19027174322351928237 48299216 n

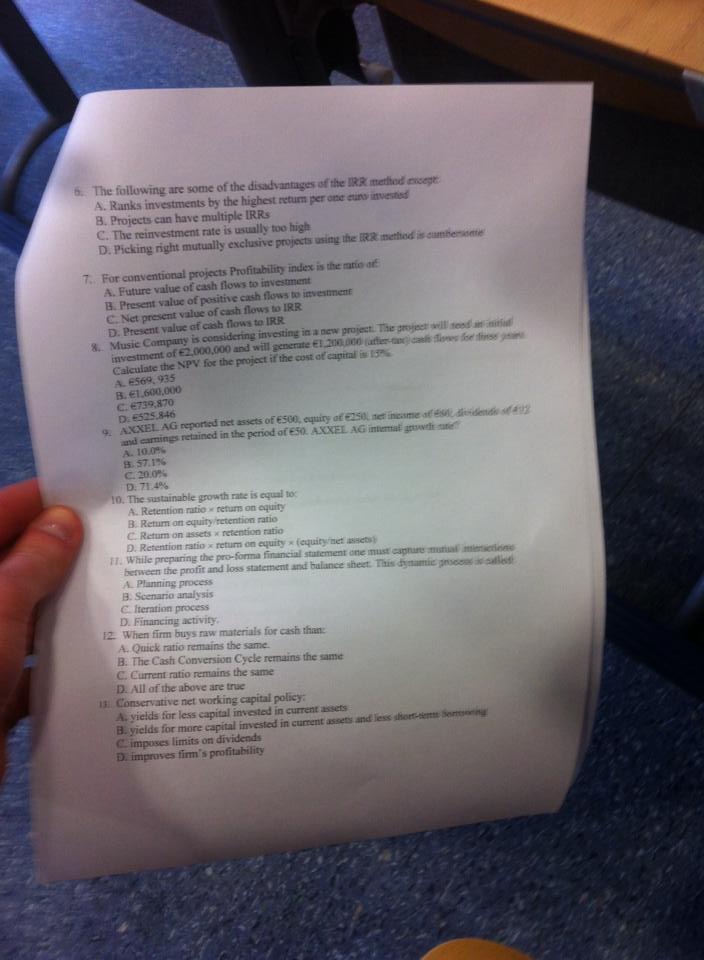

The tollowmg arc sonie of the ilisaikactugo of tisc fltSt j \. Ranka in\ citments by the higbest return per one <

B. Projccts eon havc multipk IRRs

C. The rcinvcstrocnJ ratÄ b usualh too high

D Picking nght mutualN exchai\e projects ouig be BW aertiM ⢠eamlierwm#

For cutwcntumal projects Profitabitej uxicx »tfte awrf

A. FuturÄ value ofcash flw* to tnvesunem

B. Presen* valuc of pcrutÅc cash tlous »tttseitmcnf

C. Net peesent value of cash IÅowi *> W

D Pltstnt valnc of cash lVms to IW ..__, -Ucoemdcrnc msesun* ioaocw protect

'â^tm^fC.000.000 and *tU pemK Ar»

c ^aTthe VPV fet the project ,1 the cm* of capnal â¢

*»5

{*.â¬! .600.000 C. â¬73*.*â¢

O. «I5>»o

â ,vxxa AG repncied net aucts of â¬500 eman. â¬250, i«r jicuj

jnd âHninp rrtu.ncii tn the penod of â¬50 \XXEL AG mumai ii

A.

B. 57.1%

CL 20 0*.

D.71 4^.

. The sostamabic growth raÅr u ojual »

A RetentÅon rado ⢠rer^r. on cqinn B Return on cqui:> retendoo rano I C Retom on ossets ⢠retenrien rado

D RcPeniion rano â return on cÄ \ut\ ⢠tcqiiit> net aMCtst |

, A ftiic preparrog the pro-Sann* tiruneuii sÅtfcmen:

>et"ccn r.c prv.fi: ind k>*s sLUcmert and âaiunee \ Phmung proces*

B Sccnano anai> «s C /tcratinn process

D. Financmg aeuviry

12. *Vnen firm ou^s raw rrurcrrjis toc cash [han . A. '.)uilJc rano remair-s the same

B. The Cash Comeruoo C>dc rcmam* the same â , C. < -snem rano rtmatm the vtme D. Ali uf the abosc an: tnie jl. Consen ju\c net worimg capttai polscy:

A;yidds for less capiui imested m curreor assets

CK â

tÅ*HX

B. yiclds for morÄ capttai imested in currcnt jssea

C. tmpuses limits on dÅidends O. imprmes lirmâs pmfituNlity

V

Wyszukiwarka

Podobne podstrony:

InstitutÄ of Musie University of Zielona GórapresentsLESTER LEAPS IN Composed by Lester Young Arrang

CHAPTER 8 » Involve thc students: teachers tan correct sonie of the Scripts and st

The human body ha machinÄ whkh winds itsownspringsText1:Advanced Technology in the Beauty Salon Ther

DSCF5555 My War Memories, 1914-1918 meagre. Sonie of the officials had forsaken their posts. The wir

Fitzgibbon, Constantine Secret Intelligence BS THE SECRET WAR THAfNEVERENDS... The role of under

image001 The most ezdting fiction of our time! *13 in âThe most celebrated âAll-OriginaP senes in Sc

image002 Brian Aldiss is one the most influential -and one of the best - SF writers Britain has eve

00313 N8ca2ce47ae6338a7cbe578cf96f640 316 McCaryille & Montgomery FigurÄ 1. Probabiiity of xj,,

img0159 287 First successful tests of teleportation cechnology are con-ducted by a team chat include

img025 (31) i The SPROUT TEE s crisp twisted* stitch lines gain a bit of softness when worked i

wiÄcej podobnych podstron