Spread Betting – “Quarb” Strategies

Richard Lloyd-Henderson

Introduction ................................................................................... 3

Obvious “Quarb” Strategy.............................................................. 3

“Full Quarb” Strategy..................................................................... 4

Not So Obvious “Quarb” Strategy.................................................. 5

Spread Betting Market Bias........................................................... 5

Using the “Market Bias” to your Advantage ................................... 6

Profits............................................................................................ 6

Spread Betting Risk Warning ........................................................ 6

The Arbitrage, Quarb Calculator.................................................... 6

Introduction

In a paper presented at the Royal Economic Society's Annual Conference on

Wednesday 27 March 2002, Economists Dr Paton and Prof. Vaughan

Williams at Nottingham Trent University show that punters can take

advantage of different odds quoted by spread betting companies.

The two economists investigated returns to spread bets on one of the most

popular markets, the number of bookings 'points' in Premier League football

matches. Prof. Vaughan Williams explained:

'Punters using the system pinpointed by our research would have won in more

than 60% of matches examined over the last two seasons. The key to the

system is identifying those cases where one bookmaker is offering prices out

of line with their competitors.'

The possibility of betting arbitrages - buying high with one company and

selling low with another to make a sure profit - has long been well known to

punters. But such cases are increasingly difficult to find and spread

bookmakers are known to restrict the amount of money that can be bet when

an arbitrage position is open.

The two economists describe cases where companies offer prices that are

different but not necessarily far enough apart for an arbitrage as 'Quasi-

arbitrages' or 'Quarbs'. Dr Paton commented:

'Quarbs are more common than true arbitrages, and spread bookmakers are

much less likely to restrict the number of bets on them. Although betting on a

Quarb does not guarantee you a profit, we found 136 cases (in the bookings

market) during the last two Premier League seasons. Of these, 86 would have

been winning bets and only 50 would have lost. A punter staking a modest £5

per point in each case would have won almost £5,000 over the two years.'

Obvious “Quarb” Strategy

A “Quarb” occurs in a spread betting market when one of the companies

offering a price is slightly out of sync with the other bookies. In its simplest

form the out of sync bookie needs to be quoting either a buy price the same

as one of the other bookies sell prices or visa-versa. For example Spreadex

is offering 39 – 42 for the likely number of bookings in the match (10 points for

a Yellow and 25 points for a red) and IG are quoting 42-46. In a market like

this there is obviously no over-round or under-round as you can buy with

Spreadex and sell with IG at 42.

A more complex example of a “Quarb” occurs when the best estimate of the

market matches the upper or lower end of the out of sync bookie. The

calculation of this is described in the next chapter.

When a Quarb occurs the market is considered “fair”, in that neither you nor

the bookmakers (as a whole) have an advantage. This is a good thing, and if

you know something about the market you can potentially beat the bookies.

However, if you’re probably like myself, and too lazy to study the form and not

able to make an educated guess if you tried, the above is not much use

because you still have to take a punt one way or the other.

Or do you??

For reasons that I will explain in one of the following chapters, you should

always consider selling a “Quarb” position.

“Full Quarb” Strategy

Even more help is at hand! As you will always have a number of bookmakers

quoting prices you can use their many years of expertise to work out the most

likely outcome.

Lets look at what the market thinks will be the likely number of booking points.

If we take the previous example but include all the other bookmaker’s quotes

we can work out the most likely outcome by working out the average of the

total market. The maths work like this:

Spreadex

39-42 Average = (39+42) / 2 = 40.5

Cantor

42-46 Average = (42+46) / 2 = 44

IGsport

41-45 Average = (41+45) / 2 = 43

Sporting

42-46 Average = (42+45) / 2 = 44

Sportsspread

42-46 Average = (42+46) / 2 = 44

Sum = 215.5

Average = 215.5/5 = 43.1

Therefore, using all the bookies skills, their best estimate is that there will be

43.1 points. If this best estimate figure falls outside any of the quotes in the

market we have a “Full Quarb”. In this particular example 43.1 lies outside

the Spreadex quote of 39-42 and we should buy points at 42.

