Growing short rotation coppice on agricultural land in

Germany: A Real Options Approach

Oliver Musshoff

Georg-August-Universita¨t Go¨ttingen, Faculty of Agricultural Sciences, Department for Agricultural Economics and Rural Development,

Platz der Go¨ttinger Sieben 5, D-37073 Go¨ttingen, Germany

a r t i c l e i n f o

Article history:

Received 2 March 2011

Received in revised form

5 January 2012

Accepted 1 February 2012

Available online 28 March 2012

Jel classifications:

C6

D81

D92

Q12

Keywords:

Short rotation coppice

Optimal conversion strategy

Uncertainty

Sunk costs

Entrepreneurial flexibility

Real options Approach

a b s t r a c t

In many cases decision-makers apparently do not adapt as fast as expected to changing

economic conditions. This is also the case for the conversion of farm land to short rotation

coppice. From an economic point of view, short rotation coppice has become more inter-

esting in the last few years. Nevertheless, farm land still is rarely used to grow this quite

unknown crop. Several explanatory approaches (e.g., traditionalistic behavior and risk

aversion) are currently discussed in order to explain this behavior. A relatively new

explanatory approach is the Real Options Approach. The Real Options Approach uses

a comprehensive dynamic-stochastic model that combines the uncertainty of investment

returns, the sunk costs, and the temporal flexibility of the investment implementation. The

quintessence of the Real Options Approach is thatdcompared to the Classical Investment

Theorydthe investment triggers will be shifted upwards if investments involve inter-

temporal opportunity costs. This paper develops a real options model which allows the

determination of triggers on the basis of realistic assumptions. We examined when

farmers, who only dispose of sandy soils with little water-storing capacity, should convert

set-aside land to short rotation coppice. The results show that farmers should not convert

until the present value of the investment returns exceeds the investment costs consider-

ably. Thus, they confirm the empirically observed reluctance in conversion. Furthermore, it

turned out that the magnitude of the difference between the Classical Investment Theory

and the Real Options Approach depends heavily on the type of stochastic process that

underlies the investment returns.

ª 2012 Elsevier Ltd. All rights reserved.

1.

Introduction

For several years, the use of agricultural land for the cultiva-

tion of fast-growing tree species in a so-called short rotation

coppice (SRC) has been intensively discussed. This applies not

only to Germany but also to other European and North

American states. SRCs are permanent crops that allow the

extraction of solid biomass. According to the EU premium

rights and to the German Federal Forest Act, which was

changed concerning this matter in 2010, SRCs set up on agri-

cultural land do not fall within the definition of forest. Hence,

SRCs maintain the legal status of ‘agricultural areas’ as long as

the rotation period is not longer than 20 years.

Compared to the classical agricultural production methods

(e.g. wheat or canola) SRCs are less demanding regarding soil

quality and climatic conditions

. Moreover, when imple-

menting SRCs a comparatively stable physical yield can be

expected

. Against the background of finite non-renewable

* Tel.:

þ49 551 39 4842; fax: þ49 551 39 22030.

E-mail address:

oliver.musshoff@agr.uni-goettingen.de

.

Available online at

http://www.elsevier.com/locate/biombioe

b i o m a s s a n d b i o e n e r g y 4 1 ( 2 0 1 2 ) 7 3 e8 5

0961-9534/$ e see front matter ª 2012 Elsevier Ltd. All rights reserved.

doi:

energy sources the use of wooden biomass from SRCs as

alternative energy source appears to be interesting

. Due to

higher energy costs the demand and the prices of such prod-

ucts have increased in recent years. In addition, with regards

to biodiversity, to soil protection against erosion as well as to

climate change, SRCs are assessed to be beneficial

. Recent

laws about renewable energies also set economic incentives

for the energy generation from SRCs. For instance, when

renewable raw materialsdsuch as wooddare used to

generate electricity, bonuses are paid

. Despite of these

developments, it has been observed that farmers convert even

poor locations, which can hardly be used for agricultural

production in an alternative way, only very hesitantly to SRCs.

In 2008, the area cultivated with SRC comprised only 1173 ha

throughout Germany

and, therefore, accounted only for

less than 0.01% of the total agricultural area in Germany.

There already are many studies that analyzed the on-farm

economic competitiveness of SRCs toward the classical use of

agricultural land. For example, Heaton et al.

examined the

competitiveness of SRCs in Mid-Wales, while Bemmann et al.

, Toews

as well as Wagner et al.

investigated this

matter in Germany. Thereby the farm’s individual decision to

convert to SRC is considered as an investment decision and

evaluated by referring to Classical Investment Theory in

general and the Net Present Value (NPV) in particular. On the

one hand, the conversion to SRC involves investment costs

that are at least partly sunk or irreversible. On the other hand,

due to the conversion to SRC the farm’s revenues and

expenditures are changing over a long period of time.

According to the NPV, profit-maximizers should convert to

SCR if the associated investment costs are covered by the

present value of the achieved investment returns. By applying

the Classical Investment Theory, Heaton et al.

, Styles et al.

and Wagner et al.

concluded that, from an economic

point of view, it might be beneficial for farms to convert to

SRC. All the more the question arises why do not convert more

and more farmers to SRC.

There are various explanatory approaches for the often

observed reluctance to convert. The latter could be caused, for

example, by traditionalistic behavior as well as by the

unusually long time that a piece of agricultural land is bound

by one specific crop through SRC. Furthermore, the farmers’

reluctance to convert could also be caused by risk aversion, by

open questions regarding technical production issues or by

missing liquid assets

. The Real Options Approach, which is

also called New Investment Theory, is an alternative explan-

atory approach

: Apart from the generation of sunk costs

the opportunity to invest in an SRC is characterized by the fact

that the incremental cash flow is stochastic. Moreover, there

is temporal flexibility regarding the implementation of the

conversion to SRC. In other words: the conversion to SRC can

be carried out today or in any year in the future. The Real

Options Approach evaluates entrepreneurial flexibility and

produces results that are different from the Classical Invest-

ment Theory: To put it simply, the investment threshold is

shifted upwards in case of temporal flexibility. At the end of

the day the investment returns do not only have to compen-

sate the investment costs but also the opportunity costs

meaning the profit that could be generated if the investment

would be postponed. The value of waiting is especially

pronounced if the investment returns are uncertain and the

investment would cause high sunk costs.

Some applications of the Real Options Approach can

already be found in the agricultural and forest economic

literature. For example, Pietola and Wang

as well as

Odening et al.

examine the decision to invest in a pig-

fattening farm in consideration of real options effects.

Kuminoff and Wossink

as well as Musshoff and Hir-

schauer

evaluate a farm’s opportunity to convert from

conventional to organic farming. Behan et al.

determine

the optimal time of conversion from agricultural production

to forest under consideration of temporal flexibility of the

investment implementation. Nevertheless, the uncertainty

regarding the conversion returns is left out of consideration in

the normative analysis. In the study of Wiemers and Behan

both the temporal flexibility as well as the uncertainty is

taken into account for the determination of the optimal time

of conversion from agricultural production to forest. Further

forestry studies determine the optimal length of the rotation

period of forests by applying the Real Options Approach

. The aforementioned studies illustrate that the results

of the Real Options Approach are partly significantly different

from those of the Classical Investment Theory.

So far, there are not any applications of the Real Options

Approach with regard to the question of the conversion to

SRC. In contrast to many classical agricultural production

methods, SRC does not provide a return each year. Further-

more, unlike many classical forestry production activities SRC

permits multiple harvests during its useful lifetime. In other

words: in existing studies about SRC the temporal flexibility of

the decision to convert as well as the uncertainty of the

investment returns were not considered. Consequently, it is

not clear yet at what time a farm should convert to SRC by

taking into account the real options effects as well as if the

Real Options Approach has a potential explanatory value for

the frequently observed reluctance of farmers to convert to

SRC.

Against this background, the overall aim of the present

study is to apply the Real Options Approach to SRC. The

following three sub-objectives arise: First, we want to help

farmers and/or foresters to determine whether or not they

should be using short rotation coppice as a new crop. To do so,

a real options valuation model is developed in the present

paper, which neither has been discussed in the literature nor

has been applied to agricultural or forest economic problems.

This model, which is based on a stochastic simulation and on

a parameterization of the investment trigger, can be used

regardless of the type of stochastic process, which underlies

the random variables (e.g. investment returns). Especially due

to the flexibility with respect to the type of stochastic process,

the developed real options valuation model has the potential

to be used as well in contexts other than the evaluation of the

decision to convert to SRC. Furthermore, we apply the real

options valuation model to an exemplary decision situation

with realistic assumptions. In this given situation a farm on

sandy soils in Northern Germany, which is also threatened by

drought, has the option to convert a so far set-aside agricul-

tural area to SRC. The conversion threshold and the options

value of the conversion to SRC are calculated by considering

the uncertainty, the irreversibility and the entrepreneurial

b i o m a s s a n d b i o e n e r g y 4 1 ( 2 0 1 2 ) 7 3 e8 5

74

flexibility to defer the conversion. The results are compared to

those of the Classical Investment Theory. The risk aversion of

the decision-makers is taken into account by using risk-

adjusted interest rates. The determination of the differences

between the Real Options Approach and the Classical Invest-

ment Theory allows for conclusions on the practical relevance

of option effects. Herewith, we are able to analyze the expla-

nation potential of the Real Options Approach for the

frequently observed investment reluctance, which constitutes

our second sub-objective. The third sub-objective is to inves-

tigate the sensitivity of the modeling results with respect to

the assumed stochastic process of the uncertain variable. We

think that an open and unbiased estimation of stochastic

processes as well as the processing of the results of the real

options valuation would need more attention.

