Hanna Janicka & Dominika Dzida

Bachelor Studies in Finance year 2

nd

January 2014

FINANCIAL CRISIS

Public and private sector. Role of government (public money) in saving

economies. Cases of selected countries.

Table of content:

1. What is a crisis?

2. Briefly about causes of financial crisis 2008

3. Public sector

4. Private sector

5. Government’s role

6. Selected countries cases

7. Sum up

8. Credits

Hanna Janicka & Dominika Dzida

Bachelor Studies in Finance year 2

nd

January 2014

WHAT IS CRISIS?

The term financial crisis is a situation in which the supply of money is outpaced by the demand for

money. This means that liquidity is quickly evaporated because available money is withdrawn from

banks, forcing banks either to sell other investments to make up for the shortfall or to collapse.

Types of financial crisis according to Asian Journal of Business and Management Sciences.

1.

SPECULATIVE BUBBLES AND MARKET FAILURES

Valuation of assets in terms of true value has been an old concern in economics. Many individuals that

have an interest in this issue wonder if there is a rational foundation for the current prices of : gold,

land, shares, house or the value of money before an investment decision is made. Basic theory of finance

based on the underlying market assumes that price of an asset is equal to the present value of its future

cash flows. In principle, in an economy with a certain number of traders, assets must be valued on the

basis of the fundamental values of the market.

Such conclusion cannot be sustained given that traders do not have the same information about real

situation of companies, whose shares they trade. This refers to the short and long term plans of firms.

Consequently, situation of this nature allows individuals that have insider information to speculate the

stock prices. Therefore, the difference between market price and the basic money market of an asset is

called bubble. In other words, bubbles refers to the prices movements that are based on unexplained

fundamentals.

Speculative bubbles allude to a situation in which the price of securities or stocks rises above its real

value. Such trend continues until potential investors believe that the prices are not linked with the

market value. Until then, they usually buy shares because they believe the share prices will continue to

rise to the extent that they execute profit when you decide to sell them out (Stiglitz, 1990). The presence

of speculative bubbles increases the opportunity of the market failure given the investors commitment

to buy shares while share prices rises consistently. If at some point, most trades decide to sell their

shares at the same time, there will be no buyers in the market. As a result assumed market prices will

fail, and the value of stocks and shares will go down drastically.

Some of the historical cases of speculative bubbles and market failures are : Dutch Tulip Bubble (1637),

Mississippi Bubble (1719-17200), South Sea Bubble (1720), Bull Market (1924-1929), Japanese

Economic Bubble (1984-1989) and The explosion of the internet bubble (2003)

2.

BROAD ECONOMIC CRISES

Many times throughout history, economic crises with wider dimensions have sent a shock wave

through different countries of the world. This has caused many large businesses, even those with

Hanna Janicka & Dominika Dzida

Bachelor Studies in Finance year 2

nd

January 2014

international and transatlantic activity to suffer severe blow and failures as a result of the economic

crisis with broader connotation (Rao the Naikwadi, 2009).

Crises with such proportions that affect individual countries or in block if they are under the single

umbrella of economic union are called recession and depression by economists. Negative economic

growth of the GDP for more than two consecutive quarters usually within a single economy is defined

as recession. If economic growth continues with such negative rates for longer period is called

depression. also experience increased unemployment rate in all of its economic sectors. On the other

hand, economic stagnation is defined by economists as the situation when the pace of economic

development slows down compared to the previous quarters although they are still positive. Some of

the world know crisis with larger dimensions are the great depression of 1930s and the mortgage crisis

(2008-2009) in the U.S.

3.

BANKING CRISIS

Banking crisis is a financial crisis that affects the activity of banks in how they manage assets, liabilities

and the equity in their possession. During crises, banks are exposed in so called phenomenon ''bank

run'', which means that bank depositors suddenly rush to withdraw their savings and capital. The action

comes due to the panic caused in the financial market because depositors believe that banks will soon

go bankrupt, and as a result they may lose their capital accumulated over the years. Some of the

examples of the runs are the case of the Bank of America in 1931 and of British bank Northern Rock in

2007.

