1

Cash flow forecasts

and managing cash

Chapter

24

2

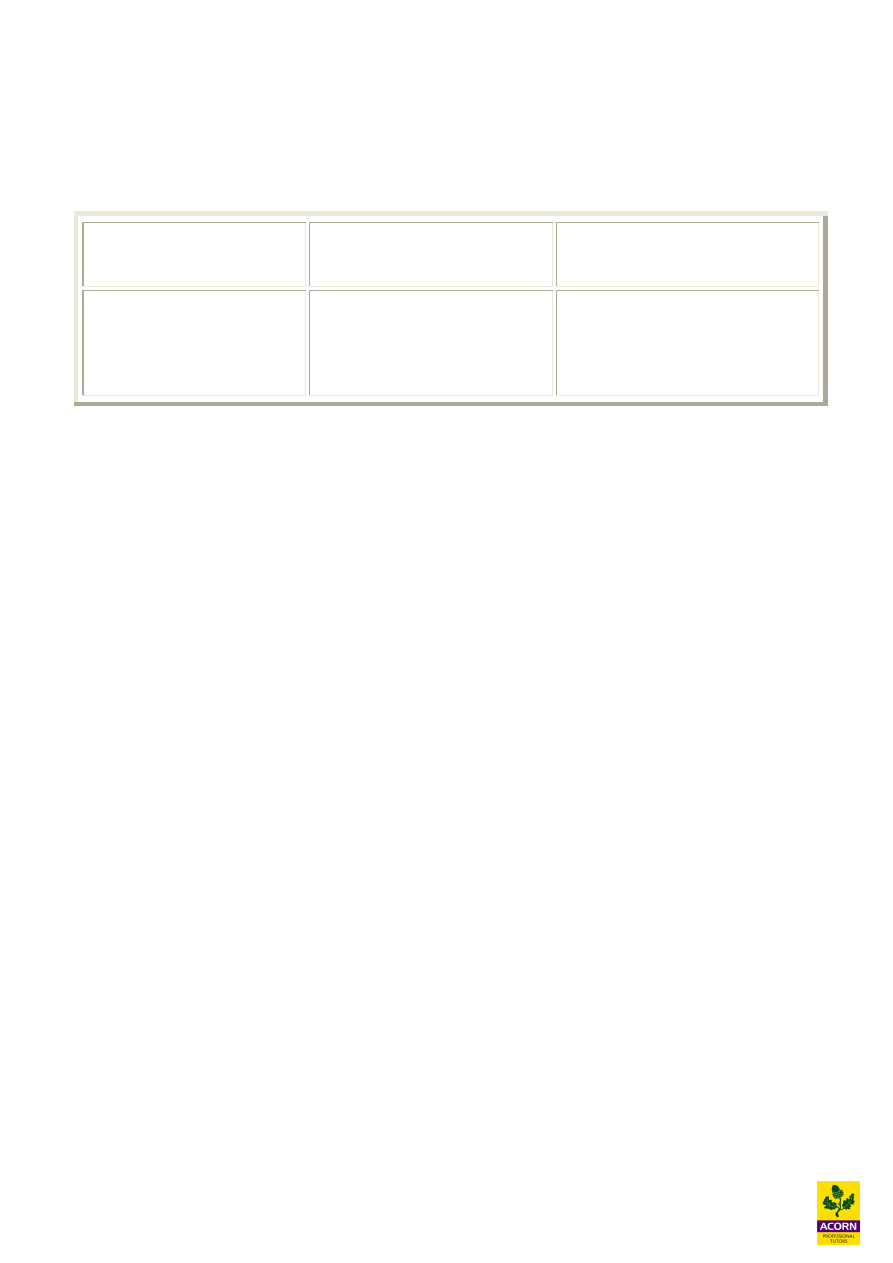

24.1 The link between cash, profit and balance sheet (statement of financial position)

Cash is the life blood of a business, allowing it to trade and purchase resources e.g. pay for

inventory, staff, overhead, capital expenditure and taxation. Cash receipts will be generated by the

organisation selling a product or service, therefore earning profit and generating positive cash-flow.

Good financial management of cash flow is the key to maintaining good liquidity for an

organisation.

Cash flows of a company will not be the same as the profit figure, as the profit figure is arrived at

using the accruals basis, and not all cash items are reported in the income statement.