In the following, Section

briefly describes the theoretical

background of valuating real options. Subsequently, the

decision-making problem to be analyzed is explained in

Section

, while results are discussed in Section

. Finally,

conclusions are drawn from the results and potential future

research areas are described (Section

).

2.

Valuation of real options

The Real Options Approach combines uncertainty of invest-

ment returns, sunk costs and temporal flexibility with regard

to the investment’s implementation in a comprehensive

dynamic-stochastic model

. The approach is based on the

analogy between financial options and physical investments.

The option to invest now or to postpone the investment is

similar to American options: The owner of an American

option as well as the investor (e.g. the farmer or the forester)

has the rightdbut is not obligateddto choose to buy an asset

(e.g. a production facility) with an uncertain development (e.g.

present value of investment returns) within a certain time

period (lifetime of the option). The purchase of the asset is

associated with (fixed) investment costs.

According to the Classical Investment Theory, the value of

an investment at the time t is equivalent to the Net Present

Value NPV

t

, thus, the difference between the present value of

the revenues R

t

and the present value of the expenditures E

t

:

NPV

t

¼ R

t

E

t

(1)

In case of a positive Net Present Value, it would be recom-

mendable for the farmer to invest.

According to the financial options pricing theory, the clas-

sical Net Present Value, which is also called intrinsic value,

represents only one part of the total value of an investment

option [

:124]. Furthermore, an investment option has

a continuation value that is similar to the discounted expected

value of the investment at the next possible chance to invest.

Investing immediately means gaining the intrinsic value and,

at the same time, loosing the continuation value. A rational

investor will only invest immediately, if the intrinsic value

exceeds the alternatively achievable continuation value. The

Bellman equation for this binary decision-making problem is

defined as follows

: chapter 4]:

F

t

¼ max

NPV

t

;

mðNPV

t

þdt

Þ$ð1 þ iÞ

dt

(2)

F stands for the value of the investment option, i for the risk-

adjusted interest rate,

m(,) for the expectation operator and

max (

,) for the maximum operator. Hence, the Net Present

Value is a lower limit for the options value. Under specified

regularity conditions the stopping region, where the intrinsic

value exceeds the continuation value, and the continuation

region, where the continuation value exceeds the intrinsic

value, are clearly separated by a critical value for the

stochastic variable. With regard to investment options, the

latter is also called investment trigger. The regularity condi-

tions require that the intrinsic value and the continuation

value are monotonous functions of the value for the

stochastic variables. In addition, they require a positive

persistence of the stochastic process, meaning that the

distribution function of the uncertainty factors at the time

t

þ dt has to be shifted to the right (left) as soon as the value in t

increases (decreases)

:128].

The solution of Equation

is not trivial. Analytical solu-

tions exist only for simple valuation problems or special cases.

Preconditions include, for example, that the evaluated

investment option has an indefinite lifetime and a time

continuous opportunity to invest. Moreover, the present value

of the revenues has to follow a geometric Brownian motion

(GBM) and there should not be any interactions between the

investment option to evaluate and the other options (e.g.

reinvestment options and disinvestment options). If these

conditions are fulfilled, the McDonald-Siegel formula can be

applied

F

0

¼ ðR

E

0

Þ$

R

0

R

b

; with

R

¼

b

b 1

$E

0

and

b ¼

1

2

$

a

s

2

þ

ffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffi

a

s

2

1

2

2

þ

2$lnð1 þ iÞ

s

2

s

(3)

In that formula

a indicates the drift rate, s the standard

deviation of the GBM and R* the critical present value of the

revenues, which triggers the investment. Since in case of an

option with an indefinite lifetime the entrepreneurial flexi-

bility remains constant, a time-independent critical value

indicates when the farmer should invest. The coefficient

b=ðb 1Þ given in Equation

, that is at

s > 0 generally greater

than one, is often also denoted investment multiple.

For many real options, the conditions of the analytical

solutions are not fulfilled, so that numerical-approximative

option valuation methods, such as the binomial tree method

or the stochastic simulation, need to be applied. Hull

provides an overview of several numerical option valuation

methods. The advantage of a simulation-based method is that

the value of an option at a given investment strategy can be

determined with relatively little effort, regardless how

complex the distributions of the stochastic variable are. Thus,

the time-discrete version of any stochastic process arising

after the implementation of an open-ended time series anal-

ysis for the stochastic variable can form the basis of the option

valuation method. It is not necessary to assume a GBM a pri-

ori, as often done in real options applications

:14]. The

disadvantage of the stochastic simulation is that it does not

contain any optimization algorithm. It is therefore only

b i o m a s s a n d b i o e n e r g y 4 1 ( 2 0 1 2 ) 7 3 e8 5

75

possible to evaluate, for example, American options with

a limited term, whose optimal investment values are depen-

dent on the remaining lifetime, by combining stochastic

simulation with optimization algorithms

. In the event

that the investment option can be postponed indefinitely and

that therefore the optimal investment strategy corresponds

with a trigger, that remains constant over the whole lifetime

(see Equation

), we suggest performing the option valuation

by applying stochastic simulation as well as a parameteriza-

tion of the trigger.

To determine the optimal investment trigger and the

options value using stochastic simulation as well as parame-

terization of the trigger we apply the following procedure:

1. It is given a variety of test triggers. In addition, a parame-

terization range for the stochastic variable (e.g. the output

price) is chosen and divided into equal intervals. The upper

and lower limit of the parameterization range can be arbi-

trarily determined. It is also possible to use the investment

trigger according to the Classical Investment Theory as

lower limit.

2. For each given test trigger, the options value is determined.

That is, stochastic simulation is used to define the devel-

opment of the stochastic variable, while the options value

is calculated for each simulation run. In doing so, the initial

value of the stochastic variable should be varied from

simulation run to simulation run. The options value that is

obtained with the respective test trigger corresponds with

the options value obtained on average in all simulation

runs.

