Important information for Travel Scheme members:

As a member of the travel scheme, we assume that:

* You travel to/from work via the 'Normal Mode of Travel' you have notified to us

* You incur costs in travelling to/from work

* You incur costs in providing subsistence (meals and beverages) for yourself while travelling to/from work or

working on Assignment

Under the terms of your contract of employment you have a duty to inform us if on any day during an Assignment you:

a) travel to/from work via a mode of travel that is different to your 'Normal Mode of Travel'

b) incur no cost in travelling to/from work

c) incur no cost in providing subsistence for yourself while travelling to/from work, or during your working day

If any of the above applies, you must inform your local branch or onsite manager confirming the date(s) to which any

of the above applies. Failure to inform as outlined above may result in incorrect expenses being paid and in

disciplinary action being taken against you. The Company will also deduct any amounts overpaid from future expenses

or any outstanding payments due to you.

To monitor ongoing compliance with the above requirements, the Company undertakes random audits which consist of

interviewing onsite mobile employees. If you are selected to participate in an audit you will be asked to produce

evidence of the following:

1) That the mode of transport notified by you is the mode of transport used for that assignment

2) That subsistence costs have been incurred by the production of receipts or evidence that you have incurred costs

whilst on the assignment.

You are therefore recommended wherever possible to obtain receipts for all travel and subsistence costs associated

with your assignments and to retain the receipts for the day. These should be presented to a member of the audit

team if requested.

Warning

Please be aware that during recent audits we have found some workers who have failed to comply with their ‘duty to

inform’ obligations. As a result, the individuals concerned have been removed from the Travel Scheme, and will no

longer be able to benefit from being a member of the scheme.

Important General Information for all Employees:-

In accordance with clause 5.1 of your contract of employment, the Company may provide your payslip in electronic,

paper or such other format as determined by the Company. Should you have any difficulties accessing your online

payslip please contact your local branch / site team who will arrange for you to receive a paper copy.

Please note if you are required to submit a timesheet you must ensure the timesheet is authorised and submitted in

accordance with clause 8.1 of your contract of employment Any failure or delay in doing so may result in payment for

the hours you have worked being delayed.

The hours stated on your payslip represent the hours during the relevant pay reference period that you have actually

worked plus any time you may have spent on formal rest breaks for which it has been agreed you will be paid.

In addition to any formal rest breaks, being the normal meal and / or tea breaks you are given whilst on assignment,

you are entitled under clause 3.12 of your contract of employment to an additional informal unpaid rest break of

12.5% of the Scheduled Working Hours, plus 12.5% of any overtime hours you agree to work.

To assist you in calculating your entitlement to the additional informal unpaid break, please see below:

Scheduled Working Hours = (A) Assigned Hours - (B) Formal Rest Break Hours, where

(A) Assigned Hours = the hours between your start and finish time.

(B) Formal Rest Break Hours = the time allocated during your shift for taking formal meal and / or tea breaks

(whether such breaks are paid or unpaid).

For example, if you are assigned to start your shift at 7.00am and finish at 4.00pm, your Assigned Hours (A) will be

9 hours. If during each working day you are allocated two formal tea / coffee breaks of 15 minutes each, plus a 30

minute lunch break, you will have been allocated a total of one hour of Formal Rest Break Hours (B). In this case,

the Scheduled Working Hours would be the Assigned Hours (9 hours) less the time provided for Formal Breaks (1 hour),

which means your Scheduled Working Hours will be 8 hours.

The entitlement to an additional unpaid informal rest break i.e. in addition to the time allocated for formal rest

breaks would therefore be 12.5% of 8 hours, which is 1 hour.

If you took some or all of this entitlement the time taken would be deducted from your weekly timesheet and would not

be paid. For members of the travel scheme it may also impact on the payments we can make to you under the scheme. If

however you do not wish to utilise your entitlement to take an additional unpaid break and instead choose to work the

time allocated, you will be paid for time worked at the relevant pay rate specified for the assignment.

If you would like to utilise your entitlement to an additional informal unpaid rest break you must notify a line

manager or supervisor of the Company, or in their absence, a line manager or supervisor of the client. If the

Client’s line manager or supervisor does not allow you to take this entitlement you must notify a member of your

relevant branch or site management team immediately.

For the avoidance of doubt, if you wish to terminate your employment with the Company you are required to give notice

in accordance with clause 10.4 of your contract of employment, such notice to be given in writing.