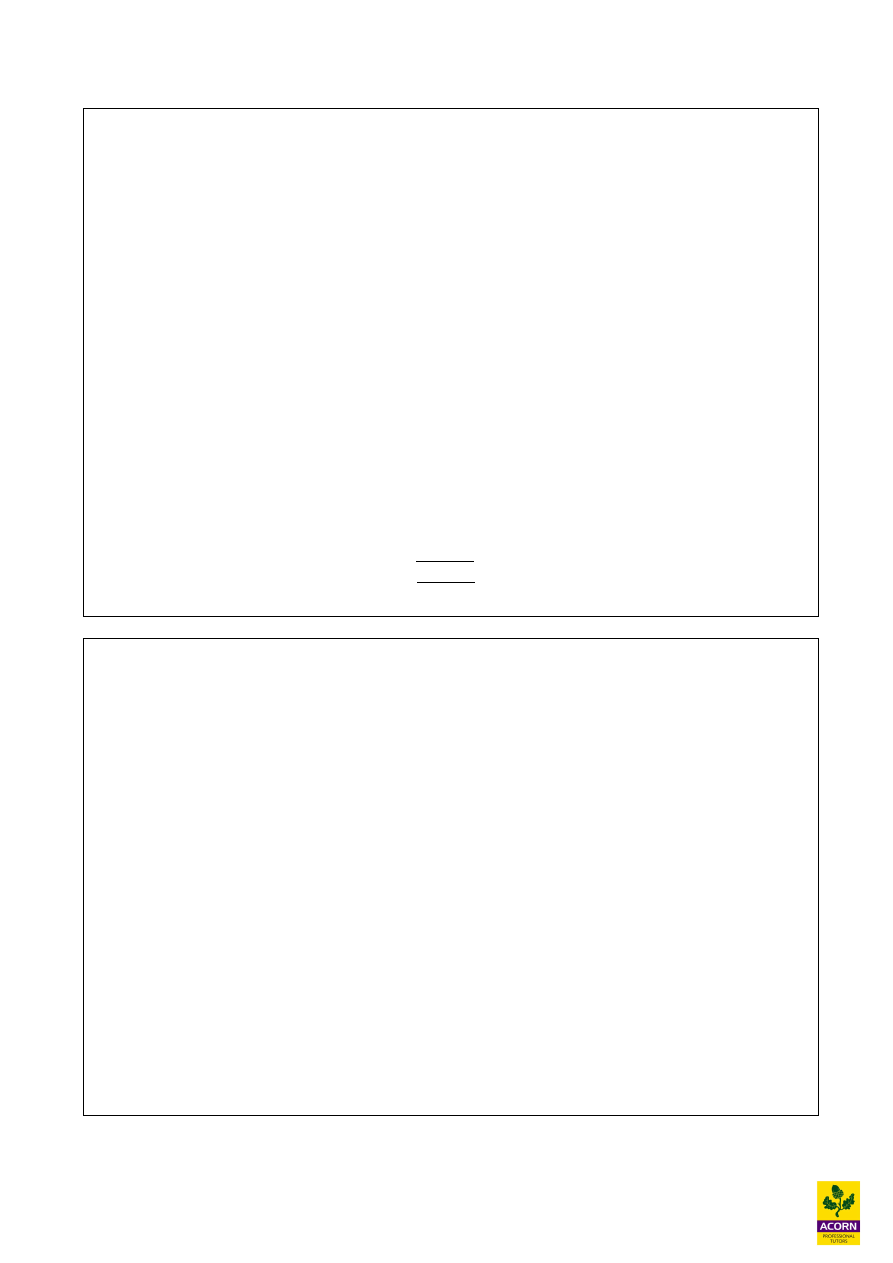

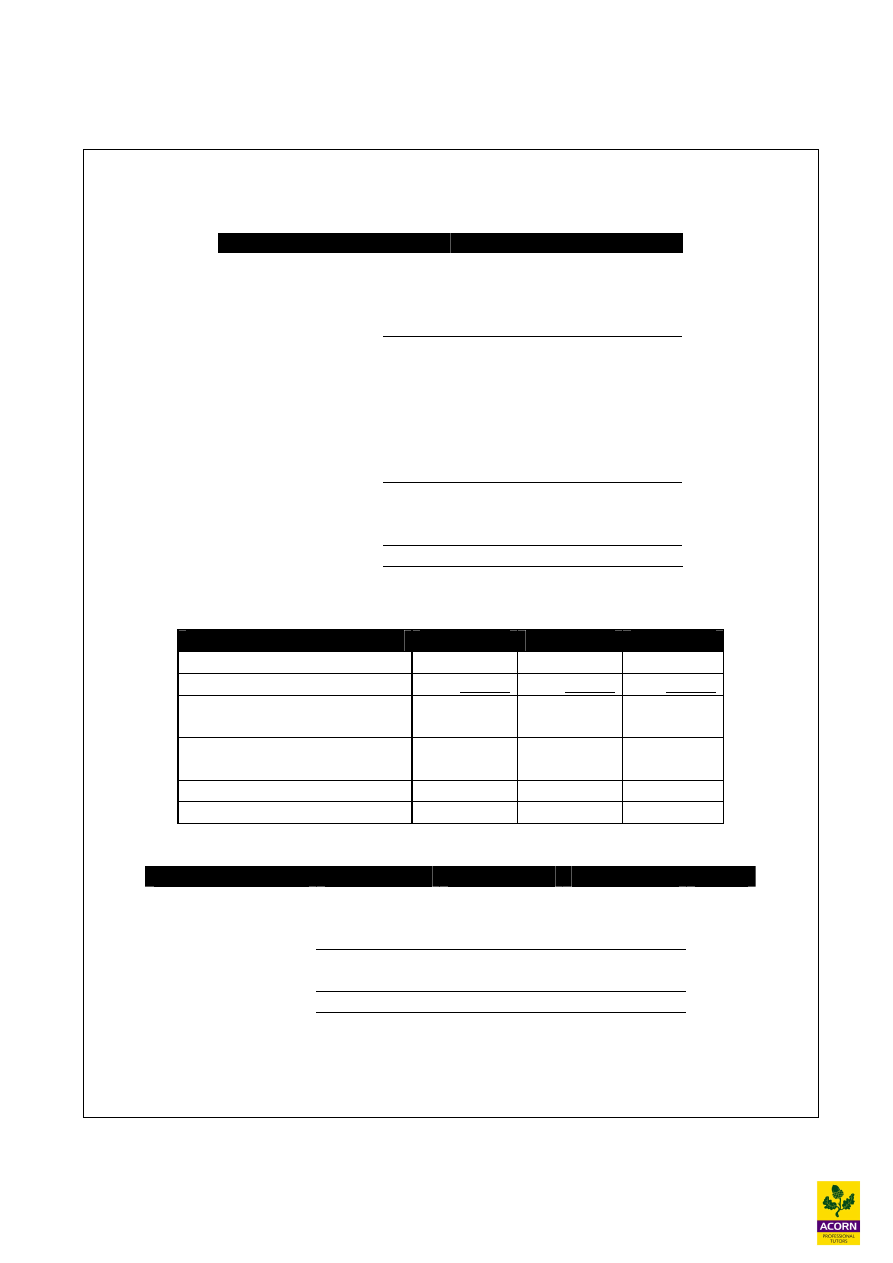

Income

statement

Balance

sheet (statement of

financial position)

Impact on

cash flow

Issue of shares or debt

No

Yes

Increase in cash

Increase in

bank overdrafts

No

Yes

Increase in cash

Purchase of

non current assets

No

Yes

Decrease in cash

Depreciation

Yes

Yes

No impact on cash

Disposal of

non current assets

Yes

Yes

Only the proceeds from

disposal will increase cash

Cash received is

not equal to sales

No

Yes impact

on trade receivables

Cash received from trade

receivables will increase cash

Cash paid is

not equal cost of sales

No

Yes impact

on trade payables

Cash paid to trade payables will

decrease cash

To calculate the operational cash flow from the profit, adopt IAS 7 Cash flow statements, as this

will make it easier.

3

Example 24.1

Operational cash flows

Nags Head Ltd had the following profit for year ending 20X2: -

£

Sales

800,000

Cost of sales

540,000

Operating profit

260,000

Opening balances

Closing balances

Inventories

24,000

42,000

Trade receivables

30,000

48,000

Trade payables

22,000

28,000

What is the operational cash flow resulting from the year’s trading?

24.2 Cash flow forecasts

Cash budgets or forecasts allow a business to plan for liquidity in the future. A cash budget will

show the level of liquidity required over future financial periods and allow the business to improve

liquidity by more effective cash planning for cash surpluses or deficits.

A cash-flow forecast is an estimate of when and how much money will be received and paid out of

a business. Cash flow reporting is normally on a month-by-month basis, typically for one financial

year.

Examples of how to improve cash-flow

· Decrease payment terms given to customers e.g. reduce trade receivables (debtors) by

getting paid earlier e.g. by offering discounts to customers for early settlement.

· Increase payment terms to suppliers e.g. increase trade payables (creditors) e.g. paying

suppliers later than normal or not paying them at all will delay cash outflows, but supplier

goodwill maybe lost.

· Purchase fewer inventories during periods of insufficient cash-flow.

· Delay cash investment in non-current assets during periods of insufficient cash-flow e.g.

capital expenditure on fixed assets such as plant, equipment or vehicles.

· Arrange finance for cash deficits e.g. a bank overdraft or business loan during periods of

insufficient cash-flow.

· Invest cash surpluses into short-term higher interest investments e.g. high interest bank

accounts or other money market investments.

