France Country Report

February 2008

1

CONTRACT

SI2.ICNPROCE009493100

IMPLEMENTED BY

FOR

DEMOLIN, BRULARD, BARTHELEMY

COMMISSION EUROPEENNE

- HOCHE -

- DG ENTREPRISE AND INDUSTRY -

Study on Effects of Tax Systems on the Retention

of Earnings and the Increase of Own Equity

Jean ALBERT

Team Leader

- ANNEX 10 -

- FRANCE -

- COUNTRY REPORT -

Submitted by Serge CASTILLON/Isabelle COURBIÈRE

Country Expert

February 15, 2008

France Country Report

February 2008

2

Mazars & Guérard

Serge Castillon/Isabelle Courbière

Exaltis

61 rue Henri Regnault

F – 92075 Paris La Défense Cedex

France

Tel 00 33 1 49 97 62 83

INTRODUCTION

At the current time, there are no particular obstacles for the retention of earnings in

France, unless thin-capitalization regime. Then distributions of earnings appear more

favourable.

Possible solutions to promote retained earnings in order to strengthen the capital

base of enterprises, especially small enterprises could be:

- to introduce a dual income tax system, which would split the tax base for profits

into two components. Those components would be taxed at different rates with one

lower rate based on the equity invested into the Undertaking. Such a tax treatment

did exist in France before 2001, but its effects were too limited because of the "avoir

fiscal" tax credit.

- concomitantly, to increase the level off which SMEs could benefit of the reduce

corporate tax rate of 15 %; as €38,120 of profits seems to be unsufficient.

FRANCE

France Country Report

February 2008

3

PART 1 – GENERAL QUESTIONS

1. What are the main characteristics of the tax systems applicable on enterprises

and business owners in your Country (corporate income tax, income tax,

capital gains tax, other profit based taxes, capital based taxes, other taxes)?

Corporate income tax

Rates (see "Code General des Impôts" i.e French Tax Code, in art 219 I, b).

Corporate Income Tax (CIT) rate: 33

1/3

%.

Reduced rate of 15 % on the portion of company’s profits less than € 38,120 if

certain conditions are met, including the turnover of the company (less than €

7,630,000) and the shareholding of the company (at least 75 % of the company is

owned by individuals or by companies that are at least 75 %- owned directly by

individuals)

Additional tax (social security surtax – CGI, art 235 ter ZC) at the rate of 3.3 % is

imposed on the portion of corporate tax due exceeding € 763,000 and if the

turnover exceed € 7,630,000 and if the shares aren’t owned at least 75 % by

individuals (or by a company owned directly owned at least 75 % by individuals).

Taxation of branch: as well as French companies

Net losses

-

Carry back: previous three fiscal year

-

Carry forward: unlimited

Scope

-

Taxable entity

France Country Report

February 2008

4

Legal entity according to their legal form or according to their activities.

-

Registration

French companies are those registered in France, regardless the nationality of

the shareholders or where the company are managed and controlled.

-

Territoriality

French tax system is based on a territorial principle. The income raised from

businesses carrying on out of French will not be taxed in French, excepted if

activities are located in a tax haven (anti-fraud tax measures).

Determination of the corporate income

Taxable income is a net income (gross income minus expenses related to

activities and allowed to deduct) based on an accurate account basis.

Certain adjustments apply to financial statement for obtaining the fiscal

statement according to prevailing law.

Capital gain tax

-

Rates

Capital gains rate: 33 1/3 % (CGI, art 209-I and 219)

Two reduced rates: 15 % and 0 % (as from 2007). For 2006, 8 %

French system is based on the distinction short-term capital gain and long-term

capital gain (CGI, art 39 duodecies, 72 and 93 quater).

-

Short-term capital gain

Gains are taxed as an ordinary income (rate : 33 1/3 %)

France Country Report

February 2008

5

-

Long-term capital gain

Taxation at a reduced rate: Company: 0 % (as from 2007, 8 % in 2006) or 15 %,

depending on the transferred assets

Administration

A tax return must be filed at least once a year

Minimum tax (Imposition forfaitaire annuelle) from CGI art 223 septies to

CGI, art 223 nonies

Taxable entities are subjected to a minimum tax which is based on the

turnover of the company.

Other significant taxes

-

Business activity tax (taxe professionnelle)

Based on annual rental value of tangible assets

Rate determined locally

Limited to 3.5% of the value added by the business

Individual Income Tax

Rates

-

Graduated tax range from 5.5 % to 40 % (CGI, art 197, I,1)

-

Flat-rate withholding of 16 % for capital gains

France Country Report

February 2008

6

-

Additional social contributions of 11%, applicable only for French residents.

Scope

-

Taxable persons

Individuals who have their fiscal residence in France according to the French

law or a tax treaty

-

Territoriality

Taxation based on worldwide incomes earned by individual

1.1. Corporate

1.1.1

What are the general principles for the computation of taxable

profits?

The taxation is based on a territorial principle (income raised from

businesses carrying on out of France will not be taxed in France,

excepted if activities are located or deemed located in a tax heaven)

Corporate income arises from all operations realized by the company,

included disposal of assets during the taxable year. As a result, profits

and losses, whatever is their source, are included in the tax result.

Likely accounting, taxable income is based upon an accrual basis. Debts

and liabilities are accounted for their face value.

Tax years are independent one from the others, debts and liabilities are

taken into account in the exercise from which they relate to.

The fiscal assessment is based on the financial statement prepared

according to generally accepted accounting principles, subject to

France Country Report

February 2008

7

certain adjustments. The various adjustments are mentioned on a

special tax form.

Tax losses may be carried forward indefinitely. In addition, enterprises

subject to corporate income tax may carry back (elected option) losses

against undistributed profits for the three preceding years. The carry

back results in a credit equal to the loss multiplied by the current

corporate tax rate, but limited to the amount of corporate tax paid

during the prior three years. The credit may be used to reduce

corporate income tax payable during the following years.

A significant change in the company’s activity may jeopardize the losses

carryover and carry back.

1.1.2

What are the main differences between the tax balance sheet and

commercial balance sheet?

Not applicable: under the French tax principles, there is only one type

of balance sheet which is the accounting balance sheet. The only

difference is the annexe.

1.1.3

What are the most important adjustments for the computation of

taxable profits/taxable gains on the base of accounting profits?

Reincorporation

External expenses

- Leasing of tourism motor vehicle: part of the royalty (included VAT)

equal to the no deductible depreciation calculated as if the company

was an owner.

- Lavish expenses provided by law : related to residence, yacht, hunting

and fishing

Taxes

France Country Report

February 2008

8

- Corporate income tax

- Tax on tourism motor vehicle

- Solidarity contribution : provision on current turnover

- Running costs : director’s fees exceeding legal amount allowed to

deduct

Financial expenses

- Interest paid on loans from direct shareholders (individuals):

o

No manager: interest are deductible to the extent that the share

capital is fully paid up and the interest rate does not exceed the

average interest rate on loans with an initial duration of more than

two years granted by banks to French companies.

o

Manager : double limitation :

Linked to the interest rate (as above)

Linked to the total amount paid : interest deductible to the

extent that they do not exceed 1.5 times the share capital

- Interest paid on loans from direct shareholders (corporate) or loans

granted by a related party

o

Related party: entity that holds directly or indirectly more than 50 %

of the borrowing company's capital; entity that manages de facto the

borrowing company; entity that is held directly or indirectly by a third

entity that itself also controls, directly or indirectly the borrowing

company.

o

To be excluded

Limitation does not apply if the interest expenses paid to

shareholders are lower than € 150,000

Bank

Under conditions, interest paid by a treasury pool under a

treasury agreement

Interest-bearing accounts payable

o

Limited rate: higher of the following:

Average interest rate on loans with an initial duration of more

than two years granted by banks to French companies.

Rate which could be obtained from independent financial

establishments

France Country Report

February 2008

9

o

Reincorporation if three cumulative limitations are exceeded

The company’s debt owed to all related parties exceeds 1.5

times its equity

Interest expenses exceed 25 % of net income exclusive of tax

and before the interest paid to related parties, depreciations

and quota of leasing

Interest expenses exceed interest collected from related

parties.

o

Tax treatment: non-deductible interest of one fiscal year may be

deducted in the following fiscal year, if the above limitations are

respected. The amount of deductible interest expenses which may be

carried forward is reduced by 5 % each year.

Exceptional expenses

- Gifts and liberality (limitation 5 p. Mille of annual turnover and tax

reduction of 60 %)

Capital allowances (depreciation)

- Tourism motor vehicles : fiscal basis : € 18,300 or € 9,900 if pollutant

motor vehicle, as from 1st January 2006

- Equipments rented or placed at the disposal of a company’s member:

limited to the difference between the received rent and the paid

expenses related to the equipment.

- Certain provisions (Decrease in the value of participation, retirement,

risk of change, mass dismissals)

“Participation des salaries”: based on the current tax year

Financial income

- Parent-subsidiary regime: 5 % portion of gross dividend income deemed

to cover the costs incurred by the dividend distribution. This amount

can be lower if the company establish the exact amount of the costs

incurred

Exceptional income

France Country Report

February 2008

10

- Net long-term depreciation

Deduction

Taxes

- Solidarity contribution: provision recorded the precedent year

- Losses carried back

- Research & development credit

Financial income

- Parent-subsidiary regime : net dividend income received from subsidiary

(French subsidiary or foreign subsidiary)

- Net long-term capital gain

1.2. Income

1.2.1. What are the general principles of income taxation of business

owners on business income, wages, distributed earnings, interest on

loans and capital gain (sale of shares)?

One-man business / sole proprietorship

Business income is taxed under the personal income tax. (CGI, art 8)

In determining the taxable income subjected to graduated tax, rules

concerning corporate income are generally applicable.

The main difference between the two regimes regards the long-term

capital gain.

Wages

Personal income tax

France Country Report

February 2008

11

Distributed earnings

As from 2006, dividend incomes are subjected to personal income tax

after a 40 % reduction on the gross basis and an additional annual fixed

allowance (€1,525 / € 3,050, respectively either unmarried or married)

A final 50 % tax credit calculated on the gross dividend incomes before

the two reductions above is granted. Its amount is limited to € 115 / €

230, respectively either unmarried or married

1.2.2. Is there a different tax treatment for income from different income

sources?

Yes,

Foreign income may be treated differently for tax purpose. Tax

treatment may depend to the provisions of the tax treaty between

France and the State from which the income arises (tax credit …)

France Country Report

February 2008

12

1.3. Capital

1.3.1. Is there a different tax treatment between distributions of earnings

and capital gains realised by the sale of the business or the shares

in the undertaking?

Parent-subsidiary regime (CGI, art 145 and 216)

As from 1

st

January 2007, tax treatment is a participation-exemption.

- Capital gains: exemption excepted on 5 % of the capital gain value

taxed at the standard rate of 33

1/3

%

- Dividend incomes: exemption excepted on 5 % of the gross dividend

income (amount could be lower if the company can establish the exact

amount of the costs incurred) imposed at the standard rate of 33

1/3

%

Portfolio investment

- Capital gains: 33

1/3

%

- Dividend incomes:

o

From French company: 33

1/3

% on the income value (no longer tax

credit)

o

From foreign company: 33

1/3

% on the income value including foreign

tax credit if provided with tax treaty

Individuals

- Dividend incomes: reduction of 40 %, than graduated tax from 5.5 % to

40 % + additional social contributions of 11 %

- Capital gains : flat-rate 16 % + additional social contribution of 11 %

France Country Report

February 2008

13

1.3.2. Are there different tax treatments for long-term capital gains and

short-term capital gains?

Partnership

The scope of long-term capital gains includes all fixed assets.

The long-term regime applies to the disposal of fixed asset retained

more than two years by the enterprise.

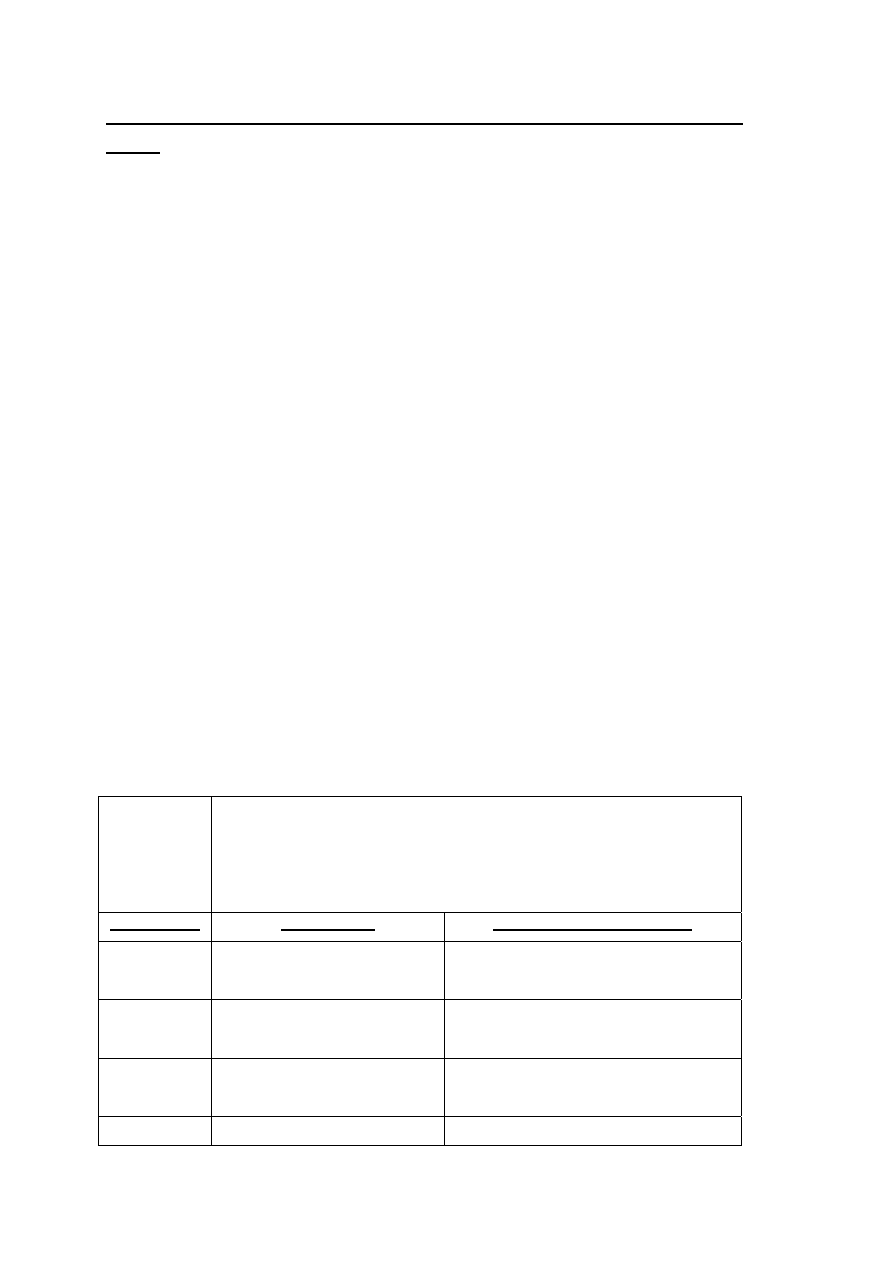

Capital gains

Capital losses

Duration of detention

Kind of assets

Less than 2 years More than 2 years Less than 2 years More than 2 years

Amortizable

asset

Short term

Short term to the

extent of the

deductible

depreciation

Long term

beyond

Short term

Short term

Unamortizable

asset

Short term

Long term

Short term

Long term

Net long-term

- Capital gains: reduced rate of 16 % (additional rate of 11 % applies for

French one-man business only)

