Performance Management and

Suppliers

What are

the right

targets?

What are the

strengths/weaknesses?

What does the

order cost?

What do we

have to

concentrate

on?

In which points are

we better/worse than

our competitors?

Why do we

have quality

problems?

What can be

outsourced?

Why

doesn’t it

go faster?

2

Supplier Management

Managing a supplier means:

• Selection

• Development

• Performance

• Retention

3

Outsourcing as a Form of Selection

• Strategic reasons

– improve business focus

– gain access to world-class capabilities

– accelerate re-engineering benefits

– share risks

– free resources for other purposes

• Tactical reasons

– reduces or controls operating costs

– makes capital funds available and provides cash infusion

– compensates for lack of internal resources

– improves management of difficult/out-of-control processes

• Empirical evidence

4

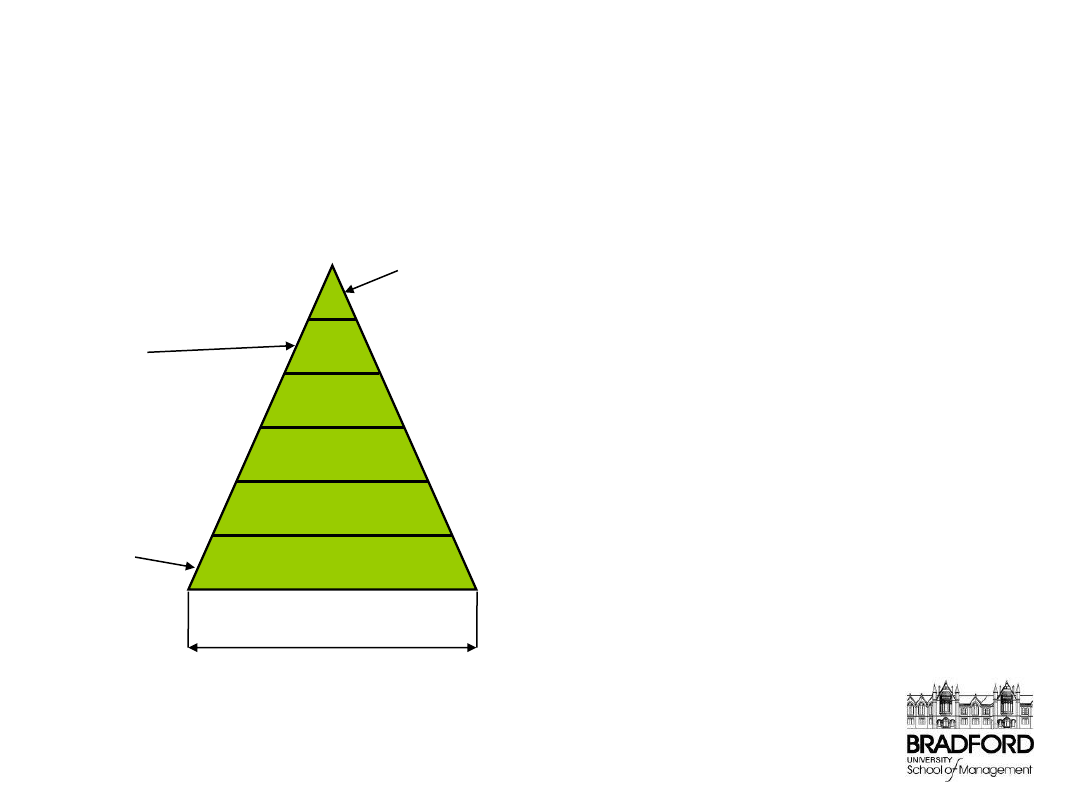

Industry level changes

•

Japanese companies

–

high proportion of outsourced products

–

multiple layered supplier pyramid

•