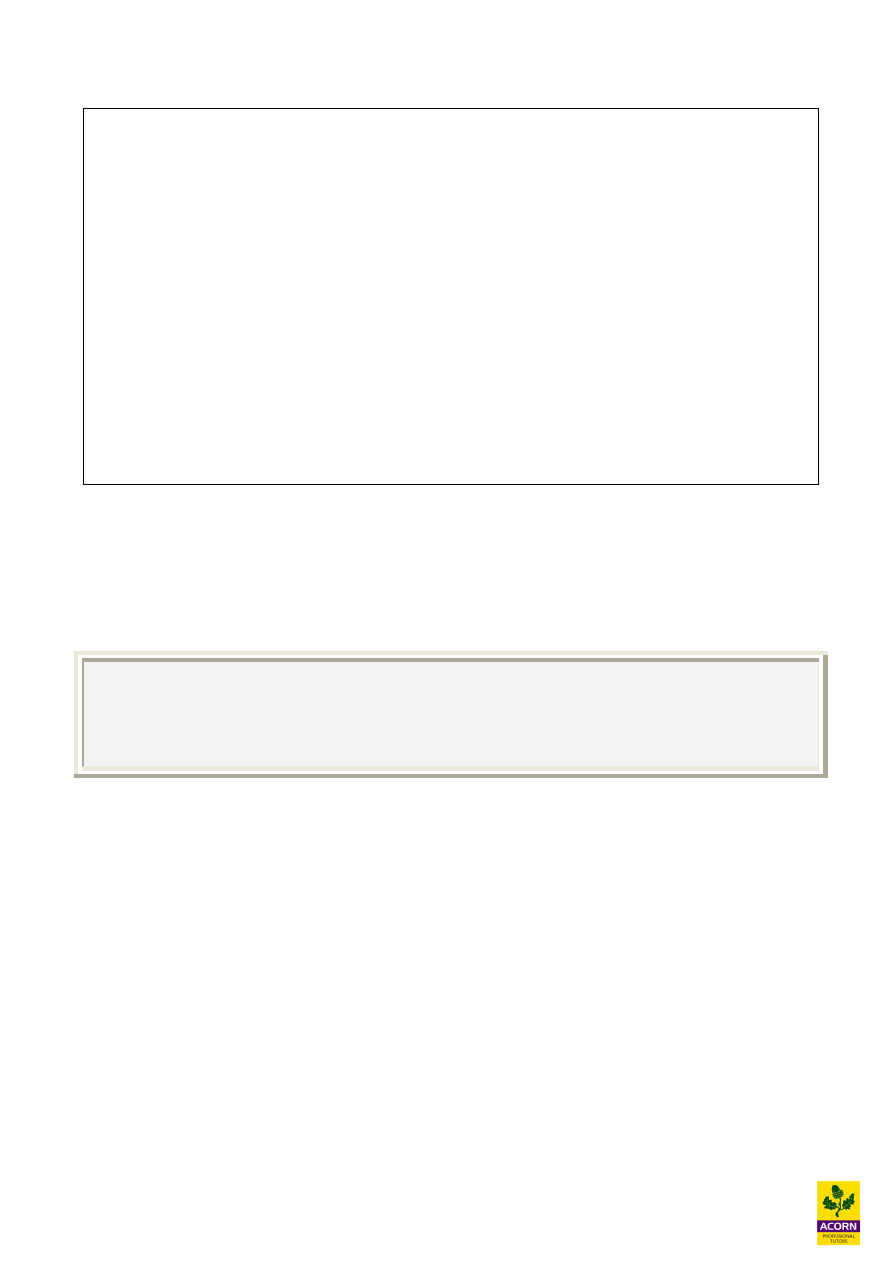

4

Note: Cash budgets never include non-cash items such as bad debts, discounts given, or the

depreciation of non-current assets.

