Sectorial Overview

Banking & Finance

August 2013

•

Industry Basics

•

Current Trends

•

UAE Bank Rankings

•

UAE‘s Legal Framework for Banking

•

Dubai International Financial Center (DIFC)

•

UAE‘s Stock Exchanges

•

Planned Projects and Future Development

•

Islamic Finance

•

Outward Investment

•

German Banks in the UAE

•

Conferences and Trade Fairs

•

Selection of Sources and Publications

Table of Contents

► Since mid-2000 the UAE, and in particular Dubai, has established itself as the

regional financial center and banking hub in the Middle East, a position which in the

past decades was held by Beirut and, more recently, Bahrain

•

Dubai’s status as an international banking center derives from its large center for re-

exports, extremely good financial and communications infrastructure and high political

stability

•

There are 23 locally incorporated commercial banks operating in UAE since 2011 with

some 768 branches, compared to 28 foreign banks with 110 representative offices

registered

•

24 finance companies, 22 investment companies, and 119 licensed money-changers

maintain some 628 branches are located in the UAE

•

After the international financial crisis ,Dubai has recovered and strengthened its position

as a banking center in the Middle East, Africa, and beyond over the past years, also due

to the political unrest in several countries in the region

Industry Basics

Current Trends

•

Total assets of UAE banks stood at Dh 1.66trn ($452bn) at the end of 2011 –

assets-to-GDP ration 137%. The UAE banking sector has grown about 30% y-o-y

for the past 5 years, making it one of the fastest growing economies worldwide

•

Over the past 4 years, banks have increased their liquid assets ratio, distribution

network and impaired loans ratio. Simultaneously, the loan-to-deposit ratio has

decreased to 86%, and Margins and Costs to Income Ratio has also declined

significantly

•

Trend of divergence in UAE‘s banking sector: Dubai – private sector vs. Abu Dhabi

