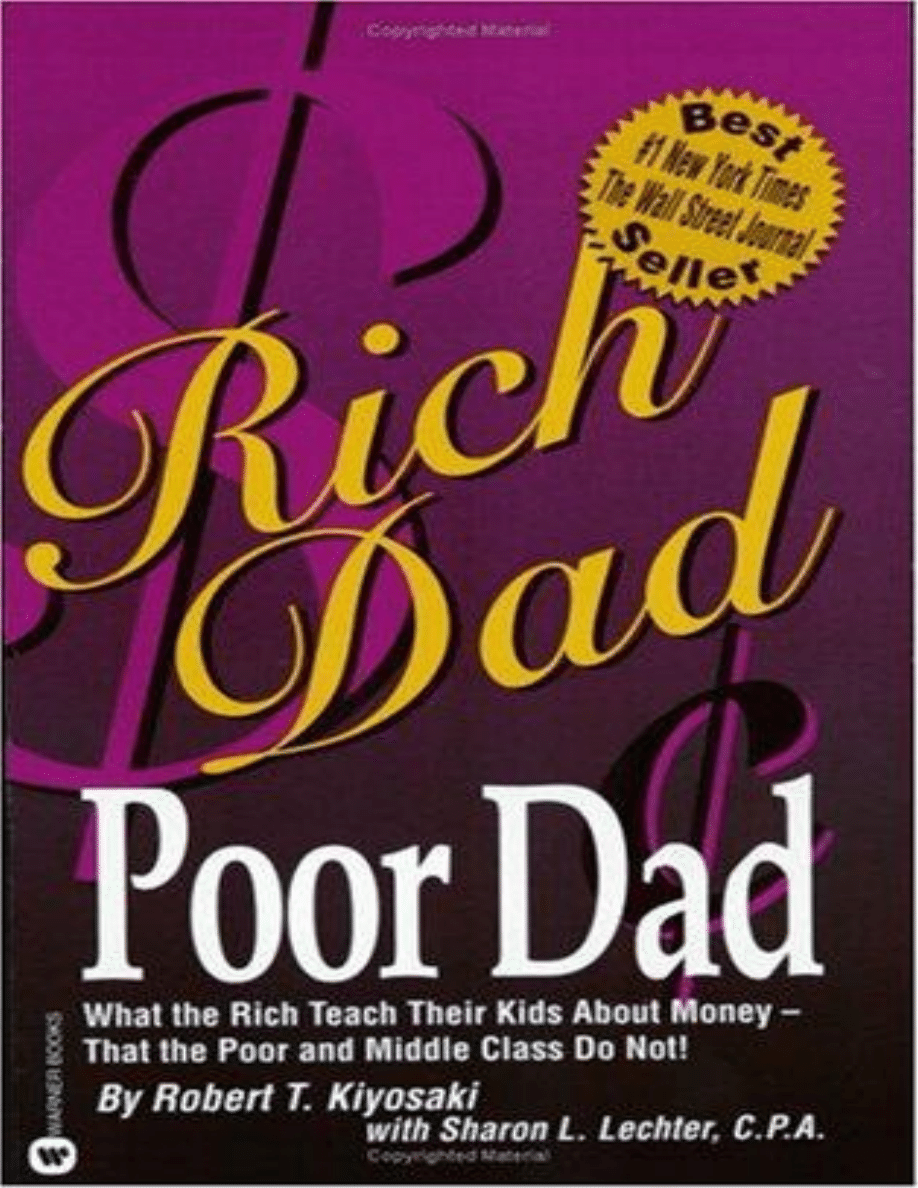

RichDad,PoorDad

RichDad,PoorDad

RichDad,PoorDad

ByRobertT.Kiyosaki

INTRODUCTION

ThereisaNeed

Doesschoolpreparechildrenfortherealworld?“Studyhardandget

goodgradesandyouwillfindahigh-payingjobwithgreatbenefits,”my

parentsusedtosay.Theirgoalinlifewastoprovideacollegeeducation

formyoldersisterandme,sothatwewouldhavethegreatestchancefor

success in life. When T finally earned my diploma in1976-graduating

with honors, and near the top of my class, in accounting from Florida

StateUniversity-myparentshadrealizedtheirgoal.Itwasthecrowning

achievement oftheir lives. In accordance with the “Master Plan,” I was

hiredbya“Big8”accountingfirm,andIlookedforwardtoalongcareer

andretirementatanearlyage.

My husband, Michael, followed a similar path. We both came from

hard?working families, ofmodest means but with strong work ethics.

Michael also graduated with honors, but he didit twice: first as an

engineer and then from law school. He was quickly recruited by a

prestigiousWashington,D.C.,lawfirmthatspecializedinpatentlaw,and

his futureseemed bright, career path well-defined and early retirement

guaranteed.

Althoughwehavebeensuccessfulinourcareers,theyhavenotturned

outquiteasweexpected.Webothhavechangedpositionsseveraltimes-

for all the right reasons-but thereare no pension plans vesting on our

behalf. Our retirement funds are growing only throughour individual

contributions.

Michael and I have a wonderful marriage with three great children.

AsIwritethis,twoareincollegeandoneisjustbeginninghighschool.

Wehavespentafortunemakingsure ourchildrenhavereceivedthebest

educationavailable.

One day in 1996, one of my children came home disillusioned with

school.Hewasboredandtiredofstudying.“WhyshouldIputtimeinto

studyingsubjectsIwillneveruseinreallife?”heprotested.

Withoutthinking,Iresponded,“Becauseifyoudon'tgetgoodgrades,

you won't get intocollege.” “Regardless of whether I go to college,” he

replied,“I'mgoingtoberich.”

“If you don't graduate from college, you won't get a good job,” I

respondedwithatingeofpanicandmotherlyconcern.“Andifyoudon't

haveagoodjob,howdoyouplantogetrich?”

My son smirked and slowly shook his head with mild boredom. We

havehadthistalkmanytimesbefore.Heloweredhisheadandrolledhis

eyes.Mywordsofmotherlywisdomwerefallingondeafearsonceagain.

Though smart and strong-willed, he has always been a polite and

respectfulyoungman.

“Mom,”hebegan.Itwasmyturntobelectured.“Getwiththetimes!

Look around; therichest people didn't get rich because of their

educations.LookatMichaelJordanandMadonna.EvenBillGates,who

droppedoutofHarvard,foundedMicrosoft;heisnowtherichestmanin

America,andhe'sstillinhis30s.Thereisabaseballpitcherwhomakes

more than $4 million a year even though he has been labeled `mentally

challenged.'”

Therewasalongsilencebetweenus.ItwasdawningonmethatIwas

giving my son thesame advice my parents had given me. The world

aroundushaschanged,buttheadvicehasn't.

Gettingagoodeducationandmakinggoodgradesnolongerensures

success,andnobodyseemstohavenoticed,exceptourchildren.

“Mom,” he continued, “I don't want to work as hard as you and dad

do.You make a lot of money, and we live in a huge house with lots of

toys. If I follow your advice, I'll windup like you, working harder and

harder only to pay more taxes and wind up in debt. Thereis no job

security anymore; I know all about downsizing and rightsizing. I also

know thatcollege graduates today earn less than you did when you

graduated. Look at doctors. Theydon't make nearly as much money as

theyusedto.IknowIcan'trelyonSocialSecurityorcompany pensions

forretirement.Ineednewanswers.”

He was right. He needed new answers, and so did I. My parents'

advice may have worked forpeople born before 1945, but it may be

disastrous for those of us born into a rapidlychangingworld.Nolonger

canIsimplysaytomychildren,

“Gotoschool,getgoodgrades,andlookforasafe,securejob.”

IknewIhadtolookfornewwaystoguidemychildren'seducation.

As a mother as well as an accountant, I have been concerned by the

lack of financialeducation our children receive in school. Many of

today's youth have credit cards beforethey leave high school, yet they

haveneverhadacourseinmoneyorhowtoinvestit,letaloneunderstand

how compound interest works on credit cards. Simply put, without

financial literacy and the knowledge of how money works, they are not

preparedtofacetheworldthatawaitsthem,aworldinwhichspendingis

emphasizedoversavings.

Whenmyoldestsonbecamehopelesslyindebtwithhiscreditcards

as a freshman incollege,Inotonlyhelpedhimdestroythecreditcards,

but I also went in search of aprogram that would help me educate my

childrenonfinancialmatters.

One day last year, my husband called me from his office. “I have

someone I think youshould meet,” he said. “His name is Robert

Kiyosaki.He'sabusinessmanandinvestor,andheishereapplyingfora

patentonaneducationalproduct.Ithinkit'swhatyouhavebeenlooking

for.”

JustWhatIWasLookingFor

My husband, Mike, was so impressed with CASHFLOW, the new

educational product that RobertKiyosaki was developing, that he

arrangedforbothofustoparticipateinatestoftheprototype.Becauseit

wasaneducationalgame,Ialsoaskedmy19-year-olddaughter,who was

a freshman at a local university, if she would like to take part, and she

agreed.

About fifteen people, broken into three groups, participated in the

test.

Mikewasright.ItwastheeducationalproductIhadbeenlookingfor.

Butithadatwist:ItlookedlikeacolorfulMonopolyboardwithagiant

well-dressed rat in the middle.Unlike Monopoly, however, there were

twotracks:oneinsideandoneoutside.Theobjectofthegamewastoget

out of the inside track-what Robert called the “Rat Race” and reachthe

outer track, or the “Fast Track.” As Robert put it, the Fast Track

simulateshowrichpeopleplayinreallife.

Robertthendefinedthe“RatRace”forus.

"Ifyoulookatthelifeoftheaverage-educated,hard-workingperson,

there is a similarpath. The child is born and goes to school. The proud

parentsareexcitedbecausethechildexcels,getsfairtogoodgrades,and

isacceptedintoacollege.Thechildgraduates,maybegoesontograduate

schoolandthendoesexactlyasprogrammed:looksforasafe,securejob

orcareer.Thechildfindsthatjob,maybeasadoctororalawyer,or joins

the Army or works for the government. Generally, the child begins to

makemoney,creditcardsstarttoarriveinmass,andtheshoppingbegins,

ifitalreadyhasn't.

