Note:Thistextisintendedtobeahigh-levelintroductiontoaccounting/bookkeeping.Theauthorwill

makehisbestefforttokeeptheinformationcurrentandaccurate;however,giventheever-changing

nature of industry regulations, no guarantee can be made as to the accuracy of the information

containedwithin.

AccountingMadeSimple:

AccountingExplainedin100PagesorLess

MikePiper

Copyright©2010MikePiper

Nopartofthispublicationmaybereproducedordistributedwithoutexpresspermissionoftheauthor.

SimpleSubjects,LLC

Chicago,Illinois60626

ISBN:978-0-9814542-2-1

Dedication

Toyou,thereader.Thankyou.

YourFeedbackisAppreciated.

Astheauthorofthisbook,I’mveryinterestedtohearyourthoughts.Ifyoufindthebookhelpful,

pleaseletmeknow!Alternatively,ifyouhaveanysuggestionsofwaystomakethebookbetter,I’m

eagertohearthattoo.

Finally,ifyou’reunsatisfiedwithyourpurchaseforanyreason,letmeknow,andI’llbehappyto

provideyouwitharefundofthecurrentlistpriceofthebook.

Youcanreachmeat:

.

BestRegards,

MikePiper

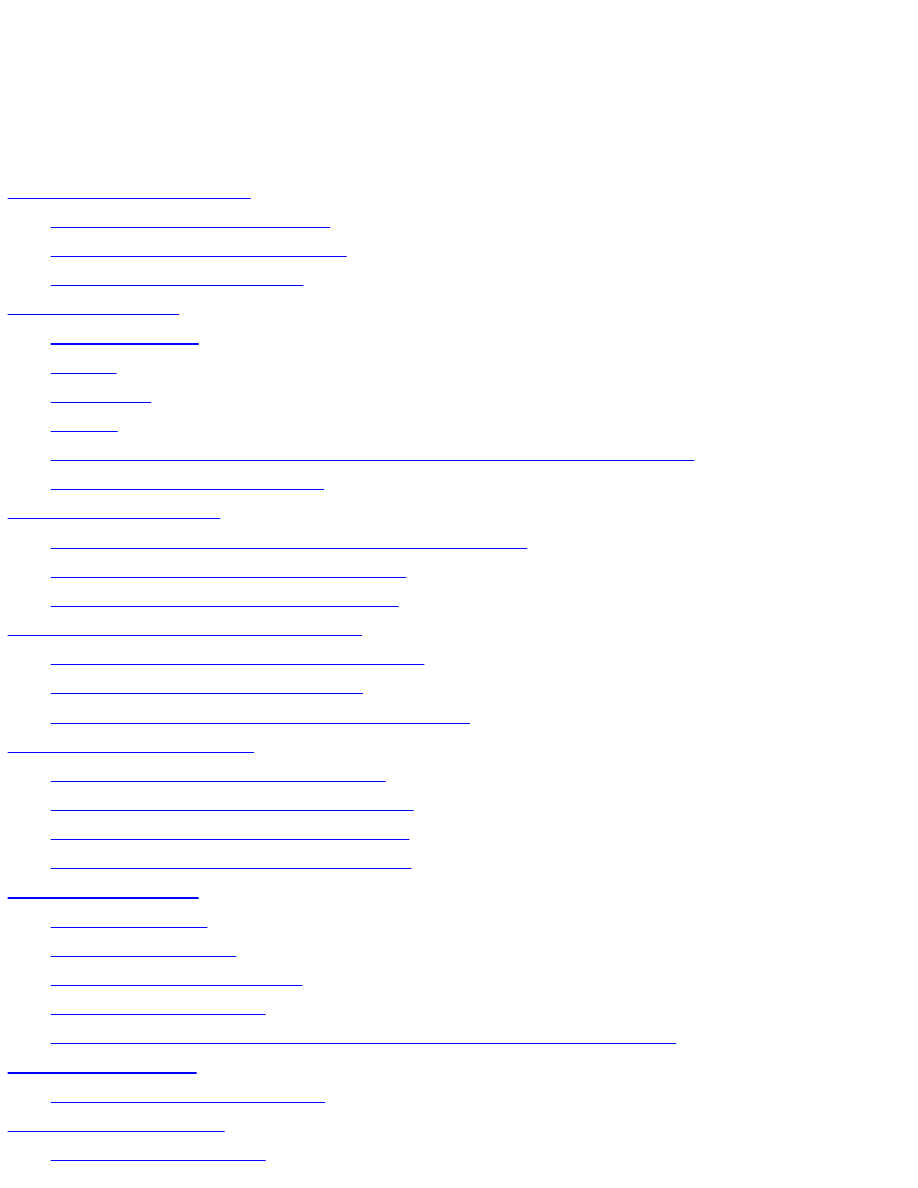

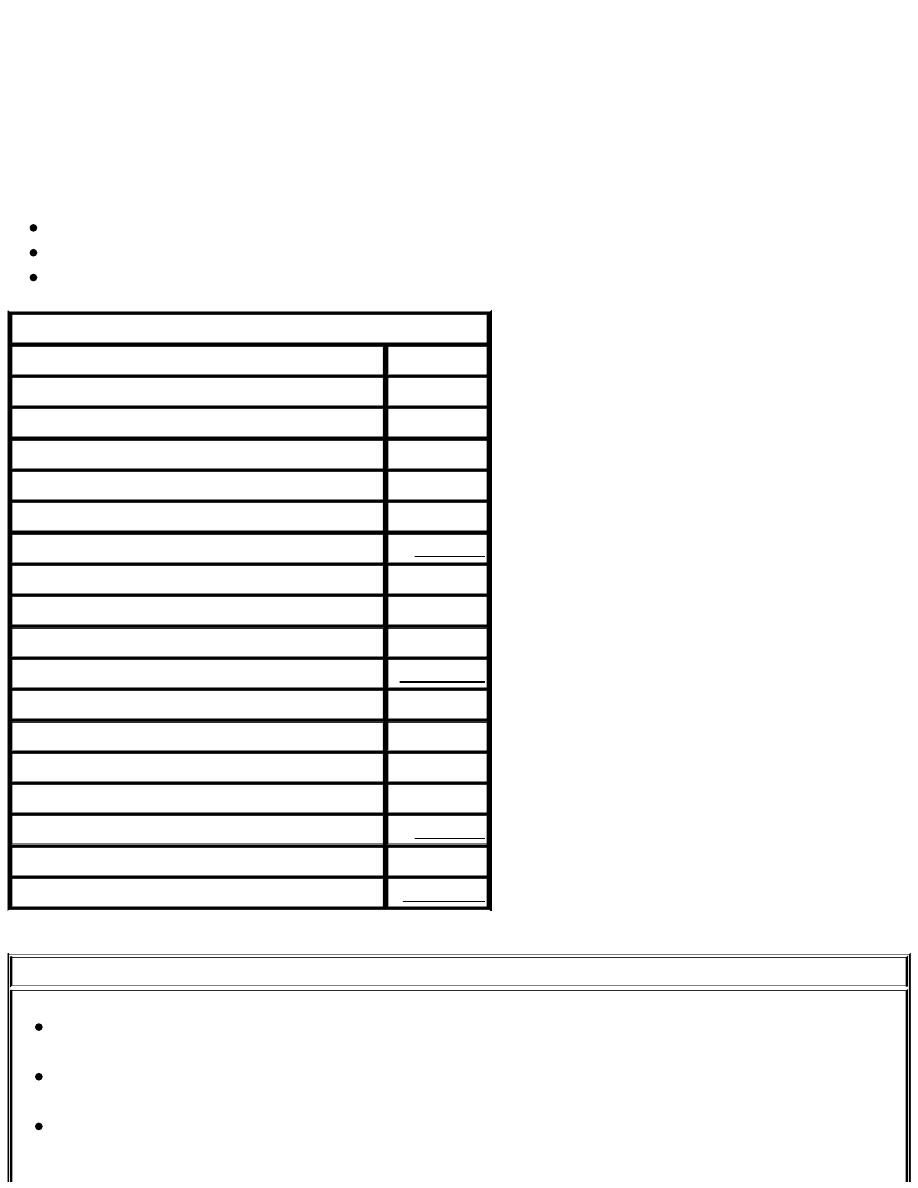

TableofContents

Alwaystrue,noexceptions

Owners’Equityisjustaplug

Myassetisyourliability

It’sasnapshot

Assets

Liabilities

Equity

Currentassetsandliabilitiesvs.long-termassetsandliabilities

Two-periodbalancesheets

Showsperiodoftimeratherthanpointintime

GrossProfit&CostofGoodsSold

OperatingIncomevs.NetIncome

Bridgebetweenfinancialstatements

Dividendsarenotanexpense!

RetainedEarnings:Notthesameascash

Asopposedtoincomestatement

Cashflowfromoperatingactivities

Cashflowfrominvestingactivities

Cashflowfromfinancingactivities

Liquidityratios

Profitabilityratios

Financialleverageratios

Assetturnoverratios

PartTwoGenerallyAcceptedAccountingPrinciples(GAAP)

Thegeneralledger

T-accounts

Thetrialbalance

Cashmethod

Accrualmethod

Prepaidexpenses

Unearnedrevenue

10.OtherGAAPConcepts&Assumptions

Historicalcost

Materiality

Moneyunitassumption

Entityassumption

Matchingprinciple

Straight-linedepreciation

AccumulatedDepreciation

Salvagevalue

Gainorlossonsale

Otherdepreciationmethods

Expensingimmaterialpurchases

12.AmortizationofIntangibleAssets

Whatareintangibleassets?

Straight-lineamortization

Legallifevs.expectedusefullife

13.Inventory&CoGS

Perpetualmethod

Periodicmethod

CalculatingCostofGoodsSold

FIFOvs.LIFO

Averagecostmethod

Introduction

Like the other books in the “…in100PagesorLess”series, this book is designed to give you a

basicunderstandingofthetopic(inthiscase,accounting),anddoitasquicklyaspossible.

Theonlywaytopackatopicsuchasaccountingintojust100pagesistobeasbriefaspossible.In

other words, the goal is not to turn you into an expert. With 100 pages, it’s simply not possible to

provide a comprehensive discussion of every topic in the field of accounting. (So if that’s what

you’relookingfor,lookforadifferentbook.)

Now,havingmadethatlittledisclaimer,IshouldstatethatIdothinkthisbookwillhelpyouachieve

adecentunderstandingofthemostimportantaccountingconcepts.

SoWhatExactlyIsAccounting?

Someprofessorsliketosaythataccountingis“thelanguageofbusiness.”Thatdefinitionhasalways

beensomewhattooabstractformytastes.Thatsaid,allthoseprofessorsareright.

At its most fundamental level, accounting is the system of tracking the income, expenses, assets,

anddebtsofabusiness.Whenlookedatwithatrainedeye,abusiness’saccountingrecordstrulytell

thestoryofthebusiness.Usingnothingbutabusiness’s“books”(accountingrecords),youcanlearn

practically anything about a business. You can learn simple things such as whether it’s growing or

declining,healthyorintrouble.Or,ifyoulookclosely,youcanseethingssuchaspotentialthreatsto

thebusiness’shealththatmightnotbeapparenteventopeoplewithinthecompany.

WhereWe’reGoing

Thisbookisbrokendownintotwomainparts:

1. A discussion of the most important financial statements used in accounting: How to read each

one,aswellaswhatlessonsyoucandrawfromeach.

2. AlookataccountingusingGenerallyAcceptedAccountingPrincipals(GAAP),including:

Topics such as double-entry bookkeeping, debits and credits, and the cash vs. accrual

methods.

How to account for some of the more complicated types of transactions, such as

depreciation expense, gains or losses on sales of property, inventory and cost of goods

sold,andsoon.

Solet’sgetstarted.

PARTONE

FinancialStatements

CHAPTERONE

TheAccountingEquation

Before you can create financial statements, you need to first understand the single most

fundamentalconceptofaccounting:TheAccountingEquation.

TheAccountingEquationstatesthatatalltimes,andwithoutexceptions,thefollowingwillbetrue:

Assets=Liabilities+Owners’Equity

Sowhatdoesthatmean?Let’stakealookattheequationpiecebypiece.

Assets:Allofthepropertyownedbythecompany.

Liabilities:Allofthedebtsthatthecompanycurrentlyhasoutstandingtolenders.

Owners’Equity(a.k.a.Shareholders’Equity):

Thecompany’sownershipinterestinitsassets,afteralldebtshavebeenrepaid.

Let’suseasimple,everydayexample:homeownership.

EXAMPLE:Lisaownsa$300,000home.Topayforthehome,shetookoutamortgage,onwhich

she still owes $230,000. Lisa would be said to have $70,000 “equity in the home.” Applying the

AccountingEquationtoLisa’ssituationwouldgiveusthis:

Assets

= Liabilities + Owners’Equity

$300,000 = $230,000 + $70,000

Inotherwords,owners’equity(thepartthatoftenconfusespeople)isjustaplugfigure.It’ssimply

the leftover amount after paying off the liabilities/debts. So while the Accounting Equation is

conventionallywrittenas:

Assets=Liabilities+Owners’Equity,

…itmightbeeasiertothinkofitthisway:

Assets–Liabilities=Owners’Equity

If,oneyearlater,Lisahadpaidoff$15,000ofhermortgage,heraccountingequationwouldnow

appearasfollows:

Assets

= Liabilities + Owners’Equity

$300,000 = $215,000 + $85,000

Becauseherliabilitieshavegonedownby$15,000—andherassetshavenotchanged—herowner ’s

equityhas,bydefault,increasedby$15,000.

MyAssetisYourLiability

Oneconceptthatcantripupaccountingnovicesistheideathataliabilityforonepersonis,infact,an

asset for somebody else. For example, if you take out a loan with your bank, the loan is clearly a

liabilityforyou.Fromtheperspectiveofyourbank,however,theloanisanasset.

Similarly,thebalanceinyoursavingsorcheckingaccountis,ofcourse,anasset(toyou).Forthe

bank,however,thebalanceisaliability.It’smoneythattheyoweyou,asyou’reallowedtodemand

fullorpartialpaymentofitatanytime.

Chapter1SimpleSummary

Acompany’sassetsconsistofallthepropertythatthecompanyowns.

Acompany’sliabilitiesconsistofallthedebtthatthecompanyowestolenders.

Acompany’sowners’equityisequaltotheowners’interestinthecompany’sassets,after

payingbackallthecompany’sdebts.

TheAccountingEquationisalwayswrittenasfollows:

Assets=Liabilities+Owners’Equity

However,it’slikelyeasiertothinkoftheAccountingEquationthisway:

Assets–Liabilities=Owners’Equity.

CHAPTERTWO

TheBalanceSheet

Acompany’sbalancesheetshowsitsfinancialsituationatagivenpointintime.Itis,quitesimply,a

formalpresentationoftheAccountingEquation.Asyou’dexpect,thethreesectionsofabalancesheet

areassets,liabilities,andowners’equity.

