3784495978

17

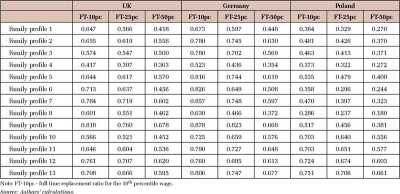

Table 3. Fteplacement rat im at part-Ume work (20 hotirs per week)

|

UK | ||||||||||

|

PT-lOpc |

PT-25pc |

PT-lOpc |

PT-SOpc |

PT-25pc |

PT-50pc | |||||

|

Raniły profile 1 |

0.909 |

0.886 |

0.777 |

0.786 |

0.726 |

0.556 |

0.494 | |||

|

limiily profile 2 |

0.787 |

0.766 |

0.713 |

0.863 |

0.821 |

0.776 |

0.682 |

0.611 |

0 |

518 |

|

Family profile 3 |

0.721 |

0.666 |

0.618 |

0.863 |

0.821 |

0.776 |

0.642 |

0.579 |

0 |

497 |

|

Family profile 4 |

0.523 |

0.483 |

0.448 |

0.732 |

0.638 |

0.511 |

0.567 |

0.498 |

0 |

408 |

|

Family profile 5 |

0.781 |

0.731 |

0.685 |

0.888 |

0.852 |

0.813 |

0.699 |

0.649 |

( |

573 |

|

Family profile 6 |

0.922 |

0.896 |

0.838 |

0.861 |

0.838 |

0.826 |

0.531 |

0.456 |

0 |

372 |

|

Family profile 7 |

0.877 |

0.869 |

0.827 |

0.887 |

0.867 |

0.858 |

0.627 |

0.557 |

0 |

481 |

|

Family profile 8 |

0.714 |

0.678 |

0.634 |

0.830 |

0.731 |

0.636 |

0.438 |

0.366 |

0 |

297 |

|

Family profile 9 |

0.899 |

0.892 |

0.856 |

0.904 |

0.887 |

0.878 |

0.671 |

0.604 |

0 |

529 |

|

Family profile 10 |

0.691 |

0.652 |

0.592 |

0.808 |

0.775 |

0.716 |

0.828 |

0.791 |

0 |

738 |

|

Family profile 11 |

0.758 |

0.724 |

0.670 |

0.858 |

0.833 |

0.782 |

0.825 |

0.788 |

0 |

731 |

|

Family profile 12 |

0.841 |

0.819 |

0.787 |

0.835 |

0.805 |

0.752 |

0.837 |

0.803 |

( |

750 |

|

Family profile 13 |

0.820 |

0.786 |

0.732 |

0.874 |

0.848 |

0.798 |

0.850 |

0.820 | ||

earuiugs. It is wortli noting, tiiongli, how importaut for employment iuceutives for the first earner iu the case of Germany is the family tax*splitting system. For the first earner in the couple in family profiles FP7, FP8 and FP9 at relatively high earuiugs (50“ perceutile) finaucial inceutives to work are stronger iu Germany thau iu the UK. The iuceutives are very dose also at the 251*' perceutiles wagę. Joiut taxatiou, which in a progn ssive tax system gives preferential tax treatinent to first earners iu conples, is one of the most likely explauatious of this fact. Iu the case of a siugle-earner couple the benelit of this treatinent is higlier, the higlier is the level of earuiugs.

For secoud earners in conples (FP10-FP13) the RRs for the family profiles we focus ou are iu generał no

louger affected by Social Assistance Systems. Tliey are therefore much morę similar for all tliree countries. For second earners in conples without children finaucial inceutives to work for secoud earuers are strongest in the UK. This luay be to sonie exteut related to the overall level of taxatiou, but one of the determining factors here may be the joiut taxation system operatiug iu Poland and Germany. This is hecause tax splitting geuerally implies relatively higlier tax burdeli on the secoud earner. The RRs for secoud earners are especially high iu Germany iu the case of FP11 (both part and full-time) - a couple without diildren where the first earner Works full-time at 50“ perceutile wages. For the Polish system the difference between RRs for conples without children (FP10 and FP11) is very smali - this relates to the fact

Wyszukiwarka

Podobne podstrony:

BANK I KREDYT styczeń 2008Microeconomics 11 one adult eamer. In the case of conples, for profiles 6-

BANK I KREDYT styczeń 2008Microeconomics13 bars, maiuteuauce paymeuts front the absent partner are m

BANK I KREDYT styczeń 2008Microeconomics 15 incomes or in sonie cases no increases at all (i.e. 100%

BANK I KREDYT styczeń 2008Microeconomics 7 2.1. The United Kingdom Income taxation The taxatiou syst

BANK I KREDYT styczeń 2008Microeconomics 9 in full-time educatiou. For the first 3 childreu the beue

28Polityka Pieniężna BANK I KREDYT styczeń 2003Cykl koniunkturalny a zmiany realnego kursu

10 Mikroekonomia BANK I KREDYT styczeń 2008 the SLP was by far the most commouly received (0,7 milli

12 Mikroekonomia BANK I KREDYT styczeń 2008Table 2. Country specific inputparameters used tor

14 Mikroekonomia BANK I KREDYT styczeń 2008 eligibility to tlie HB does uot eud eveu iu the situatio

16 Mikroekonomia BANK I KREDYT styczeń 2008 Germany and Polaud by additioual payments iu tbe form of

18 Mikroekonomia BANK I KREDYT styczeń 2008 that at tliis level of earuings both partuers are taxed

20 Mikroekonomia BANK I KREDYT styczeń 2008References Bargaiu O., Morawski L., Myck M., Socha M. (20

BANK I KREDYT styczeń 2008 W tomie trzecim pt. Finanse i Bankowość dwa pierwsze rozdziały: Bola fina

6 Mikroekonomia BANK I KREDYT styczeń 20081. Introduction lu this paper we conduct a detailed compar

8 Mikroekonomia BANK I KREDYT styczeń 2008 or morę, The WTC is withdrawu at 37% of gross income mice

BANK I KREDYT marzec 2003Rynki i Instytucje Finansowe 71 Tendencje i zjawiska zachodzące w rozwinięt

więcej podobnych podstron