ImprovingSmallBusinessCashFlow

CraigAlexanderOrrMBA,MSc,HND

Copyright2011CraigOrr

SmashwordsEdition

DiscoverothertitlesbyCraigOrratSmashwords.com:

FindingCashinYourBusiness-

http://www.smashwords.com/books/view/62199

If you have access to the Internet you can jump to the enhanced

content of this book by clicking on the links below. The links will

connect you with the podcast, the blog, presentations, the obligatory

twitterfeedandofcoursethewebsite

.

Anytrademarks,servicemarks,productnamesornamedfeaturesare

assumedtobethepropertyoftheirrespectiveowners,andareusedonly

forreference.Thereisnoimpliedendorsementiftheyareused.

Finally, use your head. Nothing in this book is intended to replace

commonsense,legal,medicalorotherprofessionaladvice,andismeant

toinformandentertainthereader.SohavefunfindingtheCashinYour

Business.

SmashwordsEdition,LicenseNotes

Thankyoufordownloadingthisfreeebook.Youarewelcometoshare

itwithyourfriends.Thisbookmaybereproduced,copiedanddistributed

fornon-commercialpurposes,providedthebookremainsinitscomplete

originalform.Ifyouenjoyedthisbook,pleasereturntoSmashwords.com

todiscoverotherworksbythisauthor.Thankyouforyoursupport.

Tableofcontents

Chapter1-Introduction

Chapter2-TheCashFlowFormula

Chapter1

CuttingcostsandimprovingCashFlowiswhereallsmallbusinesses

needtoberightnow.Thebigquestioniswheredoyoustart?Thisguide

provides the steps to help you to rapidly find the Cash buried in your

business.

Recently the owner of a small business said to me I am quoting for

morebusinessopportunitiesthaneverbefore,convertingless,constantly

runningshortoftimeandmycostskeepgoingup.Heshowedmeintohis

officewhereringbindersfullofquotesthathadnotconvertedtoorders

werestackedinwaistheightpiles,takingupvaluablefloorspace.MayI

firstsaythattheseguyswereexpertsatfillingquotes,withakeeneyefor

methodicalapproach,andifthathadbeentheircorebusinesstheywould

have been very profitable. Mentally I could see cash sticking out of the

ringbindersandfallingontothefloor.Heaskedmetheobviousquestion

why have I lost out on so many quotes? His business was a car body

repairshopandratherthanprovideananswertoasubjectIknewnothing

about. I asked him to indulge me as we started to evaluate how much

moneyhehadinvestedincreatingthestacksofquotes.Theresultswere

staggering in one year alone he had investing about two years wages,

whichhadultimatelyfeedthroughtohisbottomlinecostsandexplained

whyhewasbusierwithoutseeinganyimprovementincashflow.

Small businesses cannot afford the luxury of doing “business as

usual”inarecessionaryenvironmentitiscriticaltore-evaluatehowyour

business operates. Download The Business survival workshop -

http://www.smashwords.com/books/view/73829

onwhatyoudobest.

Costcuttingcanbeabitlikeliposuction,providinganunsustainable

quick fix, unless you make the required life style changes the problem

will quickly comes back. This short guide will provide pointers to help

you assess where you may have developed habits that are stopping you

frombeingmoreprofitable.

FirststopisaprocessofCashFlowtriage;identifyingwherethebig

issues are. Once the issues are identified it’s time to create a strategic

solutions plan. This enables the small business to achieve the greatest

returns within the shortest amount of time. The strategic solutions plan

will ensures that the life style changes required to sustain cost

management and improve long-term business performance become

embeddedintothedaytodayrunningofthebusiness.

