1

Employee Benefits

(IAS 19)

Chapter

13

2

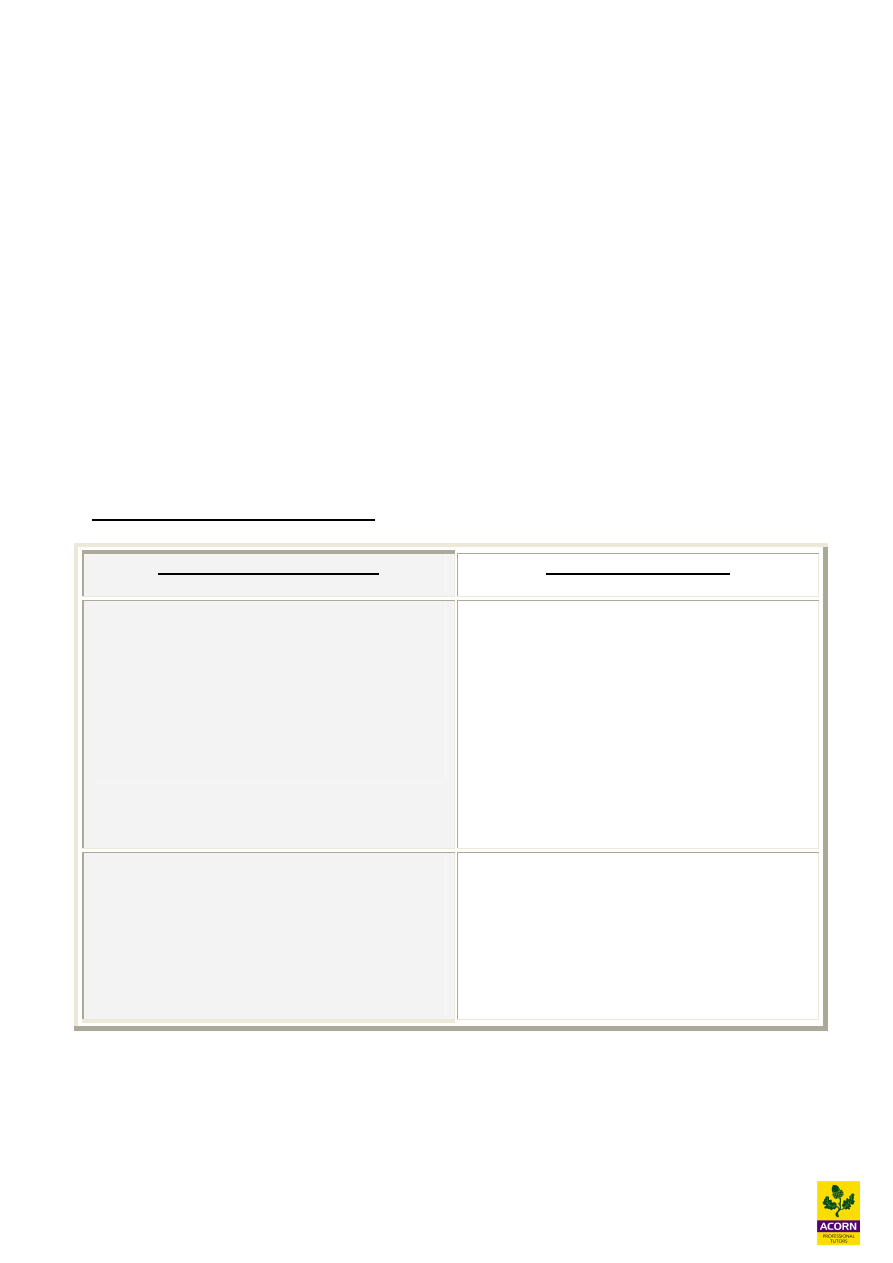

13.1

IAS 19 Accounting for employee benefits

IAS 19 deals with 2 areas of employee benefits

1

Short term employee benefits

These include wages and salaries, sick pay, bonuses and other remunerations. IAS 19 states that

these are straightforward to account for, usually the cost falls in the period that the benefit arises.

2

Post employment benefits

These are mainly in the form of pensions, and it is this that causes accounting problems.

The difficulties of accounting for the cost of pensions in the employers account

§ Amounts involved are large

§ Time scale is long

§ Estimation process is complex

§ Assumptions required in many areas of uncertainty

There are 2 types of pension schemes

Defined contribution scheme

Defined benefit schemes

Regular contributions are paid into this scheme.