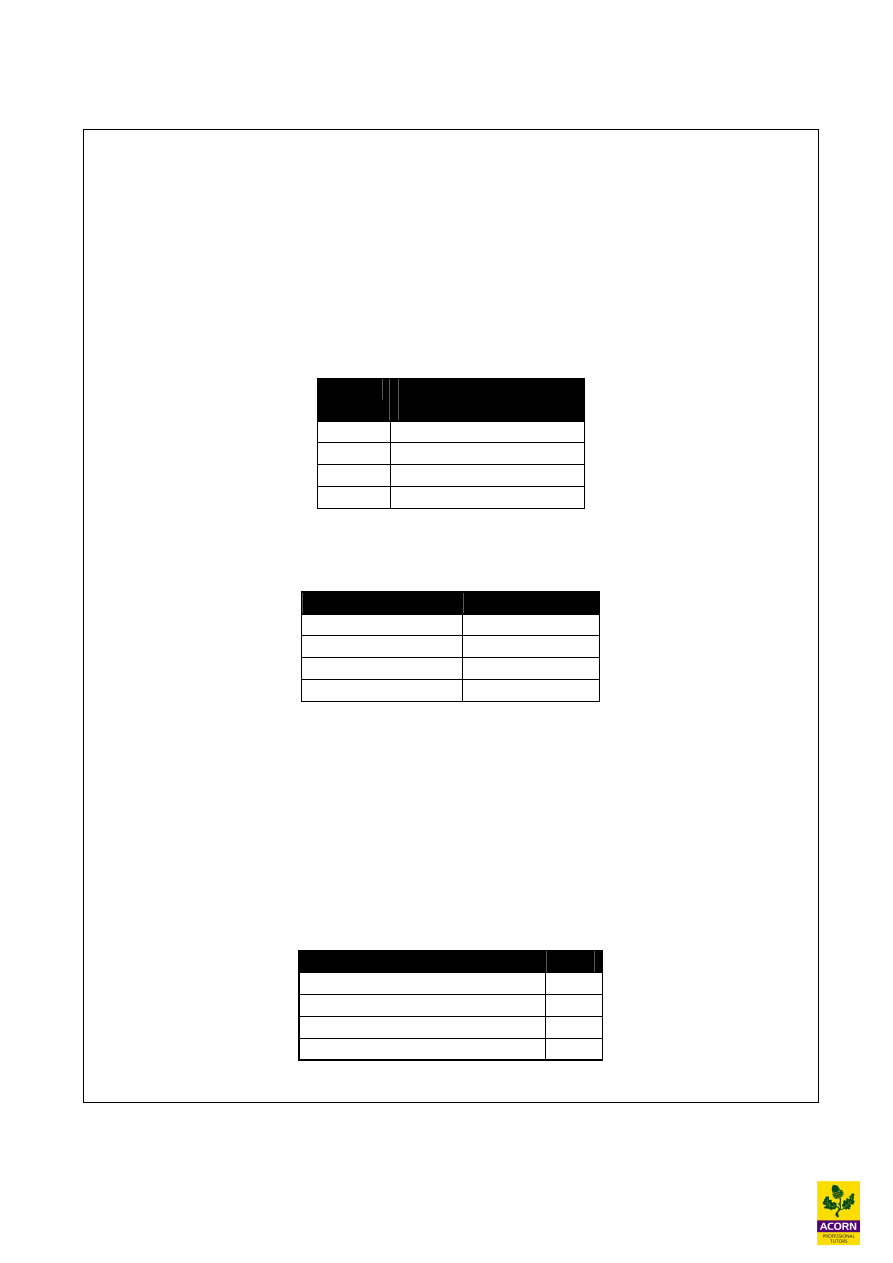

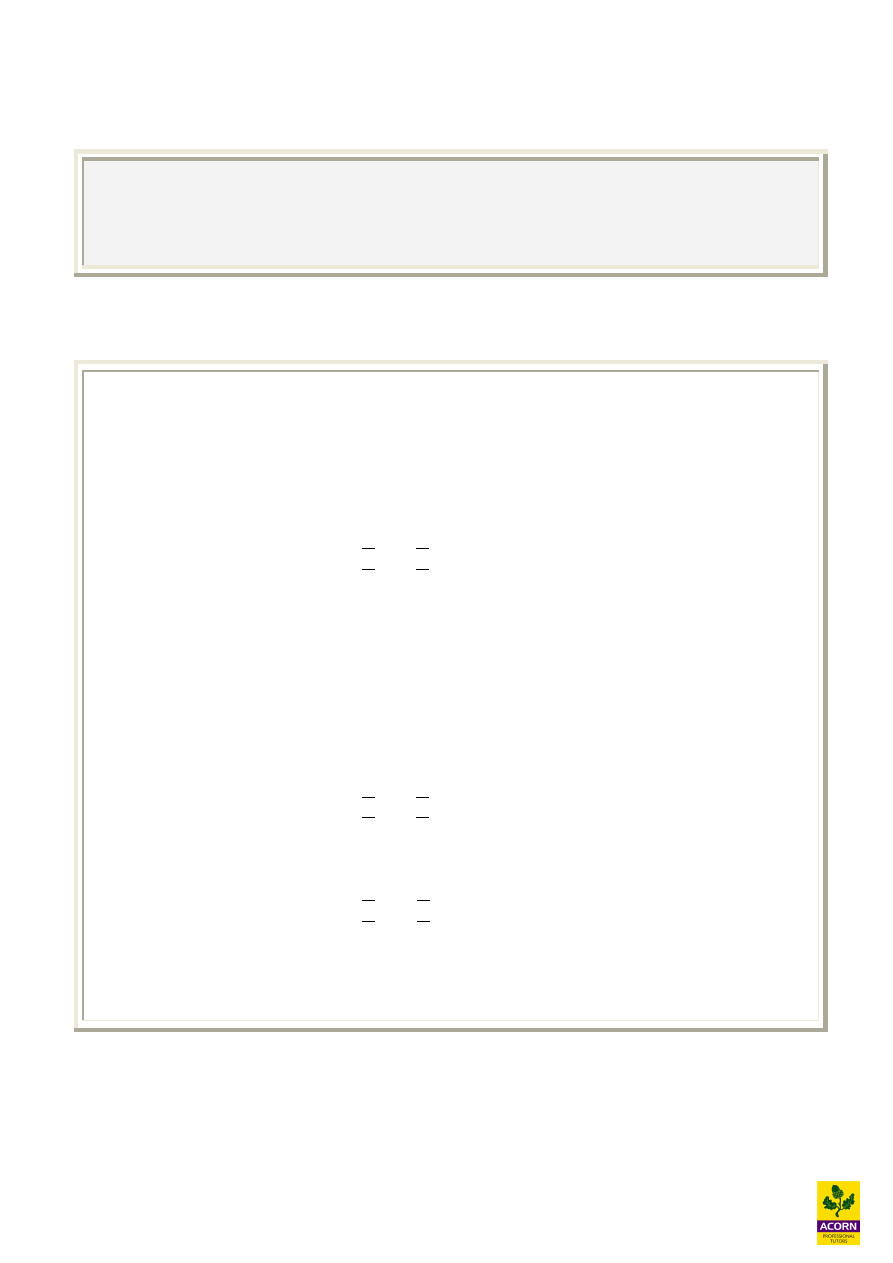

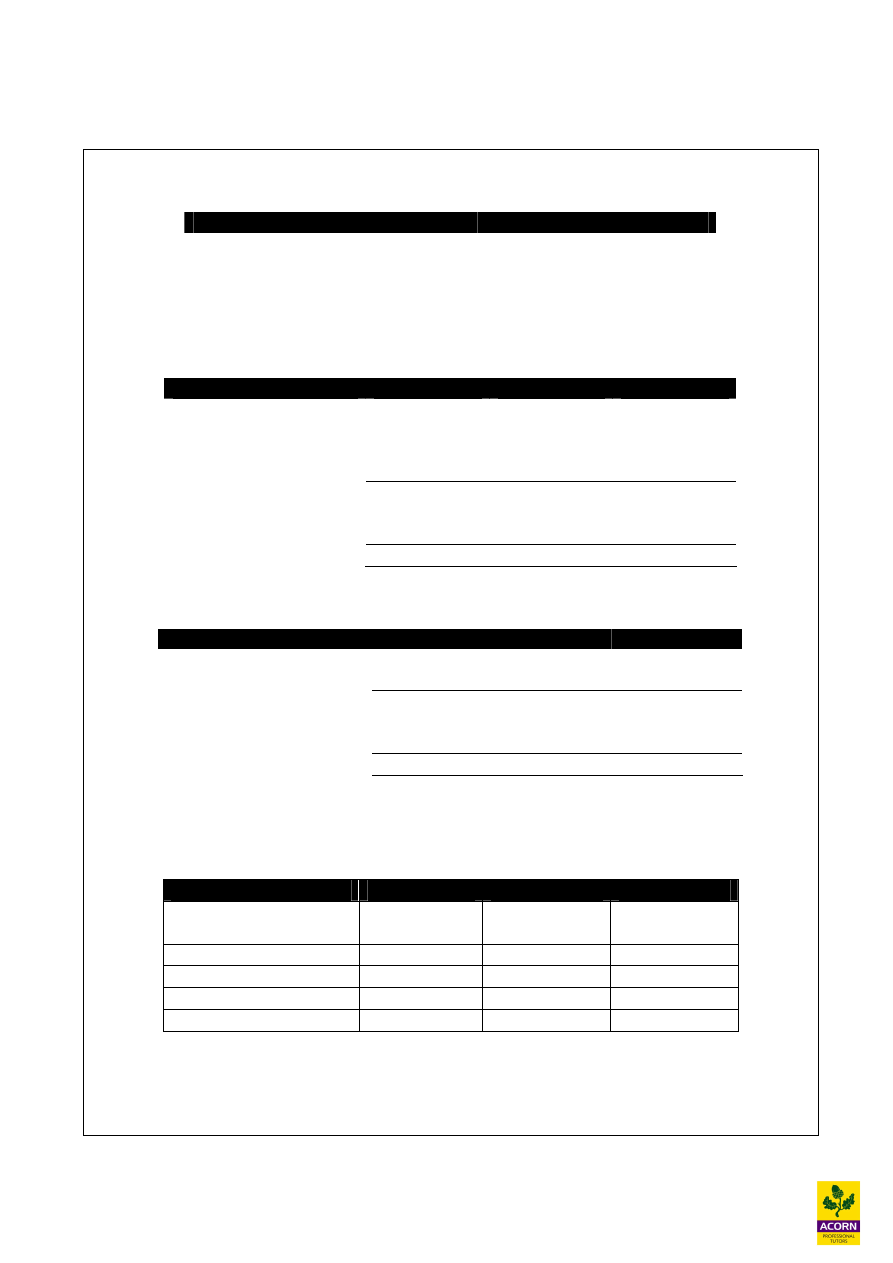

Proforma cash budget

JAN FEB…………….. column for each month

Cash inflow (receipts)

Cash sales

X

X

Debtors (trade receivables)

X

X

Sale of non-current assets

X

Loan or share issues

X

X

Total Receipts

X

X

JAN FEB…………….. column for each month

Cash outflow (payments)

Creditors (trade payables)

X

X

Expenses

X

X

Salaries

X

X

Purchase of non-current assets

X

Loan repayments X

X

Taxation paid

X

Dividends paid

X

X

Total Payments

X

X

Opening balance brought forward

X

X

Monthly net cash inflow/(outflow) X (X) (receipts less payments for the month)

Closing balance carried forward*

X (X)

* The closing bank balance at the end of a period becomes the opening balance for the start

of the next period.

5

Example 24.2 – Worked example

The following details have been extracted from the debtor collection records of S Plc

Invoice paid in the month after sale

60%

Invoice paid in the second month after sale

20%

Invoice paid in the third month after sale

10%

Bad debts

10%

Customers paying in the month after sale are entitled to receive a 15% discount.

Credit sales for January to April are budgeted as follows:

Jan

Feb

Mar

Apr

£40,000

£45,000

£50,000

£60,000

Calculate the amount forecast to be received from debtors in April.

March sales £50,000 x 0.6 x 0.85 =

£25,500

February sales £45,000 x 0.2 =

£9,000

January sales £40,000 x 0.1 =

£4,000

April cash received £38,500

Example 24.3

Trade receivables receipts

Sales (£)

April 2005

100.000

May 2005

120,000

June 2005

250,000

July 2005

300,000

Sales are received on an average basis of 40% deposit in the month of order, of the remaining debt

outstanding, 70% pay in the following month of sale and are therefore entitled to a 5% discount.

The remaining receivables left pay in the second month after sale, with 20% of these receivables

not paying at all.

Work out the receipts into the bank for the month of June and July 2005?

6

Example 24.4

Trade payables payments

Opening stock 1 July 2005 was £80,000 and this is to increase in value by 20% each month. Cost

of sales for next 3 months is as follows;

July

£480,000

August

£540,000

September

£600,000

Suppliers are paid 20% during the month of purchase as deposit, and the remainder payable one

month later. Calculate the cash amount paid to suppliers in August and September 2005?

7

Example 24.5 – (Past CIMA question)

RF Ltd is a new company which plans to manufacture a specialist electrical component. The

company founders will invest £16,250 on the first day of operations, that is, Month 1. They will

also transfer fixed capital assets to the company.

The following information is available:

Sales

The forecast sales for the first four months are as follows:

Month

Number of

components

1

1,500

2

1,750

3

2,000

4

2,100

The selling price has been set at £10 per component in the first four months.

Sales receipts

Time of payment

% of customers

Month of sale

20*

One month later

45

Two months later

25

Three months later

5

The balance represents anticipated bad debts.

*A 2% discount is given to customers for payment received in the month of sale.

Production

There will be no opening inventory of finished goods in Month 1 but after that it will be policy for

the closing inventory to be equal to 20% of the following month’s forecast sales.

Variable production cost

The variable production cost is expected to be £6·40 per component.

Time of payment

£

Direct materials

1·90

Direct wages

3·30

Variable production overheads

1·20

Total variable cost

6·40

8

Notes:

Direct materials: 100% of the materials required for production will be purchased in the month of

production. No inventory of materials will be held. Direct materials will be paid for in the month

following purchase.

Direct wages will be paid in the month in which production occurs.

Variable production overheads: 60% will be paid in the month in which production occurs and

the remainder will be paid one month later.

Fixed overhead costs

Fixed overhead costs are estimated at £75,000 per annum and are expected to be incurred in

equal amounts each month. 60% of the fixed overhead costs will be paid in the month in which

they are incurred and 30% in the following month. The balance represents depreciation of fixed

assets.

Calculations are to be made to the nearest £1.

Ignore VAT and Tax.

