1

Managing trade

receivables and payable

Chapter

23

2

23.1 Managing trade receivables

Most sales between businesses are made on credit. This creates trade receivables, which is a

current asset in the balance sheet. Businesses prefer to buy goods on credit rather than pay for

them on delivery. This hopefully will increase sales of the company, and therefore generous credit

terms can be negotiated.

Trade credit is an interest free source of finance from one business to another business, and a

means of creating or increasing sales for the supplier. There are normally terms on the invoice for

payment for example payment should be made within 30 days of invoice date.

Consumer credit is financing given for by businesses to end consumers for the purchase of goods

and services for personal consumption. This may not necessarily be an interest free source of

financing but available to ease consumer cash flow. Examples of consumer credit are hire purchase

agreements and credit cards.

One of the main costs of extending credit rather than getting the cash in straight away from sales is

the finance cost.

1. Interest forgone to invest cash (opportunity cost). Trade receivables do not earn interest.

2. Additional interest payable on short term finance if the company has cash deficits.

Credit management involves:

The benefits of extending credit to customers’ versus the cost in extending the credit.

Establishing discounts, level and length of credit that will maximise profits.

Assessing the credit risk of customers by reviewing their accounting information or obtaining

references.

Setting credit limits for customers and terms of payment.

Collecting debts and minimising risk of bad debts (credit control).

3

23.2 Extending credit

Exam questions often ask the benefits of extending credit to customers. As we know the only cost

in having trade receivables is the finance cost as trade receivable is an asset like inventories which

doesn’t earn a return.

The effect of extending the credit involves looking at the extra finance costs in investment in the

trade receivables versus the additional benefits like increase in sales / contribution.

Example 23.1

Increase in trade receivables

A plc’s current annual sales are £15 million. The average trade receivable days currently is 30 and

the company’s short term borrowing is at 11%. Contribution from sales is 10%.

A plc wants to increase it sales by £1 million over the next year by allowing an extra 15-days credit

to all its customers.

Assuming a 365-day working year, should the company pursue its plan?

Assume that there will be cash deficits next year.

Considerations before extending credit

Extra sales that will be generated from the additional credit terms.

The value of contribution of additional sales.

The additional finance costs.

The effect of additional trade receivables and payables (as more inventories will have to be

purchased).

Length of extra debt collection period.

