For latest course notes, free audio & video lectures, support and forums please visit

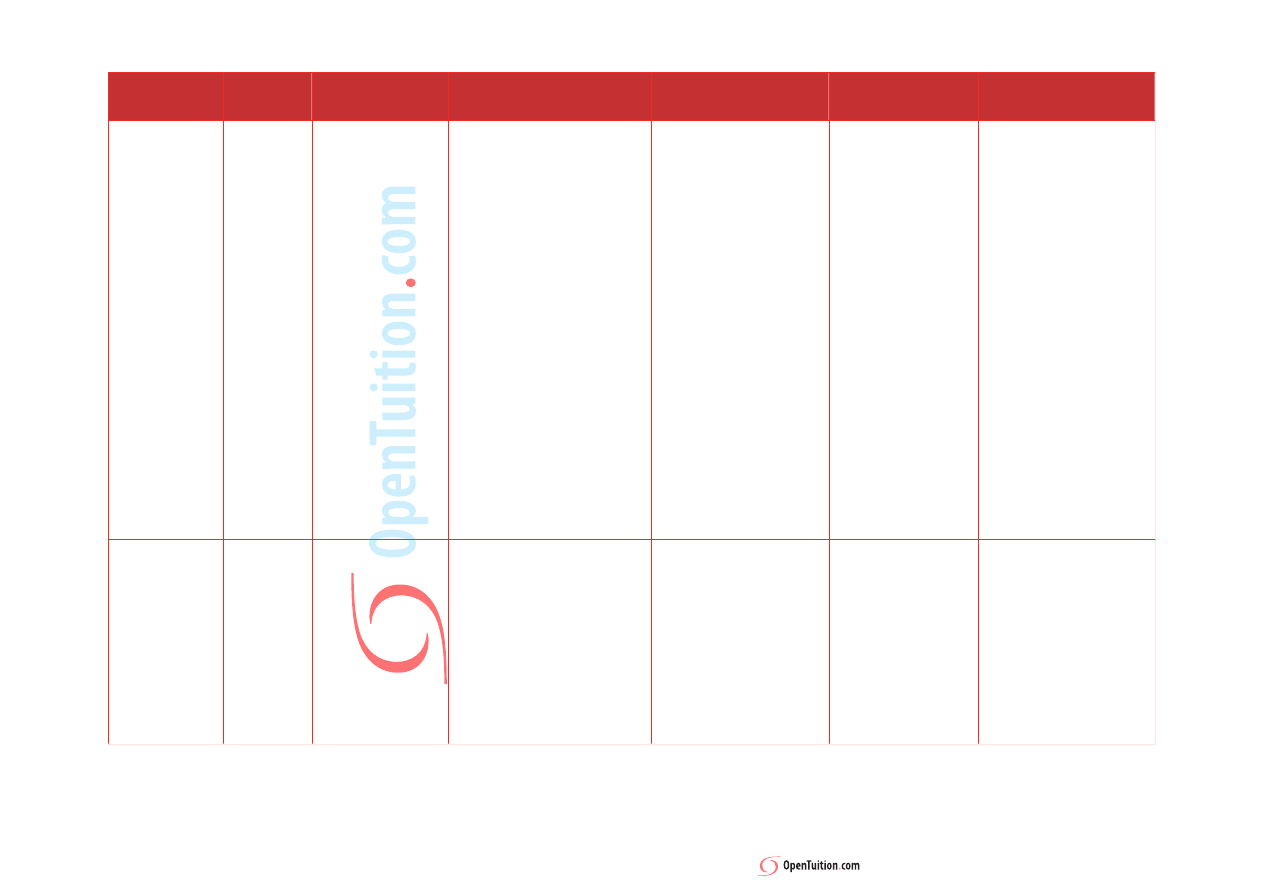

CAPITAL GAINS RELIEFS

RELIEF

WHO

CAN CLAIM

IN WHAT

CIRCUMSTANCES

ON WHICH

ASSETS

CONSEQUENCES

RESTRICTIONS

TIME LIMIT FOR CLAIMS

ENTREPRENEURS’ RELIEF INDIVIDUALS

SALE OF BUSINESS OR SHARES DISPOSAL OF THE WHOLE OR

PART OF A BUSINESS CARRIED

ON BY THE INDIVIDUAL OR

IN PARTNERSHIP.