Pyramid structures

–

stable but agile

–

flexible

–

innovative

–

efficient in cost and administration

•

Adoption of JIT techniques

–

drastically reduces inventory

–

increases vulnerability to uncertainty

–

increases dependence on supplier quality

•

Time and product variety

–

simultaneous engineering & product development teams

–

increased outsourcing - PDT members include suppliers

–

product design reflects suppliers capabilities

Finished

product

First tier

supplier

Last tier

supplier

Number of units supplied

5

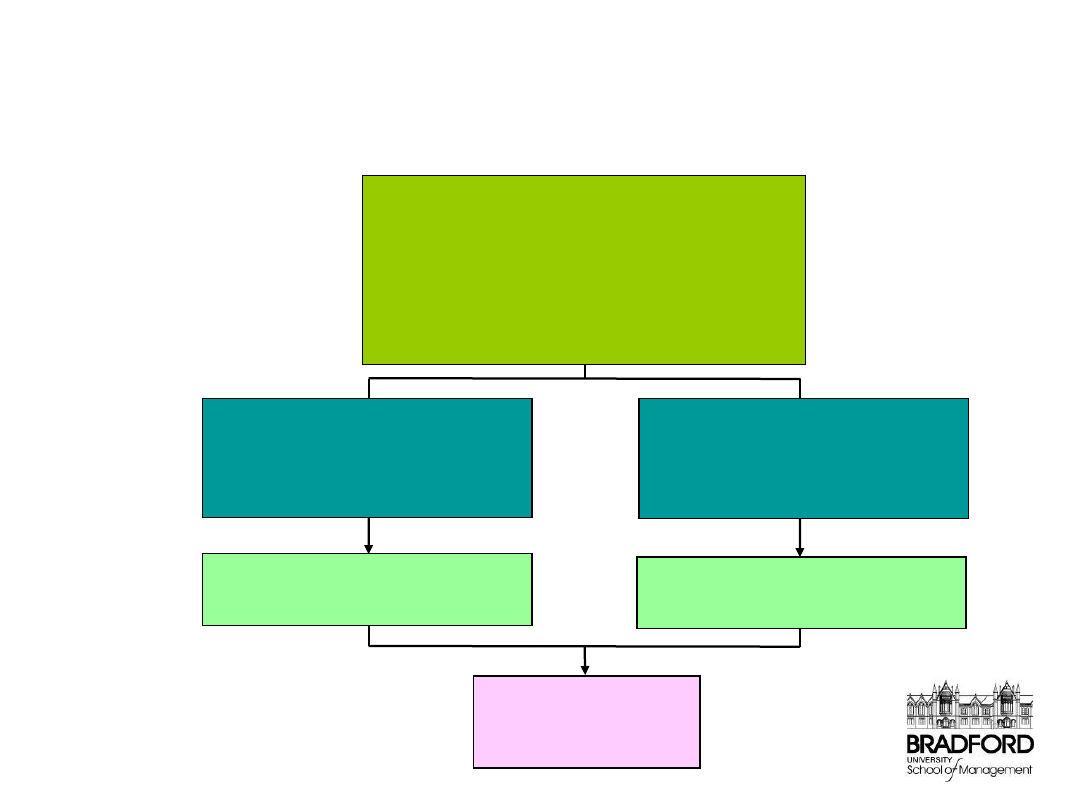

Company level changes

Multiple Criteria

•

low cost

•

high quality

•

high flexibility (volume, product variations)

•

high service

•

continues improvement and innovation

System Sourcing

•

increased value of purchase

•

reduced number of vendors

•

tiered structure of supply-chain

Collaborative Programs

•

product design and development

•

quality upgrades

•

continuous improvements

Increased value of purchase

per vendor

Long-term relationship with

vendor

Benefits due to:

•

economies of scale

•

learning curve

6

7

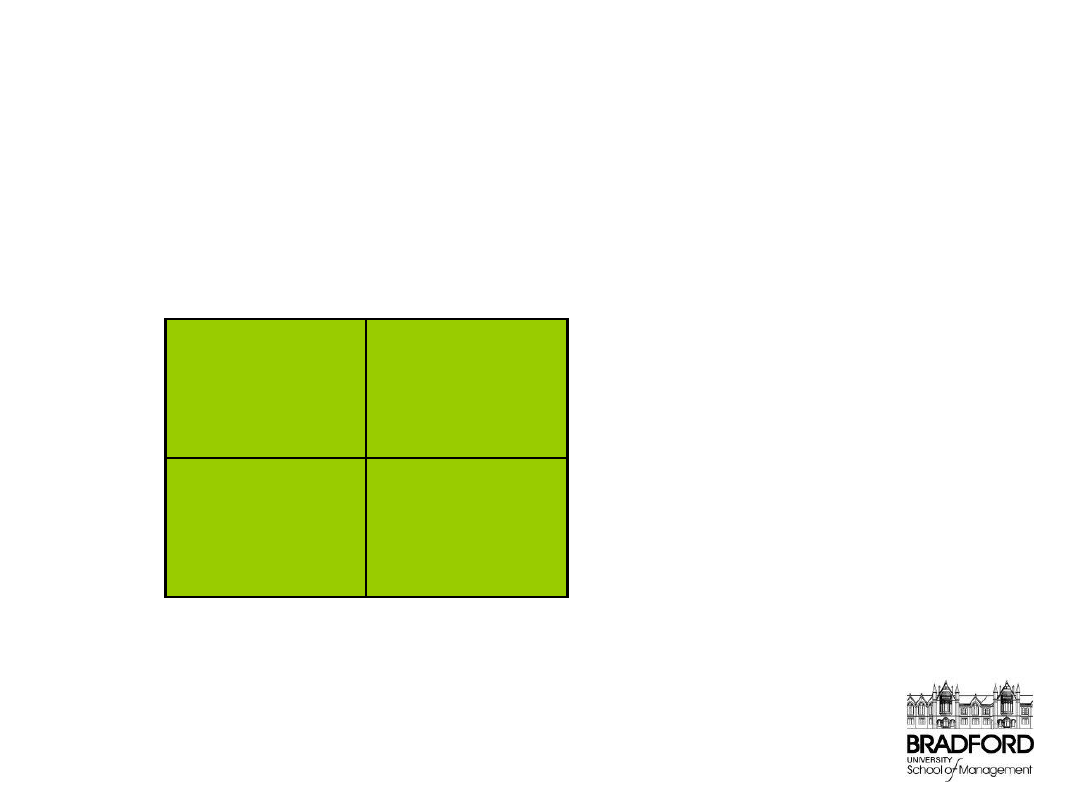

Strategic Importance & Criticality matrix

• Strategic value of part

– value of part in isolation in

market

– technological complexity,

proprietary nature of

technology, fit with PLC

• Criticality of part to assembly

– contribution to functional

performance of final

assembly

– % value of part to final

product, extent to which

quality/reliability of final

product depends on part

Novelty

(outsource or

in-house)

Proprietary

(in-house)

Commodity

(outsource)

Utility

(outsource)

High

High

Low

Low

Criticality of part

Strategic

value of

part

9

Supplier Selection Criteria Can Change

• Novelty

– functionality, quality, service

• Commodity

– price

• Utility

– Cooperation, service

Novelty

(outsource or

in-house)

Proprietary

(in-house)

Commodity

(outsource)

Utility

(outsource)

