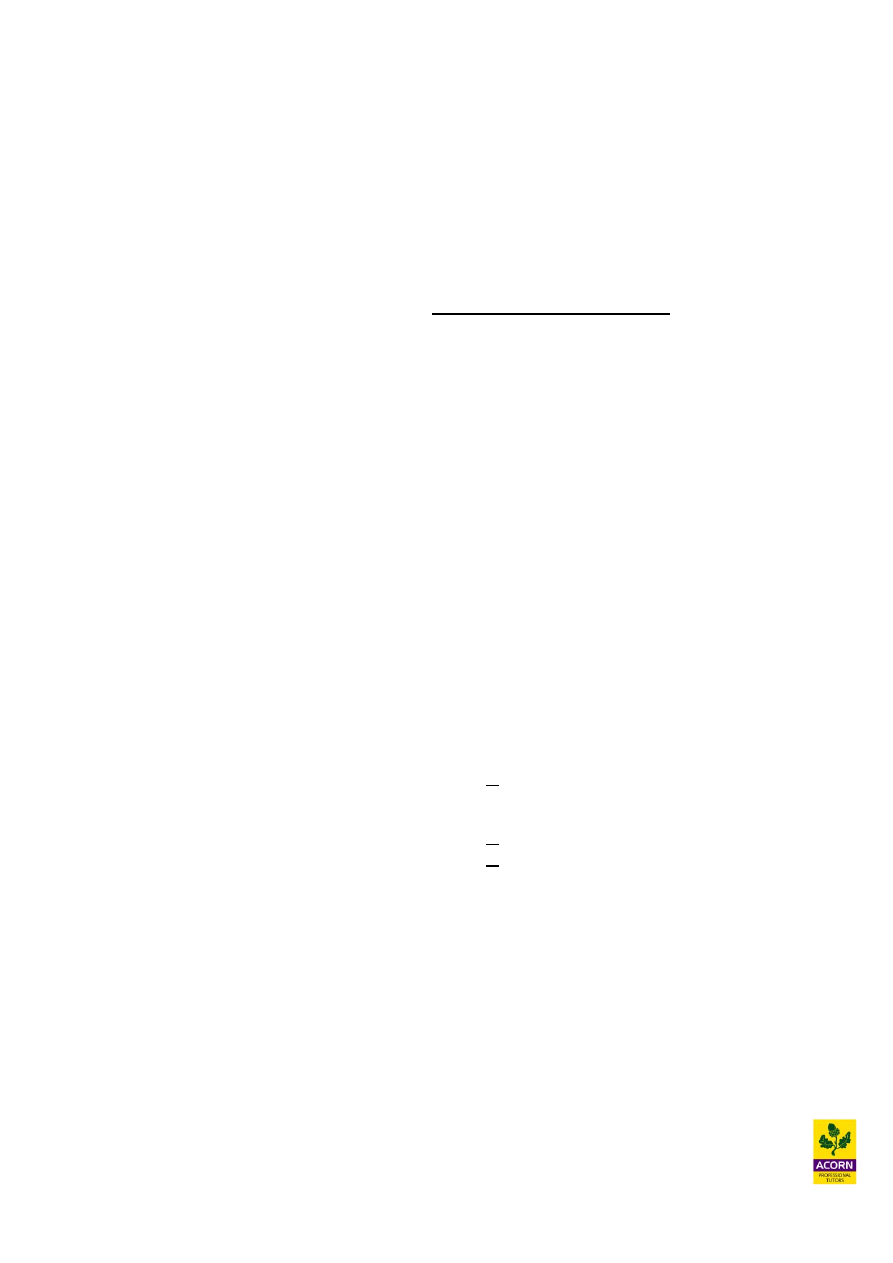

The absorption process

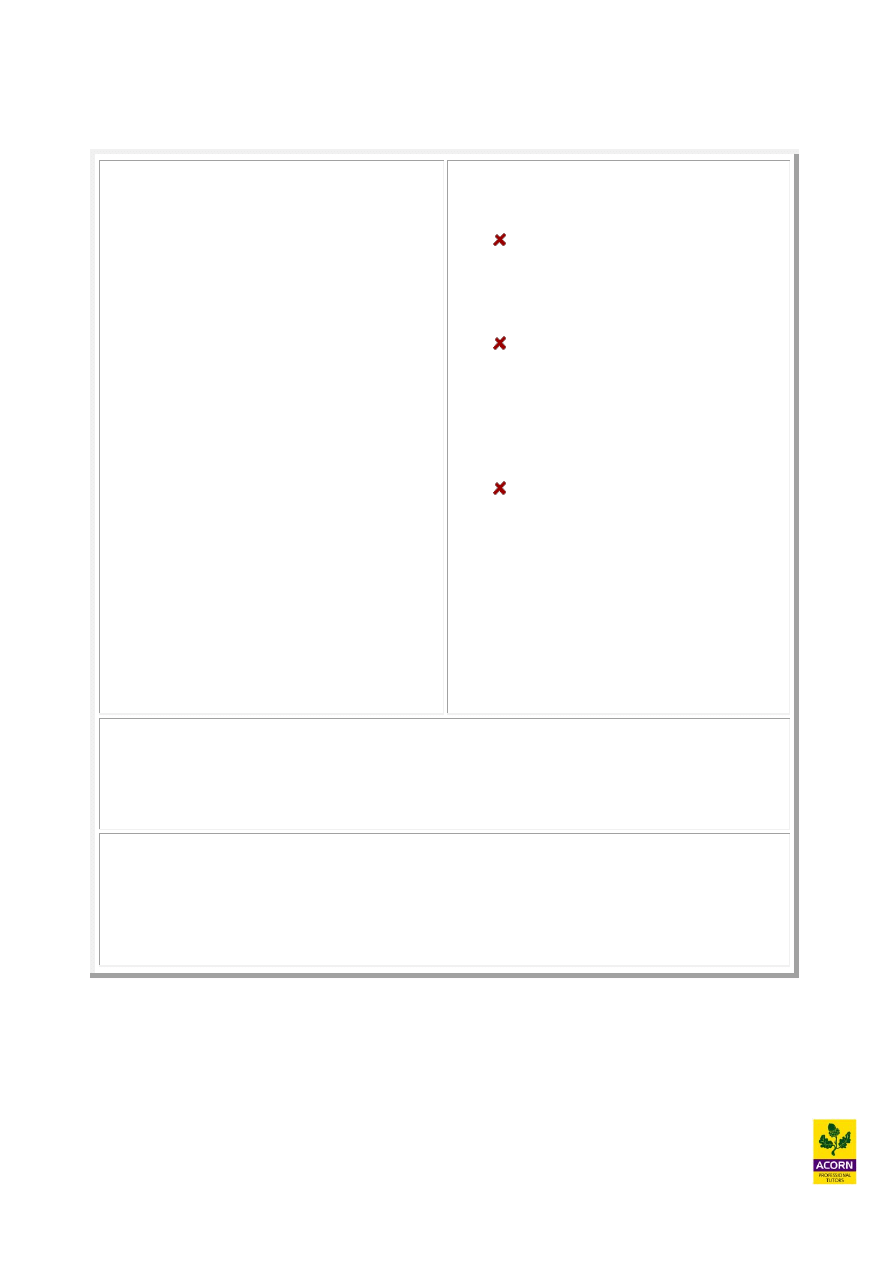

Step 1

Allocate (give directly to) or apportion (share/divide) budgeted fixed production

overhead between cost centres used by the organisation at the start of the financial

period.

Step 2

After the first process above reapportion the budgeted fixed production overhead

allocated or apportioned to service cost centres to production cost centres. This

eliminates any fixed overhead apportioned to service cost centres in Step 1.

Step 3

Absorb (charge) the budgeted fixed production overhead from production cost

centres directly to cost units, work-in-progress accounts or jobs undertaken during

the financial period by the organisation, using budgeted fixed overhead absorption

rates calculated for the different production cost centres.

4

Absorbing indirect production overhead to cost units, work-in-progress or jobs

Once the process above has been completed pre-determined overhead absorption rates can be

calculated at the beginning of the period for each production cost centre

Overhead absorption rate (OAR) =

Budgeted production overhead

Normal level of activity

The normal activity can be based upon

Budgeted units

Budgeted labour hours

Budgeted machine hours

Budgeted % of direct labour cost

Budgeted % of direct material cost

Budgeted % of prime cost

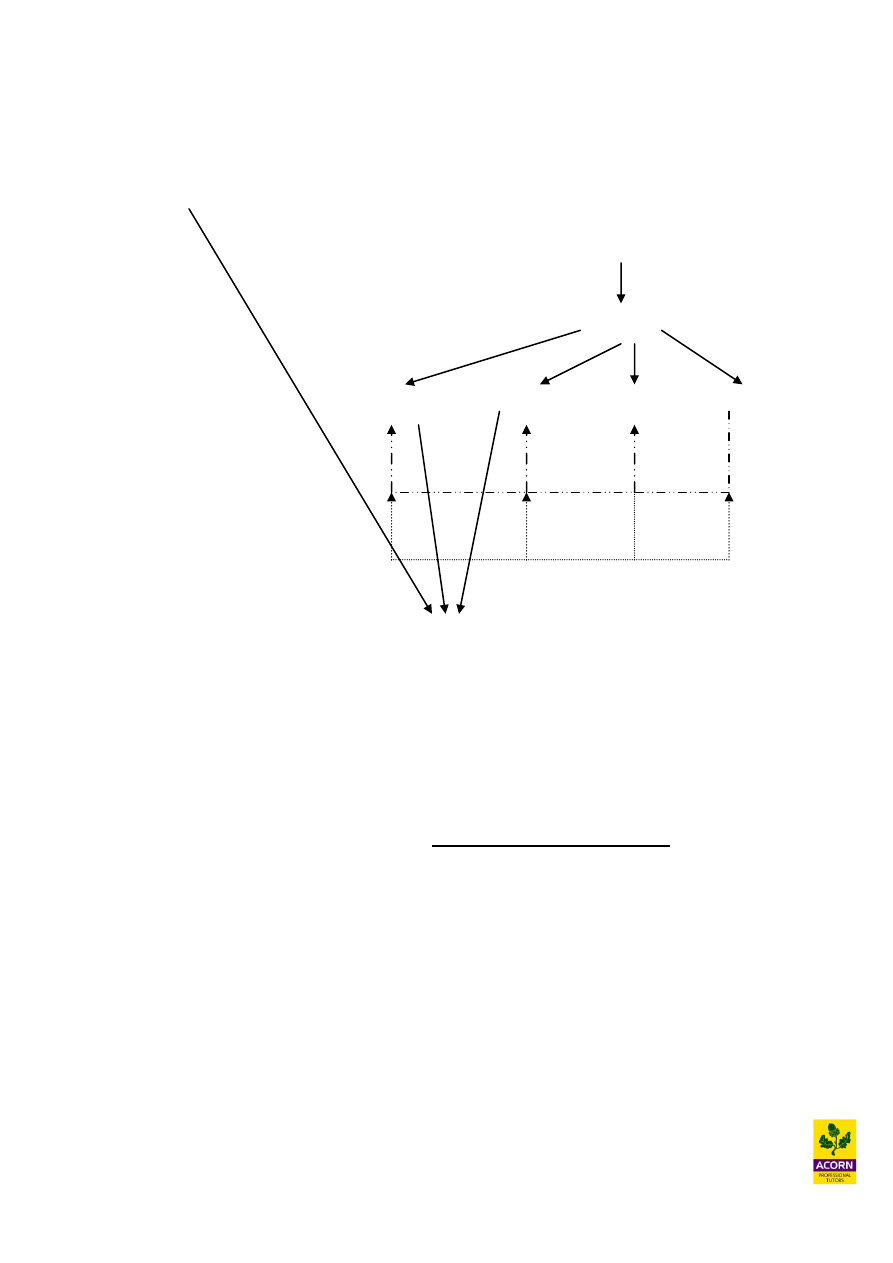

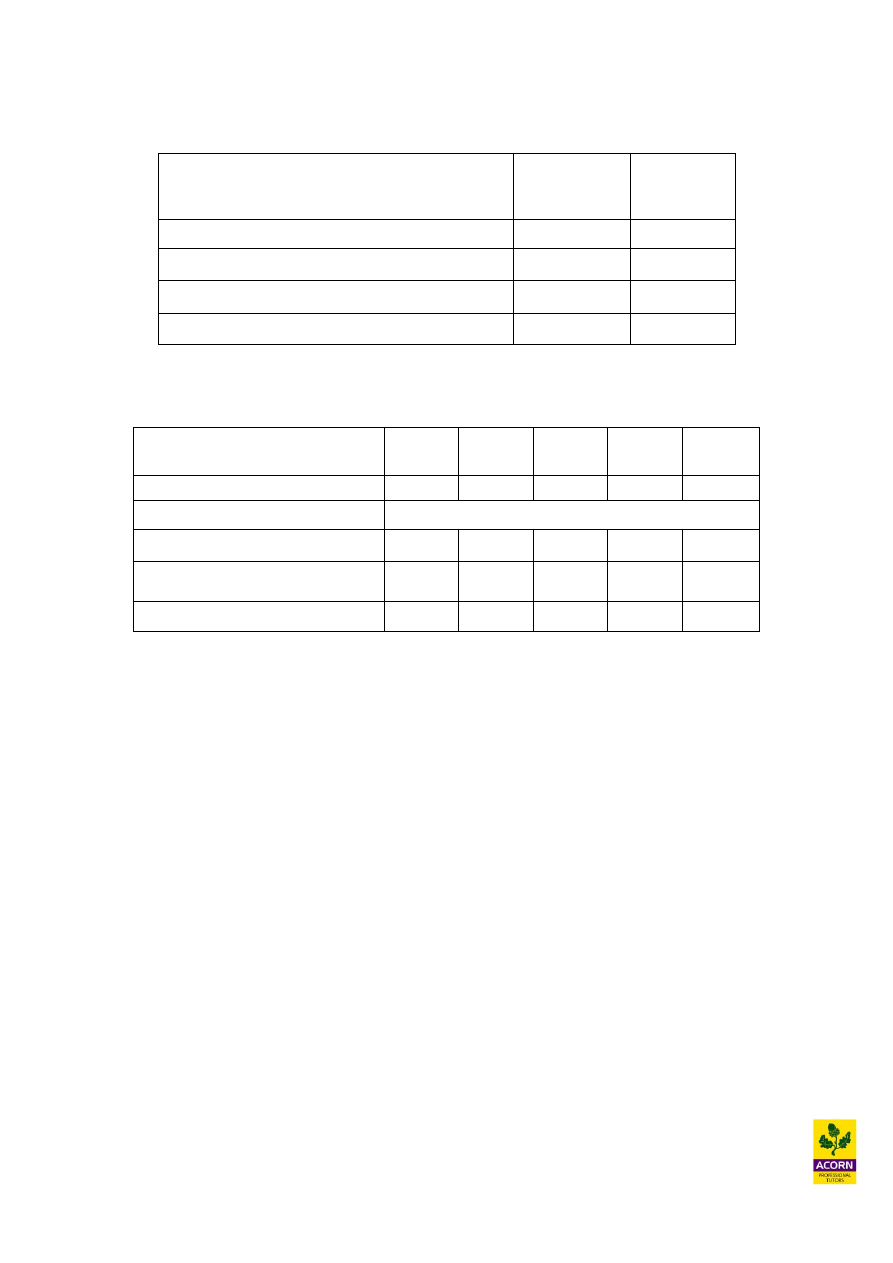

COST CENTRES

Reapportion overhead from

service to production cost

centres

Production 1

BUDGETED DIRECT COST

BUDGTED

INDIRECT

COSTS

(Production overhead)

Production 2

Service 2

Service 1

Absorb budgeted

production overhead from

production cost centres to

cost units

COST UNIT

5

Example 4.1 – Worked example

The following budgeted overhead has been apportioned to production cost centres only

Assembly Machining

Budgeted indirect overhead

allocated and apportioned (£000s)

1473.1

1976.8

The following information is available

Budgeted machine hours in department 20,000

200,000

Budgeted labour hours

in department 130,000

100,000

Given that assembly would seem to be more labour than machine hour intensive an overhead

absorption rate would be calculated as follows, using labour hours

£1,473,100/130,000 hours = O.A.R £11.33 per labour hour

Given that machining would seem to be more machine than labour hour intensive an

overhead absorption rate would be calculated as follows, using machine hours

£1,976,800/200,000 hours = O.A.R £9.88 per machine hour

These absorption rates could now be used as a basis of charging production overhead to jobs

or work-in-progress in order to find a price or measure the profitability of a job or batch

produced, we could have also used budgeted units or % of budgeted cost as other methods of

finding an overhead absorption rate.