Required:

(a) Prepare a cash budget for each of the first three months and in total.

(b) There is some uncertainty about the direct material cost. It is thought that the direct

material cost per component could range between £1·50 and £2·20.

Calculate the budgeted total net cash flow for the three month period if the cost of the direct

material is:

(i) £1.50 per component; or

(ii) £2.20 per component.

9

24.3 Sensitivity analysis

Sensitivity analysis is a modelling and risk assessment procedure in which changes are made to

significant variables in order to determine the effect of these changes on the planned outcome.

Spreadsheets are a great tool for sensitivity analysis as they allow us to view the financial impact of

changes in variables.

Sensitivity analysis can be used in cash flow forecasting to see what the risk is to the company if

certain variables changed and the impact it will have on their cash balances.

Sensitivity analysis can also be done through expected cash flows. This is where probabilities are

assigned to cash flows showing their likely hood of occurring. The result is not the actual cash

flows that will occur but the expected:

For example a receipt of £50,000 is expected next month, but there is 20% chance that the

customer may not pay on time, then the expected cash flow will be £50,000 x 80% = £40,000

Significant variables include

Changes in capacity (i.e. more or less production of goods).

Material or labour costs – increases in prices.

Labour availability – staff shortage, meaning higher costs.

Sales volume.

Interest rates and inflation rate changes.

