PortfolioWealthGlobal.com

2

It usually requires great pain and hitting a major stumbling block for

a person to radically change his ways and seek out refined knowledge,

above and beyond what he now sees as true.

This is mostly how anything in the affairs of humans gets accomplished. We hit a wall and find another way.

Nature’s way of showing us that a better path exists is through pain and failure. The greatest benefit of defeat

is that if you are disciplined enough to recognize the cause of your struggle, you’ll search for an equivalent

benefit – a lesson, a conclusion, a new course of action that is preferred to your losing one.

Its purpose is to provide you with actionable advice – what I would ask of you, had our roles been reversed.

Delve into this, and you’ll be fortified with a toolkit to take full advantage of for the rest of your life.

This is Part 1 of the King’s Wealth: The Complete Gold and Silver Stocks Playbook, and you

should find Portfolio Wealth Global’s Part 2 in this same email.

Many of the best investors of our times repeatedly read the same books, as you change and absorb another nugget

of data each time – please go back to this report in the same exact manner – to absorb the winning disciplines.

Ray Dalio is the CEO of Bridgewater Associates, the largest hedge fund ever, by a wide margin from 2nd place.

His wisdom is the result of what I term “Calculated Trial and Error.”

Studying his achievements, I learned that starting from the kitchen of his apartment in NYC in the early ‘70s, he

began placing “bets,” or trades he had perceived would be profitable, but he took one additional step. He began

tracing his mistakes, learning from them and back-testing his conclusions – nowadays, his computers can run

simulations going back decades, and even centuries.

THIS EXCLUSIVE REPORT SHOULD SERVE AS A PLAYBOOK FOR

YOU FROM HERE ON OUT.

CALCULATED TRIAL & ERROR

PortfolioWealthGlobal.com

3

That’s how he was able to avoid repeating many costly mistakes, and it’s the reason why he pioneered many of today’s

best risk vs. reward strategies.

Retaining knowledge is the key to progress – it is the means by which each of us can learn

from others and leverage everyone’s past efforts to our present advantage. In our free market

enterprise system, most, like Dalio, choose to retain the precious lessons they’ve learned, and

this becomes their competitive advantage.

Others write books or allow other authors to write books about them, granting them interviews and appearing in

conferences and lectures before younger generations, thus allowing others to capture some of their insights. Ray

Dalio belongs to this respectable camp.

It is impossible, useless, and hopeless to become an expert on many subjects. That lesson has been reaffirmed

countless times, including by the legendary Henry Ford, who was firmly convinced that the correct road to

riches isn’t to attain personal knowledge, which is limited by nature due to the constraints of time, but instead,

it is your ability to gain access to specialized knowledge that matters most. That’s probably how Ford, a 6th-

grade dropout, became the biggest industrialist of all time, and for a number of years, the richest man in the

world.

Warren Buffett, a man who has basically devoted his life to the sole mission of building a conglomerate and whose

Berkshire Hathaway owns more than 75 private and public businesses, has, from the age of 11, sacrificed all else

(including his own marriage) for the thrill of investing. It consumed him. Now, getting close to the age of 87, he sits in

his modest office for 8 hours a day, reading 5 newspapers, financial reports, and speaking to CEOs and his long-time

partner, Charlie Munger.

Devoting close to 175,000 hours to investments, his sole expertise is insurance.

Warren can look at any insurance company in the world and figure out, in a matter of 30 minutes, better than

anyone else, what the company’s intrinsic value is.

I studied his exact valuation methodology, tracking all his insurance acquisitions, and invested in 2 insurance

stocks 3 years ago.

Both have outperformed the S&P 500 and the insurance sector, as a whole, by a wide margin, and they offer

fatter dividends.

We will be publishing a new insurance stock suggestion to our Wealth Stocks Division this coming May. All previous

suggestions have crushed the S&P 500 so far.

Over the long-term, the average investor doesn’t stand a chance against Warren, so why should he even try?

Instead, he can enjoy Warren’s wisdom, or that of any other expert, by becoming his partner!

The stock market allows you, effortlessly, and without wining and dining anyone, to become

their partner – no convincing is required at all. It is the magic of the open market.

PortfolioWealthGlobal.com

4

The point is that one can only specialize in 1-2 skills at a genuinely competitive level, but he can seek out countless

experts in fields outside his own circle of competence and gain from their efforts – that is leverage when

implemented wisely.

