Kevin Campbell, University of Stirling, November 2005

1

1

2008

KOSZT I STRUKTURA

KAPITAŁU

Kevin Campbell, University of Stirling, November 2005

2

2

Cost of Capital

Cost of Capital - The return the firm’s

investors could expect to earn if they

invested in securities with comparable

degrees of risk

Capital Structure - The firm’s mix of

long term financing and equity financing

Kevin Campbell, University of Stirling, November 2005

3

3

Cost of Capital

The cost of capital represents the overall cost

of financing to the firm

The cost of capital is normally the relevant

discount rate to use in analyzing an

investment

The overall cost of capital is a weighted

average of the various sources:

•

WACC = Weighted Average Cost of Capital

•

WACC = After-tax cost x weights

Kevin Campbell, University of Stirling, November 2005

4

4

Cost of Debt

The cost of debt to the firm is the effective yield

to maturity (or interest rate) paid to its

bondholders

Since interest is tax deductible to the firm, the

actual cost of debt is less than the yield to

maturity:

•

After-tax cost of debt = yield x (1 - tax rate)

The cost of debt should also be adjusted for

flotation costs (associated with issuing new

bonds)

Kevin Campbell, University of Stirling, November 2005

5

5

with stock

with debt

EBIT

400,000

400,000

- interest expense

0

(50,000)

EBT

400,000

350,000

- taxes (34%)

(136,000) (119,000)

EAT 264,000

231,000

Example: Tax effects of

Example: Tax effects of

financing with debt

financing with debt

Now, suppose the firm pays $50,000 in

dividends to the shareholders

Kevin Campbell, University of Stirling, November 2005

6

6

with stock

with debt

EBIT

400,000

400,000

- interest expense

0

(50,000)

EBT

400,000

350,000

- taxes (34%)

(136,000) (119,000)

EAT 264,000

231,000

- dividends (50,000)

0

Retained earnings

214,000

231,000

Example: Tax effects of

Example: Tax effects of

financing with debt

financing with debt

Kevin Campbell, University of Stirling, November 2005

7

7

After-tax cost Before-tax cost Tax

of Debt of Debt

Savings

33,000 = 50,000 -

17,000

OR

33,000 = 50,000 ( 1 - .34)

Or, if we want to look at percentage costs:

-

=

Cost of Debt

Kevin Campbell, University of Stirling, November 2005

8

8

After-tax Before-tax

Marginal

% cost of % cost of x tax

Debt Debt rate

Kd = kd (1 - T)

.066 = .10 (1 - .34)

-

=

1

1

Cost of Debt

Kevin Campbell, University of Stirling, November 2005

9

9

Prescott Corporation issues a

$1,000

par,

20 year

bond paying the market

rate of

10%.

Coupons are annual.

The bond will sell for par since it pays

the market rate, but flotation costs

amount to

$50

per bond.

What is the pre-tax and after-tax cost

of debt for Prescott Corporation?

EXAMPLE: Cost of Debt

Kevin Campbell, University of Stirling, November 2005

10

10

Pre-tax cost of debt:

950 = 100(PVIFA 20, K

d

) +

1000(PVIF 20, K

d

)

using a financial calculator:

K

d

= 10.61%

After-tax cost of debt:

K

d

= K

d

(1 - T)

K

d

= .1061 (1 - .34)

K

d

= .07 = 7%

EXAMPLE: Cost of Debt

So a 10% bond

costs the firm

only 7%

(with flotation costs)

because interest

is tax deductible

Kevin Campbell, University of Stirling, November 2005

11

11

Cost of New Preferred Stock

Preferred stock:

•

has a fixed dividend (similar to debt)

•

has no maturity date

•

dividends are not tax deductible and are

expected to be perpetual or infinite

Cost of preferred stock = dividend

price -

flotation cost

Kevin Campbell, University of Stirling, November 2005

12

12

Cost of Preferred stock:

Example

Baker Corporation has preferred stock that sells for $100 per share and pays an annual

dividend of $10.50. If the flotation costs are $4 per share, what is the cost of new

preferred stock?

10.94%

.1094

4

-

$100

$10.50

K

P

Kevin Campbell, University of Stirling, November 2005

13

13

Cost of Equity:

Retained Earnings

Why is there a cost for retained

earnings?

