Comshare, Inc.

i

Management Planning and Control:

A Holistic Approach for Strategic Business Success

Management Summary.................................................................................................1

Business Drivers ..........................................................................................................2

Changing Role of Finance ........................................................................................2

Unceasing, Accelerating Speed of Change ...............................................................2

What is Management Planning and Control? ..............................................................4

Fundamental Business Questions for MPC ...............................................................4

The Traditional Approach: Neither Efficient nor Effective...........................................5

ERPs, CRM, GLs Need MPC’s Focus on the Future .................................................7

Enabling Technology for MPC .....................................................................................8

Components of an MPC Application..........................................................................8

Build or Buy a Solution .............................................................................................9

Market-driven Rules for MPC Solutions.....................................................................10

Processes ..............................................................................................................10

Business Model ......................................................................................................10

Analytical Capabilities.............................................................................................13

Technology.............................................................................................................14

Conclusion..................................................................................................................15

Sources .......................................................................................................................16

Comshare, Inc. 1

Management Summary

Management planning and control (MPC) is a single system that drives a company’s

strategic direction and overall success.

•

Management planning takes key management initiatives and supports top-down

and bottom-up planning processes. This area involves deciding on an

organization’s goals and the strategies to attain them through goal setting,

budgeting, and rolling forecasts.

•

Management control supports planning by providing organizational insight,

communication, and focus. It involves managers influencing other organizational

members to enact the strategies by monitoring plan performance, supporting the

analysis of alternatives, and taking corrective action.

Together, management planning and management control comprise the four fundamental

processes of planning, budgeting, reporting, and analysis. MPC leverages organizational

knowledge and insight by synthesizing those four processes into a single, ongoing

system to implement strategies better, strengthen decision making, and make

management more effective.

To be successful, organizations must excel at all aspects of management planning and

control. To reach this goal, organizations turn to information technology to support the four

fundamental MPC processes and the overall MPC system. In the past, this support was

achieved by setting up discreet applications using different technologies that typically

worked on the basis of a year.

But due to the ever-faster change in market dynamics that requires organizations to

respond in hours or days rather than months, and the enormous amount of time and effort

traditional systems require in maintenance and linking together, these systems have fallen

short of serving the needs of organizational MPC.

Recently, there has been a realization that the solution lies in implementing MPC “best

practices” combined with a new generation software application: one that supports the

planning, budgeting, reporting, and analysis processes as a single, closed-loop system,

recognizes that MPC involves more than fiscal accounts, and is not bound by a calendar or

fiscal year.

2 Comshare, Inc.

Business Drivers

The competitive landscape changes so quickly that organizations often find it difficult to

keep up, let alone maintain an effective system to plan and control the business. Finance

staffs add value to the organization because they are the focal point for capitalizing on

business information to secure and maintain a competitive advantage.

Changing Role of Finance

In many organizations, finance is seen as the primary, authoritative source of financial and

performance-related information. In addition, finance staff is called on to analyze and

comment on that information. More than ever, finance departments are relied on to act as

business partners by providing management counsel and support to all areas of the

enterprise. Finance supports management in formulating strategy and implementing

management initiatives. Finance supports the planning and budgeting processes across an

enterprise. And finance often supports other functions within an enterprise – like marketing,

sales, and production – by supplying information about customers, production, and the

marketplace.

A finance staff is responsible for the organization’s financial systems – the systems that

capture the operating results of the enterprise. Finance is responsible for the accurate

provision of financial information, both internally as management reports and externally as

statutory reports. Today, many finance organizations are struggling to provide the expected

value through:

•

Efficient, ongoing development of plans, budgets, forecasts, management reports,

performance tracking, and statutory reporting

•

Timely access to results, analyses, and information

•

Comments and insight on past and planned performance

Unceasing, Accelerating Speed of Change

The faster an industry moves, the faster a company shifts its priorities and needs to adjust

its plans, budgets, and forecasts. As the competitive landscape changes, companies must

change too. In times of change, organizations need to plan and re-plan quickly. Fast and

efficient budgeting, rolling forecasts, and effective management reporting and analysis are

key to better managing changing conditions or deviations from planned performance.

Comshare, Inc. 3

Today, budgets are vital to making resource allocations based on a strategic plan, not just

to control costs. The old rules no longer apply. As the pace of change continues to

increase, budgets can no longer be seen as a forecast that doesn’t change for 12 months.

The reality is that plans and forecasts become obsolete as soon as the competitive

environment changes, and budgets become misaligned within the first month as

unforeseen events occur.