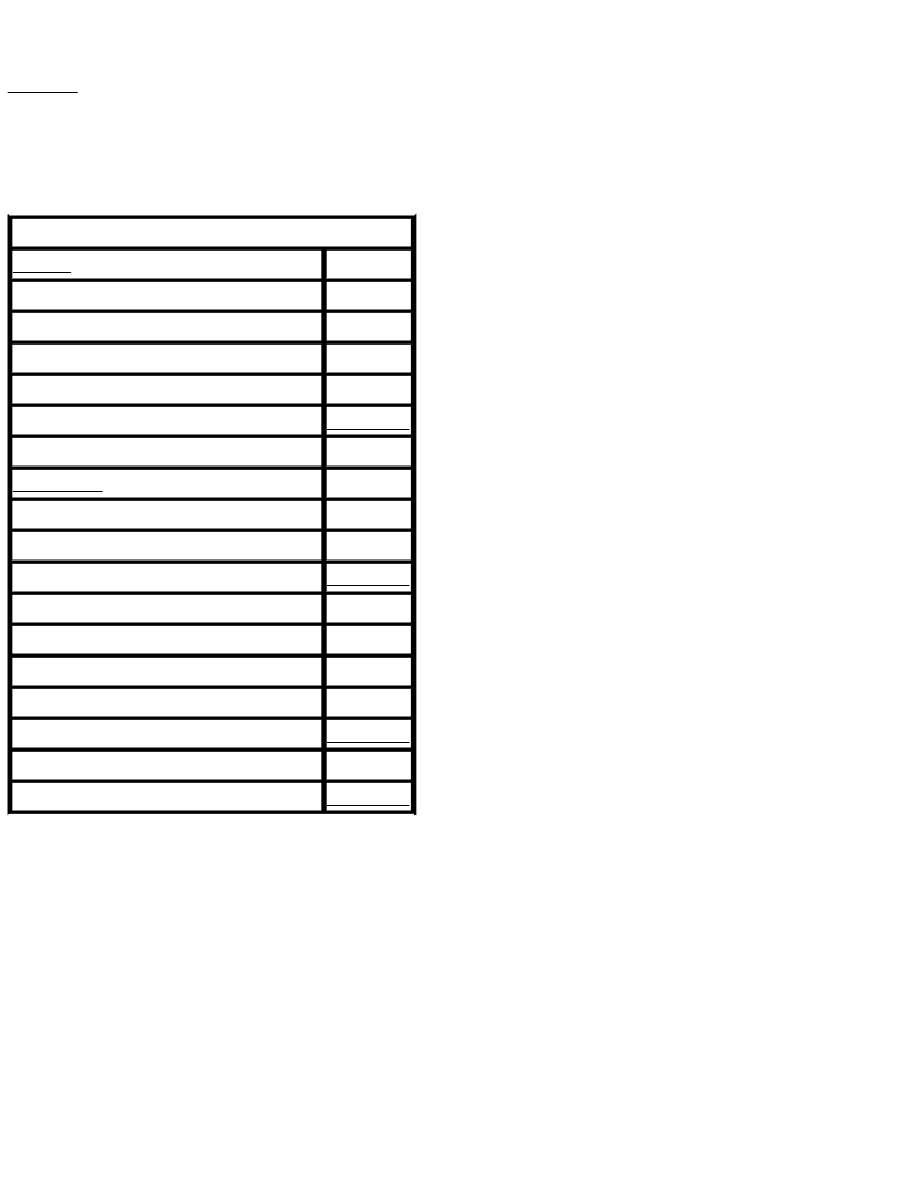

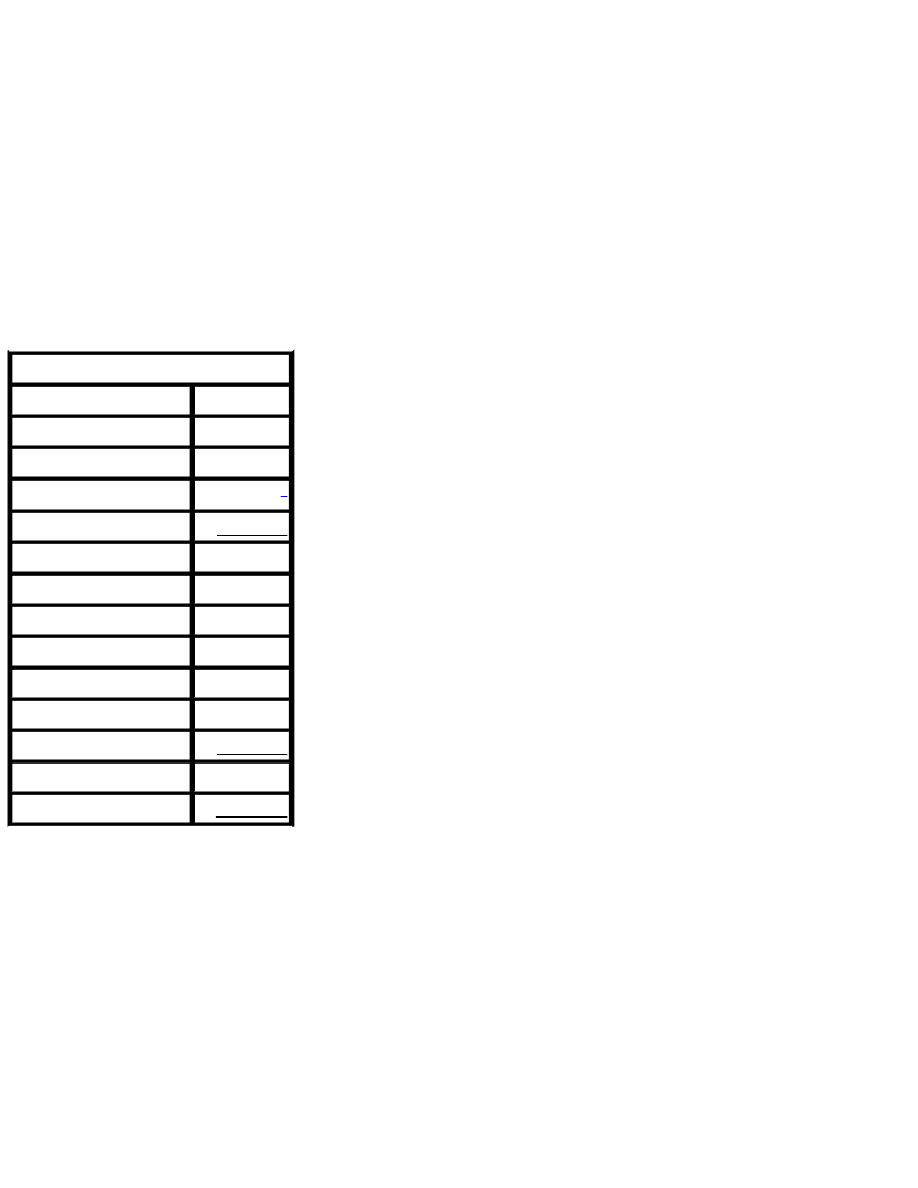

Havealookattheexampleofabasicbalancesheetonthefollowingpage.Let’sgooverwhateach

oftheaccountsrefersto.

Assets

CashandCashEquivalents:Balancesincheckingandsavingsaccounts,aswellasanyinvestments

thatwillmaturewithin3monthsorless.

BalanceSheet

Assets

CashandCashEquivalents

$50,000

Inventory

$110,000

AccountsReceivable

$20,000

Property,Plant,andEquipment

$300,000

TotalAssets:

$480,000

Liabilities

AccountsPayable

$20,000

NotesPayable

$270,000

TotalLiabilities:

$290,000

Owners’Equity

CommonStock

$50,000

RetainedEarnings

$140,000

TotalOwners’Equity

$190,000

TotalLiabilities+Owners’Equity: $480,000

Inventory:Goodskeptinstock,availableforsale.

Accounts Receivable: Amounts due from customers for goods or services that have already been

delivered.

Property,Plant,andEquipment:Assetsthatcannotreadilybeconvertedintocash—thingssuchas

computers,manufacturingequipment,vehicles,furniture,etc.

Liabilities

AccountsPayable:Amountsduetosuppliersforgoodsorservicesthathavealreadybeenreceived.

NotesPayable:Contractualobligationsduetolenders(e.g.,bankloans).

Owners’Equity

CommonStock:Amountsinvestedbytheownersofthecompany.

Retained Earnings: The sum of all net income over the life of the business that has not been

distributed to owners in the form of a dividend. (If this is confusing at the moment, don’t worry. It

willbeexplainedinmoredetailinChapter4,whichdiscussestheStatementofRetainedEarnings.)

Currentvs.Long-Term

Often, the assets and liabilities on a balance sheet will be broken down into current assets (or

liabilities) and long-term assets (or liabilities). Current assets are those that are expected to be

converted into cash within 12 months or less. Typical current assets include Accounts Receivable,

Cash,andInventory.

Everythingthatisn’tacurrentassetis,bydefault,along-termasset.Sometimes,long-termassets

arereferredto,understandably,asnon-currentassets.Property,Plant,andEquipmentisalong-term

assetaccount.

Current liabilities are those that will need to be paid off within 12 months or less. The most

common example of a current liability is Accounts Payable. Notes Payable that are paid off over a

periodoftimearesplituponthebalancesheetsothatthenext12months’paymentsareshownasa

currentliability,whiletheremainderofthenoteisshownasalong-termliability.

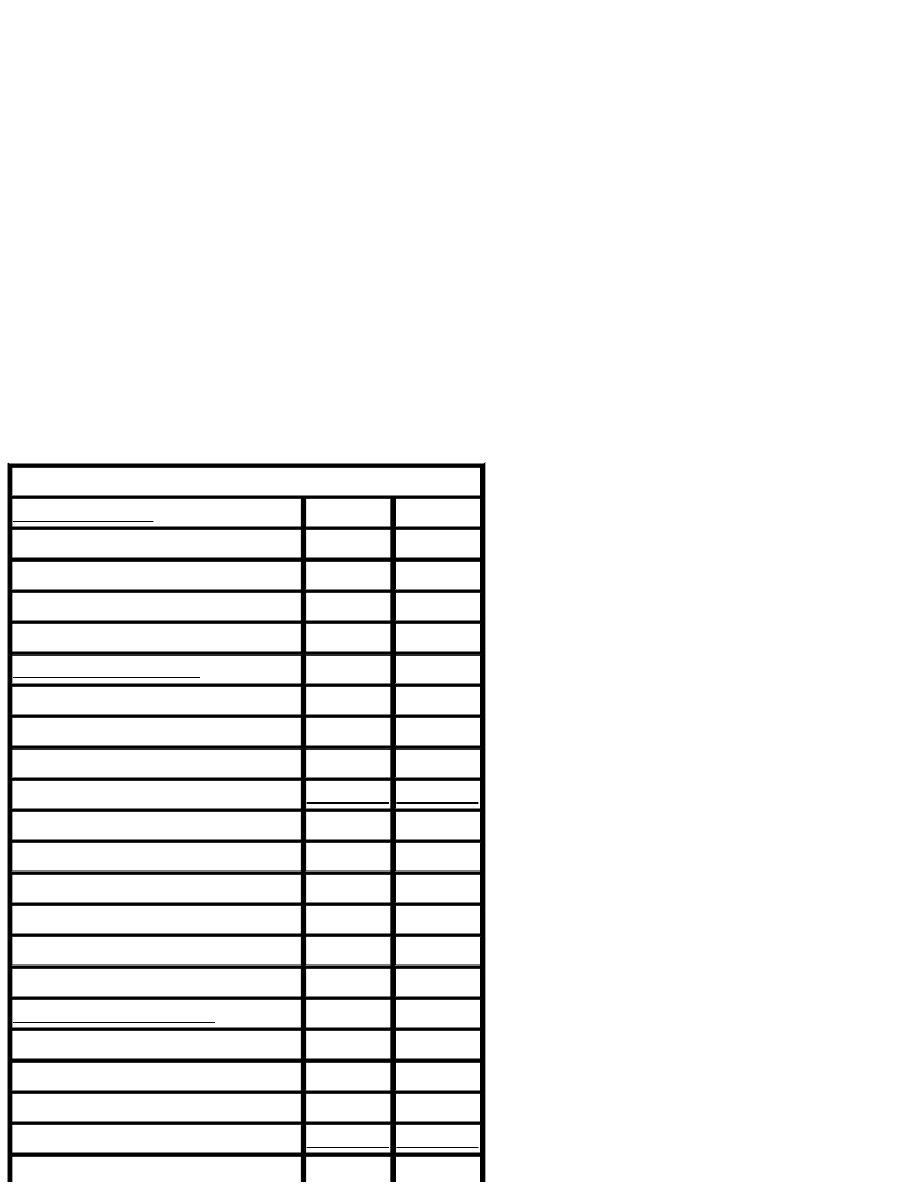

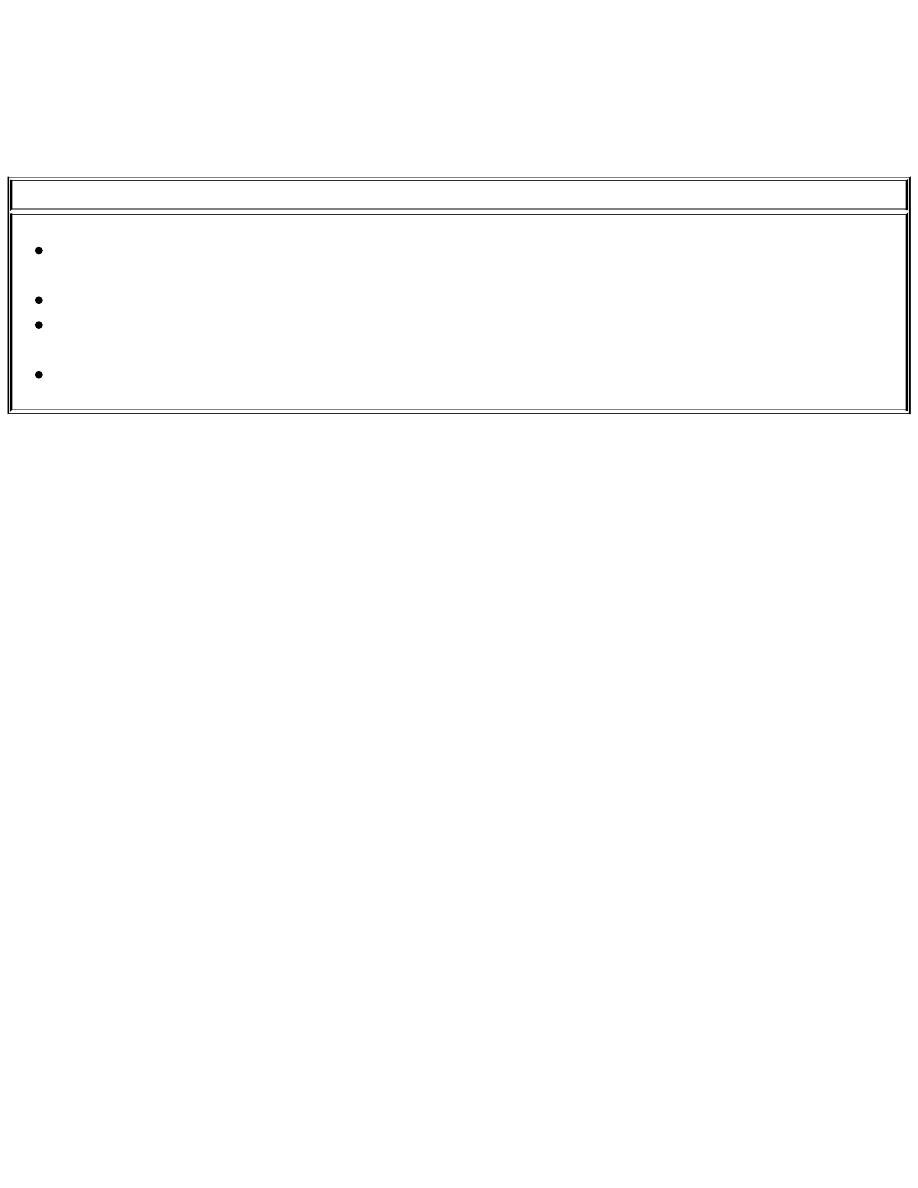

Multiple-PeriodBalanceSheets

Whatyou’lloftenseewhenlookingatpublishedfinancialstatementsisabalancesheet—suchasthe

oneonthefollowingpage—thathastwocolumns.Onecolumnshowsthebalancesasoftheendof

the most recent accounting period, and the adjoining column shows the balances as of the prior

period-end. This is done so that a reader can see how the financial position of the company has

changedovertime.

Forexample,lookingatthebalancesheetonthefollowingpagewecanlearnafewthingsabout

the health of the company. Overall, it appears that things are going well. The company’s assets are

increasingwhileitsdebtisbeingpaiddown.