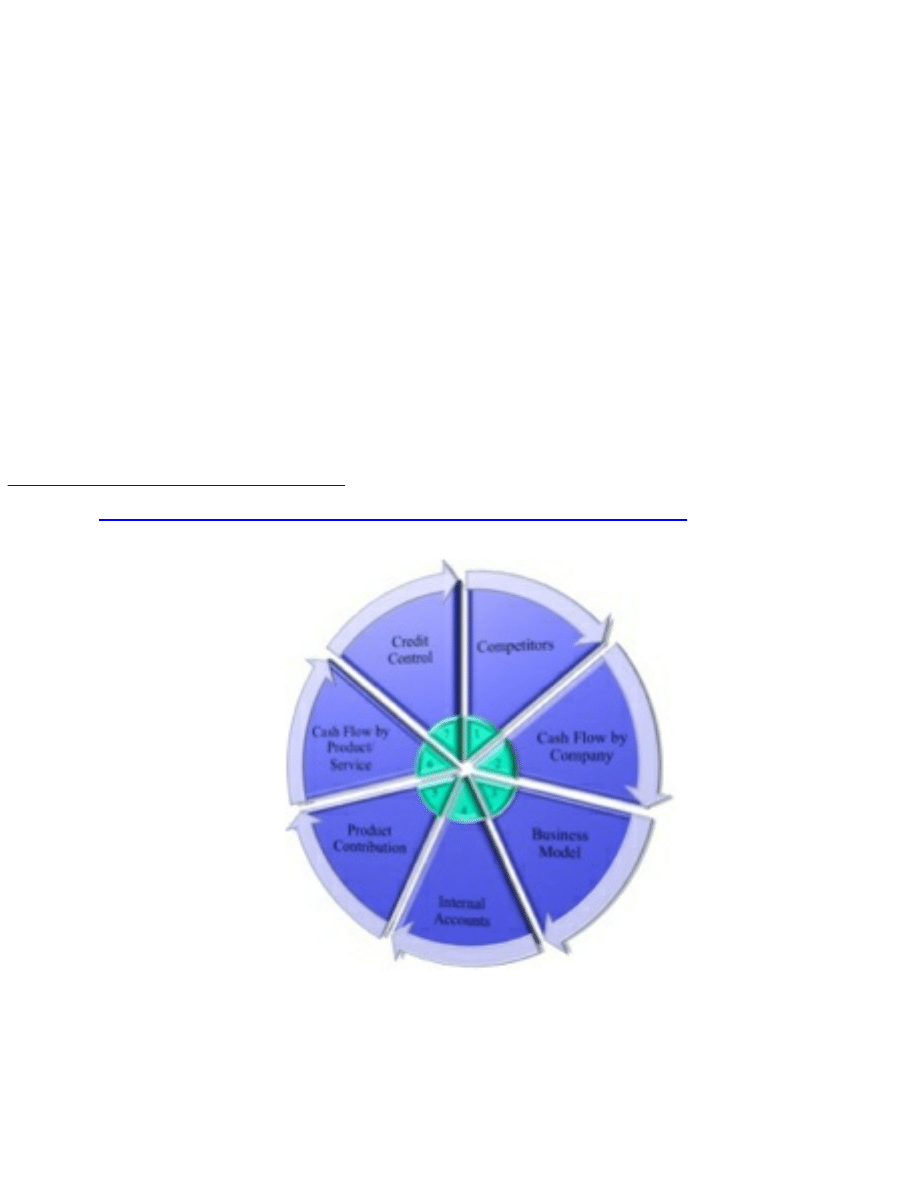

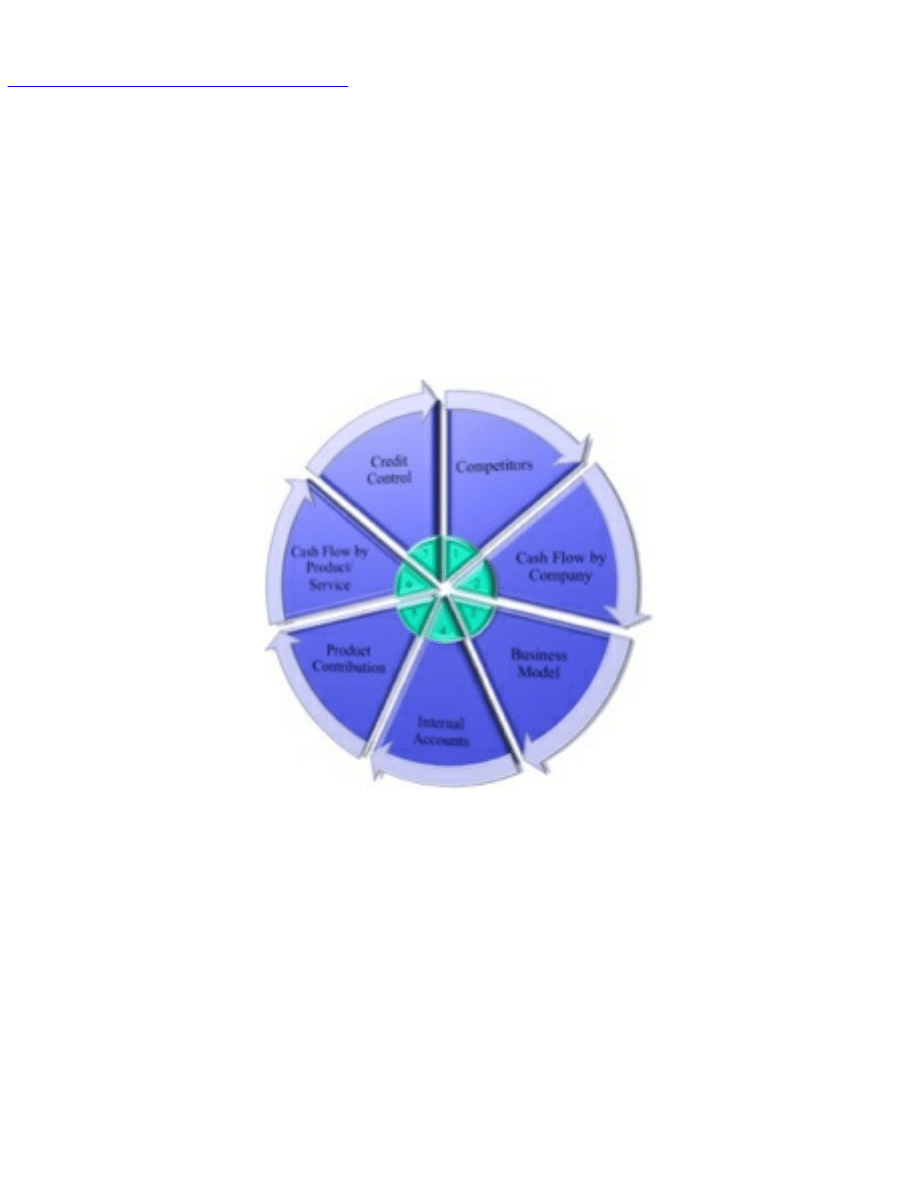

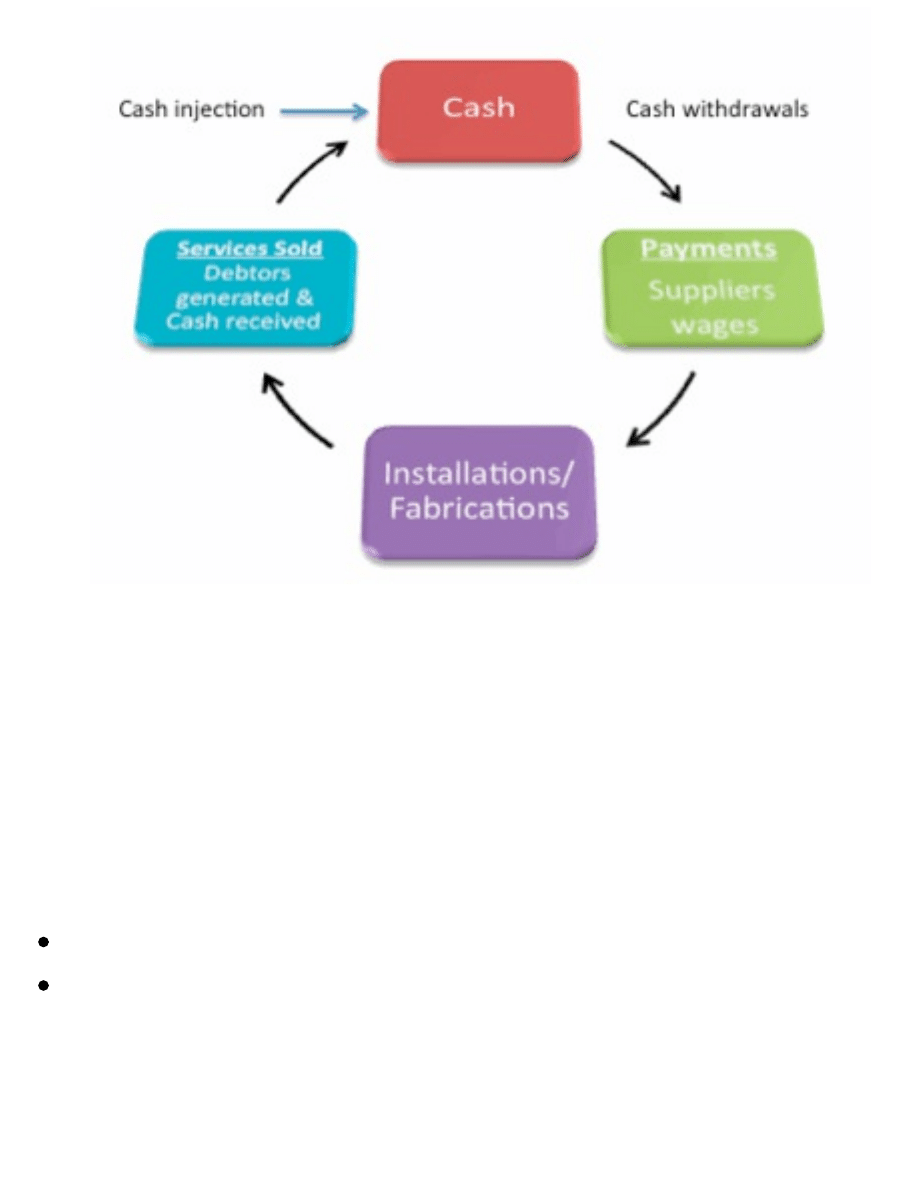

The Cash Flow Formula was developed after extensive research into

understanding and improving the way companies handle Cash. The

circular wheel shown below is the ‘aide memoire’ to drive a systematic

approach to the analyse. Each of the segments in the circle are broken

down

in

detail

in

the

various

resources

available

at

and in the Finding Cash in Your Business

ebook-

http://www.smashwords.com/books/view/62199

CashinStrategy

With most of the world’s economies at their worst condition since

World War 2, as never before a clear “Cash in” strategy plays an

important role in a small business’s success. In today’s turbulent

competitive environment, companies more than ever need a “Cash in”

strategy that keeps reminding them of the competitive advantage

achievedbybeingsmarterwithcash.

As the Global recession bites it is important to review your current

