1

Basics of Accounting

Lecture no. 9

dr Wojciech Hasik

wojciech.hasik@ue.wroc.pl

Vertical and horizontal division of

ledger accounts

For purpose of more transparent and precise

accounting the recording system is being adopted

into specific needs of the entity by

Dividing ledger accounts in the following directions

horizontal

vertical

2

The horizontal division of l. account

it consists of extracting from acc. divided a

group of accounts that are functioning in

exactly the same way as divided account

the group of analytical accounts is being

created

analytical accounts can be used next to or

instead of synthetic account

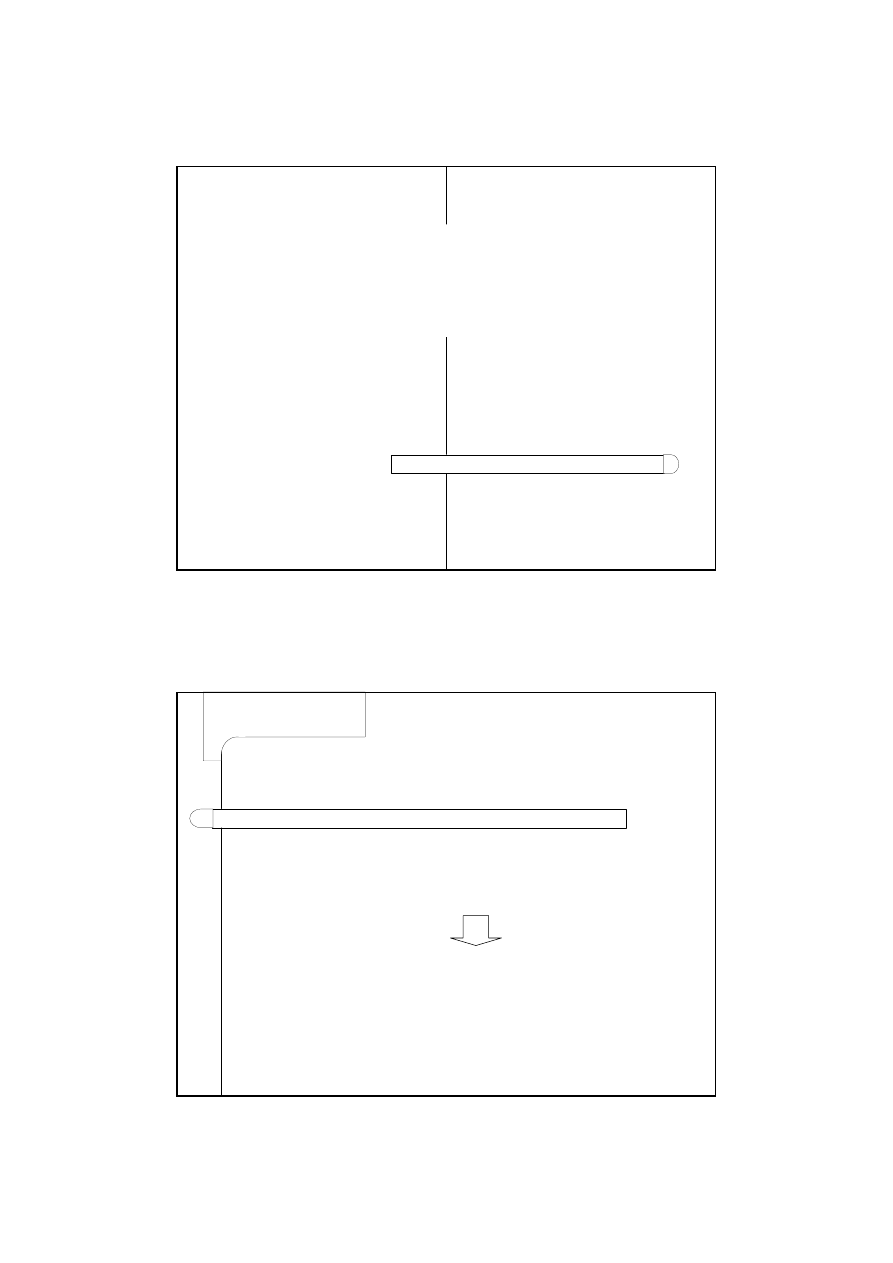

Horisontal division of l. acc.: short term

investment

Ob)

