Harvard Business Review Online | When to Walk Away from a Deal

Click here to visit:

When to Walk Away from a Deal

Even well-run companies get “deal fever.” By asking the right

questions, you can bolster your due diligence and avoid bad

bargains.

by Geoffrey Cullinan, Jean-Marc Le Roux, and Rolf-Magnus Weddigen

Geoffrey Cullinan (

) directs Bain & Company’s European private equity practice from

London. Jean-Marc Le Roux (

), in Paris, and Rolf-Magnus Weddigen (

), in Munich, also work in Bain’s European private equity practice.

Deal making is glamorous; due diligence is not. That simple statement goes a long way toward explaining why

so many companies have made so many acquisitions that have produced so little value. Although big companies

often make a show of carefully analyzing the size and scope of a deal in question—assembling large teams and

spending pots of money—the fact is, the momentum of the transaction is hard to resist once senior management

has the target in its sights. Due diligence all too often becomes an exercise in verifying the target’s financial

statements rather than conducting a fair analysis of the deal’s strategic logic and the acquirer’s ability to realize

value from it. Seldom does the process lead managers to kill potential acquisitions, even when the deals are

deeply flawed.

Take the case of Safeway, a leading American grocery chain with a string of successful mergers to its credit and

a highly respected management team. In 1998, Safeway acquired Dominick’s, an innovative regional grocer in

the Chicago area. The strategic logic for the $1.8 billion deal seemed impeccable. It would add about 11% to

Safeway’s overall sales at a time when mass retailers like Wal-Mart and Kmart were stocking groceries on their

shelves and taking market share away from established players, and it would give Safeway a strong presence in

a major metropolitan market. Although Dominick’s 7.5% operating cash flow margin lagged behind Safeway’s

8.4%, Safeway CEO Steve Burd convinced investors that he would be able to quickly raise the acquired firm’s

margin to 9.5%. Capitalizing on this momentum, Safeway closed the deal in just five weeks, about a third of the

average closing period for large acquisitions.

Safeway would come to regret not taking time for due diligence. Dominick’s focus on prepared foods, in-store

cafes, and product variety did not fit Safeway’s emphasis on store brands and cost discipline. Dominick’s strong

unions resisted Safeway’s aggressive cost-cutting plans. And with its customers unwilling to accept Safeway’s

private label goods, Dominick’s was soon losing share to its archrival, Jewel. A thorough due diligence process

would certainly have revealed these problems, and Safeway could have walked away with its pockets intact.

Instead, it is stuck with an operation it cannot sell for even a fifth of the original purchase price.

Safeway is just one of many companies to suffer from weak due diligence. In December 2002, Bain & Company

surveyed 250 international executives with M&A responsibilities. Half the participants said their due diligence

processes had failed to uncover major problems, and half found that their targets had been dressed up to look

better for the deals. Two-thirds said they routinely overestimated the synergies available from their acquisitions.

Overall, only 30% of the executives were satisfied with the rigor of their due diligence processes. Fully a third

admitted they hadn’t walked away from deals they had nagging doubts about.

What can companies do to improve their due diligence? To answer that question, we’ve taken a close look at 20

companies—both public and private—whose transactions have demonstrated high-quality due diligence. We

calibrated our findings against our experiences in 2,000-odd deals we’ve screened over the past ten years.

We’ve found that successful acquirers view due diligence as much more than an exercise in verifying data. While

http://harvardbusinessonline.hbsp.harvard.edu/...ml;jsessionid=OCXNFHTEXLARECTEQENR5VQKMSARUIPS (1 of 8) [06-Apr-04 8:53:43]

Harvard Business Review Online | When to Walk Away from a Deal

they go through the numbers deeply and thoroughly, they also put the broader, strategic rationale for their

acquisitions under the microscope. They look at the business case in its entirety, probing for strengths and

weaknesses and searching for unreliable assumptions and other flaws in the logic. They take a highly disciplined

and objective approach to the process, and their senior executives pay close heed to the results of the

investigations and analyses—to the extent that they are prepared to walk away from a deal, even in the very

late stages of negotiations. For these companies, due diligence acts as a counterweight to the excitement that

builds when managers begin to pursue a target.

Due diligence acts as a counterweight to the

excitement that builds when managers begin

to pursue a target.

The successful acquirers we studied were all consistent in their approach to due diligence. Although there were

idiosyncrasies and differences in emphasis placed on their inquiries, all of them built their due diligence process

as an investigation into four basic questions:

• What are we really buying?