The only thing that might be of concern is an increase in Accounts Receivable. An increase in

AccountsReceivablecouldbeindicativeoftroublewithgettingclientstopayontime.Ontheother

hand,it’salsoquitepossiblethatit’ssimplytheresultofanincreaseinsales,andthere’snothingto

worryabout.

BalanceSheet

CurrentAssets

12/31/11 12/31/10

CashandCashEquivalents

$50,000 $30,000

AccountsReceivable

$20,000

$5,000

TotalCurrentAssets

$70,000 $35,000

Non-CurrentAssets

Property,Plant,andEquipment

$330,000 $330,000

TotalNon-CurrentAssets:

$330,000 $330,000

TotalAssets

$400,000 $365,000

CurrentLiabilities

AccountsPayable

$20,000 $22,000

CurrentPortionofNotePayable $12,000 $12,000

TotalCurrentLiabilities

$32,000 $34,000

Long-TermLiabilities

Non-CurrentPortionofNote

$250,000 $262,000

TotalLong-TermLiabilities

$250,000 $262,000

TotalLiabilities:

$282,000 $296,000

Owners’Equity

CommonStock

$30,000 $30,000

RetainedEarnings

$88,000 $39,000

TotalOwners’Equity

$118,000 $69,000

TotalLiabilities+Equity:

$400,000 $365,000

Chapter2SimpleSummary

Acompany’sbalancesheetshowsitsfinancialpositionatagivenpointintime.Balancesheets

areformattedinaccordancewiththeAccountingEquation:

Assets=Liabilities+Owners’Equity

Currentassetsarethosethatareexpectedtobeconvertedintocashwithin12monthsorless.

Anyassetthatisnotacurrentassetisanon-current(a.k.a.long-term)assetbydefault.

Currentliabilitiesarethosethatwillneedtobepaidoffwithinthenext12months.Bydefault,

anyliabilitythatisnotacurrentliabilityisalong-termliability.

CHAPTERTHREE

TheIncomeStatement

Acompany’sincomestatementshowsthecompany’sfinancialperformanceoveraperiodoftime

(usuallyoneyear).Thisisincontrasttothebalancesheet,whichshowsfinancialpositionatapointin

time. A frequently used analogy is that the balance sheet is like a photograph, while the income

statementismoreakintoavideo.

The income statement—sometimes referred to as a profit and loss (or P&L) statement—is

organized exactly how you’d expect. The first section details the company’s revenues, while the

secondsectiondetailsthecompany’sexpenses.

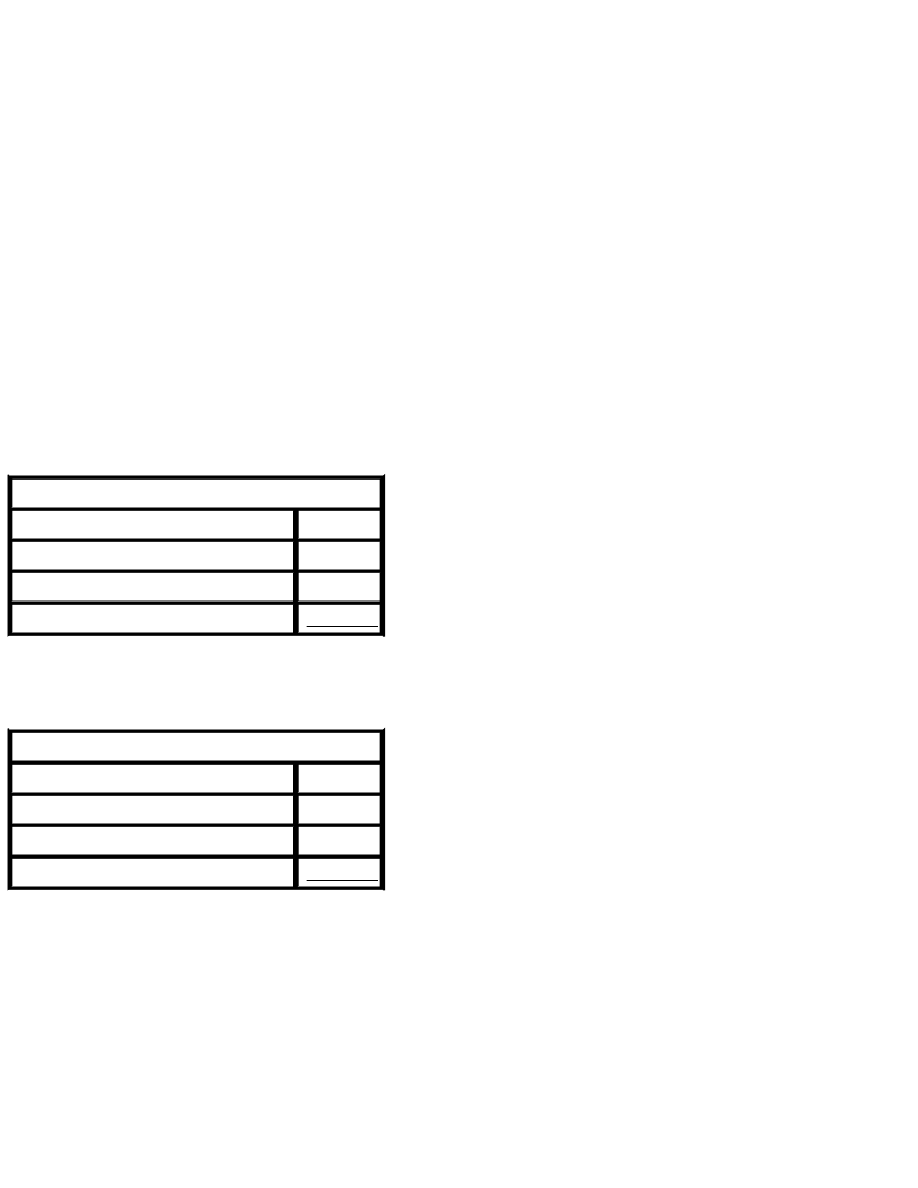

IncomeStatement

Revenue

Sales

$300,000

CostofGoodsSold (100,000)

GrossProfit

200,000

Expenses

Rent

30,000

SalariesandWages

80,000

Advertising

15,000

Insurance

10,000

TotalExpenses

135,000

NetIncome

$65,000

GrossProfitandCostofGoodsSold

GrossProfitreferstothesumofacompany’srevenues,minusCostofGoodsSold.CostofGoods

Sold (CoGS) is the amount that the company paid for the goods that it sold over the course of the

period.

EXAMPLE:Laurarunsasmallbusinesssellingt-shirtswithbandlogosonthem.Atthebeginningof

themonth,Lauraordered100t-shirtsfor$3each.Bytheendofthemonth,shehadsoldallofthet-

shirtsforatotalof$800.Forthemonth,Laura’sCostofGoodsSoldis$300,andherGrossProfitis

$500.

EXAMPLE:Richrunsasmallbusinesspreparingtaxreturns.Allofhiscostsareoverhead—thatis,

eachadditionalreturnhepreparesaddsnothingtohistotalcosts—sohehasnoCostofGoodsSold.

HisGrossProfitissimplyequaltohisrevenues.

OperatingIncomevs.NetIncome

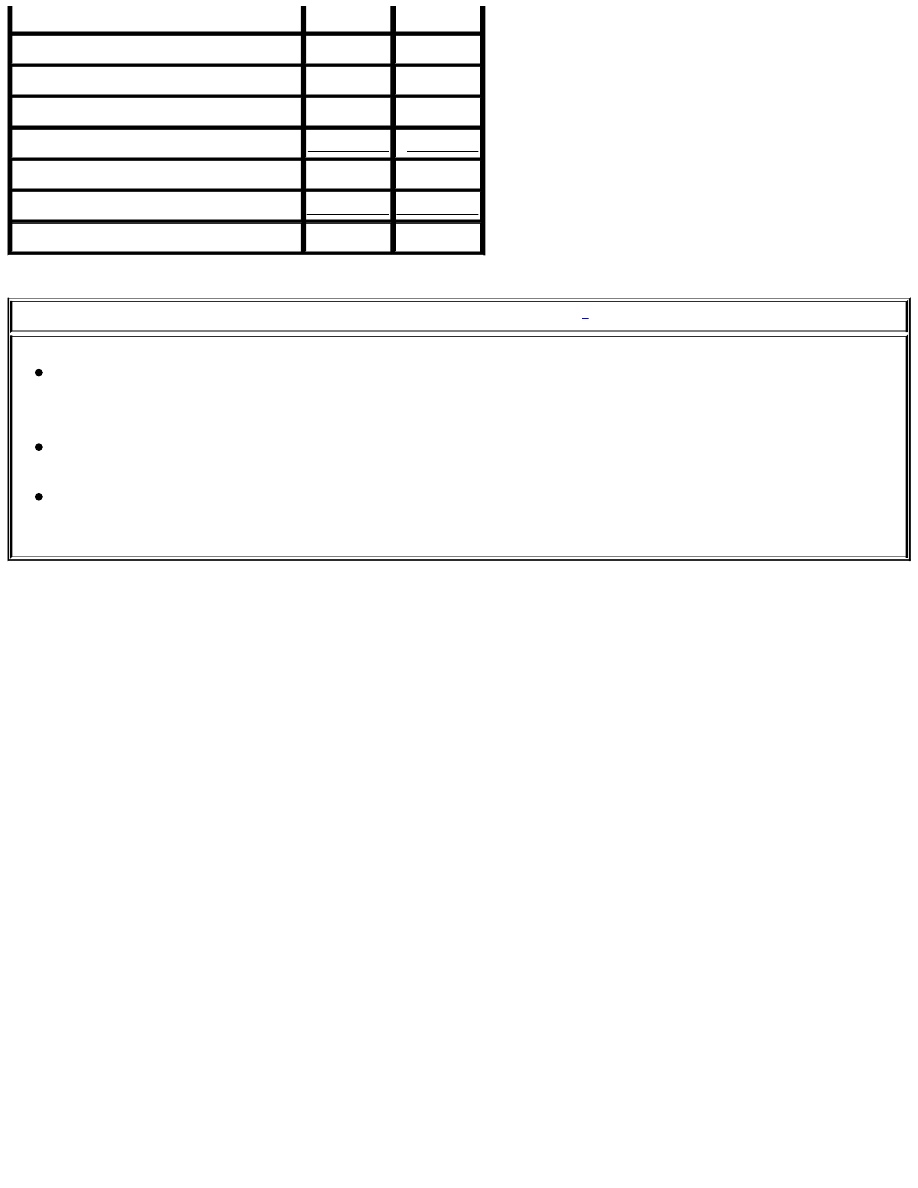

Sometimes, you’ll see an income statement—like the one on the following page—that separates

“OperatingExpenses”from“Non-OperatingExpenses.”OperatingExpensesaretheexpensesrelated

tothenormaloperationofthebusinessandarelikelytobeincurredinfutureperiodsaswell.Things

suchasrent,insurancepremiums,andemployees’wagesaretypicalOperatingExpenses.

Non-OperatingExpensesarethosethatareunrelatedtotheregularoperationofthebusinessand,

as a result, are unlikely to be incurred again in the following year. (A typical example of a Non-

OperatingExpensewouldbealawsuit.)

IncomeStatement

Revenue

Sales

$450,000

CostofGoodsSold

(75,000)

GrossProfit

375,000

OperatingExpenses

Rent

45,000

SalariesandWages

120,000

Advertising

25,000

Insurance

10,000

TotalOperatingExpenses

200,000

OperatingIncome

175,000

Non-OperatingExpenses

LawsuitSettlement

120,000

TotalNon-OperatingExpenses 120,000

NetIncome

$55,000

ThereasoningbehindseparatingOperatingExpensesfromNon-OperatingExpensesisthatitallows

forthecalculationofOperatingIncome.Intheory,OperatingIncomeisamoremeaningfulnumber

thanNetIncome,asitshouldofferabetterindicatorofwhatthecompany’sincomeisgoingtolook

likeinfutureyears.

The effect of this focus on Operating Income as opposed to Net Income has been to cause many

companies to make efforts to classify as many expenses as possible as Non-Operating with the

intention of making their Operating Income look more impressive to investors. As a result of this

“creativeaccounting,”it’sbecomeabitofadebatewhichincomefigureis,infact,thebetterindicator

offuturesuccess.

Chapter3SimpleSummary

Theincomestatementshowsacompany’sfinancialperformanceoveraperiodoftime(usually

ayear).

Acompany’sGrossisequaltoitsrevenuesminusitsCostofGoodsSold.

Acompany’sOperatingIncomeisequaltoitsGrossProfitminusitsOperatingExpenses—the

expensesthathavetodowiththenormaloperationofthebusiness.

Acompany’sNetIncomeisequaltoitsOperatingIncome,minusanyNon-OperatingExpenses.

CHAPTERFOUR

TheStatementofRetainedEarnings

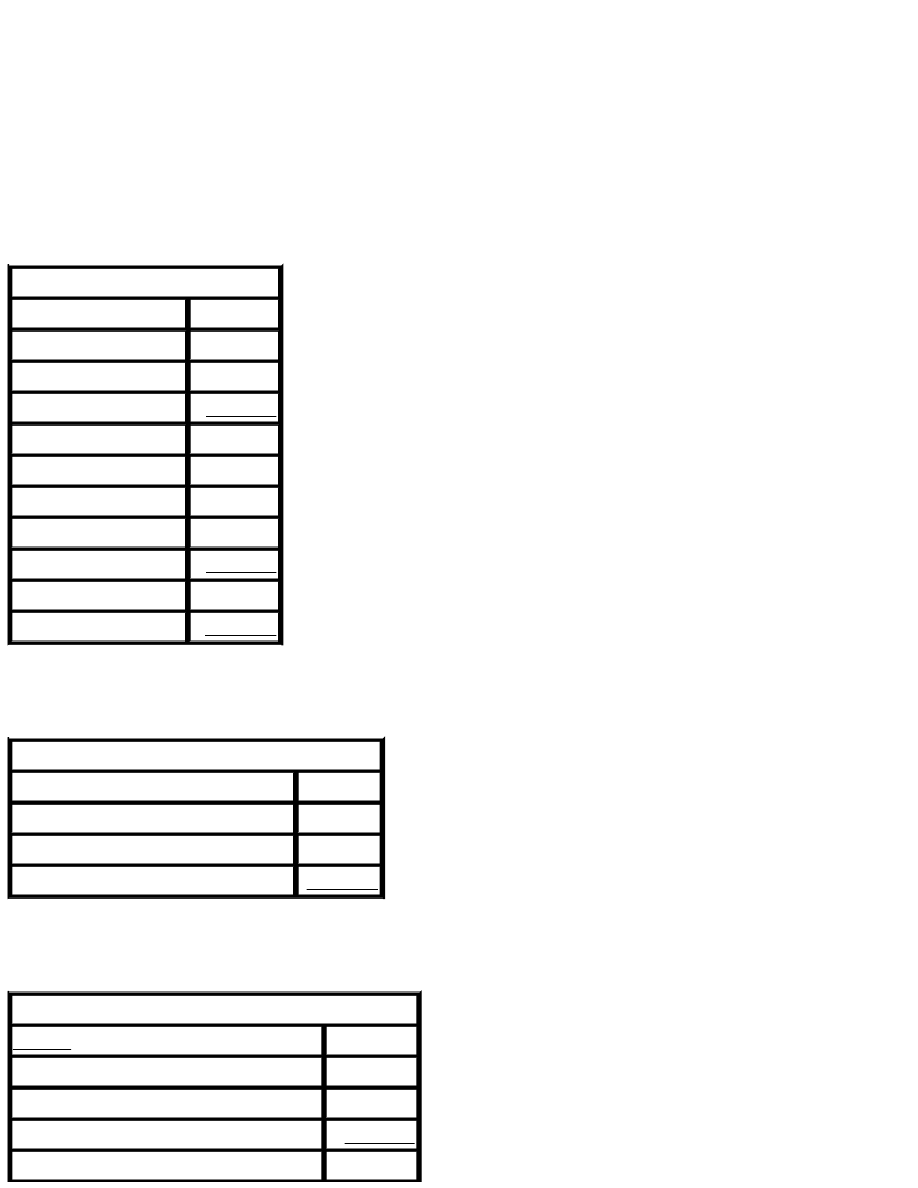

Thestatementofretainedearningsisaverybrieffinancialstatement.(Seeexampleonfollowing

page.)Ithasonlyonepurpose,which,asyouwouldexpect,istodetailthechangesinacompany’s

retainedearningsoveraperiodoftime.