+

Shares

-

Short term investment

Ob)

+

Bonds

-

Ob)

+

Cash

-

Ob)

+

-

3

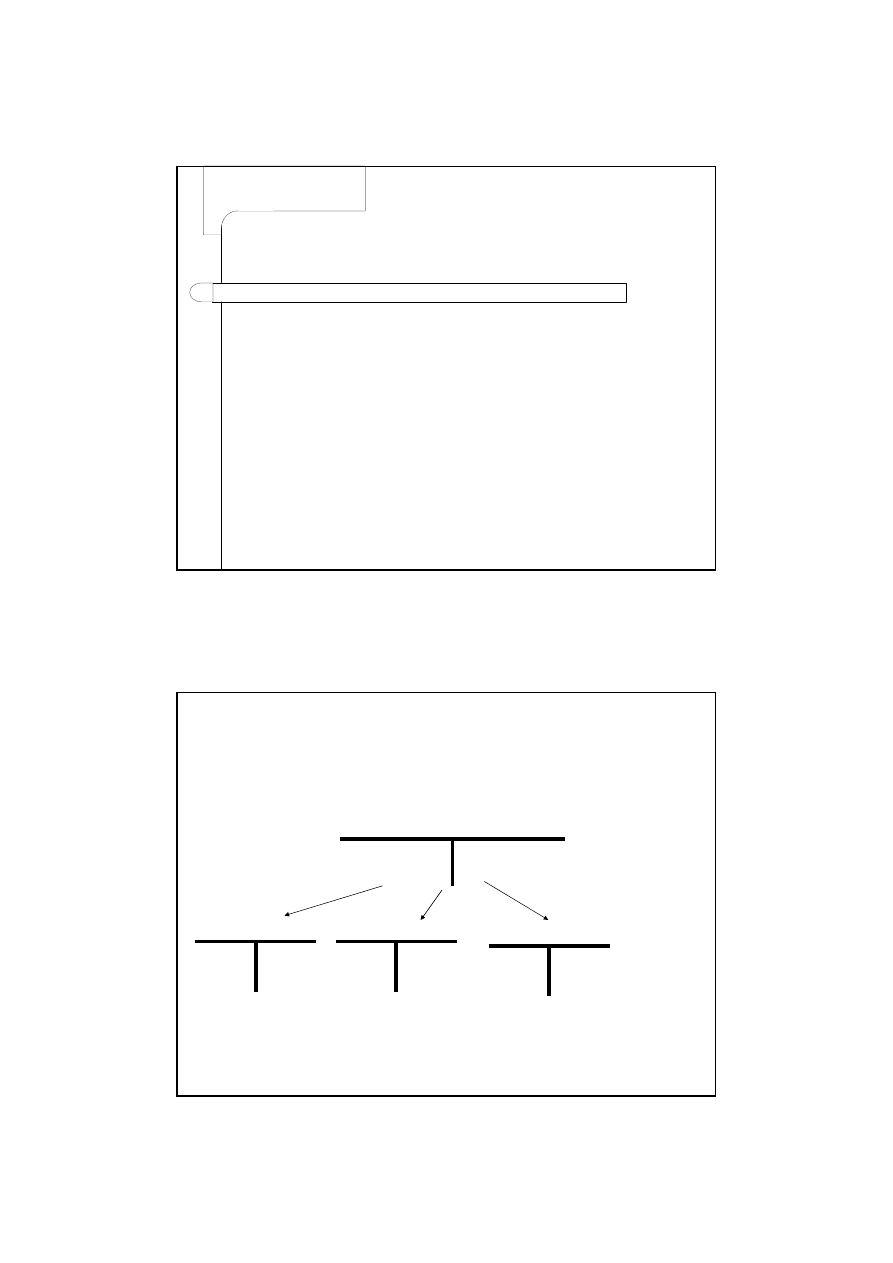

The horizontal division of l. account

• it consists of extracting from acc. divided a

group of accounts that are functioning in

exactly the same way as divided account

• the group of analytical accounts is being

created

• analytical accounts can be used next to or

instead of synthetic account

Horizontal division of l. account

Before we close the synthetic l. account

–

we have to perform a reconciliation of the

analytical accounts balances with synthetic acc.