FINANCIAL CRISIS 2008

In 2008 the world economy faced its most dangerous crisis since the Great Depression of the 1930s.

The contagion, which began in 2007 when sky-high home prices in the United States finally turned

decisively downward, spread quickly, first to the entire U.S. financial sector and then to financial markets

overseas. The casualties in the

United States included a) the

entire

investment

banking

industry, b) the biggest insurance

company, c) the two enterprises

chartered by the government to

facilitate mortgage lending, d)

the largest mortgage lender, e)

the largest savings and loan, and

f) two of the largest commercial

banks.

Hanna Janicka & Dominika Dzida

Bachelor Studies in Finance year 2

nd

January 2014

In 2001, the U.S. economy experienced a mild, short-lived recession. Although the economy nicely

withstood terrorist attacks, the bust of the dotcom bubble, and accounting scandals, the fear of

recession really preoccupied everybody's minds

To keep recession away, the Federal Reserve lowered the Federal funds rate 11 times - from 6.5% in

May 2000 to 1.75% in December 2001 - creating a flood of liquidity in the economy. Cheap money, once

out of the bottle, always looks to be taken for a ride. It found easy prey in restless bankers - and even

more restless borrowers who had no income, no job and no assets.

The Fed continued slashing interest rates, emboldened, perhaps, by continued low inflation despite

lower interest rates. In June 2003, the Fed lowered interest rates to 1%, the lowest rate in 45 years. The

whole financial market started resembling a candy shop where everything was selling at a huge discount

and without any down payment.

But the bankers thought that it just wasn't enough to lend the candies lying on their shelves. They

decided to repackage candy loans into collateralized debt obligations (CDOs) and pass on the debt to

another candy shop. Hurrah! Soon a big secondary market for originating and distributing subprime

loans developed. To make things merrier, in October 2004, the Securities Exchange Commission (SEC)

relaxed the net capital requirement for five investment banks. which freed them to leverage up to 30-

times or even 40-times their initial investment. Everybody was on a sugar high, feeling as if the cavities

were never going to come.

The trouble started when the interest rates started rising and home ownership reached a saturation

point. From June 30, 2004, onward, the Fed started raising rates. by 2004, U.S. homeownership had

peaked at 70%; no one was interested in buying or eating more candy. new homes being affected, but

many subprime borrowers now could not withstand the higher interest rates and they started defaulting

on their loans.

This caused 2007 to start with bad news from multiple sources. Every month, one subprime lender or

another was filing for bankruptcy. financial firms and hedge funds owned more than $1 trillion in

securities backed by these now-failing subprime mortgages - enough to start a global financial tsunami

if more subprime borrowers started defaulting.

It

became

apparent

in

August

2007

that

the

financial market

could not solve

the

subprime

crisis on its own

and

the

problems

spread beyond

Hanna Janicka & Dominika Dzida

Bachelor Studies in Finance year 2

nd

January 2014

the United States borders. The interbank market froze completely, largely due to prevailing fear of the

unknown amidst banks. Northern Rock, a British bank, had to approach the Bank of England for

emergency funding due to a liquidity problem. By that time, central banks and governments around the

world had started coming together to prevent further financial catastrophe.

Central banks of several countries resorted to coordinated action to provide liquidity support to

financial institutions. The idea was to put the interbank market back on its feet. The Fed started slashing

the discount rate as well as the funds rate, but bad news continued to pour in from all sides.

PUBLIC SECTOR

On 15 October 2008 in The Guardian was printed interview with Andrew Simms- Policy director of

New Economics Foundation. In the beginning of Financial Crisis he used such words to describe situation

of public sector:

"Too many of us ended up believing in the reality of economic Narnia. Now it is left to the real

economy of households, communities, natural resources and productive work to pick up the pieces. "

Unfortunately he was right but let's start from the beginning.

