£

3 , ( 1 , ' = L 3 2 / , 7 < . $

3 , ( 1 ,

1 $

0DWHULDá\GRVWXGLRZDQLDPDNURHNRQRPLL

VSLVWUH FL

ï £

)XQNFMHLGHILQLFMDSLHQL G]D 1

0LDU\SLHQL G]D 2

3LHQL G]LLQQHDNW\ZD 4

¢ £

,VWRWDSRS\WXQDSLHQL G] 5

6]\ENR üRELHJXSLHQL G]D 6

3RS\WQDSLHQL G]D]DPLDQDQDLQQHDNW\ZD 6

.RV]WDOWHUQDW\ZQ\WU]\PDQLDSLHQL G]D 7

7UDQVDNF\MQ\SRS\WQDSLHQL G]L]DVRERZDWHRULDSLHQL G]D 7

0RW\Z\XWU]\P\ZDQLDSLHQL G]D 9

)XQNFMDSRS\WXQDSLHQL G] 10

£ ¢

3.1. Rynki finansowe i system bankowy ............................................. 10

)XQNFMHEDQNXFHQWUDOQHJRQDSU]\NáDG]LH1%311

3.3. Banki komercyjne ..........................................................………. 11

.UHDFMDSLHQL G]DZNáDGRZHJR 13

0QR QLNSLHQL Q\ 14

%LODQVRZHXM FLHSRGD \SLHQL G]D15

.RQWURODSRGD \SLHQL G]D 16

à ¢ £

5yZQRZDJDU\QNXSLHQL G]DLMHM]PLDQ\ZNUyWNLPRNUHVLH 20

5yZQRZDJDU\QNXSLHQL G]DZRNUHVLHGáXJLPLFHQ\ 22

¿

) £

Warszawa 2002

M

AKROEKONOMIA

J.

K

UROWSKI

-

3,(1, '=L32/,7<.$3,(1,

1$

1

/

26

g &

3LHQL G]MHVWMHGQ\P]]DVDGQLF]\FKLV]F]HJyOQ\PGREUHPZVSyáF]HVQHMJRVSRGDUNL

:áD QLHNLONDSRGVWDZRZ\FKVSUDZGRW\F] F\FKSLHQL G]DVWDUDP\VL Z\MD QLüZW\P

rozdziale.

2GSRZLHP\QDS\WDQLDMDNLHIXQNFMHSHáQLSLHQL G]FRHNRQRPL FLXZD DM ]DSLHQL G]LMDN

PLHU] MHJR ]DVyE Z JRVSRGDUFH" 3R]QDP\ F]\QQLNL GHF\GXM FH R ]DSRWU]HERZDQLX QD

SLHQL G] ]JáDV]DQ\P SU]H] SRGPLRW\ G]LDáDM FH Z JRVSRGDUFH SU]HGVWDZLP\ WHRULH

Z\MD QLDM FH ]DOH QR FL PL G]\ W\PL F]\QQLNDPL L RNUH OLP\ IXQNFM SRS\WX QD SLHQL G]

-DNR V]F]HJyOQH GREUR JRVSRGDUF]H SLHQL G] SRZVWDMH L MHVW GRVWDUF]DQ\ X \WNRZQLNRP Z

RGPLHQQ\ VSRVyE QL ]Z\NáH GREUD 3U]H OHG]LP\ SU]HELHJ SRGD \ SLHQL G]D L URO

SRGPLRWyZXF]HVWQLF] F\FKZMHJRSRZVWDZDQLXEDQNXFHQWUDOQHJRLEDQNyZNRPHUF\MQ\FK

3RGD SLHQL G]DSRGOHJDNV]WDáWRZDQLXSU]H]ZáDG] JRVSRGDUF] =Z\NOHURODWDSU]\SDGD

EDQNRZLFHQWUDOQHPX3R]QDP\VSRVRE\LQDU] G]LDRGG]LDá\ZDQLDQD]DVyESLHQL G]DSU]H]

1DURGRZ\%DQN3ROVNL1DNRQLHFSRá F]HQLHDQDOL]\SRGD \LSRS\WXQDSLHQL G]SR]ZROL

QDPRNUH OLüZDUXQNLUyZQRZDJLU\QNXSLHQL QHJRZNUyWNLPLGáXJLPRNUHVLHRUD]]EDGDü

F]\QQLNLZSá\ZDM FHQDSU]HFKRG]HQLHRGMHGQ\FKVWDQyZUyZQRZDJLGRLQQ\FK

1.1.

)XQNFMHLGHILQLFMDSLHQL G]D

3LHQL G]HPMHVWGREURJRVSRGDUF]HSRZV]HFKQLHSU]\MPRZDQH, gdy uczestnicy gospodarki

GRNRQXM PL G]\ VRE Z\PLDQ\ Uy Q\FK GyEU 7DNLH GREUR QD]\ZD VL ZWHG\ URGNLHP

SáDWQLF]\POXE URGNLHPUHJXORZDQLD]RERZL ]D 'RNRQ\ZDQLXSáDWQR FLPRJ VáX \üW\ONR

WDNLHDNW\ZDNWyUHV ]DUyZQRZ\VWDUF]DM FRSá\QQHF]\OLáDWZRZ\PLHQLDOQHMDNLZ\VRFH

ZLDU\JRGQH dla wszystkich uczestników wymiany.

3LHQL G]VSHáQLDWU]\SRGVWDZRZHIXQNFMH

URGHN Z\PLDQ\ 3LHQL G] SR UHGQLF]\ Z WUDQVDNFMDFK PL G]\ NXSXM F\PL L

VSU]HGDM F\PL XVXZDM F ]DVDGQLF] ZDG Z\PLDQ\ EDUWHURZHM WRZDU ]D WRZDU

SROHJDM F QD NRQLHF]QR FL GRSDVRZDQLD SRWU]HE PL G]\ VWURQDPL WUDQVDNFML -HVW WR

SLHUZRWQDLGRG]L QDMLVWRWQLHMV]DIXQNFMDSLHQL G]DSU]HV G]DM FDRMHJRLVWRFLH

0LHUQLN ZDUWR FL -HGQRVWND SLHQL QD MHVW Z\JRGQ L SRZV]HFKQLH VWRVRZDQ PLDU

Z\UD DQLD ZDUWR FL Uy Q\FK SURGXNWyZ -HM X \FLH SR]ZDOD ]UHGXNRZDü LOR ü FHQ Z

JRVSRGDUFH GR OLF]E\ SURGXNWyZ JG\ QLH PXVLP\ Z\UD Dü FHQ\ SURGXNWX MDNR LOR FL

MHGQRVWHNZV]\VWNLFKLQQ\FKSURGXNWyZMDNLHPRJOLE\ P\QDQLHJRZ\PLHQLü

3LHQL G] MHVW MHGQRVWN UR]UDFKXQNRZ ZH ZV]HONLFK NDONXODFMDFK GRW\F] F\FK ]DUyZQR

ELH F\FK MDN L SU]\V]á\FK ZDUXQNyZ G]L NL F]HPX XPR OLZLD SRGHMPRZDQLH

racjonalnych decyzji.

2/

26

3U]HFKRZ\ZDQLHZDUWR FL&] üVZHJRPDM WNXOXG]LHSU]HFKRZXM ZSRVWDFLSLHQL G]D

8WU]\P\ZDQLHPDM WNXZWHMIRUPLH]UHJXá\QLH]DSHZQLDSU]\FKRGyZSRUyZQ\ZDOQ\FK]

WU]\PDQLHP DNW\ZyZ U]HF]RZ\FK E G SDSLHUyZ ZDUWR FLRZ\FK

1

ale jest wygodne ze

Z]JO GX QD GX áDWZR ü ]DPLDQ\ QD LQQH URG]DMH DNW\ZyZ F]\OL Z\VRN Sá\QQR ü

SLHQL G]D

1.2.

0LDU\SLHQL G]D

6SUyEXMP\ RNUH OLü MDNLH URG]DMH DNW\ZyZ PR H REHMPRZDü WDN RJyOQH RNUH OHQLH

SLHQL G]D

$JUHJDWSLHQL Q\0

L

ED]DPRQHWDUQD

-H OLRJUDQLF]\P\VL GR URGNyZNWyUHPRJ E\üX \WHGRGRNRQDQLDSáDWQR FLZGRZROQHM

FKZLOL L EH] SRQRV]HQLD GRGDWNRZ\FK NRV]WyZ WUDQVDNF\MQ\FK F]\OL URGNyZ R GX HM

Sá\QQR FLWRRNUH OLP\SLHQL G]ZZ VNLPXM FLX

0LDU WDNLHJR SLHQL G]D MHVW DJUHJDW 0, F]\OL VXPD JRWyZNL Z RELHJX SXEOLF]Q\P RUD]

ZNáDGyZ L LQQ\FK ]RERZL ]D ELH F\FK SáDWQ\FK QD GDQLH *RWyZND WR SLHQL G]

EDQNQRW\ L PRQHW\ Z\HPLWRZDQ\ SU]H] EDQN FHQWUDOQ\ 6WDQRZL RQ QDMZ V]\ DJUHJDW

SLHQL Q\RNUH ODQ\MDNRED]DPRQHWDUQDlub SLHQL G]UH]HUZRZ\i oznaczany symbolem 0

%DQN FHQWUDOQ\ SURZDG]L UDFKXQNL EDQNyZ NRPHUF\MQ\FK L U] GX

2

Emisja gotówki ma

PLHMVFHJG\F] ü URGNyZ]W\FKUDFKXQNyZMHVW]DPLHQLDQDQDEDQNQRW\LPRQHW\3LHQL G]

JRWyZNRZ\MHVW URGNLHPRZ\VRNLHMSá\QQR FLLMHGQRF]H QLHFLHV]\VL QDRJyá]DXIDQLHP

PLPR HMHVWSLHQL G]HPV\PEROLF]Q\Pto znaczy koszty wytworzenia banknotów i monet, a

W\P VDP\P XFLHOH QLRQD Z QLFK ZDUWR ü V QLHZVSyáPLHUQLH QLVNLH Z SRUyZQDQLX GR LFK

ZDUWR FL Z\PLHQQHM $NFHSWDFMD SLHQL G]D V\PEROLF]QHJR SU]H] X \WNRZQLNyZ SROHJD QD

]DXIDQLXGRHPLWHQWDZW\PZ\SDGNXEDQNXFHQWUDOQHJRNWyU\SRGHMPXMH]RERZL ]DQLH H

]QDNSLHQL Q\MHVWSUDZQ\P URGNLHPSáDWQLF]\PLJZDUDQWXMHMHJRZDUWR ü

&] üJRWyZNL]DWU]\P\ZDQDMHVWZV\VWHPLHEDQNRZ\PMDNRSá\QQHUH]HUZ\UHV]WDWUDILD

Z SRVLDGDQLH JRVSRGDUVWZ GRPRZ\FK ILUP L LQVW\WXFML VWDQRZL F JRWyZN Z RELHJX

publicznym, czyli poza bankami.

=EOL RQ\GRJRWyZNLVWRSLH Sá\QQR FLUHSUH]HQWXM ZNáDG\ZEDQNDFKQDUDFKXQNDFK]

NWyU\FK PR QD VZRERGQLH GRNRQ\ZDü SáDWQR FL QS SU]\ X \FLX F]HNyZ NDUW SáDWQLF]\FK

SROHFH SU]HOHZX ]ZDQ\FK UDFKXQNDPL ELH F\PL ZNáDG\ QD NVL HF]NDFK

RV]F] GQR FLRZ\FK D YLVWD RUD] LQQH ]RERZL ]DQLD ELH FH EDQNyZ 3U]\NáDG OLF]ERZ\

agregatu M1 liczonego przez NBP przedstawia tablica 1.

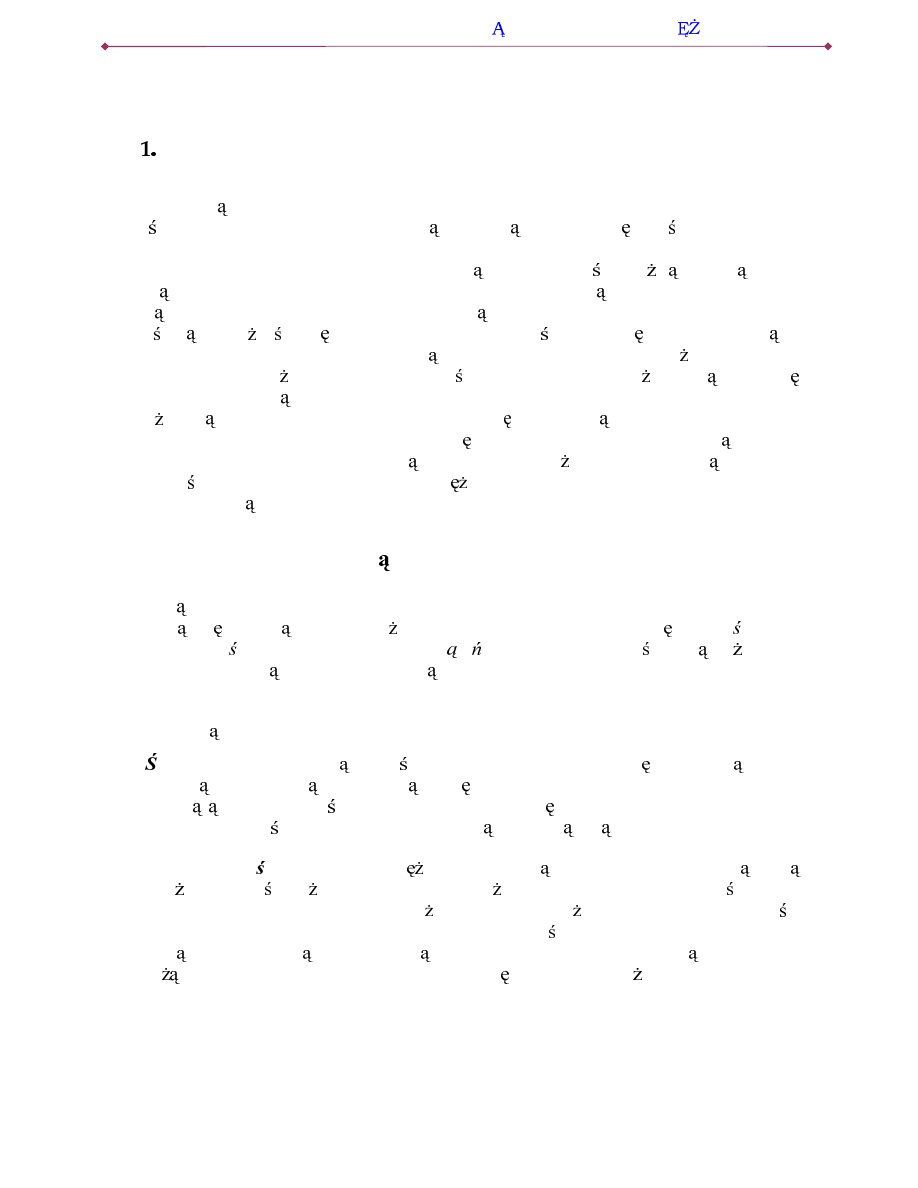

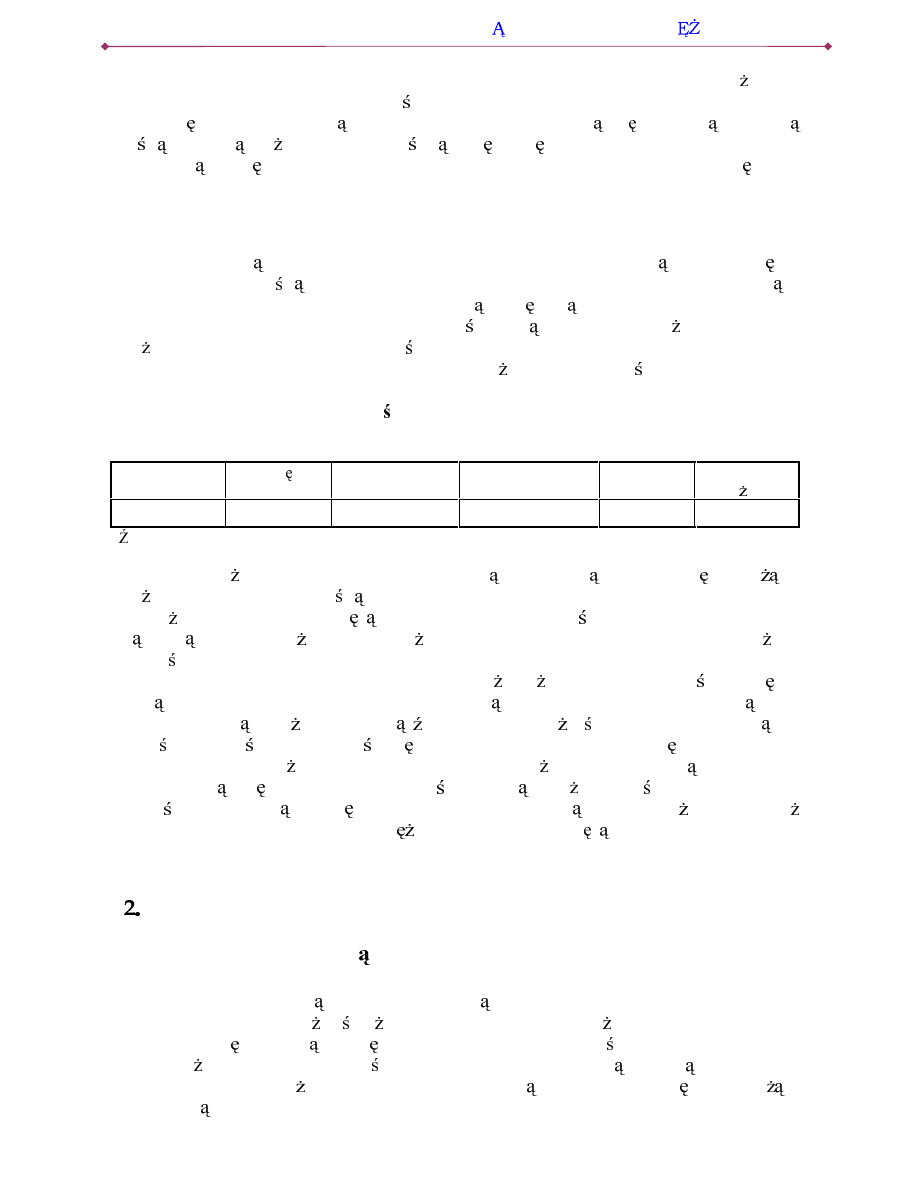

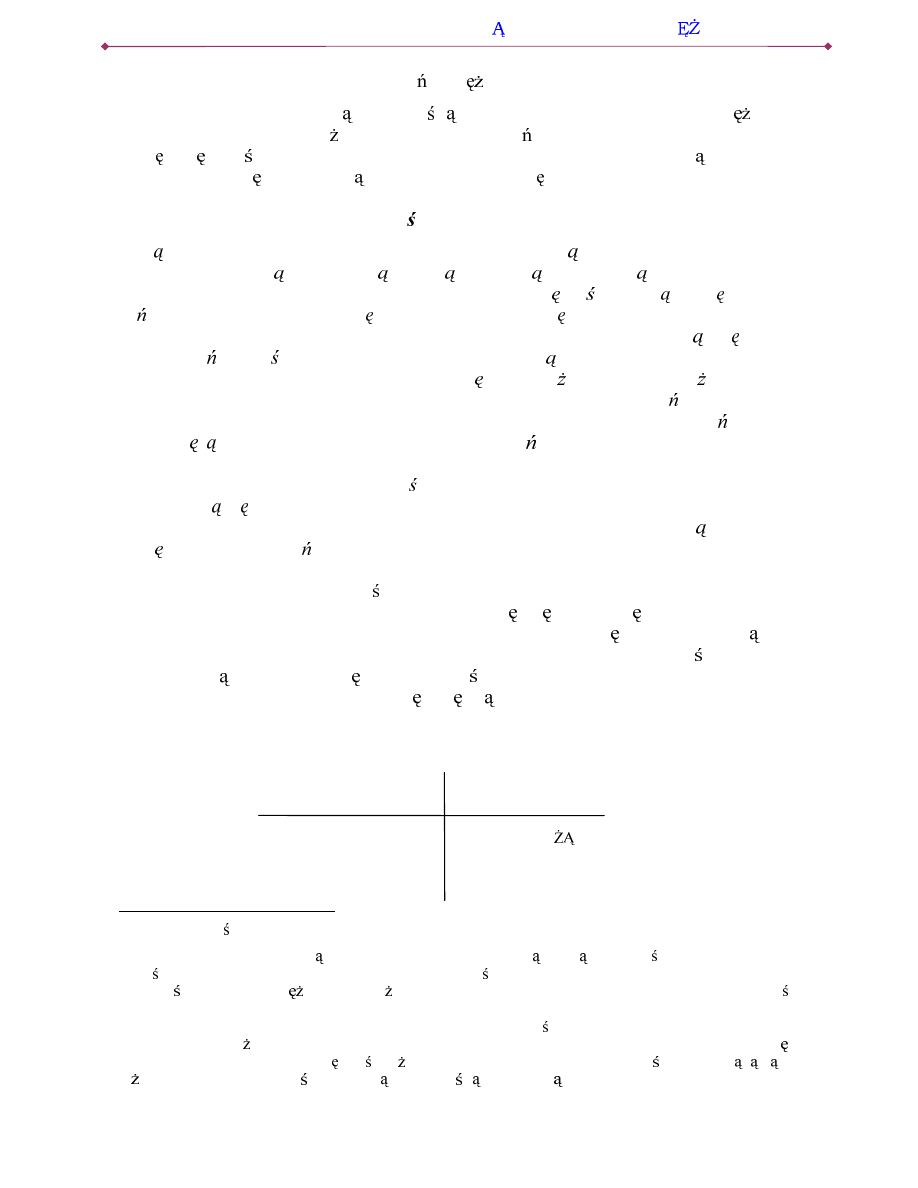

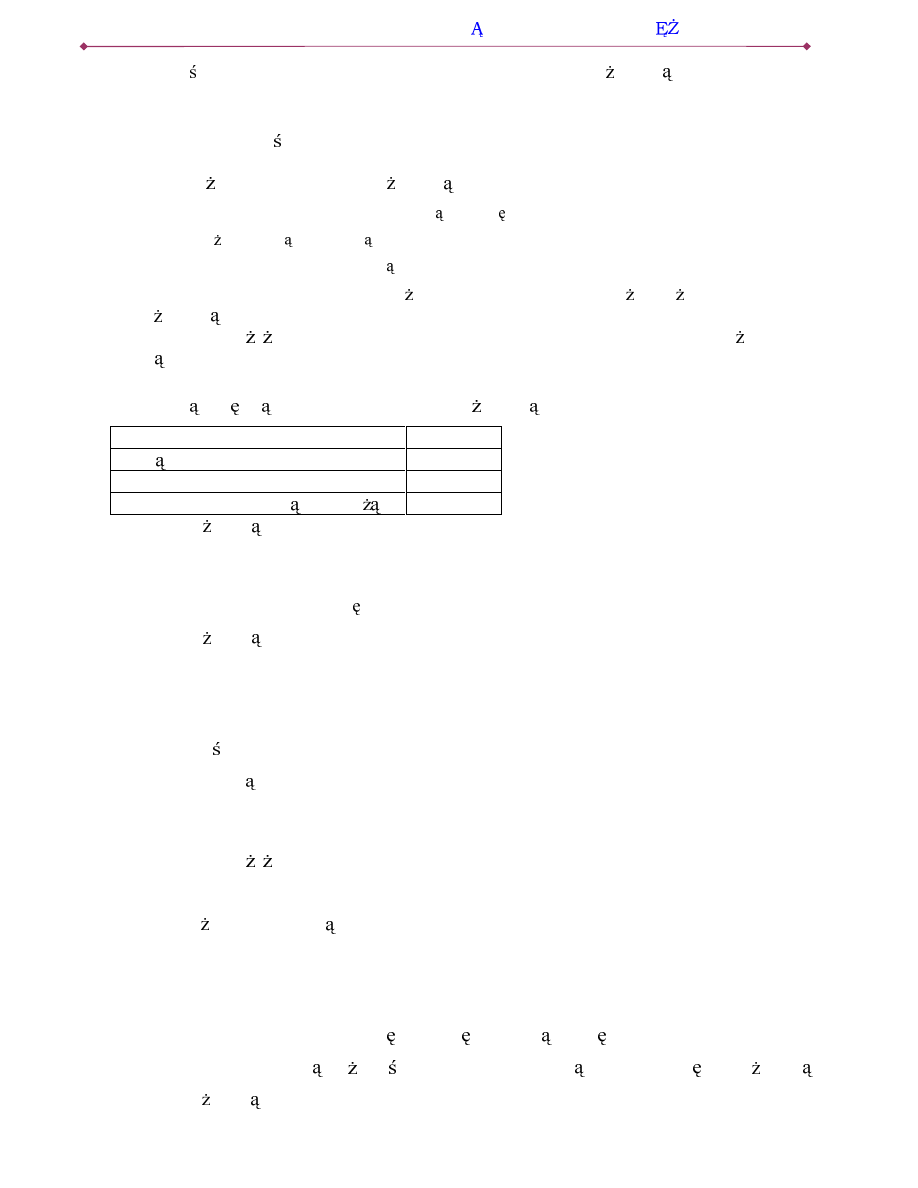

Tablica

3RGD SLHQL G]D0ZVW\F]QLXLURNX

(mln

]á

)

3LHQL G]JRWyZNRZ\ZRELHJX

31.964,2

36.756,6

'HSR]\W\LLQQH]RERZL ]DQLDELH FH

69.406,1

74.946,9

0

UyGáR1%3%LXOHW\Q,QIRUPDF\MQ\

1

àDWZR]DXZD \ü HSU]\LQIODFMLZ\QRV] FHMQSURF]QLHWU]\PDQLHPDM WNXZPRQHWDFKLEDQNQRWDFK

ZSU]HFL JXURNXSU]\QRVLVWUDW UyZQ LFKZDUWR FL

2

.U JNOLHQWyZEDQNXFHQWUDOQHJRMHVWZ]DVDG]LHRJUDQLF]RQ\GREDQNyZLQVW\WXFMLILQDQVRZ\FKLRUJDQL]DFML

U] GRZ\FK2GUHJXá\WHM]GDU]DM VL MHGQDN HZ\M WNLJG\EDQNFHQWUDOQ\SU]\MPXMHGHSR]\W\OXGQR FLMDN

PLDáRWRPLHMVFHZ3ROVFHZURNX

M

AKROEKONOMIA

J.

K

UROWSKI

-

3,(1, '=L32/,7<.$3,(1,

1$

3

/

26

6]HUV]HDJUHJDW\SLHQL QH

%DQNL FHQWUDOQH QLH RJUDQLF]DM VL QD RJyá GR MHGQHM PLDU\ SLHQL G]D 1%3 REOLF]D L

SXEOLNXMH GZD V]HUV]H RG 0 DJUHJDW\ 0 L 0 =DVDG MHVW H NROHMQH PLDU\ SLHQL G]D

XMPXM FRUD] PQLHM Sá\QQH URGNL NWyU\FK X \FLH GR UHDOL]DFML SáDWQR FL SRGOHJD

ograniczeniom. I tak M2 obejmuje agregat M1 oraz

GHSR]\W\ L ]RERZL ]DQLD ] WHUPLQHP

SLHUZRWQ\P GR ODW F]\OL QD SU]\NáDG ZNáDG\ Z EDQNDFK ]áR RQH ] ]RERZL ]DQLHP

OHWQLHJRRNUHVXLFKXWU]\P\ZDQLDMDNWH GHSR]\W\]WHUPLQHPZ\SRZLHG]HQLDGRPLHVL F\.

