A Comprehensive FOREX Survival Guide for Beginners and Profit Fixing Strategy for

Experienced Traders by George Bryer

Discover a new way to trade with a reliable strategy “Candle-Close” and “Three Dots”

Preface

George Bryer is currently a leading trader of the funds managing company

FXGEO.NET(

). He is a young proprietary trader from Sydney, Australia, with

more than 10 years of experience in trading currencies at the foreign exchange market. His

achievements are impressive and a consistent record of risk management is praiseworthy. He

boasts an average rate of 75-80% in successful trades with a total of 500-600 pips on average a

month depending on the market volatility. In this tutorial he shares his vision of the market and

shares some of the techniques which have been relied on many times by him personally, the very

techniques that he uses from day to day in his intraday trading.

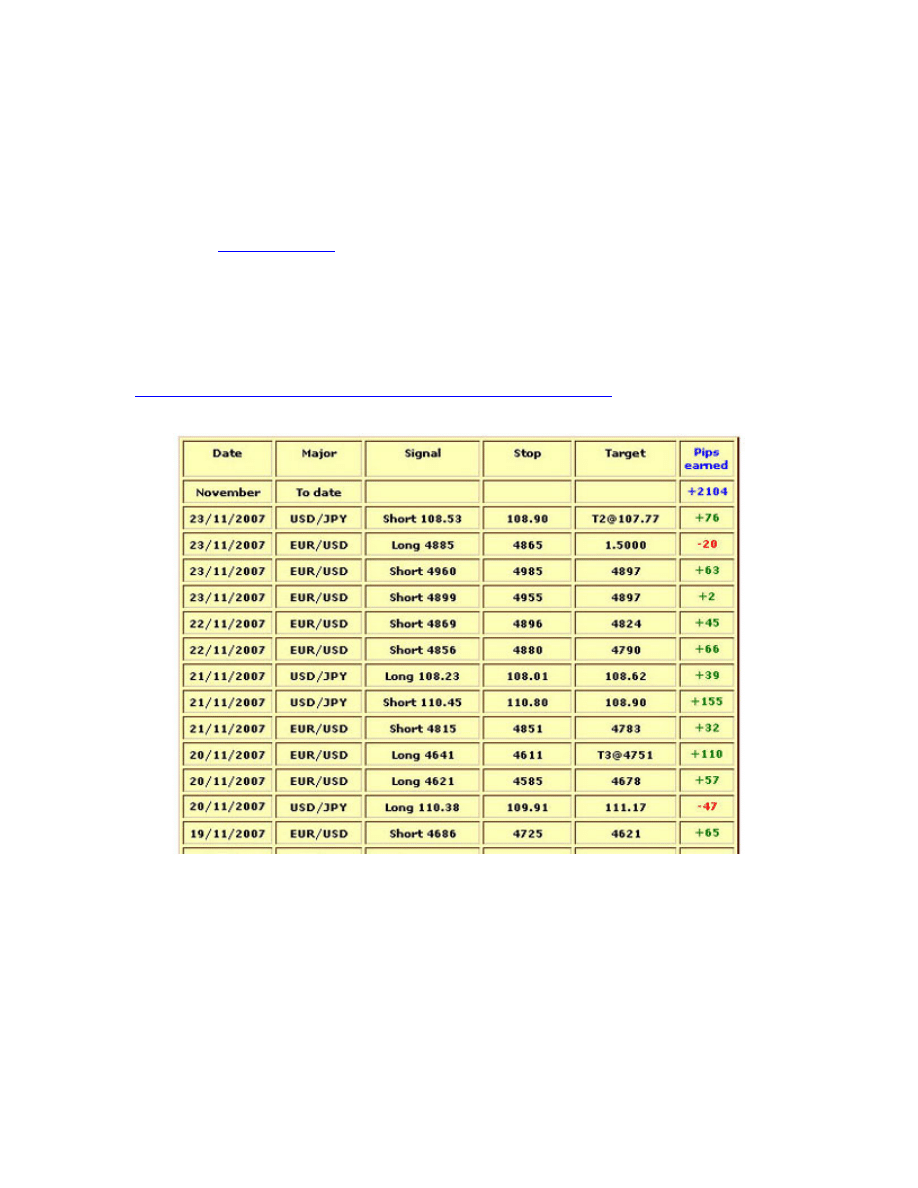

Here are some of the past results of trades undertaken by George Bryer

Chapter I

The world of new opportunities welcomes hordes of new tyro traders flocking to join an