• What is the target’s stand-alone value?

• Where are the synergies—and the skeletons?

• What’s our walk-away price?

In the following pages, we’ll examine each of these questions in depth, demonstrating how they can provide any

company with a solid framework for effective due diligence.

What Are We Really Buying?

When senior executives begin to look at an acquisition, they quickly develop a mental image of the target

company, often drawing on its public profile or its reputation within the business community. That mental image

shapes the entire deal-making process—it turns into the story that management tells itself about the deal. An

effective due diligence process challenges this mental model, getting at the real story beneath the often heavily

varnished surface. Rather than rely on secondary sources and biased forecasts provided by the target company

itself, the corporate suitor must build its own proprietary, bottom-up view of the target and its industry,

gathering information about customers, suppliers, and competitors in the field.

Bridgepoint, a leading European private equity firm, is particularly adept at this kind of strategic due diligence.

In 2000, Bridgepoint was considering buying a fruit-processing business from the French liquor giant Pernod

Ricard. The business, which for the purposes of this article we’ll call FruitCo, looked like an attractive acquisition

candidate. As the leading producer of the fruit mixtures used to flavor yogurt, it was well positioned in a growing

industry. Western consumers had been spending between 5% and 10% more each year on yogurt, and the

market was growing faster still in the developing world, particularly in Latin America and Asia. FruitCo was

posting profits and had won praise for its innovativeness and its excellence in R&D and manufacturing.

Moreover, there was nothing suspicious about Pernod Ricard’s reasons for selling—fruit processing simply lay

outside its core business.

FruitCo looked like a winner to Benoît Bassi, a managing director of Bridgepoint in Paris. He saw attractive

opportunities to boost FruitCo’s revenues and profits by expanding the business into adjacent categories, such

as ice cream and baked goods, as well as into new channels. After laying out the case for the acquisition in a

grueling five-hour meeting with his partners, Bassi got the OK to pursue the deal. Yet it never happened; just

four weeks later, Bassi killed it.

During those four weeks, the due diligence team had discovered many worms in the shiny FruitCo apple. They

tested the argument that FruitCo could make money by scaling up and competing on cost, for instance. And they

found that while the company boasted considerable global scale, regional scale turned out to be the more

relevant driver of costs. That was because the economics of transportation and purchasing made the global

sourcing of fruit—a major cost component—unfeasible. At the same time, advanced processing technologies

enabled FruitCo’s rivals to achieve competitive economics at the country level. When the team tested FruitCo’s

price and revenue forecasts, they found further cause for concern. The market for fruit yogurt was indeed

growing, but profitability in many markets—particularly in Latin America—was falling rapidly, indicating that the

product was turning into a commodity. Stemming this trend seemed unlikely; consumers told Bridgepoint’s

researchers that they would be unlikely to tolerate increased prices. The team then pored over the target

company’s customer lists. They found that FruitCo was highly dependent on sales to two large yogurt producers,

both of which seemed intent on achieving more control over the entire production process in each major market

that they competed in. FruitCo seemed fated to an erosion of market power—it would have to fight for every

http://harvardbusinessonline.hbsp.harvard.edu/...ml;jsessionid=OCXNFHTEXLARECTEQENR5VQKMSARUIPS (2 of 8) [06-Apr-04 8:53:43]

Harvard Business Review Online | When to Walk Away from a Deal

contract.

Bassi recognized that the original business case for the acquisition did not hold up under close scrutiny. He

walked away from the deal he had once coveted, probably saving Bridgepoint millions of dollars in the process.

“What we thought we knew turned out to be wrong,” Bassi unsentimentally explains.

As the story suggests, effective acquirers systematically test a deal’s strategic logic. Like Bridgepoint, they

typically organize their investigations around the four Cs of competition: customers, competitors, costs, and

capabilities (often but not necessarily in that order). Within each of these areas, due diligence teams ask hard

questions as they study their targets. Although they will rely on information provided by the targets, they do not

accept those data at face value. They conduct their own field analyses.

Get to know the customers.

Good due diligence practitioners begin by drawing a map of their target’s market,

sketching out its size, its growth rate, and how it breaks down by geography, product, and customer segment.

This allows them to compare the target’s customer segments—their profitability, promise, and vulnerability—

with those of its competitors. Has the target fully penetrated some customer segments but neglected others?

