1

Various standards:

(IAS 10, 37 and 24)

Chapter

14

2

14.1

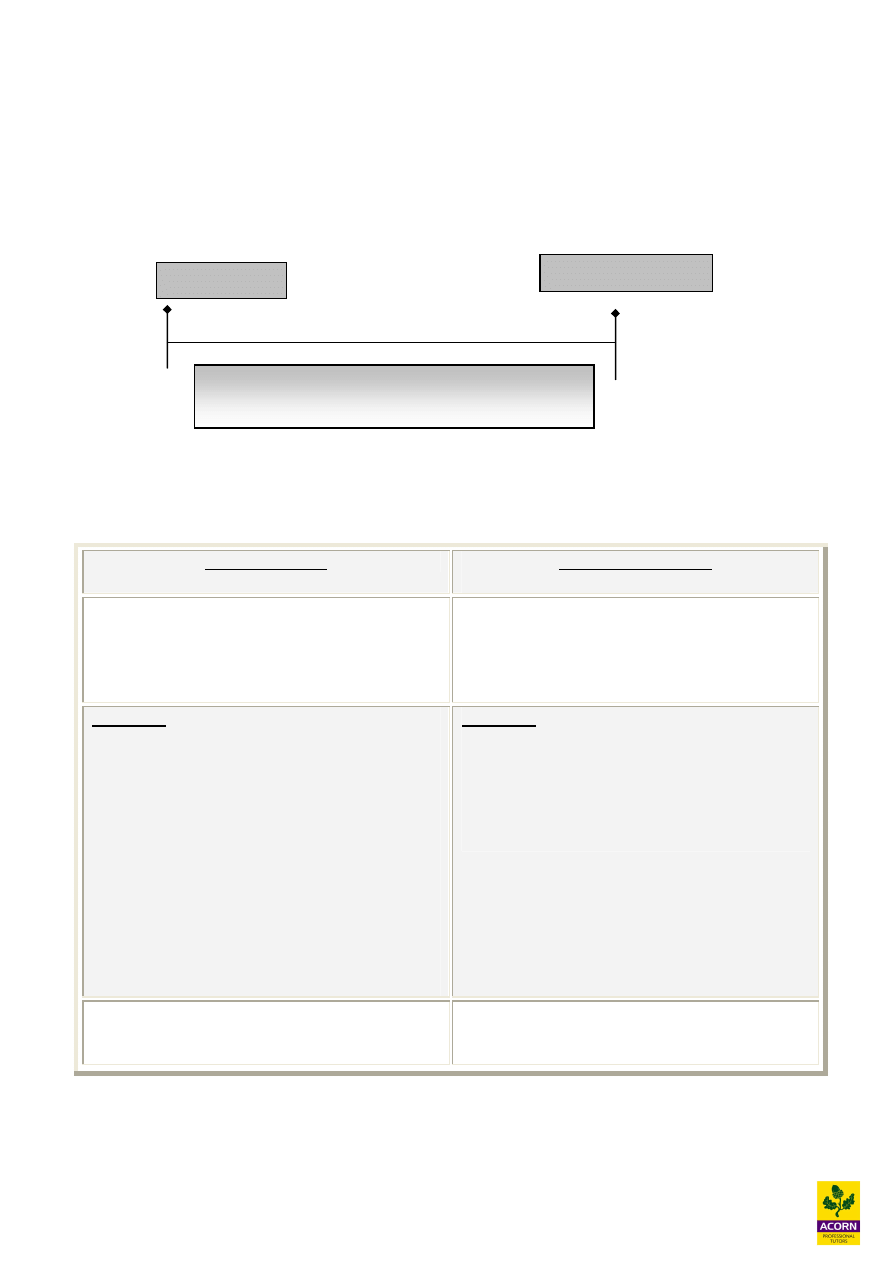

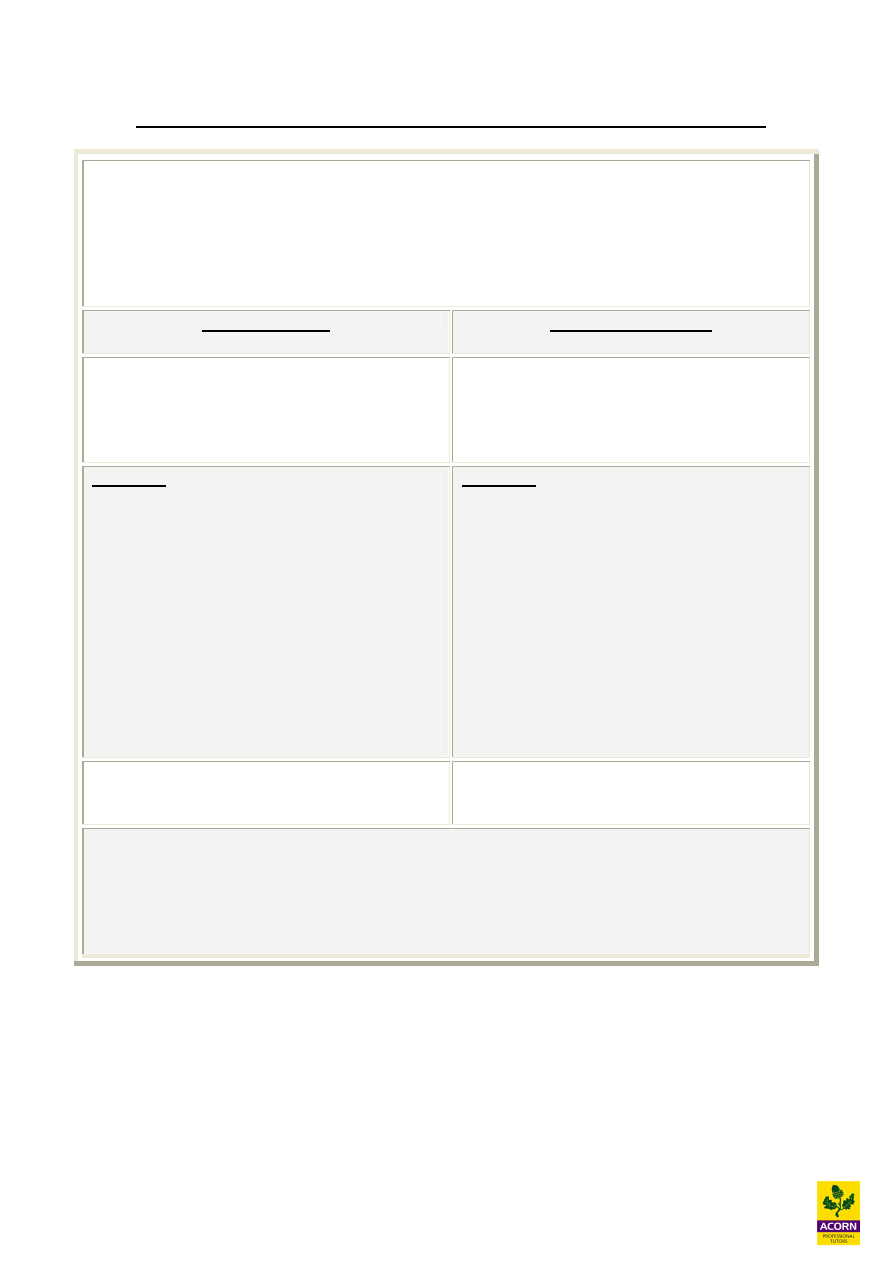

IAS 10 - Events after the reporting period

Events occur which may be favourable or unfavourable between the accounting year end date and

the signing of the financial statements. These events may or may not affect the figures in the

financial statements. If they effect the financial statements they are known as adjusting events, if

they don’t affect the financial statements they are known as non-adjusting events.

Time

Events after the reporting period end need to be reflected in the financial statements if they provide

additional evidence of conditions that existed at the year end date and are material. Disclosures

need to be made for materials events for the proper understanding of the accounts.

Adjusting events

Non-adjusting events

These require the accounts to be adjusted

because they provide additional evidence of

conditions existing at year end date.

These are events, which did not exist at the year

end date, but need to be disclosed as they are

material and to not to disclose them would

mislead the users of the accounts.

Examples

§ Non current assets – their valuation if

sold or impairment.

§ Insurance claims – if they were being

negotiated at year end date

§ Provision for bad debts - if new

information about a debtor has come to

light

§ Inventories and WIP – if sold after

year end for less than cost & NRV.

§ Changes in tax rate

§ Errors or frauds discovered

Examples

§ Issue of new share or loan capital after

the year end date

§ A major acquisition

§ A major disposal

§ Flood, fires or other catastrophes after

balance sheet date

The financial statements need to be adjusted

for any of the above events

Disclosure needs to be made in the financial

statements for the above if they are material

Year-end

Signing of accounts

Events occurring between this period can be

adjusting or non-adjusting

3

Dividends

IAS 10 states that any dividends declared after the year end date must not be recognised as a

liability. This is because at the year end date there was no obligation to pay dividends.