ASSETS OF THE INDIVIDUAL’S

OR PARTNERSHIP’S TRADING

BUSINESS THAT HAS NOW

CEASED

SHARES IF THE INDIVIDUAL

OWNED AT LEAST 5% OF THE OSC

AND WAS AN EMPLOYEE OF THE

COMPANY.

ASSETS OWNED PRIVATELY AND

USED IN THE INDIVIDUALS

COMPANY OR PARTNERSHIP IF

THE INDIVIDUAL ALSO DISPOSES

OF ALL OR PART OF THEIR

PARTNERSHIP INTEREST/SHARES

AS PART OF THEIR WITHDRAWAL

OF INVOLVEMENT IN THE

PARTNERSHIP/COMPANY

THE FIRST £1M OF

QUALIFYING GAINS ARE

REDUCED BY 4/9

RELIEF GIVEN AFTER

OTHER RELIEFS(EXCEPT

EIS RELIEF) AND

ALLOWABLE LOSSES

(OTHER THAN ANY LOSSES

ON ASSETS THAT FORM

PART OF THE BUSINESS)

RELIEF IS GIVEN BEFORE

THE ANNUAL EXEMPTION

THE ASSET BEING

DISPOSED OF MUST

HAVE BEEN

OWNED IN THE 12 MONTHS PRIOR

TO THE DISPOSAL

IF THE DISPOSAL IS AN ASSET OF

THE INDIVIDUALS OR

PARTNERSHIPS TRADING

BUSINESS THAT HAS NOW CEASED

THE DISPOSAL MUST TAKE PLACE

WITHIN 3 YEARS OF THE

CESSATION OF THE TRADE

THE £1M LIMIT IS A LIFETIME

LIMIT WHICH IS REDUCED EACH

TIME A CLAIM FOR THE RELIEF IS

MADE

12 MONTHS FROM 31 JAN

NEXT FOLLOWING THE END

OF THE TAX TEAR IN WHICH

THE DISPOSAL IS MADE.

ROLLOVER RELIEF

INDIVIDUALS AND

COMPANIES

SALE AND REINVESTMENT OF

QUALIFYING ASSETS

LAND AND BUILDINGS

FIXED PLANT AND MACHINERY USED IN THE

TRADE

GOODWILL (INDIVIDUALS ONLY)

GOODWILL (UNINCORPOATED ONLY

FULL REINVESTMENT

OF PROCEEDS=ENTIRE

GAIN IS DEFERRED

INTO BASE COST

OF NEW ASSET.

PARTIAL REINVESTMENT OF

PROCEEDS

GAIN TAXED NOW=

PROCEEDS NOT REINVESTED

(LIMITED TO ORIGINAL GAIN)

NON BUSINESS USE-

ONLY ELIGIBLE

GAIN CONSIDERED

INDIVIDUALS:

4 YEARS FROM THE END OF

THE TAX YEAR IN WHICH THE DISPOSAL

OCCURRED

COMPANIES:

4 YEARS FROM

THE END OF THE ACCOUNTING

PERIOD IN WHICH THE DISPOSAL

OCCURRED

For latest course notes, free audio & video lectures, support and forums please visit