High

High

Low

Low

Criticality of part

Strategic

value of

part

Do

Nothing

Do

Everything

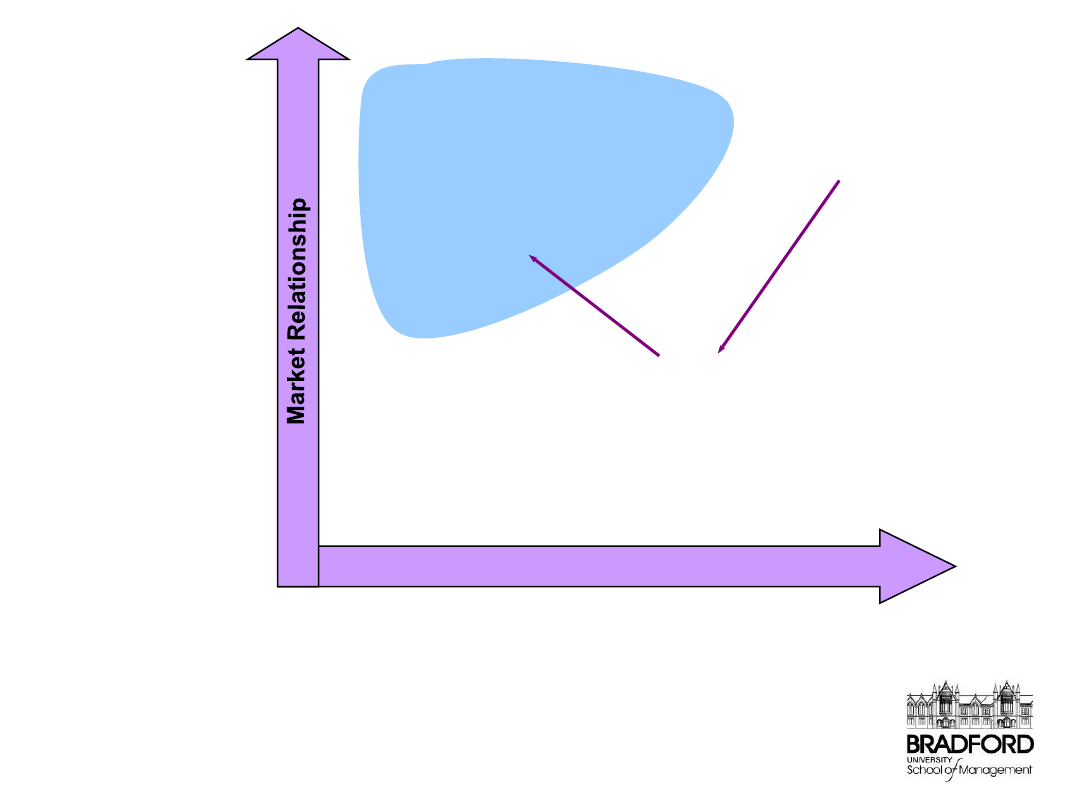

The character of internal operations activity

Virtual

Spot

Trading

Traditional

Market

Supply

Resource Scope

Long-term

Virtual

Operation

‘Partnership’

Supply

Relationships

Vertical

Integration

T

y

pe

of

int

er

-firm

con

tact

T

ran

sacti

o

n

a

l

–

M

an

y

su

p

p

li

ers

C

lo

se

–

F

ew

su

p

p

li

er

s

Slack and Lewis (2002)

Types of supply relationships

10

11

Purchase portfolio analysis

Supplier market index

(number of available suppliers)

Company index

(buyer strength)

1

11

6

0

100

1

10

0.1

Bottleneck

items

Strategic

items

Non-critical

items

Leverage

items

Company index =

% supplier’s total sales

% buyer’s total purchase

Syson’s (1992) model (See Harrison & van Hoek, 2004)

