Trading with

Trading with

Bollinger Bands

Bollinger Bands

with

with

Toni Turner

Toni Turner

www.

www.

toniturner

toniturner

.com

.com

A Brief Introduction . . .

A Brief Introduction . . .

Toni Turner

Toni Turner

President

President

TrendStar Trading Group, Inc.

TrendStar Trading Group, Inc.

A Beginner’s Guide to Day Trading Online

A Beginner’s Guide to Day Trading Online

A Beginner’s Guide to Short Selling

A Beginner’s Guide to Short Selling

(video)

(video)

A Beginner’s Guide to Short

A Beginner’s Guide to Short

-

-

Term Trading

Term Trading

Website: www.

Website: www.

toniturner

toniturner

.com

.com

How About You?

How About You?

Where are you in your trading career?

Where are you in your trading career?

What time frames do you trade?

What time frames do you trade?

Do you

Do you

use fundamental analysis as a

use fundamental analysis as a

decision support tool?

decision support tool?

Do you use technical analysis as a

Do you use technical analysis as a

primary decision support tool?

primary decision support tool?

Do you currently use Bollinger Bands?

Do you currently use Bollinger Bands?

What additional indicators do you use?

What additional indicators do you use?

Today’s Topic…

Today’s Topic…

Bollinger Bands

Bollinger Bands

Where they are used

Where they are used

Time frames

Time frames

Basic Concepts…how they work

Basic Concepts…how they work

Combining them with other indicators

Combining them with other indicators

What they are

What they are

–

–

Identify price patterns

Identify price patterns

–

–

Confirm trends

Confirm trends

–

–

Locate high

Locate high

-

-

probability setups, entries and

probability setups, entries and

exits

exits

Bollinger Bands

Bollinger Bands

What they are . . .

What they are . . .

Created by John Bollinger in early 1980’s

Created by John Bollinger in early 1980’s

Consist of upper and lower envelopes, or

Consist of upper and lower envelopes, or

bands, plotted in and around the price

bands, plotted in and around the price

pattern of a stock or index

pattern of a stock or index

Expand and contract according to volatility

Expand and contract according to volatility

Bollinger Bands Ask…

Bollinger Bands Ask…

Question: On a relative basis, are

Question: On a relative basis, are

prices high, or low?

prices high, or low?

Answer:

Answer:

–

–

Prices are high at upper band

Prices are high at upper band

–

–

Prices are low at lower band

Prices are low at lower band

Bollinger Bands

Bollinger Bands

OBV

Upper band

Lower band

20 MA

RealTick graphics used with permission of Townsend Analytics, Ltd. © 1986-2002. All rights reserved.

Bollinger Bands . . .

Bollinger Bands . . .