INFLATION

The consequence of crisis which all of us could experience firsthand is inflation. The effects of the crisis

on inflation expectations were largely temporary in the United States, but longer-lasting in the United

Kingdom. That is surprising because the United Kingdom had a formal inflation target during this period.

Expectations may have been affected more because inflation stayed above the central bank’s target for

extended periods following the crisis.

HEALTH SERVICE

One of the most important to citizen part of public sector is health service. How we can suppose it also

had problems during crisis. State didn't have enough funds to keep finance them. Because of inflation -

prices of health services was going up, because of expanding public debt - a state stopped to finance

this services. Citizens had to pay for more services that earlier.

TAXES

Tax is a key issue at any time, but during a financial crisis, when public finances suffer due to shrinking

tax receipts caused by higher unemployment and lower company profits, it becomes even more

important. The current financial crisis has seen tax issues climb higher and higher up the political

agenda, from ‘tax havens’ to tax cuts and increases. In Poland VAT increased from 22% to 23%.

Hanna Janicka & Dominika Dzida

Bachelor Studies in Finance year 2

nd

January 2014

UNEMPLOYMENT

It's not hard to believe that unemployment goes up very quickly and rapidly. 2,6 billions of people lost

their job only in USA in 2008. From our point of view USA wasn't in so strange situation because

unemployment went up to 7% but it was a record in USA. The White House is optimistic right now. In

5th anniversary of crisis government of USA published information that during last 3,5 years they

created 7,5 million new workplaces but we know that it's still to less.

Very interesting situation was in European Union. In the large majority of countries, employment in

the public sector grew up from 1999 to 2008 and total employment increased in the majority of EU

countries between 2008 and mid-2010. This situation has two reasons. First, employment cuts in the

public sector that were planned in a number of EU countries were not yet visible in data recorded by

the national and European statistical authorities.

Secondly, and most importantly, job losses have so far been lower in the public than in the private

sectors. feel affected by crisis is 53% of "private workers" and "only" 45% of people working in public

sector

PRIVATE SECTOR

UNEMPLOYMENT

The labor market situation in private sector was destroyed by financial crisis. A lot of private companies

went bankrupt. This firms which remained on the market had to fire a lot of employees. Citizens started

to save money and demand decreased. People was poor and afraid od spending money. Private

companies was most affected. Public institutions had some public money which they used to safe

establishments. Private companies without customers had to collapsed.

SALARIES

The second possibility to save company was reduction of wages. Employees started to work longer for

less money.

NEW BUSINESS AND SMALL COMPANIES

Starting a new business in this period was also a big challenge. Everybody knows that at the very

beginning companies need a big incomes. During crisis nobody can count on it. Because of the same

reason big problems had small companies like housing estate shops. They need higher income from one

shop than chain because of synergy effect. Their incomes was to small so they bankrupt.

Hanna Janicka & Dominika Dzida

Bachelor Studies in Finance year 2

nd

January 2014

LUXURY GOODS

It was the hardest time to companies which produced luxury goods. It's obvious that people start to

save money from such stuff to have enough money for proverbial bread. We learn about it on economy

classes- when incomes of people goes down - the demand on luxury goods decrease much faster in

compare with necessary goods.

EDUCATION

Crisis wasn't forgiving even for students. A lot of private schools and universities stopped teaching,

because they didn't have target which want to pay for education.

GOVERNMENTS ROLE

There are five separate initiatives the authorities need to follow to contain the crisis, reverse some of

its effects, and prevent it from happening again. National authorities are best positioned to respond

quickly to contain the crisis, international initiatives are required to avoid repetition, and some

combination of the two is best suited to reversing its effects.

National authorities can best contain the crisis through two measures.

First they must revive inter-bank markets by providing a temporary guarantee for short-term

unsecured lending between regulated institutions. Central bank disintermediation of inter-bank

markets is more costly and less sustainable.

