1

Basics of Accounting

Lecture no. 8

dr Wojciech Hasik

wojciech.hasik@ue.wroc.pl

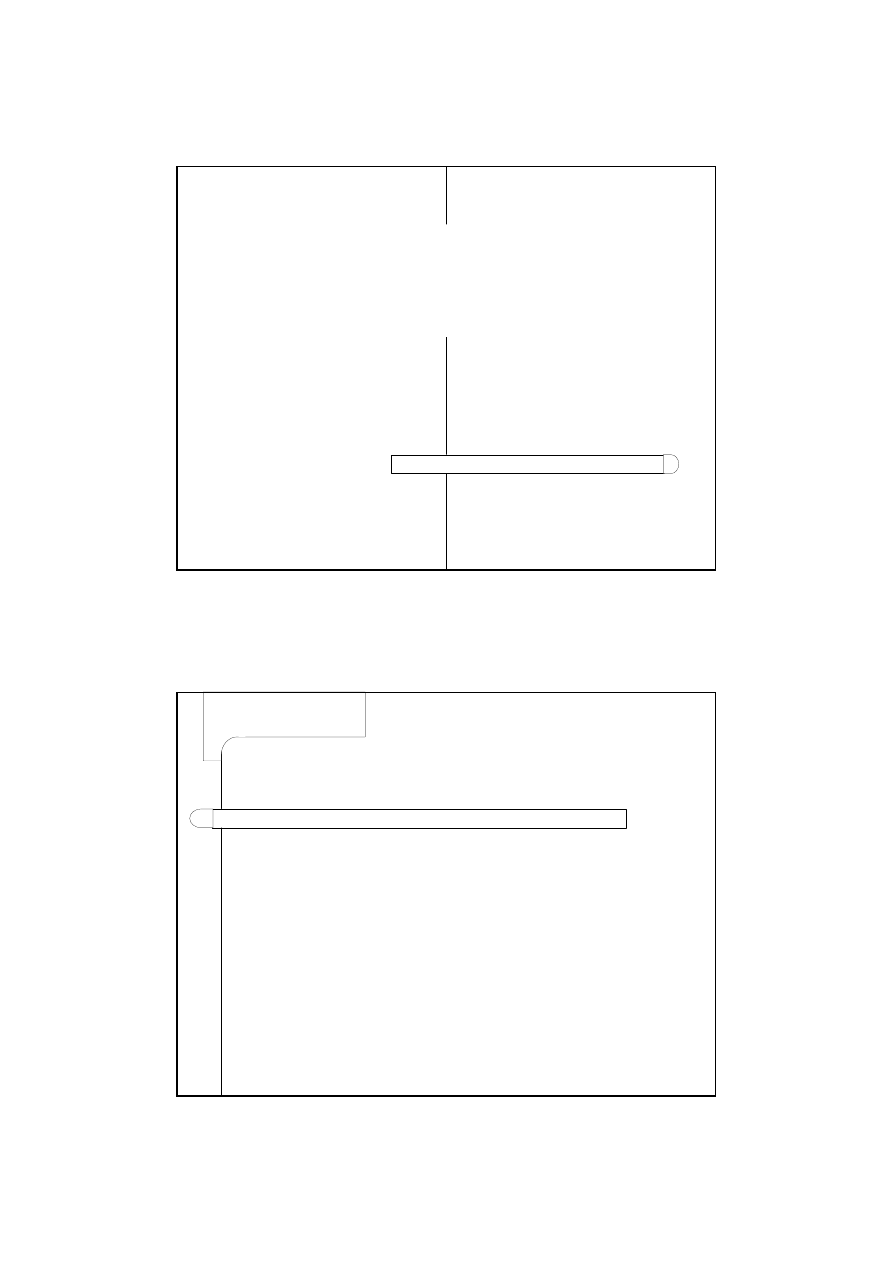

Costs of manufacture settlement

option 1: finished goods measurement at real

cost of manufacture

option 2: finished goods measurement at

standard cost of manufacture

2

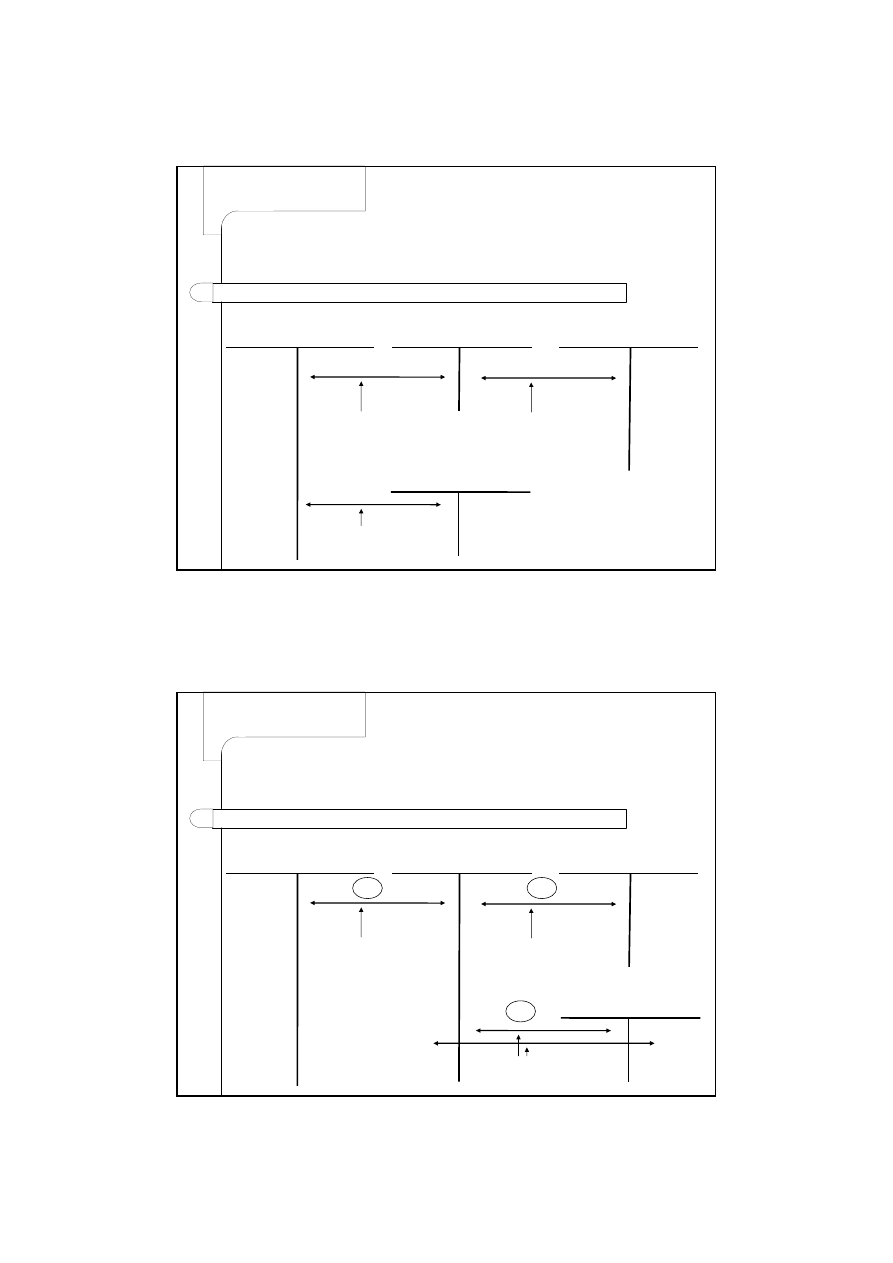

Finished goods measurement at real

cost of manufacture

Costs of basic activity

measurement of f.g. at real

cost after finishing of

technological process and

settling up financial period

costs of sales

recognition at the

moment of sale

Costs of sales

Finished goods

Production in progress

and semi finished goods

unfinished production

measurement at

balance sheet date

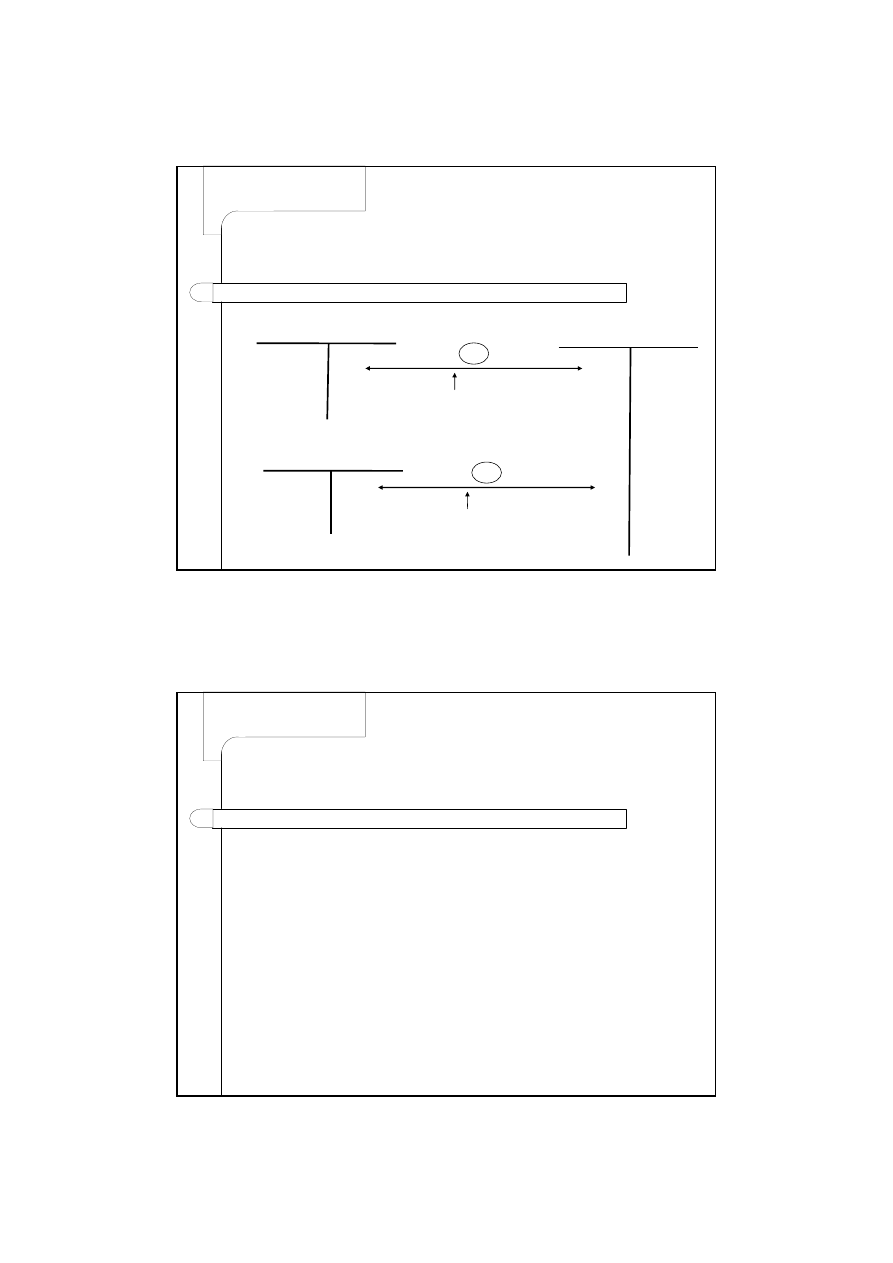

Finished goods measurement at

standard cost of manufacture

Costs of basic activity

measurement of cost of

manufacture (real) at

the and of settlement

period

f.g. storing before the

end of financial period

(no settlement of

costs)

Finished goods

Costs of manufacture

settlement

Deviation from standard

cost of manufacture

identification of

differences between real

and standard cost

1

2

3

3

Determining costs of sales

Finished goods

Deviation from standard

cost of manufacture

Costs of sales

1

accounting for sold goods