4

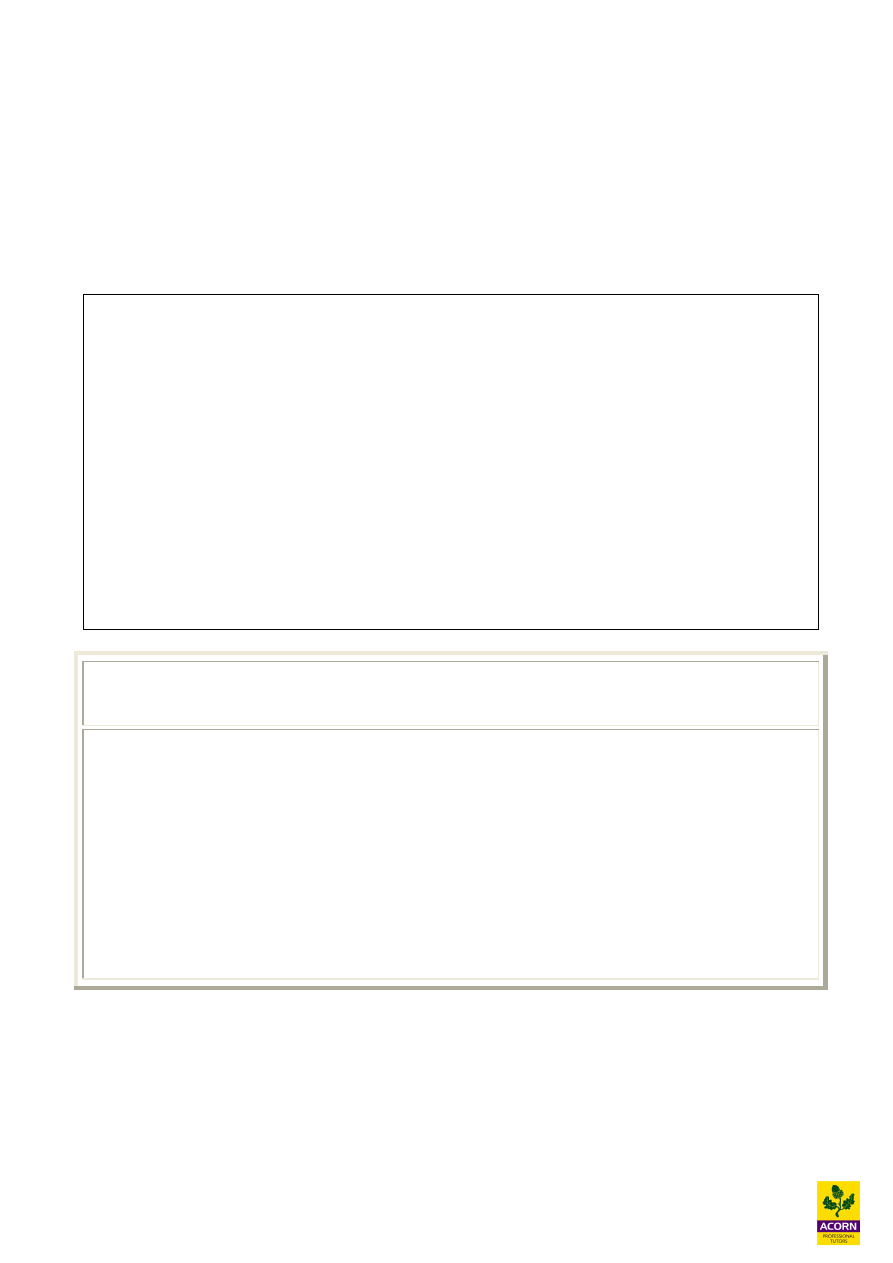

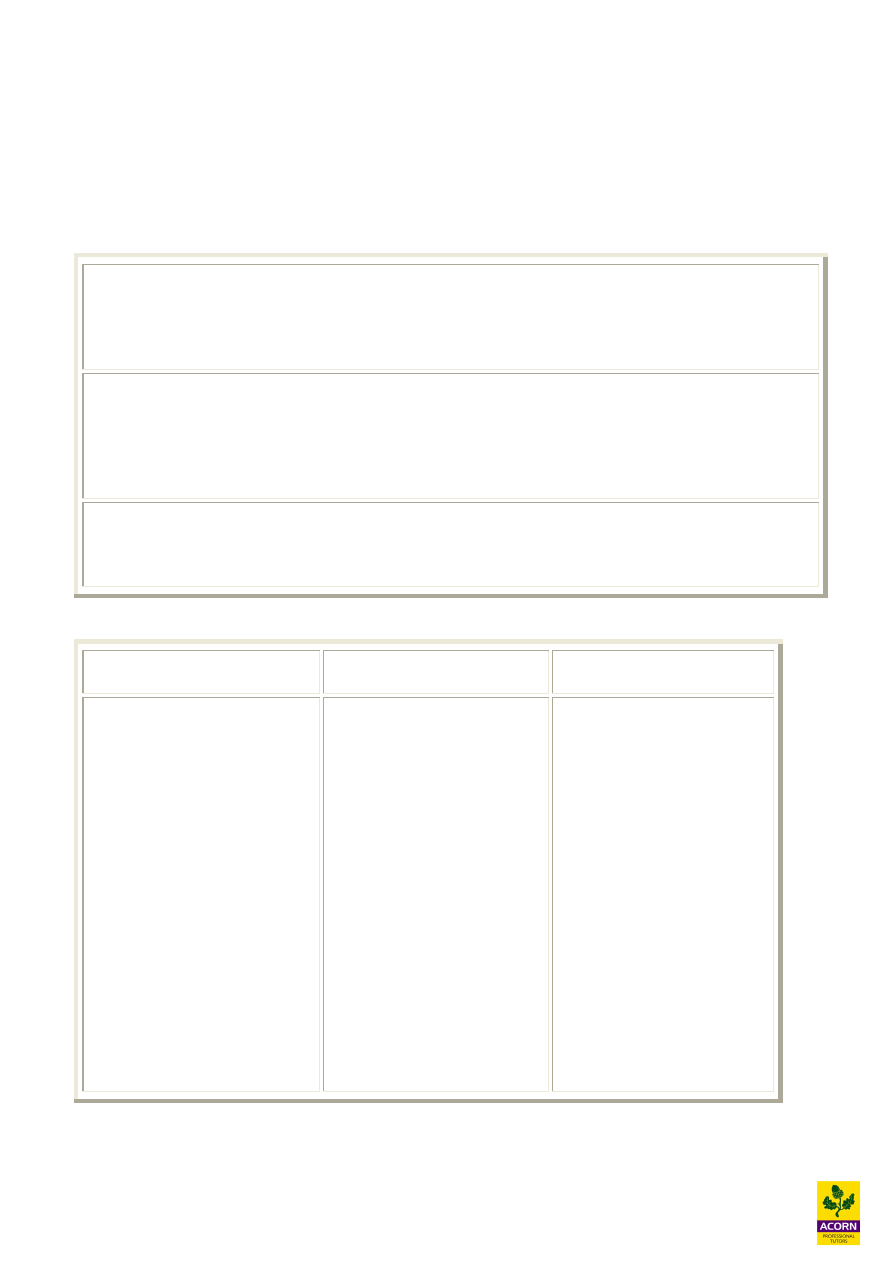

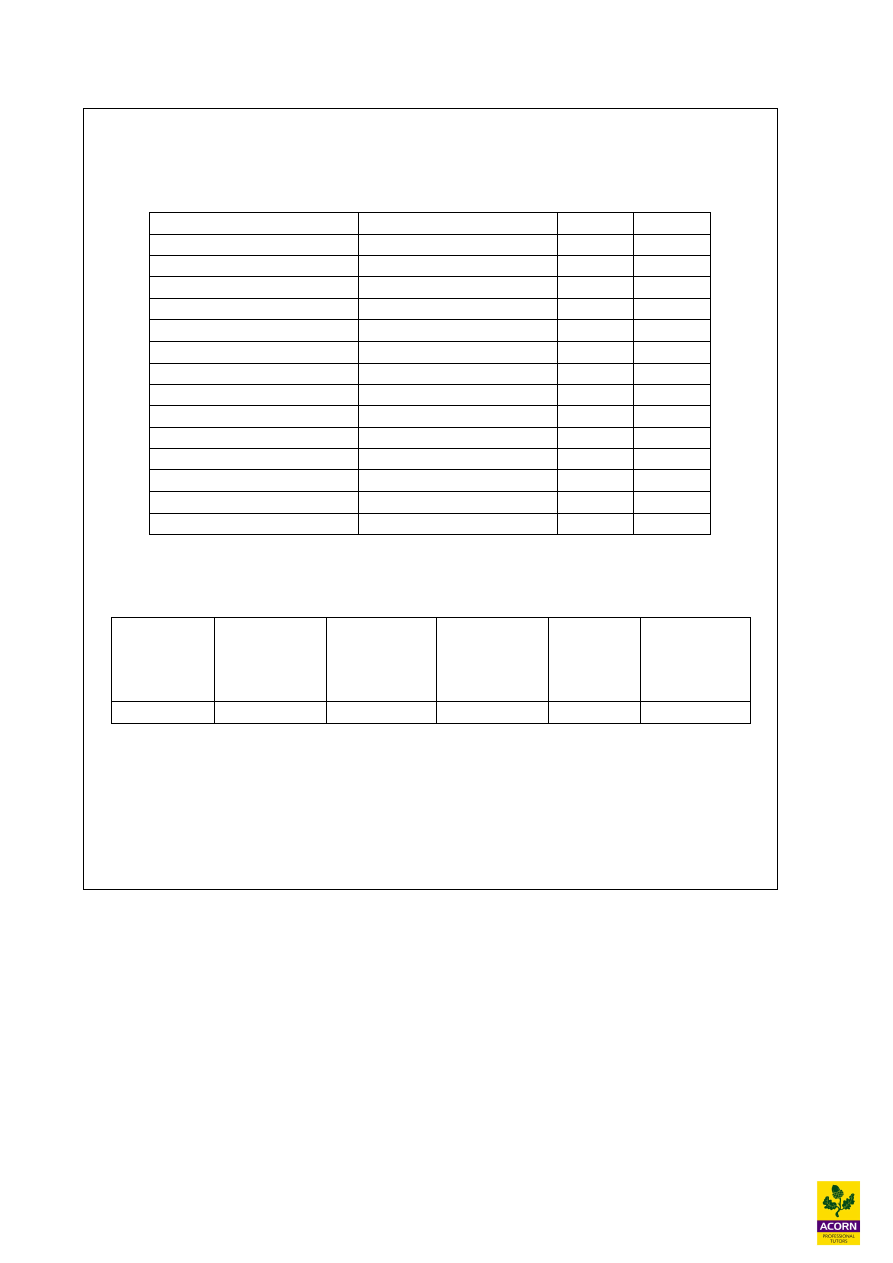

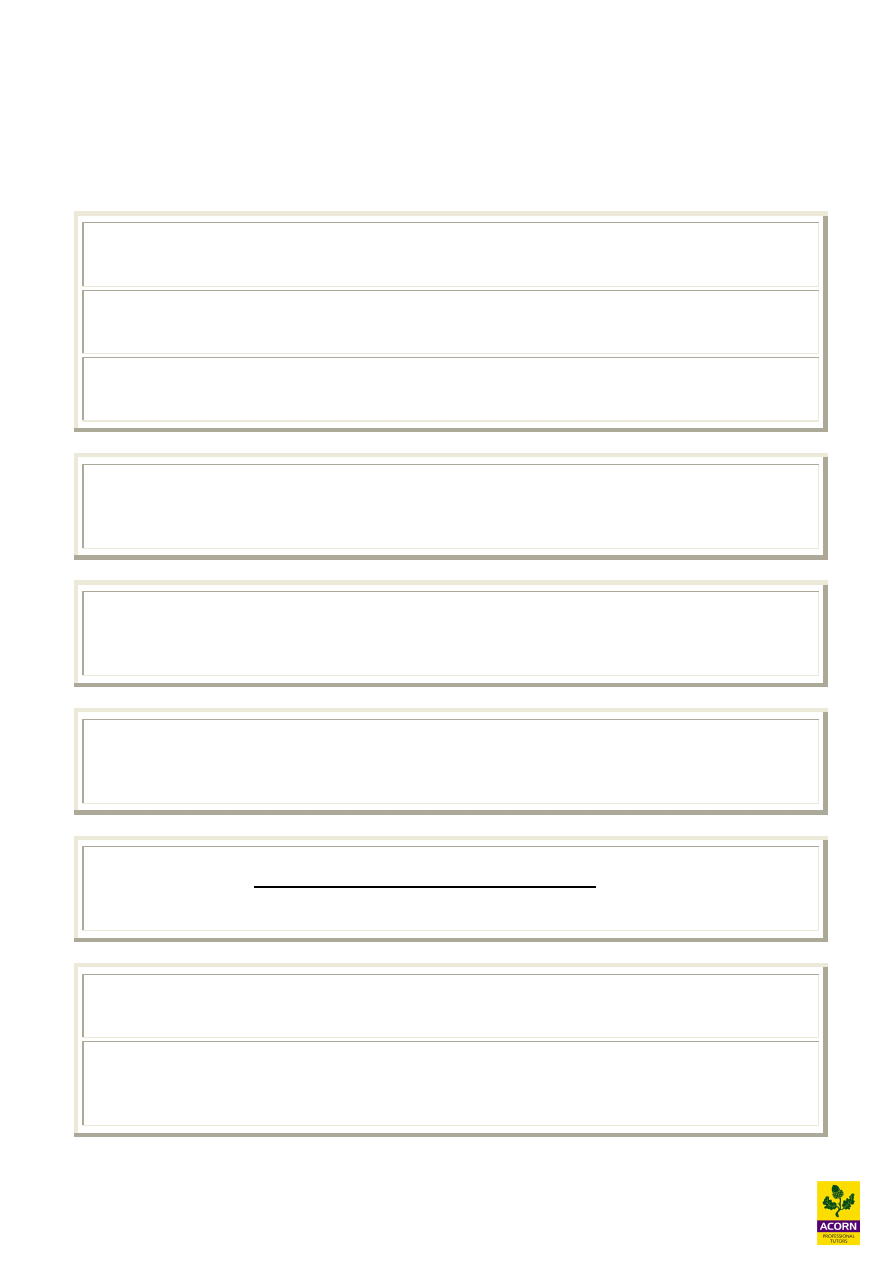

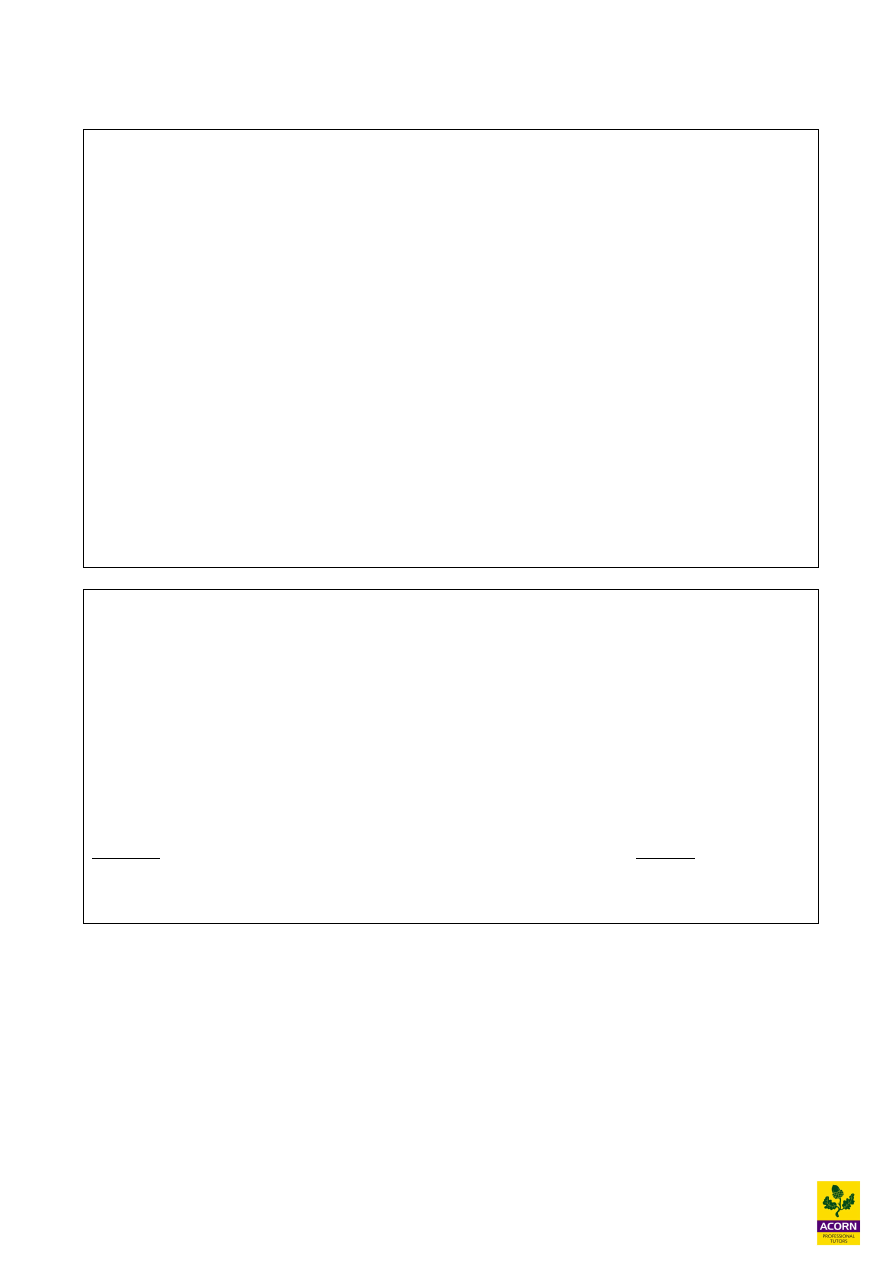

23.3 The credit cycle

The credit cycle is the time between receiving an order and the collection of money from the sale.

The longer the credit cycle the more time the cash is locked in working capital. Companies should

try to keep the credit cycle as short as possible as this will help with cash flow.

Receive order

Verify creditworthiness

of customer

Credit limit

check

Order accepted after

credit screening

Delivery goods issue

delivery note

Raise invoice

stating credit terms

Send statement

Debt collection

procedures

Receive cash

Stages in the

credit cycle

5

23.4 Cash / settlement discounts

This is a discount offered on the sale of goods on credit to customers for early payment.

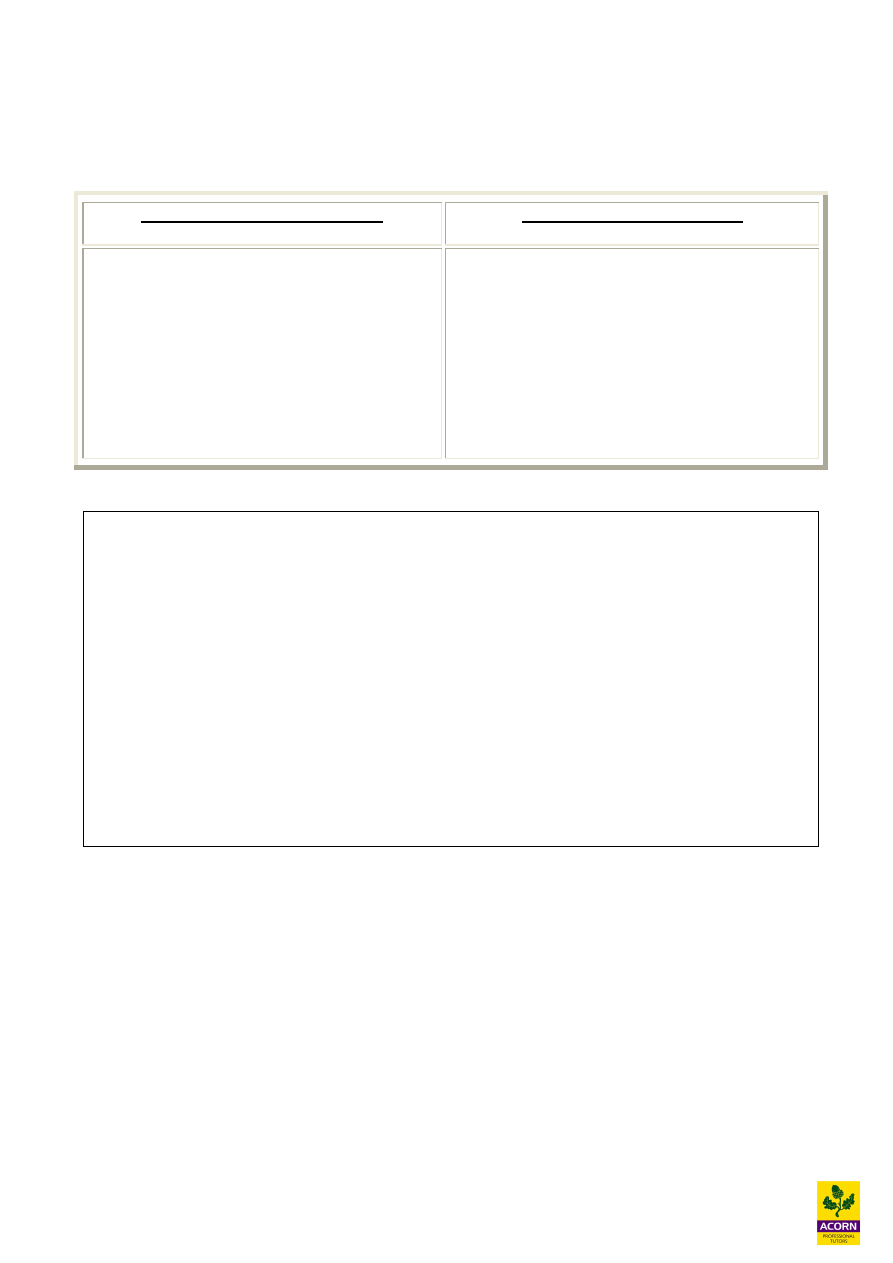

Benefits of settlement discounts

Costs of settlement discounts

· Encourages customers to pay earlier and

thus reduce financing costs.

