1/14

A Mortgage Loan Originator’s Tactical Guide to Creating Success Online

Advanced Marketing, Inc

Ÿ 2107 Highcourt Lane, Suite #301 Ÿ Herndon, VA 20170 Ÿ Tel. (703) 478-3804

© Copyright 2001, Advanced Marketing, Inc. All Rights Reserved

Introduction

The Internet has indeed proven itself an awesome agent of change and

progress. For mortgage lending professionals, continued success is

dependent upon a sound understanding of two shifting dynamics.

First, the Internet has changed how borrowers gather information, and

make decisions, regarding mortgage lending transactions.

Second, it has created new and more powerful online e-marketing

opportunities for mortgage originators. In the process it has greatly

diminished the efficacy of older, more costly traditional marketing tactics.

This White Paper addresses three general areas of e-marketing interest:

Ÿ The scope of consumer migration to the Internet

Ÿ Why a professional e-marketing strategy has become critical to

maximizing an originator’s income, performance, and success

Ÿ Identification of the single most powerful e-marketing solution

for loan originators as determined by performance, cost, and

required time commitment to implement and maintain

A Tactical Guide to Intelligent e-Marketing Solutions

Internet Trends & Mortgage Originations........................................................... 2

The Power of Email Marketing.................................................................................. 4

Why Email Marketing Works..................................................................................... 4

How Companies Are Using Email Marketing.......................................................... 4

Why Companies Are Using Email Marketing.......................................................... 4

HTML Newsletters: Maximum Performance...................................................... 6

Maximizing Email Marketing Response Rates........................................................ 6

The Advantages of HTML............................................................................................ 7

Understanding the Basic Principles of e-Marketing ......................................... 8

Delivering “Push” .......................................................................................................... 8

Creating “Pull”............................................................................................................... 8

The Trust Cycle ............................................................................................................. 9

Building Customer Loyalty ....................................................................................... 10

Customer Loyalty & Mortgage Lending ................................................................ 10

Conclusion ....................................................................................................................... 14

e-TIPS

®

HTML Newsletters for Loan Originators .......................................... 14

2/14

A Mortgage Loan Originator’s Tactical Guide to Creating Success Online

Advanced Marketing, Inc

Ÿ 2107 Highcourt Lane, Suite #301 Ÿ Herndon, VA 20170 Ÿ Tel. (703) 478-3804

© Copyright 2001, Advanced Marketing, Inc. All Rights Reserved

Internet Trends & Mortgage Originations

The Mortgage Bankers Association of America (MBA) recently revealed

some telling facts in their 2000 Internet Home and Mortgage Shopping

Survey:

Ÿ One-third of homebuyers have used the Internet to apply for a

mortgage.

Ÿ 4 in 10 indicate they are likely to do so in the future.

Ÿ One quarter of home buyers who didn’t use the Internet during the

mortgage process indicate they are extremely likely to do so in the

future.

Ÿ Half of refinancers submitted Internet loan applications.

Ÿ Virtually all refinances (95%) used the Internet at some point

during the mortgage process.

Ÿ A majority of refinancers (78%) used the Internet to obtain

information specifically about mortgage interest rates.

Ÿ

About half (44%) of refinancers indicate they are likely to use the

Internet to apply for a mortgage to purchase a house in the future.

Within two years time the World-Wide-Web has gained widespread and

pervasive use among America’s home buying population at a rate that

astonished even the most savvy Internet and marketing professionals.

An average day sees 1.5 million pages added to the World Wide Web; it

is estimated there are more than 20 million content areas. There is no

question we are in the early days of a transformation of marketing and

commerce. As a result, the practices undertaken to successfully market

one’s mortgage lending services have undergone radical changes as well.

The ability to shop and research on the Web has become a powerful tool

in the hands of shoppers. As a result, the off-line marketing tools and

solutions that served you well yesterday, are likely to fail you miserably

tomorrow. As to its impact on the effective marketing strategies of a

mortgage loan originator, the Internet represents quite simply, the most

dramatic paradigm shift in the history of the industry.