What is the target’s track record in retaining customers? Where could you adjust its offerings to grow sales or

increase prices? What channels does the target use to serve its customers, and how do those channels match

your own? In researching these questions, effective due diligence teams remember always to identify the

target’s most profitable customers and look at how well the target is managing them. They don’t rely on what

the target tells them about its customers; they approach the customers directly.

Check out the competition.

Good due diligence practitioners always examine the target’s industry

presence—How does it compare to its rivals in terms of market share, revenues, and profits by geography,

product, and segment? They look at the pool of available profits and try to determine whether the target is

getting a fair (or better) share of industry profits compared with its rivals. How does each competitor make the

profits expected from a company with its relative market share? Where in the value chain are profits

concentrated? Is there a way to capture more? Is the target underperforming operationally? Are its competitors?

Is the business correctly defined? The due diligence team should carefully consider how competitors will react to

the acquisition and how that might affect the business. Once again, effective teams don’t rely on what the target

tells them; they seek independent advice.

Verify the cost economics.

Successful due diligence teams always ask the following questions about costs: Do

the target’s competitors have cost advantages? Why is the target performing above or below expectations given

its relative market position? What is the best cost position the acquirer could reasonably achieve? The team also

needs to look at the extent to which the target is using its experience in the market to drive down costs. When

considering postmerger opportunities for cost rationalization, the team needs to assess whether the benefit of

sharing costs with other business units will outweigh the lack of focus that sharing costs across multiple

businesses might introduce. It needs to determine how low it can take costs by instituting best practices.

Benchmarking can be an important aid here. It’s also vital to look at how to allocate costs going forward. Which

products and customers really make the money, and which ones should be dropped?

Take stock of capabilities.

Effective acquirers always remember that they are not just buying a P&L and a

balance sheet but also capabilities such as management expertise. Capabilities may not be easy to measure, but

taking them for granted is too large a risk for any company because competencies largely determine how well a

company will be able to pursue its postacquisition strategy. Acquirers should ask themselves: What special skills

or technologies does the target have that create definable customer value? How can it leverage those core

competencies? What investments in technology and people will help buttress the existing competencies? What

competencies can the company do without? Assessing capabilities also involves looking at which organizational

structures will enable the business to implement its strategy most effectively. How should all other aspects of

the organization (such as compensation, incentives, promotion, information flow, authority, and autonomy) be

aligned with the strategy?

In testing a deal’s strategic logic, most companies will be on the lookout for potential problems—the smoking

guns, the skeletons in the closets. But the due diligence process can produce nice surprises as easily as nasty

ones, and it may give a would-be acquirer a reason to pursue a deal more aggressively than it otherwise might

have. Centre Partners’ acquisition in the late 1990s of American Seafoods, a fishing company, is a case in point.

(See the sidebar “Uncovering Hidden Treasure.”)

Uncovering Hidden Treasure

Sidebar R0404F_A (Located at the end of this

article)

What Is the Target’s Stand-Alone Value?

http://harvardbusinessonline.hbsp.harvard.edu/...ml;jsessionid=OCXNFHTEXLARECTEQENR5VQKMSARUIPS (3 of 8) [06-Apr-04 8:53:43]

Harvard Business Review Online | When to Walk Away from a Deal

Once the wheels of an acquisition are turning, it becomes difficult for senior managers to step on the brakes;

they become too invested in the deal’s success. Here, again, due diligence should play a critical role by imposing

objective discipline on the financial side of the process. What you find in your bottom-up assessment of the

target and its industry must translate into concrete benefits in revenue, cost and earnings, and, ultimately, cash

flow. At the same time, the target’s books should be rigorously analyzed not just to verify reported numbers and

assumptions but also to determine the business’s true value as a stand-alone concern. The vast majority of the

price you pay reflects the business as is, not as it might be once you’ve won it. Too often the reverse is true:

The fundamentals of the business for sale are unattractive relative to its price, so the search begins for

synergies to justify the deal.

Of course, determining a company’s true value is easier said than done. Ever since the old days of the barter

economy, when farmers would exaggerate the health and understate the age of the livestock they were trading,

sellers have always tried to dress up their assets to make them look more appealing than they really are. That’s

certainly true in business today, when companies can use a wide range of accounting tricks to buff their

numbers. Here are just a few of the most common examples of financial trickery used:

• Stuffing distribution channels to inflate sales projections. For instance, a company may treat as market

sales many of the products it sells to distributors—which may not represent recurring sales.