Low

High

Cost of changing suppliers

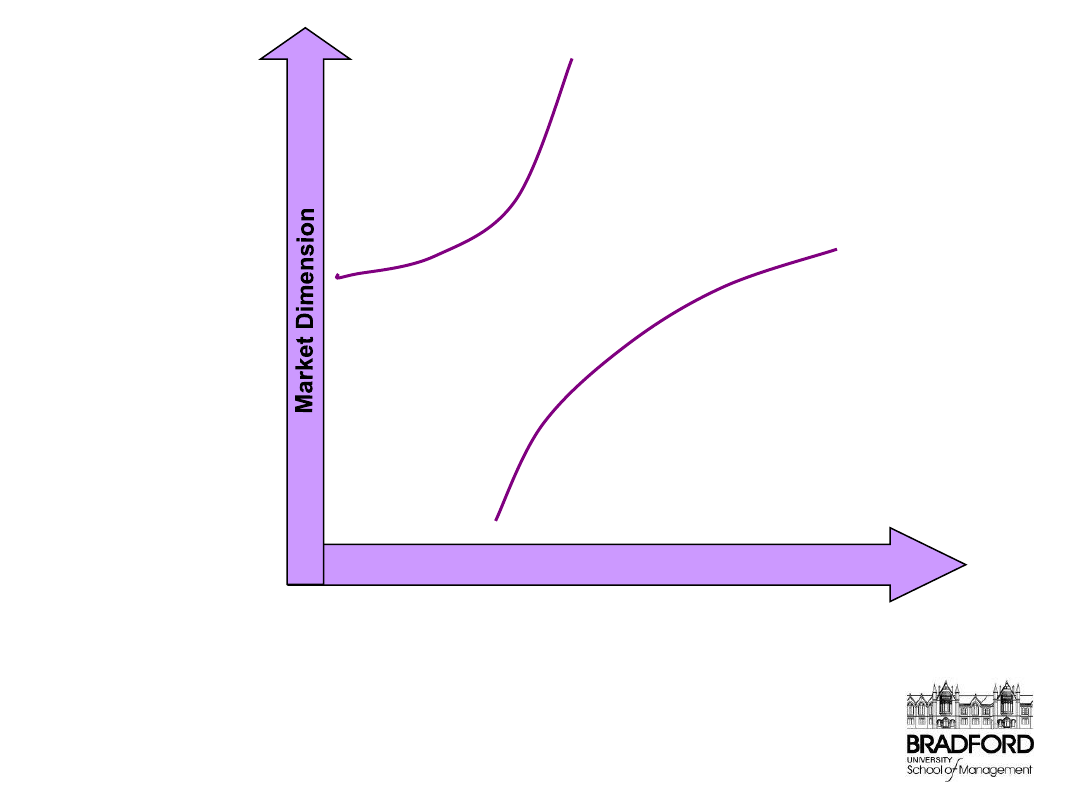

When are pure market mechanisms appropriate?

Market

mechanisms

inappropriate

Resource Dimension

Market

mechanisms

appropriate

Leverage

needs

uncertainty

Leverage

market

uncertainty

Num

ber

of

sup

ply

alternati

v

es

Few

Many

Slack and Lewis (2002)