· Improves liquidity as cash is received

earlier.

· Encourages customers to buy and

therefore increase sales.

· Reduction in bad debts due to reduced

collection period.

· The cost of the discount will reduce cash

received.

· Extra administrative costs to manage the

discounts given.

· Customers may take the discount and still

pay late if there is poor management of

settlement discounts.

Example 23.2

Offering early settlement discounts

A plc’s current annual sales are £15 million. The average trade receivable days currently are 40

days and the company’s short term borrowing is at 11%.

A plc is considering offering a discount of 0.25% for payments within 18 days. A new member of

staff will be employed to administer this new scheme, costing a total of £20,000 per year.

Evaluate the new discount scheme for A plc if:

(a)

All the customers take up the discount.

(b)

Only 20% of the customers take up the discount.

23.5 Effective cost of early settlement discount

Offering discount is gaining access to money earlier rather than later, very much like a bank loan.

Therefore we can calculate the effective cost or interest on the discount offer. This can be

calculated by using compounding interest or simple interest; they will give slightly different

answers.

If the cost of early settlement discount % is less than the borrowing costs, then the early settlement

discounts are beneficial.

6

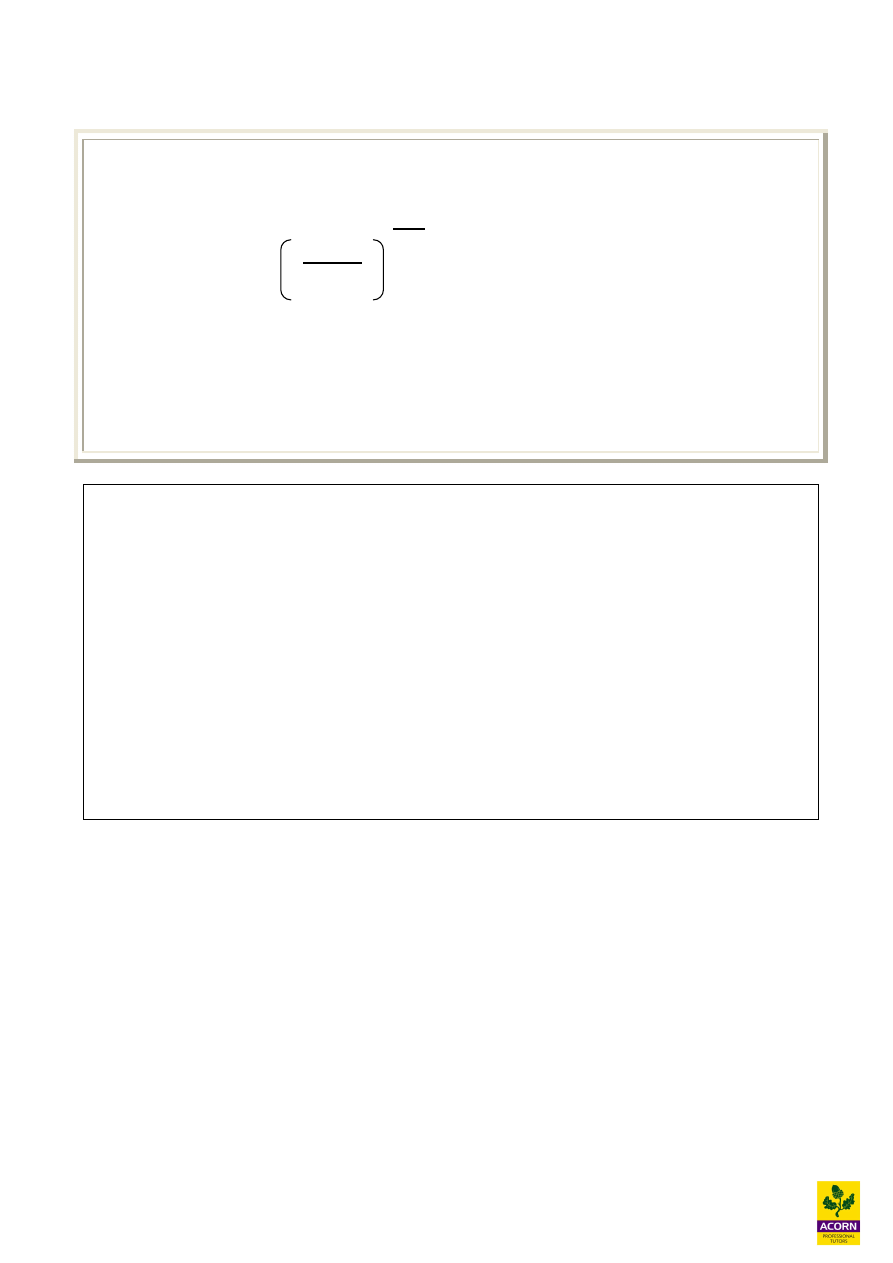

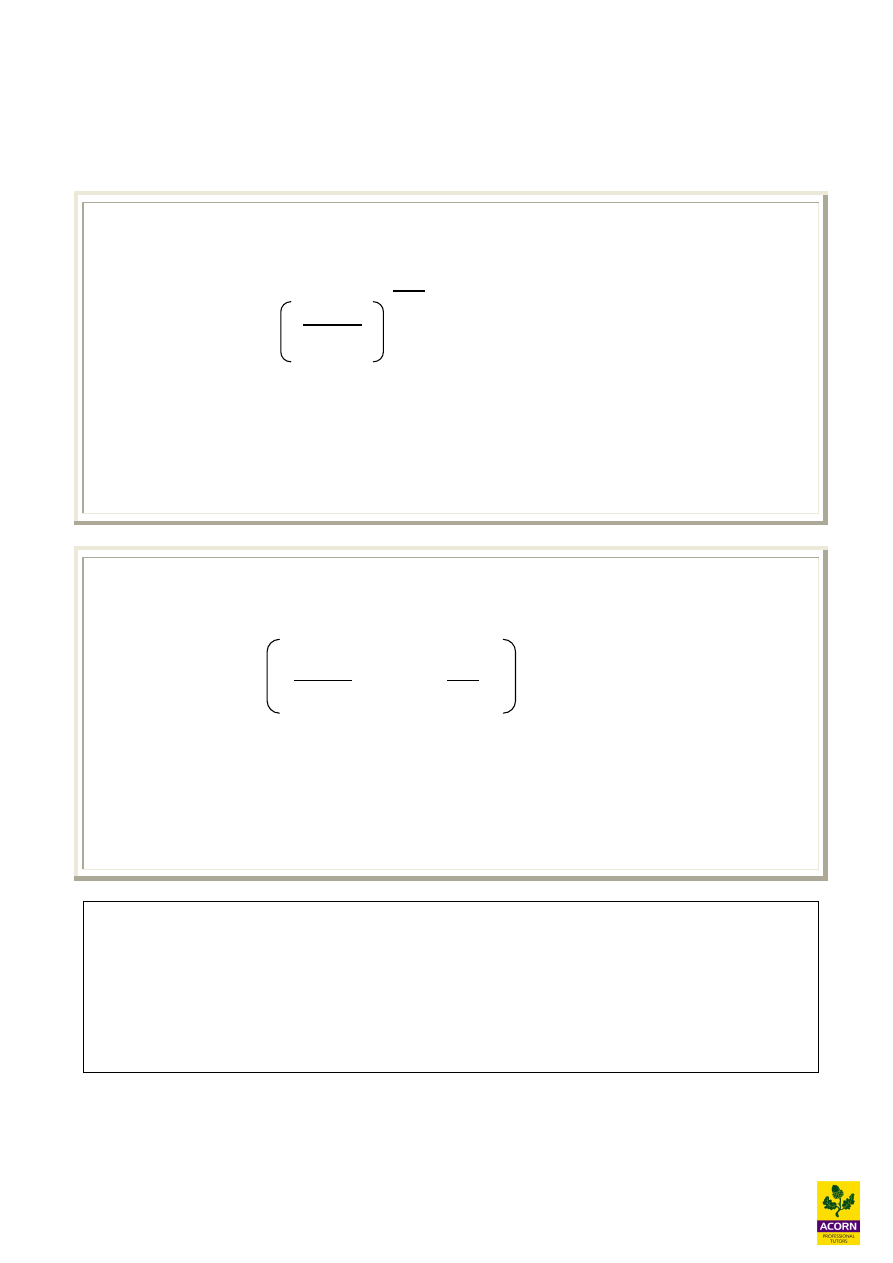

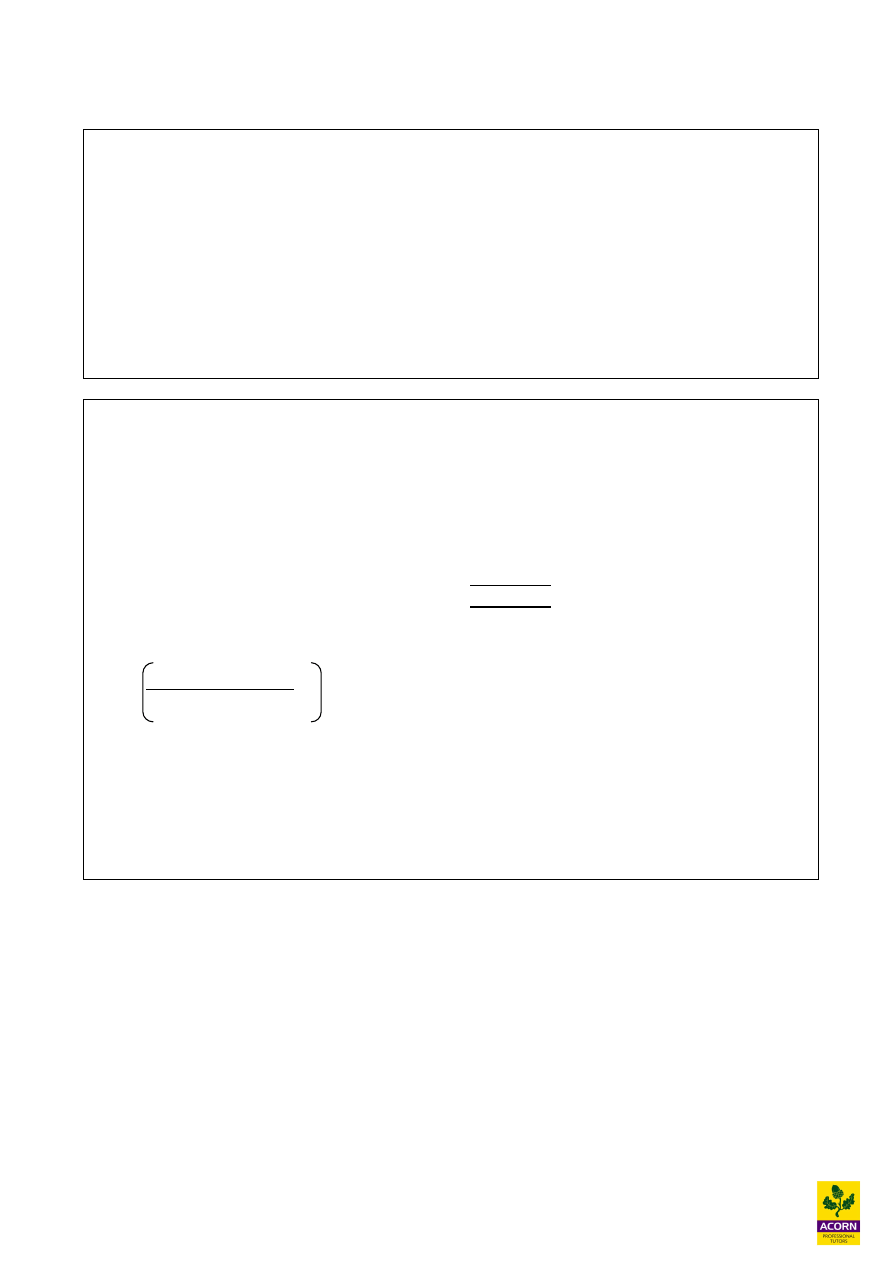

Compound formula for cost of early settlement discount (APR) – normally used

100

100 - D

- 1 x 100%

Where:

D =is discount offered in %

S = number of days credit allowed with settlement discount

N = the number of days credit offered net, for no discount

Example 12.3 – Worked example (Compound formula)

Find the annual equivalent rate of interest implicit on offering a 0.25% discount for payment within

18 days rather than 40 days. The short term borrowing rate is 11%.