4.4

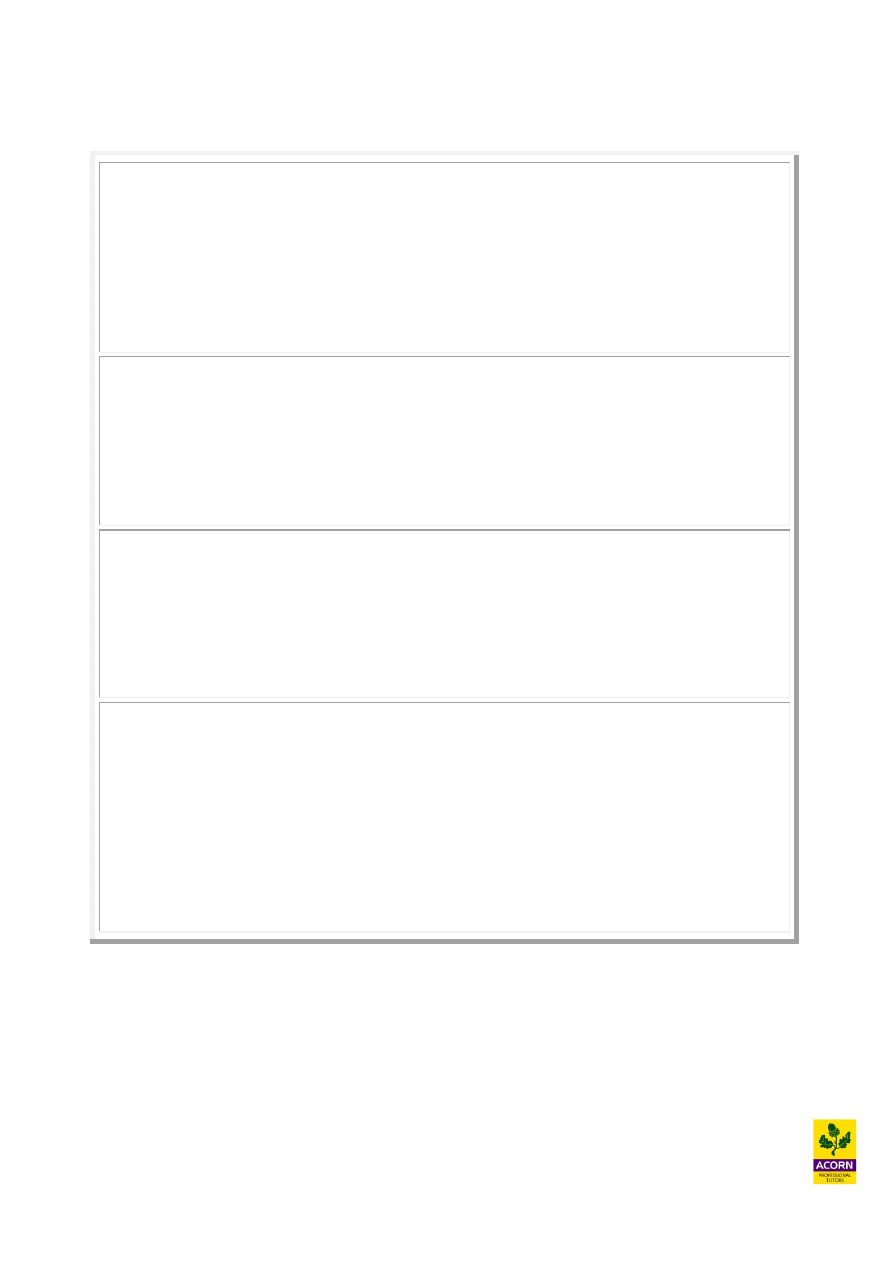

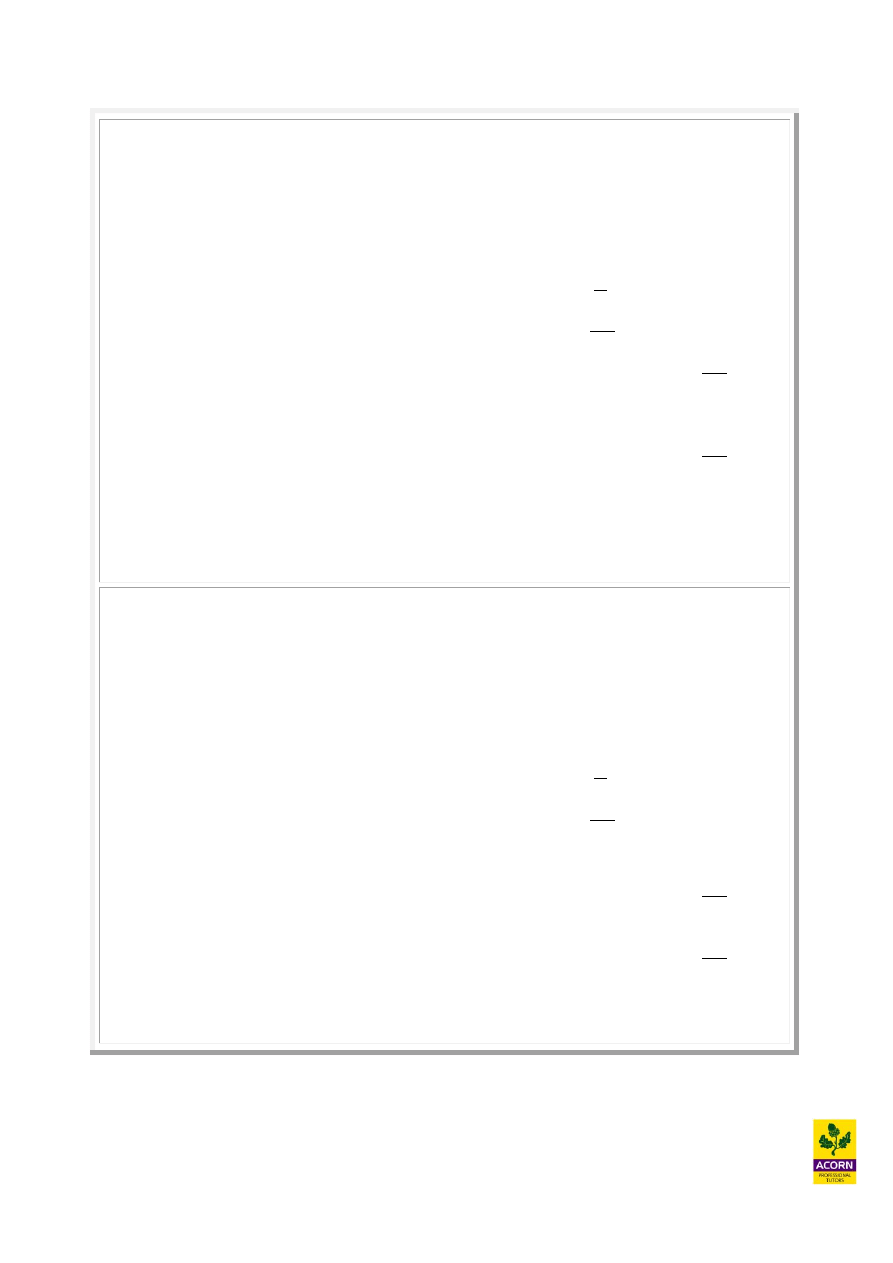

Accounting for fixed production overhead when absorption costing

Absorption accounting assigns fixed production overheads to cost units, jobs or work-in

progress accounts by using overhead absorption rates. When calculating overhead absorption

rates there is no true scientific technique used in order to select an activity level e.g. fixed

overhead can be charged on the basis of actual hours, units or cost. The method selected

should be a fair and reasonable one.

An overhead absorption rate (O.A.R) is pre-determined at the beginning of a financial period

and actual fixed overhead is charged by the process of absorption (the accounting process

below). It is likely a difference or balance within the production overhead control account

will arise at the end of a financial period, this balance is referred to as an under or over

absorption of fixed overhead. This would mean fixed overhead accounted for during a

financial period has been under or over charged.

6

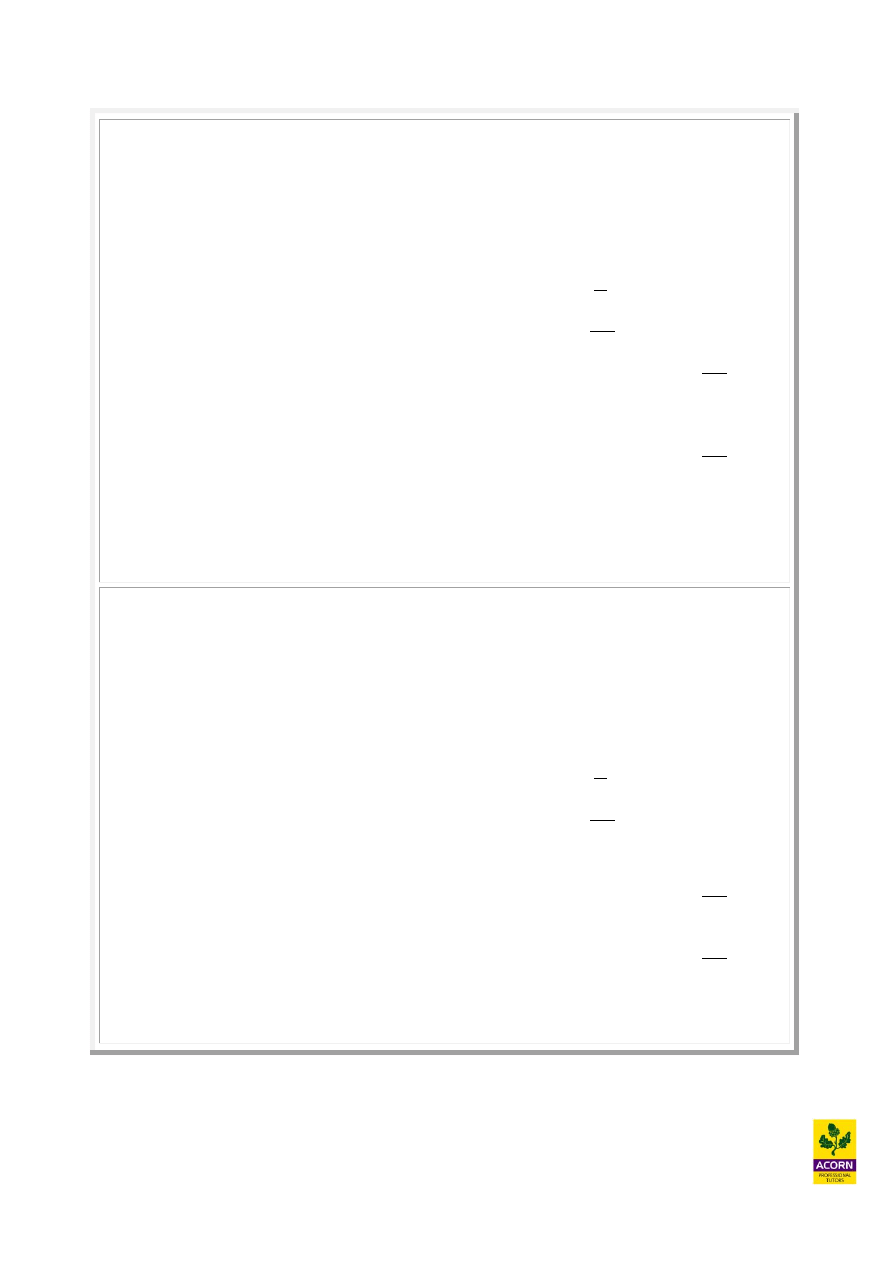

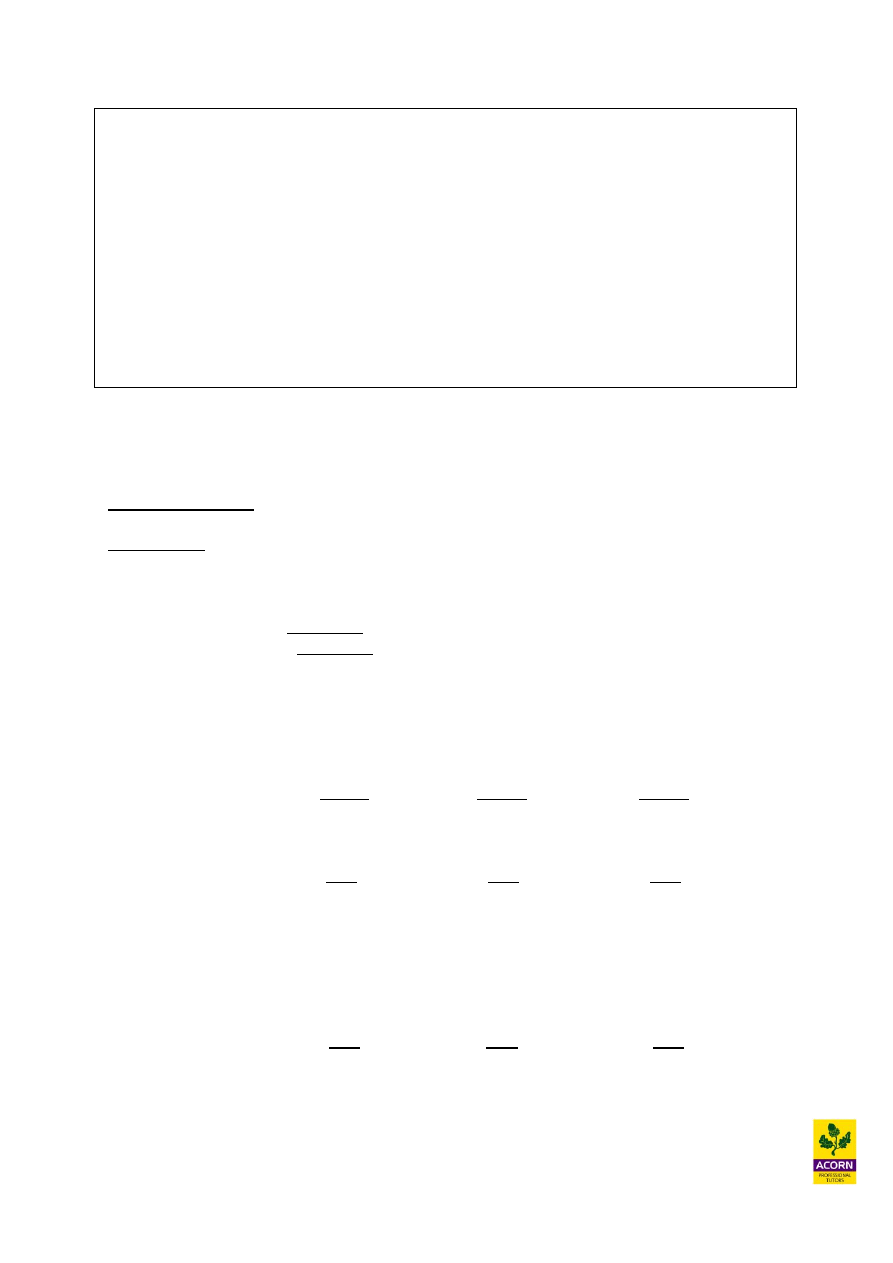

During the financial period the actual fixed overhead incurred is recorded within the

production overhead control account

Debit Production overhead control account

Credit

Creditor (or cash)

During the financial period fixed overhead is absorbed (charged) from the production

overhead control account to jobs or work-in-progress accounts (ultimately ending up

being charged as an expense in the income statement).