exciting journey of trading the foreign exchange market. Although not many realize that the rules

of this business are harsh and cruel at times, there is still an unceasing supply of funds spilt by

novice traders feeding margin calls of various brokers. There are questions demanding answers

which many beginning traders ask themselves: “How am I to survive in the next leap of

volatility?”, “Is it really possible to consistently make profits by setting stop-losses, which seem to

be always targeted by the market, as if a hungry predator hunts its prey without remorse or

compassion?”. Not to sound trivial and clichéd, I would not feel excited for the reader to hear

again, “There must be discipline, patience, decisiveness, confidence, and diligence to be patient

and disciplined and this rule can be reiterated a great many times.” However, will this really

enable you with a way to keep making decent profits? The answer will be ambiguous; it will be

both yes and no. You need a strategy that you trust, the strategy which works in rain and in

snow, in deserts and in the mountains, in one word, it has to be consistently reliable with a

minimum drawdown and at least 2:1 profit-loss ratio.

I am not going to promise to make you a millionaire in three years with asking you to work 5

hours a week without serious strain. I guess you understand this, however, we need to be clear

on this before we launch the charts and start talking about the markets. Trading forex is a

demanding yet a highly-rewarding job! It is like building a good relationship with your friends and

family, it pays off in the end.

With the intraday trading being greatly popular in the last decade with the advance of internet

brokers providing services of trading currencies, the peculiar feature is that positions can be

taken and forsaken in a matter of seconds. The time frame can be used to its maximum efficacy

and there is no need to be locked in a position for days or weeks. Our goal is to trade major

currency pairs throughout the day with a primal thought in mind to liquidate most of our

exposure before the end of the session. I don’t mean to be boring, nevertheless we still have to

apply the previously mentioned rule of discipline and patience, which is virtually indispensable in

trading. What you need to be able to do is to focus, as the development of the events in intraday

trading can often be compared with flying a supersonic jet, things may happen and do happen

extremely quickly at times reallocating billions of dollars from one pocket into another.

If you chose to trade intraday, it is not a great way to survive with you holding firm

fundamental views of a long-term nature on the currency since it takes a relatively long period of

time for those changes to occur. It means that an intraday trader must rely on technical factors

surrounding himself with charts with indicators on a greatly reduced time frame or trade the

news releases making lightning-fast decisions depending on the deviation of the release

numbers. If bad news fails to depress the market, it means that it is highly unlikely that it will

plunge, and you have to cover short positions and you should be looking for an opportunity to go

long or buy whether on dips or whenever a visible resistance gives way. The news itself is not

that important for a successful trade but the market reaction to the announcement is.

As mentioned earlier, many intraday market participants seem to close their positions

overnight, i.e. before the end of the session, and there are pros and cons to this approach. Often

it is a good idea not to be exposed overnight as there is always a risk of things changing before

the next day open. This problem is more relevant to commodity markets with late and pre-

trading sessions which has distinct gaps and holes on the charts with the start of each new

session, forex is more cohesive in this respect as it is traded 24/5 in contradistinction to the stock

markets. Even though if you were to single out only American sessions you would see enormous

gaps at times as well if Asian and European sessions are not taken into account.