Earnings can be reinvested or paid out

as dividends

Investors could buy other securities,

and earn a return.

Thus, there is an opportunity cost if

earnings are retained

Kevin Campbell, University of Stirling, November 2005

14

14

Cost of Equity:

Retained Earnings

Common stock equity is available through

retained earnings (R/E) or by issuing new

common stock:

•

Common equity = R/E + New common

stock

Kevin Campbell, University of Stirling, November 2005

15

15

Cost of Equity:

New Common Stock

The cost of new common stock is

higher than the cost of retained

earnings because of flotation costs

•

selling and distribution costs

(such as sales commissions) for

the new securities

Kevin Campbell, University of Stirling, November 2005

16

16

Cost of Equity

There are a number of methods

used to determine the cost of

equity

We will focus on two

Dividend growth Model

CAPM

Kevin Campbell, University of Stirling, November 2005

17

17

The Dividend Growth Model

Approach

Estimating the cost of equity: the dividend growth

model approach

According to the constant growth (Gordon) model,

D

1

P

0

=

R

E

- g

Rearranging D

1

R

E

= + g

P

0

Kevin Campbell, University of Stirling, November 2005

18

18

Example: Estimating the Dividend

Growth Rate

Percentage

Year Dividend Dollar Change Change

1990 $4.00-

-

1991

4.40$0.40 10.00%

1992

4.750.35

7.95

1993

5.250.50

10.53

1994

5.650.40

7.62

Average Growth Rate

(10.00 + 7.95 + 10.53 + 7.62)/4 = 9.025%

Kevin Campbell, University of Stirling, November 2005

19

19

Dividend Growth Model

This model has drawbacks:

Some firms concentrate on growth and do

not pay dividends at all, or only irregularly

Growth rates may also be hard to estimate

Also this model doesn’t adjust for market

risk

Therefore many financial managers prefer

the capital asset pricing model (CAPM) - or

security market line (SML) - approach for

estimating the cost of equity

Kevin Campbell, University of Stirling, November 2005

20

20

Capital Asset Pricing Model

(CAPM)

)

(

f

m

f

R

R

β

R

kj

Cost of

capital Risk-free

return

Average rate of return

on common stocks

(WIG)

Co-variance

of returns against

the portfolio

(departure from the average)