Debit Income statement (as a fixed overhead expense)

Credit

Production overhead control account

At the end of the financial period the fixed overhead ‘absorbed’ is compared to the

actual production overhead recorded and incurred for the period.

Any shortfall in fixed overhead absorbed during the financial period to the income

statement would be an ‘under absorption’ of production overhead

Debit Income statement (as a fixed overhead expense)

Credit

Production overhead control account

Absorbed fixed overhead + Under absorption = Actual production overhead

Any surplus in fixed overhead absorbed during the financial period to the income

statement would be an ‘over absorption’ of production overhead

Debit Production overhead control account

Credit

Income statement (as a fixed overhead expense)

Absorbed fixed overhead - Over absorption = Actual production overhead

Actual production overhead

Over absorption (Balance)? X

Absorption of fixed overhead

for the financial period

actual activity level x O.A.R

Under absorption (Balance)? X

Production overhead control account

X

X

7

Under absorption = Actual FOH > Budgeted FOH

Over absorption = Actual FOH < Budgeted FOH

Causes of over absorption for a financial period

The actual activity used to absorb fixed overhead was greater than the budgeted

activity used to calculate the overhead absorption rate and/or

The actual fixed overhead was less than the budgeted fixed overhead

Causes of under absorption for a financial period

The actual activity used to absorb fixed overhead was less than the budgeted activity

used to calculate the overhead absorption rate and/or

The actual fixed overhead was more than the budgeted fixed overhead

Example 4.2 – Worked example

A plc operates an absorption costing system; details about budget and actual cost and activity

levels are as follows:

Budget

Actual

Production (units)

12,000

12,300

Production overhead ($)

120,000 128,000

Calculate the under or over recovery of these costs for the above period.

OAR = 120,000/12,000 = $10 per unit

Absorbed (12,300 x $10)

123,000

Actual overhead

128,000

Under absorption

5,000

Example 4.3 – (CIMA past exam question)

A company operates a standard absorption costing system. The budgeted fixed production

overheads for the company for the latest year were £330,000 and budgeted output was

220,000 units. At the end of the company’s financial year the total of the fixed production

overheads debited to the Fixed Production Overhead Control Account was £260,000 and the

actual output achieved was 200,000 units.

Calculate the under / over absorption of overheads.

8

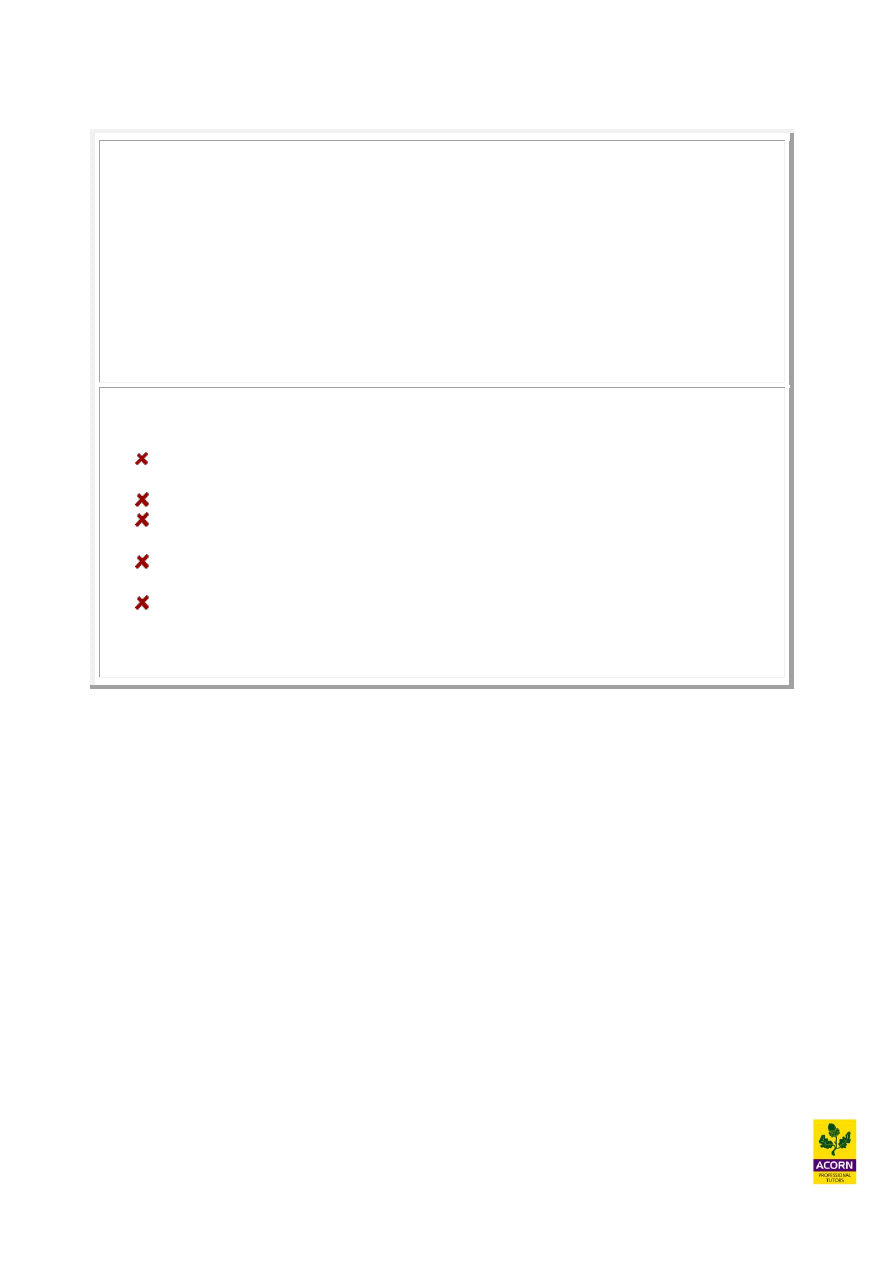

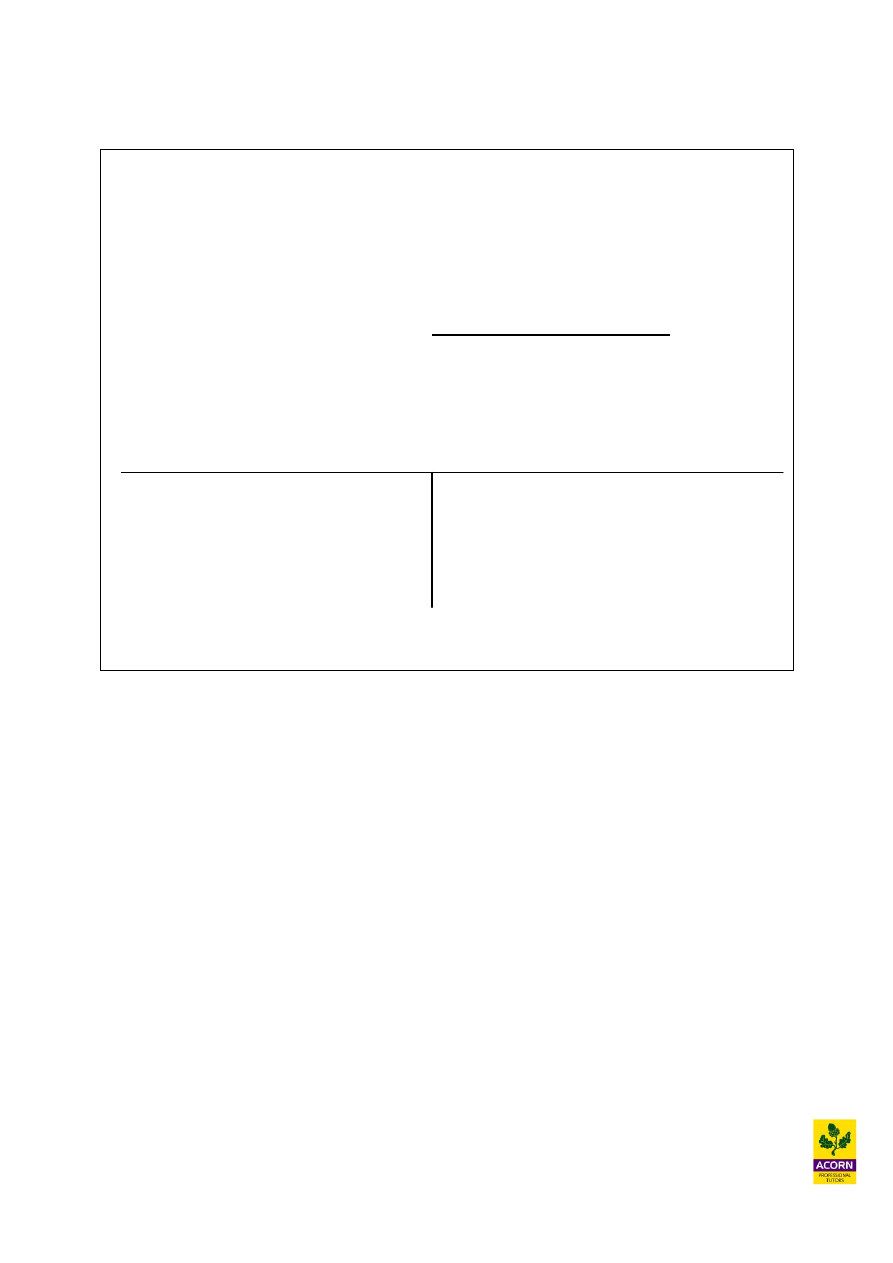

4.5

Marginal costing

Tip: A marginal cost (direct or variable cost) is a cost that can be avoided if a unit is not

produced or incurred if a unit was produced. Fixed cost remains constant whether a unit is or

is not produced, therefore including fixed overhead within a cost unit can distort decision

making when working out the profit affect of increasing or decreasing sales volume.

Marginal (or variable) costing assigns only variable costs to cost units while fixed costs are

written off as period costs.

(CIMA)

Marginal costing as a method makes no attempt to ‘absorb’ fixed production overheads

within a cost per unit or the income statement. Marginal costing treats fixed production

overheads as a period cost only and charges it entirely to the income statement for each

period. Marginal costing systems value inventory of finished goods at the direct

production cost only never full production cost. Absorption costing as a method does

however charge fixed or indirect production overheads to different products or services.

Absorption costing calculates a fixed overhead cost per unit for different products and will

value inventory of finished goods at full production cost e.g. the direct cost and indirect

production overhead per unit.