3/14

A Mortgage Loan Originator’s Tactical Guide to Creating Success Online

Advanced Marketing, Inc

Ÿ 2107 Highcourt Lane, Suite #301 Ÿ Herndon, VA 20170 Ÿ Tel. (703) 478-3804

© Copyright 2001, Advanced Marketing, Inc. All Rights Reserved

Now, it’s likely that this massive consumer migration to the Internet as

the preferred resource for finding mortgage information and service

providers will startle most loan originators but it shouldn’t. The Internet

offers unparalleled convenience, speed, and depth of information. Rest

assured that your customers will be drawn to it in greater numbers, and

rely upon it more heavily, with the passing of each month.

And while there are many businesses that, by their inherent nature, remain

unaffected by the evolving dominance of the Internet, the mortgage

lending industry is not one of them. It is an industry absolutely ripe to

deliver its services online—and your customers already know it.

Internet Trends & Mortgage Originations

So, here’s the $64,000 question:

If you know that:

a) Your customers are on-line in enormous numbers

(and will be in increasing numbers in the future);

b) They expect you, as a lending professional, to be there too;

c) If you don’t employ an effective e-marketing strategy, you will

increasingly lose new business and income to competitors

who do;

…Then, what is your e-marketing plan?

It’s not a question that can remain unanswered for very long. As your

competitors begin to take advantage of the Internet’s powerful marketing

capabilities, they will, in effect, be raising the bar. Your continued

success and financial security will depend, in large part, on your ability to

recognize and employ superior e-marketing strategies.

4/14

A Mortgage Loan Originator’s Tactical Guide to Creating Success Online

Advanced Marketing, Inc

Ÿ 2107 Highcourt Lane, Suite #301 Ÿ Herndon, VA 20170 Ÿ Tel. (703) 478-3804

© Copyright 2001, Advanced Marketing, Inc. All Rights Reserved

The Power of Email Marketing

Why Email Marketing Works

What is the value of email? In the business world, where email is the

preferred method of communication, its strategic use can produce

phenomenal results. It’s been referred to as direct mail on steroids. There

are no minimums. You can turn it on or off quickly, and you can even

arrange for a message to be delivered on a particular day, even at a

particular time. By any standard, email represents an incredible marketing

opportunity.

How Companies Are Using Email Marketing

Ÿ 66% Promotions and Discounts

Ÿ 48% Newsletters

Ÿ 34% New Product Offerings

Ÿ 28% Advertising and Marketing

Ÿ 24% Alerts and Reminders

Ÿ 8% Market Research

Ÿ 4% Other

- 2000, Jupiter Communications

Why Companies Are Using Email Marketing

Ÿ 61% Customer Loyalty & Customer Retention

Ÿ 46% Customer Acquisition

Ÿ 29% Cross Sell

Ÿ 29% Up Sell

Ÿ 18% Improve Purchase Cycle Communication

Ÿ 11% Other

- 2000, Jupiter Communications

Email is the fastest and least expensive way of communicating to a large

number of customers and prospects. It also generates the highest response

rates and conversion rates of any direct marketing tool. Compare the

average response rate of 1-2% for direct mail pieces to the opt-in email

average response rate of 12-20% and you’ll begin to realize its

tremendous business development power.

5/14

A Mortgage Loan Originator’s Tactical Guide to Creating Success Online

Advanced Marketing, Inc

Ÿ 2107 Highcourt Lane, Suite #301 Ÿ Herndon, VA 20170 Ÿ Tel. (703) 478-3804

© Copyright 2001, Advanced Marketing, Inc. All Rights Reserved

BoldFish, Inc., developers of opt-in email infrastructure software

solutions, sums up the emerging role of email marketing quite well:

“Due to the attractive metrics that e-mail provides with regard to cost,

time-to-market, and response rate, companies will increasingly utilize

e-mail to communicate with consumers. With e-mail outperforming

direct mail and other online advertising options, companies will

increasingly harness e-mail to communicate with consumers. To stay

competitive, you and your company must start using email as a

marketing tool. If you don't, you can bet your competitors will.”