– public sector

•

Dubai‘s banking sector is likely to attract more Asian banks

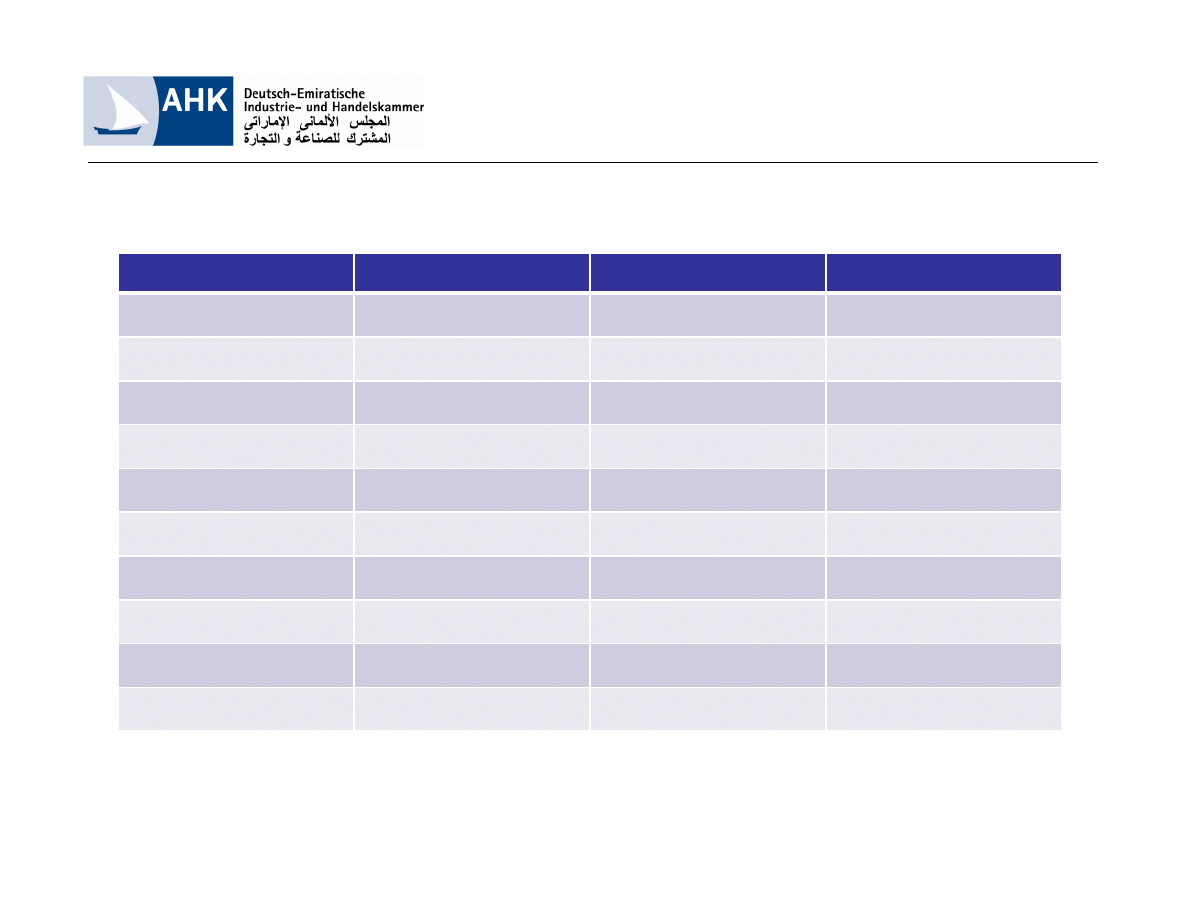

UAE Bank Rankings 2012

Bank

Assets (Dh bn)

Equity (Dh bn)

Profits (Dh m)

Emirates NBD

296.7

28.8

641

NBAD

289.3

27.1

1041

ADCB

182.9

23.1

800

FGB

159.7

26.1

935

DIB

92.5

9.9

245

UNB

86.1

13.1

471

Mashreq

76.6

12.8

271

ADIB

74.3

8.6

307

CBD

39.4

6.2

242

RAK

24.7

5

325

Source: The Report Dubai 2013, Oxford Business Group

UAE Bank Ratings 2012, Q1

•

Chief supervisor and regulator for the domestic banking sector: Abu Dhabi-based

Central Bank of the UAE (CBUAE). CBUAE organizes banks to ensure their financial

stability. Occasionally regulations are issued by the Central Bank to achieve this

objective.

•

Regulator for domestic stock exchanges:

Emirates Securities and Commodities

Authority (SCA). Through implementing legislations, the SCA aims to protect investors,

improve the profitability of UAE capital markets and develop investment as well as legal

awareness.

•

Regulator for Banks registered at Dubai International Financial Center (DIFC) and

NASDAQ Dubai:

Dubai Financial Services Authority (DFSA). The independent

DFSA’s approach is to be “risk-based and to avoid unnecessary regulatory burden”. It

supervises all financial services conducted in the DIFC, as well as persons in the DIFC

in relation to anti-money laundering, counter-terrorist financing and sanctions

compliance.

•

UAE‘s legal framework for the banking sector is based on three laws:

1980 Banking Law, 1985 Islamic Banking Code, 1993 Commercial Code

•

After the international financial crisis, UAE laws were revised to include a number of

restrictions on lending as well as liquidating assets to meet CBUAE obligations

UAE’s Legal Framework for Banks

► Dubai International Financial Center (DIFC) – UAE‘s first financial free zone

•

Since its opening in 2004, DIFC has acted as a platform for business and financial

institutions by offering a legal system mostly consistent with Common English law.

Banks registered in DIFC can be 100% foreign-owned.

•

DIFC has become the Gulf’s top financial center, housing regional headquarters for many

of the world’s biggest banks and finance firms

•

DIFC is regulated and supervised by DFSA and has its own court.

•

21 of the world‘s top 30 banks and 8 of the worlds top 10 insurance companies have been

present in DIFC since 2011

•

Since the DIFC's establishment more than 900 companies have set up there, employing

over 14,000 people

Dubai International Financial Center (DIFC)

► UAE has the most developed stock exchange in the region, ranking among the top

three best-performing worldwide in May 2013

•

Two Dubai stock exchanges under the umbrella of Bourse Dubai:

o

NASDAQ Dubai operating in DIFC: Twelve companies listed with 20 derivatives

o

Dubai Financial Market (DFM): 67 companies listed, along with eight conventional

bonds, six islamic bonds and 16 mutual funds. Despite a decrease in the DFM

traded value of sectors such as banks and real estate in 2010, most sectors have

started to recover in 2011, with the banks sector even showing an increased traded

value.

•

Abu Dhabi Security Exchange (ADX) mainly lists Abu Dhabi-based entities.

o

ADX and DFM are linked together via live market-watch screens to constitute the

Emirates Securities Market (ESM) listing the movements of securities from Abu

Dhabi and Dubai.

o

Due to screens in Sharjah, Ras Al Khaimah and Fujairah ESM offers a UAE-wide

platform for traders

•

Jumeirah Lakes Towers free zone is home to Dubai Multi Commodities Centre (DMCC)

with the

Dubai Gold and Commodities Exchange (DGCX).

o

The value of contracts traded on DCGX more than quadrupled between 2008

($57.43 bn) and 2012 ($372.8 bn)

UAE’s Stock Exchanges

•

Abu Dhabi World Financial Market (ADWFM)

ADWFM is a planned new financial free zone on Al Maryah Island, expected to be operational

by the end of 2013. It‘s legislative system will be based on British law and 100% foreign

ownership will be offered, free of tax. According to Gulf News, IMF and World Bank are to

have offices in ADWFM.

