Basics of Accounting

BSF, Univ. of Economics in Wrocław

Lecturer:

dr Wojciech Hasik

Case no. 10.

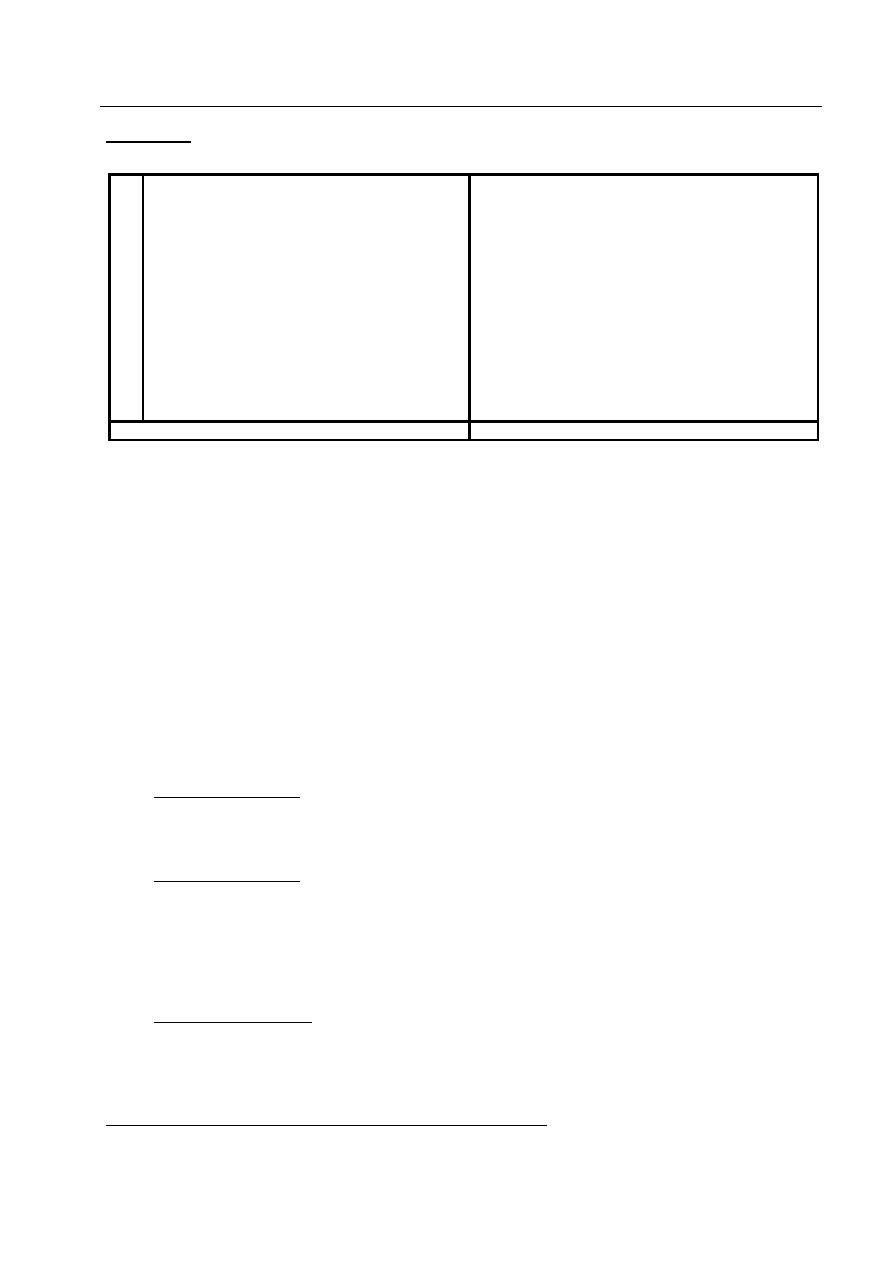

Y Company (bricks producer) reports the following balances of assets and equities:

Assets

As at

31/03/0x

Equity & Liabilities

As at

31/03/0x

A.