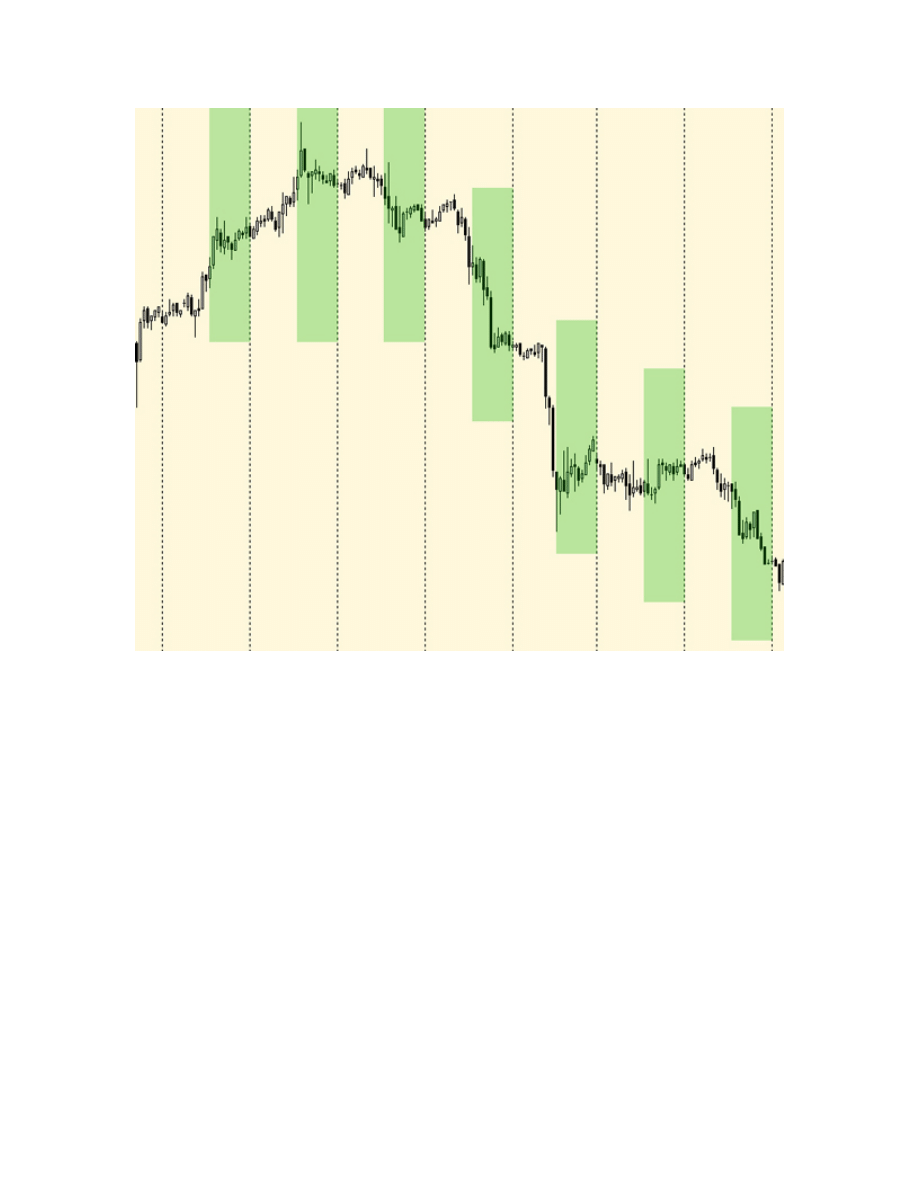

Figure I

In the Image above you can see that American session is highlighted in light green, and if you

were to trade the American session by closing your position overnight the chart would look quite

differently.