Second, national authorities should also inject preference share capital to institutions that need it on

condition of a partial swap of “old” debt for equity. Such involvement by government is best carried out

at arm’s length – in Europe’s case, the European Investment Bank may be a good vehicle.

The third thing the authorities should do is to support a more immediate reversal of this process by

facilitating the creation of long-term liquidity pools to purchase assets – rather like John Pierpont

Morgan’s 1907 money trusts.

The result of this was the Dodd-Frank Wall Street Reform Act signed on March 15, 2010 and passed

by the Senate on May 20.

Dodd-Frank proposed eight areas of regulation. Here are the major parts of the Act.

Regulate Credit Cards, Loans and Mortgages

The CFPB regulates credit fees, including credit, debit, mortgage underwriting and bank fees. It

protects homeowners in real estate transactions by requiring they understand risky mortgage loans. It

also requires banks to verify borrower's income, credit history and job status

Hanna Janicka & Dominika Dzida

Bachelor Studies in Finance year 2

nd

January 2014

Oversee Wall Street

The Financial Stability Oversight Council looks out for risks that affect the entire financial industry. It

also oversees non-bank financial firms like hedge funds. If any of these companies get too big, it can

recommend they be regulated by the Federal Reserve, which can ask it to increase its reserve

requirement.

Stop Banks from Gambling with Depositors' Money

Dodd-Frank gave banks seven years to divest the funds. They can keep any funds if that are less than

3% of revenue. Banks have lobbied hard against the rule, delaying its implementation until at least 2013.

Regulate Risky Derivatives

Dodd-Frank required that the riskiest derivatives, like credit default swaps, be regulated by the

Securities Exchange Commission (SEC) or the Commodity Futures Trading Commission (CFTC). In this

way, excessive risk-taking can be identified and brought to policy-makers' attention before a major crisis

occurs.

Bring Hedge Funds Trades Into the Light

One of the causes of the 2008 financial crisis was that, since hedge funds and other financial advisers

weren't regulated, no one knew what they were investing in or how much was at stake. To correct for

that, Dodd-Frank says that hedge funds must register with the SEC and provide date about their trades

and portfolios so the SEC can assess overall market risk. States are given more power to regulate

investment advisers, since Dodd-Frank raises the asset threshold limit from $30 million to $100 million.

Reform the Federal Reserve

The Government Accountability Office(GAO) was allowed to audit the Fed's emergency loans during

the financial crisis. It can review future emergency loans, when needed. The Fed cannot make an

emergency loan to a single entity.