Solution

{100 / (100-0.25)}

365/(40-18)

- 1

x 100%

= (1.0025)

16.591

-1

x 100%

= 1.0424

-1

x 100%

= 4.24%

This is less than the short term borrowing rate which means it is worth taking up the discount offer,

as it costs less than borrowing.

365

N- S

7

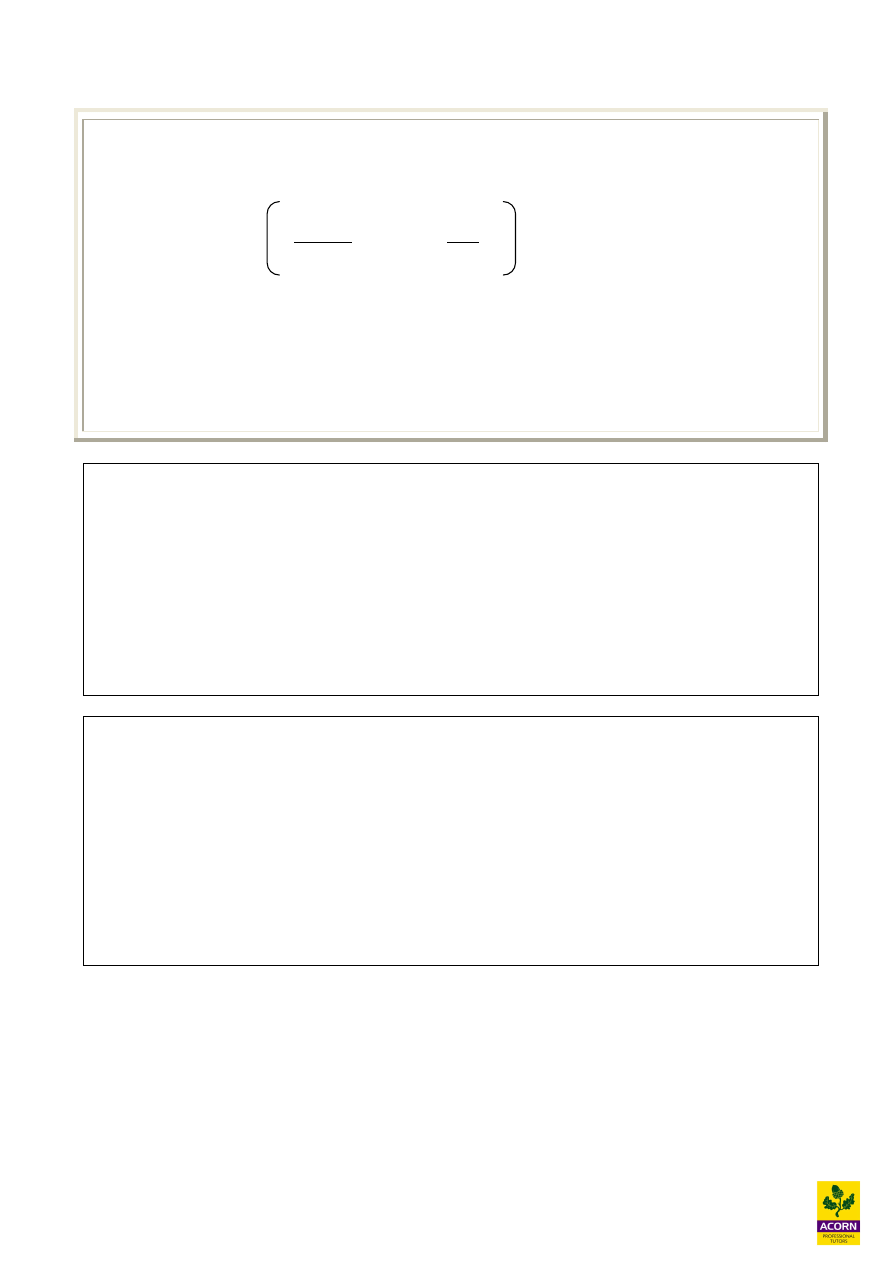

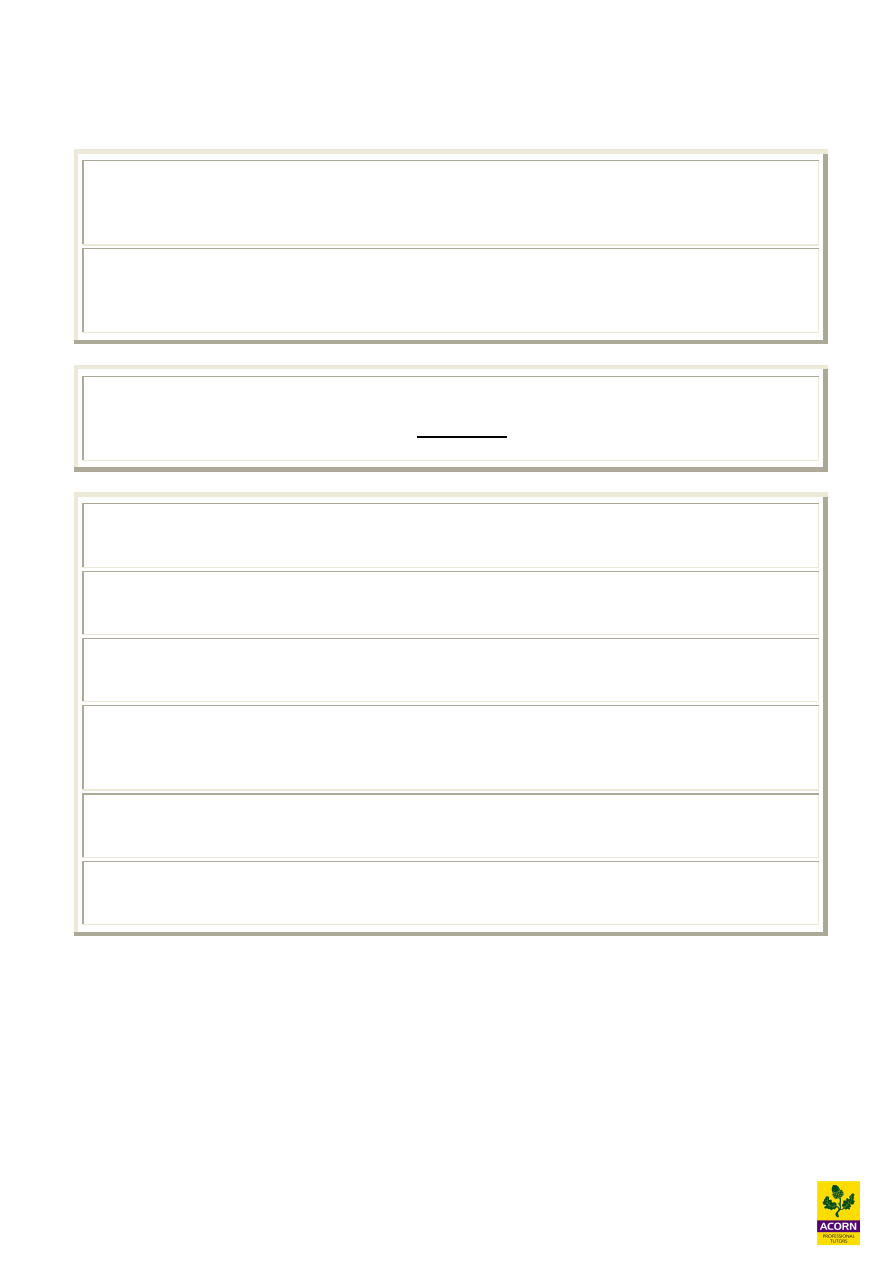

Simple formula for cost of early settlement discount

D x 365

100 – D N - S

x 100%

Where:

D =is discount offered in %

S = number of days credit allowed with settlement discount

N = the number of days credit offered net, for no discount

Example 23.4 – Worked example (simple formula)

Find the annual equivalent rate of interest implicit on offering a 0.25% discount for payment within

18 days rather than 40 days. The short term borrowing rate is 11%.

0.25 / (100-0.25)

x

365 / (40 – 18)

x 100% = 4.16%

This is less than the short term borrowing rate which means it is worth taking up the discount offer,

as it costs less than borrowing.

Example 23.5

Settlement discount

Trotters Ltd’s gives it customers’ credit term of 60 days net.

It also offers an early settlement discount of 2% for payment within 30 days.

What is the cost of early settlement discount to Trotters Ltd using both the compound and

simple formula?

8

23.6 Assessing credit worthiness

Credit risk means that there is a possibility that the debt will go bad. A credit assessment is a

judgement about the creditworthiness of a customer, providing a basis for a decision as to whether

credit should be granted.

Credit assessment will not only be needed when credit is first granted, but also when customers

request higher limits or their volume of trade takes them above their existing limits.

Assessing credit worthiness can be expensive in both time and money. More detailed

investigations need to be done for high-risk customers. The normal standard procedure for

companies is to obtain 2 trade references and the customer’s bank reference.

(i)

Trade references

Considerations in obtaining trade references

References are obtained from companies that the customer has traded with however it is important

to be aware for the following:

· The customer may maintain an untypically good relation with the referee or there maybe a

relationship between them and so the information given maybe biased.

· The referee should be offering similar terms to you.

· References should be followed up to ensure a conclusion can be reached.

· Unknown or newly created company’s references should be treated with caution.

(ii)

Bank references

A reference can be obtained from the customer’s bank but when asking the bank for references the

precise terms should be stated in the letter to the bank. However the bank maybe protective of their

client’s interests especially if they are in financial difficulties and may choose to be limited in their

response, in addition the law may prevent certain disclosures in order to protect the company. This

may limit the usefulness of bank references.

Example

Do you consider X Ltd to be good for a trade credit of £3,500 per month on terms of 30 days?’

9

(iii)

Financial numbers and credit risk

A good way of finding information about customers is to have a look at their published financial

statements; of course this is only relevant to incorporated entities.

The financial statements give a useful insight into the company’s profitability and liquidity. Ratio

analysis can be undertaken. The disadvantage of this is that the financial statements are historical

and the situation may have changed now.

(iv)

Credit reporting agencies (credit bureaux)

Credit bureaux provide information about businesses so that suppliers can assess their

creditworthiness. (e.g. Dunn & Bradstreet).

Consideration of information from credit bureaux

· The information given by the bureaux may be too summarised when more detail about the

company is needed.

· The information will be historical and may not be an indication of their current status.

· It will cost to obtain the information.

But this information can be cross referenced against other sources and therefore give a thorough

risk assessment.

(v)

Other information

Other ways in checking the credit worthiness of the customer are:

· Press – which will contain update information about any difficulties the customer is facing.

· Companies’ registry search will give you information about it’s financial affairs.

· County court records will show any convictions against the company.

· Personal visits to customers address to see if they exist and are bona fide.