business product or service and customers mix as a priority. It may be

that your order book is still full making you feel insulated from the

recession. When in fact what you are actually experiencing is the effect

of customers who are progressing orders that were approved years in

advance,andthecurrentmarketconditionmaynottakeeffectformonths

oryears.Thekeyquestionhereiscanyourcustomersstillaffordtopay?

AIR

Inpreparingforthefutureyoursmallbusinessneedsto:

A

dapttothemarketconditions;createanactionplanbasedonwhat

products and or services are most likely to continue to be sold in a

recessionaryenvironment.

I

nitiate collaborative discussion with existing customers and

supplierswhoarestruggling.

R

eview existing and target customers and set new credit limits and

create risk bandings based on which companies are most likely to

survive.

Rememberyoucannotlivewithout

AIR

.

A

dapttothemarket,

I

nitiateDialogueand

R

eviewCustomers.

Chapter2

The Cash Flow Formula has been adapted to help you develop a

systematic approach to understand and improve the cash flows within

your businesses. The Formula knits together a number of accepted

managementtechniquessuchasratioanalysisandParetotoarriveatthe

CashFlowFormula.

TheFormulacanbestartedatanyofthesevensegments,especiallyif

youalreadyhaveidentifiedareasofconcern,orasegmentdosenotapply

to your company, however, generally in small business environment

jumping straight to Credit Control will have the biggest impact on

improvingCashFlow.

Herearethe7segments:

Competitors

Identify the key customer requirements used to compare you with

your competitors. Focus the business on improving those key customer

requirements.Communicatetheimprovementstoyourcustomerbase.

CashFlowbyCompany

Focus in on the area of the company that is expected to demonstrate

the highest returns in the medium term. Where there is high growth

potentialthegreatestopportunityforpoorfinancialcontrolsexists.