Again, retained earnings is the sum of all of a company’s undistributed profits over the entire

existenceofthecompany.Wesay“undistributed”inordertodistinguishfromprofitsthathave been

distributedtocompanyshareholdersintheformofdividendpayments.

EXAMPLE: ABC Construction is formed on January 1, 2011. At its date of formation, it naturally

hasaRetainedEarningsbalanceofzero(becauseithasn’thadanynetincomeyet).

Over the course of 2011, ABC Construction’s net income is $50,000. In December of the year, it

paysadividendof$20,000toitsshareholders.Itsretainedearningsstatementfortheyearwouldlook

asfollows.

StatementofRetainedEarnings

RetainedEarnings,1/1/2011

$0

NetIncome

50,000

DividendsPaidtoShareholders (20,000)

RetainedEarnings,12/31/2011 $30,000

If,in2012,ABCConstruction’snetincomewas$70,000anditagainpaida$20,000dividend,its

2012retainedearningsstatementwouldappearasfollows:

StatementofRetainedEarnings

RetainedEarnings,1/1/2012

$30,000

NetIncome

70,000

DividendsPaidtoShareholders (20,000)

RetainedEarnings,12/31/2012 $80,000

BridgeBetweenFinancialStatements

Thestatementofretainedearningsfunctionsmuchlikeabridgebetweentheincomestatementandthe

balance sheet. It takes information from the income statement, and it provides information to the

balancesheet.

Thefinalstepofpreparinganincomestatementiscalculatingthecompany’snetincome:

IncomeStatement

Revenue

Sales

$240,000

GrossProfit

240,000

Expenses

Rent

70,000

SalariesandWages

80,000

TotalExpenses

150,000

NetIncome

$90,000

Netincomeisthenusedinthestatementofretainedearningstocalculatetheend-of-yearbalancein

RetainedEarnings:

StatementofRetainedEarnings

RetainedEarnings,Beginning

$40,000

NetIncome

90,000

DividendsPaidtoShareholders (50,000)

RetainedEarnings,Ending

$80,000

The ending Retained Earnings balance is then used to prepare the company’s end-of-year balance

sheet:

BalanceSheet

Assets

CashandCashEquivalents

$130,000

Inventory

80,000

TotalAssets:

210,000

Liabilities

AccountsPayable

20,000

TotalLiabilities:

20,000

Owners’Equity

CommonStock

110,000

RetainedEarnings

80,000

TotalOwners’Equity

190,000

TotalLiabilities+Owners’Equity: $210,000

Dividends:NotanExpense!

When first learning accounting, many people are tempted to classify dividend payments as an

expense. It’s true, they do look a lot like an expense in that they are a cash payment made from the

companytoanotherparty.

Unlike many other cash payments, however, dividends are simply a distribution of profits (as

opposed to expenses, which reduce profits). Because they are not a part of the calculation of net

income, dividend payments do not show up on the income statement. Instead, they appear on the

statementofretainedearnings.

RetainedEarnings:It’sNottheSameasCash

The definition of retained earnings—the sum of a company’s undistributed profits over the entire

existence of the company—makes it sound as if a company’s Retained Earnings balance must be

sittingaroundsomewhereascashinacheckingorsavingsaccount.Inalllikelihood,however,that

isn’tthecaseatall.

Just because a company hasn’t distributed its profits to its owners doesn’t mean it hasn’t already

usedthemforsomethingelse.Forinstance,profitsarefrequentlyreinvestedingrowingthecompany

bypurchasingmoreinventoryforsaleorpurchasingmoreequipmentforproduction.

Chapter4SimpleSummary

Thestatementofretainedearningsdetailsthechangesinacompany’sretainedearningsovera

periodoftime.

Thestatementofretainedearningsactsasabridgebetweentheincomestatementandthe

balancesheet.Ittakesinformationfromtheincomestatement,anditprovidesinformationtothe

balancesheet.

Dividendpaymentsarenotanexpense.Theyareadistributionofprofits.

Retainedearningsisnotthesameascash.Often,asignificantportionofacompany’sretained

earningsisspentonattemptstogrowthecompany.

CHAPTERFIVE

TheCashFlowStatement

Thecashflowstatementdoesexactlywhatitsoundslike:Itreportsacompany’scashinflowsand

outflowsoveranaccountingperiod.

CashFlowStatementvs.IncomeStatement

At first, it may sound as if a cash flow statement fulfills the same purpose as an income statement.

Thereare,however,someimportantdifferencesbetweenthetwo.

First, there are often differences in timing between when an income or expense item is recorded

and when the cash actually comes in or goes out the door. We’ll discuss this topic much more

thoroughlyinChapter9:Cashvs.Accrual.Fornow,let’sjustconsiderabriefexample.

EXAMPLE:In September, XYZ Consulting performs marketing services for a customer who does

not pay until the beginning of October. In September, this sale would be recorded as an increase in

bothSalesandAccountsReceivable.(AndthesalewouldshowuponaSeptemberincomestatement.)

The cash, however, isn’t actually received until October, so the activity would not appear on

September ’scashflowstatement.

Thesecondmajordifferencebetweentheincomestatementandthecashflowstatementisthatthe

cash flow statement includes several types of transactions that are not included in the income

statement.

EXAMPLE:XYZConsultingtakesoutaloanwithitsbank.Theloanwillnotappearontheincome

statement,asthetransactionisneitherarevenueitemnoranexpenseitem.Itissimplyanincreaseof

an asset (Cash) and a liability (Notes Payable). However, because it’s a cash inflow, the loan will

appearonthecashflowstatement.

EXAMPLE: XYZ Consulting pays its shareholders a $30,000 dividend. As discussed in Chapter 4,

dividendsarenotanexpense.Therefore,thedividendwillnotappearontheincomestatement.Itwill,

however,appearonthecashflowstatementasacashoutflow.

CategoriesofCashFlow

Onacashflowstatement(suchastheexampleonpage39)allcashinflowsoroutflowsareseparated

intooneofthreecategories:

1. Cashflowfromoperatingactivities,

2. Cashflowfrominvestingactivities,and

3. Cashflowfromfinancingactivities.

CashFlowfromOperatingActivities

TheconceptofcashflowfromoperatingactivitiesisquitesimilartothatofOperatingIncome.The

goal is to measure the cash flow that is the result of activities directly related to normal business

operations(i.e.,thingsthatwilllikelyberepeatedyearafteryear).

Commonitemsthatarecategorizedascashflowfromoperatingactivitiesinclude:

Receiptsfromthesaleofgoodsorservices,

Paymentsmadetosuppliers,

Paymentsmadetoemployees,and

Taxpayments.

CashFlowfromInvestingActivities

Cash flow from investing activities includes cash spent on—or received from—investments in

financial securities (stocks, bonds, etc.) as well as cash spent on—or received from—capital assets

(i.e.,assetsexpectedtolastlongerthanoneyear).Typicalitemsinthiscategoryinclude:

Purchaseorsaleofproperty,plant,orequipment,

Purchaseorsaleofstocksorbonds,and

Interestordividendsreceivedfrominvestments.

CashFlowfromFinancingActivities

Cashflowfromfinancingactivitiesincludescashinflowsandoutflowsrelatingtotransactionswith

thecompany’sownersandcreditors.Commonitemsthatwouldfallinthiscategoryinclude:

Dividendspaidtoshareholders,

Cashflowrelatedtotakingout—orpayingback—aloan,and

Cashreceivedfrominvestorswhennewsharesofstockareissued.

CashFlowStatement

CashFlowfromOperatingActivities:

Cashreceiptsfromcustomers

$320,000

Cashpaidtosuppliers

(50,000)

Cashpaidtoemployees

(40,000)

Incometaxespaid

(55,000)

NetCashFlowFromOperatingActivities 175,000

CashFlowfromInvestingActivities:

Cashspentonpurchaseofequipment

(210,000)

NetCashFlowFromInvestingActivities (210,000)

CashFlowfromFinancingActivities:

Dividendspaidtoshareholders

(25,000)

Cashreceivedfromissuingnewshares

250,000

NetCashFlowFromFinancingActivities 225,000

Netincreaseincash:

$190,000

Chapter5SimpleSummary

Thecashflowstatementandtheincomestatementdifferinthattheyreporttransactionsat

differenttimes.(We’lldiscussthismorethoroughlyinChapter9:Cashvs.Accrual.)

Thecashflowstatementalsodiffersfromtheincomestatementinthatitshowsmany

transactionsthatwouldnotappearontheincomestatement.

Cashflowfromoperatingactivitiesincludescashtransactionsthatoccurasaresultofnormal

businessoperations.

Cashflowfrominvestingactivitiesincludescashtransactionsrelatingtoacompany’s

investmentsinfinancialsecuritiesandcashtransactionsrelatingtolong-termassetssuchas

property,plant,andequipment.

Cashflowfromfinancingactivitiesincludescashtransactionsbetweenthecompanyandits

ownersorcreditors.

CHAPTERSIX

FinancialRatios

Ofcourse,nowthatyouknowhowtoreadfinancialstatements,alogicalnextstepwouldbetotake

alookatthedifferentconclusionsyoucandrawfromacompany’sfinancials.Forthemostpart,this

workisdonebycalculatingandcomparingseveraldifferentratios.

LiquidityRatios

Liquidity ratios are used to determine how easily a company will be able to meet its short-term

financialobligations.Generallyspeaking,withliquidityratios,higherisbetter.Themostfrequently

usedliquidityratioisknownasthecurrentratio:

A company’s current ratio serves to provide an assessment of the company’s ability to pay off its

currentliabilities(liabilitiesduewithinayearorless)usingitscurrentassets(cashandassetslikely

tobeconvertedtocashwithinayearorless).

A company’s quick ratio serves the same purpose as its current ratio: It seeks to assess the

company’sabilitytopayoffitscurrentliabilities.

The difference between quick ratio and current ratio is that the calculation of quick ratio excludes

inventorybalances.Thisisdoneinordertoprovideaworst-case-scenarioassessment:Howwellwill

the company be able to fulfill its current liabilities if sales are slow (that is, if inventories are not

convertedtocash)?

EXAMPLE:ABCToys(seebalancesheetonpage43)wouldcalculateitsliquidityratiosasfollows:

Acurrentratioof1tellsusthatABCToys’currentassetsmatchitscurrentliabilities,meaningit

shouldn’thaveanytroublehandlingitsfinancialobligationsoverthenext12months.

However,aquickratioofonly0.5indicatesthatABCToyswillneedtomaintainatleastsomelevel

ofsalesinordertosatisfyitsliabilities.

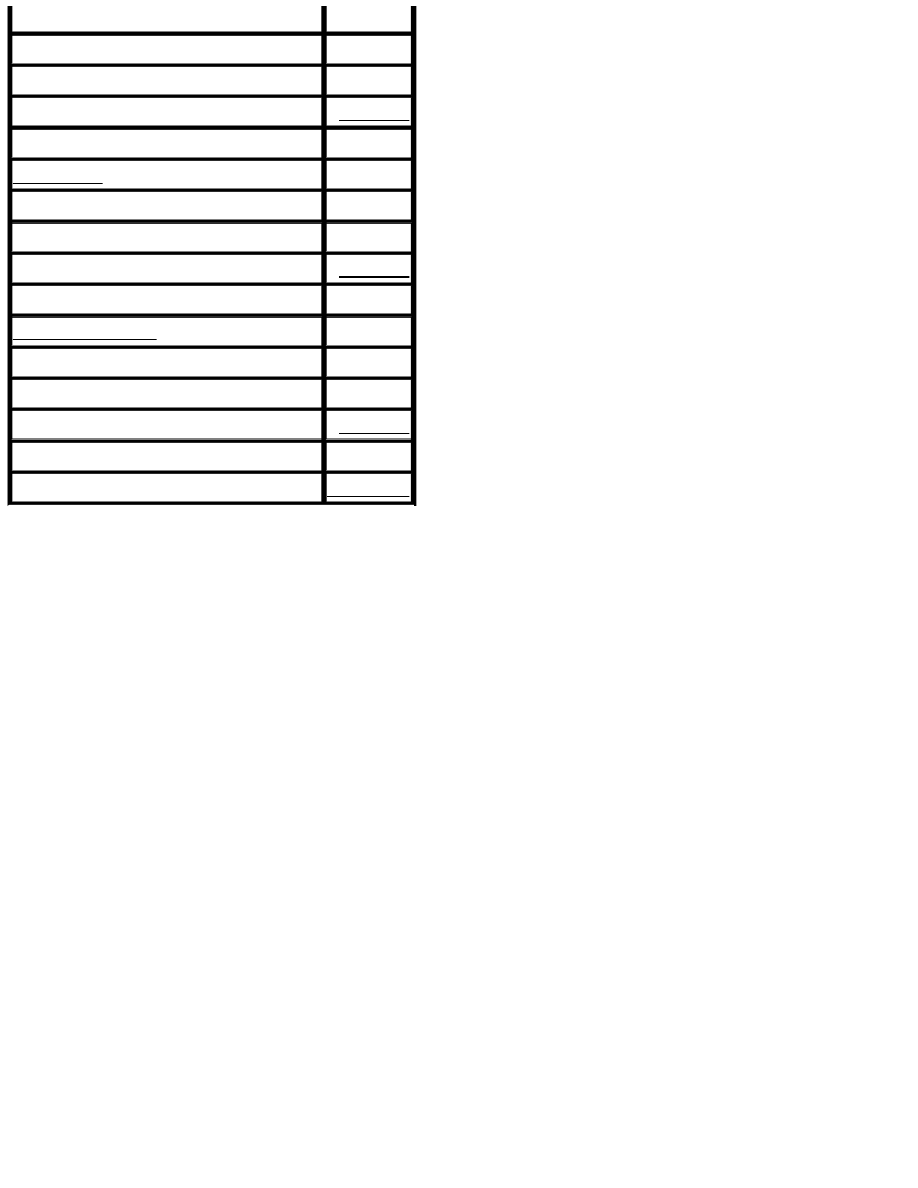

BalanceSheet,ABCToys

Assets

CashandCashEquivalents

$40,000

Inventory

100,000

AccountsReceivable

60,000

Property,Plant,andEquipment

300,000

TotalAssets:

500,000

Liabilities

AccountsPayable

50,000

IncomeTaxPayable

150,000

TotalLiabilities:

200,000

Owners’Equity

CommonStock

160,000

RetainedEarnings

140,000

TotalOwners’Equity

300,000

TotalLiabilities+Owners’Equity: $500,000

ProfitabilityRatios

Whileacompany’snetincomeiscertainlyavaluablepieceofinformation,itdoesn’ttellthewhole

storyintermsofhowprofitableacompanyreallyis.Forexample,Google’snetincomeisgoingto

absolutelydwarfthenetincomeofyourfavoritelocalItalianrestaurant.Butthetwobusinessesareof

such different sizes that the comparison is rather meaningless, right? That’s why we use the two

followingratios:

Acompany’sreturnonassetsshowsusacompany’sprofitabilityincomparisontothecompany’ssize

(as measured by total assets). In other words, return on assets seeks to answer the question, “How

efficientlyisthiscompanyusingitsassetstogenerateprofits?”

Returnonequityissimilarexceptthatshareholders’equityisusedinplaceoftotalassets.Return

onequityasks,“Howefficientlyisthiscompanyusingitsinvestors’moneytogenerateprofits?”