"Having money to burn, the child goes to places where other young

people just like themhang out, and they meet people, they date, and

sometimestheygetmarried.Lifeiswonderfulnow,becausetoday,both

menandwomenwork.Twoincomesarebliss.Theyfeelsuccessful,their

future is bright, and they decide to buy a house, a car, a television,take

vacations and have children. The happy bundle arrives. The demand for

cash isenormous.Thehappycoupledecidesthattheircareersarevitally

important and begin towork harder, seeking promotions and raises. The

raises come, and so does another child andthe need for a bigger house.

Theyworkharder,becomebetteremployees,evenmorededicated. They

go back to school to get more specialized skills so they can earn more

money.Maybetheytakeasecondjob.Theirincomesgoup,butsodoes

the tax bracketthey're in and the real estate taxes on their new large

home, and their Social Securitytaxes, and all the other taxes. They get

their large paycheck and wonder where all themoney went. They buy

somemutualfundsandbuygrocerieswiththeircreditcard.Thechildren

reach 5 or 6 years of age, and the need to save for college increases as

wellastheneedtosavefortheirretirement..

"Thathappycouple,born35yearsago,isnowtrappedintheRatRace

for the rest oftheir working days. They work for the owners of their

company,forthegovernmentpayingtaxes,andforthebankpayingoffa

mortgageandcreditcards.

“Then,theyadvisetheirownchildrento`studyhard,getgoodgrades,

and find a safe jobor career.' They learn nothing about money, except

from those who profit from theirnaïveté, and work hard all their lives.

The process repeats into another hard-workinggeneration. This is the

`RatRace'.”

Theonlywaytogetoutofthe“RatRace”istoproveyourproficiency

at both accountingand investing, arguably two of the most difficult

subjects to master. As a trained CPA who once worked for a Big 8

accounting firm, I was surprised that Robert had made the learningof

these two subjects both fun and exciting. The process was so well

disguised that whilewe were diligently working to get out of the “Rat

Race,”wequicklyforgotwewerelearning.

Soon a product test turned into a fun afternoon with my daughter,

talking about things wehad never discussed before. As an accountant,

playingagamethatrequiredanIncomeStatementandBalanceSheetwas

easy.SoIhadthetimetohelpmydaughterandtheotherplayers at my

tablewithconceptstheydidnotunderstand.Iwasthefirstperson-andthe

onlypersonintheentiretestgroup-togetoutofthe“RatRace”thatday.

Iwasoutwithin50minutes,althoughthegamewentonfornearlythree

hours.

At my table was a banker, a business owner and a computer

programmer.Whatgreatlydisturbedmewashowlittlethesepeopleknew

abouteitheraccountingorinvesting,subjectssoimportantintheirlives.I

wondered how they managed their own financialaffairs in real life. I

couldunderstandwhymy19-year-olddaughterwouldnotunderstand,but

theseweregrownadults,atleasttwiceherage.

After I was out of the “Rat Race,” for the next two hours I watched

my daughter and theseeducated, affluent adults roll the dice and move

theirmarkers.AlthoughIwasgladtheywerealllearningsomuch,Iwas

disturbedbyhowmuchtheadultsdidnotknowaboutthebasicsofsimple

accounting and investing. They had difficulty grasping the relationship

betweentheirIncomeStatementandtheirBalanceSheet.Astheybought

andsoldassets,theyhadtroublerememberingthateachtransactioncould

impacttheirmonthlycashflow.Ithought,howmanymillionsofpeople

are out there in the real world strugglingfinancially, only because they

haveneverbeentaughtthesesubjects?

Thankgoodnessthey'rehavingfunandaredistractedbythedesireto

win the game, I saidto myself. After Robert ended the contest, he

allowed us fifteen minutes to discuss andcritique CASHFLOW among

ourselves.

The business owner at my table was not happy. He did not like the

game. “I don't need toknowthis,”hesaidoutloud.“Ihireaccountants,

bankersandattorneystotellmeaboutthisstuff.”

TowhichRobertreplied,“Haveyouevernoticedthattherearealot

of accountants whoaren't rich? And bankers, and attorneys, and

stockbrokers and real estate brokers. Theyknow a lot, and for the most

partaresmartpeople,butmostofthemarenotrich.Sinceourschoolsdo

not teach people what the rich know, we take advice from these people.

Butoneday,you'redrivingdownthehighway,stuckintraffic,struggling

to get to work, andyou look over to your right and you see your

accountant stuck in the same traffic jam.You look to your left and you

seeyourbanker.Thatshouldtellyousomething.”

Thecomputerprogrammerwasalsounimpressedbythegame:“Ican

buysoftwaretoteachmethis.”

The banker, however, was moved. “I studied this in school-the

accountingpart,thatis-butIneverknewhowtoapplyittoreallife.Now

Iknow.Ineedtogetmyselfoutofthe`RatRace.'”

Butitwasmydaughter'scommentsthatmosttouchedme.“Ihadfun

learning,” she said. “Ilearned a lot about how money really works and

howtoinvest.”

Thensheadded:“NowIknowIcanchooseaprofessionfortheworkI

want to perform andnotbecauseofjobsecurity,benefitsorhowmuchI

getpaid.IfIlearnwhatthisgameteaches,I'mfreetodoandstudywhat

my heart wants to study. . .rather than studysomething because

businessesarelookingforcertainjobskills.IfIlearnthis,Iwon'thaveto

worry about job security and Social Security the way most of my

classmatesalreadydo.”

I was not able to stay and talk with Robert after we had played the

game,butweagreedtomeetlatertofurtherdiscusshisproject.Iknewhe

wanted to use the game to help othersbecome more financially savvy,

andIwaseagertohearmoreabouthisplans.

My husband and I set up a dinner meeting with Robert and his wife

withinthenextweek.Althoughitwasourfirstsocialget-together,wefelt

asifwehadknowneachotherforyears.

Wefoundoutwehadalotincommon.Wecoveredthegamut,from

sports and plays torestaurants and socio-economic issues. We talked

about the changing world. We spent a lot of time discussing how most

Americans have little or nothing saved for retirement, as wellas the

almost bankrupt state of Social Security and Medicare. Would my

children berequired to pay for the retirement of 75 million baby

boomers?Wewonderedifpeoplerealizehowriskyitistodependona

pensionplan.

Robert'sprimaryconcernwasthegrowinggapbetweenthehavesand

have nots, in Americaand around the world. A self-taught, self-made

entrepreneurwhotraveledtheworldputtinginvestmentstogether,Robert

wasabletoretireattheageof47.Hecameoutofretirementbecausehe

shares the same concern I have for my own children. He knows thatthe

world has changed, but education has not changed with it.According to

Robert,children spend years in an antiquated educational system,

studyingsubjectstheywillneveruse,preparingforaworldthatnolonger

exists.

“Today, the most dangerous advice you can give a child is `Go to

school,getgoodgradesandlookforasafesecurejob,'”helikestosay.

“That is old advice, and it's badadvice. If you could see what is

happeninginAsia,Europe,SouthAmerica,youwouldbeas concernedas

Iam.”

It'sbadadvice,hebelieves,“becauseifyouwantyourchildtohavea

financially securefuture, they can't play by the old set of rules. It's just

toorisky.”

Iaskedhimwhathemeantby“oldrules?”.

“People like me play by a different set of rules from what you play

by,” he said. “Whathappens when a corporation announces a

downsizing?”

“Peoplegetlaidoff,”Isaid."Familiesarehurt.Unemploymentgoes

up."

“Yes, but what happens to the company, in particular a public

companyonthestockexchange?”

“The price of the stock usually goes up when the downsizing is

announced,” I said. “Themarket likes it when a company reduces its

labor costs, either through automation or justconsolidating the labor

forceingeneral.”

“That'sright,”hesaid.“Andwhenstockpricesgoup,peoplelikeme,

the shareholders,get richer. That is what I mean by a different set of

rules.Employeeslose;ownersandinvestorswin.”

Robert was describing not only the difference between an employee

and employer, but alsothe difference between controlling your own

destinyandgivingupthatcontroltosomeoneelse.

“Butit'shardformostpeopletounderstandwhythathappens,”Isaid.

“Theyjustthinkit'snotfair.”

“That's why it is foolish to simply say to a child, `Get a good

education,'”hesaid.“Itisfoolishtoassumethattheeducationtheschool

system provides will prepare yourchildren for the world they will face

upon graduation. Each child needs more education.Different education.

Andtheyneedtoknowtherules.Thedifferentsetsofrules.”

“Therearerulesofmoneythattherichplayby,andtherearetherules

thattheother95percentofthepopulationplaysby,”hesaid.“Andthe95

percent learns those rules athome and in school. That is why it's risky

today to simply say to a child, `Study hard andlook for a job.'A child

todayneedsamoresophisticatededucation,andthecurrentsystemisnot

delivering the goods. I don't care how many computers they put in the

classroom or how much money schools spend. How can the education

systemteachasubjectthatitdoesnotknow?”

Sohowdoesaparentteachtheirchildren,whattheschooldoesnot?

Howdoyouteachaccountingtoachild?Won'ttheygetbored?Andhow

do you teach investing when as aparent you yourself are risk averse?

Instead of teaching my children to simply play itsafe, I decided it was

besttoteachthemtoplayitsmart.

“So how would you teach a child about money and all the things

we've talked about?” Iasked Robert. “How can we make it easy for

parentsespeciallywhentheydon'tunderstanditthemselves?”

“Iwroteabookonthesubject,”hesaid.

“Whereisit?”

“Inmycomputer.It'sbeenthereforyearsinrandompieces.Iaddto

itoccasionallybutI'venevergottenaroundtoputitalltogether.Ibegan

writing it after my other bookbecameabestseller,butIneverfinished

thenewone.It'sinpieces.”

And in pieces it was.After reading the scattered sections, I decided

thebookhadmeritandneededtobeshared,especiallyinthesechanging

times.Weagreedtoco-authorRobert'sbook.

I asked him how much financial information he thought a child

needed. He said it woulddepend on the child. He knew at a young age

thathewantedtoberichandwasfortunateenoughtohaveafatherfigure

who was rich and willing to guide him. Education is thefoundation of

success,Robertsaid.Justasscholasticskillsarevitallyimportant,soare

financialskillsandcommunicationskills.

