PortfolioWealthGlobal.com

2

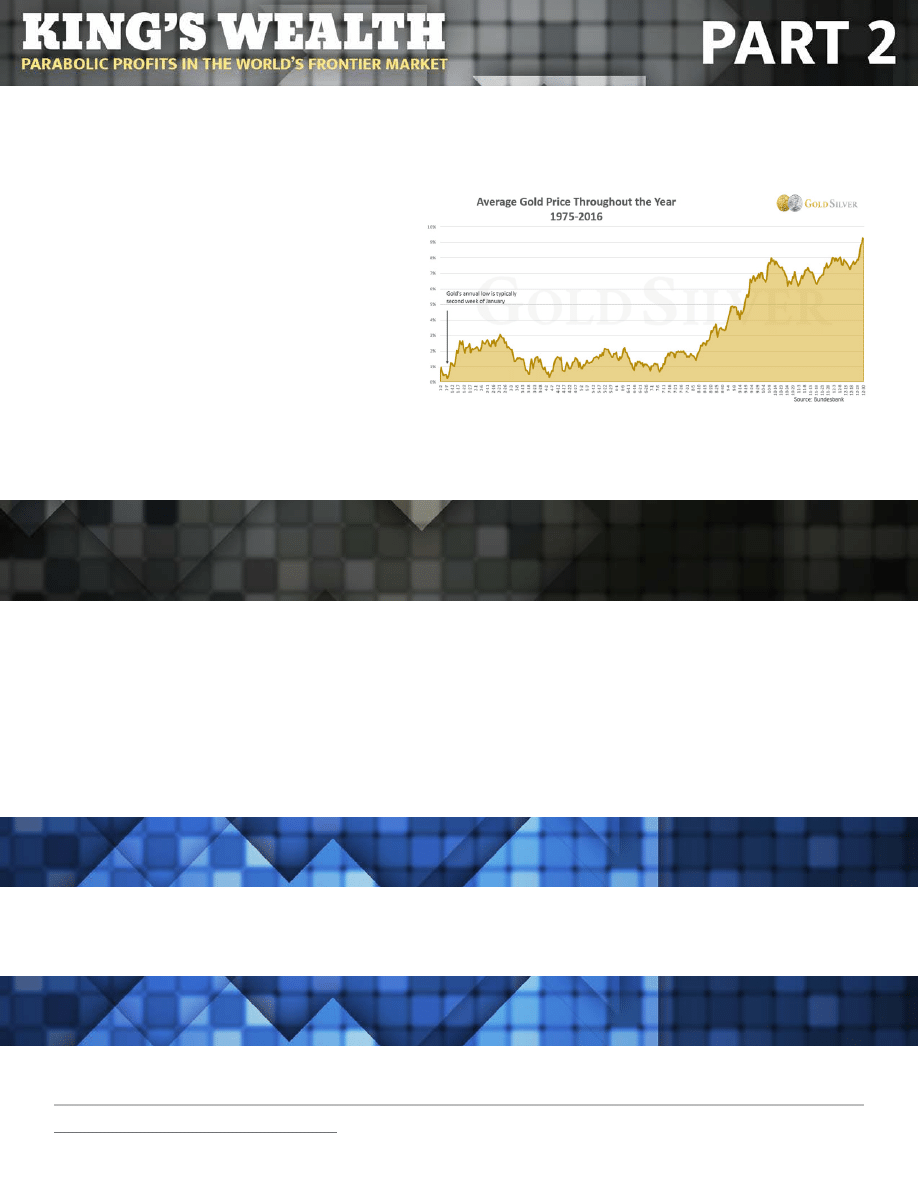

At the beginning of this year, I released my personal asset allocation model and showed that the cheapest period to

accumulate physical gold and silver (in order to own a safe haven asset and the ultimate form of money) is in January.

Gold traded for $1,158.46 and silver was $16.26.

It looks very much like the

script we laid out on the first

trading day of the year is

playing out precisely as we

anticipated, and it’s now time

to get aggressive with gold and

silver stocks.

In Part 1 of our King’s Wealth: The Complete

Gold and Silver Stocks Playbook, we focused on

the various types of conventional stages of the resource cycle. In Part 2, we will emphasize the nucleus of investing:

subjects of vetting, advanced business models, and ideal timing.

The playbook for researching resource companies is comprised of 7 subjects, and the higher they rank, the

better chance this company will be a winner for you.

It’s entirely up to you to set your Bar of Vetting, which means you need to decide what grade is considered

“vetted” for your portfolio and sufficient enough for you to commit funds to it – Portfolio Wealth global only

vets 9s or 10s.

Companies that rank below that remain in our basket of stocks to be reviewed in 3 months, but we do ask the

management to keep us posted of changes and progress in these key areas of importance.

