Psychopharmacology (2005) 182: 508

–515

DOI 10.1007/s00213-005-0110-8

O R I G I N A L I N V E S T I G ATI O N

Yu Ohmura . Taiki Takahashi . Nozomi Kitamura

Discounting delayed and probabilistic monetary gains

and losses by smokers of cigarettes

Received: 6 February 2005 / Accepted: 22 June 2005 / Published online: 16 September 2005

# Springer-Verlag 2005

Abstract

Rationale: Nicotine dependence has been

associated with impulsivity and discounting delayed/un-

certain outcomes. Objectives: This study had two main

objectives: (1) to examine the relationship between the

number of cigarettes consumed per day and the degree to

which delayed and uncertain monetary gains and losses

are discounted by smokers, and (2) to determine the re-

lationship between the estimated dose of nicotine intake

per day and the degree to which four types of discounting

occur. Methods: Twenty seven habitual smokers and 23

never smokers participated in this experiment. They were

required to choose between immediate and delayed mone-

tary rewards (or losses), or between guaranteed and prob-

abilistic rewards (or losses). Results: The degree to which

delayed monetary gains were discounted was significant-

ly and positively correlated with both the number of cig-

arettes smoked and the estimated dose of nicotine intake

per day. Conversely, there was no relationship between

smoking and the remaining three types of discounting.

Also, mild smokers in our sample did not differ from

never smokers in discounting monetary gains or losses.

Conclusions: In general, our results suggest that both the

frequency of nicotine self-administration, as well as the

dosage, are positively associated with greater delay dis-

counting of gains. One neuropsychopharmacological ex-

planation for this effect is that chronic nicotine intake

may induce neuroadaptation of the neural circuitry in-

volved in reward processing.

Keywords Addiction . Delay discounting . Probability

discounting . Cigarette smoking . Nicotine . Impulsivity .

Neuroeconomics . Intertemporal choice

Introduction

Impulsive behavior, broadly defined as

“actions that are

poorly conceived, prematurely expressed, unduly risky, or

inappropriate to the situation and that often result in un-

desirable outcomes

” (Daruna and Barnes

), are fre-

quently observed in drug-dependent subjects (see Bickel

and Marsch

for a review). In most psychopharma-

cological studies of intertemporal choice, impulsivity is

often operationalized in terms of delay discounting

—the

tendency to choose smaller, relatively immediate rewards

over larger but more delayed rewards (e.g., Kirby et al.

; Richards et al.

; Petry

; Pietras et al.

).

Dependence on drugs such as cocaine, heroin, nicotine,

or alcohol has been associated with greater discounting of

delayed rewards in a number of psychopharmacological

studies (e.g., Kirby and Petry

; Kirby et al.

;

Bickel et al.

; Petry

). However, to date, little is

known regarding the relationship between the frequency of

drug administration, or the drug dosage, and delay discount-

ing. One notable exception is a recent study by Reynolds

(

) reporting that the number of cigarettes consumed

per day was positively correlated with impulsive choice in

delay discounting. Understanding the dose-dependent rela-

tionship between a drug and delay discounting is critical

to (a) better estimate a drug

’s effect on impulsive behavior

in general, and intertemporal decision-making specifical-

ly, which can often result in problematic outcomes for the

drug user (see Bickel and Marsch

for a review) and

(b) predict vulnerability to drug dependence as a function

of discounting behavior, as suggested by a previous study

(Perry et al.

Recently, in the emerging field of neuroeconomics (see

Glimcher and Rustichini

; Schultz

for a review),

several neuroscientists and economists have collaborated to

reveal some of the neural substrates involved in economic

decision making, including those governing delay dis-

counting. For instance, we have reported that low cortisol

levels were associated with impulsive choice in delay

discounting (Takahashi

) partly via modulation of the

Y. Ohmura (

*) . T. Takahashi . N. Kitamura

Department of Behavioral Science, Hokkaido University,

N10 W7 Kita-ku,

Sapporo, 060-0810, Japan

e-mail: gwd0701@yahoo.co.jp

reward-processing, dopaminergic circuitry in the brain. In

one neuroimaging study, Loewenstein and Cohen

’s group

demonstrated that choosing a smaller, immediate mone-

tary reward was associated with activation of the reward-

processing dopaminergic circuitry located in the midbrain

(McClure et al.

). Montague and Berns (

) have

proposed that estimating future reward values is mediated

by dopaminergic circuitry (e.g., the ventral tegmental

area). Taken together, dopaminergic systems may play a

pivotal role in impulsive choice in delay discounting.

Concerning the relationship between chronic self-ad-

ministration of nicotine and dopaminergic response to

monetary gains, Schultz and his colleagues have reported a

lower dopaminergic response to monetary rewards in ha-

bitual cigarette smokers when compared to nonsmokers,

which may indicate an exaggerated devaluation of delayed

monetary rewards (i.e., greater delay discounting) in smok-

ers (Martin-Solch et al.

). Nevertheless, the re-

lationship between self-administration of a dopaminergic

drug such as nicotine and discounting behavior can be

better defined. Therefore, it is of neuropsychopharmaco-

logical interest to investigate delay discounting as a func-

tion of both the frequency of nicotine self-administration

and the strength of the dosage.

Moreover, although most studies have focused on

discounting delayed monetary gain, we feel it is important

to expand the current research design to include additional

forms of discounting. Neuroeconomic research has re-

vealed that distinct brain regions are activated in response

to monetary gains and losses (Knutson et al.

,

Breiter et al.

). Therefore, in examining the relation-

ship between cigarette smoking and impulsive discounting

delayed outcomes, it is important to include the tendency

to discount delayed monetary losses in addition to the

discounting of delayed monetary gains. Furthermore, the

relationship between drug intake and the discounting of

uncertain rewards (probability discounting) has been at-

tracting more attention recently, but with mixed results.

For instance, Mitchell, a psychopharmacologist, failed to

observe a difference between smokers and never smokers

in discounting of uncertain rewards (Mitchell

). On

the other hand, although there was no significant correla-

tion between probability discounting and breath CO levels

taken at the time of participation, smokers in the Reynolds

study discounted an uncertain monetary reward more dra-

matically when compared to never smokers (Reynolds

et al.

). One possible reason for the discrepant find-

ings may have to do with the degree to which the samples

engaged in smoking: smokers in the Mitchell study con-

sumed as few as 15 cigarettes per day, whereas those in the

Reynolds study smoked more than 20 per day. Thus, an

elevation in probability discounting may only be observed

in relatively heavy smokers. Nevertheless, the inconsis-

tency of these findings suggests that the link between

smoking and probability discounting requires further in-

vestigation. It should also be noted that whether impulsive

behavior can be defined as strong probability discounting

is still controversial (cf. Myerson et al.