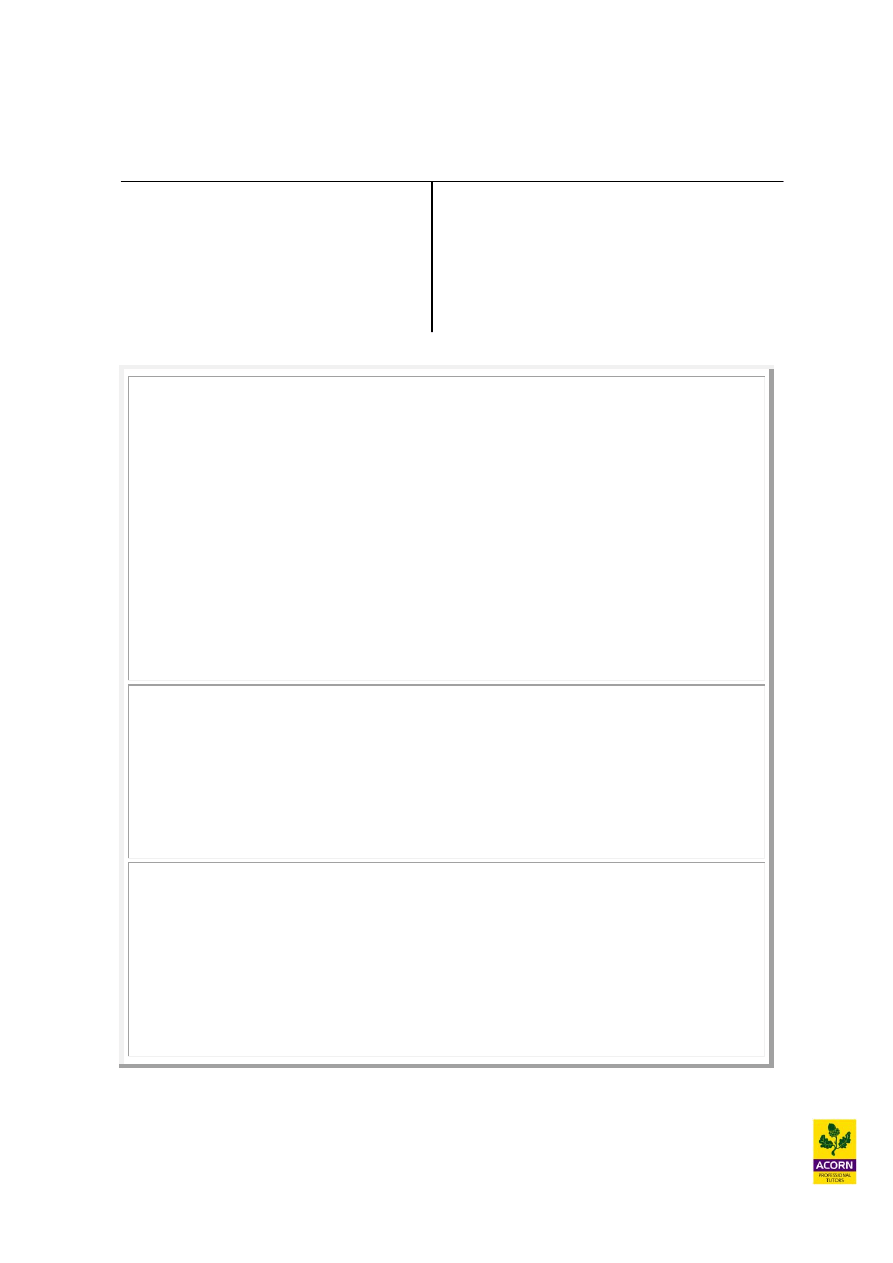

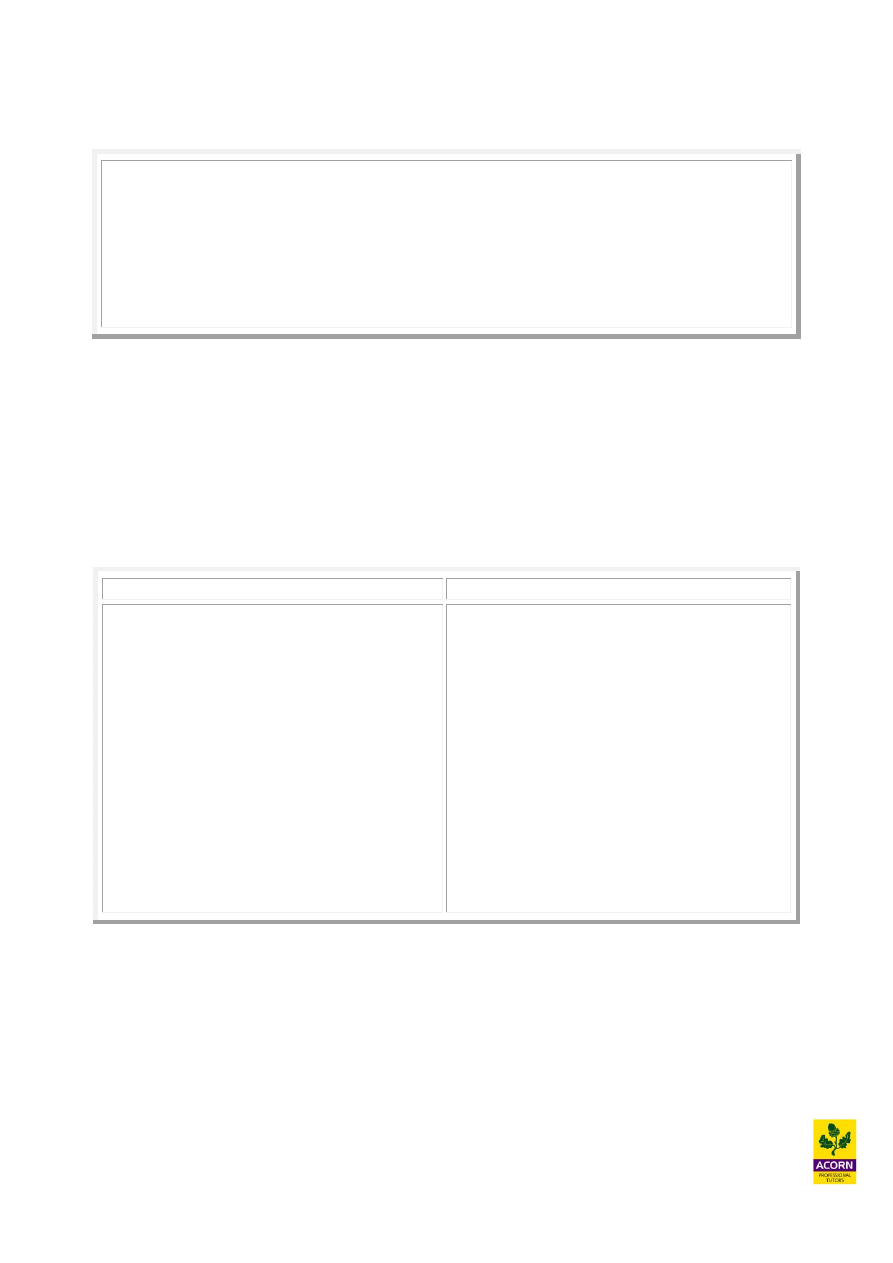

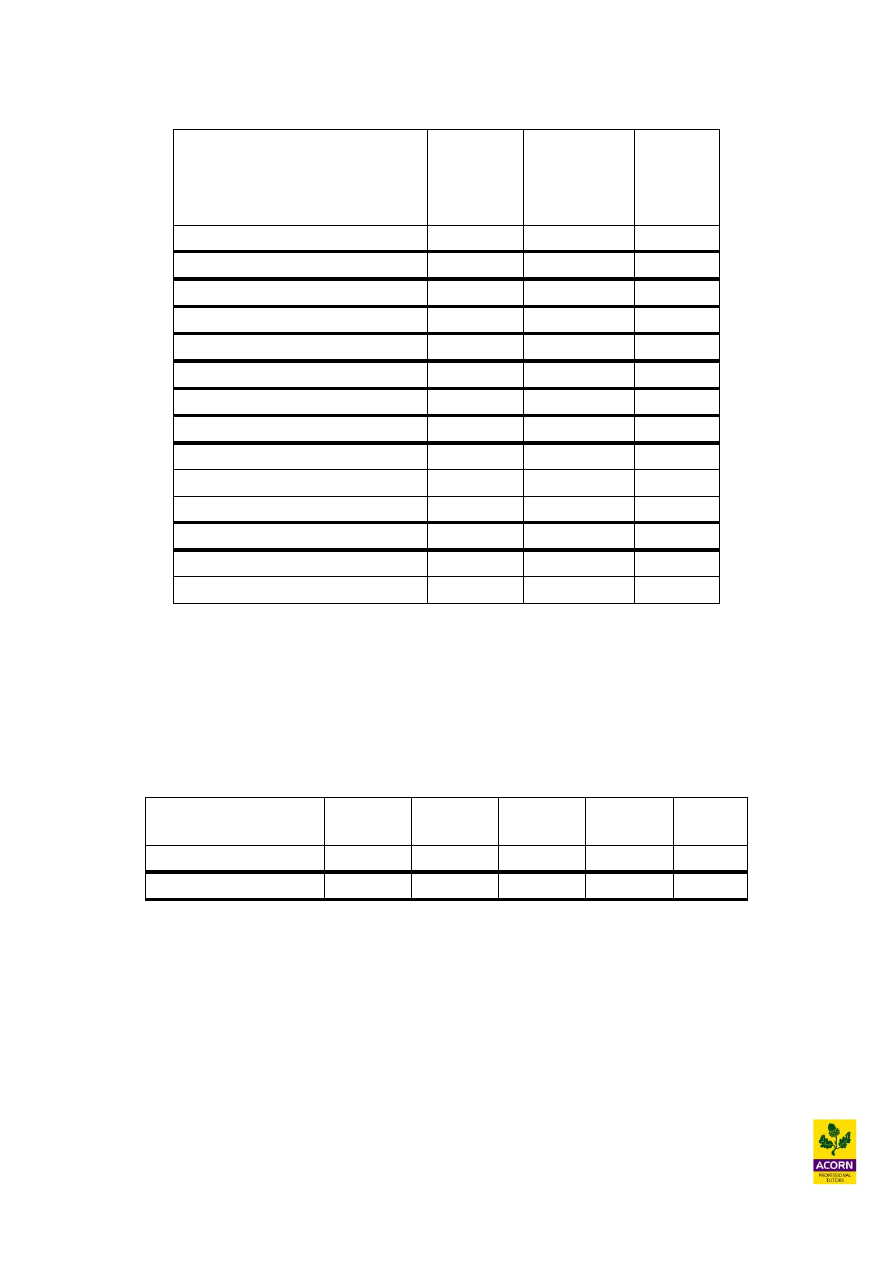

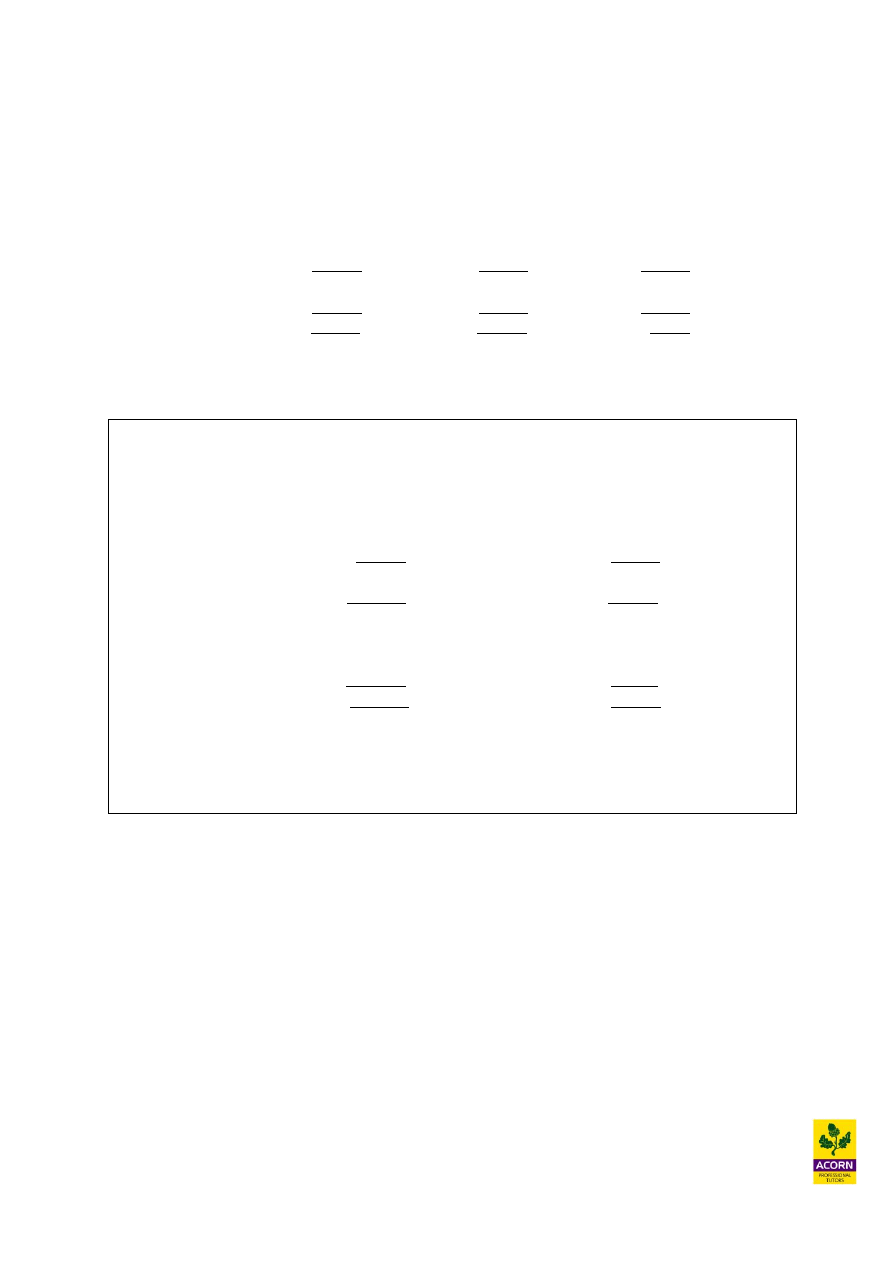

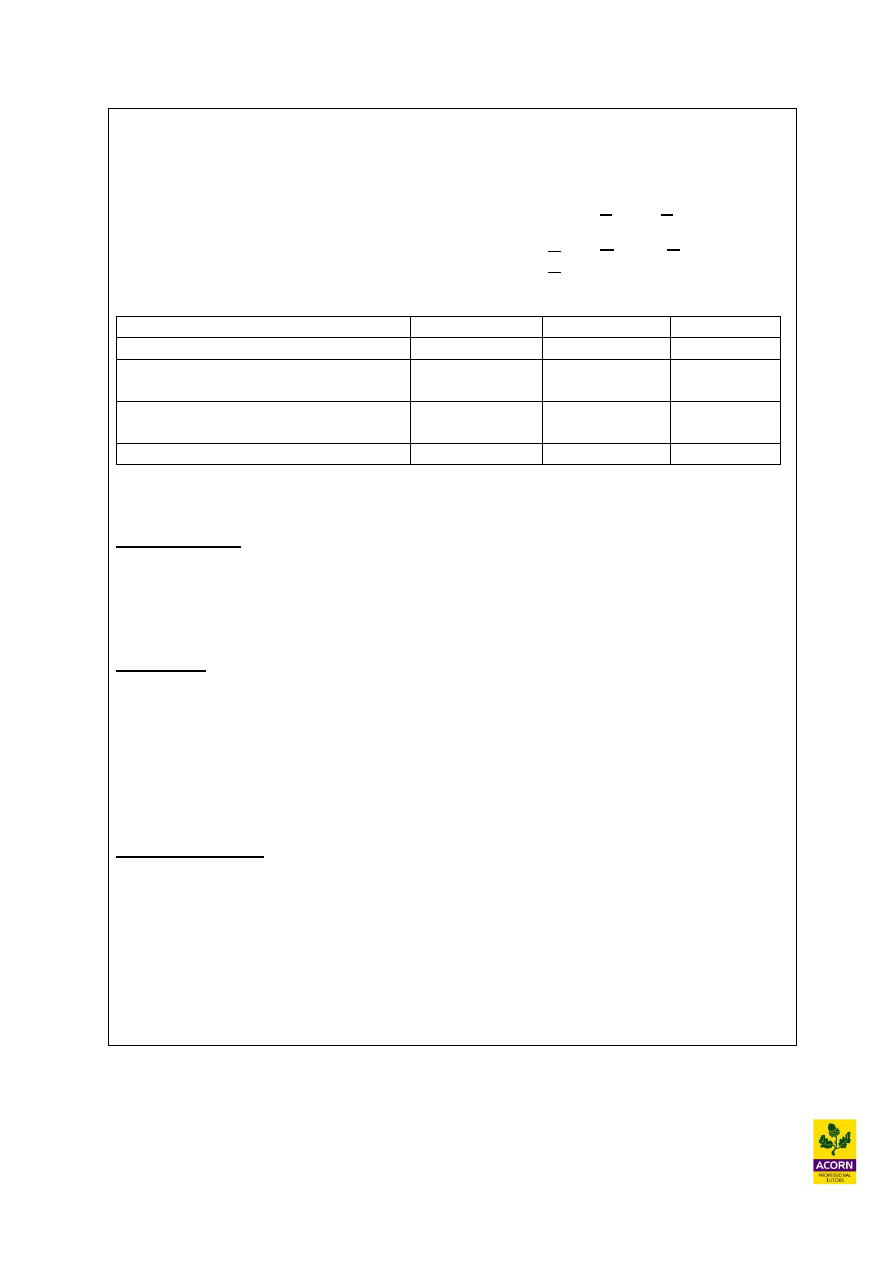

Absorption costing

Marginal costing

Values inventory of finished goods

at full production cost e.g. the

direct and indirect production cost

for each unit.

Absorbs

indirect

production

overheads using the actual level of

activity for a period x overhead

absorption rate (O.A.R).

The

income

statement

format

deducts first all production cost

(variable and fixed), then second all

non-production cost (variable and

fixed), in order to arrive at net profit.

Values any inventory of finished

goods

at

variable

(marginal)

production cost only for each unit.

Does

not

absorb

indirect

production overheads it charges all

fixed production overhead as a period

cost only.

The income statement format deducts

first all variable cost (production and

non-production), then second all

fixed cost (production and non-

production) in order to arrive at net

profit.