Because of the rate of change, the past by itself is no longer a reliable indicator of the

future. In these circumstances, measuring performance relative to the market and

competitors, as well as monitoring performance indicators, becomes imperative.

The impact of these factors means that organizations must move away from traditional

planning and reporting practices and embrace a new, more responsive management

approach—management planning and control.

4 Comshare, Inc.

What is Management Planning and Control?

Management planning and control (MPC) is more than just a set of processes for planning,

budgeting, reporting, and analysis. MPC synthesizes these once disparate processes into a

single, cohesive, and ongoing system through which management can implement

strategies better, strengthen decision making, and make management more effective.

Management planning and control is both a philosophy – or a way of thinking about the

business, and a methodology – or a way of running the business.

As a philosophy of the business, management planning takes key management initiatives

and supports top-down and bottom-up planning processes. This area involves deciding on

an organization’s goals and the strategies to attain them through goal setting, budgeting,

and rolling forecasts.

As a methodology for running the business, management control supports planning by

providing organizational insight, communication, and focus. It involves managers

influencing other organizational members to enact the strategies by monitoring plan

performance, supporting the analysis of alternatives, and taking corrective action.

Both management planning and management control involve continuous evaluation and

adjustment of plans as needed. So, MPC is not a “once-a-year” process, but an ongoing,

single system to make sure the company is on track with everything it wants to be and to

achieve.

Fundamental Business Questions for MPC

Management planning and control requires top corporate leaders to answer key questions

that shape the business. These questions can be grouped into the following categories:

Management Planning

•

Where do we want to go?

•

How do we compare with our peers and competitors?

•

What do we have to do?

•

What targets can we achieve?

•

How do we allocate resources?

Management Control

•

Where are we?

•

How are we doing compared to plan?

•

What actually happened?

•

Why did it happen?

•

What are the alternatives?

•

What decisions do we make?

•

What is the impact of those decisions?

Comshare, Inc. 5

After all the questions have been answered, you must go back to answer them again,

because the business environment continues to change, and your business must be ready,

willing, and able to adjust accordingly. So the cycle starts again and continues for the life of

the enterprise.

To answer these questions, management needs two things:

•

Relevant, timely information in the form of a model that reflects the way the

organization operates. This information is both financial and statistical on all

aspects of organization. Information about the marketplace and competitors is also

needed.

•

Technology that will enable management to create plans, manage the execution of

those plans, evaluate performance, highlight exceptions, and model decisions. The

capabilities of that technology work together as a seamless, single application that

shares a common model of the organization and a common set of data.

The Traditional Approach: Neither Efficient nor Effective

The traditional approach to management planning and control involved massive amounts of

spreadsheets, which is still a mainstay for many companies today. Spreadsheets have been

the single greatest tool for MPC. As technology advanced, better ways to run an MPC system

emerged. In fact, the evolution of MPC technology can be viewed in three stages: substitution

of new technology for old, increased demand for the functions of the new technology, and the

rise of new technology-intensive structures (Malone & Rockart, 1992).

Ledgers were kept by hand for centuries. About

20 years ago, people began adopting electronic

tools as a substitute for hand-written ledgers. This

new tool made correcting data, making changes,

and performing calculations easier and much

faster. It was seen as a boon for planning,

budgeting, reporting, and analysis.

Soon, after seeing the possibilities of this

technology, corporate management at companies

everywhere asked for more complex ways to look

at their businesses in response to increasing

competition and revolutions in industry. This

would include the rise of pivot tables and OLAP

(online analytical processing). Demand for the

kinds of functions electronic technology could

provide increased dramatically. The result was

discreet spreadsheet-based applications using

different technologies on separate data sources

that typically work on the basis of a single year.