WhatfollowsisthestoryofRobert'stwodads,arichoneandapoor

one, that expounds on the skills he's developed over a lifetime. The

contrastbetweentwodadsprovidesanimportantperspective.Thebookis

supported, edited and assembled by me.For any accountants who read

thisbook,suspendyouracademicbookknowledgeandopenyourmindto

thetheoriesRobertpresents.Althoughmanyofthemchallengethevery

fundamentalsofgenerallyacceptedaccountingprinciples,theyprovidea

valuable insightinto the way true investors analyze their investment

decisions.

Whenweasparentsadviseourchildrento“gotoschool,studyhard

andgetagoodjob,”weoftendothatoutofculturalhabit.Ithasalways

beentherightthingtodo.WhenImetRobert,hisideasinitiallystartled

me. Having been raised by two fathers, he hadbeen taught to strive for

two different goals. His educated dad advised him to work for a

corporation. His rich dad advised him to own the corporation. Both life

paths requirededucation, but the subjects of study were completely

different. His educated dadencouragedRoberttobeasmartperson.His

richdadencouragedRoberttoknowhowtohiresmartpeople.

Having two dads caused many problems. Robert's real dad was the

superintendent ofeducation for the state of Hawaii. By the time Robert

was16,thethreatof“Ifyoudon'tgetgoodgrades,youwon'tgetagood

job” had little effect. He already knew his careerpath was to own

corporations,nottoworkforthem.Infact,ifithadnotbeenforawise

and persistent high school guidance counselor, Robert might not have

gone on to college.He admits that. He was eager to start building his

assets, but finally agreed that thecollege education would also be a

benefittohim.

Truthfully, the ideas in this book are probably too far fetched and

radical for mostparents today. Some parents are having a hard enough

timesimplykeepingtheirchildreninschool.Butinlightofourchanging

times,asparentsweneedtobeopentonewandboldideas.Toencourage

childrentobeemployeesistoadviseyourchildrentopaymorethantheir

fairshareoftaxesoveralifetime,withlittleornopromiseofapension.

And itis true that taxes are a person's greatest expense. In fact, most

familiesworkfromJanuarytomid-Mayforthegovernmentjusttocover

theirtaxes.Newideasareneededandthisbookprovidesthem.

Robertclaimsthattherichteachtheirchildrendifferently.Theyteach

their children athome, around the dinner table. These ideas may notbe

the ideas you choose to discuss withyour children, but thank you for

lookingatthem.AndIadviseyoutokeepsearching.Inmyopinion,asa

momandaCPA,theconceptofsimplygettinggoodgradesandfindinga

good job is an old idea. We need to advise our children with a greater

degree ofsophistication. We need new ideas and different education.

Maybe telling our children tostrive to be good employees while also

strivingtoowntheirowninvestmentcorporationisnotsuchabadidea.

It is my hope as a mother that this book helps other parents. It is

Robert'shopetoinformpeoplethatanyonecanachieveprosperityifthey

so choose. If today you are agardener or a janitor or even unemployed,

youhavetheabilitytoeducateyourselfandteachthoseyoulovetotake

care of themselves financially. Remember that financialintelligence is

thementalprocessviawhichwesolveourfinancialproblems.

Today we are facing global and technological changes as great or

even greater than thoseeverfacedbefore.Noonehasacrystalball,but

one thing is for certain: Changes lieahead that are beyond our reality.

Whoknowswhatthefuturebrings?Butwhateverhappens,we have two

fundamental choices: play it safe or play it smart by preparing, getting

educatedandawakeningyourownandyourchildren'sfinancialgenius.-

SbaronLecbter

ForaFREEAUDIOREPORT“WhatMyRichDadTaughtMeAbout

Money” all you have to do isvisit our special website at

www.richdadbooki.comandthereportisyoursfree.

Thankyou

RichDad,PoorDad

RichDad,PoorDad

CHAPTERONE

RichDad,PoorDad

AsnarratedbyRobertKiyosaki

Ihadtwofathers,arichoneandapoorone.Onewashighlyeducated

andintelligent;hehadaPh.D.andcompletedfouryearsofundergraduate

workinlessthantwoyears.HethenwentontoStanfordUniversity,the

University of Chicago, and Northwestern University todo his advanced

studies,allonfullfinancialscholarships.Theotherfatherneverfinished

theeighthgrade.

Both men were successful in their careers, working hard all their

lives. Both earnedsubstantial incomes.Yet one struggled financially all

hislife.TheotherwouldbecomeoneoftherichestmeninHawaii.One

died leaving tens of millions of dollars to hisfamily, charities and his

church.Theotherleftbillstobepaid.

Bothmenwerestrong,charismaticandinfluential.Bothmenoffered

me advice, but theydid not advise the same things. Both men believed

stronglyineducationbutdidnotrecommendthesamecourseofstudy.

If I had had only one dad, I would have had to accept or reject his

advice. Having twodads advising me offered me the choice of

contrastingpointsofview;oneofarichmanandoneofapoorman.

Instead of simply accepting or rejecting one or the other, I found

myselfthinkingmore,comparingandthenchoosingformyself.

Theproblemwas,therichmanwasnotrichyetandthepoormannot

yet poor. Both werejust starting out on their careers, and both were

strugglingwithmoneyandfamilies.Buttheyhadverydifferentpointsof

viewaboutthesubjectofmoney.

Forexample,onedadwouldsay,“Theloveofmoneyistherootofall

evil.”Theother,“Thelackofmoneyistherootofallevil.”

As a young boy, having two strong fathers both influencing me was

difficult.Iwantedtobeagoodsonandlisten,butthetwofathersdidnot

say the same things. The contrast intheir points of view, particularly

where money was concerned, was so extreme that I grewcurious and

intrigued. I began to start thinking for long periods of time about what

eachwassaying.

Much of my private time was spent reflecting, asking myself

questions such as, “Why doeshe say that?” and then asking the same

questionoftheotherdad'sstatement.Itwouldhavebeenmucheasierto

simplysay,“Yeah,he'sright.Iagreewith that.” Or to simply reject the

point of view by saying, “The old man doesn't know what he's talking

about.”Instead, having two dads whom I loved forced me to think and

ultimately choose a way ofthinking for myself.As a process, choosing

for myself turned out to be much more valuablein the long run, rather

thansimplyacceptingorrejectingasinglepointofview.

One of the reasons the rich get richer, the poor get poorer, and the

middleclassstrugglesindebtisbecausethesubjectofmoneyistaughtat

home,notinschool.Mostofuslearnaboutmoneyfromourparents.So

what can a poor parent tell their child aboutmoney? They simply say

“Stay in school and study hard.” The child may graduate withexcellent

grades but with a poor person's financial programming and mind-set. It

waslearnedwhilethechildwasyoung.

Money is not taught in schools. Schools focus on scholastic and

professional skills, butnot on financial skills. This explains how smart

bankers, doctors and accountants whoearned excellent grades in school

may still struggle financially all of their lives. Ourstaggering national

debt is due in large part to highly educated politicians andgovernment

officials making financial decisions with little or no training on the

subjectofmoney.

I often look ahead to the new millennium and wonder what will

happen when we have millionsof people who will need financial and

medical assistance. They will be dependent on theirfamilies or the

governmentforfinancialsupport.WhatwillhappenwhenMedicareand

SocialSecurityrunoutofmoney?Howwillanationsurviveifteaching

children aboutmoneycontinuestobelefttoparents-mostofwhomwill

be,oralreadyare,poor?

BecauseIhadtwoinfluentialfathers,Ilearnedfrombothofthem.I

hadtothinkabouteachdad'sadvice,andindoingso,Igainedvaluable

insight into the power and effect of one's thoughts on one's life. For

example,onedadhadahabitofsaying,“Ican'taffordit.”Theotherdad

forbadethosewordstobeused.HeinsistedIsay,“HowcanIaffordit?”

Oneisastatement,andtheotherisaquestion.Oneletsyouoffthehook,

andtheotherforcesyoutothink.Mysoon-to-be-richdadwouldexplain

thatbyautomaticallysayingthewords“Ican'taffordit,”yourbrainstops

working.Byaskingthequestion“HowcanIaffordit?”yourbrainisput

to work. He didnot mean buy everything you wanted. He was fanatical

about exercising your mind, the mostpowerful computer in the world.

“My brain gets stronger every day because I exercise it.The stronger it

gets,themoremoneyIcanmake.”Hebelievedthatautomaticallysaying

“Ican'taffordit”wasasignofmentallaziness.

Althoughbothdadsworkedhard,Inoticedthatonedadhadahabitof

putting his brain tosleep when it came to money matters, and the other

hadahabitofexercisinghisbrain.Thelong-termresultwasthatonedad

grew stronger financially and the other grew weaker.It is not much

different from a person who goes to the gym to exercise on a regular

basisversus someone who sits on the couch watching television. Proper

physical exerciseincreases your chances for health, and proper mental

exercise increases your chances forwealth. Laziness decreases both

healthandwealth.

Mytwodadshadopposingattitudesinthought.Onedadthoughtthat

therichshouldpaymoreintaxestotakecareofthoselessfortunate.The

othersaid,“Taxespunishthosewhoproduceandrewardthosewhodon't

produce.”

Onedadrecommended,“Studyhardsoyoucanfindagoodcompany

to work for.” The otherrecommended, “Study hard so you can find a

goodcompanytobuy.”Onedadsaid,“ThereasonI'mnotrichisbecause

Ihaveyoukids.”Theothersaid,“ThereasonImustberichisbecause I

haveyoukids.”Oneencouragedtalkingaboutmoneyandbusinessatthe

dinner,table.Theotherforbadethesubjectofmoneytobediscussedover

a meal. One said,“When it comes to money, play it safe, don't take

risks.”Theothersaid,“Learntomanagerisk.”

One believed, “Our home is our largest investment and our greatest

asset.” The otherbelieved,“Myhouseisaliability,andifyourhouseis

yourlargestinvestment,you'reintrouble.”

Bothdadspaidtheirbillsontime,yetonepaidhisbillsfirstwhilethe

otherpaidhisbillslast.

Onedadbelievedinacompanyorthegovernmenttakingcareofyou

and your needs. He wasalways concerned about pay raises, retirement

plans,medicalbenefits,sickleave,vacationdaysandotherperks.Hewas

impressed with two of his uncles who joined themilitary and earned a

retirement and entitlement package for life after twenty years ofactive

service. He loved the idea of medical benefits and PX privileges the

militaryprovided its retirees. He also loved the tenure system available

throughtheuniversity.Theideaofjobprotectionforlifeandjobbenefits

seemedmoreimportant,attimes,thanthejob.Hewouldoftensay,“I've

workedhardforthegovernment,andI'mentitledtothesebenefits.”