• Using overoptimistic projections to inflate the expected returns from investments in new

technologies and other capital expenditures. A company might, for example, assume that a major uptick in

its cross selling will enable it to recoup its large investment in customer relationship management software.

• Disguising the head count of cost centers by decentralizing functions so you never see the full

picture. For instance, some companies scatter the marketing function among field offices and maintain just a

coordinating crew at headquarters, which hides the true overhead.

• Treating recurring items as extraordinary costs to get them off the P&L. A company might, for

example, use the restructuring of a sales network as a way to declare bad receivables as a onetime expense.

• Exaggerating a Web site’s potential for being an effective, cheap sales channel.

• Underfunding capital expenditures or sales, general, and administrative costs in the periods leading

up to a sale to make cash flow look healthier. For example, a manufacturer may decide to postpone its

machine renewals a year or two so those figures won’t be immediately visible in the books. But the

manufacturer will overstate free cash flow—and possibly mislead the investor about how much regular capital a

plant needs.

• Encouraging the sales force to boost sales while hiding costs. A company looking for a buyer might, for

example, offer advantageous terms and conditions on postsale service to boost current sales. The product

revenues will show up immediately in the P&L, but the lower profit margin on service revenues will not be

apparent until much later.

To arrive at a business’s true stand-alone value, all these accounting tricks must be stripped away to reveal the

historical and prospective cash flows. Often, the only way to do this is to look beyond the reported numbers—to

send a due diligence team into the field to see what’s really happening with costs and sales.

That’s what Cinven, a leading European private equity company, did before acquiring Odeon Cinemas, a UK

theater chain, in 2000. Instead of looking at the aggregate revenues and costs, as Odeon reported them,

Cinven’s analysts combed through the numbers of every individual cinema in order to understand the P&L

dynamics at each location. They were able to paint a rich picture of local demand patterns and competitor

activities, including data on attendance, revenues, operating costs, and capital expenditures that would be

required over the next five years. This microexamination of the company revealed that the initial market

valuation was flawed; estimates of sales growth at the national level were not justified by local trends. Armed

with the findings, Cinven negotiated to pay £45 million less than the original asking price.

Getting ground-level numbers usually requires the close cooperation of the acquisition target’s top brass. An

adversarial posture almost always backfires. Cinven, for example, took pains to explain to Odeon’s executives

that a deep understanding of Odeon’s business would help ensure the ultimate success of the merger. Cinven

and Odeon executives worked as a team to examine the results of each cinema and to test the assumptions of

Odeon’s business model. They held four daylong meetings in which they went through each of the sites and

agreed on the most important levers for revenue and profit growth in the local markets. Although the process

may strike the target company as excessively intrusive, target managers will find there are a number of benefits

to going along with it beyond pleasing a potential acquirer. Even if the deal with Cinven had fallen apart, Odeon

would have emerged from the deal’s due diligence process with a much better understanding of its own

economics.

Of course, no matter how friendly the approach, many targets will be prickly. The company may have something

http://harvardbusinessonline.hbsp.harvard.edu/...ml;jsessionid=OCXNFHTEXLARECTEQENR5VQKMSARUIPS (4 of 8) [06-Apr-04 8:53:43]

Harvard Business Review Online | When to Walk Away from a Deal

to hide. Or the target’s managers may just want to retain their independence; people who believe that

knowledge is power naturally like to hold on to that knowledge. But innocent or not, a target’s hesitancy or

outright hostility during due diligence is a sign that a deal’s value will be more difficult to realize than originally

expected. As Joe Trustey, managing partner of private equity firm Summit Partners, says: “We walk away from

a target whose management is uncooperative in due diligence. For us, that’s a deal breaker.”

Where Are the Synergies—and the Skeletons?

It’s hard to be realistic about the synergies an acquisition will deliver. In the fevered environment of a takeover,

managers routinely overestimate the value of cost and revenue synergies and underestimate the difficulty of

achieving them. It’s worth repeating that two-thirds of the executives in our M&A survey admitted to having

overestimated the synergies available from combining companies.

Realizing that synergy estimates are often untrustworthy, some companies have made it their policy not to take

potential synergies into account when determining the value of acquisition candidates. Although the concern

behind the policy is understandable, such an approach can be destructive: Some synergies are achievable, and

ignoring them may steer companies away from smart acquisitions. A better approach is to use the due diligence

process to carefully distinguish between different kinds of synergies, and then estimate both their potential value

and the probability that they can be realized. That assessment should also include the speed with which the

synergies can be achieved and the investments it will take to get them.