- Capital losses can be offset against the net long-term capital gains

realized the following ten financial years

Net short-term

- Capital gain: business income subjected to graduated tax

- Capital loss: deductible expense, may be offset against ordinary income

and carried forward (following six years)

Real estate gain

France Country Report

February 2008

14

As from 1

st

January 2006, 10% allowance per year of detention beyond

fifth year

Special rules for small business

Exemption related to the turnover

Activity

Full exemption

Part exemption

Selling of goods

Housing

< € 250,000

€ 250,000< turnover < €

350,000

Exempted gain = gain x

(350,000 – turnover)/

100,000

Services

< €90,000

€ 90,000< turnover < €

126,000

Exempted gain = gain x

(126,000 – turnover)/

36,000

Exemption linked to the value of the sold assets

As from 1

st

January 2006, transfer of branch of activity or transfer of

one-man business may be exempted (condition of duration of activity:

five years)

Real estate gains are excluded

Full exemption: value of transferred assets used for registration duties

is less than € 300,000

Declining exemption if the value range from € 300,000 to € 500,000

Exempted gain = Gain x (500,000 – value of transferred assets) / 200,000

France Country Report

February 2008

15

Company

Short-term capital gain

Scope

Fixed assets, excepted shareholding qualifying for the parent-subsidiary

regime

Taxation

- Net short-term capital gains: taxed as an ordinary operating income at

the standard rate 33

1/3

%

- Net short-term capital losses can be offset against ordinary income

Long-term capital gains:

Scope

Participations eligible for the parent-subsidiary regime and income

derived from the licensing of patents or patentable rights

Taxation

Capital gains are subjected to a reduced rate

As from 2007, 0%: capital gains derived by parent companies from

disposals of qualified shareholding. A 5% portion on the value of the

capital gain is taxed at the rate of 33

1/3

%

Special rules for small companies

Exemption regime related to the value of transferred assets is also

applicable

France Country Report

February 2008

16

1.3.3. Are there different tax treatments for capital gain from SME

business stock and capital gain from larger companies’ business

stock?

No.