The other believed in total financial self-reliance. He spoke out

against the“entitlement” mentality and how it was creating weak and

financially needy people. He wasemphatic about being financially

competent.

One dad struggled to save a few dollars. The other simply created

investments.

OnedadtaughtmehowtowriteanimpressiveresumesoIcouldfind

a good job. The othertaught me how to write strong business and

financialplanssoIcouldcreatejobs.

Being a product of two strong dads allowed me the luxury of

observing the effectsdifferentthoughtshaveonone'slife.Inoticedthat

peoplereallydoshapetheirlifethroughtheirthoughts.

Forexample,mypoordadalwayssaid,“I'llneverberich.”Andthat

prophesybecamereality.Myrichdad,ontheotherhand,alwaysreferred

to himself as rich. He would saythings like, “I'm a rich man, and rich

peopledon'tdothis.”Evenwhenhewasflatbrokeafteramajorfinancial

setback, he continued to refer to himself as a rich man. He wouldcover

himself by saying, “There is a difference between being poor and being

broke.-Brokeistemporary,andpooriseternal.”

My poor dad would also say, “I'm not interested in money,” or

“Moneydoesn'tmatter.”Myrichdadalwayssaid,“Moneyispower.”

Thepowerofourthoughtsmayneverbemeasuredorappreciated,but

itbecameobvioustomeasayoungboytobeawareofmythoughtsand

howIexpressedmyself.Inoticedthatmypoordadwaspoornotbecause

oftheamountofmoneyheearned,whichwassignificant,but

because of his thoughts and actions. As a young boy, having two

fathers, I became acutelyaware of being careful which thoughts I chose

to adopt as my own. Whom should I listento-my rich dad or my poor

dad?

Although both men had tremendous respect for education and

learning,theydisagreedinwhattheythoughtwasimportanttolearn.One

wanted me to study hard, earn a degree andget a good job to work for

money.Hewantedmetostudytobecomeaprofessional,anattorney or

an accountant or to go to business school for my MBA. The other

encouraged metostudytoberich,tounderstandhowmoneyworksand

to learn how to have it work forme. “I don't work for money!” were

wordshewouldrepeatoverandover,“Moneyworksforme!”

At the age of 9, I decided to listen to and learn from my rich dad

about money. In doingso, I chose not to listen to my poor dad, even

thoughhewastheonewithallthecollegedegrees.

ALessonFromRobertFrost

Robert Frost is my favourite poet. Although I love many of his

poems,myfavoriteisTheRoadNotTaken.Iuseitslessonalmostdaily:

TheRoadNotTaken

Two roads diverged in a yellow wood,And sorry I could not travel

bothAnd be onetraveler, long I stoodAnd looked down one as far as I

couldTowhereitbentintheundergrowth;

Then took the other, as just as fair, And having perhaps the better

claim, Because it wasgrassy and wanted wear Though as for that the

passingthereHadwornthemreallyaboutthesame,

And both that morning equally lay In leaves no step had trodden

black. Oh, I kept thefirst for another day!Yet knowing how way leads

ontoway,IdoubtedifIshouldevercomeback.

I shall be telling this with a sigh Somewhere ages and ages hence;

Two roads diverged in a wood, and I took the one less traveled by,And

thathasmadeallthedifference.

RobertFrost(1916)

Andthatmadeallthedifference.

Over the years, I have often reflected upon Robert Frost's poem.

Choosing not to listen tomy highly educated dad's advice and attitude

aboutmoneywasapainfuldecision,butitwasadecisionthatshapedthe

restofmylife.

Once I made up my mind whom to listen to, my education about

money began. My rich dadtaught me over a period of 30 years, until I

wasage39.HestoppedonceherealizedthatIknewandfullyunderstood

whathehadbeentryingtodrumintomyoftenthickskull.

Moneyisoneformofpower.Butwhatismorepowerfulisfinancial

education. Money comesand goes, but if you have the education about

howmoneyworks,yougainpoweroveritandcanbeginbuildingwealth.

Thereasonpositivethinkingalonedoesnotworkisbecausemostpeople

wenttoschoolandneverlearnedhowmoneyworks,sotheyspendtheir

livesworkingformoney.

BecauseIwasonly9yearsoldwhenIstarted,thelessonsmyrichdad

taught me weresimple.And when it was all said and done, there were

only six main lessons, repeated over30 years. This book is about those

six lessons, put as simply as possible as my rich dadput forth those

lessons to me. The lessons are not meant to be answers but guideposts.

Guideposts that will assist you and your children to grow wealthier no

matterwhathappensinaworldofincreasingchangeanduncertainty.

Lesson#1TheRichDon'tWorkforMoney

Lesson#2WhyTeachFinancialLiteracy?

Lesson#3MindYourownBusiness

Lesson#4TheHistoryofTaxesandthePowerofCorporations

Lesson#5TheRichInventMoney

Lesson#6WorktoLearnDon'tWorkforMoney

RichDad,PoorDad

CHAPTERTWO

LessonOne:TheRichDon'tWorkForMoney

“Dad,CanYouTellMeHowtoGetRich?”

My dad put down the evening paper. “Why do you want to get rich,

son?”

“Because today Jimmy's mom drove up in their new Cadillac, and

they were going to theirbeach house for the weekend. He took three of

his friends, but Mike and I weren't invited.They told us we weren't

invitedbecausewewere`poorkids'.”

“Theydid?”mydadaskedincredulously.

“Yeah,theydid.”Irepliedinahurttone.

My dad silently shook his head, pushed his glasses up the bridge of

his nose and went backto reading the paper. I stood waiting for an

answer.

The year was 1956. I was 9 years old. By some twist of fate, I

attendedthesamepublicschoolwheretherichpeoplesenttheirkids.We

were primarily a sugar plantation town.The managers of the plantation

and the other affluent people of the town, such as doctors,business

owners, and bankers, sent their children to this school, grades 1 to 6.

Aftergrade 6, their children were generally sent off to private schools.

Because my familylivedononesideofthestreet,Iwenttothisschool.

Had I lived on the other side ofthe street, I would have gone to a

different school, with kids from families more likemine. After grade

6,thesekidsandIwouldgoontothepublicintermediateandhighschool.

Therewasnoprivateschoolforthemorforme.

Mydadfinallyputdownthepaper.Icouldtellhewasthinking.

“Well, son,” he began slowly. “If you want to be rich, you have to

learntomakemoney.”

“HowdoImakemoney?”Iasked.

“Well, use your head, son,” he said, smiling. Which really meant,

“That's all I'm going totell you,” or “I don't know the answer, so don't

embarrassme.”

APartnershipIsFormed

Thenextmorning,Itoldmybestfriend,Mike,whatmydadhadsaid.

As best I could tell,Mike and I were the only poor kids in this school.

Mike was like me in that he was in thisschool by a twist of fate.

Someonehaddrawnajoginthelinefortheschooldistrict,andwewound

upinschoolwiththerichkids.Weweren'treallypoor,butwefeltasif

wewerebecausealltheotherboyshadnewbaseballgloves,,,,y

newbicycles,neweverything.

Momanddadprovideduswiththebasics,likefood,shelter,clothes.

:, But that wasabout it. My dad used to say, “If you want something,

work for it.” We wanted things, but there was not much work available

for9-,year-oldboys.

“Sowhatdowedotomakemoney?”Mikeasked.

“Idon'tknow,”Isaid.“Butdoyouwanttobemypartner?”

He agreed and so on that Saturday morning, Mike became my first

business partner. We spent allmorningcomingupwithideasonhowto

1'make money. Occasionally we talked about allthe “cool guys” at

Jimmy's beach house having fun. It hurt a little, but that hurt wasgood,

foritinspiredustokeepthinkingofawaytomakemoney.Finally,that

afternoon,a bolt of lightning came through our heads. It was an idea

Mike had gotten from a sciencebook he had read. Excitedly, we shook

hands,andthepartnershipnowhadabusiness.

Forthenextseveralweeks,MikeandIranaroundourneighborhood,

knocking on doors andasking our neighbors if they would save their

toothpastetubesforus.Withpuzzledlooks,mostadultsconsentedwitha

smile. Some asked us what we were doing. To which we replied,“We

can'ttellyou.It'sabusinesssecret.”

Mymomgrewdistressedastheweeksworeon.Wehadselecteda

sitenexttoherwashingmachineastheplacewewouldstockpileour

raw materials. In abrown cardboard box that one time held catsup

bottles,ourlittlepileofusedtoothpastetubesbegantogrow.

Finally my mom put her foot down. The sight of her neighbors' ,

messy, crumpled usedtoothpastetubeshadgottentoher.“Whatareyou

boys doing?” she asked. “And I don'twant to hear again that it's a

business secret. Do something with this mess or I'm goingto throw it

out.”

MikeandIpleadedandbegged,explainingthatwewouldsoonhave

enough and then we wouldbegin production. We informed her that we

werewaitingonacoupleofneighborstofinishusinguptheirtoothpaste

sowecouldhavetheirtubes.Momgrantedusaone-weekextension.

Thedatetobeginproductionwasmovedup.Thepressurewason.My

first partnership wasalready being threatened with an eviction notice

fromourwarehousespacebymyownmom.ItbecameMike'sjobtotell

the neighbors to quickly use up their toothpaste, sayingtheir dentist

wanted them to brush more often anyway. I began to put together the

productionline.

Onedaymydaddroveupwithafriendtoseetwo9-year-oldboys.in

the driveway with aproduction line operating at full speed. There was

fine white powder everywhere. On a longtable were small milk cartons

fromschool,andourfamily'shibachigrillwasglowingwithredhotcoals

atmaximumheat.

Dad walked up cautiously, having to park the car at the base of the

driveway, since theproduction line blocked the carport. As he and his

friendgotcloser,theysawasteelpotsittingontopofthecoals,withthe

toothpaste tubes being melted down. In those days,toothpaste did not

comeinplastictubes.Thetubesweremadeoflead.Sooncethepaintwas

burned off, the tubes were dropped in the small steel pot, melted until

theybecameliquid,andwithmymom'spotholderswewerepouringthe

leadthroughasmallholeinthetopofthemilkcartons.