By far, the most critical of all measures of worth are the people behind the company. Though it’s quite impossible to

quantify a given price tag to a person, what you can do is look at previous accomplishments and create an ROI for that

individual.

Once you vet the people associated with the business, switch to looking at the properties.

SUBJECTS TO VETTING

BIG BOYS AND INSIDERS

PROJECTS AND ASSETS

PortfolioWealthGlobal.com

3

Here, what you are assessing are two things:

1. Exploration Stage:

Were there significant discoveries nearby? Why has the company decided to explore here,

specifically?

2. Mining Stage:

What are the costs and how simple is it to expand the resource base and increase margins?

Compare it to other miners – look at the advantages vs. the disadvantages.

Remember that when you own an exploration, development, or permitting-stage company, you own a share of a

company that will hopefully one day stop wasting your money and begin to return your principal and make you

profits.

This is speculation; therefore you look at how indebted the company is. Researching the short-term

and long-term debts, other promises to creditors, and their cash position and burn rate is essential.

This is also important because if you like the company, it’s a chance to approach management and bring up the

option of personally participating in the next financing round.

Some companies are financed with endless dilution of shares. This means that they keep issuing new ones to fund

operations, and you own less and less of the growth, without even taking notice of it.

Two subjects of vetting are:

1. Insider Ownership:

Make sure you are in the same boat as the people who made this company happen. See

that they have not only their reputation at stake, but their livelihood. Look at how many shares they are selling –

insiders will always free up and unload shares, but the quantities matter.

2. Financing Price:

This is vitally important. You need to look at what the accredited investors -- professional

investors who get offered tons of financing deals daily -- have agreed to pay.

If you can take advantage of market volatility and purchase your own shares at cheaper

prices, it’s a huge advantage to you, as you know the selling pressure is low to virtually non-

existent.

FINANCING AND BALANCE SHEET

SHARE STRUCTURE AND DILUTION STRATEGIES

PortfolioWealthGlobal.com

4

This is an important subject that too many companies completely overlook to their peril.

There are thousands of venture stocks, and if you are not, as a matter of management policy, putting your brand out

there, you are failing your shareholders.

Remember that as shareholders of mining companies, we don’t get to enjoy dividends with

99.3% of them, so our only exit strategy is to buy low and sell high.

In order to achieve that, the company must celebrate progress, issue timely news releases, and make sure it stands

out.

That helps the share price rise and creates a loyal shareholder base, which decreases volatility.

I’ve personally been involved in deals where the managements’ connections to local officials smoothed out

many obstacles and expedited many procedures.

It’s a thing of beauty, and it certainly has a positive effect on share prices since it surprises the market.

Also, having millions of dollars invested in safe areas where you have higher certainty that the government is mining-

friendly is a serious subject of vetting.

This is a field of research that Portfolio Wealth Global pioneered. My partners and I showed this to industry

veterans, fund managers, and institutional billionaires, and we were shocked to see that although they agreed

with this method of analysis, many of them never used it as a system.

Since we only have one exit strategy, to sell higher than we bought, we must build a 2-5 year roadmap of the

coming milestones for the company (potentially).

We can then judge and evaluate progress – this also helps to determine what the share price would likely be by

looking at what similar milestones achieved by peer companies did to their share price.

AWARENESS AND MARKETING

ROADMAP OF SHORT & LONG TERM CATALYSTS

POLITICAL JURISDICTION AND

GOVERNMENTAL FRIENDLINIESS

PortfolioWealthGlobal.com

5

In his autobiographic book, President Trump says plain and simple that he lost everything because he stopped asking

one question:

“What’s the worst case scenario?”

At all the mining interviews I’ve attended over the past 3 years, when asked what the basic and the most fundamental

subject of vetting is, without a moment of hesitation, I say to evaluate the risks and where things can start to go

wrong, and see how severe it can get.

This type of thought process is the one that bursts any illusions you might have and brings you back to reality.

Always do it!

In Part 1, I wanted to bring you into the world of the typical resource life cycle, but now, I’d like to go hardcore and

show you 3 innovative and groundbreaking business models that are applied by some of the smartest people in

natural resources.

The more you become astute at investing in the coming years, the more you will diversify your portfolio and

combine both the explosiveness of exploration and the leverage of operational miners with the safety, finesse,

and elegance of these 3 business models:

1. Prospect Generators:

A project generator maintains a portfolio of multiple projects and funds major exploration

work by creating joint venture partnerships with other companies.

They acquire prospects they deem to have significant mineral potential and option them

to a partner, generally a mid-tier or major mining company.