6 Comshare, Inc.

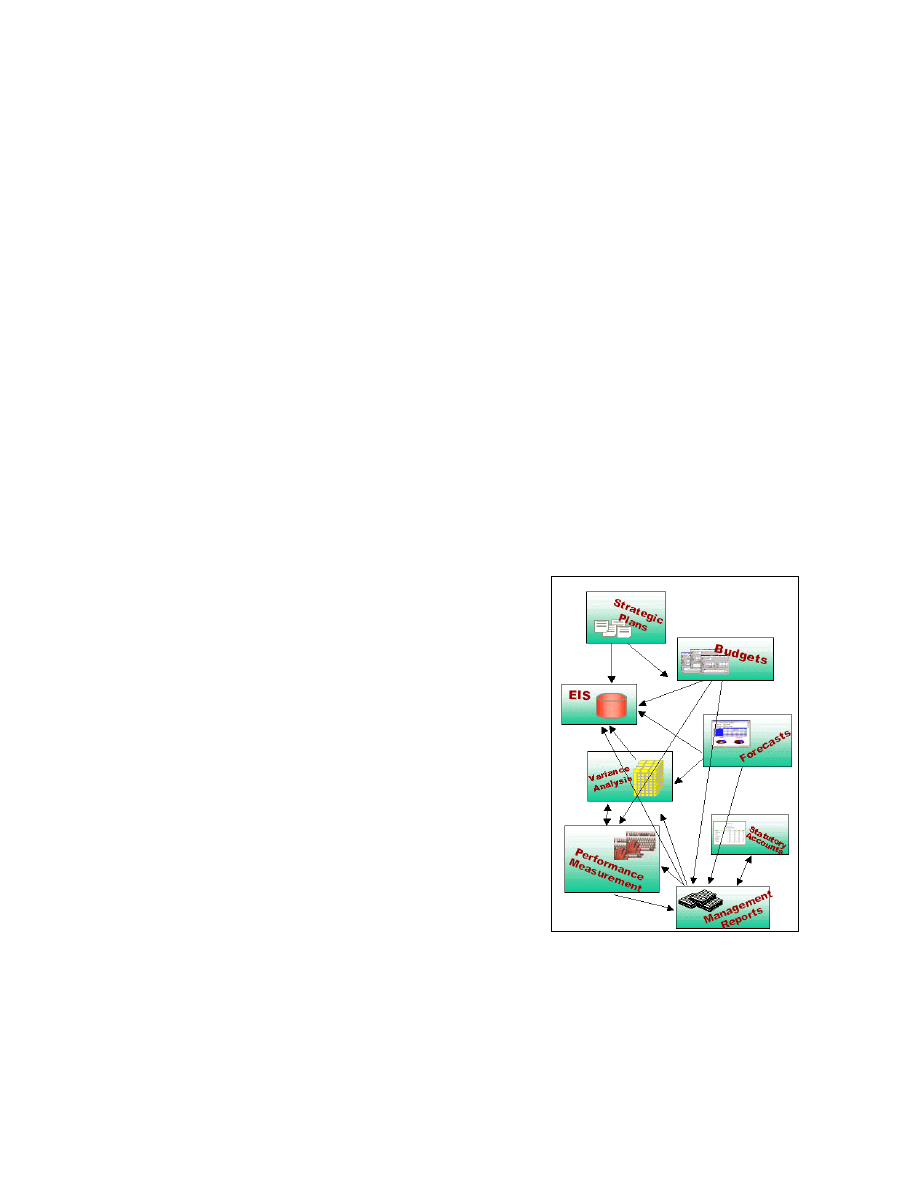

Although this functionality had its benefits, most finance departments today find themselves

(as shown in the figure) dealing with too many documents, including numerous and often

complex spreadsheets that are usually linked, poorly maintained, poorly understood, or

error-prone. Finance staff find general ledger reports inflexible, difficult to navigate, and

impossible to analyze. Add to this the complexity of multiple general ledgers, multiple

charts-of-accounts, and the mixture of home-grown systems.

Business Finance (2000) reported that 84% of finance staff time focuses on non value-

added activities, like transaction processing, data collection, and reporting. Much of this

time is spent re-keying numbers into spreadsheets or responding to singular requests for

reports. It’s no wonder many finance organizations struggle to provide the value that is

expected through plans, budgets, forecasts, management reports, performance tracking,

and statutory reporting.

Now we are seeing the emergence of new technology intensive structures that are far more

powerful, flexible, and open. These new structures are market-driven in that, according to

findings by Hackett Benchmarking Solutions (2000):

•

Only 11% of companies can analyze results at will rather than only at the end of an

accounting cycle.

•

Only about 30% of companies can access data by geography, product, commodity

customer, supplier, or major project.

•

Only about 20% of companies provide management with access to integrated

information sources like transactional or operational systems.

The new technology structures for management planning and control provide a single

source for critical management information. They also allow performing the high-value

analysis that is key to organizational success in fast-changing and competitive

environments. They foster greater communication, collaboration, and responsiveness while

reducing information overload by guiding users to data that is routine, out of line from the

plan, or atypical.

Comshare, Inc. 7

ERPs, CRM, GLs Need MPC’s Focus on the Future

In most companies, investments in ERP have not solved the problem. (See GartnerGroup

[2000] Research Note, The New Wave of Best-of-breed Financial Applications.) Over the

past few years, many companies have implemented ERP systems that were designed to

improve operational business processes such as general ledgers, order processing,

procurement, and inventory management. With these investments behind them, some

companies are now looking at how to take advantage of the latent value of the data to

support more effective management processes. Some are turning to “add-on” modules,

such as budgeting.