Themilkcartonswerefilledwithplaster-of-Paris.Thewhitepowder

everywherewastheplasterbeforewemixeditwithwater.Inmyhaste,I

hadknockedthebagover,andtheentirearealooklikeithadbeenhitby

a snowstorm. The milk cartons were the outercontainers for plaster-of-

Parismolds.

Mydadandhisfriendwatchedaswecarefullypouredthemoltenlead

throughasmallholeinthetopoftheplaster-of-Pariscube.

“Careful,”mydadsaid.

Inoddedwithoutlookingup.

Finally, once the pouring was through, I put the steel pot down and

smiledatmydad.

“Whatareyouboysdoing?”heaskedwithacautioussmile.

“We'redoingwhatyoutoldmetodo.We'regoingtoberich,”Isaid.

“Yup,”saidMike,grinningandnoddinghishead.“We'repartners.”

“Andwhatisinthoseplastermolds?”dadasked.

“Watch,”Isaid.“Thisshouldbeagoodbatch.”

Withasmallhammer,Itappedatthesealthatdividedthecubein

half.Cautiously,Ipulledupthetophalfoftheplastermoldandalead

nickelfellout."

“Oh,myGod!”mydadsaid.“You'recastingnickelsoutoflead.”

“That's right,” Mike said. “We doing as you told us to do. We're

makingmoney.”

My dad's friend turned and burst into laughter. My dad smiled and

shookhishead.Alongwithafireandaboxofspenttoothpastetubes,in

front of him were two little boyscovered with white dust and smiling

fromeartoear.

Heaskedustoputeverythingdownandsitwithhimonthefrontstep

of our house. With asmile, he gently explained what the word

“counterfeiting”meant.

Ourdreamsweredashed.“Youmeanthisisillegal?”askedMikeina

quiveringvoice.

“Let them go,” my dad's friend said. “They might be developing a

naturaltalent.”

Mydadglaredathim.

“Yes, it is illegal,” my dad said gently. “But you boys have shown

great creativity andoriginal thought. Keep going. I'm really proud of

you!”

Disappointed, Mike and I sat in silence for about twenty minutes

beforewebegancleaningupourmess.Thebusinesswasoveronopening

day.Sweepingthepowderup,IlookedatMikeandsaid,“IguessJimmy

andhisfriendsareright.Wearepoor.”

My father was just leaving as I said that. “Boys,” he said. "You're

only poor if you giveup. The most important thing is that you did

something.Mostpeopleonlytalkanddreamofgettingrich.You'vedone

something.I'mveryproudofthetwoofyou.Iwillsayitagain.

Keepgoing.Don'tquit."

MikeandIstoodthereinsilence.Theywerenicewords,butwestill

didnotknowwhattodo.

“Sohowcomeyou'renotrich,dad?”Iasked.

“Because I chose to be a schoolteacher. Schoolteachers really don't

thinkaboutbeingrich.Wejustliketoteach.IwishIcouldhelpyou,butI

reallydon'tknowhowtomakemoney.”

MikeandIturnedandcontinuedourcleanup.

“I know,” said my dad. “If you boys want to learn how to be rich,

don'taskme.Talktoyourdad,Mike.”

“Mydad?”askedMikewithascrunchedupface.

“Yeah, your dad,” repeated my dad with a smile. “Your dad and I

have the same banker, andhe raves about your father. He's told me

several times that your father is brilliant whenit comes to making

money.”

“Mydad?”Mikeaskedagainindisbelief.“Thenhowcomewedon't

haveanicecarandanicehouseliketherichkidsatschool?”

“Anicecarandanicehousedoesnotnecessarilymeanyou'rerichor

youknowhowtomakemoney,”mydadreplied.“Jimmy'sdadworksfor

the sugar plantation. He's not muchdifferent from me. He works for a

company,andIworkforthegovernment.Thecompanybuysthecarfor

him. The sugar company is in financial trouble, and Jimmy's dad may

soon havenothing.YourdadisdifferentMike.Heseemstobebuilding

anempire,andIsuspectinafewyearshewillbeaveryrichman.”

With that, Mike and I got excited again. With new vigor, we began

cleaning up the messcaused by our now defunct first business. As we

werecleaning,wemadeplansonhowandwhentotalktoMike'sdad.The

problemwasthatMike'sdadworkedlonghoursandoftendid not come

homeuntillate.Hisfatherownedwarehouses,aconstructioncompany,a

chainofstores,andthreerestaurants.Itwastherestaurantsthatkepthim

outlate.

Mikecaughtthebushomeafterwehadfinishedcleaningup.Hewas

going to talk to hisdad when he got home that night and ask him if he

wouldteachushowtobecomerich.Mikepromisedtocallassoonashe

hadtalkedtohisdad,evenifitwaslate.

Thephonerangat8:30p.m.

“OK,”Isaid.“NextSaturday.”Andputthe phone down. Mike's dad

hadagreedtomeetwithMikeandme.

At7:30Saturdaymorning,Icaughtthebustothepoorsideoftown.

TheLessonsBegin:

“I'llpayyou10centsanhour.”

Evenby1956paystandards,10centsanhourwaslow.

Michael and I met with his dad that morning at 8 o'clock. He was

already busy and had beenat work for more than an hour. His

construction supervisor was just leaving in his pickuptruck as I walked

uptohissimple,smallandtidyhome.Mikemetmeatthedoor.

“Dad's on the phone, and he said to wait on the back porch,” Mike

saidasheopenedthedoor.

TheoldwoodenfloorcreakedasIsteppedacrossthethresholdofthis

aging house. Therewas a cheap mat just inside the door. The mat was

theretohidetheyearsofwearfromcountlessfootstepsthatthefloorhad

supported.Althoughclean,itneededtobereplaced.

IfeltclaustrophobicasIenteredthenarrow living room, which was

filledwitholdmustyoverstuffedfurniturethattodaywouldbecollector's

items.Sittingonthecouchweretwowomen,alittleolderthanmymom.

Acrossfromthewomensatamaninworkman'sclothes.He wore khaki

slacks and a khaki shirt, neatly pressed but without starch, and polished

workbooks.Hewasabout10yearsolderthanmydad;I'dsayabout45

years old. TheysmiledasMikeandIwalkedpastthem,headingforthe

kitchen,whichleadtotheporchthatoverlookedthebackyard.Ismiled

backshyly.

“Whoarethosepeople?”Iasked.

“Oh,theyworkformydad.Theoldermanrunshiswarehouses,and

the women are themanagers of the restaurants. And you saw the

constructionsupervisor,whoisworkingonaroadprojectabout50miles

from here. His other supervisor, who is building a track ofhouses, had

alreadyleftbeforeyougothere.”

“Doesthisgoonallthetime?”Iasked.

“Not always, but quite often,” said Mike, smiling as he pulled up a

chairtositdownnexttome.

“Iaskedhimifhewouldteachustomakemoney,”Mikesaid.

“Oh,andwhatdidhesaytothat?”Iaskedwithcautiouscuriosity.

“Well, he had a funny look on his face at first, and then he said he

wouldmakeusanoffer.”“Oh,”Isaid,rockingmychairbackagainstthe

wall;Isatthereperchedontworearlegsofthechair.Mikedidthesame

thing.“Doyouknowwhattheofferis?”Iasked.“No,butwe'llsoonfind

out.”Suddenly,Mike'sdadburstthroughthericketyscreendoorandonto

the

porch.MikeandIjumpedtoourfeet,notoutofrespectbutbecause

wewerestartled.

“Readyboys?”Mike'sdadaskedashepulledupachairtositdown

withus.

Wenoddedourheadsaswepulledourchairsawayfromthewallto

sitinfrontofhim.

He was a big man, about 6 feet tall and 200 pounds. My dad was

taller,aboutthesameweight,andfiveyearsolderthanMike'sdad.They

sortoflookedalike,thoughnotofthesameethnicmakeup.Maybetheir

energywassimilar.

“Mike says you want to learn to make money? Is that correct,

Robert?”

Inoddedmyheadquickly,butwithalittleintimidation.Hehadalot

ofpowerbehindhiswordsandsmile.

“OK,here'smyoffer.I'llteachyou,butIwon'tdoitclassroom-style.

You work for me, I'll teach you.You don't work for me, I won't teach

you.Icanteachyoufasterifyouwork,andI'mwastingmytimeifyou

justwanttositandlisten,likeyoudoinschool.That'smyoffer.Takeit

orleaveit.”

“Ah...mayIaskaquestionfirst?”Iasked.

“No. Take it or leave it. I've got too much work to do to waste my

time.Ifyoucan'tmakeupyouminddecisively,thenyou'llneverlearnto

make money anyway. Opportunities comeand go. Being able to know

when to make quick decisions is an important skill. You have an

opportunity that you asked for. School is beginning or it's over in ten

seconds,”Mike'sdadsaidwithateasingsmile.

“Takeit,”Isaid.`

“Takeit,”saidMike.

“Good,” said Mike's dad. “Mrs. Martin will be by in ten minutes.

AfterI'mthroughwithher,youridewithhertomysuperetteandyoucan

beginworking.I'llpayyou10centsanhourandyouwillworkforthree

hourseverySaturday.”

“ButIhaveasoftballgametoday,”Isaid.

Mike'sdadloweredhisvoicetoasterntone.“Takeitorleaveit,”he

“I'lltakeit,”Ireplied,choosingtoworkandlearninsteadofplaying

softball.

30CentsLater

By9a.m.onabeautifulSaturdaymorning,MikeandIwereworking

forMrs.Martin.Shewasakindandpatientwoman.Shealwayssaidthat

Mike and I reminded her of her two sonswho were grown and gone.

Although kind, she believed in hard work and she kept us working.She

was a task master. We spent three hours taking canned goods off the

shelves and, withafeatherduster,brushingeachcantogetthedustoff,

andthenre-stackingthemneatly.Itwasexcruciatinglyboringwork.