). Again, con-

sidering that the neural responses involved in economic

gains and losses are distinct, it is important to examine

discounting of both uncertain monetary gains and losses

with regard to smoking frequency and nicotine dosage.

As far as we know, this study is the first to investigate the

relationship between the frequency and dosage of nicotine

self-administration and the tendency toward four types of

decision making (i.e., discounting of delayed and uncer-

tain monetary gains and losses) within the same subjects.

It should also be noted that, as far as we know, this study

is the first to examine discounting of uncertain monetary

losses in smokers of cigarettes. Furthermore, we examined

differences in four types of discounting between never

smokers and smokers. Additionally, to further elucidate

their distinct psychological processes (and possibly the

distinct neural mechanisms underlying these processes as

well), we compared discounting of gains and losses. Final-

ly, we examined whether a positive correlation is observed

between delay and probability discounting as expected

from the hypothesis that an increase in delay is equivalent

to a decrease in probability (Rachlin et al.

).

Materials and methods

Participants

A total of 50 subjects participated in the present study,

including 27 young-adult habitual smokers (20 males and

7 females) between 21 and 33 years of age (M=24.15;

SD=3.68), and 23 never smokers (16 males and 7 females)

between 21 and 28 years of age (M=23.26; SD=1.96). It

should be noted that the present smoker population was

relatively mild in comparison to other studies (e.g., Bickel

et al.

; Reynolds et al.

; in their studies, only

heavy smokers who consumed a minimum of 20 ciga-

rettes per day were employed); only eight smokers con-

sumed a minimum of 20 cigarettes per day, and the mean

number of cigarettes consumed per day was 14.38 (Table

Graduate and undergraduate students were recruited to par-

ticipate through advertisements posted on bulletin boards

at Hokkaido University in Sapporo, Japan. The partici-

pants were informed that the experiment involved a de-

cision-making task involving monetary gains and losses.

They signed an informed consent form before participat-

ing and received 1,000 yen (about US $10) following

completion of the experiment.

Materials and procedure

Because Johnson and Bickel (

) showed a strong cor-

relation between discounting rates for hypothetical and real

monetary gains, and Baker et al. (

) demonstrated that

discounting rates for hypothetical and real money were not

significantly different, a computerized procedure consist-

509

ing of hypothetical monetary outcomes was used to assess

discounting in the laboratory. The procedure was com-

posed of four different types of discounting (i.e., delay of

gain, delay of loss, uncertain gain, and uncertain loss).

Participants were seated individually in a semisound-

proof room and received the following instruction on the

computer screen in Japanese:

[From now, you are required to perform tasks of

decision-making on monetary reward/loss. The task is

to choose between two options. The monetary reward/

loss in this experiment is hypothetical, but we want

you to think as though it is real money].

Next, they received instructions describing the four

discounting tasks with corresponding examples. At the

beginning of each trial, the participant was asked to select

one of two cards displayed on their computer monitor. The

left card indicated the sum of money that could be received

(or lost) immediately (or certainly, in the probability-dis-

counting tasks), whereas the right card always indicated

100,000 yen (about US $1,000) that could be received (or

lost) after a certain delay (or with a certain probability).

The sum of money indicated on the left card ranged from

100,000 to 5,000 yen (or from

−100,000 to −5,000 yen, in

loss-frame tasks) in 5,000-yen intervals. In the delay-

discounting task, the delay indicated on the right card

changed between five time frames (1 week, 1 month, 6

months, 1 year, and 5 years). For the probability-discount-

ing task, the right card indicated one of five probability

values (90, 70, 50, 30, and 10%). These changes were

computerized according to the algorithm used by Richards

et al. (

). This algorithm is designed to determine

the point at which the participant switches his or her pref-

erence from the left card (immediate/guaranteed reward or

loss) to the right card (delayed/probabilistic reward or loss)

by changing the type of task and the sum of money in

accordance with previous decisions. The switching point

is regarded as the indifference point and was used to cal-

culate the dependant variable. In the present study, 20

indifference points were determined (five for each type of

discounting). This algorithm masks the true nature of the

procedure, and in the present study, distractor trials were

inserted after ten indifference points were established (for

more details, see Richards et al.

).

Following the computer task, all participants were re-

quired to answer four questions regarding their smoking

behavior, including the number of months they had

smoked, the average number of cigarettes they smoked

per day, the variation (i.e., the minimum and maximum

number of cigarettes they smoked in a day), and their usual

brand of cigarettes. The entire experimental procedure took

between 30 and 60 min to complete. For no subject did the

variation in the number of cigarettes they smoked per day

exceed five cigarettes. It should also be noted that the

results remained essentially unchanged when the number

of cigarettes smoked per day was recoded into categories

of low (1

–10 cigarettes), medium (11–20 cigarettes), and

high (21 cigarettes or more) frequencies.