Email also brings one other magical marketing advantage: The

incremental time investment and cost of contact online is virtually zero.

This means it’s as easy and inexpensive to market your services to 5,000

prospects as it is to 5.

Email is the most powerful marketing tool on the Internet:

It is critical to begin the process of migrating your current

marketing efforts and programs to the Internet. Among its many

advantages, enterprises will enjoy significant improvements in:

Ÿ Speed of communication and delivery

Ÿ Audience reach

Ÿ Customer convenience

Ÿ Depth of message and touch

Ÿ Frequency and quality of customer interaction

Ÿ Increases conversion rates from prospect-to-customer

Ÿ Increased Customer Loyalty & Share of Customer

Ÿ Reduced Marketing Costs via cost efficiency of the Internet

Ÿ Zero scalability issues

Ÿ National Reach

Ÿ Excellent New Market Expansion Tool

Ÿ Reduces Customer Acquisition Costs

6/14

A Mortgage Loan Originator’s Tactical Guide to Creating Success Online

Advanced Marketing, Inc

Ÿ 2107 Highcourt Lane, Suite #301 Ÿ Herndon, VA 20170 Ÿ Tel. (703) 478-3804

© Copyright 2001, Advanced Marketing, Inc. All Rights Reserved

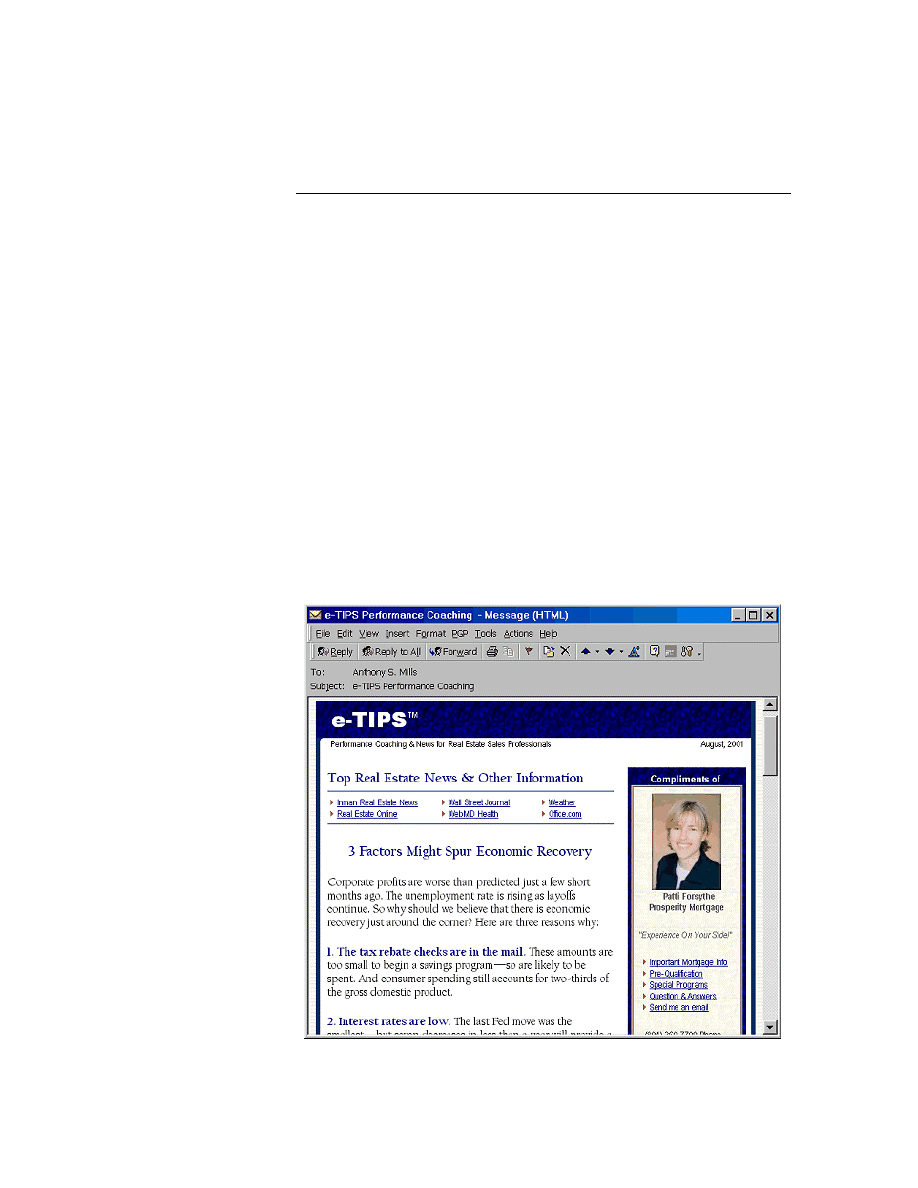

HTML Newsletters:

Maximizing Email Performance

Maximizing Email Marketing Response Rates

How you present and deliver your email message is as important as the

content of the message itself. The sample HTML email shown below

highlights two important steps to maximize your e-marketing success:

Ÿ HTML Delivery—sending your marketing email in an attractive,

HTML format, increases your readership, response rate, and your

image as a serious lending professional.

Ÿ Newsletter Format—the newsletter format is the perfect vehicle

to deliver valuable, interesting information and news to your

customers and earn the much coveted top-of-mind status.

The advantages of HTML Newsletters as a marketing medium far

outweigh those of a plain text campaign. For instance, HTML messages

tend to receive higher click-through rates than text messages, and they

enhance your branding efforts.

7/14

A Mortgage Loan Originator’s Tactical Guide to Creating Success Online

Advanced Marketing, Inc

Ÿ 2107 Highcourt Lane, Suite #301 Ÿ Herndon, VA 20170 Ÿ Tel. (703) 478-3804