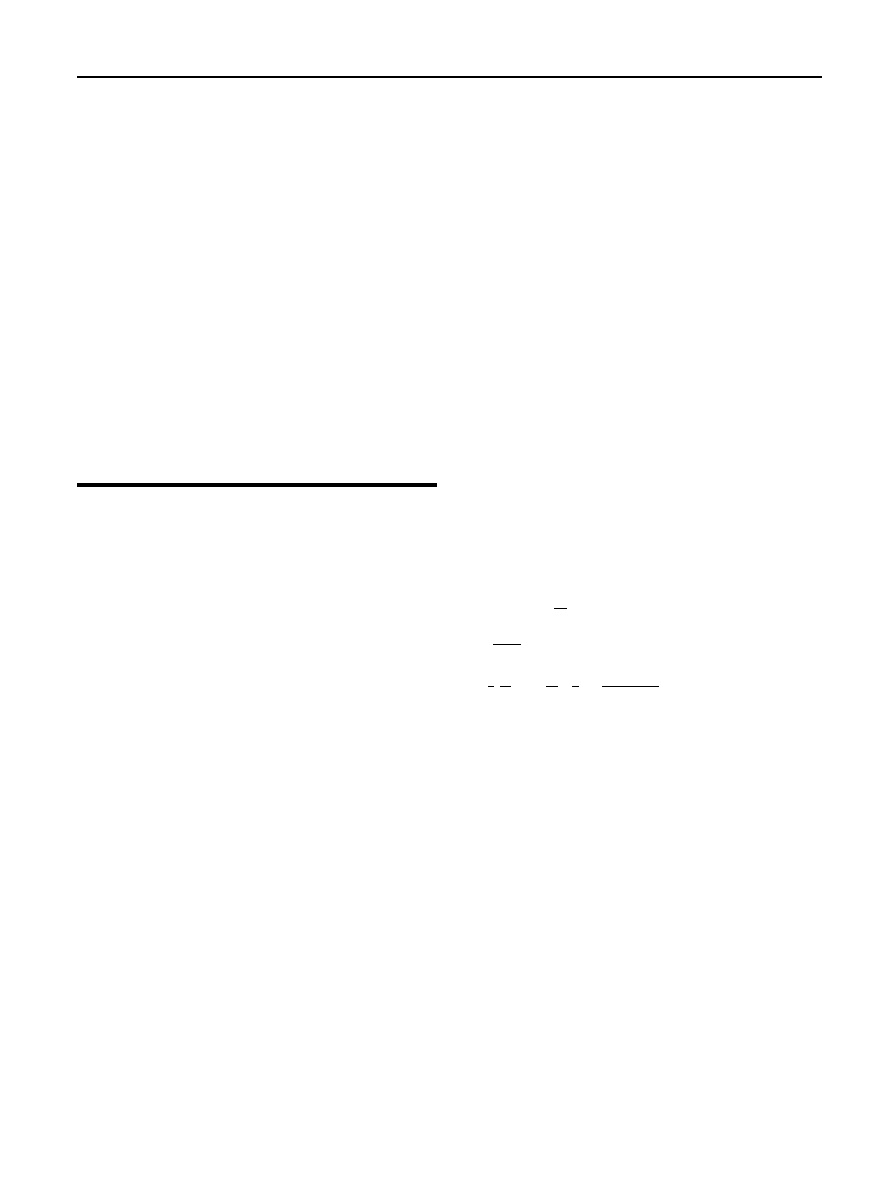

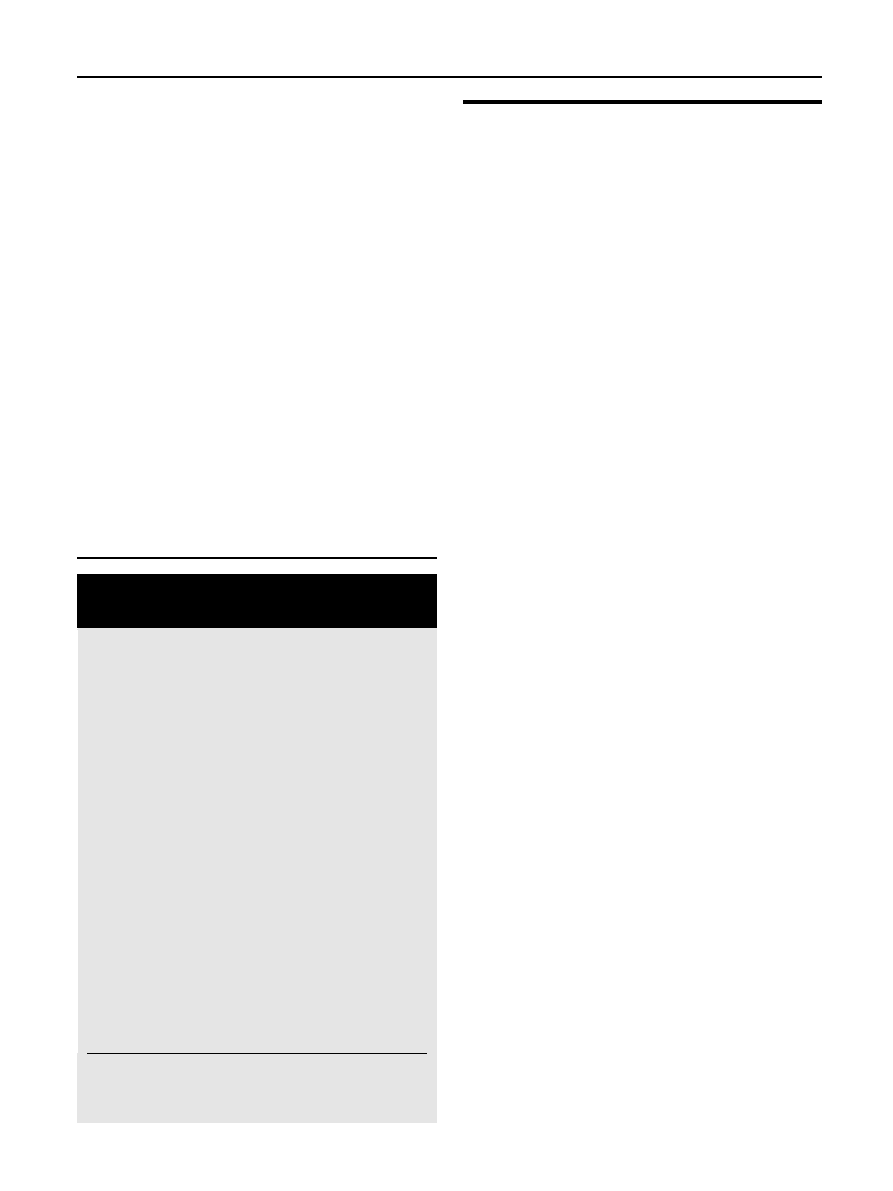

shows the relationship between the options

value and the test trigger. The figure subscripted on the left

of each P* indicates the number of the test trigger.

3. The test trigger that delivers the highest average options

value over all simulation runs is closest to the ‘true’ optimal

conversion threshold. In

,

14

P* provides the relatively

highest options value.

4. The potential solution space is ‘compressed’ in the direc-

tion of the real trigger and the options value is calculated

again. With a view to

, the test triggers

13

P* and

15

P*,

which are situated on the left and on the right of

14

P* are

defined as boundaries. The new test triggers are obtained

by dividing the parameterization range into equal intervals.

5. The approximation described in step 4 is if necessary

repeated several times and finally provides a more or less

smallddepending on the extent of the compressiondrange

for the critical value leading to maximum profit. In other

words: A more and more precise parameterization of the

critical value within a shrinking value range is performed.

6. The value of the investment option is defined on the basis

of the previously determined optimal investment trigger

and of the currently observed value of the stochastic

variable.

With a view to the result of the option valuation procedure

the following has to be taken into account: an option valuation

can be made independently of the decision-makers risk atti-

tude, if a replication portfolio of the assets can be formed that

corresponds with the stochastic results of the (dis)investment

project

: 241 ff.],

: 251 ff.]. On the one hand, this possi-

bility has to be examined on a case-by-case basis. On the other

hand, the recourse to the so-called risk neutral valuation

principle requires that a risk neutral drift is used for modeling

the stochastic variable and the risk-free interest rate is used

for discounting future payments. If the risk neutral valuation

principle cannot be applied, the results of the option valuation

apply only for the supposed risk attitude of the decision-

maker.

3.

A real options model for SRC conversion

3.1.

Description of the decision problem

The study examines exemplarily a farm in Northern Germany

that considers setting up an SRC. According to the relative

German soil quality classification scheme ranging from zero to

100 points the soil quality is 35 points. Furthermore, over the

years the precipitations reach on average only about 300 mm

in the relevant growth period from April up to and including

September. Groundwater is located at a depth of 4 m. The

available field capacity in the effective root zone is 220 mm.

The average annual temperature is approximately 8.5

C.

So far, the potential area for the SRC has been set-aside.

Due to the fact that it is not possible to generate any positive

gross margins because of the poor site conditions, no cereal or

the like is cultivated on that area. To preserve the acreage

payment that can also be obtained after the conversion to SRC

the area needs to be mulched once a year. The variable

costs associated with the mulching in the amount of 35

V ha

1

:151] could be saved when converting to SRC.

The area chosen for SRC can be planted with poplar

cuttings. In autumn, first, a total herbicide treatment is per-

formed to prepare the conversion of an agricultural area from

set-aside to SRC. In spring prior to planting, the area is plowed

and, subsequently, processed with a seedbed harrow. 9000

poplar cuttings per hectare are planted by machine. After

planting, once more a pre-emergence herbicide treatment is

carried out, in order to suppress competitive vegetation and to

facilitate an optimal growth for the cuttings. Estimated costs

for a non-selective herbicide treatment in autumn are

40

V ha

1

, costs for plowing might amount to 95

V ha

1

and

estimated costs for the seedbed harrow processing might

come to 40

V ha

1

. The price of one poplar cutting equals

0.25

V

, so that the costs of the cuttings would amount to

Fig. 1 e Stylized relationship between the option value and

the underlying investment strategy.

b i o m a s s a n d b i o e n e r g y 4 1 ( 2 0 1 2 ) 7 3 e8 5

76

2250

V ha

1

. Costs for planting performed by the contractor

are estimated at 400

V ha

1

, while those for a pre-emergence

herbicide treatment are estimated at 50

V ha

1

. Conse-

quently, the total costs of a conversion to SRC would be

2875

V ha

1

.

During the useful lifetime of the SRC neither chemical

plant protection nor additional fertilization are used. More-

over, no protection measures regarding browsing by game are

adopted

. With respect to the rotation period (period of time

between planting and harvest or between two harvests) and to

the possible number of rotations or to the total useful lifetime

(period of time between planting and recultivation of the

acreage) various experiments with SRC confirmed the

following:

The annual increase in biomass rises over a period of time of

at least five years after planting or harvest

. However,

after a growth period of more than five years, automatic

harvest is only possible to a limited extent

. Thus the

optimal rotation period is five years

. In other forestry

contexts the determination of the optimal rotation period

often has to be treated as an important separate valuation

issue

The biomass yields increase significantly from the first to

the second rotation cycle and then remain more or less

constant

. For the described location annual increases

of on average 5 t dry matter (DM) ha

1

can be expected in the

first rotation period. In the following rotation periods annual

increases of on average 8 t DM ha

1

are expectable

Due to a decline in sprouting plants, a technologically more

difficult harvest because of a higher rootstock as well as to

a lower wood chip quality of the increasing number of the

thinning down sprouts, it is impossible or uneconomical to

run more than six rotation periods

. Consequently, six

rotation periods and a total useful lifetime of the SRC of 30

years are optimal.

At the end of each rotation period, costs for harvest, drying

and transport of the wood chips incur. These steps are per-

formed by a contractor at a price of 24

V t

1

DM

We assume that the marketing strategy for wood chips

produced in SRC is defined: Since the harvest-fresh wood has

a water content of approximately 55% that has to be reduced

for combustion, the wood chips are stored for three months at

the edge of the field using the dome aeration technology. The

wood chips are sold afterward

. With a nearby biomass

heating plant it is possible to conclude a supply contract for

the wood chips over a time period of 30 years at the time of

planting of an SRC. The wood chips have to be delivered every

five years.