9

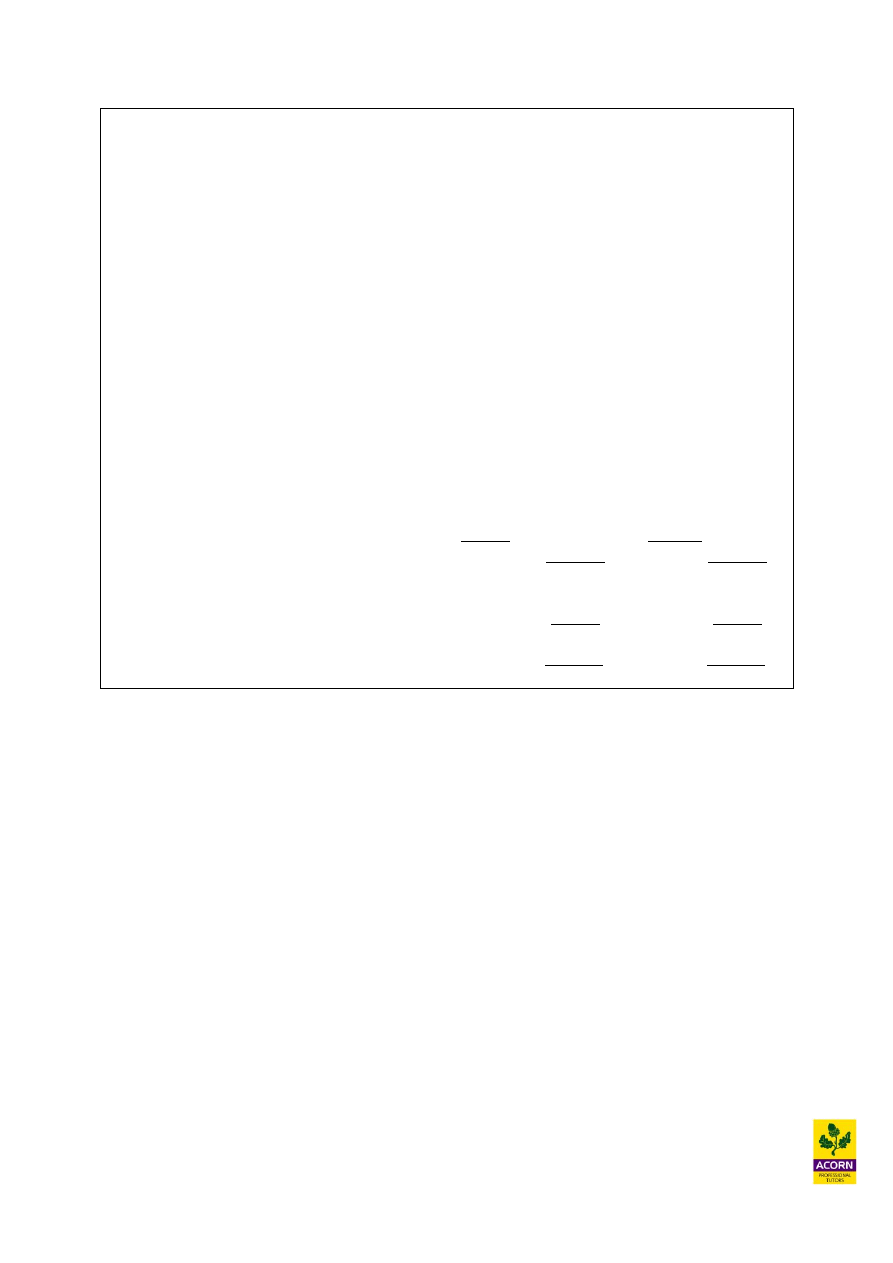

Valuation of finished goods inventory

Direct costs of production

Direct labour

X

Direct material

X

Direct variable production overhead

X

Total direct variable cost or total prime cost

X

Marginal costing stock valuation

Indirect production overhead absorbed

X

Full production cost

X

Absorption costing stock valuation

When standard costing, marginal costing organisations only use the fixed overhead

expenditure never the fixed overhead volume variance when reconciling actual to budgeted

results. Also marginal costing organisations use profit statements that highlight

‘contribution’ earned, therefore the sales volume variance would be different as would too the

operating statement, when compared with absorption costing organisations.

10

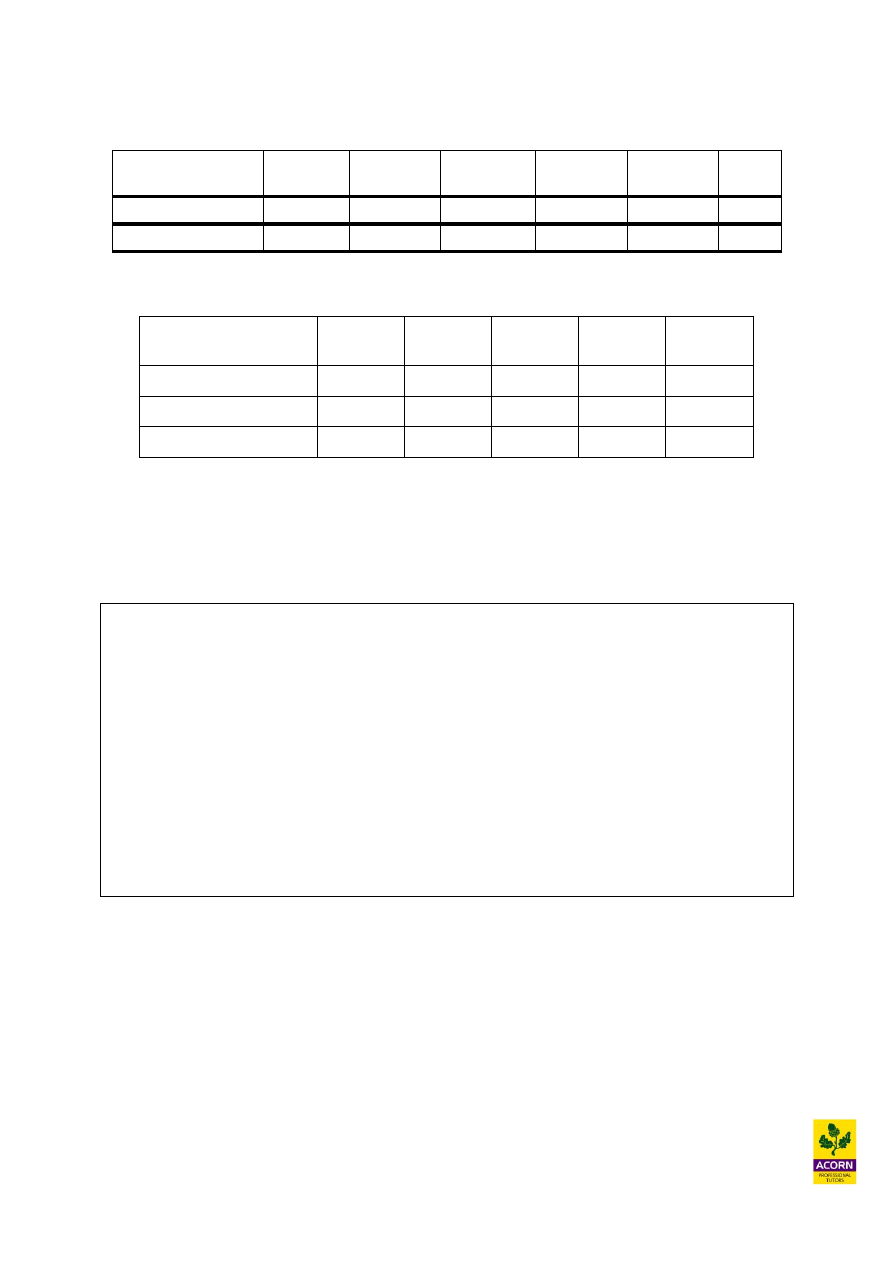

Marginal costing – pro forma income (profit) statement

$

$

Sales

X

Less cost of sales

Opening stock (valued at variable production cost only)

X

Total variable production cost*

X

X

Less closing stock (valued at variable production cost only) (X)

(X)

Less non-production variable cost

(X)

Contribution

X

Less fixed production cost

(X)

Less fixed non-production cost (X)

Net profit

X

*Direct labour, direct material and direct (or variable) production overhead

Terminology: Contribution equals Sales less ALL marginal (or variable) cost

Absorption costing – pro forma income (profit) statement

$

$

Sales

X

Less cost of sales

Opening stock (valued at full production cost)

X

Total variable production cost*

X

Fixed production overhead absorbed

X

X

Less closing stock (valued at full production cost)

(X)

X

(Over)/under absorption of fixed production overhead

(X)/X

(X)

Gross profit

X

Less non-production fixed and variable cost (X)

Net profit

X

*Direct labour, direct material and direct (or variable) production overhead

11

Example 4.4

Selling price £30.

Cost card per unit:

£

Direct material

8.00

Direct labour

5.00

Variable production overhead

4.00

17.00

Year 1

Year 2

Units

Units

Budgeted production

10,000

10,000

Actual production

11,000

9,000

Actual sales

10,000

10,000

The budgeted production overhead for both periods was £20,000 in both periods the actual

production overhead was £21,000. There is no opening stock

Produce a profit statement under both methods of absorption and marginal costing for the

above two periods?

12

4.6

Contrasting absorption with marginal costing profit

Tip: The only reason why profits will differ under both methods of costing is due to the way

that each method values finished goods inventory. The marginal costing method values

inventory at variable production cost only never full production cost. The absorption costing

method values inventory at full production cost.

When production volume > sales volume during a period

Inventory levels rise (closing inventory > opening inventory) therefore a greater amount of

fixed overhead under absorption costing is being carried forward to the following period

within the valuation of the closing inventory, therefore creating a higher profit than

marginal costing.

When production volume < sales volume during a period

Inventory levels fall (closing inventory < opening inventory) therefore a smaller amount of

fixed overhead under absorption costing is being carried forward to the following period

within the valuation of the closing inventory, therefore creating lower profit than marginal

costing.

When production volume = sales volume during a period

Inventory levels remain unchanged (closing inventory = opening inventory) therefore both

methods would give exactly the same profit.

Reconciliation of absorption to marginal costing profit

AC profit

X

Less: fixed overhead included within Closing inventory (X)

Add: fixed overhead included within Opening inventory X

MC profit

X

Closing Less

Opening Add

or ‘CLOA’

13

Example 4.5 – Worked example

Using the information from example 3.4 profits under absorption costing are reconciled to

marginal costing profit below for year 1.

AC profit (year 1)

111,000

Less: fixed overhead included within Closing inventory (1,000 x £2) (2,000)

Add: fixed overhead included within Opening inventory nil

MC profit (year 1)

109,000

Note: You can reconcile MC to AC profit by reversing the addition and subtraction of fixed

production overhead included within the finished goods inventory above.

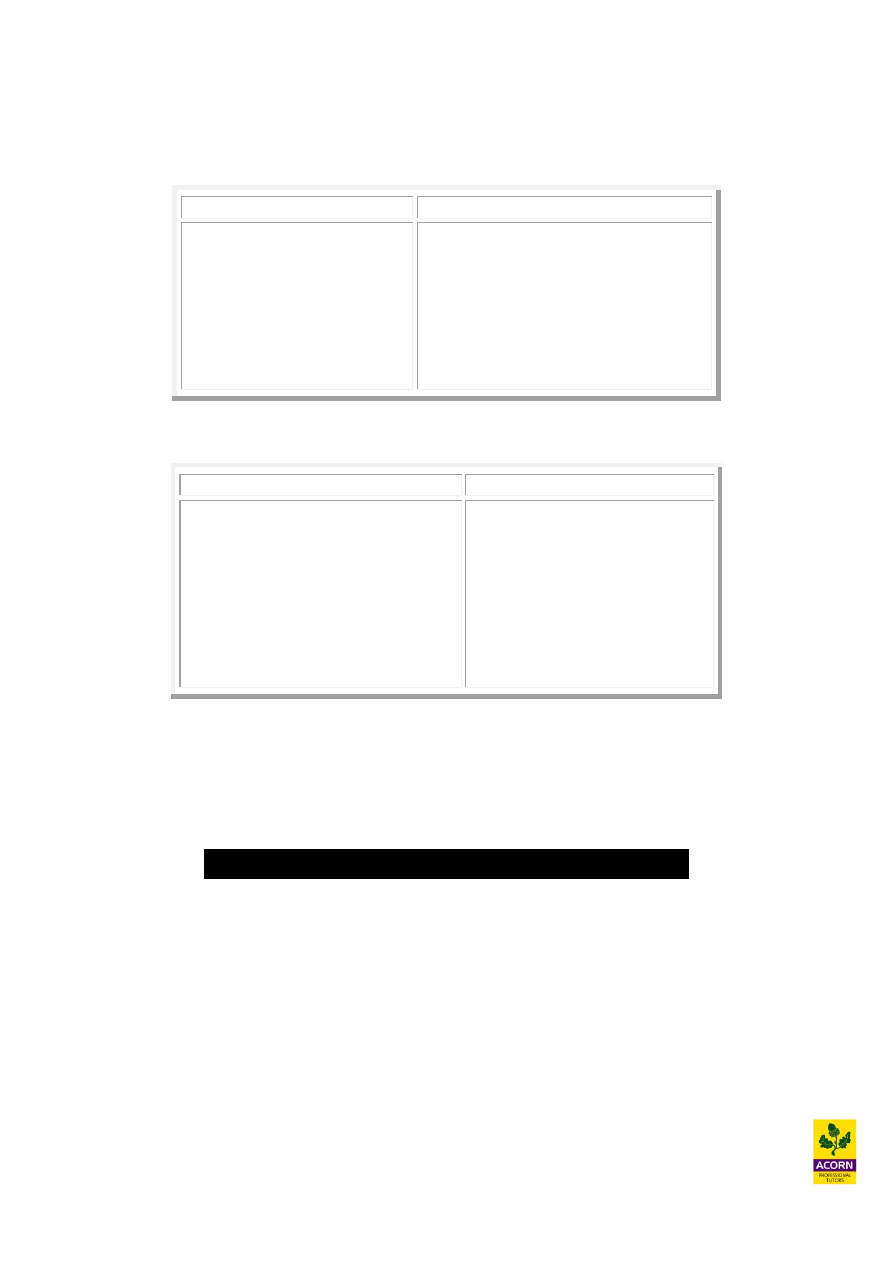

4.7

Advantages and limitations of absorption costing

Advantages

Valuation of finished goods

inventory complies with IAS

2.

Better understanding of the

profitability of products due

to the allocation of fixed

overhead to find a full

production cost per unit.

Better

understanding

for

pricing products due to the

allocation of fixed overhead

to find a full production cost

per unit e.g. pricing will

ensure

production

fixed

overhead is covered in the

long-run.

Limitations

A products unit cost will include fixed

production overhead. Fixed costs are not

relevant for decision making e.g. the

nature of cost behaviour is distorted as

fixed overhead does not rise or fall when a

different number of units are produced.

The method of absorbing fixed production

overhead to a product cost is subjective

e.g. this subjectivity could distort pricing

and profitability analysis for different

products.

Profit can be manipulated by a manager

e.g. a higher profit can be achieved by

deliberately setting a higher production

volume than sales volume for a period.

IAS 2 “Inventories” is the international accounting governing the valuation of inventory. The

accounting standards state that the cost of finished goods should include some apportioned

share of any indirect or fixed production overhead for a financial period. No detailed

knowledge of accounting policies is required for this subject.

14

4.8

Advantages and limitations of marginal costing

Advantages

A better method for decision

making in the short-term e.g. the

nature of cost behaviour is not

distorted

by

excluding

fixed

production

overhead

from

a

product unit cost. The effect on

contribution and therefore profit

can be more accurately measured

when sales volume changes.

Fixed costs are treated in

accordance with there nature e.g. it

could be argued that fixed cost is a

period not product cost.

Profit cannot be manipulated by a

manager e.g. a higher profit cannot

be achieved by deliberately setting

a higher production volume than

sales volume for a period. This is

because no fixed overhead will be

carried forward within the value of

finished goods inventory.

A simpler costing system to

understand and maintain.

Limitations

The valuation of finished goods

inventory does not comply with IAS

2. No indirect or fixed production

overhead is included within the unit

cost of making a product.

Less understanding about the cost of

making a product e.g. only the direct

or variable production cost is

considered.

This

may

distort

information used when pricing or

undertaking a profitability analysis

for different products.

All production and non-production

cost would need to be analysed into

the fixed and variable component, in

order

to

produce

an

income

statement.

This

can

be

time

consuming

especially

if

the

organisation has a high proportion of

semi-variable (or mixed) cost.

Marginal costing is more appropriate for decision making e.g. the nature of cost behaviour is

not distorted by including fixed overhead within a cost unit. Therefore in a situation where a

manager wants to view the true profit effect of increasing or decreasing sales volume,

marginal costing as a method would be more appropriate than absorption costing.

With marginal costing a manager cannot manipulate profit from one period to another by

deliberately setting the volume of production higher than the volume of sales for a period

e.g. stock piling. Using marginal costing would therefore allow a better performance

evaluation of a manager and ensure they concentrate on the maximisation of contribution

rather than profit, leading to greater cash-flow for the organisation.