Fixed Assets

A.

Owners' Equity

I

Intangible fixed assets

100 000,-

I

Share equity

350 000,-

II

Tangible fixed assets

1. Machines and equipment

200 000,- B.

Liabilities & provisions for liabil.

B.

Current Assets

III Short term liabilities

I

Inventories

2. To other entities

1. Raw materials

50 000,-

a) credits & loans

110 000,-

3. Finished goods

60 000,-

d) trade payables

20 000,-

II

Trade receivables

1 000,-

f) promissory notes

5 000,-

III Short term investments

g) VAT due

1 000,-

Cash at vault

4 000,-

Cash at bank

71 000,-

Total Assets

486 000,-

Total Equity & Liabilities

486 000,-

Additional data from the entity’s trial balance (as at the date) :

Fixed price variation (Dt)

2 500,-

Accumulated depreciation

2 000,-

Accumulated amortization

1 000,-

I.

open the ledger accounts concerting additional data from trial balance

II.

perform the accounting entries of below transactions

1.

Depreciation write off for current period

1 000,-

2.

Amortization write off for current period

500,-

3.

Clay was disposed for brick production purposes: 10 mT @ 200,-

2 000,-

4.

Settlement of variation relevant for materials disposed

………?

5.

The toner for printer was bought, cash payment

600,-

6.

Invoice form Trans-pol for materials transportation:

a)

wartość netto

500,-

b)

VAT 22%

110,-

c)

brutto

610,-

7.

Invoice from Energy Services Corp. for energy consumed:

a)

net

700,-

b)

VAT 22%

154,-

c)

total

854,-

8.

Payment for Trans-pol was executed

………?

9.

The protective clothing was bought and given to workers

500,-

10.

Invoice from print shop for delivered advertisement folders:

a)

net

1 000,-

b)

VAT 22%

220,-

c)

total

1 220,-

11.

Payroll for current month

5 000,-

12.

Call for property tax payment was received

300,-

The costs by kind to be settled into costs by function classification:

13.

Settlement of cost of clay consumed in production process

……?

14.

Settlement of depreciation:

a)

office equipment

300,-

b)

production machinery and equipment

700,-

15.

Settlement of amortization (PC software)

500,-

16.

Settlement of protective clothing cost

500,-

17.

Settlement of costs of transportation

500,-

18.

Settlement of toner for printer cost

500,-

19.

Settlement of energy consumption cost:

a)

production purposes

630,-

b)

non production purposes

70,-

20.

Settlement of advertisement folders’ costs

1 000,-

21.

Settlement of wages into places of incurring:

a)

blue collar workers

2 000,-

b)

management staff

2.000,-

c)

marketing staff

1 000,-

22.

Property tax settlement:

a)

share of production site

270,-

b)