What does this mean? Well if the market is right, and you would expect it to

be as the Bookies are still in business, you have effectively found an “under-

round” i.e. the book is less than 100%. In effect if you buy at 42 and the

market expects 43.1 you have a 1.1 point advantage.

Not So Obvious “Quarb” Strategy

If the best estimate of the bookies matches the top or bottom end of one of

the quotes you have a “Quarb”. In the previous chapter the Quarb was an

obvious spot, however this is not always the case.

Take the following quotes.

Spreadex

42-46 Average = (42+46) / 2 = 44

Cantor

39-43 Average = (42+46) / 2 = 41

IGsport

42-46 Average = (41+45) / 2 = 44

Sporting

41-45 Average = (41+45) / 2 = 43

Sportsspread

41-45 Average = (41+45) / 2 = 43

Sum = 215

Average = 215/5 = 43

In the above example the best Buy is at 43 and the best sell is at 42 so there

is no obvious Quarb, however the best estimate of the market is 43 which

matches the best buy quote so you have a Quarb.

Spread Betting Market Bias

Two things affect the market bias of spread betting quotes which you need to

be aware of before taking advantage of “Quarbs” or “Full Quarbs.

Sellers – The Unlimited Loss Fear

The first factor that puts a bias on the spread betting market is governed by

the punters fear of an unlimited loss. Taking the above example if you sell at

42 with Sportspread and assume there are no bookings in the match the

maximum you could expect to win is 42 times your stake. However, on the

downside, the maximum you could expect to lose has no exactly defined

upper limit. If there was a big punch up on the pitch and all the players

received red cards you would be looking at an extremely big loss. This is

particularly true in the Cricket market when you are selling runs. On the flip

side the Buyer has a known loss figure but more importantly the excitement of

having potentially an unlimited amount of profit

This seller fear and buyers greed tends to make punters buyers in a spread

betting market. In any market where there are more buyers than sellers the

market prices will go up so in this case the Bookies will always be quoting

slightly more bookings or minutes to the first goal.

The Thrill of the Game

If you are looking at the number of goals market and you know that you will be

watching the match, would you rather sit there grimacing every time anyone

has a shot on goal or would you rather sit there shouting your team on to

score more and more goals. Quite clearly you would have more enjoyment in

the later which would tend to make you a buyer of goals. As before this tends

to make the prices in the market slightly higher.

Using the “Market Bias” to your Advantage

In the previous Full Quarb example where the best estimate lied outside the

Spreadex quote the benefit would probably be marginal due to the

preponderance of buyers. However if the “Full Quarb” is on the Sell side

“FILL YOUR BOOTS”.

Likewise in a “Quarb” situation you should consider first the sell side.

Profits

In the bookings market alone Dr Paton’s and Prof. Vaughan Williams’

research found 136 “Quarb” and “Full Quarb” cases during the last two

Premier League seasons. Of these, 86 would have been winning bets and

only 50 would have lost. A punter staking a modest £5 per point in each case

would have won almost £5,000 over the two years.

Spread Betting Risk Warning

Research shows that, by betting sensibly, punters really can turn the odds in

their favour. But they should remember that spread betting is notoriously

volatile and it is possible to lose a lot of money in a short period of time.