10

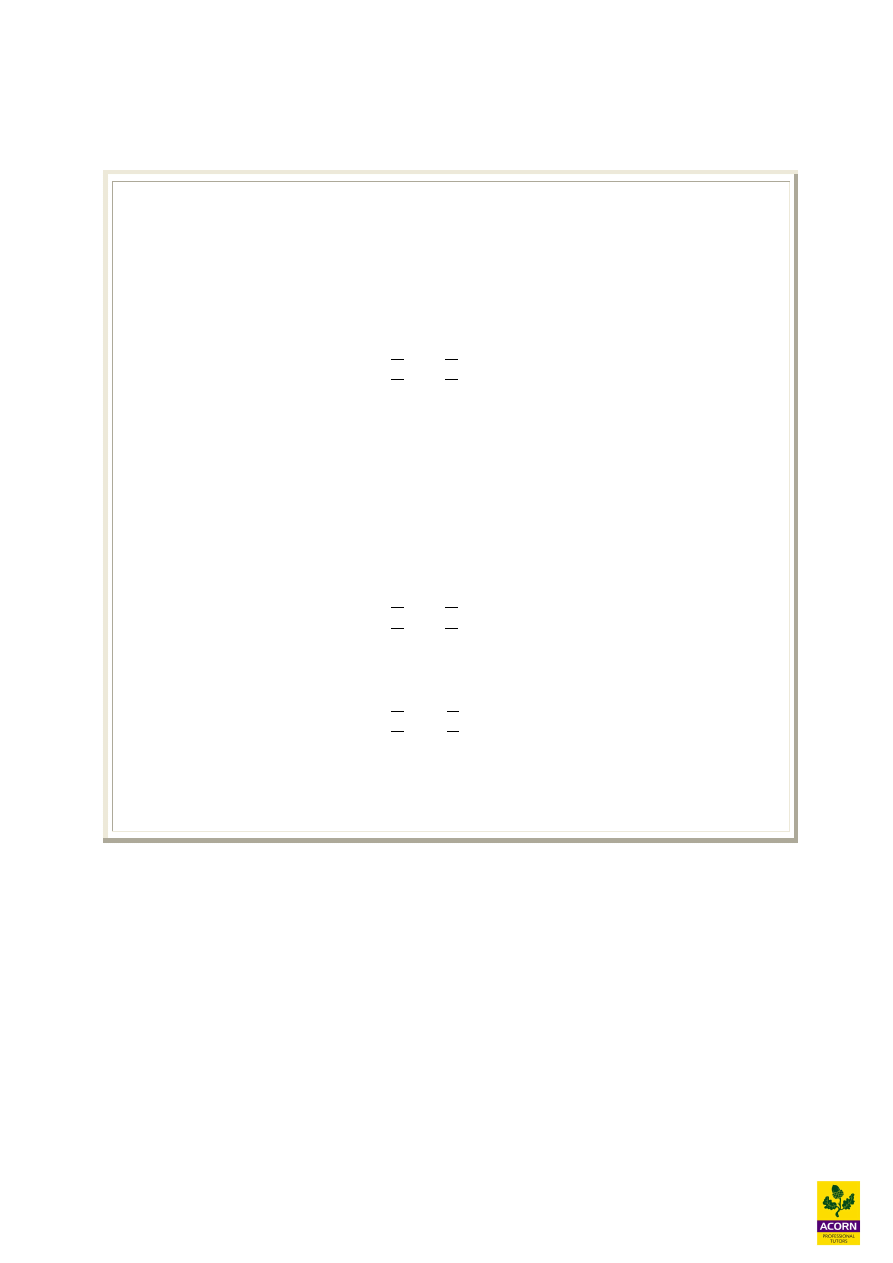

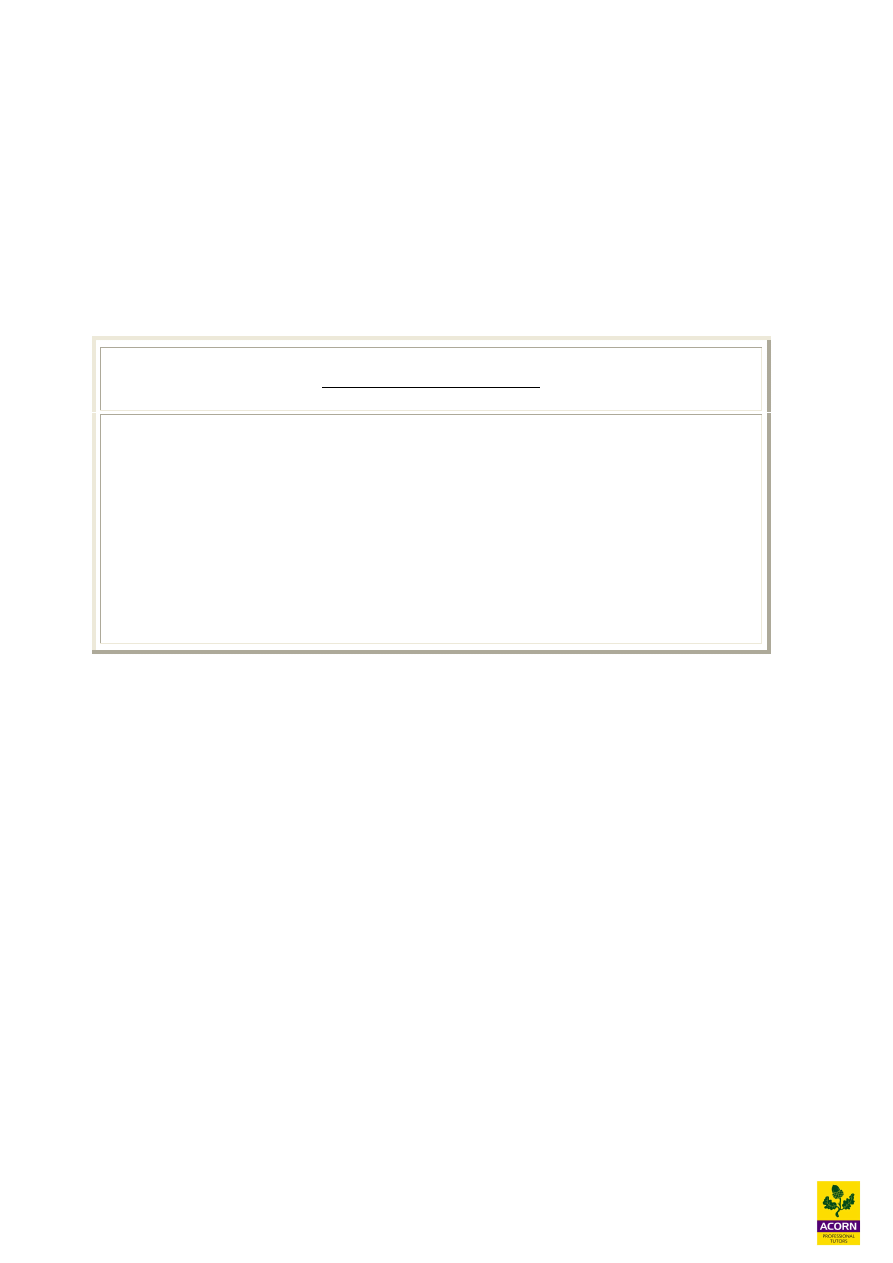

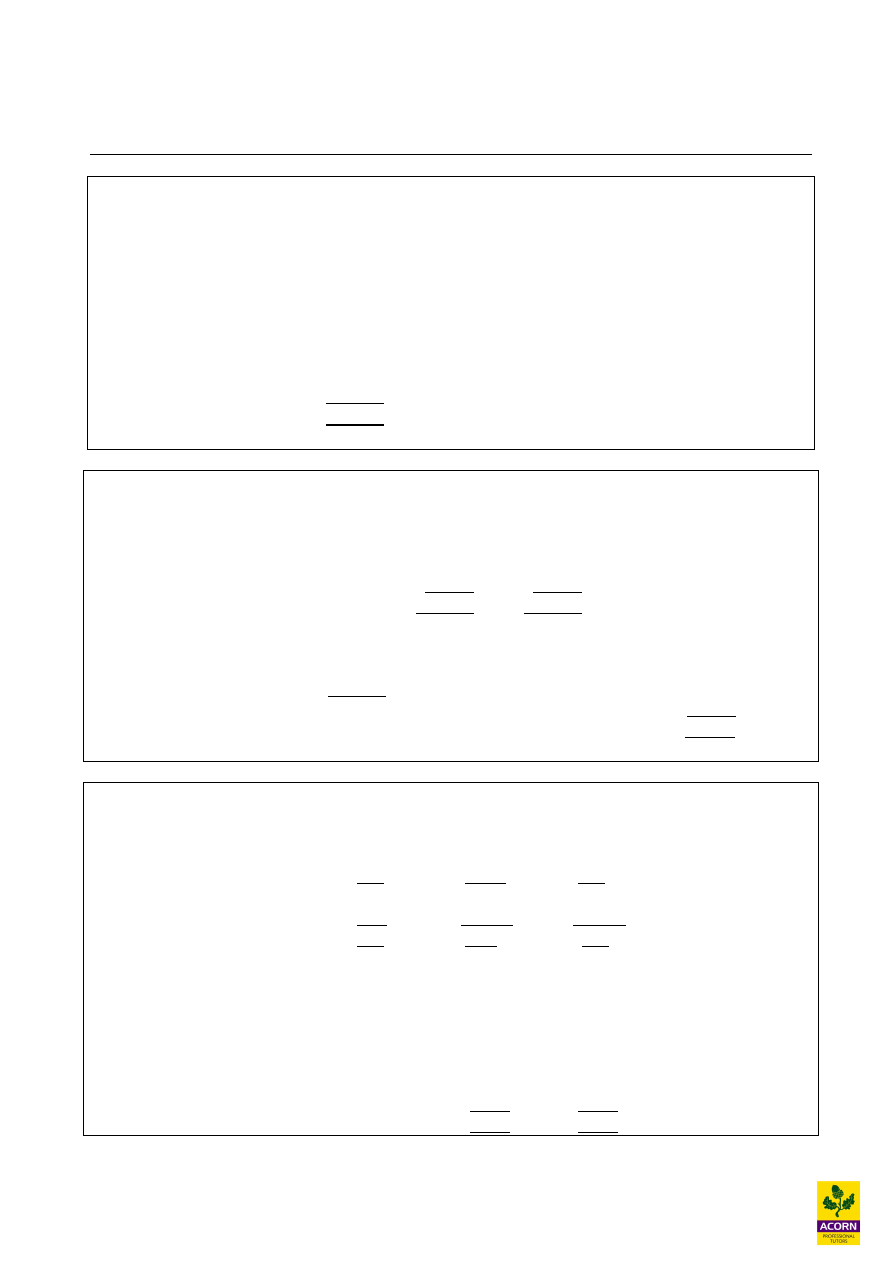

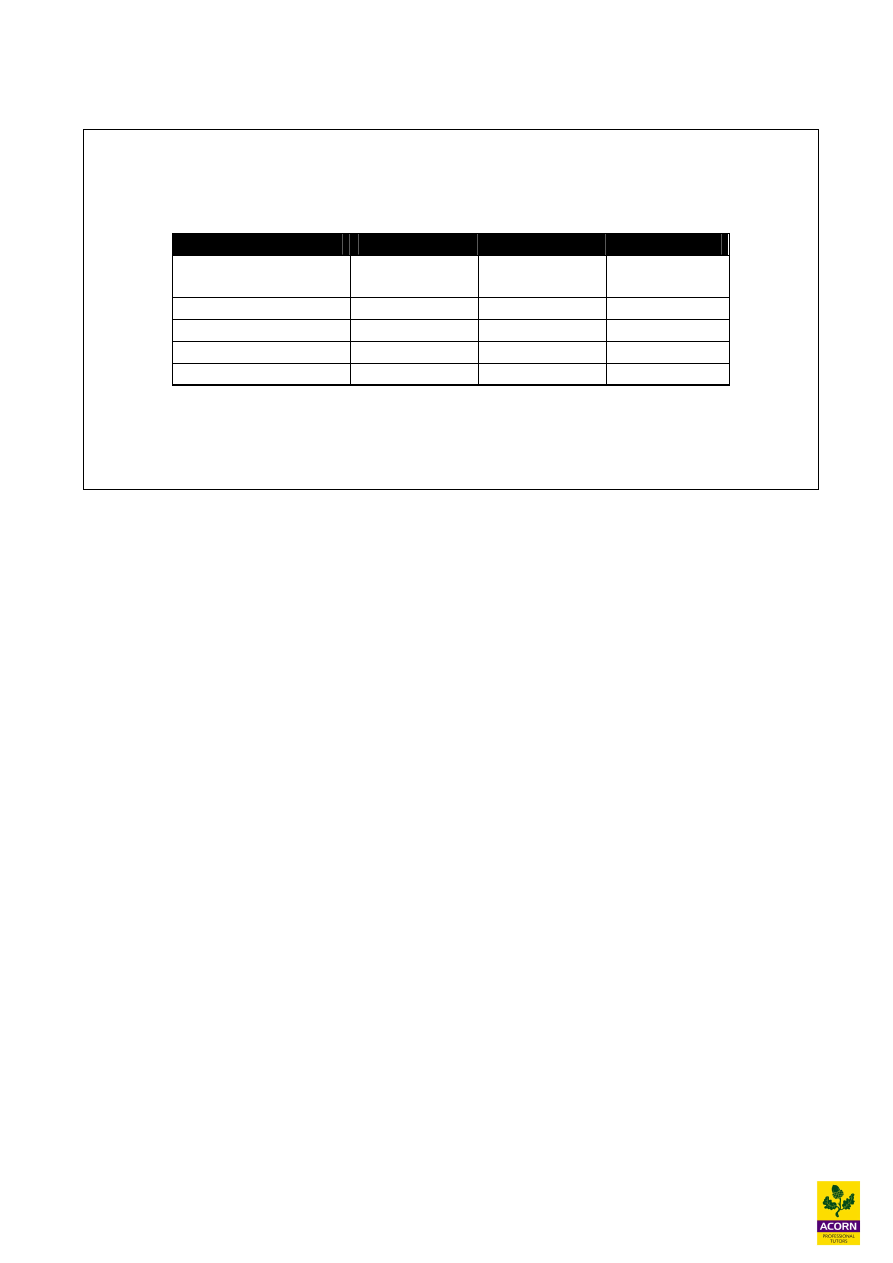

24.4 Cash flow problems

When a company highlights its cash flow problems (through using cash flow forecasts), it needs to

put a plan in place to overcome the problem.

Reasons for cash flow problems

Easing cash flow problems

Business is not doing due to a downturn in the

economy and as a result operating losses are

being made.

A program of asset replacements to take place

over the next year.