So far, there is not any market for wood chips that has

worked properly in the long term. That is why in the supply

contract the wood chip price obtained by the farmer is linked

with the uncertain development of the heating oil prices. In

concrete terms, the price of one ton of dry matter of wood

chips corresponds with the price of 1000 l of heating oil

divided by 8.802 (

¼ 3 multiplied by 2.934). On the one hand, it is

taken into account that 3 kg of wood chips have the same

energy value as 1 l of heating oil

. On the other hand, it is

considered that the mean of the heating oil prices from 2003 to

2009 divided by three is 2.934 times higher than the mean of

the observed annual wood chips prices of that time

. The

correlation between the heating oil prices of the years 2003

and 2009 or the wood chip prices derived from them and the

actually obtained wood prices is 0.73. It is not possible to

obtain energy equivalent prices on the wood chip market

because inter alia the installation of a wood chip heating at the

end-user involves considerably higher costs than the

purchase of an oil heating

At the end of the SRCs useful lifetime, i.e. after 30 years, the

acreage needs to be recultivated. For the aforementioned

reasons this is even necessary if the area is meant to be

recultivated with an SRC. The cost for recultivation by means

of stump pulling amounts to 1400

V ha

1

We assume that the observed farm can convert from

setting-aside the land to SRC within an indefinite time period.

The decision to convert can be made once a year. Moreover, it

is possibledbut not compulsorydto reinvest in an SRC after

the expiration of a SRCs useful lifetime. The farmer can

therefore omit to reinvest in an SRC and can use the area again

as set-aside land. In case of conversion to SRC, the wood chips

production will have to be maintained over 30 years, due to

the supply contract concluded with the biomass heating

plant. In other words: If the conversion to SRC has been

completed, the farmer is bound to this production method for

30 years and there is not any flexibility to recultivate the SRC

before the end of its useful lifetime.

3.2.

Modeling of the uncertain conversion returns

Besides the investment costs the profitability of converting to

SRC depends on the development of the payments caused by

the investment in SRC. Area-related direct payments are not

relevant for the decision since it is granted for set-aside land

as well as for SRCs. Concerning this matter, a possibly varying

political uncertainty is not considered. The future heating oil

prices or wood chips prices derived from the former and

relevant for the amount of the revenues from the SRC are

fraught with uncertainty.

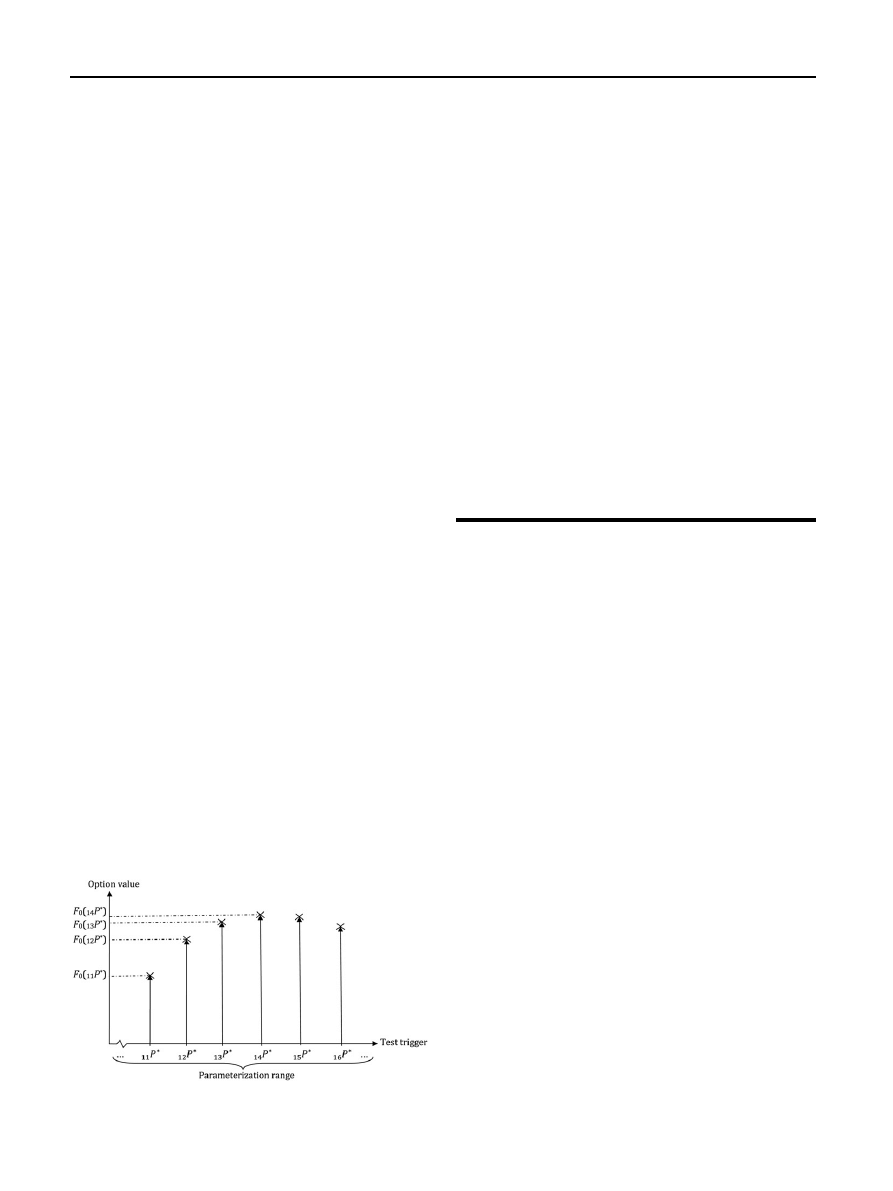

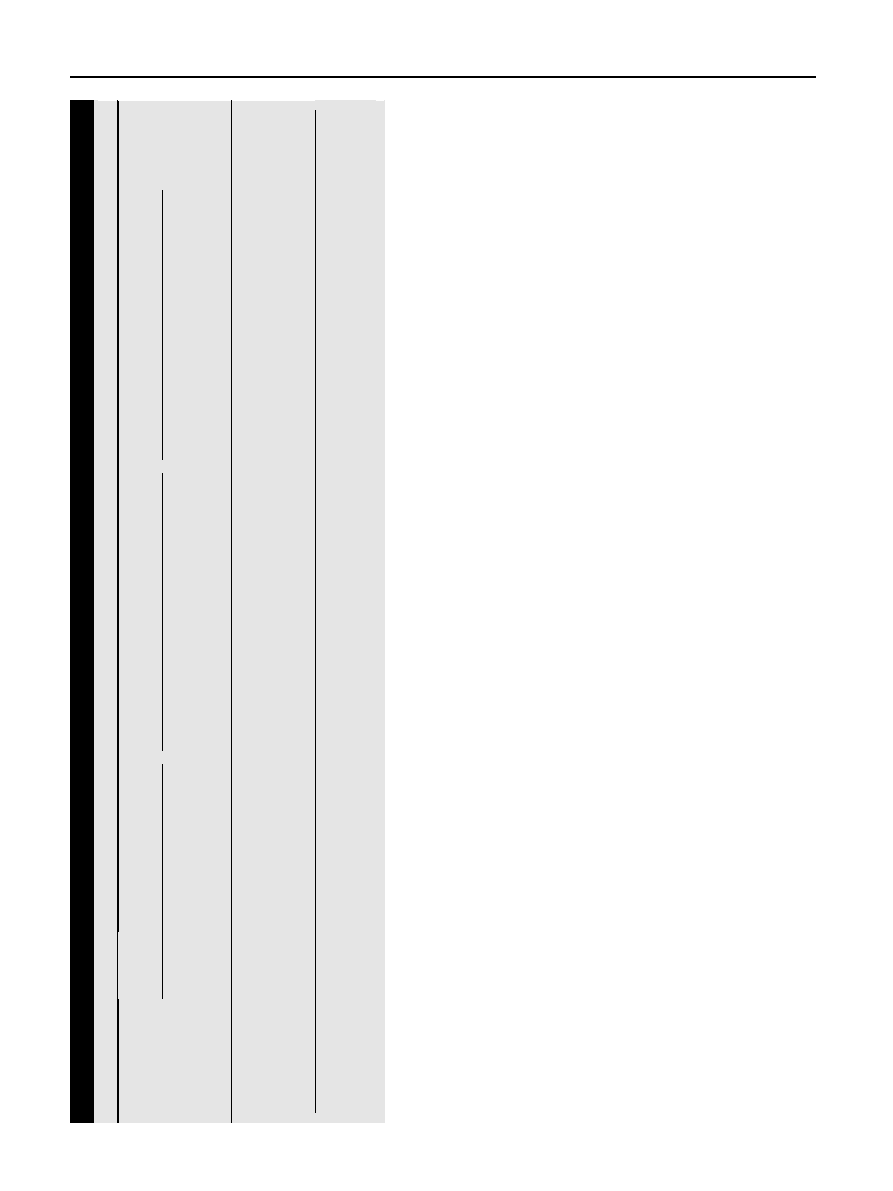

shows the development of the

wood chips prices over the time period between 1970 and

2009. These prices are derived from the heating oil prices at

that time

.

With a view to

it becomes clear that these inflation-

adjusted

wood

chips

prices

have

been

subject

to

Fig. 2 e Development of the wood chips prices derived from

heating oil prices (inflation-adjusted).

b i o m a s s a n d b i o e n e r g y 4 1 ( 2 0 1 2 ) 7 3 e8 5

77

considerable fluctuations within the observed period of time.