Capital gain from business stock is taxed at the standard rate 33

1/3

%

France Country Report

February 2008

17

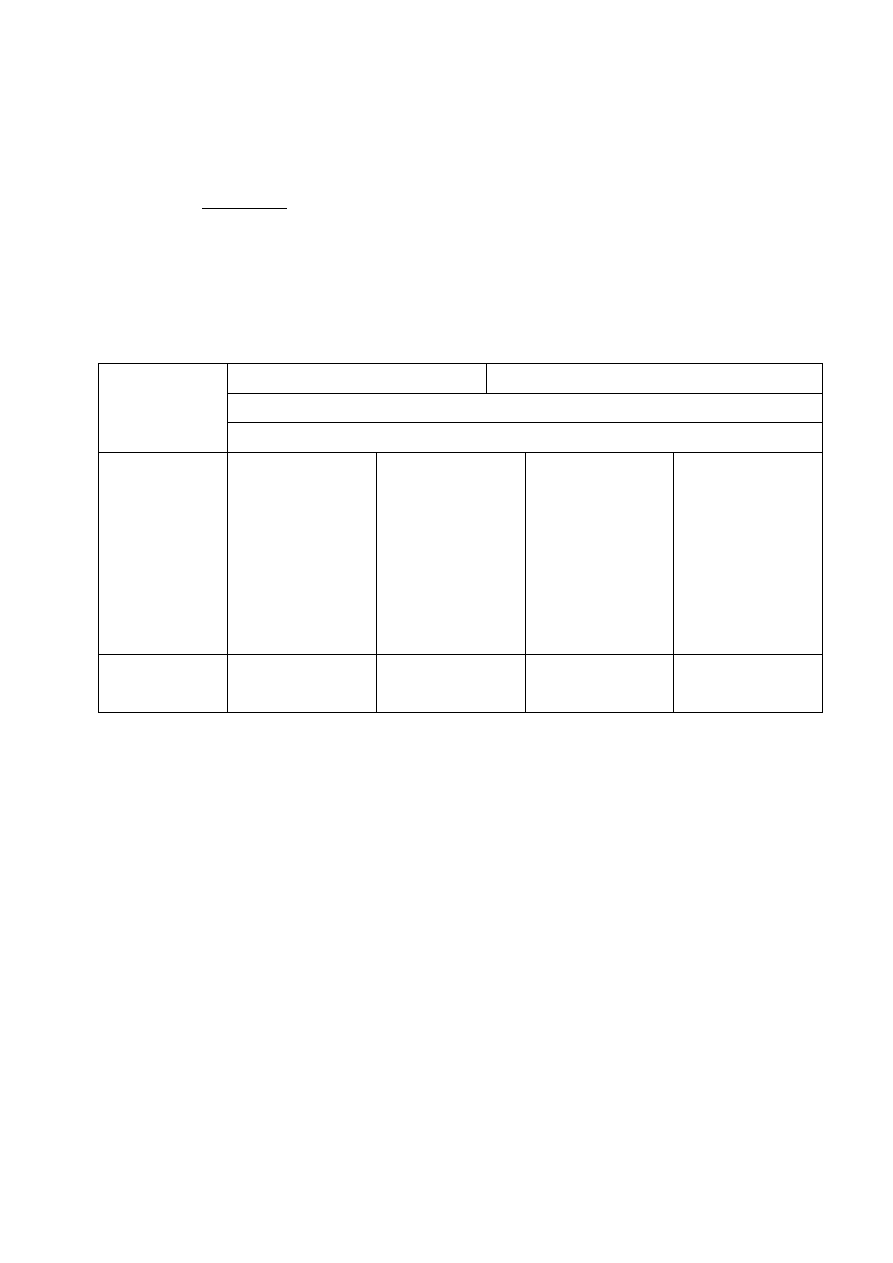

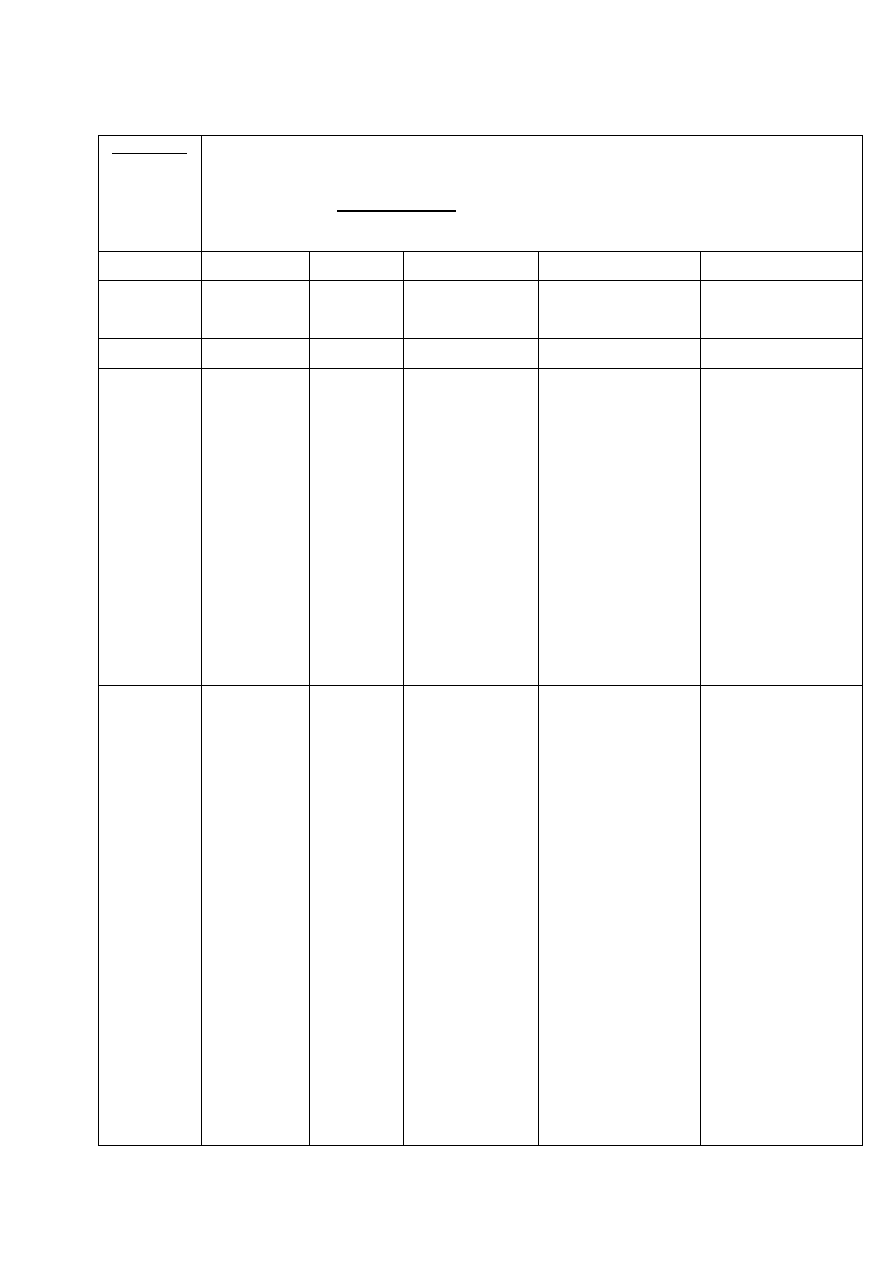

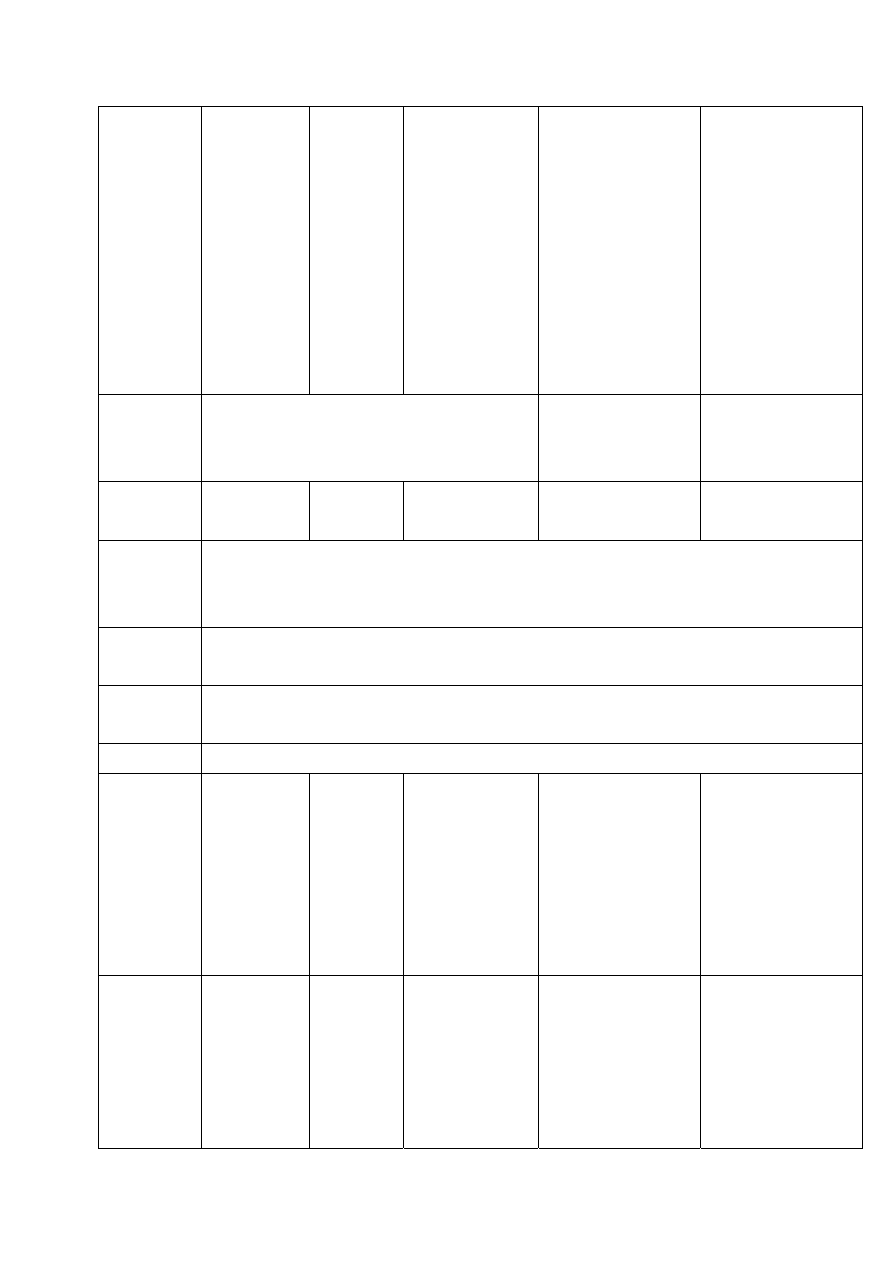

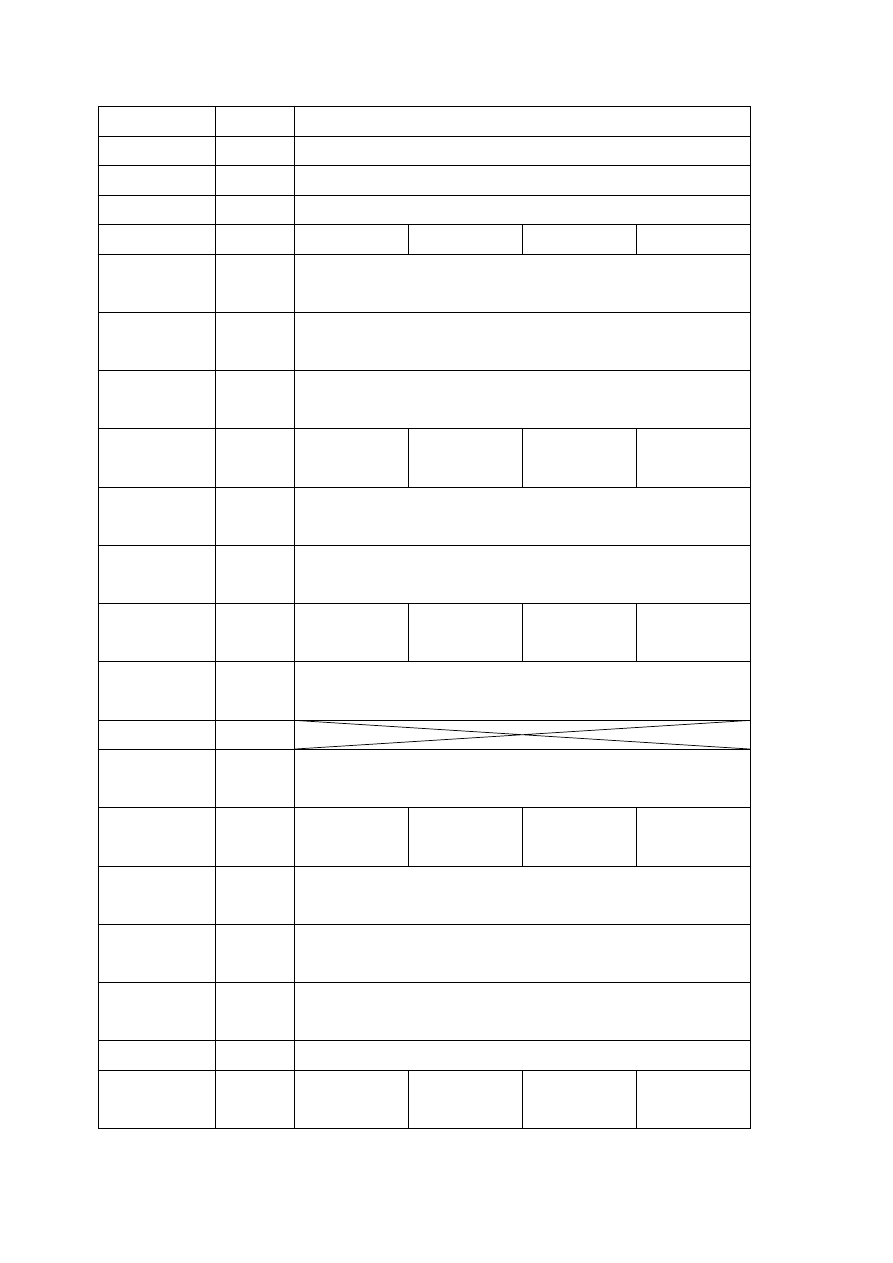

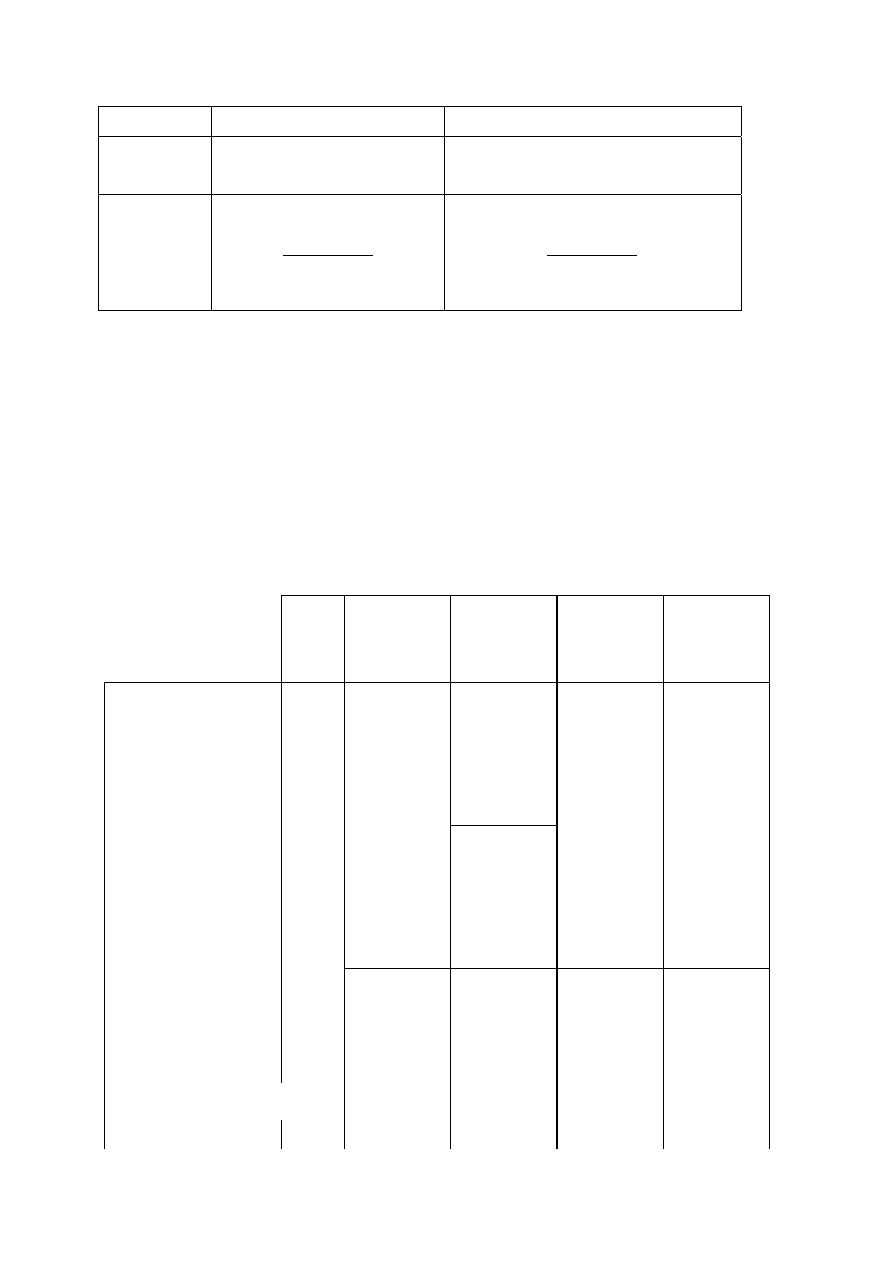

Country …

France

RELEVANT TAX PROVISIONS AND SUBSEQUENT CHANGES

FOR CORPORATIONS (distinguish specific tax rates for SMEs)

2002

2003 2004

2005

2006

Corporate

tax

1. Tax rate

Standard 33

1/3

Additional

tax: 3 % on

gross

corporate

income tax

33

1/3

Additional

tax: 3

%

on gross

corporate

income

tax

CIT: 33

1/3

Social security

surtax: 3.3 %

assessed on

corporate tax

exceeding €

763,000

Additional tax:

3 % on gross

corporate

income tax

CIT: 33

1/3

Social security

surtax: 3.3 %

assessed on

corporate tax

exceeding €

763,000

Additional tax:

1.5 % on gross CIT

CIT: 33

1/3

Social security

surtax: 3.3 %

assessed on

corporate tax

exceeding €

763,000

Additional tax has

been abolished

Reduced

15 % to €

38,120 of

SME’s

profits

(turnover

less than €

7,630,000

and at least

75% of the

enterprise

is owned by

individuals

or by

enterprises

which are

at least

15 % to €

38,120 of

SME’s

profits

(same

conditions

)

15 % to €

38,120 of SME’s

profits (same

conditions)

15 % to € 38,120 of

SME’s profits (same

conditions)

15 % to € 38,120 of

SME’s profits (same

conditions)

France Country Report

February 2008

18

75%-owned

by

individuals)

15 %:

licensing of

patents and

patentable

rights

15 %:

licensing

of patents

and

patentabl

e rights

15 %: licensing

of patents and

patentable

rights

15 %: licensing of

patents and

patentable rights

15 %: licensing of

patents and

patentable rights

Minimum

Tax

Based on the turnover of the company included VAT

Creditable against CIT due for the current year and the following

two years

Based on the

turnover of the

company, exclusive

of VAT.

Levied if turnover

up to € 300,000

Range from € 1,300

to € 110,000

Deductible expense

from financial

statement

Special

Rates

19 %

19 %

19 %

15%

8%: dividend paid

by subsidiary

eligible to parent-

subsidiary regime

Dividends paid by

qualifying

participation for

accounting purpose

15 %

Non profit

tax (local

tax on

corporation

s, energy

Business activity tax (“taxe professionnelle”):

On annual rental value of tangible assets; rate determined locally (limited to 3.5 % of

the value added by business)

France Country Report

February 2008

19

tax…)