The benefits are directly determined by the value of

contributions paid and the performance of the scheme

assets.

This scheme does not present a problem for the

company.

Under these schemes employees’ pension benefits are

specified, normally as a percentage of final salary.

An actuary will calculate the size of the fund required on

retirement to provide the specified pensions and hence

the contributions.

The rules define the benefits of independently of the

contribution payable, and the benefits are not directly

related to the investments of the scheme.

The scheme may be funded or un-funded.

Accounting

treatment

is

to

charge

the

contributions to the income statement in the

period occurred.

In the statement of financial position an accrual

or prepayment might arise if too much or too

little has been paid.

The problems with this scheme are

§ Valuing the scheme assets

§ Estimating the scheme liabilities

§ Measuring and recognising the cost

to the employing company

3

Unfunded pension schemes

The employer pays pensions due directly out of the company’s assets and therefore does not

maintain a separate pension fund. Therefore the pension is vulnerable to the company’s downturn.

It’s risky for employees. (Enron had an unfunded pension scheme).

Funded pension schemes

The contributions are made to external pension fund which is legally separate from the employer

company. These funds are either administered by trustees or insurance company. It’s better than

unfunded schemes as they will not be affected if the company hits bad times.

We shall concentrate on funded defined benefit schemes, as these are the ones that cause

accounting problems. Remember information will be given by the separate pension fund and the

organisation has to incorporate that information into its own financial statements. Contributions

made by the employee and employer are usually done through payroll, so these costs will already

be expensed in the income statement.