-HV]F]H V]HUV] PLDU VWDQRZL DJUHJDW 0 SRZVWDM F\ SU]H] GRGDQLH GR 0 RSHUDFML ]

SU]\U]HF]HQLHPRGNXSXi GáX Q\FKSDSLHUyZZDUWR FLRZ\FK]WHUPLQHPSLHUZRWQ\PGRODW

:WDEOLF\SU]HGVWDZLDP\GDQH]DZLHUDM FHVNáDGQLNLW\FKDJUHJDWyZ

Komentarz

2NUH ODQLHDJUHJDWyZSLHQL Q\FK

%DQNLFHQWUDOQHUy Q\FKNUDMyZVWRVXM RGPLHQQHVSRVRE\RNUH ODQLDLSRPLDUXZ VNLFKLV]HUV]\FK

XM üSLHQL G]D1LHNWyUHEDQNLREOLF]DM ZLHOHDJUHJDWyZ%DQN$QJOLLVWRVXMHQDVW SXM FHPLDU\

M

= JRWyZNDZRELHJX + GHSR]\W\QD GDQLH

M = M + GHSR]\W\WHUPLQRZH w

M

LM + SR]RVWDáHGHSR]\W\WHUPLQRZH

PSL

= LM - GHSR]\W\RWHUPLQLHSRZ\ HMODW + LQVWUXPHQW\U\QNXSLHQL QHJR +

+

GHSR]\W\LSDSLHU\ZDUWR FLRZHLQVW\WXFMLRV]F] GQR FLRZ\FK+

+

FHUW\ILNDW\GHSR]\WyZSRGDWNRZ\FK + XG]LDá\LZNáDG\ZWRZDU]\VWZDFKEXGRZODQ\FK

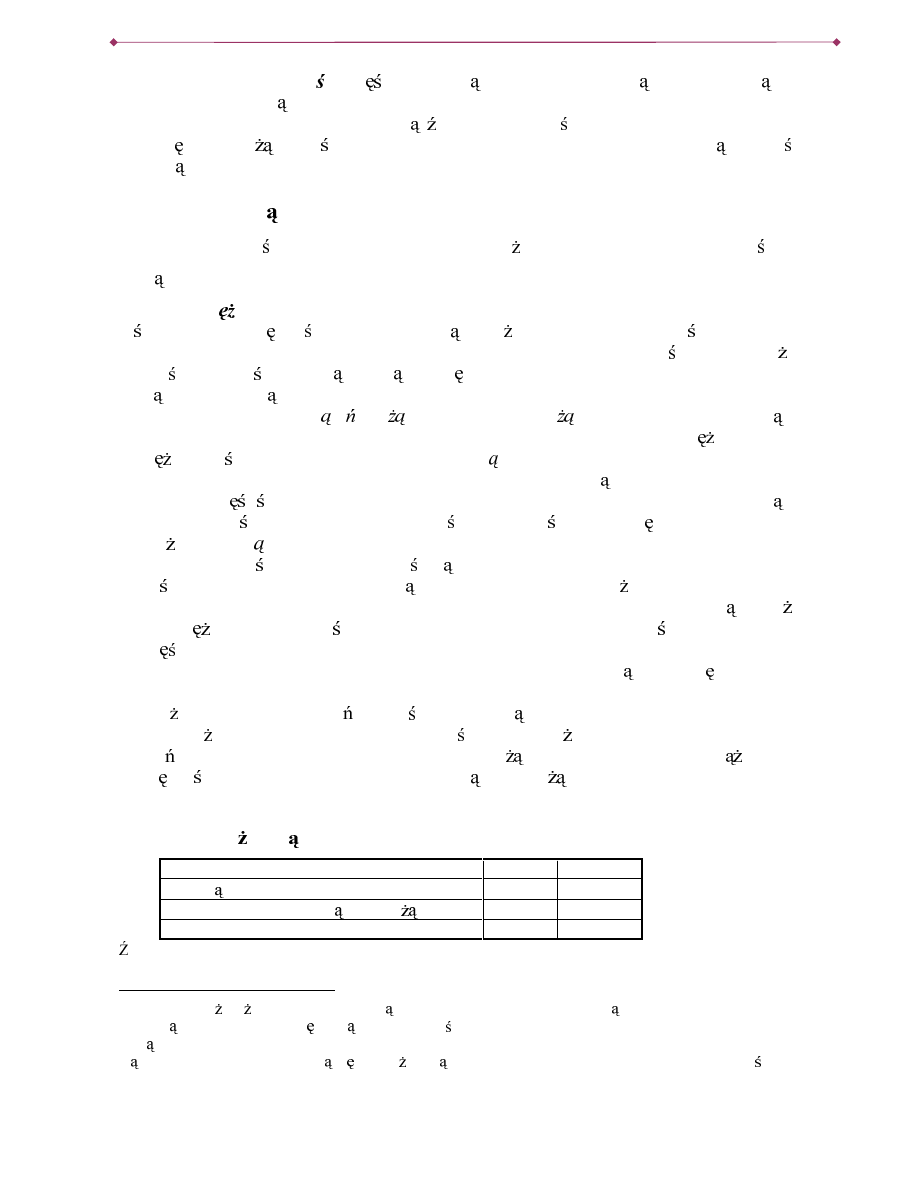

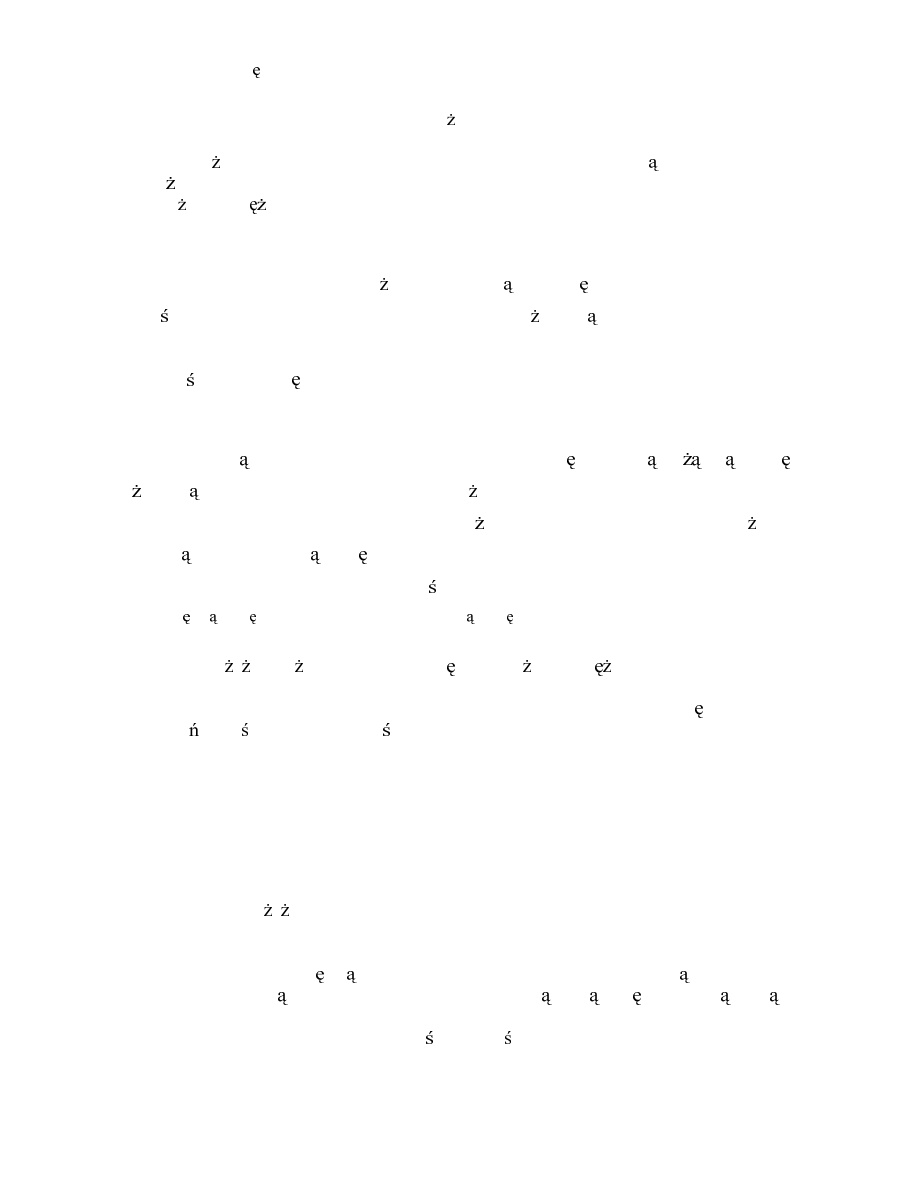

Tablica

3RGD SLHQL G]D0LMHMVNáDGQLNLZVW\F]QLXLU

6NáDGQLN

POQ]á

POQ]á

=PLDQD

3RGD SLHQL G]D0

'HSR]\W\ L LQQH ]RERZL ]DQLD ]

terminem do 2 lat

197.606,2

210.479,9

6,5

2.

Depozyty

z

terminem

Z\SRZLHG]HQLDGRPLHVL F\

0,0

0,0

0,0

3RGD SLHQL G]D00

3. Operacje z przyrzeczeniem

odkupu

2,4

33,6

1300,0

'áX QH SDSLHU\ ZDUWR FLRZH ]

terminem pierwotnym do 2 lat

260,8

221,5

-15,0

3RGD SLHQL G]D00

UyGáR1DURGRZ\%DQN3ROVNL%LXOHW\Q,QIRUPDF\MQ\

=DXZD P\ HZFL JXURNXQDVW SLáZ]URVWDJUHJDWyZSLHQL Q\FK0R QDWRZL ]Dü]

LQIODFM NWyUD Z\QLRVáD Z U -H OL QDVW SXMH RJyOQ\ Z]URVW FHQ WR VSDGD VLáD

QDE\ZF]D SLHQL G]D F]\OL PDOHMH NRV]\N GyEU MDNL PR QD QDE\ü ]D RNUH ORQ VXP

QRPLQDOQ 'OD XWU]\PDQLD UHDOQHM SRGD \ SLHQL G]D QD VWDá\P SR]LRPLH SRGD QRPLQDOQD

PXVL RGSRZLHGQLR Z]URVQ ü *G\ ZVND QLN LQIODFML MHVW Z\ V]\ QL VWRSD Z]URVWX SRGD \

SLHQL G]DPDP\GRF]\QLHQLD]HVSDGNLHPUHDOQHMSRGD \SLHQL G]DQDWRPLDVWVWRSDZ]URVWX

SRGD \ SLHQL G]D SU]HZ\ V]DM FD VWRS LQIODFML SURZDG]L GR Z]URVWX UHDOQHM SRGD \

SLHQL G]D:DQDOL]RZDQ\PRNUHVLHZ\VW SLáZ]URVWUHDOQHMSRGD \SLHQL G]D0JG\ VWRSD

LQIODFML PLHU] FD SURFHQWRZ\ Z]URVW SR]LRPX FHQ E\áD QL V]D QL VWRSD SU]\URVWX

SRGD \SLHQL G]D0

3RGVWDZRZ\PDJUHJDWHPSLHQL Q\PZVSUDZR]GDZF]R FL1%3MHVWRGPDUFDU0

8]QDQLH ]D SRGVWDZRZ PLDU SLHQL Q V]HURNLHJR DJUHJDWX RG]ZLHUFLHGOD URVQ FH

]QDF]HQLH URGNyZ XZD DQ\FK ]D PQLHM Sá\QQH NWyUH SRWHQFMDOQLH PRJ E\ü MHGQDN X \WH

MDNR URGNL SáDWQLF]H =PLDQ\ Z V\VWHPLH ILQDQVRZ\P QD]\ZDQH QLHNLHG\ LQQRZDFMDPL

4/

26

ILQDQVRZ\PL]PQLHMV]DM RJUDQLF]HQLDX \FLDLFKZFKDUDNWHU]HSLHQL G]D

3

Sposób liczenia

agregatów jest zgodny ze standardami Europejskiego Banku Centralnego.

*UDQLFD PL G]\ SLHQL G]HP Z Z VNLP L V]HURNLP XM FLX PD FKDUDNWHU XPRZQ\ JG\

]DOH \RGX]QDQLD«««MDNLHDNW\ZDILQDQVRZHVSHáQLDM NU\WHULDZ\VRNLHMSá\QQR FLL

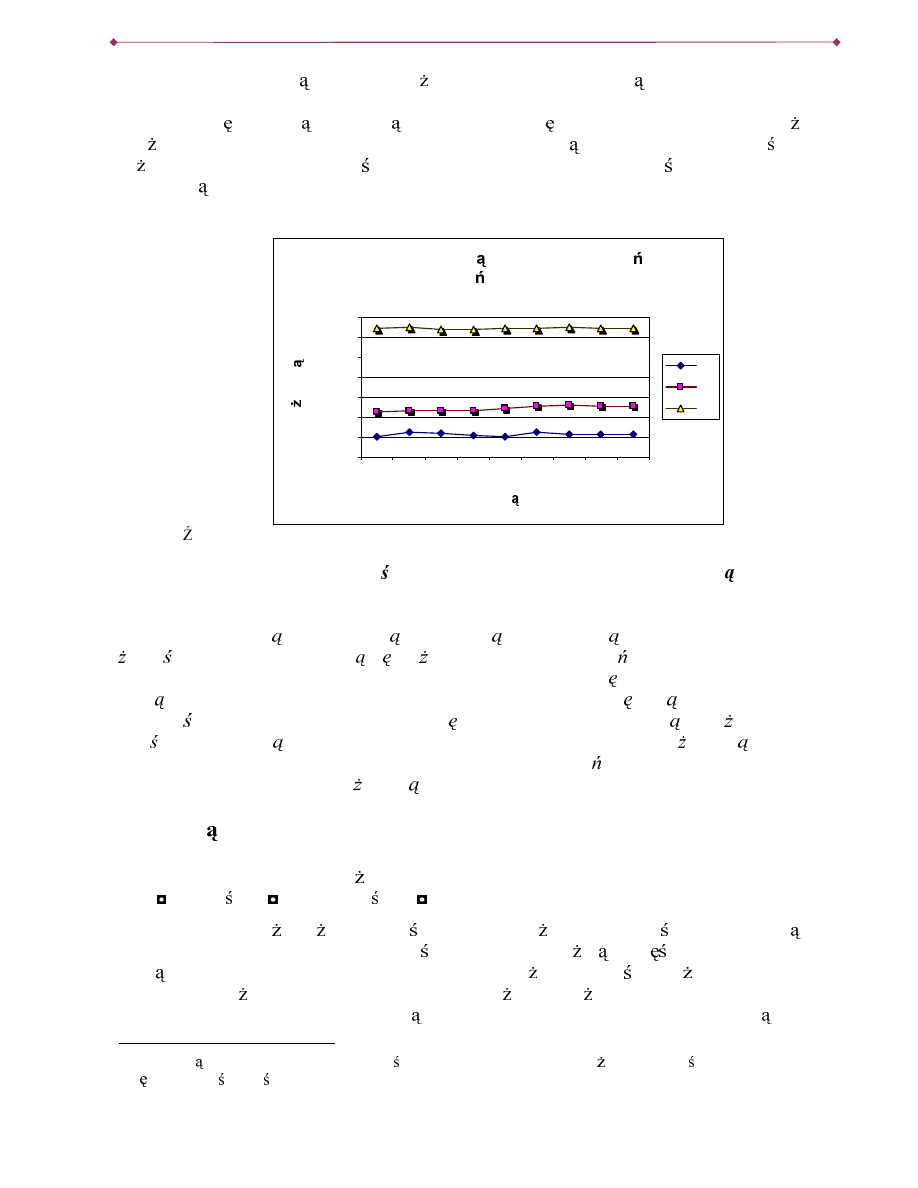

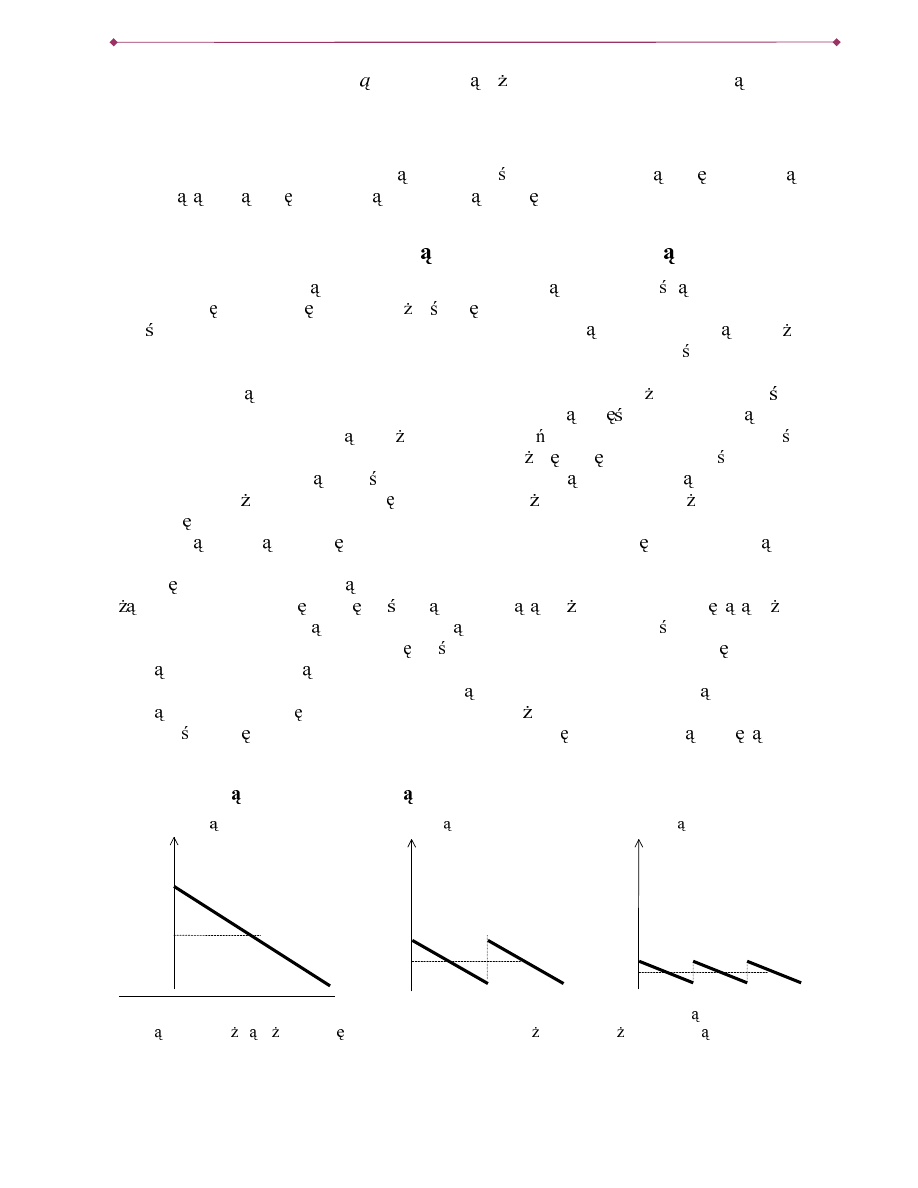

GX HMSRZV]HFKQHMZLDU\JRGQR FL Z\VWDZF\ 3RUyZQDQLH ]PLDQ ZLHONR FL SRGVWDZRZ\FK

PLDU SLHQL G]D SRGDZDQ\FK SU]H] 1DURGRZ\ %DQN 3ROVNL GOD NZDUWDáyZ U

przedstawia rysunek 1.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

UyGáR1%3%LXOHW\Q,QIRUPDF\MQ\

Komentarz

8WUDWDZLDU\JRGQR FL HPLWHQWD XFLHF]ND RG NUDMRZHJR SLHQL G]D F]\OL

SXVWHSyáNLLGRODU\]DFMDZ3ROVFH

: GUXJLHM SRáRZLH URNX PLDáR Z 3ROVFH PLHMVFH JZDáWRZQH SU]\VSLHV]HQLH LQIODFML

VSRZRGRZDQH RJyOQ QLHUyZQRZDJ JRVSRGDUF] L OLEHUDOL]DFM FHQ SU]HGH ZV]\VWNLP

\ZQR FL6WRSDZ]URVWXFHQRVL JQ áDD ZRNUHVLHJUXG]LH GRJUXGQLD

U 'UDVW\F]Q\ VSDGHN VLá\ QDE\ZF]HM ]áRWHJR VSRZRGRZDá XWUDW ]DXIDQLD GR NUDMRZHJR

SLHQL G]D/XG]LHQDW\FKPLDVWSRX]\VNDQLXGRFKRGyZSR]E\ZDOLVL WUDF F\FKJZDáWRZQLH

QDZDUWR FL]áRW\FKF]HJRSU]HMDZHPVWDá\VL SXVWHSyáNLZVNOHSDFK:\VW SLáRWH ]MDZLVNR

RNUH ODQH GRODU\]DFM JRVSRGDUNL 8G]LDá GHSR]\WyZ GHZL]RZ\FK Z SRGD \ SLHQL G]D QD

NRQLHF JUXGQLD U Z\QLyVá GOD SRUyZQDQLD Z NR FX JUXGQLD GHSR]\W\

GHZL]RZHVWDQRZLá\SRGD \SLHQL G]DRJyáHP

1.3.

3LHQL G]LLQQHDNW\ZD

:V]\VWNLHDNW\ZDILQDQVRZHPR QDFKDUDNWHU\]RZDüZHGáXJWU]HFKNU\WHULyZ

Sá\QQR FL GRFKRGRZR FL

U\]\ND

1DRJyáMHVWWDN HZ\ V]HMSá\QQR FLWRZDU]\V]\QL V]DGRFKRGRZR üPLHU]RQD VWRS

]ZURWXF]\OLLORUD]HPGRFKRGXGRZDUWR FLQRPLQDOQHMZ\UD RQ QDMF] FLHMZSURFHQWDFK

3LHQL G] JRWyZNRZ\ MHVW URG]DMHP DNW\ZyZ R QDMZ\ V]HM Sá\QQR FL JG\ Z GRZROQ\P

PRPHQFLHLEH] DGQ\FKGRGDWNRZ\FKQDNáDGyZPR H]RVWDüX \W\GR]DNXSXZ\PLDQ\QD

GRZROQ\LQQ\URG]DMDNW\ZyZ-DNZ\JO GDVWRSD]ZURWX]XWU]\P\ZDQLD]DVREyZPDM WNX

3

%DQNLPRJ QSáDJRG]LüUHVWU\NFMH]DZF]H QLHMV]HZ\FRIDQLHGHSR]\WyZ]áR RQ\FKQDRNUH ORQ\WHUPLQFR

]ZL NV]DSá\QQR üW\FK URGNyZ

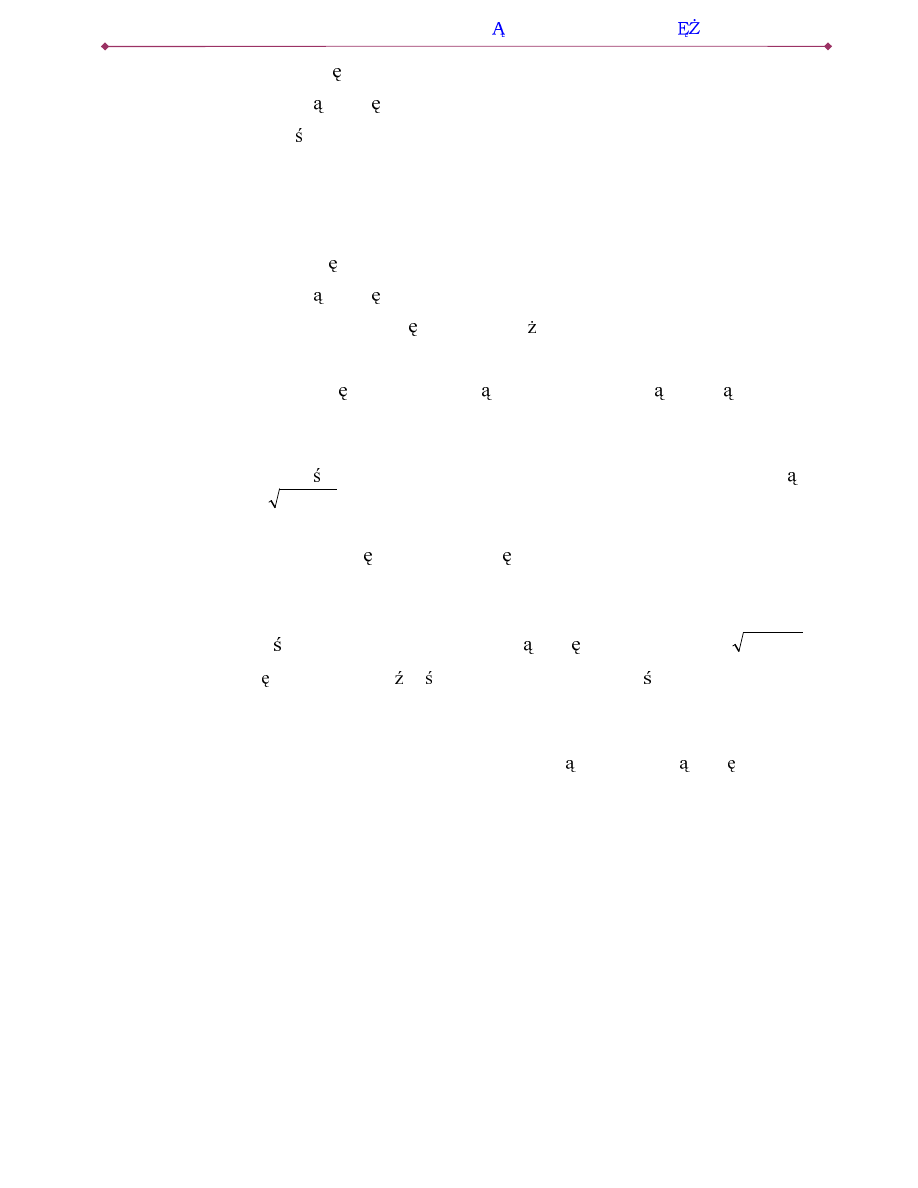

5\V0LDU\SLHQL G]DZRNUHVLHVW\F]H

ZU]HVLH POQ]á

0

50000

100000

150000

200000

250000

300000

350000

I

II

III

IV

V

VI

VII

VIII

IX

M0

M1

M3

M

AKROEKONOMIA

J.

K

UROWSKI

-

3,(1, '=L32/,7<.$3,(1,

1$

5

/

26

Z IRUPLH JRWyZNL" 1RPLQDOQLH Z\QRVL ER WU]\PDQLH EDQNQRWyZ QLH GDMH QDP DGQ\FK

GRFKRGyZ SURFHQWyZ $ UHDOQLH" -H OL Z GDQ\P NUDMX PD PLHMVFH LQIODFMD UHDOQD VWRSD

]ZURWX E G]LH XMHPQD 3LHQL G] JRWyZNRZ\ WUDFL ERZLHP VZ VLá QDE\ZF] PLHU]RQ

LOR FL GyEU MDN PR QD NXSLü ]D RNUH ORQ VXP SLHQL G]\ GRNáDGQLH Z WDNLP WHPSLH Z

MDNLPURVQ SU]HFL WQLHFHQ\GyEU5HDOQDVWRSD]ZURWX]WU]\PDQLDJRWyZNLUyZQDVL VWRSLH

inflacji, lecz z odwrotnym znakiem:

U

= -

P;

(1)

gdzie

:

U

- realna stopa zwrotu z gotówki

,

P

- stopa inflacji

Ryzyko doty

F] FH NRQNUHWQHJR URG]DMX DNW\ZyZ ILQDQVRZ\FK ]ZL ]DQH MHVW PL G]\

LQQ\PL]ZLDU\JRGQR FL HPLWHQWD:SU]\SDGNXJRWyZNLMHVWQLPEDQNFHQWUDOQ\3LHQL G]

JRWyZNRZ\XFKRG]LQD RJyá ]D PDáR U\]\NRZQ ORNDW PDM WNX MHGQDN Z SU]\SDGNX JG\

EDQN FHQWUDOQ\ QLH GED R XWU]\P\ZDQLH ZDUWR FL SLHQL G]D U\]\NR WR PR H E\ü ]QDF]QH L

PR HSURZDG]LüGRXWUDW\ZLDU\JRGQR FLHPLWHQWDRUD]XFLHF]NL RG NUDMRZHM ZDOXW\ SDWU]

NRPHQWDU]:WDEOLF\]QDMGXMHP\SU]\NáDG\Uy QLFZGRFKRGRZR FLDNW\ZyZ

Tablica

.3RUyZQDQLHGRFKRGRZR FLZ\EUDQ\FKDNW\ZyZILQDQVRZ\FK w

(nominalnie)

5RG]DM

DNW\ZyZ

DNFMH' ELFD

akcje Softbank.

obligacje skarbowe

3-letnie

gotówka

depozyty

SRZ\ HMODW

6WRSD]ZURWX

+51%

-51%

ok. 8 %

0%

ok. 7%

UyGáR3DUNLHW1%3

'LDPHWUDOQH Uy QLFH VWyS ]ZURWX ] DNFML REUD]XM U\]\NR ]ZL ]DQH ] SU]HFL WQLH GX Z

GáX V]\PRNUHVLHGRFKRGRZR FL WHJRURG]DMXDNW\ZyZ7HUPLQRZHGHSR]\W\EDQNRZHMDN

UyZQLH REOLJDFMH VNDUERZH E G FH URG]DMHP SDSLHUX ZDUWR FLRZHJR HPLWRZDQHJR SU]H]

U] G GDM ]QDF]QLH Z\ V]\ GRFKyG QL JRWyZND DOH QD RJyá NRV]WHP ]QDF]QLH QL V]HM

Sá\QQR FL

3U]HGVWDZLRQH SRUyZQDQLH SR]ZDOD ZQRVLü H Uy QLFH Z GRFKRGRZR FL SRPL G]\

SLHQL G]HP D LQQ\PL DNW\ZDPL ILQDQVRZ\PL PRJ VNáDQLDü OXG]L GR ]DPLDQ\ SLHQL G]D Z

DNW\ZDSU]\QRV] FHZ\ V]\GRFKyGE G RGZURWQLHZ]DOH QR FLRGWHJRMDNZ\FHQLDM RQL

NRU]\ FL]Sá\QQR FLLGRFKRGRZR FL% G]LHWRSU]HGPLRWHPDQDOL]\ZQDVW SQ\PSXQNFLH

: GDOV]\FK UR]ZD DQLDFK SU]\MPLHP\ SHZQH ]DáR HQLD NWyUH XáDWZL SURZDG]HQLH

DQDOL]\3LHQL G]E G]LHP\WUDNWRZDüMDNR URGNLPRJ FHVáX \üEH]SR UHGQLRGRNRQ\ZDQLX

SáDWQR FL]JRGQLH]Z VNLPXM FLHPDJUHJDW0LSU]\QRV] FHQDRJyáQL V]\GRFKyGQL

SR]RVWDáHDNW\ZDILQDQVRZH1LHSLHQL QHDNW\ZDILQDQVRZHE G UHSUH]HQWRZDQHZQDV]HM

analizie przez obligacje skarbowe.

&

2.1.