They fluctuate between 25.95

V t

1

DM in 1972 and 93.40

V t

1

DM in 2008. The wood chips prices are assumed to be the only

stochastic variable in the model. The yields of the SRC are not

assumed as stochastic variable because yield is built up over

several years and is in case of appropriate groundwater supply

anyway less dependent on precipitations than, for example,

the yield of traditional cereal production

.

In connection with the modeling of the development of

stochastic variables, stochastic processes become more and

more important. The term ‘stochastic process’ implies that

assumptions about the probability distribution of stochastic

variables are made at different times in the future. By means

of time series analysis the attempt is being made to obtain the

distribution information of

by identifying the ‘best’

stochastic processes. For this purpose, first of all, the

Augmented-Dickey-Fuller-Test

as well as the Variance-

Ratio-Test

are applied to analyze stationarity. The

consistent result of both tests is that the wood chips prices are

non-stationary (significance level of 5%).

The GBM is a plausible non-stationary process for the price

development modeling: It is ensured that the stochastic

variable cannot change the sign meaning that in case of

a positive initial value no negative values can occur. Moreover,

the BoxeJenkins test procedure

confirms that the wood

chips prices follow a Random-Walk process. Furthermore, the

GBM is the default option for the modeling of the development

of the stock price. Postali and Picchetti

provide empirical

evidence for the fact that the GBM can approximate correctly

the oil price development. The GBM can be expressed math-

ematically in discrete time as follows:

P

t

¼ P

t

Dt

$e

½ð

a0:5$s

2

Þ

$Dtþs$

ffiffiffiffi

Dt

p

$ε

t

(4)

P

t

indicates the wood chips price at the time t,

a the drift

rate,

s the standard deviation of the relative logarithmic

change in value of the wood chips prices and

ε

t

a standard

normally distributed random number. A comparison of

means of the relative logarithmic changes in value of the

wood chips prices shows that the drift rate does not differ

significantly from zero ( p-value

¼ 0.514; two-sided t-test).

Thus,

a is equal to 0% a

1

. The standard deviation

s is

21.05% a

1

(standard error

¼ 3.37%). The GBM contains the

Markov property meaning that the probability distribution of

the future wood chips prices is exclusively dependent on the

last value observed.

The expectation value of a stochastic variable following

a GBM can be calculated as follows

mðP

t

Þ ¼ P

t

Dt

$e

a$Dt

(5)

However, it has to be considered that a drift rate of zero does

not mean that the stochastic variable tends to zero during the

time observed. It rather describes the fact that the expected

relative logarithmic change in value equals zero and that

therefore the expectation value of the future wood chips pri-

ces equals the currently observed value.

While it seems plausible to assume a GBM for modeling

stock prices, this is not necessarily the case for commodity

prices or revenues as well as gross margins of real invest-

ments. Using variant calculations we therefore examine to

what extend the choice of an alternative stochastic process

influences the results. We look at a linear version of the GBM

meaning that we analyze an arithmetic Brownian motion

(ABM) that is suggested, for example, by Dixit and Pindyck

65 ff.] for the valuation of real options and that can especially

be relevant for modeling non-stationary cash-flows. The ABM

can be expressed mathematically in discrete time as follows:

P

t

¼ P

t

Dt

þ a$Dt þ s$

ffiffiffiffiffi

Dt

p

$ε

t

(6)

In the equation above

a indicates the drift and s the stan-

dard deviation measured respectively in

V t

1

DM. A

comparison of means of the absolute changes in value of the

wood chips prices shows that also the drift of the ABM does

not significantly differ from zero ( p-value

¼ 0.601; two-sided t-

test). The standard deviation

s is 11.03 V t

1

DM. For the

expectation value of a stochastic variable the following

applies:

mðP

t

Þ ¼ P

t

Dt

þ a$Dt

(7)

When assuming an ABM a sign change of the stochastic

variable cannot be excluded. Hence, due to theoretic consid-

erations the ABM is not plausible for modeling price

developments.

Although the Augmented-Dickey-Fuller-Test for the pres-

ently analyzed wood chips prices shows that the stationary

assumption does not apply, we model the logarithmic wood

chips prices in a further variational calculus. There are three

reasons for do so: First, for many economic variables it seems

plausible to assume that in the long term there is an equilib-

rium level around which their value fluctuates temporarily.

Attention is paid to the relationship between the product

prices and the long term production costs. Thus, in the long

run prices are approximating the production cost level. The

more they have diverged from that level, the higher is the

probability of return. Such behavior of a stochastic variable

can be modeled by (stationary) Mean-Reverting-Processes

(MRP) that can also be understood as a special case of a first-

order autoregressive process. Second, in the literature it is

stated that MRP can only be identified if very long time series

over a period of e.g. 100 years are available

: 510e511]. Our

time series only covers 40 observations, which might be too

low to identify an MRP. Third, Baker et al.

as well as Pili-

povic

provide empirical evidence for the assumption that

oil prices follow an MRP.

We use an Ornstein-Uhlenbeck-Process which is a special

MRP that can be expressed mathematically in discrete time as

follows

:

x

t

¼ x

t

Dt

$e

h$Dt

þ x$

1

e

h$Dt

þ s$

ffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffi

1

e

2$h$Dt

2$h

s

$ε

t

(8)

In the aforementioned equation x

t

¼ ln (P

t

).

h indicates the

speed of return of the stochastic variable x to its equilibrium

level of x. The logarithmic wood chips prices show the

following characteristics:

h ¼ 0.22, x ¼ 3:92, and s ¼ 0.22. The

expectation value for x

t

in accordance with MRP can be

determined as follows:

mðx

t

Þ ¼ x

t

Dt

$e

h$Dt

þ x$

1

e

h$Dt

(9)

b i o m a s s a n d b i o e n e r g y 4 1 ( 2 0 1 2 ) 7 3 e8 5

78

In contrast to Brownian motions, the expected change in

value can be positive (when x

t

Dt

< x), zero (when x

t

Dt

¼ x) or

negative (when x

t

Dt

> x). For the expected price based on m (x

t

)

applies:

mðP

t

Þ ¼ e

mðx

t

Þþ0:5$Varðx

t

Þ

; with

Var

ðx

t

Þ ¼ ð1 e

2$h$Dt

Þ $

s

2

2$h

(10)

Var(x

t

) indicates the variance of x

t

.

m (P

t

) converges toward

53.37

V t

1

DM.

3.3.

Evaluation of the conversion decision within the

classic investment theory

First of all, it is assumed in accordance with the Net Present

Value that a farm can convert from set-aside to permanent

SRC ‘now or never’. At an expected wood chips price that

remains constant over time

m(P

0

)

¼ m(P

1

)

¼ m(P

2

)

¼ . ¼ P the

present value of the revenues can be calculated as follows:

R

0

¼ r

n

$

1

i

ðp ¼ sÞ

ðr

n

r

s

Þ $

1

i

ðp ¼ NÞ

$ð1 þ iÞ

N

s

; with

r

s

¼ Q

s

$P und r

n

¼ Q

n

$P

(11)

Q

s

(r

s

) indicates the starting level of output (revenues) in the

starting rotation period of the SRC and Q

n

(r

n

) the normal level

of output (revenues). Furthermore, i describes the annual

adequate target rate, i( p

¼ s) the adequate target rate for

a discount period p in the amount of the rotation period

s as

well as ( p

¼ N ) the adequate target rate for a discount period

in the amount of the useful lifetime N of an SRC. There is the

following relationship between the annual interest rate i and

the interest rate i ( p) referring to a time period p in years:

i

ðpÞ ¼ ð1 þ iÞ

p

1

(12)

By using the first component of Equation

, the present

value of an infinite annuity that would result from constant

revenues at the normal level is calculated. The second

component takes account of the lower revenues of the first

rotation period of an SRC.

The investment costs IC involved in setting up an SRC is to

rise in year zero as well as in each of the following N years. The

present value of the investment costs is calculated as follows:

IC

0

¼ IC þ IC$

1

i

ðp ¼ NÞ

(13)

For the present value of the harvesting, drying and trans-

portation costs HC

0

applies analogously to Equation

HC

0

¼ hc

n

$

1

i

ðp ¼ sÞ

ðhc

n

hc

s

Þ $

1

i

ðp ¼ NÞ

$ð1 þ iÞ

N

s

; with

hc

s

¼ Q

s

$HC and hc

n

¼ Q

n

$HC

(14)

HC indicates the sum of the harvesting, drying and trans-

portation costs in

V t

1

DM.

Moreover, recultivation costs RC accrue in each of the

N years. For the present value of the recultivation costs RC

0

applies:

RC

0

¼ RC$

1

i

ðp ¼ NÞ

(15)

Furthermore, the annual set-aside costs SC are relevant.

They can be saved in case of a conversion to SRC. The present

value of the set-aside costs SC

0

equals:

SC

0

¼ SC$

1

i

(16)

The present value of the expenditures can be calculated as

follows:

E

0

¼ IC

0

þ HC

0

þ RC

0

SC

0

(17)

For the Net Present Value applies (see Equation

NPV

0

¼ R

0

E

0

(18)

On the basis of the Equations

, the (critical) present

value of the revenues R*

M

as well as the (critical) wood chips

price P*

M

can be determined. Both figures lead to a Net Present

Value of zero and therefore, define the conversion threshold.

The subscript M on the right refers to the investment

thresholds that in the context of the NPV are often called the

Marshallian-Triggers.