Data analysis

To parametrize the degree to which each subject discounted

delayed and uncertain monetary gains and losses, we com-

puted an area under the curve (AUC) for each of the four

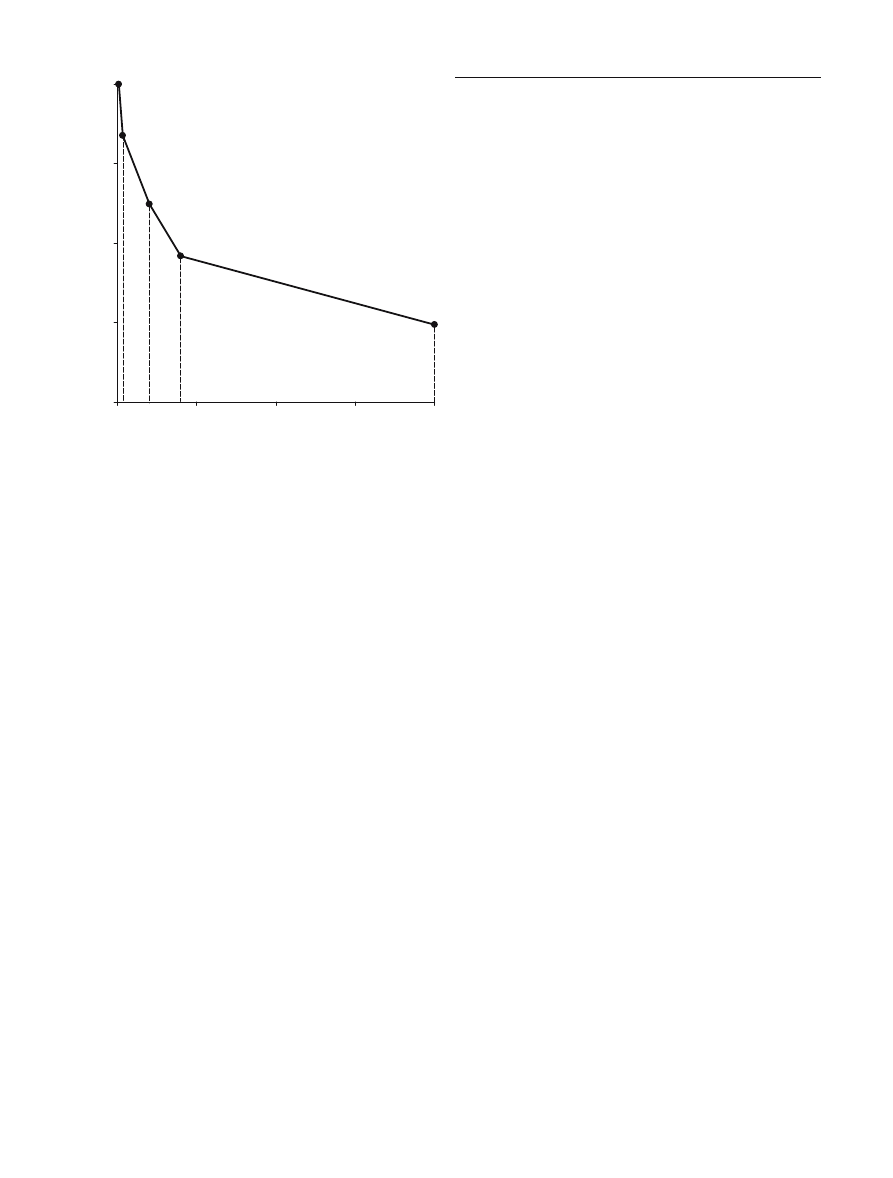

discounting tasks (cf. Fig.

). The procedure for calculat-

ing an AUC was as follows (for more details, see Myerson

et al.

). First, indifference points were plotted in two

dimensions, with either delay or odds-against [=(1/prob-

ability)

−1] (cf. Rachlin et al.

) plotted along the

horizontal axis and gain (or the absolute value of loss)

plotted along the vertical axis. Connecting the individual

indifference points defined the indifference curve. Note

that the steepness of the indifference curve indicates the

degree to which the monetary outcomes were discounted

by the subject. Second, both the horizontal and vertical

scales were divided by the largest value on their respective

axes to produce a range of values between 0 and 1. Third,

the AUC was defined as the total area under this nor-

malized indifference curve. The smaller this area, the more

dramatic the subject

’s discounting tendency. We adopted

the use of AUCs primarily to avoid equation-dependent

systematic errors that can result from specific fitting func-

tions, something the AUC parameter does not depend on.

Additionally, although it is well established that delayed

and probabilistic gains are discounted hyperbolically rather

than exponentially (e.g., Mazur

; Rachlin et al.

;

Richards et al.

; Simpson and Vuchinich

), we

compared the four types of discounting (delayed and un-

certain, gains and losses), to determine whether losses are

also discounted hyperbolically. Specifically, we performed

a nonlinear regression (SAS, PROC NLIN) to fit hyper-

bolic and exponential discounting functions to the indif-

Table 1 Mean and standard deviations for demographic variables,

smoking behavior, and AUCs for current and never smokers

Current smokers

Never smokers

Mean

SD

Mean

SD

Sex (% men)

69.57

74.07

Age (years)

24.15

3.68

23.26

1.96

Education (% graduate)

32.00

47.83

Cigarette number (per day)

14.38

6.66

Smoking history (months)

69.04

48.89

DD of gain

0.54

0.27

0.58

0.33

PD of gain

0.23

0.15

0.18

0.08

DD of loss

0.69

0.25

0.74

0.29

PD of loss

0.36

0.16

0.39

0.17

In calculating the AUC, the horizontal axis is delay (in delay

discounting) or odds-against (=1/probability

− 1, in probability

discounting), and the vertical axis is the indifference point. Note

that smaller AUC values correspond to greater discounting.

Regarding education and cigarette number, two data points

are missing due to the participants

’ omission in answering

these questions

DD Delay discounting, PD probability discounting

510

ference points at each level of delay and probability. The

exponential function was defined as

V ¼ Ae

kD

;

where V is the subjective value of a reward, A is the

(objective) amount of the reward (the monetary gain or

loss), k is a free parameter and an index of the steepness

of the discounting function (i.e., larger k values corre-

spond to steeper delay discounting), and D is the length of

the delay (delay discounting) or the odds-against (proba-

bility discounting). The hyperbolic function was defined as

V ¼ A= 1 þ kD

ð

Þ;

with the same notations. To determine which equation fits

the data better, we compared the respective R

2

values of

the hyperbolic and exponential equations.

The estimated amount of daily nicotine intake was cal-

culated by multiplying the average number of cigarettes

smoked per day by the amount of nicotine per cigarette

that was printed on the cigarette pack of the brand con-

sumed by the subject. It is noteworthy that the number of

cigarettes smoked per day indicates the frequency of nic-

otine self-administration, whereas the estimated amount

of nicotine intake per day indicates the level of chronic

nicotine exposure. To test statistical significance of corre-

lations and mean differences, Pearson

’s product–moment

correlation coefficients and t tests were utilized, respec-

tively. Alpha level was set at 5% throughout.

Results

Relationships involving demographics

and discounting behavior

Means and standard deviations for demographic variables,

smoking behavior, and AUCs for discounting are summa-

rized in Table

. Smoking and nonsmoking samples did

not differ in age, sex, or level of education, but there was a

significant difference in the average number of cigarettes

smoked per day between men and women (16.36 vs 9.29,

t (23)=2.67, P<0.05). The correlation between the average

number of cigarettes smoked per day and age was not

significant.

The present AUC values were similar to values reported

in previous studies (Myerson et al.

). A participant

’s

age did not correlate with any of the AUCs for discount-

ing, and there were no significant differences between the

AUCs of men and women or between the AUCs of grad-

uate and undergraduate students. Thus, neither age, sex,

nor education seemed to have any effect on discounting

behavior in our sample.