,VWRWDSRS\WXQDSLHQL G]

-DNLH F]\QQLNL GHF\GXM R SRS\FLH QD SLHQL G]" =DF]QLMP\ RG UR]SDWU]HQLD SURVWHJR

SU]\NáDGX 3U]\MPLMP\ H ZLH R XSLHF]RQ\ DEVROZHQW Z\ V]HM XF]HOQL Ä0DJLVWHU´

SRGHMPXMHSUDF RWU]\PXM FPLHVL F]QHZ\QDJURG]HQLHZZ\VRNR FL

]á

. Nie posiada on

SR]DW\P DGQ\FKDNW\ZyZ&DáR üGRFKRGX]SUDF\Z\GDMHZFL JXPLHVL FDZUyZQ\FK

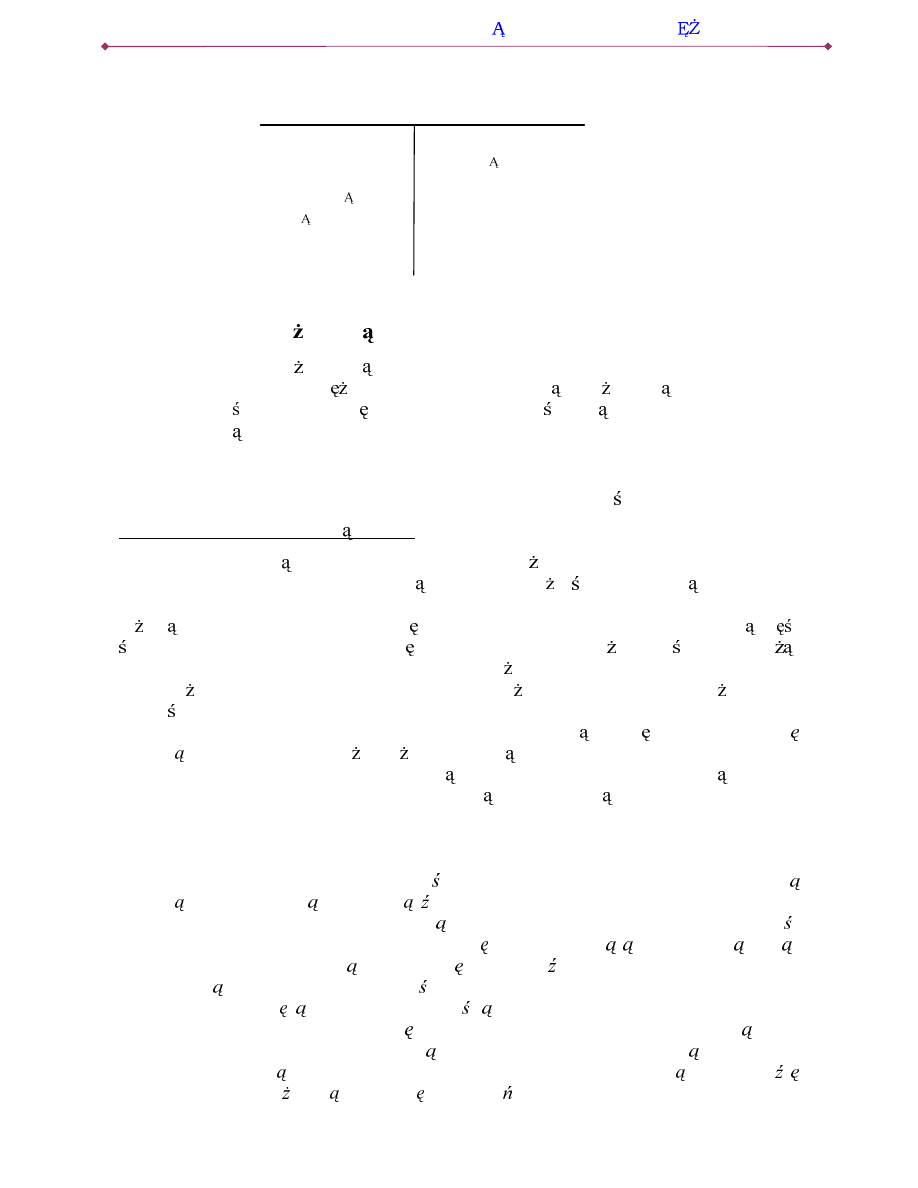

SRUFMDFKG]LHQQ\FKWDN HRVWDWQLHJRGQLDSU]HGZ\SáDW MHJRSRUWIHOVWDMHVL SXVW\%LH F\

]DVyESLHQL G]DMDNLXWU]\PXMHQDV]0DJLVWHUREUD]XMHOLQLDáDPDQDZLGRF]QDQDU\VXQNX

6/

26

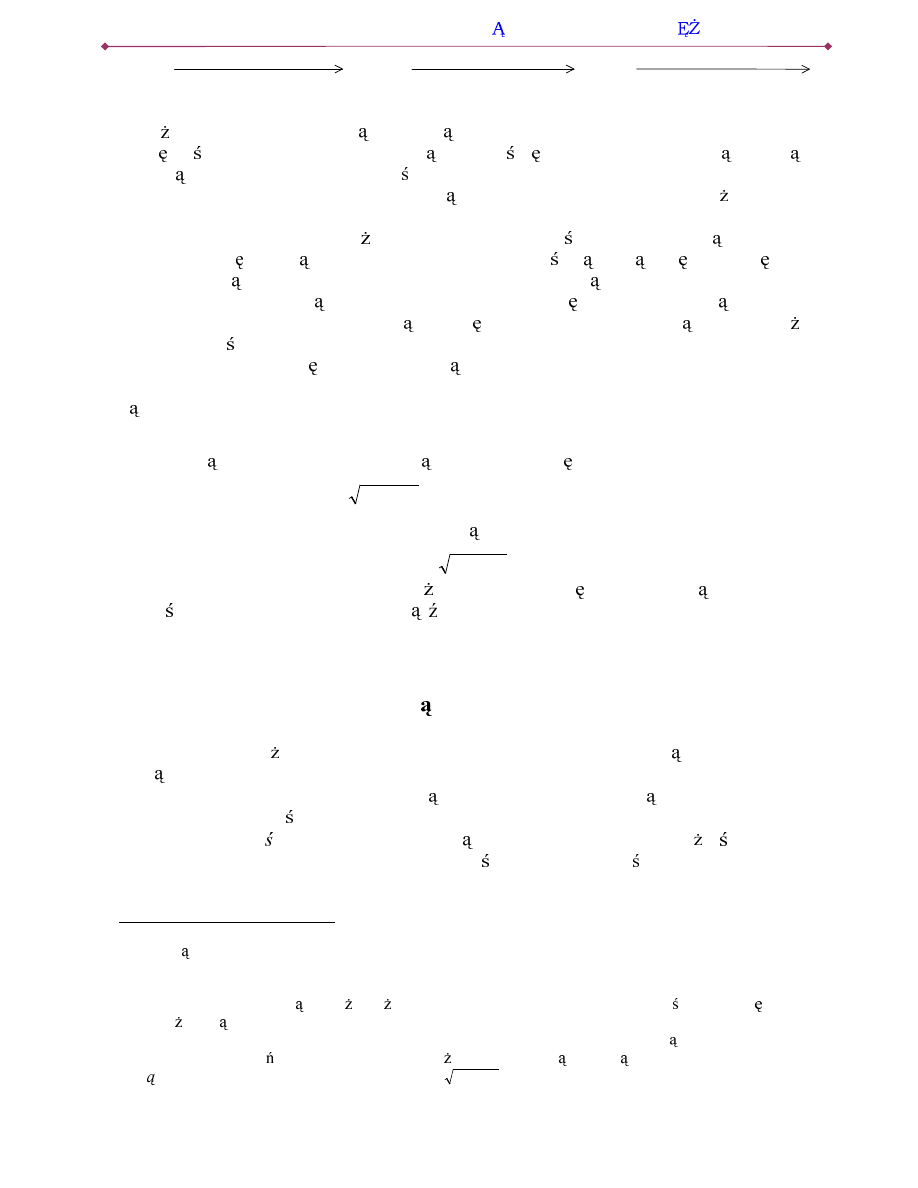

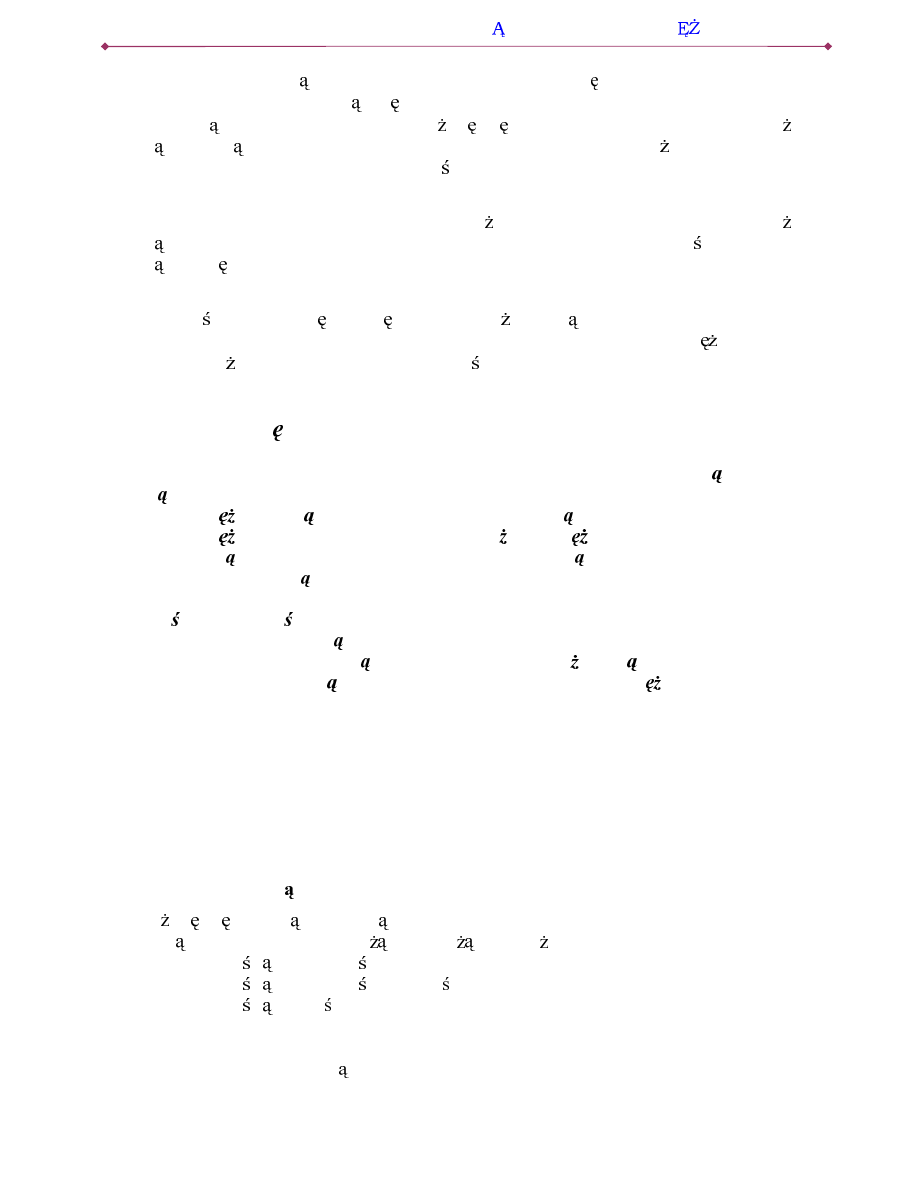

Rys.2.

=DVyESLHQL G]DLSRS\WQDSLHQL G]

'RFKyG

1000

500

0

!

#"

&]DV

6W\F]H

Luty

Marzec

.ZLHFLH

:LHONR ü LQG\ZLGXDOQHJR ]DSRWU]HERZDQLD F]\OL SRS\W 0DJLVWUD QD SLHQL G] Z\]QDF]RQ\

MHVWSU]H]SU]HFL WQ\]DVyESLHQL G]D3RQLHZD 0DJLVWHUQDSRF] WNXPLHVL FDSRZ\SáDFLH

ma 1000

]á

]D RVWDWQLHJR GQLD

]á

SU]HFL WQ\ ]DVyE SLHQL G]D D ZL F SRS\W QD SLHQL G]

wynosi 500

]á

(

0

!

#"

]á

-H OLUHDOQ\GRFKyG0DJLVWUDZVNDOLURNXR]QDF]\P\V\PEROHP

<, poziom cen 3WRPR HP\Z\]QDF]\üUHODFM ]DSRWU]HERZDQLDQDSLHQL G]GRQRPLQDOQHJR

dochodu:

0

!

#"

3< = N

!

#"

= 500

]á

12000

]á

=

(2)

=DXZD P\ H ZVSyáF]\QQLN VNáRQQR FL GR WU]\PDQLD SLHQL G]D N

!

#"

) jak i popyt na

SLHQL G]0

!

#"

]DOH RGF] VWRWOLZR FLGRNRQ\ZDQLDZ\SáDWZ\QDJURG]H

-DNNROZLHNUy QLVL RQDZUy Q\FKNUDMDFKZ]DOH QR FLRGXWUZDORQHMWUDG\FMLWRQDRJyá

QLH]PLHQLDVL V]\ENR

2WU]\PDQ\]DSLVPR HP\XRJyOQLüQDFDá JRVSRGDUN 2WU]\PXMHP\ N 0

3<a

VW G

0

= N3<

(3)

:VSyáF]\QQLN N LQWHUSUHWXMH VL MDNR VNáRQQR ü GR WU]\PDQLD SLHQL G]\ LQIRUPXM F MDN

F] üQRPLQDOQHJRSURGXNWX3<VWDQRZL]DSRWU]HERZDQLHOXG]LQDSLHQL G]0

). Równanie

SRS\WXQDSLHQL G]0

= N3<, znane jest jako równanie Cambridge.

2.2.

6]\ENR üRELHJXSLHQL G]D

*G\DQDOL]XMHP\FDá JRVSRGDUN PR HP\SRZL ]DüVNáRQQR üGRWU]\PDQLDSLHQL G]DN z

V]\ENR FL ] MDN SLHQL G] NU \ 6]\ENR ü RELHJX SLHQL G]D WR LOR ü ÄREURWyZ´ MDNLFK

GRNRQXMHSU]HFL WQLHMHGQRVWNDSLHQL QDQSZFL JXURNXXF]HVWQLF] FZWUDQVDNFMDFK-H OL

3<RNUH ODUR]PLDU\ZDUWR üWUDQVDNFML

4

WRSU]\GDQHMIXQNFMLSRS\WXQDSLHQL G]V]\ENR ü

RELHJXSLHQL G]D9) jest równa:

9 3<0

(4)

4

'RFKyG3.%QLHMHVWLGHDOQ PLDU ZDUWR FLWUDQVDNFMLGRNRQ\ZDQ\FKZJRVSRGDUFHJG\ REHMPXMHRQMDN

SDPL WDP\Z\á F]QLHVSU]HGD GyEUNR FRZ\FKRUD]QLHREHMPXMHWUDQVDNFMLILQDQVRZ\FK

M

AKROEKONOMIA

J.

K

UROWSKI

-

3,(1, '=L32/,7<.$3,(1,

1$

7

/

26

9PR QD]DWHP]LQWHUSUHWRZDüMDNR RGZURWQR ü VNáRQQR FL GR WU]\PDQLD SLHQL G]D N. Gdy

SRS\WQDSLHQL G]Z]UDVWDZZ\QLNXQSVSDGNXVWRS\SURFHQWRZHMV]\ENR üRELHJXSLHQL G]D

]PQLHMV]D VL ,P V]\EFLHM RELHJD SLHQL G] LP Z\ V]H 9 W\P PQLHMV]H E G]LH

]DSRWU]HERZDQLHMDNLH]JáRV] QD OXG]LHW\PQL V]\SRS\WQDSLHQL G]0

3<9.

2.3.

3RS\WQDSLHQL G]D]DPLDQDQDLQQHDNW\ZD

$E\EDUG]LHMV]F]HJyáRZRUR]SDWU]\üF]\QQLNLGHF\GXM FHRZLHONR FLSRS\WXQDSLHQL G]

SRZUyüP\ GR SU]\NáDGX 0DJLVWUD L ]DVWDQyZP\ VL MDNLH NURNL UDFMRQDOL]XM FH WU]\PDQLH

SLHQL G]\E\áE\RQVNáRQQ\SRGM üJG\E\VZyMURF]Q\GRFKyGZZ\VRNR FL

]á

, (czyli

WDNL VDP MDN SRSU]HGQLR RWU]\P\ZDá Z RGVW SDFK NZDUWDOQ\FK SR

]á

). Przy

UyZQRPLHUQ\P UR]NáDG]LH Z\GDWNyZ MHJR VNáRQQR ü GR WU]\PDQLD SLHQL G]\ Z\QLRVáDE\

-HGQDNZ\GáX HQLHRNUHVX]DMDNLGRVWDMHZ\QDJURG]HQLHPR HVNáRQLü

0DJLVWUDGR]UDFMRQDOL]RZDQLDVZRLFK]DFKRZD LWRQDGZDVSRVRE\

3RSLHUZV]HPR HNXSLüLXWU]\P\ZDüDNW\ZDSU]\QRV] FHZ\ V]HGRFKRG\QL SLHQL G]

QSREOLJDFMHVNDUEXSD VWZD=DXZD P\ HLPZ\ V]DMHVWVWRSDSURFHQWRZDGHF\GXM FDR

GRFKRGRZR FLREOLJDFMLW\PZL FHM0DJLVWHUWUDFLWU]\PDM FSLHQL G]HLW\PEDUG]LHME G]LH

VNáRQQ\ GR ]DPLDQ\ SLHQL G]\ QD DNW\ZD SU]\QRV] FH Z\ V]H GRFKRG\ DNW\ZD R Z\ V]HM

VWRSLH ]ZURWX 'RGDWNRZ\P F]\QQLNLHP ZSá\ZDM F\P QD VNáRQQR ü GR XWU]\P\ZDQLD

SLHQL G]D MHVW NRV]W MDNL PXVL SRQLH ü RVRED GRNRQXM FD WDNLHM UDFMRQDOL]DFML .RV]W

WUDQVDNF\MQ\WRNRV]W]ZL ]DQ\]]DPLDQ SLHQL G]DQDLQQHDNW\ZDILQDQVRZH Obejmuje on

]DUyZQRSURZL]MHPDNOHUDVSU]HGDM FHJRREOLJDFMHOXELQQHDNW\ZDMDNLF]DVSR ZL FDQ\QD

GRNRQDQLH WDNLHM WUDQVDNFML ,P Z\ V]\ MHVW NRV]W WUDQVDNF\MQ\ W\P Z\ V]D VNáRQQR ü GR

WU]\PDQLDSLHQL G]DDW\PVDP\PZ\ V]\SRS\WQDSLHQL G]

3R GUXJLH LQIODFMD PR H ]DFK FLü 0DJLVWUD GR SU]HQLHVLHQLD ]DNXSyZ GyEU ]DUD] SR

Z\SáDFLH,PZ\ V]DE G]LHSU]\W\PVWRSDLQIODFMLW\PEDUG]LHME G]LHWUDFLáSU]HWU]\PXM F

SLHQL G]H L W\P EDUG]LHM E G]LH ]DLQWHUHVRZDQ\ ]DNXSHP GyEU QD SRF] WNX NZDUWDáX -H OL

QDV] RVREQLN SRGHMPLH G]LDáDQLD UDFMRQDOL]XM FH XWU]\P\ZDQLH SLHQL G]D WR ]PQLHMV]\ VL

MHJRVNáRQQR üGRWU]\PDQLDSLHQL G]DZREXERZLHPSU]\SDGNDFKUDFMRQDOL]DFMDR]QDF]D

XWU]\P\ZDQLHSU]HFL WQLHPQLHMV]HJR]DVREXSLHQL G]D

2.4.

.RV]WDOWHUQDW\ZQ\WU]\PDQLDSLHQL G]D

=DSRWU]HERZDQLHQDSLHQL G]MHVW]DOH QHRGUHDOQHMVWRS\SURFHQWRZHMLRGVWRS\LQIODFML

5HDOQ VWRS SURFHQWRZ F]\OLVLá QDE\ZF] RGVHWHNRGSR \F]RQ\FK URGNyZSLHQL Q\FK

QS ] XWU]\P\ZDQLD REOLJDFML RNUH ODP\ MDNR Uy QLF PL G]\ VWRS QRPLQDOQ L VWRS

LQIODFML3RQLHZD U]HF]\ZLVWDLQIODFMD]QDQDMHVW]SHZQ\PRSy QLHQLHPQDOH \XZ]JO GQLü

LQIODFM RF]HNLZDQ 7D]DOH QR ü]QDQDMHVWMDNR]DVDGDFishera:

5

U LP

H

,

(5)

gdzie:

U

- realna stopa procentowa

,

L

- nominalna stopa procentowa

,

P

$

- oczekiwana stopa inflacji

.

$OWHUQDW\ZQ\ NRV]W WU]\PDQLD SHZQHM VXP\ SLHQL G]D WR Uy QLFD PL G]\ UHDOQ ZDUWR FL

RGVHWHN]ORNDW\WDNLHMVDPHMNZRW\ZDNW\ZDDOWHUQDW\ZQHREOLJDFMHLUHDOQ\P]ZURWHP]

5

)RUPXá VWZRU]\áZ\ELWQ\HNRQRPLVWDDPHU\ND VNL

Irving

Fisher (1867-1947).

8/

26

XWU]\P\ZDQLDMHMZIRUPLHSLHQL G]D3U]\MPXM F HUHDOQDVWRSD]ZURWXRGSLHQL G]DMHVW

równa stopie inflacji (oczekiwanej), lecz z odwrotnym znakiem

6

otrzymujemy:

NRV]WDOWHUQDW\ZQ\NZRW\[ [^LP

$

P

$

` [L

(6)

.RV]WDOWHUQDW\ZQ\WU]\PDQLDSLHQL G]DMHVWRNUH ORQ\SU]H]QRPLQDOQ VWRS SURFHQWRZ

REHMPXM F UHDOQ VWRS SURFHQWRZ LRF]HNLZDQ LQIODFM L UP

$

).

2.5.

7UDQVDNF\MQ\SRS\WQDSLHQL G]L]DVRERZDWHRULDSLHQL G]D

=DVRERZD WHRULD SLHQL G]D X]DVDGQLD SRS\W QD SLHQL G] NRQLHF]QR FL XWU]\P\ZDQLD

]DSDVXSLHQL G]\]HZ]JO GXQDUR]ELH QR üPL G]\WHUPLQDPLRWU]\P\ZDQLDGRFKRGyZFR

MDNL RNUHVDWHUPLQDPLGRNRQ\ZDQLDZ\GDWNyZZVSRVyEFL Já\=DVyESLHQL G]DVáX \

ZWHG\ GRNRQ\ZDQLX Z\PLDQ\ QD GURG]H WUDQVDNFML GODWHJR WHRULD WD Z\MD QLD W]Z SRS\W

transakcyjny.

7

3RS\WQDSLHQL G]]JáDV]DQ\SU]H]0DJLVWUD]QDV]HJRSU]\NáDGX]DOH \MDNVWZLHUG]LOL P\

RG UDFMRQDOL]DFML MDNLHM MHVW RQ VNáRQQ\ GRNRQDü ]DPLHQLDM F F] ü ]DVREyZ SLHQL G]D Z

DNW\ZDDOWHUQDW\ZQHSU]\QRV] FHZ\ V]\GRFKyG=PLH P\QLHFRZDUXQNLSU]\NáDGX-H OL

0DJLVWHUGRVWDMHZ\QDJURG]HQLHZIRUPLHF]HNXWRPR HW VXP ZSáDFLüZFDáR FLQDVZyM

rachunek

D YLVWD WU]\PDM F FDáR ü ]DVREX Z IRUPLH SLHQL G]D L GRNRQXM F FRG]LHQQ\FK

]DNXSyZ SU]\ X \FLX F]HNyZ Z]JO GQLH NDUW\ ]DXZD P\ QD PDUJLQHVLH H RVREQLN WHQ

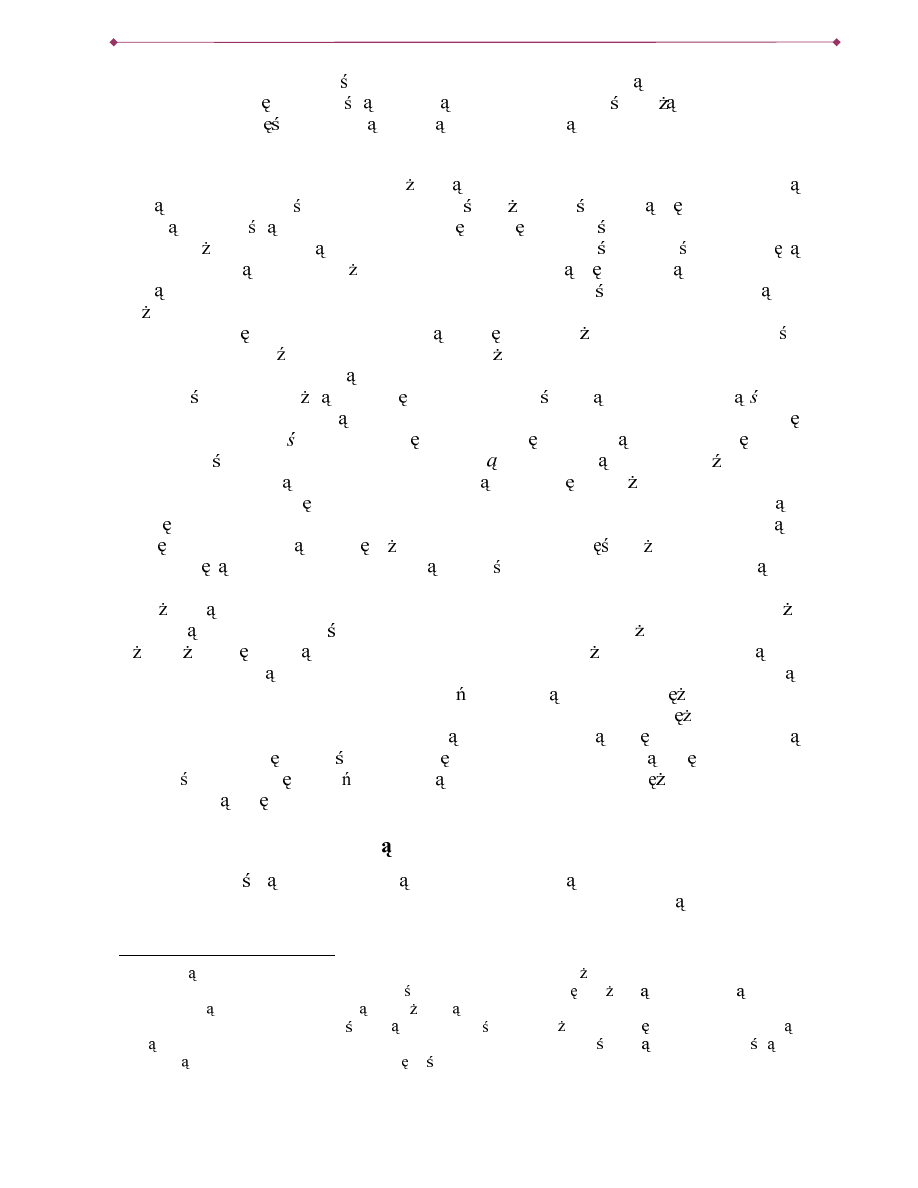

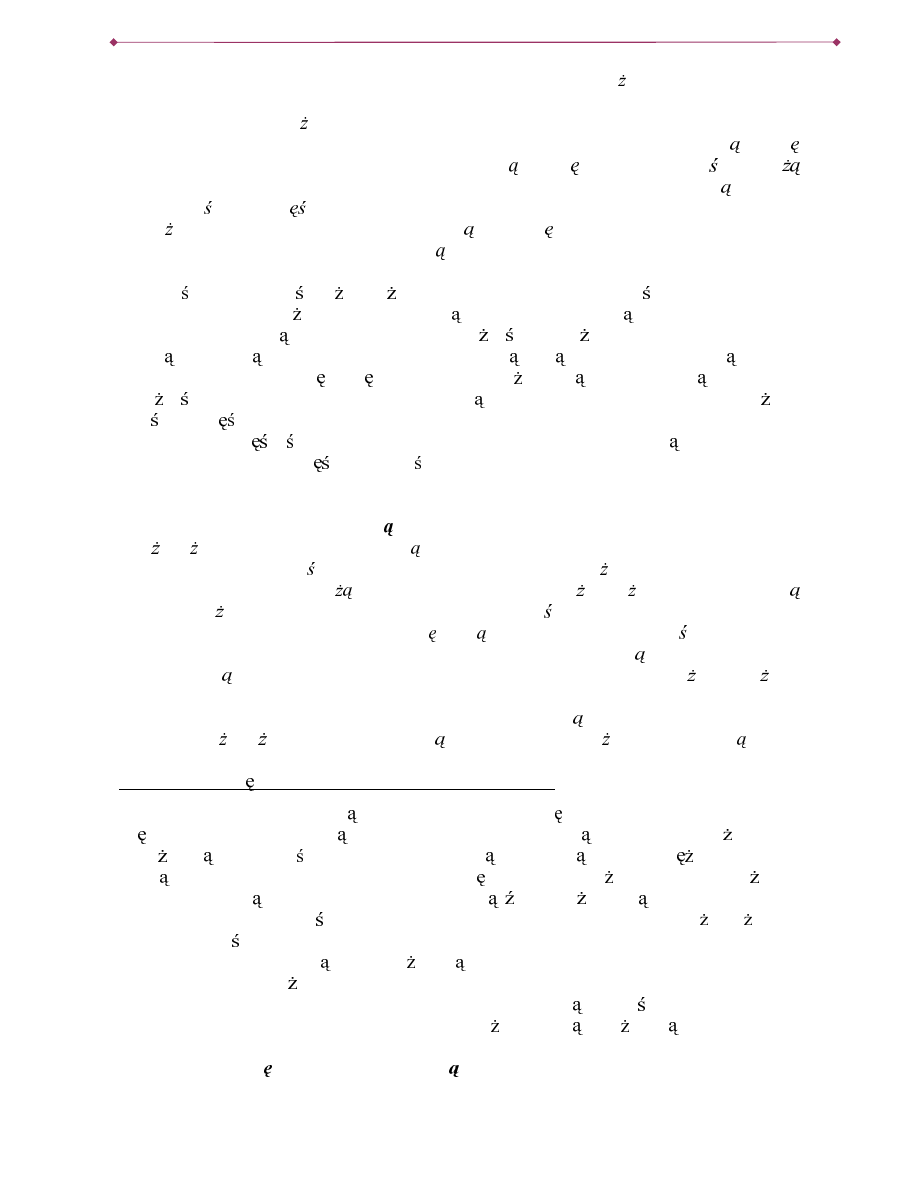

RE\ZDVL EH]JRWyZNL,OXVWUXMHWRU\VXQHND:WHMV\WXDFMLRGE\ZDZGDQ\PRNUHVLHW

QS PLHVL FX MHGQ Z\SUDZ GR EDQNX Z GQLX Z\SáDW\ -HJR SU]HFL WQ\ ]DVyE SLHQL G]D

czyli popyt, wynosi

3<, gdzie 3< - nominalny dochód w okresie t=1. Rysunek 3(b) pokazuje

V\WXDFM JG\0DJLVWHUQDSRF] WNXRNUHVXSRG]LHOLáZ\QDJURG]HQLHSRSRáRZLHQDZNáDGQD

GDQLHDYLVWDLORNDW RV]F] GQR FLRZ SU]\QRV] F Z\ V]\GRFKyGL QLHE G F MX Z

QDV]\P UR]XPLHQLX SLHQL G]HP RGZLHG]DM F EDQN SR UD] GUXJL Z URGNX RNUHVX GOD

GRNRQDQLD WUDQVIHUX ] UDFKXQNX RV]F] GQR FLRZHJR QD UDFKXQHN D YLVWD 3U]HFL WQ\ ]DVyE

SLHQL G]DSRS\WQDSLHQL G]MHVWUyZQ\3<. Rysunek 3(c) ilustruje trzy wizyty w banku i

GRNRQDQLH WU]HFK WUDQVIHUyZ 3RS\W QD SLHQL G] VSDGD GR 3< 8RJyOQLDM F SRS\W QD

SLHQL G]VWDQRZLSRáRZ VXP\WUDQVIHURZDQHMSU]\ND GHMZL]\FLHZEDQNXQDUDFKXQHND

YLVWD -H OL OLF]E ZL]\W Z EDQNX R]QDF]\P\ Q WR SU]HFL WQ\ ]DVyE SLHQL G]D E G F\ Z

posiadaniu Magistra wyniesie:

3<Q 3<Q.