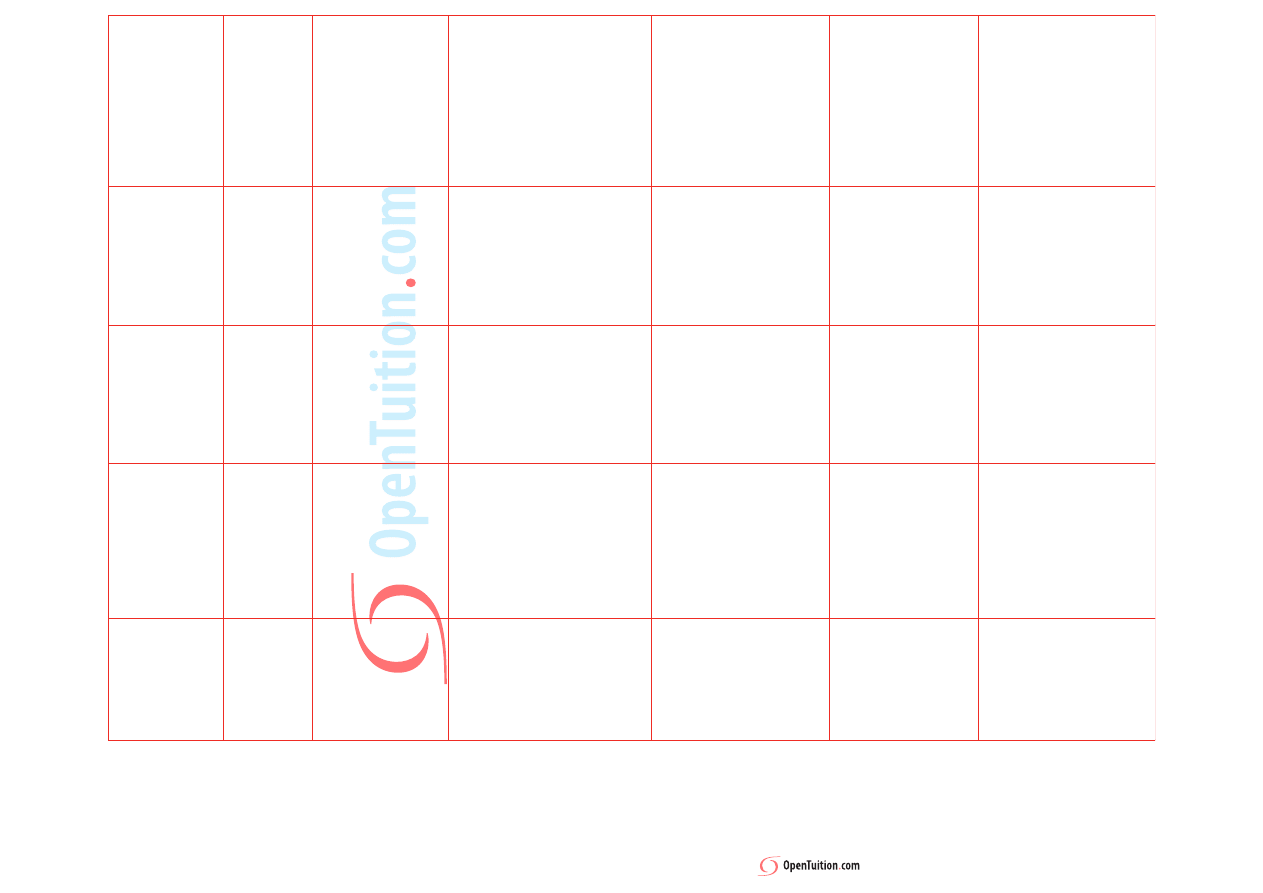

HOLDOVER RELIEF

INDIVIDUALS AND

COMPANIES

SALE OF QUALIFYING ASSSETS

AND REINVESTMENT INTO

DEPRECIATING ASSETS

DEPRECIATING ASSETS=

FIXED PLANT & MACHINERY

LEASEHOLD PROPERTY WITH LESS THAN OR

EQUAL TO 60 YEARS REMAINING

GAIN IS HELDOVER UNTIL THE EARLIEST

OF:

SALE OF THE DEPRECIATING ASSET

CEASE TO USE IN TRADE

10YRS FROM ITS ACQUISITION

NON BUSINESS USE AS ABOVE

INDIVIDUALS:

4 YEARS FROM THE END OF

THE TAX YEAR IN WHICH THE DISPOSAL

OCCURRED

COMPANIES:

4 YEARS FROM

THE END OF THE ACCOUNTING

PERIOD IN WHICH THE DISPOSAL

OCCURRED

GIFT RELIEF

INDIVIDUALS

GIFT OR SALE AT UNDERVALE

ASSETS USED IN THE TRADE OF INDIVIDUAL,OR

IN THEIR PERSONAL COMPANY(AT LEAST 5%

HOLDING)

UNQUOTED SHARES

QUOTED SHARES (AT LEAST 5% HOLDING)

OUTRIGHT GIFT=ENTIRE GAIN IS

DEFERRED ONTO DONEE.

SALE AT UNDERVALUE-GAIN TAXED

NOW=

ACTUAL PROCEEDS ABOVE COST

ANY REMAINING GAIN DEFERRED ONTO

DONEE

RESTRICT FOR PERSONAL CO

SHARES

GAIN ELIGIBLE=CBA/CA

4 YEARS FROM THE END OF

THE TAX YEAR IN WHICH THE DISPOSAL

OCCURRED

INCORPORATION RELIEF

INDIVIDUALS

UNINCORPORATED BUSINESS

TRANSFERS TRADE AND

ASSETS TO COMPANY

ALL CHARGEABLE ASSETS

GAINS ON CHARGEABLE ASSETS ARE

DEFERRED UNTIL INDIVIDUAL SELLS

SHARES

IF NON SHARE CONSIDERATION

GAIN ELIGIBLE=

GAINXSHARE CONSIDERATION/

TOTALCONSIDERATION

AUTOMATIC IF CONDITIONS MET

TIME LIMIT TO DISAPPY IS 2 YEARS FROM

31 JANUARY FOLLOWING THE END OF

THE TAX YEAR IN WHICH THE BUSINESS

IS TRANSFERRED

PRINCIPAL PRIVATE

RESIDENCE RELIEF

INDIVIDUALS

SALE OF MAIN RESIDENCE

MAIN RESIDENCE INCLUDING HALF A HECTARE

OF LAND

GAIN FULLY EXEMPTED

PPR RESTRICTED IF PERIOD OF

ABSENCE EXCLUDING DEEMED

OCCUPATION)

AUTOMATIC

TIME LIMIT FOR DETERMINATION OF

PRINCIPAL PRIVATE RESIDENCE IS 2

YEARS FROM THE ACQUISITION OF THE

SECOND PROPERTY

LETTING RELIEF

INDIVIDUALS

RENTAL OF WHOLE OR PART OF

MAIN RESIDENCE

MAIN RESIDENCE

RELIEF LOWER OF:

PPR GIVEN

£40000

GAIN DUE TO LETTING

MUST HAVE BEEN MAIN

RESIDENCE AT SOME POINT IN

TIME

AUTOMATIC

Wyszukiwarka

Podobne podstrony:

Cohen Fields Social capital and capital gains

196 Capital structure Intro lecture 1id 18514 ppt

Fundusze venture capital

GNU Linux Tools Summary

praca licencjacka finansowanie msp za pomocą funduszy venture capital m andrzejewicz

Capitalization MLA Style

Capitalism after the crisis Luigi Zingales

Project Management Six Sigma (Summary)

Summary and Analysis of?owulf

Count of Monte Cristo, The Book Analysis and Summary

F6

4-Tourism strategy summary, Turystyka, Turystyka uzdrowiskowa i odnowa biologiczna, Polityka i plano

F6 9

F6 7

Catcher in the Rye, The Book Analysis and Summary

F6 5

1984 Chapter by Chapter Summary and Reaction

Summaries of the Four Arab Israeli Conflicts in the th?n

więcej podobnych podstron