•

World‘s Tallest Office Tower in DMCC as a location for finance companies

Dubai Multi Commodities Center plans to build an office tower in the DMCC free zone to

attract finance companies looking for at least 5,000 sq. meters of office space, however

construction plans have not yet been finalized and no completion dates have been announced

yet.

•

Establishment of Al Etihad Credit Bureau

Al Etihad Credit Bureau was set up by the federal government in early 2012, and started the

collection of consumer credit data in May 2013. The new platform, once operational, will

allow financial institutions in the Gulf state check consumers’ creditworthiness before lending

to them.

Planned Projects and Future Developments

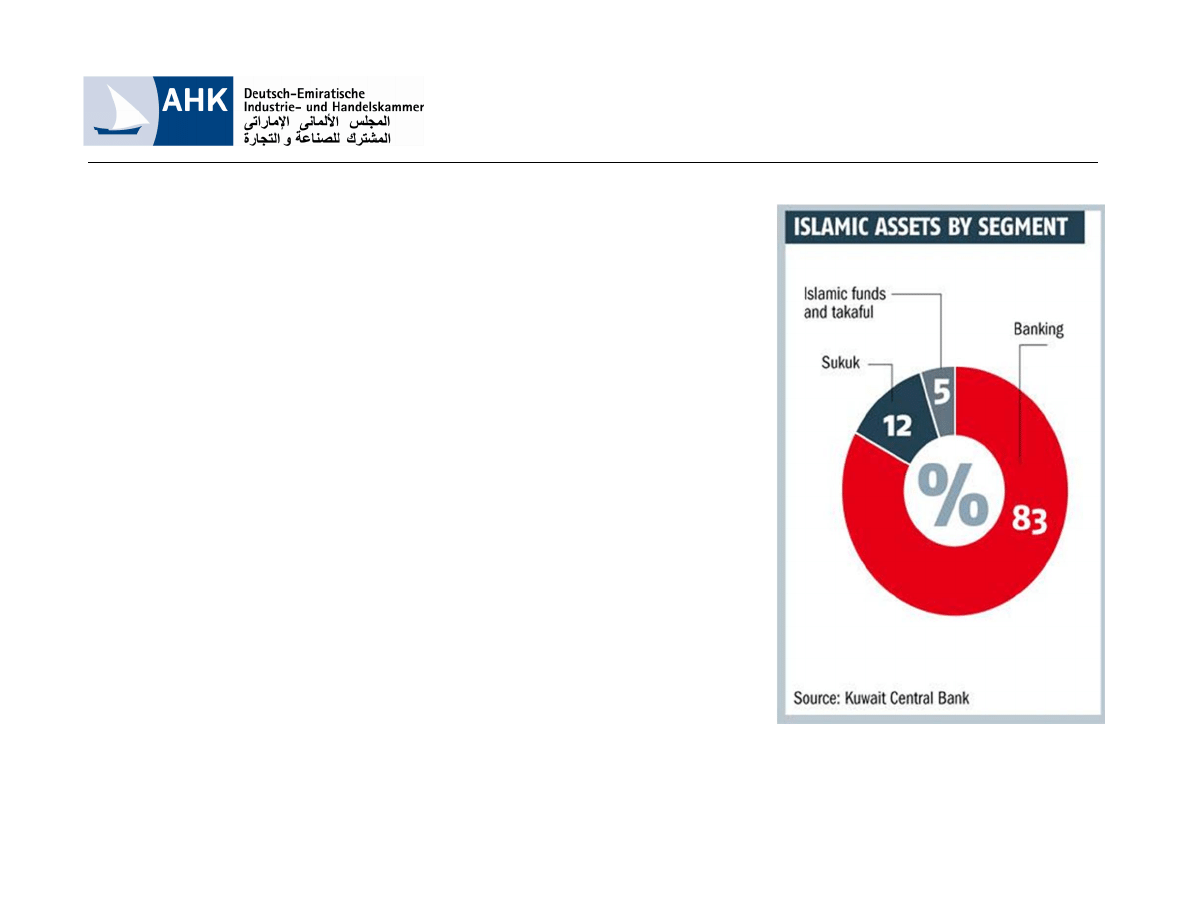

Islamic Finance

► Despite Islamic Finance still being a niche market in

the global financial markets, the sector has been

growing rapidly.

•

Key Islamic financial centers are based in Malaysia and

the Gulf regions, Muslim majority countries, but major

centers also exist in the non-Muslim world, e.g. in

Singapore, London, Paris and New York.

•

Influential financial institutions, such as the World Bank

and IMF are actively participating in developing this

field.

