3582281561

Medtech industry bracesfor excise tax impact

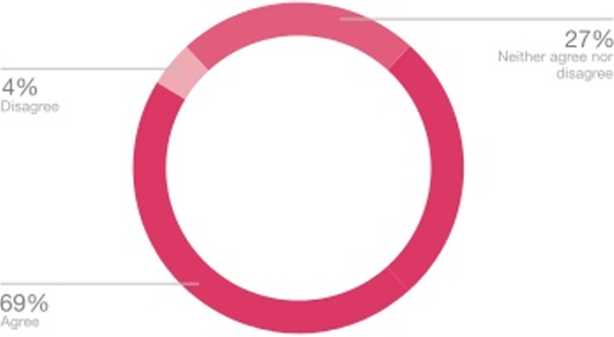

figurę 11: To what cxtcnt do you agree ordtssgrcc włththe foSomog statcmcnt: PtiarmaoeuttcrS and btomcdicalrcsearchisanimportant engme foreconomtc growth m tłiscountry?

Sojrcu F*wC Hniith f-WMmh IratAjtu Ccmjmir Sunwy. 20:2

Effective January 1,2013. the 23% excise tax on medical devices could prompt consolidation in a $308 biUionglobal industry consisting rnainly ofsmali start-ups wkh lean product port foli os and fewer than 50 employees.1 Sorne could owe morę in taxes than they generale in profits, making thern less attractive to inuestors but enticing to kuger companies that are bet ter positioned toabsorb the taxand looking to expand tlieit portfolio.

Federal coffers stand togain$29.1 biUion over thenext ten years from thistax,which was included in the Affordable Care Act (ACA).2Muchofthe industry has kibeled the taxa job and innovation killer— pred icting nearly 39.000 US job losses.*

Sorne compiinies sa>' it's just another cost pressure in anevoh'ing market,but others havealready blarned it for słielved domesticexpansion plansand layoffs.

One company is cutting its workforce by 10% and plans to movesorne operirtSons overseas.* Medtronic, a large medical devicemanufacturer, estimates that tire tax will increase its annual tax liability by $125 million to $175 million.oi l%-2%of US sales.1

Medtech companies are unlikely to pass on thetaxtocustomers for several reasons. Agroup of hospitalassockitionsopposes pass-throughof tlie tax and has urged the IRS to prewnt tliem from doing so; and industry analysts predict that compiinies dealing incommoditits, such as coronary stents or tonguedepressors, are uruible to pass it on because of pricing pressure and competition. Unkrss compiinies offer a novel product without direct competition. they will havetobear tlie cost.

As manufacturers look toshift costs, they must also innovate. Nearh170% of consumers surveyed byPwC's Health Research Insthute say that pharmaceutical and biomedical research is an important contributor toeconomicliealth (see Figurę 10).Ł Whilesorne companies expect toabsorb the taxand reduceexpenses elsewhere. others are recalibrating operations, resources, and inuestments tospur strategicgrowth in other areas to offset it. Because the tax applits onlyto US sales, medical device rnakers with robust salesabioadshould farebetter.

Implications

• Manufacturers that ltavebeen waiting and hoping for repeiil haverunoutof time.They shoukl lui\« a basie system for calcukiting tax liability. or they risk overpaying or underpaying the I RS.

• Tlie supply chain may become wlatileas manufacturers, contractors, distributors, and other third parties maneuver to avoid responsibility for tlie tax. Medtech companies shoukl msess the potential for supply chain dismptions before changing pricing policies.

• Medtech companies sliou Id consider work ing with providers on comparative effectiven<ss studia of pi od ucts before they are distr ibuted. Doing so may

he lp i educe w i ite -of fs on co ns ig nme nt Products, demonstrate value to purchasers.andstreainline the portfolio.

• Industry consolidationcouldgive medtechcompjiniagieater pricing power in negotiations with insurers, providers,andsuppliers.

PwC Hecłti Resosrch !nssxi» | top OsSTi ndasły & 2013 13

Wyszukiwarka

Podobne podstrony:

APA 11 -I Lilo Installation - Where do you want to install the bootloader? /dev/hdal &nb

without harmonization with harmonization Figurę 11. Illustrating example of the impact of different

f2 11 FIGURĘ 2.11 D w doping software using the Java API.

fig11 Figurę 11 Gold Hnafatafl piece from Tuse in Denmark

00046 ?c2509350e21c3447d8db6068221f3a 45 A Rule-Based Approach to Multiple Statistical Test Analysi

00073 ?669057b99e1a32461d685010d9b1f0 72Hembree & Zimmer Figurę 11. Adaptiye Filter Weights (tr

00381 ?c79f45a4235fae8108ab837f609112 385 Regret Indices and Capability Quantification Figurę 11. C

45 fractions obtenues (PRHex 1 a PRHex 7) sont presentees a la figurę 11. Les resultats de tests d’a

więcej podobnych podstron