B < 1, security is safer than WIG average

B > 1, security is riskier than WIG average

Kevin Campbell, University of Stirling, November 2005

21

21

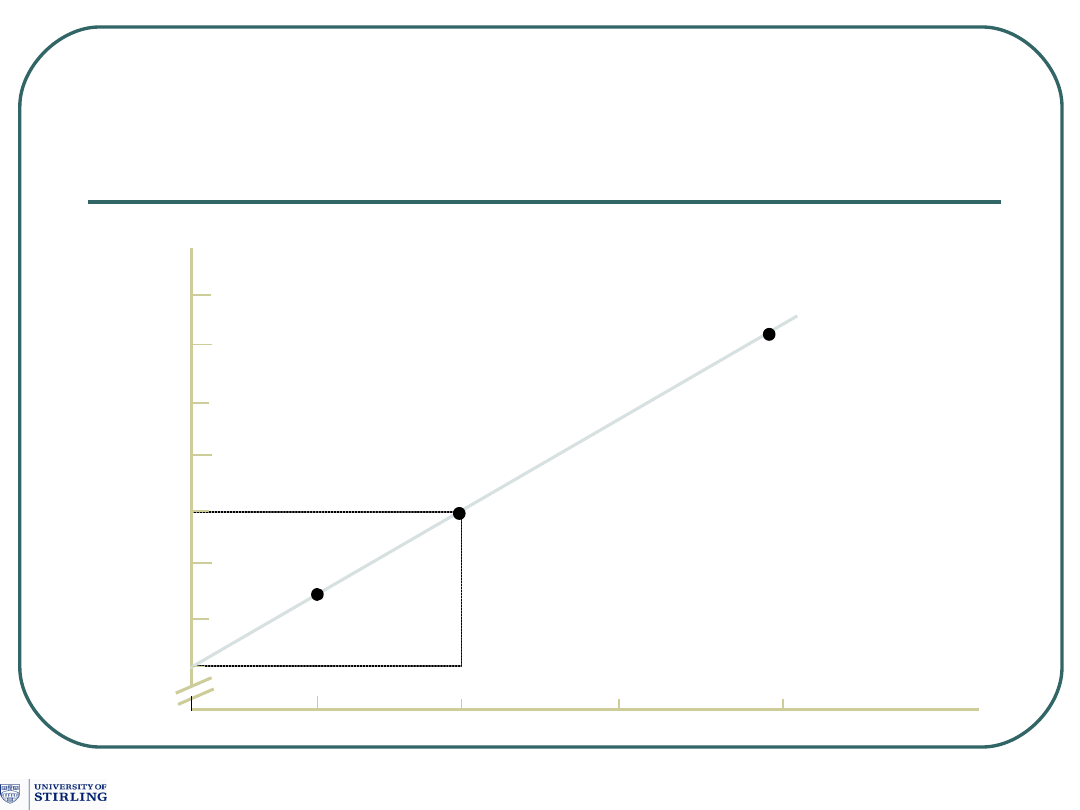

The Security Market Line (SML)

Required rate

of return

Percent

0.5

1.0

1.5

2.0

SML = R

f

+ (K

m

– R

f

)

Beta

(risk)

Market risk premium

20.

0

18.

0

16.

0

14.

0

12.

0

10.

0

8.0

5.5

R

f

Kevin Campbell, University of Stirling, November 2005

22

22

Finding the Required Return on Common

Stock using the Capital Asset Pricing

Model

The Capital Asset Pricing Model (CAPM) can be used to estimate the

required return on individual stocks. The formula:

R

K

R

K

f

m

j

f

j

where

j

K

= Required return on stock j

f

R

=

Risk-

free rate of return (usually current rate on Treasury Bill).

j

= Beta coefficient for stock j

represents risk of the stock

m

K =

Return in market as measured by some proxy portfolio (index)

Suppose that Ba

ker has the following values:

f

R

=

5.5%

j

=

1.0

m

K =

12%

.

Kevin Campbell, University of Stirling, November 2005

23

23

Finding the Required Return on Common

Stock using the Capital Asset Pricing

Model

Then, using the CAPM we would get a required

return of

12%

5.5

-

12

1.0

5.5

K

j

.

Kevin Campbell, University of Stirling, November 2005

24

24

CAPM/SML approach

Advantage: Evaluates risk, applicable

to firms that don’t pay dividends

Disadvantage: Need to estimate

•

Beta

•

the risk premium (usually based on past

data, not future projections)

•

use an appropriate risk free rate of interest

Kevin Campbell, University of Stirling, November 2005

25

25

Estimation of Beta: Measuring

Market Risk

Market Portfolio - Portfolio of all assets

in the economy

In practice a broad stock market

index, such as the WIG, is used to

represent the market

Beta - sensitivity of a stock’s return to

the return on the market portfolio

Kevin Campbell, University of Stirling, November 2005

26

26

Estimation of Beta

Theoretically, the calculation of beta is

straightforward:

Problems

1.

Betas may vary over time.

2.

The sample size may be inadequate.

3.

Betas are influenced by changing financial leverage and business risk.

Solutions

•

Problems 1 and 2 (above) can be moderated by more sophisticated

statistical techniques.

•

Problem 3 can be lessened by adjusting for changes in business and

financial risk.

•

Look at average beta estimates of comparable firms in the industry.

2

)

(

)

,

(

M

iM

M

M

i

σ

σ

R

Var

R

R

Cov

β

Kevin Campbell, University of Stirling, November 2005

27

27

Stability of Beta

Most analysts argue that betas are

generally stable for firms remaining in

the same industry

That’s not to say that a firm’s beta can’t

change

•

Changes in product line

•

Changes in technology

•

Deregulation

•

Changes in financial leverage

Kevin Campbell, University of Stirling, November 2005

28

28

What is the appropriate risk-

free rate?

Use the yield on a long-term bond if you are

analyzing cash flows from a long-term investment

For short-term investments, it is entirely

appropriate to use the yield on short-term

government securities

Use the nominal risk-free rate if you discount

nominal cash flows and real risk-free rate if you

discount real cash flows

Kevin Campbell, University of Stirling, November 2005

29

29

Survey evidence: What do you

use for the risk-free rate?