15

Example 4.6 – (CIMA past exam question)

A manufacturing company uses a standard costing system. Extracts from the budget for April

are shown below:

Sales 1,400 units

Production 2,000 units

Direct costs $15 per unit

Variable overhead $4 per unit

The budgeted fixed production overhead costs for April were $12,800.

The budgeted profit using marginal costing for April was $5,700.

(i) Calculate the budgeted profit for April using absorption costing.

(ii) Briefly explain two situations where marginal costing is more useful to management

than absorption costing.

16

4.9

Activity based costing (ABC)

Activity based costing (ABC) looks in more detail about what causes fixed overhead to be

incurred and works out many ‘cost drivers’ (activities). It is used in order to obtain a more

accurate way of looking at how fixed overhead is driven and should give a more accurate

picture when measuring the cost of supporting different products, markets or customers. It

can also be used to budget more effectively e.g. set prices. The associated revenues and cost

can be ascertained to different product lines or customer groups which can help an

organisation to understand products and customers as a source of earnings. ABC methods

allow an organisation to understand these earnings by linking fixed overhead to the support

activities these customers or products consume.

Characteristics of modern manufacturing

Wide and diverse product ranges e.g. multi-products all consuming different amounts

of manufacturing and support resources e.g. departments, machines and staff.

Fixed overhead a large percentage of total cost therefore ‘material’ in terms of how

fixed overhead should be shared between different products.

Complexity and diversity of production driving fixed overhead.

Steps in ABC

1. Group types of fixed overhead together e.g. overheads which are driven by the

same type of activity or ‘cost driver’

2. Calculate from fixed overhead cost pools a fixed overhead ‘cost per driver’ e.g.

cost per mile, cost per delivery, cost per sales visit, cost per order processed, cost per

call etc.

3. Absorb fixed overhead using ‘multiple cost drivers’ e.g. use ‘cost per driver’ to

identify costs to products, product stages, distribution channels, customer or customer

segments etc.

A cost driver is any factor that causes a change in the cost activity, so it is important to

identify a causal relationship between the cost driver and the cost. This can be done by the

logic of the situation or because some form of physical relationship does exist. Quality

control costs as an example are caused by the carrying out of inspections to ensure quality

standards are being achieved, so this seems to be a good relationship for planning and

controlling the resources that cause this cost.

Factors to consider when selecting cost drivers

1. Is there a cause and effect relationship

2. Does a suitable measure exist

17

Classification of activities

Unit-level activities

Performed each time a unit of the product or service is produced.

Resources are consumed in proportion to the number of units produced or sold.

Examples include direct materials and labour, energy costs and expenses consumed in

proportion to machine processing time.

Batch-related activities

Performed each time a batch of goods is produced.

Costs vary with the number of batches made.

Examples include set-ups, purchase ordering and first item inspection activities.

Product/service sustaining activities

Performed to enable the production of individual products or services.

Examples include activities related to maintaining an accurate bill of materials, preparing

engineering change notices.

Facility-sustaining (or business-sustaining) activities

Performed to support the organisation as a whole.

Examples include plant management, property costs and salaries of general administrative

staff. These are common to all products and services. A ‘pure’ ABC system would treat

facility-level costs as period costs and would not assign them to products. In practice,

facility-level costs might be allocated to individual products using unit-level, batch-level, or

product-level cost drivers.

18

Advantages of ABC

More efficient management of resources by understanding what drives fixed

overhead incurred e.g. elimination, reduction or improvement in the efficiency of

how resources are used can improve profitability.

Better costing information for planning and control e.g. how different products,

customers or distribution channels consume different resources.

More realistic and competitive pricing to cover overhead.

Better profitability analysis because there is more accuracy over costs. It is used in

the retail sector to understand the profitability of different products and services.

Disadvantages of ABC

Time consuming and expensive system to run and maintain e.g. ‘bespoke’

management information systems.

Limited analysis if only a small range of products or a single product is produced.

Danger of going into too much detail. For example the need to strike a balance

between benefit and cost of information.

Assumes fixed overhead is driven ‘directly’ by volume however in reality it tends to

behave in a ‘stepped cost’ way.

It maybe seen as a 100% accurate which is not true as it is only improves our

understanding of overhead cost consumption but it will not tell us how the overheads

were precisely consumed.

19

4.10

Examples of cost drivers

Activity

Cost driver

Material procurement

Material handling

Quality control

Maintenance

Production Scheduling

Set-ups

Finishing

Packaging & Shipping

No. of purchase orders

No. of movements or number of parts

No. of inspections

No. of break-downs

No. of production ‘orders’

No. of production line set-ups

Direct labour hours

Number of orders shipped

Cost drivers can also be identified in the service sector e.g., in a Hospital Cardiology Unit:

Activity

Cost driver

Booking appointments

Treating Patients

Providing hygienic care

X-ray: Equipment preparation

Patient preparation

Film processing

Responding to patient requests

Monitoring patients

Patient aftercare

No. of patients

No. of treatments

Time taken

Time taken

Time taken

No. of images

No. of requests

Monitoring hours

Time taken

Illustration of applying ABC within a service sector organisation

The Services Agency, a Not For Profit (NFP) organisation, has two divisions operating

within the same building which occupies 30,000 square metres that deliver the following

range of services to a range of customers:

Description

Service 1 Industry Advisory Services

Service 2 Community Education

Service 3 Private Practitioner Accreditation

Service 4 Policy Advice & Coordination

Employee Related Costs is the major category of cost incurred by each division. The

divisional management considers that it is cost beneficial to trace these costs directly to

individual services. All Employee Related Costs have been assumed to behave in the same

way and traced to services on the same basis. (A direct cost is a cost that can be directly

traced to a cost object in an economically feasible manner).

20

The divisional directors provided the following analysis of time spent on each service:

Service

Delivery

Division

Regulation

and Policy

Division

Service 1 : Industry Advisory Services

90%

10%

Service 2 : Community Education

10%

30%

Service 3 : Private Practitioner Accreditation

-

50%

Service 4 : Policy Advice & Coordination

-

10%

Based on this analysis, Employee Related (direct) Costs are traced to services as

follows:

Costs

Service

1

Service

2

Service

3

Service

4

Total

$’000

$’000

$’000

$’000

$’000

Employee Related Expenses:

Service Division

94,500 10,500

-

-

105,000

Regulation and Policy Division

3,200

9,600 16,000

3,200

32,000

Total Direct Costs

97,700 20,100 16,000

3,200 137,000

Other indirect costs (operating expenses) are aggregated in two cost pools:

Administration cost pool

Occupancy cost pool

It was decided that administration costs were driven by the number of employee full-time

equivalents (FTE’s) and occupancy costs were driven by space occupied by each division.

21

Service

Regulation

Delivery and Policy

Division

Division

Total

$’000

$’000

$’000

Administration cost pool

Advertising and promotion

750

250

1,000

Auditor’s remuneration

250

250

500

Consultancies

1500

500

2,000

Courier and freight

300

100

400

Operating lease

2,000

500

2,500

Telephone

2,000

1,000

3,000

Travel and accommodation

3,000

600

3,600

Other operating expenses

1,500

700

2,200

11,300

3,900

15,200

Service Sustaining cost pool

Technology

1,400

400

900

Consultancy Rooms

18,000

5,000

23,000

Total

19,400

5,400

24,800

Managers of the two divisions were asked to quantify the cost drivers. The managers

estimated the proportion of the 30,000 square metres of floor space occupied by the two

divisions to be the appropriate driver for Service Sustaining costs and the proportion of FTE’s

involved in delivering each service as the appropriate driver for administration costs.

The following budgeted driver volumes were established:

Cost Driver

Service 1 Service 2 Service 3 Service 4

Total

Employees (FTE)

1,898

390

310

62

2,660

Floor area (sq. metres) 19,000

5,000

5,000

1,000

30,000

The cost drivers established were:

Administration = $15,200 / 2,660 = $5.714 per FTE

Occupancy = $24,800 / 30,000 = 0.827 per sq. metre

22

Applying these costs drivers to each service resulted in the following activity based costs:

Costs Pool

Cost

Driver

Service 1

$’000

Service 2

$’000

Service 3

$’000

Service 4

$’000

Total

$’000

Administration

No. FTE

10,846

2,229

1,771

354 15,200

Occupancy

Floor area

15,713

4,135

4,135

827 24,800

Total Service Cost = Direct Costs + Indirect (Activity Based) Costs

Service Costs

Service 1

$’000

Service 2

$’000

Service 3

$’000

Service 4

$’000

Total

$’000

Direct Costs

97,700

20,100

16,000

3,200

137,000

Activity Based Costs

26,559

6,364

5,906

1,181

40,010

Total Service Costs

124,259

26,464

21,906

4,381

177,010

If it is not possible to find a sensible cost driver for an activity then you should leave the

activity out of your calculations as including it will make the information meaningless

because the activity will be distributed in an arbitrary basis between products. Instead we

should not include it in our calculations and seek more information about a sensible cost

driver for the activity. This should be stated quite clearly in your answer if appropriate.

Example 4.7

For a hospital which of these does not seem like a sensible activity and cost driver?

Activity

Cost driver

a) Insurance for building

Maintenance costs

b) Phone appointments

No. of patients

c) Patient main reception

No. of patients

d)

Length of patient stay

No. of patients

23

Example 4.8 – Worked example

A Ltd has recently introduced an activity based costing system. It manufactures two products

details were as follows:

Product A

Product B

Budgeted annual production (units) 50,000

30,000

Batch size (units)

1,000

300

Machine set ups per batch

7

5

Budgeted costs for the machine set up for the above period was £55,250.

Calculate the budgeted machine set up cost for the above period.

Number of batches (50,000/1,000 = 50) + (30,000/300 = 100) = 150 batches

Number of set ups (50 x 7) + (100 x 5) = 850

Therefore £55,250/850 = £65 a set up

24

Example 4.9

Pre-packed Plc makes a range of microwaveable dishes, which sell in well-known

supermarkets across the U.K. Details about 3 products it sells are as follows.

Chicken Sweet and

Lamb

Curry

Sour Vegetables Vindaloo

Monthly sales

40,000

25,000

30,000

£ £ £

Selling price

2.99

3.50

3.99

Ingredients

(0.99)

(0.50)

(1.49)

Labour

(0.50)

(0.75)

(0.50)

Contribution

1.50

2.25

2.00

Budgeted fixed overhead for one month in the factory is £100,000 and staff are paid £4 an

hour.

Pre-packed Plc also has the following information available:

Chicken

Sweet and

Lamb

Curry

Sour Vegetables Vindaloo

Cooking time per batch

In Kilojoules

6,000

4,000

10,000

Batches (number of

Set ups per month)

4

5

10

Shredding, mixing and

Packaging per batch

(Machine hours)

100

25

125

The monthly overhead after being analysed is as follows:

£

Set up costs

50,000

Cooking

30,000

Shredding, mixing

and packaging

20,000

100,000

Analyse the profitability of the 3 products using both AC and ABC costing?

25

Longer term decisions and ABC

ABC has many uses and there are very good benefits to an organisation when formulating

their long term strategic decisions, such as product pricing, mix of products, discontinuance,

launch or promotion of existing products and the launch of new products.

ABC’s strength lies in the fact it allows accuracy over costs and drivers for products and as a

result a sensible pricing strategy is achieved. It more specifically gives a good long term

understanding of the variable costs being very relevant for decision making.

However ABC information must be put into perspective as these are historic costs and cannot

be used alone to predict future costs. They should be used as a starting point and other

internal and external information should be used to determine future costs. All costs are

variable in the long term and subject to change.

4.11

Customer profitability analysis (CPA)

Relating specific costs to serving customers or groups of customers, so that their relative

profitability can be assessed. CPA uses ABC techniques in order to allocate cost.

Customer profitability analysis (CPA) focuses on cost reduction by understanding how

customers consume different support resources e.g. processing, delivery, sales visits,

telephone support, internet support etc. It allows an organisation to concentrate on the most

profitable of its customers.

CPA

Revenue

X

Less discounts (X)

Net revenue

X

Less cost of goods sold (X)

Gross margin

X

Customer specific costs

Financing

(X)

Purchasing costs

(X)

Invoicing

(X)

Deliveries made

(X)

Sales visits

(X)

After sales support

(X)

Inventory cost

(X)

Net margin

X

Gross margin/contribution is what the

organisation traditionally relied upon

Better profitability analysis using ABC

techniques

26

Other types of customer driven costs include

1. Location

2. Delivery frequency

3. Quality provided

4. After sales service activities

5. Sales and promotion effort

6. Administration

Benefits of CPA

Customer group (segment) profitability can be better understood e.g. marketing focus

on the most profitable customers.

Unprofitable customers groups can be rationalised or strategies implemented to

reduce their consumption of resources.

More effective pricing policies e.g. financial effect of customer proposals can be

better analysed when negotiating with customers.

Limitations of CPA

Limited analysis if only a small range of customer groups.

Time consuming and expensive system to run and maintain e.g. ‘bespoke’

management information systems.

Assumes fixed overhead is driven ‘directly’ by volume however in reality it tends to

behave in a ‘stepped cost’ way.

27

Example 4.10

Industrial floorings Ltd, specialises in a range of flooring for all industrial purposes. The MD

wishes to analyse two customers Robertson Interiors and BJ Flooring in order to assess their

relative profitability.

Robertson Interiors give 10 batches of orders a year (averaging 1,000 tiles in one order) and

because of this size receive a 15% discount. They are also a popular customer and therefore

are visited once a month, with sales reps driving a total of 4,500 miles a year to see this

client.

BJ Flooring gets no discount, orders 4 batches a year (averaging 500 tiles in an order), and is

normally visited twice a year. They are based in Europe and therefore sales mileage per year

for this client is 10,000 miles.

You are also provided with the following information

Total transport cost £200,000 (sales fleets normally travel about 200,000 miles a year)

Purchase order-processing cost in total £500,000 (receiving 500 very complex orders a year)

Salesman salaries £500,000 a year (the team doing around 25,000 visits a year between them)

The average price of a single floor tile is around £50 and the normal variable cost of

manufacture is £30 a tile.

Conduct a CPA on the two clients?

4.12

Direct product profitability (DPP)

By the use of “shopping basket analysis” a retailer can understand consumer behaviour

through the products that they purchase. Through database warehousing and mining of

customer purchases e.g. through EPOS systems and loyalty card schemes, a retailer can try to

infer interest, values and choice criteria and predict purchase probabilities for other products

customers may buy. ABC techniques can also be applied within the retail sector.

Traditionally the retail industry relied upon gross margins (the ratio of gross profit to sales,

also referred to as contribution to sales ratio) as a focus point for determining product

profitability. However this analysis ignores the direct store support activities, such as shelf

filling, warehousing and transportation for each product.

DPP is a decision making tool that helps a food merchandiser by providing a better indication

of the profitability of products on the supermarket shelves. DPP allocates direct product

costs to individual products. These costs are subtracted from gross profit to derive at DPP for

each product. The normal indirect costs attributed to products would be distribution,

warehousing and retailing. DPP would ignore indirect costs such as head office overhead,

only product specific fixed (indirect) cost would be analysed. e.g. shelf filling, warehousing

and transportation.

28

Why the allocation of direct support overhead to products?

Warehousing cost involves refrigeration and storage overhead, the more bulky a product is,

the more floor area it consumes, a limiting factor for most retail organisations e.g. dairy or

frozen produce will cost more to store within refrigerated units. Transport with dedicated

refrigeration will consume more overhead in delivery cost; more bulkiness means a lower

number of units being transported each time, giving a higher unit cost per delivery. The

higher the cubic capacity of a product the more shelf space it uses, the bigger the weight and

cubic capacity the greater the handling costs for staff once a product arrives in store. By

understanding what drives cost when resources are consumed to support products, this will

enable a retailer to maximise throughput of the most profitable products, as well as giving

more effective information to control cost and manage store resources e.g. making sure

vehicles carry full loads to reduce the number of journeys.