Fitness of discounting equations

Hyperbolic and exponential R

2

values were calculated

using both group medians and individual scores. For the

group data, each R

2

value associated with the hyperbolic

function (delay discounting of gain, 0.99; probability

discounting of gain, 0.98; delay discounting of loss, 0.97;

and probability discounting of loss, 0.98) was larger than

its corresponding exponential function (delay discounting

of gain, 0.91; probability discounting of gain, 0.81; delay

discounting of loss, 0.96; and probability discounting of

loss, 0.84). Moreover, except when discounting delayed

gains, each individual R

2

value associated with the hyper-

bolic function was significantly larger than its correspond-

ing exponential function [dependent sample t tests: delay

discounting of gain t (39)=1.77, P=0.08; probability dis-

counting of gain t (39)=2.80, P<0.01; delay discounting of

loss t (33)=4.93, P<0.01; and probability discounting of

loss t (38)=4.82, P<0.01]. These results suggest that the

subjects discounted most types of monetary outcomes hy-

perbolically, rather than exponentially, as a number of

previous studies have reported (e.g., Rachlin et al.

;

Vuchinich and Simpson

; Richards et al.

;

Bickel et al.

; Simpson and Vuchinich

Relationships involving smoking status

and discounting behavior

First, we investigated the relationship between the fre-

quency of nicotine intake and discounting behavior in

smokers by calculating the Pearson product

–moment cor-

relation between the number of cigarettes smoked per day

and each of the four types of discounting. The correlational

analysis revealed that the AUC for discounting delayed

0

0.25

0.5

0.75

1

0

0.25

0.5

0.75

1

Delay (proportion of maximum)

Subjective Value

Area Under the Curve

Fig. 1 Calculation of the area under the indifference curve in delay

discounting of monetary gain, a linkage of subjective values of

delayed monetary gain, for representative example (Subject 12).

Note that in probability discounting, the horizontal axis is odds-

against (=1/probability

−1)

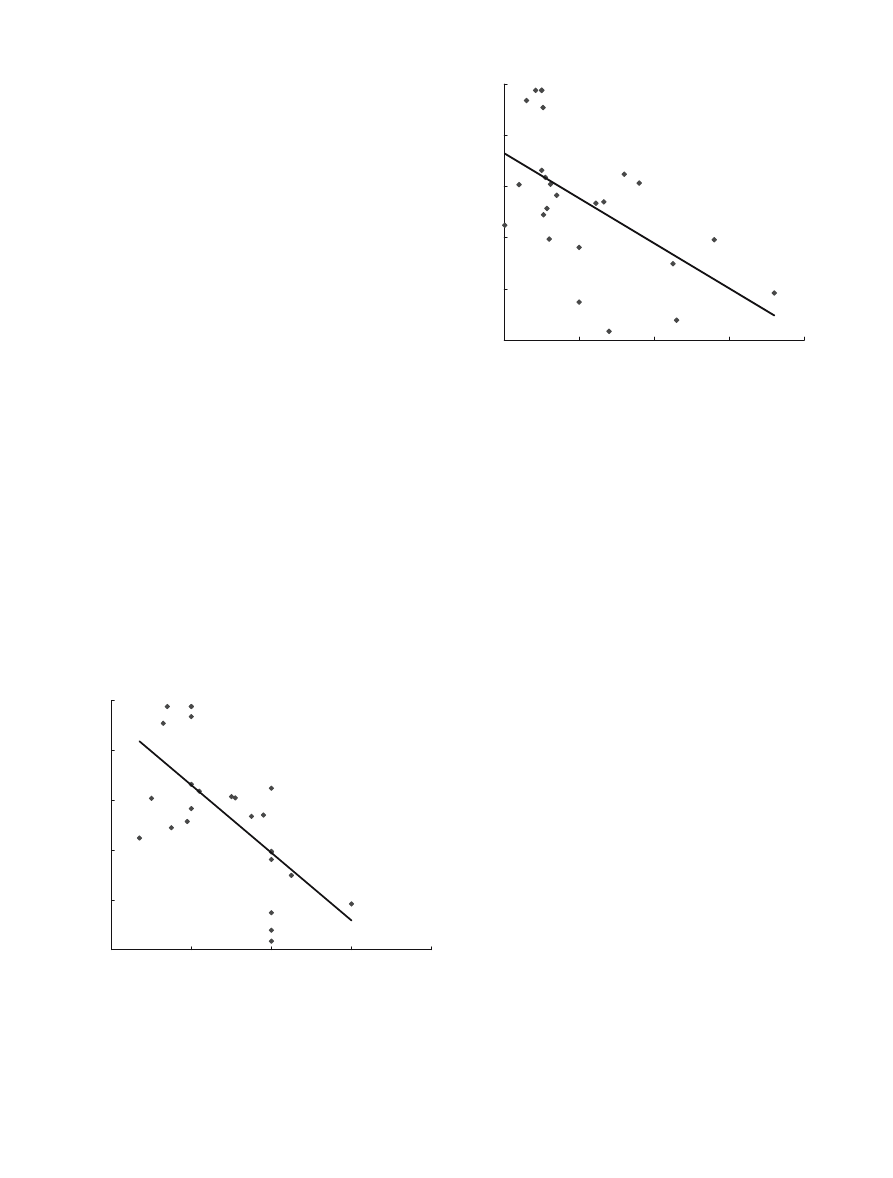

511

gains in smokers decreased significantly with the number

of cigarettes they smoked per day [r (25)=−0.66, P<0.01,

see Fig.

], suggesting that more frequent smokers are

more impulsive when discounting delayed monetary gains.

It should be noted that this finding is consistent with the

recent study by Reynolds (

), which reported a posi-

tive correlation between the number of cigarettes smoked

per day and a delay discounting rate (logged hyperbolic k)

of monetary rewards. Regarding the number of cigarettes

smoked per day and the remaining three types of dis-

counting, no other significant correlations were observed

in the present study [probability discounting of gain r (25)=

−0.00059, P=0.9978; delay discounting of loss r (25)=−0.12,

P=0.58; and probability discounting of loss r (25)= 0.10,

P=0.63]. In addition, because (a) the number of male and

female smokers (20 males and 7 females) was different and,

(b) as stated earlier, there was a significant difference in

the average number of cigarettes smoked per day between the

sexes, we omitted the female participants and repeated the

correlational analysis. Again, the AUC for delay discounting

of gains in male smokers was significantly correlated with the

number of cigarettes smoked per day [r (18)=−0.69, P<0.01],

and no other significant correlations were observed.