The Arbitrage, Quarb Calculator

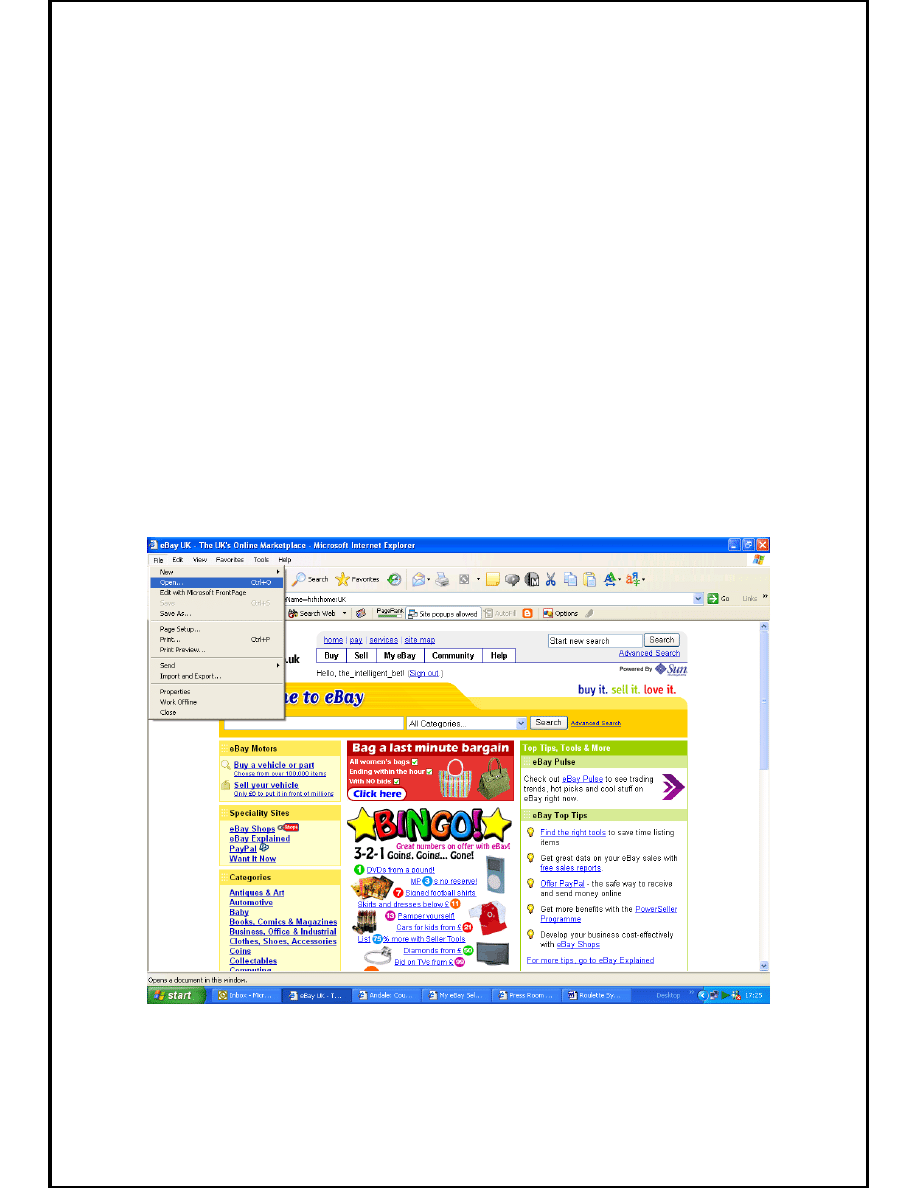

The programmes provided with this publication have been written to work in

Microsoft Internet Explorer. When you input the spread betting quotes in the

calculator it will tell you where the Quarbs and Full Quarbs are instantly.

On the email you received there will be an attachment that you can launch

directly from mail. However I would recommend that you save the attachment

somewhere on your PC so you can access it more easy. This will also

prevent you from deleting it from your emails.