Rys.3.

=DU] G]DQLH]DVREHPSLHQL G]HP

=DVyESLHQL G]D

=DVyESLHQL G]D

=DVyESLHQL G]D

PY

PY/2

PY/4

6

-HVWWRSUDZG]LZHZSU]\SDGNXJRWyZNLDOHQLH]DZV]HZSU]\SDGNXLQQ\FKVNáDGQLNyZSLHQL G]D%DQNL

RIHUXM QDRJyáZ\ V] QL ]HURVWRS RSURFHQWRZDQLDZNáDGyZ7DN HSDSLHU\GáX QH]DSHZQLDM GRFKyG

PY/6

M

AKROEKONOMIA

J.

K

UROWSKI

-

3,(1, '=L32/,7<.$3,(1,

1$

9

/

26

t =

t =

t =

a)

MHGQDZL]\WDZEDQNX

b)

GZLHZL]\W\ZEDQNX

c)

WU]\ZL]\W\ZEDQNX

.D GD ZL]\WD Z EDQNX SRFL JD ]D VRE SHZLHQ NRV]W WUDQVDNF\MQ\ ]DPLDQ\ ZNáDGX

RV]F] GQR FLRZHJRQDZNáDGDYLVWD]ZL ]DQ\]SR ZL FHQLHPF]DVXHZHQWXDOQ SURZL]M

EDQNRZ NRV]WDPL SU]HMD]GX LWS -H OL MHGQRVWNRZ\ NRV]W WUDQVDNF\MQ\ R]QDF]\P\ E, to

NRV]W\WUDQVDNF\MQHZFDá\PRNUHVLHZ\QLRV QEOLF]EDZL]\WZEDQNXSU]HPQR RQDSU]H]

koszt jednostkowy).

: MDNL VSRVyE 0DJLVWHU PR H ]RSW\PDOL]RZDü ZLHONR ü SRS\WX QD SLHQL G]" 6NRUR

SRWU]HEXMHSLHQL G]\Z\á F]QLHGOD]DNXSXWRZDUyZWRZáD FLZ ]DVDG SRVW SRZDQLDE G]LH

PLQLPDOL]DFMDá F]QHJRNRV]WXZL]\WZEDQNXLWU]\PDQLDSLHQL G]DQDUDFKXQNXDYLVWD)

8

.

.RV]W XWU]\P\ZDQLD SLHQL G]D WR NRV]W DOWHUQDW\ZQ\ SU]HFL WQHJR ]DVREX SLHQL G]D F]\OL

RGVHWNL MDNLH WUDFL 0DJLVWHU XWU]\PXM F SU]HFL WQLH 3<Q Z IRUPLH SLHQL G]D 3RQLHZD

XWUDFRQHNRU]\ FLZ\]QDF]DQRPLQDOQDVWRSDSURFHQWRZDLkoszt ten jest równy iloczynowi

VWRS\SURFHQWRZHMLSU]HFL WQHJR]DVREXSLHQL G]D

koszt alternatywny =

L3<Q

(7)

à F]Q\NRV]WZ\QRVL

7& L3<QEQ

(8)

0LQLPDOL]XM F7&RWU]\PXMHP\RSW\PDOQ dla0DJLVWUDOLF]E ZL]\WZEDQNX

9

E

L3<

Q

2

/

*

=

(9)

=JRGQLH]W\PZ\QLNLHPRSW\PDOQ\]DVyESLHQL G]DZ\QRVL

L

3<E

Q

3<

0

2

/

2

/

*

*

=

=

(10)

2WU]\PDQD IRUPXáD SR]ZDOD VWZLHUG]Lü H RSW\PDOQ\ SU]HFL WQ\ ]DVyE SLHQL G]D Z]UDVWD

JG\UR QLHSR]LRPFHQUHDOQ\GRFKyGE G NRV]WWUDQVDNF\MQ\QDWRPLDVWVSDGDZUHDNFMLQD

wzrost stopy procentowej.

2.6.

0RW\Z\XWU]\P\ZDQLDSLHQL G]D

-0.H\QHVZ\Uy QLáWU]\]DVDGQLF]HSRZRG\GODNWyU\FKOXG]LHWU]\PDM ]DVRE\

SLHQL G]D

0RW\ZWUDQVDNF\MQ\/XG]LHILUP\FKF SRVLDGDüSHZLHQ]DVyESLHQL G]DGOD

GRNRQ\ZDQLDSáDWQR FLRFKDUDNWHU]HUHJXODUQ\P

0RW\ZSU]H]RUQR FLRZ\3HZLHQ]DVyESLHQL G]DMHVWXWU]\P\ZDQ\GODRVWUR QR FLMDNR

]DEH]SLHF]HQLHZQLHSU]HZLG]LDQ\FKRNROLF]QR FLDFKQSNRQLHF]QR FL]DSáDFHQLD

mandatu.

7

3RGVWDZ E\á\dwie prace:

William

Baumol,

The

Transactions Demand for Cash: An Theoretic Approach,

4XDUWHUO\-RXUQDORI(FRQRPLFV

vol

56,

November

1952) i

James

Tobin,

The

Interest Rate Elasticity of the

Transactions Demand for Cash,

5HYLHZ RI(FRQRPLFVDQG6WDWLVWLFV

vol

.36,

September

1956.

8

8WU]\PXMHP\WXXSUDV]F]DM FH]DáR HQLH HZNáDG\DYLVWDFHFKXMHWDNDVDPDGRFKRGRZR üMDNJRWyZN FR

R]QDF]D HQLHV RQHRSURFHQWRZDQH

9

.RU]\VWDP\WX]IRUPXá\PDWHPDW\F]QHMQDPLQLPXP min7& L3<QEQRWU]\PXM FRSWLPXPSU]H]

SU]\UyZQDQLHNRV]WXNUD FRZHJRGR]HUDSRPLMDP\ HQPXVLE\üOLF]E FDáNRZLW 7&Q= L3<Q

%

E

; VN GRSW\PDOQDOLF]EDZL]\WZEDQNXZ\QRVL:

E

L3<

Q

2

/

*

=

10/

26

0RW\ZVSHNXODF\MQ\:DUWR üQRPLQDOQDLQQ\FKDNW\ZyZMDNLHPRJ XWU]\P\ZDüOXG]LH

FKDUDNWHU\]XMHVL QLHSHZQR FL 2F]HNXM FQSVSDGNXLFKZDUWR FLJUR FHJRVWUDWDPL

NDSLWDáRZ\PLF] üVZHJRPDM WNXPRJ ORNRZDüZSLHQL G]X

3U]HGVWDZLRQD Z SRSU]HGQLP SXQNFLH WHRULD ]DVRERZD WáXPDF]\ SRS\W Z\ZRáDQ\

PRW\ZHPWUDQVDNF\MQ\P=DNáDGDRQD HZ\á F]Q\PSRZRGHPGODNWyUHJROXG]LHXWU]\PXM

SLHQL G] MHVW NRQLHF]QR ü GRNRQ\ZDQLD SáDWQR FL L H SáDWQR FL WH GDM VL SU]HZLG]LHü ]H

]QDF]Q GRNáDGQR FL :DQDOL]LHWHMSRPLMDVL NZHVWL QLHSHZQR FL

3RQLHZD OXG]LH QLH V QLHNLHG\ Z VWDQLH GRNáDGQLH RNUH OLü SáDWQR FL MDNLFK E G

GRNRQ\ZDü Z FL JX QS QDMEOL V]\FK W\JRGQL ]DEH]SLHF]DM VL XWU]\PXM F SHZLHQ ]DVyE

SLHQL G]DQDWUDQVDNFMHQLHSU]HZLG]LDQH%UDNWDNLHJRSU]H]RUQR FLRZHJR]DVREXSLHQL G]D

PR HE\üSRZRGHPVWUDWSRQRV]RQ\FKQSZREOLF]XQLHRF]HNLZDQHMSRWU]HE\Z\NXSLHQLD

OHNDUVWZF]\Z]L FLDWDNVyZNLZGHV]F]RZ SRJRG 6WUDWDPR HWXSROHJDüQDNRQLHF]QR FL

Z\NXSXUHFHSW\]RSy QLHQLHPF]\UH]\JQDFML]ZD QHJRVSRWNDQLD

=DSRWU]HERZDQLH QD SLHQL G] ]JáDV]DQH SU]H] OXG]L ] PRW\ZX WUDQVDNF\MQHJR L

SU]H]RUQR FLRZHJRZ\UD DM FSRWU]HE GRNRQDQLDSáDWQR FL]ZL ]DQH MHVW ] IXQNFM URGND

Z\PLDQ\ D ]DWHP GRW\F]\ Z VNLHJR DJUHJDWX 0 0RW\Z VSHNXODF\MQ\ DNFHQWXMH IXQNFM

SU]HFKRZ\ZDQLDZDUWR FLFRNRMDU]\VL ]V]HUV]\PLXM FLDPLSLHQL G]D

10

7DNLHXM FLHMHVW

SXQNWHPZ\M FLDSRUWIHORZHMWHRULLSRS\WXQDSLHQL G]NWyUHMLVWRW MHVWRGSRZLHG QDS\WDQLH

MDN OXG]LH UR]G]LHODM SRVLDGDQH ]DVRE\ PDM WNRZH PL G]\ Uy QH URG]DMH DNW\ZyZ

ILQDQVRZ\FK"1D]\ZDVL WRNV]WDáWRZDQLHPSRUWIHOD,QZHVWRZDQLHZDNW\ZDSU]\QRV] FH

SU]HFL WQLHZ\VRNL]ZURWGRFKyGRNXSLRQHMHVWZ\VRNLPU\]\NLHP,QZHVWRU]\Z\ND]XM F\

QLHFK üGRU\]\NDVWRVXM VWUDWHJL Uy QLFRZDQLDSRUWIHOD-DNRF] ü]Uy QLFRZDQHJRSRUWIHOD

DNW\ZyZ E G FKFLHOL XWU]\P\ZDü SHZQ ZLHONR ü EH]SLHF]Q\FK DNW\ZyZ VWDQRZL F\FK

]DEH]SLHF]HQLH SU]HG SUDZGRSRGREQ\PL VWUDWDPL NDSLWDáRZ\PL QD DNW\ZDFK NWyU\FK FHQ\

]DJUR RQH V U\]\NLHP QLHNRU]\VWQ\FK ]PLDQ 7DNLP EH]SLHF]Q\P URG]DMHP DNW\ZX PR H

E\ü SLHQL G] NWyUHJR ZDUWR ü QRPLQDOQD MHVW ]QDQD L SHZQD FKRFLD SU]\QRVL RQ GRFKyG

QL V]\QL SU]HFL WQLHGDM DNW\ZDU\]\NRZQH

11

:\QLND]WHJR HF]\QQLNDPLGHF\GXM F\PL

R SRS\FLH QD SLHQL G] MDNR QDMEDUG]LHM EH]SLHF]Q\P URG]DMX DNW\ZyZ ILQDQVRZ\FK V

RF]HNLZDQLD]PLDQVWRS\SURFHQWRZHMLVWRSLH U\]\ND]ZL ]DQ\]QLHSLHQL Q\PLURG]DMDPL

aktywów finansowych.

12

6WRSD SURFHQWRZD F]\OL VWRSD ]ZURWX ] QLHSLHQL Q\FK DNW\ZyZ

NV]WDáWXMHDOWHUQDW\ZQ\NRV]WWU]\PDQLDSLHQL G]DF]\OLUHODW\ZQ VWUDW GRFKRGXSRQRV]RQ

SU]\WU]\PDQLXSLHQL G]\-H OLRF]HNXMHVL MHMZ]URVWXSRS\WQDSLHQL G]E G]LHVSDGDá=

NROHL MH OL SRGQRVL VL VWRSLH U\]\ND RVL JDQLD GRFKRGyZ ] QLHSLHQL Q\FK DNW\ZyZ WR

SRS\WQDSLHQL G]E G]LHZ]UDVWDá

2.7.

)XQNFMDSRS\WXQDSLHQL G]

&]\QQLNLRNUH ODM FHSRS\WQDSLHQL G]WR]JRGQLH]DQDOL] ZSLSVWRSDLQIODFML

SR]LRP FHQ VWRSD SURFHQWRZD GRFKyG UHDOQ\ NRV]W\ ]DPLDQ\ SLHQL G]D QD DNW\ZD

10

2EHMPXM RQH]RESPQLHMSá\QQHURG]DMHDNW\ZyZILQDQVRZ\FKQL VNáDGQLNL0MDNZNáDG\

WHUPLQRZHF]\QLHNWyUHURG]DMHSDSLHUyZZDUWR FLRZ\FKNWyU\FKOXG]LHF] VWRX \ZDM MDNRORNDWPDM WNRZ\FK

11

5\]\NR]ZL ]DQH]WU]\PDQLHPSLHQL G]DPR HURVQ üJG\LQIODFMDMHVWWUXGQDGRSU]HZLG]HQLD=QDQDMHVW

ZyZF]DVZSUDZG]LHQRPLQDOQDZDUWR üSLHQL G]DDOHZDUWR üUHDOQDPR H]PLHQLDüVL QLHRF]HNLZDQLHF]\QL F

SLHQL G]PQLHMEH]SLHF]Q\PURG]DMHPDNW\ZX:UHODFMLGRZ\VRNLHMQLHSHZQR FL]ZL ]DQHMQS]ZDUWR FL

DNFMLSLHQL G]QDZHWZyZF]DV]DFKRZXMHRSLQL GR üSHZQHJRURG]DMXDNW\ZyZ

12

Por.

James

Tobin, Liquidity Preference as Behavior toward Risk,

5HYLHZRI(FRQRPLFV6WXGLHV

February

1958.

M

AKROEKONOMIA

J.

K

UROWSKI

-

3,(1, '=L32/,7<.$3,(1,

1$

11

/

26

SU]\QRV] FH GRFKyG NRV]W\ WUDQVDNF\MQH 3U]\MPXM F NRV]W\ WUDQVDNF\MQH ]D QLH]PLHQQH

PR HP\SRS\WQDUHDOQ\SLHQL G]SU]HGVWDZLüZSRVWDFLQDVW SXM FHMIXQNFMLOLQLRZHM

13

0

3 N<KLP

(11)

3R]LRPFHQZPLDQRZQLNXOHZHMVWURQ\UyZQR FLSRZRGXMH HSU]HGVWDZLDRQDSRS\WQD

SLHQL G]ZXM FLXUHDOQ\P3R]ZDODQDPWR]LJQRURZDüFHQ\SRSUDZHMVWURQLHUyZQR FLL

RJUDQLF]\üVL GRGZyFK]PLHQQ\FK Z\]QDF]DM F\FK ]DSRWU]HERZDQLH QD URGNL SLHQL QH

3RS\WQDUHDOQ\SLHQL G]UR QLHZUD]]HZ]URVWHPUHDOQHJRGRFKRGX<LPDOHMHJG\UR QLH

stopa procentowa (

L). Parametr N to ZUD OLZR ü UHDOQHJR SRS\WX QD SLHQL G] QD ]PLDQ\

UHDOQHJR GRFKRGX SURGXNWX :]URVW GRFKRGX R MHGQRVWN SRZRGXMH Z]URVW SRS\WX QD

SLHQL G]RNZ kolei ZUD OLZR üUHDOQHJRSRS\WXQDSLHQL G]QD]PLDQ\VWRS\SURFHQWRZHM K

RNUH ODRLOHZ]UR QLHSRS\WQDUHDOQ\SLHQL G]SU]\VSDGNXVWRS\SURFHQWRZHMRMHGHQSXQNW

SURFHQWRZ\ :LHONR ü P PR QD ]LQWHUSUHWRZDü MDNR SRS\W QD SLHQL G] R FKDUDNWHU]H

autonomicznym.

6NáDGQLN SRS\WX QD SLHQL G] ]ZL ]DQ\ ] SR]LRPHP GRFKRGX N< ]DOH \ RG ZDUWR FL

WUDQVDNFMLUHDOL]RZDQ\FKZJRVSRGDUFHDZL FRGSR]LRPX3.%

=NROHLVNáDGQLNKLUHSUH]HQWXMHZSá\ZVWRS\SURFHQWRZHMQDSRS\WQDSLHQL G]6SDGHNVWRS\

SURFHQWRZHMZ\ZRáXMHZ]URVWSRS\WXQDSLHQL G]JG\ R]QDF]DRQREQL HQLHDOWHUQDW\ZQHJR

NRV]WXXWU]\P\ZDQLDSLHQL G]D

&

: SRGUR]G]LDOH RNUH OLOL P\ SRGVWDZRZH DJUHJDW\ SLHQL QH ED] PRQHWDUQ DJUHJDW\

M

M i M Z SRGUR]G]LDOH F]\QQLNL GHF\GXM FH R ]DSRWU]HERZDQLX QD SLHQL G]

]JáDV]DQ\P SU]H] JRVSRGDUN : SXQNFLH « RSLV]HP\ ]áR RQ\ SU]HELHJ GRVWDUF]DQLD

SLHQL G]DGRJRVSRGDUNLXF]HVWQLF] FHZQLPSRGPLRW\RUD]NRQWURO SRGD \SLHQL G]DSU]H]

ZáDG]HPRQHWDUQH

: ZL NV]R FL NUDMyZ W RVWDWQL IXQNFM Z\NRQXMH EDQN FHQWUDOQ\ 5yZQLH Z 3ROVFH

1DURGRZ\ %DQN 3ROVNL MHVW LQVW\WXFM RGSRZLHG]LDOQ ]D SROLW\N SLHQL Q FKRFLD

EH]SR UHGQLR NV]WDáWXMH W\ONR ED] PRQHWDUQ VWDQRZL F MHG\QLH F] ü RJyOQHJR ]DVREX

SLHQL G]D -DN VL SU]HNRQDP\ NRQWUROD QRPLQDOQHM SRGD \ SLHQL G]D PR H RND]Dü VL Z

]ZL ]NX]W\PQLH]DZV]HZSHáQLVNXWHF]QD

3.1.

5\QNLILQDQVRZHLV\VWHPEDQNRZ\

'OD ZVSyáF]HVQ\FK JRVSRGDUHN FKDUDNWHU\VW\F]Q\ MHVW GX \ XG]LDá L ]QDF]HQLH VHNWRUD

ILQDQVRZHJR 1D U\QNDFK ILQDQVRZ\FK GRNRQXMH VL WUDQVDNFML ]ZL ]DQ\FK ] DNW\ZDPL

ILQDQVRZ\PL6 WRQSREOLJDFMHERQ\NRPHUF\MQHVNDUERZHSDSLHU\ZDUWR FLRZHREOLJDFMH

VNDUEX SD VWZD ERQ\ VNDUERZH Uy QH IRUP\ SLHQL G]D NUDMRZHJR ZDOXW\ :VSyáF]H QLH

FRUD]SRSXODUQLHMV] IRUP V WUDQVDNFMHWHUPLQRZHLRSFMHQD]DNXSVSU]HGD RNUH ORQ\FK

GyEU &HFK FKDUDNWHU\VW\F]Q DNW\ZyZ ILQDQVRZ\FK RGUy QLDM F MH RG DNW\ZyZ

13

3U]HGVWDZLP\WXDOWHUQDW\ZQ\ZVWRVXQNXGRIRUPXá\]DSUH]HQWRZDQHMZSXQNFLHMDNRUyZQDQLH

&DPEULGJH]DSLVIXQNFMLSRS\WXQDSLHQL G]SU]\]DFKRZDQLXW\FKVDP\FKFRSRSU]HGQLR]PLHQQ\FK-HJR

SRGVWDZ MHVWWHRULD]DVRERZDFRR]QDF]D HZ\UD DRQ]DSRWU]HERZDQLHQDSLHQL G]0DOHMHVWRQFHORZR

uproszczony do funkcji liniowej.

12/

26

U]HF]RZ\FK WDNLFK MDN QLHUXFKRPR FL SRMD]G\ PHFKDQLF]QH VSU] W NRPSXWHURZ\ ]DSDV\

PDWHULDáyZ L VXURZFyZ MHVW WR H Z SU]\SDGNX DNW\ZyZ ILQDQVRZ\FK PDP\ ]DZV]H GR

F]\QLHQLD]]RERZL ]DQLHPLZLHU]\WHOQR FL MHGQRF]H QLH2EOLJDFMDSD VWZRZDNWyU QDE\á

SDQ.RZDOVNLVWDQRZLMHJRZLHU]\WHOQR üLMHVW]RERZL ]DQLHPVNDUEXSD VWZD%DQNQRW

]áRWRZ\ZSRUWPRQHWFHSDQL.RZDOVNLHMMHVW MHM ZLHU]\WHOQR FL PR H JR X \ü GR ]DNXSX

LQQHJR URG]DMX DNW\ZX E G ]DWU]\PDü MDNR IRUP PDM WNX = GUXJLHM VWURQ\ MHVW

]RERZL ]DQLHPHPLWHQWDEDQNXFHQWUDOQHJR

6\VWHP EDQNRZ\ VWDQRZL F] ü VHNWRUD ILQDQVRZHJR : V\VWHPLH EDQNRZ\P PR HP\

Z\Uy QLüEDQNL]RULHQWRZDQHQDUHDOL]DFM ]\VNyZDZL FE G FHSU]HGVL ELRUVWZDPLRUD]

G]LDáDM F\QDRGPLHQQ\FK]DVDGDFKEDQNFHQWUDOQ\5RO REXWDNUy Q\FKSRGPLRWyZV\VWHPX

EDQNRZHJR L MDN ZSá\ZDM RQH QD SU]HELHJ SRGD \ SLHQL G]D Z\MD QLP\ Z NROHMQ\FK

krokach.

3.2.

)XQNFMHEDQNXFHQWUDOQHJRQDSU]\NáDG]LH1%3

Narodowy Bank Polski jako bank centralny realizuje trzy podstawowe funkcje:

HPLV\MQ

NRQWUROLSRGD \SLHQL G]D

EDQNXSD VWZD

Realizacja

IXQNFML HPLV\MQHM polega na korzystaniu z monopolu do wprowadzania i

Z\FRI\ZDQLD ] RELHJX EDQNQRWyZ L PRQHW SUDZQ\FK URGNyZ SáDWQLF]\FK 1%3 SRVLDGD

Z\á F]QH SUDZR GR HPLWRZDQLD ]QDNyZ SLHQL Q\FK 53 :\NRQXM F W IXQNFM EDQN

FHQWUDOQ\GHF\GXMHRSRGD \EDQNQRWyZLPRQHWQRPLQRZDQ\FKZ]áRW\FK-HVWWRSLHQL G]

JRWyZNRZ\VWDQRZL F\]RERZL ]DQLHEDQNXFHQWUDOQHJR

Przez

NRQWURO SRGD \SLHQL G]DUR]XPLHVL UHJXORZDQLHLOR FLSLHQL G]DZJRVSRGDUFH

)XQNFMH W PR H EDQN FHQWUDOQ\ Z\SHáQLDü G]L NL X \FLX QDU] G]L NRQWUROL SLHQL QHM

(monetarnej) takich jak: operacje kredytowo - depozytowe, operacje otwartego rynku, stopa

RERZL ]NRZ\FKUH]HUZ

3HáQL FURO EDQNXSD VWZD1%3SURZDG]LUDFKXQNLEXG HWXSD VWZDREVáXJXMHSR \F]NL

SD VWZRZH]DFL JQL WHZGURG]HHPLVMLVNDUERZ\FKSDSLHUyZZDUWR FLRZ\FKZ\NRQXMHLQQH

XVáXJL ILQDQVRZH QD U]HF] RUJDQyZ SD VWZD QS SURZDG]L REVáXJ ILQDQVRZ U] GX RUD]

REVáXJ GáXJX]DJUDQLF]QHJRZ\NRQXMHXVWDORQ SU]H]U] GZSRUR]XPLHQLX]HVWDQRZL F

RUJDQ1%35DG 3ROLW\NL3LHQL QHMSROLW\N ZDOXWRZ RUD]ZVSyáG]LDáD]RUJDQDPLSD VWZD

ZNRRUG\QRZDQLXZáDVQHMSROLW\NLSLHQL QHM]FDáRNV]WDáWHPSROLW\NLJRVSRGDUF]HM

3.3.

%DQNLNRPHUF\MQH

%DQNL V V]F]HJyOQ\P W\SHP SU]HGVL ELRUVWZ 'R SRGVWDZRZ\FK F]\QQR FL EDQNRZ\FK

QDOH

SU]\MPRZDQLH ZNáDGyZ SLHQL Q\FK JRVSRGDUVWZ GRPRZ\FK L SU]HGVL ELRUVWZ L

MHGQRVWHNSD VWZRZ\FKSáDWQ\FKQD GDQLHLWHUPLQRZ\FKRUD]SURZDG]HQLHUDFKXQNyZ

W\FKZNáDGyZGRNRQ\ZDQLHSáDWQR FLQD]OHFHQLHVZRLFKNOLHQWyZ

wykorzystywanie zgromadzonych zasobów do udzielania kredytów,

prowadzenie innych rachunków bankowych,

udzielanie gwarancji bankowych,

HPLWRZDQLHEDQNRZ\FKSDSLHUyZZDUWR FLRZ\FK

M

AKROEKONOMIA

J.