One- off large expenditures.

Seasonal business fluctuations.

Postponing or delaying capital expenditure.

Getting cash in quicker from trade receivables.

Disposal of assets that are not being used.

Requesting longer credit period from suppliers.

Not paying dividends

Raising more cash from new shares issue or

loans.

An organisation that has surplus cash could implement the following financial strategies to reduce

the level of surplus cash:

§ Seek further investments opportunities by doing detailed analyses and ensuring they

choose ones which yield them the highest rate of return. They could diversify into other

areas of business.

§ Increase their current sales by advertising heavily.

§ Repaying their debt and therefore reducing their gearing. Although debt finance does

have tax advantages and also reduces the cost of capital.

§ Increasing their level of dividends to their current shareholders as part of a long term

strategy.

§ Make generous donations to charities or do something to help the local community. This

in the long term will improve the organisation’s image as a caring organisation. There has

been a huge increase in ethical investors in the past 2 decades.

11

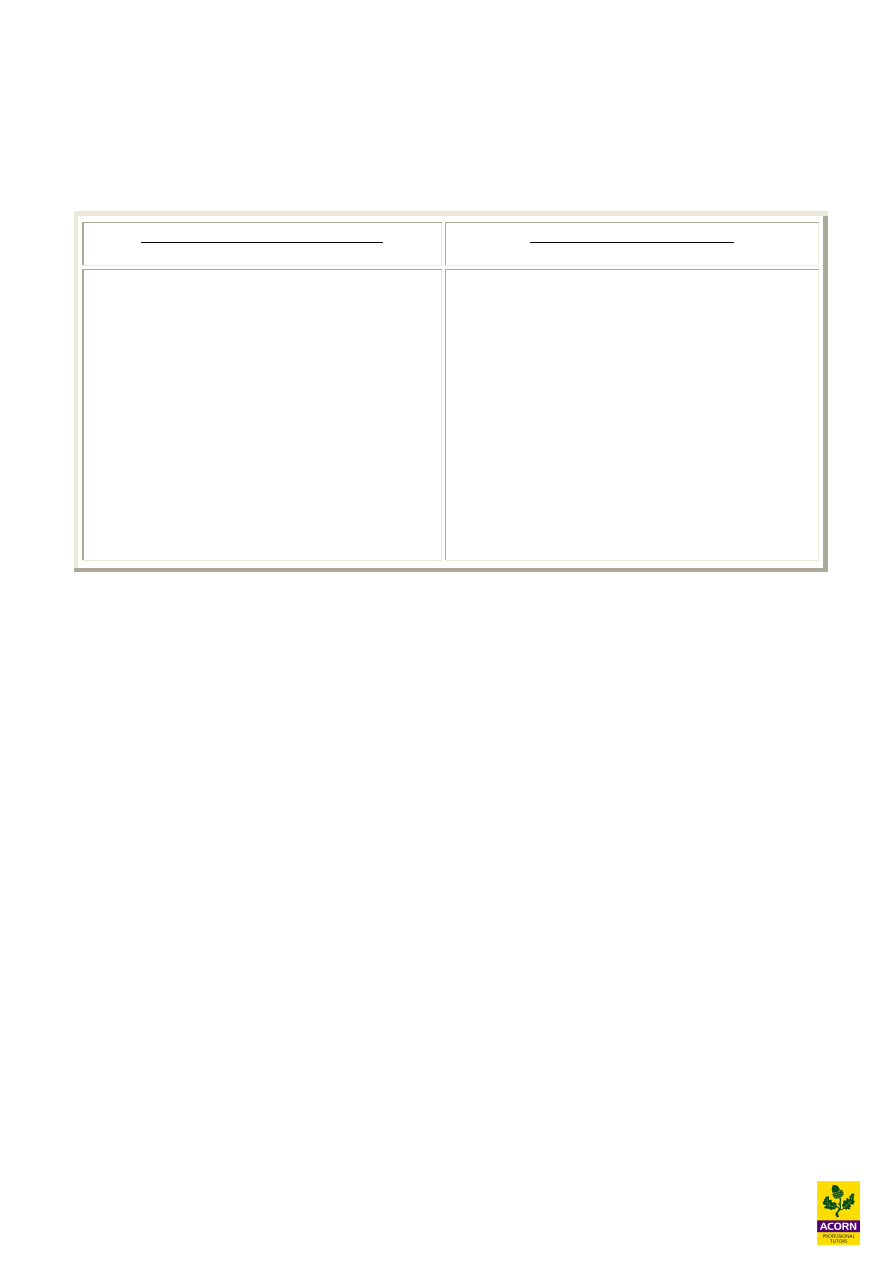

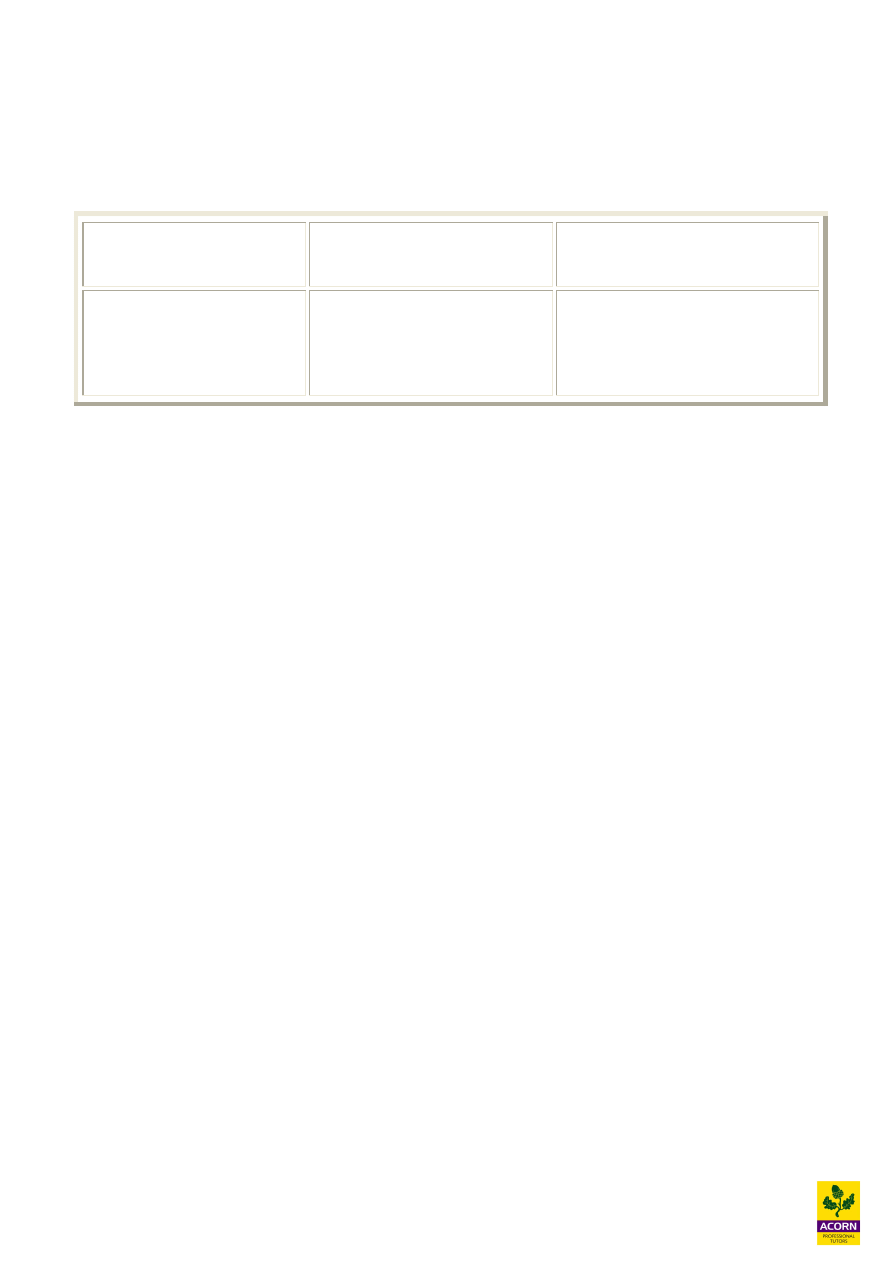

24.5 Cash management motives

There are various reasons why cash and other liquid assets are held, mainly for transactional,

precautionary and speculative motives.