BusinessModel

Analyse your business model against the business’s current

performance. Challenge yourself as to if the business model is still

currentandtheoperationalstrategyderivedfromthatisstillcorrect.

InternalAccounts

Take a close look at the Internal Accounts. Graph them over a 4-

month period and compared them to the previous years results over the

same period. This trend analysis is used to highlight areas where cash

flowimprovementsarerequired.

Productcontribution

Determining which products have the greatest contribution to the

company’sprofitscanbeusedtofocusfutureproductdevelopmentsand

withdrawals. The highest contributing products will have the greatest

impactonthemanagementofCashflows.

CashFlowbyProduct/Service

Detailed deconstruction and mapping of the Working Capital Cycle

(WCC) for each of the products is used to determine which products or

servicesprovidethebestuseofcashwithinthebusiness,italsoensures

thatsupplierscredittermsarecontrolledandmanagedeffectively.

Creditcontrol.

Analyse when customers pay their bills so that irregularities can be

identifiedbeforelargedebtsareamassed.Understandingthekeydatesin

theWCCforaproductorserviceallowsbetteruseofthecreditgivenby

vendorsandthedebtowedbycustomers.

Chapter3

Whether you are a small business or a large corporate “Having too

many customers can break you, and focus on Cash Customers is

essential!” What many businesses don't get, is that the customer

acquisition and maintenance cost are normally far greater, than the

moneythecustomerwillspendwithyouontheirfirstsale.Onaveragea

business need to bring each customer back at least 5 times before they

willbegintogenerateaprofitandbecomegoodqualityCashcustomers.

One business I looked at had just over 700 customers, but was

strugglingtosellintotheircustomerbase.

InitiallyIaskedforahistoricallistofhowmucheachcustomerhad

spentwiththecompany.

My next question was how many customers regularly do business

withthecompany.Ofthe700only70regularlydidbusinesswiththe

company.

Nowcomesthecrucialquestion‘ofthe70howmanypaytheirbills

ontimeoratall?’nowwearedownto30.

I then asked for credit ratings for the 30 left and that brought the

numberofgoodCashcustomersdownto20.

The company had made the fatal mistake of not understanding the

cost of customer acquisition and maintenance. The expectation was that

allcustomersareequalandsotheyweresharedoutequallyamongstthe

salesstaff.

The average business spends 6 times more trying to win a new

customer, than it does generating new business from an existing

customer.

In recognition of this fact the solution required a combination of

reducingthesizeofthesalesteamandprovidingamoreappropriatelevel

ofaccountmanagement.

The company now focuses on supporting the top 20 accounts with

salesexecutives.Theother680+accountsaremanagedbyacombination

ofatelesalesteamandthebailiffs.

A typical fully loaded Sales Executive cost to the business was

£100,000 and there were 30 in the team including managers. Each sales

executivehandledover20customers.Thebusinesswasspendingaround

£3msupportingcustomerswhohadnointentionofbuying.Infactonly1

outofevery35customerswasworthsupporting.

Contrary to popular opinion creating a smaller Sales team increased

motivation, productivity, salary and sales. The new smaller team had a

reducedmanagementoverheadandhadimprovedtheprofitfromexisting

turnoverbyaround7%.

The Sales executives had more time to spend with each of their

customersthatmeanttheydeliveredabetterqualityofserviceandthisin

turnencouragedthecustomertoplacemoreorders.

It was true that the business had redeployed staff but by doing so it

morethanjustsecuredthejobsofallthatremained.

Thebusinesswasnowrunningmuchmoreefficiently, it has seen an

on-going improvement to turnover, and is in a much better place to

managethegrowthofthesalesteamgoingforward.

Chapter4

Smallbusinessessufferatthehandsoflargebusinesses,asthepainof

recession passes down the food chain. Small businesses are being asked

to take drastic action, drawing up wish lists of things that need to be

completed to improve their Cash position as the banks begin to

recapitalise and ration financial support. Time is critical, focus is

paramountandastrategicsolutionsplanisessential.

Banks no longer role out the red carpet, and angel investors want to

seeifthecompaniestheyinvestedinarecapableofgeneratingfreecash

flow(FCF)beforetheydecidetoinvestanymoremoney.