10

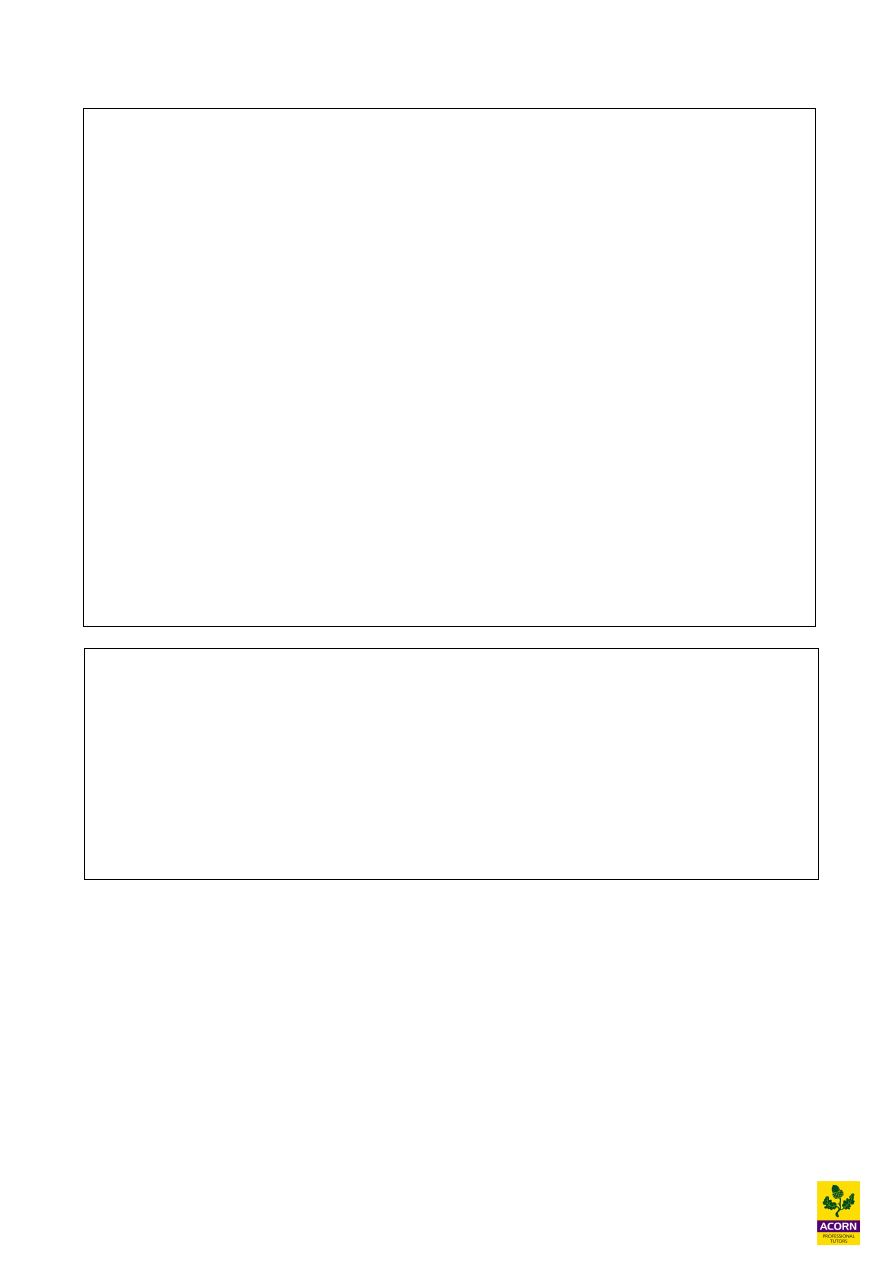

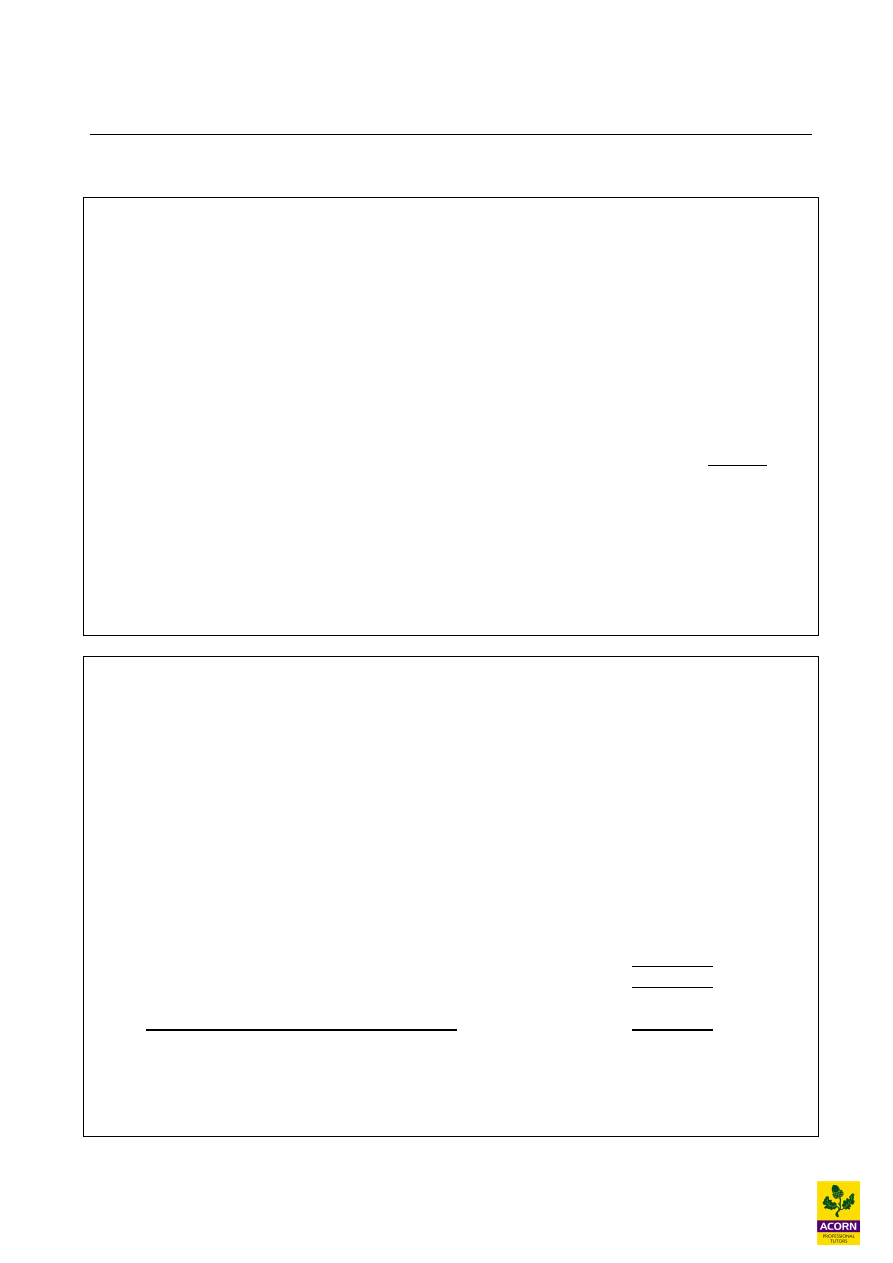

23.7 Monitoring and collecting trade receivables

Management need to ensure effective control of trade receivables collection, otherwise it could end

up facing severe liquidity problems. Care needs to be taken for a major customer, as slow payment

by them will result in cash flow problems.

To ensure effective control of trade receivables the following procedures should be adopted:

Efficient administration of the sales ledger

Prompt dispatch of invoices and statements which state payment terms and also the prompt

recording and banking of receipts.

Aged receivables analysis

A regular report should be produced showing the outstanding balances for customers, the length

of time they have been outstanding and the credit limits. This is a very useful aid in the

management and controlling of receivables.

Reviewing credit risk regularly

Ensuring that the customers’ credit risk is reviewed regularly especially high risk customers.

Collecting the debts is aided by ensuring efficient control of the sales ledger:

Invoicing

Monthly statements

detailing

Chasing slow payers

Customer fully aware of

payment terms.

Invoice correct and issued

promptly with payment

terms.

Knowledge of customer’s

system used (i.e. when is the

month end and so prompt

payment can occur).

Customer queries are

resolved quickly.

Monthly statements issued

promptly.

New invoices.

Cash received.

Outstanding balance due.

Age analysis.

Payment reminder.

Reminders.

Telephone calls.

Personal visit approach.

Debt collection agency.

Legal action but may

have an impact on

goodwill of customer.

11

23.8 Factoring

One way to release the cash on trade receivables is by factoring. The factor is a specialised

company, which manages the company’s sales ledger by providing an advance and charging a fee.

The fee consists of an admin fee and interest on the amount of money advance to the company

based on the value of the sales ledger for example 80% of the sales ledger. The sales ledger is taken

by the factor as collateral against this advance. The interest on the advance is paid for an agreed

time period or until the receivables have paid.

The factor company offers following services:

- Administration of invoices, sales accounting and debt collection service.

- Credit protection for client’s debts.

- Factor finance, payments in advance.

Factoring can either be a:

Recourse service – where the factor company will underwrite the sales ledger however if there

were any trade receivables that could not be recovered then the factor has the right to go back to the

company for compensation.

Non-recourse service - where the factor company will underwrite the sales ledger however if there

were any trade receivables that could not be recovered then the factor company does not have the

right to go back to the company for compensation.

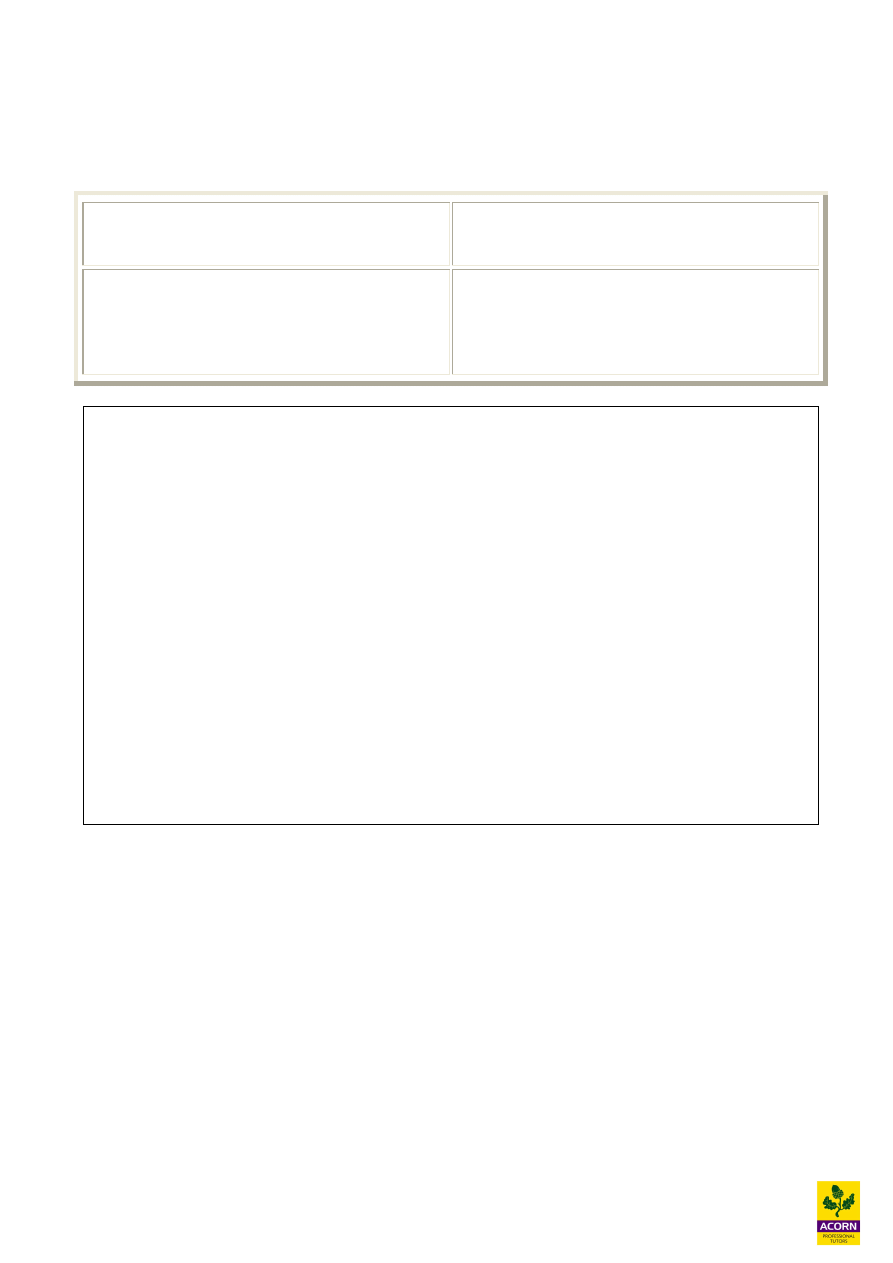

Advantages of factoring

Disadvantages of factoring

Savings in sales ledger administrative costs

such as credit control.

Cash received quicker, which means savings in

finance costs.

Can pay suppliers quicker and take advantage of

discounts.

Optimum stock levels can be maintained as cash

available.

Factors are specialist, therefore are more

effective in chasing debts.

Cost of fee to the factoring company for their

services is expensive.

May give a negative image of insolvency to

potential investors.

Factors objective is to recover the monies and

may not be friendly or courteous and this may

result in lost goodwill with your customer.

Loss of close relationship with large important

customers which prevent possible sales leads

from being exploited.

12

Evaluating the use of a factoring company

Companies need to do a cost benefit analysis before taking the decision to factor their debts.