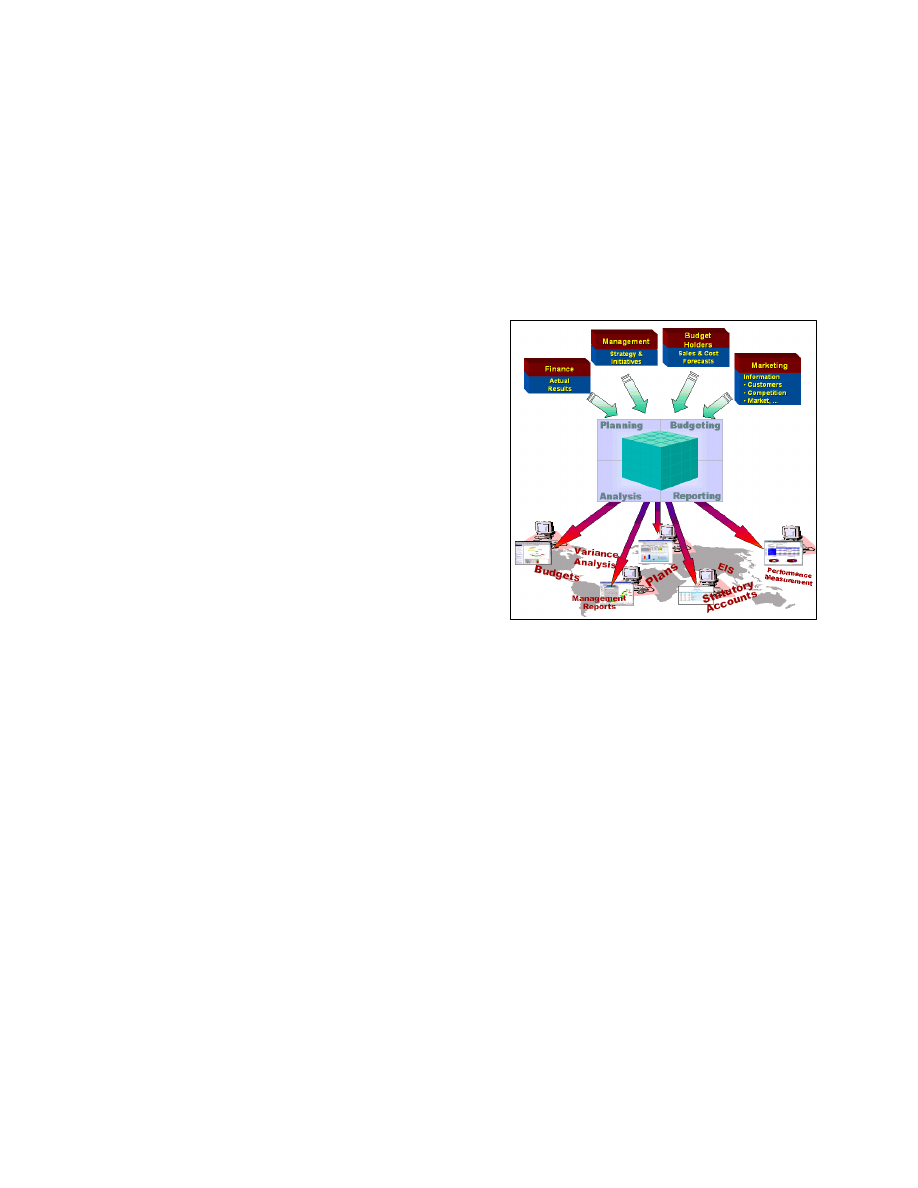

Why are companies looking for such value-

added solutions? The basic problem with

ERP systems is that they focus on

operational efficiency and, thereby, are

anchored in the past and structured around

internal operational processes. Although

this is of some value, it inherently lacks the

focus offered in an MPC system.

An MPC system focuses on management

effectiveness. Decision makers can perform

best when they have access to both internal

and external sources of information that can

help them reveal future opportunities. This

information must be transformed, modeled,

future-focused, and viewed and analyzed

from multiple business perspectives (e.g. by

strategic initiative, geography, line of business, market, and so on), as the figure here

shows. End users of MPC solutions are decision makers who must make sense of the

effects of “what if” scenarios, model alternative structures, and formulate new initiatives. All

this information is not held within an ERP system, plus structures and structural changes

are incompatible with the focus of an ERP. Corporate decision makers need quick access

to both ad hoc and formal reporting.