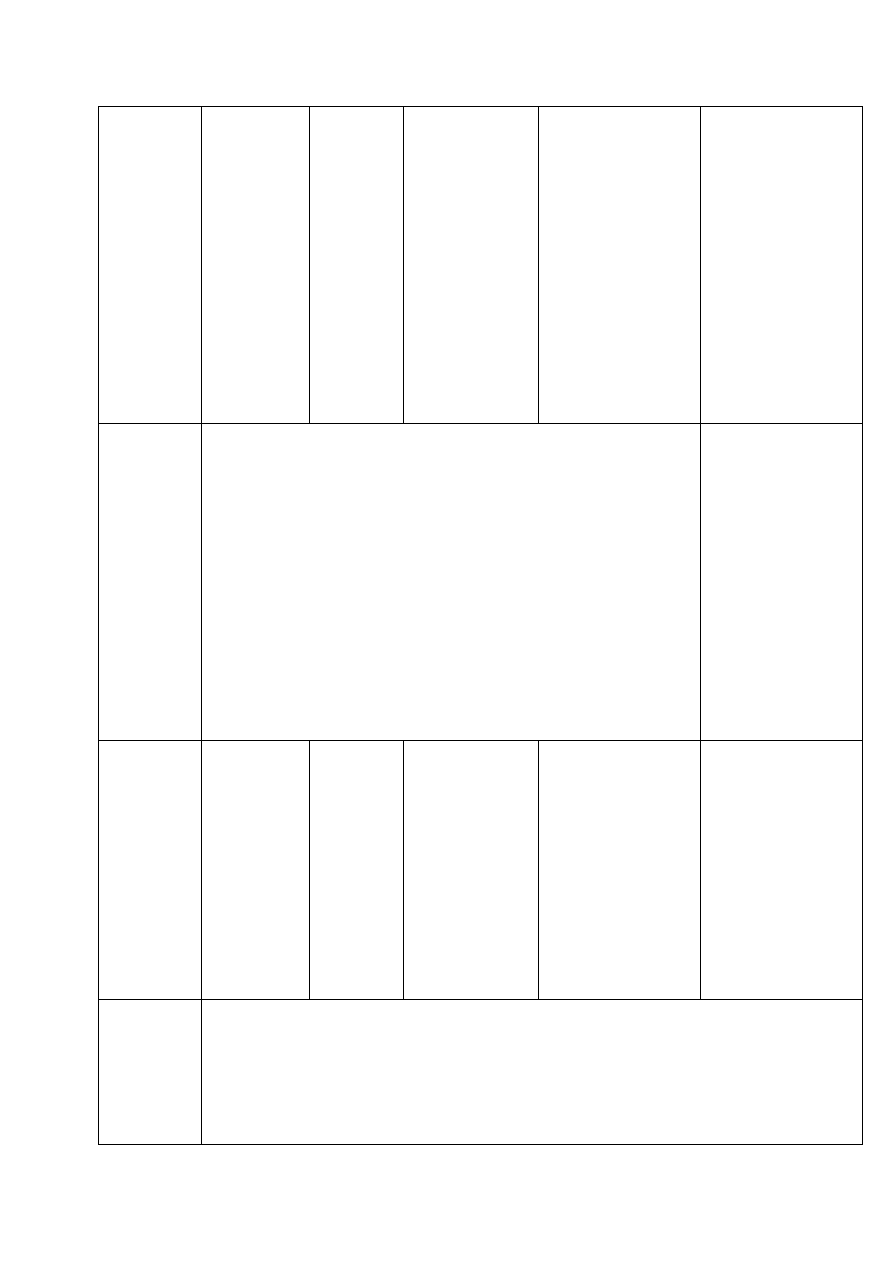

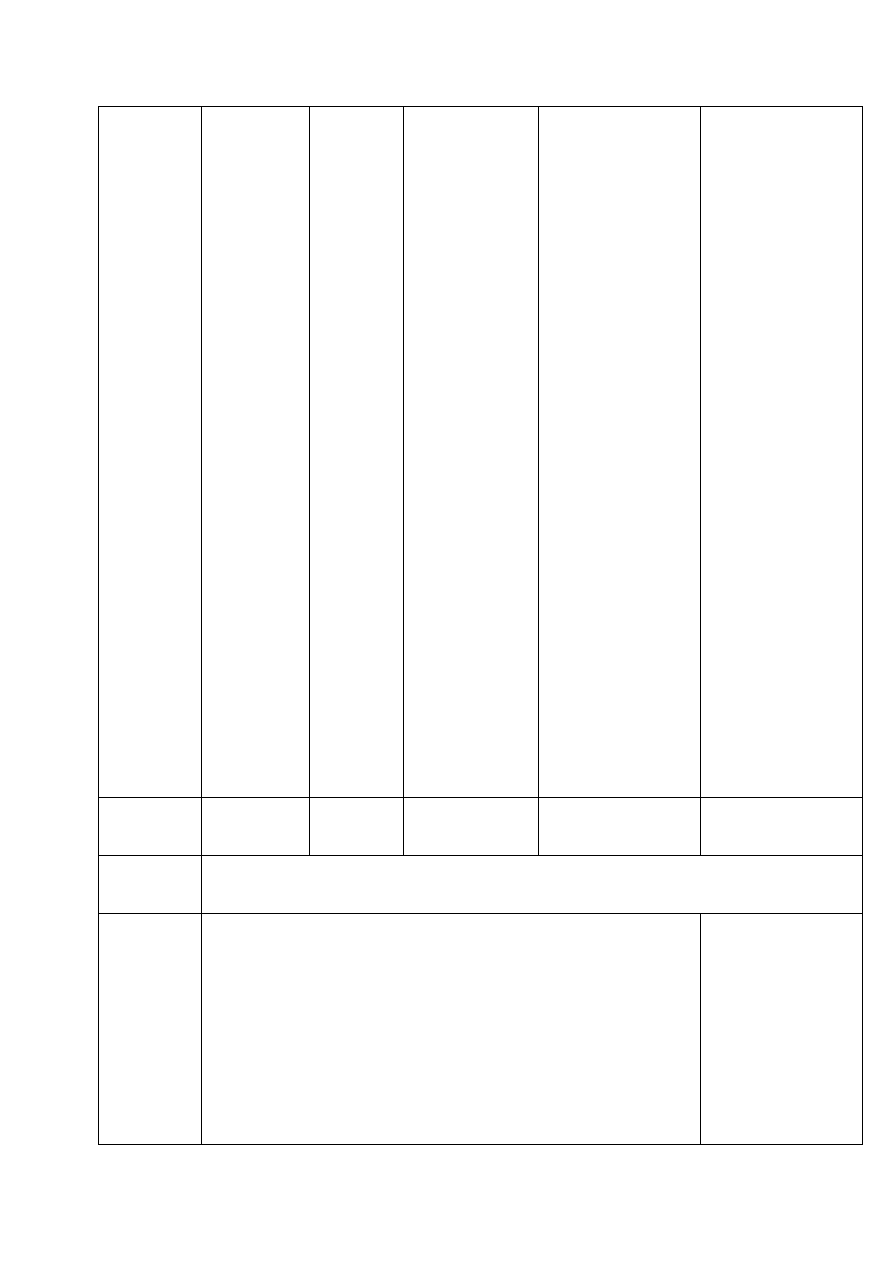

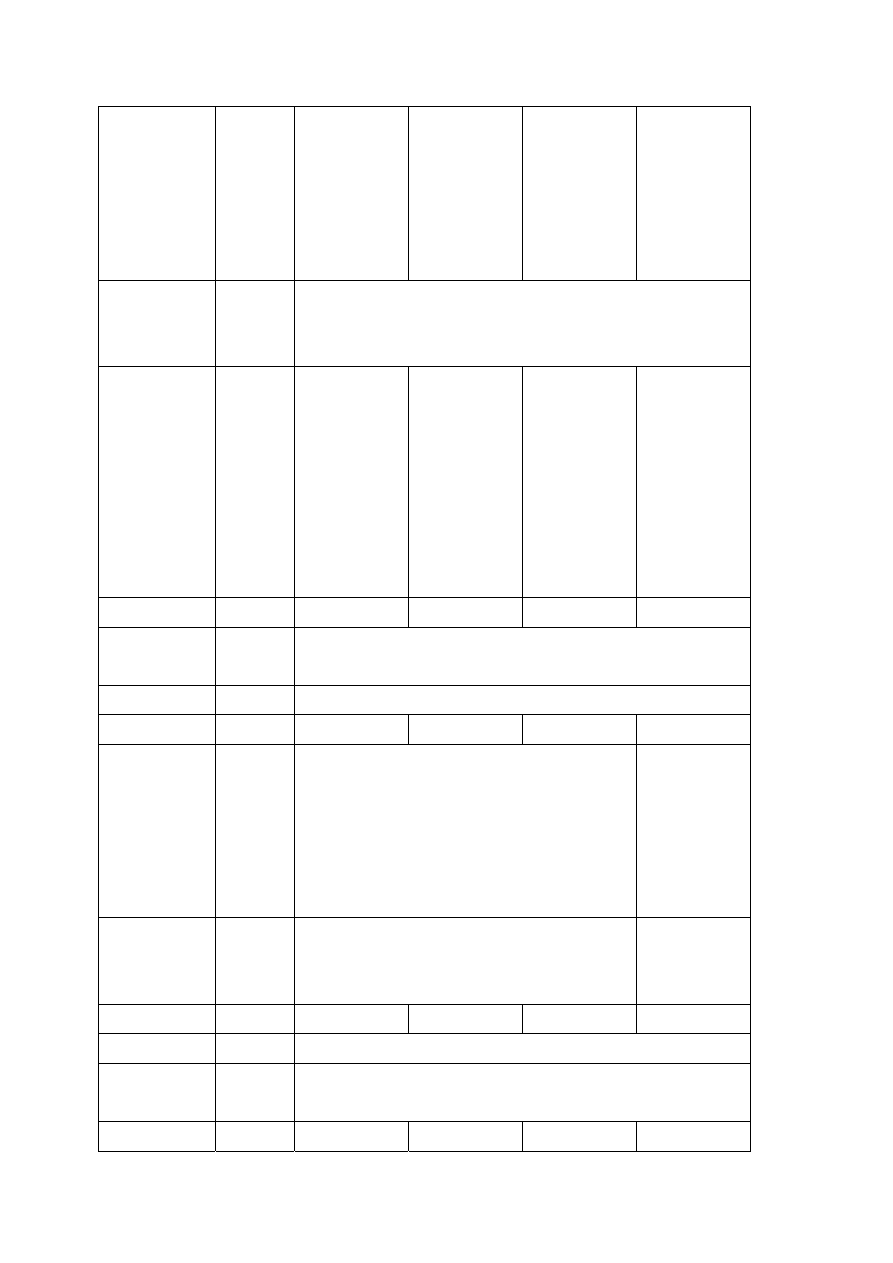

2. Tax

accounting

rules

Accrual accounting basis

3.

Depreciatio

n

Basis Cost

price

Methods

Straight-line method (In general). Declining-balance method (qualifying industrial

assets).

Accelerated-depreciation method (certain specified assets

Rates

Commercial buildings: range from 2 to 5 %

Industrial buildings: 5 %

Office equipments: range from 10 to 20 %

Motor vehicles: range from 20 to 25 %

Plant and machinery: range from 5 to 10 %

Accounting

Depreciation must be recorded

Intangibles

In limited circumstances.

Goodwill not depreciable in general

Non

depreciabl

e assets

Land

Goodwill

Shares

4.

Provisions

Risks and

futures

expenses

Deductible

Bad debts

Deductible

Pensions Not

deductible

Repairs Not

deductible

5. Losses

Carry

forward

5 years

5 years

Unlimited

Carry back

Previous three fiscal years

France Country Report

February 2008

20

Transfer of

losses

Group

relief:

transfer to the

head of group

Merger with tax

administration

agreement

6.

Inventories

Valuation

rules

Cost price or market cost, if lower

Weighted-average cost price method is also allowed

Allocation

methods

FIFO

LIFO is not permitted

Personal

Income tax

Interest

Income

Graduated tax or flate-rate withholding tax (16 % + 11 % social contributions for

French residents only)

Dividends Subjected

to personal

income tax

including

credit tax

(avoir

fiscal) on

the gross

basis and an

additional

annual fixed

allowance

A final tax

credit (33

1/3 % of the

gross

dividend

incomes

without

Subjected

to

personal

income

tax

including

credit tax

(avoir

fiscal) on

the gross

basis and

an

additional

annual

fixed

allowance

A final tax

credit (33

1/3 % of

Subjected to

personal

income tax

including credit

tax (avoir

fiscal) on the

gross basis and

an additional

annual fixed

allowance

A final tax

credit (33 1/3 %

of the gross

dividend

incomes

without

limitations) was

deducted from

the income tax

Subjected to

personal income

tax after a 50 %

reduction on the

gross basis and an

additional annual

fixed allowance (€1

220/ €2 440,

respectively either

unmarried or

married)

A final 50 % tax

credit calculated

on the gross

dividend incomes

before the two

reductions. Amount

limited to €115 /

€230, respectively

Subjected to

personal income

tax after a 40 %

reduction on the

gross basis and an

additional annual

fixed allowance

(€1 525/ €3 050,

respectively either

unmarried or

married)

A final 50 % tax

credit calculated

on the gross

dividend incomes

before the two

reductions. Amount

limited to € 115 / €

230, respectively

France Country Report

February 2008

21

limitations)

was

deducted

from the

income tax

the gross

dividend

incomes

without

limitation

s) was

deducted

from the

income

tax

either unmarried

or married

either unmarried

or married

Employmen

t income

Graduated taxation

Graduated taxation

up to 48 % on net

income

Graduated taxation

up to 40 % on net

income

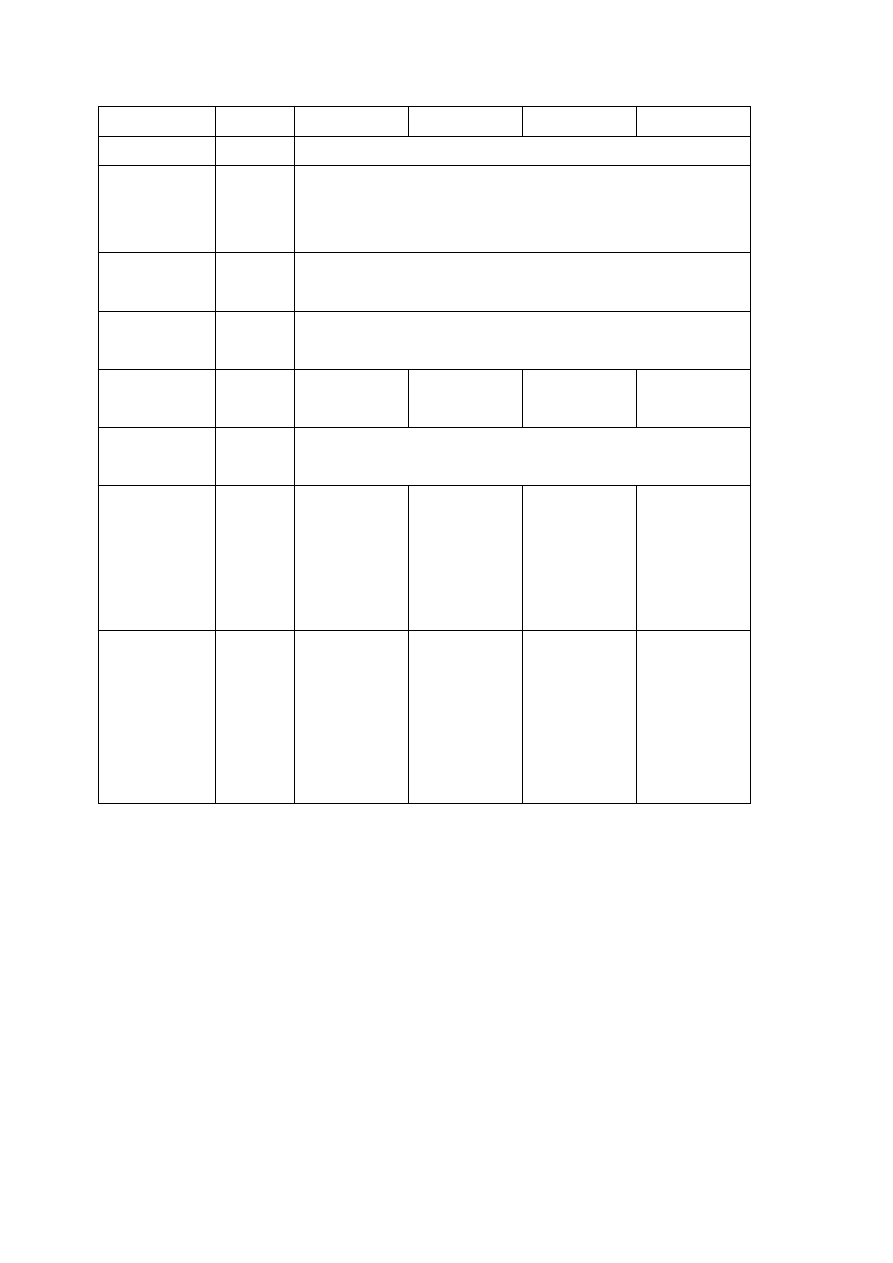

Capital

gains tax

Sale of

fixed

assets

Short-term regime

Timing

rules

N/A

Accounting

rules

Selling price – book value

Inflation N/A

Rates Short-term

regime: 33

1/3

%

Long-term

regime:

19 %

Short-

term

regime:

33

1/3

%

Long-term

regime:

19 %

Short-term

regime: 33

1/3

%

Long-term

regime: 19 %

Short-term regime:

33

1/3

%

Long-term regime:

15%

Short-term regime:

33

1/3

%

Long-term regime:

8 % or 15 %

Exemptions

Exemption

regime

for small

companies

depending on the

value of

transferred assets

Exemption regime

for small

companies

depending on the

value of

transferred assets

France Country Report

February 2008

22

Sale of

shares

Participatio

n eligible to

parent-

subsidiary

regime or as

recorded

for

accounting

purpose and

Company

with real

estate

predominan

t : 19 %

Others,

qualifying

portfolio

investment:

short-term

regime

Participati

on eligible

to parent-

subsidiary

regime or

as

recorded

for

accountin

g purpose

and

Company

with real

estate

predomin

ant : 19 %

Others,

qualifying

portfolio

investmen

t: short-

term

regime

Participation

eligible to

parent-

subsidiary

regime or as

recorded for

accounting

purpose and

Company with

real estate

predominant :

19 %

Others,

qualifying

portfolio

investment:

short-term

regime

Participation

eligible to parent-

subsidiary regime

or as recorded for

accounting purpose

and

Company with real

estate predominant

: 15 %

Others, qualifying

portfolio

investment: short-

term regime

Participation

eligible to parent-

subsidiary regime

or as recorded for

accounting

purpose: 8%

Company with real

estate

predominant: 15%

Others: short-term

regime

Capital

loss

Fixed

assets

Short-term losses may be offset against ordinary income

Shares

Carried forward 10 years to offset long-term capital gains

Allocation:

Qualifying

participations: may

be offset against

long-term capital

gains taxed at the

8 % rate

Others: offset

France Country Report

February 2008

23

against long-term

capital gains

taxable at the 15%

rate, and if any,

against long-term

capital gains at the

8% rate.