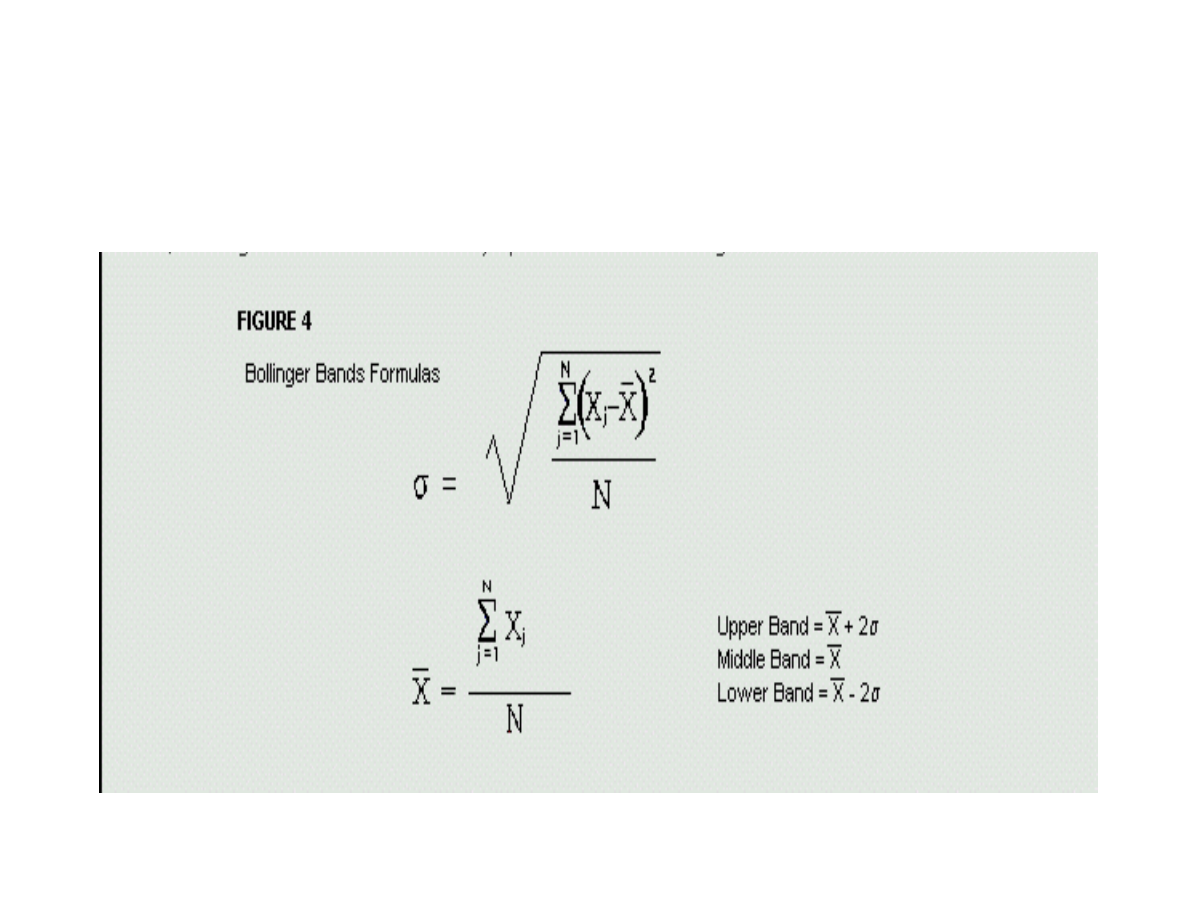

Base: middle band is usually 20

Base: middle band is usually 20

-

-

period moving

period moving

average.

average.

Upper band: spread above that MA by volatility

Upper band: spread above that MA by volatility

measure known as “standard deviation.” Default

measure known as “standard deviation.” Default

set at 2 standard deviations.

set at 2 standard deviations.

Lower band: middle band less same

Lower band: middle band less same

volatily

volatily

measure.

measure.

Bollinger Bands…

Bollinger Bands…

the formula

the formula

Let’s Translate That!

Let’s Translate That!

OBV

Upper band

Lower band

Defaults:

• 20-period MA

•Bandwidth = 2 standard deviations

RSI

RealTick graphics used with permission of Townsend Analytics, Ltd. © 1986-2002. All rights reserved.

Bollinger Band Applications . . .

Bollinger Band Applications . . .

Decision Support Tool for: stocks,

Decision Support Tool for: stocks,

indices, options, commodities, financial

indices, options, commodities, financial

futures, currencies, and mutual funds

futures, currencies, and mutual funds

Effective Time Frames: years, quarters,

Effective Time Frames: years, quarters,

months, weeks, days, hours, minutes,

months, weeks, days, hours, minutes,

ticks!

ticks!

Three Primary Uses

Three Primary Uses

Pattern recognition

Pattern recognition

–

–

Recognize double tops, head

Recognize double tops, head

-

-

and

and

-

-

shoulders,

shoulders,

double bottoms

double bottoms

Reversal signals

Reversal signals

–

–

Identify early warning signs of reversals

Identify early warning signs of reversals

Trend analysis

Trend analysis

–

–

Detect trend continuation and conclusion

Detect trend continuation and conclusion

Bollinger Bands (BB)

Bollinger Bands (BB)

Basic Concepts . . .

Basic Concepts . . .

Used to compare price and indicator

Used to compare price and indicator

action to arrive at buy and sell decisions

action to arrive at buy and sell decisions

Confirming indicators should not be

Confirming indicators should not be

directly related to each other

directly related to each other

Price can, and does, walk up the upper BB

Price can, and does, walk up the upper BB

and down the lower BB

and down the lower BB

Basic Concepts

Basic Concepts

RSI

OBV

RealTick graphics used with permission of Townsend Analytics, Ltd. © 1986-2002. All rights reserved.