In exchange for a majority share of the project, the partner agrees to spend a certain dollar amount (generally in

the millions of dollars) towards progressing the project forward.

This model enables the project generator to de-risk mineral exploration by accessing capital from partner

companies to fund the high-risk and expensive drilling phases of exploration.

2. Royalty and Streaming:

A metal stream is an agreement that provides, in exchange for an upfront deposit

payment, the right to purchase all (or a portion) of one or more of the precious metals produced from a mine at a

price determined for the life of the transaction by the purchase agreement.

Metal stream acquisitions are often larger in size than royalty acquisitions, have more flexibility in the negotiation

of terms and conditions, and generally provide both parties with tax advantages.

A royalty is the right to receive a percentage or other denomination of mineral production from a mining

operation.

RISKS AND POTENTIAL MISTAKES

ADVANCED BUSINESS MODELS

PortfolioWealthGlobal.com

6

3. Optionality and Sophisticated Hoarding:

After my team at Portfolio Wealth Global looked at over 753

companies in the last 18 months, I have become convinced that the powerbrokers -- those individuals that are

always on the cutting-edge of natural resources and are pushing the envelope -- have become addicted to this

business model.

Hoarding is simply buying resources in the ground and holding them, rather than mining or extracting

them. Companies that do this are known as “hoarders.”

These get many of the positives of owning the resources in a mine, but without the negatives associated with

mining. That is the benefit of building such a company.

Hoarders accumulate mines and undeveloped resource deposits, and they basically just sit on them. Because

they don’t operate mines, they don’t have the huge capital costs and risks of traditional mining companies.

Their share price is simply a leveraged play on the price of the underlying resource. When prices rise, the

value of the company’s deposits increases as well.

Hoarders buy the successful efforts of prior explorers – where the deposits weren’t profitable at the then-

prevailing prices – often for pennies on the dollar.

This section is where all the pieces of the puzzle come together and either generate a buying opportunity or a

“Watch List” option.

This is also where disciplined investors choose to make more “no” decisions than “yes” ones.

In fact, if you’re truly strict and educated, you’ll make no more than 10-15 trades annually.

Resource stocks represent your partial ownership of a business, and those that make you money should be the ones

you religiously own again and again.

Investing is not an adventure done for the heck of it – it’s a means of gaining substantial wealth. Treat it that way.

If you’re on the top levels of self-restraint, you’ll most likely decide to

trade in and out of the same proven stocks.