K

UROWSKI

-

3,(1, '=L32/,7<.$3,(1,

1$

13

/

26

SU]HSURZDG]DQLHEDQNRZ\FKUR]OLF]H SLHQL Q\FK

14

%DQNL NWyU\FK SRGVWDZRZ G]LDáDOQR FL MHVW SU]\MPRZDQLH ZNáDGyZ SLHQL Q\FK L

XG]LHODQLH NUHG\WyZ D WDN H GRNRQ\ZDQLH UR]OLF]H JRWyZNRZ\FK L EH]JRWyZNRZ\FK

SU]\M áR VL RNUH ODü EDQNDPL KDQGORZ\PL OXE NRPHUF\MQ\PL 7R RQH SHáQL RERN EDQNX

FHQWUDOQHJRIXQNFM NUHDFMLSLHQL G]DLQDQLFKVNXSLP\VL ZQDV]HMGDOV]HMDQDOL]LH

15

Komentarz

5HVWDXUDFMDEDQNRZR FLNRPHUF\MQHMZ3ROVFH

3RF] WNLRGEXGRZ\Z3ROVFHV\VWHPXEDQNRZHJRRGSRZLDGDM FHJRZVSyáF]HVQHMJRVSRGDUFH

U\QNRZHM Z\SU]HG]DM QLHFR ZLHON UHIRUP V\VWHPRZ ]DLQLFMRZDQ Z U : U

Z\G]LHORQR ]H VWUXNWXU\ 1%3 SRZV]HFKQH NDV\ RV]F] GQR FL WZRU] F RGU EQ\ EDQN

SD VWZRZ\ 3.2 D Z URNX QDVW SQ\P Z\G]LHORQR QDVW SQ\FK EDQNyZ NWyUH VWZRU]\á\

SRGZDOLQ\ SRG VLHü NUDMRZ\FK EDQNyZ NRPHUF\MQ\FK : U UR]SRF] á VL SURFHV

SU]HNV]WDáFH ZáDVQR FLRZ\FKVHNWRUDEDQNRZHJRQDSRF] WNXJáyZQLHSRSU]H]SRZVWDZDQLH

QRZ\FK EDQNyZ SU\ZDWQ\FK D Z ODWDFK QDVW SQ\FK WDN H SU]H] VSU]HGD LQZHVWRURP

SU\ZDWQ\PZW\P]DJUDQLF]Q\PXG]LDáyZZSU\ZDW\]RZDQ\FKEDQNDFKSD VWZRZ\FK

:UG]LDáDáRZ3ROVFHSRQDGEDQNyZNRPHUF\MQ\FKZW\PEDQNLSD VWZRZH

EDQNyZE G F\FKMHGQRRVRERZ\PLVSyáNDPLVNDUEXSD VWZDEDQNyZ]DJUDQLF]Q\FKOXE

RGG]LDáyZEDQNyZ]DJUDQLF]Q\FK3RQDGWRLVWQLDáRRNRáRQLHZLHONLFKORNDOQ\FKEDQNyZ

VSyáG]LHOF]\FK 3R ODWDFK HNVSDQVML LOR FLRZHM L SRZVWDQLX ZLHOX EDQNyZ PDá\FK RG URNX

QDVLODM VL SURFHV\ NRQVROLGDF\MQH IX]MH L WZRU]HQLH JUXS EDQNRZ\FK LQVSLURZDQH

]DUyZQR RGJyUQLH SU]H] ZáDG]H JRVSRGDUF]H JUXSD 3(.$2 6$ MDN L PDM FH FKDUDNWHU

SU]HM üIX]MD%DQNX*GD VNLHJR]%DQNLHP,QLFMDW\Z*RVSRGDUF]\FK.

:\NRU]\VWDQLH]JURPDG]RQ\FK URGNyZGRXG]LHODQLDNUHG\WyZRUD]ORNRZDQLHNDSLWDáyZ

ZáDVQ\FKLNOLHQWyZZNRU]\VWQ\FKDNW\ZDFKSU]HGVL Z]L FLDFKZ\VW SXMHZELODQVLHEDQNX

SR VWURQLH DNW\ZQHM 3R VWURQLH SDV\ZQHM ELODQVX RGQRWRZXMH VL RSHUDFMH SROHJDM FH QD

SU]\MPRZDQLXZNáDGyZLORNDWGHSR]\WyZHPLVMLZáDVQ\FKSDSLHUyZZDUWR FLRZ\FKRUD]

G]LDáDQLD PDM FH QD FHOX SRZL NV]HQLH VXP\ URGNyZ Z G\VSR]\FML EDQNX 8SURV]F]RQ\

ELODQVEDQNXNRPHUF\MQHJRSUH]HQWXMHVL QDVW SXM FR

Tablica

.4.

%LODQVEDQNXKDQGORZHJR

Aktywa

Pasywa

3à<11(5(=(5:<

:.à$'<1$ '$1,(

AKTYWA ZAGRANICZNE

:.à$'<7(50,12:(

14

=DNUHVF]\QQR FLEDQNRZ\FKUHJXOXMHZ3ROVFHXVWDZD3UDZREDQNRZH]VLHUSQLDURNX

15

,QQ\PL W\SDPL EDQNyZ V EDQNL LQZHVW\F\MQH NRQFHQWUXM FH VZ G]LDáDOQR ü QD U\QNX SDSLHUyZ

ZDUWR FLRZ\FK SU]HSURZDG]DQLH HPLVML SDSLHUyZ ZDUWR FLRZ\FK KDQGHO SDSLHUDPL QD U\QNX ZWyUQ\P

G]LDáDOQR ü QD U\QNX SLHQL Q\P W]Z LQ \QLHULD ILQDQVRZD REVáXJD IX]ML LWS 5R]G]LHOHQLH EDQNRZR FL

komercyjnej (commercial banking) i inwestycyjnej (investment banking) ma charakter umowny, a w warunkach

SROVNLFK QLH PD SUDNW\F]QLH NUDMRZ\FK EDQNyZ NWyUH PRJOLE\ P\ X]QDü ]D Z\VSHFMDOL]RZDQH EDQNL

LQZHVW\F\MQH1DMEOL V]\WDNLHPXSURILORZLE\á3ROVNL%DQN5R]ZRMXNWyU\ZSRáRZLHU]RVWDáSU]HM W\

SU]H]%DQN5R]ZRMX(NVSRUWX:L NV]R üGX \FKEDQNyZSROVNLFKSURZDG]LG]LDáDOQR üXQLZHUVDOQ á F] FZ

Uy Q\FKSURSRUFMDFKEDQNRZR üNRPHUF\MQ ]EDQNRZR FL LQZHVW\F\MQ

14/

26

KREDYTY KRAJOWE

:.à$'<:$/872:(

3.4.

.UHDFMDSLHQL G]DZNáDGRZHJR

:V\VWHPLHEDQNyZQDVW SXMHSURFHVNUHDFMLSLHQL G]DZNáDGRZHJRNWyU\Z\MD QLP\QD

SURVW\PSU]\NáDG]LH=Dáy P\ HNOLHQW%DQNX%DáW\FNLHJRVNáDGDQDVZyMUDFKXQHNGHSR]\W

Z Z\VRNR FL

]á

: ELODQVLH EDQNX ]PLDQD WD E G]LH Z\ND]DQD MDNR Z]URVW SDV\ZyZ

GHSR]\W RUD] DNW\ZyZ ZSáDFRQD JRWyZND VWDQRZL UH]HUZ R NZRW

]á

-H OL

Z\PDJDQD VWRSD UH]HUZ Z\QRVL L EDQN VL GR QLHM ]DVWRVXMH WR ]DWU]\PD Z IRUPLH

rezerwy jedynie 1000

]á

F]\OLSLHUZRWQHJRZNáDGXWZRU] F]SR]RVWDá\FK

]á

kredyt.

3U]\MPLMP\ H NOLHQW RWU]\PXM F\ NUHG\W Z IRUPLH ]DSLVX QD UDFKXQNX OXE Z IRUPLH

JRWyZNL Z\GDMH JR QD ]DNXS ORGyZNL ]D RWU]\PDQD VXPD

]á

]RVWDQLH SU]H] ILUP

KDQGORZ Z FDáR FL ZSáDFRQD GR EDQNX -HVW WR QS %DQN .DUSDFNL :]URVW GHSR]\WyZ

]RVWDQLHZ\ND]DQ\SRVWURQLHSDV\ZyZMHJRELODQVXQDWRPLDVWSRVWURQLHDNW\ZyZZ\VW SL

wzrost rezerw o 20 % sumy depozytowej, czyli 800

]á

RUD]SU]\URVWNUHG\WyZZ Z\VRNR FL

3200

]á

3URFHVWHQQLH NR F]\ VL Z W\P SXQNFLH JG\ SU]\]QDQ\ NUHG\W SR ]UHDOL]RZDQLX

]QyZ ]JRGQLH ] QDV]\P ]DáR HQLHP WUDIL Z FDáR FL GR VHNWRUD EDQNRZHJR QS GR %DQNX

ZL WRNU]\VNLHJR.XPXODW\ZQ\SURFHVNUHDFMLZNáDGyZLOXVWUXM SRND]DQHQL HM]PLDQ\Z

bilansach banków.

% G]LHRQSU]HELHJDáGDOHMRVL JDM Fá F]Q NZRW Z\NUHRZDQ\FKZNáDGyZ

]á

.

16

Banki

NRPHUF\MQH GRSURZDG] GR SRPQR HQLD ZNáDGX SRF] WNRZHJR SL FLRNURWQLH 1LH MHVW WR

przypadek. Przy stopie rezerw równej 20% i braku zatrzymywania gotówki przez ludzi i firmy

FDáD Z\FRI\ZDQD JRWyZND MHVW SRWHP SRQRZQLH ORNRZDQD Z EDQNDFK W]Z PQR QLN

ZNáDGyZLQIRUPXM F\LOHUD]\UR QLHVXPDZNáDGyZZVWRVXQNXGRZNáDGXSRF] WNRZHJR

UyZQ\MHVWMHVWRGZURWQR FL VWRS\UH]HUZRERZL ]XM FHMZV\VWHPLHEDQNRZ\P

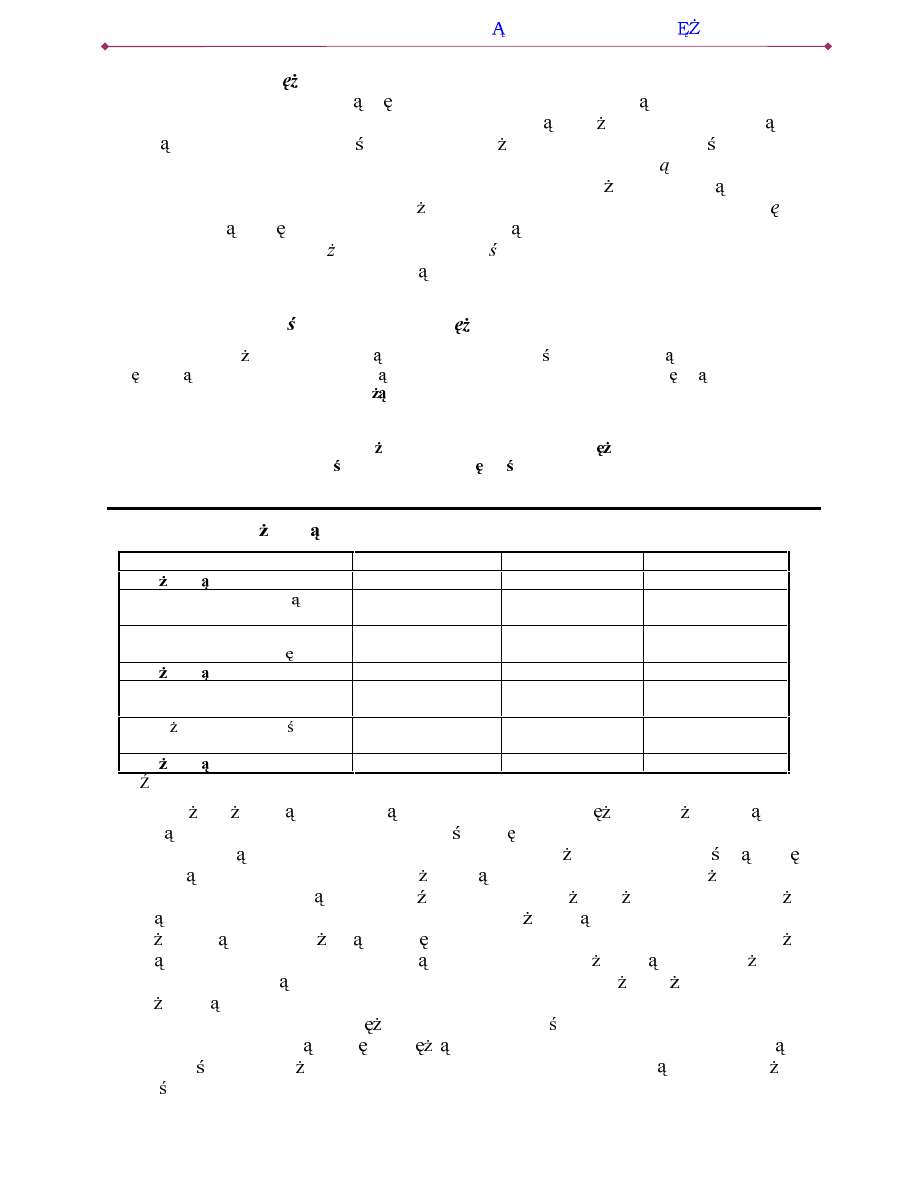

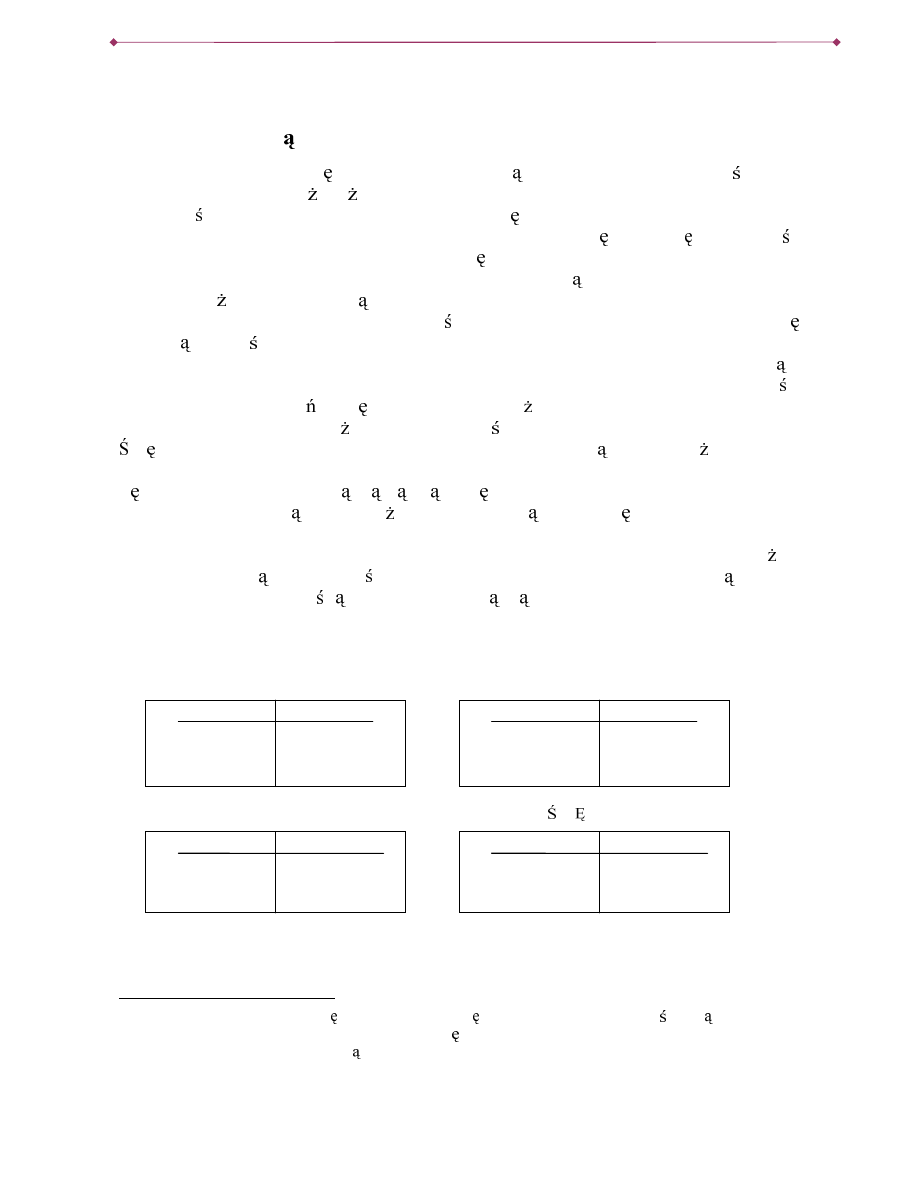

Tablica. 5.

.UHDFMDZNáDGyZZEDQNDFKNRPHUF\MQ\FK

%$1.%$à7<&.,%$1.%$à7<&.,

(a) (b)

%$1..$53$&.,%$1. :, 72.5=<6.,

(c) (d)

16

$E\WRZ\ND]DüZ\VWDUF]\WURFK PDWHPDW\NL*G\VWRS UH]HUZR]QDF]\P\V

&

DZDUWR üSRF] WNRZHJR

ZNáDGXDWRNUHG\WZ\NUHRZDQ\SU]H]SLHUZV]\EDQNE G]LHUyZQ\DV

&

przez drugi DV

&

%

przez kolejny

DV

&

'

LWG0DP\WXGRF]\QLHQLD]FL JLHPJHRPHWU\F]Q\PNWyUHJRVXPDGDQDMHVWZ]RUHP

D[V

&

V

&

%

V

&

'

] = D[V

&

]= DV

&

AKTYWA PASYWA

Rezerwy + 800 Depozyty + 4000

Kredyty + 3200

AKTYWA PASYWA

Rezerwy + 640 Depozyty + 3200

Kredyty + 2560

AKTYWA PASYWA

Rezerwy + 5000 Depozyty + 5000

AKTYWA PASYWA

Rezerwy + 1000 Depozyty + 5000

Kredyty + 4000

M

AKROEKONOMIA

J.

K

UROWSKI

-

3,(1, '=L32/,7<.$3,(1,

1$

15

/

26

3U]\URVWLOR FLSLHQL G]DZ\QLHVLHZQDV]\PSU]\NáDG]LH

]á

(25000

]á

SLHQL G]D

ZNáDGRZHJRZ\NUHRZDQHJRSU]H]EDQNLNRPHUF\MQHPLQXV

]á

SLHUZRWQHJRZNáDGX

gotówkowego).

3.5.

0QR QLNSLHQL Q\

3U]\URVW ED]\ PRQHWDUQHM SLHQL G]D UH]HUZRZHJR Z\ZRáXMH ]ZLHORNURWQLRQ\ Z]URVW

SRGD \SLHQL G]D00QR QLNSLHQL Q\RNUH ODRLOH]áRW\FKUR QLHSRGD SLHQL G]DSU]\

Z]UR FLH ED]\ PRQHWDUQHM R ]áRWHJR -H OL SU]H] & R]QDF]\P\ SLHQL G] JRWyZNRZ\ Z

RELHJX SU]H] 5 Sá\QQH UH]HUZ\ EDQNyZ NRPHUF\MQ\FK WR ED] PRQHWDUQ 0 PR HP\

]DSLVDü

0 &5

(12)

3RGD SLHQL G]DGDVL SU]HGVWDZLüMDNR

0 &'

gdzie:

'

GHSR]\W\QD GDQLH

(13)

5R]ZD P\WHUD]RGF]HJR]DOH \PQR QLNSLHQL Q\"3RWUDNWXMHP\JRMDNRLORUD]00

=DNáDGDM F H EDQNL XWU]\PXM W\ONR W\OH Sá\QQ\FK UH]HUZ LOH Z\QLND ] RERZL ]NX

QDU]XFRQHJR SU]H] EDQN FHQWUDOQ\ VWRSD UH]HUZ RERZL ]NRZ\FK MHVW MHGQRF]H QLH VWRS

rezerw

bankowych:

V

"

5' /XG]LH L ILUP\ WU]\PDM JRWyZN NWyUHM LOR ü VWDQRZL SHZQ F] ü VXP\

GHSR]\WyZQD GDQLHZHGáXJVWRS\ XWU]\P\ZDQLD JRWyZNL V

(

&'.

17

%D] PRQHWDUQ

PR HP\WHUD]]DSLVDüZIRUPLH

0 V

(

'V

"

' V

(

V

"

'

(14)

DSRGD SLHQL G]D0

0 V

(

'' V

(

'

(15)

0QR QLNSLHQL Q\RWU]\PDP\G]LHO FUyZQDQLHSU]H]UyZQDQLH

00 V

(

'V

(

V

"

' V

(

V

(

V

"

16)

2ZLHONR FLPQR QLNDSLHQL QHJRGHF\GXM GZLHVWRS\VWRSDUH]HUZEDQNyZNRPHUF\MQ\FK

RUD] VWRSD JRWyZNL Z RELHJX SR]DEDQNRZ\P ,P ZL FHM UH]HUZ Z UHODFML GR GHSR]\WyZ

XWU]\PXM EDQNL W\P QL V]\ PQR QLN SLHQL Q\ D ]DWHP W\P PQLHMV]\ E G]LH SU]\URVW

SRGD \ SLHQL G]D Z\ZRáDQ\ Z]URVWHP ED]\ PRQHWDUQHM R RNUH ORQ ZLHONR ü =DOH QR ü

PQR QLNDRGVWRS\XWU]\P\ZDQLDJRWyZNLMHVWWDNDVDPDFRGRNLHUXQNX2LOHMHGQDNVWRSD

UH]HUZPR HE\üX \WDGRZSá\ZDQLDQDPQR QLNSU]H]EDQNFHQWUDOQ\FRSU]HDQDOL]XMHP\

QL HMZSXQNFLHWRRVWRSLHXWU]\P\ZDQLDJRWyZNLGHF\GXM OXG]LHQLH]DOH QLHRGZROL

ZáDG]PRQHWDUQ\FK']LDáDQLHPHFKDQL]PXPQR QLNRZHJRSRGD \SLHQL G]DLOXVWUXMHU\V

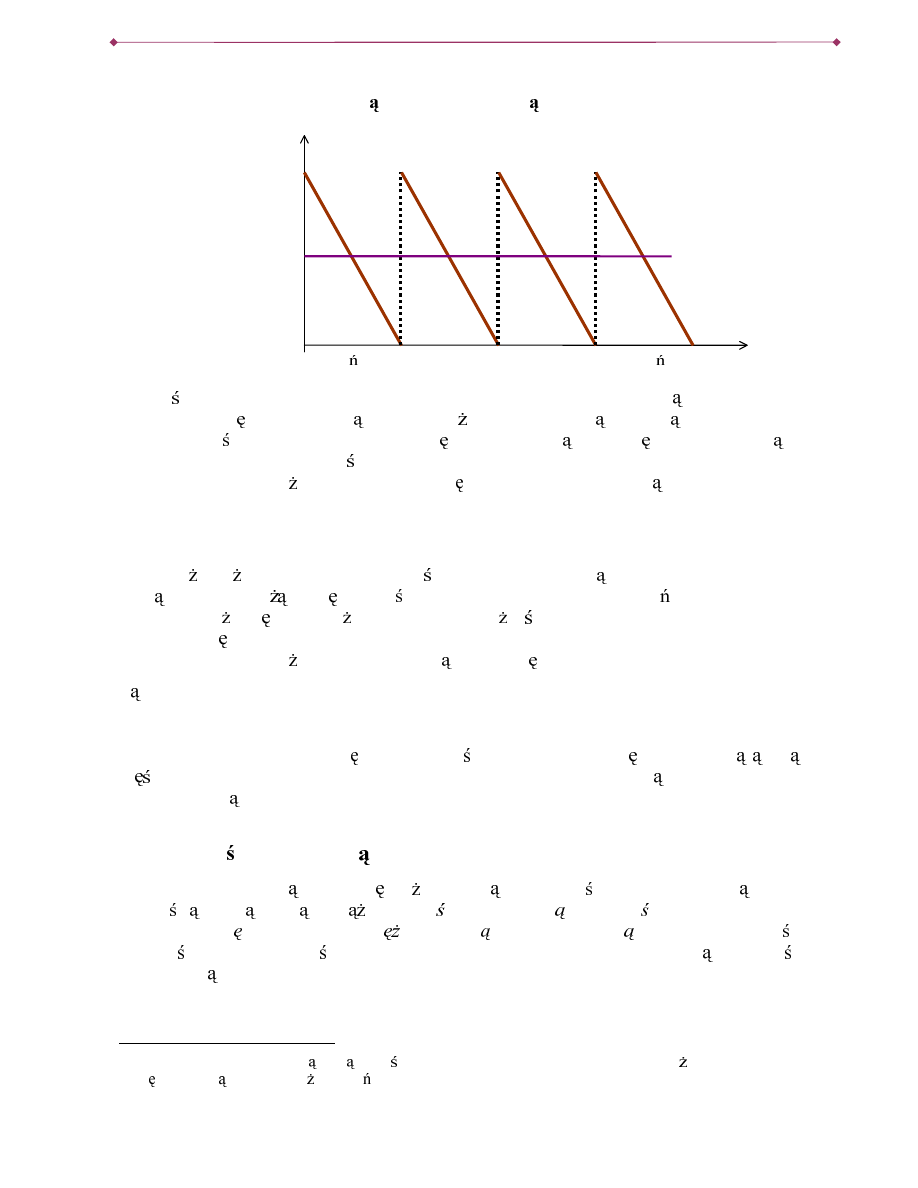

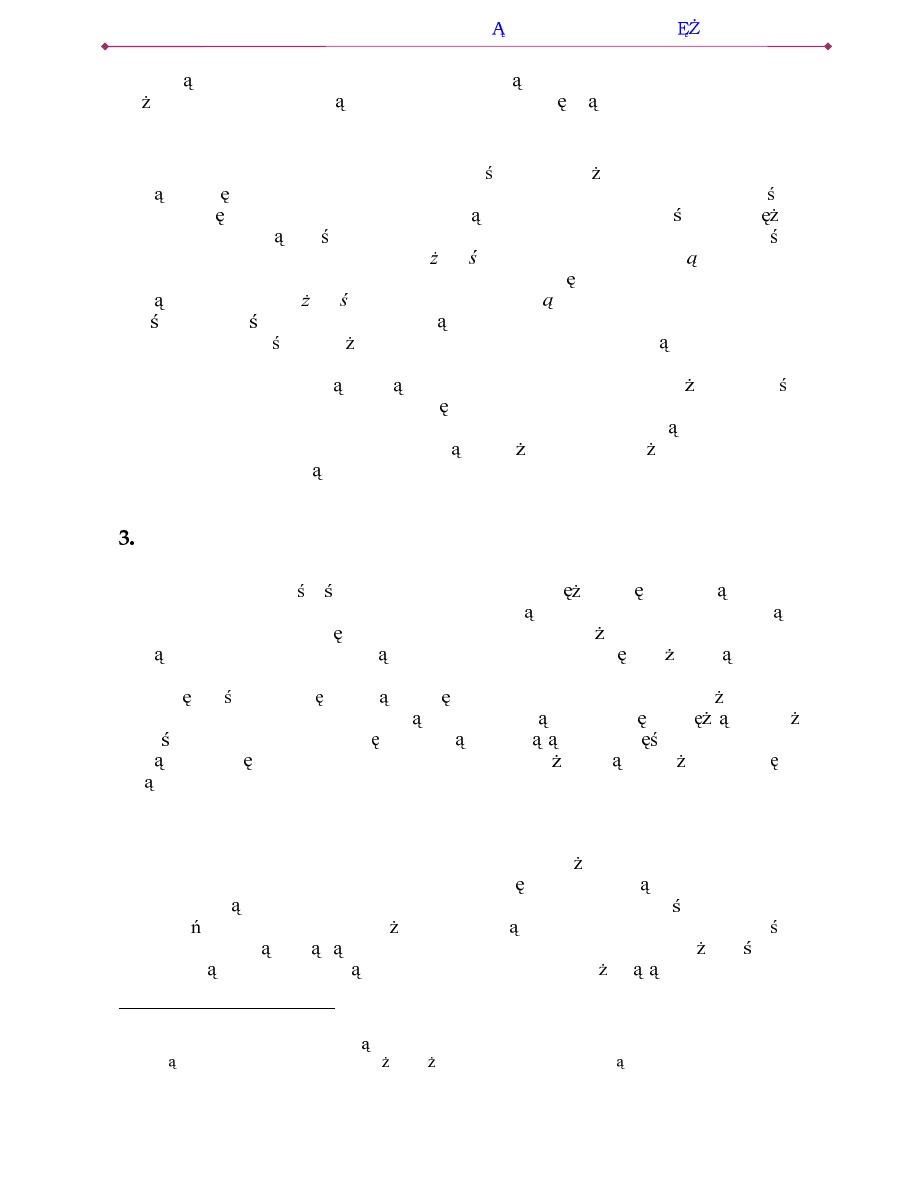

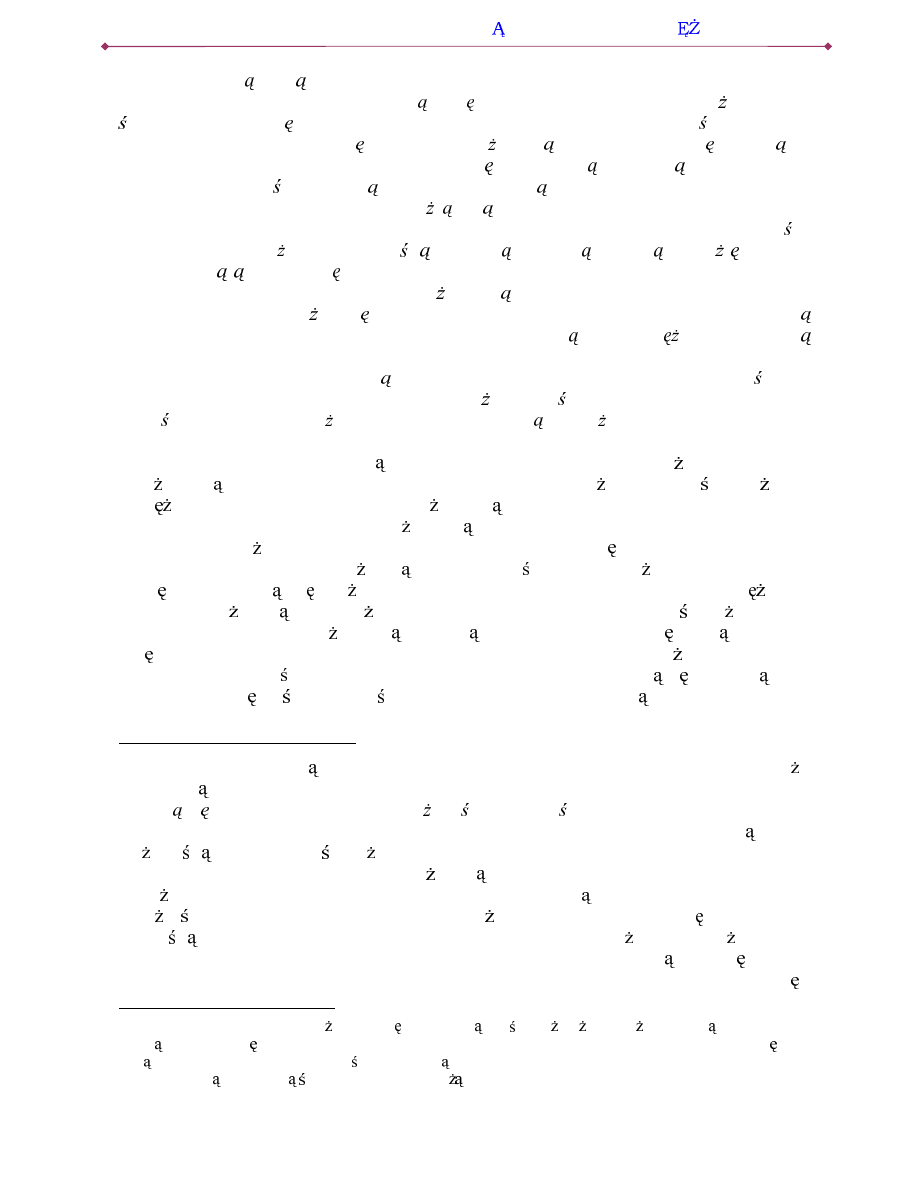

Rys.4.

