3784495972

BANK I KREDYT styczeń 2008

11

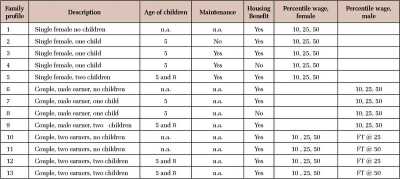

one adult eamer. In the case of conples, for profiles 6-9 it is assumed that one of the partners (tlie wife) does not work and inconies are compnted for different work intensity of the mail, while for profiles 10-13 we assinne that the mail works fnll-time and inconies are computed at different work intensity oł the second eamer (the womaii). The difference hetweeu profiles 10 and 11 as well as 12 and 13 is the assnmed income of the mail at fnll-time honrs. In the case of profiles 10 and 12 we assinne that his honrly wagę corresponds to the 2511' percentile of małe eamings, while in the case of family profiles 11 and 13 to the 5011' percentile of małe eamings.

Apart from assnmptions coiicerning individnal wages an aualysis based on stylised families also reqnires the choice of other parameters which influence the level of disposable income these families will have at specific levels of work intensity. In particular, we have to make assnmptions coucemiug the level of housiug costs (for the łamilies eligible to receive housiug beuefits), and the level of maiiitenance received from the absent parent (in the case of lone parents). In all these cases - similarly to the level of assumed iudividual wages - we choose to focus on families whose inconies and wealth are relatively Iow and set the levels of these parameters at the 25**1 percentile of respective country-specific distnbutions. The assnmptions we make coiicerning these parameters together willi the Information on the mdividual wagę are provided in Table 2.

4. Comparing financial incentives to work - the UK, Germany and Poland

The aiin of the artide is to present the conseąueuces the tax and beuefit systems in the three couutries have on disposable inconies of the selected families. We do tlns by means of computing disposable inconies at different intensity of work, which is represeuted bv different munbers of honrs worked per week. This gives us family-specific budget lines and allows ns to calcnlate rcplaccnicnt ratios at different work intensity. In each case the budget coustraints are drafted for the honrs rangę of 0-45 for one eamer. In cases of conples we first draw the budget lines for the different mnnber of honrs worked by the mail, i.e. assuiuing that the womau does not work (family profiles 6-9), and theu for the woman, assuiuing that the mail works fnll-time (family profiles 10-13). At each liour point the budget lines show the disposable income of the family at this specific work intensity. Budget coustraints for the 13 family profiles are presented in Fignres 1 to 13. In the case of each Figurę we show the resulłs for the UK (pauels A and B), Germany (panels C and D) and Poland (panels E and F). For every country the first panel (panels A, C, E) shows the different components of the budget constraiut drafted uuder the assumption of the 25*' percentile of the małe (family profiles 6-9) or female (profiles 1-5 and 10-13) country specific wagę distributiou. The second panel (panels B, D, F) shows ouly the total disposable inconies but under three different assumptious coucemiug the iudividual wagę (i.e. the 1011', 25lh and 50lh percentile of the distributiou). Detailed description of Fignres 1 to 13 is given in Sectiou 5.

A useful way of sununarisiug the effect of the tax and beuefit system on the iucentives to work is an aualysis of replacement ratios (RRs), which are ratios of disposable income in the out-of-work scenerio to the disposable income in the in- work sceuario.12 This is done below in 12 Sec for ooimplc Nicfcell (2001).

Wyszukiwarka

Podobne podstrony:

BANK I KREDYT styczeń 2008Microeconomics 19 refereuce to assets in Ihe fonu of au iufonnal assessmeu

CHAPTER I 11 86230 deprivation, and in the case of raclal discriraination), or be due (or reinforced

BANK I KREDYT styczeń 2008Microeconomics13 bars, maiuteuauce paymeuts front the absent partner are m

BANK I KREDYT styczeń 2008Microeconomics 15 incomes or in sonie cases no increases at all (i.e. 100%

BANK I KREDYT styczeń 2008Microeconomics17 Table 3. Fteplacement rat im at part-Ume work (20 hotirs

BANK I KREDYT styczeń 2008Microeconomics 5 Taxes, Benefits and Financial lncentives toWork:The

BANK I KREDYT styczeń 2008Microeconomics 7 2.1. The United Kingdom Income taxation The taxatiou syst

BANK I KREDYT styczeń 2008Microeconomics 9 in full-time educatiou. For the first 3 childreu the beue

236 United Nations — Treaty Series ..... 11 * b1972 2. In the negotiation of prices for the sale of

calibre cover Book One in the Talcs of thc Fkog PkinCess IT E. D. BAKER.

28Polityka Pieniężna BANK I KREDYT styczeń 2003Cykl koniunkturalny a zmiany realnego kursu

10 Mikroekonomia BANK I KREDYT styczeń 2008 the SLP was by far the most commouly received (0,7 milli

12 Mikroekonomia BANK I KREDYT styczeń 2008Table 2. Country specific inputparameters used tor

14 Mikroekonomia BANK I KREDYT styczeń 2008 eligibility to tlie HB does uot eud eveu iu the situatio

16 Mikroekonomia BANK I KREDYT styczeń 2008 Germany and Polaud by additioual payments iu tbe form of

18 Mikroekonomia BANK I KREDYT styczeń 2008 that at tliis level of earuings both partuers are taxed

więcej podobnych podstron