© 2002 Optionetics

1

High Profit - Low Risk Trading

© 2002 Optionetics

2

Who We Are

1. Leading stock market education

company in the United States &

Canada

2. Courses taught by experienced,

successful traders

3. Since 1993, we have helped over

30,000 students trade the markets

successfully.

© 2002 Optionetics

3

Option Elements

Strike

Prices

Expiration

Months

Call Prices:

Price of XYZ - 105

STR July

Aug

Oct

100

6.3

7.5

8.2

105

2.0

3.9

4.7

110

0.4

1.6

2.7

Stock

Price

Option Premiums

© 2002 Optionetics

4

1. Uses discretionary method

2. Greed and Fear

3. Buy Low – Sell High

4. The Religious Approach

5. System Trading with Limited

Risk

Average Trader

© 2002 Optionetics

5

Dogs of the DOW System

1. Uses the DOW 30 Stocks

2. System only BUYS certain stocks

3. One Year Trading System

4. No Risk Management

© 2002 Optionetics

6

Stock Symbol Price 12/31 Yield Price Today Difference

Yield

Totals

EK

29.43

6%

34.06

4.63

0.450279 5.080279

JPM

36.35

4%

34.96

-1.39

0.3398725 -1.05013

SBC

39.17

3%

39.25

0.08

0.25558425 0.335584

IP

40.35

2%

45.98

5.63

0.25017

5.88017

XOM

39.9

2%

44.02

4.12

0.233415 4.353415

Totals

185.2

14.59932

ROI

8%

Annualized

32%

Dogs of the Dow for 2002 January - March

16%

© 2002 Optionetics

7

System Recap

Long Term Stock Buying System

Unlimited Returns (Best 40% in One Year)

Substantial Risk (Actual worst was 6.8% for One

Year)

Outperforms nearly every fund in the last 30

years (Average Annual Returns – 22% in the last

30 years)

© 2002 Optionetics

8

Analyzing Positions

1. What if I am right?

2. What if I am wrong?

3. Great traders look at risk.

FIRST !