Costs

Savings

Service fees

Interest payable on amounts advanced

Administration savings

Example 23.6

Factoring debts

Tefal plc is a small company selling household goods to the main retailers. It is facing cash flow

problems and is considering factoring its trade receivables.

Tefal plc has annual credit sales of £5 million and it allows customers credit terms of 60 days from

date of invoice.

The factoring company would advance Tefal 70% of the value of its invoices immediately on

receipt of the invoices. It will charge a service fee of 1.5% of the total invoices and also change

interest of 12% annually on amounts advanced.

Tefal plc will make 2 credit controllers redundant if the factoring decision is taken saving £55,000

per year in total.

Calculate the annual net cost of the factoring agreement for Tefal plc.

13

23.9 Collecting money from customers

The credit control department is usually responsible for collecting debts. Efficient and effective

credit control is imperative for the company’s cash flow and it also reduces bad debts.

To motivate the credit control team to collect as much as possible, targets can be set each month to

ensure that sufficient amounts are being collected. A bonus scheme can be put into place for when

these targets are met. This is a good way of controlling trade receivables.

One way of controlling trade receivables and reducing the risk of bad debt is using age analysis of

receivables. This is a report that is generated by the sales processing system and it shows age of

the debts, usually less than one month, between one and two months and greater than three months.

Bad debt is a debt, which is considered to be uncollectible and is written off against the profit and

loss account or doubtful debts provision.

Bad debts ratio =

Bad debts

x 100%

Turnover or credit or total trade receivables

The bad debt report will give details of when the original debt arose and when the debt was written

off.

Doubtful debt is a debt for which there is some uncertainty as to whether it is bad.

Doubtful debt provision is an amount charged against profit and deducted from debtors to allow

for estimated non-recovery of proportion of debts.

Note that bad debt affects cash flow as the money has not been received. Doubtful debt provision

doesn’t affect cash flow and is just an accounting entry.

Ways of dealing with bad debt customers

· Stopping supplies to that customer and closing their account.

· Use of collection agencies.

· Legal action.

· Liquidation or winding up of a company.

· But the costs of pursuing these courses of action need to be considered.

14

Example 23.7 – Worked example (Past CIMA question)

The trade receivables ledger account for customer C shows the following entries:

Debits

Credits

$

$

Balance brought forward

0

10 June 06

Invoice 201

345

19 June 06

Invoice 225

520

27 June 06

Invoice 241

150

3 July 06

Receipt 1009 – Inv 201

200

10 July 06

Invoice 311

233

4 August 06

Receipt 1122 – Inv 225

520

6 August 06

Invoice 392

197

18 August 06

Invoice 420

231

30 August 06

Receipt 1310 – Inv 311

233

7 September 06

Invoice 556

319

21 September 06

Receipt 1501 – Inv 392

197

30 September 06

Balance

845

Prepare an age analysis showing the outstanding balance on a monthly basis for

customer C at 30 September 2006.

C

Due on

30/09/06

Current less

than 1

month

Between 1

and 2

months

Between

2 and 3

months

Greater than

3 months

$845

$319 (W1)

$231 (W2)

0 (W3)

$295 (W4)

Workings

W1 - Sept 06 = $319

W2 - Aug 06 = $197 + $231 - $197 = $231

W3 - Jul 06 = $233 - $233 = $0

W4 - Jun 06 = $345 + $520 + $150 - $200 - $520 = $295

15

Example 23.8 – (Past CIMA question)

The trade receivables ledger account for customer X is as follows:

Debits Credits

Balance

01-Jul-07

Balance b/fwd

162

12-Jul-07

Invoice AC34

172

334

14-Jul-07

Invoice AC112

213

547

28-Jul-07

Invoice AC215

196

743

08-Aug-07 Receipt RK 116 (Balance + AC34)

334

409

21-Aug-07 Invoice AC420

330

739

03-Sep-07

Receipt RL162 (AC215)

196

543

12-Sep-07

Credit note CN92 (AC112)

53

490

23-Sep-07

Invoice AC615

116

606

25-Sep-07

Invoice AC690

204

810

05-Oct-07

Receipt RM223 (AC420)

330

480

16-Oct-07

Invoice AC913

233

713

25-Oct-07

Receipt RM360 (AC615)

116

597

(a) Prepare an age analysis showing the outstanding balance on a monthly basis for customer

X.

(b) Explain how an age analysis of receivables can be useful to an entity.

Example 23.9

Trade receivables management

(a)

Explain the purposes of companies preparing an age analysis of trade receivables

analysed by individual debts.

(b)

Describe the main considerations that managers should take into account when

formulating a credit management policy.

16

23.10 Managing trade payables

Trade payables are people or organisations to which you owe money to for purchases of goods and

services. Trade credit is an important source of short-term finance.

The following need to be in place to ensure correct recording of trade payables and reporting on

debts due:

Good accounting system or recording system.

Authorisations systems with delegated authority.

Verification systems, checking orders and invoices.

Payment authorisation system, when invoices are passed for payment.

Methods of payments (BACS, cheques etc).

Establishing creditor policies, i.e. who to order from and when to pay early to take advantage

of settlement discounts etc.