%D]DPRQHWDUQDLSRGD SLHQL G]D

)*+*-,/.02143*50*

D& &5D5

D&&'D'

6

.7*

698

10

8

7+*

M

16/

26

5\VXQHNSRND]XMH H

SRGD SLHQL G]D0VWDQRZLSHZQ ZLHORNURWQR üED]\PRQHWDUQHMPQR QLNSLHQL Q\

SU]\URVW ED]\ PRQHWDUQHM Z F] FL ]ZL NV]D JRWyZN Z RELHJX Z F] FL ]D UH]HUZ\

banków komercyjnych,

RLOHZ]URVWJRWyZNLZRELHJXQLHMHVWZVWDQLHSRPQR \üLOR FLSLHQL G]DWRZ]URVWUH]HUZ

banków komercyjnych uruchamia mechanizm

PQR QLNRZ\G]L NLNUHDFMLZNáDGyZ

3.6.

%LODQVRZHXM FLHSRGD \SLHQL G]D

2JyOQ LOXVWUDFM SRGD \SLHQL G]DLMHMVNáDGQLNyZGDMHSUH]HQWDFMDELODQVyZREXVHJPHQWyZ

systemu bankowego tj. banku centralnego i sektora banków komercyjnych oraz sektora

SR]DEDQNRZHJRSU\ZDWQHJRLSXEOLF]QHJRá F]QLH%LODQVMHVW]HVWDZLHQLHPZLHU]\WHOQR FL

DNW\ZDL]RERZL ]D SDV\ZDNWyU\FKUy QLFDVWDQRZLZDUWR üQHWWRF]\OLNDSLWDáZáDVQ\

3RGD SLHQL G]D0Z\VW SXMHZELODQVDFKVHNWRUDEDQNRZHJRSRVWURQLHSDV\ZyZJRWyZND

Z RELHJX MHVW ERZLHP ]RERZL ]DQLHP EDQNX FHQWUDOQHJR ZNáDG\ QD GDQLH VWDQRZL ]D

]RERZL ]DQLHGODEDQNyZNRPHUF\MQ\FK:ELODQVLHVHNWRUDSR]DEDQNRZHJRREDVNáDGQLNL

SLHQL G]DMDNRQDOH QR FLWHJRVHNWRUDZ\VW SXM SRVWURQLHDNW\ZyZ

18

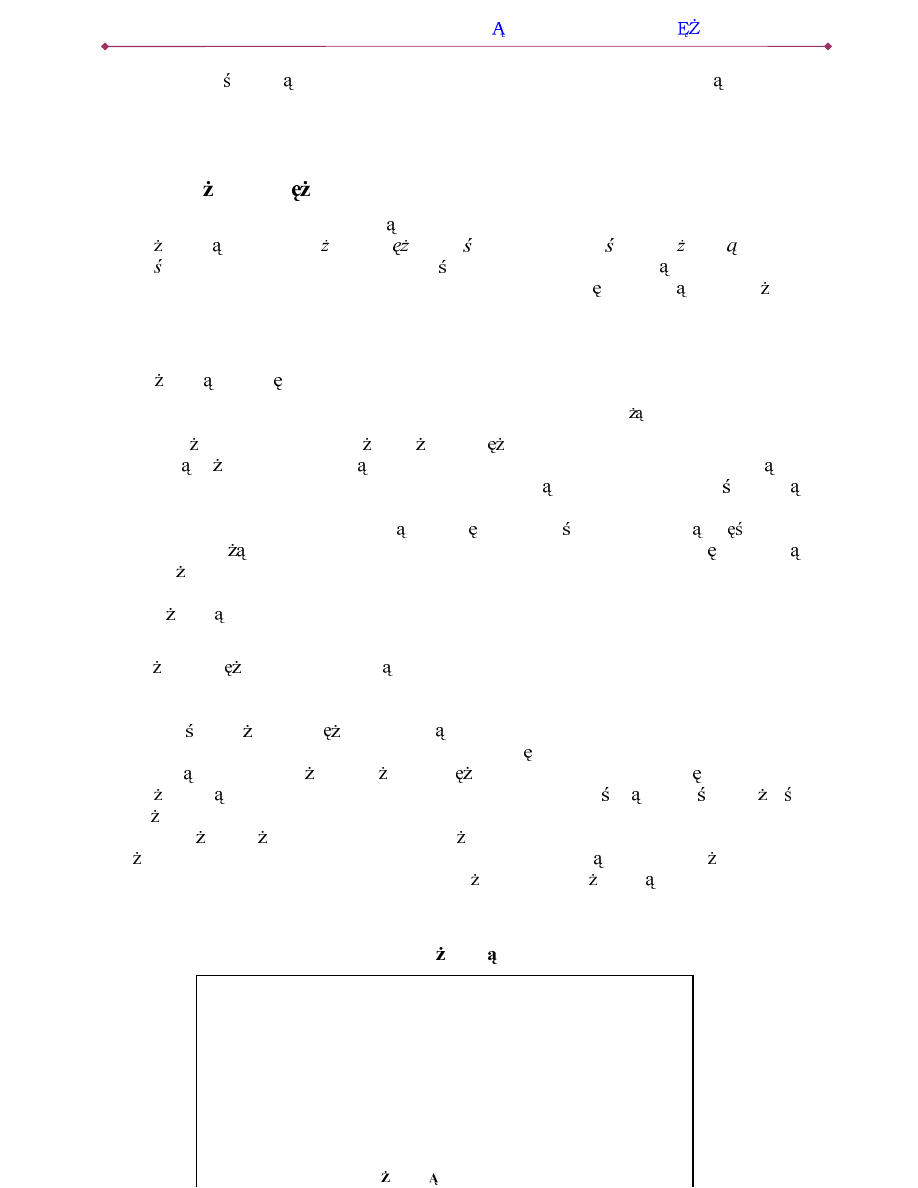

Tablica.6.

3RGD SLHQL G]DZELODQVDFKVHNWRUyZ

%LODQVEDQNXFHQWUDOQHJR

%LODQVEDQNyZNRPHUF\MQ\FK

Aktywa

Pasywa

Aktywa

Pasywa

:4;=<>;=:4?A@/?CBEDGF2H

IEJH>KE?CLEB/?MJEN4O

;9IFQP

RS

TU9@4VV;W:4;=<>;=:4?A@X?CLEU=BEY2@CVB

YB4VO

;ZP

YS

LE:4;=Y2@H>@/FY<>O

;=D>J4V;

TU9@4VV;W:4;=<>;=:4?A@

N4B4VLJE[

N4B4VLKE?

BELH>@E?CB

?CLEU=BEY2@

ZAGRANICZNE

TERMINOWE

LE:4;=Y2@H>@/FY<>O

;=D>J4V;

:JEYLEO#VB/:4BR\FVLEBR\

:4<

Y2JE?CO

:4<

YF

LE:4;=Y2@H>@

?CLEU=BEY2@

KRAJOWE

WALUTOWE

LEBETO

HGBEUW?CU=B]^V_@

LEBETO

HGBEUW?CU=B]^V_@

17

)DNWWHQSRPLQ OL P\ZSRSU]HGQLPSXQNFLHSU]\RPDZLDQLXNUHDFMLSLHQL G]DEDQNRZHJR'ODXSURV]F]HQLD

]DáR \OL P\WDP HNUHG\WZ\GDQ\QDORGyZN QDW\FKPLDVWZFDáR FLVWDMHVL ZNáDGHPEDQNRZ\P:WDNLP

SU]\SDGNXVWRSDXWU]\P\ZDQLDJRWyZNLUyZQDVL ]HUX

18

:SUDNW\FHEDQNyZFHQWUDOQ\FKSRZV]HFKQLHSU]\M WDMHVW]DVDGDVWRVRZDQDWDN HSU]H]1%3 HGHSR]\WyZ

U] GRZ\FKZEDQNXFHQWUDOQ\PQLHZOLF]DVL GRSRGD \SLHQL G]D0

M

AKROEKONOMIA

J.

K

UROWSKI

-

3,(1, '=L32/,7<.$3,(1,

1$

17

/

26

%LODQVVHNWRUDSR]DEDQNRZHJR

Aktywa

Pasywa

GOTÓWKA (C)

DEPOZYTY SEKTORA

YU=F2IA:4<

Y2JE?A@

PRYWATNEGO (D) i PRYWATNY

Y;=T`JE<=@H>@/:4<

Y2JE?C;

LEBETO

HGBEUW?CU=B]^V_@

[aBEb

HG;=L/:4<>;9R<=JE?A@

c

LEBETO

HGBEUW?CU=B]^V_@

SEKTORA BANKOWEGO

3.7.

.RQWURODSRGD \SLHQL G]D

.V]WDáWRZDQLH SRGD \ SLHQL G]D SU]H] ZáDG]H PRQHWDUQH EDQN FHQWUDOQ\ MHVW

UHDOL]RZDQLHP SROLW\NL SLHQL QHM L MHVW QD]\ZDQH NRQWURO SRGD \ SLHQL G]D %DQN PD GR

G\VSR]\FMLRNUH ORQ\]HVWDZQDU] G]LRGG]LDá\ZDQLDQDLOR üSLHQL G]DZJRVSRGDUFH

VWRSDRERZL ]NRZ\FKUH]HUZ

operacje otwartego rynku,

operacje kredytowo-depozytowe,

OLPLW\NUHG\WRZHLQWHUZHQF\MQHSU]\MPRZDQLHGHSR]\WyZOXGQR FLSU]H]EDQNFHQWUDOQ\

0LQLPDOQDVWRSDUH]HUZRERZL ]NRZ\FK

Skala

NUHDFML SLHQL G]D EDQNRZHJR ZNáDGyZ ]DOH \ RG VWRS\ UH]HUZ XWU]\P\ZDQ\FK

SU]H] EDQNL NRPHUF\MQH 5H]HUZ\ PDM FKDUDNWHU RVWUR QR FLRZ\ LFK URO MHVW ERZLHP

]DJZDUDQWRZDQLHQDW\FKPLDVWRZHJR]ZURWXZNáDGyZNOLHQWyZZPRPHQFLHNLHG\VRELHWHJR

]D \F] %DQNLZHZáDVQ\PGREU]HSRM W\PLQWHUHVLHSRZLQQ\]DWHPRGNáDGDüSHZQ F] ü

URGNyZZSRVWDFLSá\QQHMMDNRUH]HUZ QDWDNLHZ\SáDW\3RQLHZD MHGQDN URGNLWDNLHOH F

³EH]F]\QQLH´ZNDVDFKEDQNRZ\FKQLHSU]\QRVLá\E\ DGQ\FKGRFKRGyZLVWQLHMHX]DVDGQLRQD

SRNXVD X \FLD LFK Z LQQ\P FHOX L W\P VDP\P REQL HQLD SR]LRPX UH]HUZ SRQL HM JUDQLF\

ZLHONR FL EH]SLHF]QHM ] SXQNWX ZLG]HQLD REVáXJL ZNáDGyZ 0D WR V]F]HJyOQH ]QDF]HQLH Z

V\WXDFMDFK JZDáWRZQHJR Z\FRI\ZDQLD GHSR]\WyZ SU]HUDG]DM FHJR VL QLHNLHG\ Z SDQLN

EDQNRZ $E\RJUDQLF]\ü]DJUR HQLH HEDQNLXOHJQ SRNXVLHQLHEH]SLHF]QHJR]PQLHMV]HQLD

UH]HUZEDQNLFHQWUDOQHZLHOXNUDMyZXVWDODM PLQLPDOQHVWRS\UH]HUZNWyUHPDM FKDUDNWHU

REOLJDWRU\MQ\GODVHNWRUDEDQNyZNRPHUF\MQ\FK6 WRVWRS\RERZL ]NRZ\FKUH]HUZ

Komentarz

.3DQLNDEDQNRZDLJZDUDQWRZDQLHGHSR]\WyZ

3LHUZV]\.RPHUF\MQ\%DQNZ/XEOLQLHGR ZLDGF]\áZURNX]MDZLVND]ZDQHJRSDQLN

EDQNRZ %DQN XWU]\PXM F\ QLVNLH E G PDáR Sá\QQH UH]HUZ\ QLH MHVW Z VWDQLH V]\ENR

]DVSRNRLü SRS\WX VZ\FK NOLHQWyZ Z\FRIXM F\FK ZNáDG\ QS Z REDZLH R QLHZ\SáDFDOQR ü

EDQNX2FHQD]HEDQNMHVWQLHZ\SáDFDOQ\VWDMHVL VDPRVSUDZG]DM F SU]HSRZLHGQL &KF F

PDVRZR RGHEUDü VZRMH SLHQL G]H ]DQLP E G]LH ]D Sy QR SRVLDGDF]H ZNáDGyZ V]\ENR

GRSURZDG]DM GRZ\F]HUSDQLDSá\QQ\FK URGNyZUH]HUZRZ\FKEDQNX3LHUZV]\.RPHUF\MQ\

%DQN Z /XEOLQLH E G F\ ZyZF]DV ZáDVQR FL NRQWURZHUV\MQHJR EL]QHVPHQD 'DZLGD

%RJDWLQDSU]HV]HGáZNRQVHNZHQFMLZU FH1DURGRZHJR%DQNX3ROVNLHJRNWyU\UDWXM FEDQN

SU]HG XSDGNLHP GHNDSLWDOL]RZDá JR NZRW ELOLRQD VWDU\FK ]áRW\FK SU]HMPXM F MHJR

DNFML5H]HUZ\RERZL ]NRZHZHGáXJRGJyUQLHQDU]XFRQHMVWRS\RJUDQLF]DM MHG\QLHJUR E

SDQLNL EDQNRZHM JG\ SHáQ JZDUDQFM EH]SLHF]H VWZD ZNáDGyZ GDZDáDE\ VWRSD EOLVND

18/

26

3RZVWDQLXLUR]V]HU]DQLXSDQLNLEDQNRZHMSU]HFLZG]LDáDWDN HILQDQVRZHZVSLHUDQLH

EDQNyZ SU]H] EDQN FHQWUDOQ\ Z IRUPLH NUHG\WyZ ]ZDQ\FK QLHNLHG\ NUHG\WDPL RVWDWQLHM

LQVWDQFMLRSLVDQ\FKSRQL HMZSXQNFLH3RGVWDZRZHVWRS\SURFHQWRZHEDQNXFHQWUDOQHJR:

URNX ]RVWDá SRZRáDQ\ %DQNRZ\ )XQGXV] *ZDUDQF\MQ\ %)* SHáQL F\ URO

XEH]SLHF]\FLHOD ZNáDGyZ EDQNRZ\FK %DQNL ZSáDFDM VNáDGN D ]JURPDG]RQH URGNL VáX

]DEH]SLHF]HQLXZNáDGyZ:SU]\SDGNXEDQNUXFWZDEDQNXMHJRGHSR]\WDULXV]HPRJ OLF]\üQD

]ZURW FDáR FL OXE F] FL GHSR]\WX .ZRWD JZDUDQWRZDQD MHVW Z 3ROVFH VWRSQLRZR

SRGZ\ V]DQD D GRFHORZR JZDUDQFMDPL PDM E\ü REM WH ]JRGQLH ] G\UHNW\ZDPL 8QLL

(XURSHMVNLHMGHSR]\W\GRNZRW\RGSRZLDGDM FHM(FX

… … … … … … … … … … … … … … … … … … .

:F]H QLHMVWZLHUG]LOL P\ HPQR QLNZNáDGyZMHVWUyZQ\RGZURWQR FLVWRS\UH]HUZSRU

S ,P MHVW RQD Z\ V]D W\P PQLHM SLHQL G]D ZNáDGRZHJR PRJ Z\NUHRZDü EDQNL FR

RJUDQLF]D]DVyESLHQL G]DZJRVSRGDUFH=]DOH QR FLWHMPR H VNRU]\VWDü EDQN FHQWUDOQ\

RSHUXM F QDU]XFDQ EDQNRP NRPHUF\MQ\P PLQLPDOQ VWRS UH]HUZ 6WRSD RERZL ]NRZ\FK

UH]HUZ SHáQL ZyZF]DV URO QDU] G]LD NRQWUROL SRGD \ SLHQL G]D D QLH Z\á F]QLH QRUP\

RVWUR QR FLRZHM 'OD Z\HJ]HNZRZDQLD RERZL ]NRZHM UH]HUZ\ 1%3 QDND]XMH ]áR HQLH

RNUH ORQHM F] FL GHSR]\WyZ SU]\MPRZDQ\FK SU]H] EDQNL QD SURZDG]RQ\FK SU]H] VLHELH

UDFKXQNDFK:F] FL URGNLUH]HUZRZHEDQNyZNRPHUF\MQ\FKVSRF]\ZDM ZLFKZáDVQ\FK

NDVDFK

Z

F] FL

]D

QD

UDFKXQNDFK

Z

1%3

… … … … … … … … … … … … … … … … … … … … … … … … … … … … … …

3U]\NáDG. ']LDáDQLHVWRS\RERZL ]NRZ\FKUH]HUZ

=Dáy P\ HEDQNLNRPHUF\MQHXWU]\PXM UH]HUZ\QDPLQLPDOQ\PSR]LRPLHXVWDORQ\PSU]H]

EDQNFHQWUDOQ\ZZ\VRNR FL GHSR]\WyZ D YLVWD .OLHQFL ]áR \OL GRGDWNRZR POQ ]á

MDNR ZNáDG\ JRWyZNRZH QD GDQLH 3U]\ GRGDWNRZ\P ]DáR HQLX H OXG]LH QLH WU]\PDM

JRWyZNL PQR QLN NUHDFML ZNáDGyZ UyZQ\ MHVW RGZURWQR FL VWRS\ UH]HUZ F]\OL Z QDV]\P

SU]\NáDG]LHZ\QLHVLH2]QDF]DWRNUHDFM SLHQL G]DZNáDGRZHJRZZ\VRNR FL

POQ]á POG]áZW\PPOQQRZHJRSLHQL G]D

:]URVWRERZL ]NRZHMVWRS\UH]HUZGR]PLHQLDQDV]UDFKXQHNSU]H]REQL HQLHPQR QLND

ZNáDGyZGRLRJUDQLF]HQLHLFKNUHDFMLGRSR]LRPX

POQ]á POQ]áZW\PQRZHJRSLHQL G]DPOQ]á

6WZLHUG]DP\ HZ\ V]DVWRSDUH]HUZRERZL ]NRZ\FKKDPXMHSRGD EDQNRZHJRSLHQL G]D

2WZDUW\U\QHNPL G]\EDQNRZ\LRSHUDFMHEDQNXFHQWUDOQHJR

3á\QQHUH]HUZ\JRWyZNDV SU]HGPLRWHPREURWXSRPL G]\EDQNDPLNRPHUF\MQ\PL1D

PL G]\EDQNRZ\PU\QNXSLHQL G]DUH]HUZRZHJREDQNLSRVLDGDM FHF]DVRZHQDGZ\ NLUH]HUZ

Z\SR \F]DM MH SR RNUH ORQHM FHQLH ]ZDQHM VWRS SURFHQWRZ U\QNX SLHQL QHJR EDQNRP

FLHUSL F\PQDLFKEUDN1DWHQRWZDUW\U\QHNPL G]\EDQNRZ\PR HZNUDF]DüUyZQLH EDQN

FHQWUDOQ\ GRNRQXM F LQWHUZHQF\MQ\FK ]DNXSyZ E G VSU]HGD \ SLHQL G]D UH]HUZRZHJR Z

]DPLDQ ]D SDSLHU\ ZDUWR FLRZH QD RJyá VNDUERZH OXE ZáDVQH 6SU]HGD SR \F]ND

SDSLHUyZZDUWR FLRZ\FKSU]H]EDQNFHQWUDOQ\EDQNRPNRPHUF\MQ\P]PQLHMV]DUH]HUZ\W\FK

RVWDWQLFKLG]LDáDRJUDQLF]DM FRQDSRGD SLHQL G]D:RGZURWQ\PNLHUXQNXRGG]LDáXMH]DNXS

SDSLHUyZ OXE LFK SR \F]HQLH QD RWZDUW\P U\QNX SU]H] EDQN FHQWUDOQ\ RG EDQNyZ

NRPHUF\MQ\FK : WHQ VSRVyE EDQN FHQWUDOQ\ UHJXOXMH RJyOQ ZLHONR ü UH]HUZ Z VHNWRU]H

EDQNyZNRPHUF\MQ\FKDW\PVDP\PSRSU]H]PQR QLNRJyOQ SRGD SLHQL G]D

Komentarz

. 0L G]\EDQNRZ\U\QHNSLHQL G]DUH]HUZRZHJRZ3ROVFHLRSHUDFMH

RWZDUWHJRU\QNX1%3

M

AKROEKONOMIA

J.

K

UROWSKI

-

3,(1, '=L32/,7<.$3,(1,

1$

19

/

26

&KDUDNWHU\VW\F]Q FHFK KDQGOX UH]HUZDPL V]F]HJyOQLH Z ODWDFK E\áD

QLHUyZQRZDJD VWUXNWXUDOQD SU]HMDZLDM FD VL Z UHODW\ZQHM SU]HZDG]H SRGD \ Sá\QQ\FK

URGNyZ QD U\QNX PL G]\EDQNRZ\P =MDZLVNR WR ]\VNDáR PLDQR QDGSá\QQR FL Z VHNWRU]H

EDQNRZ\PLZ\ZRá\ZDáWHQGHQFM GRZ]URVWXSRGD \SLHQL G]DMDNZLHP\LPZL FHMSLHQL G]D

UH]HUZRZHJR MHVW Z SRVLDGDQLX EDQNyZ W\P ZL FHM Z\HPLWXM RQH SLHQL G]D EDQNRZHJR

=MDZLVNR QDGSá\QQR FL MHVW ]ZL ]DQH ] XNV]WDáWRZDQ Z ]QDF]Q\P VWRSQLX Z RNUHVLH

JRVSRGDUNL FHQWUDOQLH SODQRZDQHM SRZD Q URO WDNLFK EDQNyZ NRPHUF\MQ\FK FKRG]L WX

JáyZQLH R 3.2 %3 Z NWyU\FK VNDOD JURPDG]RQ\FK SDV\ZyZ GHSR]\WyZ OXGQR FL

]GHF\GRZDQLHSU]HZD DQDGG]LDáDOQR FL NUHG\WRZ Z\ZRáXM F]QDF]Q QDGZ\ N Sá\QQ\FK

UH]HUZWUDILDM F QDU\QHNPL G]\EDQNRZ\

: FHOX SU]HFLZG]LDáDQLD QDUDVWDQLX SRGD \ ÂSLHQL G]D EDQN FHQWUDOQ\ SURZDG]Lá RSHUDFMH

RWZDUWHJR U\QNX.

d^e

5R]Uy QLD VL RSHUDFMH EH]ZDUXQNRZH L ZDUXQNRZH 7H SLHUZV]H PDM

FKDUDNWHU WUDQVDNFML RVWDWHF]Q\FK *áyZQ\P LQVWUXPHQWHP V ERQ\ SLHQL QH 1%3 NWyUH V

VSU]HGDZDQH Z IRUPLH SU]HWDUJX RUJDQL]RZDQHJR SU]H] 1%3 : SU]\SDGNX RSHUDFML

ZDUXQNRZ\FK ]ZDQ\FK UHSR RERZL ]XMH NODX]XOD RGNXSX SDSLHUyZ SR XSá\ZLH RNUH ORQHJR

WHUPLQX FR SR]ZDOD WUDNWRZDü MH MDNR SR \F]DQLH URGNyZ SRG ]DVWDZ SDSLHUyZ

ZDUWR FLRZ\FK3DSLHUDPLX \ZDQ\PLZRSHUDFMDFKPRJ E\üWDN HERQ\VNDUERZH

2SHUDFMH RWZDUWHJR U\QNX PRJ PLHü QD FHOX XNV]WDáWRZDQLH QD ]DáR RQ\P SR]LRPLH

SRGD \ SLHQL G]D UH]HUZRZHJR ED]\ PRQHWDUQHM FR SU]\ ]DáR HQLX VWDELOQR FL PQR QLND

SLHQL QHJR R]QDF]D NV]WDáWRZDQLH SRGD \ SLHQL G]D QS DJUHJDWX 0 $OWHUQDW\ZQ\P

VSRVREHP SURZDG]HQLD NRQWUROL SRGD \ SLHQL G]D SRSU]H] RSHUDFMH RWZDUWHJR U\QNX MHVW

NV]WDáWRZDQLH]DáR RQHJRSR]LRPXVWySSURFHQWRZ\FKQDU\QNXPL G]\EDQNRZ\PF]\OLFHQ

SR MDNLFK EDQNL NRPHUF\MQH SR \F]DM VRELH Sá\QQH URGNL 3RQLHZD EDQN FHQWUDOQ\ PD

V]DQV JUDüWXJáyZQ URO PR HZ\ZLHUDüZSá\ZQDVWRS\:]URVWVWySU\QNXSLHQL QHJR

RJUDQLF]DSRGD SLHQL G]DSRGUD DERZLHPSá\QQHUH]HUZ\GODEDQNyZ]D REQL HQLHVWyS

SURZDG]L GR Z]URVWX SRGD \ SLHQL G]D &KF F QS ]PQLHMV]\ü NUHDFM SLHQL G]D 1%3

]ZL NV]DPLQLPDOQ\SR]LRPVWRS\SURFHQWRZHMSRNWyUHMLQWHUZHQF\MQLHSR \F]DRGEDQNyZ

NRPHUF\MQ\FKSá\QQH URGNLQDRWZDUW\PU\QNX6WRS\U\QNRZHSRGQRV] VL SURZDG] FGR

]PQLHMV]HQLDGRVW SQR FLSá\QQ\FK URGNyZLRJUDQLF]HQLDNUHDFMLSLHQL G]D

Operacje kredytowo-depozytowe

%DQNLNRPHUF\MQHPRJ NRU]\VWDü]NUHG\WyZXG]LHODQ\FKSU]H]EDQNFHQWUDOQ\3RQLHZD

NUHG\W]DFL JDQ\ZEDQNXFHQWUDOQ\PPDFKDUDNWHUNUHG\WXRVWDWQLHMLQVWDQFMLRNWyU\EDQNL

XELHJDM VL ZV\WXDFMLEUDNXLQQ\FKPR OLZR FL]GRE\FLD URGNyZ, jest on oprocentowany

RGSRZLHGQLRZ\VRNR6WRSDRSURFHQWRZDQLDPXVLERZLHPSRNU\üZ\VRNLHU\]\NR]ZL ]DQH]

PR OLZR FL QLHZ\SáDFDOQR FL SR \F]NRELRUF\ 0HFKDQL]P RGG]LDá\ZDQLD VWyS NUHG\WRZR

GHSR]\WRZ\FKEDQNXFHQWUDOQHJRQDSRGD SLHQL G]DPDZ]QDF]QHMPLHU]HSV\FKRORJLF]QH

SRGáR H:\VRNLHVWRS\NUHG\WRZDQLDZRVWDWQLHMLQVWDQFMLPDM ]D]DGDQLHVNáRQLüEDQNLGR

RVWUR QR FL Z UR]ZLMDQLX DNFML NUHG\WRZHM JG\ HZHQWXDOQH SRMDZLHQLH VL NáRSRWyZ ]