before calculation of real cost

of manufacture

2

settling up deviation from

standard cost on products

sold

[increasing and decreasing]

An example – initial assumptions

Company „X” is tail and brick manufacturer.

We’ve got the following balances of chosen accounts:

Costs of basic production

13 000,-

Indirect costs of production

10 500,-

General administrative costs

2 000,-

Selling costs

1 500,-

4

Case 1- finished goods treatment at real

cost of manufacture

1.

Indirect costs of manufacture were settled (assigned)…………?

2.

Finished goods are recognized (10 000 pcs. of tails) at real cost of

manufacture, work in progress was measured at 5 500,- ; cost of

one unit manufacture …………/pcs?

3.

Invoice for a customer for sold tails:

a)

net value: 3 000 pcs. @ 3,50

10 500,-

b)

VAT 22%

2 310,-

c)

gross

12 810,-

4.

Sold tails were freighted to a customer, cost of sold goods was

recognized (at value of real cost of manufacture …………/pcs

Case 2 - finished goods treatment at

standard cost of manufacture

1.

Finished goods are recognized (10 000 pcs. of tails) at standard cost of

manufacture of 2,10 per unit

21.000,-

2.

Invoice for a customer for sold tails:

a)

net value: 3 000 pcs. @ 3,50

10 500,-

b)

VAT 22%

2 310,-

c)

gross 12 810,-

3.

Sold tails were freighted to a customer, cost of sold goods was