© Copyright 2001, Advanced Marketing, Inc. All Rights Reserved

The Advantages of Offering HTML

HTML messages offer you a larger palette with which you can craft your

message. HTML messages allow the sender to utilize color, text and page

formatting, and graphics (such as product images or your company logo)

to improve your message and enhance your branding efforts. These items

make for a more compelling message, and ultimately, higher click-

through rates. HTML messages have the added bonus of enabling

marketers to calculate an estimated “open rate” by counting the number of

times a certain image is retrieved from the sender’s server. The

differences between Plain Text and HTML messages exist not only in

their appearances, but also in their impact.

HTML Newsletters: Maximize email performance and impact

Ÿ Jupiter Communications reports that HTML newsletters receive

twice the response rates of their Plain Text counterparts.

Ÿ According to the latest Email Marketing Report from e-Marketer,

anecdotal evidence suggests that HTML e-mail campaigns get

2 to 3 times higher response rate than plain text.

Ÿ

Direct Research indicated that the average click-through rate for

text was 15.4% while the rate for HTML was 18.4%.

8/14

A Mortgage Loan Originator’s Tactical Guide to Creating Success Online

Advanced Marketing, Inc

Ÿ 2107 Highcourt Lane, Suite #301 Ÿ Herndon, VA 20170 Ÿ Tel. (703) 478-3804

© Copyright 2001, Advanced Marketing, Inc. All Rights Reserved

Understanding the Basics of e-Marketing:

Push, Pull, and the Trust Cycle

Let’s look, for a moment, at how your HTML Newsletter relates to the

mortgage e-marketing process. While you may never have had the need in

the past to consider the principles of Push, Pull, and the Trust Cycle,

you’ll surely need to understand and apply them now.

Delivering “Push”

Push has a very specific meaning in the world of e-marketing. It refers to

the process of using your HTML newsletter to send or push your

marketing message directly to your customers. From a pure marketing

viewpoint, it is the single most powerful advantage offered by the Internet

Creating “Pull”

Pull, on the other hand, refers to the process of drawing or pulling visitors

to your website or point-of-sale. Think of pull as “desired effect of push”.