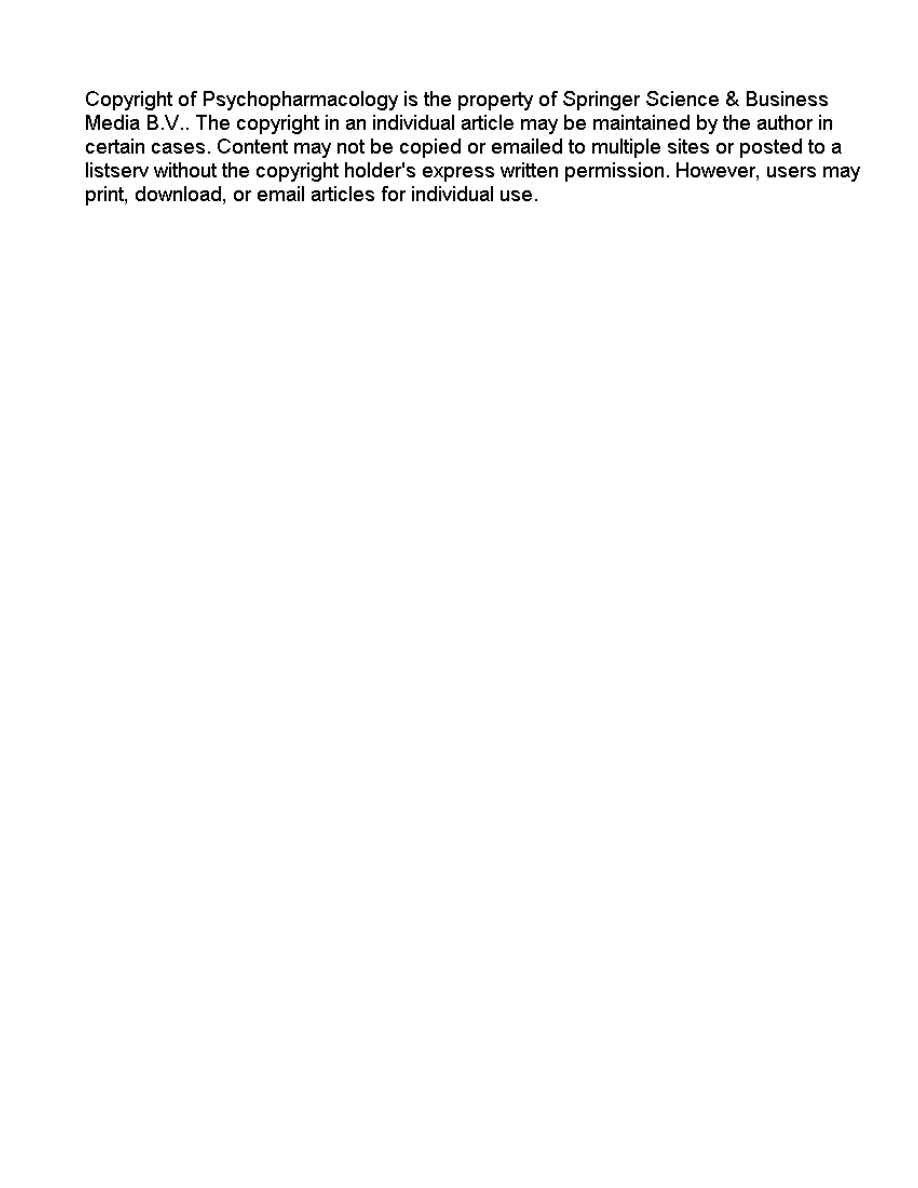

Second, correlations between the level of chronic nic-

otine exposure and the degree of discounting similarly re-

vealed a significant relationship between the AUC for

discounting delayed gains by smokers and the estimated

amount of nicotine intake per day [r (25)=−0.57, P<0.01,

see Fig.

]. This indicates that subjects with higher levels

of chronic nicotine exposure were more impulsive in dis-

counting delayed monetary gains. Regarding the relation-

ships between the estimated amount of nicotine intake per

day and the remaining three types of discounting, no other

significant relationships were observed [probability dis-

counting of gain r (25)=0.22, P=0.29; delay discounting

of loss r (25)=−0.05, P=0.82; and probability discounting

of loss r (25)=−0.12, P=0.56]. When the analysis was

restricted to male participants, the results were the same;

the only significant correlation between nicotine intake per

day and discounting was that involving delay discounting

of gains by male smokers [r (18)=−0.56, P<0.05].

Additionally, the number of months the subject had

smoked was unrelated to his or her discounting behavior

[delay discounting of gain r (25)=−0.18, P=0.38; proba-

bility discounting of gain r (25)=−0.10, P=0.63; delay

discounting of loss r (25)=0.34, P=0.08; and probability

discounting of loss r (25)=0.21, P=0.30] but was signif-

icantly correlated with both the estimated nicotine intake

per day and the number of cigarettes smoked per day

(r (25)=0.46, P<0.05 and r (25)=0.42, P<0.05, respec-

tively). These findings are consistent with those reported

in the report of Reynolds (

). Also, the number of cig-

arettes smoked per day was correlated with the amount of

nicotine per cigarette [r (25)=0.55, P<0.01]. This indicates

that habitual smokers who consume more cigarettes reg-

ularly tend to smoke stronger cigarettes. Consequently, the

number of cigarettes smoked per day was correlated with

the estimated amount of nicotine intake per day [r (25)=

0.87, P<0.01].

Group differences in the degree of discounting

between never smokers and smokers

To examine whether a previously reported group difference

between never smokers and heavy smokers was replicated

in the present study, we compared delay discounting of

monetary gains in smokers and never smokers and found

0

0.2

0.4

0.6

0.8

1

0

10 20

30

40

The number of cigarettes smoked per day

AUC of delay discounting of monetary gains

r = -0.66

Fig. 2 Scatterplot of the number of cigarettes smoked per day and

the AUC for delay discounting of monetary gains in smokers. A

significant negative correlation was observed (n=25, P<0.01). Note

that a smaller AUC indicates a higher degree of discounting. Two

data points are missing due to the participants

’ omission in an-

swering questions about their smoking behavior

0

0.2

0.4

0.6

0.8

1

0

10

20

30

40

Estimated nicotine intake per day

AUC of delay discounting of monetary gains

r = -0.57

Fig. 3 Scatterplot of the estimated amount of nicotine intake per

day and the AUC for delay discounting of monetary gains in

smokers. A significant negative correlation was observed (n=25,

P<0.01). Note that a smaller AUC indicates a higher degree of

discounting. Two data points are missing due to the participants

’

omission in answering questions about their smoking behavior

512

no significant difference [t (48)=0.48, P=0.63]. Moreover,

there was no difference between smokers and never

smokers in any of the other three types of discounting

[probability discounting of gain t (40.5)=−1.78, P=0.08;

delay discounting of loss t (48)=0.57, P=0.57; and

probability discounting of loss t (48)=0.78, P=0.44]. It

has already been noted that the smokers in our sample were

relatively mild nicotine users compared to those who have

participated in previous studies (e.g., Bickel et al.