recognized (at standard cost of manufacture 2,10/pcs 6 300,-

4.

Indirect costs of manufacture were settled (assigned)…………?

5.

The actual cost of manufacture was calculated, work in progress was

measured at 5 500,-

……………

6.

The deviation from standard cost of man. was calculated and assigned

7.

The deviation was assigned at finished goods left and sold

Wyszukiwarka

Podobne podstrony:

Buying Trances A New Psychology of Sales and Marketing

The High Hidden Costs of Coaching

The energy consumption and economic costs of different vehicles used in transporting woodchips Włoch

BA L7 costs by function

The Costs of Hospital Infection

BA L9 division of ledger accounts

Global Issues Brief Economic costs of terrorism

the costs of deception

The costs of terrorism

Joe Vitale Buying Trances A New Psychology of Sales and Marketing 798 KB

Effect of File Sharing on Record Sales March2004

Legalization of Drugs Extensive Analysis of the?bate

The Issue of Human Cloning Both Sides of the?bate

Home Power Magazine Issue 109 Extract pg22 Making Sense of Solar Electricity Costs

Eleswarapu And Venkataraman The Impact Of Legal And Political Institutions On Equity Trading Costs A

Eleswarapu, Thompson And Venkataraman The Impact Of Regulation Fair Disclosure Trading Costs And Inf

więcej podobnych podstron