Mike's dad, whom I call my rich dad, owned nine of these little

superetteswithlargeparkinglots.Theyweretheearlyversionofthe7-11

convenience stores. Littleneighborhood grocery stores where people

boughtitemssuchasmilk,bread,butterandcigarettes.Theproblemwas,

thiswasHawaiibeforeairconditioning,andthestorescouldnotcloseits

doorsbecauseoftheheat.Ontwosidesofthestore,thedoorshadtobe

wideopentotheroadandparkinglot.Everytimeacardrovebyorpulled

intotheparkinglot,dustwouldswirlandsettleinthestore.

Hence,wehadajobforaslongastherewasnoairconditioning.

Forthreeweeks,MikeandIreportedtoMrs.Martinandworkedour

three hours. By noon,our work was over, and she dropped three little

dimesineachofourhands.Now,evenattheageof9inthemid-1950s,

30centswasnottooexciting.Comicbookscost10centsbackthen,soI

usuallyspentmymoneyoncomicbooksandwenthome.

ByWednesdayofthefourthweek,Iwasreadytoquit.Ihadagreedto

workonlybecauseIwantedtolearntomakemoneyfromMike'sdad,and

now I was a slave for 10 cents an hour.On top of that, I had not seen

Mike'sdadsincethatfirstSaturday.

“I'm quitting,” I told Mike at lunchtime. The school lunch was

miserable.Schoolwasboring,andnowIdidnotevenhavemySaturdays

tolookforwardto.Butitwasthe30centsthatreallygottome.

ThistimeMikesmiled.

“Whatareyoulaughingat?”Iaskedwithangerandfrustration.

“Dad said this would happen. He said to meet with him when you

werereadytoquit.”

“What?”Isaidindignantly.“He'sbeenwaitingformetogetfedup?”

“Sortof,”Mikesaid.“Dad'skindofdifferent.Heteachesdifferently

from your dad.Your mom and dad lecture a lot. My dad is quiet and a

man of few words. You just wait till this Saturday. I'll tell him .you're

ready.”

“YoumeanI'vebeensetup?”

“No,notreally,butmaybe.DadwillexplainonSaturday.”

WaitinginLineonSaturday

I was ready to face him and I was prepared. Even my real dad was

angrywithhim.Myrealdad,theoneIcallthepoorone,thoughtthatmy

richdadwasviolatingchildlaborlawsandshouldbeinvestigated.

MyeducatedpoordadtoldmetodemandwhatIdeserve.Atleast25

centsanhour.MypoordadtoldmethatifIdidnotgetaraise,Iwasto

quitimmediately.

“You don't need that damned job anyway,” said my poor dad with

indignity.At 8 o'clock Saturday morning, I was going through the same

ricketydoorofMike'shouse.

“Takeaseatandwaitinline,”Mike'sdadsaidasIentered.Heturned

anddisappearedintohislittleofficenexttoabedroom.

I looked around the room and did not see Mike anywhere. Feeling

awkward,Icautiouslysatdownnexttothesametwowomenwhowhere

there four weeks earlier. They smiled and slidacrossthecouchtomake

roomforme.

Forty-fiveminuteswentby,andIwassteaming.Thetwowomenhad

met with him and leftthirtyminutesearlier.Anoldergentlemanwasin

therefortwentyminutesandwasalsogone.

Thehousewasempty,andIsatoutinhismustydarklivingroomona

beautiful sunnyHawaiian day, waiting to talk to a cheapskate who

exploitedchildren.Icouldhearhimrustlingaroundtheoffice,talkingon

the phone, and ignoring me. I was now ready to walkout, but for some

reasonIstayed.

Finally,fifteenminuteslater,atexactly9o'clock,richdadwalkedout

ofhisoffice,saidnothing,andsignaledwithhishandformetoenterhis

dingyoffice.

“Iunderstandyouwantaraiseoryou'regoingtoquit,”richdadsaid

asheswiveledinhisofficechair.

“Well, you're not keeping your end of the bargain,” I blurted out

nearlyintears.Itwasreallyfrighteningfora9-year-oldboytoconfronta

grownup.

“You said that you would teach me if I worked for you. Well, I've

worked for you. I'veworked hard. I've given up my baseball games to

work for you. And you don't keep yourword. You haven't taught me

anything.You are a crook like everyone in town thinks you are. You're

greedy.You want all the money and don't take care of your employees.

You make mewaitanddon'tshowmeanyrespect.I'monlyalittleboy,

andIdeservetobetreatedbetter.”

Rich dad rocked back in his swivel chair, hands up to his chin,

somewhatstaringatme.Itwaslikehewasstudyingme.

“Notbad,”hesaid.“Inlessthanamonth,yousoundlikemostofmy

employees.”

“What?”Iasked.Notunderstandingwhathewassaying,Icontinued

with my grievance. “Ithought you were going to keep your end of the

bargainandteachme.Insteadyouwanttotortureme?That'scruel.That's

reallycruel.”

“Iamteachingyou,”richdadsaidquietly.

“What have you taught me? Nothing!” I said angrily. "You haven't

eventalkedtomeoncesinceIagreedtoworkforpeanuts.Tencentsan

hour.Hah!Ishouldnotifythegovernmentaboutyou.

We have child labor laws, you know. My dad works for the

government,youknow."

“Wow!” said rich dad. “Now you sound just like most of the people

whousedtoworkforme.PeopleI'veeitherfiredorthey'vequit.”

“Sowhatdoyouhavetosay?”Idemanded,feelingprettybravefora

little kid. “You lied to me. I've worked for you, and you have not kept

yourword.Youhaven'ttaughtmeanything.”

“HowdoyouknowthatI'venottaughtyouanything?”askedrichdad

calmly.

“Well, you've never talked to me. I've worked for three weeks, and

youhavenottaughtmeanything,”Isaidwithapout.

“Doesteachingmeantalkingoralecture?”richdadasked.

“Well,yes,”Ireplied.

“That's how they teach you in school,” he said smiling. “But that is

not how life teachesyou,andIwouldsaythatlifeisthebestteacherof

all.Mostofthetime,lifedoesnottalktoyou.Itjustsortofpushesyou

around.Eachpushislifesaying,`Wakeup. There'ssomethingIwantyou

tolearn.'”

“What is this man talking about?” I asked myself silently. “Life

pushingmearoundwaslifetalkingtome?”NowIknewIhadtoquitmy

job.Iwastalkingtosomeonewhoneededtobelockedup.

“If you learn life's lessons, you will do well. If not, life will just

continue to pushyou around. People do two things. Some just let life

push them around. Others get angryand push back. But they push back

against their boss, or their job, or their husband orwife. They do not

knowit'slifethat'spushing.”

Ihadnoideawhathewastalkingabout.

“Lifepushesallofusaround.Somegiveup.Othersfight.Afewlearn

the lesson and moveon. They welcome life pushing them around. To

thesefewpeople,itmeanstheyneedandwanttolearnsomething.They

learnandmoveon.Mostquit,andafewlikeyoufight.”

Rich dad stood and shut the creaky old wooden window that needed

repair. “If you learnthis lesson, you will grow into a wise, wealthy and

happy young man. If you don't, youwill spend your life blaming a job,

low pay or your boss for your problems.You'll live life hoping for that

bigbreakthatwillsolveallyourmoneyproblems.”

RichdadlookedoveratmetoseeifIwasstilllistening.Hiseyesmet

mine.Westared ateachother,streamsofcommunicationgoingbetween

us through our eyes. Finally, Ipulled away once I had absorbed his last

message.Iknewhewasright.Iwasblaminghim,andIdidasktolearn.I

wasfighting.

Richdadcontinued.“Orifyou'rethekindofpersonwhohasnoguts,

youjustgiveupeverytimelifepushesyou.Ifyou'rethatkindofperson,

you'll live all your lifeplaying it safe, doing the right things, saving

yourself for some event that neverhappens. Then, you die a boring old

man. You'll have lots of friends who really like you because you were

suchanicehard-workingguy.Youspentalifeplayingitsafe,doingthe

rightthings.Butthetruthis,youletlifepushyouintosubmission.Deep

downyouwereterrifiedoftakingrisks.Youreallywantedtowin,butthe

fear of losing was greaterthan the excitement of winning. Deep inside,

you and only you will know you didn't go forit. You chose to play it

safe.”

Our eyes met again. For ten seconds, we looked at each other, only

pullingawayoncethemessagewasreceived.

“You'vebeenpushingmearound”Iasked.

“Some people might say that,” smiled rich dad. "I would say that I

just

gaveyouatasteoflife.“”Whattasteoflife?"Iasked,stillangry,but

nowcurious.Evenreadytolearn.

“Youboysarethefirstpeoplethathaveeveraskedmetoteachthem

how to make money. Ihave more than 150 employees, and not one of

themhasaskedmewhatIknowaboutmoney.Theyaskmeforajoband

apaycheck,butnevertoteachthemaboutmoney.Somostwillspendthe

best years of their lives working for money, not really understanding

whatitistheyareworkingfor.”

Isattherelisteningintently.

“So when Mike told me about you wanting to learn how to make

money, I decided to design acourse that was close to real life. I could

talk until I was blue in the face, but youwouldn't hear a thing. So I

decidedtoletlifepushyouaroundabitsoyoucouldhearme.That'swhy

Ionlypaidyou10cents.”

“So what is the lesson I learned from working for only 10 cents an

hour?”Iasked.“Thatyou'recheapandexploityourworkers?”

Richdadrockedbackandlaughedheartily.Finally,afterhislaughing

stopped, he said,“You'd best change your point of view. Stop blaming

me,thinkingI'mtheproblem.IfyouthinkI'mtheproblem,thenyouhave

tochangeme.Ifyourealizethatyou'retheproblem,thenyoucanchange

yourself, learn something and grow wiser. Most people want everyone

elseintheworldtochangebutthemselves.Letmetellyou,it'seasierto

changeyourselfthaneveryoneelse.”

“Idon'tunderstand,”Isaid.

“Don't blame me for your problems,” rich dad said, growing

impatient.

“Butyouonlypayme10cents.”

“Sowhatareyoulearning?”richdadasked,smiling.

“Thatyou'recheap,”Isaidwithaslygrin.

“See,youthinkI'mtheproblem,”saidrichdad.

“Butyouare.”

"Well,keepthatattitudeandyoulearnnothing.Keeptheattitude

thatI'mtheproblemandwhatchoicesdoyouhave?"

“Well,ifyoudon'tpaymemoreorshowmemorerespectandteach

me,I'llquit.”

“Well put,” rich dad said. “And that's exactly what most people do.