Wages

Average

cost to the

Undertakin

g

Brutto +

Social

insurances

35% to 45 %

Brutto +

Social

insurances

35% to 45

%

Brutto +

Social

insurances 35%

to 45 %3

Brutto +

Social insurances

35% to 45 %

Brutto +

Social insurances

35% to 45 %

Average

cost to the

employee

Brutto less

18 % to 23 %

Brutto

less 18 %

to 23 %

Brutto less 18 %

to 23 %

Brutto less 18 % to

23 %

Brutto less 18 % to

23 %

Overall tax

on

distributed

earnings

or

Dividends

Timing

Tax credit

structure

Excluding

non profit

tax

Including

non profit

tax

N/A

Deduction

of

expenses

General

rule

In general, expenses are deductible if they are paid in interest’s company and involve

a decrease of the net asset

France Country Report

February 2008

24

Non-

deductibilit

y of

expenses

Leasing of tourism motor vehicle: part of the royalty (included VAT) equal to the no

deductible depreciation calculated as if the company was an owner.

Lavish expenses provided by law : related to residence, yacht, hunting and fishing

Corporate income tax / Tax on tourism motor vehicle

Director’s fees exceeding legal amount allowed to deduct

Net long-term depreciation

France Country Report

February 2008

25

Thin

capitalizati

on

Double limitation

Linked to the interest rate: interests are deductible to the

extent that the share capital is fully paid up and the interest

rate does not exceed the average interest rate on loans with an

initial duration of more than two years granted by banks to

French companies.

Linked to the total amount paid : interest deductible to the

extent that they do not exceed 1.5 times the share capital

Interest paid on

loans from direct

shareholders

(corporate) or

loans granted by a

related party

Limitation does not

apply if the

interest expenses

paid to

shareholders are

lower than €

150,000

Limited rate:

higher of the

following:

Average interest

rate on loans with

an initial duration

of more than two

years granted by

banks to French

companies or

rate which could

be obtained from

independent

financial

establishments

Reincorporation if

three cumulative

limitations are

exceeded:

France Country Report

February 2008

26

1) The company’s

debt owed to all

related parties

exceeds 1.5 times

its equity;

2)Interest expenses

exceed 25 % of net

income exclusive

of tax and before

the interest paid to

related parties,

depreciations and

quota of leasing;

3) Interest

expenses exceed

interest collected

from related

parties.

Non-deductible

interest of one

fiscal year may be

deducted in the

following fiscal

year, if the above

limitations are

respected. The

amount of

deductible interest

expenses which

may be carried

forward is reduced

by 5 % each year.

Overall

corporate

France Country Report

February 2008

27

tax on

retained

earnings

Excluding

non profit

tax

N/A N/A

N/A

N/A

N/A

Including

non profit

tax

N/A N/A

N/A

N/A

N/A

Debt

financing

Interest

deductibilit

y

In general, interest payments are fully deductible

Certain restrictions are imposed

Limits on

interest

deductibilit

y

Thin-capitalization rules

Non-deductible interest of one fiscal year may be deducted in the following fiscal

year, if the above limitations are respected. The amount of deductible interest

expenses which may be carried forward is reduced by 5% each year.

Interest

deductibilit

y on

business

owner loan

to

Undertakin

g

France Country Report

February 2008

28

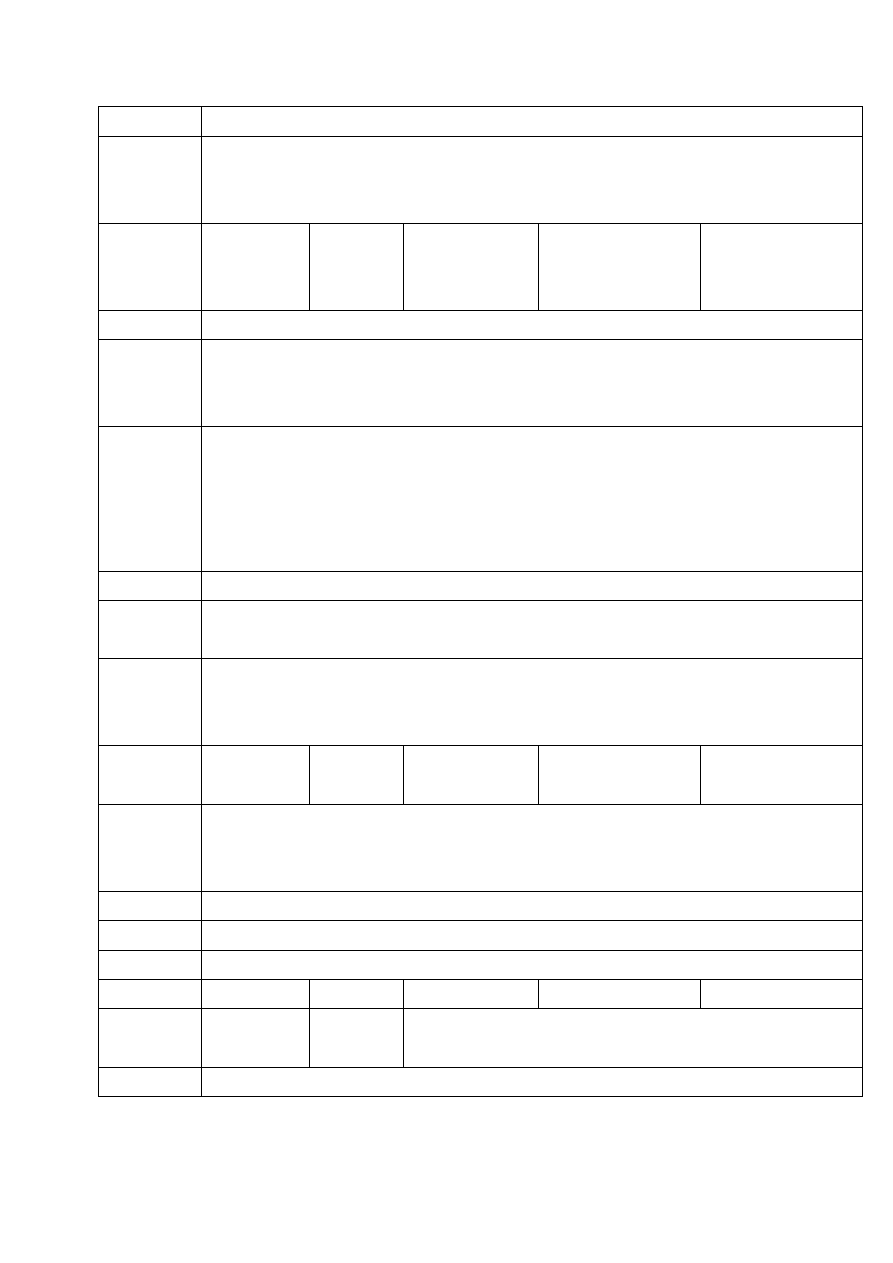

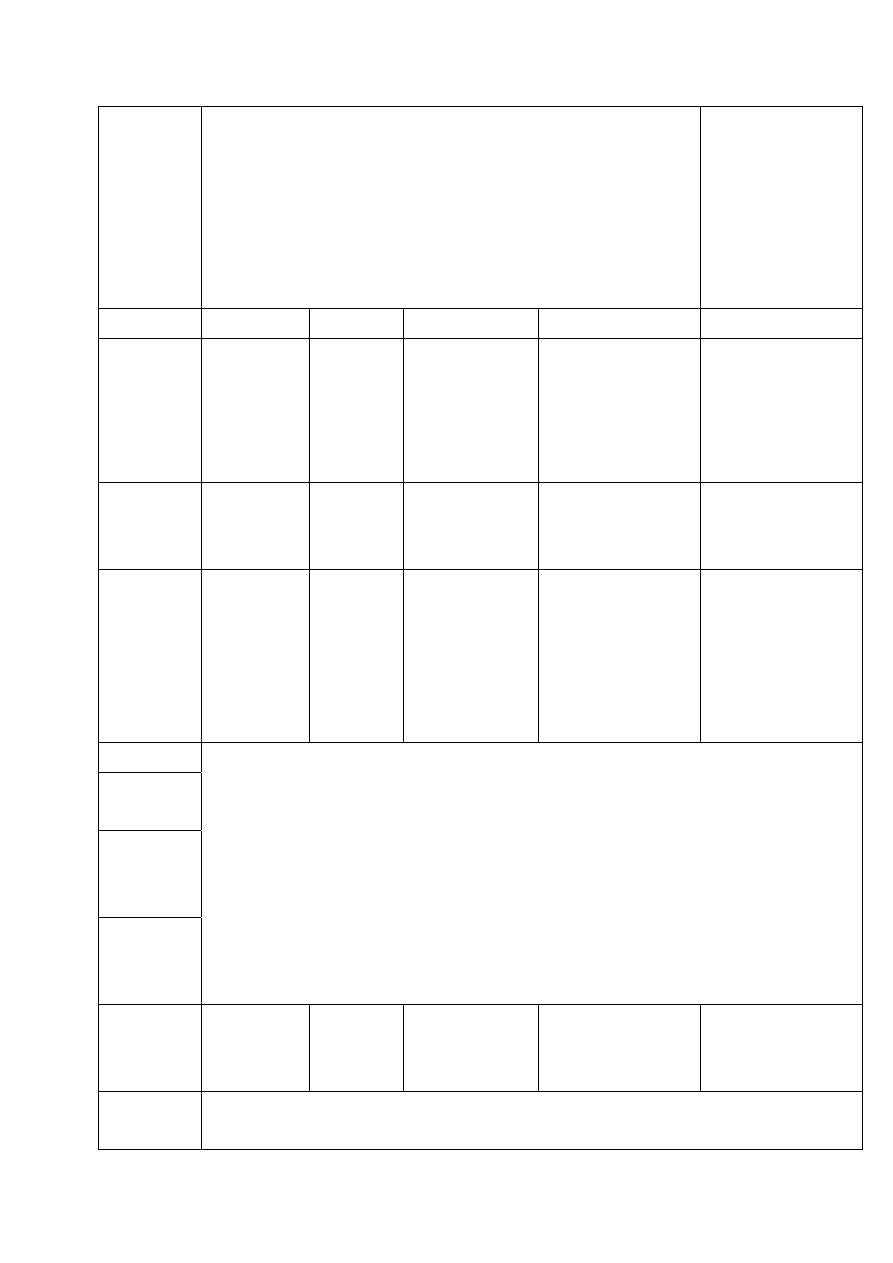

Country ….

France

RELEVANT TAX PROVISIONS AND SUBSEQUENT CHANGES

FOR PARTNERSHIPS (distinguish specific rates for SMES)

2002 2003 2004 2005 2006

Tax

applicable to

partnerships

1. Tax rate

Standard Idem

Reduced Idem

Minimum Tax Idem

Special Rates Idem

Tax transparent (IIT rules) – or Option for CIT (see above)

Non profit

tax (local tax

on

corporations,

energy tax…)

Idem

Same as corporations

2. Tax

accounting

rules

Idem

Same as corporations

3.

Depreciation

Idem

Same as corporations

Basis

Idem

Same as corporations

Methods

Idem

Same as corporations

Rates

Idem

Same as corporations

Accounting

Idem

Same as corporations

Intangibles

Idem

Same as corporations

Non

depreciable

assets

Idem

Same as corporations

4. Provisions

Idem

Same as corporations

Risks and

futures

Idem

Same as corporations

France Country Report

February 2008

29

expenses

Bad debts

Idem

Same as corporations

Pensions

Idem

Same as corporations

Repairs

Idem

Same as corporations

5. Losses

Idem

Carry

forward

Idem

NA –rules applicable according to the shareholders' quality

(corporation or individuals)

Carry back

Idem

NA –rules applicable according to the shareholders' quality

(corporation or individuals)

Transfer of

losses

Idem

NA – transfer to the shareholders of their quota of losses

6.

Inventories

Valuation

rules

Idem

Same as corporations

Allocation

methods

Idem

Same as corporations

Personal

Income tax

Interest

Income

Idem

Rules applicable according to the shareholders' quality

(corporation or individuals)

Dividends Idem

Employment

income

Idem

Rules of wages – see below

Capital gains

tax

Sale of fixed

assets

Idem

Business gains : see above.

Private gains : 16 % + social contributions [11%]

Timing rules

Idem

Business gains : see above.

Private gains: no rules

Accounting

rules

Idem

Same as corporations

Inflation Idem

No

Rates Idem

Business

gains : see

Business

gains : see

Business

gains : see

Business

gains : see

France Country Report

February 2008

30

above.

Private gains

> 15 000 €:

16 % + social

contributions

[11 %]

above.

Private gains

> 15 000 €:

16 % + social

contributions

[11 %]

above.

Private gains

> 15 000 €:

16 % + social

contributions

[11 %]

above.

Private gains

> 15 000 €:

16 % + social

contributions

[11 %]

Exemptions

Idem

No unless 100 % sale by the business ownership if the

activity has been last for at least 5 years and the last

annual turnover is under certain limits

Sale of

shares

Idem Business

gains : see

above.

Private gains

> 15 000 €:

16 % + social

contributions

[11 %]

Business

gains : see

above.

Private gains

> 15 000 €:

16 % + social

contributions

[11 %]

Business

gains : see

above.

Private gains

> 15 000 €:

16 % + social

contributions

[11 %]

Business

gains: see

above.