12

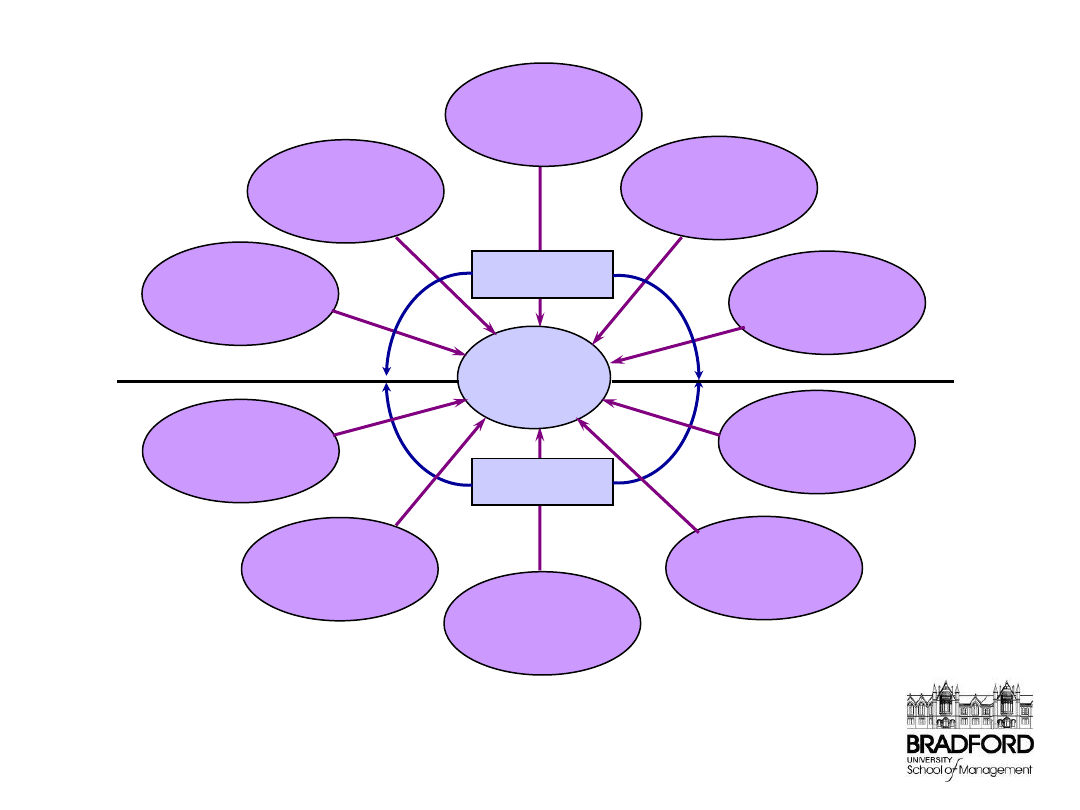

Joint

learning

Joint co-

ordination of

activities

Multiple

points of

contact

Trust

Sharing

success

Few

relationships

Information

transparency

Dedicated

assets

Joint

problem

solving

Long-term

expectations

Attitudes

Actions

Closeness of

relationship

Elements of partnership relationships

Slack and Lewis (2002)

13

Degrees of Trust

Slack and Lewis (2002)

14

…trusting you is likely to

give me more benefits

than not trusting you...

…I believe I can trust you

because I think I know

you enough to be

confident you will behave

as I would wish...

…I trust you because I

know that you know that I

wouldn’t let you down and

you know that I know that

you wouldn’t either......

Calculative

trust

Cognitive

trust

Bonding

trust

Based on

knowledge

Based on

feelings

T

ime

Cumulativ

e

po

sitiv

e

ex

perie

nce

s

Key issues in Relationship

Development

• Economic consequences need evaluating

• Supplier relationships differ

• The level of involvement needs managing

• Supplier-buyer interface points must be

identified

• Interdependency must be handled

• Suppliers need motivating

Finally……Contracts must be specified

15

16

Strategic Business Implications

• Buy decisions cannot always be reversed

– reacquiring competences

• Division of labour applies to both supplier and buyer

– effectiveness of process design

• Core competences can be difficult to identify

– competences change with time

• Outsourcing decisions change control boundaries

– access and control of critical resources

• Specialisation affects depth and scope of knowledge

– supplier buyer interaction influences evolution

Wyszukiwarka

Podobne podstrony:

Lecture 2 Customer Relationship Management

Lecture 3 Employee Relationship Management v2

CRM - customer relationship management, CRM, czyli skrót od Customer Relationship Management, to okr

McGraw Hill Briefcase Books Customer Relationship Management

Lecture 1 Business Performance Management

Customers Relationship Management

Customer Relationship Management

Advertising, Marketing, Promotions, Public Relations, and Sales Managers

Norbury General relativity and cosmology for undergraduates (Wisconsin lecture notes, 1997)(116s)

(IV)Relative therapeutic efficacy of the Williams and McKenzie protocols in back pain management

Lecture 12 Where Next for Performance Management

Lecture 10 Frameworks for Quality Performance Management

Gardner Differential geometry and relativity (lecture notes, web draft, 2004) (198s) PGr

The Gospel of St John in Relation to the Other Gospels esp that of St Luke A Course of Fourteen Lec

IR Lecture1

uml LECTURE

więcej podobnych podstron