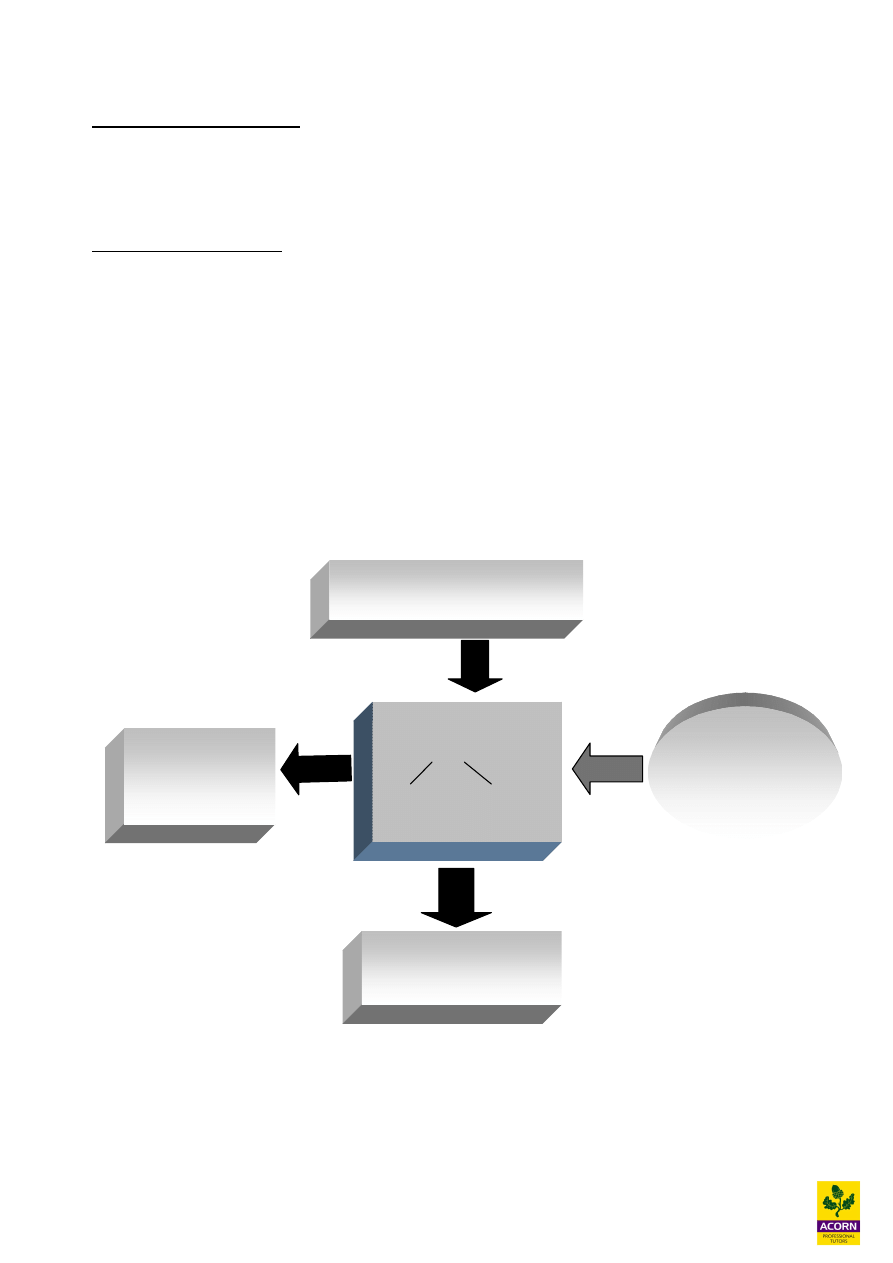

13.2

Accounting for defined benefit schemes

Funded defined benefit scheme

This fund either grows (surplus) or reduces (deficit) according to returns and pension obligations.

PENSION FUND

Deficit Surplus

Investments in

shares,

properties etc.

reduce fund

Returns from

investments go

back into the

fund

Pension payouts

reduce fund assets and

liabilities

Contributions from employer

and employees increase fund

4

For exam purposes only the impact on the financial statements relating to defined benefit scheme

are required. The information is provided by the pension company which the organisation has to

journal into the financial statements.

§ The impact on the income statement for all the pension costs and returns

§ The value of the net pension asset or liability in the statement of financial position

(present value of the obligations less the fair value of the assets)

§ The calculation of the actuarial gains or losses and showing these under other

comprehensive income.

Items and accounting treatment

Current service costs

This is the increase in the present value of the scheme liabilities expected to arise from employee

service in the current period (the actuarial estimate of benefits earned by employee service in the

period). It is shown in the income statement as pension cost

Interest cost

The expected increase during the period in the present value of the scheme liabilities because the

benefits are one period closer to settlement. It is shown in the income statement. Also referred to as

the Unwinding of the discount

Expected return on assets – Expected rate of return on the market value of the assets held by the

scheme at the start of the accounting period. This is taken to the income statement

Past service costs

The increase in the present value of the scheme liabilities related to employee service in prior

periods arising in the current period due to improvements.

IAS 19 states that past service costs must be taken to the income statement immediately

Gains/losses on settlements and curtailments

Settlement. This may occur because the employer has offered something else, which reduces or