Private gains

> 15 000 € :

16 % + social

contributions

[11 %]

Capital loss

Fixed assets

Idem

Deductible or rules applicable according to the

shareholders' quality

Shares

Idem

Depends on the quality of the owner (CIT or IIT)

Wages

Average cost

to the

Undertaking

Idem

Wage of the business owner = non

deductible + Payroll taxes

Wage of the

business

owner = non

deductible +

Payroll taxes

[45 %]

Average cost

to the

employee

Idem

Same as corporations

Same as

corporations:

20 %

Dividends

Timing NA

NA

Tax credit

structure

NA NA

Deduction of

France Country Report

February 2008

31

expenses

General rule

Idem

Expenses in the interest of the company

Non-

deductibility

of expenses

Idem

Others than in the interest of the company

Thin

capitalization

Idem

Same as corporations

Retained

earnings

NA

NA

Debt

financing

Interest

deductibility

Idem

If debts in the interest of the society

Limits on

interest

deductibility Idem

No – Loans

by business

owners

limited [ see

§ 34]

No – Loans

by business

owners

limited [ see

§ 34]

No – Loans

by business

owners

limited [see

§ 34]

No – Loans

by business

owners

limited [see

§ 34]

Interest

deductibility

on business

owner loan

to

Undertaking

Idem Loans

by

business

owners

limited

(5.05 %): see

§ 34

Loans by

business

owners

limited

(4.58 %): see

§ 34

Loans by

business

owners

limited

(4.21 %): see

§ 34

Loans by

business

owners

limited :

(4.48 %) see

§ 34

2.

What are the main types of business entities and the main differences in

(corporate) income taxation for sole traders, general partnerships, limited

partnerships and corporation and other business entities if relevant?

In France the business entities are the following: sole trader, general

partnership, limited partnership and corporation. The main difference is that

corporations can’t be treated tax transparent.

France Country Report

February 2008

32

2.1. Are partnerships treated transparent for tax purposes?

Yes

2.2. Can partnerships opt for corporate income tax?

Yes (CGI, art 206-3 and 239)

2.3. Once they have opted for a regime is it easy to switch back?

It is impossible

2.4. Is there a difference in this respect between general and limited

partnerships?

No

2.5. Can corporations opt to be treated tax transparent?

No, unless "Family Limited Liability Company"

2.6. Once they have opted for a regime is it easy to switch back?

In general: impossible – Family Limited Liability Company can opt back

for CIT

2.7. Are there differences in this respect between the different types of

corporations?

France Country Report

February 2008

33

In general: impossible – Family Limited Liability Company can opt back

for CIT

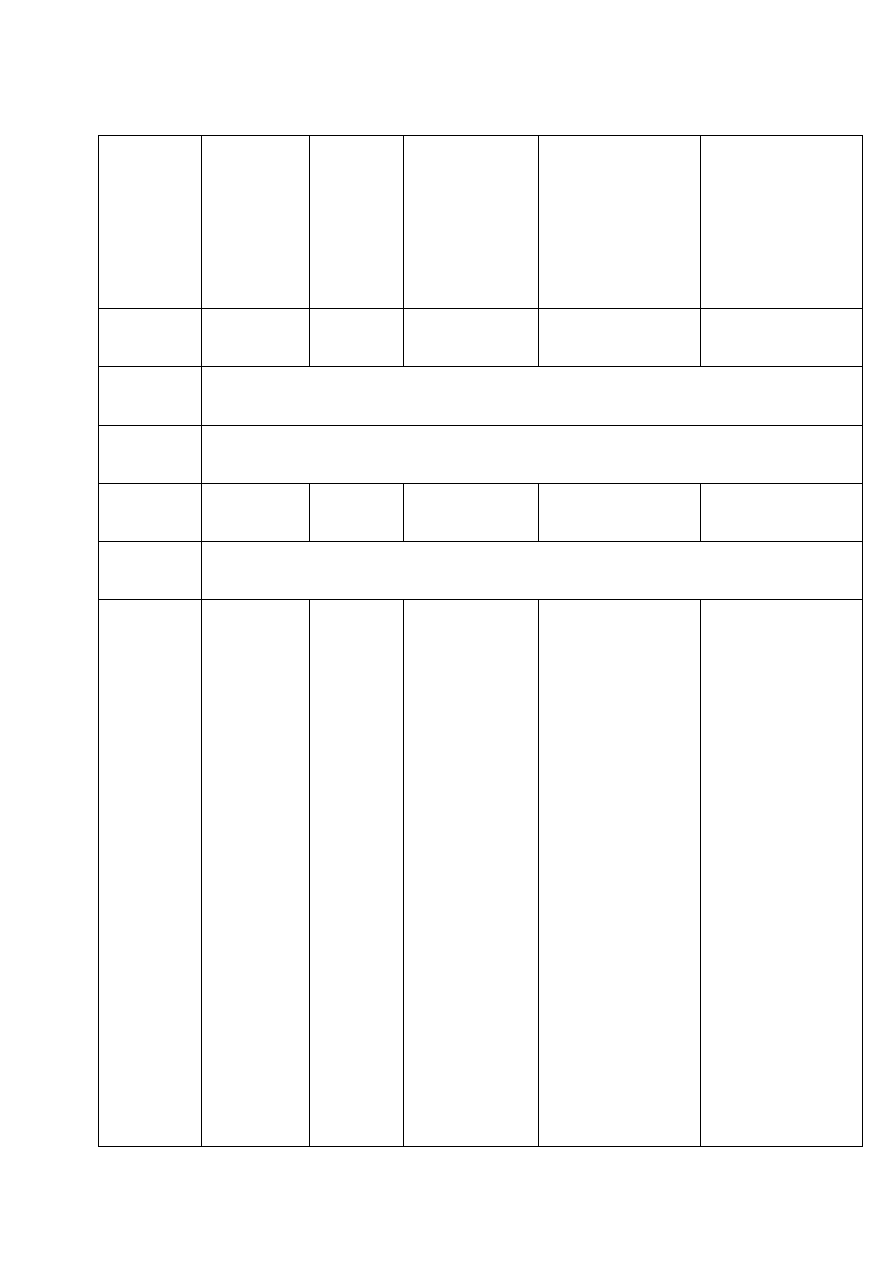

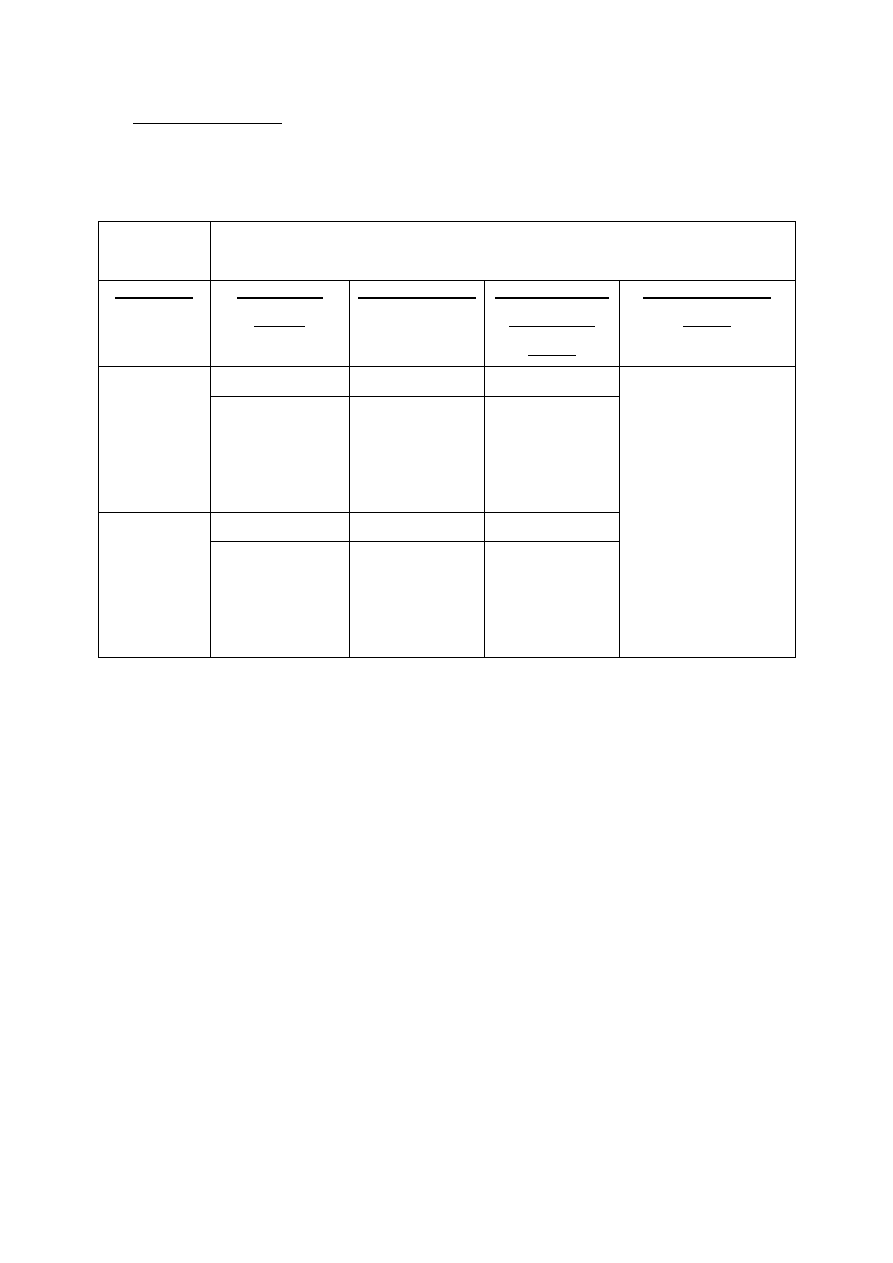

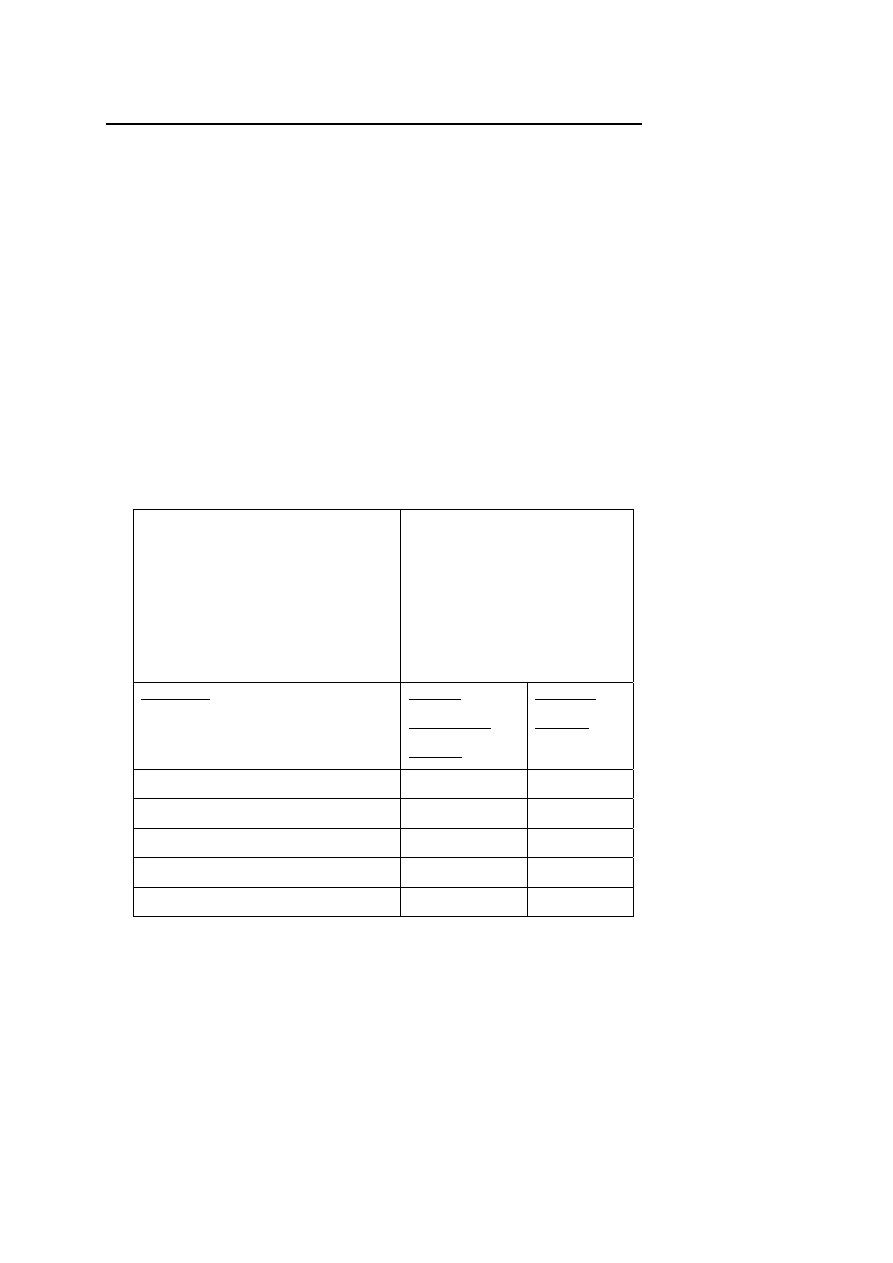

INCLUDE RELEVANT TAX PROVISIONS IN 2002 AND SUBSEQUENT

CHANGES UP TO 2007

France

General

Partnership

Limited

Partnership

Corporation Sole

Trader

Corporate

tax

Option Option

Yes

Option

Income tax

Yes Yes

General case: No

option.

Unless: "Family

Limited Liability

Company"

Yes

Capital gains

tax

Yes Yes

Yes

Yes

…

Option for

Transparent

treatment

Legal

applicable

regime

Legal

applicable

regime

General case: No

option.

Unless: "Family

Limited Liability

Company"

Legal

applicable

regime

…

3.

Are there any special tax regimes for SMEs for (corporate) income tax

purposes?

YES

- SME: Reduce tax rate: 15 % on benefits ≤ € 38,120 (CGI 219,I b)

France Country Report

February 2008

34

if SME: maximum annual turnover: € 7,630,000

capital fully paid up;

continuously held by individuals or corporations held by

individuals for at least 75 %;

minimum percentage of detention required: 75 %

- "micro-entreprises" regime (CGI 50-0, 1)

→

taxable income = turnover – standard deduction (68 % or 45 %); for sole

ownerships whose annual turnover ≤ € 76,300 or € 27,000 € (according to their

activities)

- "RSI" (simplified regime of taxation) (CGI ann. II, 267 sexies and septies C)

→ lighten accounting obligations and returns; for sole ownerships whose

annual turnover ≤ € 763,000 or € 270,000 but > € 76,300 or € 27,000 (according

to their activities)

3.1. What are the conditions to be fulfilled in order to benefit from

these special tax regimes?

if SME: maximum annual turnover: € 7,630,000

capital fully paid up;

continuously held by individuals or corporations held by

individuals for at least 75 %;

minimum percentage of detention required: 75 %

3.2. Are there limits on the length of time during which these special

tax regimes are available, or other limits?