They quit and golooking for another job, better opportunity, and higher

pay,actuallythinkingthatanewjobormorepaywillsolvetheproblem.

Inmostcases,itwon't.”

“Sowhatwillsolvetheproblem?”Iasked.“Justtakethismeasly10

centsanhourandsmile?”

Rich dad smiled. “That's what the other people do. Just accept a

paycheck knowing thatthey and their family will struggle financially.

But that's all they do, waiting for araisethinkingthatmoremoneywill

solve the problem. Most just accept it, and some takea second job

workingharder,butagainacceptingasmallpaycheck.”

Isatstaringatthefloor,beginningtounderstandthelessonrichdad

was presenting. Icould sense it was a taste of life. Finally, I looked up

andrepeatedthequestion.“Sowhatwillsolvetheproblem?”

“This,” he said tapping me gently on the head. “This stuff between

yourears.”

It was at that moment that rich dad shared the pivotal point of view

that separated himfromhisemployeesandmypoordad-andledhimto

eventually become one of the richest menin Hawaii while my highly

educated,butpoor,dadstruggledfinanciallyallhislife.Itwasasingular

pointofviewthatmadeallthedifferenceoveralifetime.

Rich dad said over and over, this point of view, which I call Lesson

No.1.

“The poor and the middle class work for money.” “The rich have

moneyworkforthem.”

On that bright Saturday morning, I was learning a completely

differentpointofviewfromwhatIhadbeentaughtbymypoordad.At

theageof9,Igrewawarethatbothdadswantedmetolearn.Bothdads

encouragedmetostudy...butnotthesamethings.

MyhighlyeducateddadrecommendedthatIdowhathedid.“Son,I

wantyoutostudyhard,getgoodgrades,soyoucanfindasafe,securejob

with a big company.And make sure it has excellent benefits.” My rich

dad wanted me to learn how money works so I could make itwork for

me. These lessons I would learn through life with his guidance, not

becauseofaclassroom.

Myrichdadcontinuedmyfirstlesson,“I'mgladyougotangryabout

workingfor10centsanhour.Ifyouhadnotgottenangryandhadgladly

acceptedit,IwouldhavetotellyouthatIcouldnotteachyou.Yousee,

truelearningtakesenergy,passion,aburning desire.Angerisabigpart

ofthatformula,forpassionisangerandlovecombined.Whenit comes

to money, most people want to play it safe and feel secure. So passion

doesnotdirectthem:Feardoes.”

“Soisthatwhythey'lltakeajobwithlowpar?”Iasked.

“Yes,” said rich dad. “Some people say I exploit people because I

don't pay as much as thesugar plantation or the government. I say the

peopleexploitthemselves.It'stheirfear,notmine.”

“Butdon'tyoufeelyoushouldpaythemmore?”Iasked.

“Idon'thaveto.Andbesides,moremoneywillnotsolvetheproblem.

Justlookatyourdad.Hemakesalotofmoney,andhestillcan'tpayhis

bills.Mostpeople,givenmoremoney,onlygetintomoredebt.”

“Sothat'swhythe10centsanhour,”Isaid,smiling.“It'sapartofthe

lesson.”

“That'sright,”smiledrichdad.“Yousee,yourdadwenttoschooland

got an excellenteducation,sohecouldgetahigh-payingjob.Whichhe

did. But he still has moneyproblemsbecauseheneverlearnedanything

about money at school. On top of that, hebelieves in working for

money.”

“Andyoudon't?”Iasked.

“No, not really,” said rich dad. “If you want to learn to work for

money,thenstayinschool.Thatisagreatplacetolearntodothat.Butif

youwanttolearnhowtohavemoneyworkforyou,thenIwillteachyou

that.Butonlyifyouwanttolearn.”

“Wouldn'teveryonewanttolearnthat”Iasked.

“No,” said rich dad. “Simply because it's easier to learn to work for

money, especially iffear is your primary emotion when the subject of

moneyisdiscussed.”

“Idon'tunderstand,”Isaidwithafrown.

"Don't worry about that for now. Just know that it's fear that keeps

mostpeopleworkingatajob.Thefearofnotpayingtheirbills.Thefear

ofbeingfired.Thefearofnothavingenoughmoney.Thefearof

starting over. That's the price of studying to learn a profession or

trade, and thenworking for money. Most people become a slave to

money...andthengetangryattheirboss."

“Learning to have money work for you is a completely different

courseofstudy?”Iasked.

“Absolutely,”richdadanswered,“absolutely.”

We sat in silence on that beautiful Hawaiian Saturday morning. My

friends would have justbeen starting their Little League baseball game.

But far some reason, I was now thankful Ihad decided to work for 10

cents an hour. I sensed that I was about to learn something myfriends

wouldnotlearninschool.

“Readytolearn?”askedrichdad.

“Absolutely,”Isaidwithagrin.

“Ihavekeptmypromise.I'vebeenteachingyoufromafar,”myrich

dad said. “At 9 yearsold, you've gotten a taste of what it feels like to

workformoney.Justmultiplyyourlastmonthbyfiftyyearsandyouwill

haveanideaofwhatmostpeoplespendtheirlifedoing.”

“Idon'tunderstand,”Isaid.

“How did you feel waiting in line to see me? Once to get hired and

oncetoaskformoremoney?”

“Terrible,”Isaid.

“If you choose to work for money, that is what life is like for many

people,”saidrichdad.

“AndhowdidyoufeelwhenMrs.Martindroppedthreedimesinyour

handforthreehours'work?”

“I felt like it wasn't enough. It seemed like nothing. I was

disappointed,”Isaid.

“And that is how most employees feel when they look at their

paychecks.Especiallyafterallthetaxandotherdeductionsaretakenout.

Atleastyougot100percent.”

“You mean most workers don't get paid everything?” I asked with

amazement.

“Heavensno!”saidrichdad.“Thegovernmentalwaystakesitsshare

first.”

“Howdotheydothat.”Iasked.

“Taxes,” said rich dad. “You're taxed when you earn. You're taxed

when you spend. You're taxed when you save. You're taxed when you

die.”

“Whydopeopleletthegovernmentdothattothem?”

“Therichdon't,”saidrichdadwithasmile.“Thepoorandthemiddle

classdo.I'llbetyouthatIearnmorethanyourdad,yethepaysmorein

taxes.”

“Howcanthatbe?”Iasked.Asa9-year-oldboy,thatmadenosense

tome.“Whywouldsomeoneletthegovernmentdothattothem?”

Richdadsatthereinsilence.Iguesshewantedmetolisteninsteadof

jabberawayatthemouth.

Finally, I calmed down. I did not like what I had heard. I knew my

dad complainedconstantlyaboutpayingsomuchintaxes,butreallydid

nothingaboutit.Wasthatlifepushinghimaround?

Richdadrockedslowlyandsilentlyinhischair,justlookingatme.

“Readytolearn?”heasked.

Inoddedmyheadslowly.

“AsIsaid,thereisalottolearn.Learninghowtohavemoneywork

foryouisalifetimestudy.Mostpeoplegotocollegeforfouryears,and

their education ends. I already knowthat my study of money will

continueovermylifetime,simplybecausethemoreIFindout,themore

IfindoutIneedtoknow.Mostpeopleneverstudythesubject.Theygoto

work,gettheirpaycheck,balancetheircheckbooks,andthat'sit.Ontop

of that, they wonderwhy they have money problems. Then, they think

thatmoremoneywillsolvetheproblem.Fewrealizethatit'stheirlackof

financialeducationthatistheproblem.”

“Somydadhastaxproblemsbecausehedoesn'tunderstandmoney?”

Iasked,confused.

“Look,” said rich dad. “Taxes are just one small section on learning

howtohavemoneyworkforyou.Today,Ijustwantedtofindoutifyou

stillhavethepassiontolearnaboutmoney.Mostpeopledon't.Theywant

togotoschool,learnaprofession,havefunattheirwork,andearnlotsof

money. One day they wake up with big money problems, and thenthey

can't stop working. That's the price of only knowing how to work for

money instead ofstudyinghowtohavemoneyworkforyou.Sodoyou

stillhavethepassiontolearn?”askedrichdad.

Inoddedmyhead.

“Good,”saidrichdad.“Nowgetbacktowork.Thistime,Iwillpay

younothing.”

“What?”Iaskedinamazement.

"Youheardme.Nothing.Youwillworkthesamethreehoursevery

Saturday, but this time you will not be paid 10 cents per hour.You

saidyouwantedtolearntonotworkformoney,soI'mnotgoingtopay

youanything."

Icouldn'tbelievewhatIwashearing.

“I'vealreadyhadthisconversationwithMike.He'salreadyworking,

dusting and stackingcanned goods for free. You'd better hurry and get

backthere.”

“That'snotfair,”Ishouted.“You'vegottopaysomething.”

“Yousaidyouwantedtolearn.Ifyoudon'tlearnthisnow,you'llgrow

uptobelikethetwowomenandtheoldermansittinginmylivingroom,

workingformoneyandhopingIdon'tfirethem.Orlikeyourdad,earning

lotsofmoneyonlytobeindebtuptohiseyeballs,hopingmoremoney

willsolvetheproblem.Ifthat'swhatyouwant,I'llgobacktoouroriginal

dealof10centsanhour.Oryoucandowhatmostpeoplegrowuptodo.

Complain that there is not enough pay, quit and go looking for another

job.”

“ButwhatdoIdo?”Iasked.

Rich dad tapped me on the head. “Use this,” he said. “If you use it

well,youwillsoonthankmeforgivingyouanopportunity,andyouwill

growintoarichman.”

I stood there still not believing what a raw deal I had been handed.

HereIcametoaskforaraise,andnowIwasbeingtoldtokeepworking

fornothing.

Rich dad tapped me on the head again and said, “Use this. Now get

outofhereandgetbacktowork.”

LESSON#l:TheRichDon'tWorkForMoney

I didn't tell my poor dad I wasn't being paid. He would not have

understood,andIdidnotwanttotrytoexplainsomethingthatIdidnot

yetunderstandmyself.

For three more weeks, Mike and I worked for three hours, every

Saturday, for nothing. Thework didn't bother me, and the routine got

easier. It was the missed baseball games andnotbeingabletoaffordto

buyafewcomicbooksthatgottome.