eliminates all further obligations under the plan to the employer e.g. a lump-sum cash payment to

scheme members in exchange for their rights to receive specified pension benefits.

Curtailment. This is a reduction in the obligations. Curtailments include:

§ Termination of employees’ services earlier than expected, e.g. closing part of a business.

§ Termination of, or amendment to the terms of, a defined benefit scheme so that some or all

future service by current employees will no longer qualify for benefits or will qualify only

for reduced benefits.

Gains or losses on settlement and curtailments are recognised immediately in the income statement.

5

Accounting for defined benefit schemes is complex and the following steps need to be taken:

1

Establish the present value of future obligations and the current service cost

Using actuarial techniques, the amount of future benefits that the employees’ have earned from

their service in the current period is established. This involves taking into consideration factors

such as employee salaries, future salary growth, employee life expectancy, expected return on

assets and discount rates.

Worked example (simplified example - not examinable for information purposes only)

A company offers a defined benefit pension scheme to its employees. On 1/1/X0, an employee is

paid an annual salary of £50,000. The pension plan will entitle him to 1% of his final salary as one

lump payment for each year of employment. His salary is expected to increase by 3%

(compounded) each year (beginning next year) until he leaves employment.

The employee is expected to leave in 5 years time

1

The expected final salary in five years time is £50,000 x (1.03)

4

= £56,275

2

The lump sum payment on retirement is therefore 1% x £56,275 x 5 years = £2,815

3

Each year’s service will give entitlement to £563 (£2,815 / 5 yrs). Discount rate of 8% is to

be used.

A liability is set up in the balance for these future obligations, but discounted as they are future

cash flows. The other side is charged to the income statement as current service cost each year.