It’s the reason behind the motto I’ve coined for my own ventures:

China is the best example of this. It was an all-powerful empire 700 years ago. It possessed knowledge, tools, skills,

methods, and wisdom that the Europeans only attained 400-500 years later. China was so rich and powerful that its

leaders wanted to find a way to preserve their country’s fortune, but the Caesars of the Ming dynasty took the worst

course of action towards building a thriving economy.

In order to stay on top, they deduced that their advanced capabilities should be kept within their national borders

and made all contact to the outside world forbidden and restricted.

Information didn’t flow freely -- or even at cost -- in and out, and so it died with the people who mastered it.

Information wasn’t written down or passed on. That was a huge mistake, as by the 20th century, China was

ranked as one of the poorest nations in the world.

After learning these lessons and completing careful research into the mechanisms of the fiat monetary system, my

partners and I decided to launch Portfolio Wealth Global on the premise of publishing our own highest-conviction

ideas.

Our strategy is to avoid mistakes committed by others in the past at all costs and to build

relationships with the most accomplished and proven experts – those whose track records,

and not their mouths, speak for them. We chose to focus on the most ballistic sectors: mining,

cutting-edge technologies, and cannabis legalization.

Small-cap investing requires becoming an expert of people, more than anything else. It will take you forever to

become a master of geology, raising funds, structuring a shell company correctly, staking out assets, negotiating,

motivating a team, attracting quality management, and learning countless other skills needed to make a fortune in

mining.

That’s the reason why we publish our highest-conviction stock suggestions, and it’s why we have our track

record of partnering with companies that outperform their entire sector over the long-term.

BECOMING AN EXPERT AT FINDING EXPERTS

The alternate route is to cut this unreasonable task into a workable investment plan

by narrowing down your lens to studying existing leaders – the top dogs.