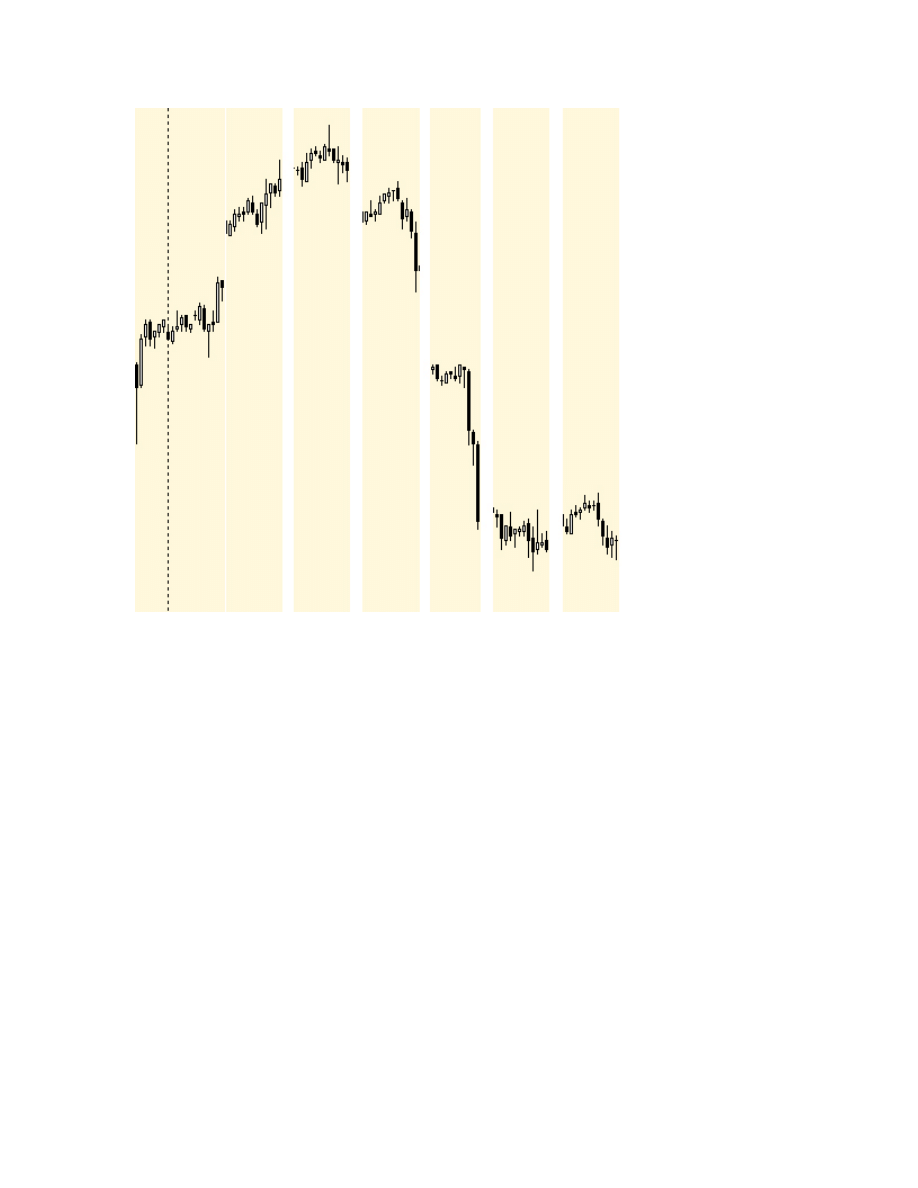

Figure II

So what this basically means is that without leaving your position overnight, you have to

monitor and analyze the markets again before entering a new position. This process might affect

your ability to profit from the Asian and European sessions with lots of good setups appearing

during those times. Oftentimes, you are forced to enter new positions even though it is not a

perfect timing in the market to do so, but due to the time constraints of trading one particular

session, you are induced into making wrong decisions.

In case you carry positions overnight, you might benefit from the development of larger trends

as markets as a rule continue the following day in the direction of the previous day’s close. In our

instance, larger trends are classified as those which last for a day or two as we zero in on trading

intraday.

What is of paramount importance to us is the ability to analyze a combination of all possibly

useful time frames to be successfully able to take positions. The time frames would include

monthly charts, which help you better understand the overall trend of the currency, weekly,

daily, 4-hour, 1-hour, 15-min, 5-min, and 1-min.