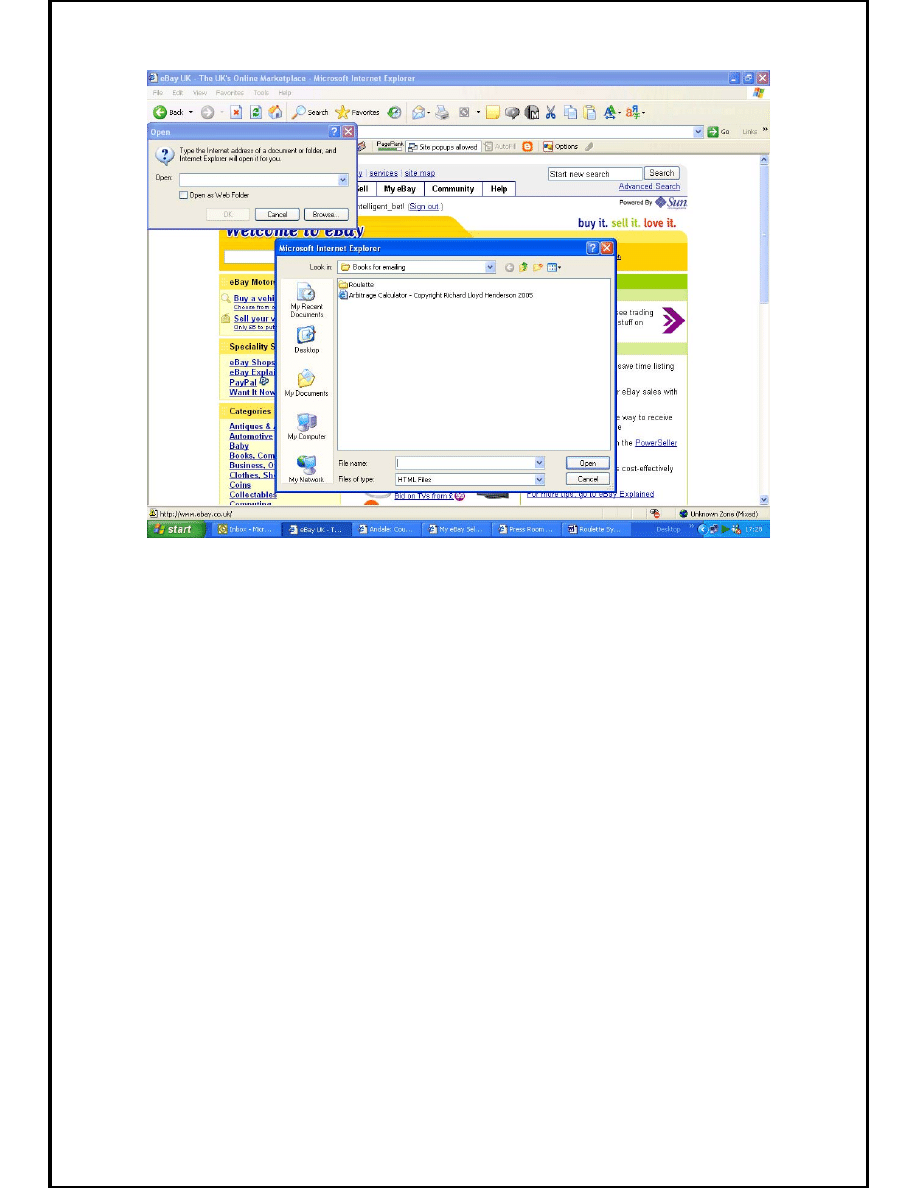

Once you have saved it in an appropriate place you can open it manually in

Internet Explorer by clicking on “file” followed by “open”

Then use “browse” to locate the programme and click open.

©

Richard Lloyd-Henderson 2005

The rights of Richard Lloyd-Henderson to be identified as the author of this work

have been asserted in accordance with the Copyright, Designs and Patents Act 1988.

All rights reserved. No part of this publication may be reproduced, stored in a

retrieval system, or transmitted, in any form or by any means, electronic, mechanical,

photocopying, recording and/or otherwise without the prior written permission of the

publishers. This book may not be, lent, resold, hired out or otherwise disposed of by

way of trade in any form, binding or cover other than that in which it is published,

without prior consent of the publishers.

Wyszukiwarka

Podobne podstrony:

ultimate spread betting system

OPTIMAL STRATEGIES FOR SPORTS BETTING POOLS

Creating a Profitable Betting Strategy

Reverse Labouchere Betting Strategy

OPTIMAL BETTING STRATEGIES FOR SIMULTANEOUS GAMES

Strategie marketingowe prezentacje wykład

STRATEGIE Przedsiębiorstwa

5 Strategia Rozwoju przestrzennego Polskii

Strategia zrównoważonego rozwoju

strategie produktu

Proces wdrazania i monitoringu strategii rozwoju

Planowanie strategiczne i operac Konferencja AWF 18 X 07

modul I historia strategii2002

W 6 STRATEGIE MARKETINGOWE FIRMA USúUGOWYCH

budowa strategii firmy

więcej podobnych podstron