Mitchell

; Reynolds et al.

), which may have

resulted in a nonsignificant group difference.

Relationship between discounting gains

and discounting losses

In addition, we examined the relationship between dis-

counting a gain and discounting a loss across all 50 partic-

ipants for delay and probability discounting and confirmed

positive and negative relationships, respectively [delay

discounting r (50)=0.60, P<0.01; probability discounting

r (50)=−0.49, P<0.01]. Moreover, mean AUCs for dis-

counting gains were significantly smaller than those for

losses [dependent sample t tests: delay discounting t (49)=

4.34, P<0.01; probability discounting t (49)=4.66, P<

0.01]. This implies that people more steeply discount fu-

ture/uncertain gains than losses.

Relationship between delay discounting

and probability discounting

Finally, we analyzed the relationship between delay dis-

counting and probability discounting independently for

gains and losses across all 50 participants. For gains,

Pearson product

–moment correlations revealed a posi-

tive, but nonsignificant, relationship between the AUCs

of delay and probability discounting [r (50)=0.17, P=

0.23]. This observation is consistent with the study of

Myerson et al. (

) reporting a relatively weak to modest

positive relationship between discounting of delayed and

uncertain gains. The correlation between discounting de-

layed and uncertain losses was likewise nonsignificant

[r (50)=0.16, P=0.28]. Together, these results suggest that

the cognitive processes involved in evaluating delayed

rewards (or losses) may differ from those involved with

uncertain rewards (or losses).

Discussion

Our study is the first to examine the relationships between

the number of cigarettes smoked per day, the estimated

amount of nicotine intake per day, and four types of dis-

counting (i.e., delay and probability discounting of mon-

etary gains and losses) within the same subjects. Our data

suggest five general conclusions: (1) the frequency of

nicotine self-administration is positively associated with

impulsive behavior in discounting delayed monetary re-

wards, (2) the level of chronic nicotine exposure is sim-

ilarly associated with impulsive behavior in discounting

delayed monetary gains, (3) relatively mild smokers do not

discount delayed or uncertain gains or losses more than

never smokers, (4) discounting monetary losses is not

strongly associated with smoking, and (5) the relationship

between smoking and probability discounting is not as

strong as that observed between smoking and delay dis-

counting of gains.

The correlations observed between smoking behavior

and delay discounting of monetary rewards are consistent

with previous studies. For example, Reynolds (

) re-

cently reported a significant positive correlation between

the number of cigarettes smoked per day and a delay dis-

counting rate (logged hyperbolic k). In addition to the

positive relationship observed between discounting of de-

layed rewards and smoking frequency (Fig.

), we also

reported a positive association involving nicotine dosage

(Fig.

), whereby higher doses of nicotine were associated

with a greater tendency to discount delayed rewards. Neu-

ropsychopharmacologically, because chronic nicotine ex-

posure is known to associate with strong neuroadaptation,

predominantly in reward-processing brain regions (Liu

and Jin

; Rahman et al.

), it is possible that

chronic exposure to nicotine may reduce dopaminergic

activity in the neural circuitry, resulting in augmented de-

valuation of delayed monetary gains. However, whether

drug-intake-induced neuroadaptation actually causes strong

delay discounting of gain should be more extensively stud-

ied. Moreover, it was observed that habitual smokers who

consume more cigarettes regularly tend to smoke stronger

cigarettes. Therefore, smoking frequency (i.e., the num-

ber of cigarettes consumed per day) can alternatively be

adopted to estimate nicotine exposure when more biologi-

cally significant measures are unavailable (e.g., the amount

of daily nicotine intake or cotinine level).

Although smokers and never smokers did not differ in

their discounting behavior overall, this likely resulted from

the number of relatively mild nicotine users in our sample.

Most studies have focused on heavy smokers who consume

no less than 20 cigarettes per day (e.g., Bickel et al.

;

Reynolds et al.

); in contrast, only eight of the nicotine

users in our study met this criterion. As such, our inves-

tigation is the first to demonstrate that relatively mild

smokers do not more rapidly discount delayed monetary

rewards than never smokers. One possible interpretation

of this result is that the level of chronic nicotine exposure

in mild smokers might not be strong enough to affect

impulsivity.

Although there was a relationship with delay discount-

ing of gains, we did not detect a relationship between

smoking behavior and delay discounting of monetary

losses. This observation may reflect the unique neural ac-

tivation patterns observed in response to gains and losses

during decision making; dopaminergic neural responses

are evoked in response to monetary gains, whereas other

brain regions (e.g., the right anterior cingulate, thalamus,

and left amygdala) are more strongly activated in response

to monetary losses (Knutson et al.

; Breiter et al.

513

). It should be noted that several studies have shown

that heavy smokers tend to discount delayed losses more

steeply than never smokers (Odum et al.

; Baker et al.

). Again, this discrepancy might be explained by the

relatively mild nicotine use exhibited by our sample of

smokers. This point should be further investigated in future

studies to draw more definitive conclusions.

Whereas delay discounting of gain was associated with

smoking behavior, we did not observe a significant correla-

tion between probability discounting of gain and smoking

behavior. Likewise, we did not find a significant differ-

ence in probability discounting of gain between smokers

and never smokers. The smokers employed in both our

present study and Mitchell

’s (

) study were relatively

light smokers, which may have resulted in a nonsignif-

icant difference in probability discounting of gain between

smokers and never smokers. On the other hand, the study

of Reynolds and his colleagues reported that heavy smok-

ers discounted an uncertain monetary reward more drama-

tically when compared to never smokers, possibly because

they employed heavier smokers (Reynolds et al.

Considering these results, it is possible that probability

discounting is related to smoking only in heavy smokers.

We further examined the relationships between the four

types of discounting regardless of smoking status. It was

revealed that the participants discounted both delayed and

uncertain gains more steeply than delayed and uncertain

losses, respectively, which is in line with previous reports

of an asymmetry in the decisions made regarding gains

and losses in discounting tasks (Tversky and Kahneman

; Thaler

; Baker et al.

). It was also dem-

onstrated that the association between the tendency to

discount rewards and the tendency to discount losses was

positive in direction for delay discounting, but negative

for probability discounting. The latter finding can explain

paradoxical behavior observed in antisocial psychiatric

patients with comorbid drug dependence (Kausch

who exhibit both low discounting of probabilistic rewards

(e.g., a preference for gambling) and high discounting of

probabilistic losses (e.g., low aversion to possible HIV

infection caused by needle sharing or high-risk sexual

behavior). Finally, although the direction of the correla-

tion observed between delay and probability discounting

of gains was positive, the coefficient did not reach sta-

tistical significance. This is consistent with the conclusion

of Myerson et al. (

) that the tendencies to discount

delayed and uncertain gains is only weakly to modestly

related at best. However, because several studies have

shown a strong positive correlation between them (e.g.,

Richards et al.