Transaction motive

Precautionary motive

Speculative motive

Cash needed for normal

business, paying suppliers,

wages etc

Cash held for unexpected

purposes like increase in a

liability (taxation).

Cash held for opportunities,

which may arise, like a

takeover of another company.

Holding cash carries a cost, the opportunity cost of lost interest or other return of investing cash

elsewhere. Therefore maintaining the right level of cash is important, and the balance between

liquidity (holding too much cash) and illiquidity (holding too little cash) needs to be established.

12

Key summary of chapter

A cash-flow forecast is an estimate of when and how much money will be received and paid out of

a business. Cash flow reporting is normally on a month-by-month basis, typically for one financial

year.

Note: Cash budgets never include non-cash items such as bad debts, discounts given, or the

depreciation of non-current assets.

Proforma cash budget

JAN FEB…………….. column for each month

Cash inflow (receipts)

Cash sales

X

X

Debtors (trade receivables)

X

X

Sale of non-current assets

X

Loan or share issues

X

X

Total Receipts

X

X

JAN FEB…………….. column for each month

Cash outflow (payments)

Creditors (trade payables)

X

X

Expenses

X

X

Salaries

X

X

Purchase of non-current assets

X

Loan repayments X

X

Taxation paid

X

Dividends paid

X

X

Total Payments

X

X

Opening balance brought forward

X

X

Monthly net cash inflow/(outflow) X (X) (receipts less payments for the month)

Closing balance carried forward*

X (X)

* The closing bank balance at the end of a period becomes the opening balance for the start of the

next period.

13

Cash management motives

There are various reasons why cash and other liquid assets are held, mainly for transactional,

precautionary and speculative motives.

Transaction motive

Precautionary motive

Speculative motive

Cash needed for normal

business, paying suppliers,

wages etc

Cash held for unexpected

purposes like increase in a

liability (taxation).

Cash held for opportunities,

which may arise, like a

takeover of another company.

14

Solutions to Lecture Examples

Example 24.1

Operational cash flows

Reconciliation of operating profit to operating cash flow

£

Operating profit

260,000

Inc/Dec in inventories (24-42) (18,000) - More money spent on inventories = cash outflow

Inc/Dec in receivables (30-48) (18,000) - More money tied up in receivables = cash outflow

Inc/Dec in payables (22-28) 6,000 - Less payments made to creditors = cash inflow

Operating cash flow

230,000

Example 24.3

June

July

Cash

100,000

120,000

Debtors one month after sale

47,880

99,750

Debtors two months after sale

14,400 17,280

Total receipts

162,280

237,030

Example of calculation of June cash receipts

Cash 0.4 x June sales 250,000 = 100,000

Debtors 1 month after sale paying in June 0.6 x May sales 120,000 x 0.7 x 0.95 = 47,880

Debtors 2 months after sale paying in June 0.6 x April sales 100,000 x 0.3 x 0.8 = 14,400

Example 24.4

July

Aug

Sept

Opening stock

80

96

115.2

Purchases (balance figure)

496

559.2

623

576

655.2

738.2

Closing stock

(96)

(115.2) (138.2)

Cost of sales

480

540 600

August payments will be 20% August purchases and 80% of July purchases

September payments will be 20% September purchases and 80% of August purchases

Aug Sept

Cash payments

111.8

124.6

Creditor payments after 1 month

396.8

447.4

508.6

572.0

15

Example 24.5

(a)

Mth1

Mth 2

Mth 3

Total

£

£

£

£

RECEIPTS

Sales (W1)

2,940

10,180

15,545

28,665

Capital

16,250

16,250

Total receipts

19,190

10,180

15,545

44,915

PAYMENTS

Material (W2)

0

3,515

3,420

6,935

Labour (W3)

6,105

5,940

6,666

18,711

Variable O/H (W4)

1,332

2,184

2,318

5,834

Fixed O/H (W5)

3,750

5,625

5,625

15,000

Total payments

11,187

17,264

18,029

46,480

Net cashflow

8,003

(7,084)

(2,484)

(1,565)

Bal b/f

0

8,003

919

0

Bal c/f

8,003

919 (1,565) (1,565)

Workings

(W1) Sales

Mth 1

Mth 2

Mth 3

£

£

£

Sales (units x selling price)

15,000

17,500

20,000

Receipts in 1

st

month (20%)

and 2% discount given

3,000 – 60

= 2,940

3,500 – 70

= 3,430

4,000 – 80

= 3,920

Receipts in 2

nd

month (45%)

6,750

7,875

Receipts in 3rd month (25%)

3,750

Total

2,940

10,180

15,545

(W2) Material

Mth 1

Mth 2

Mth 3 Mth 4

Units

Units

Units

Units

Forecast sales

1,500

1,750

2,000

2,100

Opening inventory

0

(350)

(400)

1,500

1,400

1,600

Closing inventory

350

400

420

Production

1,850

1,800

2,020

Material cost

(£1.90 x units)

£1.90 x 1,850

= £3,515

£1.90 x 1,800

= £3,420

£1.90 x 2,020

= £3,838

Material payments

£3,515

£3,420

16

(W3) Labour

Mth 1

Mth 2

Mth 3

Production units

1,850

1,800

2,020

Labour cost

(£3.30 x units)

£3.30 x 1,850

= £6,105

£3.30 x 1,800

= £5,940

£3.30 x 2,020

= £6,666

(W4) Variable O/H

Mth 1

Mth 2

Mth 3

Production units

1,850

1,800

2,020

Variable O/H cost

(£1.20 x units)

£1.20 x 1,850

= £2,220

£1.20 x 1,800

= £2,160

£1.20 x 2,020

= £2,424

Payments

£

£

£

60% in 1

st

month

1,332

1,296

1,454

40% in 2

nd

month

888

864

Variable O/H payments

1,332

2,184

2,318

(W5) Fixed O/H

Mth 1

Mth 2

Mth 3

£

£

£

Fixed costs (£75,000 / 12)

6,250

6,250

6,250

Payments

60% in 1

st

month

3,750

3,750

3,750

30% in 2

nd

month

1,875

1,875

Fixed O/H payments

3,750

5,625

5,625

(b) (i)

If the cost was £1.50 there would be saving of £0.40 per unit.

Mth 1

Mth 2

Mth 3

Production cost savings

1,850 x £0.40

= £740

1,800 x £0.40

= £720

2,020 x £0.40

= £808

Savings received

£740

£720

Total saving

£1,460

New total budget cash flow = Savings received + Current total budget cash flow

£1,460 + -£1,565 = (£105)

17

(b) (ii)

If the cost was £2.20 there would be an extra cost of £0.30 per unit.

Mth 1

Mth 2

Mth 3

Production extra cost

1,850 x £0.30

= £555

1,800 x £0.30

= £540

2,020 x £0.30

= £606

Extra costs to pay

£555

£540

Total extra cost

£1,095

New total budget cash flow = Extra costs to pay + Current total budget cash flow

-£1,095 + -£1,565 = (£2,660)

Wyszukiwarka

Podobne podstrony:

F1 Cash flow statements for single company

3 OPENING AND MANAGING CASUALTY'S AIRWAY POLok

F1 Short term borrowing and investing

F1 Share capital transactions and financial instruments

Detecting Metamorphic viruses by using Arbitrary Length of Control Flow Graphs and Nodes Alignment

Understanding and Managing Polymorphic Viruses

Client Fee and Cash Flow Projection

A Comparison Of Dividend Cash Flow And Earnings Approaches To Equity Valuation

Analiza finansowa AZF, ANSF03, ˙wiatowe standardy dopuszczaj˙ stosowanie metody bezpo˙redniej i po˙r

Zadanie 2 cash flow (wykład)

przyklady cash flow

Cash flow

Analiza wskaznikowa cash flow

Cash flow

cash flow

cash flow

#0668 – Having Cash Flow Problems

ANALIZA CASH FLOW

Cash flow

więcej podobnych podstron