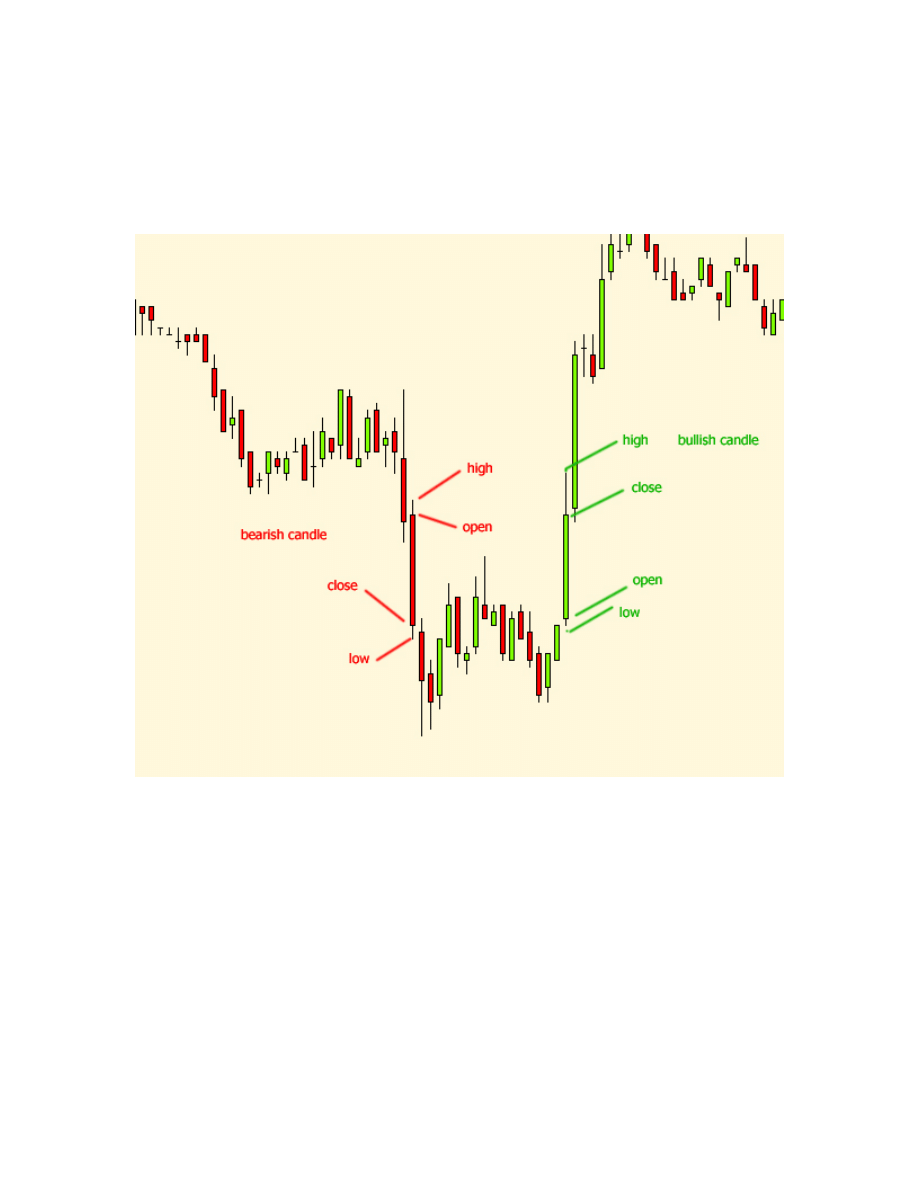

Intraday charts can be broken down into many different time frames, the smallest price change

is called a tick, and quite often it is not a very valuable tool for an intraday trader. Therefore,

using a 5-min chart instead bears more fruits and gives a clearer picture of the trend. Looking at

a 5-min candle as you would with any other candle, you can see a candle’s opening price, high,

low and close at a 5-min interval. You could get the same information looking at a daily candle,

but it comprises data of the whole trading session of that particular day. I found in my

experience that 15-min, 30-min and 1-hour charts are particularly useful. The key here is to

experiment with different time frames whilst finding which time frame suits you best. It will be

discussed later but I will sow the notion right now, we will be trying to enter trades basing on the

close of 4-hour candles, seeking the best entry on a 5 min chart, once the trading set-up has

been confirmed. You should always keep in mind that no matter what intraday time frame you

chose to use, you have to be mindful of a longer-term trend as this will give you some

perspective.

Figure III

Having a trading strategy means that you can base your decisions confidently whilst working

with markets and it can be dubbed a “driving force” for you when taking positions. In order to

either buy or sell, you should have a justification prior to the action which should be different

from just a gut feeling that the price is going to rise or fall. “Having a hunch” about the next

direction of the market does not always portend a successful outcome of the trade, as markets

are counter-intuitive in their nature. This is the reason why not everyone is suitable for the job,

as well as not everyone can be a physicist, many can be trained to become one, as well as many

can become traders after being properly trained, however, there are traders with natural flair

with 7 years of high school education who made millions of dollars without graduating from

Harvard or working at Wall Street.

The strategy that you feel comfortable using is the key, it could be as simple as buying higher

highs or selling lower lows, or it could be a more complex integration of watching cross-overs of

moving averages and seeking confirmation from oscillators’ readings of overbought/oversold

levels with divergences and so forth. The important factor here is that you must be able to utilize

a strategy which will enable you with entering positions in a methodic and impartial way. At this

stage you might be wondering what on earth that strategy could be, although, it is the purpose

of this tutorial to feed you with some potentially profitable strategies, which have worked in the

past and keep working presently and will continue to do so in the future as this is a framework of

any market movement.