That is to say, you send (push) your HTML newsletter to your customers

so it will draw (pull) them back to your website where they can be

persuaded of their need for, and the value of, your services more

thoroughly and successfully.

Internet marketing Guru, Ralph Wilson, describes the relationship

between Push and Pull in this way:

“…Pull people to your website by your attractive content, then push

quality information to them regularly via email.

Websites, by their very nature are passive creatures, like fireside

dogs. They just lie there wagging their tail listlessly and smiling

wanly until someone enters the door.

Email messages, on the other hand, are active animals like St.

Bernard Rescue Dogs, always ready to go where you send them and

deliver a refreshing cask of information, and an invitation to return to

your website to see the newest things you have to offer.

A website should pull your customers in with some promise of

valuable content, while your HTML newsletter pushes its message

into your customer’s inbox. Most business can’t survive on one-time

sales only. The cost of customer acquisition is too high for just a

9/14

A Mortgage Loan Originator’s Tactical Guide to Creating Success Online

Advanced Marketing, Inc

Ÿ 2107 Highcourt Lane, Suite #301 Ÿ Herndon, VA 20170 Ÿ Tel. (703) 478-3804

© Copyright 2001, Advanced Marketing, Inc. All Rights Reserved

sales only. The cost of customer acquisition is too high for just a

single sale. They need to draw customers back again and again for

repeat sales. The Law of Push and Pull accomplishes this vital task.”

You can begin to see the powerful, synergistic relationship between push

and pull. Having one, without the other, diminishes its potential value

enormously. Employing both produces results greater than the sum of its

individual parts.

The Basics of e-Marketing:

Deliver

Push and create Pull for greater marketing synergy

The Trust Cycle

There’s a bonus to be found in the Push/Pull relationship—and it’s

absolutely priceless—it’s “Trust”.

When you or your organization makes a promise of value to a customer,

then keeps that promise, the customer learns to trust. The level of trust

escalates through repeated cycles of the “promise made—promise

delivered” exchange. This exchange is more commonly referred to as the

Trust Cycle.

Interestingly enough, the size, scope or value of the promise is, for the

most part, irrelevant. Even small, perhaps insignificant promises to your

customer are as effective in developing trust—provided, of course, that

you deliver on the promise made.

The Trust Cycle:

Every time you send your HTML Newsletters to a Realtor or

customer you are making, and keeping, an implicit promise of

value, commitment, and professionalism—and each time, you earn

more trust.

10/14 A Mortgage Loan Originator’s Tactical Guide to Creating Success Online

Advanced Marketing, Inc

Ÿ 2107 Highcourt Lane, Suite #301 Ÿ Herndon, VA 20170 Ÿ Tel. (703) 478-3804

© Copyright 2001, Advanced Marketing, Inc. All Rights Reserved

Building Customer Loyalty Online

Customer Loyalty & Mortgage Lending

Over the past ten years, we’ve provided more than 16,000 mortgage

lenders and brokers with marketing consultation services, training, and

business development tools. During the analysis and review of their

marketing efforts, one very startling revelation arose again and again: A

surprising 92% of mortgage originators had failed to correctly recognize

the role, and impact, of Customer Loyalty in the mortgage industry.

Thus, their marketing efforts were either under-performing or failing

entirely. Fortunately for many of them, when business is good, poor

marketing is punished less harshly than it is when business is scarce.

Before mapping any marketing strategy for mortgage loan originators, it

is critical that that we correctly identify the nature of the relationship

between mortgage service providers and their customers. Marketing

experts Don Peppers and Martha Roger, Ph.D., provide the following

paraphrased analysis:

Think for a minute about the differences between mortgage

companies and bookstores, in terms of each one's base of customers.

A mortgage company’s customers (Realtors and borrowers) are

characterized by a very steep value skew, with a small proportion of

high-value customers accounting for the vast majority of the

mortgage company’s profit. Once a mortgage company’s customer

has made an application, however, there is very little different about

the service needed. What the borrower wants is what every other

borrower wants—to have a mortgage loan approved and closed on

time with no hassles. The bookstore's customer base, on the other

hand, doesn't have nearly as steep a value skew as the mortgage

company, even though clearly some customers will consume more in

any given year than others. But everyone who goes in to a bookstore

will want a different book, and there may literally be a hundred

thousand or more to choose from.