Sá\QQR FL LNRU]\VWDQLH]XVáXJNUHG\WRZ\FKEDQNXFHQWUDOQHJRQDUD DEDQNQDGX HNRV]W\

=PLDQ\ VWyS SURFHQWRZ\FK )(' )XQGXV]X 5H]HUZ\ )HGHUDOQHM SHáQL FHJR URO EDQNX

FHQWUDOQHJR 86$ F]\ (XURSHMVNLHJR %DQNX &HQWUDOQHJR Z 8( QD RJyá VSRW\ND VL

19

=GUXJLHMVWURQ\ZV]\VWNRWRPR HZ\GDüVL ]DVWDQDZLDM FHMH OL]ZD \ü HQDGZ\ NRZ\SLHQL G]UH]HUZRZ\

WUDILDM F\QDU\QHNPL G]\EDQNRZ\PXVLDá]RVWDüZ\HPLWRZDQ\SU]H]EDQNFHQWUDOQ\NWyU\SRWHPWUXG]LáVL E\

³]GM ü´JR]U\QNX:LVWRFLHRZLHONR FLHPLVMLSLHQL G]DJRWyZNRZHJRGHF\GXMHMHGQDNWRZMDNLHMVNDOLEDQNL

NRPHUF\MQHLU] G]DPLHQLDM URGNLQDUDFKXQNDFKELH F\FKZEDQNXFHQWUDOQ\PQDEDQNQRW\LPRQHW\

20/

26

] QDW\FKPLDVWRZ\P RG]HZHP VHNWRUD EDQNRZHJR Z SRVWDFL RJUDQLF]HQLD HPLVML SLHQL G]D

EDQNRZHJR%DQNLZ3ROVFHNRU]\VWDM QS]NUHG\WXORPEDUGRZHJR udzielanego pod zastaw

SDSLHUyZZDUWR FLRZ\FK'R ZLDGF]HQLDVWRVRZDQLDVWySNUHG\WRZ\FK1%3MDNRQDU] G]LD

SROLW\NLSLHQL QHMFHFKRZDáDV]F]HJyOQLHZURJUDQLF]RQDVNXWHF]QR ü:\MD QLHQLHP

PR H E\ü RSLVDQH Z NRPHQWDU]X ]MDZLVNR QDGSá\QQR FL 3ROVNLH EDQNL U]DGNR E\á\

]PXV]RQH GR VWDUD R ]DFL JDQLH NUHG\WX RVWDWQLHM LQVWDQFML JG\ U\QHN PL G]\EDQNRZ\

GRVWDUF]DWD V]\FK URGNyZ

Komentarz

+DPRZDQLHZ]URVWXSRGD \SLHQL G]DSU]H]1%3ZURNX

&KF F RJUDQLF]\ü Z]URVW SRGD \ SLHQL G]D Z W\P JáyZQLH XG]LHODQ\FK SU]H] EDQNL

NUHG\WyZ 1%3 SRGHMPRZDá Z URNX NROHMQH G]LDáDQLD SU]\ X \FLX QDU] G]L NRQWUROL

PRQHWDUQHM : NR FX OXWHJR VWRSD RERZL ]NRZHM UH]HUZ\ RG GHSR]\WyZ ]áRWRZ\FK D YLVWD

]RVWDáDSRGQLHVLRQD]GR]D ZNR FXPDMDRG]áRWRZ\FKGHSR]\WyZWHUPLQRZ\FK]

GR 1D SRF] WNX VLHUSQLD 1%3 SRGQLyVá VZRMH VWRS\ SRGVWDZRZH VWRS NUHG\WX

ORPEDUGRZHJR]GRDVWRS UHG\VNRQWDZHNVOL]GR:Sá\Z]PLDQVWyS«

1%3QDRSURFHQWRZDQLHGHSR]\WyZLNUHG\WyZZEDQNDFKQLHE\áGR üVLOQ\LQLHZ\ZRáDá

]DPLHU]RQHJRRJUDQLF]HQLDNUHDFMLSLHQL G]DEDQNRZHJR NUHG\W\ UHGQLH RSURFHQWRZDQLH

GHSR]\WyZ PLHVL F]Q\FK Z EDQNDFK Z]URVáR ]DOHGZLH ] Z OLSFX GR Z

VLHUSQLX L ZH ZU]H QLX 2SURFHQWRZDQLH NUHG\WyZ MHVW X]DOH QLRQH RG

RSURFHQWRZDQLDGHSR]\WyZNWyUHRVWDWHF]QLHV JáyZQ\PVSRVREHPJURPDG]HQLDSá\QQ\FK

URGNyZ SU]H] EDQNL 3U]\F]\Q EUDNX VNXWHF]QR FL ]DVWRVRZDQ\FK QDU] G]L E\á

SUDZGRSRGREQLHRSLVDQ\Z\ HMIHQRPHQQDGSá\QQR FLZVHNWRU]HEDQNRZ\PSRZRGXM F\ H

EDQNLW\ONRVSRUDG\F]QLH]PXV]RQHV XELHJDüVL R URGNLZ1%3NRU]\VWDM F]GX HMSRGD \

QD U\QNX PL G]\EDQNRZ\P 6NáRQLáR WR EDQN FHQWUDOQ\ GR X \FLD QLHNRQZHQFMRQDOQHJR

LQVWUXPHQWXZHZU]H QLXUR]SRF] áRQSU]\MPRZDQLHWHUPLQRZ\FKGHSR]\WyZRGOXGQR FLQD

SURFHQW SU]HELMDM F RIHUW\ EDQNyZ NRPHUF\MQ\FK

fg

: WHQ VSRVyE ³ FL JQ á´ ] RELHJX

POG]á]PXV]DM FMHGQRF]H QLHEDQNLGR]DRIHURZDQLDOHSV]\FKZDUXQNyZRSURFHQWRZDQLD

GHSR]\WyZ 3U]H] FDá\ F]DV 1%3 SU]HSURZDG]Dá UyZQLH Z VSRVyE FL Já\ LQWHUZHQFMH QD

RWZDUW\P U\QNX VSU]HGDM F VZH ERQ\ SLHQL QH L GRNRQXM F WUDQVDNFML UHYHUVH UHSR

SROHJDM F\FKQDSR \F]DQLXSá\QQ\FK URGNyZEDQNyZNRPHUF\MQ\FKSRG]DVWDZSDSLHUyZ

ZDUWR FLRZ\FK

3U]\NáDGHPRSHUDFMLGHSR]\WRZ\FK1%3MHVWZSURZDG]RQ\ZJUXGQLXUGHSR]\WQD

NRQLHFGQLD%DQNLG\VSRQXM FHZROQ\PL URGNDPLPRJ MHGHSRQRZDüZ1%3]WHUPLQHP

]ZURWXZQDVW SQ\PGQLXRSHUDF\MQ\P2LOHVWRSDNUHG\WXORPEDUGRZHJRZ\]QDF]DJyUQ\

SR]LRP ZDKD VWyS NUyWNRWHUPLQRZ\FK U\QNX PL G]\EDQNRZHJR WR VWRSD GHSR]\WRZD

RNUH ODSR]LRPGROQ\

X &

4.1.

$QDOL]DUyZQRZDJLU\QNXSLHQL G]DZNUyWNLPRNUHVLH

20

'HSR]\W\ 1%3 E\á\ RSURFHQWRZDQH ZHGáXJ VWDáHM VWRS\ SURFHQWRZHM Z\QRV] FHM GOD GHSR]\WX

PLHVL F]QHJR Z VNDOL URF]QHM D GOD GHSR]\WX PLHVL F]QHJR 2SURFHQWRZDQLH WR SU]HNUDF]DáR

SR]LRP RIHURZDQ\ SU]H] EDQNL NRPHUF\MQH Z NWyU\FK UHGQLH RSURFHQWRZDQLH GHSR]\WyZ PLHVL F]Q\FK

Z\QRVLáR Z OLSFX Z VLHUSQLX ]D ZH ZU]H QLX Z]URVáR GR SR]LRPX RUD] Z

SD G]LHUQLNX

M

AKROEKONOMIA

J.

K

UROWSKI

-

3,(1, '=L32/,7<.$3,(1,

1$

21

/

26

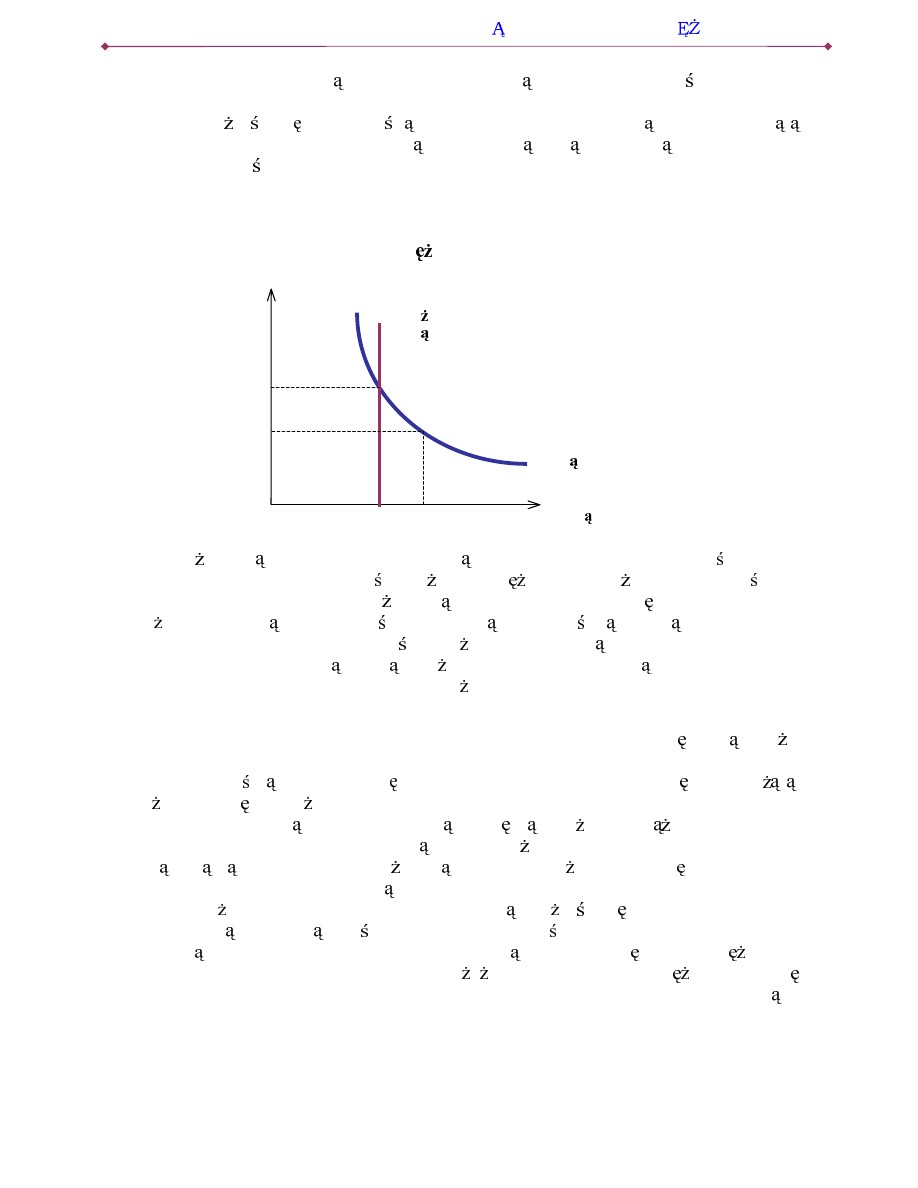

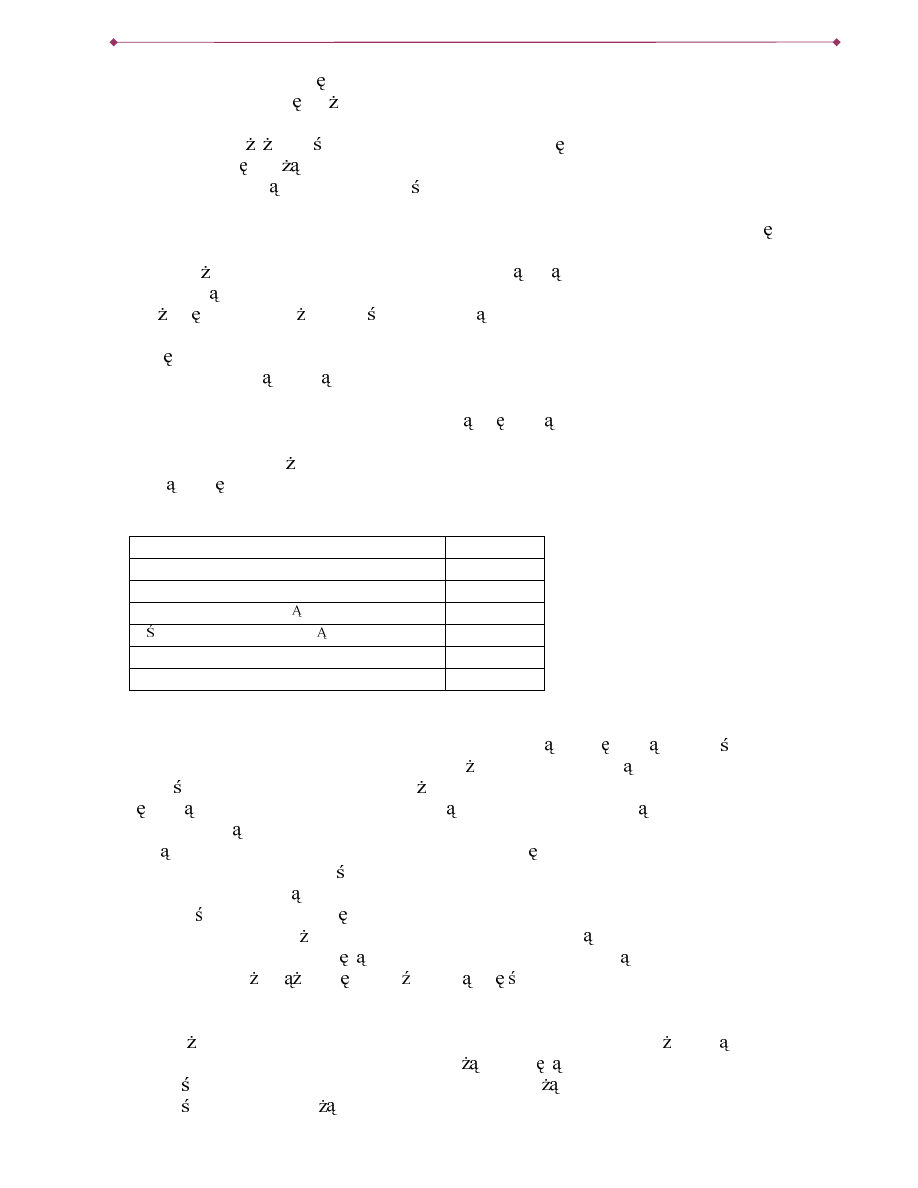

*áyZQHF]\QQLNLNV]WDáWXM FHUHDOQ\SRS\WQDSLHQL G]WRMDNVWZLHUG]LOL P\ZSXQNFLH

2.5, nominalna stopa procentowa i realny produkt gospodarki. Na rysunku 5 pokazana jest

RGZURWQD ]DOH QR ü PL G]\ ZLHONR FL SRS\WX QD UHDOQ\ ]DVyE SLHQL G]D L Z\]QDF]DM F

DOWHUQDW\ZQ\ NRV]W XWU]\P\ZDQLD SLHQL G]D QRPLQDOQ VWRS SURFHQWRZ .U]\ZD SRS\WX

RGSRZLDGDWXRNUH ORQHPXSR]LRPRZLSURGXNWX3.%

Rys.5.

5yZQRZDJDU\QNXSLHQL QHJRZNUyWNLPRNUHVLH

L

h

$

L

i

%

0

C

D

2 SRGD \ SLHQL G]D Z JRVSRGDUFH GHF\GXM ZáDG]H PRQHWDUQH SRSU]H] RNUH ODQLH ED]\

PRQHWDUQHMLZSá\ZDQLHQDZLHONR üPQR QLNDSLHQL QHJR&KRFLD MDNWRSRND]DOL P\Z

SRSU]HGQLPSXQNFLHNRQWURODSRGD \SLHQL G]DQLH]DZV]HRND]XMH VL VNXWHF]QD X]QDP\

SRGD UHDOQHJRSLHQL G]D]DZLHONR üHJ]RJHQLF]Q F]\OLRNUH ORQ ]]HZQ WU]SU]H]ZáDG]H

PRQHWDUQH EDQN FHQWUDOQ\ :LHONR ü SRGD \ UHDOQHJR SLHQL G]D REUD]XMH QD U\VXQNX

SLRQRZDOLQLDNWyUDMHVWQDV] NU]\Z SRGD \5yZQRZDJDU\QNXSLHQL G]DMHVWZ\]QDF]RQD

SU]H]]UyZQDQLHUHDOQHJRSRS\WXLUHDOQHMSRGD \

0

j

3 0

k

3

(17)

1DU\VXQNXPDWRPLHMVFHZSXQNFLH$JG]LHNU]\ZDSRS\WXSU]HFLQDVL ]OLQL SRGD \

Taka interpretacja jest ograniczona do bardzo krótkiego okresu, w którym jedynym

F]\QQLNLHP RNUH ODM F\P UyZQRZDJ MHVW VWRSD SURFHQWRZD 3HáQL RQD URO UyZQRZD F

=Dáy P\ V\WXDFM QDGZ\ NRZHJR SRS\WX JG\ SU]\ VWRSLH SURFHQWRZHM L

i

ludzie chcieliby

XWU]\P\ZDü]DVyESLHQL G]D2'SU]HNUDF]DM F\GRVW SQ SRGD 2&:G HQLXGRX]\VNDQLD

GRGDWNRZ\FK Sá\QQ\FK ]DVREyZ SRGHMP RQL VSU]HGD LQQ\FK DNW\ZyZ QS REOLJDFML OXE

]HFKF ]DFL JQ üNUHG\W\6WDáDSRGD SLHQL G]D2&XQLHPR OLZLDUHDOL]DFM W\FKSODQyZZ

VNDOLRJyOQHM.RQNXURZDQLHRSLHQL G]GRSURZDG]LGRZ]URVWXVWRS\SURFHQWRZHMQDVNXWHN

Z]URVWXSRGD \REOLJDFMLLVSDGNXLFKFHQRGZURWQ ]DOH QR üPL G]\U\QNRZ\PLFHQDPL

REOLJDFMLLVWRS SURFHQWRZ Z\MD QLDNRPHQWDU]7RZáD QLHUXFK\VWRS\SURFHQWRZHMLFHQ

REOLJDFMLV F]\QQLNLHPGRVWRVRZDZF]\PSU]\ZUDFDM F\PUyZQRZDJ U\QNXSLHQL QHJRZ

NUyWNLPRNUHVLH7HQZQLRVHNSRND]XMHUyZQLH HUyZQRZDJDU\QNXSLHQL QHJRQLHGDVL

RGG]LHOLüRGU\QNyZLQQ\FKDNW\ZyZILQDQVRZ\FKZQDV]\PUR]XPRZDQLXUHSUH]HQWXM MH

obligacje.

Komentarz

5\QNRZDFHQDREOLJDFMLDVWRSDSURFHQWRZD

QRPLQDOQD

VWRSD

SURFHQWRZD

krzywa

SRGD \

SLHQL G]D

krzywa

SRS\WXQD

SLHQL G]

UHDOQ\]DVyE

SLHQL G]D

22/

26

2EOLJDFMDMHVWSDSLHUHPZDUWR FLRZ\PVWDQRZL F\P]RERZL ]DQLHHPLWHQWDGRZ\SáDWSU]H]

RNUH ORQ\F]DVSHZQHMNZRW\5\QNRZ FHQ REOLJDFMLRNUH ODP\X \ZDM FUDFKXQNXZDUWR FL

]DNWXDOL]RZDQHMNWyU\VSURZDG]DNZRW\RF]HNLZDQ\FKZSU]\V]áR FLGRFKRGyZGRZDUWR FL

DNWXDOQHM 6WRVXM F WHQ UDFKXQHN ]DGDMHP\ S\WDQLH MDND NZRWD E\áDE\ SRWU]HEQD G]L DE\

X]\VNDü GDQ ZDUWR ü GRFKRGX Z SU]\V]áR FL" -H OL QS RF]HNXMHP\

]á

]D URN D VWRSD

SURFHQWRZD Z\QRVL WR DNWXDOQ G]LVLHMV] ZDUWR ü WHM VXP\ VWDQRZL NZRWD ; NWyUD

]DLQZHVWRZDQDG]L GD]DURN

]á

3RQLHZD ; WR;

]á

*G\WDNLHM

VDPHMNZRW\GRFKRGX

]á

VSRG]LHZDP\VL ]DGZDODWDWR;

f

]á

VN GMHJR

DNWXDOQDZDUWR üZ\QLHVLH;

]á

&HQDREOLJDFMLMHVWVXP ]DNWXDOL]RZDQ\FKZDUWR FL

GRFKRGyZVSRG]LHZDQ\FKZNROHMQ\FKSU]\V]á\FKRNUHVDFK3U]\MPLMP\GODXSURV]F]HQLD H

PDP\GRF]\QLHQLD]REOLJDFM RELHFXM FDVWDá\GRFKyGEH]WHUPLQRZRZQLHVNR F]RQR ü

fd

2 MHM FHQLH GHF\GXMH ]DNWXDOL]RZDQD ZDUWR ü Z\SáDW NWyUH SU]\QLHVLH Z NROHMQ\FK ODWDFK

2]QDF]DM FVWDá\GRFKyGURF]Q\OLWHU DVWRS SURFHQWRZ LRWU]\PDP\

S DLDL

f

DL

l

DL

m

DL (18)

:LG]LP\ H FHQD WDNLHM REOLJDFML MHVW RGZURWQLH SURSRUFMRQDOQD GR VWRS\ SURFHQWRZHM :

SU]\SDGNX REOLJDFML R RNUH ORQ\P F]DVLH Z\NXSX IRUPXáD MHVW EDUG]LHM ]áR RQD SR]RVWDMH

MHGQDNUHJXá HZ\ V]DVWRSDSURFHQWRZDREQL DFHQ\REOLJDFML

1DV] SURVW\ PRGHO SR]ZDOD XZ]JO GQLü SU]HM FLH RG SRF] WNRZHJR GR LQQHJR VWDQX

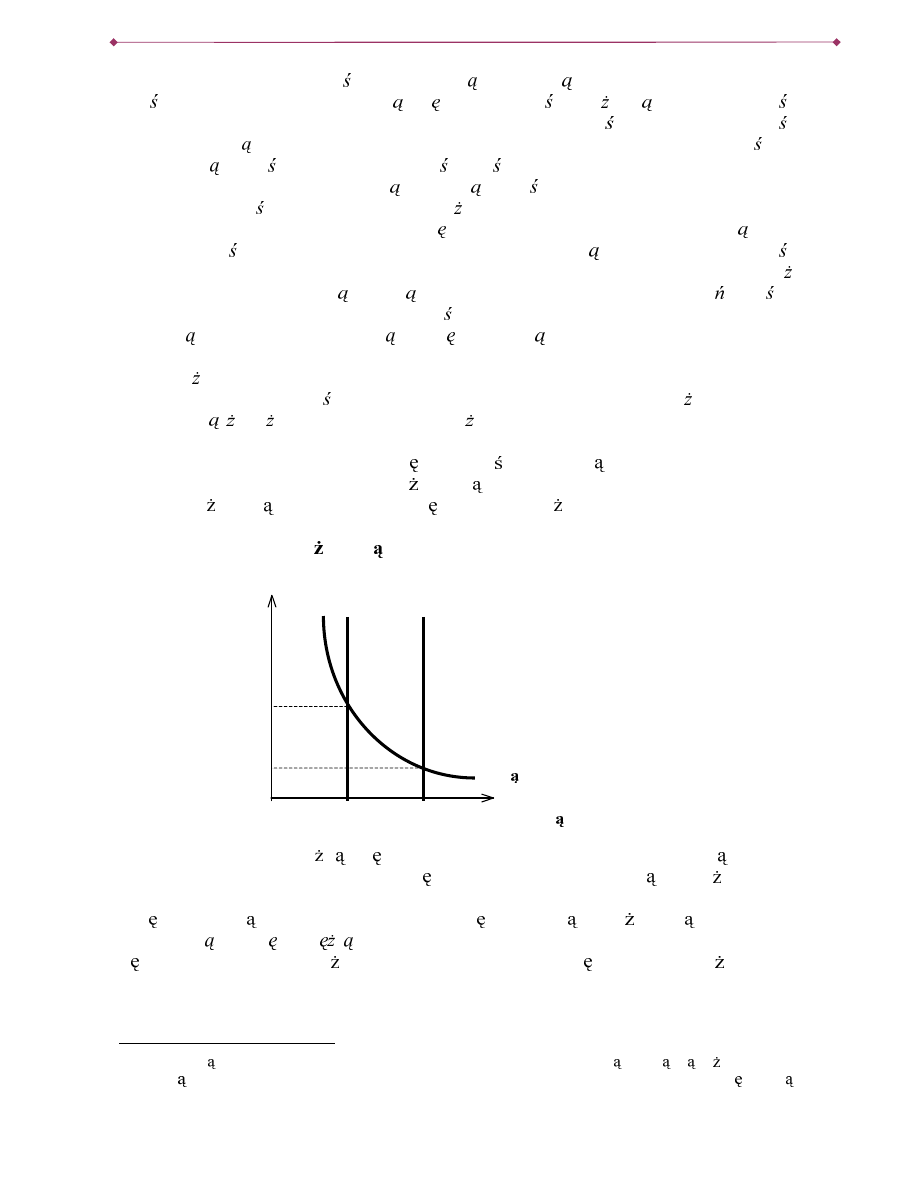

UyZQRZDJL Z\ZRáDQH ]PLDQDPL SRGD \ SLHQL G]D L ]PLDQDPL GRFKRGX 3.% :]URVW

UHDOQHMSRGD \SLHQL G]DREUD]XMHSU]HVXQL FLHNU]\ZHSRGD \ZSUDZRQDU\VXQNX

Rys.6.

:]URVWSRGD \SLHQL G]D

0

n

3

h

0

n

3

i

L

o

$

L

h

5HDOQ\]DVyESLHQL G]D

6WRSD SURFHQWRZD REQL DM F VL Z\ZRáXMH Z]URVW SRS\WX UHDOQHJR QD SLHQL G] 1RZD

równowaga ma miejsce w p. A

1

SU]\ZL NV]\PUHDOQ\P]DVRELHSLHQL G]DLQL V]HMVWRSLH

procentowej (

L

d

7DND]PLDQDVWDQXUyZQRZDJLLOXVWUXMHRGG]LDá\ZDQLHEDQNXFHQWUDOQHJRQD

VWRS SURFHQWRZ *G\ EDQN FHQWUDOQ\ ]ZL NV]D UHDOQ SRGD SLHQL G]D SURZDG]L

HNVSDQV\ZQ SROLW\N SLHQL Q Natomiast SROLW\NDUHVWU\NF\MQDma miejsce, gdy dokonuje

VL ]PQLHMV]HQLHUHDOQHMSRGD \F]HPXRGSRZLDGDáRE\SU]HVXQL FLHNU]\ZHMSRGD \ZOHZRL

wzrost stopy procentowej.

21

-HVWWRUR]ZL ]DQLHQLHVWRVRZDQHGRW\FKF]DVZ3ROVFH:QLHNWyU\FKNUDMDFKU] G\]DFL JDM SR \F]NL

JZDUDQWXM FEH]WHUPLQRZRSUDZRGRVWDáHJRGRFKRGX::LHONLHM%U\WDQLLWHQW\SREOLJDFMLQD]\ZDVL NRQVRO

1RPLQDOQD

VWRSD

SURFHQWRZD

3RS\WQD

SLHQL G]

$

h

M

AKROEKONOMIA

J.

K

UROWSKI

-

3,(1, '=L32/,7<.$3,(1,

1$

23

/

26

6NXWNL Z]URVWX UHDOQHJR 3.% SRND]DQH V QD U\V .U]\ZD SRS\WX QD UHDOQ\ SLHQL G]

SU]HVXZDVL ZSUDZR3U]\GDQHMUHDOQHMSRGD \SLHQL G]DGOD]DFKRZDQLDUyZQRZDJLPXVL

QDVW SLüZ]URVWVWRS\SURFHQWRZHM]PQLHMV]DM F\SRS\WQDSLHQL G]D GRPRPHQWXSHáQHJR

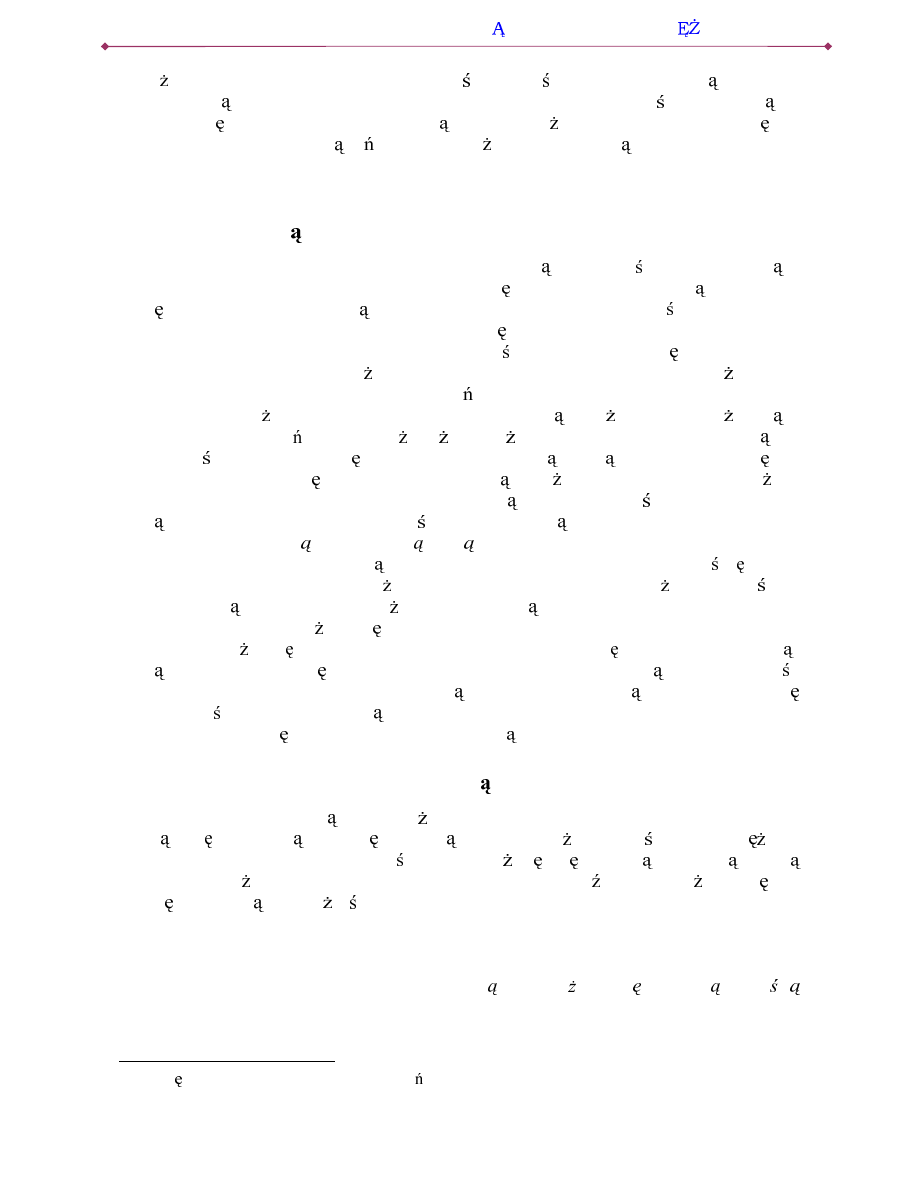

]UHNRPSHQVRZDQLD MHJR Z]URVWX VSRZRGRZDQHJR ]ZL NV]HQLHP GRFKRGX F]\OL UHDOQHJR

PKB.