When working with an annual adequate target rate in the

amount of the risk-free interest rate, the decision-maker is

assumed to be risk neutral. The risk-free interest rate can be

deduced from the return of quoted quasi secure German

federal bonds. The mean of the nominal return of the German

federal bonds with a residual lifetime of more than 15e30

years from 1988 to 2009 is 5.92% a

1

. In the same period,

the inflation rate stood at 1.98% a

1

. We use the corre-

sponding real interest rate of 3.87% a

1

as proxy for the risk-

free interest rate.

It is hard to assume that entrepreneurs are risk neutral.

They are more or less risk-averse. The consideration of the

risk attitude can be ensured in the investment planning, for

example, through risk-adjusted discount rates. In the Risk-

Adjusted-Discount-Rate-Approach, a risk-adjusted interest

rate is determined subjectively in accordance with the risk

aversion of the decision-maker. Due to the difficulties of the

empirical determination of a decision-maker’s risk premium

, the risk premium is often parameterized

. In

accordance with this, we carry out variant calculations in

order to test how the optimal conversion strategy changes

with the risk attitude of the decision-maker. The following

mathematical relationship applies:

i

¼ rf þ r

(19)

i describes the risk-adjusted interest rate, rf the risk-free

interest rate and

r the risk premium that is added to the

risk-free interest rate. To examine the general effects of risk

aversion, we use three risk-adjusted interest rates: 3.87% a

1

(risk neutral), 8.87% a

1

(risk-averse) and 13.87% a

1

(strongly

risk-averse). The level of the risk premium is varied by 0%e

10% in accordance with the literature, which often mentions

risk premiums in the amount of 8%e12%

3.4.

Evaluation of the conversion decision within the

Real Options Approach

In contrast to the NPV, the Real Options Approach considers

the combined effect of the uncertainty of the investment

b i o m a s s a n d b i o e n e r g y 4 1 ( 2 0 1 2 ) 7 3 e8 5

79

returns, the irreversibility of the investment costs and the

temporal flexibility of the investment implementation that is

relevant with respect to the conversion from agricultural

production to SRC. In case wood chips prices follow a GBM, the

investment option has an indefinite lifetime, and a time

continuous exercise opportunity exists as well as there are no

interactions between different options, Equation

could be

used to determine the options value and the critical exercise

value. However, in our case the preconditions for applying

Equation

are not fulfilled. Therefore, we have to value the

option using a numerical method.

The future returns can be calculated as follows:

In words, Equation

can be described as follows:

There will not be any changes in the revenues and expen-

ditures (S

t

¼ 0) if the land use has so far been set-aside

(LU

t

¼ 0) and the stochastic wood chips price P

t

is lower

than the trigger price P* (P

t

< P*) meaning that the land use is

also set-aside in the next period (LU

t

þ1

¼ 0).

S

t

corresponds with the expenditures in the amount of the

investment costs for an SRC (S

t

¼ IC) if the land has so far

been used as set-aside (LU

t

¼ 0) and the stochastic wood

chips price P

t

is above or equal to the trigger price P* (P

t

P*)

meaning that the land use will be converted to SRC

(LU

t

þ1

¼ 1).

S

t

corresponds with the output Q

s

that is connected to the

first rotation period of the SRC, multiplied by the difference

between the wood chips price P

t

and the harvesting, drying

and transportation costs HC plus the saved set-aside costs

SC. This is the case if the land is used as SRC (LU

t

¼ 1) and the

year of use N

jt

of the SRC j at the time t corresponds with the

rotation period

s(N

jt

¼ s).

S

t

corresponds with the output Q

n

multiplied by the differ-

ence between the wood chips price P

t

and the harvesting,

drying and transportation costs HC plus the saved set-aside

costs SC. This is the case if the land is used as SRC (LU

t

¼ 1)

and the respective SRC is harvested in all rotation periods

from

the

second

to

the

second

last

period

T

(N

jt

¼ 2$sn/n N

jt

¼ ðT 1Þ$s).

S

t

corresponds with the output Q

n

multiplied by the differ-

ence between the wood chips price P

t

and the harvesting,

drying and transportation costs HC plus the saved set-aside

costs SC and less the recultivation costs RC. This is the case

if the land is used as SRC (LU

t

¼ 1), the respective SRC is

harvested for the last time (N

jt

¼ T$s) and the stochastic

wood chips price P

t

is lower than the trigger P* (P

t

< P*)

meaning that the land is set-aside again after the useful

lifetime of the SRC.

S

t

corresponds with the output Q

n

multiplied by the differ-

ence between the wood chips price P

t

and the harvesting,

drying and transportation costs HC plus the saved set-aside

costs SC and less the recultivation costs RC as well as the

investment costs IC of a new SRC. This is the case if the land

is used as SRC (LU

t

¼ 1), the respective SRC is harvested for

the last time (N

jt

¼ T$s) and the stochastic wood chips price

P

t

is higher or equal to the trigger P* (P

t

P*) meaning that the

area will continue to be used as SRC after the expiration of

the useful lifetime of the previous SRC.

S

t

corresponds with the saved set-aside costs SC if the area

is cultivated with SRC but is not harvested at the respective

point in time.

For the determination of the critical wood chips price P*,

the objective function F

0

that corresponds with the value of

the conversion opportunity respectively with the options

value has to be maximized. The stochastic-dynamic invest-

ment planning problem can formally be expressed as follows:

F

0

¼

X

N

t

¼0

S

t

ðP

Þ$ð1 þ iÞ

t

/ max!

P

(21)

To calculate the options value, it is necessary to determine

the present value of the future investment returns S

t

obtained

at optimal conversion strategy during the planning period t

(t

¼ 0,1, ., N).

Due to the fact that it is not possible to develop a replica-

tion portfolio (see Section

) for the examined decision situa-

tion including the above-mentioned individual supply

contract of the wood chips over 30 years, the annual adequate

target rate i is also varied in the real options valuation. As with

of the NPV, a risk neutral decision-maker (i

¼ 3.87%), a risk-

averse decision-maker (i

¼ 8.87%) and a strongly risk-averse

decision-maker (i

¼ 13.87%) are examined.

The maximizing problem described in Equation

corre-

sponds with the determination of the value of an American

option with an indefinite lifetime. Due to the fact that for the

disaggregated variable ‘wood chips price’, to which the

uncertainty regarding the investment returns can be attrib-

uted to, a GBM is plausible, it is also possible to model the

present value of the revenues by using a GBM featuring the

same process parameters. Hence, at first it seems to be

reasonable to refer to Equation

for option valuation.

Nevertheless, realistically, on the one hand, there is not any

time continuous opportunity to convert to SRC and, on the

S

t

ðP

Þ ¼

8

>

>

>

>

>

>

>

>

<

>

>

>

>

>

>

>

>

:

0

; if LU

t

¼ 0 L P

t

< P

IC; if LU

t

¼ 0 L P

t

P

Q

s

$ðP

t

HCÞ þ SC; if LU

t

¼ 1 L N

jt

¼ s

Q

n

$ðP

t

HCÞ þ SC; if LU

t

¼ 1 L N

jt

¼ 2$s V.V N

jt

¼ ðT 1Þ$s

Q

n

$ðP

t

HCÞ þ SC RC; if LU

t

¼ 1 L N

jt

¼ T$s L P

t

< P

Q

n

$ðP

t

HCÞ þ SC RC IC; if LU

t

¼ 1 L N

jt

¼ T$s L P

t

P

SC

; otherwise

(20)

b i o m a s s a n d b i o e n e r g y 4 1 ( 2 0 1 2 ) 7 3 e8 5

80

other hand, after setting up one SRC there is again the chance

to set up another one. Therefore, it is not possible to evaluate

the conversion to SRC analytically. The time continuous

investment opportunity implied in Equation

causes the

overestimation of the investment trigger and the options value

(more entrepreneurial flexibility). The reinvestment opportu-

nity that is not considered in Equation

has an opposite

effect (less entrepreneurial flexibility). The significance of the

respective effect cannot be assessed offhand. Therefore, the

simulation-based option valuation method described in

Section

is applied. This method can be validated for the

special case that can be solved by means of Equation

.

If we apply the simulation-based options valuation proce-

dure in order to determine the thresholds and the options

values for the conversion from agricultural production to SRC,

an indefinite planning period has to be approximated through

a finite value as with all numerical valuation procedures. We

look at a period of time of 500 years. The resulting approxi-

mation error can be assessed as small because the present

value of, for instance, 100,000

V, which are achieved in 500

years at an interest rate of 3.87%, amounts to less than 1 cent.

We refine the parameterization interval of the conversion

trigger to up to 0.20

V t

1

DM and use MS-EXCEL to perform

50,000 simulation runs for the determination of the options

values. Haug

:140], for example, suggests performing at

least 10,000 simulation runs

.

4.

Results

shows the optimal conversion strategies according to

the Classical Investment Theory and to the Real Options

Approach assuming GBM, which according to statistical tests

best describes the development of the wood chips price.

Furthermore, Net Present Values and options values resulting

from a wood chips price of 62.76

V t

1

DM observed in 2009 are

indicated. In line 1 we look at a risk neutral decision-maker,

which uses the risk-free interest rate for discounting future

payments. The results have to be interpreted as follows:

The columns 5 to 7 show the results that would emerge if

the temporal flexibility regarding the conversion to SRC is

not taken into account (‘now-or-never-decision’). By looking

at column 5 it becomes clear that a risk neutral decision-

maker should convert to SRC if the wood chips price is

higher than or equal to 47.0

V t

1

DM (equals 0.41

V l

1

of

heating oil). The corresponding critical present value of the

revenues of 8137

V ha

1

(column 6) is equivalent to the

present value of the expenditures (column 3). From the

current wood chips price of 62.76

V t

1

DM would result

a present value of revenues of 10,862

V ha

1

and, therefore,

in the event of conversion a Net Present Value of

2725

V ha

1

. Consequently, given a wood chips price of

62.76

V t

1

DM, the conversion to SRC would be profitable

and therefore should be implemented.