By using return on assets or return on equity, you can actually make meaningful comparisons

betweentheprofitabilityoftwocompanies,evenifthecompaniesareofdrasticallydifferentsizes.

EXAMPLE:Usingthebalancesheetfrompage43andtheincomestatementbelow,wecancalculate

thefollowingprofitabilityratiosforABCToys:

IncomeStatement,ABCToys

Revenue

Sales

$300,000

CostofGoodsSold (100,000)

GrossProfit

200,000

Expenses

Rent

30,000

SalariesandWages

80,000

TotalExpenses

110,000

NetIncome

$90,000

Acompany’sgrossprofitmarginshowswhatpercentageofsalesremainsaftercoveringthecost

ofthesoldinventory.Thisgrossprofitisthenusedtocoveroverheadcosts,withtheremainderbeing

thecompany’snetincome.

EXAMPLE:Virginiarunsabusiness sellingcosmetics.Over thecourseofthe year,hertotalsales

were$80,000,andherCostofGoodsSoldwas$20,000.Virginia’sgrossprofitmarginfortheyearis

75%,calculatedasfollows:

Gross profit margin is often used to make comparisons between companies within an industry. For

example,comparingthegrossprofitmarginoftwodifferentgrocerystorescangiveyouanideaof

whichonedoesabetterjobofkeepinginventorycostsdown.

Gross profit margin comparisons across different industries can be rather meaningless. For

instance,agrocerystoreisgoingtohavealowerprofitmarginthanasoftwarecompany,regardless

ofwhichcompanyisruninamorecost-effectivemanner.

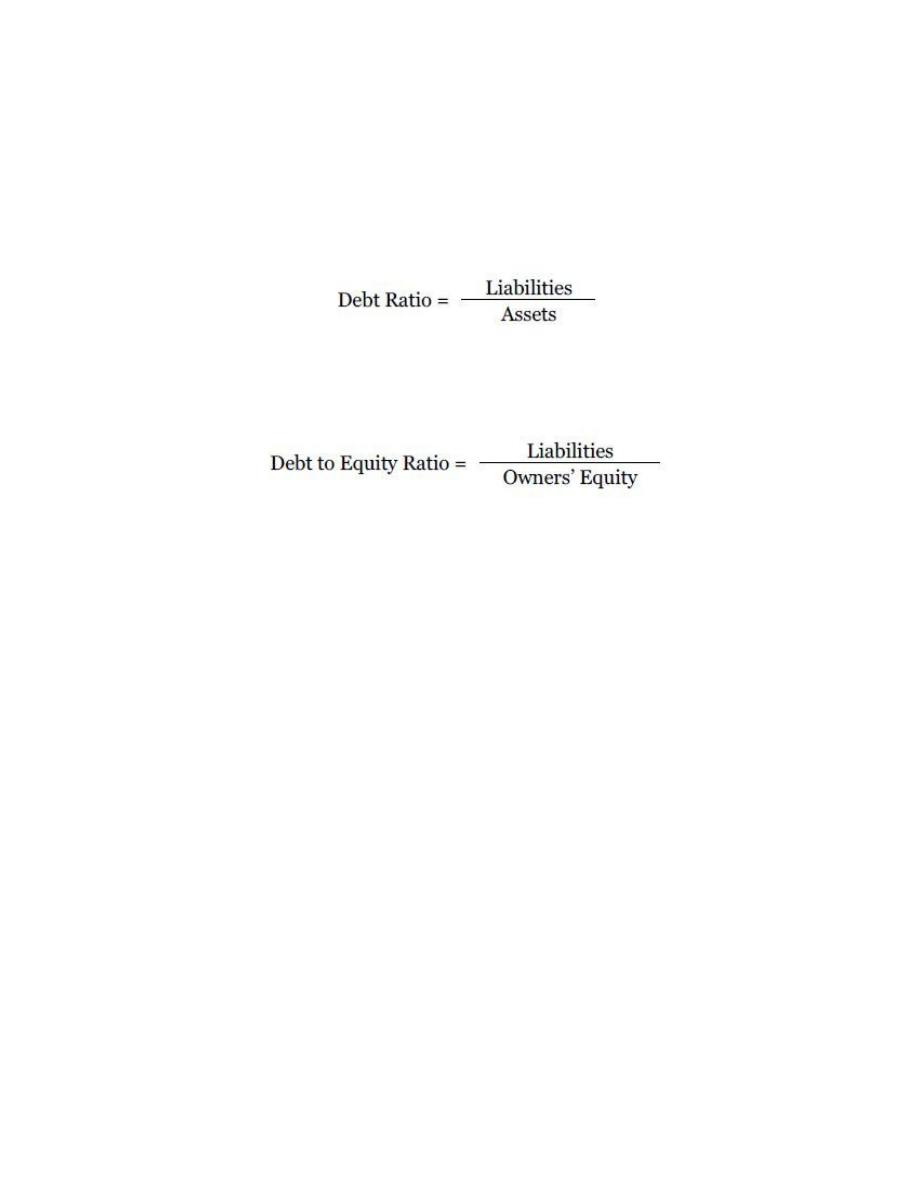

FinancialLeverageRatios

Financial leverage ratios attempt to show to what extent a company has used debt (as opposed to

capitalfrominvestors)tofinanceitsoperations.

Acompany’sdebtratioshowswhatportionofacompany’sassetshasbeenfinancedwithdebt.

Acompany’sdebt-to-equityratioshowstheratiooffinancingviadebttofinancingviacapitalfrom

investors.

TheProsandConsofFinancialLeverage

It’sobviouslyriskyforacompanytobeveryhighlyleveraged(thatis,financedlargelywithdebt).

There is, however, something to be gained from using leverage. The more highly leveraged a

companyis,thegreateritsreturnonequitywillbeforagivenamountofnetincome.Thatmaysound

confusing;let’slookatanexample.

EXAMPLE:XYZSoftwarehas$200millionofassets,$100millionofliabilities,and$100million

ofowners’equity.XYZ’snetincomefortheyearis$15million,givingthemareturnonequityof

15%($15millionnetincomedividedby$100millionowners’equity).

If, however, XYZ Software’s capital structure was more debt-dependent—such that they had $150

million of liabilities and only $50 million of equity—their return on equity would now be much

greater.Infact,withthesamenetincome,XYZwouldhaveareturnonequityof30%($15millionnet

incomedividedby$50millionowners’equity),therebyofferingthecompany’sownerstwiceasgreat

areturnontheirmoney.

Inotherwords,whenthecompany’sdebt-to-equityratioincreased(from1inthefirstexampleto3

in the second example), the company’s return on equity increased as well, even though net income

remainedthesame.

Inshort,thequestionofleverageisaquestionofbalance.Beingmorehighlyleveraged(i.e.,more

debt,lessinvestmentfromshareholders)allowsforagreaterreturnontheshareholders’investment.

On the other hand, financing a company primarily with loans is obviously a risky way to run a

business.

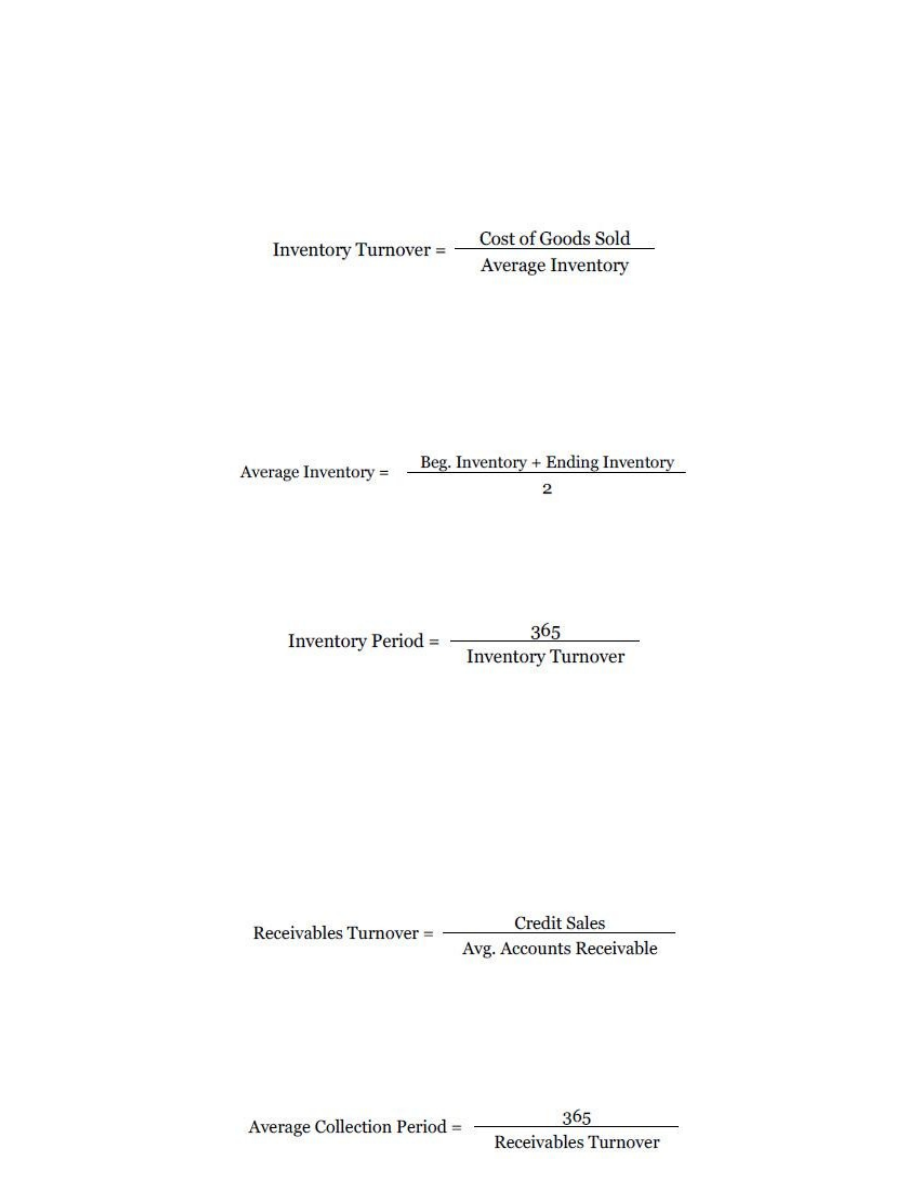

AssetTurnoverRatios

Assetturnoverratiosseektoshowhowefficientlyacompanyusesitsassets.Thetwomostcommonly

usedturnoverratiosareinventoryturnoverandaccountsreceivablesturnover.

The calculation of inventory turnover shows how many times a company’s inventory is sold and

replaced over the course of a period. The “average inventory” part of the equation is the average

Inventorybalanceovertheperiod,calculatedasfollows:

Inventoryperiodshowshowlong,onaverage,inventoryisonhandbeforeitissold.

Ahigherinventoryturnover(andthus,alowerinventoryperiod)showsthatthecompany’sinventory

issellingquicklyandisindicativethatmanagementisdoingagoodjobofstockingproductsthatare

indemand.

A company’s receivables turnover (calculated as credit sales over a period divided by average

Accounts Receivable over the period) shows how quickly the company is collecting upon its

AccountsReceivable.

Averagecollectionperiodisexactlywhatitsoundslike:theaveragelengthoftimethatareceivable

fromacustomerisoutstandingpriortocollection.

Obviously,higherreceivablesturnoverandloweraveragecollectionperiodisgenerallythegoal.Ifa

company’s average collection period steadily increases from one year to the next, it could be an

indication that the company needs to address its policies in terms of when and to whom it extends

creditwhenmakingasale.

Chapter6SimpleSummary

Liquidityratiosshowhoweasilyacompanywillbeabletomeetitsshort-termfinancial

obligations.Thetwomostfrequentlyusedliquidityratiosarecurrentratioandquickratio.

Profitabilityratiosseektoanalyzehowprofitableacompanyisinrelationtoitssize.Returnon

assetsandreturnonequityarethemostimportantprofitabilityratios.

Financialleverageratiosexpresstowhatextentacompanyisusingdebt(insteadofshareholder

investment)tofinanceitsoperations.

Themoreleveragedacompanyis,thehigherreturnonequityitwillbeabletoprovideits

shareholders.However,increasingdebtfinancingcandramaticallyincreasethebusiness’srisk

level.

Assetturnoverratiosseektoshowhowefficientlyacompanyusesitsassets.Inventoryturnover

andreceivablesturnoverarethemostimportantturnoverratios.

PARTTWO

GenerallyAcceptedAccountingPrinciples(GAAP)

CHAPTERSEVEN

WhatisGAAP?

In the United States, Generally Accepted Accounting Principles (GAAP) is the name for the

frameworkofaccountingrulesusedinthepreparationoffinancialstatements.GAAPiscreatedbythe

FinancialAccountingStandardsBoard(FASB).

The goal of GAAP is to make it so that potential investors can compare financial statements of

variouscompaniesinordertodeterminewhichone(s)theywanttoinvestin,withouthavingtoworry

that one company appears more profitable on paper simply because it is using a different set of

accountingrules.

WhoisRequiredtoFollowGAAP?

All publicly traded companies are required by the Securities and Exchange Commission to follow

GAAP procedures when preparing their financial statements. In addition, because of GAAP’s

prevalence in the field of accounting—and because of the resulting fact that accountants are trained

according to GAAP when they go through school—many companies follow GAAP even when they

arenotrequiredtodoso.

GovernmentalentitiesarerequiredtofollowGAAPaswell.Thatsaid,thereareadifferentsetof

GAAP guidelines (created by a different regulatory body) for government organizations. So, while

they are following GAAP, their financial statements are quite different from those of public

companies.

Chapter7SimpleSummary

GenerallyAcceptedAccountingPrinciples(GAAP)istheframeworkofaccountingrulesand

guidelinesusedinthepreparationoffinancialstatements.

TheSecuritiesandExchangeCommissionrequiresthatallpubliclytradedcompaniesadhereby

GAAPwhenpreparingtheirfinancialstatement

CHAPTEREIGHT

DebitsandCredits

Most people (without knowing it) use a system of accounting known as single-entry accounting

when they record transactions relating to their checking or savings accounts. For each transaction,

oneentryismade(eitheranincreaseordecreaseinthebalanceofcashintheaccount).

Likely the single most important aspect of GAAP is the use of double-entry accounting, and the

accompanyingsystemofdebitsandcredits.Withdouble-entryaccounting,eachtransactionresultsin

twoentriesbeingmade.(Thesetwoentriescollectivelymakeupwhatisknownasa“journalentry.”)

Thisisactuallyfairlyintuitivewhenyouthinkbacktotheaccountingequation:

Assets=Liabilities+Owners’Equity.

Ifeachtransactionresultedinonlyoneentry,theequationwouldnolongerbalance.That’swhy,with

eachtransaction,entrieswillberecordedtotwoaccounts.

EXAMPLE:Acompanyuses$40,000cashtopurchaseanewpieceofequipment.Inthejournalentry

torecordthistransaction,Cashwilldecreaseby$40,000andEquipmentwillincreaseby$40,000.As

aresult,the“Assets”sideoftheequationwillhaveanetchangeofzero,andnothingchangesatallon

the“Liabilities+Owners’Equity”sideoftheequation.

Assets = Liabilities + Owners’Equity

-40,000 nochange nochange

+40,000

Alternatively,ifthecompanyhadpurchasedtheequipmentwithaloan,thejournalentrywouldbean

increasetoEquipmentof$40,000andanincreasetoNotesPayableof$40,000.Inthiscase,eachside

oftheequationwouldhaveincreasedby$40,000.

Assets = Liabilities + Owners’Equity

+40,000 +40,000

nochange

So,WhatareDebitsandCredits?

Debitsandcreditsaresimplythetermsusedforthetwohalvesofeachtransaction.Thatis,eachof

thesetwo-entrytransactionsinvolvesadebitandacredit.