Every business can characterize their customers in these ways—by

customers who have a diverse set of values (as in the mortgage

company’s case) or a diverse set of needs (as in the bookstore's). The

11/14 A Mortgage Loan Originator’s Tactical Guide to Creating Success Online

Advanced Marketing, Inc

Ÿ 2107 Highcourt Lane, Suite #301 Ÿ Herndon, VA 20170 Ÿ Tel. (703) 478-3804

© Copyright 2001, Advanced Marketing, Inc. All Rights Reserved

company’s case) or a diverse set of needs (as in the bookstore's). The

nature of customer differentiation at a firm can point the way to an

appropriate marketing strategy.

For businesses whose customers possess widely varying tastes and

preferences, like the bookstore, it makes sense for them to

differentiate their customers on their needs first. Naturally, the more

customers differ from one another in things like tastes and sizes, the

more benefit can be gained from offering a variety of products, and

even customizing—treating different customers differently right

down to the individual level. On the other hand, while the mortgage

company has customers who are highly differentiated in terms of their

value to the firm, these same customers are much more uniform in

their needs and preferences. Therefore, customization is less

compelling. A more appropriate strategy would be to secure the

continued "loyalty" of those most valuable customers.

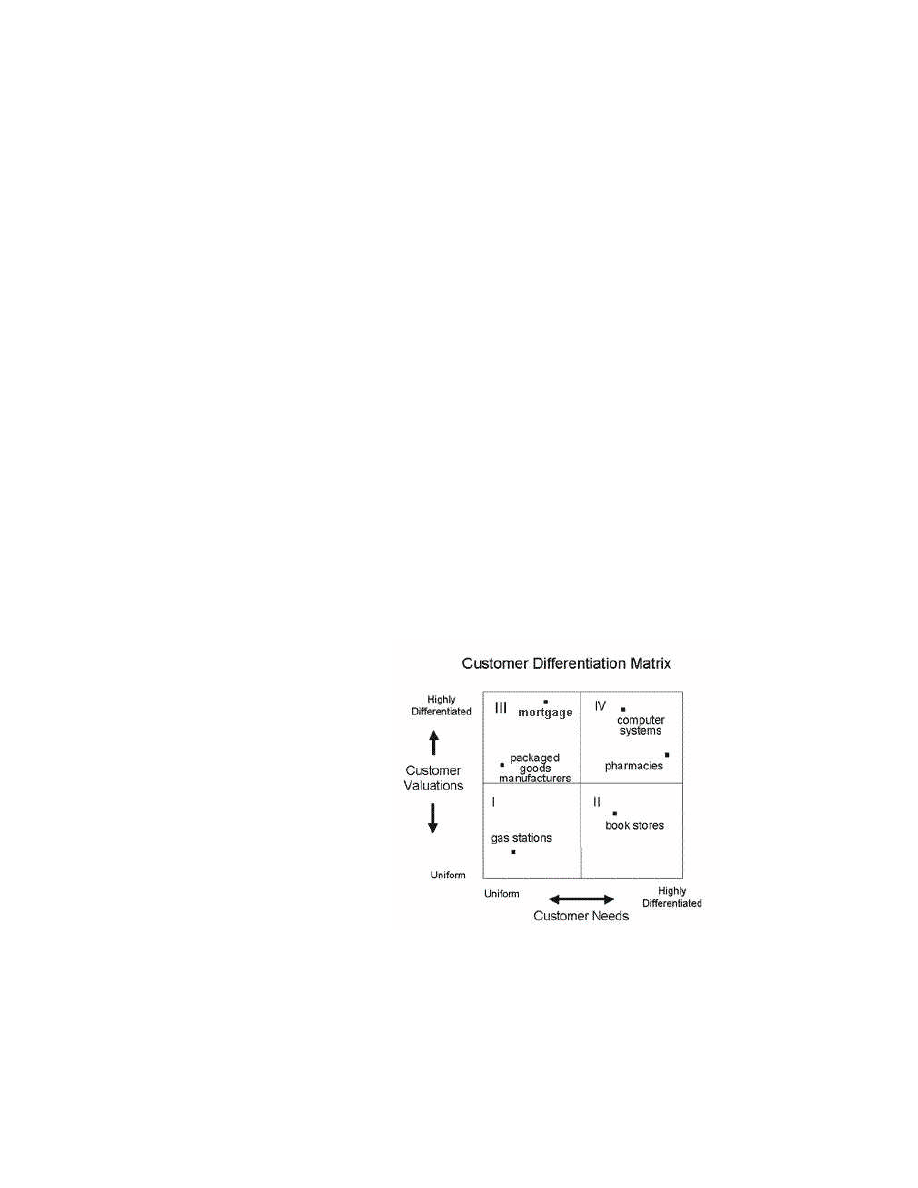

In the Customer Differentiation Matrix below, we have divided the

range of potential business situations into four basic quadrants,

depending on how diverse the enterprise's customers are, in both

needs and valuations:

Quadrant III businesses, in the upper left of our diagram, are those

characterized by commodity like services or products but diverse

customer valuations. That is, even though the customers of a

Quadrant III business have fairly uniform needs from the firm, they

will have wide variations in their value to the firm.

12/14 A Mortgage Loan Originator’s Tactical Guide to Creating Success Online

Advanced Marketing, Inc

Ÿ 2107 Highcourt Lane, Suite #301 Ÿ Herndon, VA 20170 Ÿ Tel. (703) 478-3804

© Copyright 2001, Advanced Marketing, Inc. All Rights Reserved

will have wide variations in their value to the firm.

Mortgage companies fall into Quadrant III because, while a small

minority of business customers (Realtors, in this case) account for