This clashes with UK GAAP as incorporated entities are required to incorporate proposed

dividends even if they were declared after the year end date. IAS 10 does not permit this.

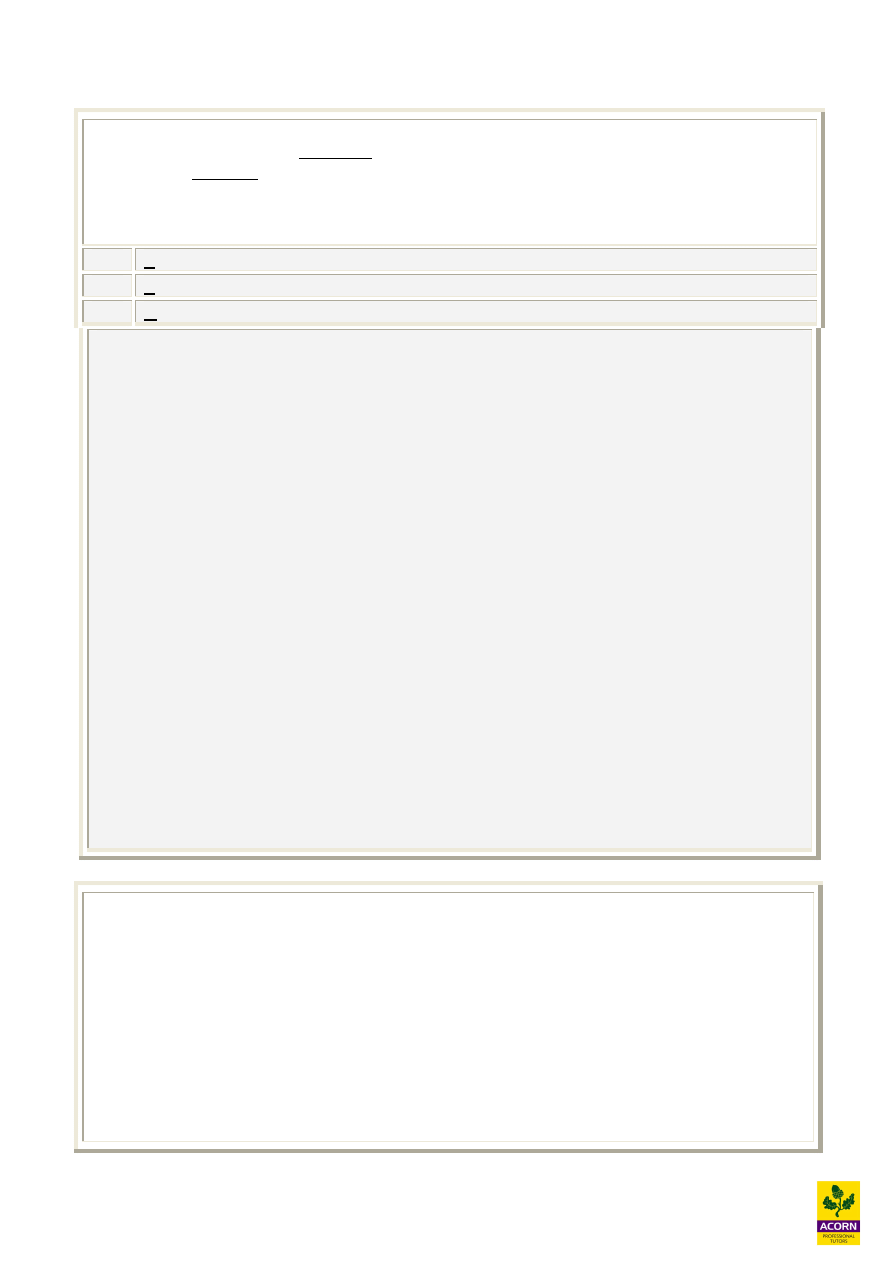

Lecture Example 14.1

How would the following matters be dealt with?

(i)

The professional valuation of a property one month after the year end date at a figure

of £270,000 below the market value.

(ii)

The destruction of a company’s factory two weeks after the year end date. The factory

was not insured due to an administrative error and the loss has been estimated at £500,000.