What needs to be ascertained by novice traders is that risk management is the key to surviving

the turbulent waters of the ocean called FOREX. When you see a violent storm in the ocean with

huge waves of 3-5 meters, it is common sense not to swim. It is often the case when a rookie

trader brings a thousand dollars into the market in his newly opened trading account and tries to

trade one lot or contract where the value of the smallest pip or tick is 10-12 dollars. Any adverse

movement of 50 pips which sometimes can happen during the news announcement within a

couple of seconds effaces the account of the newbie and leaves him with a bad taste in his

mouth. Don’t swim when the ocean rages. We are all prone to think promptly about profits, but

few of us concentrate on losses, yet managing losses is the first significant step that we are to

take, as you are not a good soldier once you lost your rifle, or what kind of farmer are you

without a hoe. On the other hand limiting risk and quickly taking losses will allow you to come

back time after time.

Having a $2000 account means that if you trade with one standard lot (1 lot ~ 100k of

leveraged currency) with a 100:1 leverage with 1% margin and the market moves a mere 100

pips against you, your broker will close your position and you will be left with $1000 in your

account. (1 lot = $10 per pip). Average stop-loss is around 30 pips. This means that if you have

4 consecutive losses your equity will be $-1200, paralyzing your trading account. Therefore, you

need to make sure that with each trade you ideally risk only 3% of your account equity. This

means that with a $2000 account you should only risk $60 per trade. If you divide $60 (risk per

trade) by 30 pips (stop-loss in pips), you should be trading 0.2 lots, or 2 mini lots, or 20k of

leveraged currency. Therefore, if you want to safely trade 1 standard lot, or 10 mini lots, you

would need to multiply your 2k account by 5 (1/0.2=5). In order to trade 1 standard lot

reasonably safely, you would require a balance of $10,000 in your trading account.

Thus I always ask myself before I even enter my limit order, “What is my potential reward and

what is my potential risk?” If the reward does not exceed the risk by a decent profitable margin,

it is not worth getting into position.

Since intraday trading involves leverage, money management involves the optimum allocation

of capital to a margined position. This means you should abstain from putting all of your money

at risk in one or two trades. You should allocate a small amount first, and after learning to lose

money and becoming more confident, you can extend the amount of capital at risk somewhat

more, but never more than 5% at a time. One of the golden rules is that you should concentrate

on taking money out of the markets in small amounts. Don’t ever try to score a home run by

placing large bets. First, it will be a total overkill for you emotionally, which will make you lose

the first asset of the trader – objectivity, and second, you might win once or even twice, but the

market will catch up with your gun slinging technique and wipe you out.

The assumption of the technical analysis is that the markets move in trends, and once the

trend begins it tends to perpetuate. Practically, all the work we do in technical analysis is trying

to identify when these trends reverse, so that the new positions could be entered or the older

ones reversed. Thus, the techniques that I will discuss in this tutorial will emphasize the methods

identifying the set-ups of when the trends reverse, or might reverse giving us an opportunity to

sell or buy. These price levels are called support and resistance. The tools that I use to identify

trend reversals are targeting the early stages thereof. Since the trades have a tendency to

perpetuate, we ride those trends until the weight of the evidence that the market is stalling

proves that the trend has reversed. The more indicators point out in the same direction, the

greater the probability of the trend reversing.

In financial markets, whilst using technical analysis we are always dealing with

probabilities and never with certainties, this should be embossed in your mind and become

your trading motto.

Unfortunately, there is no way to forecast the magnitude and duration of the trend, this means

that we face picking odds and identifying reversals with any degree of consistency is an

extremely cumbersome task.