large quantities of business, the customers all get the same

commodity like service from the mortgage company. Loan programs

and interest rates are virtually identical, and the service is totally

generic. On the other hand, some Realtors are likely to do vastly

greater volume than others, and to have correspondingly more value

as customers to the firm.

The natural strategy for a business that finds itself in Quadrant III is

to secure the continued loyalty of those most valuable customers who

mean the most to the business.

So, Why is this all so important to you?

Customer Loyalty, plain and simple. Because any marketing effort

or money you spend that does not, at its core, promote customer

loyalty, is virtually wasted.

It is estimated that the average consumer will engage in more than 7

mortgage transaction in their lifetime and be in the position of offering

hundreds of referrals. This loss of future revenue and profit is absolutely

staggering and unnecessary. Every mortgage lending professional must

implement a mechanism with which to dialogue and build trust and

loyalty with their customers.

Customer loyalty expert Frederick Reichheld, of management consulting

firm Bain & Company reveals that:

Ÿ

On average, U.S. companies lose 50 percent of their customers in

five years.

Ÿ

A 5 percent increase in customer retention can increase an

organization’s profitability by 25 to 100 percent.

Ÿ

It can cost five to twelve time more to acquire a new customer than

to keep an existing customer.

Ÿ

Loyal, long-term customers cost less to serve. They have developed

greater trust in your organization and are generally more familiar

with your policies and processes, so they tend to ask fewer

questions and consume fewer marketing, sales and service

13/14 A Mortgage Loan Originator’s Tactical Guide to Creating Success Online

Advanced Marketing, Inc

Ÿ 2107 Highcourt Lane, Suite #301 Ÿ Herndon, VA 20170 Ÿ Tel. (703) 478-3804

© Copyright 2001, Advanced Marketing, Inc. All Rights Reserved

questions and consume fewer marketing, sales and service

resources.

Ÿ

For virtually every organization, loyal customers are the best source

of referrals.

Ÿ

Loyal customers are significantly more likely to engage in cross-

selling and up-selling programs and offers.

Ÿ

Loyal customers are less price-sensitive than other customers and

are willing to pay a premium for products and services.