Corporations

Financial Advisors

90-day T-bill (4%)

90-day T-bill (10%)

3-7 year Treasuries (7%)

5-10 year Treasuries (10%)

10-year Treasuries (33%)

10-30 year Treasuries (30%)

20-year Treasuries (4%)

30-year Treasuries (40%)

10-30 year Treasuries (33%)

N/A (10%)

10-years or 90-day; depends

(4%)

N/A (15%)

Source: Bruner et. al. (1998)

Kevin Campbell, University of Stirling, November 2005

30

30

Weighted Average Cost of Capital

(WACC)

WACC weights the cost of equity and the

cost of debt by the percentage of each

used in a firm’s capital structure

WACC=(E/ V) x R

E

+ (D/ V) x R

D

x (1-T

C

)

•

(E/V)= Equity % of total value

•

(D/V)=Debt % of total value

•

(1-Tc)=After-tax % or reciprocal of corp tax rate

Tc. The after-tax rate must be considered

because interest on corporate debt is deductible

Kevin Campbell, University of Stirling, November 2005

31

31

WACC Illustration

ABC Corp has 1.4 million shares common valued at

$20 per share =$28 million. Debt has face value of

$5 million and trades at 93% of face ($4.65 million)

in the market. Total market value of both equity +

debt thus =$32.65 million. Equity % = .8576 and

Debt % = .1424

Risk free rate is 4%, risk premium=7% and ABC’s

β=.74

Return on equity per SML : R

E

= 4% + (7% x .

74)=9.18%

Tax rate is 40%

Current yield on market debt is 11%

Kevin Campbell, University of Stirling, November 2005

32

32

WACC Illustration

WACC = (E/V) x R

E

+ (D/V) x R

D

x (1-Tc)

= .8576 x .0918 + (.1424 x .11 x .60)

= .088126 or 8.81%

Kevin Campbell, University of Stirling, November 2005

33

33

Final notes on WACC

WACC should be based on market rates and

valuation, not on book values of debt or

equity

Book values may not reflect the current

marketplace

WACC will reflect what a firm needs to earn

on a new investment. But the new

investment should also reflect a risk level

similar to the firm’s Beta used to calculate

the firm’s R

E

.

•

In the case of ABC Co., the relatively low WACC of

8.81% reflects ABC’s β=.74. A riskier investment

should reflect a higher interest rate.