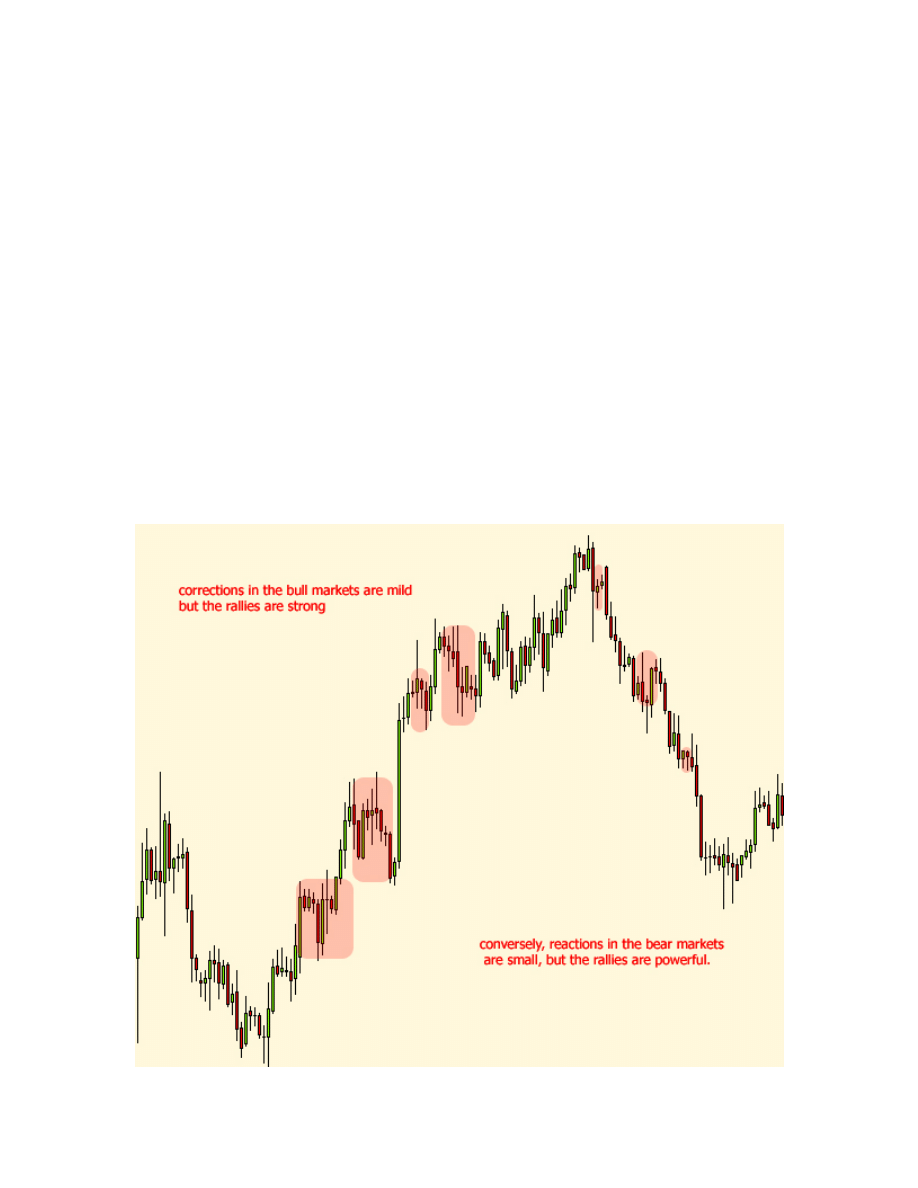

If you have a question, “What is a trend? How long do they last?” the answer is that there are

primary, intermediate and short term trends. Typical duration of the bull market is around 10

month running up to 2 years, and bearish market troughs are separated by around 4 years.

Primary trends are interwoven with intermediate trends of rallies or impulses or reactions, also

knows as retracements or corrections. The intermediate trends last from 6 weeks up to 9 month

in duration. They usually develop as a result of changed perceptions about economic, political or

social events. It is important to have some awareness on the development of the primary trend,

the reason for that is that the impulsive advances, or waves in the bull markets are strong and

reactions/corrections are weak. Conversely, reactions in the bear markets are short, sharp and

unpredictable, but the rallies are powerful. If you understand the underlying primary trend, then

you will be better prepared for intermediate rallies’ reactions.

The intermediate trends could also be broken down into shorter-term trends which last from as

little as two weeks to as much as 5-6 weeks. It is not a secret that the best time to accumulate is

at the reversal of primary trend and to liquidate when the trend is reversing in the opposite

direction.

You might ask that it takes us far away from intraday charting and to some extent it really

does, however, you have to realize, that even on the shorter-term trends, intermediate and long-

term trends are evident on the intraday chart moves.