; Reynolds et al.

), further studies

are required to elucidate this relationship.

Although promising, there are limitations to our present

study. First, we did not restrict the participant

’s access to

nicotine prior to the experiment. In our opinion, it is im-

probable that the time of the last cigarette prior to partic-

ipating in the experiment significantly affected our results,

since (1) the time to complete our study was typically less

than 1 h, and (2) one previous study (Mitchell

) has

shown that even a 24-h nicotine deprivation did not change

the discounting behavior of monetary outcomes (although

discounting cigarettes was significantly increased). Never-

theless, future studies should examine how the time of last

cigarette affects the subject

’s discounting behavior. Sec-

ond, we did not assess breath CO levels or urine cotinine

levels. It is, however, noteworthy that a number of studies

(Ueda et al.

; Benowitz et al.

; Binnie et al.

have shown that there is a significant correlation between

self-reported smoking status and urinary cotinine levels,

especially in mild smokers, suggesting that self-reported

smoking status is a good estimate of actual nicotine in-

take. It should also be noted that our results are consistent

with the study of Reynolds et al. (

) reporting that CO

levels were positively associated with delay discounting

of gains, but not with probability discounting of gains.

Nevertheless, it would be preferable for future studies to

assess biological markers of nicotine exposure such as

plasma cotinine levels and CSF (cerebrospinal fluid) nico-

tine levels.

Finally, we suggest future directions: (1) the effects of

acute and chronic nicotine administration on discounting

should be compared since psychopharmacological studies

have revealed that an acute administration of a dopami-

nergic drug may actually reduce impulsive behavior in

delay discounting of gains, whereas chronic exposure may

induce neuroadaptation and thereby increase impulsive

behavior in delay discounting of gains (Richards et al.

; Cardinal et al.

; Wade et al.

; de Wit et al.

; Pietras et al.

), and (2) future investigations

should combine a genetic analysis with a psychophar-

macological methodology to further elucidate the neuro-

psychopharmacological correlates of delay and probability

discounting of gains and losses because considerable evi-

dence indicates that nicotine use is influenced by our ge-

notype, such as DRD2 polymorphism (see Munafo et al.

for a review).

Acknowledgements

The research reported in this paper was

supported by grants from the Grant-in-Aid for Scientific Research

(

“21st century center of excellence” grant and grant#17650074) from

the Ministry of Education, Culture, Sports, Science and Technology

of Japan, and a Yamaguchi endocrinological disorder grant. We are

grateful to Dr. Paul Wehr and anonymous reviewers for critical

reading of our manuscript.

References

Baker F, Johnson MW, Bickel WK (2003) Delay discounting in

current and never-before cigarette smokers: similarities and

differences across commodity sign and magnitude. J Abnorm

Psychol 112:382

–392

Benowitz NL, Pomerleau OF, Pomerleau CS, Jacob P III (2003)

Nicotine metabolite ratio as a predictor of cigarette consump-

tion. Nicotine Tob Res 5:621

–624

Bickel WK, Marsch LA (2001) Toward a behavioral economic

understanding of drug dependence: delay discounting pro-

cesses. Addiction 96:73

–86

Bickel WK, Odum AL, Madden GJ (1999) Impulsivity and cigarette

smoking: delay discounting in current never and ex-smokers.

Psychopharmacology 146:447

–454

514

Binnie V, McHugh S, Macpherson L, Borland B, Moir K, Malik K

(2004) The validation of self-reported smoking status by an-

alysing cotinine levels in stimulated and unstimulated saliva,

serum and urine. Oral Dis 10:287

–293

Breiter HC, Aharon I, Kahneman D, Dale A, Shizgal P (2001)

Functional imaging of neural responses to expectancy and

experience of monetary gains and losses. Neuron 30:619

–639

Cardinal RN, Robbins TW, Everitt BJ (2000) The effects of

D

-amphetamine chlordiazepoxide alpha-flupenthixol and be-

havioural manipulations on choice of signalled and unsignalled

delayed reinforcement in rats. Psychopharmacology 152:362

–

375

Daruna JH, Barnes PA (1993) A neurodevelopmental view of

impulsivity. In: McCown WG, Johnson JL, Shure MB (eds)

The impulsive client: theory research and treatment. American

Psychological Association, Washington, DC, pp 23

–37

de Wit H, Enggasser JL, Richards JB (2002) Acute administration

of

D

-amphetamine decreases impulsivity in healthy volunteers.

Neuropsychopharmacology 27:813

–825

Glimcher PW, Rustichini A (2004) Neuroeconomics: the consilience

of brain and decision. Science 306:447

–452

Johnson MW, Bickel WK (2002) Within-subject comparison of real

and hypothetical money rewards in delay discounting. J Exp

Anal Behav 77:129

–146

Kausch O (2003) Patterns of substance abuse among treatment-

seeking pathological gamblers. J Subst Abuse Treat 25:263

–

270

Kirby KN, Petry NM (2004) Heroin and cocaine abusers have

higher discount rates for delayed rewards than alcoholics or

non-drug-using controls. Addiction 99:461

–471

Kirby KN, Petry NM, Bickel WK (1999) Heroin addicts have higher

discount rates for delayed rewards than non-drug-using con-

trols. J Exp Psychol Gen 128:78

–87

Knutson B, Westdorp A, Kaiser E, Hommer D (2000) FMRI

visualization of brain activity during a monetary incentive delay

task. NeuroImage 12:20

–27

Knutson B, Fong GW, Bennett SM, Adams CM, Hommer D (2003)

A region of mesial prefrontal cortex tracks monetarily re-

warding outcomes: characterization with rapid event-related

fMRI. NeuroImage 18:263

–272

Liu ZH, Jin WQ (2004) Decrease of ventral tegmental area do-

pamine neuronal activity in nicotine withdrawal rats. Neuro-

report 15:1479

–1481

Martin-Solch C, Magyar S, Kunig G, Missimer J, Schultz W,

Leenders KL (2001) Changes in brain activation associated

with reward processing in smokers and nonsmokers. A positron

emission tomography study. Exp Brain Res 139:278

–286

Martin-Solch C, Missimer J, Leenders KL, Schultz W (2003) Neural

activity related to the processing of increasing monetary reward

in smokers and nonsmokers. Eur J Neurosci 18:680

–688

Mazur JE (1987) An adjusting procedure for studying delayed

reinforcement. In: Commons ML, Mazur JE, Nevin JA, Rachlin

H (eds) Quantitative analysis of behavior, vol 5. The effects

of delay and of intervening events on reinforcement value.