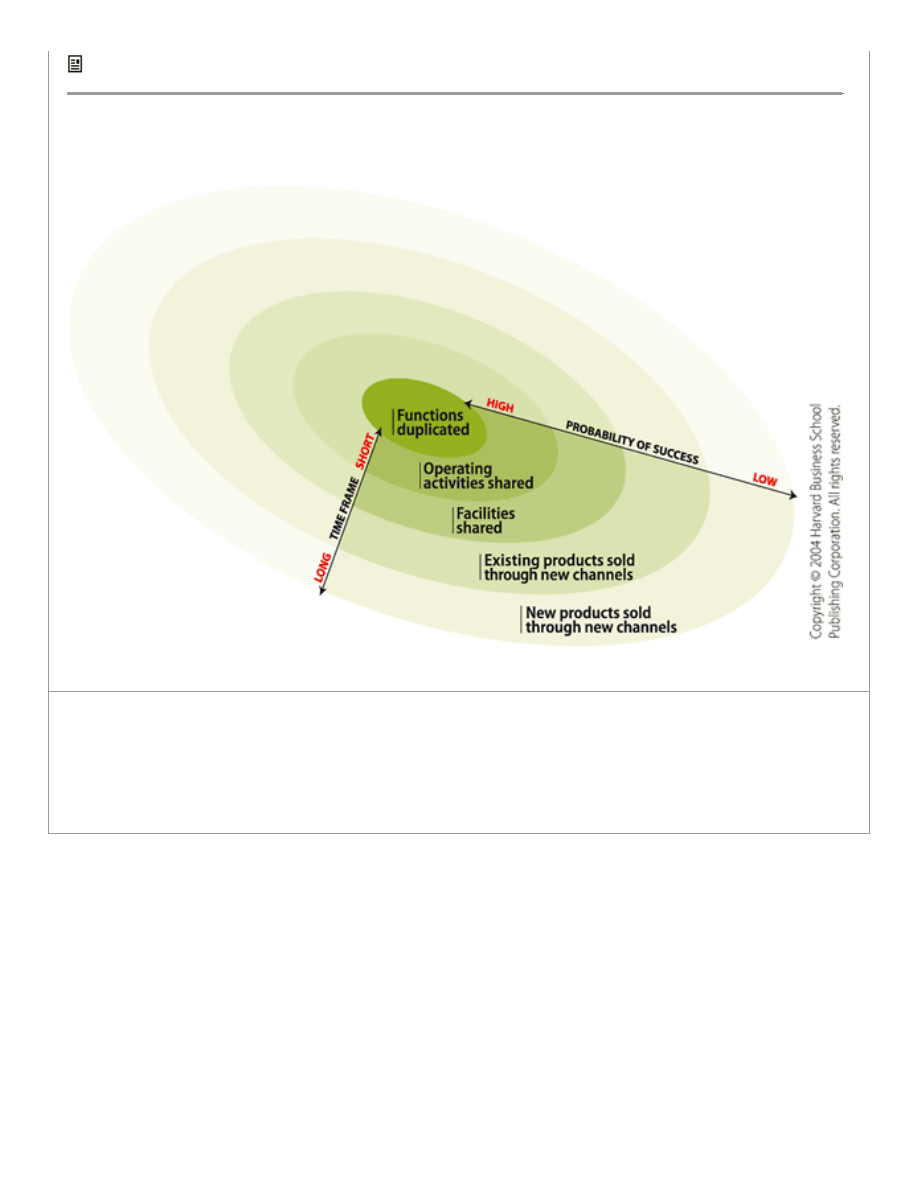

We’ve found it useful to think of potential synergies as a series of concentric circles, as shown in the exhibit, “A

Map of Synergies.” The synergies at the center come from eliminating duplicate functions, business activities,

and costs—for instance, combining legal staffs, treasury oversight, and board expenses. These are the easiest

synergies to achieve; companies are sure to realize most of the potential savings here. The next closest circle

represents the savings realized from cutting shared operating costs, such as distribution, sales, and regional

overhead expenses. Most companies will realize the majority of these savings, as well. Then come the savings

from facilities rationalization, which are typically more difficult to achieve because they can involve significant

personnel and regulatory issues. Farther out are the more elusive revenue synergies, starting with sales of

existing products through new channels and moving to the outermost circle, selling new products through new

channels. Each circle offers large rewards, but the farther out the savings or revenues lie, the more difficult they

become to achieve and the longer it will take. Categorizing synergies in this way provides a useful framework for

valuing them. Analysts can assign to each circle a potential value, a probability for achieving the value, and a

timetable for implementation, which can be used to model the synergies’ effect on the combined cash flows of

the companies.