The current service cost is charged to the Income statement plus interest cost which relates to the

present value of liabilities recognised in the prior years.

The method used by IAS 19 to allocate the costs is known as projected unit credit method and it

works like this:

Year

1

2

3

4

5

Current year benefit

563

563

563

563

563

Prior years

0

563

1,126

1,689

2,252

Total

563

1,126

1,689

2,252

2,815

Statement of financial

position (opening liability)

-

413

893

1,446

2,083

Current service cost

(income statement)

(563x0.735)

413

(563x0.794)

447

(563x0.857)

482

(563x0.926)

521

563

Interest (income

statement)

-

33

71

116

167

Statement of financial

position (closing liability)

413

893

1,446

2,083

2,813

(Rounding

difference)

6

Current service cost is the present value of the annual benefit discounted at 8%. Interest is 8% on

opening liability. Closing liability is opening balance plus current service cost plus interest. Items

going to the income statement include the current service cost plus the interest.

2

Establish the fair value of the pension scheme assets

The fair value of the pension scheme assets need to be established. Investments done by pension

firms include the equity market, bond market and property market. This is always given in the

exam.

3

Establish the actuarial gain or loss

The actuarial gains or losses are the difference between the amounts shown in the statement of

financial position relating to the pension scheme and the actual revised value. The two reasons

why there may be differences are the assumptions used by the actuary no longer apply and other

events have occurred which need to be adjusted for (experience surpluses or deficits).

On 16 June 2011, the IASB published an amended IAS 19 Employee Benefits, with application

from 1

st

January 2013. The treatment of actuarial gains and losses has changed. The

corridor method is no longer applicable.

Under the new revised accounting standard, actuarial gains and losses are recognised

immediately under other comprehensive income (OCI).

Corridor method – no longer allowed under revised IAS 19 (2011)

The actuarial gain or losses are recognised in the income statement as income or

expense if these gains or losses (at the start of the period) exceed 10% of the

greater of:

§ The present value of the plan obligation before deducting the plan

assets (at start of year).

§ Fair value of any plan assets (at start of year).

This is known as the corridor.

In another words only the excess is recognised in the income statement as part of

the profit for the year. The excess can either taken to the income statement in full

or spread over the average remaining working lives of the employees in the

scheme.

Under the revised accounting standard all re-measurements are recognised immediately under other

comprehensive income.

7

Re-measurements consist of:

§ Actuarial gains and losses

§ The return on plan assets, excluding amounts included in net interest on the net defined

liability (asset) and :

§ Any change in the affect of the asset ceiling, excluding amounts included in net interest on

the net defined liability (asset)

Overview of changes of revised IAS 19 (2011)

·

Re-measurements (including actuarial gains and losses) recognise immediately

under other comprehensive income

·

Enhanced disclosures about defined benefit plans

·

Changes to termination benefits and the point when this is recognised

·

Clarification of miscellaneous issues, including the classification of employee

benefits, current estimates of mortality rates, tax and administration costs and

risk-sharing and conditional indexation features

Asset ceiling – additional information

The amendment to IAS 19 in May 2002 prevents the recognition of gains solely as a result of

deferral of actuarial losses or past service cost, and prohibits the recognition of losses solely as a

result of deferral of actuarial gains.

Where an organisation has a surplus in a defined benefit plan and cannot, based on the current

terms of the plan, recover that surplus fully through refunds or reductions in future contributions.

In such cases, deferral of past service cost and actuarial losses that arise in the period will increase

the cumulative unrecognised net actuarial losses and past service cost. If that increase does not

result in a refund to the organisation or a reduction in future contributions to the pension fund, a

gain would have been recognised under IAS 19 prior to this amendment. The amendment now

prohibits recognising a gain in these circumstances. The opposite effect arises with deferred

actuarial gains that arise in the period. This amendment prohibits recognising a loss in these

circumstances.

Please visit the IASB website for all the latest news – www.iasb.org

8

Worked example - calculation of actuarial gains and losses

T plc has a defined benefit pension scheme and makes up financial statements to 31 May each year.

The net pension liability at 31 May 20X3 was £590 million (PV of liabilities was £1,000 million

and fair value of plan assets was £410 million). On 31 May 20X2 the figures was £470 million,

PV of obligations £1,000 million, fair value of assets £530 million).