balance

4

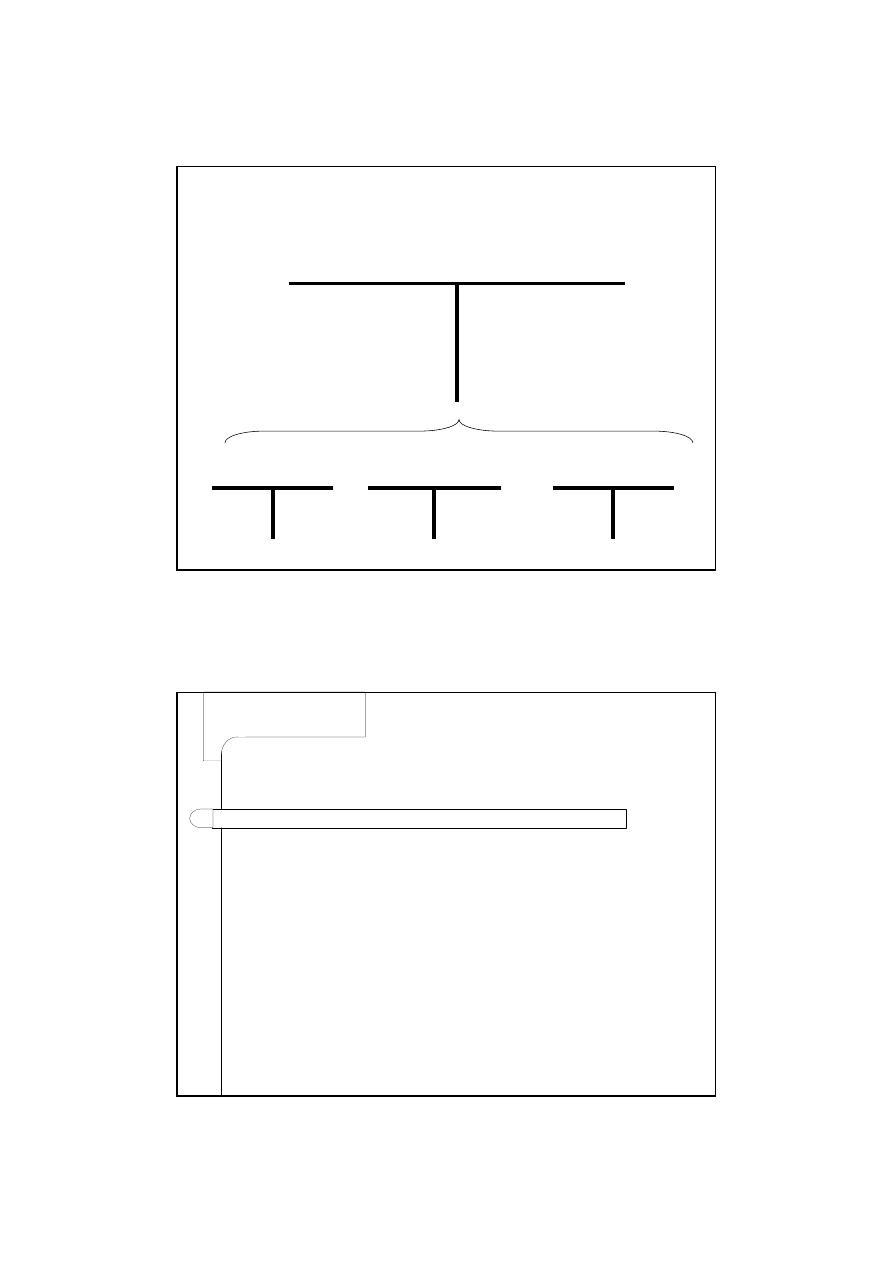

Vertical division of l. acc. – Tangible Fixed

Assets

OB)

acquire

Tangible fixed assets

disposal

Tangible fixed assets at carrying value

Ob. at historical cost)

acquire of t.f.a.

reversing of depreciation write off for

disposed asset

reversing of impairment write off

accumulated depreciation write off

disposal of t.f.a.

creating an impairment write off

depreciation

write off

Accumulated deprec.

reversing of

write off

creating an

write off

Impairment write off

reversing of

the write off

The contra account

the result of vertical division of the main ledger

account

5

The contra asset account

It is used for the purpose of registering the changes and

states of different types of assets book value adjustments

resulting from:

•

prudence:

•

accumulated depreciation and amortization

•

impairment write offs

•

reversing of write offs

•

using standard costs and prices to carry assets (in

values different to real ones):

•

standard prices (merchandise, materials)

•

standard costs (finished and semi finished goods)

•

gross or net selling price (merchandise)

Why do we need it?

Problem 1:

we purchase the same supplies from different

suppliers at different prices

how to measure each supply?

Problem 2:

we are manufacturing in an ongoing system

how to measure each portion of finished goods?

6

contra asset account example:

„deviation from standard price of materials”

3 deliveries of the same type

1.

@ 90

2.

@ 105

3.

@ 110

total value of deliveries: 305

treatment?

contra asset account example:

„deviation from standard price of materials”

Using standard price (or cost or selling price):

simplification allowed in PAA and other jurisdictions

(including IFRS)

deviations (differences) between standard price (cost)