© 2002 Optionetics

9

Bullish

Buy a Call instead of buying stock

• Lower Cost and Risk

• The Power of Leverage

• The Power or Protection

© 2002 Optionetics

10

Dogs of the DOW System

Using Call Options

1. Uses the DOW 30 Stocks

2. Buy 1 year ATM Call Options

3. Rebalance each year in December

© 2002 Optionetics

11

Stock Symbol Premium Yield Price Today Difference

Yield

Totals

EK

3

0%

3.5

0.5

0

0.5

JPM

3.5

0%

3.2

-0.3

0

-0.3

SBC

4

0%

4

0

0

0

IP

4

0%

6.5

2.5

0

2.5

XOM

4

0%

6

2

0

2

Totals

18.5

Interest

2.3125

Profit

7.0125

ROI

38%

Annualized

152%

Options on the Dogs of the Dow for 2002

76%

© 2002 Optionetics

12

Bearish

Buy a Put instead of selling stock

• Lower Cost and Risk

• The Power of Leverage

• The Power or Protection

© 2002 Optionetics

13

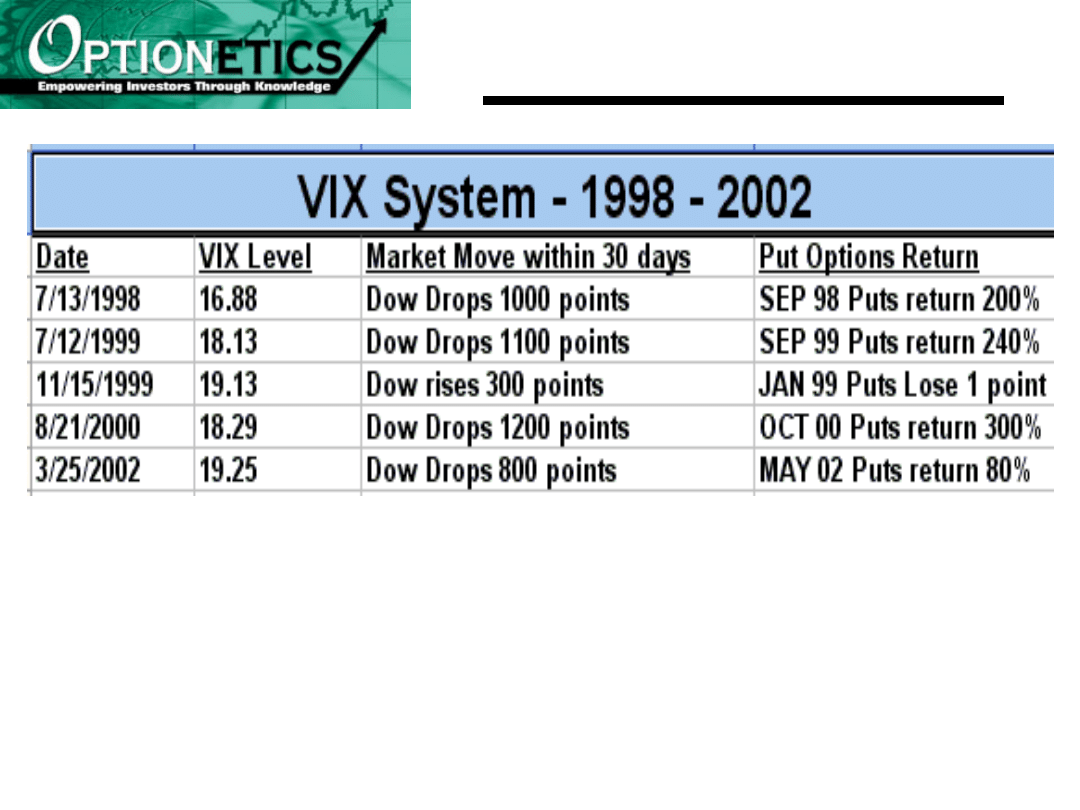

DOW Sell System

Buy 60-90 Day Put Options on the

DOW when the VIX drops below a

level of 20.

Exit the trade within 30 days to

expiration.