The following additional information is relevant for the year ended 31 May 20X3:

- The expected return on the pension scheme assets was £295 million

- The interest on pension liabilities was £230 million

- The current service costs was £70 million

- The increase in the actuarial liability in respect of employee service in prior periods was £25

million (past service costs)

- The company paid pension contributions of £60 million.

What is the actuarial gain or loss arising in the year ended 31 May 20X3?

Solution

Gain or loss on net obligation

£m

Net obligation in scheme at 31 May 20X2

(470)

Current service costs

(70)

Past service costs

(25)

Contributions to the scheme

60

Net interest/return on assets (295 – 230)

65

Subtotal

(440)

Actuarial loss (difference bal fig.)

(150)

Net obligation in scheme at 31 May 20X3

(590)

The actuarial losses of £150m will be recognised immediately under other comprehensive

income (revised IAS 19 2011).

Old corridor method – no longer allowed under revised IAS 19

Recognition in the income statement profit for the year also no longer allowed.

In the statement of financial position a net pension liability of £590 million will be shown

under non current liabilities.

The current service costs, past service costs, net interest / return on assets will be shown in

the income statement under pension costs.

The contributions are already in the financial statements as these would have been paid

during payroll throughout the year by the company.

9

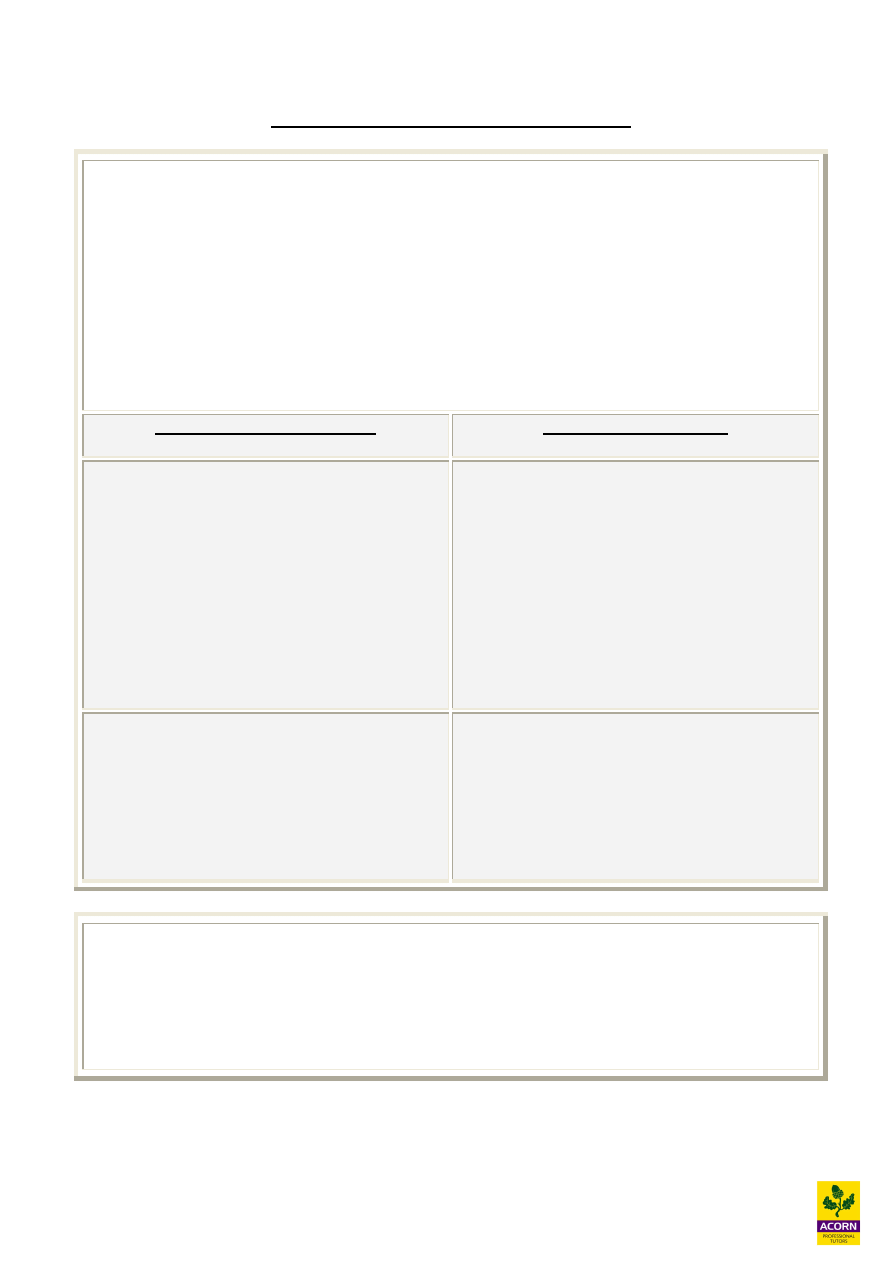

Lecture Example 13.1

Defined benefit scheme

Enrunrun plc has a defined benefit pension scheme for its employees. An insurance company

administers the scheme. The company’s pension contributions are directly proportional to the

salaries.

Enrunun plc’s figures for year ending 31 December 20X4 are as follows:

§

Current service cost is £1.6 m per annum.

§

Expected return on pension scheme assets is £1.3m for the year.

§

Unwinding of the discount pension scheme liabilities is £1.7m.

§

Contributions paid into the scheme were £0.7 million

§

The net actuarial loss was £2.8 million.

What is the amount going to the income statement profit for the year, for the above pension benefit

scheme for the year ending 31 December 20X4?