PortfolioWealthGlobal.com

5

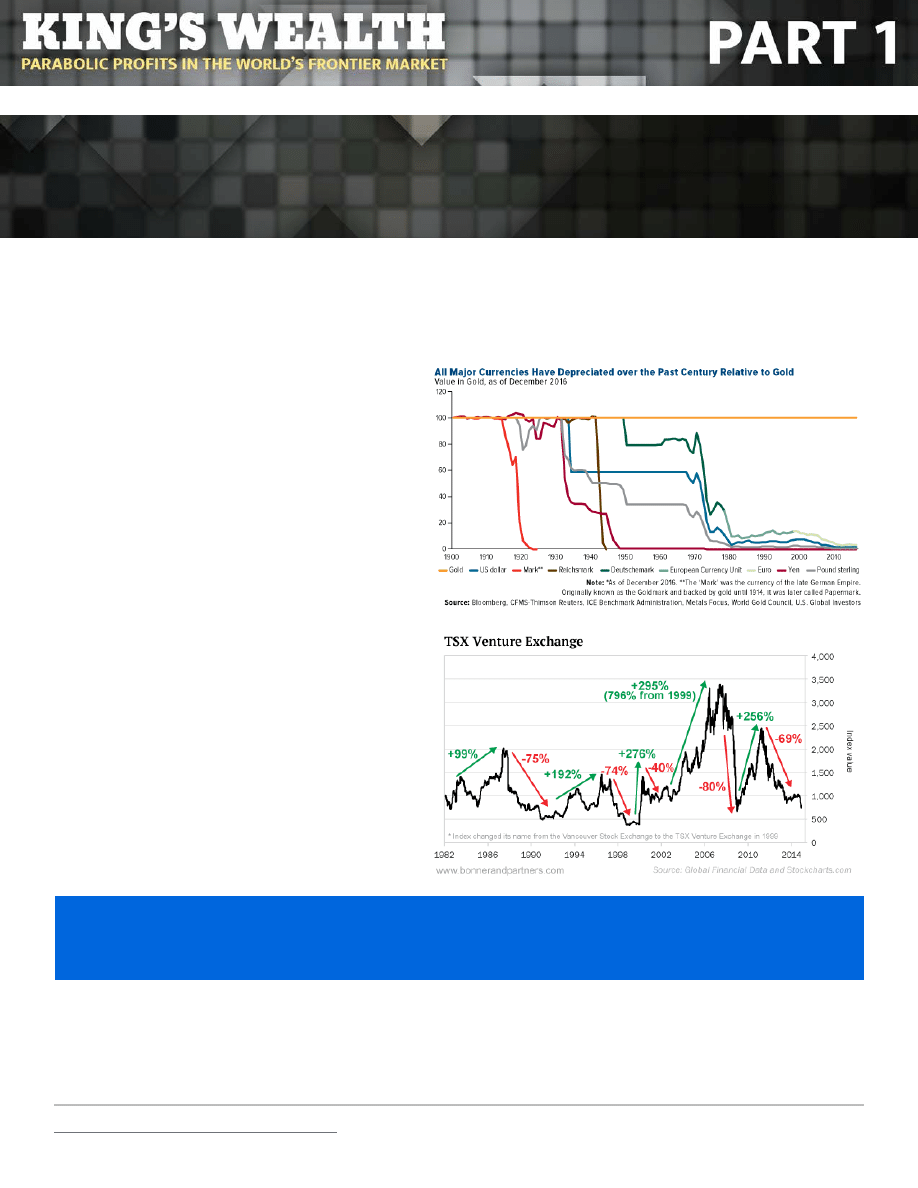

The most important factor driving gold and silver stocks up and down is the fact that national

currencies are not backed by gold. This means that, in nominal terms, the price of gold (as

measured by dollars, euros, pounds, yens, and all other currencies) floats and changes every

second.

In terms of purchasing power, holding gold over

currencies has absolutely been the best option,

but the nominal price has changed constantly

since 1971.

This has major implications. Unlike during the gold

standard days, when miners could easily figure out

the value of their precious metal assets, today’s

miners see the price of their assets fluctuate

immensely, and these swings turn the table between

profitability and losses.

This process is outside the realm of their control,

therefore the boom and bust cycles have become

much more volatile than ever before.

Here’s how you should look at this. In the 1940s, the

price of one ounce of gold was $35, so the company

mining it could simply sum up the costs of their

operations and figure out its profitability. Investors

could also easily evaluate the value of the mine.

THE GOLD & SILVER STOCKS BACKGROUND

1971-2017

Today, the value changes daily, as the bottom line is affected by market players and,

many say, by rigging the price of precious metals.