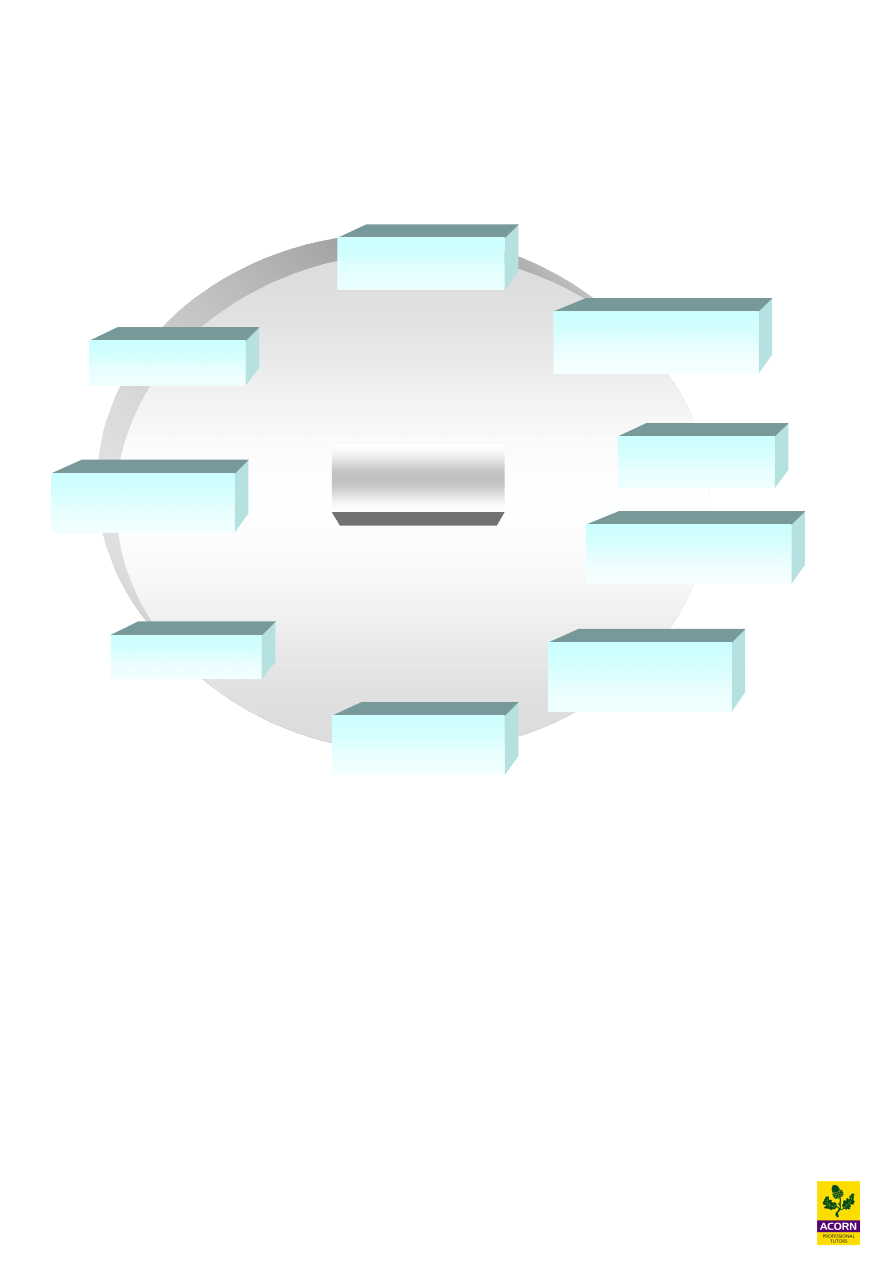

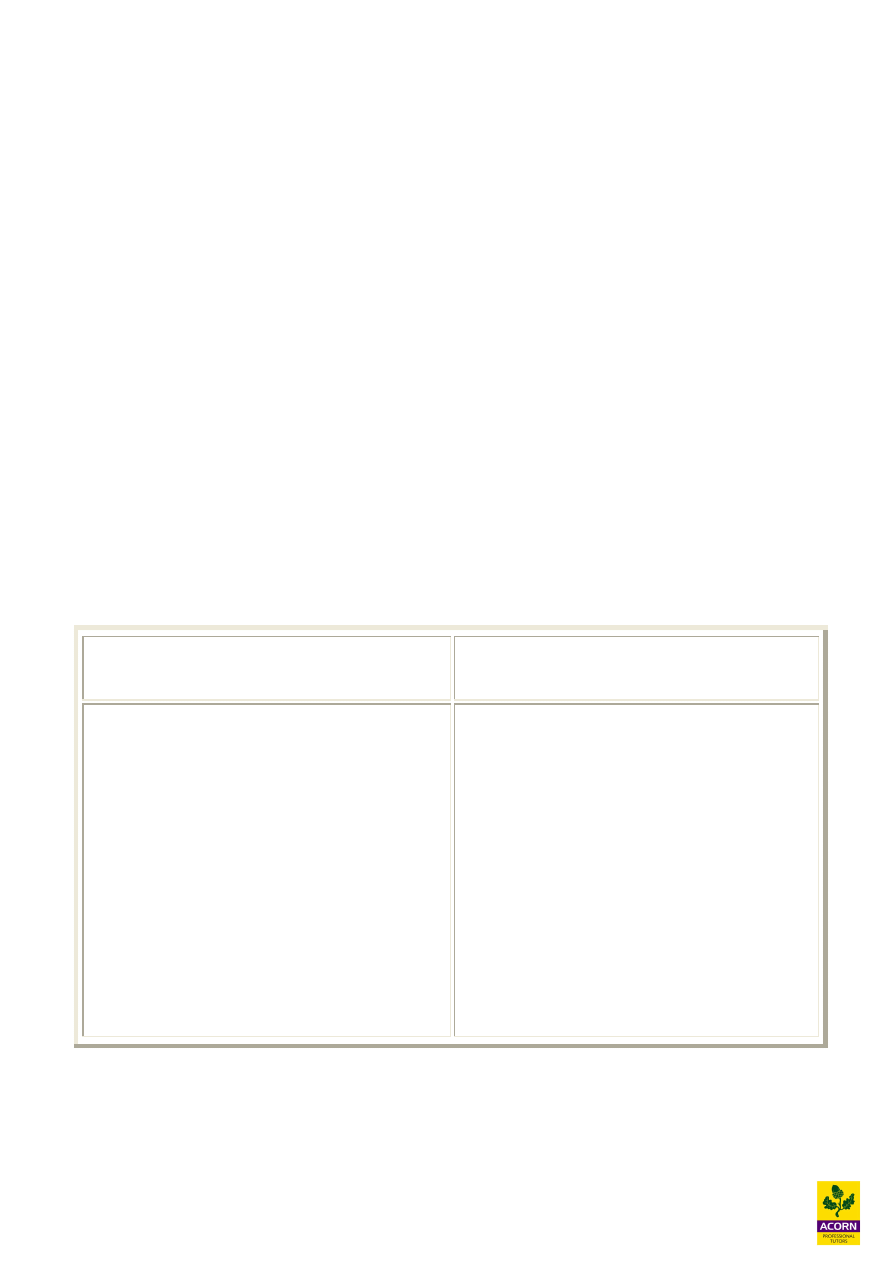

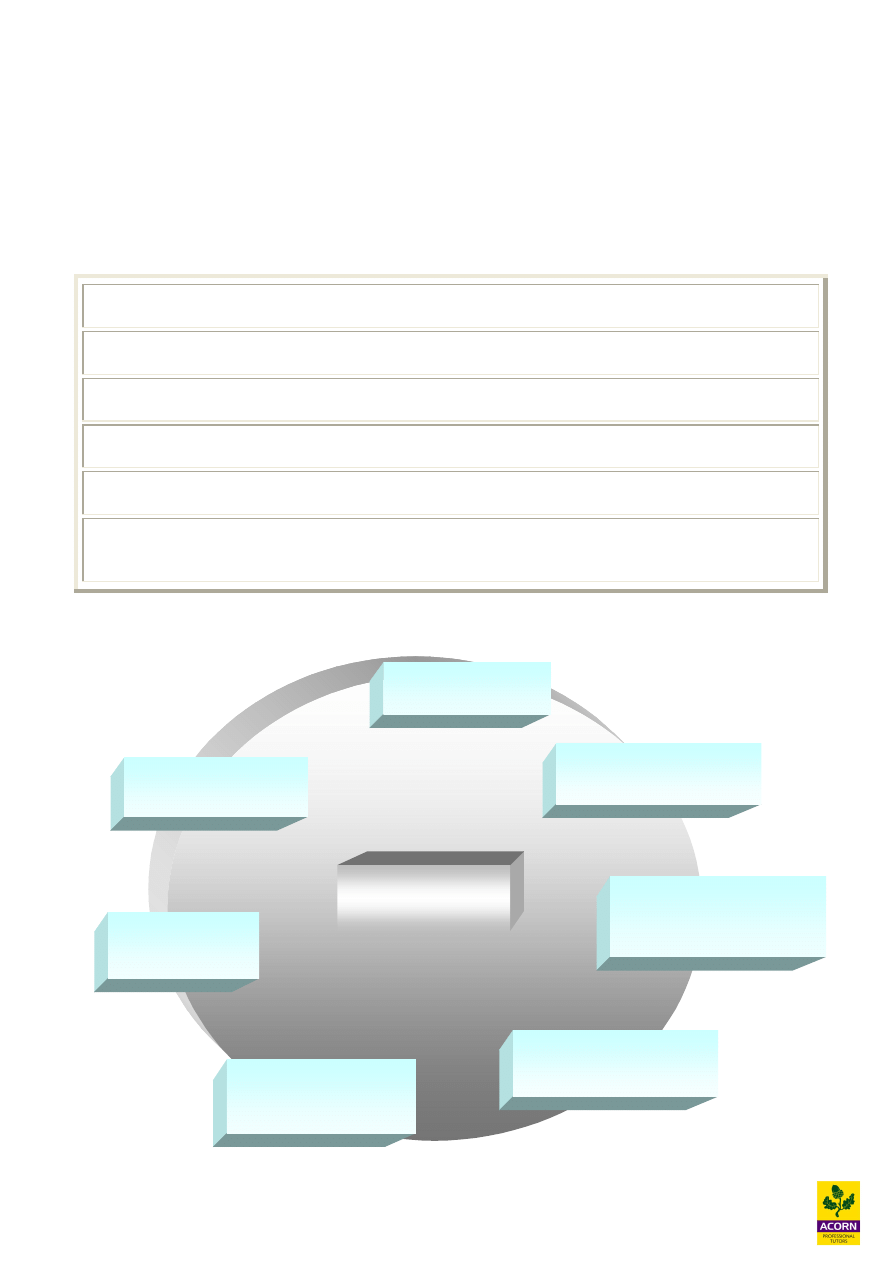

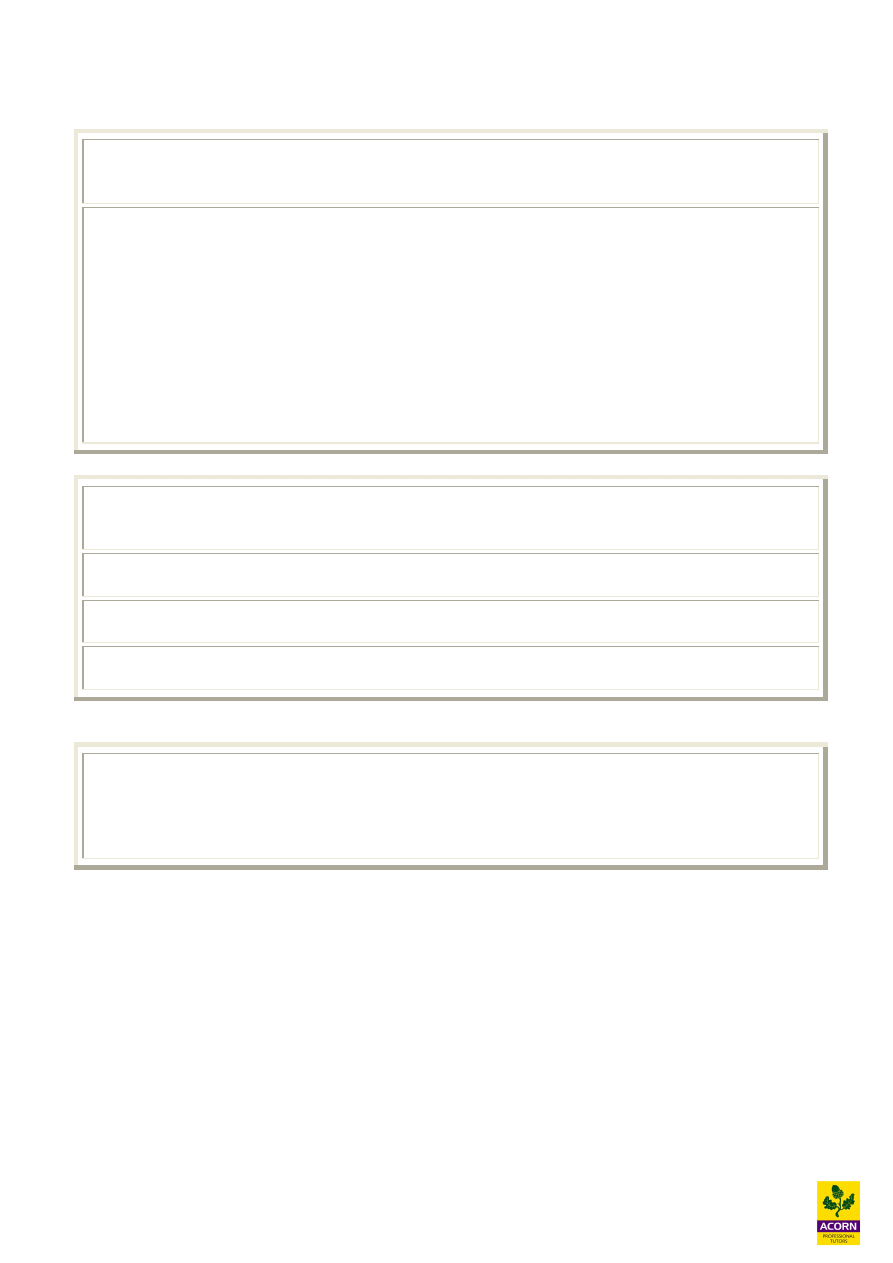

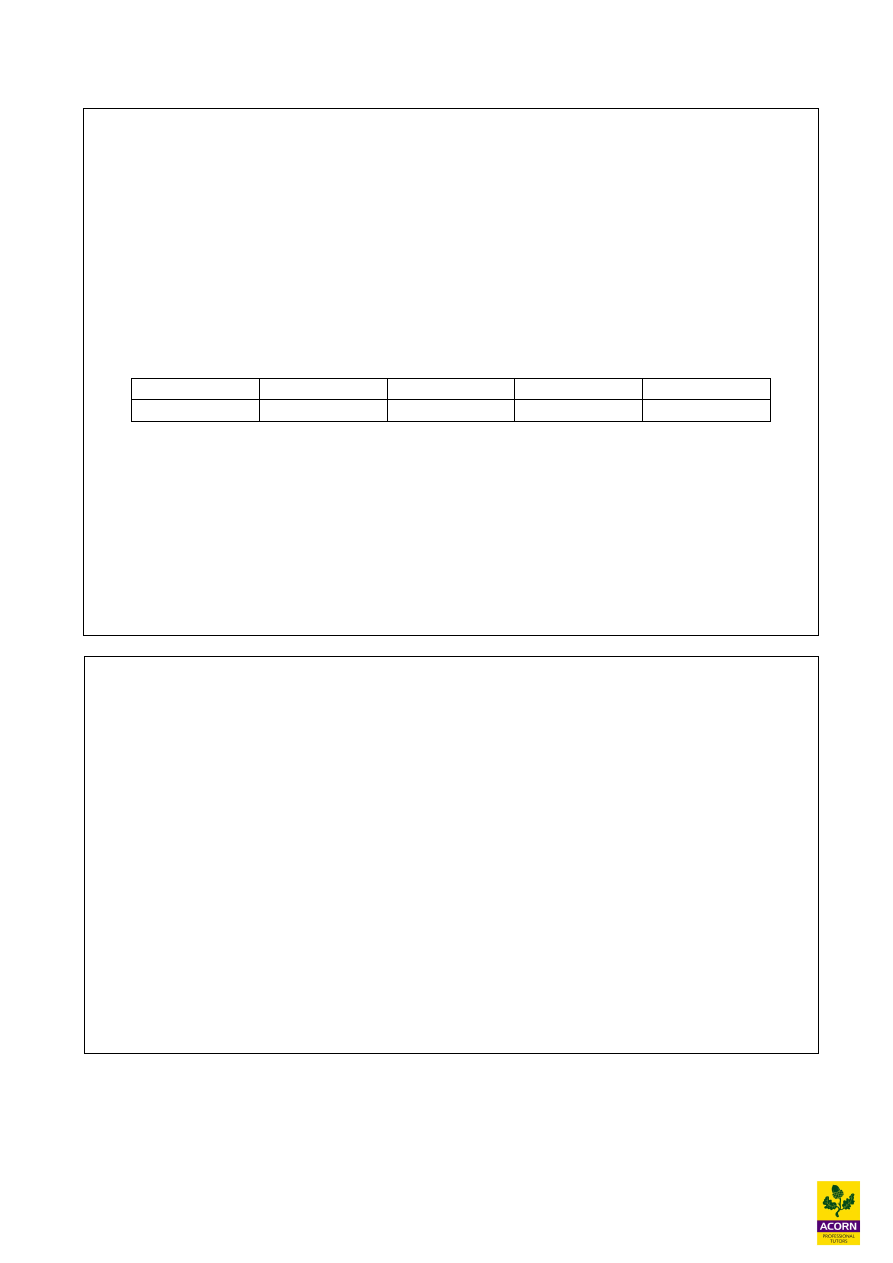

23.11 The purchasing cycle

Goods or services

requisitioned

Authorise order and

send to supplier

Goods received. Check

order and raise goods

received note (GRN)

Invoice received, check

against order and GRN

Check statement

received from

supplier

Authorise

payment

Make payment

Stages in the

purchase cycle

17

Management of trade payables involves:

Obtaining satisfactory credit, by ensuring a good credit history.

The ability to extend credit if cash is short. This means good supplier relationships are

maintained.

If payments are delayed, this may result in loss of goodwill.

23.12 Settlement discounts

One of the decisions that need to be made is whether or not to take up the settlement discount

offered by suppliers by paying earlier.

Remember that trade credit is an interest free source of finance, and by paying suppliers early to

take advantage of the settlement discount means less finance is being taken on which is interest

free. This “loss” in interest free credit needs to be compared with the savings in the discount for

cost-benefit analysis.

Example 23.10

Trade payables settlement discount

Baggins Ltd buys its goods from Potter Ltd. Baggins Ltd purchases goods worth £15million every

year and is allowed 60 days credit. Baggins Ltd always pays on time.

Potter Ltd is offering 1.5% discount if payment is made within 25 days.

Overdraft interest is currently at 11% pa.

Should Baggins take up the discount offer for early settlement of its debts?

Assume a 365 working days per year

18

The cost of taking the early settlement discount can be expressed as an effective annual interest rate

(APR). This percentage can then be compared with the interest rates for financing for the business.

Note that paying early is advancing of cash which requires financing.