No

4.

Are there any special tax incentives, such as (re-)investment reserves or

provisions, special depreciations/capital allowances deductible for

(corporate) income tax purposes?

France Country Report

February 2008

35

a)- Reinvestment reserves or provisions: no;

b)- Special depreciations/capital allowances: no;

c)- Tax credit or tax reduction: yes, such as

• new societies created in certain geographical areas (AFR, ZRR, ZRU…)

• growth companies

• investments in new technologies.

These tax credits or reductions are very complicated, and above all this they

are levelled off (minimis regime).

4.1. Do these elements of internal financing represent an important

alternative to the financing by retained earnings?

NO

4.2. Are there any compulsory measures in relation to the retention of

earnings (e.g. legal constraints for the distribution of profits and

dividend policy)?

YES,

Compulsory appropriation of the legal reserve (5 %) - in the limit of 10 %

of the capital.

5.

Are there any differences in the tax treatment of stock and cash

dividends

1

?

NO

1

For the Undertaking stock dividend means increased own equity. For the shareholder it

means additional shares in the Undertaking which may be untaxed until sold, unlike a cash

dividend.

France Country Report

February 2008

36

6.

Have there been any changes in the tax regulation in recent years - since

2002 – that have had an important effect on the retention of earnings, the

distribution earnings or the reinvestment of profits for a particular

purpose?

YES

The abolition of the "avoir fiscal" (tax credit) and of the "precompte" (tax

deduction at source) lead to retention of earnings.

The reduced rate of 15 % on the portion of company’s profits less than €

38,120 if certain conditions are met, including the turnover of the company

(less than € 7,630,000) and the shareholding of the company (at least 75 % of

the company is owned by individuals or by companies that are at least 75 %-

owned directly by individuals) had the same consequences.

7.

Are there any current plans for tax reforms that have as their object to

have an impact on the retention of earnings?

NO, because of the elections

France Country Report

February 2008

37

PART 2 – TAX ASPECTS OF RETAINED EARNINGS VERSUS DISTRIBUTED PROFITS AND

WAGES

8.

What is the tax treatment of retained earnings compared to distribution of

earnings on the level of the Undertaking and at a combined level of

Undertaking (corporate) and business owner (individual)?

Retained earnings:

33.

1/3

% + sale of the share by the business owner: 16% +

social contributions [11 %]

Distribution of earnings: 33.

1/3

% + Taxation of the business owner (40 %) +

social contributions [11 %]

8.1. Is there an economic double taxation of distribution of earnings (taxation

of Undertaking income and then taxation on the distribution of earnings

at the Undertaking level or at the business owner level)?