A Map of Synergies

Sidebar R0404F_B (Located at the end of this

article)

It’s important that this analysis also explicitly consider the cost of achieving the synergies, in both cash and

time. In one dramatic case, the Canadian real estate companies O&Y Properties and Bentall Capital called off

their planned merger in 2003 after tallying up the integration costs necessary to realize the synergies. O&Y

managed properties throughout eastern Canada, while Bentall’s holdings were concentrated in the West. In

addition to complementing each other geographically, the two companies believed they could rationalize

expenses over a larger collection of properties and still have representatives on the ground in every major North

American city. Yet, after due diligence, both sides realized that the high costs of integration would likely

overwhelm any long-run savings and revenue gains. Bentall president Gary Whitelaw told the press that his

company had grown “increasingly concerned that the scale of the integration could divert resources away from

our primary objective.…The merger risks would have been significant, demanding increased management

attention, and resulting in larger integration costs than at first may have been thought.” The deal was scuttled,

to the benefit of O&Y’s and Bentall’s shareholders.

It is perhaps understandable that managers might want to put off thinking about the sensitive issues inherent in

integration planning until after the deal is signed and sealed. But that is often a serious mistake. Integration

planning—and the costs of integration—are among the biggest determinants of an acquisition’s ultimate success

or failure, and you can’t really declare a due diligence process complete unless you’ve looked closely at those

costs. The due diligence team’s deep knowledge of the acquisition target makes it an ideal body to develop an

initial road map for combining two companies’ staffs and operations.

In addition to examining the cost of achieving positive synergies, the due diligence team also needs to consider

how potential conflicts between the merged businesses may sap revenues or add costs. These negative

synergies—the skeletons in the closet of every deal—can take many forms. Once two companies combine their

accounts, for example, some of their joint customers may curtail their purchases for fear of being overly reliant

on a single supplier. Difficulties in integrating back-office operations or systems may at least briefly impede

http://harvardbusinessonline.hbsp.harvard.edu/...ml;jsessionid=OCXNFHTEXLARECTEQENR5VQKMSARUIPS (5 of 8) [06-Apr-04 8:53:43]

Harvard Business Review Online | When to Walk Away from a Deal

customer service and order fulfillment, leading to a loss of sales. Seeing more competition for promotions,

talented employees may leave, sometimes taking customers with them. And the inevitable distractions of a

merger may force management to pay less attention to the core business, undermining its results. Despite their

often immense importance, negative synergies are routinely overlooked in due diligence. A common mistake, for

example, is to create a valuation model that adds up the revenues of the two companies, plus the synergies,

without subtracting an estimated amount for revenue erosion or increased costs.

Even the best acquirers will encounter negative synergies. An executive who left cereal giant Kellogg after its

2001 merger with biscuit maker Keebler told us that the company experienced negative synergies when it

decided to put new-product launches on hold in order to focus on integrating the two companies. Some potential

revenues were lost as a result even though Kellogg met its targets for cost reductions. A more devastating

example of negative synergies occurred in the 1996 merger of the Southern Pacific and the Union Pacific

railroads. Incompatibilities in the companies’ information systems, combined with other operating conflicts,

created massive disruptions in rail traffic throughout the western United States, leading to delayed and

misrouted shipments and irate customers. In the end, the government had to declare a federal transportation

emergency.

What’s Our Walk-Away Price?

The final leg of a sound due diligence process is determining a walk-away price—the top price you are willing to

pay when the final price negotiation is conducted.

The walk-away price should never include the full potential value of the synergies, which is why it’s important to

calculate the deal’s stand-alone value separately. Synergies—especially the elusive outer-circle synergies—are

something that you target in managing a completed acquisition; they should not unduly influence the

negotiation of the deal unless you can be fairly certain about the numbers.