Kevin Campbell, University of Stirling, November 2005

34

34

Final notes on WACC

The WACC is not constant

It changes in accordance with the

risk of the company and with the

floatation costs of new capital

Kevin Campbell, University of Stirling, November 2005

35

35

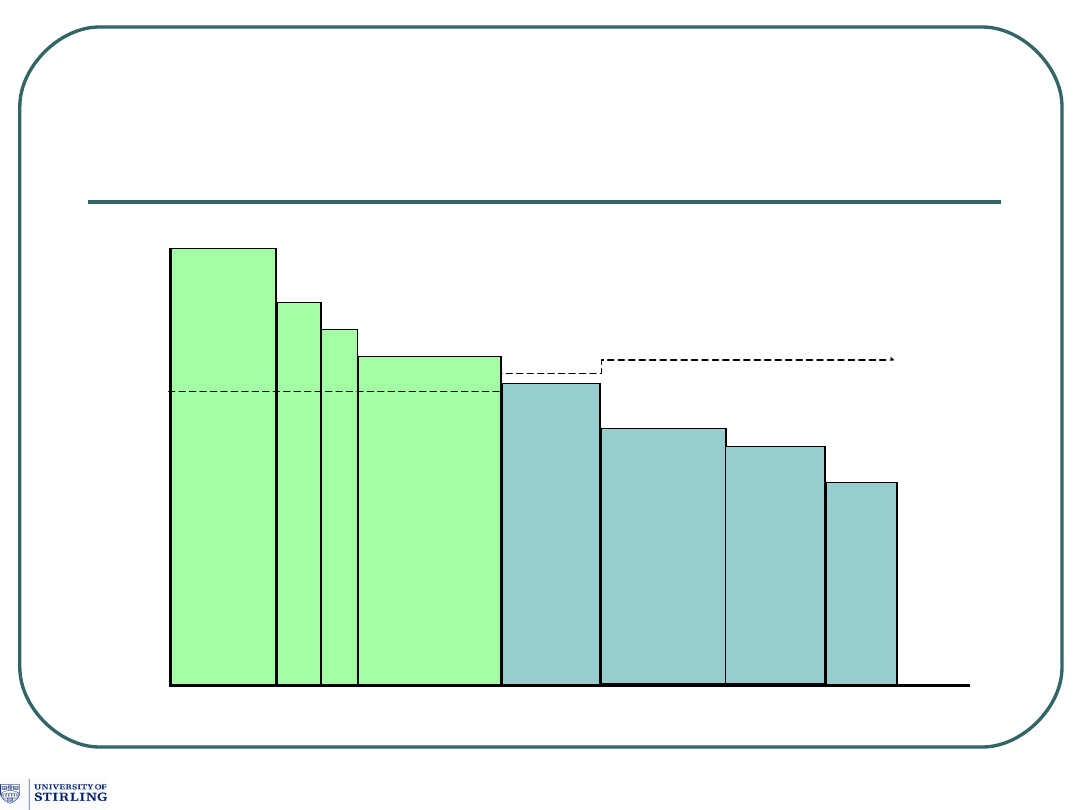

Marginal cost of capital and

investment projects

16.0

14.0

12.0

10.0

8.0

6.0

4.0

2.0

0.0

Percen

t

10 15

19

50

39

Amount of capital ($

millions)

11.23

%

70

85

95

Margin

al cost

of

capital

K

mc

A

B

C

D

E

F

G

H

10.77

%

10.41

%

-

-

-

-

-

-

-

-

-

Kevin Campbell, University of Stirling, November 2005

36

36

The End ….

KAPITAŁ - bogactwo zebrane uprzednio w celu podjęcia dalszej produkcji

(F. Quesnay, XVIII)

wszelki wynik procesu produkcyjnego, który przeznaczony jest do

późniejszego wykorzystania w procesie produkcyjnym (MCKenzzie,

Nardelli,1991)

całokształt zaangażowanych w przedsiębiorstwie wewnętrznych i

zewnętrznych, własnych i obcych, terminowych i nieterminowych

zasobów (bilans)

STRUKTURA KAPITAŁU

proporcja udziału kapitału własnego i obcego w finansowaniu działalności

przedsiębiorstwa

relacja wartości zadłużenia długoterminowego do kapitałów własnych

przedsiębiorstwa

struktura finansowania – struktura kapitału = zobowiązania

bieżące

ramy statycznego kompromisu, w którym przedsiębiorstwo ustala

docelową wielkość wskaźnika zadłużenia i stopniowo zbliża się do jego

osiągnięcia.

Document Outline

- Slide 1

- Slide 2

- Slide 3

- Slide 4

- Slide 5

- Slide 6

- Slide 7

- Slide 8

- Slide 9

- Slide 10

- Slide 11

- Slide 12

- Slide 13

- Slide 14

- Slide 15

- Slide 16

- Slide 17

- Slide 18

- Slide 19

- Slide 20

- Slide 21

- Slide 22

- Slide 23

- Slide 24

- Slide 25

- Slide 26

- Slide 27

- Slide 28

- Slide 29

- Slide 30

- Slide 31

- Slide 32

- Slide 33

- Slide 34

- Slide 35

- Slide 36

Wyszukiwarka

Podobne podstrony:

195 KC Cost of capital lecture kiskid 18505 ppt

197 Capital structure lecture Gdansk 2006 Lecture 2id 18521 ppt

12 Intro to origins of lg LECTURE2014

DV8 Physical Theatre the cost of living, STUDIA Pedagogika resocjalizacyjna

12 Intro to origins of lg LECTURE2014

Cost of living London

Max Weber Protestantism and The Spirit of Capitalism

[Форекс] The Cost of Technical Trading Rules in the Forex Market

w sapx363 Managing the Total Cost of Ownership of Business Intelligence

M Euwe Course of chess lectures, Strategy and tactic (RUS, 1936) 2(1)

Reactions of alkenes lecture1

A cost of function analysis of shigellosis in Thailand

The Cost of Doing Business Leslie What

the opportunity cost of social relations on the effectiveness of small worlds

Alfred North Whitehead The Aim of Philosophy (from Modes of Thought , Lecture IX) 1956

Weber Max Protestantism and the Rise of Capitalism(1)

The Real Cost of a Virus Outbreak

Xu, Labute Fundamentals of ODE (Lecture notes, 1997)(153s) MCde

więcej podobnych podstron