IMAG0774

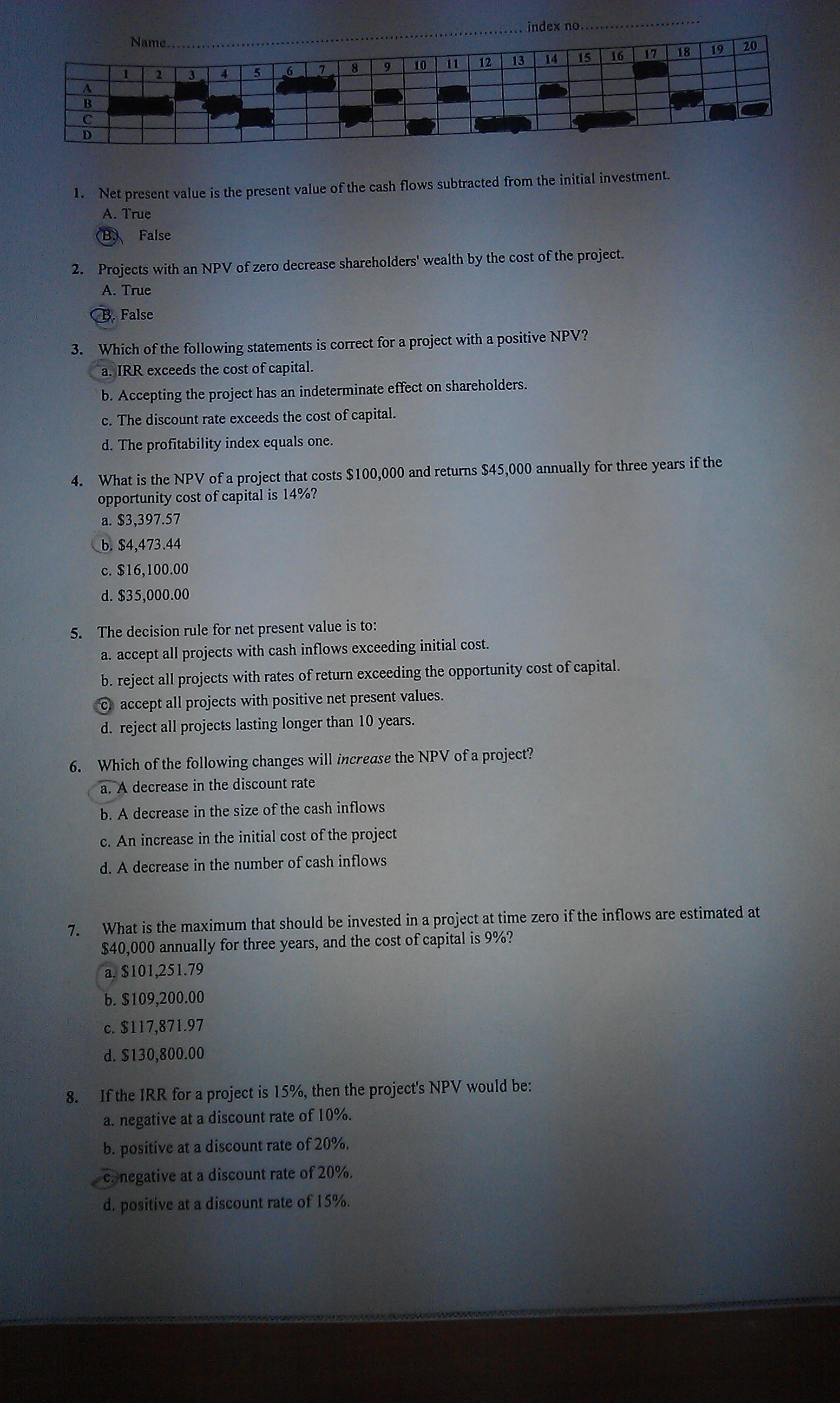

I. Net present value is the present value of the cash flows subtracted from the initial in vestment.

A. True False

2. Projects with an NPV of zero decrease shareholders' wealth by the cost of the project.

.>s A. Trixe

False

3. Which of the fbllowing statements is correct for a project with a positive NPV? fa^IRR exceeds the cost of Capital.

b. Accepting the project has an indeterminate effect on shareholders.

c. The discount ratę exceeds the cost of Capital.

d. The profitability index equals one.

4. What is the NPV of a project that costs $ 100,000 and retums $45,000 annually for three years if the opportunity cost of Capital is 14%?

^^397.5^

<3^4,473.44

||E $p%100.00

d. $35,000.00

5. The decision rule for net present value is to:

a. accept all projects with cash inflows exceeding initial cost.

b. reject all projects with rates of return exceeding the opportunity cost of Capital.

Q accept all projects with positive net present values.

d. reject all projects lasting longer than 10 years.

6. Which of the following changes will increase the NPV of a project? r'aTA decrease in the discount ratę

b. A decrease in the size of the cash inflows

c. An increase in the initial cost of the project

d. A decrease in the number of cash inflows

7. What is the maximum that should be invested in a project at time zero if the inflows are estimated at $40,000 annually for three years, and the cost of Capital is 9%?

/a| $101,251.79

b. $109,200.00

c. $117,871.97

d. $130,800.00

8. If the IRR for a project is 15%, then the projecfs NPV would be:

a. negative at a discount ratę of 10%.

b. positive at a discount ratę of 20%.

<£^negative at a discount ratę of 20%.

d. positive at a discount ratę of 15%.

Wyszukiwarka

Podobne podstrony:

Grammar 9 TASK 4 What is the difference in meaning between (a) and (b) below? la My brother, who is

image002 ORBIT 8 is the latest in this unique series of anthologies of the best new SF. Fourteen sto

MEDECINS SANS FRONTIERES YOU THINK This is the design in development for the

7THE FIRST FLOOR Is approached by an exceptionally fine MASSIVE OAK STAIRCASE which is the feature i

17 Plant metaphors for the expression of emotions THE HEART IS THE SOIL. In this interpretation, dee

ZDIĘCIA0092 I can ujz diffcrtti fbrnu of tUz passlvt. 1 What is the book in the photo? Read the text

Where is the Substrate in the Germanie Lexicon?ROLAND SCHUHMANN Ntun di Science kctwccn both appłoae

12 3 4 The blue egg is the tree. r in The yellow egg is the nest. on The pink egg is the

Roles in the?mily 2 Look at the questions below. What is the situation in your country and why? Is i

strona@ (4) Listening 3 1 Discuss. 1 Where is the place in the&n

What is the problem, in codę? A Unit5,999 miles V_1_v_/ A Ouantity int distance = 5999; //in miles f

12 3 4 The blue egg is the tree. r in The yellow egg is the nest. on The pink egg is the

00082 ae3029ab37e06a00bafcfcfbbff716 81Adaptive Hierarchical Bayesian Kalman Filtering There is al

00219 a6d333666646e915e39fbc117115f5 221 Applications of the EWMA The Control Algorithm In this al

00344 ?901c63c87335b6f7bf31c8dbbac4a5 348 Prairie & Zimmer ąuality. The purpose of the plans pr

7. Opublikowane badania własne / One! et of. / falonro 138 (2015) S4-70 rcsponse variable. and y, is

więcej podobnych podstron