The GartnerGroup (1999) strategic analysis report, Administrative Applications: Around the

Edges, explained that ERP suites are weak in these areas, and enterprises should turn to

specialist vendors offering planning, budgeting, reporting, and analysis solutions. The

capabilities necessary for an MPC system are in stark contrast to ERPs and transactional

applications, like CRM and general ledger (GL) systems. The latter are designed to track

history as efficiently as possible with very little regard to modeling, analysis, trends, and

general end user data consumption.

Nevertheless, MPC solutions complement ERP, CRM, and GL systems by accessing

relevant base data from those systems and creating a focus on the future rather than the

past. These solutions are designed to add value to the raw information they are fed, and

have specific functionality to support the complete MPC process.

8 Comshare, Inc.

Enabling Technology for MPC

Technology enables people to address key MPC issues that companies face. Business

users need to constantly monitor business performance, highlight exceptional variances,

model new initiatives, and where necessary, re-plan initiatives at any time. Management

needs a specialized combination of technologies that will enable people to use the MPC

system for more effective planning, budgeting, reporting, and analysis.

Components of an MPC Application

Technology applied to an MPC system utilizes best practices in planning, budgeting,

reporting, and analysis. An illustration of an MPC solution is shown here. Software

solutions for MPC have a number of components, including:

•

A collaborative planning

environment where budget

holders and budget

controllers can jointly

develop and communicate

plans.

•

A central, financially

intelligent database to hold

the organizational model,

data, and results. This

database can interact with

an organization’s general

ledger and other systems

that supply information to

the planning and reporting process.

•

Workflow support that guides users (budget holders, budget controller, business

managers, and executives) through the different planning and reporting processes.

•

Specific processing capabilities that allow the formulation of plans, budgets, and

reports.

•

Powerful ad hoc analysis capabilities that can be accessed throughout the

organization.

•

A comprehensive security system that prevents unauthorized access or change to

the different parts of the database.

Comshare, Inc. 9

Build or Buy a Solution

Until recently, MPC software applications were not available. Organizations have had to

rely on either linking together multiple, discreet applications for planning, budgeting,

reporting, and analysis, or have had to build unsophisticated MPC applications themselves.

This build option typically involves using a generic OLAP tool with a spreadsheet program.

This requires extensive effort in building and maintaining not only a financially intelligent

model, but also the various end user functions required by each part of the MPC process,

such as submission tracking, salary planning, currency conversion, journaling, and end

user ad hoc analysis capabilities.

Consistent with the evolution of MPC technology, the GartnerGroup (1998) report,

Financial Business Intelligence Applications, predicted that a new breed of software will

become available:

“Finance organizations evaluating leading Financial Business Intelligence

Applications (FBIA) seek both strong analytical features and deep process support

for financial planning, budgeting and consolidation. They also seek a single set of

tools and the ability to share common data.

“By 2002, 60 percent of FBIA vendors will provide a single-application environment

to support financial planning, consolidation and analysis while sharing common

data (0.7 probability).”

These solutions are starting to become a reality, although many of the mainstream vendors

still produce single-focus applications. They continue to develop and market discreet

applications, which are then linked together to give the overall impression of an MPC

application. But these solutions do not deliver the real benefits that only a true MPC

solution can give. These single-focus applications have limited appeal and will disappear

completely over the next three years as MPC systems become mainstream. The only

company that currently provides true MPC solutions is Comshare.

10 Comshare, Inc.

Market-driven Rules for MPC Solutions

MPC systems are fundamentally different from systems that consist of a number of

separate, single-focus applications with a common front-end. The following nine rules for

true MPC solutions have been developed from market analyses so that users can

distinguish between “integrated” applications and true MPC systems. These rules are

grouped into categories: the way these systems handle the MPC process, characteristics

of the business model, their analytical capabilities, and the technology they employ.

Processes

Rule 1: Integrated Processes

An MPC system supports planning, budgeting, consolidation, and management reporting

and analysis in a single, “closed-loop” application. Users should be able to swap from one

process to the other without having to change environments or move data.

•

Planning involves “top-down” target setting and the ability to evaluate alternative

scenarios.

•

Budgeting involves providing a collaborative environment where both budget

holders and budget controllers can communicate on goals and submissions.

•

Consolidation deals with the matching and elimination of inter-company accounts

and the handling of adjustments according to FASB requirements, which should

leave automatic audit trails that can be interrogated for audit purposes.