10

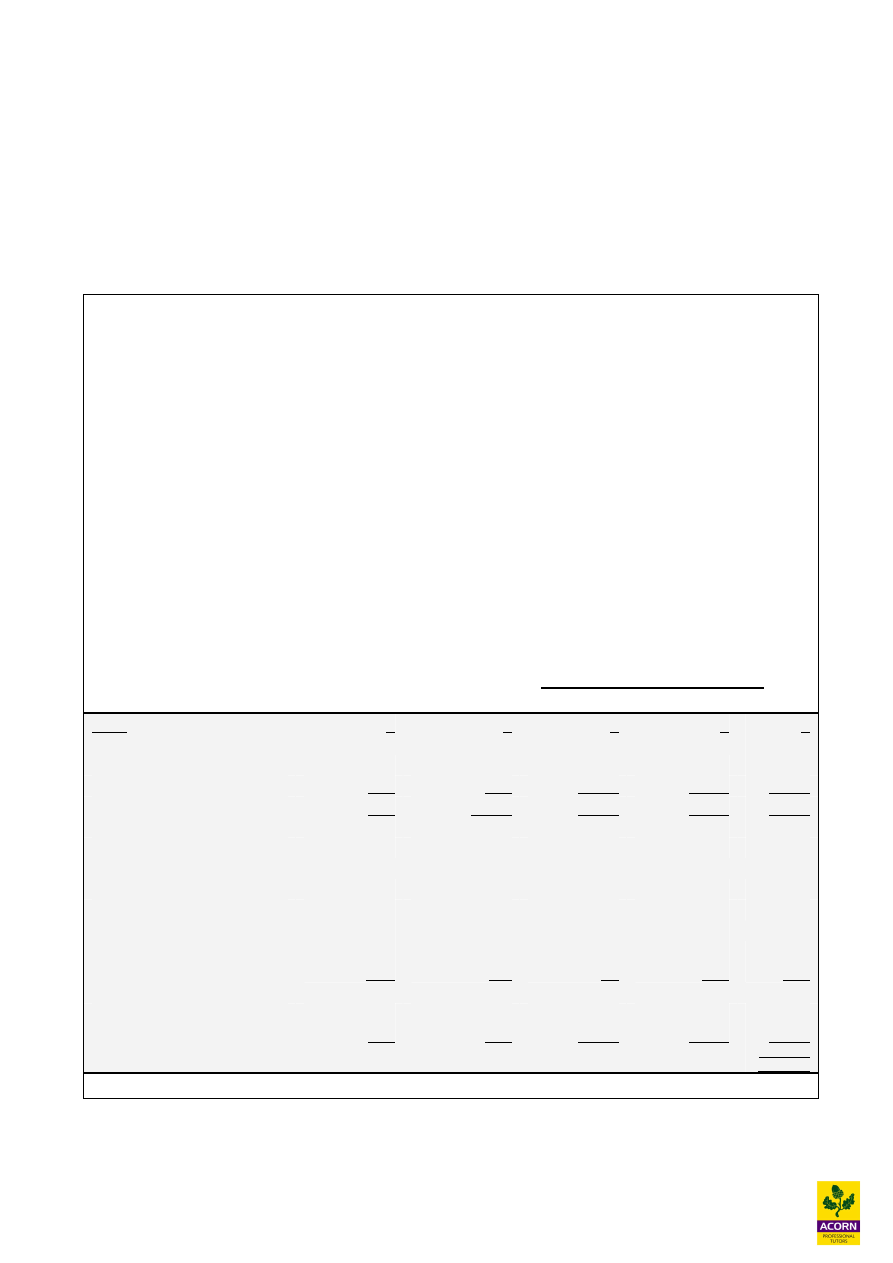

Worked example – IAS 19 pensions (Past CIMA question)

The following information relates to the defined benefits pension scheme of BGA, a listed entity:

The present value of the scheme obligations at 1 November 20X6 was $18,360,000, while the fair

value of the scheme assets at that date was $17,770,000. During the financial year ended 31

October 20X7, a total of $997,000 was paid into the scheme in contributions. Current service cost

for the year was calculated at $1,655,000, and actual benefits paid were $1,860,300. The applicable

interest cost for the year was 6⋅ 5% and the expected return on plan assets was 9⋅ 4%.

The present value of the scheme obligations at 31 October 20X7 was calculated as $18,655,500,

and the fair value of scheme assets at that date was $18,417,180.

Requirement:

Calculate the actuarial gains or losses on BGA’s pension scheme assets and liabilities for the year

ended 31 October 20X7. Explain the treatment of these actuarial gains or losses

Solution

$

Fair value of

pension assets

Fair value of

pension

liabilities

Net

pension

Bal b/f (01/11/X6)

17,770,000

18,360,000

(590,000)

Current service costs

1,655,000 (1,655,000)

Interest costs (6.5% x $18,360,000)

1,193,400 (1,193,400)

Expected returns (9.4 x $17,770,000)

1,670,380

1,670,380

*Pension paid to members

(1,860,300)

(1,860,300)

0

Contributions made

997,000

-

997,000

Sub total

18,577,080

19,348,100

(771,020)

Actuarial losses on pension assets

(159,900)

(159,900)

Actuarial gains on pension liabilities

(692,600)

692,600

532,700

Bal c/f (31/10/X7)

18,417,180

18,655,500

(238,320)

The actuarial gains and losses will be recognised under other comprehensive income.