Building Customer Loyalty:

It’s no surprise that loan officers that keep valuable customers are

more profitable than those with little repeat business.

14/14 A Mortgage Loan Originator’s Tactical Guide to Creating Success Online

Advanced Marketing, Inc

Ÿ 2107 Highcourt Lane, Suite #301 Ÿ Herndon, VA 20170 Ÿ Tel. (703) 478-3804

© Copyright 2001, Advanced Marketing, Inc. All Rights Reserved

Conclusion

HTML Newsletters offer a dramatic breakthrough in a mortgage

originator’s, or lending enterprises’, ability to achieve greater customer

acquisition and retention, top-of-mind positioning, and customer loyalty.

Even more extraordinary, these increased gains can be made at a

substantially lower cost than can be generated by older, less effective, off-

line marketing techniques.

The facts, re-stated below, reveal HTML Newsletters as the single most

powerful e-marketing solution for loan originators as determined by

performance, cost, and required time commitment to implement and

maintain:

Ÿ Your customers are on-line in enormous numbers (and will be in

increasing numbers in the future).

Ÿ They expect you, as a lending professional, to be there too.

Ÿ Email is the most powerful marketing tool on the Internet.

Ÿ HTML Newsletters maximize email performance and impact.

Ÿ HTML Newsletters achieve unsurpassed event maximization.

Ÿ Deliver push and create pull for greater marketing synergy.

Ÿ It’s no surprise that loan officers who keep valuable customers are

more profitable than those with little repeat business.

About e-TIPS

®

HTML Newsletters

e-TIPS

®

is the premier provider of online marketing solutions and

HTML Newsletters for mortgage originators and lending enterprises.

Loan Originators can take advantage of customized versions of

e-TIPS for both Realtors and consumers.

Mortgage Companies can take advantage of enterprise-wide

HTML Newsletter solutions and e-marketing consulting.

Visit

www.OriginationPro.com/etips.html

to view samples

Document Outline

- Creating Success Online Cover

- Introduction

- Internet Trends & Mortgage Originations

- The Power of Email Marketing

- HTML Newsletters

- Push, Pull, and the Trust Cycle

- Building Customer Loyalty Online

- Conclusion

- e-TIPS HTML Newsletters

- Visit the e-TIPS Website

- The Realtor Version

- View a Sample Issue

- The Consumer Version

- View a Sample Issue

- The Corporate Version

- The Realtor Version

- View the e-TIPS User's Guide

- Order Your e-TIPS Subscription

- Visit the e-TIPS Website

Wyszukiwarka

Podobne podstrony:

Jak oglądać filmy on-line bez pobierania za DARMO, PROBLEMY

Praca zaliczeniowa Dzieci on-line

Lekcja 5, ArchiCAD, praktyczny kurs on-line

Lekcja 10, ArchiCAD, praktyczny kurs on-line

Jak oglądać filmy on-line bez pobierania za DARMO, Instrukcja

Lekcja 15, ArchiCAD, praktyczny kurs on-line

Lekcja 3, ArchiCAD, praktyczny kurs on-line

Wprowadzenie i spis tresci, ArchiCAD, praktyczny kurs on-line

Lekcja 6, ArchiCAD, praktyczny kurs on-line

Lekcja 7, ArchiCAD, praktyczny kurs on-line

Lekcja 2, ArchiCAD, praktyczny kurs on-line

Lekcja 13, ArchiCAD, praktyczny kurs on-line

Lekcja 8, ArchiCAD, praktyczny kurs on-line

Lekcja 4, ArchiCAD, praktyczny kurs on-line

Lekcja 9, ArchiCAD, praktyczny kurs on-line

Lekcja 1, ArchiCAD, praktyczny kurs on-line

Gitara lekcje pl Lekcja 2 (teoria) tercjowa budowa akordów (darmowy kurs gry na gitarze on line)

kl 5 on line uebungen

Gitara lekcje pl Lekcja 3 Modyfikacja bicia na 3 4 (darmowy kurs gry na gitarze on line)

więcej podobnych podstron