Bollinger Bands (BB)

Bollinger Bands (BB)

Basic Concepts . . . continued

Basic Concepts . . . continued

Tags of bands

Tags of bands

are not necessarily

are not necessarily

buy/sell

buy/sell

signals

signals

Closes outside

Closes outside

BBs

BBs

can be

can be

continuation

continuation

signals

signals

if confirmed by other indicators

if confirmed by other indicators

Contraction (The Squeeze) is followed by

Contraction (The Squeeze) is followed by

Expansion, is followed by Contraction….

Expansion, is followed by Contraction….

Basic Concepts

Basic Concepts

RealTick graphics used with permission of Townsend Analytics, Ltd. © 1986-2002. All rights reserved.

Basic Concepts . . .

Basic Concepts . . .

BBs

BBs

are based on a simple moving

are based on a simple moving

average. Default is 20

average. Default is 20

-

-

period MA with 2

period MA with 2

standard deviations.

standard deviations.

Default contains 95% of price action

Default contains 95% of price action

Works well on most time frames

Works well on most time frames

Longer term: 50

Longer term: 50

-

-

period MA, 2.1 std. dev.

period MA, 2.1 std. dev.

Shorter term: 10

Shorter term: 10

-

-

period MA, 1.9 std. dev.

period MA, 1.9 std. dev.

Time Frame: Weekly Chart

Time Frame: Weekly Chart

RealTick graphics used with permission of Townsend Analytics, Ltd. © 1986-2002. All rights reserved.

Time Frame: 15

Time Frame: 15

-

-

Minute Chart

Minute Chart

Gulp!

Check out

volume

RealTick graphics used with permission of Townsend Analytics, Ltd. © 1986-2002. All rights reserved.

Time Frame: 5

Time Frame: 5

-

-

Minute Chart

Minute Chart

Gulp!

Check out

volume

Head-and-Shoulders

RealTick graphics used with permission of Townsend Analytics, Ltd. © 1986-2002. All rights reserved.

Strategy:

Strategy:

Double Bottom

Double Bottom

-

-

Bottom

Bottom

Fishing

Fishing

Locate stock basing by forming a double

Locate stock basing by forming a double

bottom (time frame

bottom (time frame

—

—

your choice).

your choice).

First bottom may penetrate lower BB.

First bottom may penetrate lower BB.

Second bottom

Second bottom

may be lower

may be lower

than prior

than prior

bottom (!), but

bottom (!), but

may not penetrate

may not penetrate

band.

band.

Strategy:

Strategy:

Double Bottom

Double Bottom

-

-

Bottom

Bottom

Fishing

Fishing

Other indicators must show bullish

Other indicators must show bullish

divergence.

divergence.

Confirming break to upside must be on

Confirming break to upside must be on

high volume.

high volume.

Place protective stop just below recent

Place protective stop just below recent

bottom.

bottom.

Double Bottom

Double Bottom

-

-

Bottom Fishing

Bottom Fishing

10 point day!

RealTick graphics used with permission of Townsend Analytics, Ltd. © 1986-2002. All rights reserved.

Double Bottom

Double Bottom

-

-

Bottom Fishing

Bottom Fishing

RealTick graphics used with permission of Townsend Analytics, Ltd. © 1986-2002. All rights reserved.

Shorting Strategy: Double Top

Shorting Strategy: Double Top

Head

Head

-

-

and

and

-

-

Shoulders

Shoulders

Locate stock forming Double (or Triple)

Locate stock forming Double (or Triple)

Top, or Head

Top, or Head

-

-

and

and

-

-

Shoulders

Shoulders

First top, or left shoulder + head, will

First top, or left shoulder + head, will

penetrate upper BB

penetrate upper BB

Second top, or right shoulder,

Second top, or right shoulder,

may not

may not

penetrate

penetrate

upper band

upper band

Shorting Strategy: Double Top

Shorting Strategy: Double Top

Head

Head

-

-

and

and

-

-

Shoulders

Shoulders

Additional indicators show bearish divergence

Additional indicators show bearish divergence

Double Top

Double Top

–

–

Second pivot: Sell short as stock falls below

Second pivot: Sell short as stock falls below

low of

low of

high day

high day

–

–

Final leg: Sell fall of fall below middle pivot of “M,”

Final leg: Sell fall of fall below middle pivot of “M,”

or support area

or support area

–

–

Low risk: Wait for throwback rally to fail

Low risk: Wait for throwback rally to fail

Head

Head

-

-

and

and

-

-

Shoulders

Shoulders

–

–

Sell short as stock breaks neckline

Sell short as stock breaks neckline

–

–

Low risk: Wait for throwback rally to fail

Low risk: Wait for throwback rally to fail

Sell Short Double Top

Sell Short Double Top

Throwback rally

RealTick graphics used with permission of Townsend Analytics, Ltd. © 1986-2002. All rights reserved.