Now,ifyou’vebeenusingabankaccountforanyperiodoftime,youlikelyhaveanideathatdebit

meansdecreasewhilecreditmeansincrease.Thatis,however,notexactlytrue.Adebit(orcredit)to

anaccountmayincreaseitordecreaseit,dependinguponwhattypeofaccountitis:

A debit entry will increase an asset account, and it will decrease a liability or owners’ equity

account.

A credit entry will decrease an asset account, and it will increase a liability or owners’ equity

account.

Fromtheperspectiveofyourbank,yourcheckingaccountisaliability—thatis,it’smoneythatthey

oweyou.Becauseit’saliability,yourbankcreditstheaccounttoincreasethebalanceanddebitsthe

accounttodecreasethebalance.

Let’sapplythissystemofdebitsandcreditstoourearlierexample.

EXAMPLE:Acompanyuses$40,000cashtopurchaseanewpieceofequipment.Cashwilldecrease

by $40,000 and Equipment will increase by $40,000. To record this decrease to Cash (an asset

account)weneedtocreditCashfor$40,000.TorecordthisincreasetoEquipment(anassetaccount),

weneedtodebitEquipmentfor$40,000.

Thistransactioncouldberecordedasajournalentryasfollows:

DR.Equipment 40,000

CR.Cash

40,000

As you can see, when recording a journal entry, the account that is debited is listed first, and the

accountthatiscreditedislistedsecond,withanindentationtotheright.Also,debitisconventionally

abbreviated as “DR” and credit is abbreviated as “CR.” (Often, these abbreviations are omitted, and

creditsaresignifiedentirelybythefactthattheyareindentedtotheright.)

An easy way to keep everything straight is to think of “debit” as meaning “left,” and “credit” as

meaning“right.”Inotherwords,debitsincreaseaccountsontheleftsideoftheaccountingequation,

andcreditsincreaseaccountsontherightside.Also,thishelpsyoutorememberthatthedebithalfof

ajournalentryisontheleft,whilethecredithalfisindentedtotheright.

Let’s take a look at a few more example transactions and see how they would be recorded as

journalentries.

EXAMPLE: Chris’ Construction takes out a $50,000 loan with a local bank. Cash will increase by

$50,000, and Notes Payable will increase by $50,000. To increase Cash (an asset account), we will

debitit.ToincreaseNotesPayable(aliabilityaccount),wewillcreditit.

DR.Cash

50,000

CR.NotesPayable 50,000

EXAMPLE: Last month, Chris’ Construction purchased $10,000 worth of building supplies, using

credittodoso.BuildingSupplies(asset)andAccountsPayable(liability)eachneedtobeincreased

by$10,000.Todoso,we’lldebitBuildingSupplies,andcreditAccountsPayable.

DR.BuildingSupplies 10,000

CR.AccountsPayable 10,000

Eventually, Chris’s Construction will pay the vendor for the supplies. When they do, we’ll need to

decrease Accounts Payable and Cash by $10,000 each. To decrease a liability, we debit it, and to

decreaseanasset,wecreditit.

DR.AccountsPayable 10,000

CR.Cash

10,000

RevenueandExpenseAccounts

So far, we’ve only discussed journal entries that deal exclusively with balance sheet accounts.

Naturally,journalentriesneedtobemadeforincomestatementtransactionsaswell.

For the most part, when making a journal entry to a revenue account, we use a credit, and when

making an entry to an expense account, we use a debit. This makes sense when we consider that

revenuesincreaseowners’equity(andthus,likeowners’equity,shouldbeincreasedwithacredit)and

thatexpensesdecreaseowners’equity(andtherefore,unlikeowners’equity,shouldbeincreasedwith

adebit).

EXAMPLE:Darla’sDresseswritesacheckfortheirmonthlyrent:$4,500.WeneedtodecreaseCash

andincreaseRentExpense.

DR.RentExpense 4,500

CR.Cash

4,500

EXAMPLE:Connie,asoftwareconsultant,makesasalefor$10,000andispaidincash.We’llneed

toincreasebothCashandSalesby$10,000each.

DR.Cash 10,000

CR.Sales 10,000

Sometimesatransactionwillrequiretwojournalentries.

EXAMPLE:Darla’sDressessellsaweddingdressfor$1,000cash.Darlahadoriginallypurchased

thedressfromasupplierfor$450.WehavetoincreaseSalesandCashby$1,000each.Wealsohave

todecreaseinventoryby$450andincreaseCostofGoodsSold(anexpenseaccount)by$450.

DR.Cash

1,000

CR.Sales

1,000

DR.CostofGoodsSold 450

CR.Inventory

450

TheGeneralLedger

The general ledger is the place where all of a company’s journal entries get recorded. Of course,

hardlyanybodyusesanactualpaperdocumentforageneralledgeranymore.Instead,journalentries

areenteredintothecompany’saccountingsoftware,whetherit’sahigh-endcustomizedprogram,a

more affordable program like QuickBooks, or even something as simple as a series of Excel

spreadsheets.

The general ledger is a company’s most important financial document, as it is from the general

ledger ’sinformationthatacompany’sfinancialstatementsarecreated.

T-Accounts

Inmanysituations,itcanbeusefultolookatalltheactivitythathasoccurredinasingleaccountover

a given time period. The tool most frequently used to provide this one-account view of activity is

knownasthe“T-Account.”OnelookatanexampleT-accountandyou’llknowwhereitgetsitsname:

TheaboveT-accountshowsusthat,overtheperiodinquestion,Cashhasbeendebitedfor$400,$550,

and$300,aswellascreditedfor$200and$950.

Often,aT-accountwillincludetheaccount’sbeginningandendingbalances:

ThisT-accountshowsusthatatthebeginningoftheperiod,Inventoryhadadebitbalanceof$600.It

wasthendebitedforatotalof$750(250+500)andcreditedforatotalof$500(200+300).Asaresult,

Inventoryhadadebitbalanceof$850attheendoftheperiod($600beginningbalance,plus$250net

debitovertheperiod).

TheTrialBalance

A trial balance is simply a list indicating the balances of every single general ledger account at a

givenpointintime.Thetrialbalanceistypicallypreparedattheendofaperiod,priortopreparing

theprimaryfinancialstatements.

Thepurposeofthetrialbalanceistocheckthatdebits—intotal—areequaltothetotalamountof

credits. If debits do not equal credits, you know that an erroneous journal entry must have been

posted.Whileatrialbalanceisahelpfulcheck,it’sfarfromperfect,astherearenumeroustypesof

errorsthatatrialbalancedoesn’tcatch.(Forexample,atrialbalancewouldn’talertyouifthewrong

asset account had been debited for a given transaction, as the error wouldn’t throw off the total

amountofdebits.)

Chapter8SimpleSummary

Foreverytransaction,ajournalentrymustberecordedthatincludesbothadebitandacredit.

Debitsincreaseassetaccountsanddecreaseequityandliabilityaccounts.

Creditsdecreaseassetaccountsandincreaseequityandliabilityaccounts.

Debitsincreaseexpenseaccounts,whilecreditsincreaserevenueaccounts.

Thegeneralledgeristhedocumentinwhichacompany’sjournalentriesarerecorded.

AT-accountshowstheactivityinaparticularaccountoveragivenperiod.

Atrialbalanceshowsthebalanceineachaccountatagivenpointintime.Thepurposeofatrial

balanceistocheckthattotaldebitsequaltotalcredits.

CHAPTERNINE

Cashvs.Accrual

Individualsandmostsmallbusinessesuseamethodofaccountingknownas“cashaccounting.”In

order to be in accordance with GAAP, however, businesses must use a method known as “accrual

accounting.”

TheCashMethod

Under the cash method of accounting, sales are recorded when cash is received, and expenses are

recordedwhencashissentout.It’sstraightforwardandintuitive.Theproblemwiththecashmethod,

however,isthatitdoesn’talwaysreflecttheeconomicrealityofasituation.

EXAMPLE:Pamrunsaretailicecreamstore.Herleaserequireshertoprepayherrentforthenext3

monthsatthebeginningofeveryquarter.Forexample,inApril,sheisrequiredtopayherrentfor

April,May,andJune.

IfPamusesthecashmethodofaccounting,hernetincomeinAprilwillbesubstantiallylower

thanhernetincomeinMayorJune,evenifhersalesandotherexpensesareexactlythesamefrom

monthtomonth.Ifapotentialcreditorwastolookatherfinancialstatementsonamonthlybasis,the

lender would get the impression that Pam’s profitability is subject to wild fluctuations. This is, of

course,adistortionofthereality.

TheAccrualMethod

Under the accrual method of accounting, revenue is recorded as soon as services are provided or

goods are delivered, regardless of when cash is received. (Note: This is why we use an Accounts

Receivableaccount.)

Similarly, under the accrual method of accounting, expenses are recognized as soon as the

companyreceivesgoodsorservices,regardlessofwhenitactuallypaysforthem.(AccountsPayable

isusedtorecordtheseas-yet-unpaidobligations.)

Thegoaloftheaccrualmethodistofixthemajorshortcomingofthecashmethod:Distortionsof

economic reality due to the frequent time lag between a service being performed and the service

beingpaidfor.

EXAMPLE:Mariorunsanelectronicsstore.Onthe5thofeverymonth,hepayshissalesrepstheir

commissionsforsalesmadeinthepriormonth.InAugust,hissalesrepsearnedtotalcommissionsof

$93,000.IfMariousestheaccrualmethodofaccounting,hemustmakethefollowingentryattheend

ofAugust:

CommissionsExpense 93,000

CommissionsPayable 93,000

Wheneveranexpenseisrecordedpriortoitsbeingpaidfor—suchasintheaboveentry—thejournal

entryisreferredtoasan“accrual,”hence,the“accrualmethod.”Theneedfortheaboveentrycould

be stated by saying that, at the end of August, “Mario has to accrue for $93,000 of Commissions

Expense.”

Then, on the 5th of September, when he pays his reps for August, he must make the following

entry:

CommissionsPayable 93,000

Cash

93,000

A few points are worthy of specific mention. First, because Mario uses the accrual method, the

expense is recorded when the services are performed, regardless of when they are paid for. This

ensures that any financial statements for the month of August reflect the appropriate amount of

CommissionsExpenseforsalesmadeduringthemonth.

Second,afterbothentrieshavebeenmade,theneteffectisadebittotherelevantexpenseaccount

andacredittoCash.(Notehowthisisexactlywhatyou’dexpectforanentryrecordinganexpense.)

Last point of note: Commissions Payable will have no net change after both entries have been

made.ItsonlypurposeistomakesurethatfinancialstatementspreparedattheendofAugustwould

reflectthat—atthatparticularmoment—anamountisowedtothesalesreps.

Let’srunthroughafewmoreexamplessoyoucangetthehangofit.

EXAMPLE: Lindsey is a freelance writer. During February she writes a series of ads for a local

business and sends them a bill for the agreed-upon fee: $600. Lindsey makes the following journal

entry:

AccountsReceivable 600

Sales

600

WhenLindseyreceivespayment,shewillmakethefollowingentry:

Cash

600

AccountsReceivable 600

EXAMPLE:OnJanuary1st,whenLindseystartedherbusiness,shetookouta6-month,$3,000loan

with a local credit union. The terms of the loan were that, rather than making payments over the

courseoftheloan,shewouldrepayitall(alongwith$180ofinterest)onJuly1st.

BecauseLindseyusestheaccrualmethod,shemustrecordtheinterestexpenseoverthelifeofthe

loan,ratherthanrecordingitallattheendwhenshepaysitoff.

WhenLindseyinitiallytakesouttheloan,shemakesthefollowingentry:

Cash

3,000

NotesPayable 3,000

Then, at the end of every month, Lindsey records 1/6th of the total interest expense by making the

followingentry:

InterestExpense 30

InterestPayable 30

OnJuly1st,Lindseypaysofftheloan,makingthefollowingentry:

NotesPayable

3,000

InterestPayable 180

Cash

3,180

PrepaidExpenses

Sofar,allofourexampleshavelookedatscenariosinwhichthecashexchangeoccurredafter the

goods/servicesweredelivered.Naturally,thereareoccasionsinwhichtheoppositesituationarises.

Again,thegoaloftheaccrualmethodistorecordtherevenuesorexpensesintheperiodduring

which the real economic transaction occurs (as opposed to the period in which cash is exchanged).

Let’srevisitourearlierexampleofPamwiththeicecreamstore.

EXAMPLE:Pam’smonthlyrentis$1,500.However,Pam’slandlord—RetailRentals—requiresthat

sheprepayherrentforthenext3monthsatthebeginningofeveryquarter.OnApril1st,Pamwritesa

checkfor$4,500(rentforApril,May,andJune).Shemakesthefollowingentry:

PrepaidRent 4,500

Cash

4,500

Intheaboveentry,PrepaidRentisanassetaccount.Overthecourseofthethreemonths,the$4,500

will be eliminated as the expense is recorded. Assets caused by the prepayment of an expense are

known,quitereasonably,as“prepaidexpenseaccounts.”

Then,attheendofeachmonth(April,May,andJune),Pamwillmakethefollowingentrytorecord

herrentexpensefortheperiod:

RentExpense 1,500

PrepaidRent 1,500

Again,bytheendofthethreemonths,PrepaidRentwillbebacktozero,andshewillhaverecognized

the proper amount of Rent Expense each month ($1,500). Of course, the process will start all over

againonJuly1stwhenPamprepaysherrentforthethirdquarteroftheyear.

UnearnedRevenue

From Pam’s perspective, the early rent payment created an asset account (Prepaid Rent). Naturally,

from the perspective of her landlord, the early payment must have the opposite effect: It creates a

liabilitybalanceknownas“unearnedrevenue.”

EXAMPLE:OnApril1st,whenRetailRentalsreceivesPam’scheckfor$4,500,theymustsetupan

UnearnedRentliabilityaccount.Then,theywillrecordtherevenuemonthbymonth.

OnApril1st,RetailRentalsreceivesthecheckandmakesthefollowingentry:

Cash

4,500

UnearnedRent 4,500

Then,attheendofeachmonth,RetailRentalswillrecordtherevenuebymakingthefollowingentry:

UnearnedRent 1,500

RentalIncome 1,500

Chapter9SimpleSummary

InordertobeinaccordancewithGAAP,businessesmustusetheaccrualmethodofaccounting

(asopposedtothecashmethod).

Thegoaloftheaccrualmethodistorecognizerevenue(orexpense)intheperiodinwhichthe

serviceisprovided,regardlessofwhenitispaidfor.

CHAPTERTEN

OtherGAAPConceptsandAssumptions

Again, the goal of GAAP is to ensure that companies’ financial statements are prepared using a

consistentsetofrulesandassumptionssothattheycanbecomparedtothoseofanothercompanyina

meaningfulway.Inthischapterwe’llexamineafewoftheassumptionsthatareusedwhenpreparing

GAAP-compliantfinancialstatements.

HistoricalCost

UnderGAAP,assetsarerecordedattheirhistoricalcost(i.e.,theamountpaidforthem).Thisseems

obvious,buttherearetimesinwhichitwouldappearreasonableforacompanytoreportanassetata

valueotherthantheamountpaidforit.Forexample,ifacompanyhasownedapieceofrealestate

forseveraldecades,reportingthepieceoflandatitshistoricalcostmayverysignificantlyunderstate

thevalueoftheland.

However, if GAAP allowed companies to use any other valuation method—current market value

forinstance—itwouldintroduceagreatdealofsubjectivityintotheprocess.(Tousetheexampleof

real estate again: Depending upon what method you use or who you ask, you could find several

differentanswersforthefairmarketvalueofapieceofrealestate.)Instead,GAAPusuallyrequires

thatcompaniesreportassetsusingthemostobjectivevalue:thecostpaidforthem.

Materiality

Under GAAP, the materiality (or immateriality) of a transaction refers to the impact that the

transaction will have on the company’s financial statements. If a mistake in recording a given

transactioncouldcauseaviewerofthecompany’sfinancialstatementstomakeadifferentdecision

than he or she would make if the transaction were reported correctly, the transaction is said to be

“material.”