Rys.7.

:]URVWUHDOQHJRSURGXNWX(PKB)

L

i

L

h

0

p

3

i

0

p

3

h

5HDOQ\]DVyESLHQL G]D

4.2.

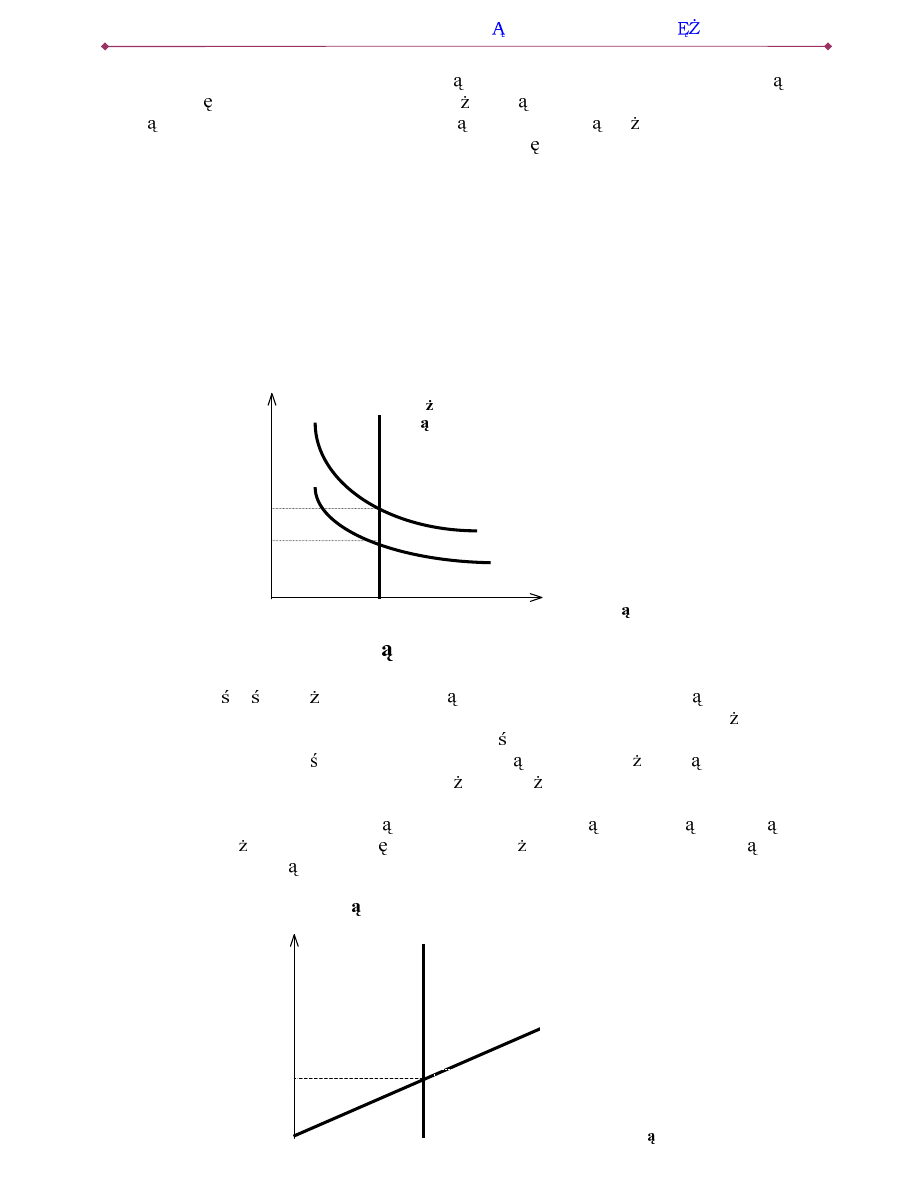

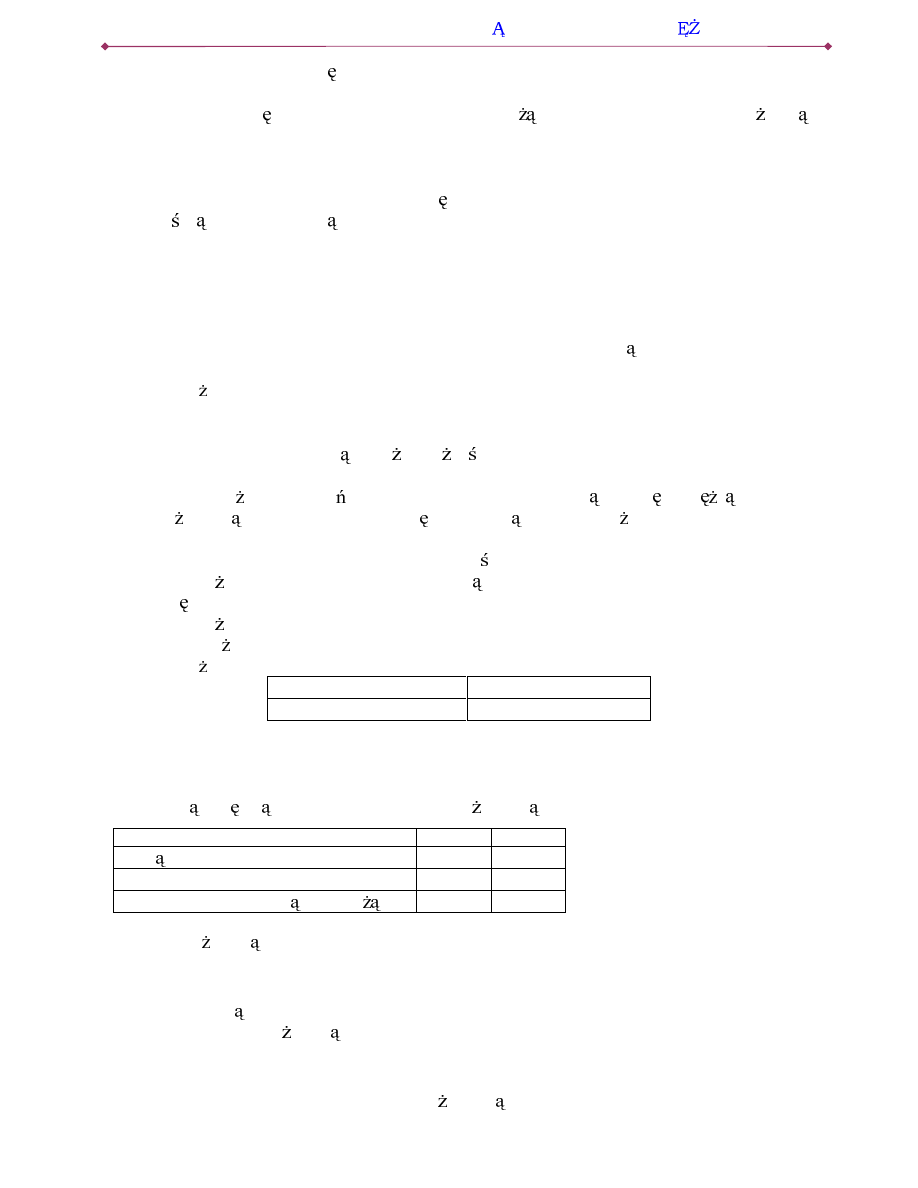

5yZQRZDJDU\QNXSLHQL G]DZGáXJLPRNUHVLH

-DN SRGNUH ODOL P\ Z\ HM SRS\W QD SLHQL G] WR ]DSRWU]HERZDQLH QD SLHQL G] UHDOQ\ :

GáXJLPRNUHVLHSRS\WQRPLQDOQ\MHVWSURSRUFMRQDOQ\GRSR]LRPXFHQFRR]QDF]D HZ]URVW

3 Z\ZRáXMH SURSRUFMRQDOQ\ Z]URVW 0

d

1D U\V R SLRQRZD PLHU]\ SR]LRP FHQ 3 QD RVL

SR]LRPHM RGNáDGDP\ ]D QRPLQDOQ\ ]DVyE SLHQL G]D 0 3RGD SLHQL G]D M

s

jest

SU]HGVWDZLRQD MDNR OLQLD SLRQRZD SRQLHZD QLH ]DOH \ RQD RG SR]LRPX FHQ OHF] PD

podobnie jak w analizie krótkiego okresu charakter egzogeniczny (jest wyznaczana przez

ZáDG]H PRQHWDUQH 3RS\W QD SLHQL G] LOXVWUXMH SURVWD Z]QRV] FD Z\FKRG] FD ] SRF] WNX

XNáDGX3RQLHZD ZW\PSURVW\PXM FLXSU]\MPXMHP\ HSURGXNWLVWRSDSURFHQWRZDV GDQH

WRSRS\WQDUHDOQ\SLHQL G]MHVWVWDá\

Rys.8.

5\QHNSLHQL G]DZGáXJLPRNUHVLH

3R]LRPFHQ

1RPLQDOQ\

]DVyESLHQL G]D

1RPLQDOQD

VWRSD

SURFHQWRZD

3RGD

SLHQL G]D

0

q

0

r

3

0

$

24/

26

=UyZQDQLHSRS\WX]SRGD PDPLHMVFHZSXQNFLH$NWyU\RNUH ODSR]LRPFHQUyZQRZDJL

(

3

0

-DNLHF]\QQLNLRGG]LDá\ZDM QD]PLDQ\UyZQRZDJLZGáXJLPRNUHVLH"0R QDSU]\M ü H

VWRSDSURFHQWRZDPLPR]QDF]QHM]PLHQQR FLNUyWNRRNUHVRZHMQLHZ\ND]XMHWHQGHQFML]PLDQ

GáXJRRNUHVRZ\FKFRSR]ZDODSRPLQ üM ZDQDOL]LH=PLDQ\SRGD \SLHQL G]DV SRZL ]DQH

]H ]PLDQDPL SR]LRPX FHQ :]URVW SRGD \ SLHQL G]D ]LOXVWURZDQ\ QD U\V SU]HVXQL FLHP

NU]\ZHMSRGD \]SR]\FML0

n

h

do pozycji

0

n

i

prowadzi do podniesienia poziomu cen z

3

h

do

3

i

.

Rys.9.

:]URVWSRGD \SLHQL G]DZGáXJLPRNUHVLH

7DNL ]ZL ]HN MHVW IXQGDPHQWDOQ FHFK PRGHOX NODV\F]QHJR (NRQRPLD NODV\F]QD

]DNáDGDM F GRVNRQDá NRQNXUHQFM QD U\QNDFK SHáQH ]DWUXGQLHQLH Z JRVSRGDUFH RUD] VWDá

V]\ENR üRELHJXSLHQL G]DSU]\MPXMH H]PLDQ\QRPLQDOQHMSRGD \SLHQL G]DSURZDG] GR

proporcjonalnych zmian poziomu cen,

22

QLH V QDWRPLDVW Z VWDQLH ZSá\ZDü QD SURGXNW

UHDOQ\ (NRQRPL FL WHJR NLHUXQNX VWRM QD VWDQRZLVNX G\FKRWRPLL VIHU\ UHDOQHM L VIHU\

SLHQL QHM ]JRGQLH ] NWyU Z\á F]QLH F]\QQLNL UHDOQH MDN QDNáDG\ LQZHVW\F\MQH SU]\URVW

]DWUXGQLHQLD F]\ SRVW S WHFKQLF]Q\ PRJ RGG]LDá\ZDü QD Z]URVW JRVSRGDUF]\ F]\OL

UHDOL]RZDQH Z GáXJLP RNUHVLH SU]\URVW\ SURGXNWX =PLDQ\ SRGD \ SLHQL G]D SURZDG] GR

]PLDQZLHONR FLQRPLQDOQ\FKF]\OLZ\UD RQ\FKZZDOXFLHNUDMRZHM

3RZ\ V]H VWZLHUG]HQLH PD GX H ]QDF]HQLH Z DQDOL]LH LQIODFML :\QLND ] QLHJR H Z

GáXJLP RNUHVLH VWRSD LQIODFML P D33 MHVW UyZQD WHPSX Z]URVWX SRGD \ SLHQL G]D m

D0

k

0

k

'RW G QLH XZ]JO GQLDOL P\ MHGQDN Z]URVWX UHDOQHJR SURGXNWX FR MDN ZLHP\

ZSá\ZD QD UyZQRZDJ SRSU]H] SRS\W QD SLHQL G] -H OL SU]H] h R]QDF]\P\ HODVW\F]QR ü

22

0R QDWRZ\ND]DüSU]\SRPLQDM F]DSLVSRS\WXQDSLHQL G]]SXQNWX0

s

3<9 Warunek równowagi

U\QNXSLHQL QHJRSU]\MPXMHSRVWDü0

t

3<93U]\GDQHMV]\ENR FLRELHJXSLHQL G]D9LEUDNX]PLDQ

SURGXNWXUHDOQHJR<]PLDQ\SRGD \SLHQL G]DZ\ZRáXM MHG\QLHSURSRUFMRQDOQHGRQLFKUXFK\SR]LRPXFHQ

7DNLHXM FLHMHVWQD]\ZDQHLOR FLRZ WHRUL SLHQL G]DLZ]PRG\ILNRZDQHMZHUVMLVWDáRVL SRGVWDZ QXUWX

monetarystycznego w ekonomii

3R]LRPFHQ

1RPLQDOQ\

]DVyESLHQL G]D

0

q

u

0

q

v

0

r

3

u

$

3

v

%

M

AKROEKONOMIA

J.

K

UROWSKI

-

3,(1, '=L32/,7<.$3,(1,

1$

25

/

26

UHDOQHJRSRS\WXQDSLHQL G]ZUHODFMLGRSURGXNWX3.%DVWRS Z]URVWXUHDOQHJRSURGXNWX

przez

JWRSRS\WQDUHDOQ\SLHQL G]E G]LHZ]UDVWDáZHGáXJVWRS\hJ. Stopa wzrostu realnego

]DVREXSLHQL G]DD0

k

30

k

3VWDQRZLUy QLF PL G]\WHPSHPZ]URVWXQRPLQDOQHMSRGD \

SLHQL G]DLVWRS LQIODFML'ODXWU]\PDQLDUyZQRZDJLWHPSRZ]URVWXSRGD \PXVLE\üUyZQH

WHPSXZ]URVWXSRS\WXF]\OL]DFKRG]LUyZQR ü

mP hJ

(19)

6WRSD LQIODFML Z GáXJLP RNUHVLH MHVW UyZQD Uy QLF\ WHPSD Z]URVWX QRPLQDOQHM SRGD \

SLHQL G]D L LORF]\QX WHPSD Z]URVWX SURGXNWX L ZVSyáF]\QQLND HODVW\F]QR FL SRS\WX QD

SLHQL G]Z]JO GHPSURGXNWX

P mhJ (20)

,QIODFMD UR QLH JG\ ]ZL NV]D VL WHPSR SRGD \ SLHQL G]D 3U]\VSLHV]HQLH Z]URVWX

gospodarczego (wzrost

JMHVWZVWDQLHáDJRG]LüLQIODF\MQHVNXWNLHNVSDQVMLSLHQL QHMLWRW\P

EDUG]LHMLPZ\ V]\MHVWZVSyáF]\QQLNHODVW\F]QR FLh.

3RGVWDZRZHSRM FLD

%D]DPRQHWDUQD

3RUWIHORZDWHRULDSRS\WXQDSLHQL G]

3LHQL G]JRWyZNRZ\

%DQNNRPHUF\MQ\

$JUHJDWSLHQL Q\0Z VNL

.UHDFMDSLHQL G]DZNáDGRZHJR

$JUHJDWSLHQL Q\0V]HURNL

0QR QLNSLHQL Q\

3RS\WQDSLHQL G]

5H]HUZ\RERZL ]NRZH

$OWHUQDW\ZQ\NRV]WSLHQL G]D

2SHUDFMHRWZDUWHJRU\QNX

=DVDGD)LVKHUD

6WRS\SRGVWDZRZHEDQNXFHQWUDOQHJR

3á\QQR üLGRFKRGRZR üDNW\ZyZ

.UHG\WRGDZFDRVWDWQLHMLQVWDQFML

7UDQVDNF\MQ\SRS\WQDSLHQL G]

%LODQV$NW\ZDLSDV\ZD

=DVRERZDWHRULDSRS\WXQDSLHQL G]

.RQWURODSRGD \SLHQL G]D

6SHNXODF\MQ\SRS\WQDSLHQL G]

5yZQRZDJDU\QNXSLHQL QHJR

ûZLF]HQLDWHVWRZH

A.

3\WDQLDVSUDZG]DM FH

1.

Uy QLF PL G]\VWRS SURFHQWRZ RGDNW\ZyZWDNLFKMDNGáXJRWHUPLQRZHREOLJDFMHD

VWRS ]ZURWXRGGHSR]\WyZQD GDQLHELH F\FKPR QDWáXPDF]\ü

a)

Z\PLHQQR FL GRFKRGRZR FLLU\]\ND

b)

Z\PLHQQR FL GRFKRGRZR FLLSá\QQR FL

c)

Z\PLHQQR FL Sá\QQR FLLU\]\ND

Odp:b Tak!

a, c Nie! Ryzyko jest w obu przypadkach jednakowo znikome.

2.

*G\E\VWRSDUH]HUZRERZL ]NRZ\FKZ\QRVLáD

a)

EDQNLQLHPRJá\E\XG]LHODüNUHG\WyZ

26/

26

b)

EDQNLXG]LHODá\E\ZL FHMNUHG\WyZ

c)

NUHG\W\VWDá\E\VL GUR V]H

Odp:a Tak!

b, c

1LH=DXZD HFDáR üGHSR]\WyZVWDQRZLáDE\UH]HUZ

3.

&RVWDáRE\VL ]SR GDQ\PUHDOQ\P]DVREHPJRWyZNLJRVSRGDUVWZDGRPRZHJRUHDOQ\P

SRS\WHPQDSLHQL G]JRWyZNRZ\MH OLUHDOQDVWRSDSURFHQWRZDZ]UDVWDDOHQRPLQDOQD

stopa procentowa pozostaje bez zmian?

a)

VSDGáE\

b)

Z]UyVáE\

c)

QLH]PLHQLáE\VL

Odp: c Tak!

a, b Nie!

:D QDMHVWQRPLQDOQDVWRSDSURFHQWRZDSU]HV G]DM FDRDOWHUQDW\ZQ\PNRV]FLH

WU]\PDQLDSLHQL G]DJRWyZNL

4.

1DOH \VL VSRG]LHZDü HV]\ENR üRELHJXSLHQL G]DMHVWZNUDMX]HVWDELOQ\PSR]LRPHP

cen:

a)

ZL NV]D

b)

mniejsza,

c)

taka sama,

MDNZNUDMX]Z\VRN LQIODFM

Odp:b Tak!

a, c Nie!

3U]\Z\VRNLHMLQIODFMLOXG]LHÄSR]E\ZDM ´VL SLHQL G]D

5.

=DNZDOLILNXMSRGDQHQL HMSR]\FMHMDNRDNW\ZDOXESDV\ZDZELODQVLHEDQNXFHQWUDOQHJR

ZSLVXM FOLWHU $DNW\ZDOXE3SDV\ZD

32=<&-$

$F]\3"

1. REZERWY WALUT

w`x

TU9@4VV;W:4;=<>;=:4?A@/N4B4VLKE?

yx

LE:4;=Y2@H>@/FY<>O

;=D>J4V;W:4<

Y2JE?CO

z`x

:JEYLEO#VB/:4BR\FVLEBR\{:4<

YF

5. GOTÓWKA W OBIEGU (C)

6. KREDYTY UDZIELONE BANKOM

Odp;1. A, 2. P, 3. A, 4. P, 5. P, 6. A Tak!

6.

Ä=QDNLZ\SXV]F]RQHSU]H]RVRE\OXEILUP\SU\ZDWQHPRJ VWDüVL SLHQL G]HP-H OLQS

SHZLHQVWXGHQWZ\VWDZLNROHG]HRGNWyUHJRSR \F]\á]á]RERZL ]DQLHVSáDW\WHMNZRW\

ZRNUH ORQ\PWHUPLQLHWRSDSLHUWHQPR HE\üSU]H]ZLHU]\FLHODSXV]F]RQ\ZRELHJLVWDü

VL SLHQL G]HP´2]QDF]DUJXPHQW\SRSLHUDM FHWDNLHVWZLHUG]HQLHOLWHU 7DDUJXPHQW\

SU]HFLZNROLWHU 1

a)

NU JRGELRUFyZWDNLFK]QDNyZMHVWQLHZLHONL]HZ]JO GXQDEUDNSRZV]HFKQHJR

SU]HNRQDQLDRZLDU\JRGQR FLHPLWHQWD

b)

REUyWWDNLPL]RERZL ]DQLDPLQLHMHVW]DEURQLRQ\

c)

Sá\QQR üWDNLHJRSDSLHUXE G]LHQLHZLHOND

d)

MHVWSUDZGRSRGREQH HZ\VWDZFD]QDNXQLHZ\SHáQL]RERZL ]DQLD

e)

]QDMRPLZ\VWDZF\]QDNXE G VNáRQQL]DDNFHSWRZDüMHJR]RERZL ]DQLH

f)

WDNLSDSLHUPR HNU \üPL G]\OXG PLVWDM FVL URGNLHPSáDWQLF]\P

Odp: b, e, f

T,

a,c,d

N

7.

:QDMEOL V]\FKODWDFKZ3ROVFHSUDZGRSRGREQH]PLDQ\ZVWUXNWXU]HSRGD \SLHQL G]D0

JRWyZNDZRELHJXSXEOLF]Q\PGHSR]\W\QD GDQLHE G SROHJDá\QD

a)

Z]UR FLHJRWyZNLZRELHJXZUHODFMLGRGHSR]\WyZQD GDQLH

b)

Z]UR FLHGHSR]\WyZQD GDQLHZRELHJXZUHODFMLGRJRWyZNL

M

AKROEKONOMIA

J.

K

UROWSKI

-

3,(1, '=L32/,7<.$3,(1,

1$

1

/

26

c)

VWUXNWXUDQLH]PLHQLVL

Odp:b Tak!

a, c Nie!

&RUD]ZL FHMRVyENRU]\VWD]UDFKXQNyZELH F\FKZEDQNDFKW]Z525X \ZDM F

NDUWSáDWQLF]\FK

8.

W pewnej gospodarce odnotowano wzrost realnej stopy procentowej z 3 do 5%, podczas gdy

QRPLQDOQDVWRSDSURFHQWRZDXWU]\PDáDVL QDVWDá\PSR]LRPLH:V]\VWNLHLQQHF]\QQLNL

RNUH ODM FHSRS\WQDSLHQL G]SR]RVWDá\SU]\W\PQDQLH]PLHQLRQ\PSR]LRPLH:]URVWRZL

UHDOQHMVWRS\SURFHQWRZHMPXVLDáWRZDU]\V]\ü

a)

wzrost inflacji,

b)

spadek inflacji,

c)

VWDáDLQIODFMD

Odp:b Tak!

a, c Nie! Skorzystaj z zasady Fishera

9.

6WRSDLQIODFMLZ3ROVFHZODWDFKV\VWHPDW\F]QLHVSDGDáD6SDGDM FDLQIODFMD

a)

podnosi nominalne stopy procentowe,

b)

REQL DQRPLQDOQHVWRS\SURFHQWRZH

c)

QLHZSá\ZDQDQRPLQDOQHVWRS\SURFHQWRZH

. Odp:b Tak!

a, c Nie!

8SRGVWDZWHJR]ZL ]NXOH \]DOH QR ü]QDQDMDNR]DVDGDFishera

10.

.WyUH]SRQL V]\FK]GDU]H ]DNZDOLILNXMHV]MDNRHNVSDQV\ZQ SROLW\N SLHQL Q Z]URVW

SRGD \SLHQL G]DDNWyUHMDNRSROLW\N UHVWU\NF\MQ VSDGHNSRGD \ZVWDZOLWHUNLZ

odpowiednim miejscu tabelki.

a)

]DNXSSU]H]EDQNFHQWUDOQ\SDSLHUyZZDUWR FLRZ\FKQDRWZDUW\PU\QNX

b)

SRGZ\ NDPLQLPDOQHMVWRS\UH]HUZRERZL ]NRZ\FK

c)

FL FLHVWySSURFHQWRZ\FKEDQNXFHQWUDOQHJRORPEDUGRZHMLUHG\VNRQWRZHM

d)

SRGZ\ NDPLQLPDOQHMVWRS\LQWHUZHQFMLEDQNXFHQWUDOQHJRQDRWZDUW\PU\QNX

e)

VSU]HGD SU]H]EDQNFHQWUDOQ\SDSLHUyZ]SU]\U]HF]HQLHPRGNXSXEDQNRPNRPHUF\MQ\P

f)

REQL NDVWRS\GHSR]\WRZHMEDQNXFHQWUDOQHJR

3ROLW\NDHNVSDQV\ZQD

3ROLW\NDUHVWU\NF\MQD

Odp ekspansywna: a, c, f, restrykcyjna: b, d, e.

B.

=DGDQLDUDFKXQNRZH

1.

'DQHV QDVW SXM FHSR]\FMHVNáDGQLNyZSRGD \SLHQL G]DZ3ROVFH

w mln

]á

XII. 2000 XII. 2001

3LHQL G]JRWyZNRZ\ZRELHJX

34 112,7 38 213,5

Rezerwy gotówkowe banków

12 240,3 13 668,4

'HSR]\W\LLQQH]RERZL ]DQLDELH FH

72 343,2 80 083,5

|

SRGD SLHQL G]D0ZREXODWDFKZ\QLRVáDRGSRZLHGQLRPOQ]á

a)

118 696,2 i 131 965,4

b)

46 353,0 i 51 881,9

c)

106 455.9 i 118 297,0

Odp: c Tak!

a, b

1LH3LHQL G]0WRJRWyZNDZRELHJXLUH]HUZ\EDQNyZ

|

QRPLQDOQDSRGD SLHQL G]DZ]URVáDR

d)

11,1%

e)

11,9%

f)

15,7

Odp: d Tak!

e, f Nie! Zbadaj

SURFHQWRZ\SU]\URVWSRGD \SLHQL G]D0

M

AKROEKONOMIA

J.

K

UROWSKI

-

3,(1, '=L32/,7<.$3,(1,

1$

1

/

26

|

MH OLLQIODFMDZZ\QLRVáDWR]PLDQDUHDOQHMSRGD \SLHQL G]DZ\QLRVáD

g)

16,6%

h)

5,6%

i)

-5,6%

Odp: h Tak!

g, i

1LH3RZLQLHQH Z\HOLPLQRZDüZSá\ZLQIODFML

|

SRZ\ V]D]PLDQDUHDOQHMSRGD \SLHQL G]D

j)

PRJáDE\E\üX]QDQD]DF]\QQLNSRGWU]\PXM F\LQIODFM

k)

QLHPR HPLHü]ZL ]NX]LQIODFM

l)

MHVWHOHPHQWHPSROLW\NLILVNDOQHMU] GX

Odp: j

7DN6]F]HJyOQLHJG\ZLHP\ HWHPSRZ]URVWX3.%E\áRQL V]HQL Z]URVWUHDOQHM

SRGD \SLHQL G]D

k, l

1LH=DXZD HZGáXJLPRNUHVLHVWRSDLQIODFMLUyZQDMHVWWHPSXZ]URVWXSRGD \

SLHQL G]DSU]\GDQ\PSR]LRPLHUHDOQHJR3.%:URNXSU]\URVW3.%E\áQLHZLHONL

2.

'DQHV QDVW SXM FHSR]\FMHVNáDGQLNyZSRGD \SLHQL G]DZ3ROVFH

w mld

]á

VI. 2001

3LHQL G]JRWyZNRZ\ZRELHJX

34,7

Rezerwy gotówkowe banków

12,2

'HSR]\W\LLQQH]RERZL ]DQLDELH FH

69,7

|

3RGD SLHQL G]D0ED]DPRQHWDUQDZ\QLRVáD

a)

116,6

POG]á

b)

104,4

c)

46,9

Odp: c Tak!

a, b

1LH0REHMPXMHJRWyZN ZRELHJXLUH]HUZ\JRWyZNRZHEDQNyZ

|

3RGD SLHQL G]D0Z\QLRVáD

d)

116,6

POG]á

e)

104,4

f)

46,9

Odp: e Tak!

d, f Nie! M1 to gotówka w obiegu i rezerwy banków.

|

ZDUWR FLOLF]ERZHVWRS\UH]HUZJRWyZNRZ\FKV

}