•

Management reporting and analysis involves producing reports, analyses, and

exception alerting, as well as allowing unlimited ad hoc end user investigation.

Organizations are better able to link planning to budgeting, budgeting to reporting, and

analysis to planning. Management can respond to variances quickly by evaluating

alternatives, adjusting plans, and informing users, without the effort of learning and

maintaining multiple technologies and applications. Ultimately, management can drive the

successful implementation of the corporate strategy throughout the business.

Business Model

Rule 2: Common Business Rules and Common Data

An MPC system has a common set of dimensions, business members, and business rules,

although rules may be specifically restricted to specific processes. As a result, one change

in a structure or member automatically updates associated reports and analyses.

Similarly, only one set of data is held, even though multiple versions may be required. This

means that a specific number – whether it appears in the strategic plan, the budget, or

actuals – is only held once. So only one version of “the truth” is open and available to all

users.

Comshare, Inc. 11

Using a common model avoids the hassles and risks of moving data or updating a rule in

multiple systems. No effort is required to maintain links and duplicate changes. No time is

lost while those changes/movements are made. And you can be certain of the integrity of

the changes. Everyone who accesses a number can be assured it is the only version and

was calculated by exactly the same rule. No one needs to wait or debate who has the right

version of the truth, and can instead concentrate on what the value represents.

Rule 3: Built-in Financial Intelligence

Financial intelligence means a system can automatically cope with financial statements and

associated analyses without a user having to program the system. Financial intelligence

includes:

•

Multidimensionality. It supports unlimited business perspectives, e.g. by

organization, cost center, product, market, or channel; and unlimited members

within each dimension. These dimensions must support multiple hierarchies, such

as product and channel, while at the same time supporting multiple alternative

hierarchies.

•

Restricted dimensional focus on accounts. Within a business dimension, it must

be possible to restrict which dimensions apply to what accounts. For example,

sales may be dimensioned by product or line of business, but the balance sheet

items may just be collected at an organizational unit level.

•

Support for different measure types. Measures can be both financial and non-

financial. Measures like ratios must not be consolidated while non-financial

measures, like headcount, should not be converted to a base currency. The system

also needs to understand the difference between P&L and balance sheet type

measures which are then used to correctly calculate year-to-date totals in both

reports and ad hoc analyses.

•

Support for natural signs. Essential for any financial account is the

understanding of debits and credits. This information should be used in reports and

ad hoc analyses to produce better/worse variance reporting.

•

Support for open/closing balances. Some measures may be defined as

“opening balances.” These should be automatically populated from the appropriate

closing balance.

•

Support for currency reporting. Often there is a need to support multiple

currency perspectives for global planning and reporting. The database must be

able to translate accounts at different rates, detect and calculate exchange

gains/losses, and then consolidate the results into a base currency or currencies. It

must also be able to convert measures at multiple sets of rates and allow the

comparison of results to assess the affects of exchange fluctuations.

•

Level of detail intelligence. Different MPC processes require different levels of

detail. For example, strategic plans may occur at a divisional level, budgets at a

departmental level, and actuals are collected by product, customer, etc. Where the

level of detail coincides, it should be possible to compare data directly.

12 Comshare, Inc.

Financial intelligence is a fundamental requirement of an MPC solution. If any part is

missing, it will need to be programmed, requiring more time and effort to set up and

maintain an application – and reliance on the skill of the administrator. Embedded financial

intelligence not only saves time and effort, but it ensures end users have the right answers.

As users manipulate data within the database for their own ad hoc analyses, the system

correctly processes debits/credits, profit and loss (P&L), and balance sheet accounts, so

that the answers portray the right meaning, i.e. analyses will display the right variances,

currency values, and summations across periods.

Rule 4: Unrestricted Rules

The business rules should be able to access any item (measure or dimension member

including consolidation points) in the database. The MPC software must be capable of

carrying out data consolidation several times over.

By allowing these types of rules, the system can cope with a range of requirements that

would otherwise be impossible. This includes allocations and the calculation of minority

interests. The benefits are, from a management view, realistic views of results, and from an

administration point of view, easier setup and maintenance.

Rule 5: Time Intelligence

An MPC solution must have the capability and intelligence to handle various measures of

time that meet process, reporting, and other needs. There are a number of issues with

time:

•

Accounting cycle. The system should allow financial accounting cycles of any

length (quarters, months, weeks), and store data for any length of time (past and

future years).

•

Restricting measures. There must be some way to restrict the periods to which

measures apply. For example, some can occur on a weekly basis while others may

apply to a month or a quarter.