Figure IV

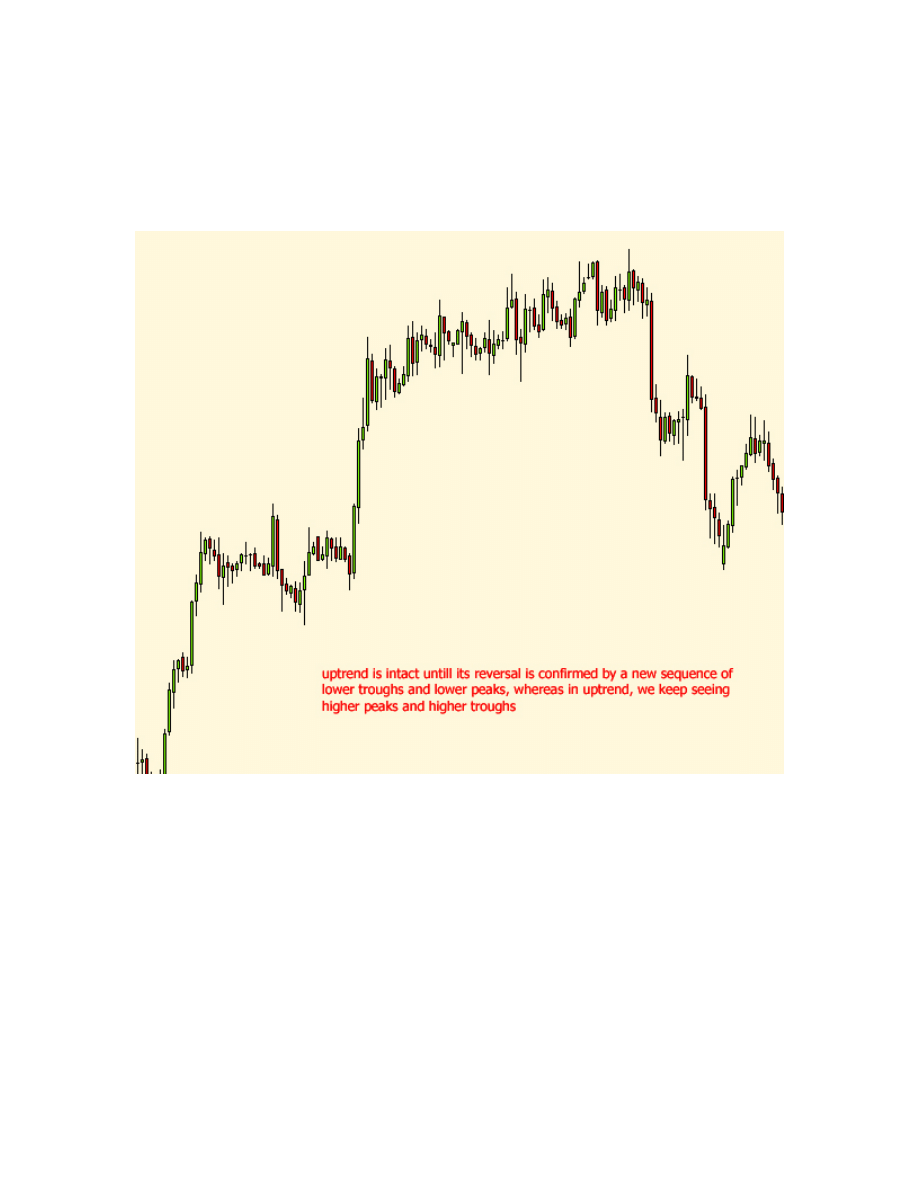

I am quite certain that many of you noticed that prices don’t move in a straight line, they

rather form a rising sequence of peaks and troughs in an uptrend, and a declining series of peaks

and troughs in the downtrend. It is particularly easy to notice on the intraday charts.

Figure V

Wyszukiwarka

Podobne podstrony:

Forex For Everyone Learn To Trade The Forex Market Like A Professional

Forex Intraday Pivots Trading System Complete System

Trading Online Learn forex and trading techniques finance,economics,investment,market,exchange,mon

by e6+cz b3ow +to+w b3a 9cnie+by e6+odpowiedz 2QPD522DC3VIENYQNHWEPJEOWDTRFILOMLK2PIY

Countdown to French Learn to Communicate in 24 Hours

Learn To Speak Swedish

a projekt made by ja, Koksowanie węgla to ogrzewanie węgla w atmosferze nieutleniającej z wytwarzani

BY CZ OWIEKIEM, TO BY OD, Być człowiekiem - to być odpowiedzialnym, „Być człowiekiem - to być

5 min MA intraday trading system(update)

Diy Japanese Garden Easy Step By Step Guide To Make

How To Make Your Mind a Money Magnet by Robert Anthony

Learn To Crochet

Learn to play the Piano

Learn to Speak Better Russian DLI

1855 Six Sermons on Immortality (by George Storrs)

więcej podobnych podstron