Rich dad stopped by at noon on the third week. We heard his truck

pullupintheparkinglotandsputterwhentheenginewasturnedoff.He

entered the store and greeted Mrs.Martin with a hug.After finding out

howthingsweregoinginthestore,hereachedintotheice-creamfreezer,

pulledouttwobars,paidforthem,andsignalledtoMikeandme.

“Let'sgoforawalkboys.”

Wecrossedthestreet,dodgingafewcars,andwalkedacrossalarge

grassy field, where afewadultswereplayingsoftball.Sittingdownata

remotepicnictable,hehandedMikeandmetheice-creambars.

“How'sitgoingboys?”

“OK,”Mikesaid.

Inoddedinagreement.

“Learnanythingyet?”richdadasked.

Mike and I looked at each other, shrugged our shoulders and shook

ourheadsinunison.

AvoidingOneofLife'sBiggestTraps

“Well, you boys had better start thinking. You're staring at one of

life's biggestlessons.Ifyoulearnthelesson,you'llenjoyalifeofgreat

freedom and security. Ifyou don't learn the lesson, you'll wind up like

Mrs. Martin and most of the people playingsoftball in this park. They

workveryhard,forlittlemoney,clingingtotheillusionofjob security,

lookingforwardtoathree-weekvacationeachyearandaskimpypension

afterforty-fiveyearsofwork.Ifthatexcitesyou,I'llgiveyouaraiseto

25centsanhour.”

“But these are good hard-working people. Are you making fun of

them?”Idemanded.

Asmilecameoverrichdad'sface.

“Mrs. Martin is like a mother to me. I would never be that cruel. I

maysoundcruelbecauseI'mdoingmybesttopointsomethingouttothe

two of you. I want to expand yourpoint of view so you can see

something. Something most people never have the benefit ofseeing

because their vision is too narrow. Most people never see the trap they

arein.”

MikeandIsatthereuncertainofhismessage.Hesoundedcruel,yet

wecouldsensehewasdesperatelywantingustoknowsomething.

With a smile, rich dad said, “Doesn't that 25 cents an hour sound

good?Doesn'titmakeyourheartbeatalittlefaster.”

I shook my head “no,” but it really did. Twenty five cents an hour

wouldbebigbuckstome.

“OK,I'llpayyouadollaranhour,”richdadsaid,withaslygrin.

Nowmyheartwasbeginningtorace.Mybrainwasscreaming,

An

“Takeit.Takeit.”IcouldnotbelievewhatIwashearing.Still,Isaid

nothing.

“OK,$2anhour.”

Mylittle9-year-oldbrainandheartnearlyexploded.Afterall,itwas

1956 and beingpaid $2 an hour would have made me the richest kid in

theworld.Icouldn'timagineearningthatkindofmoney.Iwantedtosay

“yes.” I wanted the deal. I could see a newbicycle, new baseball glove,

and adoration of my friends when I flashed some cash. On topof that,

Jimmyandhisrichfriendscouldnevercallmepooragain.Butsomehow

mymouthstayedsilent.

Maybemybrainhadoverheatedandblownafuse.Butdeepdown,I

badlywantedthat$2anhour.

The ice cream had melted and was running down my hand. The ice-

cream stick was empty, andunder it was a sticky mess of vanilla and

chocolate that ants were enjoying. Rich dad waslooking at two boys

staring back at him, eyes wide open and brains empty. He knew he was

testing us, and he knew there was a part of our emotions that wanted to

takethedeal.Heknewthateachhumanbeinghasaweakandneedypart

oftheirsoulthatcanbebought.Andheknewthateachhumanbeingalso

hadapartoftheirsoulthatwasstrongandfilledwitharesolvethatcould

never be bought. It was only a question of which one wasstronger. He

had tested thousands of souls in his life. He tested souls every time he

interviewedsomeoneforajob.

“OK,$5anhour.”

Suddenlytherewasasilencefrominsideme.Somethinghadchanged.

Theofferwastoobigandhadgottenridiculous.Nottoomanygrownups

in 1956 made more than $5 an hour. Thetemptation disappeared, and a

calmsetin.SlowlyIturnedtomylefttolookatMike.Helookedbackat

me.Thepartofmysoulthatwasweakandneedywassilenced.Thepart

ofmethathadnopricetookover.Therewasacalmandacertaintyabout

moneythatenteredmybrainandmysoul.IknewMikehadgottentothat

pointalso.

“Good,” rich dad said softly. “Most people have a price. And they

haveapricebecauseofhumanemotionsnamedfearandgreed.First,the

fearofbeingwithoutmoneymotivatesustoworkhard,andthenoncewe

get that paycheck, greed or desire starts us thinking aboutall the

wonderfulthingsmoneycanbuy.Thepatternisthenset.”

“Whatpattern?”Iasked.

“Thepatternofgetup,gotowork,paybills,getup,gotowork,pay

bills... Theirlivesarethenrunforeverbytwoemotions,fearandgreed.

Offer them more money, and they continue the cycle by also increasing

theirspending.ThisiswhatIcalltheRatRace.”

“Thereisanotherway?”Mikeasked.

“Yes,”saidrichdadslowly.“Butonlyafewpeoplefindit.”

“Andwhatisthatway?”Mikeasked.

“That'swhatIhopeyouboyswillfindoutasyouworkandstudywith

me.ThatiswhyItookawayallformsofpay.”

“Any hints?” Mike asked. “We're kind of tired of working hard,

especiallyfornothing.”

“Well,thefirststepistellingthetruth,”saidrichdad.

“Wehaven'tbeenlying.”Isaid.

“Ididnotsayyouwerelying.Isaidtotellthetruth,”richdadcame

back.

“Thetruthaboutwhat?”Iasked.

“How you're feeling,” rich dad said. “You don't have to say it to

anyoneelse.Justyourself.”

“Youmeanthepeopleinthispark,thepeoplewhoworkforyou,Mrs.

Martin,theydon'tdothat?”Iasked.

“I doubt it,” said rich dad. “Instead, they feel the fear of not having

money. Instead ofconfrontingthefear,theyreactinsteadofthink.They

reactemotionallyinsteadofusingtheirheads,”richdadsaid,tappingus

on our heads. “'Then, they get a few bucks intheir hands, and again the

emotion of joy and desire and greed take over, and again theyreact,

insteadofthink.”

“Sotheiremotionsdotheirthinking,”Mikesaid.

“That'scorrect,”saidrichdad."Insteadoftellingthetruthabouthow

theyfeel,theyreacttotheirfeeling,failtothink.Theyfeelthefear,they

go to work, hoping thatmoney will soothe the fear, but it doesn't. That

oldfearhauntsthem,andtheygobacktowork,hopingagainthatmoney

will calm their fears, and again it doesn't. Fear has themin this trap of

working,earningmoney,working,earningmoney,hopingthefearwillgo

away. But every day they get up, and that old fear wakes up with them.

Formillionsofpeople,thatoldfearkeepsthemawakeallnight,causing

anightofturmoilandworry.Sotheygetupandgotowork,hopingthata

paycheckwillkillthatfeargnawingattheirsoul.Moneyisrunningtheir

lives,andtheyrefusetotellthetruthaboutthat.

Moneyisincontroloftheiremotionsandhencetheirsouls."

Richdadsatquietly,lettinghiswordssinkin.MikeandIheardwhat

he said, but reallydid not understand fully what he was talking about. I

justknewthatIoftenwonderedwhygrownupshurriedofftowork.Itdid

notseemlikemuchfun,andtheyneverlookedthathappy,butsomething

keptthemhurryingofftowork.

Realizingwehadabsorbedasmuchaspossibleofwhathewastalking

about, rich dad said,“I want you boys to avoid that trap. That is really

whatIwanttoteachyou.Notjusttoberich,becausebeingrichdoesnot

solvetheproblem.”

“Itdoesn't?”Iasked,surprised.

“No, it doesn't. Let me finish the other emotion, which is desire.

Some call it greed, butI prefer desire. It is perfectly normal to desire

somethingbetter,prettier,morefunor exciting.Sopeoplealsoworkfor

moneybecauseofdesire.Theydesiremoneyforthejoytheythinkitcan

buy. But the joy that money brings is often short lived, and they soon

need more money for more joy, more pleasure, more comfort, more

security. So they keepworking, thinking money will soothe their souls

thatistroubledbyfearanddesire.Butmoneycannotdothat.”

“Evenrichpeople?”Mikeasked.

“Richpeopleincluded,”saidrichdad.“Infact,thereasonmanyrich

peoplearerichisnotbecauseofdesirebutbecauseoffear.Theyactually

think that money can eliminatethat fear of not having money, of being

poor, so they amass tons of it only tofind out thefear gets worse. They

now fear losing it. I have friends who keep working even though they

haveplenty.Iknowpeoplewhohavemillionswhoaremoreafraidnow

thanwhentheywerepoor.They'reterrifiedoflosingalltheirmoney.The

fearsthatdrovethemtogetrichgotworse.Thatweakandneedypartof

their soul is actually screaming louder. They don'twant to lose the big

houses, the cars, the high life that money has bought them. Theyworry

aboutwhattheirfriendswouldsayiftheylostalltheirmoney.Manyare

emotionally desperate and neurotic, although they look rich and have

moremoney.”

“Soisapoormanhappier?”Iasked.

“No, I don't think so,” replied rich dad. “The avoidance of money is

justaspsychoticasbeingattachedtomoney.”

As if on cue, the town derelict went past our table, stopping by the

large rubbish can andrummaging around in it. The three of us watched

himwithgreatinterest,whenbeforeweprobablywouldhavejustignored

him.

Rich dad pulled a dollar out of his wallet and gestured to the older

man. Seeing themoney, the derelict came over immediately, took the

bill, thanked rich dad profusely andhurried off ecstatic with his good

fortune.

“He'snotmuchdifferentfrommostofmyemployees,”saidrichdad.

“I'vemetsomanypeoplewhosay,`Oh,I'mnotinterestedinmoney.'Yet

they'llworkatajobforeighthoursaday.That'sadenialoftruth.Ifthey

weren't interested in money, then why arethey working? That kind of

thinkingisprobablymorepsychoticthanapersonwhohoardsmoney.”

AsIsattherelisteningtomyrichdad,mymindwasflashingbackto

the countless timesmyowndadsaid,“I'mnotinterestedinmoney.”He