•

The financial crisis sparked a search for more viable,

stable and ethical alternatives. Debates about the future

of finance are occurring worldwide. This resulted in a

wider interest in Islamic finance also from Non-Muslim

clients.

•

Global Financial Assets of Islamic Banks in 2011: worth

$1.2 trn, observed growth of 150% over past 5 years.

Source: MEED

Islamic Finance

•

Islamic Banks in the UAE are regulated by the Central Bank of the UAE

•

Main Islamic banks in UAE:

o

Dubai Islamic Bank (DIB)

o

Emirates Islamic Bank (EIB)

o

Noor Islamic Bank (NIB)

•

Many conventional banks and financial institutions are increasingly

becoming interested in Islamic finance and investment and have opened

“Islamic Windows” offering Shariah compliant products

•

Real Estate Financing as main asset base: market recovery from 2008 finance

crash, with Emaar (main local real estate company) doubling its profits in 2012

causing Islamic Bank‘s income to increase as well

•

Islamic Insurance Companies (Takaful) also observed a profit rise starting in 2010

•

Each bank has its own Sharia Board, leading to a spectrum from conservative to

more liberal Islamic banks

•

Shariah compliant products, such as Sukuk and Murabaha have attracted public

interest and are expected to grow in volume

Outward Investments

► GCC Sovereign Wealth Funds (SWFs) count to the world’s richest

and are significant players on the international investment stage

•

In order to form a security net to protect from oil-related risk, the UAE

devotes a portion of its reserves to an SWF that invests on the global

markets in other types of assets to diversify its revenue streams.

•

List of UAE government-owned investment institutions:

–

Abu Dhabi Investment Authority (ADIA)

–

Abu Dhabi Investment Council (ADIC)

–

Mubadala Development Company (MDC)

–

International Petroleum Investment Company (IPIC)

–

Dubai World

–

Dubai International Capital (DIC)

German Banks in the UAE

► A number of German banks have set up shop in the UAE to capitalize on

corporate banking flows between the Gulf state and Europe, as well as delve

into wealth management and Shariah-banking business

•

German banks in the UAE:

o

BHF-BANK Representative Office Abu Dhabi

o

Commerzbank AG Dubai branch (DIFC)

o

Deutsche Bank AG Abu Dhabi Branch

o

Deutsche Bank AG Dubai branch (DIFC)

o

KfW IPEX-Bank GmbH Rep. Office Abu Dhabi

o

Landesbank Baden-Württemberg Representative Office Middle East (DIFC)

Trade Fairs in UAE

•

MENA Forex Show: Managed Funds and Investment Opportunities Expo and Conference, 25 –

26 April 2013, Jumeirah Emirates Towers, Dubai

•

AIM Congress: Annual Investment Meeting, 30 April – 2 May 2013, Dubai International

Convention and Exhibition Center

•

Cards & Payments Middle East, 14 – 15 May 2013, Dubai International Convention and

Exhibition Center

•

Financial Technology Summit & Meetings - Middle East, 27 – 28 May 2013, JW Marriott Marquis

Dubai

•

SIBOS 2013, 16 – 19 September 2013, DWTC, Dubai. Annual conference, exhibition and

networking event organized by SWIFT for the financial industry

•

International Conference on Business, Economics, and Financial Sciences, and Management, 22

– 23 October 2013, Crowne Plaza Hotel Dubai

Conferences and Trade Fairs

Abu Dhabi Securities Exchange

www.adx.ae

Central Bank UAE

www.centralbank.ae/en

Dubai International Financial Center

www.difc.ae

Dubai Financial Market

www.dfm.ae

Dubai Financial Services Authority

www.dfsa.ae

Emirates Securities and Commodities Authority

www.sca.gov.ae

NASDAQ Dubai

www.nasdaqdubai.com

MEED

www.meed.com

Oxford Business Group (2013): The Report Dubai 2013

Emirates NBD: Outlook for UAE Banking Sector (2011)

Selection of Sources and Publications

Wyszukiwarka

Podobne podstrony:

BANK organization przybysz, 03 banking & finance

finance glossary, 03 banking & finance

retail banking glossary, 03 banking & finance

CORPORATE BANKING glossary, 03 banking & finance

BANK organization przybysz, 03 banking & finance

A Cebenoyan Risk Management, capital structure and lending at banks Journal of banking & finance v

Islamic Finance and banking news

Check your Vocabulary for Banking and Finance

Islamic Banking A new era of financing

Financial Accounting & Banking Interview Questions and Answers

Ritter Investment Banking and Securities Insurance (Handbook of the Economics of Finance)(1)

Check Your English Vocabulary For Banking And Finance

03 2000 Revisions Overview Rev 3 1 03

Financial Institutions and Econ Nieznany

Meezan Banks Guide to Islamic Banking

więcej podobnych podstron