Erlbaum, Hillsdale, NJ, pp 55

–73

McClure SM, Laibson DI, Loewenstein G, Cohen JD (2004)

Separate neural systems value immediate and delayed monetary

rewards. Science 306:503

–507

Mitchell SH (1999) Measures of impulsivity in cigarette smokers

and non-smokers. Psychopharmacology 146:455

–464

Mitchell SH (2004) Effects of short-term nicotine deprivation on

decision-making: delay, uncertainty and effort discounting. Nic-

otine Tob Res 6:819

–828

Montague PR, Berns GS (2002) Neural economics and the bio-

logical substrates of valuation. Neuron 36:265

–284

Munafo M, Clark T, Johnstone E, Murphy M, Walton R (2004) The

genetic basis for smoking behavior: a systematic review and

meta-analysis. Nicotine Tob Res 6:583

–597

Myerson J, Green L, Warusawitharana M (2001) Area under the

curve as a measure of discounting. J Exp Anal Behav 76:235

–

243

Myerson J, Green L, Hanson JS, Holt DD, Estle SJ (2003)

Discounting delayed and probabilistic rewards: processes and

traits. J Econ Psychol 24:619

–635

Odum AL, Madden GJ, Bickel WK (2002) Discounting of delayed

health gains and losses by current never- and ex-smokers of

cigarettes. Nicotine Tob Res 4:295

–303

Perry JL, Larson EB, German JP, Madden GJ, Carroll ME (2005)

Impulsivity (delay discounting) as a predictor of acquisition of

IV cocaine self-administration in female rats. Psychopharma-

cology 178:193

–201

Petry NM (2001) Delay discounting of money and alcohol in ac-

tively using alcoholics currently abstinent alcoholics and con-

trols. Psychopharmacology 154:243

–250

Pietras CJ, Cherek DR, Lane SD, Tcheremissine OV, Steinberg JL

(2003) Effects of methylphenidate on impulsive choice in adult

humans. Psychopharmacology 170:390

–398

Rachlin H, Raineri A, Cross D (1991) Subjective probability and

delay. J Exp Anal Behav 55:233

–244

Rahman S, Zhang J, Engleman EA, Corrigall WA (2004) Neu-

roadaptive changes in the mesoaccumbens dopamine system

after chronic self-administration: a microdialysis study. Neuro-

science 129:415

–424

Reynolds B (2004) Do high rates of cigarette consumption increase

delay discounting? A cross-sectional comparison of adolescent

smokers and young-adult smokers and nonsmokers. Behav

Processes 67:545

–549

Reynolds B, Karraker K, Horn K, Richards JB (2003) Delay and

probability discounting as related to different stages of adoles-

cent smoking and non-smoking. Behav Processes 64:333

–344

Reynolds B, Richards JB, Horn K, Karraker K (2004) Delay

discounting and probability discounting as related to cigarette

smoking status in adults. Behav Processes 65:35

–42

Richards JB, Sabol KE, de Wit H (1999a) Effects of methamphet-

amine on the adjusting amount procedure, a model of impulsive

behavior in rats. Psychopharmacology 146:432

–439

Richards JB, Zhang L, Mitchell SH, de Wit H (1999b) Delay or

probability discounting in a model of impulsive behavior: effect

of alcohol. J Exp Anal Behav 71:121

–143

Schultz W (2004) Neural coding of basic reward terms of animal

learning theory game theory microeconomics and behavioural

ecology. Curr Opin Neurobiol 14:139

–147

Simpson CA, Vuchinich RE (2000) Reliability of a measure of

temporal discounting. Psychol Rec 50:3

–16

Takahashi T (2004) Cortisol levels and time-discounting of mon-

etary gain in humans. Neuroreport 15:2145

–2147

Thaler R (1981) Some empirical evidence on dynamic inconsis-

tency. Econ Lett 8:201

–207

Tversky A, Kahneman D (1981) The framing of decisions and the

psychology of choice. Science 211:453

–458

Ueda K, Kawachi I, Nakamura M, Nogami H, Shirokawa N, Masui

S, Okayama A, Oshima A (2002) Cigarettes nicotine yields and

nicotine intake among Japanese male workers. Tob Control

11:55

–60

Vuchinich RE, Simpson CA (1998) Hyperbolic temporal discount-

ing in social drinkers and problem drinkers. Exp Clin Psycho-

pharmacol 6:292

–305

Wade TR, de Wit H, Richards JB (2000) Effects of dopaminergic

drugs on delayed reward as a measure of impulsive behavior in

rats. Psychopharmacology 150:90

–101

515

Document Outline

- Discounting delayed and probabilistic monetary gains and losses by smokers of cigarettes

- Abstract

- Abstract

- Abstract

- Abstract

- Abstract

- Abstract

- Introduction

- Materials and methods

- Results

- Relationships involving demographics and discounting behavior

- Fitness of discounting equations

- Relationships involving smoking status and discounting behavior

- Group differences in the degree of discounting between never smokers and smokers

- Relationship between discounting gains and discounting losses

- Relationship between delay discounting and probability discounting

- Discussion

- References

Wyszukiwarka

Podobne podstrony:

Foucault Discourse and Truth The Problematization of Parrhesia (Berkeley,1983)

Delayed?onomic and?ucation Progress

cicourel, a v the interaction of discourse, cognition and culture

Hagos Michael, Enemy Images and Cultural Racist Discourse, How and Why the West Creates Enemy Images

Barbara Jonnstone Discourse Analysis and Narrative

Lucid Dreaming and Meditation by Wallace

Kundalini Is it Metal in the Meridians and Body by TM Molian (2011)

Affirmative Action and the Legislative History of the Fourteenth Amendment

Oakeley, H D Epistemology And The Logical Syntax Of Language

Zizek And The Colonial Model of Religion

Introduction to Prana and Pranic Healing – Experience of Breath and Energy (Pran

Botox, Migraine, and the American Academy of Neurology

Potentiometric and NMR complexation studies of phenylboronic acid PBA

Master Wonhyo An Overview of His Life and Teachings by Byeong Jo Jeong (2010)

89 1268 1281 Tool Life and Tool Quality Summary of the Activities of the ICFG Subgroup

Contrastic Rhetoric and Converging Security Interests of the EU and China in Africa

więcej podobnych podstron