other spaces

30,-

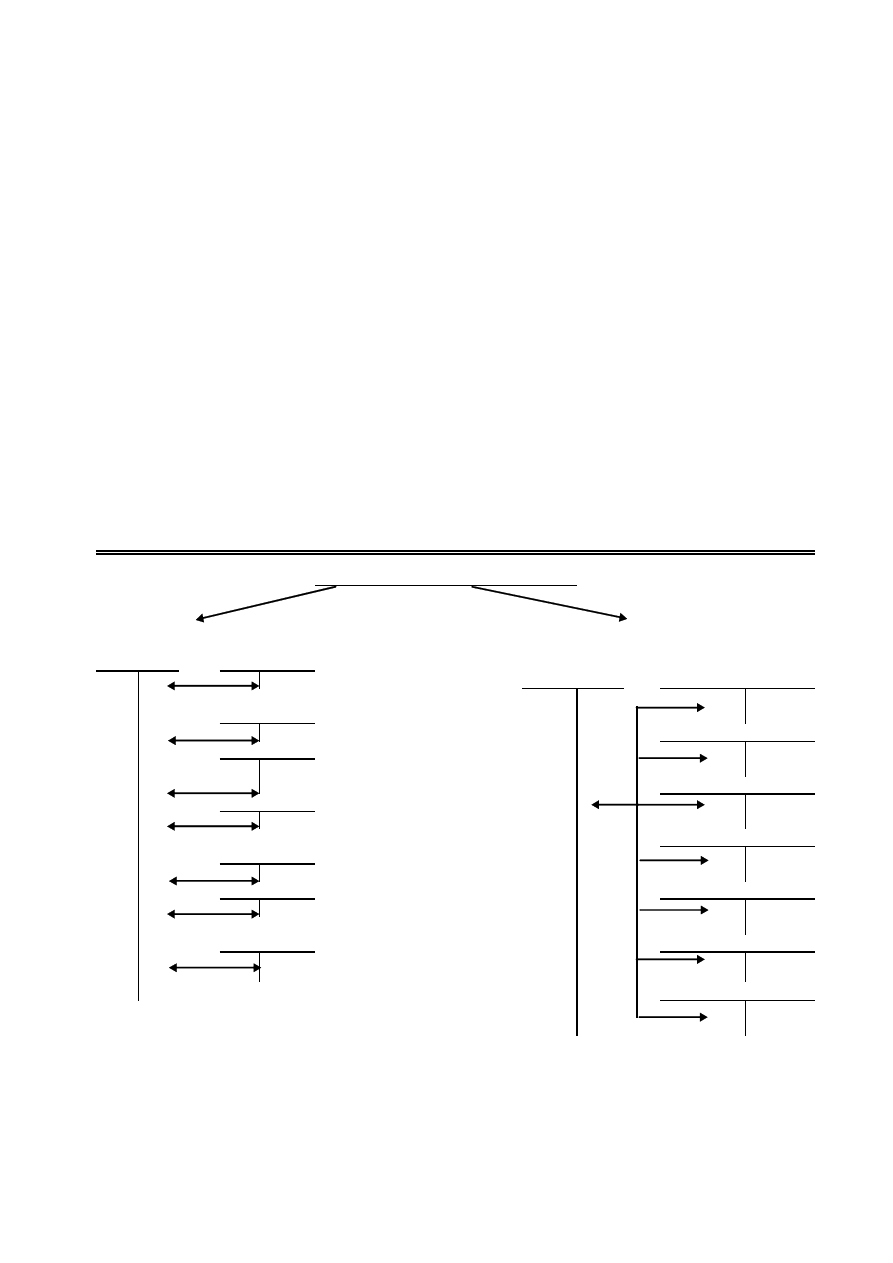

Costs of core activity (basic operational costs)

COSTS BY KIND

COSTS BY FUNCTION

Deprec.& Amortization

(1)

Materials & energy

(1)

(1) cost is incurred

Indirect costs of production

(2) cost is settled into

(1)

functional classification

(2)

of costs (places of incurring)

(1)

Social security

(1)

Taxes and charges

(1)

Other costs

(1)

Purchasing costs

Costs of basic activity

(pruduction or services)

Different l. acc.

Costs by kind settlement

Accruals

by kind

Costs of auxiliary activities

Selling costs

Administrative costs

consumption

Services

Wages

& benefits

Wyszukiwarka

Podobne podstrony:

BSF Basics of Accounting Case 13

BSF Basics of Accounting Case 14

BSF Basics of Accounting Cases 4 7

BSF Basics of Accounting Cases 8 9

Basics of management for BSF

Basics of Assembler

Basics Of Hacking 2 VAXs

2 Basics of Fiber Optics

Basics Of Hacking 3 ?ta

Basics Of Hacking Intro

Basics Of Hacking 1 ?Cs

SHSBC207 BASICS OF AUDITING

BASICS OF ENVIRONMENTAL CHEMISTRY lab no2

Basics of the Coaching Relationship

Wolves of Stone Ridge 10 The Wolf Biker s Mate

v ray basics of the render settings part 4 of 5

The Development of the Case System in French

Wójcik, Marcin Rural space and the concept of modernisation Case of Poland (2014)

więcej podobnych podstron