PortfolioWealthGlobal.com

6

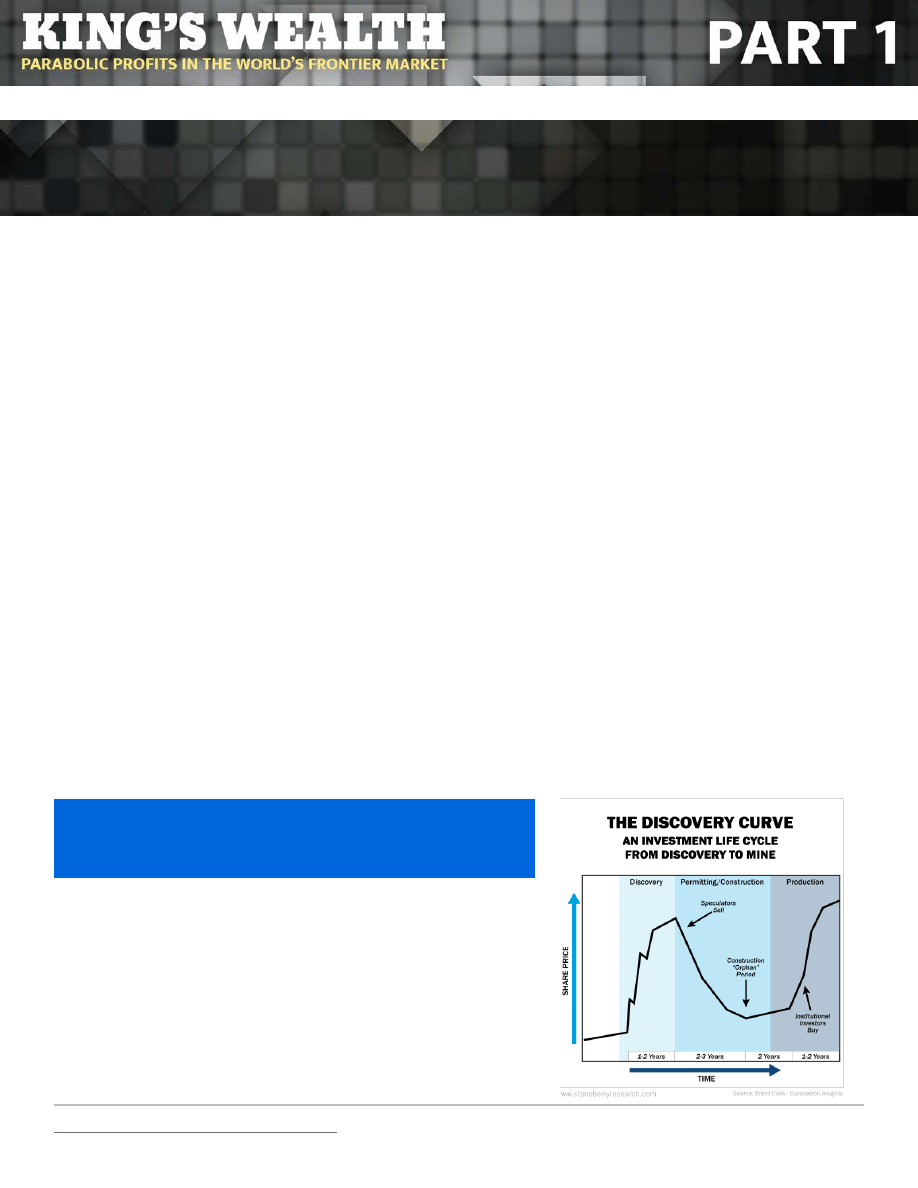

In Part 1, we will boil down the various stages in the lifecycle of a typical mining company, and

in Part 2, we will cover how to analyze and research methodically and scientifically, as well as

the timing factor behind buying right and advanced strategies that we ought to constantly be

utilizing.

There’s no logic in doing something that isn’t battle-tested – there’s only logic in sticking with what brings repeated

and predictable results.

The typical lifecycle of a mine consists of 6 key stages:

1. Generative exploration.

2. Primary exploration.

3. Evaluation.

4. Mine development.

5. Mine production.

6. Mine closure and rehabilitation.

Before these 6 stages even gain traction, the company must initially be incorporated. This is a critical part

where the forming crew has the idea to pursue a certain business model.

Portfolio Wealth Global always looks at the preliminary vision of the dealmakers to see whether or not their initial

plan is panning out.

When we speak with management teams, the 1st question we ask

is, “What’s your plan, and who are the executors of it?”

Here are the various typical stages:

1. Generative exploration

is a desktop study with minimal field work.

Geologists probe public and private geophysical data, such as

seismic activity, magnetics, satellite images, and contour maps for

potential targets.

TYPES OF MINING COMPANIES

Be very cautious with under-deliverers and

those who over-promise.

PortfolioWealthGlobal.com

7

Field mapping, prospecting, and sampling programs are then conducted on promising targets.

What to watch:

At this point, the most important thing to watch is the caliber and quality of the geologists involved – you want

professionals who are committed to a conservative point of view and the facts, as opposed to dreamers, who will

come to overly ambitious conclusions and will lose us money.

Government connections are important to verify if the data available is trustworthy as well. Lastly, it’s

important to see if the bureaucratic paperwork is easy to deal with and make sure that government officials

aren’t spreading the word about this deal because our costs will begin to rise immediately.

2. Primary exploration

involves drilling out the target location to delineate likely zones of mineralization. Drill

cuttings will be sent to the laboratory to assay for geochemical analysis. The main aim is to broadly define the

limits of the mineral deposit.

What to watch:

First, we want the funding rounds to be done with as little dilution as possible. The more creditworthy the

insiders are, the more the financial backers (friends, family, institutions and accredited investors) will be willing to

bring to the table for more reasonable terms.

This is simple to understand: if the people behind the deal have made money for shareholders before, they

get to dictate terms and keep the debt load, dilution, and terms in everyone’s favor.

3. Once a

mineral deposit is identified

, evaluation begins with a scoping study and ends with a feasibility study, on

which a final investment decision is usually made.

The evaluation stage is often lengthy for large mining projects. Not too long ago, a reputable company

commenced a scoping study for their gold project located in Papua New Guinea in 2009, and it has only recently

progressed to final feasibility in 2015! If all goes to plan, production is estimated to begin in 2020.