Hanna Janicka & Dominika Dzida

Bachelor Studies in Finance year 2

nd

January 2014

SELECTED COUNTRIES CASES

Iceland

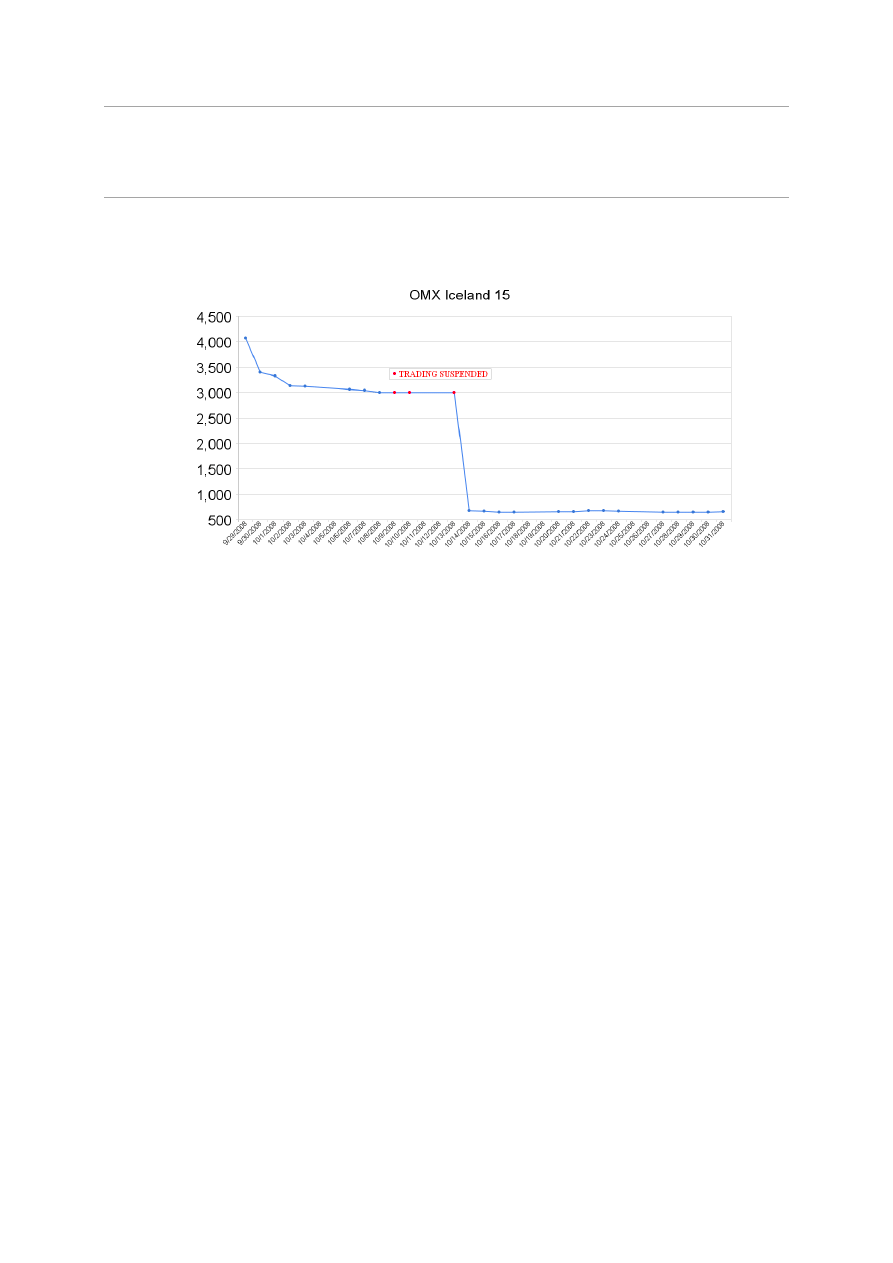

Iceland truly is one of the most interesting cases among the countries that got seriously hit by financial

crisis in 2008. Although as much as their beginnings could be compared to the others, the overall

approach to the crisis was completely opposite of Europe and US strategy.

Starting from the very beginning, Iceland had three biggest banks: Kaupthing, Glitnir i Landsbankinn,

which in 2008 had debt of 85 billion dollars with GDP 12 billion USD dollars. Unemployment increased

three times up to approximately 9% and inflation during the crisis was 20%.

They didn’t save their banks: the theory was totally different. Iceland let their banks collapse and

focused on finding out who abused his power and is responsible for all that. They went into bankruptcy

soon after that pretty dramatically.

By August 2011, Iceland had graduated from its International Monetary Fund bailout programme with

flying colors. The economy – having shrunk more than 10% in two years – bounced in 2011 and 2012,

and will grow by about 1.9% this year. But that is not the whole story. Throughout the crisis, the Icelandic

population has maintained the lowest risk of poverty or social exclusion in Europe. Unemployment,

which briefly rose to 9.2%, has dropped back to 5.1%. Inflation is falling back to its target range, and

house prices in Reykjavik are on the rise.

Hanna Janicka & Dominika Dzida

Bachelor Studies in Finance year 2

nd

January 2014

Greece

Reasons of crisis in Greece:

1. Greece joined the euro zone too hastily. They should have control over their public finances, but how

we'll see, they didn't. They published false statistics of debt.

2. After 2001 (year when Greece joined the euro zone) investors started to treat them like Germany-

Greece could borrow as cheap as Germany. When the financial crisis began, investors was scared

that Greece will not be solvent anymore and they increased interest costs. After that Greece was in

the even worst position.