The columns 8 to 11 show the results if the conversion can

be postponed and accepted annually. Compared to the

‘now-or-never-decision’ significant differences emerge. A

risk neutral decision-maker, for example, should only

convert immediately to SRC, if the present wood chips price

is higher than or equal to 73.6

V t

1

DM (equals 0.65

V l

1

of

heating oil). Only in case of a wood chips price of that height,

no higher expected Net Present Value would emerge at any

later stage. The critical present value of the revenues is

12,739

V ha

1

. Hence, it would be favorable for risk neutral

farmers to convert at a present value of the revenues that is

1.57 times higher than the present value of the expenditures

(investment multiple; column 11). In case of the current

wood chips price of 62.76

V t

1

DM the options value

amounts to 4317

V ha

1

. At a wood chips price of

62.76

V t

1

DM it therefore would not be recommendable to

convert immediately. To convince risk neutral farmers to

convert to SRC, it would be necessary to pay monetary

incentives in the amount of the values of waiting, meaning

at least 1592

V ha

1

(

¼ 4317 V ha

1

e2725 V ha

1

).

To illustrate the consequences of higher investment costs

for SRC, line 2 indicates the results in case of twice as high

investment costs (5750

V ha

1

). It becomes clear that accord-

ing to both the Classical Investment Theory and to the Real

Options Approach the conversion threshold increases

together with the investment costs. The investment multiple,

however, remains constant at 1.57. Marginal differences result

from the parameterization area as well as from the fact that

the figures were randomly drawn. This is also confirmed by

further variant calculations regarding the investment costs. In

other words: If the investment multiple is known, the

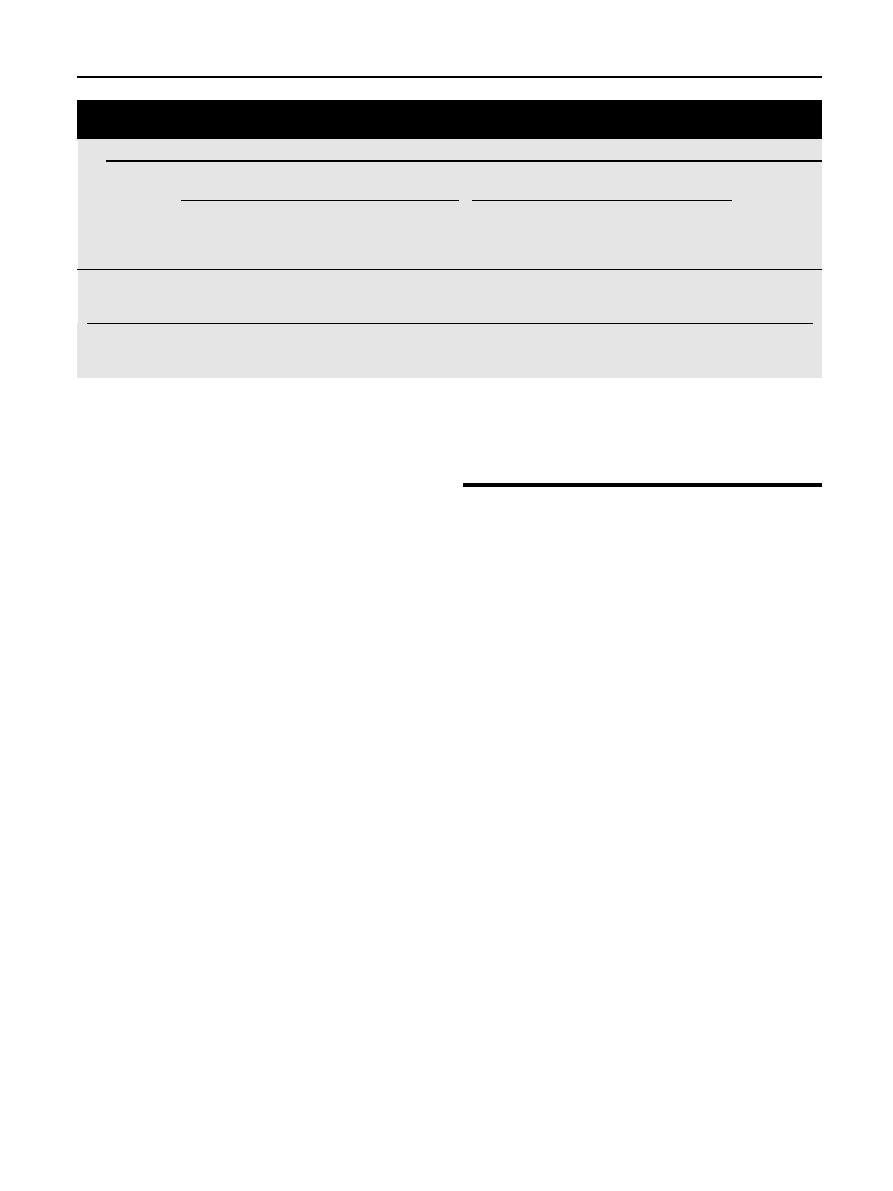

Table 1 e Overview of the assumed model parameters

a

(applicable to classical investment model and real

options model).

Investment costs for an SRC IC:

2875

V ha

1

Harvesting, drying and

transportation costs HC:

24

V t

1

DM

Rotation period

s:

5 years

Number of rotation periods T:

6

Useful lifetime of an SRC N:

30 years

Output of the SRC

In 1. rotation period after

setting up Q

s

:

25 t DM ha

1

In 2. to 6. rotation period

after setting up Q

n

:

40 t DM ha

1

Recultivation costs for an

SRC RC:

1400

V ha

1

Potential implementation

period for the conversion:

N (annual implementation

right and reinvestment

opportunity in SRC)

Risk-free interest rate rf:

3.78% a

1

Risk premium

r:

0% a

1

(risk neutral

decision-maker)

Stochastic process for the

wood chips prices:

Geometric Brownian

motion (GBM)

Process parameters

Drift rate

a:

0% a

1

Standard deviation

s:

21.05% a

1

Annual disposable set-aside

costs SC:

35

V ha

1

Currently observed wood

chips price P

0

:

62.76

V t DM

a In variant calculations the sensitivity of the results is examined

with regard to (i) the amount of the investment costs IC, (ii) the

amount of the risk premium

r and (iii) the type of the underlying

stochastic process.

b i o m a s s a n d b i o e n e r g y 4 1 ( 2 0 1 2 ) 7 3 e8 5

81

conversion thresholds at different investment costs can be

determined easily under the assumption of a GBM.

To illustrate the effect of risk aversion, the consequences

for decision-makers with different risk attitudes are indicated

in line 3 and 4. It becomes clear that:

A risk-averse decision-maker, who uses an interest rate of

8.87% for discounting future payments (line 3) and who, in

addition, ignores the temporal flexibility, should convert to

SRC if the wood chips price is higher than or equal to

67.8

V t

1

DM. In accordance with the commonly known

statement that risk aversion induces investment reluctance,

a risk-averse decision-maker would only make a risky

investment in case of a higher wood chips price. The present

value of the revenues of 4400

V ha

1

, which would result

from a wood chips price of 67.8

V t

1

DM, however, is

equivalent to the present value of the expenditures. In other

words: With regard to the critical present value in case of

a ‘now-or-never-decision’ the same decision rule applies to

decision-makers with diverse risk attitudes. In case of the

current wood chips price of 62.76

V t

1

DM the Net Present

Value of the risk-averse decision-maker would amount to

327 V ha

1

. Hence, it would not be attractive for a risk-

averse decision-maker to convert to SRC. For a risk-averse

decision-maker, who works with a risk-adjusted interest

rate of 13.87% (line 4) these effects even amplify.

When taking into account the temporal flexibility regarding

the conversion to SRC for a risk-averse decision-maker and

comparing the results to that of a risk neutral decision-

maker (line 1), it becomes apparent that the critical wood

chips price rises in the former case. Nevertheless, the

investment multiple falls in comparison to a situation in

which only the temporal flexibility is taken into account and

not at the same time the risk aversion (1.57 vs. 1.42 or 1.34).

In other words: the delay of a per se profitable investment

(in case of a high wood chips price) is less advantageously at

a higher discounting rate. In addition, it becomes clear that

the opportunity to convert is of less value for a risk-averse

decision-maker than for a risk neutral one assuming

conditions being equal.

The results indicated in line 5 refer to a situation in which

the farmer could decide only once to cultivate SRC on a certain

agricultural area for 30 years. In this case there would not be

any further reinvestment options. Assuming that the setting

up of an SRC also involves costs in the amount of 2875

V ha

1

the present value of the expenditures would fall from

8137

V ha

1

(including reinvestment, line 1) to 5532

V ha

1

.

When ignoring temporal flexibility regarding the time of

conversion, the same critical wood chips price of 47.0

V t DM

results from that ceteris paribus comparison. Taking into

account that it is also possible once to convert to SRC at a later

point in time, the critical wood chips price rises to

87.6

V t

1

DM and therefore increases more significantly than

in case of further reinvestment options. If the farmer has only

one single chance to convert, the investment multiple is 1.86.