YES

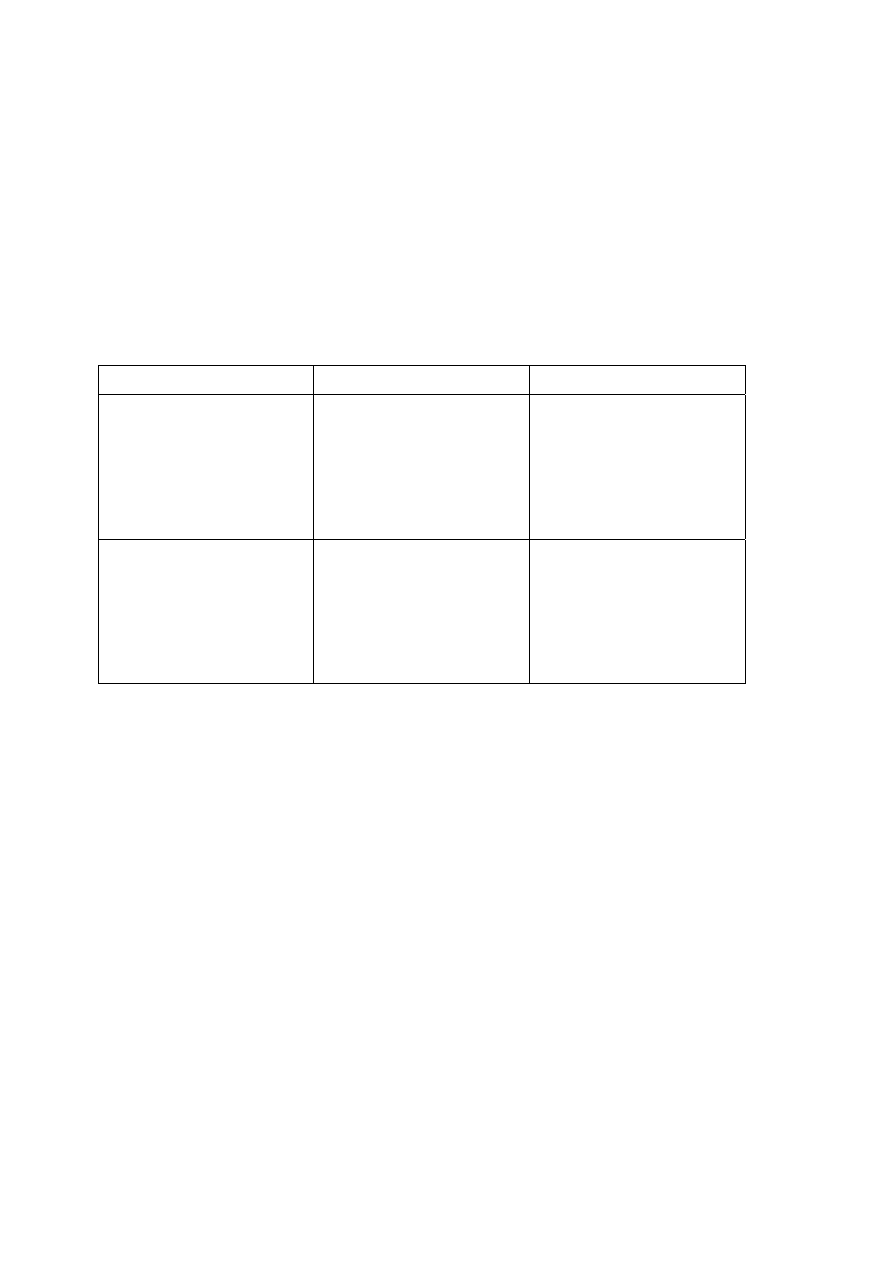

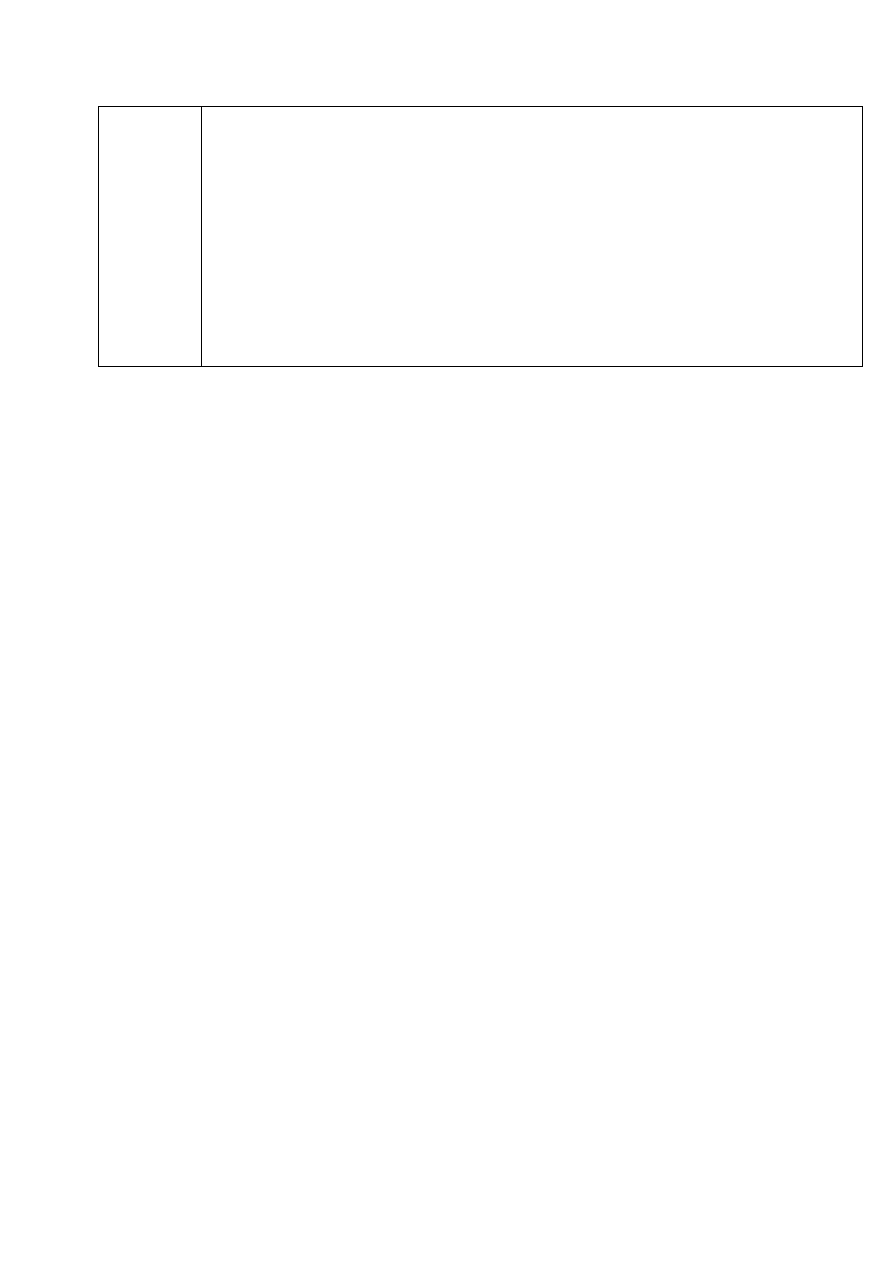

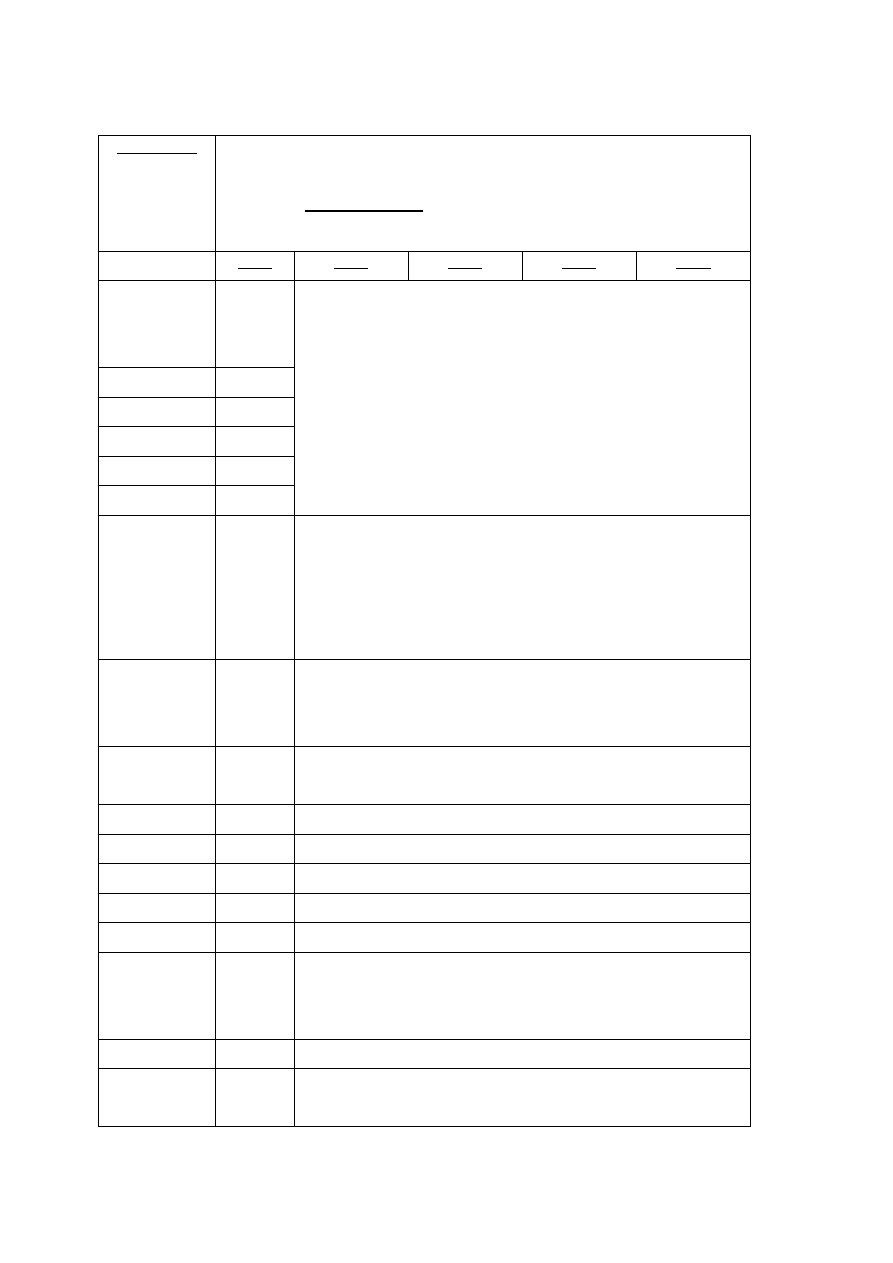

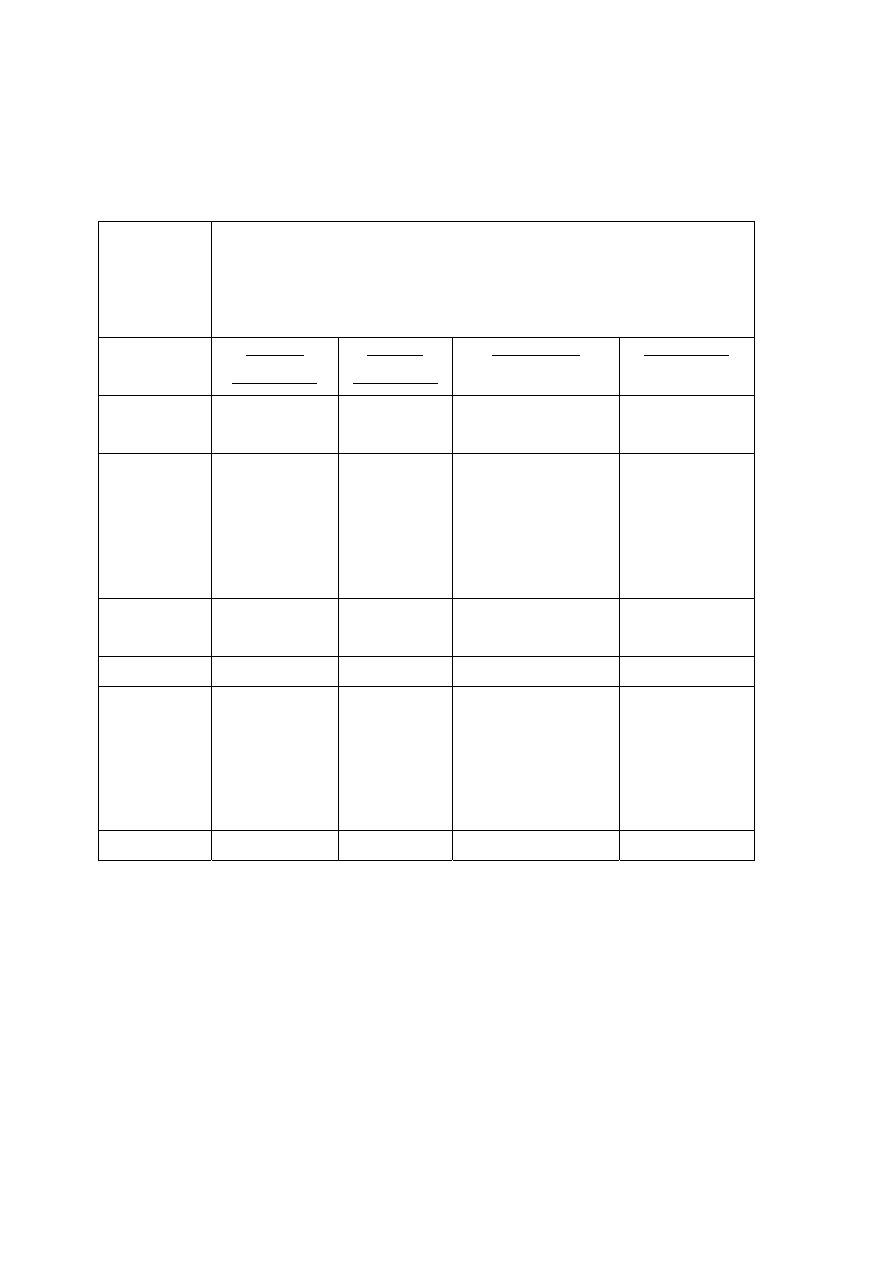

INCLUDE RELEVANT TAX PROVISIONS IN 2002 AND SUBSEQUENT

CHANGES UP TO 2007

Country …… Undertaking Individual

Business

owner

Corporate

tax

33.

1/3

%

IIT: maxi 40 %

+ social contributions (11 %)

Income tax

IIT: maxi 40 %

+ social contributions (11 %)

Dividend tax

IIT: maxi 40 %

+ social contributions (11 %)

Dividend

-

maxi 230 €

France Country Report

February 2008

38

credit

Capital gains

tax

16 %

+ social contributions (11 %)

16 %

+ social contributions (11 %)

If option for

Transparent

treatment

chosen

Not possible Not

possible

9.

Please described the differences in the tax treatment of distribution of

earnings realised as a capital gain in the context of a sale of the shares or

of the business compared to that (i) of retained earnings, (ii) of wages

salaries paid to the business owner and (iii) of a loan granted by the

Undertaking to the business owner?

Rate

Dividends

Wages

Retained

Profits

Gains (Sale

of 100% of

the shares)

Corporate

Capital

100 000

100 000

100 000

100 000

Result before salaries

15 000

15 000

15 000

15 000

Gross salary

-10 000

Payroll taxes

45%

-4 500

Result after wages

15 000

500

15 000

15 000

CIT 33.33

%

-5 000

-167

-5 000

-5 000

Result after CIT

10 000

333

10 000

10 000

Distributed dividends

10 000

0

0

0

Sale of shares

110 000

Business owner / Shareholer

Payroll taxes

20%

-2 000

France Country Report

February 2008

39

Received salary

8 000

Taxable wages

10%

7 200

Received dividends

10 000

Taxable dividends

60%

6 000

Gain received

10 000

Tax base

6 000

7 200

10 000

Tax to be paid

16%

-1 600

IIT to be paid

40%

-2 400

-2 880

Social contribution

(CSG)

-1

100

-776

-1

100

Total tax

-3 500

-3 656

-2 700

Net cash after tax

6 500

4 344

0

7 300

France Country Report

February 2008

40

and in a table form:

INCLUDE RELEVANT TAX PROVISIONS IN 2002 AND SUBSEQUENT CHANGES

UP TO 2007

Country …

France

Distributed

profits

Retained Profit

Wages/Salaries

to business

owner

Loan to business

owner

33.

1/3

%

33.

1/3

%

Social taxes

Sale of

shares

Long Term: 0 %,

15 % or 33.

1/3

%

Short Term:

33.

1/3

%

Long Term: 0 %,

15 % or 33.

1/3

%

Short Term:

33.

1/3

%

Long Term: 0 %,

15 % or 33.

1/3

%

Short Term:

33.

1/3

%

33.

1/3

%

33.

1/3

%

Social taxes

Sale of

business

Long Term: 0 %,

15 % or 33.

1/3

%

Short Term:

33.

1/3

%

Long Term: 0 %,

15 % or 33.

1/3

%

Short Term:

33.

1/3

%

Long Term: 0 %,

15 % or 33.

1/3

%

Short Term:

33.

1/3

%

Prohibited

10.

Is the combination of wages (paid to the business owner by the

Undertaking), profit distributions and retained earnings a tax planning

issue that is anticipated and addressed by business owners in view of

minimising the overall tax burden of the business owner and the

Undertaking?

YES

11.

In respect to the previous question, is the business owner more interested

in minimising his/her tax burden and then the Undertaking’s or both

equally?

Psycologically, the business owner is more interested in minimising his tax

burden

France Country Report

February 2008

41

12.

Are there instances in which minimising the tax burden of the business

owner would mean dramatically increasing the tax burden of the

Undertaking?

Yes, taxes on society vehicules (CGI, articles 1010).

13.

For corporate income tax or capital gains tax purposes, are there any

incentives/disincentives to retain earnings rather than distribute them or

pay wages?

NO

13.1. Are there any limitations or ceilings for these incentives?

NA

13.2. Is there a risk that these incentives can be used more than one time

by the business owners by splitting up the business activities into

different legal entities?

NA, as there are no incentives

14.

What is the tax treatment of declared loans granted by the Undertaking to

the business owner?

They are prohibited (commercial code). But see 34. for loans granted by the

business owner to the Undertaking

France Country Report

February 2008

42

14.1. Is there a minimum interest rate to be charged for tax purposes?

NA

14.2. How is the interest rate treated for tax purposes for the

Undertaking?

NA

14.3. How is the interest rate treated for tax purposes for the business

owner?

NA

14.4. What are the combined tax effects of such a loan compared to a

distribution of earnings equivalent in amount?

NA

15.

Are there any other taxes (e.g. net worth tax) which are imposed or based

on the net equity of the Undertaking?

NO

16.

Are there any other tax incentives for either the retention of earnings or

their distribution of profits?

NO

France Country Report

February 2008

43

PART 3 – TAX ASPECTS OF RETAINED EARNINGS FINANCING VS DEBT FINANCING

17.

In debt financing, what is the tax treatment of interest expenses paid or

accrued by the Undertaking?

Interests are deductible on a tax purpose if the loan is taken in the interest or

for the need of the company.

"Anti thin-capitalization" mechanism: in small groups, the deductibility of the

financial charges on intra-group loans has change. Since January, 1

st

, 2007,

interest paid to affiliated company are deductible in the limit of € 150,000.

17.1. Is there a different tax treatment to deductions on interest paid when

the lender is a resident or a non-resident for tax purposes?

Since, January, 1

st

, 2007.

17.2. Is there a different tax treatment on interest on long-term debt and

interest on short-term debt

No

18.

Are there any tax benefits that are actionable based on specific amounts

of equity (e.g. notional interest expense based on the increase of own

equity or the total amount of equity)?

No

18.1. What is the exact calculation method used to implement this

incentive and to evaluate the benefits once this incentive is

implemented?

France Country Report

February 2008

44

NA

18.2. Are there any other tax provisions favouring increases in own equity?

NA

19.

Is debt financing of an enterprise by the business owner himself of his/her

family recognised for tax purposes (ie. If the business owner or his/her

family lends money to the Undertaking are they treated differently than

other lenders for tax purposes)?

Yes, there are legal limitations of the amount of deductible interest:

• loans must be declared to the tax administration (formal obligation)

• the amount of deductible interest for the company is levelled off. (4.48 %

for 2006 – this rate is published each year in the official journal)

• the total amount of the money lend to the undertaking by shareholders ≤

1.5 x capital

19.1. If so, are there any incentives for the business owners to debt-finance

their enterprise instead of retained earnings financing or equity

financing?

Yes,

• Tax credit in case of cash taking up of the authorized capital,

• Tax credit in case of increase in capital.

20.

Is there a general discrimination between retained earnings financing and

debt financing from a tax point of view?

YES, but it depends from which point of view (CIT or IIT) you consider the

problem.

France Country Report

February 2008

45

20.1. Is there a general discrimination between retained earnings financing

and equity financing from a tax point of view?

YES, as there is:

• a tax credit in case of increase in capital

• a possibility to deduce certain expenses

20.2. Is there a general discrimination between equity financing and debt

financing from a tax point of view?

YES, there is a general discrimination, because from a tax point of view

debts can be deductible charges.

21.

Are there any debt to equity ratios limiting the deductibility of interest

expenses for tax purposes?

YES

"Anti thin-capitalization" mechanism: in small groups, the deductibility of the

financial charges on intra-group loans has change. Since January, 1

st

, 2007,

interest paid to affiliated company are deductible in the limit of € 150,000.

21.1. If so, does the limitation apply to loans granted by the business owner

and affiliated persons or does it include loans granted by third

parties?

Individuals: NO

Corporations: Yes

21.2. What are the consequences if the debt to equity ratio is not

respected?

France Country Report

February 2008

46

The interests are partially non deductibles.

22.

Are there any tax provisions likely to impact the conversion of retained

earnings into share paid in capital (For example share buy-back)?

NO

23.

Are there any other taxes that have as their object to affect or impact on

either Undertaking debt financing or retained earnings financing?

NO

France Country Report

February 2008

47

PART 4 – TAX ASPECTS OF BUSINESS INCOME VERSUS PRIVATE INCOME

24.

In respect to individual business owners, what is the general tax treatment

for private (ie: interest on passive investment) income compared to

business income (ie: income generated from your business activity)?

As business incomes are taxed directly in the hand of the business owner (see

part 1 question 2), the general tax treatment for private investment income

in France is the same as the business income. There were no changes since

2007.

INCLUDE RELEVANT TAX

PROVISIONS IN 2002 AND

SUBSEQUENT CHANGES UP

TO 2007

Country: France Private

Investment

Income

Business

Income

… IIT

IIT

…

…

…

…

24.1. Are there different allowances or special treatments for private

investment income and business income?

YES, but there are no consequences on the tax level

France Country Report

February 2008

48

25.

Is there a different tax treatment for interest income received in a private

investors capacity (ie: business owner investment return in another

Undertaking) and interest income earned through business activity (ie:

business owner investment return from the Undertaking)?

NO

26.

Does the tax system encourage business owners to invest in private assets,

which are subsequently rented or leased to their enterprises?

NO

27.

By opposition to Question 26, does the tax system encourage that assets

be acquired by the Undertaking and rented or leased to the business

owner?

YES

Rentals of goods to the business owners are controlled agreements. Such

advantages can be reputed as benefits in kind for the business owner.

28.

Are capital gains from private assets taxed in the same way as capital gains

realised within the context of a business activity?

YES, basically capital gains from private assets and capital gains realised

within the context of a business activity are taxed at a rate of 16 % (+ social

taxes for a global rate of 11 %. That is an effective rate of 27 %).

But in the case of a retirement from a society which respond to the definition

of "Small and Medium Entreprise" (SME), capital gains realised within the

context of this business activity shall be tax exempted.

France Country Report

February 2008

49

28.1. If capital gains from private assets are taxed lower, does this

represent an important incentive for the business not to invest in

their own Undertaking?

NA

29.

Are interest expenses incurred on private debts deductible for tax

purposes?

NO, except from individual business

30.

Is there a tax advantage for the Undertaking in transferring debts from the

business owner to the Undertaking?

YES,

• the interests are deductible for the society;

• but they are not deductible for the business owner unless debts relative

to the share purchasing.

31.

Is there a tax advantage for the business owner in transferring debts from

the business owner to the Undertaking?

YES, ISF (wealth tax) but the transfer must be done in accordance with the

interest of the company

32.

Are there other taxes such as inheritance tax which have an important

impact on own equity and retention of earnings decisions?

YES, ISF (wealth tax)

Document Outline

- INTRODUCTION

- 1. What are the main characteristics of the tax systems applicable on enterprises and business owners in your Country (corpora

- 1.1.1 What are the general principles for the computation of taxable profits?

- 1.1.2 What are the main differences between the tax balance sheet and commercial balance sheet?

- 1.1.3 What are the most important adjustments for the computation of taxable profits/taxable gains on the base of accounting p

Wyszukiwarka

Podobne podstrony:

podatki po ang(1)

cv po ang, Po I-III rok

Podręcznik zasad udzielania omocy MSP po ang

i idealism po ang

2 dni wycieczki po ang

Podatnik ma prawo do zwrotu nadwyżki podatku po zakończeniu działalności gospodarczej

slm po ang

przepisy na naturalne kosmetyki, ZDROWIE ks po ang!

przyrządy pomiarowe po ang

po ang treść prezentacji

list po ang polecenie strony internetowej

Wykład doktryny po ang

CHile po ang

cv po ang, Po I-III rok

co mówić po ang relacjonowanie wyd(1)

statut katalonii po ang

więcej podobnych podstron