Sell Short Head

Sell Short Head

-

-

and

and

-

-

Shoulders

Shoulders

Tag

No tag

RealTick graphics used with permission of Townsend Analytics, Ltd. © 1986-2002. All rights reserved.

Strategy:

Strategy:

Identify Market Tops

Identify Market Tops

RealTick graphics used with permission of Townsend Analytics, Ltd. © 1986-2002. All rights reserved.

Strategy:

Strategy:

Play “The Squeeze”

Play “The Squeeze”

Locate a stock in a “tight Squeeze”

Locate a stock in a “tight Squeeze”

Identify prevailing trend

Identify prevailing trend

Scan additional indicators to prepare for

Scan additional indicators to prepare for

possible entry

possible entry

Once in, set trailing stop

Once in, set trailing stop

Play “The Squeeze”

Play “The Squeeze”

Head Fake!

Yesssssssss!

RealTick graphics used with permission of Townsend Analytics, Ltd. © 1986-2002. All rights reserved.

In Conclusion . . .

In Conclusion . . .

Bollinger Bands help you, the trader

Bollinger Bands help you, the trader

and/or investor, to identify price patterns,

and/or investor, to identify price patterns,

trend direction, and reversals.

trend direction, and reversals.

This knowledge aids you in placing well

This knowledge aids you in placing well

-

-

thought out, disciplined, low

thought out, disciplined, low

-

-

risk trades.

risk trades.

Remember…your first priority is

Remember…your first priority is

always

always

to

to

conserve your capital!

conserve your capital!

Document Outline

- Trading withBollinger Bands

- A Brief Introduction . . .

- How About You?

- Today’s Topic…Bollinger Bands

- Bollinger Bands What they are . . .

- Bollinger Bands Ask…

- Bollinger Bands

- Bollinger Bands . . .

- Bollinger Bands…the formula

- Let’s Translate That!

- Bollinger Band Applications . . .

- Three Primary Uses

- Bollinger Bands (BB)Basic Concepts . . .

- Basic Concepts

- Bollinger Bands (BB)Basic Concepts . . . continued

- Basic Concepts

- Basic Concepts . . .

- Time Frame: Weekly Chart

- Time Frame: 15-Minute Chart

- Time Frame: 5-Minute Chart

- Strategy: Double Bottom-Bottom Fishing

- Strategy: Double Bottom-Bottom Fishing

- Double Bottom-Bottom Fishing

- Double Bottom-Bottom Fishing

- Shorting Strategy: Double TopHead-and-Shoulders

- Shorting Strategy: Double TopHead-and-Shoulders

- Sell Short Double Top

- Sell Short Head-and-Shoulders

- Strategy: Identify Market Tops

- Strategy: Play “The Squeeze”

- Play “The Squeeze”

- In Conclusion . . .

Wyszukiwarka

Podobne podstrony:

Thomas M Truxes Defying Empire, Trading with the Enemy in Colonial New York (2008)

Pristine Core Trading With Oliver Velez

Alan Farley Pattern Cycles Mastering Short Term Trading With Technical Analysis (Traders Library)

Explosive Forex Trading with Live Forex Trading Examples Udemy

Bandlien Trading with Muslims and the Sami in Med

Dennis D Peterson Developing A Trading System Combining Rsi & Bollinger Bands

Trading with Volume indicator offers the following features

Bollinger Bands, giełda(3)

Pristine Intra day Trading Techniques With Greg Capra

Beating The Bear Short Term Trading Tactics for Difficult Markets with Jea Yu

LEAPS Trading Strategies Powerful Techniques for Options Trading Success with Marty Kearney

Mastering Option Trading Volatility Strategies with Sheldon Natenberg

Pristine Intra day Trading Techniques With Greg Capra

101 Things to Do With Ramen Noodles Toni Patrick

An Introduction To Options Trading Success with James Bittman

Aldo Colombini The Band 13 New Effects With Cards & Rubber Bands

więcej podobnych podstron