Strategies to improve customer or product profitability

1. Increase price

2. Increase volume sold

3. Reduce support activities that incur specific customer or product cost

4. Withdrawal e.g. discontinue selling

Viewing either products or customers as a source of earnings

Profitability analysis often ignores the ‘life cycle of earnings’ from customers or

products e.g. students at university may have low earning potential before graduating,

however could be a bigger source of earnings when they graduate and become more

affluent.

Basis of calculating earnings can be subjective e.g. what costs do we include and how

do we attach them?

Decisions about earnings often ignore interdependence e.g. unprofitable products may

attract more customers into a store to buy other items.

Product or customer views of earnings can conflict e.g. low profit on product A but

customer B buys other products as well therefore a source of high earnings. So do

discontinue A? DPP would suggest so however CPA may not.

29

Example 4.11 - homework

Cheap and cheerful supermarkets operate 5 supermarkets across the UK and details about

current overhead of support activities to the stores are given.

Warehousing cost per week

£000s

Staff overhead

350

Refrigeration

50

Building overhead

250

650

Cost of one supermarket per week

£000s

Staff overhead

50

Refrigeration

50

Building overhead

50

150

Transport cost

Refrigerated lorries £3,000 a delivery (carrying up to 120 cubic metres)

Standard lorries £2,000 a delivery (carrying up to 120 cubic metres)

The total volume of all goods sold for all 5 supermarkets is 100,000 cubic metres a week of

which 20% of this amount is refrigerated produce.

The manager of a supermarket is unsure about 2 products, the 4-pint of organic skimmed

milk and the own brand pack of 50 disposable nappies, details of which are as follows;

Milk

Nappies

Price

£1.09

£11.95

Cost of good

£0.24

£7.95

Number of items per metre cube

100

20

Time in warehouse (weeks)

0.5

4

Time on shelf (weeks)

0.2

1

Sales per week

10,000

500

Conduct a DPP analysis on the 2 products concerned and recommend ways in which Cheap

and cheerful can reduce overhead or increase the efficiency of their operations?

30

4.13

Distribution channel profitability (DCP)

DCP another ABC concept, is about relating specific distribution costs to serving customers

or groups of customers, so that their relative profitability can be assessed. Typical supply

chain channels today include the internet, e-mail, shops/branches, post, telephone, catalogues,

other distributors etc. Supply chain management has become a large part of costs today due

to the huge amount of different sales mediums that organisations now have to offer

customers.

4.14

Activity based budgeting (ABB)

Activity based budgeting (ABB) uses cost driver data in the budgetary planning and control

stage, in other words cost levels are forecast and determined by using ABC techniques.

Therefore ABB is a form of budget preparation that focuses on the activities of an

organisation. All costs are related to those activities and can be split into primary activities

(value added activities) and secondary activities (non-value added activities). Non-value

added activities if not supporting the value added activities effectively, should be questioned

as to whether it should exist at all.

ABB recognises that different costs have different causes, rather than assuming that all costs

can be absorbed on the basis of labour hours (the more traditional approach). ABB therefore

should produce more accurate budgeted figures against which actual costs can be compared

to yield more meaningful variances.

31

Example 4.12

Pre-packed Plc within example 4.9, which makes a range of microwaveable dishes, which

sell in well-known supermarkets across the U.K, is thinking of producing a ‘Mex Tex’ Chilli

version for there existing product range. The new recipe has been given the following details

by the head chef.

Direct cost of manufacture per unit

£

Ingredients

0.89

Labour

0.50

Total direct cost

1.39

‘Mex Tex’ Chilli (2,000 in a batch) new recipe

Cooking time per batch

In Kilojoules

5,000

Shredding, mixing and

Packaging per batch

(Machine hours)

30

Due to uncertainty of forecasting demand, Pre-packed Plc has decided to cook the new dish,

in batches of 2,000 only, selling them at a retail price of £3.99, using the cost drivers

calculated within example 3.9; produce a budget based on 1 batch of ‘Mex Tex’ Chilli, and

comment on your results?

32

Example 4.13 – (CIMA past exam question)

RJ produces and sells two high performance motor cars: Car X and Car Y. The company

operates a standard absorption costing system. The company’s budgeted operating statement

for the year ending 30 June 2008 and supporting information is given below:

Operating statement year ending 30 June 2008

Car X

Car Y

Total

$000

$000

$000

Sales

52,500

105,000

157,500

Production cost of sales

40,000

82,250

122,250

Gross profit

12,500

22,750

35,250

Administration costs

Variable

6,300

12,600

18,900

Fixed

7,000

9,000

16,000

Profit/(loss)

(800)

1,150

350

The production cost of sales for each car was calculated using the following values:

Car X

Car Y

Units

$000

Units

$000

Opening inventory

200

8,000

250

11,750

Production

1,100

44,000

1,600

75,200

Closing inventory

(300) (12,000)

(100)

(4,700)

Cost of sales

1,000

40,000

1,750

82,250

Production costs

The production costs are made up of direct materials, direct labour, and fixed production

overhead. The fixed production overhead is general production overhead (it is not product

specific). The total budgeted fixed production overhead is $35,000,000 and is absorbed using

a machine hour rate. It takes 200 machine hours to produce one Car X and 300 machine hours

to produce one Car Y.

Administration costs

The fixed administration costs include the costs of specific marketing campaigns: $2,000,000

for Car X and $4,000,000 for Car Y.

(a) Produce the budgeted operating statement in a marginal costing format. (7 marks)

(b) Reconcile the total budgeted absorption costing profit with the total budgeted

marginal costing profit as shown in the statement you produced in part (a). (3 marks)

33

The company is considering changing to an activity based costing system. The company has

analysed the budgeted fixed production overheads and found that the costs for various

activities are as follows:

$000

Machining costs

7,000

Set up costs

12,000

Quality inspections

7,020

Stores receiving

3,480

Stores issues

5,500

35,000

The analysis also revealed the following information:

Car X Car Y

Budgeted production (number of cars)

1,100

1,600

Cars per production run

10

40

Inspections per production run

20

80

Number of component deliveries during the year

492

900

Number of issues from stores

4,000

7,000

(c) Calculate the budgeted production cost of one Car X and one Car Y using the

activity based costing information provided above. (10 marks)

(d) Prepare a report to the Production Director of RJ which explains the potential

benefits of using activity based budgeting for performance evaluation. (5 marks)

4.15

Job and batch costing

Job costing is a form of specific order costing where costs are charged to individual orders or

jobs for customers e.g. printers or a special purpose machine, tailor made to order. Job sheets

or cost records are normally assigned to a job code, keeping record of labour, material or

overhead to be charged or allocated to it. This ensures costs are kept under control, but also

cost estimates can be used in order to charge a price, which is more likely to earn profit. Job

cards would include customer details, a job number, as well as columns for calculation of

material, labour and overhead estimates.

Batch costing is a form of specific order costing; similar in most ways to job costing e.g. the

job would be to manufacture a large number of identical items (or a batch), such as 1000

identical commemorative mugs.

34

Example 4.14

Estimate details regarding Job 1056 to make and assemble specialist engineering equipment

for an extraction machine:

Direct labour hours worked on job 1056

37 hours (grade A staff)

50 hours (grade B staff)

Components and parts issued to job 1056

£8,560 (£3,000 returned)

Grade A staff are paid £8.60 an hour

Grade B staff are paid £6.50 an hour

The company operates an absorption costing system charging the following rates for

production overhead

Grade A £5.00 an hour overhead absorption rate

Grade B £3.00 an hour overhead absorption rate

Given the company adds a mark-up of 100% to the total cost of a job in order to charge

the customer, what would be the price of job 1056?

4.16

Service costing

Characteristics of service organisations

Intangible e.g. cannot touch or feel what is offered

Simultaneous e.g. cannot be returned if faulty

Perishable e.g. cannot be stored

Heterogeneous e.g. differences in the exact service supplied each time not perfectly

identical (homogenous)

Why use service costing

To help control the departments costs e.g. budgetary control

To help improve the efficiency of how the service is used by other departments when

internal or external charging takes place

35

Examples of cost units for service organisations

Cost per hour

Cost per tonne

Cost per kilogram

Cost per mile

Cost per service unit produced e.g. any operation performed

Sometimes it is difficult to use a standard single measure, generally defined as cost divided

by a unit of time, weight, distance or unit of measure of some other kind. Service

organisations may make use of composite cost units; whereby the cost is expressed using

two combined measures. Composite cost units are when an organisation uses some kind of

cost per unit made up of two parts, a system used more often for service organisations than a

manufacturer.

Composite cost units are sometimes more useful for control purposes e.g. it may not be just

the weight being carried for a transportation organisation that is important, but also how far it

is transported as well that drives costs to be incurred.

Examples of composite cost units

Cost per tonne per mile

Cost per passenger per mile

Cost per employee per hour

Cost per patient per day

36

Key summary of chapter

Absorption costing

Traditional absorption costing takes the total budgeted fixed overhead for a period and

divides by a budgeted (or normal) activity level in order to find the overhead absorption

rate. This is a simple fixed overhead costing method, allowing fixed overhead to be

allocated to products, jobs, and stock or work-in-progress.

Overhead absorption rate (OAR) =

Budgeted production overhead

Normal level of activity

Any under charge to the profit and loss account would be an ‘under absorption’

of production overhead e.g. DR profit and loss account CR Production overhead

control account.

Any over charge to the profit and loss account would be an ‘over absorption’ of

production overhead e.g. CR profit and loss account DR Production overhead control

account.

Marginal costing

A marginal cost (direct or variable cost) is a cost that can be avoided if a unit is not produced

or incurred if a unit was produced. Fixed cost remains constant whether a unit is or is not

produced. Marginal (or variable) costing assigns only variable costs to cost units while fixed

costs are written off as period costs.

Cost per unit:

Direct costs of production

Direct labour

X

Direct material

X

Direct variable production overhead

X

Total direct variable cost or total prime cost

X

Marginal costing stock valuation

Indirect production overhead absorbed

X

Full production cost

X

Absorption costing stock valuation

37

Marginal costing – pro forma income (profit) statement

$

$

Sales

X

Less cost of sales

Opening stock (valued at variable production cost only)

X

Total variable production cost*

X

X

Less closing stock (valued at variable production cost only) (X)

(X)

Less non-production variable cost

(X)

Contribution

X

Less fixed production cost

(X)

Less fixed non-production cost (X)

Net profit

X

*Direct labour, direct material and direct (or variable) production overhead

Terminology: Contribution equals Sales less ALL marginal (or variable) cost

Absorption costing – pro forma income (profit) statement

$

$

Sales

X

Less cost of sales

Opening stock (valued at full production cost)

X

Total variable production cost*

X

Fixed production overhead absorbed

X

X

Less closing stock (valued at full production cost)

(X)

X

(Over)/under absorption of fixed production overhead

(X)/X

(X)

Gross profit

X

Less non-production fixed and variable cost (X)

Net profit

X

*Direct labour, direct material and direct (or variable) production overhead

38

Reconciliation of absorption to marginal costing profit

AC profit

X

Less: fixed overhead included within Closing inventory (X)

Add: fixed overhead included within Opening inventory X

MC profit

X

Activity based costing (ABC)

Activity based costing (ABC) looks in more detail about what causes fixed overhead to be

incurred and works out many ‘cost drivers’ (activities).

Steps in ABC

1. Group types of fixed overhead together.

2. Calculate from fixed overhead cost pools a fixed overhead ‘cost per driver’.

3. Absorb fixed overhead using ‘multiple cost drivers’.

A cost driver is any factor that causes a change in the cost activity, so it is important to

identify a causal relationship between the cost driver and the cost.

Customer profitability analysis (CPA)

Relating specific costs to serving customers or groups of customers, so that their relative

profitability can be assessed. CPA uses ABC techniques in order to allocate cost.

Customer profitability analysis (CPA) focuses on cost reduction by understanding how

customers consume different support resources e.g. processing, delivery, sales visits,

telephone support, internet support etc. It allows an organisation to concentrate on the most

profitable of its customers.

Direct product profitability (DPP)

DPP is a decision making tool that helps a food merchandiser by providing a better indication

of the profitability of products on the supermarket shelves. DPP allocates direct product

costs to individual products. These costs are subtracted from gross profit to derive at DPP for

each product. The normal indirect costs attributed to products would be distribution,

warehousing and retailing. DPP would ignore indirect costs such as head office overhead,

only product specific fixed (indirect) cost would be analysed. e.g. shelf filling, warehousing

and transportation

Closing Less

Opening Add

or ‘CLOA’

39

Activity based budgeting (ABB)

ABB uses cost driver data in the budgetary planning and control stage, in other words cost

levels are forecast and determined by using ABC techniques. Therefore ABB is a form of

budget preparation that focuses on the activities of an organisation. All costs are related to

those activities and can be split into primary activities (value added activities) and secondary

activities (non-value added activities). Non-value added activities if not supporting the value

added activities effectively, should be questioned as to whether it should exist at all.

Job and batch costing

Job costing is a form of specific order costing where costs are charged to individual orders or

jobs for customers e.g. printers or a special purpose machine, tailor made to order.

Batch costing is a form of specific order costing; similar is most ways to job costing e.g. the

job would be to manufacture a large number of identical items (or a batch), such as 1000

identical commemorative mugs.