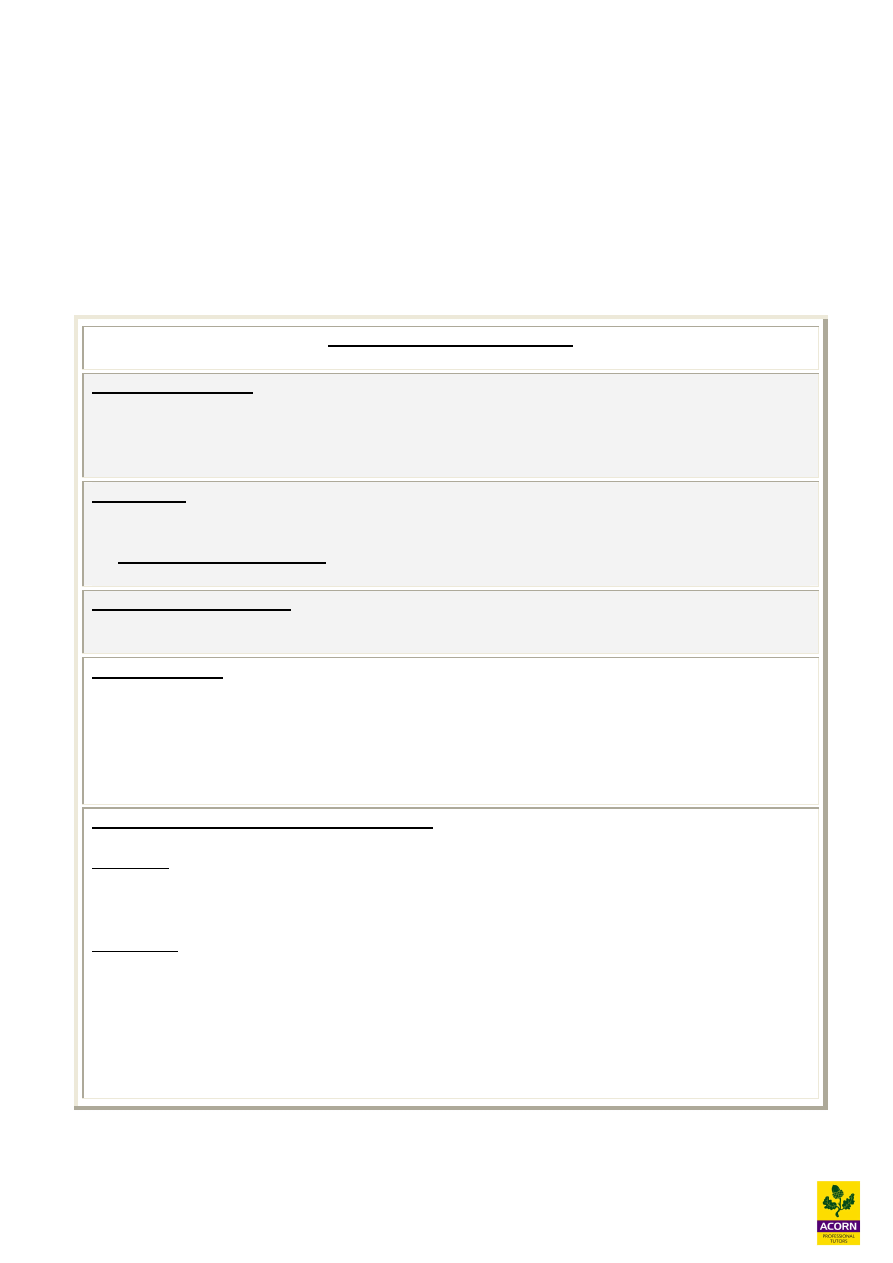

11

Key summary of chapter “retirement benefits”

IAS 19 deals with 2 areas of employee benefits

1

Short term employee benefits

These include wages and salaries, sick pay, bonuses and other remunerations. IAS 19 states that

these are straightforward to account for, usually the cost falls in the period that the benefit arises.

2

Post employment benefits

These are mainly in the form of pensions, and it is this that causes accounting problems.

Defined contribution scheme

Defined benefit schemes

Regular contributions are paid into this scheme.

The benefits are directly determined by the value of

contributions paid and the performance of the scheme

assets.

This scheme does not present a problem for the

company.

Under these schemes employees’ pension benefits are

specified, normally as a percentage of final salary.

An actuary will calculate the size of the fund required on

retirement to provide the specified pensions and hence

the contributions.

The rules define the benefits of independently of the

contribution payable, and the benefits are not directly

related to the investments of the scheme.

The scheme may be funded or un-funded.

Accounting treatment is to charge the

contributions to the income statement in the

period occurred.

In the statement of financial position an accrual

or prepayment might arise if too much or too

little has been paid.

The problems with this scheme are

§ Valuing the scheme assets

§ Estimating the scheme liabilities

§ Measuring and recognising the cost

to the employing company

Accounting for defined benefit schemes is complex and the following steps need to be taken:

§ Establish the present value of future obligations and the current service cost

§ Establish the fair value of the pension scheme assets

§ Establish the actuarial gain or loss and recognised immediately in full under other

comprehensive income.

12

Solutions to Lecture Examples

Solution to Lecture Example 13.1

Defined benefit scheme

Income statement charges

£’000

Current service cost

(1,600)

Expected return on assets

1,300

Unwinding of discount

(1,700)

Net charge to income statement

(2,000)

The contributions will already been charged to the income statement as part of the payroll.

The net actuarial loss of £2.8 million will be shown under other comprehensive income.

Wyszukiwarka

Podobne podstrony:

F1 Various standards IAS 10, 37 and 24

F1-19 Podstawy teorii

F1 19 Podstawy teorii

F1 19 Podstawy teorii

F1 Inventories IAS 2 and Government grants IAS 20

19 Mikroinżynieria przestrzenna procesy technologiczne,

Prezentacja1 19

new employee safety orientation 1201643571904060 5

19 183 Samobójstwo Grupa EE1 Pedagogikaid 18250 ppt

19 Teorie porównanie

Sys Inf 03 Manning w 19

19 piątek

19 Emptio venditio ppt

PRCz Wyklady 19 21a

więcej podobnych podstron