•

Relative referencing of periods. The system should handle rolling budgets. It

should be possible to reference a period by an offset (e.g. July 2000 + 6 months)

and correctly assign the appropriate month and year (e.g. January 2001).

•

Smart YTD totals. The system should generate YTD figures without having to set

rules and automatically handle P&L and balance sheet type accounts.

•

Support for current period indicator. To save time on maintenance, there must

be some way of telling the system about the current reporting period that then

changes all the reports and analyses to focus on that period.

This intelligence makes systems much easier to set up and allows them to cope with the

move to continuous planning. It also means that the system does not need any special

processing as the organization moves from one year to the next, and reports need no

maintenance from one period to the next.

Comshare, Inc. 13

Analytical Capabilities

Rule 6: Communication and Collaboration

Security permitting, users should be able to access data online in any time period/version

without advance notice, i.e. not as part of a pre-configured report. Users should be able to

view and analyze data across any appropriate dimensions, without limitations, such as by

initiative, product, line of business, etc. They must also be able to rotate and nest

dimensions as well as drill down to lower levels of detail within the model. These drill-

downs should use the most current structures. When the lowest level of the business model

is reached, drill-downs should be capable of going back to the underlying data source.

End users must also be able to produce their own unrestricted (security permitting)

analyses such as ranking, sorting, charts, and ad hoc calculations. Capabilities to save

analyses, and recall them later with the latest data, should be provided.

This capability significantly strengthens the way people work together, as they share their

knowledge, handle opportunities, and fulfill the company’s strategy using the MPC solution.

They see greater benefits to the system and the effort finance has to put in to support

them. Users can produce their own analyses simply and without finance’s support, so they

are not restricted in terms of data or access to suitable personnel. Finance no longer has to

produce and maintain numerous “one-off” reports and analyses, and can concentrate on

commenting on the results.

Rule 7: Guided Analysis

MPC systems should focus users’ attention on exceptions and provide tools to guide them

through those variances in detail. By investigating what is not normal and routine, users

can develop more insightful analyses.

Users should automatically be alerted to exceptions that would otherwise go undetected.

Examples of exception techniques include:

•

Broad-based exceptions: Areas of an organization that exhibit out-of-line

performance can be highlighted hierarchically according a product line or

organization structure, or geographically based on global locations.

•

Detailed exceptions at a summary level: These exceptions appear on

summaries to warn users that, although the summary may be within limit, there is a

detailed member at a lower level who is outside the accepted level, but offset by

someone who is above.

•

Software agents: This function performs routine surveillance of the database,

given the parameters or criteria set by an individual user. When something is found

that meets a user’s criteria for a problem area in the data, that finding is

automatically reported back to the user.

It is far too easy for end users to waste time looking through a sea of data and never spot

the significant issues. These techniques ensure that users’ attention is focused on the

issues, and there’s no wasted time looking for issues that don’t exist. So users have more

time to assess what the exceptions mean to the business and formulate what actions they

should take.

14 Comshare, Inc.

Technology

Rule 8: Web Architecture

To support efficient, broad deployment across the enterprise, an MPC solution should be

fully Web-architected. This means that users – whether budget holders, budget controllers,

business managers, or executives – must be able to access the system and the

appropriate functions through a Web browser.

It should be possible for any user to be free from both location and machine when using the

system. They should be able to use any machine, from any location, providing it has a

suitable Web browser and there is a suitable connection to the system. No other software

should be required.

The Web interface should allow setting up a complete MPC portal where users can access

and easily integrate information from virtually any source or Website.

The Web brings five significant benefits to the planning process. First, it is an intuitive

environment that enables users to access and share information from a variety of sources

without having to learn the technologies involved. Second, systems can be deployed to

large user populations with little effort and at a very low cost. Third, it eliminates the need to

distribute the application to each person’s computer, ensuring that everyone uses the same

version. Fourth, any changes are instantly and automatically distributed to those users,

which greatly improves integrity. Finally, users are not restricted to a machine or location,

which frees them to access the system anywhere at any time.

Rule 9: Central Database Employing Scalable, Mainstream Technology

MPC applications are built on top of a central database rather than using proprietary file

structures that are common in many of today’s systems. All users get information from this

database to plan, budget, report, and analyze. This database makes use of mainstream

relational technology for scalability and robustness, although for smaller applications OLAP

databases can also be applied. According to the Dataquest (1999) market analysis, the

world’s leading mainstream relational technologies are those from IBM, Oracle, and

Microsoft. These technologies:

•

Are highly scalable

•

Handle very large numbers of users

•

Support advanced security systems

•

Easily integrate with existing ERP and transaction-based systems

A central database greatly improves data integrity and accuracy. Other key benefits include:

•

Discontinuing the need to collect results, because as soon as data is entered, it is

immediately available for consolidation and analysis.