EXAMPLE:Martin’sbusinesscurrentlyhas$50,000ofcurrentassets,$20,000ofcurrentliabilities,

andowes$75,000onaloanthatwillbeduein2years.Theloanisclearlymaterial,asamisstatement

of the amount, or an exclusion of it from the company’s balance sheet would very likely lead a

potentialinvestor(orcreditor)tomakeapoordecisionregardinginvestingin(orlendingmoneyto)

thecompany.

EXAMPLE: Carly runs a nicely profitable graphic design business. Her monthly revenues are

usually around $20,000, and her monthly expenses are approximately $8,000. In August, Carly

purchases$80worthofofficesupplies,butsheforgetstorecordthepurchase.

While Carly should make sure to record the purchase at some point, the $80 expense is clearly

immaterial. If creditors were looking at her financial statements at the end of August, the $80

understatement of expenses would be unlikely to cause them to make a different decision than they

wouldiftheexpensehadbeenaccuratelyrecorded.

MonetaryUnitAssumption

GAAP makes the assumption that the dollar is a stable measure of value. It’s no secret that this is a

faulty assumption due to inflation constantly changing the real value of the dollar. The reason for

using such a flawed assumption is that the benefit gained from adjusting the value of assets on a

regular basis to reflect inflation would be far outweighed by the cost in both time and money of

requiringcompaniestodoso.

EntityAssumption

ForGAAPpurposes,it’sassumedthatacompanyisanentirelyseparateentityfromitsowners.This

conceptisknownasthe“entityassumption”or“entityconcept.”

The most important ramification of the entity assumption is the requirement for documenting

transactions between a company and its owners. For example, if you wholly own a business, any

transfersfromthebusiness’sbankaccounttoyourbankaccountneedtoberecorded,despitethefact

that it doesn’t exactly seem like a “transaction” in that you’re really just moving around your own

money.

MatchingPrinciple

According to GAAP, the matching principle dictates that expenses must be matched to the revenues

that they help generate, and recorded in the same period in which the revenues are recorded. This

concept goes hand-in-hand with the concept of accrual accounting. For example, it’s the matching

principlethatdictatesthatacompany’sutilityexpensesforthemonthofMarchmustberecordedin

March(ratherthaninApril,whentheyarelikelypaid).ThereasoningisthatMarch’sutilityexpenses

contributetotheproductionofMarch’srevenues,sotheymustberecordedinMarch.

Similarly, it is the matching principle that dictates that if a company purchases an asset that is

expectedtoprovidebenefittothecompanyformultipleaccountingperiods(adesk,forinstance),the

costoftheassetmustbespreadoutovertheperiodforwhichitisexpectedtoprovidebenefits.This

processisknownasdepreciation,andwe’lldiscussitmorethoroughlyinChapter11.

Chapter10SimpleSummary

Anasset’shistoricalcostisoftenquitedifferentfromitscurrentmarketvalue.However,dueto

itsobjectivenature,historicalcostisgenerallyusedwhenreportingthevalueofassetsunder

GAAP.

Atransactionissaidtobeimmaterialifamistakeinrecordingthetransactionwouldnotresult

inasignificantmisstatementofthecompany’sfinancialstatements.

UnderGAAP,inordertosimplifyaccounting,currencyisgenerallyassumedtohaveastable

value.Thisisknownasthemonetaryunitassumption.

ForGAAPaccounting,abusinessisassumedtobeanentirelyseparateentityfromitsowners.

Thisisknownastheentityconceptorentityassumption.

AccordingtoGAAP’smatchingprinciple,expensesmustbereportedinthesameperiodasthe

revenueswhichtheyhelptoproduce.

CHAPTERELEVEN

DepreciationofFixedAssets

Asmentionedbrieflyinthepreviouschapter,whenacompanybuysanassetthatwillprobablylast

for greater than one year, the cost of that asset is not counted as an immediate expense. Rather, the

costisspreadoutoverseveralyearsthroughaprocessknownasdepreciation.

Straight-LineDepreciation

The most basic form of depreciation is known as straight-line depreciation. Using this method, the

costoftheassetisspreadoutevenlyovertheexpectedlifeoftheasset.

EXAMPLE: Daniel spends $5,000 on a new piece of equipment for his carpentry business. He

expectstheequipmenttolastfor5years,bywhichpointitwilllikelybeofnosubstantialvalue.Each

year,$1,000oftheequipment’scostwillbecountedasanexpense.

WhenDanielfirstpurchasestheequipment,hewouldmakethefollowingjournalentry:

DR.Equipment 5,000

CR.Cash

5,000

Then, each year, Daniel would make the following entry to record Depreciation Expense for the

equipment:

DepreciationExpense

1,000

AccumulatedDepreciation 1,000

Accumulated Depreciation is what’s known as a “contra account,” or more specifically, a “contra-

asset account.” Contra accounts are used to offset other accounts. In this case, Accumulated

DepreciationisusedtooffsetEquipment.

Atanygivenpoint,thenetofthedebitbalanceinEquipment,andthecreditbalanceinAccumulated

DepreciationgivesusthenetEquipmentbalance—sometimesreferredtoas“netbookvalue.”Inthe

example above, after the first year of depreciation expense, we would say that Equipment has a net

bookvalueof$4,000.($5,000originalcost,minus$1,000AccumulatedDepreciation.)

WemakethecreditentriestoAccumulatedDepreciationratherthandirectlytoEquipmentsothat

we:

1. Havearecordofhowmuchtheassetoriginallycost,and

2. Havearecordofhowmuchdepreciationhasbeenchargedagainsttheassetalready.

EXAMPLE(CONTINUED):Eventually,after5years,AccumulatedDepreciationwillhaveacredit

balance of 5,000 (the original cost of the asset), and the asset will have a net book value of zero.

WhenDanieldisposesoftheasset,hewillmakethefollowingentry:

AccumulatedDepreciation 5,000

Equipment

5,000

After making this entry, there will no longer be any balance in Equipment or Accumulated

Depreciation.

SalvageValue

What if a business plans to use an asset for a few years, and then sell it before it becomes entirely

worthless?Inthesecases,weusewhatiscalled“salvagevalue.”Salvagevalue(sometimesreferredto

asresidualvalue)isthevaluethattheassetisexpectedtohaveaftertheplannednumberofyearsof

use.

EXAMPLE:Lydiaspends$11,000onofficefurniture,whichsheplanstouseforthenexttenyears,

afterwhichshebelievesitwillhaveavalueofapproximately$2,000.Thefurniture’soriginalcost,

minusitsexpectedsalvagevalueisknownasitsdepreciablecost—inthiscase,$9,000.

Eachyear,Lydiawillrecord$900ofdepreciationasfollows:

DepreciationExpense

900

AccumulatedDepreciation 900

After ten years, Accumulated Depreciation will have a $9,000 credit balance. If, at that point, Lydia

doesinfactsellthefurniturefor$2,000,she’llneedtorecordtheinflowofcash,andwriteoffthe

OfficeFurnitureandAccumulatedDepreciationbalances:

Cash

2,000

AccumulatedDepreciation 9,000

OfficeFurniture

11,000

GainorLossonSale

Ofcourse,it’sprettyunlikelythatsomebodycanpredictexactlywhatanasset’ssalvagevaluewillbe

severalyearsfromthedatesheboughttheasset.Whenanassetissold,iftheamountofcashreceived

is greater than the asset’s net book value, a gain must be recorded on the sale. (Gains work like

revenueinthattheyhavecreditbalances,andincreaseowners’equity.)If,however,theassetissold

forlessthanitsnetbookvalue,alossmustberecorded.(Lossesworklikeexpenses:Theyhavedebit

balances,andtheydecreaseowners’equity.)

Determining whether to make a gain entry or a loss entry is never too difficult: Just figure out

whetheranadditionaldebitorcreditisneededtomakethejournalentrybalance.

EXAMPLE(CONTINUED): If, after ten years, Lydia had sold the furniture for $3,000 rather than

$2,000,shewouldrecordthetransactionasfollows:

Cash

3,000

AccumulatedDepreciation 9,000

OfficeFurniture

11,000

GainonSaleofFurniture 1,000

EXAMPLE (CONTINUED): If, however, Lydia had sold the furniture for only $500, she would

makethefollowingentry:

Cash

500

AccumulatedDepreciation 9,000

LossonSaleofFurniture 1,500

OfficeFurniture

11,000

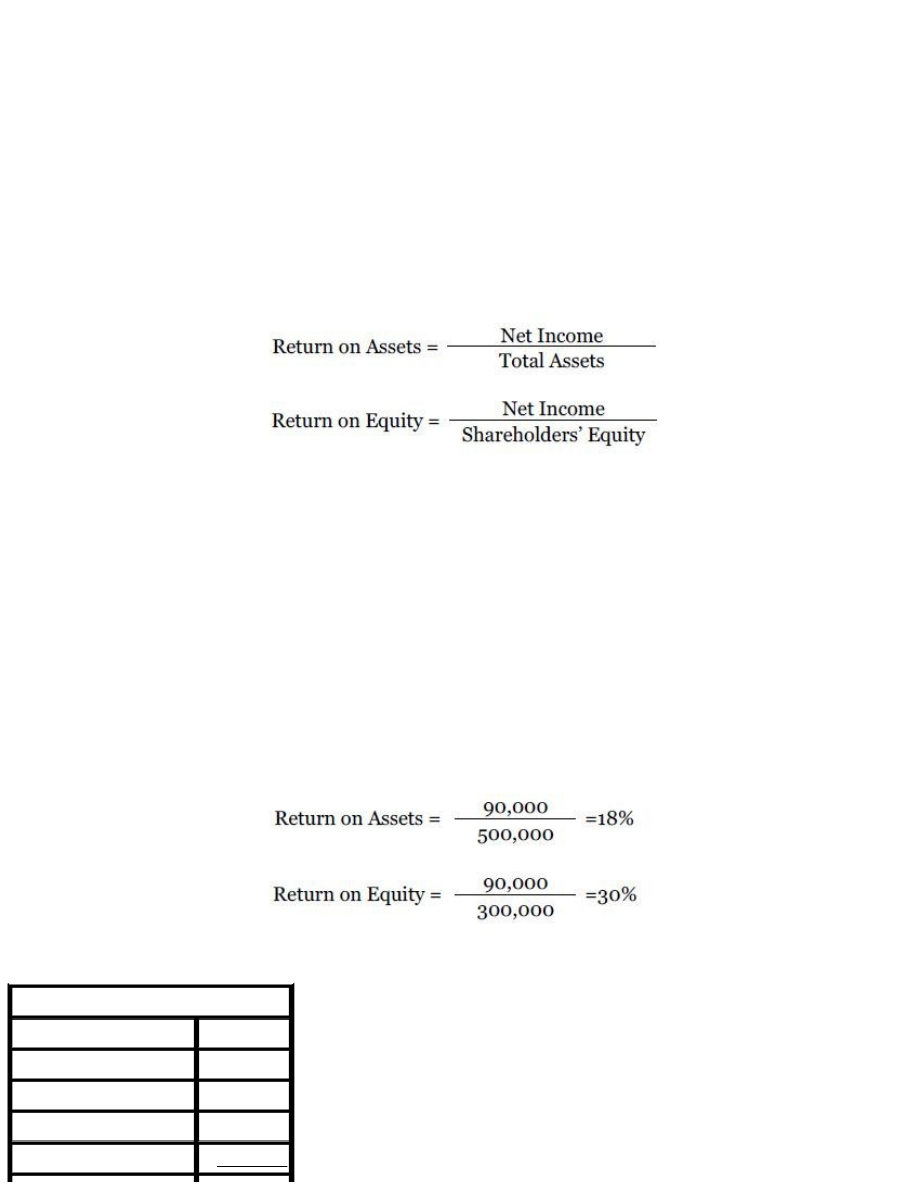

OtherDepreciationMethods

Inadditiontostraight-line,thereareahandfulofother(morecomplicated)methodsofdepreciation

that are also GAAP-approved. For example, the double declining balance method consists of

multiplyingtheremainingnetbookvaluebyagivenpercentageeveryyear.Thepercentageusedis

equaltodoublethepercentagethatwouldbeusedinthefirstyearofstraight-linedepreciation.

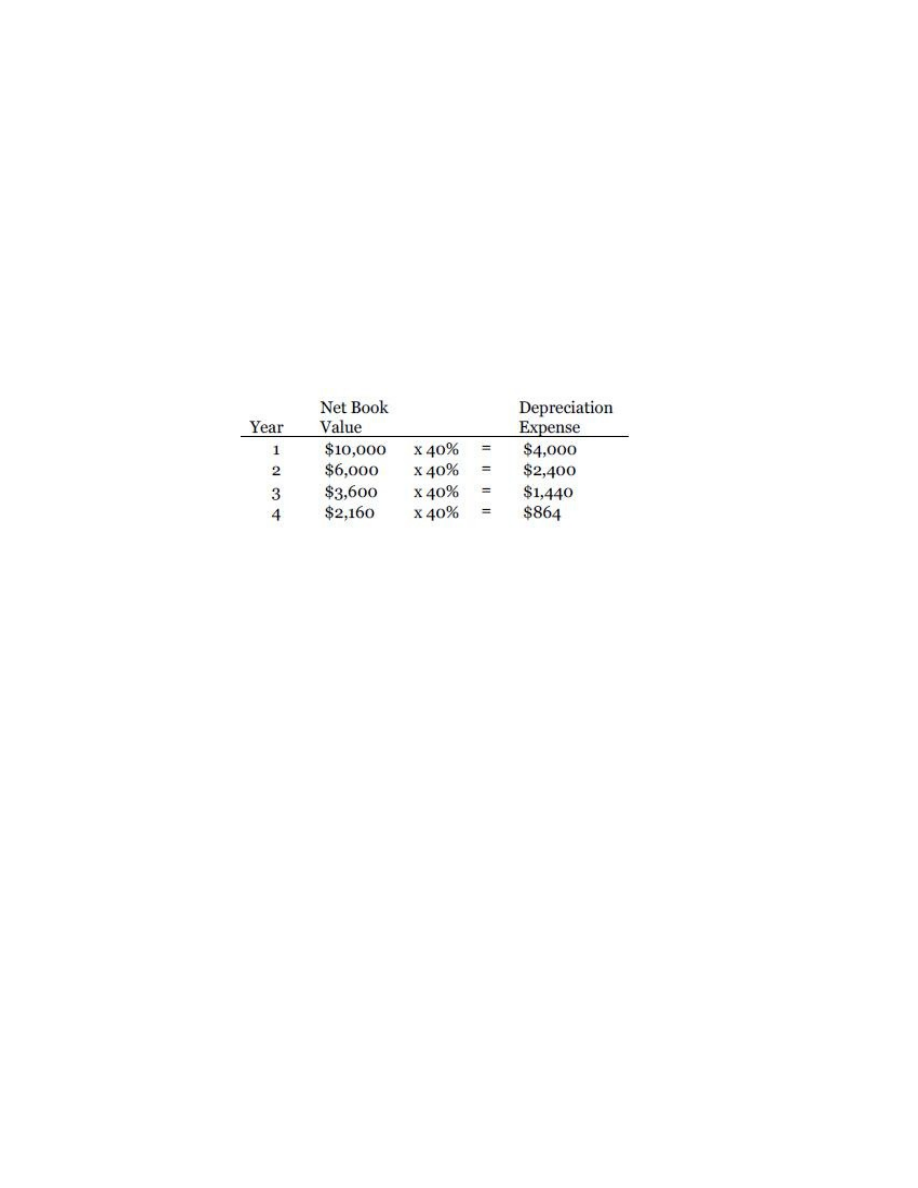

EXAMPLE: Randy purchases $10,000 of equipment, which he plans to depreciate over five years.