Issue 9

1 / 2

PMP Recruitment Ltd t/a Abacus Recruitment

35 - 37 Wellington Street

Luton

Bedfordshire

Chevron House, 346 Long Lane, Hillingdon, Middlesex, UB10 9PF

LU1 2QH

PMP Recruitment Ltd

35 - 37 Wellington Street

Luton

Bedfordshire

LU1 2QH

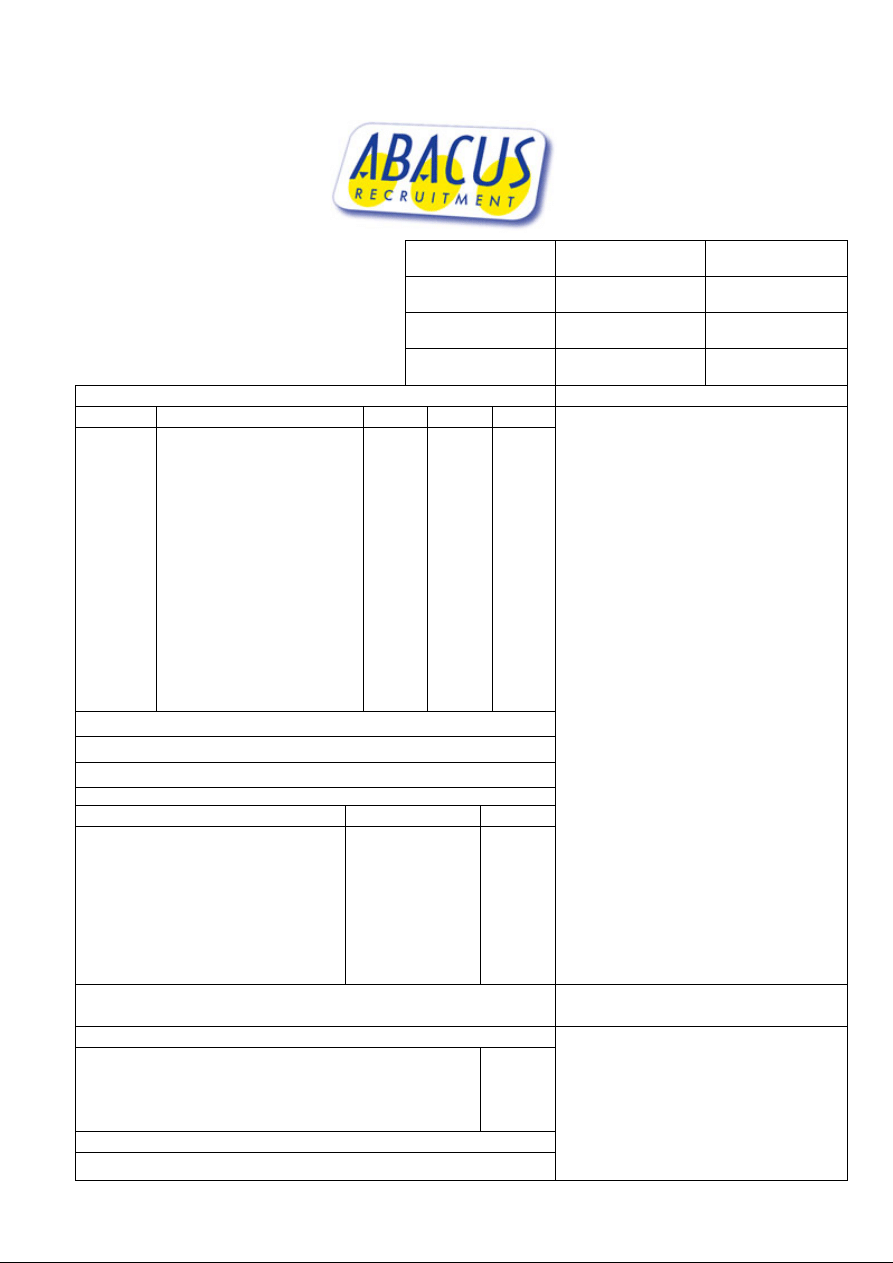

MALGORZATA DEC

Had you not been a member of the

Abacus Recruitment travel scheme,

your pay details would have been

as follows:

Net Pay

Total Deductions

N.I.

PAYE

Taxable Pay

Total Gross Pay

Confidential Helpline: Speak to an independent multi-lingual person about any concerns including whistle blowing, bad practice or poor

treatment of yourself or others on 01302 556 428 / 07971 568 151 open Mon - Fri 9:00 AM - 5:00 PM

Payroll Support: Contact your branch for all payroll enquiries.

Net Pay

Total Tax Free Expenses

Tax Free Expenses

Total Deductions

Balance YTD

Taxable Pay

Salary adjustment

Gross Pay

Value

Value

Rate

Hours

Description

T/Sheet

Information

Payments

Pay Method

Tax Code

NI Number

Pay Period

Pay Date

Taxable Pay to Date

Payroll Company

Employer

Year to date, you have earned

more in net pay

Average cost of meal paid

Please note; amounts shown are daily

averages and vary dependent on number

of days worked, length of time away

from home, amounts shown should

therefore not be compared to current

week expenses

Employment Commencement Date

Your net pay has increased by

As you are a member of the Abacus

Recruitment travel scheme:

Comments

Deduction type

Deductions

Your Employee Number is:

109157260

BASIC RATE

6.31

33.99

214.48

07/07/2014

0.00

MALGORZATA DEC

£214.48

£214.48

£2.91

£0.00

£1.97

£1.97

£7.38

£202.90

£4.20

£11.58

BACS

214.48

32.30

182.18

26.19

204.87

3.50

Travel Scheme

1000L/1

SG274566C/A

16/2015

P138156

310.02

25/07/14

26.19

PAYE

0.00

0.00

N.I.

3.50

3.50

2 / 2

Wyszukiwarka

Podobne podstrony:

niemiecki, NIEMIECKI DEKLINACJA S ABA, Deklinacja słaba Rzeczowników

aba studenci

aba

ABA ETYLEN 2008

ABA

g3 mfi ign syst aba 96 99

aba

133 aba who

ABA jako mediator SA

aba

g3 mfi ign syst aba 93 95

motronic mfi aba

formy ABA

WYTYCZNE ABA EBA ANZBA DOTYCZĄCE OPARZEŃ POLiSH

ABA

więcej podobnych podstron