3. Greece has been spending beyond its means for 15 years. It owed in the beginning of 2011- 150%

of its GDP, which in real terms means it owes one and a half times its country total output per annum.

4. Greece tolerated too high expenditures, e.g. state railway. Someone told that it would be cheaper

for Greece to pay for taxi to everyone than for railway.

5. Finally - social advantages. Government has to pay too much for early retirement in some

professions. In Greece teachers and public workers work are one of the least working in Europe.

As the effect of this situation Budget gap increased to 150% of GDP and Inflation went up to 10,3%.

When we look at this rates together we’ll see that it was big recession.

Help for Greece

Greece had only two options to solve its financial problems.

First of all they needed economy to grow. However, the Greek economy was becoming less productive

compared to other Eurozone countries.

The second option was introducing an austerity program by Greek government. They should spend

less money while increasing taxes. This would reduce the size of the government deficit, meaning the

government would have to borrow less.

To decrease the size of the Greek government budget, the government was forced to make many

unpopular decisions. For instance, the retirement age was increased. They increased taxes to help pay

its debt, but this solution did not work very well . In fact, the economy went into sharp decline producing

even less revenue and higher costs.

This program did not solve the Greek government’s financial problems and caused Greek people

protest in the streets. Greece still needed to borrow more money, but they could no longer afford these

loans.

Hanna Janicka & Dominika Dzida

Bachelor Studies in Finance year 2

nd

January 2014

In May 2010, Greece was forced to accept a founding worth €110 billion ($145 billion) from the EU,

the European Central Bank, and the International Monetary Fund (IMF). This money would help them

to continue paying its bills for three years. In return for the money Greece was supposed to keep on its

austerity program, make its economy more competitive and privatize many of the companies owned by

the Greek government.

Unfortunately it did not help as much as expected. EU agreed to extend the repayment period,

decrease the interest rates of loans and even commercial banks decided to decreased liabilities of

Greece.

They are 3 possibilities to deal with situation of Greece:

1. Exclude Greece from the Euro Zone

2. Avoid bankruptcy of Greece

3. Implement the assistance and reforms in the same time - but it has to be controlled by EU and IMF

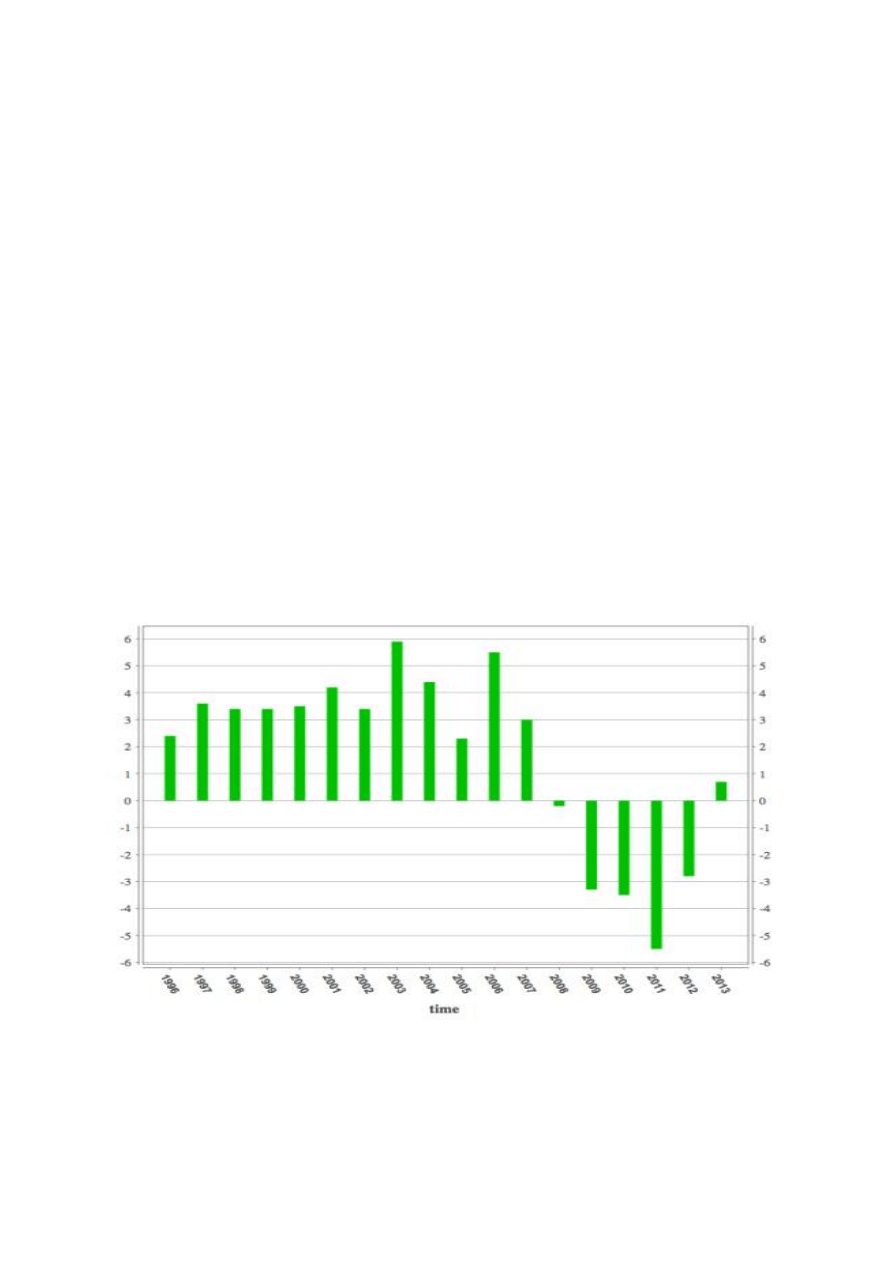

The last option is continuing right now. As we can see on the graph below this policy works and Greek

economy started to be out of the woods.

Greek Real GDP

Hanna Janicka & Dominika Dzida

Bachelor Studies in Finance year 2

nd

January 2014

SUM UP

Financial crisis is the result of overvaluing an asset. Crisis from 2008 called Credit Crisis was partially

caused by extremely risky investments made by quite a lot of people. This crisis has affected both the

public and private sectors and effects was terrible. Citizens lost their jobs, opportunities and confidence

in financial sector.

The approach to the crisis was different in Europe, US and Iceland. The island decided to let their banks

go bankrupt in order to rebuilt their economy from the scratch when meanwhile the other countries

focused on rescuing theirs. Greece went bankrupt as they consumed the borrowed money and not

invest it what caused really difficult situation. For now Greece is a crucial country for Eurozone as their

bankruptcy might cause failure of many other countries involved.

Right at the moment we are not done with financial crisis yet but as statistics shows we are doing

much better and there is a light at the end of the tunnel. As for Eurozone, because America is facing