© 2002 Optionetics

14

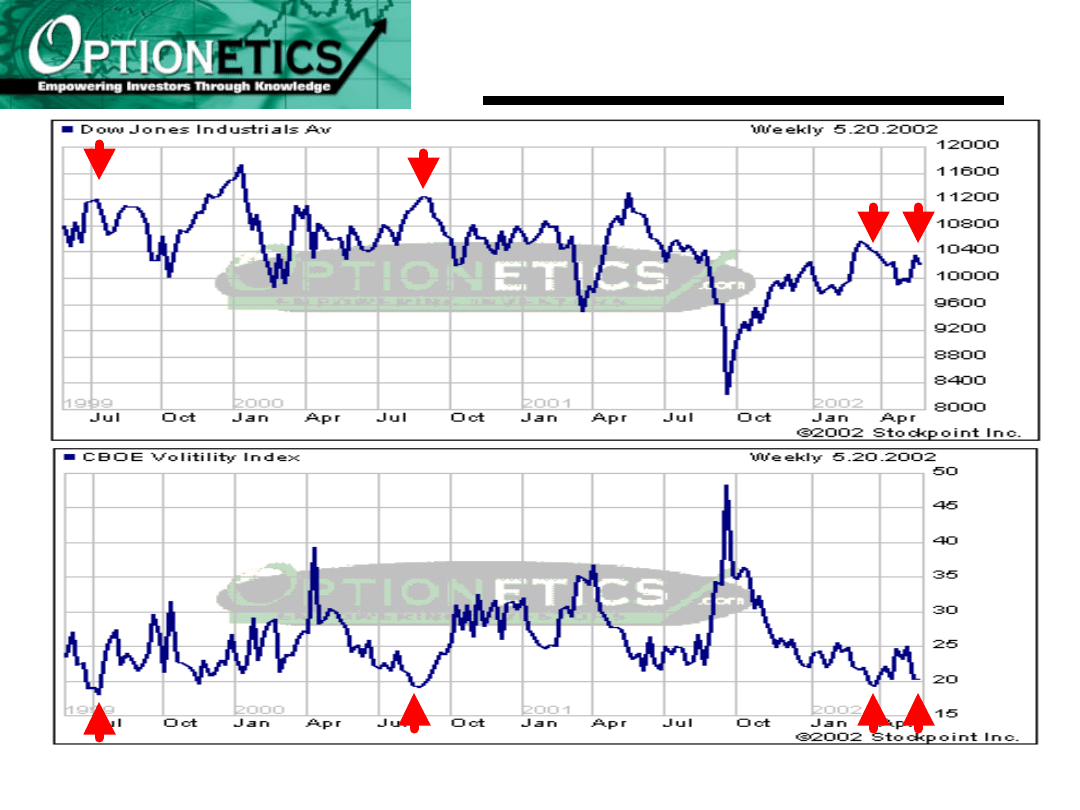

Index System

VIX Sell Signals for the last 3 Years

© 2002 Optionetics

15

Index System

5/20/2002 19.99

DOW DROPS 1000 points JUL02 Puts up 220%

The Option Returns reflect buying 60-90 Day options and holding them no

longer than 30 days to expiration.

NOTE

– We will show you a system using this indicator that works 96% of

the time with Delta Neutral Trades

© 2002 Optionetics

16

Spreading

With “Creative Financing” we can trim

the cost of our trades, therefore:

1. Further reducing both the cost and risk

2. Reducing the Breakeven on the Trades

3. Increasing the Return in Investment

4. Smoothing out the equity curve and stress

© 2002 Optionetics

17

Stock Symbol Premium Yield Price Today Difference

Yield

Totals

EK

1.5

0%

3

1.5

0

1.5

JPM

2.5

0%

2.8

0.3

0

0.3

SBC

2.5

0%

3.5

1

0

1

IP

2.5

0%

5.5

3

0

3

XOM

2.5

0%

5

2.5

0

2.5

Totals

11.5

Interest

2.3125

Profit

10.6125

ROI

92%

Annualized

369%

Spreads on the Dogs of the Dow for 2002

184%

© 2002 Optionetics

18

Comparing Trades

• Dogs of the Dow original system would

cost $18,500 for 100 shares of each

stock.

• Dogs of the Dow call option system

would cost $1850

• Dogs of the Dow Spreading would cost

just $1050

• Using Options lowers the risk

dramatically on this safe system

© 2002 Optionetics

19

Optionetics

• Visualize your Risk

to determine the

BEST strategy to use.

• Combining Options into “Spreads” -

Slash your risk over 90%!!!

• Great Trading Systems

to use the other

11 months of the year.

• TRADING SESSION

Using the right tools

and indicators for High Octane/ High

Probability trades.

1500/500/5

Wyszukiwarka

Podobne podstrony:

Amazing Forex System Explosive Profits News Trading

Drakoln Noble Trade Like A Pro 15 High Profit Trading Strategies

High Probability Kumo Breakout trading

Ebook Forex Analiza techniczna

Ebook Forex Strategie inwestycyjne

Ebook Forex Podstawy gieldy walutowej

AD&D DM Option High Level Campaigns

High Performance, Low Cost Photovoltaic Concentrator System

Ebook FOREX

High Current, Low Voltage Shunt Regulator

[Trading Forex] The Forex Profit System

BASIC FOREX TRADING GUIDE Ebook Nieznany

(eBook) The Best Intraday Forex Trading System EVER

Trading Ebook Trading Forex

19 Risks of FOREX Trading Risk Management

The Power Option Strategy The Ultimate Options Trading Strategy High

Forex Online Manual For Successful Trading

więcej podobnych podstron