and real price (cost) are booked on separate account

at the end of financial period total accumulated

deviations are allocated to:

–

inventory left (asset)

–

inventory disposed (cost)

technically through adjustment (+ or -) of cost (inventory

disposal) by appropriate portion of deviation

7

Bookkeeping documents

every entry into accounting books must result

from appropriate, fairly prepared, formally

proper, and correct document – that is

bookkeeping document

bookkeeping document is a written

presentation of real accounting event

(transaction)

Bookkeeping errors corrections

errors in documents

errors in books:

–

entering the adjustment entry: contra entry (storno)

negative contra entry (red storno)

(regular, black) contra entry – positive entry:

–

full contra entry (using double entry adjustment)

–

part contra entry (to adjust only one side entry)

Wyszukiwarka

Podobne podstrony:

The divisions of societys povety classes

living church of god accounts 2006

BA L1 Basic issues in Accounting v2

BA L8 costs of sales

living church of god accounts 2006

#0537 – Types of Bank Accounts

Orszulak Dudkowska, Katarzyna Food Expenses in the Rhythm of Daily Life An Analysis of Household Ac

Partington A linguistic account of wordplay

Legalization of Drugs Extensive Analysis of the?bate

Accounts of Eros in the Symposium

The Issue of Human Cloning Both Sides of the?bate

Partington A linguistic account of wordplay

Bartolome de Las Casas The Devastation of the Indies, A Brief Account

The First Mystics Some Recent Accounts of Neolithic Shamanism by Barry Cooper (2010)

An Account of A A by Aleister Crowley

Önnerfors Andreas The Earliest Account of Swedish Freemasonry

Accounting Recording and Firm Reporting as Source of Information for Users to Take Economic Decision

więcej podobnych podstron