(iii)

When drafting the final accounts, a company’s accountant includes a figure of £6,500 as the

net realisable value of damaged inventory. The cost of these items was £8,200 and the

normal selling price would be £9,700. Between the year end date and approval of the

accounts, the items are sold for £9,100. Assume these figures are material.

4

14.2

IAS 37: Provisions, contingent liabilities and contingent assets

(Tutor note: IAS 37 is not examinable in this paper; this is additional reading for better

understanding).

A provision is a liability (an obligation to transfer economic benefits as a result of past transactions

or events) of uncertain timing and amount. Uncertainty is what distinguishes a provision from

another type of liability such as trade payables.

IAS 37 states that an organisation can only make a provision if certain criteria are met.

The double entry for setting up a provision is:

Debit

Expense (income statement)

Credit Provisions (statement of financial position)

When a provision is paid, it won’t affect the income statement:

Debit

Provisions (statement of financial position)

Credit Bank (statement of financial position)

Provisions must be reviewed every year and adjusted accordingly.

Traditionally, companies were urged to be prudent and be cautious about future outcomes by

providing for possible losses / costs.

However this was abused as companies started to set up provisions when there was no need to.

These provisions were then released in future periods to smooth profits.

IAS 37 stops the abuses of provisions by ensuring that the strict criterion is met before provisions

can be made.