For a walk-away price to have meaning, you really have to be willing to walk away. A useful lesson in that

regard comes from Kellogg’s CEO, Carlos Gutierrez, who negotiated the purchase of Keebler. Gutierrez dearly

wanted to close the deal. Keebler’s vaunted direct-to-store delivery system enabled it to carry products to stores

in its own trucks, bypassing the retailers’ warehouses altogether. Gutierrez saw enormous potential for funneling

Kellogg products through Keebler’s highly efficient system. But Kellogg’s rigorous due diligence analysis made it

clear that the maximum he should pay for Keebler was $42 a share, which he expected was less than what

Keebler was looking for. “Even though this was a deal that we desperately wanted,” Gutierrez later recalled, “I

conditioned myself mentally to say we might not have it.” In a final bargaining session in New York, Gutierrez

told Keebler’s management that a share price of $42 was his maximum offer—and that if they could get more

from someone else, they should take it. Gutierrez went off to watch a Mets game, determined not to give any

more thought to the negotiation. Two days later, Keebler accepted Gutierrez’s offer.

“Even though this was a deal that we

desperately wanted, I conditioned myself

mentally to say we might not have it.”

—Kellogg CEO Carlos Gutierrez

To establish a walk-away price, successful deal makers convene a decision-making body of trusted individuals

who are less attached to the deal than senior management is. They insist on senior management’s approval of

the body and establish a decision-making process that clearly delineates who in the company recommends

deals, who holds veto power, whose input should be solicited, and who decides yea or nay in the final instance.

They adopt formal checks and balances that rely on predetermined walk-away criteria.

Bridgepoint assembles a team of six managers, each of whom represents one of four viewpoints. One is the

prosecutor, who plays the role of devil’s advocate. The second is the less-experienced manager, whose

involvement is a key part of his or her training. The third is a senior managing director, who no longer has any

hierarchical function at the company and who therefore cannot be undermined by corporate politics. The final

members of the panel are managing directors who still have operational roles. The team’s goal is to provide a

thorough, balanced, and unbiased examination of the acquisition candidate and hold everyone’s feet to the fire

on walk-away criteria. “That makes quite a balanced whole,” says Bridgepoint’s Bassi. “Is it perfect? I don’t

know. But it works.”

Companies can also adjust their compensation systems as added incentive against overpaying for deals. For

instance, at Clear Channel, an international radio, billboard, and live entertainment company, line managers

have to sign off “in blood,” as CFO Randall Mays puts it, on the cash flows that any acquisitions will deliver. The

company ties managers’ future compensation to meeting the division’s cash flow projections, which include

results from those acquisitions. The salaries for Clear Channel’s M&A teams are also tied to the contribution that

acquisitions make to the company’s financial performance. The division presidents and M&A teams meet Mays at

http://harvardbusinessonline.hbsp.harvard.edu/...ml;jsessionid=OCXNFHTEXLARECTEQENR5VQKMSARUIPS (6 of 8) [06-Apr-04 8:53:43]

Harvard Business Review Online | When to Walk Away from a Deal

year’s end to study all the acquisitions they have made in the previous three years to see whether they

delivered what they promised and to review compensation at the same time. As Mays puts it, the deals they

make “are tied to them forever.”

• • •

The backward-looking science of due diligence is vital. But it is a meaningless exercise without the forward-

looking art of strategic due diligence. In the wake of so many disappointing mergers and acquisitions, more and

more organizations are realizing that there are few better ways of spending managers’ time and investors’

money than in a careful and creative analysis of an acquisition candidate.

In the end, effective due diligence is as much about managerial humility as anything else. It’s about testing

every assumption and questioning every belief. It’s about not falling into the trap of thinking you’ll be able to fix

any problem after the fact. The best private equity firms are particularly good models in this regard, since they

look at every potential deal coldly, without bias or overconfidence. As Bridgepoint’s Benoît Bassi puts it, “When

you work for a corporation and you buy something you think is in your core business or fits with your core

business, you assume you know what you are buying. By contrast, [private equity investors] have to rediscover

everything. There can be a certain arrogance in corporations, which causes them to make silly mistakes.” And

those silly mistakes can end up costing companies millions, or even billions, of dollars.

Reprint Number R0404F

Uncovering Hidden Treasure

Sidebar R0404F_A

A comprehensive due diligence effort can uncover good news as well as bad. In some cases, it can even lead a

company to make a strong acquisition that it might otherwise have passed up. That’s what happened when the

private equity firm Centre Partners looked into buying a fishing company called American Seafoods in the late

1990s. The company caught and processed Alaskan pollock and other species from seven fishing trawlers

operating in U.S. waters in the Bering Sea. At the time, American Seafoods was owned by a Norwegian parent

company. But when the U.S. Congress enacted a law that made it illegal for a foreign concern to own companies

fishing in American waters, the Norwegian parent was forced to sell.