Compound formula for cost of early settlement discount (APR) – normally used

100

100 - D

- 1 x 100%

Where:

D =is discount offered in %

S = number of days credit allowed with settlement discount

N = the number of days credit offered net, for no discount

Simple formula for cost of early settlement discount

D x 365

100 – D N - S

x 100%

Where:

D =is discount offered in %

S = number of days credit allowed with settlement discount

N = the number of days credit offered net, for no discount

Example 23.11

Cost of early settlement discount

Following on from the previous lecture example, what is the annual rate of interest implied

by the discount offered to Baggins Ltd under the compound formula and the simple formula?

365

N- S

19

23.13 Age analysis of trade payables

One way of controlling trade payables is using an age analysis of payables. This is a report that is

generated by the purchase processing system and shows the age of payables, usually less than one

month, between one and two months and greater than three months.

The report is similar to the aged trade receivables analysis and shows the company how long

amounts are outstanding owed to suppliers.

The report can highlight important things like:

· When are we paying suppliers? If we are paying them too early then we may not be taking

advantage of the interest free credit offered.

· Are we taking advantage of discounts for early settlement? If discounts are taken then this

may result in substantial savings on supplier costs.

·

Old trade payable amounts. These should be easier to review and can be investigated as to

why they are still outstanding. Reasons for outstanding payables maybe because there are

disputes over the quality of the items received, the wrong items were received and we are

still awaiting the correct items or accounting errors

.

20

Key summary of chapter

Trade credit is an interest free source of finance from one business to another business, and a

means of creating or increasing sales for the supplier.

Consumer credit is financing given for by businesses to end consumers for the purchase of goods

and services for personal consumption.

One of the main costs of extending credit rather than getting the cash in straight away from sales is

the finance cost.

Credit management involves:

The benefits of extending credit to customers’ versus the cost in extending the credit.

Establishing discounts, level and length of credit that will maximise profits.

Assessing the credit risk of customers by reviewing their accounting information or obtaining

references.

Setting credit limits for customers and terms of payment.

Collecting debts and minimising risk of bad debts (credit control).

21

Considerations before extending credit

Extra sales that will be generated from the additional credit terms.

The value of contribution of additional sales.

The additional finance costs.

The effect of additional trade receivables and payables (as more inventories will have to be

purchased).

Length of extra debt collection period.

Benefits of settlement discounts

Costs of settlement discounts

· Encourages customers to pay earlier and

thus reduce financing costs.

· Improves liquidity as cash is received

earlier.

· Encourages customers to buy and

therefore increase sales.

· Reduction in bad debts due to reduced

collection period.

· The cost of the discount will reduce cash

received.

· Extra administrative costs to manage the

discounts given.

· Customers may take the discount and still

pay late if there is poor management of

settlement discounts.

Compound formula for cost of early settlement discount (APR) – normally used

100

100 - D

- 1 x 100%

Where:

D =is discount offered in %

S = number of days credit allowed with settlement discount

N = the number of days credit offered net, for no discount

365

N- S

22

Simple formula for cost of early settlement discount

D x 365

100 – D N - S

x 100%

Where:

D =is discount offered in %

S = number of days credit allowed with settlement discount

N = the number of days credit offered net, for no discount

A credit assessment is a judgement about the creditworthiness of a customer, providing a basis for

a decision as to whether credit should be granted.

Trade references are obtained from companies that the customer has traded with.

Bank references can be obtained from the customer’s bank but when asking the bank for

references the precise terms should be stated in the letter to the bank.

The financial statements give a useful insight into the company’s profitability and liquidity.

Credit reporting agencies or credit bureaux provide information about businesses so that

suppliers can assess their creditworthiness. (e.g. Dunn & Bradstreet).

23

Monitoring and collecting trade receivables

Management need to ensure effective control of trade receivables collection, otherwise it could end

up facing severe liquidity problems.

Efficient administration of the sales ledger

Aged receivables analysis

Reviewing credit risk regularly

Factoring is a way to release the cash on trade receivables. The factor is a specialised company,

which manages the company’s sales ledger by providing an advance and charging a fee.

Age analysis of receivables is a report that shows the age of debts, usually less than one month,

between one and two months and greater than three months.

Bad debt is a debt, which is considered to be uncollectible and is written off against the

profit and loss account or doubtful debts provision.

Bad debts ratio =

Bad debts

x 100%

Turnover or credit or total trade receivables

Doubtful debt is a debt for which there is some uncertainty as to whether it is bad.

Doubtful debt provision is an amount charged against profit and deducted from debtors to allow

for estimated non-recovery of proportion of debts.

24

Ways of dealing with bad debt customers

· Stopping supplies to that customer and closing their account.

· Use of collection agencies.

· Legal action.

· Liquidation or winding up of a company.

· But the costs of pursuing these courses of action need to be considered.

Management of trade payables involves:

Obtaining satisfactory credit, by ensuring a good credit history.

The ability to extend credit if cash is short. This means good supplier relationships are maintained.

If payments are delayed, this may result in loss of goodwill.

Age analysis of payables is a report that is generated by the purchase processing system and

shows the age of payables, usually less than one month, between one and two months and greater

than three months.

25

Solutions to Lecture Examples

Example 23.1

Increase in trade receivables

We need to compare the increased contribution with the increase finance cost of additional trade

receivables.

Current trade receivables

=

30 / 365 x £15 million =

£1.234 million

New trade receivables

=

45 / 365 x £16 million =

£1.973 million

Increase in trade receivables

£0.739 million

Additional finance cost if this amount needs to borrowed at 11% = £0.739m x 0.11 = £81,290

Increase in contribution = £1 million x 10% = £100,000

Therefore it is worthwhile increasing the credit terms to 45 days as the cost of additional trade

receivables is less than the increase in contribution through increase in sales.

The net benefit is 100,000 – 81,290 = £18,710

Example 23.2

Offering early settlement discounts

In both the above requirements, the reduction in finance costs due to reduction in trade receivables

needs to be compared with the increased admin costs and reduction in revenue due to discount

allowable expense.

(a)

All the customers take up the discount

A

Reduction in finance cost for reduced trade receivables

Old trade receivables = £15m x 40/365

=

£1,643,836

New trade receivables = £15m x 18/365

=

£ 739,726

Reduction in trade receivables

=

£ 904,110

Saving in finance charge (904,110 x 11%)

=

£ 99,452

Reduction in debtors can alternatively be worked out as:

26

Change in trade receivable days x old trade receivable = (22 / 40) x £1,643,836 = £904,110

Old trade receivable days

B

Costs of discount scheme

Reduction in revenue = £15m x 0.0025

=

£ 37,500

Extra staff costs

=

£ 20,000

Total costs

=

£ 57,500

Net benefit of discount scheme = A - B = (99,452 – 57,500) = £41,952

The scheme should be introduced if all customers take up the discount offer as it will increase the

profits by £41,952.

(b)

Only 20% of the customers take up the discount.

A

Reduction in finance cost for reduced trade receivables

Old trade receivables = £15m x 40/365

=

£1,643,836

New trade receivables

Don’t take up offer

= £15m x 40/365 x 80%

=

£1,315,068

Do take up offer

= £15m x 18/365 x 20%

=

£ 147,945

£1,463,013

Reduction in trade receivables

£ 180,823

Saving in finance charges (£180,823 x 11%)

=

£ 19,891

B

Costs of discount scheme

Reduction in revenue = £15m x 0.0025 x 20%

=

£ 7,500

Extra staff costs

=

£ 20,000

Total costs

=

£ 27,500

Net cost of discount scheme = A - B = (19,891 – 27,500) = (£7,609)

If only 20% of the customers take up the discount offer, the scheme should not be introduced as the

profits will reduce by £7,609.

27

Example 23.5

Settlement discount

Compound

100 / (100-2)

365/30

-1 x 100%

=

27.9%

Simple

(2/ (100 – 2) x 365/(60-30))

=

24.8%.

The discount is only worthwhile financially if Trotters Ltd borrowing costs are greater than 24.8%

or 27.9% depending on which calculation is used.

If they did not offer the discount then they would have to borrow at the interest rate chargeable for

short term finance to source their requirements for cash. If the borrowing interest rate was say 35%

then it is cheaper to give the settlement discount to their trade receivables which will only cost

them 24.8% or 27.9%.

Example 23.6

Factoring debts

Annual factoring costs

Service fees payable to factoring company (1.5% x £5 million)

£75,000

Interest payable to factoring company (60/365 x £5m x 70% x 12%)

£69,041

Annual savings – costs of two credit controllers

(£55,000)

Net costs

£89,041

The factoring brings in cash immediately, which will help ease, the cash flow problems.

28

Example 23.8

(a) Aged analysis

Tick and bash the invoices with the payments. The outstanding items are shown in the age analysis

– group the items according to their age.

05/10 to 25/10 =

less than 1 month

03/09 to 25/09 =

between 1 month and 2 months

28/07 to 21/08 =

between 2 month and 3 months

01/07 to 14/07 =

Greater than 3 months

> 3 months

2 to 3 months

1 to 2 months

< than 1 month

Total

160

0

204

233

597

(b) Usefulness of age analysis of receivables

· It is useful to the management in controlling debtors.

· It highlights slow payers and therefore action can be taken to reduce the amount of credit to

these customers.

· It can be used to set credit limits to customers.

· Effective and appropriate action can be taken to collect debts.

· It can be used to estimate a provision for bad debts for the year end accounts.

Example 23.9

Debtor management

(a)

Analysis of debts

Aged trade receivable listing splits up the total balance on the account of each customer across

different columns according to the dates of transactions which make up the total balance.

The analysis highlights:

(a)

Overdue accounts.

(b)

Customers who have exceeded their credit limit.

The main purposes of the aged analysis:

(a)

Help to decide what action to take about older debts.

(b)

Highlights outstanding amounts, therefore important tool for cash management and

revising cash forecasts.

(c)

Evaluating staffs who are involved in debt collection.

29

(b) Policy for credit management

When a policy is formulated, the management should consider the following notes:

1 Average period of credit to be given.

2 Investigating credit worthiness of new customers.

3 Debt collection policies.

4 Accounting reports required i.e. aged trade receivables list.

5 Policies on persuading debtors to pay promptly i.e. discount schemes.

6 Consider the use of factoring services.

Example 23.10

Trade payables settlement discount

1

The reduction in trade payables needs to be established first.

Old trade payables - £15m x 60/365 =

£2,465,753

New creditors - £15m x 25/365

=

£1,027,397

Reduction

=

£1,438,356

Reduction in creditors can alternatively be worked out as:

Change in creditor days x old creditors = (35 / 60) x £2,465,753 = £1,438,356

Old creditor days

2

The loss of interest free credit = £1,438,356 x 11%

=

£158,219

3

The cash benefit of the discount = 1.5% x £15m

=

£225,000

Therefore the net benefit (3-2) = £225,000 - £158,219 = £66,781. Baggins should take up the

discount offer and pay the supplier by 25 days.

30

Example 23.11

Cost of early settlement discount

Compound

(100 / 98.5)

365 (60-25)

-1 x 100%

=

17.07%

Simple

1.5 / (100-1.5) x 365 / (60-25)

x 100%

=

15.88%

Taking up the discount is only worthwhile if the cost of borrowing for Baggins Ltd is less than

15.88% or 17.07% as this is the rate they are saving if they take up the settlement discounts.

Currently the borrowing rate for any cash flow needs is at 11% this is a smaller cost compared to

the savings made if they accept the settlement discount rate of 15.88% or 17.07%. It is therefore

worthwhile taking up the discount.

Wyszukiwarka

Podobne podstrony:

F1 Cash flow forecasts and managing cash

14 Trade, WTO and Global Trade

Knapp Thalassocracies in bronze age eastern mediterranean trade making and breaking a myth

Lesson Plan Receiving and Turning with the ball

F1 Short term borrowing and investing

F1 Share capital transactions and financial instruments

F1 Managing inventories

Direct Conversion Receiver, MPSKIQ and Direct Conversion

ECP Alchemy of the Heart How to Give and Receive More Love [OCR]

Comparison of the U S Japan and German British Trade Rivalr

International trade in ICT goods and services

3 OPENING AND MANAGING CASUALTY'S AIRWAY POLok

Finance and trade memoire

11 4 2 7 Lab Managing?vice Configuration Files Using TFTP, Flash, and USB

Intermediate Making a Formal Argument Giving and Receiving

managing corporate identity an integrative framework of dimensions and determinants

więcej podobnych podstron