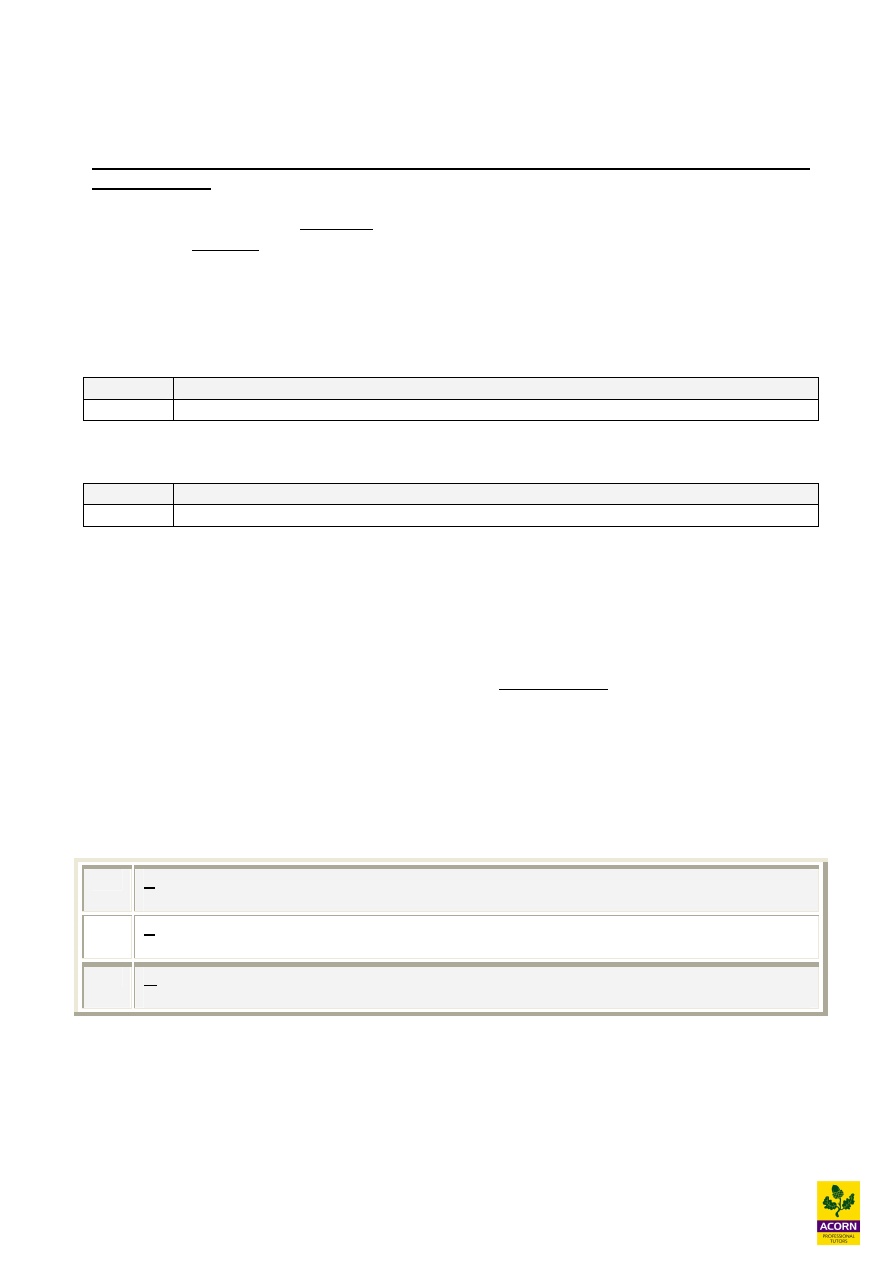

Criteria for making a provision

A provision should be recognised in the financial statements when all the below are met. (PPR)

P

Present obligation (legal or constructive) as a result of past transaction or events

P

Probable transfer of economic benefits to settle (more likely than not)

R

Reliable estimate can be made of obligation

If these conditions are not met, then no provision can be made in the financial statements.

5

Contingent liabilities

A contingency is a condition that exists at the year end date, but whose outcome can only be

confirmed by the occurrence of one or more uncertain future events, which are may be outside the

control of the company.

A contingent liability described by IAS 37 either a possible obligation or a present obligation that

does not meet all the criteria for a provision.

Accounting treatment is:

1

Do not recognise in the financial statements

2

Only disclose the information if it is material. If the contingent liability is remote, then no

disclosure is required.

An example of a contingent liability is a customer suing for compensation, but the outcome of

the court case is uncertain at the year end date.

Contingent asset

A possible asset that arises as a result of past transaction or events, but whose existence will only be

confirmed by the occurrence or non occurrence of one or more uncertain future events, which may

be outside the control of the company.

Accounting treatment is:

1

Do not recognise in the financial statements as an asset or income in the income statement.

2

Only disclose the information if it is material, and probable that there will be inflow of

economic benefits.

An example of a contingent asset is the company suing another party for compensation, but

the outcome of the court case is uncertain at the year end date.

6

14.3

IAS 24 related parties

(Tutor note: IAS 24 is not examinable in this paper, this is additional reading for better

understanding).

IAS 24 related party disclosure is a disclosure requirement where a company might not be carrying

out transactions at a normal arms length basis. Users of the accounts need to know if the

organisation has undertaken any transactions with a related party as this could affect their decision

making process

The key requirements are to:

· Identify the related parties

· Disclose any transactions undertaken with the related parties, being at arms length

or not

· Disclose any outstanding amounts

Related parties

Two or more parties are related parties when at any time during the financial period: -

a)

One party has direct or indirect control over the other party, or

b)

Parties are subject to common control from the same source, or

c)

One party has significant influence over the financial and operating policies of the

other.

d)

Parties are subject to significant influence from the same source.

Examples of related party

· Companies in same group

· Associates and joint ventures

· Directors

· Pension funds

· Key management

· Someone owning more than 20% of voting rights

· Companies managed under a management contract

· Partnerships, companies, trusts, other entities

Control - The ability to direct the financial and operating policies of an entity with a view to

gaining economic benefits from its activities.

Related party transactions - The transfer of assets or liabilities or the performance of services by,

to or for a related party irrespective of whether a price is charged.

Accounting treatment for related party transactions

· Names of the transacting related parties, and the relationship

· Description of transactions, the amounts involved and the amounts due to and from at the

year end date.

· The amounts written off in respect of debts from related parties

7

Summary of chapter “various accounting standards – IAS 10, IAS 37 and IAS 24”

IAS 10 - Events after the reporting period

Events occur which may be favourable or unfavourable between the accounting year end date and

the signing of the financial statements. These events may or may not affect the figures in the

financial statements. If they effect the financial statements they are known as adjusting events, if

they don’t affect the financial statements they are known as non-adjusting events.

Adjusting events

Non-adjusting events

These require the accounts to be adjusted

because they provide additional evidence of

conditions existing at year end date.

These are events, which did not exist at the

year end date, but need to be disclosed as they

are material and to not to disclose them would

mislead the users of the accounts.

Examples

§ Non current assets – their valuation if

sold or impairment.

§ Insurance claims – if they were being

negotiated at year end date

§ Provision for bad debts - if new

information about a debtor has come to

light

§ Inventories and WIP – if sold after

year end for less than cost & NRV.