Although American Seafoods’ profits jumped in 1999—its EBITDA hit $60 million that year, more than double the

annual average of approximately $26 million in the three preceding years—the fishing business did not, at first

blush, seem particularly attractive to Centre Partners. Historically subject to wide swings in supplies and prices

and under increasingly tight regulation, the business seemed fated to volatile and potentially weak returns. But

when Centre Partners sent in a crack due diligence team, combining experts in consumer products, fishing

operations, and marine biology, it found that, far from being a blip, American Seafoods’ profit boom appeared

sustainable.

The team’s global analysis of the health of major fisheries turned up the most interesting data. Centre Partners

discovered that the total biomass of the U.S. Alaskan pollock fishery was expected to grow in coming years,

while the biomasses of competing fisheries—Russian Alaskan pollock and Atlantic cod, most notably—were

dropping, some at a fast clip. Overall supplies of pollock and cod would fall, in other words, but the share of the

market represented by U.S. Alaskan pollock would probably rise. That was good news from a revenue and

pricing standpoint, and the news got even better when the due diligence team looked more closely at trends in

fish prices. Although pollock prices had recently increased, as overall supplies fell, they remained well below the

levels of competing whitefish like cod, tilapia, and hoki. As a result, there seemed little chance that pollock

would be subject to significant price competition for the foreseeable future. The big Japanese market for pollock

roe, meanwhile, remained strong while supplies were falling, leading to a sharp and sustainable increase in roe

prices that seemed likely to benefit American Seafoods well into the future.

Based on the results of the due diligence analysis, Centre Partners made a successful bid for American Seafoods.

It turned out to be quite a catch. Within three years, EBITDA grew to $109 million, and the private equity firm

had recapitalized the company and sold a portion of its stake. Today, the firm is exploring an initial public

offering. In the process, Centre Partners realized nearly four times its initial investment and retained control of

the business as it sought to further grow revenue and increase profits.

http://harvardbusinessonline.hbsp.harvard.edu/...ml;jsessionid=OCXNFHTEXLARECTEQENR5VQKMSARUIPS (7 of 8) [06-Apr-04 8:53:43]

Harvard Business Review Online | When to Walk Away from a Deal

A Map of Synergies

Sidebar R0404F_B

A deal’s potential synergies are best viewed as a series of concentric circles. Those close to the center tend to be

cost-saving synergies, which can be realized quickly and are likely to succeed. Those on the outside are revenue-

generating synergies, which require a lot of time and management and are less likely to succeed. In determining

your walk-away price, your discount factor for synergies should rise as you move away from the center.

Copyright © 2004 Harvard Business School Publishing.

This content may not be reproduced or transmitted in any form or by any means, electronic or

mechanical, including photocopy, recording, or any information storage or retrieval system, without

written permission. Requests for permission should be directed to permissions@hbsp.harvard.edu, 1-

888-500-1020, or mailed to Permissions, Harvard Business School Publishing, 60 Harvard Way,

Boston, MA 02163.

http://harvardbusinessonline.hbsp.harvard.edu/...ml;jsessionid=OCXNFHTEXLARECTEQENR5VQKMSARUIPS (8 of 8) [06-Apr-04 8:53:43]

Document Outline

Wyszukiwarka

Podobne podstrony:

ref 2004 04 26 object pascal

How to draw Donkey from Shrek

How and When to Be Your Own Doctor

04 Melosik To samo supermarke Nieznany

Michelin to Withdraw Stomil from WSE

2004 04, dzieje zlotego

2004 04 Fonty w Linuksie [Administracja]

2004 04 Moduł zasilacza do wzmacniaczy mocy

Evanescence Away from me

DzU 151 2004 04 16 O ochronie przyrody

Encyclopedia Biblica Vol 1 04 Hints To Reader

konstrukcyjne cennik 2004 04 01

Matematyka dyskretna 2004 04 Rachunek prawdopodobieństwa

When you walk through the storm put your head high, Teksty

DON'T WALK AWAY, Michael Jackson, Teksty z tłumaczeniami

[Mises org]French,Doug Walk Away The Rise And Fall of The Home Ownership Myth

2004 04 Automatyczny wyłącznik TV

Inżynier Budownictwa 2004 04

When to use the?lls

więcej podobnych podstron