Using straight-line, Randy would be depreciating 20% of the value (100% ÷ five years) in the first

year. Therefore, the double declining balance method will use 40% depreciation every year (2 x

20%).Thedepreciationforeachofthefirstfouryearswouldbeasfollows:

EXAMPLE (CONTINUED): Because the equipment is being depreciated over five years, Randy

wouldrecord$1,296(thatis,2,160–864)ofdepreciationexpenseinthefifthyearinordertoreduce

theasset’snetbookvaluetozero.

AnotherGAAP-acceptedmethodofdepreciationistheunitsofproductionmethod.Undertheunits

ofproductionmethod,therateatwhichanassetisdepreciatedisnotafunctionoftime,butrathera

functionofhowmuchtheassetisused.

EXAMPLE: Bruce runs a business making leather jackets. He spends $50,000 on a piece of

equipment that is expected to last through the production of 5,000 jackets. Using the units of

production method of depreciation, Bruce would depreciate the equipment each period based upon

howmanyjacketswereproduced(atarateof$10depreciationperjacket).

If, in a given month, Bruce’s business used the equipment to produce 150 jackets, the following

entrywouldbeusedtorecorddepreciation:

DepreciationExpense

1,500

AccumulatedDepreciation 1,500

ImmaterialAssetPurchases

The concept of materiality plays a big role in how some assets are accounted for. For example,

considerthecaseofa$15wastebasket.Giventhefactthatawastebasketisalmostcertaintolastfor

greaterthanoneyear,itshould,theoretically,bedepreciatedoveritsexpectedusefullife.

However—in terms of the impact on the company’s financial statements—the difference between

depreciating the wastebasket and expensing the entire cost right away is clearly negligible. The

benefit of the additional accounting accuracy is far outweighed by the hassle involved in making

insignificant depreciation journal entries year after year. As a result, assets of this nature are

generally expensed immediately upon purchase rather than depreciated over multiple years. Such a

purchasewouldordinarilyberecordedasfollows:

OfficeAdministrativeExpense 15.00

Cash(orAccountsPayable)

15.00

Chapter11SimpleSummary

Straight-linedepreciationisthesimplestdepreciationmethod.Usingstraight-line,anasset’s

costisdepreciatedoveritsexpectedusefullife,withanequalamountofdepreciationbeing

recordedeachmonth.

Accumulateddepreciation—acontra-assetaccount—isusedtokeeptrackofhowmuch

depreciationhasbeenrecordedagainstanassetsofar.

Anasset’snetbookvalueisequaltoitsoriginalcost,lesstheamountofaccumulated

depreciationthathasbeenrecordedagainsttheasset.

Ifanassetissoldformorethanitsnetbookvalue,againmustberecorded.Ifit’ssoldforless

thannetbookvalue,alossisrecorded.

Immaterialassetpurchasestendtobeexpensedimmediatelyratherthanbeingdepreciated.

CHAPTERTWELVE

AmortizationofIntangibleAssets

Intangibleassetsarereal,identifiableassetsthatarenotphysicalobjects.Commonintangibleassets

includepatents,copyrights,andtrademarks.

Amortization

Amortizationistheprocess—veryanalogoustodepreciation—inwhichanintangibleasset’scostis

spread out over the asset’s life. Generally, intangible assets are amortized using the straight-line

methodovertheshorterof:

Theasset’sexpectedusefullife,or

Theasset’slegallife.

EXAMPLE: Kurt runs a business making components for wireless routers. In 2011, he spends

$60,000obtainingapatentforanewmethodofproductionthathehasrecentlydeveloped.Thepatent

willexpirein2031.

Eventhoughthepatent’slegallifeis20years,itsusefullifeislikelytobemuchshorter,asit’sa

nearcertainty that thismethod will becomeobsolete in well under20 years, giventhe rapid rate of

innovationinthetechnologyindustry.Assuch,Kurtwillamortizethepatentoverwhatheprojectsto

beitsusefullife:fouryears.Eachyear,thefollowingentrywillbemade:

AmortizationExpense

15,000

AccumulatedAmortization 15,000

Chapter12SimpleSummary

Amortizationistheprocessinwhichanintangibleasset’scostisspreadoutovertheasset’s

life.

Thetimeperiodusedforamortizinganintangibleassetisgenerallytheshorteroftheasset’s

legallifeorexpectedusefullife.

CHAPTERTHIRTEEN

InventoryandCostofGoodsSold

UnderGAAP,therearetwoprimarymethodsofkeepingtrackofinventory:theperpetualmethod

andtheperiodicmethod.

PerpetualMethodofInventory

Any business that keeps real-time information on inventory levels and that tracks inventory on an

item-by-itembasisisusingtheperpetualmethod.Forexample,retaillocationsthatusebarcodesand

point-of-salescannersareutilizingtheperpetualinventorymethod.

Therearetwomainadvantagestousingtheperpetualinventorysystem.First,itallowsabusiness

toseeexactlyhowmuchinventorytheyhaveonhandatanygivenmoment,therebymakingiteasier

toknowwhentoordermore.Second,itimprovestheaccuracyofthecompany’sfinancialstatements

because it allows very accurate recordkeeping as to the Cost of Goods Sold over a given period.

(CoGSwillbecalculated,quitesimply,asthesumofthecostsofalloftheparticularitemssoldover

theperiod.)

Theprimarydisadvantagetousingtheperpetualmethodisthecostofimplementation.

PeriodicMethodofInventory

Theperiodicmethodofinventoryisasysteminwhichinventoryiscountedatregularintervals(at

month-end,forinstance).Usingthismethod,abusinesswillknowhowmuchinventoryithasatthe

beginningandendofeveryperiod,butitwon’tknowpreciselyhowmuchinventoryisonhandinthe

middleofanaccountingperiod.

Aseconddrawbackoftheperiodicmethodisthatthebusinesswon’tbeabletotrackinventoryon

an item-by-item basis, thereby requiring assumptions to be made as to which particular items of

inventoryweresold.(Moreontheseassumptionslater.)

CalculatingCoGSunderthePeriodicMethodofInventory

Whenusingtheperiodicmethod,CostofGoodsSoldiscalculatedusingthefollowingequation:

Beginning

Inventory

+

Inventory

Purchases

-

Ending

Inventory

=

Costof

GoodsSold

Thisequationmakesperfectsensewhenyoulookatitpiecebypiece.Beginninginventory,plusthe

amount of inventory purchased over the period gives you the total amount of inventory that could

have been sold (sometimes known, understandably, as Cost of Goods Available for Sale). We then

assume that, if an item isn’t in inventory at the end of the period, it must have been sold. (And

conversely, if an item is in ending inventory, it obviously wasn’t sold, hence the subtraction of the

endinginventorybalancewhencalculatingCoGS).

EXAMPLE: Corina has a business selling books on eBay. An inventory count at the beginning of

November shows that she has $800 worth of inventory on hand. Over the month, she purchases

another$2,400worthofbooks.HerinventorycountattheendofNovembershowsthatshehas$600

ofinventoryonhand.

Using the equation above, we learn that Corina’s Cost of Goods Sold for November is $2,600,

calculatedasfollows:

Beginning

Inventory

+ Purchases -

Ending

Inventory

=

Costof

GoodsSold

800

+ 2,400

- 600

= 2,600

Granted,thisequationisn’tperfect.Forinstance,itdoesn’tkeeptrackofthecostofinventorytheft.

AnystolenitemswillaccidentallygetbundledupintoCoGS,because:

1. Theyaren’tininventoryattheendoftheperiod,and

2. There is no way to know which items were stolen as opposed to sold, because inventory isn’t

beingtrackeditem-by-item.

AssumptionsUsedinCalculatingCoGSunderthePeriodicMethod

Of course, the calculation of CoGS is a bit more complex out in the real world. For example, if a

businessisdealingwithchangingper-unitinventorycosts,assumptionshavetobemadeastowhich

onesweresold(thecheaperunitsorthemoreexpensiveunits).

EXAMPLE:Maggiehasabusinesssellingt-shirtsonline.Shegetsallofherinventoryfromasingle

vendor. In the middle of April, the vendor raises its prices from $3 per shirt to $3.50 per shirt. If

Maggie sells 100 shirts during April—and she has no way of knowing which of those shirts were

purchasedatwhichprice—shouldherCoGSbe$300,$350,orsomewhereinbetween?

Theanswerdependsuponwhichinventory-valuationmethodisused.Thethreemostusedmethods

areknownasFIFO,LIFO,andAverageCost.UnderGAAP,abusinesscanuseanyofthethree.

First-In,First-Out(FIFO)

Under the “First-In, First-Out” method of calculating CoGS, we assume that the oldest units of

inventoryarealwayssoldfirst.Sointheaboveexample,we’dassumethatMaggiesoldallofher$3

shirtsbeforesellinganyofher$3.50shirts.

Last-In,First-Out(LIFO)

Underthe“Last-In,First-Out”method,theoppositeassumptionismade.Thatis,weassumethatallof

thenewestinventoryissoldbeforeanyolderunitsofinventoryaresold.So,intheaboveexample,

we’dassumethatMaggiesoldallofher$3.50shirtsbeforesellinganyofher$3shirts.

EXAMPLE(CONTINUED):AtthebeginningofApril,Maggie’sinventoryconsistedof50shirts—

allofwhichhadbeenpurchasedat$3pershirt.Overthemonth,shepurchased100shirts,60at$3per

shirt,and40at$3.50pershirt.Intotal,Maggie’sGoodsAvailableforSaleforAprilconsistsof110

shirtsat$3pershirt,and40shirtsat$3.50pershirt.

If Maggie were to use the FIFO method of calculating her CoGS for the 100 shirts she sold in

April, her CoGS would be $300. (She had 110 shirts that cost $3, and FIFO assumes that all of the

olderunitsaresoldbeforeanynewerunitsaresold.)

100x3=300

If Maggie were to use the LIFO method of calculating her CoGS for the 100 shirts she sold in

April,herCoGSwouldbe$320.(LIFOassumesthatall40ofthenewer,$3.50shirtswouldhavebeen

sold,andtheother60musthavebeen$3shirts.)

(40x3.5)+(60x3)=320

It’simportanttonotethatthetwomethodsresultnotonlyindifferentCostofGoodsSoldfor

theperiod,butindifferentendinginventorybalancesaswell.

Under FIFO—because we assumed that all 100 of the sold shirts were the older, $3, shirts—it

wouldbeassumedthat,attheendofApril,her50remainingshirtswouldbemadeupof10shirtsthat

were purchased at $3 each, and 40 that were purchased at $3.50 each. Grand total ending inventory

balance:$170.

In contrast, the LIFO method would assume that—because all of the newer shirts were sold—the

remainingshirtsmustbetheolder,$3shirts.Assuch,Maggie’sendinginventorybalanceunderLIFO

is$150.

AverageCost

Theaveragecostmethodisjustwhatitsoundslike.Itusesthebeginninginventorybalanceandthe

purchases over the period to determine an average cost per unit. That average cost per unit is then

usedtodetermineboththeCoGSandtheendinginventorybalance.

Avg.Cost/UnitxUnitsSold=CostofGoodsSold

Avg.Cost/UnitxUnitsinEnd.Inv.=End.Inv.Balance

EXAMPLE (CONTINUED): Under the average cost method, Maggie’s average cost per shirt for

Apriliscalculatedasfollows:

BeginningInventory:50shirts($3/shirt)

Purchases:100shirts(60at$3/shirtand40at$3.50/shirt)

Hertotalunitsavailableforsaleovertheperiodis150shirts.HertotalCostofGoodsAvailablefor

Saleis$470(110shirtsat$3eachand40at$3.50each).

Maggie’saveragecostpershirt=$470/150=$3.13

Usinganaveragecost/shirtof$3.13,wecancalculatethefollowing:

CoGSinApril=$313(100shirtsx$3.13/shirt)

EndingInventory=$157(50shirtsx$3.13/shirt)

Chapter13SimpleSummary

Theperiodicmethodofinventoryinvolvesdoinganinventorycountattheendofeachperiod,

thenmathematicallycalculatingCostofGoodsSold.

Theperpetualmethodofinventoryinvolvestrackingeachindividualitemofinventoryona

minute-to-minutebasis.Itcanbeexpensivetoimplement,butitimprovesandsimplifies

accounting.

FIFO(first-in,first-out)istheassumptionthattheoldestunitsofinventoryaresoldbeforethe

newerunits.

LIFO(last-in,first-out)istheoppositeassumption:Thenewestunitsofinventoryaresold

beforeolderunitsaresold.

TheaveragecostmethodisaformulaforcalculatingCoGSandendinginventorybasedupon

theaveragecostperunitofinventoryavailableforsaleoveragivenperiod.

CONCLUSION

TheHumbleLittleJournalEntry

Thegoalofaccountingistoprovidepeople—bothinternalusers(managers,owners)andexternal

users (creditors, investors)—with information about a company’s finances. This information is

provided in the form of financial statements. These financial statements are compiled using

information found in the general ledger, which is, essentially, the collection of all of a business’s

journalentries.

Inthisway,wecanseethatit’sthehumblelittlejournalentry(anditsrespectivecomponents:debits

and credits) that provides the information upon which decisions are made in the world of business.

Tensofbillionsofdollarschangehandseverydaybasedultimatelyuponthejournalentriesrecorded

byaccountants—andaccountingsoftware—aroundtheworld.

Thesejournalentriesarebased,inturn,upontheframeworkprovidedbytheAccountingEquation

andthedouble-entryaccountingsystemthatgoesalongwithit.

Meanwhile,it’stheguidelinesprovidedbyGAAPthatmakethesejournalentries(andthefinancial

statements they eventually make up) meaningful. Because without the consistency of accounting

provided for by GAAP, making a worthwhile comparison between two companies’ financial

statementswouldproveimpossible.

EndNotes

Sample accounting problems for each chapter of this book are available at:

www.obliviousinvestor.com/example-accounting-

.Isuggesttakingadvantageofthemifyoufeelthatyourunderstandingofatopiccouldusesomehelp.

Just

a

reminder:

Sample

accounting

problems

for

each

chapter

of

this

book

are

available

at:

www.obliviousinvestor.com/example-accounting-problems.

Inaccounting,negativenumbersareindicatedusingparentheses.

Ifacompanydoesn’tsellallofitsinventoryoverthecourseoftheperiod,theCostofGoodsSoldcalculationbecomesalittle

moreinvolved.We’llbecoveringsuchcalculationsinChapter13.

APPENDIX

HelpfulOnlineResources

The author ’s blog. Includes a wide variety of articles regarding personal finance, accounting,

andtaxation.

RunbyIntuit,thisprogramisanexcellentbookkeepingresource.

Themostwell-known(anddeservedlyso)publisheroflegalself-helpbooks.

The website of the Financial Accounting Standards Board, the organization responsible for

creatingandupdatingGAAP.

RecommendedReading

QuickBooksforDummies,byStephenL.Nelson

QuickBooks:TheMissingManual,byBonnieBiafore

AlsobyMikePiper

InvestingMadeSimple:InvestinginIndexFundsExplainedin100PagesorLess

ObliviousInvesting:BuildingWealthbyIgnoringtheNoise

SurprisinglySimple:IndependentContractor,SoleProprietor,andLLCTaxesExplainedin100Pages

orLess,byMikePiper

SurprisinglySimple:LLCvs.S-Corpvs.C-CorpExplainedin100PagesorLess,byMikePiper

TaxesMadeSimple:IncomeTaxesExplainedin100PagesorLess,byMikePiper

Document Outline

- 1. Accounting Equation

- 2. Balance Sheet

- 3. Income Statement

- 4. Statement of Retained Earnings

- 5. Cash Flow Statement

- 6. Financial Ratios

- 7. What is GAAP?

- 8. Debits and Credits

- 9. Cash vs. Accrual

- 10. Other GAAP Concepts & Assumptions

- 11. Depreciation of Fixed Assets

- 12. Amortization of Intangible Assets

Wyszukiwarka

Podobne podstrony:

16352479 Software Design Patterns Made Simple

CreateSpace SEO Made Simple 2011