Consequently, the results indicated in line 5 make clear, on

the one hand, that the farmers’ reluctance to convert would be

overestimated if the realistically possible repeated reinvest-

ment options are not taken into account. On the other hand,

Table

2

e

Crit

ical

wood

chips

prices,

cri

tical

present

values

of

reven

ues

and

value

of

con

version

oppo

rtunitie

s

assuming

GBM.

Col

umn

1

Col

umn

2

Column

3

Col

umn

4

Col

umn

5

Colum

n

6

Colum

n

7

Co

lumn

8

Column

9

Col

umn

10

Colum

n

11

As

sumptio

ns

Without

temp

oral

flexib

ility

(cl

assical

inves

tment

theor

y)

With

temp

oral

flexib

ility

(Re

al

Optio

ns

App

roach)

Inves

tmen

t

multi

ple

R

=R

M

Re

investme

nt

option

Inves

tmen

t

costs

of

an

SR

C

(V

ha

1

)

Pre

sent

value

of

the

ex

pend

itures

a

(V

ha

1

)

Inter

est

rate

(%

a

1

)

Critica

l

wood

chip

s

pric

e

P

M

(V

t

1

DM)

Critica

l

presen

t

value

of

the

reven

ues

R

M

(V

ha

1

)

Net

Pre

sent

Valu

e

NPV

0

c

(V

ha

1

)

Critica

l

wood

chips

price

P

*

b

(V

t

1

DM

)

Critical

prese

nt

value

of

the

rev

enues

R

*

(V

ha

1

)

Optio

ns

va

lue

F

0

c

(V

ha

1

)

1

With

2875

8137

3.87

47.0

8137

2725

73.6

12,739

4317

1.57

2

With

5750

12,366

3.87

71.5

12,366

1504

112.0

19,385

3005

1.57

3

With

2875

4400

8.87

67.8

4400

327

96.0

6231

678

1.42

4

With

2875

3569

13.87

99.9

3569

1325

133.4

4768

131

1.34

5

Without

2875

5532

3.87

47.0

5532

1852

87.6

10,308

2545

1.86

a

Present

value

of

the

investment

costs

plus

the

present

value

of

the

harvesting,

drying

and

transportation

costs

of

the

wood

chips

plus

the

present

val

ue

of

the

recultivation

costs

minus

the

present

value

of

the

saved

setting-aside

costs

by

the

conversion

to

SRC.

In

the

case

which

includes

reinvestment

options

a

permanent

cultivation

with

SRC

is

as

sumed.

b

The

parameterization

interval

of

the

conversion

trigger

is

refined

to

up

to

0.20

V

t

1

DM.

c

The

Net

Present

Value

and

options

value

have

been

calculated

for

an

initial

wood

chips

price

of

P

0

¼

62.76

V

t

1

DM;

50,000

simulation

runs.

b i o m a s s a n d b i o e n e r g y 4 1 ( 2 0 1 2 ) 7 3 e8 5

82

the results indicated in line 5 allow of a validation of the used

simulation-based real options valuation model. On the basis

of the analytical solution described in Equation

, the critical

present value of the revenues as well as the option price,

which apply in case of a time-continuous option to convert,

can be determined. From a present value of the expenditures

of 5532

V ha

1

results a critical present value of the revenues

of 11,669

V ha

1

, which corresponds with a critical wood chips

price of 99.2

V t

1

DM. At a current wood chips price of

62.76

V t

1

DM the options value amounts to 2572

V ha

1

. Due

to the fact that in the analytical solution it was assumed

implicitly that it is permanently possible for farmers to

convert to SRC, implying additional entrepreneurial flexibility,

both the critical values as well as the options values are

slightly higher than those indicated in line 5. In the light of

that, the results of the numerical option valuation procedure

seem to be valid.

The comparison of the results indicated in

, on the

one hand, clarifies the flexibility of the suggested valuation

procedure with regard to the type of the underlying stochastic

process. On the other hand, the sensitivity of the results

regarding the stochastic process becomes clear: The conver-

sion trigger and investment multiple as well as the options

values of the MRP differ clearly from those of the GBM and

ABM, although the parameter estimation is based on the same

data. This difference can be explained by the respective

process characteristics, which exist with regard to positive

future developments. While prices are fluctuating around

their equilibrium level in an MRP, they can drift freely in the

Brownian motions. That is why the opportunity costs of

immediate conversion are lower for an MRP than for a GBM

and for an ABM. The reasons for the low conversion trigger

price in case of MRP are the relatively high speed of return of

the prices as well as the high equilibrium price level

amounting to 53.4

V t

1

DM which exceeds the cost-covering

constant expected wood chips price of 47.0

V t

1

DM (cf.

Equation

). Thus, a Net Present Value of zero can only arise

from an initial level lower than 47.0

V t

1

DM. The compara-

tively significant effect results from the fact that the wood

chips price will not become relevant for the revenues during

the first four yearsdduring which a low initial value causes

a relatively low expected valuedbut as from the fifth year

after conversion to SRC.

5.

Conclusion and future research

Although numerous studies show that the utilization of agri-

cultural areas for the production of wooden biomass in SRC

might be profitable, only few farmers convert to this cultiva-

tion method. To explain the phenomenon of the observed

reluctance to adapt, different explanatory approaches are

discussed including, for instance, traditionalistic behavior

and risk aversion. However, when assuming that the decision

to convert from a classical agricultural production method to

SRC is an investment decision, a relatively new explanatory

approach gains in importance: Investment decisions are

usually characterized by uncertainty, sunk costs and temporal

flexibility. Taking into account these three aspects, invest-

ment planning takes place within the framework of the Real

Options Approach. Thusdcontrary to the Classical Invest-

ment Theorydthe conversion to SRC can only be recom-

mended if the Net Present Value achieved in case of

immediate conversion compensates at least the opportunity

costs involved at this time, which also include the profitability

of postponing the conversion. In the present study, conver-

sion thresholds and options values are determined for

a model farm at a poor and drought threatened location in

Northern Germany, which has the option to convert a set-

aside agricultural area to SRC. The farmers can postpone the

decision to convert as long as they like. To facilitate the

decision a numerical real options valuation model is devel-

oped. This model is flexible regarding the type of the under-

lying stochastic process.

The results from the examined location illustrate that in

case of realistic assumptions a risk neutral decision-maker

should only convert from set-aside to SRC if the present

value of the revenues is equivalent to 1.57 times the present

value of the expenditures. Hence, there are considerable

differences to the Classical Investment Theory, which

recommends to invest in the event of an investment multiple

of one. Furthermore, the model calculations make clear that

Table 3 e Critical wood chips prices, critical present values of revenues and value of conversion opportunities for different

stochastic processes.

a

Column 1

Column 2

Column 3

Column 4

Column 5

Column 6

Column 7

Column 8

Stochastic

process

Without temporal flexibility (classical

investment theory)

With temporal flexibility (real options

approach)

Investment

multiple

R

=R

M

Critical wood

chips price P

M

(

V t

1

DM)

Critical present

value of the

revenues R

M

(

V ha

1

)

Net Present

Value NPV

0

c

(

V ha

1

)

Critical wood

chips price P*

b

(

V t

1

DM)

Critical present

value of the

revenues R*

(

V ha

1

)

Options

value F

0

c

(

V ha

1

)

1

GBM

47.0

8137

2725

73.6

12,739

4317

1.57

2

ABM

47.0

8137

2725

69.6

12,046

4295

1.48

3

MRP

4.1

8137

1219

40.0

9100

1233

1.12

a With reinvestment option, investment costs of an SRC equal to 2875

V ha

1

, interest rate equal to 3.87% a

1

.

b The parameterization interval of the conversion trigger is refined to up to 0.20

V t

1

DM.

c The Net Present Value and options value have been calculated for an initial wood chips price of P

0

¼ 62.76 V t

1

DM; 50,000 simulation runs.

b i o m a s s a n d b i o e n e r g y 4 1 ( 2 0 1 2 ) 7 3 e8 5

83

the results depend significantly on the type of the stochastic

process underlying the valuation. Besides these normative

statements the results show that the Real Options Approach

indeed has an explanatory potential regarding the frequently

observed reluctance to convert. Of course, it needs to be

checked in further investigations to what extend the results

are specific for the set assumptions of the present study and

how strongly they are influenced by the location conditions,

by the so far applied agricultural production method etc.

From an agricultural and forest policy-makers’ point of

view, the results are relevant as they do not only draw the

attention to the generally known determinants of an invest-

ment decision (e.g. the amount of the investment returns and

their uncertainty or the amount of the costs of conversion) but

also to the temporal flexibility of the investment imple-

mentation under uncertainty. What could policy makers do to

increase the percentage of agricultural area that is used for

SRC, if this is requested? Policy makers, for instance, could pay

additional area payments for SRC, entailing an increase in the

conversion returns. Alternatively, subsidies for cuttings could

be granted. When comparing Net Present Values and options

values it becomes clear that these conversion aids need to be

considerably higher than it might be expected according to the

Classical Investment Theory to have the corresponding effect.

The effect of conversion aids, however, could be amplified if

the payment is limited in time. Ultimately, the opportunity

costs would thereby be reduced over time and the decision to

convert would be shifted more toward a ‘now-or-never-deci-