§ Changes in tax rate

§ Errors or frauds discovered

Examples

§ Issue of new share or loan capital after

the year end date

§ A major acquisition

§ A major disposal

§ Flood, fires or other catastrophes after

balance sheet date

The financial statements need to be adjusted

for any of the above events

Disclosure needs to be made in the financial

statements for the above if they are material

Dividends

IAS 10 states that any dividends declared after the year end date must not be recognised as a

liability. This is because at the year end date there was no obligation to pay dividends.

8

IAS 37: Provisions, contingent liabilities and contingent assets

A provision is a liability (an obligation to transfer economic benefits as a result of past transactions

or events) of uncertain timing and amount. Uncertainty is what distinguishes a provision from

another type of liability such as trade payables. A provision should be recognised in the financial

statements when all the below are met. (PPR).

P

Present obligation (legal or constructive) as a result of past transaction or events

P

Probable transfer of economic benefits to settle (more likely than not)

R

Reliable estimate can be made of obligation

Contingent liabilities

A contingency is a condition that exists at the year end date, but whose outcome can only be

confirmed by the occurrence of one or more uncertain future events, which are may be outside

the control of the company.

A contingent liability described by IAS 37 either a possible obligation or a present obligation that

does not meet all the criteria for a provision.

Accounting treatment is:

§ Do not recognise in the financial statements

§ Only disclose the information if it is material. If the contingent liability is remote, then no

disclosure is required.

Contingent asset

A possible asset that arises as a result of past transaction or events, but whose existence will only

be confirmed by the occurrence or non occurrence of one or more uncertain future events, which

may be outside the control of the company.

Accounting treatment is:

§ Do not recognise in the financial statements as an asset or income in the income statement.

§ Only disclose the information if it is material, and probable that there will be inflow of

economic benefits.

IAS 24 related parties

IAS 24 related party disclosure is a disclosure requirement where a company might not be

carrying out transactions at a normal arms length basis. Users of the accounts need to know if the

organisation has undertaken any transactions with a related party as this could affect their decision

making process

The key requirement is to:

1

Identify the related parties

2

Disclose any transactions undertaken with the related parties, being at arms length or not

3

Disclose any outstanding amounts

9

Solutions to Lecture Examples

Solution to Lecture Example 14.1

a)

This is an adjusting event, since the valuation provides information about a condition

existing at the balance sheet. It would become a non-adjusting event only if it could be

proved that the decline in value occurred after the year-end.

b)

This is a non-adjusting event as it occurred after the balance sheet date. However as it is a

material amount it will need to be disclosed by a way of note.

c)

The valuation in the accounts should be adjusted to £8,200 (cost), since the NRV has turned

out to be higher than the cost. This is a adjusting post balance sheet event.

Solution to Lecture Example 14.2

For a provision to be recognised the PPR must be met

1

Present obligation as the result of a past event.

2

Probable transfer

3

Reliable estimate

1 PC Worldcom

Present obligation – Yes – the past (obligating) event is the sale of the product, which gives rise to

a legal obligation (under the contract).

Probable transfer – Yes, there will probably be claims for the warranties as a whole.

Reliable estimate – PC Worldcom can use past data to predict

Therefore – recognise a provision, the amount to be recognised based on past experience.

2 Parks & Mincer plc

Present obligation – Yes – The past event is the sale of the product which gives rise to a

constructive obligation.

Probable transfer- yes

Reliable estimate – Parks & Mincer plc can use past history to predict

Therefore – recognise a provision.

3 Unfortunate plc

Present obligation – No at the balance sheet date.

The obligating event is the announcement of the plan, which creates a constructive obligation.

This did not take place until after the year end date.

Therefore no provision is recognised at the year end date

Wyszukiwarka

Podobne podstrony:

MEMO 10 37 EN

10 (37)

2003 10 37

Mechanika - Dynamika, cwiczeniadynamika10, Ćwiczenia 10

10 1996 23 24

handlowe-prominska, 24.10.2007r., Wyklad 7 24

MEMO 10 37 EN

TI 10 98 06 24 B pl

10 GERUND and INFINITIVE

(Atheism, Humanism) Sam Harris 10 myths and 10 truths about atheism

10 1996 23 24

Standardy wymagan 311[37]

PBO TD04 F01 Standards of vessel speed and daily consumption

2003 10 37

F1 Employee benefits (IAS 19)

Paranormal Dating Agency 10 Bearfoot and Pregnant Milly Taiden

2001 10 Onwards and Upwards

więcej podobnych podstron