The working capital cycle shown below is an integral part of

understanding a business’s capital requirements, it’s capacity to service

externaldebts,it’sabilitytosustaingrowthandit’spotentialtogenerate

freecashflow.

UsingtheCashFlowFormulatohighlighttheareasthatwillprovide

the biggest improvements in Cash flow in the shortest period of time a

strategicsolutionplancanbeimplemented.Theplanensuresthatthelife

style changes required to sustain cost management and improve long-

term business performance become embedded into the companies’

culture.

Thestrategicsolutionsplanshouldincludethefollowing;

Thedetailedcashflowevaluationhighlightingareasofconcern

A detailed improvement Solutions report detailing any changes to

thewaythebusinessneedstooperate.Thereportshouldincludeany

3rd Party Supplier proposals required, and a proposed

implementationtimetable.

No matter where your finances are today, improving Cash Flow will

helpyoutooptimiseortransformtheperformanceofYourBusiness.

Chapter5

Thisguidehasprovidedyouwithanoverviewofthestepsrequiredto

analyseandimprovetheCashFlowwithinyourbusiness;recentmarket

conditions have had a dramatic impact on the global markets, and as

never before the lifeblood of the cash needs to pump through your

businessesarteries.

The global economy has started to contract and is unlikely to revert

backtotheheadydaysofdouble-digitgrowth,atleastforawhile.So,for

a while it will be hard to raise a loan or equity capital, except for

companies already generating free cash flow or those with a strong

emphasisoncashcontrol.Sothekeytosurvivingtheglobalcreditcrunch

istolookforcashinyourBusiness,findit,handleitwellandlookforthe

goldenopportunitiesitcreates.

###

AbouttheAuthor:

CraigisaBusinessstrategistwithafreshmarketperspective

combiningtechnologicalawareness,deliverableexperiencewithstrong

costmanagementandleadershipskills.Craiglikestothinkofhimselfas

theengineerwhounderstandscosts.CraigholdsbothanMScfrom

CranfieldandanexecutiveMBAfromBradford.Hehasassisted

CompaniesfromstartuptoFTSE100innearlyeveryregionoftheworld

forover25years.Hestates“thattosurviveintoday’scompetitive

marketplacecompaniesneedtofocusontheircorestrengths,and

outsourcetheareasthatdonotdifferentiatethemfromthecompetition.”

WhilstcompletinghisstudiesCraigremodelledthebusinessplanforthe

companyhewasworkingformakingthemthemostcostawareand

successfulbusinessinthesector.ThatsuccesspropelledhimintoBT

wherehewasresponsiblefortargetingoutsourcingopportunities,which

nowgeneraterevenuesinexcessof£200m,andsupportsalltargeted

communicationsproviders.

DiscoverothertitlesbyCraigOrratSmashwords.com:

FindingCashinYourBusiness-

http://www.smashwords.com/books/view/62199

I’msureonthebasisofthisguideyou’vegotquestionsand

comments.Itrusttheinformationsharedhasstruckachordwithyou.

There’llbeotherareasyouwantmetoexpandupon.EitherwayIwantto

hearfromyou…

ConnectwithMeOnline:

Smashwords:

http://www.smashwords.com/profile/view/craigscopy

http://craigscopy.blogspot.com/

Twitter:

Document Outline

- Chapter 1 - Introduction

- Chapter 2 - The Cash Flow Formula

- Chapter 3 - Focus on Cash Customers

- Chapter 4 - Strategic Solutions Plan

- Chapter 5 - Conclusion

Wyszukiwarka

Podobne podstrony:

Marketing a small business

Analiza finansowa AZF, ANSF03, ˙wiatowe standardy dopuszczaj˙ stosowanie metody bezpo˙redniej i po˙r

ABC Small Business'u

ABC small business'u

Improve Yourself Business Spontaneity at the Speed of Thought

Wykonywanie kopii zapasowej i przywracanie programu Windows Small Business Server 2003, Instrukcje P

ABC small businessu

Kompendium small businessu pracuj

F1 Cash flow forecasts and managing cash

Zadanie 2 cash flow (wykład)

przyklady cash flow

Cash flow

Small Business Success Secrets

Windows Small Business Server 2003 Administracja systemem 2

więcej podobnych podstron