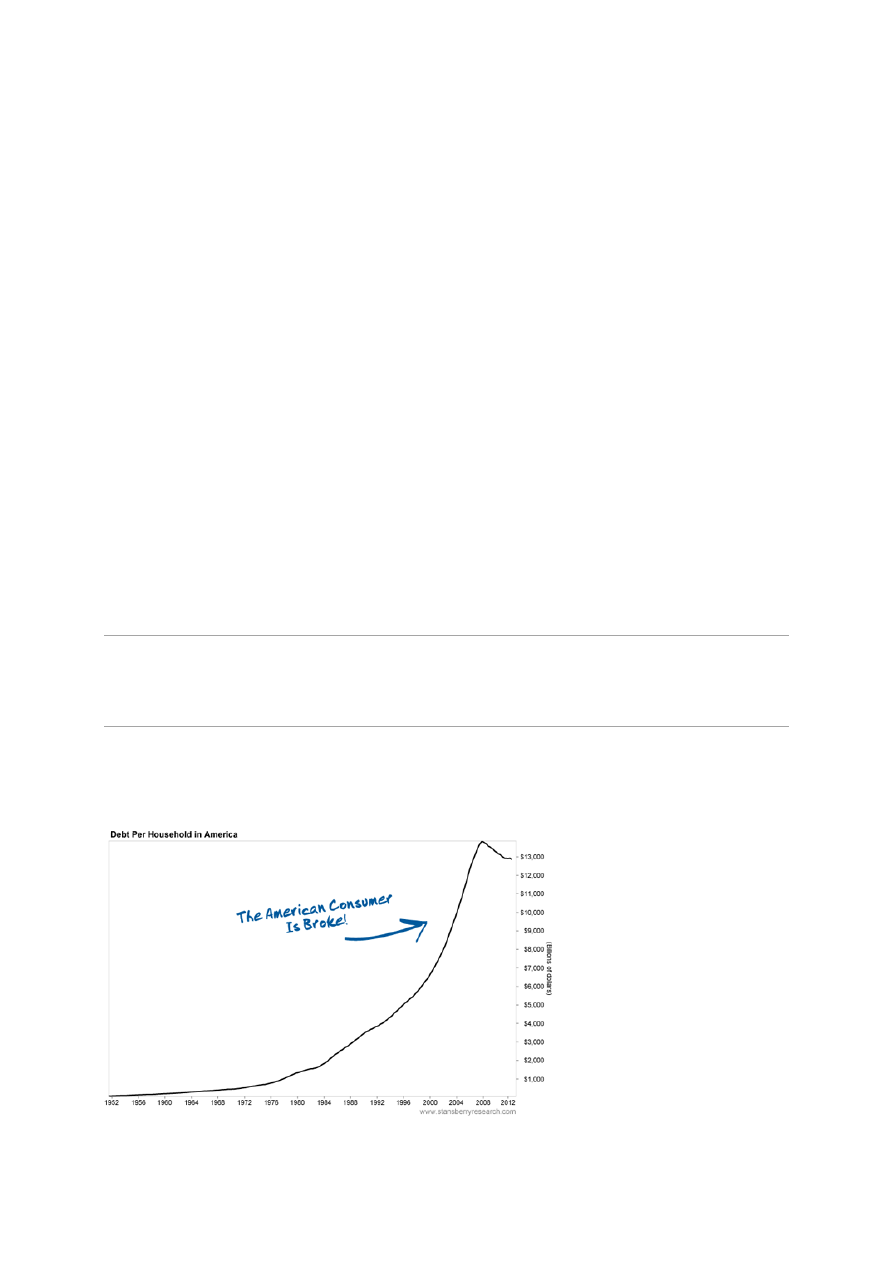

now the biggest public debt in history that still has to be dealt with.

CREDITS

Investopedia.com

Youtube.com

Wallstreetoasis.com

Imf.org

Hdr.undp.org

Economist.com

OECD publishing - OECD Economics Department Working Papers

Wyszukiwarka

Podobne podstrony:

Financial Crisis Essay

OECD The Financial Crisis, Reform and Exit Strategies (2009)

FINANCIAL CRISIS

The Financial Crisis and Lessons for Insurers

OECD The Financial Crisis, Reform and Exit Strategies (2009)

Questions and Answers about the Financial Crisis

Financial Crisis rozszerzony

the impacct of war and financial crisis on georgian confidence in social and governmental institutio

caryle group financial crisis 2008

Financial Institutions and Econ Nieznany

Financial Freedom

Crisis Management the Japanese way

BANK organization przybysz, 03 banking & finance

financial market poprawka egzamin

Finance and?nking

Creative Writing New York Times Essay Collection Writers On Writing

Aftershock Protect Yourself and Profit in the Next Global Financial Meltdown

Principles Of Corporate Finance

Financial Times Coach yourself to optimum emotional intelligence

więcej podobnych podstron