Service costing

Characteristics of service organisations

Intangible e.g. cannot touch or feel what is offered

Simultaneous e.g. cannot be returned if faulty

Perishable e.g. cannot be stored

Heterogeneous e.g. differences in the exact service supplied each time not perfectly

identical (homogenous)

Why use service costing

To help control the departments costs e.g. budgetary control

To help improve the efficiency of how the service is used by other departments when

internal or external charging takes place

Examples of cost units for service organisations

Cost per hour

Cost per tonne

Cost per kilogram

Examples of composite cost units

Cost per tonne per mile

Cost per passenger per mile

40

41

Solutions to lecture examples

42

Chapter 4

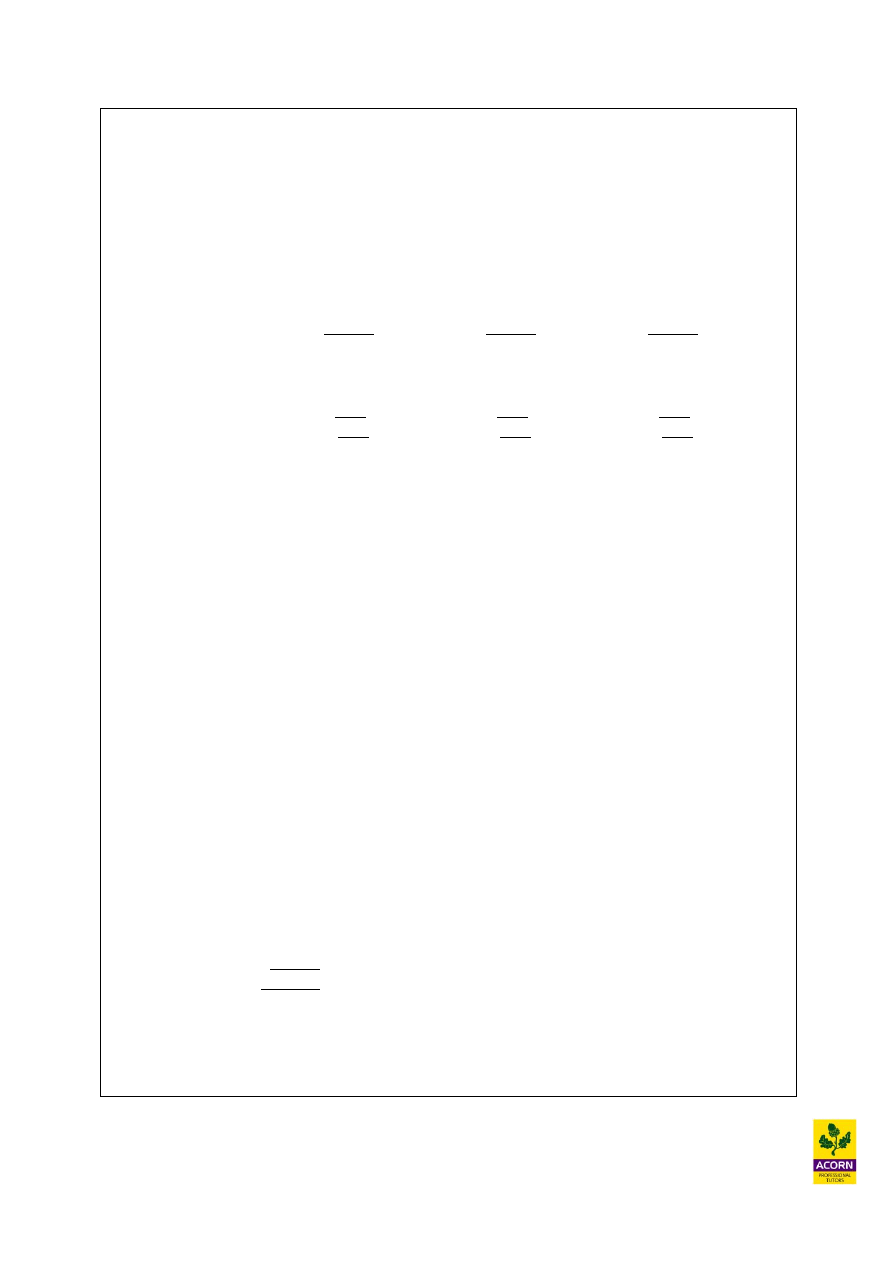

Example 4.3 – (CIMA past exam question)

Traditional absorption costing takes the total budgeted fixed overhead for a period and

divides by a budgeted (or normal) activity level e.g. units, in order to find the overhead

absorption rate. This is a simple method of charging fixed overhead and allows fixed

overhead to be allocated to products, jobs or work-in-progress

Overhead absorption rate (OAR) =

Budgeted production overhead

Normal/budget level of activity

*Std Overhead absorption rate per unit (£330,000 ÷ 220,000) = £1.50

Over absorption of fixed overheads for the period is £40,000.

Actual production overhead

Actual production (200,000 units) x *O.A.R £1.50

= F/OH charge during the period £300,000

Production fixed overhead control account

£260,000

Over absorption

(£300,000 - £260,000) £40,000

43

Example 4.4

Marginal costing statement

Year 1

Year 2

£

£

£

£

Sales

(10,000 x £30)

300,000

(10,000 x £30)

300,000

Less cost of sales

Opening stock

(1,000 x £17.00)

0

17,000

Production variable cost

(11,000 x £17.00)

187,000

(9,000 x £17.00)

153,000

Less closing stock

(1,000 x £17.00)

(17,000)

0

(170,000)

(170,000)

Contribution

130,000

130,000

Fixed production cost (actual)

(21,000)

(21,000)

Net profit

109,000

109,000

44

Absorption costing statement

Year 1

Year 2

£

£

£

£

Sales

(10,000 x £30)

300,000

(10,000 x £30)

300,000

Less Production cost

Opening stock

(1,000 x £19.00)

0

19,000

Production variable cost

(11,000 x £17.00)

187,000

(9,000 x £17.00)

153,000

Fixed production cost absorbed

(11,000 x £2.00)

22,000

(9,000 x £2.00)

18,000

Less closing stock

(1,000 x £19.00)

(19,000)

0

(Over)/under absorption

(1,000)

3,000

(189,000)

(193,000)

Net profit

111,000

107,000

The delay in charging fixed production overhead under absorption costing leads to the

following situations, assuming the OAR in the case above remains constant.

Production > Sales (Year 1) Stock levels are rising therefore a greater proportion of fixed

overhead under absorption costing is being carried forward to the following period therefore

creating a greater profit than marginal costing.

Production < Sales (Year 2) Stock levels are falling therefore a smaller proportion of fixed

overhead under absorption costing is carried forward to the following period therefore

creating lower profit (by charging more fixed overhead for this period) than marginal

costing.

Production = Sales (Year 1 and 2) As should be in the long-run, both methods would give

exactly the same profit. If you add both years profits above together under both methods, the

total comes to £248,000, in both years together production equals sales. This is because

under absorption costing the same overhead would be brought in as is taken out in stock

valuation.

Note: Remember the only reason why profits differ under both methods is because of

differences in stock valuation.

45

Example 4.6 – (CIMA past exam question)

Part (i)

Under the absorption costing method $3,840 of fixed overhead would be carried forward to

the next financial period, due to production being higher than sales (production > sales).

(2,000 units – 1,400 units) x $6.40 = $3,840. Therefore absorption costing profit would be

$3,840 greater than using marginal costing.

Budgeted profit for absorption costing

$

Marginal costing profit

5,700

Add: Fixed overhead carried forward to the next period

3,840

Absorption costing profit

9,540

Part (ii)

Tip: A marginal cost (variable cost) is a cost that can be avoided if a unit is not

produced or would be incurred if a unit was produced. A fixed cost remains constant

whether a unit is or is not produced, therefore including fixed overhead within a cost

unit can distort decision making when working out the profit effect of increasing or

decreasing sales.

Marginal costing is more appropriate for decision making e.g. the nature of cost

behaviour is not distorted by including fixed overhead within a cost unit. Therefore

in a situation where a manager wants to view the true profit effect of increasing or

decreasing sales volume, marginal costing would be more appropriate e.g. for

techniques such as sensitivity, ‘what if?’ or break-even analysis.

A manager cannot manipulate profit from one period to the next by deliberately

setting the volume of production higher than sales for a period e.g. stock piling.

Using marginal costing would therefore allow a better performance evaluation of a

manager and ensure they concentrate on the maximisation of contribution leading to

greater cash-flow for the organisation.

46

Example 4.7

For a hospital which of these does not seem like a sensible activity and cost driver?

Activity

Cost driver

a) Insurance for building

Maintenance costs

b) Phone appointments

No. of patients

c) Patient main reception

No. of patients

d)

Length of patient stay

No. of patients

The answer is d

Example 4.9

Pre-packed Plc

Absorption costing

Labour hours

CC 40,000 x 0.50/4.00 = 5,000 hrs

SV 25,000 x 0.75/4.00 = 4,688 hrs

LV 30,000 x 0.50/4.00 = 3,750 hrs

13,438 hrs

£100,000 / 13,438 = £7.44 PER LABOUR HOUR

Chicken

Sweet and Lamb

Curry Sour Vegetables

Vindaloo

Monthly sales

40,000

25,000

30,000

£ £ £

Selling price

2.99

3.50

3.99

Ingredients

(0.99)

(0.50)

(1.49)

Labour

(0.50)

(0.75)

(0.50)

Contribution

1.50

2.25

2.00

Fixed overhead

£7.44 x

0.50/4.00

(0.93)

0.75/4.00

(1.40)

0.50/4.00

(0.93)

PROFIT

0.57

0.85

1.07

TOTAL PROFIT £22,800 £21,250 £32,100

47

ABC

Set ups 4 + 5 + 10 = 19

£50,000/19 = £2,632 a batch

Shredding mixing and packaging

100 x 4 = 400

25 x 5 = 125

125 x 10 = 1,250

1,775 machine hours

£20,000/1,775 = £11.27 per machine hour

Cooking

6,000Kj x 4 = 24,000

4,000Kj x 5 = 20,000

10,000Kj x 10 = 100,000

144,000

£30,000/144,000 = £0.208 per Kj

Fixed overhead analysis

Chicken

Sweet and

Lamb

Curry

Sour Vegetables

Vindaloo

£ £ £

Set up

£2632 x

4

10,528

5

13,160

10

26,320

Shredding mixing

And packaging

£11.27 an hour x

100 hrs x 4

4,508

25 hrs x 5

1,409

125 hrs x 10

14,088

Cooking

£0.21 per Kj x

6,000 Kj x 4

5,040

4,000 Kj x 5

4,200

10,000 Kj x 10

21,000

Total F/OH per unit 20,076

38,845

61,408

48

Chicken Sweet and

Lamb

Curry

Sour Vegetables

Vindaloo

Monthly sales

40,000

25,000

30,000

£ £ £

Revenue

119,600

87,500

119,700

Ingredients

(39,600)

(12,500)

(44,700)

Labour

(20,000)

(18,750)

(15,000)

Contribution

60,000

56,250

60,000

Fixed overhead

(20,076) (38,845) (61,408)

PROFIT

39,924

17,405

(1,408)

Notice how after using ABC the overall profitability of lamb turns into a loss. This will be

useful to management!

Example 4.10

Robertson Interiors (£)

BJ Flooring (£)

Revenue

500,000

100,000

15% DISCOUNT

(75,000)

n/a

Net revenue

425,000

100,000

Cost of goods sold

(300,000)

(60,000)

Gross margin

125,000

40,000

Transport

(4500)

(10,000)

Orders

(10,000)

(4,000)

Visits

(240)

(40)

Net margin

110,260

25,960

Transport £200,000/200,000 miles = £1 a mile

Orders £500,000/500 orders = £1,000 an order

Salesman £500,000/25,000 visits = £20 a visit

49

Example 4.11

Warehouse

Labour 350,000/100,000 = £3.50 per mc per week

Refrigeration 50,000/20,000 = £2.50 per mc per week

Building 250,000/100,000 = £2.50 per mc per week

Supermarkets

Staff 50,000 x 5/100,000 = £2.50 per mc per week

Refrigeration 50,000 x 5/20,000 = £12.50 per mc per week

Building 50,000 x 5/100,000 = £2.50 per mc per week

Transport

Refrigeration £3,000/120 mc = £25.00 per mc delivery cost

Standard £2,000/120 mc = £16.67 per mc delivery cost

Milk (£)

Nappies (£)

Price

1.09

11.95

Cost of good sold

0.24

7.95

Gross margin

0.85

4.00

Warehouse

Labour 3.50/100 x 0.5

0.02

Labour 3.50/20 x 4

0.70

Refrigeration 2.50/100 x 0.5 0.013

Building 2.50/100 x 0.5

0.013

Building 2.50/20 x 4

0.50

Supermarkets

Staff 2.50/100 x 0.2

0.005

Staff 2.50/20 x 1

0.125

Refrigeration 12.50/100 x 0.2

0.025

Building 2.50/100 x 0.2

0.005

Building 2.50/20 x 1

0.125

Transport

25.00/100

0.25

16.67/20

0.834

Profit

0.519

1.716

Focus on trying to reduce the stockholding period for nappies. Also transportation costs

could be passed on to the supplier or concentrate on carrying full loads if the company has to

use their own vehicles.

50

Example 4.12

Fixed overhead budgeted cost of a batch of 2.000 ‘Mex Tex’ Chillies

Set up

£2,632

Shredding, mixing and

Packaging

Machine hours £11.27 per machine hour x 30 hours =

£338

Cooking

£0.208 per Kj x 5,000 Kilojoules

£1,040

£4,010

Retail value (2,000 units in a batch x £3.99)

£7,980

Direct cost of manufacture

£1.39 x 2000 units in a batch (£2,780)

Fixed overhead consumed (as above)

(£4,010)

Profit

£1,190

Presumably the retailer will want a fair margin for each unit sold at £3.99; this will not leave

very much profit, if any at all if this is the case. Perhaps the ‘Tex Mex’ is priced

competitively, in which case Pre-packed Plc must find ways of reducing the resources each

production run would consume. Perhaps consider a reduction in weight of the product to

reduce ingredients used or the production of a greater number of units produced in one set up

in order to reduce the average fixed cost per unit.

51

Example 4.13 – (CIMA past exam question)

Part (a)

First we need to work out variable production costs per car. In order to find this we must

work out fixed production costs per car and deduct this from total production costs per car

given to give us variable production cost per car.

Total production costs per car

Car X total production cost per car = $40,000,000 / 1,000 = $40,000

Car Y total production cost per car = $82,250,000 / 1,750 = $47,000

Fixed production overheads absorbed per car

Fixed production overheads = $35,000,000

Budgeted machine hours = (1,100 x 200) + (1,600 x 300) = 700,000 machine hours

OAR = $35,000,000 / 700,000 = $50 per machine hour

Therefore per car:

Car X = $50 x 200 hrs = $10,000

Car Y = $50 x 300 hrs = $15,000

Variable production costs per car

Car X = $40,000 - $10,000 = $30,000

Car Y = $47,000 - $15,000 = $32,000

Car X ($’000)

Car Y ($’000)

Total ($’000)

Sales

52,500

105,000

157,500

Variable costs

Production costs

30,000

56,000

86,000

Admin costs

6,300

12,600

18,900

Contribution

16,200

36,400

52,600

Specific fixed costs

Marketing

2,000

4,000

6,000

14,200

32,400

46,600

General fixed costs

Production

35,000

Admin (16,000 – 6,000)

10,000

Profit

1,600

52

Part (b)

AC profit

X

Less: fixed overhead included within closing stock (X)

Add: fixed overhead included within opening stock

X

MC profit

X

AC profit

$350,000

Car X

Car Y

Less: fixed overhead in closing stock

300 x $10,000

= $3,000,000

100 x $15,000

= $1,500,000

($4,500,000)

Add: fixed overhead in opening stock

200 x $10,000

= $2,000,000

250 x $15,000

= $3,750,000

$5,750,000

MC profit

$1,600,000

Part (c)

Machining costs

This cost is driven by machine hours.

$7,000,000 / 700,000 hrs = $10 per machine hour

Set up costs

This cost is driven by the number of production runs.

Car X = (1,100 /10) = 110 runs

Car Y = (1,600 / 40) = 40 runs

Total runs = 110 + 40 = 150 runs

$12,000,000 / 150 runs = $80,000 per run

Quality inspections

This cost is driven by the number of inspections.

Car X = (110 x 20) = 2,200 inspections

Car Y = (40 x 80) = 3,200 inspections

Total inspections = 2,200 + 3,200 = 5,400 inspections

$7,020,000 / 5,400 inspections = $1,300 per inspection

Closing Less

Opening Add

or ‘CLOA’

53

Stores receiving

This cost is driven by the number of deliveries.

$3,480,000 / (492 + 900) = $2,500 per delivery

Stores issues

This cost is driven by the number of issues.

$5,500,000 / (4,000 + 7,000) = $500 per issue

Car X

$,000

Machining costs

1,100 units x 200 hrs x $10 per hr

2,200

Set up costs

110 runs x $80,000

8,800

Quality inspections

2,200 inspections x $1,300

2,860

Stores receiving

492 deliveries x $2,500

1,230

Stores issues

4,000 issues x $500

2,000

Total overheads

17,090

Direct costs

1,100 units x $30,000 per car

33,000

Total production costs

50,090

Cost per car

$50,090,000 / 1,100 units

45,536

Car Y

$,000

Machining costs

1,600 units x 300 hrs x $10 per hr

4,800

Set up costs

40 runs x $80,000

3,200

Quality inspections

3,200 inspections x $1,300

4,160

Stores receiving

900 deliveries x $2,500

2,250

Stores issues

7,000 issues x $500

3,500

Total overheads

17,910

Direct costs

1,600 units x $32,000 per car

51,200

Total production costs

69,110