IDEAL TIMING

PortfolioWealthGlobal.com

7

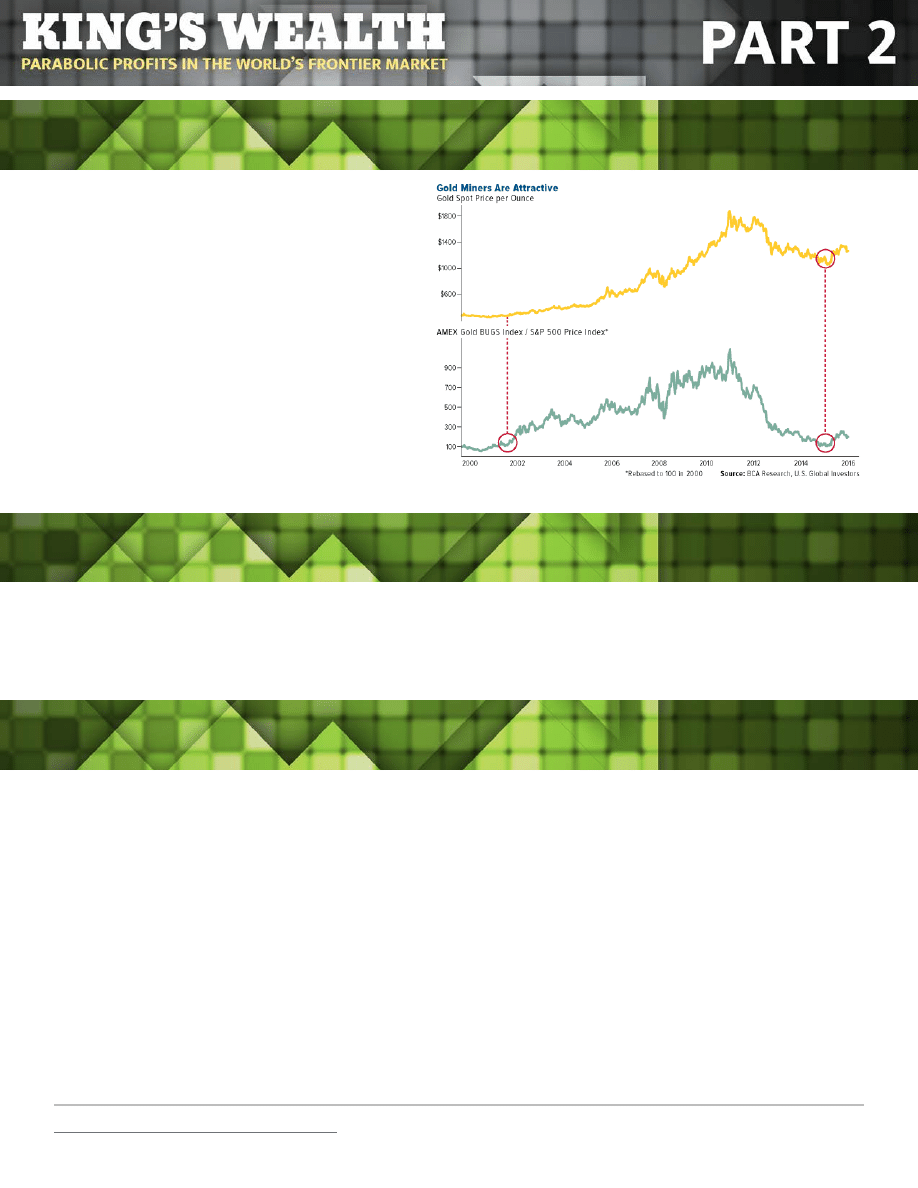

This is obviously a tell-tale sign that mining shares

are about to make a move higher.

The metal prices are highly correlated with rising

share prices.

At the end of each quarter, we can get a clear view of

which companies have been effective and efficient.

This creates an element of surprise when

companies sustain high profit margins and

improve upon them.

I love these because they create a huge payday!

Your patience and your strategy all boil down to this type of event, and owning shares of companies that make

for likely takeover candidates is smart!

This is an event that is incredible to be a part of!

The reason why it’s a sheer volume generator and a pivotal point of entry for locking a position is

that it

changes a company forever.

An acquisition of a solid property makes your shares worth more, and the beauty about this is that it takes a few

weeks for the market to appreciate this, so shares usually rise for a number of weeks. This depends, of course, on

metrics like whether or not the acquisition is in line with the company’s overall strategy and their marketing and

awareness campaigns.

PHYSICAL BULLION PRICING RISING

TAKEOVER RUMORS, BIDS, AND AGREEMENTS

ACQUISITION OF PROJECTS

PortfolioWealthGlobal.com

8

This is an important timing factor.

Some of these companies take a long time to get recognized. Being early is a huge component to success.

Another sharp and insightful way of getting involved with under-the-radar trades is to buy shares of companies

that have a name change or a ticker change.

Under-the-radar trades don’t come around often, so pay attention to them when they do.

Disclaimer

This work is based on SEC filings, current events, interviews, corporate press releases and what we’ve learned as financial journalists. It may

contain errors and you shouldn’t make any investment decision based solely on what you read here. It’s your money and your responsibility. The

information herein is not intended to be personal legal or investment advice and may not be appropriate or applicable for all readers. If person-

al advice is needed, the services of a qualified legal, investment or tax professional should be sought.

Please read our full disclaimer at

PortfolioWealthGlobal.com/disclaimer

IPO’S AND UNDER-THE-RADAR TRADES

Wyszukiwarka

Podobne podstrony:

Kings Wealth Part1 Parabolic Profits in the Worlds Frontier Market portfoliowealthglobal com TomBeck

Aftershock Protect Yourself and Profit in the Next Global Financial Meltdown

Aftershock Protect Yourself and Profit in the Next Global Financial Meltdown

15th Lecture Extra Profit In The Blinds

Lasenby et al 2 spinors, Twistors & Supersymm in the Spacetime Algebra (1992) [sharethefiles com]

S M Stirling Lords of Creation 02 In the Courts of the Crimson Kings

Being Warren Buffett [A Classroom Simulation of Risk And Wealth When Investing In The Stock Market]

Gardeła, Entangled Worlds Archaeologies of Ambivalence in the Viking Age

Halldórsson Danish Kings and the Jomsvikings in the Greatest Saga of Óláfr Tryggvason

James Axler Outlander 21 Devil in the Moon The Dragon Kings, Book 1

Mettern S P Rome and the Enemy Imperial Strategy in the Principate

Early Variscan magmatism in the Western Carpathians

Applications and opportunities for ultrasound assisted extraction in the food industry — A review

In the end!

Cell surface in the interaction Nieznany

Post feeding larval behaviour in the blowfle Calliphora vicinaEffects on post mortem interval estima

Multiple Intelligences in the Elementary Classroom

Fascia in the Lateral Upper Arm tapeSP

A Guide to the Law and Courts in the Empire

więcej podobnych podstron