•

Moving data between applications is not required, so there are no links to maintain.

•

Making changes only once – everyone gets instant access to those changes.

Comshare, Inc. 15

Using the same technology that is already in place also helps organizations maximize the

huge investments already made in infrastructure. Companies get more application value

with less implementation and training costs for their IT staff.

Conclusion

A comprehensive MPC software application enables the processes of planning, budgeting,

reporting, and analysis for everyone who relies on it. It transforms data from an

organization’s transaction-based or ERP systems into business-critical information that can

be used to make sound planning and management decisions. With a single MPC solution,

companies can simultaneously link strategic plans, operational budgets, and actuals to

forecasts with unrestricted analysis capabilities, thereby eliminating a large source of data

integrity problems and unproductive time.

An MPC system also allows finance departments to become business partners on several

important levels. Finance staff is able to spend more time performing the high-value

activities of planning and analysis. Management has ready access to the rationale and

assumptions behind the budget and forecast numbers, thus avoiding misunderstandings

that are often frustrating and unproductive. Executives can better drive strategy and

management initiatives by ensuring the allocation of resources in support of the strategic

plan. An improved planning process ensures organizational buy-in, which can result in

greater accountability. Budget holders have a more thorough understanding of the strategy

and ready access to targets, so they better understand what is expected of them and how

they are being measured. Ultimately, everyone benefits from savings in time and effort

through a streamlined system that removes the drudgery and makes communication and

collaboration easier.

16 Comshare, Inc.

Sources

Business Finance (2000, July). “Finance Managers on the Wrong Track,” p. 10.

Dataquest (1999, March 29). Worldwide DBMS Preliminary Market Statistics: 1998.

Stamford, CT.

GartnerGroup (1998, Nov. 3). Financial Business Intelligence Applications. Stamford, CT.

GartnerGroup (2000, April 22). The New Wave of Best-of-breed Financial Applications.

Stamford, CT.

GartnerGroup (1999, Sept. 13). Administrative Applications: Around the Edges. Stamford,

CT.

Hackett Benchmarking Solutions (2000). The Book of Numbers: Planning and

Performance Measurement. Hudson, OH.

Malone, T. W. & Rockart, J. F. (1992). Information technology and the new organization.

Proceedings of the 25

th

Hawaii International Conference on System Sciences, Vol. 4 (pp.

636-643). Washington, DC: Institute of Electrical and Electronics Engineers.

In North, Central

and South America:

Corporate Headquarters

555 Briarwood Circle

Ann Arbor, Michigan 48108 USA

telephone 1.800.922.7979

telephone 1.734.994.4800

fax

1.734.769.6943

info@comshare.com

Comshare is represented in more than 35 countries worldwide.

In the United Kingdom

and in other countries:

European Operations

22 Chelsea Manor Street

London SW3 5RL England

telephone +44 (0)20 7349 6000

fax

+44 (0)20 7376 5058

info@comshare.com

Comshare is a registered trademark of Comshare, Inc. All other products are the property of their respective holders.

Serial Number 040.01.0800 Copyright © 2000 Comshare, Inc. Printed in the U.S.A.

www

•

comshare

•

com

Wyszukiwarka

Podobne podstrony:

Monitoring and Controlling the Project

101 Project Management Problems and How to Solve Them 2011

The Social Processes in Urban Planning and Management

w aaaa1904 Microsoft Excel or Microsoft Project Why Microsoft Office Project 2007 is Easier and Mor

Marijuana is one of the most discussed and controversial topics around the world

P4 explain how an individual?n exercise command and control

Power Converters And Control Renewable Energy Systems

Causes and control of filamentous growth in aerobic granular sludge sequencing batch reactors

What is command and control

2009 6 NOV Small Animal Parasites Biology and Control

Active Sub Woofer and Controller

[0] Step Motor And Servo Motor Systems And Controls

foc im and control by sliding mode

ACCA F5 Performance Management Practice and Revision Kit BPP Learning Media

Matlab Tutorial for Systems and Control Theory (MIT) (1999) WW

How to Persuade and Influence Your Managers Colleagues and Employees

The man The intelect and emotion Knowledge and thinking (122)

9781933890517 Chapter 5 Project Scope Management

więcej podobnych podstron