Scoping studies are typically the first broad economic evaluation of a project, and they aim to highlight any

technical issues that will require specific attention in the upcoming studies.

Pre-feasibility and feasibility studies are comprehensive studies that consider the technical and economic

viability of a mining project, including the mine design, production schedule, operating costs, processing

plant design and performance, and expenses.

A Chinese company recently demonstrated how quickly things can change between the feasibility and production

stages. Their project, located in western Australia, had an initial budget of $2.5 billion but was completed at a cost

of $10 billion and was three years late!

What to watch:

This stage tires and bores most investors. What you want, ideally, is either to avoid owning shares if you were part

of ownership during exploration and discovery, or buy when shares are truly depressed, because once rumors of

upcoming production hit the market, the stock will begin moving higher.

Sell your position on high volume days during the discovery cycle.

PortfolioWealthGlobal.com

8

4. Development

of the project begins after the necessary regulatory permits and licensing have been obtained. This

involves the construction of the infrastructure required for a fully operational mine. Critical components include

site access and services, mining production, and crushing facilities and ore handling facilities.

What to watch:

Similar to the evaluation phase, this part is lengthy and offers no upside potential. Be a buyer on dips here when

everyone else throws in the towel. I’ve done that numerous times (even on the same stock) and doubled my

money in months during the 2009-2011 market roars.

Make sure the project manager is an expert. So many things can make this project go over the budget – have

you ever seen a builder on a residential property finish the work on time and within the budget? Rarely!

5. Production

processes vary significantly depending on each individual mine, but they typically involve controlled

blasting, hauling, crushing, and processing of the mineral ore. The final product is then transported off-site.

What to watch:

Here, what matters are the bottom line margins, and I also want to make sure my profits are used to either pay

out a dividend or acquire more juicy projects.

I also want the mine manager to be the absolute best.

6. Mine closure

and

rehabilitation

aim to return the land to a state similar to that before mining commenced. This

stage can be extremely costly, depending on the extent of environmental damage and remediation required.

What to watch:

This is where we must leave a good impression as a company so this country appreciates our business

practices.

In Part 2, I will show you the 3 unconventional mining business models.

Part 2 will also include the initial 7 areas of analysis to examine before even devoting a second to calling the company

or diving into the financial statements.

Disclaimer

This work is based on SEC filings, current events, interviews, corporate press releases and what we’ve learned as financial journalists. It may

contain errors and you shouldn’t make any investment decision based solely on what you read here. It’s your money and your responsibility. The

information herein is not intended to be personal legal or investment advice and may not be appropriate or applicable for all readers. If person-

al advice is needed, the services of a qualified legal, investment or tax professional should be sought.

Please read our full disclaimer at

PortfolioWealthGlobal/disclaimer

Gold and silver are precious metals, therefore, investing in shares of precious metal

mining companies is different from that of commodities.

Wyszukiwarka

Podobne podstrony:

Kings Wealth Part2 Parabolic Profits in the Worlds Frontier Market portfoliowealthglobal com TomBeck

Aftershock Protect Yourself and Profit in the Next Global Financial Meltdown

Aftershock Protect Yourself and Profit in the Next Global Financial Meltdown

15th Lecture Extra Profit In The Blinds

Lasenby et al 2 spinors, Twistors & Supersymm in the Spacetime Algebra (1992) [sharethefiles com]

S M Stirling Lords of Creation 02 In the Courts of the Crimson Kings

Being Warren Buffett [A Classroom Simulation of Risk And Wealth When Investing In The Stock Market]

Gardeła, Entangled Worlds Archaeologies of Ambivalence in the Viking Age

Halldórsson Danish Kings and the Jomsvikings in the Greatest Saga of Óláfr Tryggvason

James Axler Outlander 21 Devil in the Moon The Dragon Kings, Book 1

Mettern S P Rome and the Enemy Imperial Strategy in the Principate

Early Variscan magmatism in the Western Carpathians

Applications and opportunities for ultrasound assisted extraction in the food industry — A review

In the end!

Cell surface in the interaction Nieznany

Post feeding larval behaviour in the blowfle Calliphora vicinaEffects on post mortem interval estima

Multiple Intelligences in the Elementary Classroom

Fascia in the Lateral Upper Arm tapeSP

A Guide to the Law and Courts in the Empire

więcej podobnych podstron